ROUNDUP/'WSJ': FBI ermittelt wegen Falschangaben zu Model 3 gegen Tesla (Seite 203) | Diskussion im Forum

eröffnet am 28.10.18 21:38:04 von

neuester Beitrag 22.04.24 10:30:17 von

neuester Beitrag 22.04.24 10:30:17 von

Beiträge: 10.213

ID: 1.291.475

ID: 1.291.475

Aufrufe heute: 0

Gesamt: 653.436

Gesamt: 653.436

Aktive User: 0

ISIN: US88160R1014 · WKN: A1CX3T · Symbol: TSLA

168,20

EUR

+0,08 %

+0,14 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

02.05.24 · wallstreetONLINE Redaktion |

| Tesla zündet den Turbo – der Abwärtstrend ist vorbei!Anzeige |

Tech-Market Report: TecDAX und NASDAQ klettern kräftig - Kurssprung bei Apple (APC) und Nvidia (NVD) 03.05.24 · Shareribs Anzeige |

03.05.24 · Felix Haupt Anzeige |

Werte aus der Branche Fahrzeugindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4.899,00 | +23,84 | |

| 1.021,40 | +20,23 | |

| 12,880 | +14,18 | |

| 3,2900 | +12,29 | |

| 1,8500 | +12,12 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 25,60 | -9,86 | |

| 4,1650 | -10,04 | |

| 46,65 | -11,73 | |

| 1,9700 | -22,29 | |

| 1,4000 | -30,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.454.596 von faultcode am 29.04.22 10:45:46Fri, April 29, 2022, 10:17 AM

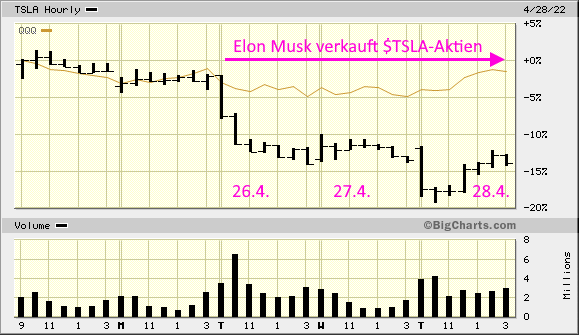

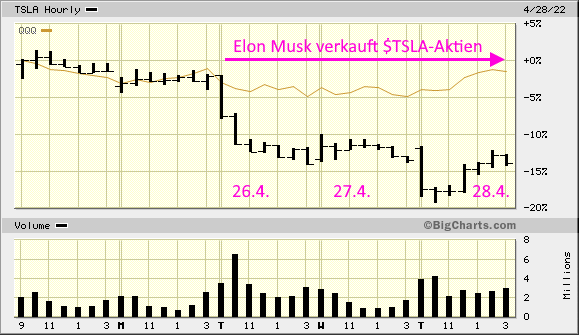

Elon Musk sold $4 billion worth of Tesla shares after sealing Twitter deal

https://news.yahoo.com/elon-musk-sold-4-billion-081748352.ht…

...

Elon Musk sold $4 bilion (£3.2 billion) worth of Tesla shares in the days after sealing a deal to buy Twitter, new filings show.

Musk sold around 4 million shares in the electric car company he runs on Tuesday and Wednesday. On Monday, he had reached a deal with Twitter’s board to buy the social media company for $44 billion.

The stock sales appear to go some way to answering the question of how Musk will fund his portion of the Twitter takeover. He has pledged to provide $21 billion in equity towards the deal, but estimates suggests he had just $3 billion of cash on hand prior to the latest stock sales.

...

Elon Musk sold $4 billion worth of Tesla shares after sealing Twitter deal

https://news.yahoo.com/elon-musk-sold-4-billion-081748352.ht…

...

Elon Musk sold $4 bilion (£3.2 billion) worth of Tesla shares in the days after sealing a deal to buy Twitter, new filings show.

Musk sold around 4 million shares in the electric car company he runs on Tuesday and Wednesday. On Monday, he had reached a deal with Twitter’s board to buy the social media company for $44 billion.

The stock sales appear to go some way to answering the question of how Musk will fund his portion of the Twitter takeover. He has pledged to provide $21 billion in equity towards the deal, but estimates suggests he had just $3 billion of cash on hand prior to the latest stock sales.

...

Antwort auf Beitrag Nr.: 71.426.639 von faultcode am 26.04.22 14:54:51

https://www.cnbc.com/2022/04/28/elon-musk-will-be-most-indeb…

...

Two-thirds of Elon Musk’s financing for the $44 billion deal to take Twitter private will have to come out of his own pocket. That pocket is deep. He has a net worth of about $250 billion.

Yet because his wealth is tied up in Tesla stock, along with equity in his SpaceX and The Boring Co., Musk will have to sell millions of his shares and pledge millions more to raise the necessary cash.

According to his SEC filings, Musk’s financing plan includes $13 billion in bank loans and $21 billion in cash, likely from selling Tesla shares. It also includes a $12.5 billion margin loan, using his Tesla stock as collateral. Because banks require more of a cushion for high-beta stocks like Tesla, Musk will need to pledge about $65 billion in Tesla shares, or about a quarter of his current total, for the loan, according to the documents.

Even before the Twitter bid, Musk had pledged 88 million shares of the electric auto maker for margin loans, although it’s unclear how much cash he’s already borrowed from the facility.

...

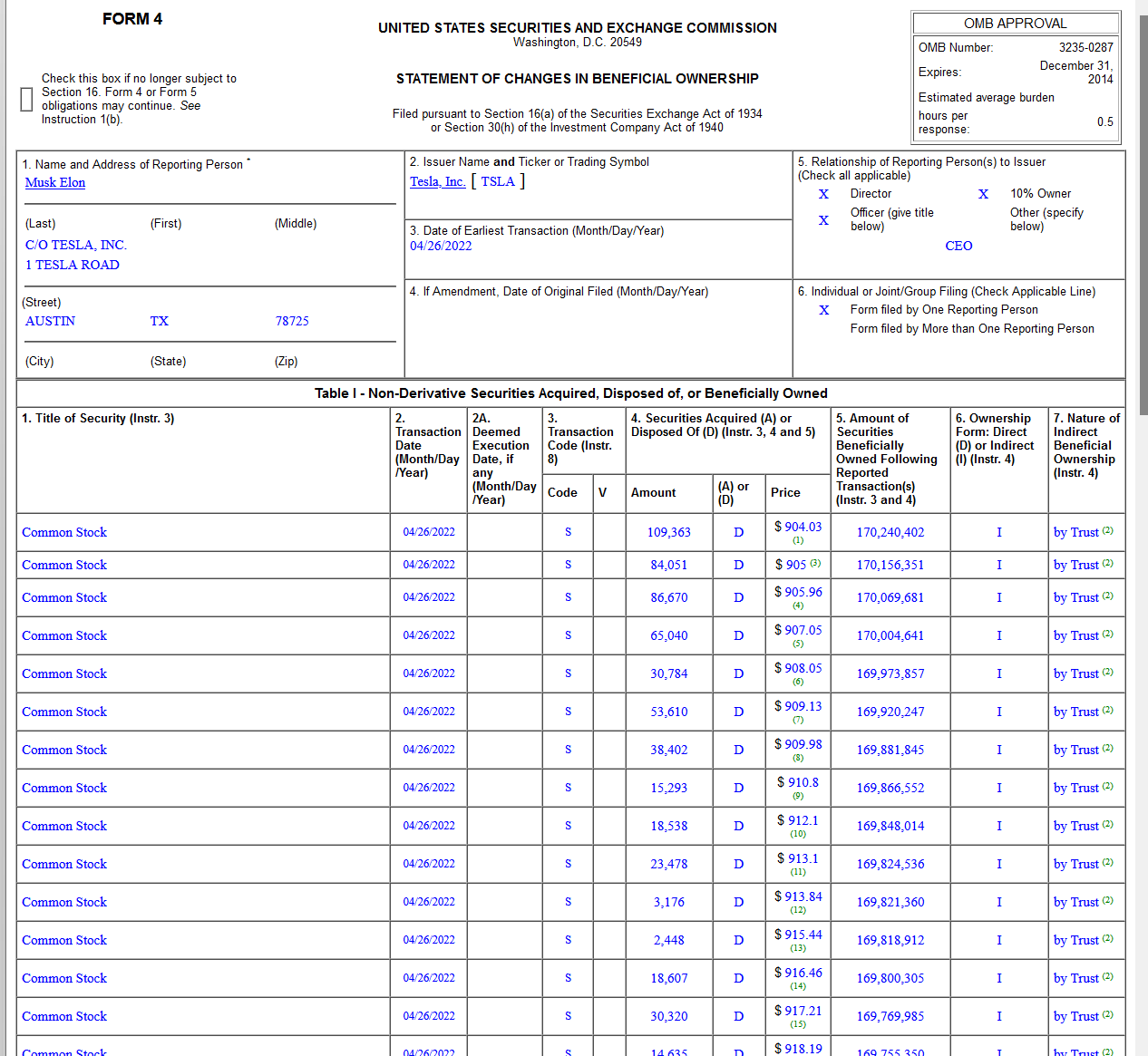

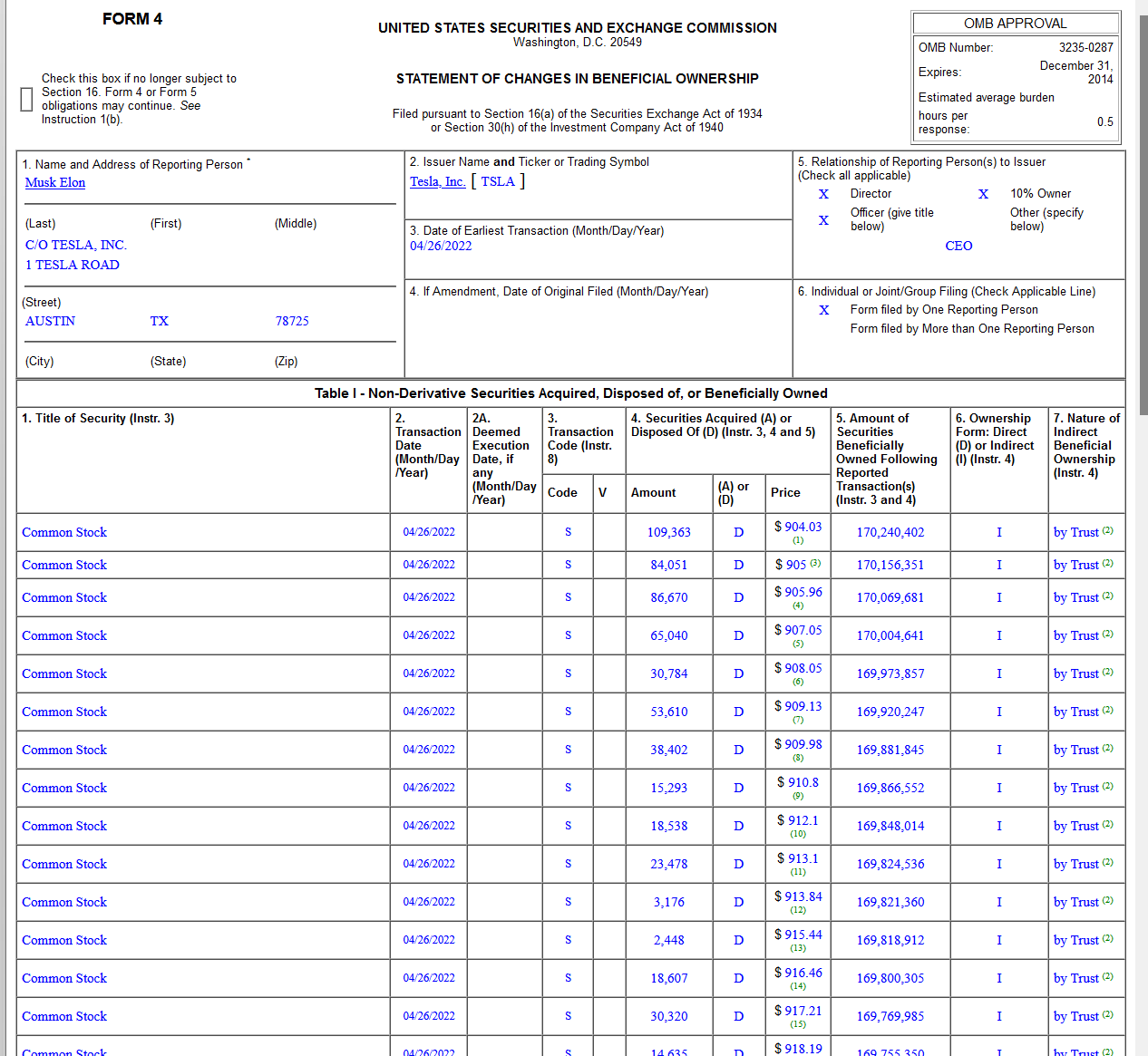

=> am Dienstag, 26.4., ging's schon los mit dem Verkauf von $TSLA-Shares aus dem Altbestand:

...

This Form 4 is the second of five Form 4s being filed by the Reporting Person relating to the same event. The Form 4 has been split into five filings to cover all 138 individual transactions that occurred on two consecutive Transaction Dates, because the SEC's EDGAR filing system limits a single Form 4 to a maximum of 30 separate transactions. Each Form 4 will be filed by the Reporting Person. ...

...

http://archive.fast-edgar.com/20220428/ARZDTQ22ZC2SRZYR222O2…

=>

https://www.cnbc.com/2022/04/28/elon-musk-will-be-most-indeb…

...

Two-thirds of Elon Musk’s financing for the $44 billion deal to take Twitter private will have to come out of his own pocket. That pocket is deep. He has a net worth of about $250 billion.

Yet because his wealth is tied up in Tesla stock, along with equity in his SpaceX and The Boring Co., Musk will have to sell millions of his shares and pledge millions more to raise the necessary cash.

According to his SEC filings, Musk’s financing plan includes $13 billion in bank loans and $21 billion in cash, likely from selling Tesla shares. It also includes a $12.5 billion margin loan, using his Tesla stock as collateral. Because banks require more of a cushion for high-beta stocks like Tesla, Musk will need to pledge about $65 billion in Tesla shares, or about a quarter of his current total, for the loan, according to the documents.

Even before the Twitter bid, Musk had pledged 88 million shares of the electric auto maker for margin loans, although it’s unclear how much cash he’s already borrowed from the facility.

...

=> am Dienstag, 26.4., ging's schon los mit dem Verkauf von $TSLA-Shares aus dem Altbestand:

...

This Form 4 is the second of five Form 4s being filed by the Reporting Person relating to the same event. The Form 4 has been split into five filings to cover all 138 individual transactions that occurred on two consecutive Transaction Dates, because the SEC's EDGAR filing system limits a single Form 4 to a maximum of 30 separate transactions. Each Form 4 will be filed by the Reporting Person. ...

...

http://archive.fast-edgar.com/20220428/ARZDTQ22ZC2SRZYR222O2…

=>

Antwort auf Beitrag Nr.: 71.445.395 von faultcode am 28.04.22 12:33:00der Begriff "Asperger's Syndrome" kam noch nicht vor. Aber wenn man mich frägt: Elon Musk wird bei der SEC/DoJ noch die "Asperger's-Karte" als ein letztes Mittel der Verteidigung ziehen (*) (**):

9.5.2021

(*) Elizabeth Holmes/Theranos zog vor Gericht sogar die "Vergewaltigungs-Karte":

In tearful and intense testimony, Elizabeth Holmes said from the witness stand Monday that she had been raped while studying at Stanford University and not long after entered into an abusive relationship with the man who would become her top deputy at Theranos Inc.

29.11.2021

Theranos Founder Elizabeth Holmes Testifies Balwani Berated, Abused Her

https://www.wsj.com/articles/elizabeth-holmes-trial-theranos…

(**) ich denke, daß die "Asperger's-Karte" bei einigen EM-Fans gut ankäme:

https://twitter.com/alex_avoigt/status/1510947764506705926

9.5.2021

Zitat von faultcode: ...WSJ, 9.5.:

Elon Musk on ‘SNL’ Says He Has Asperger’s, Jokes About Dogecoin

Cryptocurrency was trading lower after the Tesla CEO called it ‘a hustle’ in a sketch

https://www.wsj.com/articles/elon-musks-quips-about-his-aspe…

...

(*) Elizabeth Holmes/Theranos zog vor Gericht sogar die "Vergewaltigungs-Karte":

In tearful and intense testimony, Elizabeth Holmes said from the witness stand Monday that she had been raped while studying at Stanford University and not long after entered into an abusive relationship with the man who would become her top deputy at Theranos Inc.

29.11.2021

Theranos Founder Elizabeth Holmes Testifies Balwani Berated, Abused Her

https://www.wsj.com/articles/elizabeth-holmes-trial-theranos…

(**) ich denke, daß die "Asperger's-Karte" bei einigen EM-Fans gut ankäme:

https://twitter.com/alex_avoigt/status/1510947764506705926

Antwort auf Beitrag Nr.: 71.421.296 von xwin am 25.04.22 20:23:26

bei sowas kommt immer erst die SEC (Zivilrecht), dann das DoJ (Strafrecht).

Mir ist kein umgekehrter Fall bekannt (was aber nichts heißen soll).

=> mit anderen Worten: solange die SEC in keinem der Fälle einen Erfolg erringt (momentan sieht es aber im Fall "SEC v. Elon Musk"; no. 1_18-cv-8865-AJN, 1_18-cv-8947-AJN danach aus), solange sammelt das DoJ im Hintergrund nur (mMn)

Das war übrigens auch bei der privaten Theranos so; dort errang auch erst die SEC einen Erfolg (Geldstrafe und Verbannung), bevor die strafrechtliche Anklage ("INDICTMENT") 3 Monate später einrollte:

14.3.2018

Theranos and its founder settle U.S. fraud charges: SEC

https://www.reuters.com/article/us-theranos-sec-idUSKCN1GQ2H…

14.6.2018

U.S. v. Elizabeth Holmes, et al.

https://www.justice.gov/usao-ndca/us-v-elizabeth-holmes-et-a…

--> Resources --> Holmes and Balwani Indictment

Zitat von xwin: ... ich hoffe immer noch auf das DoJ.

bei sowas kommt immer erst die SEC (Zivilrecht), dann das DoJ (Strafrecht).

Mir ist kein umgekehrter Fall bekannt (was aber nichts heißen soll).

=> mit anderen Worten: solange die SEC in keinem der Fälle einen Erfolg erringt (momentan sieht es aber im Fall "SEC v. Elon Musk"; no. 1_18-cv-8865-AJN, 1_18-cv-8947-AJN danach aus), solange sammelt das DoJ im Hintergrund nur (mMn)

Das war übrigens auch bei der privaten Theranos so; dort errang auch erst die SEC einen Erfolg (Geldstrafe und Verbannung), bevor die strafrechtliche Anklage ("INDICTMENT") 3 Monate später einrollte:

14.3.2018

Theranos and its founder settle U.S. fraud charges: SEC

https://www.reuters.com/article/us-theranos-sec-idUSKCN1GQ2H…

14.6.2018

U.S. v. Elizabeth Holmes, et al.

https://www.justice.gov/usao-ndca/us-v-elizabeth-holmes-et-a…

--> Resources --> Holmes and Balwani Indictment

Antwort auf Beitrag Nr.: 71.439.719 von faultcode am 27.04.22 19:23:38

PDF zum Urteil ("OPINION AND ORDER"; 18-cv-8865 (LJL)): https://twitter.com/montana_skeptic/status/15193580835955261… --> https://t.co/iPlPmnULBr

und das hat es in sich mMn:

...

...

=> offenbar gilt hier: ein Mann weiß mehr

(mMn)

engaged in conducted that... = ~ in etwas verwickelt sein

"..Tesla and its officers engaged in conducted that violated ... of the Securities Act of 1933, ..."

Richter Liman ("Twitter Sitter", 2018) ist offenbar nicht Richter Slights ("SolarCity"):PDF zum Urteil ("OPINION AND ORDER"; 18-cv-8865 (LJL)): https://twitter.com/montana_skeptic/status/15193580835955261… --> https://t.co/iPlPmnULBr

und das hat es in sich mMn:

...

...

=> offenbar gilt hier: ein Mann weiß mehr

(mMn)

engaged in conducted that... = ~ in etwas verwickelt sein

Antwort auf Beitrag Nr.: 70.564.667 von faultcode am 19.01.22 18:04:4327.4.

Judge rules for Elon Musk in $13 billion lawsuit over Tesla-SolarCity deal

https://finance.yahoo.com/news/judge-rules-elon-musk-tesla-2…

...

Tesla Inc Chief Executive Officer Elon Musk did not unjustly enrich himself when he guided the electric vehicle maker in 2016 to acquire SolarCity Corp, where Musk was chairman and the largest shareholder, a Delaware judge ruled on Wednesday.

Tesla shareholders had accused Musk of coercing Tesla's board into buying SolarCity, a struggling rooftop solar panel maker, to rescue his investment, and had sought up to $13 billion in damages.

The ruling comes as Musk is tapping his vast fortune to acquire Twitter Inc, which accepted his $44 billion offer on Monday.

"The preponderance of the evidence reveals that Tesla paid a fair price — SolarCity was, at a minimum, worth what Tesla paid for it, and the acquisition otherwise was highly beneficial to Tesla," said the opinion by Vice Chancellor Joseph Slights of Delaware's Court of Chancery.

There was no immediate response from Musk or plaintiffs' lawyers to a request for comment on the ruling.

Slights said the deal process had its flaws and Musk was more involved than he should have been, but a fair price for SolarCity outweighed claims the deal unjustly enriched Musk.

The ruling follows a 10-day trial in July and may be appealed. Musk testified during the first two days.

...

Judge rules for Elon Musk in $13 billion lawsuit over Tesla-SolarCity deal

https://finance.yahoo.com/news/judge-rules-elon-musk-tesla-2…

...

Tesla Inc Chief Executive Officer Elon Musk did not unjustly enrich himself when he guided the electric vehicle maker in 2016 to acquire SolarCity Corp, where Musk was chairman and the largest shareholder, a Delaware judge ruled on Wednesday.

Tesla shareholders had accused Musk of coercing Tesla's board into buying SolarCity, a struggling rooftop solar panel maker, to rescue his investment, and had sought up to $13 billion in damages.

The ruling comes as Musk is tapping his vast fortune to acquire Twitter Inc, which accepted his $44 billion offer on Monday.

"The preponderance of the evidence reveals that Tesla paid a fair price — SolarCity was, at a minimum, worth what Tesla paid for it, and the acquisition otherwise was highly beneficial to Tesla," said the opinion by Vice Chancellor Joseph Slights of Delaware's Court of Chancery.

There was no immediate response from Musk or plaintiffs' lawyers to a request for comment on the ruling.

Slights said the deal process had its flaws and Musk was more involved than he should have been, but a fair price for SolarCity outweighed claims the deal unjustly enriched Musk.

The ruling follows a 10-day trial in July and may be appealed. Musk testified during the first two days.

...

Antwort auf Beitrag Nr.: 71.421.182 von faultcode am 25.04.22 20:09:2227.4.

Musk Loses Bid to End Agreement with SEC

https://finance.yahoo.com/news/elon-musk-loses-bid-end-15303…

...

Elon Musk, who is close to acquiring Twitter Inc., lost a court bid to undo a 2018 agreement that required all his Tesla Inc.-related tweets to be screened by a company official who’s been referred to as the chief executive officer’s “Twitter Sitter.”

“Musk cannot now seek to retract the agreement he knowingly and willingly entered by simply bemoaning that he felt like he had to agree to it at the time but now -- once the specter of the litigation is a distant memory and his company has become, in his estimation, all but invincible -- wishes that he had not,” U.S. District Judge Lewis Liman said Wednesday.

Last month, Musk asked the judge to end his 2018 deal with the U.S. Securities and Exchange Commission and the oversight of his tweets. He accused the agency of harassing him with excessively broad investigative demands and claiming the agreement violates his right to free speech.

...

Musk Loses Bid to End Agreement with SEC

https://finance.yahoo.com/news/elon-musk-loses-bid-end-15303…

...

Elon Musk, who is close to acquiring Twitter Inc., lost a court bid to undo a 2018 agreement that required all his Tesla Inc.-related tweets to be screened by a company official who’s been referred to as the chief executive officer’s “Twitter Sitter.”

“Musk cannot now seek to retract the agreement he knowingly and willingly entered by simply bemoaning that he felt like he had to agree to it at the time but now -- once the specter of the litigation is a distant memory and his company has become, in his estimation, all but invincible -- wishes that he had not,” U.S. District Judge Lewis Liman said Wednesday.

Last month, Musk asked the judge to end his 2018 deal with the U.S. Securities and Exchange Commission and the oversight of his tweets. He accused the agency of harassing him with excessively broad investigative demands and claiming the agreement violates his right to free speech.

...

es ging immer nur um den Aktienkurs, nie um die Umwelt:

https://twitter.com/TeslaPodcast/status/1518971703447093248

=> von einem hohen Aktienkurs kann man eine Weile leben; Umweltschutz hingegen ist sehr langsam und oft sieht man kleine Effekte erst nach Jahren

Tag: Rob Maurer

https://twitter.com/TeslaPodcast/status/1518971703447093248

=> von einem hohen Aktienkurs kann man eine Weile leben; Umweltschutz hingegen ist sehr langsam und oft sieht man kleine Effekte erst nach Jahren

Tag: Rob Maurer

Antwort auf Beitrag Nr.: 67.692.958 von faultcode am 02.04.21 19:31:20Hwang festgenommen!

=> man arbeitet sich nun offenbar von außen nach innen vor

=> man arbeitet sich nun offenbar von außen nach innen vor

Zitat von faultcode: ...27.4.

Archegos Owner Bill Hwang Arrested by Federal Agents

https://www.nytimes.com/2022/04/27/business/archegos-bill-hw…

The men were charged with crimes including racketeering conspiracy in connection with a scheme to manipulate the company’s stock prices.

Federal agents arrested Bill Hwang, the owner of Archegos Capital Management, the $10 billion family office that imploded last year in a trading debacle, and his former chief financial officer on Wednesday morning.

Mr. Hwang and his former top lieutenant, Patrick Halligan, were arrested at their homes and are expected to appear in Manhattan federal court later today. The arrests were announced by Manhattan federal prosecutors.

Federal prosecutors said the men were charged with racketeering conspiracy, securities fraud and wire fraud in connection with a scheme to manipulate the prices of publicly traded stocks in order to boost returns. They said the plan, which relied heavily on leverage, helped pump up the firm’s portfolio from $1.5 billion to $35 billion in a single year.

The collapse of Archegos shocked Wall Street and caused major losses for big banks and led to investigations by federal prosecutors, the Securities and Exchange Commission and other regulators.

The arrests would mark one of the biggest Wall Street white collar prosecutions in years.

...

Antwort auf Beitrag Nr.: 71.426.327 von faultcode am 26.04.22 14:17:08

Morgan Stanley und alle anderen wissen, daß EM mit den weiterhin unverpfändeten $TSLA-Aktien, die es also immer noch gibt, machen kann was er will (innerhalb der Gesetze, die aber für EM bislang nicht so sehr gegolten haben):

Each Commitment Party acknowledges that the Principal owns common stock of Tesla, Inc. that are not pledged to secure any outstanding obligations and will not be pledged to secure the Facility (the “Unpledged Shares”). Each Commitment Party further acknowledges that the Principal may sell, dispose of or transfer such Unpledged Shares at any time in accordance with applicable securities laws.

geschickt: EM behält seine Stimmrechte an Tesls:

• Voting of Shares -- Borrower may continue to exercise its voting rights in respect of the Collateral Shares

Morgan Stanley und Co. dürfen hedgen:

• Confidentiality -- Typical provisions for a transaction of this nature, including customary exceptions to permit the Lenders to assign, sub-participate or hedge

...

• Information Covenants -- Including, but not limited to the following (and subject to customary exceptions and qualifications to be agreed): unaudited annual balance sheet and unaudited statement of profit and loss of the Borrower; notices of any material events; no provision of material non-public information concerning the Issuer; compliance with Exchange Act requirements; notification of default; semi-annual certificates from the Borrower with respect to no continuing Event of Default and compliance with the Prohibition on Other Financings provision; all reasonable KYC due diligence requirements; and provision of information, documentation and consents required to facilitate hedging transactions and foreclosure upon enforcement

nebenbei: EM kann sich nach meiner Lesart aus den unverpfändeten $TSLA-Aktien bei der X Holdings III noch ein "Taschengeld" von bis zu USD150M durch ein anderes Pfand darauf geben lassen:

• Prohibition on Other Financings -- The Borrower shall not, and the Borrower shall procure that each of its affiliates (other than the Issuer or any of its subsidiaries) shall not, directly or indirectly, grant, or suffer to exist, any lien on any Shares that do not constitute Collateral Shares to secure any obligation of the Borrower or any of its affiliates, other than any such liens that were granted by affiliates of the Borrower prior to the Countersign Effective Date (as defined below) and the re-financing of such obligations secured by such liens in an amount not to exceed the amount so refinanced (plus premiums, accrued interest, fees and expenses) (each, a “Permitted Refinancing”); provided that any liens on Shares not constituting Collateral Shares securing obligations of affiliates of the Borrower incurred on or after the Countersign Effective Date and prior to the Funding Date (other than a Permitted Refinancing) that do not in the aggregate of all such obligations exceed $150 million in principal amount shall be excluded from the foregoing restriction.

take the money and run (2)

ansonsten: Morgan Stanley und alle anderen wissen, daß EM mit den weiterhin unverpfändeten $TSLA-Aktien, die es also immer noch gibt, machen kann was er will (innerhalb der Gesetze, die aber für EM bislang nicht so sehr gegolten haben):

Each Commitment Party acknowledges that the Principal owns common stock of Tesla, Inc. that are not pledged to secure any outstanding obligations and will not be pledged to secure the Facility (the “Unpledged Shares”). Each Commitment Party further acknowledges that the Principal may sell, dispose of or transfer such Unpledged Shares at any time in accordance with applicable securities laws.

geschickt: EM behält seine Stimmrechte an Tesls:

• Voting of Shares -- Borrower may continue to exercise its voting rights in respect of the Collateral Shares

Morgan Stanley und Co. dürfen hedgen:

• Confidentiality -- Typical provisions for a transaction of this nature, including customary exceptions to permit the Lenders to assign, sub-participate or hedge

...

• Information Covenants -- Including, but not limited to the following (and subject to customary exceptions and qualifications to be agreed): unaudited annual balance sheet and unaudited statement of profit and loss of the Borrower; notices of any material events; no provision of material non-public information concerning the Issuer; compliance with Exchange Act requirements; notification of default; semi-annual certificates from the Borrower with respect to no continuing Event of Default and compliance with the Prohibition on Other Financings provision; all reasonable KYC due diligence requirements; and provision of information, documentation and consents required to facilitate hedging transactions and foreclosure upon enforcement

nebenbei: EM kann sich nach meiner Lesart aus den unverpfändeten $TSLA-Aktien bei der X Holdings III noch ein "Taschengeld" von bis zu USD150M durch ein anderes Pfand darauf geben lassen:

• Prohibition on Other Financings -- The Borrower shall not, and the Borrower shall procure that each of its affiliates (other than the Issuer or any of its subsidiaries) shall not, directly or indirectly, grant, or suffer to exist, any lien on any Shares that do not constitute Collateral Shares to secure any obligation of the Borrower or any of its affiliates, other than any such liens that were granted by affiliates of the Borrower prior to the Countersign Effective Date (as defined below) and the re-financing of such obligations secured by such liens in an amount not to exceed the amount so refinanced (plus premiums, accrued interest, fees and expenses) (each, a “Permitted Refinancing”); provided that any liens on Shares not constituting Collateral Shares securing obligations of affiliates of the Borrower incurred on or after the Countersign Effective Date and prior to the Funding Date (other than a Permitted Refinancing) that do not in the aggregate of all such obligations exceed $150 million in principal amount shall be excluded from the foregoing restriction.

03.05.24 · Thomas Heydrich · Tesla |

02.05.24 · wallstreetONLINE Redaktion · BYD |

02.05.24 · dpa-AFX · Tesla |

02.05.24 · nebenwerte ONLINE · Airbus |

01.05.24 · dpa-AFX · BMW |

01.05.24 · dpa-AFX · BMW |

30.04.24 · dpa-AFX · Coca-Cola |

| Zeit | Titel |

|---|---|

| 00:00 Uhr | |

| 01.05.24 | |

| 26.04.24 | |

| 26.04.24 | |

| 24.04.24 | |

| 15.04.24 | |

| 12.04.24 | |

| 07.04.24 | |

| 05.04.24 | |

| 04.04.24 |