PacWest Bancorp nach dem Crash der U.S. regional banks (Seite 3)

eröffnet am 10.03.23 20:40:05 von

neuester Beitrag 06.12.23 17:45:38 von

neuester Beitrag 06.12.23 17:45:38 von

Beiträge: 41

ID: 1.367.463

ID: 1.367.463

Aufrufe heute: 1

Gesamt: 5.535

Gesamt: 5.535

Aktive User: 0

ISIN: US6952631033 · WKN: A0Q16R · Symbol: PACW

7,5400

USD

0,00 %

0,0000 USD

Letzter Kurs 01.12.23 Nasdaq

Neuigkeiten

20.12.23 · wallstreetONLINE NewsUpdate |

20.12.23 · wallstreetONLINE Redaktion |

30.11.23 · Business Wire (engl.) |

22.11.23 · globenewswire |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,8900 | +19,69 | |

| 6,3200 | +15,75 | |

| 1.350,00 | +12,50 | |

| 15.000,00 | +11,11 | |

| 6,7000 | +8,94 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,3000 | -14,00 | |

| 1,1000 | -14,73 | |

| 26,00 | -16,13 | |

| 1,1000 | -17,91 | |

| 6,3000 | -31,97 |

Beitrag zu dieser Diskussion schreiben

Es ist irgendwann Schluss aber bis diesem Monats Ende

Gleiche Schicksal wie First Republic Bank. KURSZIEL bis diesem Monats Ende 0,90 Dollar dann ist Schluß.

Antwort auf Beitrag Nr.: 73.776.669 von faultcode am 03.05.23 13:13:50

nein - da wussten mMn einige schon vorher was lief:

3. Mai 2023 um 22:44 MESZUpdated on4. Mai 2023 um 00:14 MESZ

PacWest Is Weighing Strategic Options, Including Possible Sale

https://www.bloomberg.com/news/articles/2023-05-03/pacwest-s…

• The bank put aside a previous effort to raise capital

• A breakup is one idea considered by financial adviser

...

Zitat von faultcode: Kollateralschaden (wegen First Republic Bank)?

...

nein - da wussten mMn einige schon vorher was lief:

3. Mai 2023 um 22:44 MESZUpdated on4. Mai 2023 um 00:14 MESZ

PacWest Is Weighing Strategic Options, Including Possible Sale

https://www.bloomberg.com/news/articles/2023-05-03/pacwest-s…

• The bank put aside a previous effort to raise capital

• A breakup is one idea considered by financial adviser

...

Antwort auf Beitrag Nr.: 73.784.616 von Theo697 am 04.05.23 11:32:41Hahaha der war gut!!!  It's the BIG BANG...

It's the BIG BANG...

It's the BIG BANG...

It's the BIG BANG...

Wenn die Panik weg ist und Ruhe wieder einkehrt geht es schnell wieder hoch.

Kollateralschaden (wegen First Republic Bank)?

auch hier ganz schön wildes Hin und Her in der First Republic Bank-Krise:

Apr. 25, 2023 6:18 PM ET

PacWest stock jumps 14% after hours as Q1 earnings top estimates, deposits stabilize

https://seekingalpha.com/news/3960192-pacwest-stock-jumps-14…

...

Q1 adj. EPS was $0.66 vs. $0.54 in Q1 2022, and revenue increased 94.7% Y/Y to $315.69M. Net interest income declined 13.5% sequentially to $279.3M due to higher interest expense on deposits and borrowings.

Total deposits increased $1.1B to $28.2B at March 31, from the lender's recent update of $27.1B as of March 20. Deposit balances further grew ~$700M as of April 24.

Total insured deposits, including accounts eligible for pass-through insurance, represented ~73% of total deposits as of April 24, up from 48% at December 31, 2022.

Immediately-available liquidity stood at $12.4B, which exceeded uninsured deposits of $8.1B, with a coverage ratio of 153% at March 31.

PacWest (PACW) recorded a goodwill impairment of $1.38B due to the recent stock selloff. This is a non-cash charge and has no impact on regulatory capital ratios or liquidity position.

"We expect our total assets will be closer to $35B within the next few months, after we complete certain asset sales and bring down liquidity to more normal levels," said Paul Taylor, President and CEO. "These actions will improve our liquidity position and are expected to increase our CET1 capital ratio to above 10%."

...

Apr. 25, 2023 6:18 PM ET

PacWest stock jumps 14% after hours as Q1 earnings top estimates, deposits stabilize

https://seekingalpha.com/news/3960192-pacwest-stock-jumps-14…

...

Q1 adj. EPS was $0.66 vs. $0.54 in Q1 2022, and revenue increased 94.7% Y/Y to $315.69M. Net interest income declined 13.5% sequentially to $279.3M due to higher interest expense on deposits and borrowings.

Total deposits increased $1.1B to $28.2B at March 31, from the lender's recent update of $27.1B as of March 20. Deposit balances further grew ~$700M as of April 24.

Total insured deposits, including accounts eligible for pass-through insurance, represented ~73% of total deposits as of April 24, up from 48% at December 31, 2022.

Immediately-available liquidity stood at $12.4B, which exceeded uninsured deposits of $8.1B, with a coverage ratio of 153% at March 31.

PacWest (PACW) recorded a goodwill impairment of $1.38B due to the recent stock selloff. This is a non-cash charge and has no impact on regulatory capital ratios or liquidity position.

"We expect our total assets will be closer to $35B within the next few months, after we complete certain asset sales and bring down liquidity to more normal levels," said Paul Taylor, President and CEO. "These actions will improve our liquidity position and are expected to increase our CET1 capital ratio to above 10%."

...

22.4.

PacWest Bancorp Explores Sale of Its Lender Finance Division

https://finance.yahoo.com/news/pacwest-bancorp-explores-sale…

...

PacWest Bancorp, a regional bank left reeling following the collapse of two rival lenders last month, is exploring a sale of its lender finance arm, according to people familiar with the matter.

The Beverly Hills, California-based bank is working with a financial adviser to solicit interest in the business, said the people, who asked to not be identified because the matter isn’t public. An agreement could be reached within two months, one of the people said.

Unloading the unit would shrink PacWest’s balance sheet while freeing up capital, the people said. No final decision has been made and PacWest could opt to hold onto the business, the people added.

The lender finance business, which had about $3 billion of loans at the end of 2022, provides revolving credit lines to small business and commercial real estate lenders that are used to purchase finance receivables, according to PacWest’s most recent annual report.

...

PacWest Bancorp Explores Sale of Its Lender Finance Division

https://finance.yahoo.com/news/pacwest-bancorp-explores-sale…

...

PacWest Bancorp, a regional bank left reeling following the collapse of two rival lenders last month, is exploring a sale of its lender finance arm, according to people familiar with the matter.

The Beverly Hills, California-based bank is working with a financial adviser to solicit interest in the business, said the people, who asked to not be identified because the matter isn’t public. An agreement could be reached within two months, one of the people said.

Unloading the unit would shrink PacWest’s balance sheet while freeing up capital, the people said. No final decision has been made and PacWest could opt to hold onto the business, the people added.

The lender finance business, which had about $3 billion of loans at the end of 2022, provides revolving credit lines to small business and commercial real estate lenders that are used to purchase finance receivables, according to PacWest’s most recent annual report.

...

22.3.

Pacific Western Bank Provides Further Update and Details on Financial Strength

https://www.wallstreet-online.de/nachricht/16714147-pacific-…

...

Pacific Western Bank (the “Bank”), the primary subsidiary of PacWest Bancorp (NASDAQ: PACW) (the “Company”), today issues the following update regarding its financial strength, including liquidity and deposits, as well as other recent developments. Financial information is unaudited.

Consistent with its announcement on March 17, 2023, the Bank continues to benefit from solid liquidity and stabilized deposit balances, with over $11.4 billion in available cash as of March 20, 2023, which exceeds total uninsured deposits of $9.5 billion as of March 20, 2023.

The Bank also continues to have a diversified deposit base that includes commercial, community banking, homeowners associations, retail, and venture customers. Selected deposit information is shown below.

In total, as of March 20, 2023, FDIC-insured deposits exceeded 65% of total deposits, including accounts eligible for pass-through insurance, and FDIC-insured venture-specific deposits accounted for more than 82% of total venture-specific deposits, including accounts eligible for pass-through insurance. The Bank also has $600 million of deposits that are backed by other tradeable securities. The Bank’s spot deposit rates reflect a modest increase from year-end, increasing from 1.71% at December 31, 2022 to 2.04% at March 20, 2023.

Adding to the stabilized deposit levels, the Bank has proactively taken a number of steps to bolster its liquidity. These steps include having drawn on available federal facilities, including $3.7 billion of borrowings from the FHLB, $10.5 billion of borrowings from the Federal Reserve Discount Window, and $2.1 billion in Bank Term Funding Program borrowings, in each case as of March 20, 2023.

The Bank has seen validation from the private sector as well, having secured $1.4 billion in fully funded cash proceeds from ATLAS SP Partners through a new senior asset-backed financing facility, which unlocked liquidity from unencumbered, high-quality assets in an expeditious manner. The Bank has also experienced increased account opening in its Venture Banking business line with approximately 130 new accounts opened since March 9, 2023.

Market developments and strategic positioning also have affected the Bank favorably, with the Bank’s accumulated other comprehensive loss declining from $791 million at December 31, 2022 to $704 million at March 17, 2023. Through February 28, 2023, the Bank estimates net income of $48.9 million, which includes $8.2 million of pre-tax severance expense primarily related to the previously announced restructuring of Civic Financial Services, a lending subsidiary, and stockholders’ equity of $4.0 billion at February 28, 2023. As previously previewed, gross loans have intentionally decreased to $28.6 billion as of March 20, 2023, and asset quality remains excellent with no significant changes since year-end, including classified assets, non-performing assets, and charge-offs.

In addition to these liquidity-enhancing measures, and as part of its proactive approach to capital and liquidity management, the Company has explored a capital raise with potential investors. In light of the current volatility in the market and depressed market prices for regional bank stocks, as well as the availability of other options to enhance capital, the Company determined it would not be prudent to move forward with a transaction at this time. This decision reflects the Company’s confidence in its financial strength and commitment to ensuring the long-term stability and profitability of the institution.

...

------

...

PacWest, founded in 1999, got bigger in the aftermath of the 2008 financial crisis by scooping up deposits and assets from several banks seized by regulators over a period of several years.

Its new financing of $1.4 billion announced Tuesday is from Atlas SP Partners, where Apollo is the majority owner.

...

https://finance.yahoo.com/news/pacwest-lands-14-billion-in-n…

Pacific Western Bank Provides Further Update and Details on Financial Strength

https://www.wallstreet-online.de/nachricht/16714147-pacific-…

...

Pacific Western Bank (the “Bank”), the primary subsidiary of PacWest Bancorp (NASDAQ: PACW) (the “Company”), today issues the following update regarding its financial strength, including liquidity and deposits, as well as other recent developments. Financial information is unaudited.

Consistent with its announcement on March 17, 2023, the Bank continues to benefit from solid liquidity and stabilized deposit balances, with over $11.4 billion in available cash as of March 20, 2023, which exceeds total uninsured deposits of $9.5 billion as of March 20, 2023.

The Bank also continues to have a diversified deposit base that includes commercial, community banking, homeowners associations, retail, and venture customers. Selected deposit information is shown below.

In total, as of March 20, 2023, FDIC-insured deposits exceeded 65% of total deposits, including accounts eligible for pass-through insurance, and FDIC-insured venture-specific deposits accounted for more than 82% of total venture-specific deposits, including accounts eligible for pass-through insurance. The Bank also has $600 million of deposits that are backed by other tradeable securities. The Bank’s spot deposit rates reflect a modest increase from year-end, increasing from 1.71% at December 31, 2022 to 2.04% at March 20, 2023.

Adding to the stabilized deposit levels, the Bank has proactively taken a number of steps to bolster its liquidity. These steps include having drawn on available federal facilities, including $3.7 billion of borrowings from the FHLB, $10.5 billion of borrowings from the Federal Reserve Discount Window, and $2.1 billion in Bank Term Funding Program borrowings, in each case as of March 20, 2023.

The Bank has seen validation from the private sector as well, having secured $1.4 billion in fully funded cash proceeds from ATLAS SP Partners through a new senior asset-backed financing facility, which unlocked liquidity from unencumbered, high-quality assets in an expeditious manner. The Bank has also experienced increased account opening in its Venture Banking business line with approximately 130 new accounts opened since March 9, 2023.

Market developments and strategic positioning also have affected the Bank favorably, with the Bank’s accumulated other comprehensive loss declining from $791 million at December 31, 2022 to $704 million at March 17, 2023. Through February 28, 2023, the Bank estimates net income of $48.9 million, which includes $8.2 million of pre-tax severance expense primarily related to the previously announced restructuring of Civic Financial Services, a lending subsidiary, and stockholders’ equity of $4.0 billion at February 28, 2023. As previously previewed, gross loans have intentionally decreased to $28.6 billion as of March 20, 2023, and asset quality remains excellent with no significant changes since year-end, including classified assets, non-performing assets, and charge-offs.

In addition to these liquidity-enhancing measures, and as part of its proactive approach to capital and liquidity management, the Company has explored a capital raise with potential investors. In light of the current volatility in the market and depressed market prices for regional bank stocks, as well as the availability of other options to enhance capital, the Company determined it would not be prudent to move forward with a transaction at this time. This decision reflects the Company’s confidence in its financial strength and commitment to ensuring the long-term stability and profitability of the institution.

...

------

...

PacWest, founded in 1999, got bigger in the aftermath of the 2008 financial crisis by scooping up deposits and assets from several banks seized by regulators over a period of several years.

Its new financing of $1.4 billion announced Tuesday is from Atlas SP Partners, where Apollo is the majority owner.

...

https://finance.yahoo.com/news/pacwest-lands-14-billion-in-n…

PACW... der nächste Dominostein der fällt....

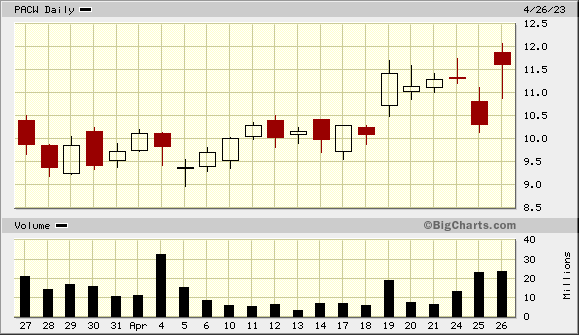

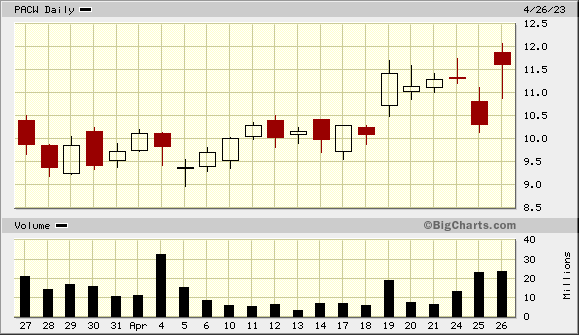

$PACW sieht konstruktiv aus, anders (mMn) als $FRC:

20.12.23 · wallstreetONLINE NewsUpdate · JPMorgan Chase |

20.12.23 · wallstreetONLINE Redaktion · JPMorgan Chase |