Südkorea-Bank: KB Financial Group - Die letzten 30 Beiträge

eröffnet am 13.06.18 16:41:14 von

neuester Beitrag 02.02.24 12:54:24 von

neuester Beitrag 02.02.24 12:54:24 von

Beiträge: 32

ID: 1.282.338

ID: 1.282.338

Aufrufe heute: 0

Gesamt: 3.871

Gesamt: 3.871

Aktive User: 0

ISIN: US48241A1051 · WKN: A0RAQX · Symbol: KB

54,66

USD

+8,99 %

+4,51 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9000 | +20,00 | |

| 2,1875 | +19,37 | |

| 4,5000 | +15,38 | |

| 6,3000 | +14,55 | |

| 0,5700 | +14,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3500 | -10,60 | |

| 7,16 | -12,04 | |

| 10,799 | -12,20 | |

| 12,90 | -20,07 | |

| 1,5000 | -40,00 |

Beitrag zu dieser Diskussion schreiben

2.1.

Banks Bring Back Night Shifts as Korean Won Trading Hours Stretch Past Midnight

https://finance.yahoo.com/news/banks-bring-back-night-shifts…

...

Shinhan Bank started rostering traders to work nights in September, while Korea Development Bank, Woori Bank, Industrial Bank of Korea and NongHyup Bank have all taken steps toward doing the same. Suhyup Bank is planning to add more staff without specifying whether or not they will work at night.

“We are analyzing our middle and back offices along with IT and other related departments and preparing for any risks that may emerge in the first stages of the FX market reform,” Industrial Bank said in a statement released in response to a Bloomberg query.

Korea’s onshore dollar-won currency market is currently open from 9 a.m. until 3:30 p.m. Seoul time. The close will be set back until 2 a.m. the following morning starting from the second half of 2024, the government said early in 2023. The first tests will be held in February, the Seoul Foreign Exchange Committee announced Dec. 21.

The lengthening of won trading hours is part of Korea’s bid to improve access and boost the case for its equities to be included in MSCI’s developed-market stock index. The authorities said in February they ultimately want the won to trade 24 hours.

...

Banks Bring Back Night Shifts as Korean Won Trading Hours Stretch Past Midnight

https://finance.yahoo.com/news/banks-bring-back-night-shifts…

...

Shinhan Bank started rostering traders to work nights in September, while Korea Development Bank, Woori Bank, Industrial Bank of Korea and NongHyup Bank have all taken steps toward doing the same. Suhyup Bank is planning to add more staff without specifying whether or not they will work at night.

“We are analyzing our middle and back offices along with IT and other related departments and preparing for any risks that may emerge in the first stages of the FX market reform,” Industrial Bank said in a statement released in response to a Bloomberg query.

Korea’s onshore dollar-won currency market is currently open from 9 a.m. until 3:30 p.m. Seoul time. The close will be set back until 2 a.m. the following morning starting from the second half of 2024, the government said early in 2023. The first tests will be held in February, the Seoul Foreign Exchange Committee announced Dec. 21.

The lengthening of won trading hours is part of Korea’s bid to improve access and boost the case for its equities to be included in MSCI’s developed-market stock index. The authorities said in February they ultimately want the won to trade 24 hours.

...

22.12.

Top-performing Korea hedge fund is bullish on banks for 2024

https://www.businesstimes.com.sg/companies-markets/banking-f…

...

A HEDGE fund that has returned 30 per cent this year is bullish on Korean bank stocks on the view local policymakers will cut interest rates less than the market is forecasting.

The nation’s financial firms will also benefit as populist calls for tighter regulation ease after legislative elections due in April, according to Life Asset Management, which oversees the equivalent of US$643 million. Higher interest rates are generally favorable for banks as they enable them to have wider net interest margins.

“Those expecting a big rate cut by the Bank of Korea next year may be disappointed,” said Darren Kang, chief executive of Life Asset in Seoul. “Korea’s economy isn’t doing bad, with corporate earnings growth for next year expected to be the best in the world. For financial stocks, now is the time to buy.”

Local banks are also attractive due to their high dividend payouts and cheap valuations, Kang said. The hedge funds top picks include Woori Financial Group, which has relatively little exposure to the beleaguered real estate sector, and Meritz Financial Group, he said.

The Bank of Korea will probably lower its key rate by just 25 basis points next year to 3.25 per cent, based on the scenario that the Federal Reserve trims its benchmark by 75 basis points, Kang said. Economists are much more dovish, predicting the BOK will ease by 125 basis points over the course of 2024, according to a Bloomberg survey published this month.

...

Top-performing Korea hedge fund is bullish on banks for 2024

https://www.businesstimes.com.sg/companies-markets/banking-f…

...

A HEDGE fund that has returned 30 per cent this year is bullish on Korean bank stocks on the view local policymakers will cut interest rates less than the market is forecasting.

The nation’s financial firms will also benefit as populist calls for tighter regulation ease after legislative elections due in April, according to Life Asset Management, which oversees the equivalent of US$643 million. Higher interest rates are generally favorable for banks as they enable them to have wider net interest margins.

“Those expecting a big rate cut by the Bank of Korea next year may be disappointed,” said Darren Kang, chief executive of Life Asset in Seoul. “Korea’s economy isn’t doing bad, with corporate earnings growth for next year expected to be the best in the world. For financial stocks, now is the time to buy.”

Local banks are also attractive due to their high dividend payouts and cheap valuations, Kang said. The hedge funds top picks include Woori Financial Group, which has relatively little exposure to the beleaguered real estate sector, and Meritz Financial Group, he said.

The Bank of Korea will probably lower its key rate by just 25 basis points next year to 3.25 per cent, based on the scenario that the Federal Reserve trims its benchmark by 75 basis points, Kang said. Economists are much more dovish, predicting the BOK will ease by 125 basis points over the course of 2024, according to a Bloomberg survey published this month.

...

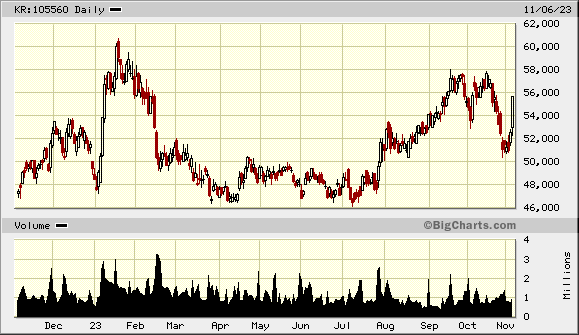

6.11.

Short-Selling Ban Sparks Biggest Rally in Korean Stocks Since 2020

https://finance.yahoo.com/news/south-korea-stocks-jump-natio…

...

South Korean stocks soared after the country reimposed a full ban on short-selling, a controversial move that regulators said was needed to stop the illegal use of a trading tactic deployed regularly by hedge funds and other investors around the world.

The nearly eight-month ban may help appease retail investors who have complained about the impact of shorting — the selling of borrowed shares by institutional investors — ahead of elections in April, several market watchers said. However, it could deter participation by foreign funds in the $1.7 trillion equity market and complicate Korea’s bid to seek a developed-market status in MSCI Inc.’s indexes.

The Kospi (^KS11) ended the day up 5.7% to cap its biggest gain since March 2020 amid a surge in trading volumes. Overseas investors were big buyers on a net basis, indicating that funds were covering short positions. Stocks that had recently witnessed an increase in short selling — including LG Energy Solution Ltd. and Posco Future M Co. — were among the biggest contributors to the benchmark’s advance. The small-cap Kosdaq Index jumped 7.3%.

...

=>

Short-Selling Ban Sparks Biggest Rally in Korean Stocks Since 2020

https://finance.yahoo.com/news/south-korea-stocks-jump-natio…

...

South Korean stocks soared after the country reimposed a full ban on short-selling, a controversial move that regulators said was needed to stop the illegal use of a trading tactic deployed regularly by hedge funds and other investors around the world.

The nearly eight-month ban may help appease retail investors who have complained about the impact of shorting — the selling of borrowed shares by institutional investors — ahead of elections in April, several market watchers said. However, it could deter participation by foreign funds in the $1.7 trillion equity market and complicate Korea’s bid to seek a developed-market status in MSCI Inc.’s indexes.

The Kospi (^KS11) ended the day up 5.7% to cap its biggest gain since March 2020 amid a surge in trading volumes. Overseas investors were big buyers on a net basis, indicating that funds were covering short positions. Stocks that had recently witnessed an increase in short selling — including LG Energy Solution Ltd. and Posco Future M Co. — were among the biggest contributors to the benchmark’s advance. The small-cap Kosdaq Index jumped 7.3%.

...

=>

5.7.

New Players Can Enter Korea’s Banking Sector for First Time in 30 Years

https://www.straitstimes.com/business/new-players-can-enter-…

...

South Korea will allow new players to enter its banking industry for the first time in 30 years to boost competition in the sector, which is currently dominated by five major banks.

The country’s financial regulator will permit licenses of nationwide commercial banks to existing financial companies, the Financial Services Commission (FSC) said in a statement on Wednesday, the first time it’s doing so since 1992 with the move seen as paving the way for lower interest rate costs for consumers.

Daegu Bank, a regional banking unit of DGB Financial Group Inc., has an intention to transform into a nationwide bank, according to the statement.

The country’s move comes after President Yoon Suk Yeol earlier this year criticized banks for having what it called a “money feast”: booking “easy” profits from the gap between interest rates on deposits and those on loans, while paying their executives big bonuses as borrowers struggled to pay high interest rates.

...

New Players Can Enter Korea’s Banking Sector for First Time in 30 Years

https://www.straitstimes.com/business/new-players-can-enter-…

...

South Korea will allow new players to enter its banking industry for the first time in 30 years to boost competition in the sector, which is currently dominated by five major banks.

The country’s financial regulator will permit licenses of nationwide commercial banks to existing financial companies, the Financial Services Commission (FSC) said in a statement on Wednesday, the first time it’s doing so since 1992 with the move seen as paving the way for lower interest rate costs for consumers.

Daegu Bank, a regional banking unit of DGB Financial Group Inc., has an intention to transform into a nationwide bank, according to the statement.

The country’s move comes after President Yoon Suk Yeol earlier this year criticized banks for having what it called a “money feast”: booking “easy” profits from the gap between interest rates on deposits and those on loans, while paying their executives big bonuses as borrowers struggled to pay high interest rates.

...

12.6.

Bank of Korea Warns of Financial Risk as Real Estate Loans Fail

https://finance.yahoo.com/news/bank-korea-warns-financial-ri…

...

Bank of Korea Governor Rhee Chang-yong flagged growing financial sector risks amid a rise in real estate loan delinquencies— even as the broader housing market slowly recovers.

“In the mid- to long-term, it is necessary to find a way to smoothly deleverage household debt in cooperation with relevant institutions so that financial imbalances don’t accumulate again,” Rhee said in the text of a speech he gave Monday to mark the central bank’s 73rd anniversary.

The BOK’s ability to address this risk may be more limited today since a bigger chunk of loans and assets has shifted to non-bank financial firms, which the BOK doesn’t oversee. The share of deposits by these alternative institutions has already exceeded that of banks, and they’re highly interconnected, he said in the text.

“As the importance of non-banking and the complexity of the system have increased, it is difficult to achieve the goal of financial stability for the entire national economy by targeting only banks,” Rhee said. He urged strengthened cooperation with supervisory authorities and “if necessary, measures to achieve financial stability goals should be devised.”

Rhee also spoke about overall economic conditions, saying that it’s yet too early to be confident that inflation is easing as core inflation is taking longer to cool. A “sophisticated policy response” is needed to address the changing dynamics of growth and price pressures, adding that the BOK needs to prepare for the possibility of changes in current account balance and appropriate liquidity levels.

...

Bank of Korea Warns of Financial Risk as Real Estate Loans Fail

https://finance.yahoo.com/news/bank-korea-warns-financial-ri…

...

Bank of Korea Governor Rhee Chang-yong flagged growing financial sector risks amid a rise in real estate loan delinquencies— even as the broader housing market slowly recovers.

“In the mid- to long-term, it is necessary to find a way to smoothly deleverage household debt in cooperation with relevant institutions so that financial imbalances don’t accumulate again,” Rhee said in the text of a speech he gave Monday to mark the central bank’s 73rd anniversary.

The BOK’s ability to address this risk may be more limited today since a bigger chunk of loans and assets has shifted to non-bank financial firms, which the BOK doesn’t oversee. The share of deposits by these alternative institutions has already exceeded that of banks, and they’re highly interconnected, he said in the text.

“As the importance of non-banking and the complexity of the system have increased, it is difficult to achieve the goal of financial stability for the entire national economy by targeting only banks,” Rhee said. He urged strengthened cooperation with supervisory authorities and “if necessary, measures to achieve financial stability goals should be devised.”

Rhee also spoke about overall economic conditions, saying that it’s yet too early to be confident that inflation is easing as core inflation is taking longer to cool. A “sophisticated policy response” is needed to address the changing dynamics of growth and price pressures, adding that the BOK needs to prepare for the possibility of changes in current account balance and appropriate liquidity levels.

...

31.5.

Korean Stocks Flirt With Bull Market as AI Mania Boosts Inflows

https://finance.yahoo.com/news/kospi-climbs-20-september-low…

...

South Korea’s equity benchmark flirted with bull market territory as a global investor frenzy for all things tied to artificial intelligence saw foreign funds accelerate purchases of the nation’s chipmakers.

An advance in the Kospi early Wednesday took its advance from a Sept. 30 low to 20%, before the gauge pulled back as weakening factory activity in China triggered broad weakness in Asia. The benchmark ended the day down 0.3%, but has still gained roughly 15% this year in one of the top performances in the region.

...

Korean Stocks Flirt With Bull Market as AI Mania Boosts Inflows

https://finance.yahoo.com/news/kospi-climbs-20-september-low…

...

South Korea’s equity benchmark flirted with bull market territory as a global investor frenzy for all things tied to artificial intelligence saw foreign funds accelerate purchases of the nation’s chipmakers.

An advance in the Kospi early Wednesday took its advance from a Sept. 30 low to 20%, before the gauge pulled back as weakening factory activity in China triggered broad weakness in Asia. The benchmark ended the day down 0.3%, but has still gained roughly 15% this year in one of the top performances in the region.

...

16.3.

South Korea Considers Requiring Banks to Hold More Capital as a Buffer

https://www.bnnbloomberg.ca/south-korea-considers-requiring-…

...

South Korea is mulling whether to require banks to hold more capital, as officials seek safeguard the financial system in the face an increase in interest rates and delinquencies.

The country is “actively considering” increasing its countercyclical capital buffer this year as well as introducing a system imposing additional capital on banks based on the results of stress tests, the Financial Services Commission said in a statement Thursday. The regulator cited increased uncertainties due to sharp rise in interest rates and the exchange rate. Household debt delinquencies were rising, it said.

Introduced in 2016, South Korea’s countercyclical capital buffer is currently set at 0%.

“Capital adequacy is relatively insufficient, and the possibility of a future capital ratio decline is increasing due to recent moves to increase dividends,” it said. Plans are due to be drawn up in the first half of the year, with implementation in the second half.

...

South Korea Considers Requiring Banks to Hold More Capital as a Buffer

https://www.bnnbloomberg.ca/south-korea-considers-requiring-…

...

South Korea is mulling whether to require banks to hold more capital, as officials seek safeguard the financial system in the face an increase in interest rates and delinquencies.

The country is “actively considering” increasing its countercyclical capital buffer this year as well as introducing a system imposing additional capital on banks based on the results of stress tests, the Financial Services Commission said in a statement Thursday. The regulator cited increased uncertainties due to sharp rise in interest rates and the exchange rate. Household debt delinquencies were rising, it said.

Introduced in 2016, South Korea’s countercyclical capital buffer is currently set at 0%.

“Capital adequacy is relatively insufficient, and the possibility of a future capital ratio decline is increasing due to recent moves to increase dividends,” it said. Plans are due to be drawn up in the first half of the year, with implementation in the second half.

...

...

The gloomy economic outlook may also weigh on corporate notes. South Korea lowered its economic growth forecast for next year while predicting inflation would stay elevated.

The nation will face challenges in exports and in attracting investments amid a global slowdown and a sluggish semiconductor market, while higher interest rates will limit how much consumer spending recovers, the Finance Ministry said earlier this month.

...

26.12.

Credit-Market Rebound Leaves Korea’s Weaker Firms Lagging Behind

https://finance.yahoo.com/news/credit-market-rebound-leaves-…

The gloomy economic outlook may also weigh on corporate notes. South Korea lowered its economic growth forecast for next year while predicting inflation would stay elevated.

The nation will face challenges in exports and in attracting investments amid a global slowdown and a sluggish semiconductor market, while higher interest rates will limit how much consumer spending recovers, the Finance Ministry said earlier this month.

...

26.12.

Credit-Market Rebound Leaves Korea’s Weaker Firms Lagging Behind

https://finance.yahoo.com/news/credit-market-rebound-leaves-…

8.12.

BOK Able to Supply More Liquidity to Prevent Year-End Crunch

https://finance.yahoo.com/news/bok-ready-more-liquidity-need…

...

The Bank of Korea is ready to provide more liquidity to stabilize short-term money markets if needed, Deputy Governor Lee Sang-hyeong said, as officials seek to head off a year-end cash crunch.

Uncertainty is high as financial institutions typically shift more money around at the end of the year, Lee said in a briefing on Thursday. The BOK would provide the additional infusion via repo transactions, he said.

Although the strains in Korea’s credit market have shown signs of easing in recent days, Lee’s comments underscore the fragility of the recovery. Following the default of a property developer, yields on short-term debt surged to their highest since the global financial crisis.

As part of a bevy of measures authorities in Seoul rushed out to staunch burgeoning meltdown, the BOK said in October it would provide 6 trillion won ($4.6 billion) of liquidity to securities firms and Korea Securities Finance Corp. via repos. Lee’s announcement on Thursday means that sum would increase.

The BOK also plans to conduct two to three repo auctions by the end of this year, starting Monday.

...

BOK Able to Supply More Liquidity to Prevent Year-End Crunch

https://finance.yahoo.com/news/bok-ready-more-liquidity-need…

...

The Bank of Korea is ready to provide more liquidity to stabilize short-term money markets if needed, Deputy Governor Lee Sang-hyeong said, as officials seek to head off a year-end cash crunch.

Uncertainty is high as financial institutions typically shift more money around at the end of the year, Lee said in a briefing on Thursday. The BOK would provide the additional infusion via repo transactions, he said.

Although the strains in Korea’s credit market have shown signs of easing in recent days, Lee’s comments underscore the fragility of the recovery. Following the default of a property developer, yields on short-term debt surged to their highest since the global financial crisis.

As part of a bevy of measures authorities in Seoul rushed out to staunch burgeoning meltdown, the BOK said in October it would provide 6 trillion won ($4.6 billion) of liquidity to securities firms and Korea Securities Finance Corp. via repos. Lee’s announcement on Thursday means that sum would increase.

The BOK also plans to conduct two to three repo auctions by the end of this year, starting Monday.

...

Antwort auf Beitrag Nr.: 68.883.759 von faultcode am 27.07.21 13:50:28hat jemand von hier schon die Dividende erhalten ?

ZAHLTAG

10. November 2022

ZAHLTAG

10. November 2022

...

29.10.

Financial Crisis Haunts Korea as It Confronts a Credit Meltdown

https://news.yahoo.com/crisis-trauma-haunts-korea-confronts-…

...

Past financial crises are haunting South Korean policy makers as they rush to support a local credit market that’s quickly gone from one of the world’s safest to teetering on the brink.

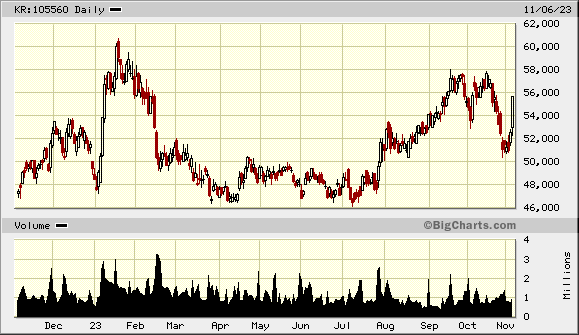

As Korea gets swept into a global debt market rout, corporate treasurers and market regulators in Seoul are staring down one of the most rapid deteriorations in the nation’s credit market ever. The rout is one of the worst in Asia’s local-currency markets amid a broader fixed-income slump this year.

Yields on top-rated five-year Korean corporate debt have spiked 157 basis points in the three months through October, the worst such blowout on record. One particularly alarming development has been yields surging to a 13-year high on local commercial paper, which companies use to raise funds for short-term payments like payroll.

The spike in the cost to borrow in that key money market intensified after a shock default in late September, when the developer of the Legoland Korea theme park in Gangwon Province to the northeast of Seoul missed payment on a kind of commercial paper repackaging loans. The builder’s largest shareholder is Gangwon, underscoring fears that in the new global era of rising interest rates, even borrowers with government backing are vulnerable.

The type of financial engineering involved in that case is called project finance asset-backed commercial paper, or PF-ABCP as the Korean press shorthands it. It’s a key source of funds for the broader property sector.

...

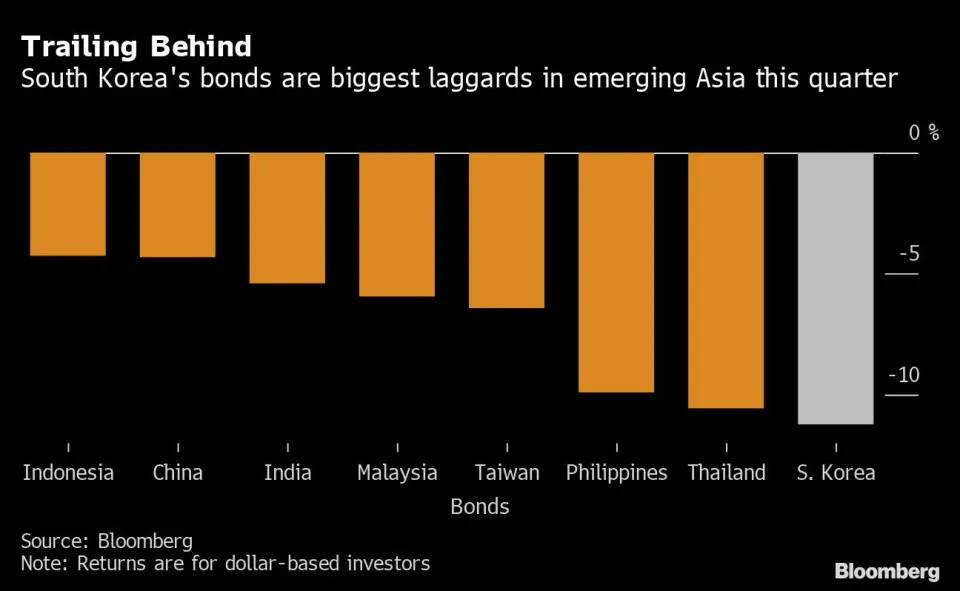

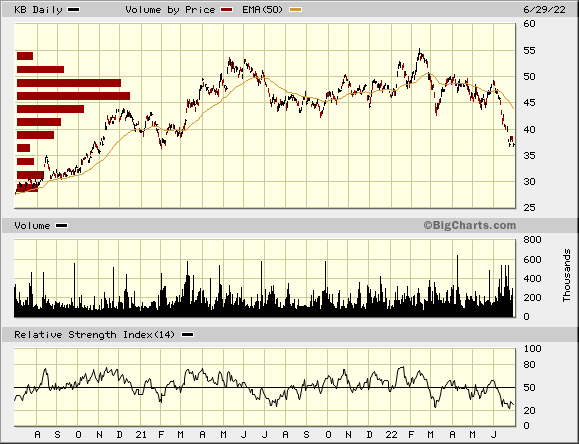

Antwort auf Beitrag Nr.: 71.660.517 von faultcode am 26.05.22 14:28:31

30.6.

Bond Traders Bet Market Has Swung Too Far on Korea Rate Hikes

https://finance.yahoo.com/news/bond-traders-bet-market-swung…

...

Valuations are starting to turn attractive for South Korea bonds amid signs the market has overpriced how much the most hawkish central bank in emerging Asia may raise rates.

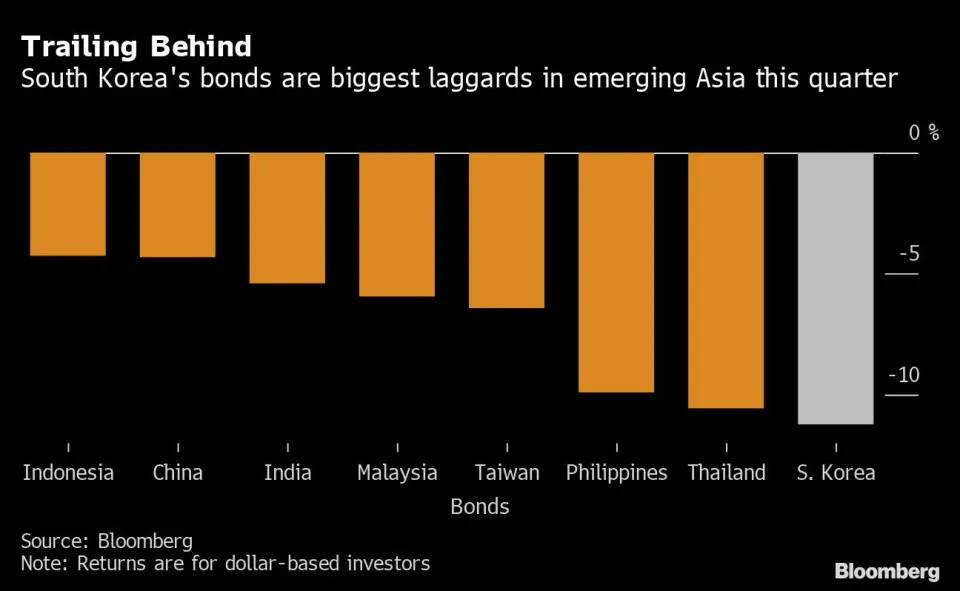

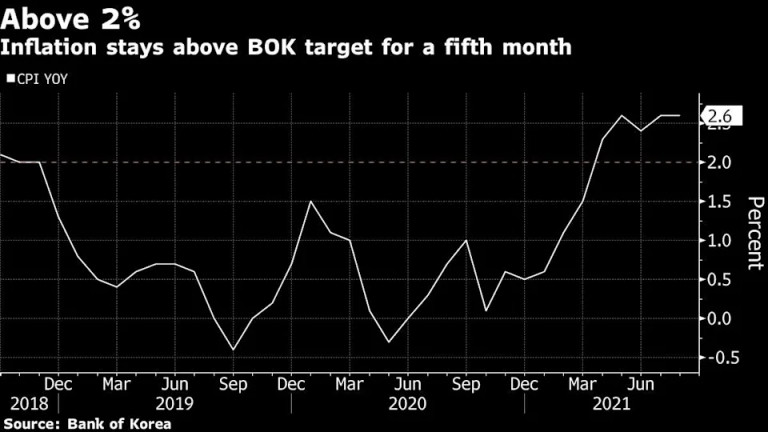

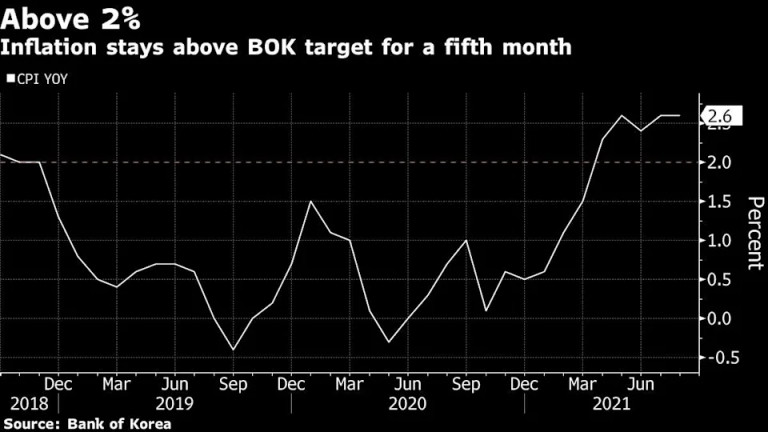

Won forward rates are pricing in about 125 basis points of hikes over the next six months, far above economists’ forecasts for how much the Bank of Korea will move. This points to an improving environment for won bonds, the biggest loser among emerging-Asia’s sovereign debt this quarter as inflation quickened to a 14-year high and bets on rate increases jumped.

Increased flows into Korean debt may help ease pressures on the won, which last week reached a 13-year low. The country is vulnerable to soaring imports exacerbated by a weak currency. It also means that Korean bonds may start to diverge from other emerging markets in Asia, where the risk of interest-rate swaps and yields moving higher is clouding the outlook.

“We see value in Korean government bonds, as the market pricing of the policy rate hikes looks excessive at 25 basis points per meeting for the rest of the year, and as supply dynamics will turn somewhat more favorable in the second half,” said Jin Yang Lee, an investment manager for sovereign debt at abrdn in Singapore.

...

=>

30.6.

Bond Traders Bet Market Has Swung Too Far on Korea Rate Hikes

https://finance.yahoo.com/news/bond-traders-bet-market-swung…

...

Valuations are starting to turn attractive for South Korea bonds amid signs the market has overpriced how much the most hawkish central bank in emerging Asia may raise rates.

Won forward rates are pricing in about 125 basis points of hikes over the next six months, far above economists’ forecasts for how much the Bank of Korea will move. This points to an improving environment for won bonds, the biggest loser among emerging-Asia’s sovereign debt this quarter as inflation quickened to a 14-year high and bets on rate increases jumped.

Increased flows into Korean debt may help ease pressures on the won, which last week reached a 13-year low. The country is vulnerable to soaring imports exacerbated by a weak currency. It also means that Korean bonds may start to diverge from other emerging markets in Asia, where the risk of interest-rate swaps and yields moving higher is clouding the outlook.

“We see value in Korean government bonds, as the market pricing of the policy rate hikes looks excessive at 25 basis points per meeting for the rest of the year, and as supply dynamics will turn somewhat more favorable in the second half,” said Jin Yang Lee, an investment manager for sovereign debt at abrdn in Singapore.

...

=>

26.5.

Südkorea hebt wegen hoher Inflation erneut Zinsen an

https://www.finanzen.net/nachricht/zinsen/suedkorea-hebt-weg…

...

Die Notenbank Südkoreas hat angesichts der hohen Inflation ihre Zinsen erneut angehoben. Der Leitzins steige um 0,25 Prozentpunkte auf 1,75 Prozent, teilte die Bank of Korea am Donnerstag in Seoul nach ihrer Zinssitzung mit. Analysten hatten dies im Schnitt erwartet.

Die Zentralbank begründete ihre fünfte Zinsanhebung seit Mitte 2021 mit dem hohen Preisauftrieb. Der neue Notenbankchef Rhee Chang-yong sprach von einer "präventiven Reaktion" auf die negativen Auswirkungen der Inflation. Das Treffen war die erste Sitzung unter Vorsitz des neuen Zentralbankgouverneurs, der am 25. April sein Amt angetreten hatte.

Die Inflationsprognose für das laufende Jahr wurde auf 4,5 Prozent angehoben. Bei der letzten Prognose war die Notenbank noch von 3,1 Prozent ausgegangen. Sie strebt eine Inflationsrate von zwei Prozent an. Im April hatte die Inflationsrate bei 4,8 Prozent gelegen.

...

Südkorea hebt wegen hoher Inflation erneut Zinsen an

https://www.finanzen.net/nachricht/zinsen/suedkorea-hebt-weg…

...

Die Notenbank Südkoreas hat angesichts der hohen Inflation ihre Zinsen erneut angehoben. Der Leitzins steige um 0,25 Prozentpunkte auf 1,75 Prozent, teilte die Bank of Korea am Donnerstag in Seoul nach ihrer Zinssitzung mit. Analysten hatten dies im Schnitt erwartet.

Die Zentralbank begründete ihre fünfte Zinsanhebung seit Mitte 2021 mit dem hohen Preisauftrieb. Der neue Notenbankchef Rhee Chang-yong sprach von einer "präventiven Reaktion" auf die negativen Auswirkungen der Inflation. Das Treffen war die erste Sitzung unter Vorsitz des neuen Zentralbankgouverneurs, der am 25. April sein Amt angetreten hatte.

Die Inflationsprognose für das laufende Jahr wurde auf 4,5 Prozent angehoben. Bei der letzten Prognose war die Notenbank noch von 3,1 Prozent ausgegangen. Sie strebt eine Inflationsrate von zwei Prozent an. Im April hatte die Inflationsrate bei 4,8 Prozent gelegen.

...

14.4.

Südkorea strafft Geldpolitik wegen hoher Inflation

https://www.finanzen.net/nachricht/zinsen/suedkorea-strafft-…

...

Die Notenbank Südkoreas hat ihre Geldpolitik weiter gestrafft. Der Leitzins steige um 0,25 Prozentpunkte auf 1,5 Prozent, teilte die Bank of Korea am Donnerstag in Seoul nach ihrer Zinssitzung mit. Analysten waren sich im Vorfeld uneinig, ob die Zinsen weiter steigen oder nicht. Die koreanische Notenbank ist für einen eher vorsichtigen, auch auf das Wirtschaftswachstum bedachten Kurs bekannt.

Die Zentralbank begründete ihre vierte Zinsanhebung seit Mitte 2021 mit der hohen Inflation. Aktuell liegt die Inflationsrate bei rund vier Prozent und damit doppelt so hoch wie das Inflationsziel der Zentralbank von zwei Prozent. Es sei davon auszugehen, dass sich die Teuerung auf absehbare Zeit um die Vier-Prozent-Marke herum bewege, erklärten die Währungshüter. Der Ukraine-Krieg treibt derzeit weltweit die Preise, stellt aber auch eine Belastung für die globale Wirtschaft dar.

...

Südkorea strafft Geldpolitik wegen hoher Inflation

https://www.finanzen.net/nachricht/zinsen/suedkorea-strafft-…

...

Die Notenbank Südkoreas hat ihre Geldpolitik weiter gestrafft. Der Leitzins steige um 0,25 Prozentpunkte auf 1,5 Prozent, teilte die Bank of Korea am Donnerstag in Seoul nach ihrer Zinssitzung mit. Analysten waren sich im Vorfeld uneinig, ob die Zinsen weiter steigen oder nicht. Die koreanische Notenbank ist für einen eher vorsichtigen, auch auf das Wirtschaftswachstum bedachten Kurs bekannt.

Die Zentralbank begründete ihre vierte Zinsanhebung seit Mitte 2021 mit der hohen Inflation. Aktuell liegt die Inflationsrate bei rund vier Prozent und damit doppelt so hoch wie das Inflationsziel der Zentralbank von zwei Prozent. Es sei davon auszugehen, dass sich die Teuerung auf absehbare Zeit um die Vier-Prozent-Marke herum bewege, erklärten die Währungshüter. Der Ukraine-Krieg treibt derzeit weltweit die Preise, stellt aber auch eine Belastung für die globale Wirtschaft dar.

...

14.1.

Bank of Korea Flags More Rate Hikes to Come Over Inflation Fears

https://news.yahoo.com/bank-korea-hikes-again-inflation-0155…

...

Bank of Korea Governor Lee Ju-yeol signaled the likelihood of more interest rate increases to come following Friday’s hike, as the central bank clearly put inflation concerns ahead of uncertainties over Covid-19.

Even though the key policy rate, now at 1.25%, is back at pre-pandemic levels, Lee said it was at an accommodative level, adding that another hike still wouldn’t amount to a tightening of policy.

The BOK now expects inflation to stay over 3% for “a considerable time” and it was one of the main driving forces behind the need for higher rates, Lee added.

Still, the timing of the next hike is complicated by the ending of Lee’s term as governor and a presidential election in March.

...

Bank of Korea Flags More Rate Hikes to Come Over Inflation Fears

https://news.yahoo.com/bank-korea-hikes-again-inflation-0155…

...

Bank of Korea Governor Lee Ju-yeol signaled the likelihood of more interest rate increases to come following Friday’s hike, as the central bank clearly put inflation concerns ahead of uncertainties over Covid-19.

Even though the key policy rate, now at 1.25%, is back at pre-pandemic levels, Lee said it was at an accommodative level, adding that another hike still wouldn’t amount to a tightening of policy.

The BOK now expects inflation to stay over 3% for “a considerable time” and it was one of the main driving forces behind the need for higher rates, Lee added.

Still, the timing of the next hike is complicated by the ending of Lee’s term as governor and a presidential election in March.

...

31.12.

Bank of Korea’s Lee Says Recovery, Prices Set Normalization Pace

https://www.bnnbloomberg.ca/bank-of-korea-s-lee-says-recover…

...

The Bank of Korea will continue to adjust policy in line with the economy’s recovery and keep an eye on the risk that high inflation lasts longer, Governor Lee Ju-yeol said in a speech marking the new year.

Following two interest-rate hikes in 2021, the South Korean central bank will watch growth and inflation trends, financial imbalances and changes in global monetary policy as it decides when to reduce accommodation again, Lee said Friday.

“The economy will continue steady growth on the back of exports and investment, but uncertainties surrounding the economy remain high,” Lee said, according to a statement from the BOK. “With the emergence of the new variant, it’s difficult to gauge when the pandemic will end, and there are concerns that high inflation may last longer than expected due to supply disruptions and climate change polices.”

...

Data released earlier Friday showed Korea’s inflation hovered near a decade high in December, underscoring persistent price pressures facing the economy.

South Korea Inflation Exceeds 3% for Third Month in December

In Friday’s statement, Lee also expressed concern over excess debt buildup, an issue that has prompted the BOK to start reining in stimulus in 2021 earlier than most Asian peers.

...

Lee added that financial markets and capital flows could become more volatile as global central banks normalize policy, and called for timely action to stabilize markets.

...

Bank of Korea’s Lee Says Recovery, Prices Set Normalization Pace

https://www.bnnbloomberg.ca/bank-of-korea-s-lee-says-recover…

...

The Bank of Korea will continue to adjust policy in line with the economy’s recovery and keep an eye on the risk that high inflation lasts longer, Governor Lee Ju-yeol said in a speech marking the new year.

Following two interest-rate hikes in 2021, the South Korean central bank will watch growth and inflation trends, financial imbalances and changes in global monetary policy as it decides when to reduce accommodation again, Lee said Friday.

“The economy will continue steady growth on the back of exports and investment, but uncertainties surrounding the economy remain high,” Lee said, according to a statement from the BOK. “With the emergence of the new variant, it’s difficult to gauge when the pandemic will end, and there are concerns that high inflation may last longer than expected due to supply disruptions and climate change polices.”

...

Data released earlier Friday showed Korea’s inflation hovered near a decade high in December, underscoring persistent price pressures facing the economy.

South Korea Inflation Exceeds 3% for Third Month in December

In Friday’s statement, Lee also expressed concern over excess debt buildup, an issue that has prompted the BOK to start reining in stimulus in 2021 earlier than most Asian peers.

...

Lee added that financial markets and capital flows could become more volatile as global central banks normalize policy, and called for timely action to stabilize markets.

...

25.11.

Bank of Korea’s Lee Signals More Hikes Ahead, Avoids Timetable

https://finance.yahoo.com/news/bank-korea-raises-rates-again…

...

Bank of Korea Governor Lee Ju-yeol said interest rates are still accommodative after two hikes since August, suggesting further tightening is in the pipeline as inflation risks mount in the recovering economy.

The board considered the price pressures building in the economy and financial imbalances when it decided to raise rates by 25 basis points to 1% on Thursday, Lee said at a press briefing.

The central bank revised up its inflation outlook to 2.3% for this year and 2% for 2022, expecting price gains will exceed, or at least hover around, its target through next year.

“With this hike, the policy rate is still below the neutral level, the real rate is still negative, and there’s plenty of liquidity,” Lee said. “It’s natural that we normalize the rate, which has been excessively low, as the economy recovers.”

...

Bank of Korea’s Lee Signals More Hikes Ahead, Avoids Timetable

https://finance.yahoo.com/news/bank-korea-raises-rates-again…

...

Bank of Korea Governor Lee Ju-yeol said interest rates are still accommodative after two hikes since August, suggesting further tightening is in the pipeline as inflation risks mount in the recovering economy.

The board considered the price pressures building in the economy and financial imbalances when it decided to raise rates by 25 basis points to 1% on Thursday, Lee said at a press briefing.

The central bank revised up its inflation outlook to 2.3% for this year and 2% for 2022, expecting price gains will exceed, or at least hover around, its target through next year.

“With this hike, the policy rate is still below the neutral level, the real rate is still negative, and there’s plenty of liquidity,” Lee said. “It’s natural that we normalize the rate, which has been excessively low, as the economy recovers.”

...

Antwort auf Beitrag Nr.: 69.154.862 von faultcode am 26.08.21 11:33:27

2.9.

Bank of Korea’s Lee Sees Solid Recovery as Data Beat Estimates

https://finance.yahoo.com/news/bank-korea-lee-sees-solid-012…

2.9.

Bank of Korea’s Lee Sees Solid Recovery as Data Beat Estimates

https://finance.yahoo.com/news/bank-korea-lee-sees-solid-012…

Antwort auf Beitrag Nr.: 68.883.759 von faultcode am 27.07.21 13:50:28so ist es: +0.5%

https://www.godmode-trader.de/artikel/us-techkonzerne-invest…

https://www.godmode-trader.de/artikel/us-techkonzerne-invest…

Antwort auf Beitrag Nr.: 67.552.482 von faultcode am 22.03.21 13:36:16

...

https://www.bloomberg.com/news/articles/2021-07-26/south-kor…

...

https://www.bloomberg.com/news/articles/2021-07-26/south-kor…

Antwort auf Beitrag Nr.: 65.822.544 von faultcode am 24.11.20 12:57:2222.3.

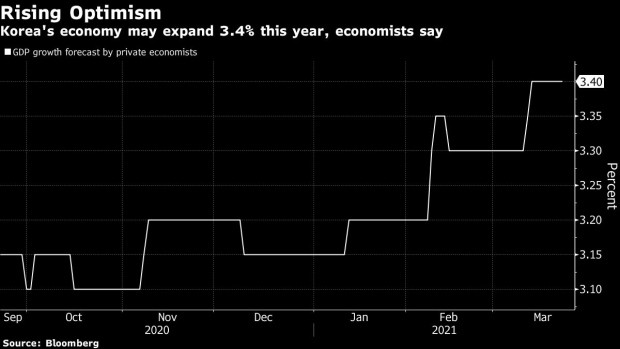

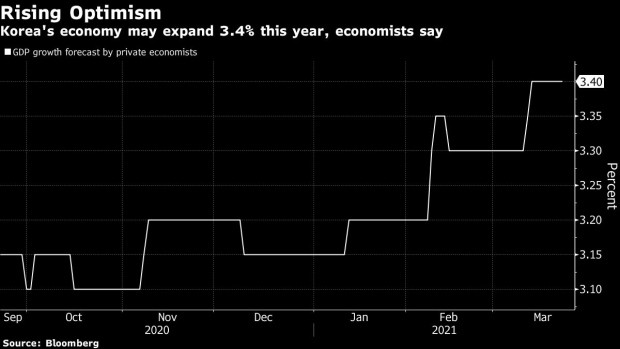

Moon Sees Stronger Korea Recovery in 2021 Than Earlier Expected

• President Moon Jae-in comments in meeting with aides

• Korea to seek ways to boost economy as vaccination proceeds

https://www.bloomberg.com/news/articles/2021-03-22/moon-sees…

...

South Korea’s economy will probably rebound “faster and stronger” this year than earlier expected as exports and investment rise, President Moon Jae-in said.

Moon’s comments Monday reflect his growing confidence in an economic recovery as global trade rebounds and benefits the export-dependent economy. The president also said employment may improve in March above last year’s levels, and noted an uptick in consumption.

Customs office data earlier Monday showed Korean exports are set for another strong monthly rise, as chips and cars helped drive an overall 12.5% gain in shipments in the first 20 days of March.

Moon didn’t give his forecast for economic growth in the meeting with top aides. The Finance Ministry’s latest forecast in December is for a 3.2% expansion in 2021, while the Bank of Korea sees 3% growth.

...

...

Moon Sees Stronger Korea Recovery in 2021 Than Earlier Expected

• President Moon Jae-in comments in meeting with aides

• Korea to seek ways to boost economy as vaccination proceeds

https://www.bloomberg.com/news/articles/2021-03-22/moon-sees…

...

South Korea’s economy will probably rebound “faster and stronger” this year than earlier expected as exports and investment rise, President Moon Jae-in said.

Moon’s comments Monday reflect his growing confidence in an economic recovery as global trade rebounds and benefits the export-dependent economy. The president also said employment may improve in March above last year’s levels, and noted an uptick in consumption.

Customs office data earlier Monday showed Korean exports are set for another strong monthly rise, as chips and cars helped drive an overall 12.5% gain in shipments in the first 20 days of March.

Moon didn’t give his forecast for economic growth in the meeting with top aides. The Finance Ministry’s latest forecast in December is for a 3.2% expansion in 2021, while the Bank of Korea sees 3% growth.

...

...

Antwort auf Beitrag Nr.: 63.226.425 von faultcode am 03.04.20 12:14:11

24.11.

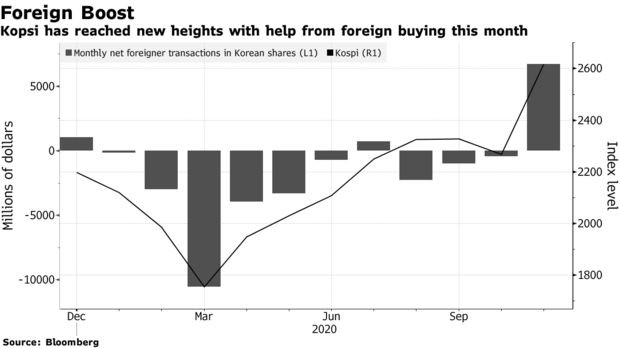

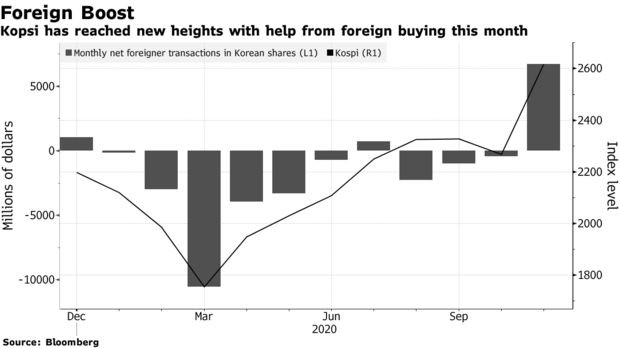

From Asian Loser To Darling: South Korea’s Stocks Win Fund Fans

https://www.bloomberg.com/news/articles/2020-11-24/from-asia…

24.11.

From Asian Loser To Darling: South Korea’s Stocks Win Fund Fans

https://www.bloomberg.com/news/articles/2020-11-24/from-asia…

offenbar lieben Retailer auf der ganzen Welt anti-zyklisches Investieren/Spekulieren:

3.4.

Retail Investors Pump Money MoneyKorean Stocks Like Never Before

https://finance.yahoo.com/news/retail-investors-pump-money-k…

While the pros are shunning Korean stocks, the nation’s mom-and-pops are diving right in.

The benchmark Kospi index has rebounded almost 20% from a low in March, even as foreign and local funds kept fleeing the market, offloading some 24 trillion won ($19.5 billion) net of the gauge’s shares this year. That’s because retail investors -- known as “patriotic ants” for their herd behavior that’s propping up the market -- have been buying at a record pace. They’ve added 22 trillion won net of the equities, including the biggest quarterly additions since Bloomberg began compiling the data in 1997.

Known for their appetite for products ranging from complex structured notes to risky hedge funds, Korea’s individual traders usually favor short-term, speculative bets and account for nearly 60% of Kospi volume, according to NH Investment & Securities Co. The recent Bank of Korea rate cut is now also drawing wealthy investors with a long-term view to the nation’s $1 trillion stock market, Samsung Securities Co. said.

“Most retail investors were speculative traders, but recently I saw many wealthy people coming to the stock market,” said You Seung-Min, chief strategist at Samsung Securities. “Bank of Korea’s 50 basis-point cut seems to have shocked them. The government’s stronger regulations on real estate are pushing them to seek a return from stocks.”

Their favorite pick has been Samsung Electronics Co., the nation’s biggest stock, followed by peer SK Hynix Inc. Both have tumbled 16% this year. On Naver Corp., the nation’s biggest portal website, at least 80 community posts read, “Do you think it’s the right time to buy Samsung Electronics?” or “Samsung will never fail, it’s like a bond.”

“Samsung’s stock is probably a good investment for retail investors, as it is planning to offer about a 3% dividend yield for this year, higher than the interest rate in Korea,” said Chung Chang-won, an analyst at Nomura International Hong Kong Ltd. who noted it has become easier to invest in the shares since a split in 2018.

Korean regulators said in a Thursday statement that retail investors should refrain from “reckless buying” of the nation’s equities, especially with borrowed money. Leveraged investments in the market hit 10.5 trillion won on Feb. 25, the highest since June 2019, according to the latest data from the Korea Financial Investment Association.

“There is at least 1,000 trillion won of floating money in Korea,” Chung said. “They really have nowhere to invest.”

3.4.

Retail Investors Pump Money MoneyKorean Stocks Like Never Before

https://finance.yahoo.com/news/retail-investors-pump-money-k…

While the pros are shunning Korean stocks, the nation’s mom-and-pops are diving right in.

The benchmark Kospi index has rebounded almost 20% from a low in March, even as foreign and local funds kept fleeing the market, offloading some 24 trillion won ($19.5 billion) net of the gauge’s shares this year. That’s because retail investors -- known as “patriotic ants” for their herd behavior that’s propping up the market -- have been buying at a record pace. They’ve added 22 trillion won net of the equities, including the biggest quarterly additions since Bloomberg began compiling the data in 1997.

Known for their appetite for products ranging from complex structured notes to risky hedge funds, Korea’s individual traders usually favor short-term, speculative bets and account for nearly 60% of Kospi volume, according to NH Investment & Securities Co. The recent Bank of Korea rate cut is now also drawing wealthy investors with a long-term view to the nation’s $1 trillion stock market, Samsung Securities Co. said.

“Most retail investors were speculative traders, but recently I saw many wealthy people coming to the stock market,” said You Seung-Min, chief strategist at Samsung Securities. “Bank of Korea’s 50 basis-point cut seems to have shocked them. The government’s stronger regulations on real estate are pushing them to seek a return from stocks.”

Their favorite pick has been Samsung Electronics Co., the nation’s biggest stock, followed by peer SK Hynix Inc. Both have tumbled 16% this year. On Naver Corp., the nation’s biggest portal website, at least 80 community posts read, “Do you think it’s the right time to buy Samsung Electronics?” or “Samsung will never fail, it’s like a bond.”

“Samsung’s stock is probably a good investment for retail investors, as it is planning to offer about a 3% dividend yield for this year, higher than the interest rate in Korea,” said Chung Chang-won, an analyst at Nomura International Hong Kong Ltd. who noted it has become easier to invest in the shares since a split in 2018.

Korean regulators said in a Thursday statement that retail investors should refrain from “reckless buying” of the nation’s equities, especially with borrowed money. Leveraged investments in the market hit 10.5 trillion won on Feb. 25, the highest since June 2019, according to the latest data from the Korea Financial Investment Association.

“There is at least 1,000 trillion won of floating money in Korea,” Chung said. “They really have nowhere to invest.”

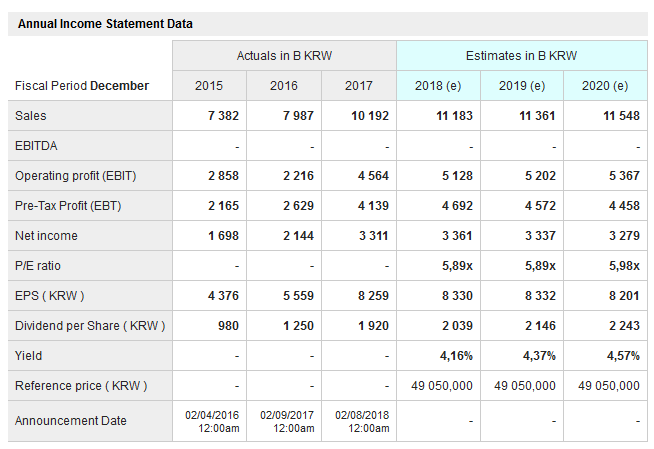

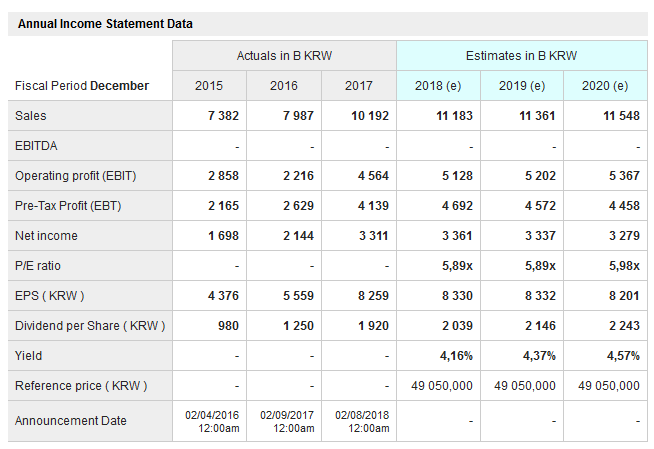

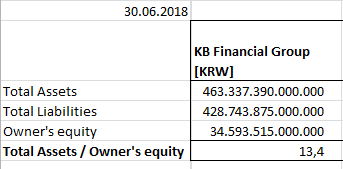

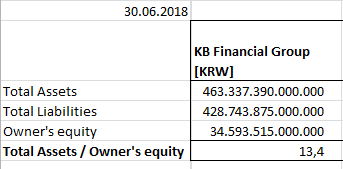

Antwort auf Beitrag Nr.: 62.209.194 von Fmüller am 20.12.19 19:02:07die Brutto-Dividenden-Rendite liegt z.Z. bei so 4%:

https://www.marketscreener.com/KB-FINANCIAL-GROUP-INC-650033…

--> aus dem Form 6-K sieht man die genauen Angaben (hier für FY2018):

Declaration of Dividends

A cash dividend of KRW 1,920 per common share was declared

Total dividend amount: KRW 759,736,452,480

Dividend yield: 4.0%

https://www.sec.gov/Archives/edgar/data/1445930/000119312519…

https://www.kbfg.com/Eng/ir/sec/Current/1/list.jsp?P=1&SEARC…

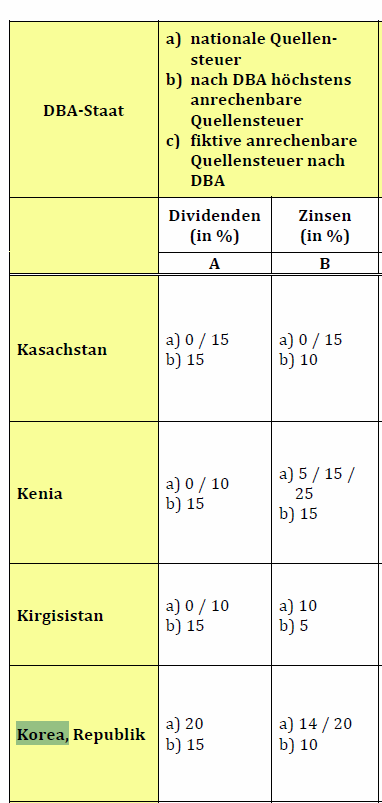

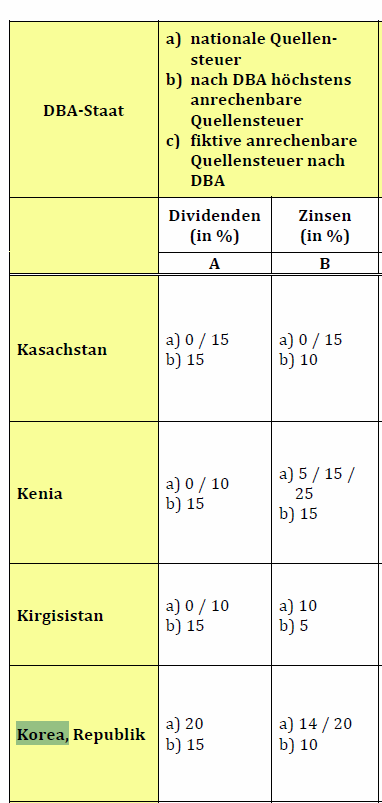

--> ja eine Quellensteuer/Withholding tax auf die Dividende wird einbehalten: 20% in Deutschland

https://www.bzst.de/SharedDocs/Downloads/DE/EU_OECD/anrechen…

https://www.marketscreener.com/KB-FINANCIAL-GROUP-INC-650033…

--> aus dem Form 6-K sieht man die genauen Angaben (hier für FY2018):

Declaration of Dividends

A cash dividend of KRW 1,920 per common share was declared

Total dividend amount: KRW 759,736,452,480

Dividend yield: 4.0%

https://www.sec.gov/Archives/edgar/data/1445930/000119312519…

https://www.kbfg.com/Eng/ir/sec/Current/1/list.jsp?P=1&SEARC…

--> ja eine Quellensteuer/Withholding tax auf die Dividende wird einbehalten: 20% in Deutschland

https://www.bzst.de/SharedDocs/Downloads/DE/EU_OECD/anrechen…

Antwort auf Beitrag Nr.: 62.208.822 von faultcode am 20.12.19 18:18:27Wie viel Dividende zahlen die???? Wollen die Körperschaftssteuer????

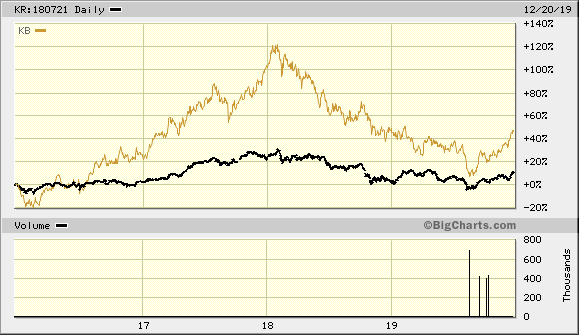

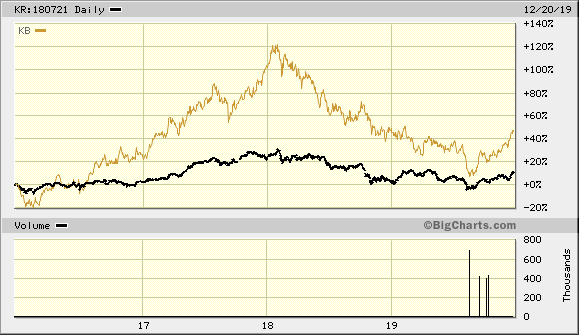

Antwort auf Beitrag Nr.: 61.055.380 von faultcode am 18.07.19 14:07:27hier wird mMn eine China-Erholung gespielt:

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?…

KR:180721 = KOSPI Composite (Kursindex)

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?…

KR:180721 = KOSPI Composite (Kursindex)

Antwort auf Beitrag Nr.: 60.241.839 von faultcode am 31.03.19 23:47:08

https://www.usnews.com/news/business/articles/2019-07-17/sou…

=>

...South Korea's central bank on Thursday cut its policy rate for the first time in three years to shore up growth threatened by a trade dispute with Japan.

The Bank of Korea lowered its key interest rate by a quarter percentage point to 1.50% following a meeting of its monetary policy committee, which also cut its growth forecast for the country's economy this year from 2.5% to 2.2%.

The bank cited slowing exports and domestic investment and volatility in financial markets related to the trade war between the U.S. and China and Japanese curbs on certain technology exports to South Korea. The bank had hiked the rate by 0.25% points in November and last lowered borrowing costs in June 2016.

The bank said in a statement it will "carefully monitor developments such as the U.S.-China trade dispute, Japan's export restrictions, any changes in the economies and monetary policies of major countries ... and geopolitical risks, while examining their effects on domestic growth and inflation."

Lee Ju-yeol, the bank's governor, said South Korea's exports and domestic investment during the first half of the year were more sluggish than expected and that it's "hard to be optimistic about the (economic) conditions moving forward."

The rate cut came amid escalating tensions between South Korea and Japan over Tokyo's move to tighten controls on the exports of photoresists and two other chemicals to South Korean companies that use them to produce semiconductors and display screens for smartphones and TVs.

South Korea says the Japanese trade curbs could hurt its export-dependent economy and disrupt global supply chains. Lee said the bank's monetary policymakers assessed how the trade dispute could affect growth at the macroeconomic level.

South Korea has accused Japan of weaponizing trade to retaliate against South Korean court rulings calling for Japanese companies to compensate aging South Korean plaintiffs for forced labor during World War II, and plans to file a complaint with the World Trade Organization.

Tokyo says the materials affected by the export controls can be sent only to trustworthy trading partners. Without presenting specific examples, it has questioned Seoul's credibility in controlling the exports of arms and items that can be used both for civilian and military purposes.

South Korea is also bracing for the possibility that Japan will take further steps by removing it from a 27-country "whitelist" receiving preferential treatment in trade....

South Korea's Central Bank Lowers Rate Amid Japan Trade Row

17.7.https://www.usnews.com/news/business/articles/2019-07-17/sou…

=>

...South Korea's central bank on Thursday cut its policy rate for the first time in three years to shore up growth threatened by a trade dispute with Japan.

The Bank of Korea lowered its key interest rate by a quarter percentage point to 1.50% following a meeting of its monetary policy committee, which also cut its growth forecast for the country's economy this year from 2.5% to 2.2%.

The bank cited slowing exports and domestic investment and volatility in financial markets related to the trade war between the U.S. and China and Japanese curbs on certain technology exports to South Korea. The bank had hiked the rate by 0.25% points in November and last lowered borrowing costs in June 2016.

The bank said in a statement it will "carefully monitor developments such as the U.S.-China trade dispute, Japan's export restrictions, any changes in the economies and monetary policies of major countries ... and geopolitical risks, while examining their effects on domestic growth and inflation."

Lee Ju-yeol, the bank's governor, said South Korea's exports and domestic investment during the first half of the year were more sluggish than expected and that it's "hard to be optimistic about the (economic) conditions moving forward."

The rate cut came amid escalating tensions between South Korea and Japan over Tokyo's move to tighten controls on the exports of photoresists and two other chemicals to South Korean companies that use them to produce semiconductors and display screens for smartphones and TVs.

South Korea says the Japanese trade curbs could hurt its export-dependent economy and disrupt global supply chains. Lee said the bank's monetary policymakers assessed how the trade dispute could affect growth at the macroeconomic level.

South Korea has accused Japan of weaponizing trade to retaliate against South Korean court rulings calling for Japanese companies to compensate aging South Korean plaintiffs for forced labor during World War II, and plans to file a complaint with the World Trade Organization.

Tokyo says the materials affected by the export controls can be sent only to trustworthy trading partners. Without presenting specific examples, it has questioned Seoul's credibility in controlling the exports of arms and items that can be used both for civilian and military purposes.

South Korea is also bracing for the possibility that Japan will take further steps by removing it from a 27-country "whitelist" receiving preferential treatment in trade....

South Korea Producer Price Index (PPI), 2009-2019

.

aus: WSJ, The Daily Shot

=> das sieht nicht gut aus...

Antwort auf Beitrag Nr.: 57.981.114 von faultcode am 13.06.18 23:44:12Hintergrund: https://www.wallstreet-online.de/diskussion/1086090-92061-92…

=>

=> geht so...

=>

=> geht so...