Starbucks übertrifft Schätzungen um 2 Cents (Seite 7) | Diskussion im Forum

eröffnet am 01.02.06 22:20:14 von

neuester Beitrag 20.02.24 11:29:42 von

neuester Beitrag 20.02.24 11:29:42 von

Beiträge: 1.235

ID: 1.037.210

ID: 1.037.210

Aufrufe heute: 0

Gesamt: 123.333

Gesamt: 123.333

Aktive User: 0

ISIN: US8552441094 · WKN: 884437 · Symbol: SBUX

88,25

USD

+0,47 %

+0,41 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

| Starbucks Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

24.04.24 · dpa-AFX |

24.04.24 · Aktienwelt360 |

23.04.24 · Business Wire (engl.) |

23.04.24 · BNP Paribas Anzeige |

Werte aus der Branche Nahrungsmittel

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5100 | +32,46 | |

| 22,800 | +28,09 | |

| 16,200 | +24,23 | |

| 467,60 | +19,99 | |

| 0,6580 | +16,67 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0100 | -18,55 | |

| 1,4100 | -22,53 | |

| 11,840 | -23,42 | |

| 1,0500 | -50,24 | |

| 17.000,00 | -80,35 |

Beitrag zu dieser Diskussion schreiben

per 30.6. minus 4 Mrd. USD EK

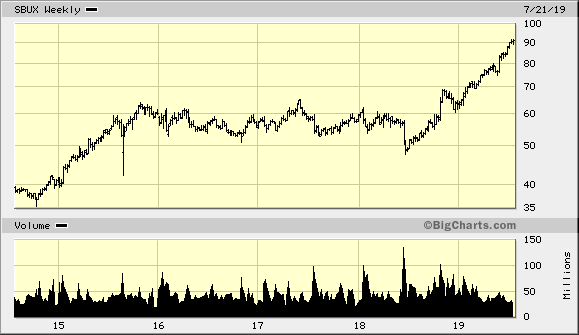

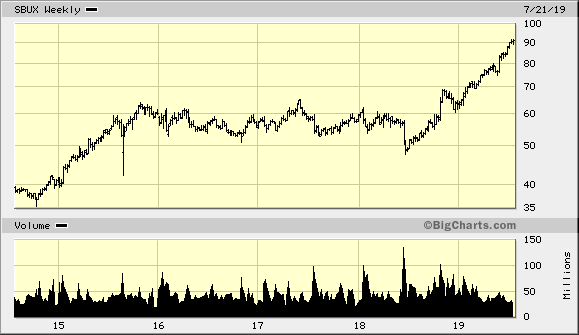

SBUX hat nen Chart wie ne IT-Blase

=> +50%+ in 9 Monaten sind auch total normal für so'n Wert mit MC > ~USD70Mrd.

=> +50%+ in 9 Monaten sind auch total normal für so'n Wert mit MC > ~USD70Mrd.

von Intrinsic Investing:

Excerpt (Sean Stannard-Stockton speaking):While manufactures depend on Fastenal for inputs that power everything they do, the same might be said for the role that coffee plays in many people’s lives. Speaking for myself at least, without my regular dose of daily caffeine, the rest of my day pretty much grinds to a halt. Luckily for me and the rest of humanity responsible for consuming 400 billion cups of coffee every year, while caffeine is addictive, studies have continuously found it has very limited negative health implications with more and more studies pointing to its role in making people happy, healthy and productive.

It is for this reason that when we added Starbucks to our portfolio last year, we joked that the company was like Philip Morris and McDonalds rolled together but with the negative health implications removed. In our view, Starbucks is the premier global supplier of a key aspect of the human diet. Like all addictive substances, consumers of caffeine wrap their habit in a set of rituals. It is these rituals that provide an opportunity for Starbucks to cater to their customers desires in a way that is highly profitable.

The ritual of coffee consumption is important to Starbucks core customers. In the US, 40% of sales are made to active rewards members, those people who have the Starbucks app on their phone and use it to pay. Of these customers, half of them visit a Starbucks 16 times a month on average. In some ways, the Starbucks digital payment system can be considered the most successful digital currency of all time.

Katherine Fischer, who introduced the call today, has told me that she orders a Starbucks drink from their app on most work days. The app saves her preferred drink – a venti Americano with a regular splash of steamed soy milk – so just two or three clicks on her phone will have her favorite drink waiting for her to pick up on her way to the office. When I asked Katherine to review this part of our call script, she pointed out that she doesn’t only go on most weekdays, but often orders from Starbucks on the weekends as well and in fact had ordered twice this past Sunday.

And in addition to her coffee-based drink, Katherine noted that she will occasionally add a spinach feta wrap if she needs an easy meal. Picking up a mobile order at Starbucks literally takes about 15 seconds. This is important to a parent of young children like Katherine who told me “When I’m with my kids the Starbucks mobile app it is such a lifesaver. It means I don’t have to wait in line and tell the kids no to pastries when all I want is my morning coffee.”

So what happens if a new coffee shop opens near Katherine and offers a modestly cheaper or even better product? Habits are powerful drivers of human behavior. Starbucks mobile infrastructure is designed to remove friction from the experience of buying from them. So while a casual coffee drinker out for a walk and planning to wait in line anyway might give the new shop a try, a mobile first, habitual Starbucks customer, of the type that generates as much as 40% of their revenue, experiences much higher “switching costs” to try something new. Add in the rewards they offer to these customers and competitors need to offer significantly superior value propositions to steal customers away.

There is one type of coffee retailer that is trying to do just this. Known collectively as Third Wave Coffee, these retailers lead by Blue Bottle and including many local and/or small chain stores, are attempting to offer a significantly higher end experience. Our bullish view on Starbucks is not based on a belief these efforts will fail, but instead only that they will take limited market share and that Starbucks own Roastery and Reserve concepts will win a segment of customers wanting this higher end experience.

Mike Navone, one of the advisors here at Ensemble, is currently on vacation in Italy and sent us back a report of his visit to Starbucks Milan Roastery location. Here’s what he wrote:

“If there was one takeaway from Starbucks Milan I’d say two words: an experience. It was beautiful inside and the place was packed. Upon entry, you’re greeted and directed to where you should go (food, coffee, or the bar). We had espresso martinis. The server recommended some other drinks but at over 20 euros each we stuck with our martinis. Drinks surprisingly came with a full cheese board with olives, a nice touch! The couple next to us ordered one of the expensive drinks and the server said we should watch the preparation for ‘the experience.’ It was neat. Very carefully made with a beaker to steep, then shaken with ice. They wheeled out a special cart just to make this drink. Everyone was watching and taking pictures.

Then a huge copper cylinder in the center of the cafe had all the panels open up, like a flower blooming, and it revealed the coffee beans being sent to be washed, roasted, and packaged. There were no less than 30 people filming with their phones. The cafe was great, not a place to grab and go but instead stay for the experience and the show. It’s pricey but felt worth it for the unique experience.”

Now many retail products have gone through a premiumization process in recent years. Whether it is high end chocolate, craft beer or organic, locally sourced produce, consumers have shown an appetite for replacing traditional mainstream products with higher end versions. Our contention is that this process has already happened with coffee and it was triggered by Starbucks successful efforts to premiumize coffee in the 1980s and 90s. While craft beer today still only makes up 25% of the beer market, Starbucks flipped closer to 80% of the coffee market to premium. What we see now with Third Wave Coffee is an ultra premiumization trend. For a small slice of the coffee market, some customers are willing and able to spend even more on their coffee and they seek a truly authentic experience. On our own research team, Arif is a fan of Blue Bottle and other Third Wave coffee shops. While he rarely visits a Starbucks on his own, he will admit that when traveling with his wife and children, they will often choose Starbucks because it offers a range of products to fit their varied needs. And so in the end we do not believe that the Third Wave trend is so broadly applicable that it threatens Starbucks in a meaningful way.

We’ve written in the past about the difference between search cost brands and identity brands. The former are those brands that offer a guarantee of a good product at a consistent quality level. The latter offers the purchaser a signal to them or their peers that reinforces the buyers’ self-identity. Our contention is that in branded consumer products, search cost brands are dying as consumers have come to depend on Amazon star ratings and social media recommendations to influence purchase decisions.

But Starbucks offers a service, not a product. When you are in a new town, or in an airport or even just in a different part of your home city, Starbucks offers a specific, known and consistent value proposition based on delivering you the dose of caffeine you seek and wrapping the purchase with a range of healthy foods or tasty treats as the occasion might call for. Speaking for myself, being served a bad cup of coffee is really annoying. And like most coffee drinkers, I have strong preferences that map not so much to objectively high or low quality, but instead are driven by what I’m used to. I saw this preference on display recently when I was at JFK airport and found myself walking past five separate places offering coffee in order to buy from Starbucks, the brand I trust to provide me the coffee I crave.

LUCKIN COFFEE : Starbucks-Rivale aus China will an amerikanische Börse

https://www.faz.net/aktuell/wirtschaft/unternehmen/chinesisc…" target="_blank" rel="nofollow ugc noopener">https://www.faz.net/aktuell/wirtschaft/unternehmen/chinesisc…

https://www.faz.net/aktuell/wirtschaft/unternehmen/chinesisc…" target="_blank" rel="nofollow ugc noopener">https://www.faz.net/aktuell/wirtschaft/unternehmen/chinesisc…

Antwort auf Beitrag Nr.: 60.240.774 von buddha1337 am 31.03.19 18:52:31

und wenn du bei 80 verkaufst und dann vergeblich auf 60 oder 63$ wartest? Lässt du dann diese schöne Perle links liegen?

Zitat von buddha1337:Zitat von bpmeister13: ...

und wann willst du wieder einsteigen, wenn du jetzt verkaufst?

Meine Tendenz wäre im Bereich 75-80$ auszusteigen und bei 60€ wieder einzusteigen.

und wenn du bei 80 verkaufst und dann vergeblich auf 60 oder 63$ wartest? Lässt du dann diese schöne Perle links liegen?

Antwort auf Beitrag Nr.: 60.240.600 von bpmeister13 am 31.03.19 18:14:31

Meine Tendenz wäre im Bereich 75-80$ auszusteigen und bei 60€ wieder einzusteigen.

Zitat von bpmeister13:Zitat von buddha1337: Ich bin seit Anfang 2018 in Starbucks investiert. Mir erscheint der aktuelle Kursanstieg etwas übertrieben und überlege mein Paket zu verkaufen. Grundsätzlich bin ich weiterhin vom Unternehmen überzeugt.

und wann willst du wieder einsteigen, wenn du jetzt verkaufst?

Meine Tendenz wäre im Bereich 75-80$ auszusteigen und bei 60€ wieder einzusteigen.

Antwort auf Beitrag Nr.: 60.239.586 von buddha1337 am 31.03.19 13:41:15

und wann willst du wieder einsteigen, wenn du jetzt verkaufst?

Zitat von buddha1337: Ich bin seit Anfang 2018 in Starbucks investiert. Mir erscheint der aktuelle Kursanstieg etwas übertrieben und überlege mein Paket zu verkaufen. Grundsätzlich bin ich weiterhin vom Unternehmen überzeugt.

und wann willst du wieder einsteigen, wenn du jetzt verkaufst?

Ich bin seit Anfang 2018 in Starbucks investiert. Mir erscheint der aktuelle Kursanstieg etwas übertrieben und überlege mein Paket zu verkaufen. Grundsätzlich bin ich weiterhin vom Unternehmen überzeugt.

Ein chinesisches Kaffee-Startup will Starbucks in seinem Heimatmarkt verdrängen

https://www.businessinsider.de/chinas-kaffeehauskette-luckin…

https://www.businessinsider.de/chinas-kaffeehauskette-luckin…

24.04.24 · dpa-AFX · McDonald's |

24.04.24 · Aktienwelt360 · Bristol-Myers Squibb |

22.04.24 · dpa-AFX · McDonald's |

13.03.24 · wallstreetONLINE Redaktion · Coca-Cola |

| Zeit | Titel |

|---|---|

| 29.07.23 |