Mortgage 1% des Portfolio. Mal sehen

eröffnet am 28.03.20 19:32:02 von

neuester Beitrag 06.06.22 13:26:50 von

neuester Beitrag 06.06.22 13:26:50 von

Beiträge: 35

ID: 1.322.575

ID: 1.322.575

Aufrufe heute: 0

Gesamt: 2.650

Gesamt: 2.650

Aktive User: 0

ISIN: US46131B7047 · WKN: A3DMJV · Symbol: IVR

8,4300

USD

-2,09 %

-0,1800 USD

Letzter Kurs 02:04:00 NYSE

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5100 | +37,27 | |

| 4,5000 | +15,38 | |

| 6,3000 | +14,55 | |

| 3,4200 | +14,00 | |

| 1,6503 | +10,07 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 45,82 | -10,02 | |

| 19,960 | -10,25 | |

| 8,4200 | -11,74 | |

| 1,5000 | -23,08 | |

| 5,2250 | -50,38 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.722.211 von faultcode am 06.06.22 13:23:37============================

weiter hier: https://www.wallstreet-online.de/diskussion/1361024-1-10/inv…

============================

weiter hier: https://www.wallstreet-online.de/diskussion/1361024-1-10/inv…

============================

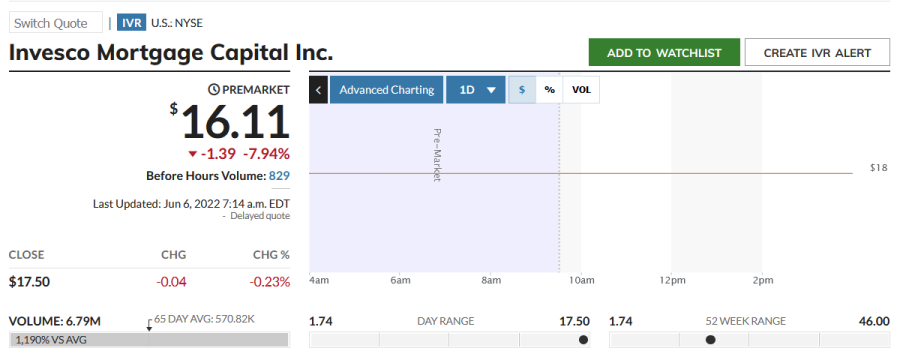

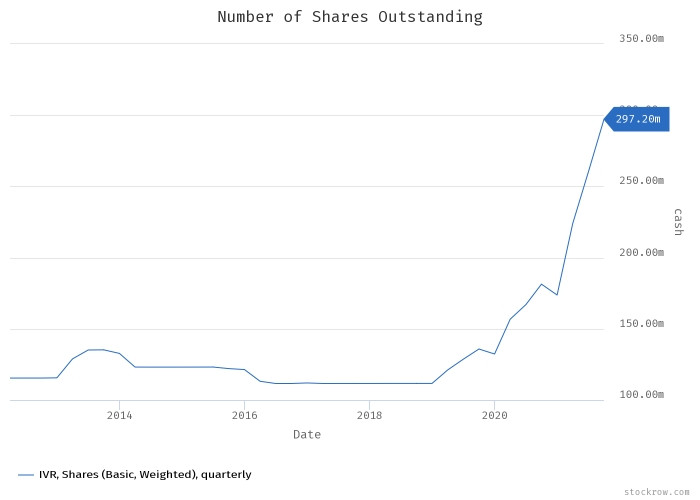

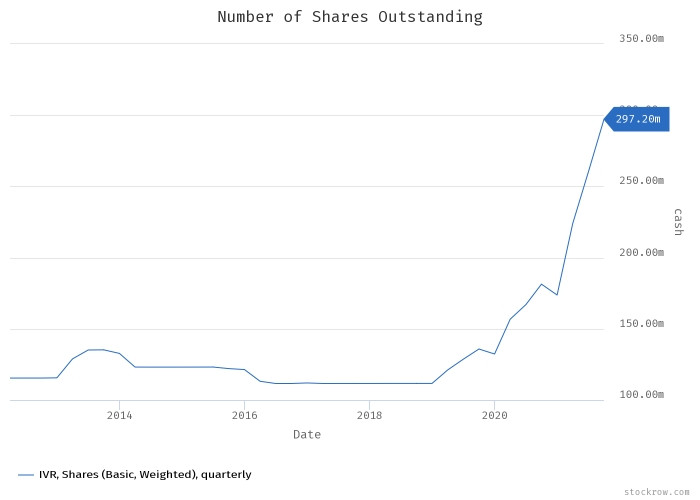

Reverse stock split 1:10:

..

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

After the close of business on June 3, 2022, Invesco Mortgage Capital Inc. (the “Company”) effected the previously announced 1-for-10 reverse stock split (the “Reverse Stock Split”) of its outstanding shares of common stock, par value $0.01 per share (the “Common Stock”).

On June 1, 2022, the Company filed with the State Department of Assessments and Taxation of Maryland two Articles of Amendment (the “Amendments”) to its charter that: (i) provided for a 1-for-10 reverse stock split of the issued and outstanding shares of Common Stock, effective at 5:00 p.m., Eastern Time, on June 3, 2022, and (ii) provided for the par value of the Common Stock to be changed from $0.10 per share (as a result of the reverse stock split) back to $0.01 per share, effective at 5:01 p.m., Eastern Time, on June 3, 2022.

Fractional shares resulting from the Reverse Stock Split will be paid in cash based on the closing price of the Common Stock on the New York Stock Exchange (“NYSE”) on June 3, 2022, after taking into account the Reverse Stock Split.

The Reverse Stock Split affected all record holders of Common Stock uniformly and did not affect any record holder’s percentage ownership interest, except for de minimis changes as a result of the elimination of fractional shares.

The Reverse Stock Split did not affect the number of the Company’s authorized shares of Common Stock under its charter. The Common Stock will begin trading on a split-adjusted basis on the NYSE at the opening of trading on June 6, 2022. The Common Stock continues to trade on the NYSE under the symbol “IVR”, but with a new CUSIP number: 46131B704.

...

https://www.invescomortgagecapital.com/filings-financials/do…

=> neue ISIN = US46131B7047 (alt = US46131B1008)

..

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

After the close of business on June 3, 2022, Invesco Mortgage Capital Inc. (the “Company”) effected the previously announced 1-for-10 reverse stock split (the “Reverse Stock Split”) of its outstanding shares of common stock, par value $0.01 per share (the “Common Stock”).

On June 1, 2022, the Company filed with the State Department of Assessments and Taxation of Maryland two Articles of Amendment (the “Amendments”) to its charter that: (i) provided for a 1-for-10 reverse stock split of the issued and outstanding shares of Common Stock, effective at 5:00 p.m., Eastern Time, on June 3, 2022, and (ii) provided for the par value of the Common Stock to be changed from $0.10 per share (as a result of the reverse stock split) back to $0.01 per share, effective at 5:01 p.m., Eastern Time, on June 3, 2022.

Fractional shares resulting from the Reverse Stock Split will be paid in cash based on the closing price of the Common Stock on the New York Stock Exchange (“NYSE”) on June 3, 2022, after taking into account the Reverse Stock Split.

The Reverse Stock Split affected all record holders of Common Stock uniformly and did not affect any record holder’s percentage ownership interest, except for de minimis changes as a result of the elimination of fractional shares.

The Reverse Stock Split did not affect the number of the Company’s authorized shares of Common Stock under its charter. The Common Stock will begin trading on a split-adjusted basis on the NYSE at the opening of trading on June 6, 2022. The Common Stock continues to trade on the NYSE under the symbol “IVR”, but with a new CUSIP number: 46131B704.

...

https://www.invescomortgagecapital.com/filings-financials/do…

=> neue ISIN = US46131B7047 (alt = US46131B1008)

Q1:

...

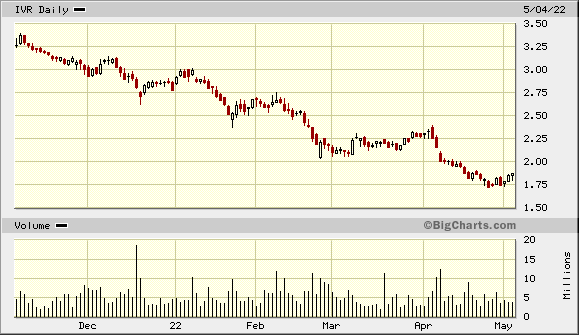

Book value per common share for the first quarter of 2022 decreased 28.5% to $2.08 and is estimated to be between $1.77 and $1.83 as of April 30, 2022. The anticipation of an accelerated timeline for balance sheet reduction and the sharp pivot to tighter monetary policy by the Federal Reserve has pressured valuations lower in 2022

...

https://www.invescomortgagecapital.com/news-market-data/pres…

mit: Common stock dividend of $0.09 per common share, unchanged from Q4 2021

=> 4 x $0.09 / ~$1.87 = ~19% Dividendenrendite

<als Annahme, da eben gilt: ...earnings available for distribution should not be considered as an indication of the Company's taxable income, a guaranty of its ability to pay dividends or as a proxy for the amount of dividends it may pay, as earnings available for distribution excludes certain items that impact its cash needs.>

...

Book value per common share for the first quarter of 2022 decreased 28.5% to $2.08 and is estimated to be between $1.77 and $1.83 as of April 30, 2022. The anticipation of an accelerated timeline for balance sheet reduction and the sharp pivot to tighter monetary policy by the Federal Reserve has pressured valuations lower in 2022

...

https://www.invescomortgagecapital.com/news-market-data/pres…

mit: Common stock dividend of $0.09 per common share, unchanged from Q4 2021

=> 4 x $0.09 / ~$1.87 = ~19% Dividendenrendite

<als Annahme, da eben gilt: ...earnings available for distribution should not be considered as an indication of the Company's taxable income, a guaranty of its ability to pay dividends or as a proxy for the amount of dividends it may pay, as earnings available for distribution excludes certain items that impact its cash needs.>

Antwort auf Beitrag Nr.: 70.880.179 von faultcode am 18.02.22 22:56:18gerade kam schon wieder ein Prospekt herein über den Verkauf von weiteren Aktien.

bis zum 30.9.2021 sah das so aus:

bis zum 30.9.2021 sah das so aus:

Q4: Buchwert nun bei USD2.91 pro Aktie:

Book value per common share(2) of $2.91 compared to $3.25 at Q3 2021

(2) Book value per common share is calculated as total stockholders' equity less the liquidation preference of the Company's Series B Preferred Stock ($155.0 million) and Series C Preferred Stock ($287.5 million), divided by total common shares outstanding.

https://www.invescomortgagecapital.com/news-market-data/pres…

ansonsten:

Update from John Anzalone, Chief Executive Officer:

"Agency RMBS performed poorly in the fourth quarter, completing a difficult year in which returns for the asset class ranked among the worst in the last ten years. The Federal Reserve's pivot in November towards a faster removal of monetary policy accommodation signaled a more rapid reduction of asset purchases by the central bank, worsening an already challenging picture for supply and demand in 2022.

Heightened interest rate volatility, spurred by increased expectations of interest rate hikes by the Federal Reserve, and lower premiums on specified pool collateral also contributed to underperformance.

"While the recent widening of spreads, moderating prepayment speeds and the continued attractiveness in the dollar roll market support earnings available for distribution, we remain cautious on the outlook for Agency RMBS valuations. Increased expectations for accelerated interest rate hikes and balance sheet reduction by the Federal Reserve during 2022 further challenged Agency RMBS valuations at the start of the year.

We continue to evaluate additional investment opportunities to complement our Agency RMBS strategy by expanding our target assets and portfolio diversification."

Book value per common share(2) of $2.91 compared to $3.25 at Q3 2021

(2) Book value per common share is calculated as total stockholders' equity less the liquidation preference of the Company's Series B Preferred Stock ($155.0 million) and Series C Preferred Stock ($287.5 million), divided by total common shares outstanding.

https://www.invescomortgagecapital.com/news-market-data/pres…

ansonsten:

Update from John Anzalone, Chief Executive Officer:

"Agency RMBS performed poorly in the fourth quarter, completing a difficult year in which returns for the asset class ranked among the worst in the last ten years. The Federal Reserve's pivot in November towards a faster removal of monetary policy accommodation signaled a more rapid reduction of asset purchases by the central bank, worsening an already challenging picture for supply and demand in 2022.

Heightened interest rate volatility, spurred by increased expectations of interest rate hikes by the Federal Reserve, and lower premiums on specified pool collateral also contributed to underperformance.

"While the recent widening of spreads, moderating prepayment speeds and the continued attractiveness in the dollar roll market support earnings available for distribution, we remain cautious on the outlook for Agency RMBS valuations. Increased expectations for accelerated interest rate hikes and balance sheet reduction by the Federal Reserve during 2022 further challenged Agency RMBS valuations at the start of the year.

We continue to evaluate additional investment opportunities to complement our Agency RMBS strategy by expanding our target assets and portfolio diversification."

17.9.

...

Invesco Ltd. is in talks to merge with State Street Corp.’s asset-management business, people familiar with the matter said.

A deal isn’t imminent, and the discussions might not result in an agreement, the people said. It isn’t clear what the terms of a potential deal would look like, but it would be one of the industry’s biggest in recent memory, given State Street’s asset-management unit manages nearly $4 trillion in assets.

...

WSJ: Invesco in merger talks with State Street’s asset-management business

https://www.marketwatch.com/story/invesco-in-merger-talks-wi…

...

Invesco Ltd. is in talks to merge with State Street Corp.’s asset-management business, people familiar with the matter said.

A deal isn’t imminent, and the discussions might not result in an agreement, the people said. It isn’t clear what the terms of a potential deal would look like, but it would be one of the industry’s biggest in recent memory, given State Street’s asset-management unit manages nearly $4 trillion in assets.

...

WSJ: Invesco in merger talks with State Street’s asset-management business

https://www.marketwatch.com/story/invesco-in-merger-talks-wi…

Antwort auf Beitrag Nr.: 68.635.693 von faultcode am 28.06.21 21:58:20Danke Faultcode☺️

Ein bisschen verstehe ich aber nicht ganz.

Ich beobachte diese Aktie noch weiter, aber nicht jetzt kaufen.

Denn hab ich gelesen irgendwo, dass Aktien Markt bis Ende Jahr 2021 noch korrigiert wird. Wenn ich was finde, melde mich auch hier an.

Ein bisschen verstehe ich aber nicht ganz.

Ich beobachte diese Aktie noch weiter, aber nicht jetzt kaufen.

Denn hab ich gelesen irgendwo, dass Aktien Markt bis Ende Jahr 2021 noch korrigiert wird. Wenn ich was finde, melde mich auch hier an.

Antwort auf Beitrag Nr.: 68.632.471 von LuyiWang am 28.06.21 16:14:39so bis bislang. Der Preis orientiert sich eng am Buchwert (der steht bei P/B ~1.1) und was verdient wird, wird ausgeschüttet.

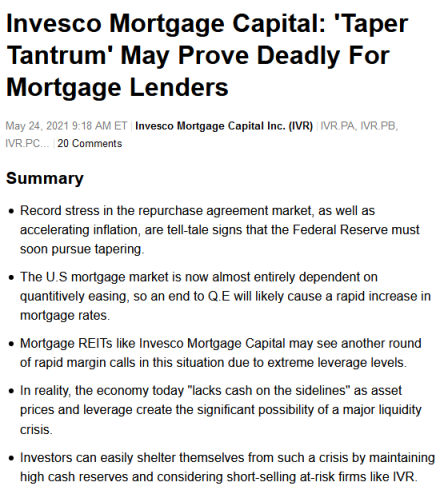

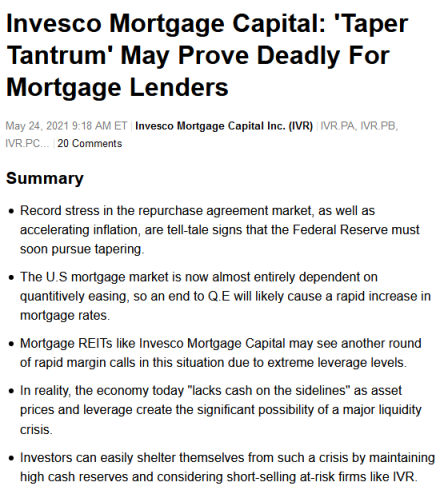

Ich suche noch jemanden, der erklären kann, was z.B. Tapering für mRETs bedeutet bzw. bedeuten kann. Manchen sagen, daß dann die Gewinn-Margen größer werden, andere, wie unten, daß sie dann schrumpfen.

Ein Problem bei mREITs mMn ist, daß man von außen als Laie nicht erkennen kann, wie clever das Hedging ist. Also lass ich das Timing - außer in Extremfällen wie in 2020.

...

https://seekingalpha.com/article/4430848-invesco-mortgage-ca…

Ich suche noch jemanden, der erklären kann, was z.B. Tapering für mRETs bedeutet bzw. bedeuten kann. Manchen sagen, daß dann die Gewinn-Margen größer werden, andere, wie unten, daß sie dann schrumpfen.

Ein Problem bei mREITs mMn ist, daß man von außen als Laie nicht erkennen kann, wie clever das Hedging ist. Also lass ich das Timing - außer in Extremfällen wie in 2020.

...

https://seekingalpha.com/article/4430848-invesco-mortgage-ca…

Mortgage 1% des Portfolio. Mal sehen