CREDIT SUISSE belässt BOEING CO auf 'Outperform' (Seite 41) | Diskussion im Forum

eröffnet am 24.08.19 19:32:32 von

neuester Beitrag 24.04.24 21:59:07 von

neuester Beitrag 24.04.24 21:59:07 von

Beiträge: 409

ID: 1.309.981

ID: 1.309.981

Aufrufe heute: 0

Gesamt: 27.124

Gesamt: 27.124

Aktive User: 0

ISIN: US0970231058 · WKN: 850471 · Symbol: BA

167,22

USD

+0,25 %

+0,41 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

24.04.24 · wallstreetONLINE Redaktion |

| Boeing Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

26.04.24 · dpa-AFX |

Werte aus der Branche Luftfahrt und Raumfahrt

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,1500 | +27,86 | |

| 2,9900 | +22,54 | |

| 5,3600 | +6,99 | |

| 5,6800 | +5,58 | |

| 6,9400 | +5,47 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 13,650 | -3,53 | |

| 1,2350 | -4,04 | |

| 4,7100 | -4,75 | |

| 24,220 | -7,27 | |

| 2,1700 | -10,70 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 61.365.707 von faultcode am 29.08.19 00:56:48

https://www.finanzen.net/nachricht/aktien/nach-abstuerzen-un…

=>

Die US-Fluggesellschaften United Airlines und American Airlines nehmen die nach zwei Abstürzen mit Startverboten belegten Boeing-Jets vom Typ 737 Max noch länger aus dem Flugplan.

Zudem gab die US-Luftfahrtaufsicht FAA bekannt, dass die Ergebnisse eines mit der ursprünglichen Zulassung der Krisenflieger betrauten Sonderausschusses noch etwas länger auf sich warten lassen werden...

United und American Airlines streichen Boeings 737-Max-Krisenjets länger aus dem Flugplan

2.9.https://www.finanzen.net/nachricht/aktien/nach-abstuerzen-un…

=>

Die US-Fluggesellschaften United Airlines und American Airlines nehmen die nach zwei Abstürzen mit Startverboten belegten Boeing-Jets vom Typ 737 Max noch länger aus dem Flugplan.

Zudem gab die US-Luftfahrtaufsicht FAA bekannt, dass die Ergebnisse eines mit der ursprünglichen Zulassung der Krisenflieger betrauten Sonderausschusses noch etwas länger auf sich warten lassen werden...

Antwort auf Beitrag Nr.: 61.352.665 von faultcode am 27.08.19 17:20:09

..oder noch viel schlimmer?!?

28.8.

Criminal Prosecution Exposure In Boeing Investigation May Come To Light With Expert Report

https://www.forbes.com/sites/jacobfrenkel/2019/08/28/crimina…

=>

...For Boeing and the individuals responsible, the time-tested corporate enforcement strategy of throw officers and employees under the bus as part of a corporate resolution certainly could come into play. In evaluating a corporation’s compliance program and in considering how to resolve criminal charges against a corporation, prosecutors consider remedial measures adopted by the corporation.

Such remedial measures include discipline of responsible persons. For example, Boeing President, Chairman and CEO Dennis Muilenberg, who is an aerospace engineer by training, could be imputed with a technical understanding and appreciation of problems with the MCAS system. If Muilenberg or any other senior official involved in preparing and issuing the service bulletin knew that the publication simply was applying a bandage to a catastrophic problem, then prosecutors could be expecting that Boeing deliver evidence of such knowledge to serve as the basis for a prosecution of the individual.

Experience dictates that the deal-making is well underway, and at the corporate level for Boeing likely is well-advanced. Needless to say, before prosecutors bring any case or seek a guilty plea there will be a determination as to whether there is evidence to warrant criminal charges against the company and individuals. Nevertheless, as Taylor observed, in her more than 10 years working in the commercial airline industry, “This investigation will set a new standard for compliance and enforcement. Major regulatory reforms, such as we haven’t seen since the 2009 Colgan Air accident, will follow in the U.S. aviation industry.”

Zitat von faultcode: ...--> BA ist, wenn auch auf anderem Wege, die "GE der Lüfte" geworden...

..oder noch viel schlimmer?!?

28.8.

Criminal Prosecution Exposure In Boeing Investigation May Come To Light With Expert Report

https://www.forbes.com/sites/jacobfrenkel/2019/08/28/crimina…

=>

...For Boeing and the individuals responsible, the time-tested corporate enforcement strategy of throw officers and employees under the bus as part of a corporate resolution certainly could come into play. In evaluating a corporation’s compliance program and in considering how to resolve criminal charges against a corporation, prosecutors consider remedial measures adopted by the corporation.

Such remedial measures include discipline of responsible persons. For example, Boeing President, Chairman and CEO Dennis Muilenberg, who is an aerospace engineer by training, could be imputed with a technical understanding and appreciation of problems with the MCAS system. If Muilenberg or any other senior official involved in preparing and issuing the service bulletin knew that the publication simply was applying a bandage to a catastrophic problem, then prosecutors could be expecting that Boeing deliver evidence of such knowledge to serve as the basis for a prosecution of the individual.

Experience dictates that the deal-making is well underway, and at the corporate level for Boeing likely is well-advanced. Needless to say, before prosecutors bring any case or seek a guilty plea there will be a determination as to whether there is evidence to warrant criminal charges against the company and individuals. Nevertheless, as Taylor observed, in her more than 10 years working in the commercial airline industry, “This investigation will set a new standard for compliance and enforcement. Major regulatory reforms, such as we haven’t seen since the 2009 Colgan Air accident, will follow in the U.S. aviation industry.”

Antwort auf Beitrag Nr.: 61.335.343 von faultcode am 24.08.19 20:04:20hier ist eine gute Gesamtdarstellung der bisherigen Geschehnisse und zur Firmenkultur bei Boeing:

26.8.

Pushing It to the Max -- Boeing's Crashes Expose Systemic Failings

The crash of two Boeing 737 Max jets in the course of just months has created an existential crisis for the company. Were the 346 who died in Indonesia and Ethiopia the victims of shortcuts and cutthroat competition in the aviation industry? By DER SPIEGEL Staff

https://www.spiegel.de/international/business/737-max-boeing…

=>

...The alienation began with the merger of Boeing and McDonnell Douglas in 1997 and the increasing amount of attention being paid to the company's share price, Gates says. Longtime CEO James McNerney, the predecessor of current company head Muilenburg, charted a course aimed at drastically increasing profits. He sought out conflict with the unions, which had until then been an important part of company culture and a point of pride among employees. Even senior company managers were union members, though that didn't stop McNerney. On the contrary...

--> BA ist, wenn auch auf anderem Wege, die "GE der Lüfte" geworden

=> das derzeitige Top-Management und BoD muss und wird mMn ausgetauscht werden

Aber das wird dauern.

26.8.

Pushing It to the Max -- Boeing's Crashes Expose Systemic Failings

The crash of two Boeing 737 Max jets in the course of just months has created an existential crisis for the company. Were the 346 who died in Indonesia and Ethiopia the victims of shortcuts and cutthroat competition in the aviation industry? By DER SPIEGEL Staff

https://www.spiegel.de/international/business/737-max-boeing…

=>

...The alienation began with the merger of Boeing and McDonnell Douglas in 1997 and the increasing amount of attention being paid to the company's share price, Gates says. Longtime CEO James McNerney, the predecessor of current company head Muilenburg, charted a course aimed at drastically increasing profits. He sought out conflict with the unions, which had until then been an important part of company culture and a point of pride among employees. Even senior company managers were union members, though that didn't stop McNerney. On the contrary...

--> BA ist, wenn auch auf anderem Wege, die "GE der Lüfte" geworden

=> das derzeitige Top-Management und BoD muss und wird mMn ausgetauscht werden

Aber das wird dauern.

Antwort auf Beitrag Nr.: 61.335.343 von faultcode am 24.08.19 20:04:20

https://www.ft.com/content/30a68cd4-c84b-11e9-a1f4-3669401ba…

Russian aircraft leasing group Avia sues to cancel order for 35 of the grounded planes

=>

A Russian aircraft leasing company is suing Boeing for breach of contract in connection with its grounded 737 Max in what is the first lawsuit brought against the US manufacturer by a customer over the safety crisis.

Avia Capital Services, a subsidiary of Russian state conglomerate Rostec, claims two deadly crashes were due to the “negligent actions and decisions of Boeing” not just in designing a plane that was “defective” but also in “withholding critical information” from the US aviation safety regulator during certification.

The complaint, which was filed in Cook county circuit court in Chicago on Monday, claims that Boeing “intentionally” failed to disclose information about the airworthiness of the Max to its customers, including Avia, in order to induce them to buy the aircraft.

Avia ordered 35 Max 8 jets from Boeing before they were grounded worldwide in March, and now it wants the order cancelled. The company says it gave Boeing a cash deposit of $35m to secure the order, and is asking for that amount to be returned with interest, along with $75m in lost profits for a total of $115m in compensatory damages, plus “several times the amount” in punitive damages....

Boeing faces first lawsuit from 737 Max customer

27.8.https://www.ft.com/content/30a68cd4-c84b-11e9-a1f4-3669401ba…

Russian aircraft leasing group Avia sues to cancel order for 35 of the grounded planes

=>

A Russian aircraft leasing company is suing Boeing for breach of contract in connection with its grounded 737 Max in what is the first lawsuit brought against the US manufacturer by a customer over the safety crisis.

Avia Capital Services, a subsidiary of Russian state conglomerate Rostec, claims two deadly crashes were due to the “negligent actions and decisions of Boeing” not just in designing a plane that was “defective” but also in “withholding critical information” from the US aviation safety regulator during certification.

The complaint, which was filed in Cook county circuit court in Chicago on Monday, claims that Boeing “intentionally” failed to disclose information about the airworthiness of the Max to its customers, including Avia, in order to induce them to buy the aircraft.

Avia ordered 35 Max 8 jets from Boeing before they were grounded worldwide in March, and now it wants the order cancelled. The company says it gave Boeing a cash deposit of $35m to secure the order, and is asking for that amount to be returned with interest, along with $75m in lost profits for a total of $115m in compensatory damages, plus “several times the amount” in punitive damages....

Boeing 737 MAX pilot class action grows

27.8.https://australianaviation.com.au/2019/08/boeing-737-max-pil…

=>

About 3,000 pilots from 12 airlines have joined a class action seeking compensation for financial and other losses following the global grounding of the Boeing 737 MAX fleet after two fatal accidents in Indonesia and Ethiopia.

The claim is estimated in court documents filed in the United States District Court for the Northern District of Illinois to potentially cost Boeing US$250 million (A$369 million).

Brisbane-based air and space law firm International Aerospace Law & Policy Group (IALPG) and Chicago-based PMJ PLLC filed the initial action in May on behalf of Pilot X, a Canadian citizen at a major international airline who chose to remain anonymous to safeguard against any “reprisal from Boeing or its customers”.

“We could never have predicted that so many would come forward feeling that their trust as safety professionals was abused,” PMJ PLLC Patrick Jones managing partner and founder said in a statement on Tuesday.

The hearing is scheduled for October 21, in Chicago, where Boeing has its headquarters.

The pilots who have progressively joined the action since Pilot X’s filing are also seeking anonymity so that they are not prejudiced in present or future employment....

Antwort auf Beitrag Nr.: 61.335.256 von faultcode am 24.08.19 19:33:36

12.8.

https://www.flightglobal.com/news/articles/boeing-juggles-kc…

=>

Boeing is redesigning the actuator to address hardware specification flaws coming from the service’s initial design requirements. Designing and retrofitting the aircraft will likely cost more than $300 million, according to a Government Accountability Office (GAO) report released in June 2019. Programme officials told GAO that developing a solution, and receiving Federal Aviation Administration certification, would likely take three to four years.

The boom's issues became apparent during developmental flight testing, when pilots of lighter receiver aircraft – such as Fairchild Republic A-10s and Lockheed Martin F-16s – reported they needed more force to connect and disconnect their aircraft from the boom, as compared to older tankers, like the KC-135 and KC-10, says GAO.

The additional force required can cause the receiving aircraft to suddenly lunge and collide with the boom, damaging the aircraft’s glass cockpit canopy or tail. It can also damage the boom.

...

Boeing’s KC-46 deliveries to the USAF have been slowed, and at times halted, by issues with Foreign Object Debris (FOD) found inside the airframes. Boeing says it has implemented new FOD-awareness days and clean-as-you-go practices to eliminate the problem, but declines to say if FOD has been discovered in the aircraft in recent months.

--> also auch im Militärbereich läuft's offenbar nicht besonders störungsfrei bei Boeing

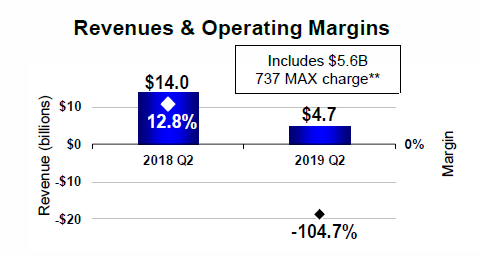

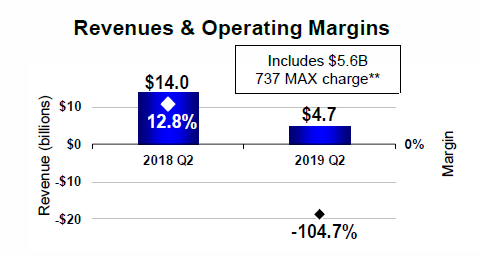

2018Q2, revenues -- also vor dem MAX-Desaster (*)

• Commercial Airplanes: USD14.0b = 58% (~)

• Defense, Space & Security: USD6.1b = 25%

• Global Services: USD4.1b (gemischt zivil + militärisch) = 17% => 8.5% + 8.5% (~) <meine willkürliche Annahme>

-------------------------------

= USD24.3b (Rundungseffekt)

(*) ..wie es sich hier darstellt im krassen Umsatzrückgang 2018Q2 --> 2019Q2:

<Commercial Airplanes>

=> demnach lag vor dem MAX-Desaster der zivile Umsatzanteil bei Boeing bei so rund (58+8.5)% = ~2/3

--> auch mal gut zu wissen

Der Backlog im Bereich Defense, Space & Security ist laut Boeing zum 30.6.2019 mit USD64b sehr hoch (das scheint offenbar gewohnheitsmäßig so zu sein bei Boeing)

--> Orders valued at $4B; Backlog of $64B

--> hier scheint also immer noch ein (gesund) hohes Book-to-bill Ratio zu bestehen

--> bei Commercial Airplanes sagt Boeing (immer noch): Healthy backlog of $390B

=> ich sehe es derzeit so, daß der Markt in Summe das MAX-Desaster nur als eine vorübergehende Delle sieht, gestützt von einem weiterhin starken Militärgeschäft (unter Pres.Trump)

Boeing delivered three more KC-46A Pegasus in-flight refuelling tankers to the US Air Force (USAF)...

... on 8 and 9 August, a week after winning a $55 million contract to redesign the aircraft’s boom telescope actuator.12.8.

https://www.flightglobal.com/news/articles/boeing-juggles-kc…

=>

Boeing is redesigning the actuator to address hardware specification flaws coming from the service’s initial design requirements. Designing and retrofitting the aircraft will likely cost more than $300 million, according to a Government Accountability Office (GAO) report released in June 2019. Programme officials told GAO that developing a solution, and receiving Federal Aviation Administration certification, would likely take three to four years.

The boom's issues became apparent during developmental flight testing, when pilots of lighter receiver aircraft – such as Fairchild Republic A-10s and Lockheed Martin F-16s – reported they needed more force to connect and disconnect their aircraft from the boom, as compared to older tankers, like the KC-135 and KC-10, says GAO.

The additional force required can cause the receiving aircraft to suddenly lunge and collide with the boom, damaging the aircraft’s glass cockpit canopy or tail. It can also damage the boom.

...

Boeing’s KC-46 deliveries to the USAF have been slowed, and at times halted, by issues with Foreign Object Debris (FOD) found inside the airframes. Boeing says it has implemented new FOD-awareness days and clean-as-you-go practices to eliminate the problem, but declines to say if FOD has been discovered in the aircraft in recent months.

--> also auch im Militärbereich läuft's offenbar nicht besonders störungsfrei bei Boeing

2018Q2, revenues -- also vor dem MAX-Desaster (*)

• Commercial Airplanes: USD14.0b = 58% (~)

• Defense, Space & Security: USD6.1b = 25%

• Global Services: USD4.1b (gemischt zivil + militärisch) = 17% => 8.5% + 8.5% (~) <meine willkürliche Annahme>

-------------------------------

= USD24.3b (Rundungseffekt)

(*) ..wie es sich hier darstellt im krassen Umsatzrückgang 2018Q2 --> 2019Q2:

<Commercial Airplanes>

=> demnach lag vor dem MAX-Desaster der zivile Umsatzanteil bei Boeing bei so rund (58+8.5)% = ~2/3

--> auch mal gut zu wissen

Der Backlog im Bereich Defense, Space & Security ist laut Boeing zum 30.6.2019 mit USD64b sehr hoch (das scheint offenbar gewohnheitsmäßig so zu sein bei Boeing)

--> Orders valued at $4B; Backlog of $64B

--> hier scheint also immer noch ein (gesund) hohes Book-to-bill Ratio zu bestehen

--> bei Commercial Airplanes sagt Boeing (immer noch): Healthy backlog of $390B

=> ich sehe es derzeit so, daß der Markt in Summe das MAX-Desaster nur als eine vorübergehende Delle sieht, gestützt von einem weiterhin starken Militärgeschäft (unter Pres.Trump)

Antwort auf Beitrag Nr.: 61.335.250 von faultcode am 24.08.19 19:32:32weiter von hier: https://www.wallstreet-online.de/diskussion/1294941-41-50/fl…

<Platzhalter>

Es handelt sich um einen automatisiert angelegten Thread zur Nachricht "CREDIT SUISSE belässt BOEING CO auf 'Outperform'" vom Autor dpa-AFX Analysen

Die Schweizer Bank Credit Suisse hat das Kursziel für Boeing von 427 auf 425 US-Dollar gesenkt, die Einstufung aber auf "Outperform" belassen. Das Papier des Flugzeugbauers eigne sich derzeit bestenfalls für längerfristig orientierte Investoren, die …

Lesen Sie den ganzen Artikel: CREDIT SUISSE belässt BOEING CO auf 'Outperform'

Die Schweizer Bank Credit Suisse hat das Kursziel für Boeing von 427 auf 425 US-Dollar gesenkt, die Einstufung aber auf "Outperform" belassen. Das Papier des Flugzeugbauers eigne sich derzeit bestenfalls für längerfristig orientierte Investoren, die …

Lesen Sie den ganzen Artikel: CREDIT SUISSE belässt BOEING CO auf 'Outperform'

26.04.24 · dpa-AFX · Boeing |

26.04.24 · dpa-AFX · Boeing |

25.04.24 · dpa-AFX · Boeing |

24.04.24 · dpa-AFX · Boeing |

24.04.24 · dpa-AFX · Boeing |

24.04.24 · dpa-AFX · Boeing |

24.04.24 · dpa-AFX · Alaska Air Group |

24.04.24 · dpa-AFX · ASM International |

| Zeit | Titel |

|---|---|

| 26.04.24 | |

| 26.04.24 | |

| 25.04.24 | |

| 25.04.24 | |

| 18.04.24 | |

| 22.03.24 | |

| 09.01.24 | |

| 25.10.23 |