Giyani Metals -- ehem. Giyani Gold - Älteste Beiträge zuerst (Seite 31)

eröffnet am 27.07.16 09:25:44 von

neuester Beitrag 08.12.23 00:02:00 von

neuester Beitrag 08.12.23 00:02:00 von

Beiträge: 558

ID: 1.235.791

ID: 1.235.791

Aufrufe heute: 0

Gesamt: 49.497

Gesamt: 49.497

Aktive User: 0

ISIN: CA37637H1055 · WKN: A2DUU8 · Symbol: EMM

0,0900

CAD

0,00 %

0,0000 CAD

Letzter Kurs 08.05.24 TSX Venture

Neuigkeiten

24.04.24 · globenewswire |

09.04.24 · globenewswire |

28.03.24 · globenewswire |

21.02.24 · globenewswire |

20.02.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8100 | +11,11 | |

| 0,8000 | +11,11 | |

| 2,0800 | +10,05 | |

| 10,770 | +9,50 | |

| 16.000,00 | +8,11 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5200 | -10,34 | |

| 10,520 | -12,33 | |

| 0,9860 | -12,74 | |

| 0,6601 | -26,22 | |

| 46,43 | -98,01 |

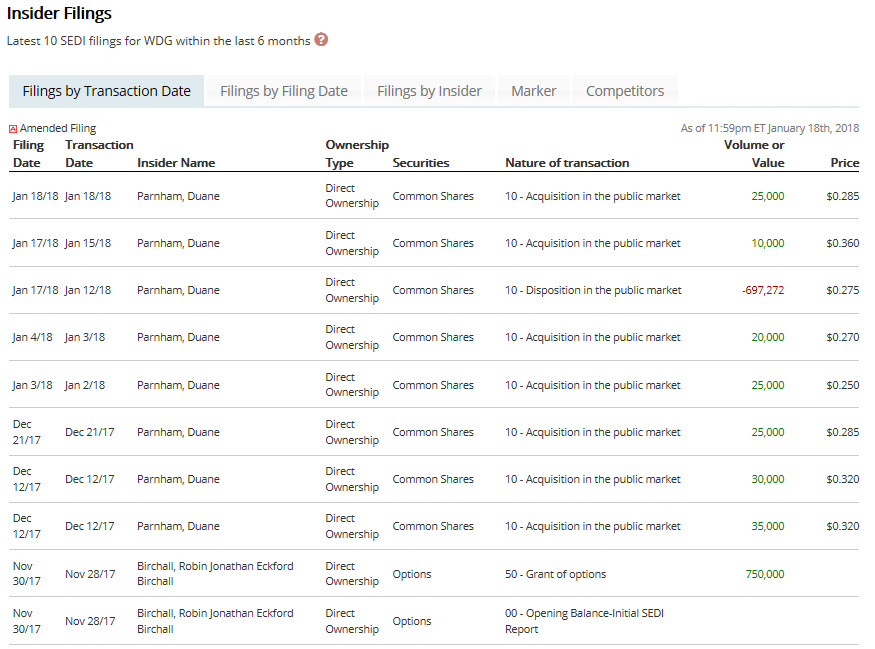

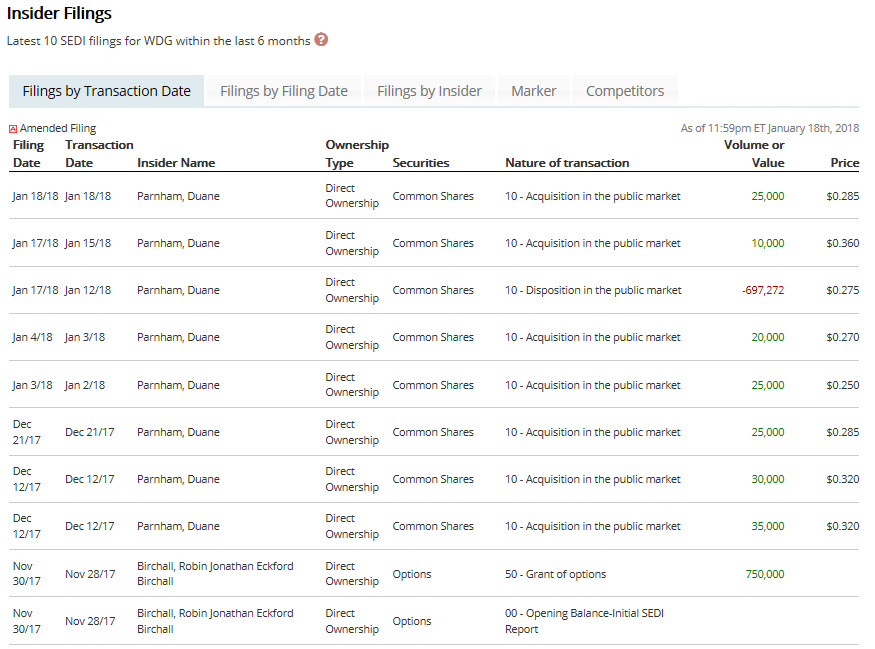

Duane war wieder aktiv.

Kann sich einer den Verkauf zu CAD 0,275 erklären? Steuerlich motiviert? PP?

Schließlich kauft der Strolch anschließend (höher) weiter.

Quelle: https://www.canadianinsider.com/company?menu_tickersearch=Gi…

Zusätzlich noch ein Beitrag aus dem bullboard von stockhouse:

"The year of the WeDGe

I am participating in this recent PP with a significant amount of money and understand that closure is imminent. Be patient folks – good things coming soon.

In regards to DP’s recent transaction in the public market, I have a very good feeling everyone will see once the PP closes that he did not reduce his holdings.

Feeling extremely excited about what’s coming – looking forward to a very profitable year.

Good luck to everyone"

wisly

Quelle: http://www.stockhouse.com/companies/bullboard?symbol=v.wdg&p…" target="_blank" rel="nofollow ugc noopener">http://www.stockhouse.com/companies/bullboard?symbol=v.wdg&p…

Ein schönes WE wünscht

L234

Kann sich einer den Verkauf zu CAD 0,275 erklären? Steuerlich motiviert? PP?

Schließlich kauft der Strolch anschließend (höher) weiter.

Quelle: https://www.canadianinsider.com/company?menu_tickersearch=Gi…

Zusätzlich noch ein Beitrag aus dem bullboard von stockhouse:

"The year of the WeDGe

I am participating in this recent PP with a significant amount of money and understand that closure is imminent. Be patient folks – good things coming soon.

In regards to DP’s recent transaction in the public market, I have a very good feeling everyone will see once the PP closes that he did not reduce his holdings.

Feeling extremely excited about what’s coming – looking forward to a very profitable year.

Good luck to everyone"

wisly

Quelle: http://www.stockhouse.com/companies/bullboard?symbol=v.wdg&p…" target="_blank" rel="nofollow ugc noopener">http://www.stockhouse.com/companies/bullboard?symbol=v.wdg&p…

Ein schönes WE wünscht

L234

Antwort auf Beitrag Nr.: 56.763.654 von links-zwo-drei-vier am 19.01.18 08:24:41 Also das würde mich auch interessieren?!

Also das würde mich auch interessieren?!

Also das würde mich auch interessieren?!

Also das würde mich auch interessieren?!

Antwort auf Beitrag Nr.: 56.763.654 von links-zwo-drei-vier am 19.01.18 08:24:41Was sich ja sehen lässt ist dass Er nicht so lang davon auch Optionen ausgeübt hat,

die in ähnlicher Höhe wie Der "grosse" Verkauf; ein bisschen drüber; liegen.

Also ich würde Das nicht überinterpretieren

(die "persönliche story" kennt man eh Meistens nicht, und man sollte Soetwas auch im Zusammenhang Einer Gesamtholding/Anteilsbestand sehen),

und mich mehr um fundamentale Fragen kümmern.

die in ähnlicher Höhe wie Der "grosse" Verkauf; ein bisschen drüber; liegen.

Also ich würde Das nicht überinterpretieren

(die "persönliche story" kennt man eh Meistens nicht, und man sollte Soetwas auch im Zusammenhang Einer Gesamtholding/Anteilsbestand sehen),

und mich mehr um fundamentale Fragen kümmern.

Hallo in die Runde,wannglaubt ihr, ist bei Giyani wieder mit News zu rechnen?

Antwort auf Beitrag Nr.: 56.502.287 von links-zwo-drei-vier am 20.12.17 12:25:31

Canoe Signs Services Agreement with OpenPort to Build a Blockchain TMS for use in the Traditional Mining Industry

http://www.stockhouse.com/news/press-releases/2018/01/25/can…

L234

Zitat von links-zwo-drei-vier: Laut Homepage besitzt Giyani Metals 28% der Anteile an CANOE MINING VENTURES CORP. (noch aus der Zeit mit Fokussierung auf Goldliegenschaften).

Quelle: http://giyanimetals.com/#page

Duane will nun anscheinend CANOE MINING VENTURES CORP. komplett neu aufstellen mit Stichwort: "Blockchain".

Die News dazu vom 18.12.2017: Canoe Mining Evaluating New Opportunities

"....Canoe Mining Ventures Corp. (TSX VENTURE:CLV) ("Canoe") wishes to disclose that it will be evaluating possible investment and business opportunities in various sectors, including but not limited to: mining, cannabis and blockchain technology...."

Quelle: http://www.stockhouse.com/news/press-releases/2017/12/18/can…

Entsprechend ist der Kurs bereits angestiegen, es könnte interessant werden.

LG

L234

Canoe Signs Services Agreement with OpenPort to Build a Blockchain TMS for use in the Traditional Mining Industry

http://www.stockhouse.com/news/press-releases/2018/01/25/can…

L234

DP sollte sich einmal entscheiden:

---> Laut homepage hält Giyani Metals 28% der Anteile an Canoe Mining

Quelle: http://giyanimetals.com/

---> Laut einem aktuellen Newsletter nur 19,6%

L234

---> Laut homepage hält Giyani Metals 28% der Anteile an Canoe Mining

Quelle: http://giyanimetals.com/

---> Laut einem aktuellen Newsletter nur 19,6%

L234

Antwort auf Beitrag Nr.: 56.834.998 von links-zwo-drei-vier am 26.01.18 08:55:12naja in den seltensten fällen sind da alle eckfeiler auf so einer homepage bei den rohstoffern up to date.

die unterschiedlichen daten sind anscheinend darauf zurückzuführen, dass seit dem invest in 2016 canoe im september letzten jahres eine KE durchführte und dabei 20 mio aktien ausgab. das verwässert ja bekannterweise dann die anteile. also halte ich die 19% für realistisch.

die unterschiedlichen daten sind anscheinend darauf zurückzuführen, dass seit dem invest in 2016 canoe im september letzten jahres eine KE durchführte und dabei 20 mio aktien ausgab. das verwässert ja bekannterweise dann die anteile. also halte ich die 19% für realistisch.

Vielleicht bringt der Preisanstieg da mal etwas Bewegung in den Wert

https://www.metalbulletin.com/Article/3782814/Manganese-flak…" target="_blank" rel="nofollow ugc noopener">

https://www.metalbulletin.com/Article/3782814/Manganese-flak…

Manganese flake rally heats up on China’s latest round of environmental inspections

Manganese flake prices surged above $2,000 per tonne amid ongoing environmental inspections in China with further production disruptions adding fresh impetus to this year's rally.

“The price rally seems to be heading up. I had bids at $1,950 for prompt in Rotterdam this week. I am not selling at this level anymore though. I’m holding out for above $2,000 now,” a manganese trader told Metal Bulletin.

“The market seems really tight. There are no sellers in the market and everything coming out of China is suggesting higher prices,” a second trader said.

Metal Bulletin assessed the manganese flake in-warehouse Rotterdam price at $1,990-2,050 per tonne on Wednesday January 24, up 3.6% from the previous assessment.

The last time manganese flake prices went above the $2,000-per-tonne level was in June 2017. Prices had been trading steadily for the most part of the second half of 2017, with limited spot activity.

“Smaller producers have stopped operations for environmental checks. There is not a lot of competition on the production side in China and if you have material you can basically offer anything you want and you will still find buyers,” a second trader said.

The world’s largest manganese flake producer – Ningxia Tianyuan – had halted its production at the end of last year amid ongoing environmental inspections in China, prompting the first increase in manganese flake prices, but has since restarted its operations.

“Although Ningxia is back to production, the production is very limited. They still got the order of 10,000 tonnes for January shipment, so far they have only shipped 5,000 tonnes,” a market source in China said.

Ningxia Tianyuan’s production capacity amounts to 800,000 tonnes per year, according to market sources.

“They [Ningxia Tianyuan] cannot offer to others until March. They think the market will be firm in February and prices will keep increasing. Other suppliers cannot offer February shipment either,” the Chinese market source added.

The nationwide campaign against environmental violations has forced some smaller illegally-operated miners, smelters and flotation plants across 30 different Chinese provinces to close since the beginning of last year.

“I understand Ningxia resumed production but they are busy delivering material under old contracts with clients, therefore they have little available for spot market,” a second market source in China said.

“Manganese flake production in Guizhou is also affected by environmental inspections. Manganese ore production in Hunan has reduced due to environmental inspections,” the second source said.

Hunan, Guizhou and Chongqing are China’s major production hubs for manganese flake along with Ningxia province.

Material tightness has also been caused by “speculation from some producers who hold material, to delay sales and expect higher prices,” the second source in China said, adding, “The current market price is around 12,500-12,800 yuan ($1,951.91-1,998.76) per tonne VAT paid. The selling price for export is $2,050 per tonne cif Rotterdam, which is too high for global buyers.”

Prices should remain at these elevated levels until at least the end of the first quarter, according to market participants.

“There are no offers on manganese. I’m giving bids to the Chinese but they want to wait till after the Lunar New Year. I don’t want to wait though because I know prices will be even higher then. The only offers I can get are for March shipment and are still high, which means the market will remain tight till the end of the first quarter,” a third trader said, adding, “I believe in $2,100 [per tonne] within one week.”

Forthcoming national holidays in China will disrupt supply further, and cause markets to start winding down before the end of the month, market participants said. Lunar New Year is on February 16 this year.

Still, the recent rally has some market participants warning of a pullback.

“There is strong resistance on the high prices of manganese flake and lumpy from local steel mills so maybe there will be a small price correction after the Lunar New Year,” the second Chinese source said.

This article was updated on January 25 to reflect that Ningxia Tianyuan’s production capacity amounts to 800,000 tonnes per year.

https://www.metalbulletin.com/Article/3782814/Manganese-flak…" target="_blank" rel="nofollow ugc noopener">

https://www.metalbulletin.com/Article/3782814/Manganese-flak…

Manganese flake rally heats up on China’s latest round of environmental inspections

Manganese flake prices surged above $2,000 per tonne amid ongoing environmental inspections in China with further production disruptions adding fresh impetus to this year's rally.

“The price rally seems to be heading up. I had bids at $1,950 for prompt in Rotterdam this week. I am not selling at this level anymore though. I’m holding out for above $2,000 now,” a manganese trader told Metal Bulletin.

“The market seems really tight. There are no sellers in the market and everything coming out of China is suggesting higher prices,” a second trader said.

Metal Bulletin assessed the manganese flake in-warehouse Rotterdam price at $1,990-2,050 per tonne on Wednesday January 24, up 3.6% from the previous assessment.

The last time manganese flake prices went above the $2,000-per-tonne level was in June 2017. Prices had been trading steadily for the most part of the second half of 2017, with limited spot activity.

“Smaller producers have stopped operations for environmental checks. There is not a lot of competition on the production side in China and if you have material you can basically offer anything you want and you will still find buyers,” a second trader said.

The world’s largest manganese flake producer – Ningxia Tianyuan – had halted its production at the end of last year amid ongoing environmental inspections in China, prompting the first increase in manganese flake prices, but has since restarted its operations.

“Although Ningxia is back to production, the production is very limited. They still got the order of 10,000 tonnes for January shipment, so far they have only shipped 5,000 tonnes,” a market source in China said.

Ningxia Tianyuan’s production capacity amounts to 800,000 tonnes per year, according to market sources.

“They [Ningxia Tianyuan] cannot offer to others until March. They think the market will be firm in February and prices will keep increasing. Other suppliers cannot offer February shipment either,” the Chinese market source added.

The nationwide campaign against environmental violations has forced some smaller illegally-operated miners, smelters and flotation plants across 30 different Chinese provinces to close since the beginning of last year.

“I understand Ningxia resumed production but they are busy delivering material under old contracts with clients, therefore they have little available for spot market,” a second market source in China said.

“Manganese flake production in Guizhou is also affected by environmental inspections. Manganese ore production in Hunan has reduced due to environmental inspections,” the second source said.

Hunan, Guizhou and Chongqing are China’s major production hubs for manganese flake along with Ningxia province.

Material tightness has also been caused by “speculation from some producers who hold material, to delay sales and expect higher prices,” the second source in China said, adding, “The current market price is around 12,500-12,800 yuan ($1,951.91-1,998.76) per tonne VAT paid. The selling price for export is $2,050 per tonne cif Rotterdam, which is too high for global buyers.”

Prices should remain at these elevated levels until at least the end of the first quarter, according to market participants.

“There are no offers on manganese. I’m giving bids to the Chinese but they want to wait till after the Lunar New Year. I don’t want to wait though because I know prices will be even higher then. The only offers I can get are for March shipment and are still high, which means the market will remain tight till the end of the first quarter,” a third trader said, adding, “I believe in $2,100 [per tonne] within one week.”

Forthcoming national holidays in China will disrupt supply further, and cause markets to start winding down before the end of the month, market participants said. Lunar New Year is on February 16 this year.

Still, the recent rally has some market participants warning of a pullback.

“There is strong resistance on the high prices of manganese flake and lumpy from local steel mills so maybe there will be a small price correction after the Lunar New Year,” the second Chinese source said.

This article was updated on January 25 to reflect that Ningxia Tianyuan’s production capacity amounts to 800,000 tonnes per year.

Antwort auf Beitrag Nr.: 56.837.011 von Reiners am 26.01.18 11:19:23Ja, die Preise sind ganz schön.

Aber hältst Du denn Deren "fast tracking" Ansatz für realistisch?

Aber hältst Du denn Deren "fast tracking" Ansatz für realistisch?

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -2,94 | |

| +0,82 | |

| 0,00 | |

| 0,00 | |

| -0,57 | |

| +4,55 | |

| 0,00 | |

| 0,00 | |

| +10,00 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 288 | ||

| 107 | ||

| 107 | ||

| 74 | ||

| 71 | ||

| 63 | ||

| 60 | ||

| 46 | ||

| 45 | ||

| 42 |