BMA NOTICE: Rosen Law Firm Continues to Investigate Securities Claims Against Banco Macro S.A. – BMA - Die letzten 30 Beiträge | Diskussion im Forum

eröffnet am 01.09.18 14:57:41 von

neuester Beitrag 05.01.24 13:44:37 von

neuester Beitrag 05.01.24 13:44:37 von

Beiträge: 67

ID: 1.287.506

ID: 1.287.506

Aufrufe heute: 0

Gesamt: 2.367

Gesamt: 2.367

Aktive User: 0

ISIN: US05961W1053 · WKN: A0JJT4 · Symbol: B4W

59,00

EUR

0,00 %

0,00 EUR

Letzter Kurs 13:14:25 Tradegate

Neuigkeiten

15.12.23 · wallstreetONLINE NewsUpdate |

15.12.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 40,00 | +300,00 | |

| 0,6550 | +43,17 | |

| 1,4600 | +43,14 | |

| 4,5000 | +20,00 | |

| 5,9000 | +15,69 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 30,85 | -9,93 | |

| 14,750 | -14,14 | |

| 0,7200 | -14,29 | |

| 1.138,25 | -16,86 | |

| 1,0750 | -21,82 |

Beitrag zu dieser Diskussion schreiben

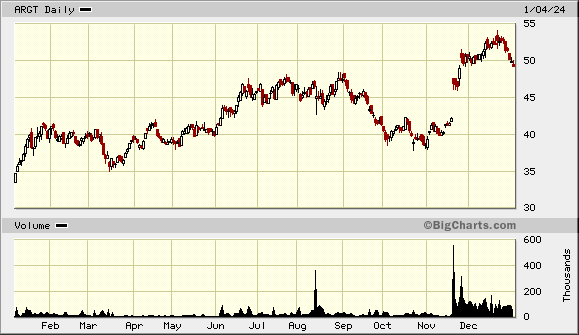

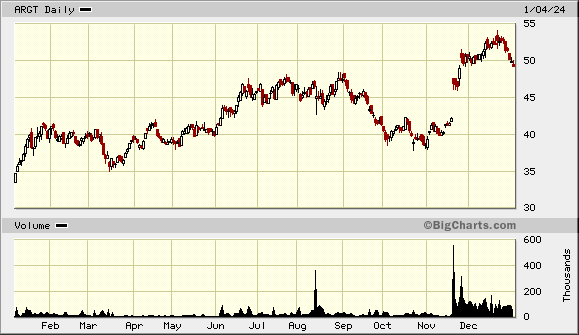

$ARGT-ETF in U.S. dollar:

4.1.

Best ETF in the World Faces Crucial Test With Milei’s Argentina Overhaul Under Fire

https://finance.yahoo.com/news/best-etf-world-faces-crucial-…

...

The Global X MSCI Argentina ETF was the best-performing single-country equity ETF in the world in 2023, with returns of 53%, data compiled by Bloomberg show.

The fund, one of the main securities for investors interested in putting money in a country where access to local markets is complicated by capital controls, saw assets jump four-fold in the past year, to $124 million.

The ETF attracted about $30 million of inflows in December alone, the most since its launch in 2011, as Milei took office and announced a slate of measures to shrink the state and try to stem inflation that’s running at 160% a year. Investors, who poured another $2 million into ARGT on the first US trading session of 2024, see additional gains hinging on his ability to push through a contentious reform agenda with little support in congress.

“There’s upside if things stay on track,” said Greg Lesko, managing director at Deltec Asset Management LLC in New York. “Protests and the courts will be a challenge.”

...

4.1.

Best ETF in the World Faces Crucial Test With Milei’s Argentina Overhaul Under Fire

https://finance.yahoo.com/news/best-etf-world-faces-crucial-…

...

The Global X MSCI Argentina ETF was the best-performing single-country equity ETF in the world in 2023, with returns of 53%, data compiled by Bloomberg show.

The fund, one of the main securities for investors interested in putting money in a country where access to local markets is complicated by capital controls, saw assets jump four-fold in the past year, to $124 million.

The ETF attracted about $30 million of inflows in December alone, the most since its launch in 2011, as Milei took office and announced a slate of measures to shrink the state and try to stem inflation that’s running at 160% a year. Investors, who poured another $2 million into ARGT on the first US trading session of 2024, see additional gains hinging on his ability to push through a contentious reform agenda with little support in congress.

“There’s upside if things stay on track,” said Greg Lesko, managing director at Deltec Asset Management LLC in New York. “Protests and the courts will be a challenge.”

...

28.12.

Argentina’s First ‘Reconstruction’ Bond Sale to Importers Flops

https://finance.yahoo.com/news/argentina-first-reconstructio…

...

The Argentine Central Bank’s first auction to pay down importers’ debts owed to suppliers abroad flopped Thursday as the monetary authority only sold a fraction of the total it had offered.

...

The central bank reported that it sold just $68 million after receiving 34 offers from Argentine importers when it previously announced a maximum of $750 million in notes available. Bloomberg reported the sum earlier Thursday. Importers bought the bonds first, but have the right to resell most of the notes in the secondary market to other investors.

In a statement, central bank officials anticipated that “the volume of participation will go up,” as the bank “continues clarifying the operative processes for subscription and required documentation.”

The auction results mark Milei’s first setback in markets after a relatively successful currency devaluation followed by a record sale of peso debt, build up of foreign reserves and dollar bond rally. Clearing away the $30 billion importers owe abroad is a key step before Milei’s administration can remove byzantine financial controls it inherited from the previous government. The bonds serve another purpose too of mopping up peso liquidity that could stoke inflation already above 160%.

“The instrument is very important for the exchange rate unification of Argentina, because it helps to normalize the debt stocks of importers and serves as a mechanism to absorb pesos from the economy,” said Pedro Siaba Serrate, a senior economist with PP Inversiones in Buenos Aires. “If the government wants to achieve exchange rate unification, this should work better.”

...

Argentina’s First ‘Reconstruction’ Bond Sale to Importers Flops

https://finance.yahoo.com/news/argentina-first-reconstructio…

...

The Argentine Central Bank’s first auction to pay down importers’ debts owed to suppliers abroad flopped Thursday as the monetary authority only sold a fraction of the total it had offered.

...

The central bank reported that it sold just $68 million after receiving 34 offers from Argentine importers when it previously announced a maximum of $750 million in notes available. Bloomberg reported the sum earlier Thursday. Importers bought the bonds first, but have the right to resell most of the notes in the secondary market to other investors.

In a statement, central bank officials anticipated that “the volume of participation will go up,” as the bank “continues clarifying the operative processes for subscription and required documentation.”

The auction results mark Milei’s first setback in markets after a relatively successful currency devaluation followed by a record sale of peso debt, build up of foreign reserves and dollar bond rally. Clearing away the $30 billion importers owe abroad is a key step before Milei’s administration can remove byzantine financial controls it inherited from the previous government. The bonds serve another purpose too of mopping up peso liquidity that could stoke inflation already above 160%.

“The instrument is very important for the exchange rate unification of Argentina, because it helps to normalize the debt stocks of importers and serves as a mechanism to absorb pesos from the economy,” said Pedro Siaba Serrate, a senior economist with PP Inversiones in Buenos Aires. “If the government wants to achieve exchange rate unification, this should work better.”

...

...

Ungeachtet der Proteste begann die neue Regierung des ultraliberalen Präsidenten Javier Milei mit dem Umbau der bislang streng regulierten Wirtschaft. »Wir leiten die wirtschaftliche Deregulierung ein, die Argentinien so dringend braucht«, sagte Milei am Mittwoch in einer Fernsehansprache und kündigte ein Dekret mit insgesamt 300 Maßnahmen an.

Unter anderem sollen zahlreiche Gesetze beispielsweise zur Regulierung des Arbeits- und Immobilienmarkts aufgehoben werden. Zudem werden alle Staatsbetriebe in Aktiengesellschaften überführt, um sie später zu privatisieren.

...

21.12.

Geplanter Umbau der Wirtschaft: Tausende Argentinier demonstrieren gegen neuen Präsidenten Milei

https://www.spiegel.de/ausland/argentinien-tausende-demonstr…

...

Ungeachtet der Proteste begann die neue Regierung des ultraliberalen Präsidenten Javier Milei mit dem Umbau der bislang streng regulierten Wirtschaft. »Wir leiten die wirtschaftliche Deregulierung ein, die Argentinien so dringend braucht«, sagte Milei am Mittwoch in einer Fernsehansprache und kündigte ein Dekret mit insgesamt 300 Maßnahmen an.

Unter anderem sollen zahlreiche Gesetze beispielsweise zur Regulierung des Arbeits- und Immobilienmarkts aufgehoben werden. Zudem werden alle Staatsbetriebe in Aktiengesellschaften überführt, um sie später zu privatisieren.

...

21.12.

Geplanter Umbau der Wirtschaft: Tausende Argentinier demonstrieren gegen neuen Präsidenten Milei

https://www.spiegel.de/ausland/argentinien-tausende-demonstr…

...

der aktuelle Wirtschaftsminister:

13.12.

‘There Is No Money’: Argentina Begins Economic Shock Remedy

https://finance.yahoo.com/news/no-more-money-argentina-begin…

...

Economy chief Luis Caputo spent the better part of his first televised address explaining how Argentina got into such a dire economic situation: An “addiction” to debt, for which the only medicine is a shock treatment.

“There is no more money,” Caputo said repeatedly in the recorded video published Tuesday night, echoing President Javier Milei’s words during his inaugural speech on Sunday.

The Wall Street veteran then outlined 10 initial measures designed to jolt the stagnant economy, starting with a massive 54% devaluation of the peso’s official exchange rate and austerity measures including halving the number of ministries, cutting transfers to provinces, suspending public works and reducing subsidies.

Total spending cuts will amount to 2.9% of gross domestic product, a senior government official said later. The goal is to eliminate the primary budget deficit, which doesn’t take into account interest payments, by the end of 2024.

The International Monetary Fund praised the government’s “bold initial actions” and many investors welcomed the measures as steps in the right direction. Yet many also remained skeptical, considering the moves either insufficient or hard to implement — or both.

...

13.12.

‘There Is No Money’: Argentina Begins Economic Shock Remedy

https://finance.yahoo.com/news/no-more-money-argentina-begin…

...

Economy chief Luis Caputo spent the better part of his first televised address explaining how Argentina got into such a dire economic situation: An “addiction” to debt, for which the only medicine is a shock treatment.

“There is no more money,” Caputo said repeatedly in the recorded video published Tuesday night, echoing President Javier Milei’s words during his inaugural speech on Sunday.

The Wall Street veteran then outlined 10 initial measures designed to jolt the stagnant economy, starting with a massive 54% devaluation of the peso’s official exchange rate and austerity measures including halving the number of ministries, cutting transfers to provinces, suspending public works and reducing subsidies.

Total spending cuts will amount to 2.9% of gross domestic product, a senior government official said later. The goal is to eliminate the primary budget deficit, which doesn’t take into account interest payments, by the end of 2024.

The International Monetary Fund praised the government’s “bold initial actions” and many investors welcomed the measures as steps in the right direction. Yet many also remained skeptical, considering the moves either insufficient or hard to implement — or both.

...

10.12.

In inaugural speech, Argentina's Javier Milei prepares nation for painful shock adjustment

https://www.msn.com/en-us/news/world/in-inaugural-speech-arg…

...

Rather, Argentina's newly empowered President Javier Milei presented figures to lay bare the scope of the nation's economic “emergency,” and sought to prepare the public for a shock adjustment with drastic public spending cuts.

...

“We don’t have margin for sterile discussions. Our country demands action, and immediate action," he said. "The political class left the country at the brink of its biggest crisis in history. We don’t desire the hard decisions that will need to be made in coming weeks, but lamentably they didn't leave us any option.”

...

In inaugural speech, Argentina's Javier Milei prepares nation for painful shock adjustment

https://www.msn.com/en-us/news/world/in-inaugural-speech-arg…

...

Rather, Argentina's newly empowered President Javier Milei presented figures to lay bare the scope of the nation's economic “emergency,” and sought to prepare the public for a shock adjustment with drastic public spending cuts.

...

“We don’t have margin for sterile discussions. Our country demands action, and immediate action," he said. "The political class left the country at the brink of its biggest crisis in history. We don’t desire the hard decisions that will need to be made in coming weeks, but lamentably they didn't leave us any option.”

...

21.11.

Milei’s Dollarization Gets First Test as Argentine Banks Reopen

https://finance.yahoo.com/news/milei-dollarization-gets-firs…

...

Javier Milei couldn’t have hoped for a better reception from investors on his first day as Argentina’s president-elect.

On Wall Street, the country’s stocks soared the most in at least a decade and bonds climbed on optimism that he might be able to fix the beleaguered economy and tame inflation. The corporate world was also elated, with chief executives from MercadoLibre Inc. and Globant SA joining Elon Musk to note their approval.

Day two is going to be a lot tougher. Tuesday will see the reopening of local markets and banks after a holiday weekend, and concern is growing about the potential for a wave of Argentines withdrawing pesos to buy dollars. While banks took steps to ensure they’d have enough cash on hand in the run-up to the vote, executives are telling regulators in private conversations that they may need additional help to shore up the system.

“Tomorrow’s gonna be the day that we see the tone,” Hans Humes, the chief executive officer of Greylock Capital, said in an interview on Bloomberg Television on Monday.

...

Milei’s Dollarization Gets First Test as Argentine Banks Reopen

https://finance.yahoo.com/news/milei-dollarization-gets-firs…

...

Javier Milei couldn’t have hoped for a better reception from investors on his first day as Argentina’s president-elect.

On Wall Street, the country’s stocks soared the most in at least a decade and bonds climbed on optimism that he might be able to fix the beleaguered economy and tame inflation. The corporate world was also elated, with chief executives from MercadoLibre Inc. and Globant SA joining Elon Musk to note their approval.

Day two is going to be a lot tougher. Tuesday will see the reopening of local markets and banks after a holiday weekend, and concern is growing about the potential for a wave of Argentines withdrawing pesos to buy dollars. While banks took steps to ensure they’d have enough cash on hand in the run-up to the vote, executives are telling regulators in private conversations that they may need additional help to shore up the system.

“Tomorrow’s gonna be the day that we see the tone,” Hans Humes, the chief executive officer of Greylock Capital, said in an interview on Bloomberg Television on Monday.

...

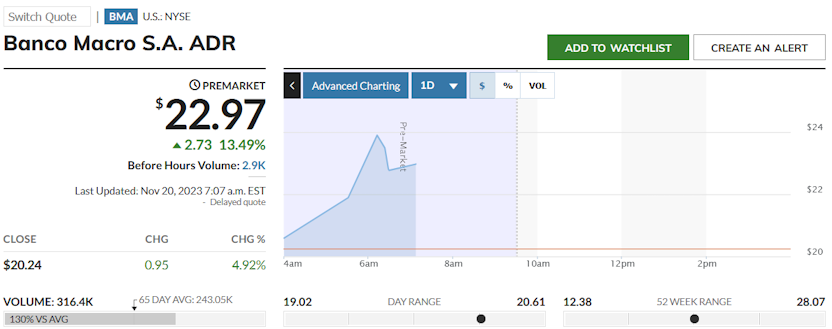

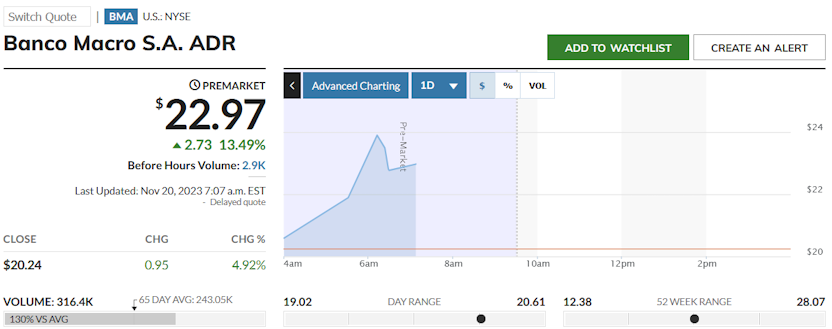

Antwort auf Beitrag Nr.: 74.834.064 von faultcode am 20.11.23 13:22:15

20.11.

Argentina Investors Cheer Milei Victory, Brace for Peso Selloff

https://www.bnnbloomberg.ca/argentina-investors-cheer-milei-…

...

Argentina investors cheered libertarian economist Javier Milei’s bigger-than-expected win in Sunday’s presidential vote and his pledges to usher in a radical remake of South America’s second-largest economy.

Sovereign dollar bonds and US-listed stocks of Argentine companies gained on Monday, as traders weighed the maverick outsider’s chances of turning around policies that have the country headed to its sixth recession in a decade with 140% inflation.

...

“This is the opportunity for a new beginning,” said Jorge Piedrahita, founder of Gear Capital Management in New York.

The peso is set to weaken in parallel markets used to skirt currency controls, reflecting Milei’s plan to replace it with the dollar. On Sunday, it fell to about 1,000 per dollar on local cryptocurrency exchanges. That was an 8% decline from Friday’s price of about 920 per dollar. Local markets are closed Monday for a national holiday.

“The peso is likely to remain under significant pressure,” said Leandro Galli, an emerging-market debt portfolio manager at JP Morgan Asset Management. “The FX gap between market-based measures and the official exchange rate is likely to narrow, which could lead to an acceleration of inflation in the coming year.”

JP Morgan Asset Management’s Galli said this opens the door for a “potentially more draconian fiscal consolidation plan and reforms,” which may provide some support to the nation’s dollar bonds. However, upside is limited by concerns regarding the transition, governability and implementation risks.

...

=>

Argentina Investors Cheer Milei Victory, Brace for Peso Selloff

https://www.bnnbloomberg.ca/argentina-investors-cheer-milei-…

...

Argentina investors cheered libertarian economist Javier Milei’s bigger-than-expected win in Sunday’s presidential vote and his pledges to usher in a radical remake of South America’s second-largest economy.

Sovereign dollar bonds and US-listed stocks of Argentine companies gained on Monday, as traders weighed the maverick outsider’s chances of turning around policies that have the country headed to its sixth recession in a decade with 140% inflation.

...

“This is the opportunity for a new beginning,” said Jorge Piedrahita, founder of Gear Capital Management in New York.

The peso is set to weaken in parallel markets used to skirt currency controls, reflecting Milei’s plan to replace it with the dollar. On Sunday, it fell to about 1,000 per dollar on local cryptocurrency exchanges. That was an 8% decline from Friday’s price of about 920 per dollar. Local markets are closed Monday for a national holiday.

“The peso is likely to remain under significant pressure,” said Leandro Galli, an emerging-market debt portfolio manager at JP Morgan Asset Management. “The FX gap between market-based measures and the official exchange rate is likely to narrow, which could lead to an acceleration of inflation in the coming year.”

JP Morgan Asset Management’s Galli said this opens the door for a “potentially more draconian fiscal consolidation plan and reforms,” which may provide some support to the nation’s dollar bonds. However, upside is limited by concerns regarding the transition, governability and implementation risks.

...

=>

https://tradingeconomics.com/argentina/stock-market

=> Aktien schützen vor Inflation, aber nur im Schnitt und eigentlich nur Standardwerte

23.10.

Argentina Assets Brace for Selloff After Massa Forces Runoff

https://news.yahoo.com/argentina-markets-brace-selloff-massa…

...

Argentina investors again braced for a selloff after Economy Minister Sergio Massa did better than forecast in Sunday’s presidential vote, dashing hopes for an outright win by a more market-friendly candidate.

The country’s dollar bonds — already trading below 30 cents on the dollar — extended their losses on Monday, with five of them including the 2029 note figuring among the worst performers in emerging markets. The peso may weaken on parallel currency markets used to skirt controls on the expectation Argentines will rush into dollars as the government continues spending policies that are seen stoking inflation already running over 130%.

Massa surprised pundits Sunday night by taking 37% of the vote, forcing a second-round ballot next month with runner-up Javier Milei, the firebrand libertarian outsider who got 30% support with 97% of votes counted. The biggest question for investors is who backers of third-place candidate Patricia Bullrich migrate to in the Nov. 19 runoff.

...

Argentina Assets Brace for Selloff After Massa Forces Runoff

https://news.yahoo.com/argentina-markets-brace-selloff-massa…

...

Argentina investors again braced for a selloff after Economy Minister Sergio Massa did better than forecast in Sunday’s presidential vote, dashing hopes for an outright win by a more market-friendly candidate.

The country’s dollar bonds — already trading below 30 cents on the dollar — extended their losses on Monday, with five of them including the 2029 note figuring among the worst performers in emerging markets. The peso may weaken on parallel currency markets used to skirt controls on the expectation Argentines will rush into dollars as the government continues spending policies that are seen stoking inflation already running over 130%.

Massa surprised pundits Sunday night by taking 37% of the vote, forcing a second-round ballot next month with runner-up Javier Milei, the firebrand libertarian outsider who got 30% support with 97% of votes counted. The biggest question for investors is who backers of third-place candidate Patricia Bullrich migrate to in the Nov. 19 runoff.

...

10.10.

Argentina’s Black Market Peso Rate Tops 1,000 Per Dollar

https://news.yahoo.com/argentina-black-market-peso-rate-1512…

...

Argentina’s black market exchange rate hit a record 1,040 pesos per dollar Tuesday, continuing a sharp selloff as Argentines rush to buy greenbacks before the Oct. 22 presidential election.

The rate, known locally as the “dollar blue,” was near half that level as recently as July, highlighting the panic that’s gripping markets and population at large as inflation surges above 120% while frontrunner Javier Milei advocates replacing the peso with the US dollar as the nation’s currency.

Even a week ago, the illegal rate closed at 800 per dollar, according to data tracked by websites DolarHoy.com and Ambito. Argentine Finance Secretary Eduardo Setti downplayed the peso’s selloff in the black market Tuesday, noting the illegal rate often trails other parallel rates instead of being out in front.

“It’s evident there’s just four guys operating illegally to create fear and uncertainty about people’s savings,” Setti posted on X, the social media platform formerly known as Twitter.

Amid the currency selloff, the government’s tax authority AFIP took the dramatic step of closing the cargo terminal at Argentina’s main international airport for 72 hours to investigate “irregularities.” While official statements made no mention about the peso’s fall, Argentina is running out of dollars to pay for imports, while strict currency controls encourage business to under-report exports.

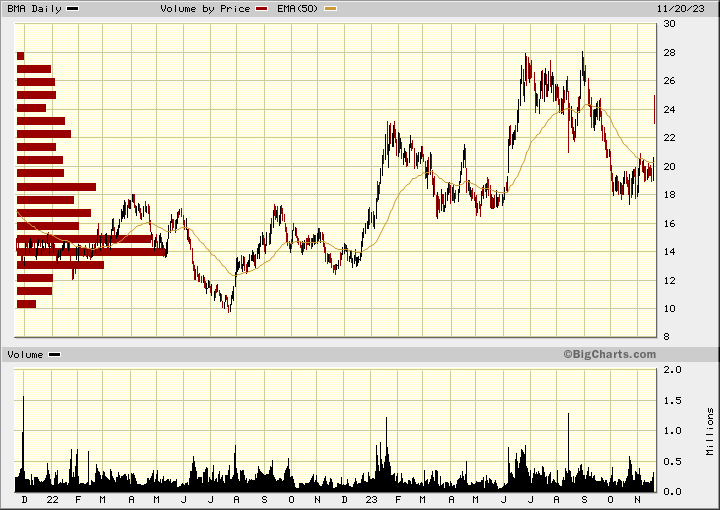

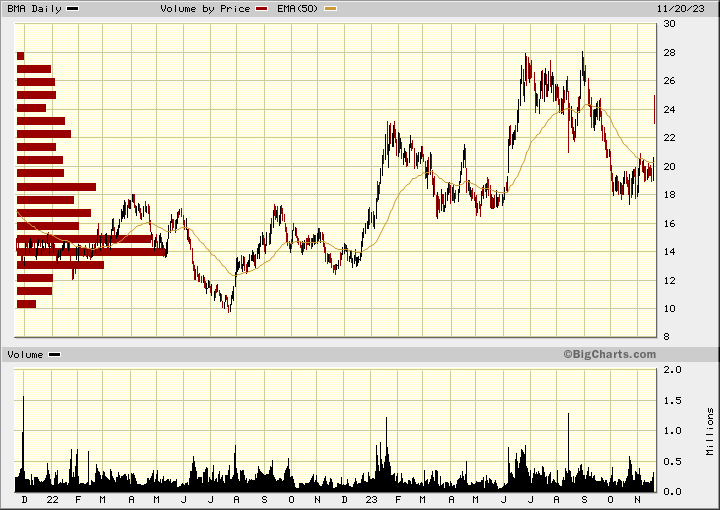

The slump sent Argentina’s Merval stock index higher as investors sought assets that would track inflation higher. Argentina-listed shares for steel manufacturer Ternium climbed as much as 17%, while Argentine banking stocks including Grupo Galicia, BBVA Argentina and Banco Macro edged higher.

Official inflation data will be published Thursday with economists surveyed by Bloomberg forecasting an annual rate of 135%, which would be the fastest since Argentina exited hyperinflation in the early 1990s.

...

ansonsten:

Argentina’s Black Market Peso Rate Tops 1,000 Per Dollar

https://news.yahoo.com/argentina-black-market-peso-rate-1512…

...

Argentina’s black market exchange rate hit a record 1,040 pesos per dollar Tuesday, continuing a sharp selloff as Argentines rush to buy greenbacks before the Oct. 22 presidential election.

The rate, known locally as the “dollar blue,” was near half that level as recently as July, highlighting the panic that’s gripping markets and population at large as inflation surges above 120% while frontrunner Javier Milei advocates replacing the peso with the US dollar as the nation’s currency.

Even a week ago, the illegal rate closed at 800 per dollar, according to data tracked by websites DolarHoy.com and Ambito. Argentine Finance Secretary Eduardo Setti downplayed the peso’s selloff in the black market Tuesday, noting the illegal rate often trails other parallel rates instead of being out in front.

“It’s evident there’s just four guys operating illegally to create fear and uncertainty about people’s savings,” Setti posted on X, the social media platform formerly known as Twitter.

Amid the currency selloff, the government’s tax authority AFIP took the dramatic step of closing the cargo terminal at Argentina’s main international airport for 72 hours to investigate “irregularities.” While official statements made no mention about the peso’s fall, Argentina is running out of dollars to pay for imports, while strict currency controls encourage business to under-report exports.

The slump sent Argentina’s Merval stock index higher as investors sought assets that would track inflation higher. Argentina-listed shares for steel manufacturer Ternium climbed as much as 17%, while Argentine banking stocks including Grupo Galicia, BBVA Argentina and Banco Macro edged higher.

Official inflation data will be published Thursday with economists surveyed by Bloomberg forecasting an annual rate of 135%, which would be the fastest since Argentina exited hyperinflation in the early 1990s.

...

ansonsten:

14.8.

Argentine Presidential Primary Voters Propel Far-Right Outsider to Surprise Win

Javier Milei has pledged to dissolve central bank, slash spending in a country hammered by inflation, poverty and a moribund economy

https://www.wsj.com/articles/argentine-presidential-primary-…

...

Javier Milei, a far-right outsider in Argentina who has pledged to close ministries and slash spending if elected president, rocked the political establishment Sunday by beating out conservatives and the ruling Peronist coalition in a primary vote ahead of October’s elections.

...

=>

Argentine Presidential Primary Voters Propel Far-Right Outsider to Surprise Win

Javier Milei has pledged to dissolve central bank, slash spending in a country hammered by inflation, poverty and a moribund economy

https://www.wsj.com/articles/argentine-presidential-primary-…

...

Javier Milei, a far-right outsider in Argentina who has pledged to close ministries and slash spending if elected president, rocked the political establishment Sunday by beating out conservatives and the ruling Peronist coalition in a primary vote ahead of October’s elections.

...

=>

17.7.

Argentina Bonds Jump After Opposition Wins Province Primary Vote

https://news.yahoo.com/argentina-bonds-jump-opposition-wins-…

...

The results signal high disapproval for the ruling Peronist coalition and show voters are angling to install the more business-friendly coalition, known in Spanish as Juntos por el Cambio, after the presidential elections this October.

“The elections in Santa Fe show Juntos por el Cambio could potentially perform better than what polls seem to be showing,” said Pilar Tavella, an economist at Barclays in New York.>

...

Antwort auf Beitrag Nr.: 74.033.457 von faultcode am 20.06.23 20:31:13wenn die Aktie der Deutschen Bank fundamental so bewertet werden würde wie eine $BMA (z.B. KGV 2023e, S&P Global Market Intelligence), dann würde sie locker bei über 30 Euro stehen und nicht bei lausigen 9,326

ansonsten:

6.6.

UPDATE 2-Brazil's Itau Unibanco in talks with Banco Macro to sell Argentina ops

https://www.reuters.com/article/itau-unibco-hldg-ma-banco-ma…

...

SAO PAULO, June 6 (Reuters) - Brazil’s largest private lender Itau Unibanco is in talks with Banco Macro SA to sell its operations in Argentina, the lender said on Tuesday, a move that comes as the neighboring country grapples with a severe economic crisis.

Itau disclosed the “preliminary talks” in a securities filing, touting Macro as “one of the main private banks in Argentina with an extensive network of branches,” but noted that no binding agreement had been reached so far.

...

ansonsten:

6.6.

UPDATE 2-Brazil's Itau Unibanco in talks with Banco Macro to sell Argentina ops

https://www.reuters.com/article/itau-unibco-hldg-ma-banco-ma…

...

SAO PAULO, June 6 (Reuters) - Brazil’s largest private lender Itau Unibanco is in talks with Banco Macro SA to sell its operations in Argentina, the lender said on Tuesday, a move that comes as the neighboring country grapples with a severe economic crisis.

Itau disclosed the “preliminary talks” in a securities filing, touting Macro as “one of the main private banks in Argentina with an extensive network of branches,” but noted that no binding agreement had been reached so far.

...

"emerging markets rally" 😜

24.4.

Argentina Economy Stagnated as Inflation Surged Past 100%

https://finance.yahoo.com/news/argentina-economy-stagnated-i…

...

Argentina’s economy stagnated in February as inflation surpassed 100% for the first time in three decades and a record drought began to take a heavy toll on industries tied to agriculture.

...

Economists surveyed by Argentina’s central bank in March forecast gross domestic product contracting 2.7% this year, with sequential declines in the first and second quarters. The economy shrank in the final quarter of last year too. It would be Argentina’s sixth recession in the past 10 years.

...

Daher weht der Wind offenbar:

22.1.

Brasilien und Argentinien wollen angeblich erneut gemeinsame Währung prüfen

Die gemeinsame Währung könnte laut einem Medienbericht „sur“ heißen. Neben Brasilien und Argentinien wäre auch eine Erweiterung auf weitere Staaten in Südamerika denkbar.

https://www.handelsblatt.com/politik/international/suedameri…

...

Brasilien und Argentinien werden laut „Financial Times“ (FT) in den nächsten Tagen den Start von Vorarbeiten für eine gemeinsame Währung verkünden. Das berichtete die Zeitung am Sonntag und berief sich dabei auf Regierungsvertreter der beiden südamerikanischen Staaten.

Der Plan solle in der neuen Woche bei einem Gipfeltreffen in der argentinischen Hauptstadt Buenos Aires diskutiert werden. Es werde erörtert, wie die neue Währung den Handel in der Region verstärken und die Abhängigkeit vom amerikanischen Dollar verringern könne. Brasilien will die neue Währung „sur“ (Süden) nennen.

Der argentinische Wirtschaftsminister Sergio Massa sagte der FT, es werde eine Entscheidung geben, die nötigen Parameter für eine gemeinsame Währung zu prüfen. Dabei werde es etwa um die Größe der Volkswirtschaften, Finanzthemen und die Rolle der Notenbanken gehen.

Die Idee wurde bereits 2019 in beiden Ländern diskutiert. Damals gab es aber von der brasilianischen Zentralbank Vorbehalte. Laut FT könnte das Währungsgebiet - ähnlich wie der Euro in Europa - später um weitere lateinamerikanische Länder erweitert werden.

...

22.1.

Brasilien und Argentinien wollen angeblich erneut gemeinsame Währung prüfen

Die gemeinsame Währung könnte laut einem Medienbericht „sur“ heißen. Neben Brasilien und Argentinien wäre auch eine Erweiterung auf weitere Staaten in Südamerika denkbar.

https://www.handelsblatt.com/politik/international/suedameri…

...

Brasilien und Argentinien werden laut „Financial Times“ (FT) in den nächsten Tagen den Start von Vorarbeiten für eine gemeinsame Währung verkünden. Das berichtete die Zeitung am Sonntag und berief sich dabei auf Regierungsvertreter der beiden südamerikanischen Staaten.

Der Plan solle in der neuen Woche bei einem Gipfeltreffen in der argentinischen Hauptstadt Buenos Aires diskutiert werden. Es werde erörtert, wie die neue Währung den Handel in der Region verstärken und die Abhängigkeit vom amerikanischen Dollar verringern könne. Brasilien will die neue Währung „sur“ (Süden) nennen.

Der argentinische Wirtschaftsminister Sergio Massa sagte der FT, es werde eine Entscheidung geben, die nötigen Parameter für eine gemeinsame Währung zu prüfen. Dabei werde es etwa um die Größe der Volkswirtschaften, Finanzthemen und die Rolle der Notenbanken gehen.

Die Idee wurde bereits 2019 in beiden Ländern diskutiert. Damals gab es aber von der brasilianischen Zentralbank Vorbehalte. Laut FT könnte das Währungsgebiet - ähnlich wie der Euro in Europa - später um weitere lateinamerikanische Länder erweitert werden.

...

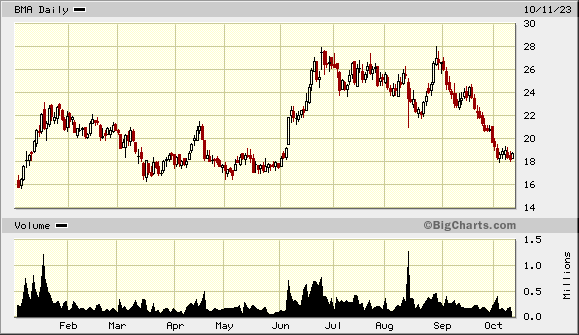

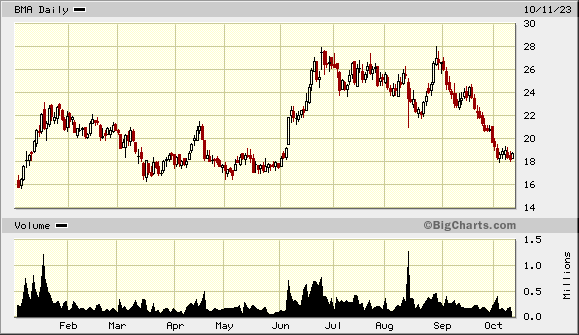

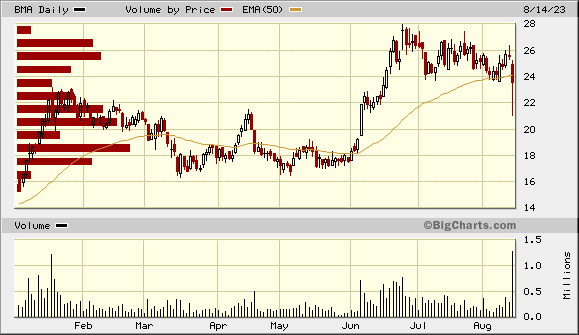

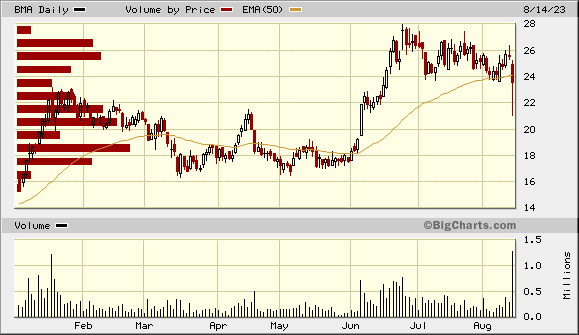

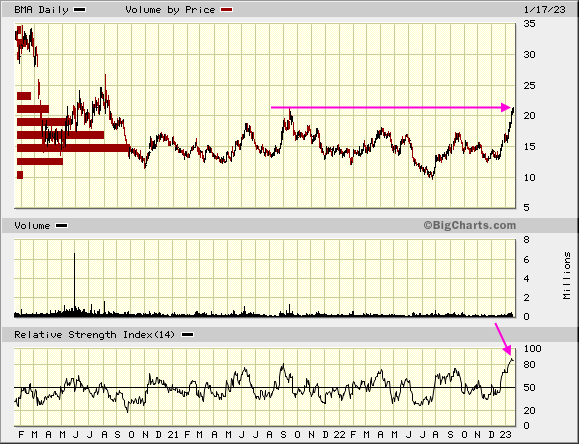

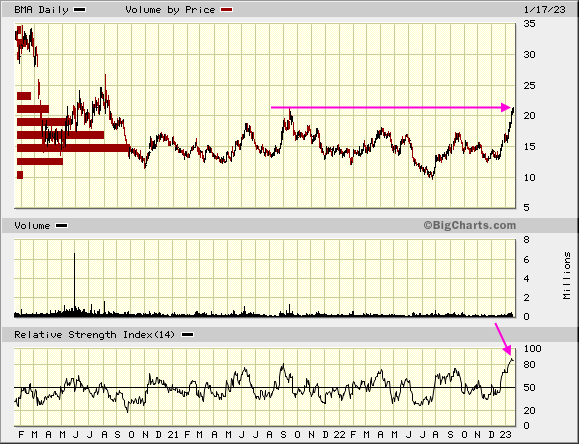

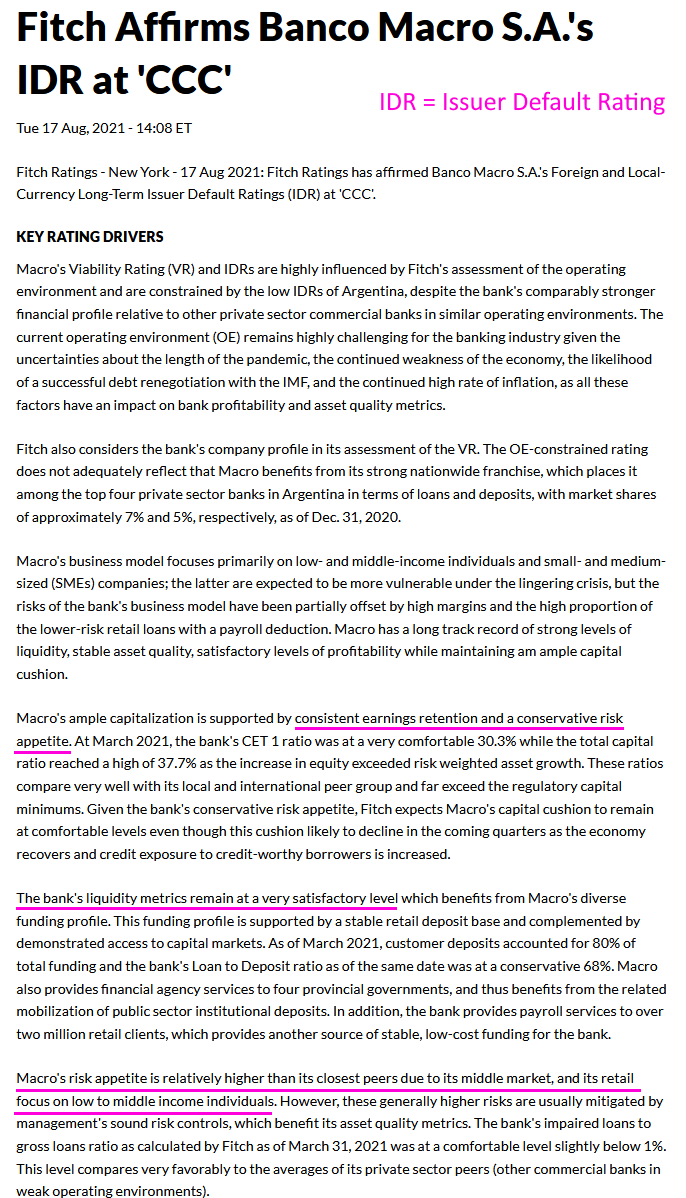

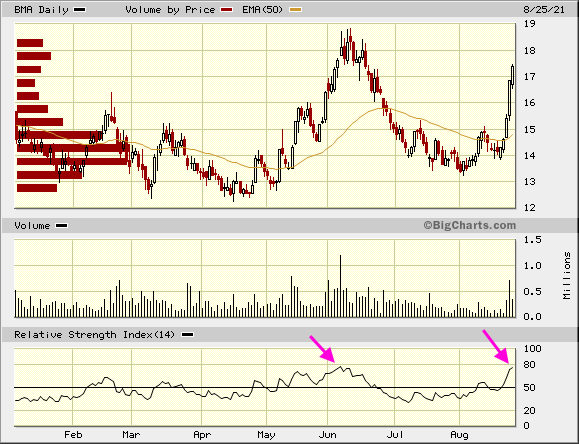

Kurs heute auf 2-Jahreshoch; nun aber schon recht heiß gelaufen mMn:

26.10.

Argentina Downgraded by Fitch on Rising Debt Repayment Risk

https://finance.yahoo.com/news/argentina-downgraded-fitch-ri…

...

Argentina was slashed deeper into junk by Fitch Ratings on risk the nation’s deep macroeconomic imbalances and “highly constrained” external-liquidity position will undermine its ability to repay debt.

The South American nation’s credit score was cut by a notch to CCC- from CCC, according to a Wednesday statement. A deal with the International Monetary Fund reached earlier this year hasn’t been a strong anchor for policy improvement to build reserves and improve the prospect of accessing markets, according to Fitch.

The downgrade “reflects deep macroeconomic imbalances and a highly constrained external liquidity position, which Fitch expects to increasingly undermine repayment capacity as foreign-currency debt service ramps up in the coming years,” Fitch analysts including Todd Martinez wrote.

Argentina’s dollar bonds maturing in 2030 slipped 0.2 cent to about 22 cents on the dollar, as of 1:40 p.m. in New York. The sovereign debt is down more than 36% this year as the government failed to meaningfully reign in annual inflation barreling toward triple digits.

Infighting between factions of the government’s ruling coalition has also given investors little faith the government will turn the economy around before the October 2023 presidential elections. Argentine Vice President Cristina Fernandez de Kirchner fueled uncertainty on Wednesday, criticizing price increases authorized by her own government amid a wave of cabinet resignations.

...

Argentina Downgraded by Fitch on Rising Debt Repayment Risk

https://finance.yahoo.com/news/argentina-downgraded-fitch-ri…

...

Argentina was slashed deeper into junk by Fitch Ratings on risk the nation’s deep macroeconomic imbalances and “highly constrained” external-liquidity position will undermine its ability to repay debt.

The South American nation’s credit score was cut by a notch to CCC- from CCC, according to a Wednesday statement. A deal with the International Monetary Fund reached earlier this year hasn’t been a strong anchor for policy improvement to build reserves and improve the prospect of accessing markets, according to Fitch.

The downgrade “reflects deep macroeconomic imbalances and a highly constrained external liquidity position, which Fitch expects to increasingly undermine repayment capacity as foreign-currency debt service ramps up in the coming years,” Fitch analysts including Todd Martinez wrote.

Argentina’s dollar bonds maturing in 2030 slipped 0.2 cent to about 22 cents on the dollar, as of 1:40 p.m. in New York. The sovereign debt is down more than 36% this year as the government failed to meaningfully reign in annual inflation barreling toward triple digits.

Infighting between factions of the government’s ruling coalition has also given investors little faith the government will turn the economy around before the October 2023 presidential elections. Argentine Vice President Cristina Fernandez de Kirchner fueled uncertainty on Wednesday, criticizing price increases authorized by her own government amid a wave of cabinet resignations.

...

Antwort auf Beitrag Nr.: 71.174.407 von faultcode am 23.03.22 13:46:0013.5.

Argentina Central Bank Raises Key Rate to 49% As Inflation Jumps

https://financialpost.com/pmn/business-pmn/argentina-central…

...

The rate increase comes after Argentina’s statistics agency earlier on Thursday released data showing consumer prices rose 6% in April, bringing it to the highest annual level since 1992.

Russia’s invasion of Ukraine, which propelled energy and food prices around the world, has given Argentina’s already high inflation another boost. A faster rate of controlled devaluations on the peso and import restrictions have also pushed prices higher, while a plan to unwind subsidies on electricity bills this year stands to keep inflation elevated too.

Argentina is also raising rates to comply with its $44 billion agreement with the International Monetary Fund, which calls for the government to keep borrowing costs, measured by the effective annual rate, above inflation.

Argentina Central Bank Raises Key Rate to 49% As Inflation Jumps

https://financialpost.com/pmn/business-pmn/argentina-central…

...

The rate increase comes after Argentina’s statistics agency earlier on Thursday released data showing consumer prices rose 6% in April, bringing it to the highest annual level since 1992.

Russia’s invasion of Ukraine, which propelled energy and food prices around the world, has given Argentina’s already high inflation another boost. A faster rate of controlled devaluations on the peso and import restrictions have also pushed prices higher, while a plan to unwind subsidies on electricity bills this year stands to keep inflation elevated too.

Argentina is also raising rates to comply with its $44 billion agreement with the International Monetary Fund, which calls for the government to keep borrowing costs, measured by the effective annual rate, above inflation.

23.3.

Argentina Raises Key Rate to 44.5% as Inflation Heats Up

https://finance.yahoo.com/news/argentina-raises-key-rate-44-…

...

Argentina’s central bank raised its benchmark rate Tuesday for the third time this year as inflation continues to speed up.

Officials increased the key, 28-day Leliq rate by 200 basis points to 44.5%, according to a statement. The announcement comes after President Alberto Fernandez declared a “war on inflation” last week, adding days later that the government will take “all necessary measures” to combat price increases.

Government data last week showed consumer prices in February rose 4.7% from January, the fastest monthly pace in nearly a year and the third straight month of higher inflation.

Raising borrowing costs above Argentina’s 52% annual inflation rate is a pillar of the monetary policy the government agreed upon in its pending program with the International Monetary Fund. Tuesday’s rate increase boosts the effective annual rate, which accounts for compounded interest, to 53.3%.

Policy makers at the central bank consider that the effective annual rate is the one that needs to exceed inflation to comply with the IMF’s goal of positive rates.

...

Argentina Raises Key Rate to 44.5% as Inflation Heats Up

https://finance.yahoo.com/news/argentina-raises-key-rate-44-…

...

Argentina’s central bank raised its benchmark rate Tuesday for the third time this year as inflation continues to speed up.

Officials increased the key, 28-day Leliq rate by 200 basis points to 44.5%, according to a statement. The announcement comes after President Alberto Fernandez declared a “war on inflation” last week, adding days later that the government will take “all necessary measures” to combat price increases.

Government data last week showed consumer prices in February rose 4.7% from January, the fastest monthly pace in nearly a year and the third straight month of higher inflation.

Raising borrowing costs above Argentina’s 52% annual inflation rate is a pillar of the monetary policy the government agreed upon in its pending program with the International Monetary Fund. Tuesday’s rate increase boosts the effective annual rate, which accounts for compounded interest, to 53.3%.

Policy makers at the central bank consider that the effective annual rate is the one that needs to exceed inflation to comply with the IMF’s goal of positive rates.

...

11.3.

Argentinisches Parlament billigt neues Schuldenabkommen mit IWF

https://www.finanzen.net/nachricht/aktien/argentinisches-par…

...

Nach einer Marathonsitzung in der Abgeordnetenkammer stimmten am frühen Freitagmorgen (Ortszeit) 202 Parlamentarier für das Gesetz und 37 dagegen, während sich 13 enthielten. Trotz der politischen Spaltung in Argentinien wurde die Initiative auch von vielen Abgeordneten der Opposition mitgetragen.

Vor dem Kongress lieferten sich während der Debatte Demonstranten heftige Auseinandersetzungen mit der Polizei. Die Gegner des neuen Schuldenabkommens steckten Barrikaden in Brand und schleuderten Steine und Brandsätze auf die Beamten. Die Polizisten feuerten Gummigeschosse in die Menge.

Mit dem neuen Abkommen sollen Kredite von 45 Milliarden Dollar (40,6 Mrd Euro) umgeschuldet werden. Es ersetzt den Vertrag von 2018 aus dem der Großteil der Verbindlichkeiten in diesem und im kommenden Jahr fällig geworden wären. Angesichts der schleppenden Konjunktur und der hohen Inflation kann das Land das nicht leisten.

Nun soll Argentinien mehr Zeit bekommen und die Schulden ab 2026 zurückzahlen. Die Gegner des Abkommens befürchten, dass der IWF die Regierung im Gegenzug zu Sparmaßnahmen wie zur Kürzung von Energiesubventionen drängen wird.

...

Argentinisches Parlament billigt neues Schuldenabkommen mit IWF

https://www.finanzen.net/nachricht/aktien/argentinisches-par…

...

Nach einer Marathonsitzung in der Abgeordnetenkammer stimmten am frühen Freitagmorgen (Ortszeit) 202 Parlamentarier für das Gesetz und 37 dagegen, während sich 13 enthielten. Trotz der politischen Spaltung in Argentinien wurde die Initiative auch von vielen Abgeordneten der Opposition mitgetragen.

Vor dem Kongress lieferten sich während der Debatte Demonstranten heftige Auseinandersetzungen mit der Polizei. Die Gegner des neuen Schuldenabkommens steckten Barrikaden in Brand und schleuderten Steine und Brandsätze auf die Beamten. Die Polizisten feuerten Gummigeschosse in die Menge.

Mit dem neuen Abkommen sollen Kredite von 45 Milliarden Dollar (40,6 Mrd Euro) umgeschuldet werden. Es ersetzt den Vertrag von 2018 aus dem der Großteil der Verbindlichkeiten in diesem und im kommenden Jahr fällig geworden wären. Angesichts der schleppenden Konjunktur und der hohen Inflation kann das Land das nicht leisten.

Nun soll Argentinien mehr Zeit bekommen und die Schulden ab 2026 zurückzahlen. Die Gegner des Abkommens befürchten, dass der IWF die Regierung im Gegenzug zu Sparmaßnahmen wie zur Kürzung von Energiesubventionen drängen wird.

...

6.1.

Argentina’s Central Bank Hikes Rate for First Time in a Year

https://finance.yahoo.com/news/argentina-central-bank-hikes-…

...

Argentina raised its benchmark interest rate for the first time in over a year as it faces calls from the International Monetary Fund to tighten its monetary policy.

The central bank lifted the key Leliq rate to 40% from 38%, the level it had stood for over a year even with annual inflation running at around 50%. The bank’s unorthodox approach until now had contrasted with a wave of rate hikes by central banks across the globe, seeking to battle accelerating inflation.

IMF officials urged Argentina in December to implement an “appropriate” monetary policy as part of talks for a new program to reschedule payments on about $40 billion owed to the lender. They specifically called for interest rates to exceed inflation.

“The rate hike is a step in the right direction, but too timid to matter,” said Adriana Dupita, an economist with Bloomberg Economics. “The central bank will need to raise the rate further if it intends to use monetary policy to tackle inflation -- with or without a deal with the Fund.”

...

Es ist ein Genuss auf Türkische Lira zu schauen, wenn man nicht investiert ist.

Schaun mer mal was uns Latinos zu bieten haben.

Allen viel Erfolg und ein glückliches Händchen !

https://twitter.com/i/status/1460283616693407746

Schaun mer mal was uns Latinos zu bieten haben.

Allen viel Erfolg und ein glückliches Händchen !

https://twitter.com/i/status/1460283616693407746

https://bluedollar.net/

Hier der argentinische Schwarzmarktkurs. Derzeit 100% Aufschlag. Wenn sich das entläd dürfte in den Bilanzen einiges an Korrekturbedarf entstehen. Markt hat davon vermutlich schon viel, vielleicht zu viel eingepreist.

Hier der argentinische Schwarzmarktkurs. Derzeit 100% Aufschlag. Wenn sich das entläd dürfte in den Bilanzen einiges an Korrekturbedarf entstehen. Markt hat davon vermutlich schon viel, vielleicht zu viel eingepreist.

Hat jemand Nachrichten die den Kursrutsch trotz possitiven Wahlausgang erklären?

Dollarstärke?

Dollarstärke?

Antwort auf Beitrag Nr.: 69.151.544 von faultcode am 26.08.21 00:21:48

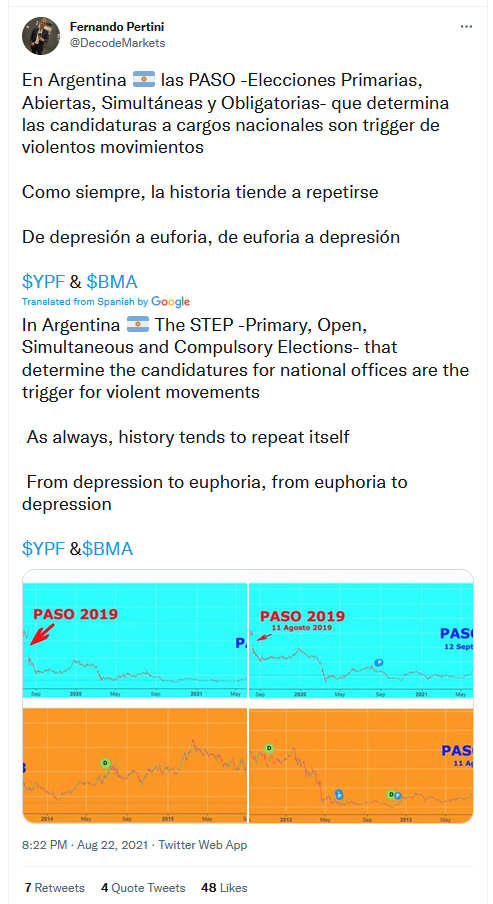

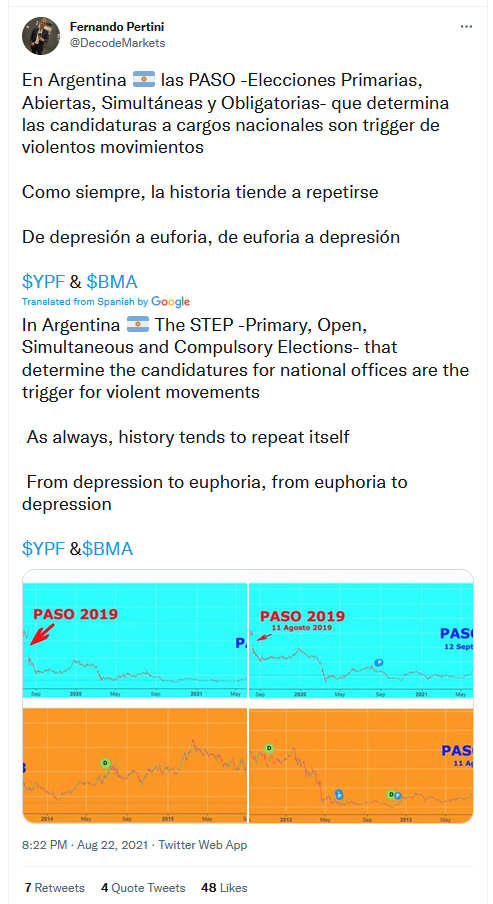

erst lesen, dann schreiben:

Kadidatenlisten für Wahlen (aus Vorwahlen?) sind veröffentlicht worden, was offenbar alleine schon für solche Kursbewegungen in ARG sorgt:

https://twitter.com/DecodeMarkets/status/1429509243967787022

Zitat von faultcode: ...

erstaunlich: der Kurs zog schon 3 Tage vor den gefälligen Q2-Ergebnissen an (gerade eben reingekommen)...

erst lesen, dann schreiben:

Kadidatenlisten für Wahlen (aus Vorwahlen?) sind veröffentlicht worden, was offenbar alleine schon für solche Kursbewegungen in ARG sorgt:

https://twitter.com/DecodeMarkets/status/1429509243967787022

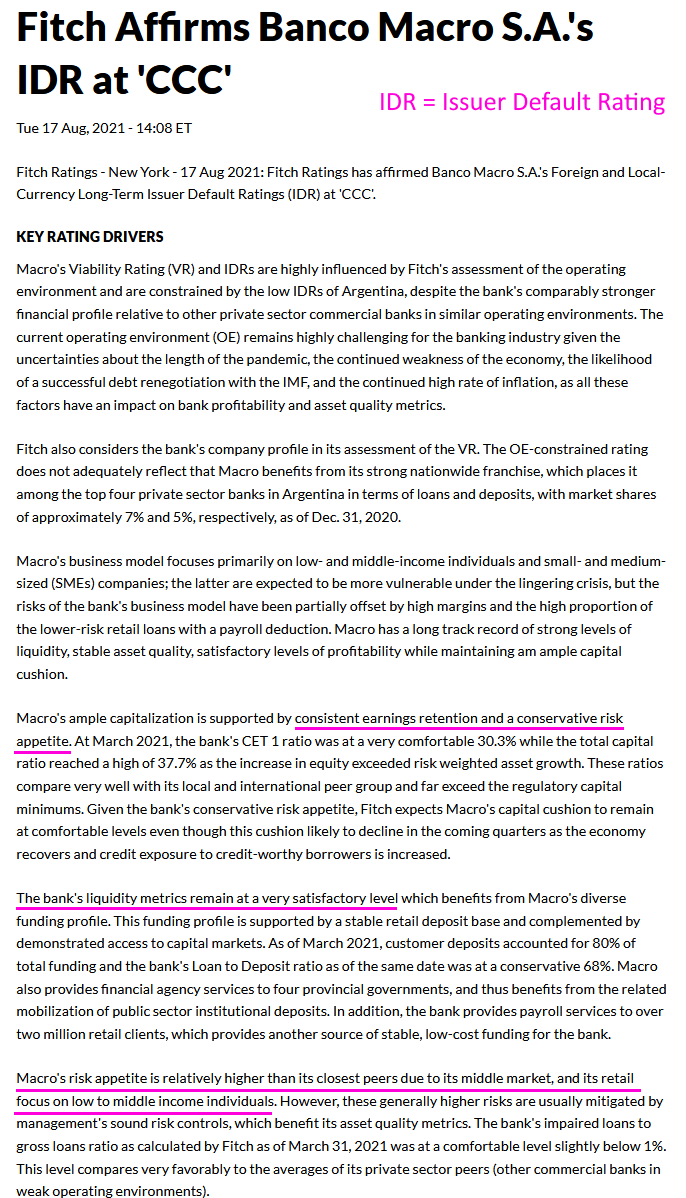

Antwort auf Beitrag Nr.: 69.151.544 von faultcode am 26.08.21 00:21:48Fitch hat am 17.8. was zu BMA geschrieben:

https://www.fitchratings.com/research/banks/fitch-affirms-ba…

...

https://www.fitchratings.com/research/banks/fitch-affirms-ba…

...

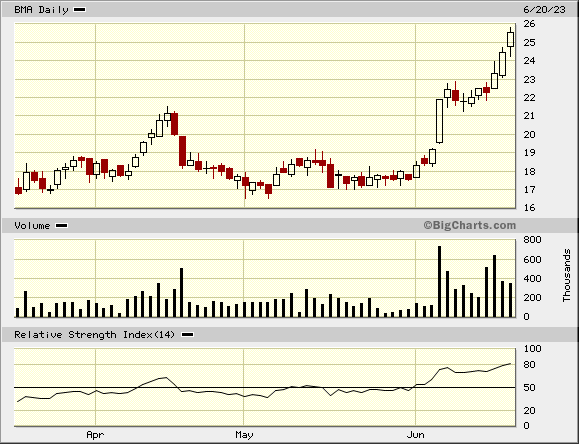

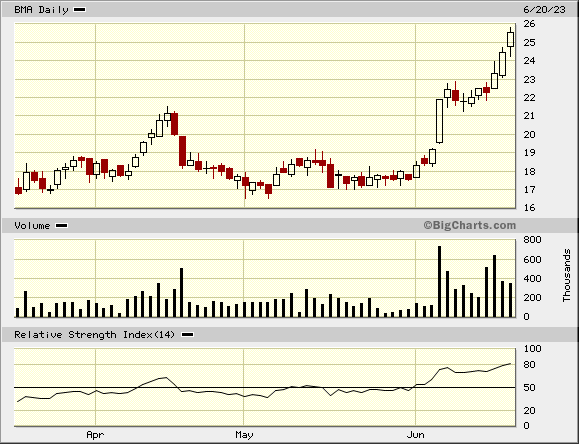

BMA zeigt wieder Anzeichen von Leben:

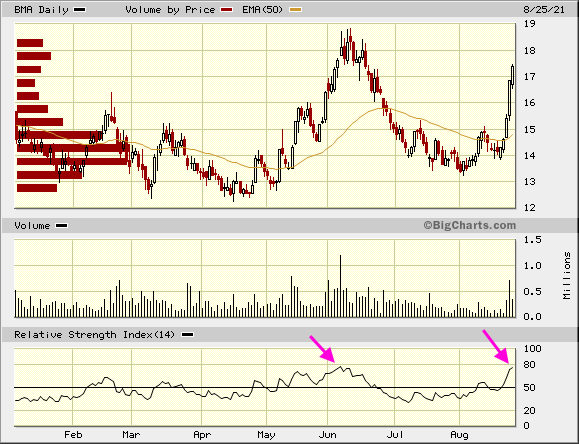

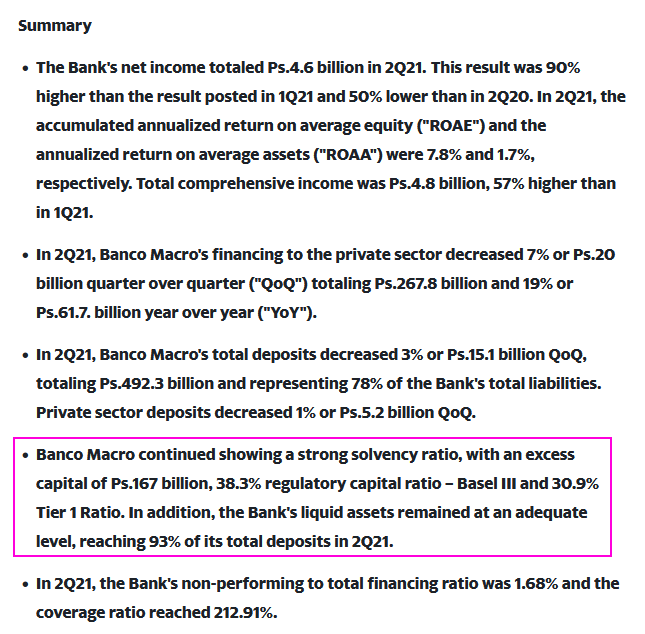

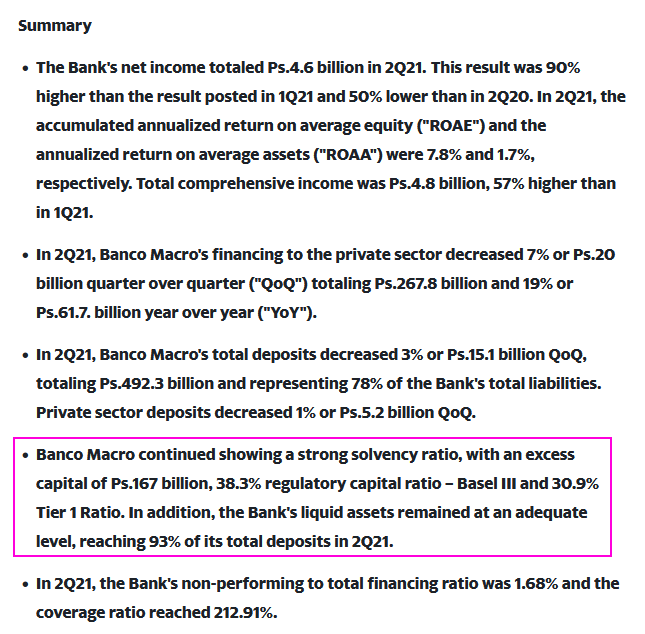

erstaunlich: der Kurs zog schon 3 Tage vor den gefälligen Q2-Ergebnissen an (gerade eben reingekommen)

...

...

https://finance.yahoo.com/news/banco-macro-announces-results…

Auch eine netter Satz daraus:

As of 1Q20, the Bank began reporting results applying Hyperinflation Accounting, in accordance with IFRS IAS 29 as established by the Central Bank. For ease of comparison, figures of previous quarters of 2020 have been restated applying IAS 29 to reflect the accumulated effect of the inflation adjustment for each period through June 30, 2021.

erstaunlich: der Kurs zog schon 3 Tage vor den gefälligen Q2-Ergebnissen an (gerade eben reingekommen)

...

...

https://finance.yahoo.com/news/banco-macro-announces-results…

Auch eine netter Satz daraus:

As of 1Q20, the Bank began reporting results applying Hyperinflation Accounting, in accordance with IFRS IAS 29 as established by the Central Bank. For ease of comparison, figures of previous quarters of 2020 have been restated applying IAS 29 to reflect the accumulated effect of the inflation adjustment for each period through June 30, 2021.

15.12.23 · wallstreetONLINE NewsUpdate · YPF (D) (D) |

15.12.23 · wallstreetONLINE Redaktion · YPF (D) (D) |