Diskussion zum Thema Silber (Seite 17525)

eröffnet am 23.04.05 14:56:42 von

neuester Beitrag 28.04.24 12:25:44 von

neuester Beitrag 28.04.24 12:25:44 von

Beiträge: 175.733

ID: 976.618

ID: 976.618

Aufrufe heute: 285

Gesamt: 15.012.833

Gesamt: 15.012.833

Aktive User: 1

ISIN: XD0002746952 · WKN: CG3AB1

18,23

USD

0,00 %

0,00 USD

Letzter Kurs 06.04.17 Eurex

Neuigkeiten

27.04.24 · wallstreetONLINE Redaktion |

27.04.24 · Jörg Schulte Anzeige |

27.04.24 · Nebenwerte Magazin |

26.04.24 · onemarkets Blog Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,6900 | +23,96 | |

| 5,1500 | +21,75 | |

| 15,890 | +21,67 | |

| 0,8900 | +17,11 | |

| 0,9000 | +16,13 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,5200 | -6,61 | |

| 1,1200 | -6,67 | |

| 10,040 | -7,89 | |

| 0,5700 | -8,06 | |

| 46,98 | -98,00 |

Beitrag zu dieser Diskussion schreiben

WEEKLY COMMENTARY

September 6, 2005

Every Picture Tells A Story

By Theodore Butler

(This essay was written by silver analyst Theodore Butler, an independent consultant. Investment Rarities does not necessarily endorse these views, which may or may not prove to be correct.)

Even though there is almost too much to write about in silver, I have to force myself to do so, given the overwhelming enormity of the nation’s greatest natural disaster. It seems shallow to write about silver in light of this tragedy. My heart goes out to those suffering and my admiration to those helping. This will be a long recovery process and we must all do what we can to help our fellow Americans. While many seem preoccupied with assigning blame, I doubt that is constructive. What would be constructive would be for those of us who are not victims to count our blessings and pitch in and help on any way possible.

That would certainly include sharing any material bounty that might come our way by virtue of silver investment gains. Based upon recent developments, those gains might be closer than otherwise expected. The first development is in the market structure, as defined by the Commitment of Traders Report (COT).

The most recent silver COT was shockingly bullish. Every category exhibited positive changes, but the standout was the stunning increase in the tech funds’ short position, which doubled to an extreme not seen in a couple of years. It appears the recent shakeout in silver just may be the final one, as the tech funds’ apparently took the dealers’ bait and fully committed to the short side.

Not only was there an increase in the large tech funds’ existing short positions, but there was also a notable increase in the number of tech funds jumping on the short side of silver. Since these brain dead tech funds stand absolutely no chance of delivering actual silver against their short positions, it’s just a matter of when and at what price they rush to buy back these shorts. Make no mistake; there was nothing accidental about the recent sell-off to new lows in silver. It was designed to lure the tech funds onto the short side. A more bullish COT structure is hard to imagine.

It appears that the dealers have succeeded in transferring a sizable portion of the short liability to the hapless tech funds. The funds are potentially trapped. Now we await the resolution. As always, the price action will depend upon how aggressive the dealers are in selling short on the next rally. If they don’t short aggressively, the price of silver will explode. If the dealers do short aggressively on the next rally, the gains will be much more subdued.

In gold, there was a large improvement in the just-reported COT report on the sharp price decline below the 50 moving average on the last reporting day, Tuesday, August 30. But even with this improvement the gold market structure can hardly be labeled as bullish, particularly when considering the subsequent deterioration from the cut-off. It’s still a case of the gold COTs being in dangerous territory, while silver is in a spectacularly bullish configuration. As mentioned previously, it is an unprecedented dichotomy.

As exciting and important as the COT market structure may be, it is not the only noteworthy development in silver. There were also unusual developments in warehouse stock movements and the first few days’ deliveries in the big September COMEX contract. On two days, over 4 million ounces of silver were brought in to the COMEX warehouses. While many still assume an increase in COMEX inventories is bearish, I don’t agree. This silver was brought in because it had to be brought in, to satisfy delivery demands. If there was available silver to deliver readily in the warehouses already, more wouldn’t be brought in. Certainly, the price action seemed to confirm and did not negate my bullish interpretation, as price rose strongly immediately after the inventory addition.

The actual number of deliveries over the first few days were the largest in more than a year, also confirming overall physical silver demand. More importantly, the largest stopper, or taker of deliveries, was none other than AIG, who had virtually disappeared from COMEX silver delivery dealings, after long dominating such activities.

Those are the facts; now I’d like to speculate. Recently, I wrote that I noticed a significant increase in the commercials’ gross long position and remarked how that could indicate coming physical delivery demands. In trying to guess which commercials might be responsible for these new long positions, I must admit I did not think of AIG first.

My first thoughts were it could be preparatory silver buying for the pending silver ETF. After all, the quantities and timing of the unusual commercial buying seemed to coincide with the filing of the preliminary prospectus for the Barclays’ silver ETF. The buying commenced within days of the June 17th filing of the prospectus. Now, I know the silver ETF may never be approved, as I wrote in "The Coming Silver ETF?" but a close reading of the prospectus indicates that Barclays can not issue shares in the silver ETF, even if approved, without first owning and possessing actual silver.

Therefore, Barclays cannot wait for regulatory approval before making arrangements to get the real silver. It must have a decent quantity of silver in place before regulatory approval, as the announcement of approval alone, if it comes, will impact the price of silver. I still think the silver ETF will be bullish for silver whether it is approved or not, because it will prove how scarce real silver is in either event. Either ETF buying (or conversion from futures to actuals) will propel silver upward, or the denial by regulators will only come because they know the real silver doesn’t exist to back the fund. The denial of even a single silver ETF will prove to all just how rare silver is compared to gold, where many ETFs haven’t impacted the price. Even the most casual observer will have to conclude that silver is much rarer than gold if the regulators deny even one measly silver ETF, compared to the many in gold, no matter what the spin.

I still think the silver ETF may be behind some of the commercial futures buying, and note with interest that, if true, it highlights how the COMEX is where silver must be bought, as there is very little silver available in London or elsewhere. After all, why buy under the relative glare of COMEX transparency, when you can do so in the much more secretive London or Zurich venues? Especially when the prospectus calls for London storage.

But the sudden appearance of AIG as the major delivery stopper, after such a long and conspicuous absence, creates another possibility. (Izzy, my silver Godfather, from the start of the unusual commercial buying, favored this other possibility even before AIG’s name turned up in the delivery process). Considering the regulatory hot water that AIG has found itself in over the past year or so, this is one corporation that you can be sure is walking the legal straight and narrow. It is inconceivable that AIG would do anything cute at this particular time. For them to show up as a notable silver delivery participant after all their legal troubles and past allegations by me of wrongdoing in the silver market, means AIG has a compelling reason to do so.

This is speculation on my part (actually on Izzy’s part), but the compelling reason why AIG must take delivery of silver is because it is obligated to do so, by virtue of prior lease obligations to Red China. Quite simply, China may want its silver back and AIG must return it. AIG is procuring it from the COMEX, also in the full glare of transparency, as that is the last remaining place to get quantities of silver. If this speculation is close to being true, you can be sure that the quantities of silver needed to be returned involve a lot more silver than the 8.5 million ounces of silver taken by AIG in the first few days of the September delivery.

Maybe it’s for the ETF, maybe it’s for lease returns by AIG, or maybe it’s both, but if this is why the commercials are buying silver futures in unusual quantities, this puts real pressure on the physical market for silver. It promises continued delivery pressure in the future. Combined with the extreme COT readings, this is a very volatile and bullish brew. With silver still below the primary cost of production, it is not a time to be shy about being on the long side.

On a personal note, I’ve fallen badly behind on my e-mails. I read them all, but haven’t been able to respond to many, particularly those requiring detailed responses. If you don’t mind, please resend your note if you really need a response.

September 6, 2005

Every Picture Tells A Story

By Theodore Butler

(This essay was written by silver analyst Theodore Butler, an independent consultant. Investment Rarities does not necessarily endorse these views, which may or may not prove to be correct.)

Even though there is almost too much to write about in silver, I have to force myself to do so, given the overwhelming enormity of the nation’s greatest natural disaster. It seems shallow to write about silver in light of this tragedy. My heart goes out to those suffering and my admiration to those helping. This will be a long recovery process and we must all do what we can to help our fellow Americans. While many seem preoccupied with assigning blame, I doubt that is constructive. What would be constructive would be for those of us who are not victims to count our blessings and pitch in and help on any way possible.

That would certainly include sharing any material bounty that might come our way by virtue of silver investment gains. Based upon recent developments, those gains might be closer than otherwise expected. The first development is in the market structure, as defined by the Commitment of Traders Report (COT).

The most recent silver COT was shockingly bullish. Every category exhibited positive changes, but the standout was the stunning increase in the tech funds’ short position, which doubled to an extreme not seen in a couple of years. It appears the recent shakeout in silver just may be the final one, as the tech funds’ apparently took the dealers’ bait and fully committed to the short side.

Not only was there an increase in the large tech funds’ existing short positions, but there was also a notable increase in the number of tech funds jumping on the short side of silver. Since these brain dead tech funds stand absolutely no chance of delivering actual silver against their short positions, it’s just a matter of when and at what price they rush to buy back these shorts. Make no mistake; there was nothing accidental about the recent sell-off to new lows in silver. It was designed to lure the tech funds onto the short side. A more bullish COT structure is hard to imagine.

It appears that the dealers have succeeded in transferring a sizable portion of the short liability to the hapless tech funds. The funds are potentially trapped. Now we await the resolution. As always, the price action will depend upon how aggressive the dealers are in selling short on the next rally. If they don’t short aggressively, the price of silver will explode. If the dealers do short aggressively on the next rally, the gains will be much more subdued.

In gold, there was a large improvement in the just-reported COT report on the sharp price decline below the 50 moving average on the last reporting day, Tuesday, August 30. But even with this improvement the gold market structure can hardly be labeled as bullish, particularly when considering the subsequent deterioration from the cut-off. It’s still a case of the gold COTs being in dangerous territory, while silver is in a spectacularly bullish configuration. As mentioned previously, it is an unprecedented dichotomy.

As exciting and important as the COT market structure may be, it is not the only noteworthy development in silver. There were also unusual developments in warehouse stock movements and the first few days’ deliveries in the big September COMEX contract. On two days, over 4 million ounces of silver were brought in to the COMEX warehouses. While many still assume an increase in COMEX inventories is bearish, I don’t agree. This silver was brought in because it had to be brought in, to satisfy delivery demands. If there was available silver to deliver readily in the warehouses already, more wouldn’t be brought in. Certainly, the price action seemed to confirm and did not negate my bullish interpretation, as price rose strongly immediately after the inventory addition.

The actual number of deliveries over the first few days were the largest in more than a year, also confirming overall physical silver demand. More importantly, the largest stopper, or taker of deliveries, was none other than AIG, who had virtually disappeared from COMEX silver delivery dealings, after long dominating such activities.

Those are the facts; now I’d like to speculate. Recently, I wrote that I noticed a significant increase in the commercials’ gross long position and remarked how that could indicate coming physical delivery demands. In trying to guess which commercials might be responsible for these new long positions, I must admit I did not think of AIG first.

My first thoughts were it could be preparatory silver buying for the pending silver ETF. After all, the quantities and timing of the unusual commercial buying seemed to coincide with the filing of the preliminary prospectus for the Barclays’ silver ETF. The buying commenced within days of the June 17th filing of the prospectus. Now, I know the silver ETF may never be approved, as I wrote in "The Coming Silver ETF?" but a close reading of the prospectus indicates that Barclays can not issue shares in the silver ETF, even if approved, without first owning and possessing actual silver.

Therefore, Barclays cannot wait for regulatory approval before making arrangements to get the real silver. It must have a decent quantity of silver in place before regulatory approval, as the announcement of approval alone, if it comes, will impact the price of silver. I still think the silver ETF will be bullish for silver whether it is approved or not, because it will prove how scarce real silver is in either event. Either ETF buying (or conversion from futures to actuals) will propel silver upward, or the denial by regulators will only come because they know the real silver doesn’t exist to back the fund. The denial of even a single silver ETF will prove to all just how rare silver is compared to gold, where many ETFs haven’t impacted the price. Even the most casual observer will have to conclude that silver is much rarer than gold if the regulators deny even one measly silver ETF, compared to the many in gold, no matter what the spin.

I still think the silver ETF may be behind some of the commercial futures buying, and note with interest that, if true, it highlights how the COMEX is where silver must be bought, as there is very little silver available in London or elsewhere. After all, why buy under the relative glare of COMEX transparency, when you can do so in the much more secretive London or Zurich venues? Especially when the prospectus calls for London storage.

But the sudden appearance of AIG as the major delivery stopper, after such a long and conspicuous absence, creates another possibility. (Izzy, my silver Godfather, from the start of the unusual commercial buying, favored this other possibility even before AIG’s name turned up in the delivery process). Considering the regulatory hot water that AIG has found itself in over the past year or so, this is one corporation that you can be sure is walking the legal straight and narrow. It is inconceivable that AIG would do anything cute at this particular time. For them to show up as a notable silver delivery participant after all their legal troubles and past allegations by me of wrongdoing in the silver market, means AIG has a compelling reason to do so.

This is speculation on my part (actually on Izzy’s part), but the compelling reason why AIG must take delivery of silver is because it is obligated to do so, by virtue of prior lease obligations to Red China. Quite simply, China may want its silver back and AIG must return it. AIG is procuring it from the COMEX, also in the full glare of transparency, as that is the last remaining place to get quantities of silver. If this speculation is close to being true, you can be sure that the quantities of silver needed to be returned involve a lot more silver than the 8.5 million ounces of silver taken by AIG in the first few days of the September delivery.

Maybe it’s for the ETF, maybe it’s for lease returns by AIG, or maybe it’s both, but if this is why the commercials are buying silver futures in unusual quantities, this puts real pressure on the physical market for silver. It promises continued delivery pressure in the future. Combined with the extreme COT readings, this is a very volatile and bullish brew. With silver still below the primary cost of production, it is not a time to be shy about being on the long side.

On a personal note, I’ve fallen badly behind on my e-mails. I read them all, but haven’t been able to respond to many, particularly those requiring detailed responses. If you don’t mind, please resend your note if you really need a response.

Text u. Graphik

http://www.gold-eagle.com/editorials_05/lofberg090305.html

commercial_positions_short_all (red-line = ca. -75.000)

silver-cot

http://www.gold-eagle.com/editorials_05/lofberg090305.html

commercial_positions_short_all (red-line = ca. -75.000)

silver-cot

# 487

Schon richtig, die Bemerkung mit dem Silber im Keller.

Wer aber in N.O Silber im Keller hatte, oder vielleicht auch Gold,vermutlich ein paar Weiße, wird es sicherlich mitgenommen haben. Meinst Du nicht ?

Schon richtig, die Bemerkung mit dem Silber im Keller.

Wer aber in N.O Silber im Keller hatte, oder vielleicht auch Gold,vermutlich ein paar Weiße, wird es sicherlich mitgenommen haben. Meinst Du nicht ?

02.09.2005 - 12:43

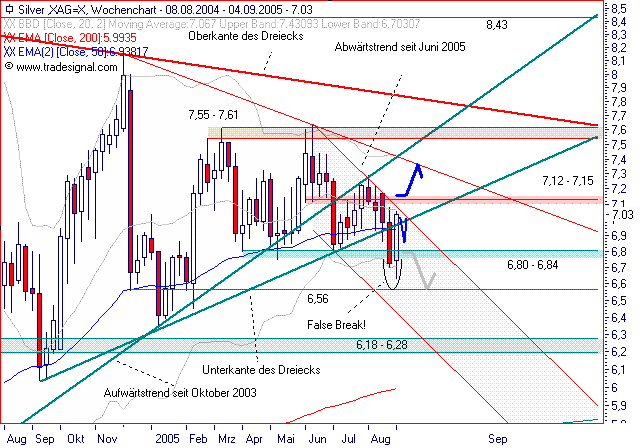

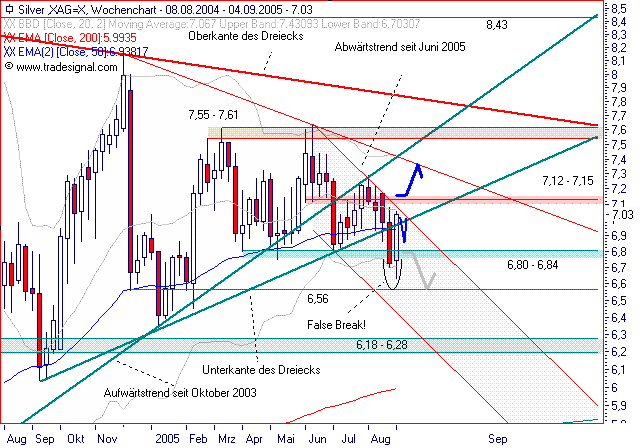

SILBER - "Fulminantes Comeback!"

(©GodmodeTrader - http://www.godmode-trader.de/)

Silber: 7,03 $ pro Feinunze

Aktueller Wochenchart (log) seit 08.08.2004 (1 Kerze = 1 Woche)

Kurz-Kommentierung: SILBER macht den bärischen Ausbruch der letzten Woche wieder komplett rückgänging und erobert die zentrale Horizontalunterstützung bei 6,80 - 6,84 $ und die Dreiecksunterkante bei 6,94 $ wieder zurück. Im bisherigen heutigen Verlauf übersteigt Silber sogar wieder wichtige GDL auf Tages- und Wochenbasis. Die aktuelle Wochenkerze ist unter dem Aspekt eines sauberen "False Break" als extrem bullisch zu werten. Damit wechselt das mittelfristig Chartbild wieder auf bullisch. Das kurzfristig noch neutrale Bild wird mit dem Überschreiten der Widerstandszone des Abwärtstrend seit Juni 2005 bei 7,09 $ und dem Horizontalwiderstand bei 7,12 - 7,15 $ wieder bullisch. Kurzfristig ist mit einer Korrektur spätestens an besagter Widerstandszone zu rechnen. Negativ zu werten wäre ein Rückfall unter 6,80 $.

COT Daten kenne ich nur den Link:

http://www.softwarenorth.com/trading/commitmentscurrent/

Kürzel für Silber: SI

Viele Grüsse

Mysti

SILBER - "Fulminantes Comeback!"

(©GodmodeTrader - http://www.godmode-trader.de/)

Silber: 7,03 $ pro Feinunze

Aktueller Wochenchart (log) seit 08.08.2004 (1 Kerze = 1 Woche)

Kurz-Kommentierung: SILBER macht den bärischen Ausbruch der letzten Woche wieder komplett rückgänging und erobert die zentrale Horizontalunterstützung bei 6,80 - 6,84 $ und die Dreiecksunterkante bei 6,94 $ wieder zurück. Im bisherigen heutigen Verlauf übersteigt Silber sogar wieder wichtige GDL auf Tages- und Wochenbasis. Die aktuelle Wochenkerze ist unter dem Aspekt eines sauberen "False Break" als extrem bullisch zu werten. Damit wechselt das mittelfristig Chartbild wieder auf bullisch. Das kurzfristig noch neutrale Bild wird mit dem Überschreiten der Widerstandszone des Abwärtstrend seit Juni 2005 bei 7,09 $ und dem Horizontalwiderstand bei 7,12 - 7,15 $ wieder bullisch. Kurzfristig ist mit einer Korrektur spätestens an besagter Widerstandszone zu rechnen. Negativ zu werten wäre ein Rückfall unter 6,80 $.

COT Daten kenne ich nur den Link:

http://www.softwarenorth.com/trading/commitmentscurrent/

Kürzel für Silber: SI

Viele Grüsse

Mysti

Wann wird eigentlich der COT freitags veröffentlicht und wo kann man ihn bzw. gleich eine Analyse möglichst zeitnah anschauen? Ich habe mich bislang auf Butlers Kommentare beschränkt, aber in Anbetracht der Bedeutung der COTs und der Größe meiner Position muss ich mich mit dem Bericht doch mal intensiver beschäftigen. Gibt es vielleicht auch ein englischsprachiges Forum, in dem intensiv über Silber und die COT-Zahlen diskutiert wird?

die sind dann völlig auf dem falschen Fuss erwischt worden und müsen jetzt eindecken. (Short Squeeze)

Deswegen bin ich ja recht enttäuscht. Das war ne 1A-Bärenfalle, ohne New Orleans wären wir jetzt wahrscheinlich auch immer noch unter 6,8. Die Gegenreaktion zeigt aber überhaupt keine Anzeichen von Panik. Euro und Gold steigen und der Silberpreis trottet gemütlich centweise hinterher.

Apropos New Orleans, den Seitenhieb an die "Physiker" kann ich mir nicht verkneifen. Wer dort Silber im Keller hat(te), steht jetzt eindeutig schlechter da als der mit den Zertis. Dabei entsprechen die Zustände in New Orleans jetzt dem, was uns die Untergangspropheten so gerne vorhersagen.

Deswegen bin ich ja recht enttäuscht. Das war ne 1A-Bärenfalle, ohne New Orleans wären wir jetzt wahrscheinlich auch immer noch unter 6,8. Die Gegenreaktion zeigt aber überhaupt keine Anzeichen von Panik. Euro und Gold steigen und der Silberpreis trottet gemütlich centweise hinterher.

Apropos New Orleans, den Seitenhieb an die "Physiker" kann ich mir nicht verkneifen. Wer dort Silber im Keller hat(te), steht jetzt eindeutig schlechter da als der mit den Zertis. Dabei entsprechen die Zustände in New Orleans jetzt dem, was uns die Untergangspropheten so gerne vorhersagen.

Wenn ich mich recht entsinne, wollte Hunt das alte Verhältnis von 16:1 durch Spekulationen wieder herstellen, was natürlich Quatsch war.

Das hat der Markt bald wieder reguliert.

Den Vorteil von Silber sehe ich gegenüber Gold in den vielen industriellen und medizinischen Anwendungen.

Aber warum soll es ein Verhältnis geben, wenn Gold und Silber keine Währungen mehr sind ?

Genausogut könnte man ein Verhältnis zwischen anderen Metalle konstruieren.

Das hat der Markt bald wieder reguliert.

Den Vorteil von Silber sehe ich gegenüber Gold in den vielen industriellen und medizinischen Anwendungen.

Aber warum soll es ein Verhältnis geben, wenn Gold und Silber keine Währungen mehr sind ?

Genausogut könnte man ein Verhältnis zwischen anderen Metalle konstruieren.

[posting]17.764.976 von noch-n-zocker am 02.09.05 09:50:10[/posting]"Mit Gewalt aus dem Sumpf gezogen" wahrscheinlich auch durch die Katastrophe in New Orleans.

Das hat sich auf den Dollar ausgewirkt und im Sog dann auch auf die Edelmetalle.

Kurz vorher hatten wohl sehr viele ihr Heil in Shortpositionen versucht (als die Unterstützungszone durchbrochen wurde), die sind dann völlig auf dem falschen Fuss erwischt worden und müsen jetzt eindecken. (Short Squeeze)

Solche Schieflagen eröffnen meist ein hohes Potential, so dass ich vermute, dass das auch noch viel weiter geht, zumal jetzt auch der MACD gedreht hat (#475 ), was weitere Anleger dazu bringt zu kaufen.

Ich werde mal versuchen irgendwie noch aufzuspringen, ein paar Cent sollten sich da ja eigentlich noch verdienen lassen.

Viele Grüsse

Mysti

Das hat sich auf den Dollar ausgewirkt und im Sog dann auch auf die Edelmetalle.

Kurz vorher hatten wohl sehr viele ihr Heil in Shortpositionen versucht (als die Unterstützungszone durchbrochen wurde), die sind dann völlig auf dem falschen Fuss erwischt worden und müsen jetzt eindecken. (Short Squeeze)

Solche Schieflagen eröffnen meist ein hohes Potential, so dass ich vermute, dass das auch noch viel weiter geht, zumal jetzt auch der MACD gedreht hat (#475 ), was weitere Anleger dazu bringt zu kaufen.

Ich werde mal versuchen irgendwie noch aufzuspringen, ein paar Cent sollten sich da ja eigentlich noch verdienen lassen.

Viele Grüsse

Mysti

[posting]17.765.523 von LastHope am 02.09.05 10:17:10[/posting]... in der Geschichte der Menschheit hat noch nie ein Vorstand von Silber Konkurs angemeldet.

http://www.nndb.com/people/569/000055404/

http://www.nndb.com/people/569/000055404/

27.04.24 · wallstreetONLINE Redaktion · BHP Group |

27.04.24 · Nebenwerte Magazin · Gold |

26.04.24 · PR Newswire (dt.) · Gold |

26.04.24 · Martin Siegel · Gold |

25.04.24 · Dr. Hamed Esnaashari · Hecla Mining |

25.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |