Diskussion zu Silver Elephant Mining Corp, ehemals Prophecy Development Corp. - Älteste Beiträge zuerst (Seite 3149)

eröffnet am 21.06.11 18:39:01 von

neuester Beitrag 20.04.24 12:49:13 von

neuester Beitrag 20.04.24 12:49:13 von

Beiträge: 35.000

ID: 1.167.075

ID: 1.167.075

Aufrufe heute: 55

Gesamt: 4.089.728

Gesamt: 4.089.728

Aktive User: 0

ISIN: CA82770L3074 · WKN: A3DWAL

0,2270

EUR

-1,30 %

-0,0030 EUR

Letzter Kurs 12:15:30 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 15.699,00 | +15,27 | |

| 0,7999 | +14,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8950 | -7,25 | |

| 0,5100 | -8,11 | |

| 0,5400 | -8,47 | |

| 39,20 | -8,84 | |

| 46,88 | -97,99 |

Nevada (Gibellini) TOP... Bolivien (Pulacayo/Paca) HOP

https://www.fraserinstitute.org/studies/annual-survey-of-min…

Was hat das mit PCY zu tun? Siehe 1. Zeile

https://www.fraserinstitute.org/studies/annual-survey-of-min…

Was hat das mit PCY zu tun? Siehe 1. Zeile

Antwort auf Beitrag Nr.: 60.156.243 von Luttn am 20.03.19 23:14:14

Ich liebe diese bezahlten Märchenberichterstattungen

LG Pieselwitz

Zitat von Luttn: https://investorintel.com/investorintel-video/prophecy-devel…

Ich liebe diese bezahlten Märchenberichterstattungen

LG Pieselwitz

Antwort auf Beitrag Nr.: 60.156.243 von Luttn am 20.03.19 23:14:14This month we are about to submit all our baseline studies on the project.

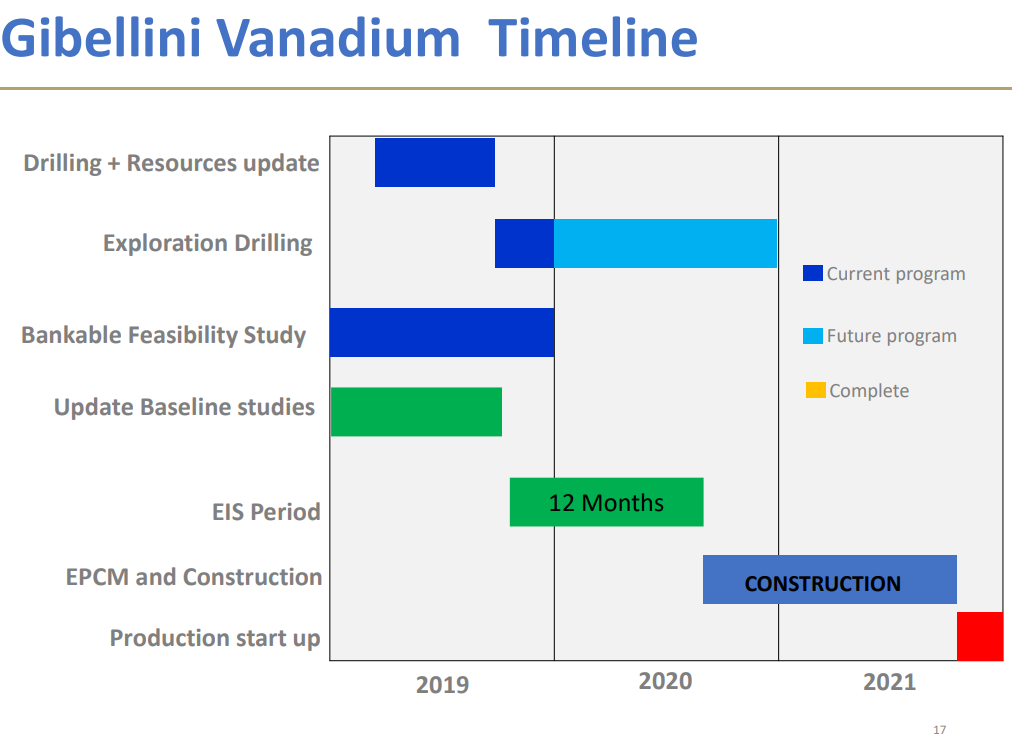

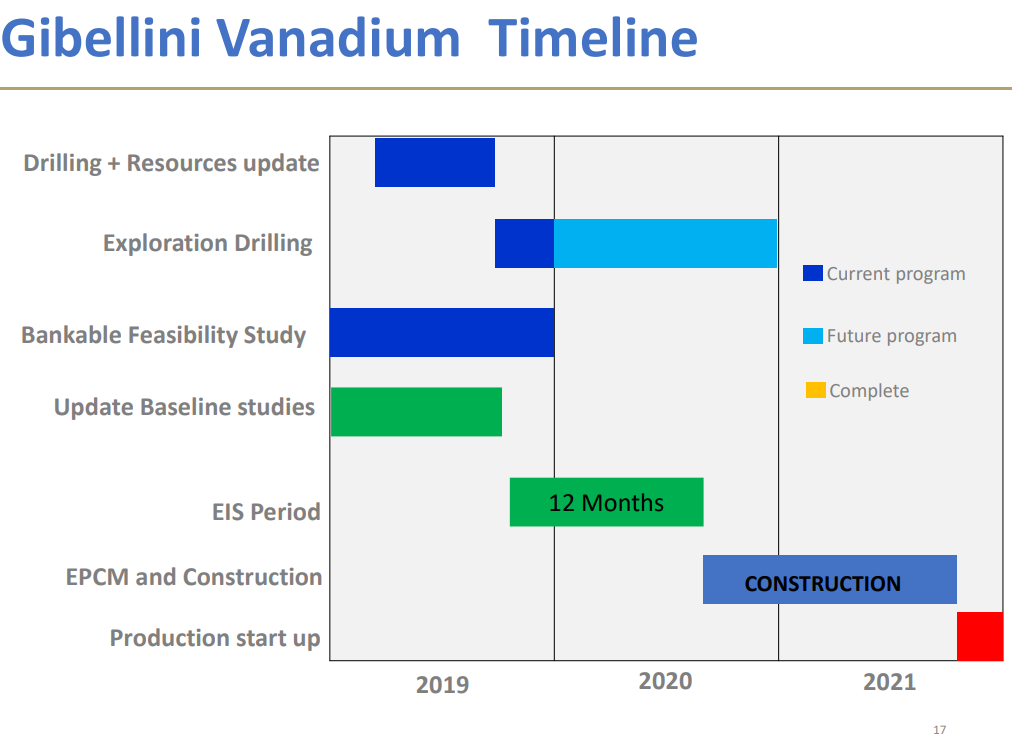

Also sind sie schneller als ursprünglich geplant (siehe Zeitschiene der Präsentation)

https://www.prophecydev.com/PCY_2019-02-25th_Corp_Presentati…

Also sind sie schneller als ursprünglich geplant (siehe Zeitschiene der Präsentation)

https://www.prophecydev.com/PCY_2019-02-25th_Corp_Presentati…

im SH Largo Thread abgeguckt.

einiges ist auch für PCY interessant (relevant) ( rot markiert):

"Piyush Sood Morgan Stanley March 21, 2019 4:03 AM GMT A deficit/rally in vanadium is now a show-me story and LGO-T is discounting steep price declines. We believe demand will slowly improve and prices will settle above the market's expectation. With bull case fading away, we are lowering our PT to C$4, aligning it with our unchanged base case. Stay OW. Lowering our PT to C$4 from C$6 and aligning it with our unchanged base case... We had originally set our PT at C$6, between our C$8 bull case and C$4 base case, as we expected vanadium prices to decline slowly, possibly even overshoot our base case, and LGO-T to trade above its fundamental value. However, vanadium prices have declined faster than we expected, already down ~40% from their peak in November, which drove a ~50% decline in LGO-T. The price decline was led by falling rebar margins in China, slower than expected enforcement of China's new rebar standards, no signs of restocking post Chinese New Year, and higher than expected substitution. Our DCF derived base case stays unchanged at C$4 and is now our PT....but staying OW as we think the market is now overly bearish on underlying fundamentals. Spot vanadium (V2O5) price is at $17/lb (down from peak at $29/lb) and we forecast it to fall another ~10% to $15/lb in 2Q19, stabilize there for the mid term (until 2022) and then settle out at ~$12/lb over the long term. That's above the $9/lb level LGO-T is pricing in and substantially above the ~$6/lb floor for some investors. We stay OW for ~80% upside, since we expect slow demand improvement from China and prices to stabilize above the market's expectations. We calculate 17% FCF yield on 2019 and see shareholder returns beginning in 2Q. The 4 key factors behind recent decline in vanadium prices- Chinese vanadium prices are down more than 50% from $34/lb in early November to $15/lb this week, and in turn, the benchmark European price is down from $29/lb in late November to $17/lb.Tightening rebar margins in China. China's rebar market accounts for ~34% of global

Read more at https://stockhouse.com/companies/bullboard?symbol=t.lgo&post…

einiges ist auch für PCY interessant (relevant) ( rot markiert):

"Piyush Sood Morgan Stanley March 21, 2019 4:03 AM GMT A deficit/rally in vanadium is now a show-me story and LGO-T is discounting steep price declines. We believe demand will slowly improve and prices will settle above the market's expectation. With bull case fading away, we are lowering our PT to C$4, aligning it with our unchanged base case. Stay OW. Lowering our PT to C$4 from C$6 and aligning it with our unchanged base case... We had originally set our PT at C$6, between our C$8 bull case and C$4 base case, as we expected vanadium prices to decline slowly, possibly even overshoot our base case, and LGO-T to trade above its fundamental value. However, vanadium prices have declined faster than we expected, already down ~40% from their peak in November, which drove a ~50% decline in LGO-T. The price decline was led by falling rebar margins in China, slower than expected enforcement of China's new rebar standards, no signs of restocking post Chinese New Year, and higher than expected substitution. Our DCF derived base case stays unchanged at C$4 and is now our PT....but staying OW as we think the market is now overly bearish on underlying fundamentals. Spot vanadium (V2O5) price is at $17/lb (down from peak at $29/lb) and we forecast it to fall another ~10% to $15/lb in 2Q19, stabilize there for the mid term (until 2022) and then settle out at ~$12/lb over the long term. That's above the $9/lb level LGO-T is pricing in and substantially above the ~$6/lb floor for some investors. We stay OW for ~80% upside, since we expect slow demand improvement from China and prices to stabilize above the market's expectations. We calculate 17% FCF yield on 2019 and see shareholder returns beginning in 2Q. The 4 key factors behind recent decline in vanadium prices- Chinese vanadium prices are down more than 50% from $34/lb in early November to $15/lb this week, and in turn, the benchmark European price is down from $29/lb in late November to $17/lb.Tightening rebar margins in China. China's rebar market accounts for ~34% of global

Read more at https://stockhouse.com/companies/bullboard?symbol=t.lgo&post…

Antwort auf Beitrag Nr.: 60.166.989 von uralsib am 21.03.19 23:49:17Da werden einige Projekte nicht entwickelt wenn diese V205 Preise Wirklichkeit werden.

PCY ist profitabel: NPV @ 7 % bei 12,73 V205 Preis = 338 Mio US-D.

Wir werden sehen was bei der neuen BFS rauskommt Ende 2019.

PCY ist profitabel: NPV @ 7 % bei 12,73 V205 Preis = 338 Mio US-D.

Wir werden sehen was bei der neuen BFS rauskommt Ende 2019.

Antwort auf Beitrag Nr.: 60.168.279 von Rohstoffinvestor am 22.03.19 08:51:41Was soll "dabei rauskommen"?? Nichts als ein weiteres Papierchen mit bunten Bildern, wie bei jedem dieser desaströsen Projekte in der Vergangenheit auch.

Keinerlei Aussagekraft, denn es bringt keinerlei Mehrwert für seriöse Investoren, einzig für die, die religionsartige "Glaubensbekenntnisse" für PCY abgeben udn damit seit zig Jahren "schief liegen".

Selbiges gilt für den Vanadiumpreis, der ja wie einst der Silberpreis auch immer als "Vehikel" oder Anlass genommen wurde, Misserfolge auf die "äußeren Umstände" zu schieben, anstatt diese einmal originär bei der "Firma" selber zu sehen.

Keinerlei Aussagekraft, denn es bringt keinerlei Mehrwert für seriöse Investoren, einzig für die, die religionsartige "Glaubensbekenntnisse" für PCY abgeben udn damit seit zig Jahren "schief liegen".

Selbiges gilt für den Vanadiumpreis, der ja wie einst der Silberpreis auch immer als "Vehikel" oder Anlass genommen wurde, Misserfolge auf die "äußeren Umstände" zu schieben, anstatt diese einmal originär bei der "Firma" selber zu sehen.

Antwort auf Beitrag Nr.: 60.166.989 von uralsib am 21.03.19 23:49:17den kompletten Bericht von BMO zu Vanadium kann ich ich nicht posten, aber paar Auszüge schon:

Übrigens, BMO jat letztes Jahr ein ausführliches DD von Gibellini durchgeführt, und als Folge an letzter Finanzierung (5mio) maßgeblich beteiligt. (Ich dachte zuerst es waren Geralds Vorarbeit/Kontakte, in der Tat war es John's 100% Leistung)

Auch BMO hat darauf bestanden ein BFS zu aktualisieren, sprich die Luie Hill Ressourcen (M&I) mitaufzunehmen (geplant zum Ende 2019)

Interessant ist, auf heutigem Niveau (0,235-0,25) 80% Aktien werden von BMO gekauft.

Übrigens, BMO jat letztes Jahr ein ausführliches DD von Gibellini durchgeführt, und als Folge an letzter Finanzierung (5mio) maßgeblich beteiligt. (Ich dachte zuerst es waren Geralds Vorarbeit/Kontakte, in der Tat war es John's 100% Leistung)

Auch BMO hat darauf bestanden ein BFS zu aktualisieren, sprich die Luie Hill Ressourcen (M&I) mitaufzunehmen (geplant zum Ende 2019)

Interessant ist, auf heutigem Niveau (0,235-0,25) 80% Aktien werden von BMO gekauft.

Antwort auf Beitrag Nr.: 60.180.162 von uralsib am 23.03.19 19:33:44aus dem BMO Report 2019 ( veröffentlicht am 19.03.19)

"Bottom Line: Vanadium was very much the commodity story of 2018. Having

appreciated by over 700% in the preceding two years, from a November 2018 peak

the price subsequently halved. We believe that 2019 will be a very telling one for the

vanadium market as supply continues to struggle to respond to the demand shock

originating from new Chinese rebar standards. Niobium substitution will play a role in

this, but nevertheless we anticipate vanadium demand growth remaining strong for the

next five years, with the supply response to this inhibited by stagnant Chinese output.

"

"Adjustment Will Take Place, but the Process Takes Time

In conclusion, while the supply side of the market catches up with the spike in demand resulting from

the rebar standards, we expect the market to remain fundamentally tight in the short term, with

inventories remaining low. Assuming CBMM can satisfy some of the new demand, substituting a

reasonable portion of vanadium in steel applications, we see the market tightness of the past two years marginally easing. As we move into the summer and Chinese steel mills begin ramping up their output, a much clearer picture of these dynamics will become apparent. It is our view that average prices for the year will remain at or around current levels, with a small push higher through peak northern hemisphere construction season in April and May, before reverting back to these levels later in the year.

Looking longer term, as mills adapt to the new standards, prices will see gradual downward pressure

through to 2025 as we head towards a V2O5 equilibrium price of nearer $10/lb. A positive catalyst to our outlook would be if Chinese mills have been misreporting their rebar grades. New enforcement,

including inspections at mills and severe penalties, may expose further potential demand growth.

Another positive would be for similar standards to be rolled out across other major developing

economies. We do though expect greater niobium substitution, as Chinese technological advancements allow the possibility of more fluid transitions between the two steel-strengthening agents, thus diluting vanadium demand."

"Bottom Line: Vanadium was very much the commodity story of 2018. Having

appreciated by over 700% in the preceding two years, from a November 2018 peak

the price subsequently halved. We believe that 2019 will be a very telling one for the

vanadium market as supply continues to struggle to respond to the demand shock

originating from new Chinese rebar standards. Niobium substitution will play a role in

this, but nevertheless we anticipate vanadium demand growth remaining strong for the

next five years, with the supply response to this inhibited by stagnant Chinese output.

"

"Adjustment Will Take Place, but the Process Takes Time

In conclusion, while the supply side of the market catches up with the spike in demand resulting from

the rebar standards, we expect the market to remain fundamentally tight in the short term, with

inventories remaining low. Assuming CBMM can satisfy some of the new demand, substituting a

reasonable portion of vanadium in steel applications, we see the market tightness of the past two years marginally easing. As we move into the summer and Chinese steel mills begin ramping up their output, a much clearer picture of these dynamics will become apparent. It is our view that average prices for the year will remain at or around current levels, with a small push higher through peak northern hemisphere construction season in April and May, before reverting back to these levels later in the year.

Looking longer term, as mills adapt to the new standards, prices will see gradual downward pressure

through to 2025 as we head towards a V2O5 equilibrium price of nearer $10/lb. A positive catalyst to our outlook would be if Chinese mills have been misreporting their rebar grades. New enforcement,

including inspections at mills and severe penalties, may expose further potential demand growth.

Another positive would be for similar standards to be rolled out across other major developing

economies. We do though expect greater niobium substitution, as Chinese technological advancements allow the possibility of more fluid transitions between the two steel-strengthening agents, thus diluting vanadium demand."

Vancouver, British Columbia, March 26, 2019 – Prophecy Development Corp. (“Prophecy” or the “Company”) (TSX:PCY, OTCQX:PRPCF, Frankfurt:1P2N) is pleased to announce vanadium assay results from its Fall 2018 exploration reconnaissance program on its Gibellini vanadium project, located in Eureka County, Nevada, USA. The 155 assays are taken from three prospective exploration areas all within 5km to existing Gibellini vanadium NI43-101 compliant resource pit outline whereat 49.9 million lbs measured and 81.5 million lbs indicated vanadium resource have already been identified (see Company’s press release dated May 29th, 2018).

Surface grab samples assay as high as 2% vanadium pentoxide (V2O5) and 75 samples (48% of total 155) have V2O5 grades greater than the Gibellini deposit’s cut-off grade of 0.101% V2O5 at $12.5/lb V2O5; V2O5 currently trades at approximately $16/lb.

The high vanadium assay results along the 5-kilometer northeast-southwest trend which line-up the Northeast Prospect, through Gibellini Hill, Louie Hill, Middle Earth Prospect, and Big Sky Prospect providing an indication of potential and possibly significant future expansion of vanadium mineralization along this corridor.

“From a geological perspective, the rocks at all three of these prospects have the same visual hallmarks as what we see in the oxidized and transition zones at Gibellini Hill deposit which are amenable to heap leach recovery” states Danniel Oosterman, Prophecy’s VP Exploration.

“Assay results demonstrate extensive vanadium mineralization with nearly half of the samples well above the cut-off grades adopted at Gibellini. This confirms that any occurrence of the Woodruff Formation in this region is prospective from an exploration standpoint.”...

https://www.prophecydev.com/prophecy-discovers-multiple-vana…

Surface grab samples assay as high as 2% vanadium pentoxide (V2O5) and 75 samples (48% of total 155) have V2O5 grades greater than the Gibellini deposit’s cut-off grade of 0.101% V2O5 at $12.5/lb V2O5; V2O5 currently trades at approximately $16/lb.

The high vanadium assay results along the 5-kilometer northeast-southwest trend which line-up the Northeast Prospect, through Gibellini Hill, Louie Hill, Middle Earth Prospect, and Big Sky Prospect providing an indication of potential and possibly significant future expansion of vanadium mineralization along this corridor.

“From a geological perspective, the rocks at all three of these prospects have the same visual hallmarks as what we see in the oxidized and transition zones at Gibellini Hill deposit which are amenable to heap leach recovery” states Danniel Oosterman, Prophecy’s VP Exploration.

“Assay results demonstrate extensive vanadium mineralization with nearly half of the samples well above the cut-off grades adopted at Gibellini. This confirms that any occurrence of the Woodruff Formation in this region is prospective from an exploration standpoint.”...

https://www.prophecydev.com/prophecy-discovers-multiple-vana…

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +11,29 | |

| 0,00 | |

| +7,58 | |

| +5,68 | |

| +2,79 | |

| 0,00 | |

| +2,65 | |

| +9,62 | |

| +4,22 | |

| +1,43 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 233 | ||

| 108 | ||

| 97 | ||

| 87 | ||

| 62 | ||

| 38 | ||

| 36 | ||

| 36 | ||

| 33 | ||

| 32 |