Uravan Minerals - Noch unentdeckter Uran-Explorer - 500 Beiträge pro Seite

eröffnet am 05.01.07 23:00:34 von

neuester Beitrag 10.04.08 21:56:31 von

neuester Beitrag 10.04.08 21:56:31 von

Beiträge: 105

ID: 1.103.645

ID: 1.103.645

Aufrufe heute: 0

Gesamt: 5.653

Gesamt: 5.653

Aktive User: 0

ISIN: CA91703R1091 · WKN: A0F46L

0,0151

EUR

-6,23 %

-0,0010 EUR

Letzter Kurs 22.07.19 Lang & Schwarz

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9900 | +90,38 | |

| 1,0800 | +34,98 | |

| 5,1500 | +19,35 | |

| 429,65 | +10,73 | |

| 2,4200 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,9300 | -7,33 | |

| 33,20 | -7,52 | |

| 225,60 | -8,33 | |

| 107,78 | -9,41 | |

| 72.500,00 | -9,94 |

Hallo,

Uravan ist meiner bescheidenen Meinung nach eine extrem unterbewertete Uran-Aktie. Aussichtsreiche Properties, JV mit Cameco, erfahrenes Managment ...

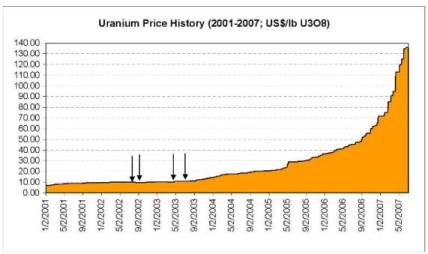

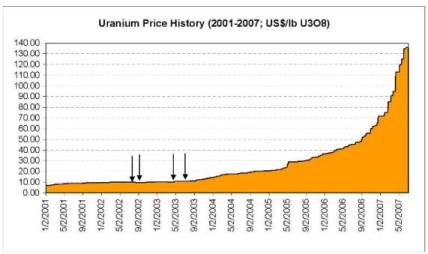

Uravan Minerals Inc. ("Uravan") (TSXV: UVN) is a Calgary, Alberta based mineral exploration company focused on uranium exploration and development in canada and other global environments. Due to the sudden and persistent increase in uranium prices, going from $7.10 per pound U3O8 in 2000 to $61.00 recently, Uravan is encouraged about the future of the uranium market and has become highly engaged in planning further exploration for potential high grade unconformity-type uranium deposits on its Boomerang and Gary Lake uranium projects, Thelon Basin, Northwest Territories (NT).

CEO:Larry Lahusen, B.Sc. Geol.

Founded Uravan in 1997, 13 years experience in uranium exploration during 1970's early 80's discovered and developed 2 uranium deposits in the Lisdon Valley District, Utah; a total of 35 years experience in exploration and development of mineral deposits; Shares owned: 25%

Viel mehr Infos auf der Homepage: http://www.uravanminerals.com/index.html

Freue mich über jede Meinung.

Uravan ist meiner bescheidenen Meinung nach eine extrem unterbewertete Uran-Aktie. Aussichtsreiche Properties, JV mit Cameco, erfahrenes Managment ...

Uravan Minerals Inc. ("Uravan") (TSXV: UVN) is a Calgary, Alberta based mineral exploration company focused on uranium exploration and development in canada and other global environments. Due to the sudden and persistent increase in uranium prices, going from $7.10 per pound U3O8 in 2000 to $61.00 recently, Uravan is encouraged about the future of the uranium market and has become highly engaged in planning further exploration for potential high grade unconformity-type uranium deposits on its Boomerang and Gary Lake uranium projects, Thelon Basin, Northwest Territories (NT).

CEO:Larry Lahusen, B.Sc. Geol.

Founded Uravan in 1997, 13 years experience in uranium exploration during 1970's early 80's discovered and developed 2 uranium deposits in the Lisdon Valley District, Utah; a total of 35 years experience in exploration and development of mineral deposits; Shares owned: 25%

Viel mehr Infos auf der Homepage: http://www.uravanminerals.com/index.html

Freue mich über jede Meinung.

Das Management hält aktuell Aktien im Wert von 9,600,000 Can$.

Knapp 40% von der MK. Fällt unter "Familienbetrieb".

Hab ich seit Januar unter Beobachtung: + 2,94%.

Allerdings in Frankfurt nur Kursbewegung ohne Umsatz.

In Canada: Avg Vol (3m) 22,677. Viel zu dünn.

Knapp 40% von der MK. Fällt unter "Familienbetrieb".

Hab ich seit Januar unter Beobachtung: + 2,94%.

Allerdings in Frankfurt nur Kursbewegung ohne Umsatz.

In Canada: Avg Vol (3m) 22,677. Viel zu dünn.

Antwort auf Beitrag Nr.: 26.709.389 von VeuveClicquot am 06.01.07 08:19:25Stimmt schon, der Umsatz ist auch in Kanada ziemlich dünn, allerdings hat er in den letzten Wochen zugenommen.

Dass das Managment so viele Aktien hält, ist doch eigentlich positiv zu sehen, oder?

Dass das Managment so viele Aktien hält, ist doch eigentlich positiv zu sehen, oder?

Antwort auf Beitrag Nr.: 26.713.525 von heddog am 06.01.07 12:06:31Ja, das stimmt.

Unternehmen an sich macht auch keinen schlechten Eindruck.

Website fast altmodisch, aber was zählt:

Alle Daten ordentlich und schnell auffindbar.

An sich finde ich kleine Volumen nicht tragisch.

Solange ruhige Hände im Wert sind.

Unternehmen an sich macht auch keinen schlechten Eindruck.

Website fast altmodisch, aber was zählt:

Alle Daten ordentlich und schnell auffindbar.

An sich finde ich kleine Volumen nicht tragisch.

Solange ruhige Hände im Wert sind.

GOLDINVEST-Kolumne: Die Großen im Uransektor beginnen jetzt ihre Reserven durch Übernahmen aufzustocken und Forsys Metals könnte auch bald auf deren Radarschirm erscheinen

Der hohe Uranpreis, die starke Zunahme der Explorationsaktivitäten vieler kleinerer Junior-Explorationsgesellschaften und die sich stetig vergrößernde Kluft zwischen Produktion und Nachfrage hat in der Uranbergbaubranche eine Konsolidierungswelle in Bewegung gesetzt.

Denison Mines Inc., ein Uranproduzent mit Sitz in Toronto hat Anfang Dezember 2006 in einem freundlichen Übernahmeversuch 154 Millionen CAD für OmegaCorp Ltd., eine australische Explorationsgesellschaft mit einem Uranprojekt in Sambia, geboten.

In der Zwischenzeit berichtete Cameco Corp., der größte Uranproduzent der Welt, dass es kleinere Konkurrenten akquirieren könnte, da nach Jahren unzureichender Investitionen das Uranangebot knapp werde und die Preise stiegen.

Laut "The Ux Consulting Co. LLC", die den wöchentlichen Spot-Preis für Uran auf ihrer Webseite veröffentlicht, wird zur Zeit das Pfund Uran zu 72 US-Dollar gehandelt.

Denison, das erst Anfang Dezember mit dem kanadischen Unternehmen International Uranium Corp. fusionierte, wird 1,10 AUD je Aktie für OmegaCorp. bieten, das ihren Sitz in Perth hat. Nach Worten des Präsidenten der Denison Mines, Ron Hochstein, sei dieses freundliche Barangebot der erste Schritt in einer globalen Expansionsstrategie, die sich auf die Uranexploration und -produktion konzentrieren werde.

Das Kariba-Projekt der OmegaCorp. könnte 13,7 Millionen Pfund Uran enthalten, mit deren Abbau Danison nach eigenen Erwartungen zwischen Ende 2009 und 2011 beginnen würde. Laut einer vorläufigen Studie einer von OmegaCorp beauftragten Beraterfirma würde die Entwicklung eines Tagebaus mit einer Kapazität von 1,5 Millionen Pfund Uran pro Jahr ungefähr 60 Millionen US-Dollar kosten.

"Wir haben seit einiger Zeit darüber gesprochen, dass wir uns vergrößern und Projekte zu fairen Preisen kaufen werden," sagte Peter Farmer, CEO der Denison Mines. Ein Marktbeobachter bezeichnete das Angebot als ziemlich billig und schätzte, dass es dem 0,9fachen des Nettovermögenswerts des Unternehmens entspreche. Das wirft die Frage auf, ob Konkurrenten wie SXR Uranium One Inc., Paladin Resources Ltd. oder Lundin Mining Corp. Gegenangebote abgeben könnten. "Paladin und Lundin besitzen große Erfahrung im Betrieb von Minen und bei der Exploration in Afrika, aber es könnte sich auch für ein Unternehmen wie SXR lohnen, dort einzusteigen," sagte ein Analyst. In einer Telefonkonferenz sagte Herr Farmer, dass er sich nicht sicher sei, ob Denison eventuellen Konkurrenzangeboten gegenüberstehen werde. Denison erwartet, ihre Uranproduktion bis 2010 auf 5,5 Millionen Pfund zu erhöhen. Dieses Jahr wird das Unternehmen ungefähr 1 Mio. Pfund produzieren.

Cameco auf der anderen Seite bemüht sich jetzt um eine Erweiterung der Unternehmensbasis, da sich die Konstruktion der Cigar-Lake-Mine in der kanadischen Provinz Saskatchewan aufgrund der Überflutung eines Teils der Mine weiter verzögert. GOLDINVEST-Daily berichtete darüber Ende Oktober 2006. Die Marktbeobachter können sich gut vorstellen, dass Cameco ein Auge auf SXR werfen könnte, das ein Uranprojekt in Südafrika besitzt. Eine Übernahme der Denison Mines durch den Urangiganten erscheint den Marktbeobachtern auch nicht so abwegig. Jerry Grandey, CEO der Cameco, sagte, dass sein Unternehmen die Fortschritte der Junior-Explorationsgesellschaften genau beobachte. "Und wenn sie dann irgendeinmal das Fachwissen, Geld, ein Joint Venture oder eine Übernahme wünschen, dann wäre das im Rahmen des Möglichen," erklärte Herr Grandey.

Ein Unternehmen, das sicher auf Camecos Radarschirm sein dürfte, ist die kanadische Explorationsgesellschaft Forsys Metals Corp. aus Toronto, deren Aktien seit Oktober 2006 an der Toronto Stock Exchange gehandelt werden. Das Kernstück des Unternehmens ist die im Juli 2005 erworbene Uranlagerstätte Valencia in Namibia. Valencia verfügt gemäß National Instrument 43-101 über eine Ressource von 32 Millionen t mit 0,22 kg/t U3O8 (kurz: Uran). Im Herbst berichtete Forsys signifikante Urangehalte in Bohrungen, die Teil der Vorarbeiten zur Machbarkeits- und Wirtschaftlichkeitsstudie auf Valencia sind. In den Bohrungen konnten bis zu 0,61 kg/t U3O8 nachgewiesen werden. Und erst letzte Woche stellte das Unternehmen eine neue Entdeckung, die Joly-Zone, vor, die nur 1.500 m nördlich der Valencia Main Zone liegt. Diese Entdeckung umfasst eine ca. 1000 m mal 25 m mächtige Gangintrusion, die hauptsächlich aus einem Alaskit-Granit besteht. In Proben aus dieser Zone konnten bis zu 5,1 kg/t U308 nachgewiesen werden.

Valencia liegt nur 35 km von Rio Tintos Uranmine Rössing entfernt, deren Uranvorräte in einem ähnlichen geologischen Rahmen vorkommen. Rössing ist die fünftgrößte Uranmine der Welt, die in 2005 3.711 t U3O8 aus 12 Millionen t Erz im Tagebau produzierte. Das entspricht ungefähr 7,5 Prozent der Weltproduktion.

Läuft alles nach Plan, dann könnte Forsys in drei bis vier Jahren mit dem Abbau auf Valencia beginnen.

Der hohe Uranpreis, die starke Zunahme der Explorationsaktivitäten vieler kleinerer Junior-Explorationsgesellschaften und die sich stetig vergrößernde Kluft zwischen Produktion und Nachfrage hat in der Uranbergbaubranche eine Konsolidierungswelle in Bewegung gesetzt.

Denison Mines Inc., ein Uranproduzent mit Sitz in Toronto hat Anfang Dezember 2006 in einem freundlichen Übernahmeversuch 154 Millionen CAD für OmegaCorp Ltd., eine australische Explorationsgesellschaft mit einem Uranprojekt in Sambia, geboten.

In der Zwischenzeit berichtete Cameco Corp., der größte Uranproduzent der Welt, dass es kleinere Konkurrenten akquirieren könnte, da nach Jahren unzureichender Investitionen das Uranangebot knapp werde und die Preise stiegen.

Laut "The Ux Consulting Co. LLC", die den wöchentlichen Spot-Preis für Uran auf ihrer Webseite veröffentlicht, wird zur Zeit das Pfund Uran zu 72 US-Dollar gehandelt.

Denison, das erst Anfang Dezember mit dem kanadischen Unternehmen International Uranium Corp. fusionierte, wird 1,10 AUD je Aktie für OmegaCorp. bieten, das ihren Sitz in Perth hat. Nach Worten des Präsidenten der Denison Mines, Ron Hochstein, sei dieses freundliche Barangebot der erste Schritt in einer globalen Expansionsstrategie, die sich auf die Uranexploration und -produktion konzentrieren werde.

Das Kariba-Projekt der OmegaCorp. könnte 13,7 Millionen Pfund Uran enthalten, mit deren Abbau Danison nach eigenen Erwartungen zwischen Ende 2009 und 2011 beginnen würde. Laut einer vorläufigen Studie einer von OmegaCorp beauftragten Beraterfirma würde die Entwicklung eines Tagebaus mit einer Kapazität von 1,5 Millionen Pfund Uran pro Jahr ungefähr 60 Millionen US-Dollar kosten.

"Wir haben seit einiger Zeit darüber gesprochen, dass wir uns vergrößern und Projekte zu fairen Preisen kaufen werden," sagte Peter Farmer, CEO der Denison Mines. Ein Marktbeobachter bezeichnete das Angebot als ziemlich billig und schätzte, dass es dem 0,9fachen des Nettovermögenswerts des Unternehmens entspreche. Das wirft die Frage auf, ob Konkurrenten wie SXR Uranium One Inc., Paladin Resources Ltd. oder Lundin Mining Corp. Gegenangebote abgeben könnten. "Paladin und Lundin besitzen große Erfahrung im Betrieb von Minen und bei der Exploration in Afrika, aber es könnte sich auch für ein Unternehmen wie SXR lohnen, dort einzusteigen," sagte ein Analyst. In einer Telefonkonferenz sagte Herr Farmer, dass er sich nicht sicher sei, ob Denison eventuellen Konkurrenzangeboten gegenüberstehen werde. Denison erwartet, ihre Uranproduktion bis 2010 auf 5,5 Millionen Pfund zu erhöhen. Dieses Jahr wird das Unternehmen ungefähr 1 Mio. Pfund produzieren.

Cameco auf der anderen Seite bemüht sich jetzt um eine Erweiterung der Unternehmensbasis, da sich die Konstruktion der Cigar-Lake-Mine in der kanadischen Provinz Saskatchewan aufgrund der Überflutung eines Teils der Mine weiter verzögert. GOLDINVEST-Daily berichtete darüber Ende Oktober 2006. Die Marktbeobachter können sich gut vorstellen, dass Cameco ein Auge auf SXR werfen könnte, das ein Uranprojekt in Südafrika besitzt. Eine Übernahme der Denison Mines durch den Urangiganten erscheint den Marktbeobachtern auch nicht so abwegig. Jerry Grandey, CEO der Cameco, sagte, dass sein Unternehmen die Fortschritte der Junior-Explorationsgesellschaften genau beobachte. "Und wenn sie dann irgendeinmal das Fachwissen, Geld, ein Joint Venture oder eine Übernahme wünschen, dann wäre das im Rahmen des Möglichen," erklärte Herr Grandey.

Ein Unternehmen, das sicher auf Camecos Radarschirm sein dürfte, ist die kanadische Explorationsgesellschaft Forsys Metals Corp. aus Toronto, deren Aktien seit Oktober 2006 an der Toronto Stock Exchange gehandelt werden. Das Kernstück des Unternehmens ist die im Juli 2005 erworbene Uranlagerstätte Valencia in Namibia. Valencia verfügt gemäß National Instrument 43-101 über eine Ressource von 32 Millionen t mit 0,22 kg/t U3O8 (kurz: Uran). Im Herbst berichtete Forsys signifikante Urangehalte in Bohrungen, die Teil der Vorarbeiten zur Machbarkeits- und Wirtschaftlichkeitsstudie auf Valencia sind. In den Bohrungen konnten bis zu 0,61 kg/t U3O8 nachgewiesen werden. Und erst letzte Woche stellte das Unternehmen eine neue Entdeckung, die Joly-Zone, vor, die nur 1.500 m nördlich der Valencia Main Zone liegt. Diese Entdeckung umfasst eine ca. 1000 m mal 25 m mächtige Gangintrusion, die hauptsächlich aus einem Alaskit-Granit besteht. In Proben aus dieser Zone konnten bis zu 5,1 kg/t U308 nachgewiesen werden.

Valencia liegt nur 35 km von Rio Tintos Uranmine Rössing entfernt, deren Uranvorräte in einem ähnlichen geologischen Rahmen vorkommen. Rössing ist die fünftgrößte Uranmine der Welt, die in 2005 3.711 t U3O8 aus 12 Millionen t Erz im Tagebau produzierte. Das entspricht ungefähr 7,5 Prozent der Weltproduktion.

Läuft alles nach Plan, dann könnte Forsys in drei bis vier Jahren mit dem Abbau auf Valencia beginnen.

Antwort auf Beitrag Nr.: 26.916.374 von heddog am 14.01.07 18:28:42Mir fällt da auch noch ein geeigneter Übernahmekandidat, der bereits ein JV mit Cameco hat, ein.

Sind eventuell Übernahmegerüchte der Grund für den Kursanstieg in Kanada am Freitag?

Sind eventuell Übernahmegerüchte der Grund für den Kursanstieg in Kanada am Freitag?

Uravan Adds New Depth and Strength to its Management Team

TSXV: UVN

CALGARY, Jan. 16 /CNW/ - The Board of Directors of Uravan Minerals Inc

("Uravan") (TSXV: UVN) is honored and pleased to announce the appointments of

Mr. James G. Gardiner as Director, Mr. William E. Grafham as Director ,

Dr. Allan Miller as Vice President of Exploration and Mr. Ian R. Fraser as

Senior Geologist. These appointments are effective January 1, 2007 and have

been made as an on going effort to add new knowledge and diversification to

Uravan's management team. The following is a brief back ground description of

each of these key individuals:

Mr. James Gardiner is a 1967 Civil Engineering graduate from the

University of Saskatchewan. Jim's professional career is defined by 37 years

in the mining industry of Canada. Although Jim has worked for company

stalwarts such as Cominco and Kilborn Engineering, most of Jim's career was

spent as top management for Fording Inc. From 1993 - 2004, during Jim's

29-year career with Fording, he worked his way up through the ranks to become

President and Chief Executive Officer of Fording Inc., Elk Valley Coal

Corporation and Fording Canadian Coal Trust. Although Jim marshals many

accolades such as Director, Westshore Terminals Limited; Past Chairman, Coal

Association of Canada; and Past Chairman, Coal Industry Advisory Board, in

1995 Jim was presented with the 'Outstanding Contribution to Coal Mining in

Canada Award' and in 2002, Jim received the 'Resource Person of the Year

Award' presented by the Alberta Chamber of Resources. In addition to these

accomplishments, Jim was the Canadian representative for the Coal Industry

Advisory Board to the International Energy Agency as well as the coal industry

representative to the Canadian Government's Sectoral Advisory Group on

International Trade-Energy.

Mr. William Grafham has had a long and highly successful career in the

management of venture capital for natural resources companies and

partnerships. Early in Bill's career, from 1955 to 1963, he was a Flying

Officer in the Royal Canadian Air Force (RCAF) and flew with the 409 All

Weather Fighter Squadron at Comox, B.C. and the Electronic Warfare Unit at St.

Hubert, P.Q. After leaving the RCAF with an honorable discharge in 1963 Bill

began his career in the financial world by joining Richardson Securities, and

in 1970 opened an office for Cochran Murray Ltd in Calgary, which became

Merrill Lynch Canada and more recently CIBC Wood Gundy. In 1974, at the

beginning of the previous uranium boom, Bill was responsible for bringing two

West Germany groups to Canada to form major West German tax oriented

partnerships, and in 1976 Bill was responsible for an additional German

partnership which largely focused on uranium and precious metals in North

America. From 1974 to the late 1980's these German partnerships, under Bill's

guidance, invested hundred's of millions of dollars in oil and gas, uranium

and gold exploration projects in Canada and the US, resulting in the

development of three gold mines, three uranium mines, one copper deposit, many

oil and gas projects, and many good exploration projects that were either sold

or farmed out. Some of the companies that were formed as a result of this

exploration success and of which Bill was a founder and/or principal, were E&B

Exploration, Ferret Exploration, Mascot Gold Mines, Crow Butte Uranium Mine,

Western Goldfields and Baja Gold.

Dr. Allan Miller obtained his B.Sc. in Geology, from Carleton University

and Ph.D. from the University of Western Ontario and he is certified by the

Association of Professional Geoscientists of Ontario (P.Geo.). Al has served

as Director and Senior Scientific Advisor for Uravan for the past ten years.

Prior to joining the Uravan Board of Directors in 1997, Al was a mineral

deposits research scientist with the Geological Survey of Canada (GSC). During

his 25-year career with the GSC, Al focused on the mineral deposits of the

Western Churchill Province and participated extensively in regional mapping

programs across the Northwest Territories and Nunavut. Al's experience within

the GSC and more recently as a consulting mineral research specialist includes

the following ore deposit types: uranium, magmatic nickel-copper, lode gold,

epithermal precious metal, diamond, volcanic-associated massive sulphide,

sediment-hosted copper, Broken Hill-type lead-zinc-silver, redbed copper and

porphyry copper. Al's exploration activities and mineral deposit studies have

exposed him to many geological provinces throughout North America as well as

globally, in areas such as the Americas, Russia, China, Southeast Asia and the

Middle East. Al's extensive knowledge in mineral deposit formation is an

invaluable asset to guide Uravan's exploration activities in Canada and in

other global domains. Specifically, Al's experience in the uranium deposit

types of the Western Churchill Uranium Province and in particular the Thelon

Basin, Northwest Territories and Nunavut, the Athabasca Basin, Saskatchewan

and Kombolgie Basin, Australia are impressive and key to Uravan's future

uranium exploration success.

Mr. Ian Fraser obtained his B.Sc. in Geology from Laurentian University

and he is certified by the Association of Professional Engineers & Geologist

of Saskatchewan (APEGS) as a Professional Geologist (P. Geo.). Ian has over

twenty years of experience in the mining industry as an exploration and mine

geologist for major and junior mining companies including Inco, Kerr Addison

Mines, Golden Band Resources Inc., Wallbridge Mining Co. and the Golden Rule

Group of Companies. Ian has worked on numerous precious metal and base metal

exploration and development projects throughout Canada, designing and

implementing many surface mapping and geochemical sampling programs, along

with organizing numerous airborne and surface geophysical programs and the

budgeting and implementation of diamond drill programs. As a chief mine

geologist in a narrow vein gold mine owned by Waddy Lake Mines, Ian

coordinated underground grade control and stope design, detailed underground

mapping and designed drill programs. Since 1998 Ian has been working with

Uravan's technical team and has become Uravan's resident specialist in nickel,

copper, gold and platinum group element (Ni-Cu-PGE-Au) exploration and is the

project geologist for the Rottenstone Ni-Cu-PGE Property. Recently Ian has

been working very closely with Dr Allan Miller on Uravan's uranium projects in

the Thelon Basin, NT and NU.

About Uravan Minerals Inc.

--------------------------

Uravan Minerals Inc. ("Uravan") is a Calgary, Alberta based mineral

exploration company specializing in uranium, base metal (nickel, copper) and

precious metal (gold, platinum, and palladium) exploration. Uravan's principal

assets are the Boomerang uranium project, the Garry Lake uranium property and

the Rottenstone Nickel-Copper-PGM project. Due to the persistent increase in

the uranium prices, going from $7.10 per pound U3O8 in 2000 to $72.00

recently, Uravan has become highly focused in pursuing exploration for

potential high-grade unconformity-type uranium deposits on its joint

Cameco-Uravan Boomerang uranium project and its Gary Lake uranium projects

plus acquiring other uranium properties in a variety of potential geological

domains. 2007 exploration programs and budgets will be announced in the near

future on both of these projects. Uravan is a publicly listed company on the

TSX Venture Exchange under the trading symbol UVN. Uravan has 24,285,114

shares outstanding and $10 million in working capital. All of the mineral

properties Uravan owns are considered in the exploration stage of development.

This press release may contain forward looking statements including those

describing the Corporation's future plans and the expectations of management

that a stated result or condition will occur. Any statement addressing future

events or conditions necessarily involves inherent risk and uncertainty.

Actual results can differ materially from those anticipated by management at

the time of writing due to many factors, the majority of which are beyond the

control of the Corporation and its management.

The TSX Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

For further information: Larry Lahusen, President, Uravan Minerals Inc.,

Tel: (403) 949-3311, Fax: (403) 949-3309, Email: llahusen@uravanminerals.com,

Website: www.uravanminerals.com

TSXV: UVN

CALGARY, Jan. 16 /CNW/ - The Board of Directors of Uravan Minerals Inc

("Uravan") (TSXV: UVN) is honored and pleased to announce the appointments of

Mr. James G. Gardiner as Director, Mr. William E. Grafham as Director ,

Dr. Allan Miller as Vice President of Exploration and Mr. Ian R. Fraser as

Senior Geologist. These appointments are effective January 1, 2007 and have

been made as an on going effort to add new knowledge and diversification to

Uravan's management team. The following is a brief back ground description of

each of these key individuals:

Mr. James Gardiner is a 1967 Civil Engineering graduate from the

University of Saskatchewan. Jim's professional career is defined by 37 years

in the mining industry of Canada. Although Jim has worked for company

stalwarts such as Cominco and Kilborn Engineering, most of Jim's career was

spent as top management for Fording Inc. From 1993 - 2004, during Jim's

29-year career with Fording, he worked his way up through the ranks to become

President and Chief Executive Officer of Fording Inc., Elk Valley Coal

Corporation and Fording Canadian Coal Trust. Although Jim marshals many

accolades such as Director, Westshore Terminals Limited; Past Chairman, Coal

Association of Canada; and Past Chairman, Coal Industry Advisory Board, in

1995 Jim was presented with the 'Outstanding Contribution to Coal Mining in

Canada Award' and in 2002, Jim received the 'Resource Person of the Year

Award' presented by the Alberta Chamber of Resources. In addition to these

accomplishments, Jim was the Canadian representative for the Coal Industry

Advisory Board to the International Energy Agency as well as the coal industry

representative to the Canadian Government's Sectoral Advisory Group on

International Trade-Energy.

Mr. William Grafham has had a long and highly successful career in the

management of venture capital for natural resources companies and

partnerships. Early in Bill's career, from 1955 to 1963, he was a Flying

Officer in the Royal Canadian Air Force (RCAF) and flew with the 409 All

Weather Fighter Squadron at Comox, B.C. and the Electronic Warfare Unit at St.

Hubert, P.Q. After leaving the RCAF with an honorable discharge in 1963 Bill

began his career in the financial world by joining Richardson Securities, and

in 1970 opened an office for Cochran Murray Ltd in Calgary, which became

Merrill Lynch Canada and more recently CIBC Wood Gundy. In 1974, at the

beginning of the previous uranium boom, Bill was responsible for bringing two

West Germany groups to Canada to form major West German tax oriented

partnerships, and in 1976 Bill was responsible for an additional German

partnership which largely focused on uranium and precious metals in North

America. From 1974 to the late 1980's these German partnerships, under Bill's

guidance, invested hundred's of millions of dollars in oil and gas, uranium

and gold exploration projects in Canada and the US, resulting in the

development of three gold mines, three uranium mines, one copper deposit, many

oil and gas projects, and many good exploration projects that were either sold

or farmed out. Some of the companies that were formed as a result of this

exploration success and of which Bill was a founder and/or principal, were E&B

Exploration, Ferret Exploration, Mascot Gold Mines, Crow Butte Uranium Mine,

Western Goldfields and Baja Gold.

Dr. Allan Miller obtained his B.Sc. in Geology, from Carleton University

and Ph.D. from the University of Western Ontario and he is certified by the

Association of Professional Geoscientists of Ontario (P.Geo.). Al has served

as Director and Senior Scientific Advisor for Uravan for the past ten years.

Prior to joining the Uravan Board of Directors in 1997, Al was a mineral

deposits research scientist with the Geological Survey of Canada (GSC). During

his 25-year career with the GSC, Al focused on the mineral deposits of the

Western Churchill Province and participated extensively in regional mapping

programs across the Northwest Territories and Nunavut. Al's experience within

the GSC and more recently as a consulting mineral research specialist includes

the following ore deposit types: uranium, magmatic nickel-copper, lode gold,

epithermal precious metal, diamond, volcanic-associated massive sulphide,

sediment-hosted copper, Broken Hill-type lead-zinc-silver, redbed copper and

porphyry copper. Al's exploration activities and mineral deposit studies have

exposed him to many geological provinces throughout North America as well as

globally, in areas such as the Americas, Russia, China, Southeast Asia and the

Middle East. Al's extensive knowledge in mineral deposit formation is an

invaluable asset to guide Uravan's exploration activities in Canada and in

other global domains. Specifically, Al's experience in the uranium deposit

types of the Western Churchill Uranium Province and in particular the Thelon

Basin, Northwest Territories and Nunavut, the Athabasca Basin, Saskatchewan

and Kombolgie Basin, Australia are impressive and key to Uravan's future

uranium exploration success.

Mr. Ian Fraser obtained his B.Sc. in Geology from Laurentian University

and he is certified by the Association of Professional Engineers & Geologist

of Saskatchewan (APEGS) as a Professional Geologist (P. Geo.). Ian has over

twenty years of experience in the mining industry as an exploration and mine

geologist for major and junior mining companies including Inco, Kerr Addison

Mines, Golden Band Resources Inc., Wallbridge Mining Co. and the Golden Rule

Group of Companies. Ian has worked on numerous precious metal and base metal

exploration and development projects throughout Canada, designing and

implementing many surface mapping and geochemical sampling programs, along

with organizing numerous airborne and surface geophysical programs and the

budgeting and implementation of diamond drill programs. As a chief mine

geologist in a narrow vein gold mine owned by Waddy Lake Mines, Ian

coordinated underground grade control and stope design, detailed underground

mapping and designed drill programs. Since 1998 Ian has been working with

Uravan's technical team and has become Uravan's resident specialist in nickel,

copper, gold and platinum group element (Ni-Cu-PGE-Au) exploration and is the

project geologist for the Rottenstone Ni-Cu-PGE Property. Recently Ian has

been working very closely with Dr Allan Miller on Uravan's uranium projects in

the Thelon Basin, NT and NU.

About Uravan Minerals Inc.

--------------------------

Uravan Minerals Inc. ("Uravan") is a Calgary, Alberta based mineral

exploration company specializing in uranium, base metal (nickel, copper) and

precious metal (gold, platinum, and palladium) exploration. Uravan's principal

assets are the Boomerang uranium project, the Garry Lake uranium property and

the Rottenstone Nickel-Copper-PGM project. Due to the persistent increase in

the uranium prices, going from $7.10 per pound U3O8 in 2000 to $72.00

recently, Uravan has become highly focused in pursuing exploration for

potential high-grade unconformity-type uranium deposits on its joint

Cameco-Uravan Boomerang uranium project and its Gary Lake uranium projects

plus acquiring other uranium properties in a variety of potential geological

domains. 2007 exploration programs and budgets will be announced in the near

future on both of these projects. Uravan is a publicly listed company on the

TSX Venture Exchange under the trading symbol UVN. Uravan has 24,285,114

shares outstanding and $10 million in working capital. All of the mineral

properties Uravan owns are considered in the exploration stage of development.

This press release may contain forward looking statements including those

describing the Corporation's future plans and the expectations of management

that a stated result or condition will occur. Any statement addressing future

events or conditions necessarily involves inherent risk and uncertainty.

Actual results can differ materially from those anticipated by management at

the time of writing due to many factors, the majority of which are beyond the

control of the Corporation and its management.

The TSX Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

For further information: Larry Lahusen, President, Uravan Minerals Inc.,

Tel: (403) 949-3311, Fax: (403) 949-3309, Email: llahusen@uravanminerals.com,

Website: www.uravanminerals.com

Antwort auf Beitrag Nr.: 26.964.129 von heddog am 16.01.07 19:20:04Uravan has become highly focused in pursuing exploration for

potential high-grade unconformity-type uranium deposits on its joint

Cameco-Uravan Boomerang uranium project and its Gary Lake uranium projects plus acquiring other uranium properties in a variety of potential geological domains. 2007 exploration programs and budgets will be announced in the near Future on both of these projects.

potential high-grade unconformity-type uranium deposits on its joint

Cameco-Uravan Boomerang uranium project and its Gary Lake uranium projects plus acquiring other uranium properties in a variety of potential geological domains. 2007 exploration programs and budgets will be announced in the near Future on both of these projects.

Ganz interessant:

Uranium set to benefit from a nuclear renaissance

Cigar Lake, in Canada's Saskatchewan province, is home to one of the richest uranium ore bodies on the planet. At 232 million pounds of proven and probable reserves, the economic value of the find is nearly $14 billion by recent spot price.

Cigar Lake production was expected to save the day for hungry nuclear power utilities - 103 of which operate in the United States. The plan was to have 7-8 million pounds of production online by 2008, with as much as 18 million pounds a year not long after. Cigar Lake was expected to supply 50% of all new uranium production within five years.

Then the walls caved in. Literally.

Concrete-reinforced steel doors were in place to hold back the lake, but an underground rock fall caused the doors to give way. Water rushed in at 1,500 cubic meters an hour; in due time, the mine was flooded.

The flood is a costly setback for Cameco, 50% joint owner of the Cigar Lake mine, and a major headache for uranium buyers in general. Kevin Bambrough of Sprott Asset Management believes American utilities will be particularly squeezed.

"The delays...will create a sense of urgency for the next few years,"

Bambrough said. "It's almost the equivalent of the oil industry losing Saudi Arabia."

What production setbacks mean for the uranium price

Uranium prices are surveyed and quoted on a weekly basis by various industry watchers. The recent move from $56 to $60 a pound was "the largest weekly increase on record," according to Eric Webb of Ux Consulting. Long- term forecasts of $75 and even $100 a pound now appear justified; uranium would have to trade above $111 a pound to break its inflation-adjusted highs from 1978.

This is more than just subterranean cave-in blues: The uranium spot price hasn't seen a down month since 2001. For years now, uranium producers have met just 60% of total annual demand - the other 40% coming from government stockpiles and decommissioned nuclear warheads. This can go on for only so long.

The tightness of supply comes at a time of atomic resurgence. Three large-scale factors have turned the tide in favour of nuclear energy:

geopolitics, global warming and developing world growth.

Why nuclear power is back on the agenda

First, geopolitics: The unpleasant consequences of fossil fuel addiction splash across the headlines every week. Mahmoud Ahmadinejad predicts the collapse of Israel, the UK and the United States...Hugo Chavez vows to defeat "the most powerful empire on Earth"...Vladimir Putin waves off brutal assassinations while cranking up the Cold War rhetoric...and so on.

All this and more is fuelled by an unquenchable thirst for oil and gas.

Nuclear power may not offer a direct path to energy independence - we can't put uranium rods in our gas tanks, as Peter Tertzakian observes - but it is a big step in the right direction. (And if hybrid car sales continue to skyrocket, drivers could conceivably "plug in" at night, when traditional electricity demand is low.)

Second, global warming: The debate rages on; many still agree with Sen.

James Inhofe (Oklahoma), who called global warming the "greatest hoax ever perpetrated on the American people."

Yet political ideologies aside, mounting evidence is getting harder to ignore. While China, North America and Australia are endowed with huge deposits of thermal coal, the consequences of accelerated coal use could be dire. (Air pollution factors in too; filters in Lake Tahoe, your editor's beloved backyard, are already clogging up with Chinese gunk.)

Whether the public accepts global warming or not, Western governments surely do. The United States was arguably the last holdout, and with Sen. Barbara Boxer(California) succeeding Inhofe as chair of the Environment and Public Works Committee, that domino has clearly fallen. Politics aside, this is another feather in uranium's cap: Regime change in Washington, combined with the urgent need to "do something" about global warming, works in favour of nuclear energy.

The Democrats would no doubt like to rely more on greener solutions, like solar and wind, but those industries are still too small to pack a meaningful wallop. The green technologies of tomorrow hold great promise, but they have not yet demonstrated an ability to perform at scale. Nuclear power has already demonstrated its safety, scalability and 90%-plus reliability, with next-gen technology like pebble bed reactors offering improved maintenance and safety to boot.

The final factor driving a nuclear renaissance is developing world growth. The historical correlation between energy use and economic growth is high; when rapid industrialization kicks in for a developing world country, the energy consumption path goes parabolic.

Asia knows that relying on fossil fuels to drive the next stage is a mug's game, for geopolitical, environmental and financial reasons. Besides, there will already be enough headaches as we try to fill up all those cars (hybrid diesels anyone?) and enough pollution to deal with aside from new power plants. Fossil fuel use is going to rise dramatically no matter what; nuclear power will help take an edge off that pain. Let a hundred reactors bloom.

Top uranium production trends

So where will the uranium to fuel a nuclear resurgence come from? With government stockpiles covering 40% of present demand, the question looms large.

For one, Cameco is confident that Cigar Lake will eventually be up and running. The costs will be high, but that uranium is too valuable not to be accessed - and Cameco should recoup its recovery costs and more in the long run.

An important future source could be Australia, home to 38% of the world's low-cost uranium reserves. Surprisingly, for a country so rich in the stuff, Australia does not operate a single nuclear power plant - yet. The "lucky country" still relies on coal for 80% of electricity needs. Yet a government report recommends adding nuclear to Australia's energy mix to lower greenhouse gas emissions, and Prime Minister John Howard recently called the rise of nuclear power in Australia "inevitable."

A commissioned study argues Australia could quadruple its export profits by enriching and fabricating uranium at home, rather than shipping it abroad unprocessed. Local environmentalists may protest against expanded uranium trade, but friendly pressure from the United States could win out...especially when combined with lucrative economic incentive.

Another country keen on nuclear power is Russia. Home to an estimated 15% of world uranium reserves, Russia could yet go from exporter to importer in the coming years. The official plan is to dramatically expand nuclear power's share of the Russian energy mix, to 25% by 2020.

Russian uranium production will have to grow approximately 433%, from 3,000 tons a year to 16,000 tons, if domestic supply is to do the job.

On the positive side, existing government stockpiles of uranium can act as a buffer against volatile demand. Construction costs make up the lion's share of investment for a new plant, with ongoing fuel and maintenance costs relatively small in comparison; the hitch is that a steady supply of fuel - the uranium itself - should be locked up in advance, preferably via ironclad contracts. This puts a lot of power in the hands of financiers, who like to see a reasonably steady production stream before committing funds. The financiers are thus relieved to know that governments are on their side, with a willingness to act as swing supplier in the event of temporary shortages. The US government in particular is doing all it can to get the nuclear resurgence jump-started, including making generous offers of "regulatory insurance" to utilities who get the ball rolling.

All in all, the pieces are in place. The rise of safe, clean nuclear power is in most everyone's best interest...except the petrocrats who want to keep the world as addicted to fossil fuels as possible. Uranium producers could have some very good years ahead.

By Justice Litle for The Daily Reckoning. You can read more from Justice and many others at www.dailyreckoning.co.uk

Editor's Note: Justice Litle is an editor of Outstanding Investments, ranked number one by Hulbert's Financial Digest for total return performance over the past five years. He has worked with soybean farmers, cattle ranchers, energy consultants, currency hedgers, scrap metal dealers and everything in between, including multiple hedge funds. Mr Litle also acted as head trader for a private equity partnership, and made contributions to Trend Following: How Great Traders Make Millions in Up or Down Markets, a popular trading book by Mike Covel (FT/Prentice Hall).

http://www.moneyweek.com/file/24001/uranium-is-set-to-benefi…

Uranium set to benefit from a nuclear renaissance

Cigar Lake, in Canada's Saskatchewan province, is home to one of the richest uranium ore bodies on the planet. At 232 million pounds of proven and probable reserves, the economic value of the find is nearly $14 billion by recent spot price.

Cigar Lake production was expected to save the day for hungry nuclear power utilities - 103 of which operate in the United States. The plan was to have 7-8 million pounds of production online by 2008, with as much as 18 million pounds a year not long after. Cigar Lake was expected to supply 50% of all new uranium production within five years.

Then the walls caved in. Literally.

Concrete-reinforced steel doors were in place to hold back the lake, but an underground rock fall caused the doors to give way. Water rushed in at 1,500 cubic meters an hour; in due time, the mine was flooded.

The flood is a costly setback for Cameco, 50% joint owner of the Cigar Lake mine, and a major headache for uranium buyers in general. Kevin Bambrough of Sprott Asset Management believes American utilities will be particularly squeezed.

"The delays...will create a sense of urgency for the next few years,"

Bambrough said. "It's almost the equivalent of the oil industry losing Saudi Arabia."

What production setbacks mean for the uranium price

Uranium prices are surveyed and quoted on a weekly basis by various industry watchers. The recent move from $56 to $60 a pound was "the largest weekly increase on record," according to Eric Webb of Ux Consulting. Long- term forecasts of $75 and even $100 a pound now appear justified; uranium would have to trade above $111 a pound to break its inflation-adjusted highs from 1978.

This is more than just subterranean cave-in blues: The uranium spot price hasn't seen a down month since 2001. For years now, uranium producers have met just 60% of total annual demand - the other 40% coming from government stockpiles and decommissioned nuclear warheads. This can go on for only so long.

The tightness of supply comes at a time of atomic resurgence. Three large-scale factors have turned the tide in favour of nuclear energy:

geopolitics, global warming and developing world growth.

Why nuclear power is back on the agenda

First, geopolitics: The unpleasant consequences of fossil fuel addiction splash across the headlines every week. Mahmoud Ahmadinejad predicts the collapse of Israel, the UK and the United States...Hugo Chavez vows to defeat "the most powerful empire on Earth"...Vladimir Putin waves off brutal assassinations while cranking up the Cold War rhetoric...and so on.

All this and more is fuelled by an unquenchable thirst for oil and gas.

Nuclear power may not offer a direct path to energy independence - we can't put uranium rods in our gas tanks, as Peter Tertzakian observes - but it is a big step in the right direction. (And if hybrid car sales continue to skyrocket, drivers could conceivably "plug in" at night, when traditional electricity demand is low.)

Second, global warming: The debate rages on; many still agree with Sen.

James Inhofe (Oklahoma), who called global warming the "greatest hoax ever perpetrated on the American people."

Yet political ideologies aside, mounting evidence is getting harder to ignore. While China, North America and Australia are endowed with huge deposits of thermal coal, the consequences of accelerated coal use could be dire. (Air pollution factors in too; filters in Lake Tahoe, your editor's beloved backyard, are already clogging up with Chinese gunk.)

Whether the public accepts global warming or not, Western governments surely do. The United States was arguably the last holdout, and with Sen. Barbara Boxer(California) succeeding Inhofe as chair of the Environment and Public Works Committee, that domino has clearly fallen. Politics aside, this is another feather in uranium's cap: Regime change in Washington, combined with the urgent need to "do something" about global warming, works in favour of nuclear energy.

The Democrats would no doubt like to rely more on greener solutions, like solar and wind, but those industries are still too small to pack a meaningful wallop. The green technologies of tomorrow hold great promise, but they have not yet demonstrated an ability to perform at scale. Nuclear power has already demonstrated its safety, scalability and 90%-plus reliability, with next-gen technology like pebble bed reactors offering improved maintenance and safety to boot.

The final factor driving a nuclear renaissance is developing world growth. The historical correlation between energy use and economic growth is high; when rapid industrialization kicks in for a developing world country, the energy consumption path goes parabolic.

Asia knows that relying on fossil fuels to drive the next stage is a mug's game, for geopolitical, environmental and financial reasons. Besides, there will already be enough headaches as we try to fill up all those cars (hybrid diesels anyone?) and enough pollution to deal with aside from new power plants. Fossil fuel use is going to rise dramatically no matter what; nuclear power will help take an edge off that pain. Let a hundred reactors bloom.

Top uranium production trends

So where will the uranium to fuel a nuclear resurgence come from? With government stockpiles covering 40% of present demand, the question looms large.

For one, Cameco is confident that Cigar Lake will eventually be up and running. The costs will be high, but that uranium is too valuable not to be accessed - and Cameco should recoup its recovery costs and more in the long run.

An important future source could be Australia, home to 38% of the world's low-cost uranium reserves. Surprisingly, for a country so rich in the stuff, Australia does not operate a single nuclear power plant - yet. The "lucky country" still relies on coal for 80% of electricity needs. Yet a government report recommends adding nuclear to Australia's energy mix to lower greenhouse gas emissions, and Prime Minister John Howard recently called the rise of nuclear power in Australia "inevitable."

A commissioned study argues Australia could quadruple its export profits by enriching and fabricating uranium at home, rather than shipping it abroad unprocessed. Local environmentalists may protest against expanded uranium trade, but friendly pressure from the United States could win out...especially when combined with lucrative economic incentive.

Another country keen on nuclear power is Russia. Home to an estimated 15% of world uranium reserves, Russia could yet go from exporter to importer in the coming years. The official plan is to dramatically expand nuclear power's share of the Russian energy mix, to 25% by 2020.

Russian uranium production will have to grow approximately 433%, from 3,000 tons a year to 16,000 tons, if domestic supply is to do the job.

On the positive side, existing government stockpiles of uranium can act as a buffer against volatile demand. Construction costs make up the lion's share of investment for a new plant, with ongoing fuel and maintenance costs relatively small in comparison; the hitch is that a steady supply of fuel - the uranium itself - should be locked up in advance, preferably via ironclad contracts. This puts a lot of power in the hands of financiers, who like to see a reasonably steady production stream before committing funds. The financiers are thus relieved to know that governments are on their side, with a willingness to act as swing supplier in the event of temporary shortages. The US government in particular is doing all it can to get the nuclear resurgence jump-started, including making generous offers of "regulatory insurance" to utilities who get the ball rolling.

All in all, the pieces are in place. The rise of safe, clean nuclear power is in most everyone's best interest...except the petrocrats who want to keep the world as addicted to fossil fuels as possible. Uranium producers could have some very good years ahead.

By Justice Litle for The Daily Reckoning. You can read more from Justice and many others at www.dailyreckoning.co.uk

Editor's Note: Justice Litle is an editor of Outstanding Investments, ranked number one by Hulbert's Financial Digest for total return performance over the past five years. He has worked with soybean farmers, cattle ranchers, energy consultants, currency hedgers, scrap metal dealers and everything in between, including multiple hedge funds. Mr Litle also acted as head trader for a private equity partnership, and made contributions to Trend Following: How Great Traders Make Millions in Up or Down Markets, a popular trading book by Mike Covel (FT/Prentice Hall).

http://www.moneyweek.com/file/24001/uranium-is-set-to-benefi…

A Big Year Ahead For Uranium

http://www.stockinterview.com/News/01182007/Uranium-Year-Ahe…

http://www.stockinterview.com/News/01182007/Uranium-Year-Ahe…

Aus den Stockhouse Boards:

"Rumour out of Australia trading desk this morning (full disclosure - I am close to an institutional trader) that Cigar lake may be scratched all together. We know that Cameco is giving an update to the market in early Tuesday on the project"

Das würde sicherlich nochmal einen richtigen Schub für alle Uran-Aktien geben.

Und Cameco muss erst Recht zusehen, seine Reserven durch Übernahmen aufzustocken.

"Rumour out of Australia trading desk this morning (full disclosure - I am close to an institutional trader) that Cigar lake may be scratched all together. We know that Cameco is giving an update to the market in early Tuesday on the project"

Das würde sicherlich nochmal einen richtigen Schub für alle Uran-Aktien geben.

Und Cameco muss erst Recht zusehen, seine Reserven durch Übernahmen aufzustocken.

Uran extrem bullische Fundamentals

23.01.2007

Rohstoff-Trader

Gerbrunn (aktiencheck.de AG) - Während sich vor allem einige Metalle und Energie-Rohstoffe bereits seit längerem im Korrektur-Modus befinden, scheint bei Uran nichts und niemand die "Jahrhundert-Rally" aufhalten zu können, so die Experten vom "Rohstoff-Trader".

Zur Stunde notiere das "strahlende" Metall bei sage und schreibe 72 US-Dollar pro amerikanisches Pfund. Anfang 2001 sei ein Pound noch für rund sieben US-Dollar zu haben gewesen. Angesichts einer derart beeindruckenden Performance sei es nur zu verständlich, dass sich immer mehr Anleger fragen würden: Wie lange könne diese gewaltige "Hausse" noch weiterlaufen? Wenngleich vorübergehende Korrekturen natürlich niemals gänzlich ausgeschlossen werden könnten, neige sich der "Bullenmarkt" noch längst nicht seinem Ende zu.

Denn die Fundamentaldaten sprächen eine klare Sprache: Während die Politiker hierzulande an dem Atomausstieg festhalten wollen, erlebe die Kernkraft in der übrigen Welt eine bis vor einigen Jahren kaum für möglich gehaltene Renaissance. Vor allem in China und Indien aber auch in Russland würden in der kommenden Dekade entsprechende Kraftwerke förmlich wie Pilze aus dem Boden schießen. Die Uran-Nachfrage dürfte damit in Zukunft weiter sprunghaft ansteigen.

Dabei sei die Versorgungslage bereits heute mehr als angespannt: 2005 habe einem globalen Uran-Bedarf von gut 70.000 Tonnen eine Bergbau-Produktion von lediglich 41.595 Tonnen gegenübergestanden. Diese massive Lücke sei bislang hauptsächlich durch die Wiederverwertung alter russischer Nuklearsprengköpfe aus Atomwaffen geschlossen worden. Doch langsam aber sicher würden sich die Bestände ihrem Ende zuneigen. Und die Suche nach neuen Vorkommen gestalte sich überaus schwierig, weil Uran nun einmal ein in der Natur außerordentlich seltenes Element sei. Unterm Strich bleibe daher festzuhalten, dass sich das Angebotsdefizit in den nächsten Jahren massiv ausweiten dürfte.

http://www.aktiencheck.de/artikel/analysen-Marktberichte-146…

23.01.2007

Rohstoff-Trader

Gerbrunn (aktiencheck.de AG) - Während sich vor allem einige Metalle und Energie-Rohstoffe bereits seit längerem im Korrektur-Modus befinden, scheint bei Uran nichts und niemand die "Jahrhundert-Rally" aufhalten zu können, so die Experten vom "Rohstoff-Trader".

Zur Stunde notiere das "strahlende" Metall bei sage und schreibe 72 US-Dollar pro amerikanisches Pfund. Anfang 2001 sei ein Pound noch für rund sieben US-Dollar zu haben gewesen. Angesichts einer derart beeindruckenden Performance sei es nur zu verständlich, dass sich immer mehr Anleger fragen würden: Wie lange könne diese gewaltige "Hausse" noch weiterlaufen? Wenngleich vorübergehende Korrekturen natürlich niemals gänzlich ausgeschlossen werden könnten, neige sich der "Bullenmarkt" noch längst nicht seinem Ende zu.

Denn die Fundamentaldaten sprächen eine klare Sprache: Während die Politiker hierzulande an dem Atomausstieg festhalten wollen, erlebe die Kernkraft in der übrigen Welt eine bis vor einigen Jahren kaum für möglich gehaltene Renaissance. Vor allem in China und Indien aber auch in Russland würden in der kommenden Dekade entsprechende Kraftwerke förmlich wie Pilze aus dem Boden schießen. Die Uran-Nachfrage dürfte damit in Zukunft weiter sprunghaft ansteigen.

Dabei sei die Versorgungslage bereits heute mehr als angespannt: 2005 habe einem globalen Uran-Bedarf von gut 70.000 Tonnen eine Bergbau-Produktion von lediglich 41.595 Tonnen gegenübergestanden. Diese massive Lücke sei bislang hauptsächlich durch die Wiederverwertung alter russischer Nuklearsprengköpfe aus Atomwaffen geschlossen worden. Doch langsam aber sicher würden sich die Bestände ihrem Ende zuneigen. Und die Suche nach neuen Vorkommen gestalte sich überaus schwierig, weil Uran nun einmal ein in der Natur außerordentlich seltenes Element sei. Unterm Strich bleibe daher festzuhalten, dass sich das Angebotsdefizit in den nächsten Jahren massiv ausweiten dürfte.

http://www.aktiencheck.de/artikel/analysen-Marktberichte-146…

NEWS

Uravan Accelerates Drilling Expenditure on the Boomerang Uranium Project for 2007

TSXV: UVN

CALGARY, Jan. 23 /CNW/ - Uravan Minerals Inc ("Uravan") have concluded

the results of the 2006 reconnaissance diamond drill program on the Boomerang

uranium project, Thelon Basin, NT was a significant technical and geological

success. Based on the positive 2006 drill results, Cameco Corporation

("Cameco") has allocated $4.0 million in 2007 to fund a more aggressive

reconnaissance exploration drill program across the northern part of the

Boomerang uranium property. It is estimated this accelerated drilling

expenditure will provide Uravan's exploration team the funds to complete 20 to

25 diamond drill holes along the continuous and highly prospective F- and

G-conductive trends. This widely-spaced (greater than 2000 metre)

reconnaissance drill program will attempt to assess the uranium-bearing

potential along the entire interpreted length of the F- and G-conductive

trends. It is anticipated the initial drill-hole locations will be

pre-selected using the interpreted airborne MEGATEM geophysical data followed

by defining specific drill targets in the field using detailed ground TDEM

(Time Domain Electromagnetic) fixed-loop geophysical surveys base on single

traverse lines. Uravan is currently in the planning stages for this

reconnaissance drill program and will be in a position to disclose more

details in the near future. Mobilization of this drill program is currently

scheduled to commence mid April 2007. Uravan holds an approved Land Use Permit

(LUP) for the Boomerang project and additional land use permitting may be

required.

The F- and G-trends are two major subparallel basement-hosted EM

conductive anomalies that were previously identified from a 2005 airborne

MEGATEM geophysical survey. In July 2006 Fugro Airborne Surveys completed a

second airborne MEGATEM geophysical survey, extending the 2005 survey to the

northeast covering the projection of the F- and G- conductors. Based on

interpretive work from the merged MEGATEM data sets, the F- and G-conductive

trends individually have a strike length of (greater than)50 kilometers and

strike northeast across the entire Boomerang uranium property. The importance

of both the extensions of the F- and G- conductive trends is that major

basement-hosted conductive anomalies have been identified along their entire

strike lengths. These anomalies have the potential to host unconformity-type

uranium deposits. The F- and G-conductive trends are 2 to 3 kilometers wide

and lie within broader structural corridors that are comprised in part of

prospective graphite-bearing pelitic metasedimentary basement rocks that

underlie sandstones of the Thelon Basin.

In August 2006, the Cameco-Uravan joint exploration program completed six

(6) NQ widely-spaced incline diamond drill holes (BL06-60 thru -65 inclusive);

totaling 1558.7 meters drilled, on the southwestern portion of these two

conductive trends. These reconnaissance diamond drill holes were located on

pre-selected geophysical cross sections through the F- and G-conductive

trends. These inclined reconnaissance drill holes were positioned to intersect

conductive geophysical structures in the basement and interpreted structural

zones in the Thelon sandstone, both critical elements in the search for

high-grade uranium deposits positioned at the unconformity and within the

basement beneath the unconformity. All drill holes were sampled intensively

and submitted for major oxides and trace elements analysis and clay

mineralogy. All analytical results from all six (6) drill holes have been

received and petrogaphic and X-ray analyses techniques have commenced on

selected samples from both trends. Although no economic uranium mineralization

was intersected, anomalous uranium mineralization was encountered at the

Thelon-basement contact in both trends, which further substantiates the

Thelon-basement contact has the potential to host unconformity-type uranium

deposits.

Based on the observations of Uravan's technical team plus the analytical

results and on going mineralogical work, the 2006 drill program identified the

following critically important attributes required for the formation of

unconformity-type uranium deposits:

<<

- The basal Thelon sandstone-conglomerate in the drilled portions of

the F- and G-trends is a clay-rich paleoaquifer with locally

anomalous uranium abundances (greater than 1 ppm U).

- The Thelon sandstone sections drilled have sustained extensive

reduction (bleaching) during high-grade diagenesis.

- The basement rocks beneath the Thelon sandstone in both of the

drilled segments of the conductive F- and G-trends possess

lithologies that support the occurrence of unconformity-type uranium

mineralization.

- The drilling confirmed the presence of post-Thelon brittle faults

that displace the Thelon unconformity. These reactivated basement-

structures display post-Thelon chloritization and bleaching; a

structural-hydrothermal feature that confirms the transmission of

basement-derived hydrothermal fluids along structures near the

faulted unconformity.

- Fracture-controlled and disseminated sulphide mineralization was

intersected in highly reduced clay-rich Thelon sandstone at and near

the unconformity in both the F- and G-trends. The occurrence of this

mineralization-type demonstrates that unconformity-related

mineralizing processes were operative in both of these structural

corridors and that mineralizing processes were operative over

significant strike lengths within these corridors.

>>

The Boomerang uranium project is located about 300 miles east of

Yellowknife, NT and consists of 5 mineral leases and 253 contiguous mining

claims covering about 647,003 acres located along the southwestern margin of

the Thelon Basin, NT. The Boomerang Uranium Project is a joint exploration

effort between Cameco and Uravan whereby Uravan granted Cameco an option to

earn 60% interest in the Boomerang uranium property by funding an aggregate of

$10,000,000. Uravan is currently the operator with the responsibility to plan

organize and carry out exploration programs on the Boomerang property in

consultation with and on behalf of Cameco. Cameco is expected to fund 100% of

the 2007 exploration expenditure.

This press release has been prepared under the supervision of Dr. Allan

Miller, P. Geo., and a Qualified Person as defined by National instrument

43-101.

About Uravan Minerals Inc.

--------------------------

Uravan Minerals Inc. ("Uravan") is a Calgary, Alberta based mineral

exploration company specializing in uranium, base metal (nickel, copper) and

precious metal (gold, platinum, and palladium) exploration. Uravan's principal

assets are the Boomerang uranium project, the Garry Lake uranium property and

the Rottenstone Nickel-Copper-PGE project. Due to the persistent increase in

the uranium prices, going from $7.10 per pound U3O8 in 2000 to $72.00

recently, Uravan has become highly focused in pursuing exploration for

potential high-grade unconformity-type uranium deposits on its joint

Cameco-Uravan Boomerang uranium project and its Gary Lake uranium project plus

acquiring additional uranium properties in other potential geological domains.

Uravan is a publicly listed company on the TSX Venture Exchange under the

trading symbol UVN. Uravan has 24,420,114 shares outstanding and $10 million

in working capital. All of the mineral properties Uravan owns are considered

in the exploration stage of development.

This press release may contain forward looking statements including those

describing Uravan's future plans and the expectations of management that a

stated result or condition will occur. Any statement addressing future events

or conditions necessarily involves inherent risk and uncertainty. Actual

results can differ materially from those anticipated by management at the time

of writing due to many factors, the majority of which are beyond the control

of Uravan and its management.

The TSX Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

For further information: Larry Lahusen, President, Uravan Minerals Inc.,

Tel: (403) 264-2630, Email: llahusen@uravanminerals.com, Website:

www.uravanminerals.com

Uravan Accelerates Drilling Expenditure on the Boomerang Uranium Project for 2007

TSXV: UVN

CALGARY, Jan. 23 /CNW/ - Uravan Minerals Inc ("Uravan") have concluded

the results of the 2006 reconnaissance diamond drill program on the Boomerang

uranium project, Thelon Basin, NT was a significant technical and geological

success. Based on the positive 2006 drill results, Cameco Corporation

("Cameco") has allocated $4.0 million in 2007 to fund a more aggressive

reconnaissance exploration drill program across the northern part of the

Boomerang uranium property. It is estimated this accelerated drilling

expenditure will provide Uravan's exploration team the funds to complete 20 to

25 diamond drill holes along the continuous and highly prospective F- and

G-conductive trends. This widely-spaced (greater than 2000 metre)

reconnaissance drill program will attempt to assess the uranium-bearing

potential along the entire interpreted length of the F- and G-conductive

trends. It is anticipated the initial drill-hole locations will be

pre-selected using the interpreted airborne MEGATEM geophysical data followed

by defining specific drill targets in the field using detailed ground TDEM

(Time Domain Electromagnetic) fixed-loop geophysical surveys base on single

traverse lines. Uravan is currently in the planning stages for this

reconnaissance drill program and will be in a position to disclose more

details in the near future. Mobilization of this drill program is currently

scheduled to commence mid April 2007. Uravan holds an approved Land Use Permit

(LUP) for the Boomerang project and additional land use permitting may be

required.

The F- and G-trends are two major subparallel basement-hosted EM

conductive anomalies that were previously identified from a 2005 airborne

MEGATEM geophysical survey. In July 2006 Fugro Airborne Surveys completed a

second airborne MEGATEM geophysical survey, extending the 2005 survey to the

northeast covering the projection of the F- and G- conductors. Based on

interpretive work from the merged MEGATEM data sets, the F- and G-conductive

trends individually have a strike length of (greater than)50 kilometers and

strike northeast across the entire Boomerang uranium property. The importance

of both the extensions of the F- and G- conductive trends is that major

basement-hosted conductive anomalies have been identified along their entire

strike lengths. These anomalies have the potential to host unconformity-type

uranium deposits. The F- and G-conductive trends are 2 to 3 kilometers wide

and lie within broader structural corridors that are comprised in part of

prospective graphite-bearing pelitic metasedimentary basement rocks that

underlie sandstones of the Thelon Basin.

In August 2006, the Cameco-Uravan joint exploration program completed six

(6) NQ widely-spaced incline diamond drill holes (BL06-60 thru -65 inclusive);

totaling 1558.7 meters drilled, on the southwestern portion of these two

conductive trends. These reconnaissance diamond drill holes were located on

pre-selected geophysical cross sections through the F- and G-conductive

trends. These inclined reconnaissance drill holes were positioned to intersect

conductive geophysical structures in the basement and interpreted structural

zones in the Thelon sandstone, both critical elements in the search for

high-grade uranium deposits positioned at the unconformity and within the

basement beneath the unconformity. All drill holes were sampled intensively

and submitted for major oxides and trace elements analysis and clay

mineralogy. All analytical results from all six (6) drill holes have been

received and petrogaphic and X-ray analyses techniques have commenced on

selected samples from both trends. Although no economic uranium mineralization

was intersected, anomalous uranium mineralization was encountered at the

Thelon-basement contact in both trends, which further substantiates the

Thelon-basement contact has the potential to host unconformity-type uranium

deposits.

Based on the observations of Uravan's technical team plus the analytical

results and on going mineralogical work, the 2006 drill program identified the

following critically important attributes required for the formation of

unconformity-type uranium deposits:

<<

- The basal Thelon sandstone-conglomerate in the drilled portions of

the F- and G-trends is a clay-rich paleoaquifer with locally

anomalous uranium abundances (greater than 1 ppm U).

- The Thelon sandstone sections drilled have sustained extensive

reduction (bleaching) during high-grade diagenesis.

- The basement rocks beneath the Thelon sandstone in both of the

drilled segments of the conductive F- and G-trends possess

lithologies that support the occurrence of unconformity-type uranium

mineralization.

- The drilling confirmed the presence of post-Thelon brittle faults

that displace the Thelon unconformity. These reactivated basement-

structures display post-Thelon chloritization and bleaching; a

structural-hydrothermal feature that confirms the transmission of

basement-derived hydrothermal fluids along structures near the

faulted unconformity.

- Fracture-controlled and disseminated sulphide mineralization was

intersected in highly reduced clay-rich Thelon sandstone at and near

the unconformity in both the F- and G-trends. The occurrence of this

mineralization-type demonstrates that unconformity-related

mineralizing processes were operative in both of these structural

corridors and that mineralizing processes were operative over

significant strike lengths within these corridors.

>>

The Boomerang uranium project is located about 300 miles east of

Yellowknife, NT and consists of 5 mineral leases and 253 contiguous mining

claims covering about 647,003 acres located along the southwestern margin of

the Thelon Basin, NT. The Boomerang Uranium Project is a joint exploration

effort between Cameco and Uravan whereby Uravan granted Cameco an option to

earn 60% interest in the Boomerang uranium property by funding an aggregate of

$10,000,000. Uravan is currently the operator with the responsibility to plan

organize and carry out exploration programs on the Boomerang property in

consultation with and on behalf of Cameco. Cameco is expected to fund 100% of

the 2007 exploration expenditure.

This press release has been prepared under the supervision of Dr. Allan

Miller, P. Geo., and a Qualified Person as defined by National instrument

43-101.

About Uravan Minerals Inc.

--------------------------

Uravan Minerals Inc. ("Uravan") is a Calgary, Alberta based mineral

exploration company specializing in uranium, base metal (nickel, copper) and

precious metal (gold, platinum, and palladium) exploration. Uravan's principal

assets are the Boomerang uranium project, the Garry Lake uranium property and

the Rottenstone Nickel-Copper-PGE project. Due to the persistent increase in

the uranium prices, going from $7.10 per pound U3O8 in 2000 to $72.00

recently, Uravan has become highly focused in pursuing exploration for

potential high-grade unconformity-type uranium deposits on its joint

Cameco-Uravan Boomerang uranium project and its Gary Lake uranium project plus

acquiring additional uranium properties in other potential geological domains.

Uravan is a publicly listed company on the TSX Venture Exchange under the

trading symbol UVN. Uravan has 24,420,114 shares outstanding and $10 million

in working capital. All of the mineral properties Uravan owns are considered

in the exploration stage of development.

This press release may contain forward looking statements including those

describing Uravan's future plans and the expectations of management that a

stated result or condition will occur. Any statement addressing future events

or conditions necessarily involves inherent risk and uncertainty. Actual

results can differ materially from those anticipated by management at the time

of writing due to many factors, the majority of which are beyond the control

of Uravan and its management.

The TSX Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

For further information: Larry Lahusen, President, Uravan Minerals Inc.,

Tel: (403) 264-2630, Email: llahusen@uravanminerals.com, Website:

www.uravanminerals.com

Antwort auf Beitrag Nr.: 27.136.757 von heddog am 23.01.07 19:54:23Die News scheint jedenfalls gut anzukommen in Kanada...

Aktuell + 7%

Aktuell + 7%

... eine Std. später ein Plus von 17%!

Da ist möglicherweise noch mehr im Busch.

Nur meine Meinung, Infos habe ich keine gefunden.

Da ist möglicherweise noch mehr im Busch.

Nur meine Meinung, Infos habe ich keine gefunden.

Antwort auf Beitrag Nr.: 27.139.533 von Bienenvater am 23.01.07 22:09:36Und die Umsätze sind für UVN-Verhältnisse ja schon riesig...

Ist mögliicherweise das hier aus den News mit ein Grund für den starken Anstieg?

Cameco Corporation("Cameco") has allocated $4.0 million in 2007 to fund a more aggressive reconnaissance exploration drill program across the northern part of the Boomerang uranium property.

Cameco Corporation("Cameco") has allocated $4.0 million in 2007 to fund a more aggressive reconnaissance exploration drill program across the northern part of the Boomerang uranium property.

Sollte natürlich so geschrieben werden, nicht als URL.

$4.0 million

$4.0 million

Hallo allerseits,

bin auf UVN durch Augen Capital, einer kanadischen Investmentgesellschaft, aufmerksam geworden. Die hielten zum 30.11.06 einen sagenhaften Portfolioanteil von 25%

in UVN.

in UVN.

http://www.augencc.com/docs/PDF/rsf.pdf

Augen hat in der Vergangenheit öfter einen guten Riecher gehabt. Mit Sicherheit wissen die mehr.

Mao

bin auf UVN durch Augen Capital, einer kanadischen Investmentgesellschaft, aufmerksam geworden. Die hielten zum 30.11.06 einen sagenhaften Portfolioanteil von 25%

in UVN.

in UVN.http://www.augencc.com/docs/PDF/rsf.pdf

Augen hat in der Vergangenheit öfter einen guten Riecher gehabt. Mit Sicherheit wissen die mehr.

Mao

Antwort auf Beitrag Nr.: 27.159.530 von mao_1 am 24.01.07 20:12:36Hallo,

habe UVN auch durch Augen Capital "entdeckt".

Die haben z.Bsp auch schon bei Energy Fuels einen sehr guten Riecher gehabt.

habe UVN auch durch Augen Capital "entdeckt".

Die haben z.Bsp auch schon bei Energy Fuels einen sehr guten Riecher gehabt.

Antwort auf Beitrag Nr.: 27.159.931 von heddog am 24.01.07 20:32:21Interessant...Bin gerade dabei mir einige Mining-Funds anzuschauen. Eine solche Übergewichtung nach einer längeren Talfahrt muss schon gute Gründe haben. Werde auf alle Fälle mal ein Auge darauf werfen.

Mao

Mao

Und noch mehr hohe Prozent-Zahlen (siehe Posting #2):

"Das Management hält aktuell Aktien im Wert von 9,600,000 Can$.

Knapp 40% von der MK."

Das wird wohl auch seine Gründe haben...

"Das Management hält aktuell Aktien im Wert von 9,600,000 Can$.

Knapp 40% von der MK."

Das wird wohl auch seine Gründe haben...

@ Mao

Lese seit einiger Zeit Deine versierten Beiträge im Arafura thread.

Bin leider bei Uravan vor knapp einem Jahr eingestiegen und trort Überzeugung nicht gerade vom Kursverlauf verwöhnt worden.

Gerade mit Camecos frühzeitigem Engagement eine interessante stoy.

Off Topic:

Bin dann im Verlaufe des letzten Jahres zwangsläufig über bayswater gestolpert, die ja komplett entweder direkt oder über JV das südliche Thelonbecken vereinnahmt haben. Wie ist Deine Meinung zu diesem Titel?

Lese seit einiger Zeit Deine versierten Beiträge im Arafura thread.

Bin leider bei Uravan vor knapp einem Jahr eingestiegen und trort Überzeugung nicht gerade vom Kursverlauf verwöhnt worden.

Gerade mit Camecos frühzeitigem Engagement eine interessante stoy.

Off Topic:

Bin dann im Verlaufe des letzten Jahres zwangsläufig über bayswater gestolpert, die ja komplett entweder direkt oder über JV das südliche Thelonbecken vereinnahmt haben. Wie ist Deine Meinung zu diesem Titel?

Heute mal wieder schönes Volumen in Kanada...

Aus dem Stockhouse-Board, ich lass das mal so stehen.

SUBJECT: Comparison Posted By: Jackshaft

Post Time: 1/29/2007 11:37

PTU- JV with CCO, PTU operating/paying all the bills to earn. Market cap of nearly $100 million, cash of $4 million in the bank.

UVN- JV with CCO, more land, CCO paying all the bills to earn, UVN operating, $10 million in the bank (40 cents/share!)Market cap of $35 million.