PacWest Bancorp nach dem Crash der U.S. regional banks

eröffnet am 10.03.23 20:40:05 von

neuester Beitrag 06.12.23 17:45:38 von

neuester Beitrag 06.12.23 17:45:38 von

Beiträge: 41

ID: 1.367.463

ID: 1.367.463

Aufrufe heute: 0

Gesamt: 5.485

Gesamt: 5.485

Aktive User: 0

ISIN: US6952631033 · WKN: A0Q16R · Symbol: PACW

7,5400

USD

0,00 %

0,0000 USD

Letzter Kurs 01.12.23 Nasdaq

Neuigkeiten

20.12.23 · wallstreetONLINE NewsUpdate |

20.12.23 · wallstreetONLINE Redaktion |

30.11.23 · Business Wire (engl.) |

22.11.23 · globenewswire |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 32,00 | +27,95 | |

| 0,5800 | +23,40 | |

| 6,1100 | +18,64 | |

| 2,3200 | +17,17 | |

| 5,9000 | +15,69 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2200 | -11,59 | |

| 14,750 | -14,14 | |

| 1,8775 | -14,17 | |

| 1,2600 | -16,00 | |

| 1.138,25 | -16,86 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 74.900.373 von faultcode am 02.12.23 14:46:17================= ENDE =================

hier geht's weiter: https://www.wallstreet-online.de/diskussion/1374208-1-10/ban…

hier geht's weiter: https://www.wallstreet-online.de/diskussion/1374208-1-10/ban…

Banc of California Announces Completion of Transformational Merger with PacWest Bancorp and $400 Million Equity Raise

https://investors.bancofcal.com/news-events-and-presentation…

Company Release - 11/30/2023

Combined bank emerges as the third-largest bank headquartered in California and one of the nation’s premier relationship-focused business banks

LOS ANGELES--(BUSINESS WIRE)-- Banc of California, Inc. (“Banc of California”) (NYSE: BANC) today announced the completion of its transformational merger with PacWest Bancorp (“PacWest”) (Nasdaq: PACW), pursuant to which PacWest has merged into Banc of California, and as of December 1, 2023, Banc of California, N.A. will have merged into Pacific Western Bank (the “combined bank”). The combined bank will operate under the Banc of California name and brand. Concurrent with the completion of the merger, Banc of California also completed its $400 million equity raise from affiliates of funds managed by Warburg Pincus LLC and certain investment vehicles sponsored, managed or advised by Centerbridge Partners, L.P. and its affiliates.

...

https://investors.bancofcal.com/news-events-and-presentation…

Company Release - 11/30/2023

Combined bank emerges as the third-largest bank headquartered in California and one of the nation’s premier relationship-focused business banks

LOS ANGELES--(BUSINESS WIRE)-- Banc of California, Inc. (“Banc of California”) (NYSE: BANC) today announced the completion of its transformational merger with PacWest Bancorp (“PacWest”) (Nasdaq: PACW), pursuant to which PacWest has merged into Banc of California, and as of December 1, 2023, Banc of California, N.A. will have merged into Pacific Western Bank (the “combined bank”). The combined bank will operate under the Banc of California name and brand. Concurrent with the completion of the merger, Banc of California also completed its $400 million equity raise from affiliates of funds managed by Warburg Pincus LLC and certain investment vehicles sponsored, managed or advised by Centerbridge Partners, L.P. and its affiliates.

...

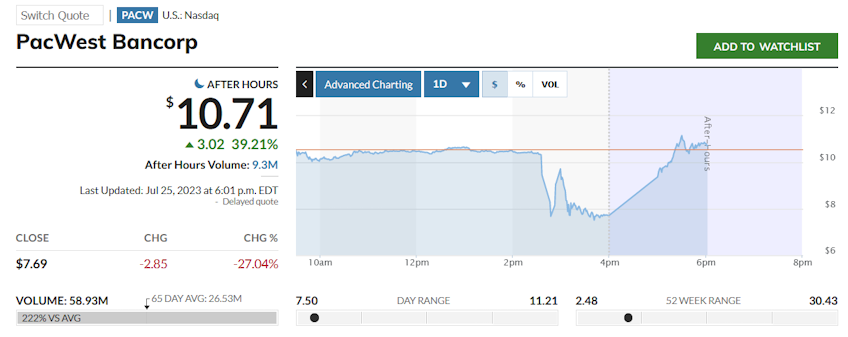

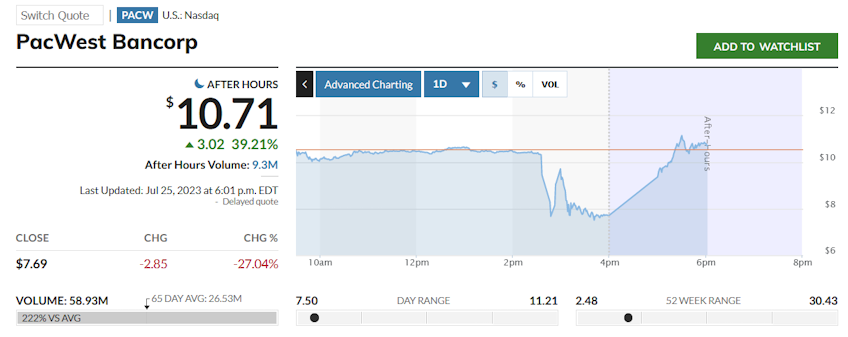

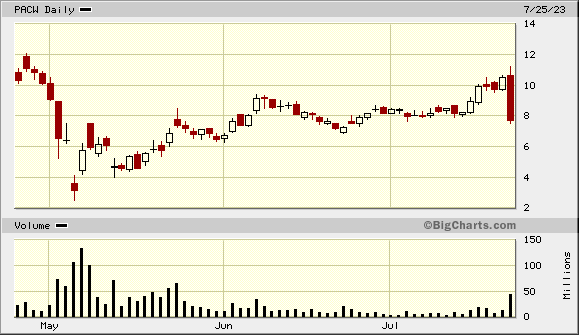

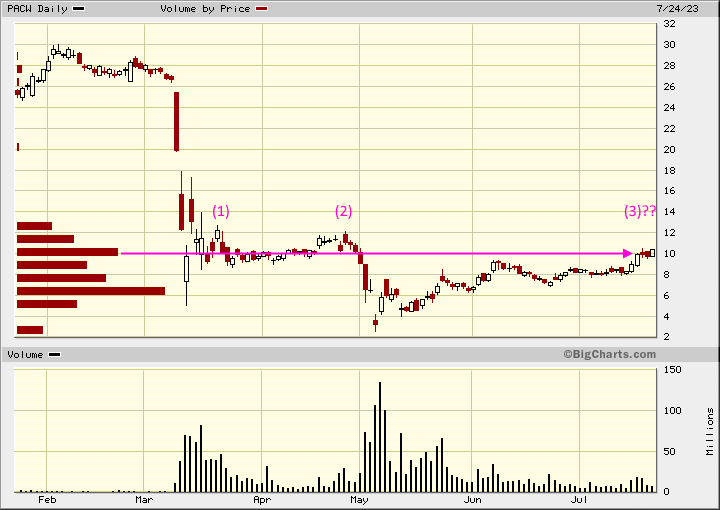

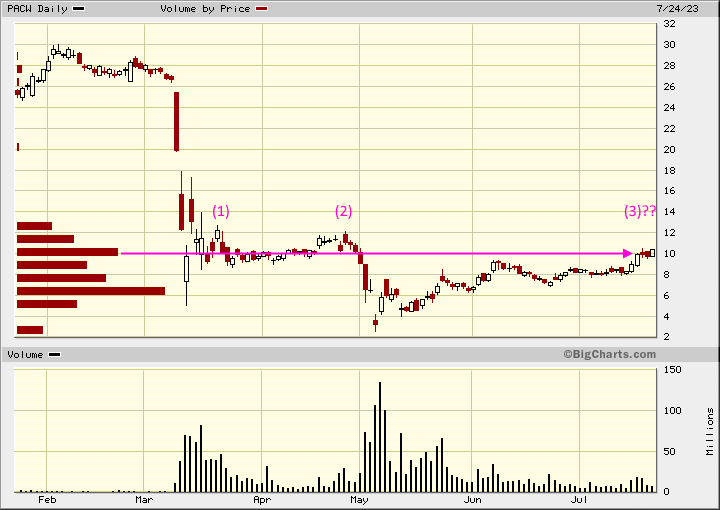

"efficient markets"

Antwort auf Beitrag Nr.: 74.206.470 von faultcode am 25.07.23 22:10:14July 25, 2023 at 11:32 PM GMT+2

PacWest agrees to combine with Banc of California

https://finance.yahoo.com/news/pacwest-agrees-to-combine-wit…

...

PacWest (PACW) agreed to combine with smaller rival Banc of California (BANC), an all-stock deal that would end the independence of a regional lender that came under intense scrutiny following the downfall of Silicon Valley Bank.

The stock of Beverly Hills-based PacWest fell 27% Tuesday after news of the deal was reported by The Wall Street Journal, and the stock of Santa Ana-based Banc of California rose 11%.

Private equity groups Warburg Pincus and Centerview helped arrange $400 million in new equity from investors as part of the deal and would own roughly 20% of the combined bank. The pact is expected to close in late 2023 or early 2024, if it receives approvals from shareholders and regulators.

The union would create a $36 billion lender headquartered in Los Angeles under the Banc of California name, with more than 70 branches in California. It will be run by Banc of California CEO Jared Wolff.

Both banks serve wealthier customers in California, and PacWest is the far bigger lender when measured by assets. It was the nation's 49th-largest bank as of March 31 by that measure, while Banc of California was the 135th largest.

But PacWest's market value was just slightly higher as Tuesday's close, $924 million as compared to Banc of California's $842 million.

...

PacWest agrees to combine with Banc of California

https://finance.yahoo.com/news/pacwest-agrees-to-combine-wit…

...

PacWest (PACW) agreed to combine with smaller rival Banc of California (BANC), an all-stock deal that would end the independence of a regional lender that came under intense scrutiny following the downfall of Silicon Valley Bank.

The stock of Beverly Hills-based PacWest fell 27% Tuesday after news of the deal was reported by The Wall Street Journal, and the stock of Santa Ana-based Banc of California rose 11%.

Private equity groups Warburg Pincus and Centerview helped arrange $400 million in new equity from investors as part of the deal and would own roughly 20% of the combined bank. The pact is expected to close in late 2023 or early 2024, if it receives approvals from shareholders and regulators.

The union would create a $36 billion lender headquartered in Los Angeles under the Banc of California name, with more than 70 branches in California. It will be run by Banc of California CEO Jared Wolff.

Both banks serve wealthier customers in California, and PacWest is the far bigger lender when measured by assets. It was the nation's 49th-largest bank as of March 31 by that measure, while Banc of California was the 135th largest.

But PacWest's market value was just slightly higher as Tuesday's close, $924 million as compared to Banc of California's $842 million.

...

25.7.

Banc of California in talks to buy PacWest: WSJ

PacWest stock gives back all of its gains in the past month as reports surface of a deal with Banc of California.

https://www.marketwatch.com/story/banc-of-california-in-talk…

...

weiter durch nach oben?

Antwort auf Beitrag Nr.: 73.957.391 von faultcode am 05.06.23 16:32:56Kennedy Wilson lines up Fairfax Financial as buyer of PacWest loan portfolio

https://www.marketwatch.com/story/kennedy-wilson-lines-up-fa…

https://www.marketwatch.com/story/kennedy-wilson-lines-up-fa…

5.6.

...

Kennedy Wilson Holdings Inc. said Monday it inked an agreement to sell to Canada’s Fairfax Financial Holdings Ltd. a large portion of a previously announced purchase of a portfolio of real estate construction loans from PacWest Bancorp.

Kennedy Wilson KW, -2.65% and Fairfax Financial FFH, +0.19% will purchase 63 of the 73 initial PacWest PACW, -2.72% loans for about $2.1 billion for loans with roughly $2.3 billion in aggregate principal currently outstanding, according to a filing. Fairfax’s portion of the purchase is 95%.

Kennedy Wilson said it was working on finalizing arrangements with PacWest for “certain PacWest employees” that originated and currently manage the loans to join the company as employees during the second and third quarters of 2023.

Kennedy Wilson did not say how many PacWest employees would be included in the move.

Fairfax CEO Prem Watsa said the company was buying, “a stable and attractive loan portfolio that further strengthens the foundation of interest and dividend income-generating assets that will benefit Fairfax over the next two to three years.”

Fairfax also agreed to make a $200 million preferred equity investment in Kennedy Wilson in the form of perpetual preferred stock with a 6% annual dividend rate, which is callable by Kennedy Wilson at any time. It also acquired seven-year warrants to buy up to 12.3 million shares with an initial strike price of $16.21 per share, or $199 million, based on Kennedy Wilson’s closing price on June 2.

...

...

Kennedy Wilson Holdings Inc. said Monday it inked an agreement to sell to Canada’s Fairfax Financial Holdings Ltd. a large portion of a previously announced purchase of a portfolio of real estate construction loans from PacWest Bancorp.

Kennedy Wilson KW, -2.65% and Fairfax Financial FFH, +0.19% will purchase 63 of the 73 initial PacWest PACW, -2.72% loans for about $2.1 billion for loans with roughly $2.3 billion in aggregate principal currently outstanding, according to a filing. Fairfax’s portion of the purchase is 95%.

Kennedy Wilson said it was working on finalizing arrangements with PacWest for “certain PacWest employees” that originated and currently manage the loans to join the company as employees during the second and third quarters of 2023.

Kennedy Wilson did not say how many PacWest employees would be included in the move.

Fairfax CEO Prem Watsa said the company was buying, “a stable and attractive loan portfolio that further strengthens the foundation of interest and dividend income-generating assets that will benefit Fairfax over the next two to three years.”

Fairfax also agreed to make a $200 million preferred equity investment in Kennedy Wilson in the form of perpetual preferred stock with a 6% annual dividend rate, which is callable by Kennedy Wilson at any time. It also acquired seven-year warrants to buy up to 12.3 million shares with an initial strike price of $16.21 per share, or $199 million, based on Kennedy Wilson’s closing price on June 2.

...

24.5.

PacWest sells real-estate lending unit to Roc360

https://finance.yahoo.com/news/pacwest-sell-civic-financial-…

...

PacWest Bancorp agreed to sell its Civic Financial Services unit to real estate lending firm Roc360, as the regional bank seeks to bolster liquidity following turmoil among its peers.

Roc360 has purchased the origination assets of Civic Financial, the New York-based firm said in a statement Tuesday. Excluded from the sale are previously originated, loans and loan servicing operations.

Civic Financial, which PacWest acquired in early 2021, specializes in so-called residential business-purpose loans, or mortgages explicitly made for a borrower’s investment property. Civic has lent more than $9.4 billion through its borrower-direct, broker, and correspondent channels since 2014, according to the statement.

Representatives for Beverly Hills-based PacWest didn’t immediately respond to a request for comment placed outside business hours. The Wall Street Journal reported the news earlier, citing Maksim Stavinsky, Roc360’s co-founder and president.

...

PacWest sells real-estate lending unit to Roc360

https://finance.yahoo.com/news/pacwest-sell-civic-financial-…

...

PacWest Bancorp agreed to sell its Civic Financial Services unit to real estate lending firm Roc360, as the regional bank seeks to bolster liquidity following turmoil among its peers.

Roc360 has purchased the origination assets of Civic Financial, the New York-based firm said in a statement Tuesday. Excluded from the sale are previously originated, loans and loan servicing operations.

Civic Financial, which PacWest acquired in early 2021, specializes in so-called residential business-purpose loans, or mortgages explicitly made for a borrower’s investment property. Civic has lent more than $9.4 billion through its borrower-direct, broker, and correspondent channels since 2014, according to the statement.

Representatives for Beverly Hills-based PacWest didn’t immediately respond to a request for comment placed outside business hours. The Wall Street Journal reported the news earlier, citing Maksim Stavinsky, Roc360’s co-founder and president.

...

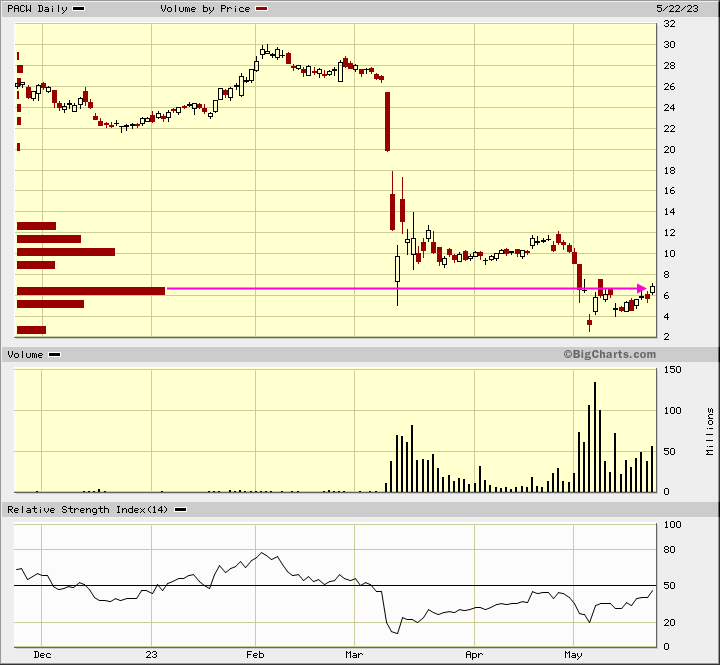

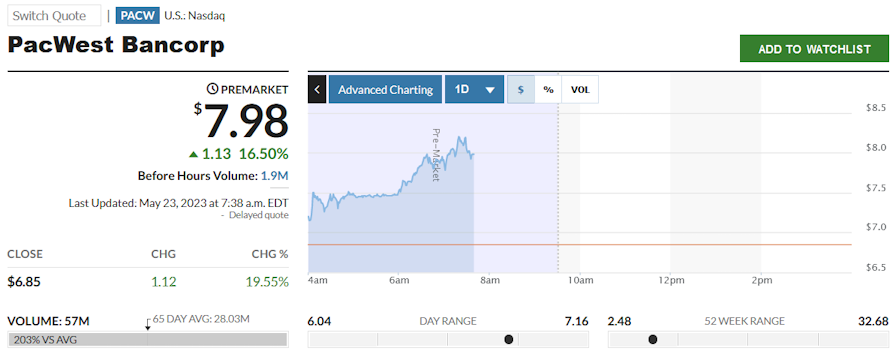

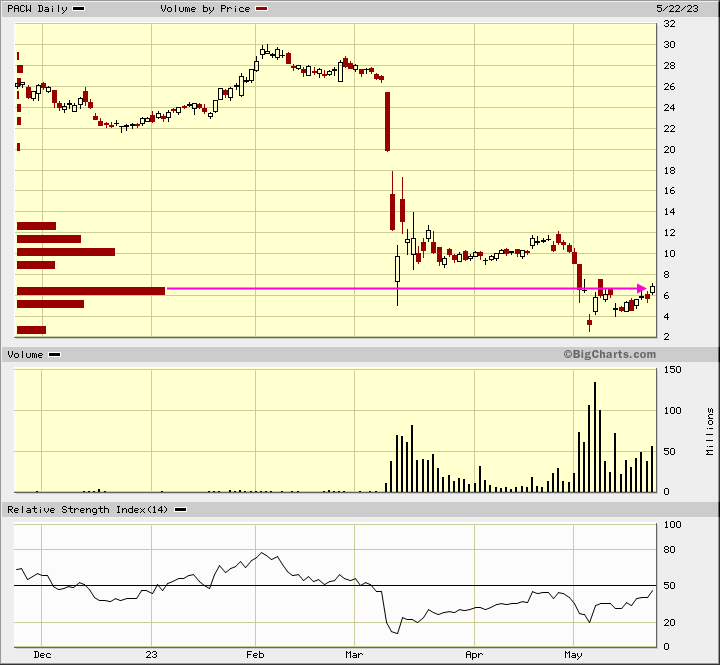

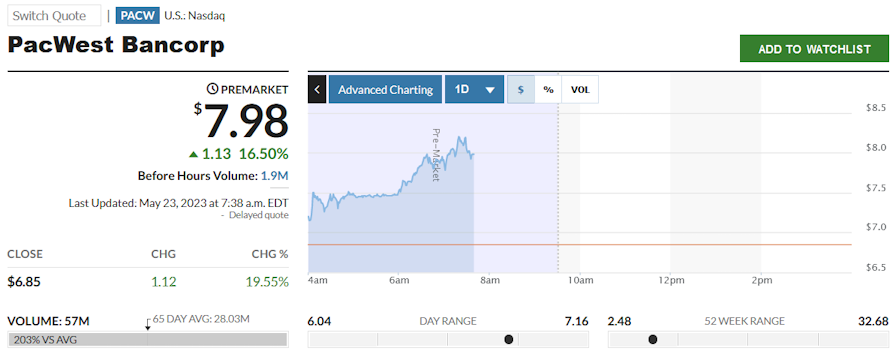

gleich könnte hier der Deckel wegfliegen..

..nach dem erfolgreichen Verkauf des Immo-Kredit-Portfolios:

22.5.

PACW Up after Announcing Sale of Real Estate Loans

https://www.tipranks.com/news/pacw-up-after-announcing-sale-…

...

Shares of PacWest Bancorp (NASDAQ: PACW) were up in pre-market trading at the time of publishing on Monday after the bank stated that it will sell a portfolio of 74 real estate construction loans with an aggregate principal balance of around $2.6 billion currently outstanding to a subsidiary of Kennedy-Wilson Holdings (KW).

The regional bank also announced the sale of six additional real estate construction loans with an aggregate principal balance of around $363 million to Kennedy-Wilson.

The sale is anticipated to close in multiple tranches during the second half of this year. PacWest has one of the highest concentrations of commercial real estate loans among the regional banks.

=>

..nach dem erfolgreichen Verkauf des Immo-Kredit-Portfolios:

22.5.

PACW Up after Announcing Sale of Real Estate Loans

https://www.tipranks.com/news/pacw-up-after-announcing-sale-…

...

Shares of PacWest Bancorp (NASDAQ: PACW) were up in pre-market trading at the time of publishing on Monday after the bank stated that it will sell a portfolio of 74 real estate construction loans with an aggregate principal balance of around $2.6 billion currently outstanding to a subsidiary of Kennedy-Wilson Holdings (KW).

The regional bank also announced the sale of six additional real estate construction loans with an aggregate principal balance of around $363 million to Kennedy-Wilson.

The sale is anticipated to close in multiple tranches during the second half of this year. PacWest has one of the highest concentrations of commercial real estate loans among the regional banks.

=>

20.12.23 · wallstreetONLINE NewsUpdate · JPMorgan Chase |

20.12.23 · wallstreetONLINE Redaktion · JPMorgan Chase |