Melkior: Uran mit Santoy für nur 7 Mio. Kap! (Seite 155)

eröffnet am 12.01.07 15:38:44 von

neuester Beitrag 07.11.23 16:10:32 von

neuester Beitrag 07.11.23 16:10:32 von

Beiträge: 1.709

ID: 1.104.860

ID: 1.104.860

Aufrufe heute: 0

Gesamt: 99.585

Gesamt: 99.585

Aktive User: 0

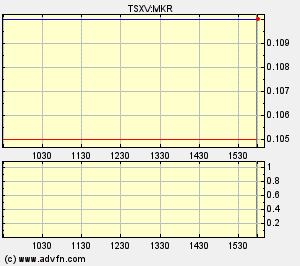

ISIN: CA58549W3030 · WKN: A2P0Z5 · Symbol: MKR

0,1050

CAD

-4,55 %

-0,0050 CAD

Letzter Kurs 26.04.24 TSX Venture

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 1,0100 | +13,48 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5700 | -8,06 | |

| 3,3200 | -9,78 | |

| 3,9600 | -15,74 | |

| 12,000 | -25,00 | |

| 46,98 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 27.550.659 von Panem am 09.02.07 16:38:17ä ä

Antwort auf Beitrag Nr.: 27.550.635 von mrbk1234 am 09.02.07 16:37:26Sachma: Hast Du hier für 26 gekauft?

... und sie läuft!!

Antwort auf Beitrag Nr.: 27.523.404 von Klardoch am 08.02.07 19:50:30hier die textliche Wiedergabe des Interviews in voller Länge...gegen Ende wird sogar Marathon (MTN.AX) empfohlen, was wahrhaftig ungewöhnlich ist...Sprott und Konsorten sind eigentlich recht heimatverbunden...

Part 1

Embry Text from Feb 8 not yet proofread or checked against the tape.

TV Channel 3 Thu Feb 08 09:30:34 2007

>> Jim: Welcome to "market call," thursday edition. I'm jim o'connell, our guest today is john embry from sprott asset management, here to answer your questions on precious metals for the next hour. John, we will come back. Good to see you. >> It's always nice to be here, jim.

>> What's your assessment of the way gold is performing right now.

>> I think gold is doing magnificent job in the face of considerable skepticism it's just pounding higher, and it's being driven, physical demand for all corners of the globe. It's coming from three source, the mines, scrap, and the central banks. The key is how account central banks being -- feeding gold in the market. When that stop, it's going go a lot higher than it is noW. >> Jim: How much higher?

>> I think--I'll give you 7:75 this year. Some people think of the all time high, i think now, the way things have been shaping up in the U.S., And sort of the global currency creation that's going on, i see thousands, easy now, and then beyond that we'll discuss what when it gets there.

>> Jim: So 1,000 sfleez and how many of is it is a U.S. Dollar story now.

>> A significant proportion is the U.S. Dollar but it's also what the U.S. Dollar is doing other countries who do not want the U.S. Dollar to fall so they're creating all sorts of their own money to cope buying the U.S. Dollar and keep this whole charade going and gold marking time, but it's showing -- I think, showing good vengE. >> You say you called it a charade. You think that the fed is deliberately covering data.

>> Oh, for sure. I mean, I think you -- I mean, i disbe half of what I hear from a country out of washington these days with respect to economic numbers and inflation numbers and everything. I think the situation is infinitely worse. Everything keeps talking about the bottoming and the housing market. It looks like a freefall and we're still in the middle of it. Stay tuned it's going to be an interesting year. >> So you think it's going to be sugar coated by the fed?

>> Absolutely.

>> Jim: You see a recession.

>> I think we could definitely have a recession at some point. This talk of higher rates to me seems absurd, really. Because the consumers almost -- you know, almost die doing now. Given you see the number of bankruptcies and housing foreclosures and whatever you. I mean, the savings rates, -1°%, this is remarkable. So yeah, i think it's going to be -- it's going to be an interesting year. >> It's just question before interest rates start to come down.

>> I still think that the next move and any significance in -- significance in interest rates could be down, down sharply but they got to be careful because they're still trying to jug dell with the economy and the U.S. Dollar. One's going to take it in the ear and I think they'd prefer it to be it the U.S. Dollar in the end rather than the economy.

>> We'll take some calls in just a moment. I don't know with us for the hour talking precious metals and here's our phone numbers if you'd like to give us a call. Be right back. >> Jim: Let's take some calls. Rank in mississauga. Hello, frank.

>> God afternoon, jim and john. John, orvana's trading at four times earnings and assuming a higher gold price eventually bringing the upper mineralized zon in production, which adds the years of life to the mine, it seems this stock is foolishly low even taking into account the bolivia factor. Would you agree? Would you be buying here?

>> I would definitely be buoying here the bolivia factor is over done. I do not think he will nationallize this mine. He was chatting to an analyst list friends of mine this morning and he calculates the company will have enough cash in the treasury by the end of september to justify its current stock price. It's yen rating cash so quickly. And you've got the upper mineralized zone, which is on a net asset value's probably worth what the stock's worth and you've got the ongoing production from the current mine. The stock is extraordinarily cheap but it lacks sponsorship because of the ball livian issue.

>> You own a big chunk of that?

>> Yeah, i own 10%.

>> Jim, jim in ottawa. Hello jim. Hello jim.

>> My question's on malchia resource, i see they've assembled a great package of claims for a junior. A joint claim in the otish mountain. There is also claims from west timmins, as well as property partners with ex trat that and gave have a, that has a nickel deposit, canadian royalties, and i was curious to have your opinion on this company considering your package of properties? >> John embry: Well i own this company. I actually purchased it in a tax shelter and so I mean, i clearly have a buy view since I'm long, but i think scrmd ens hansen has done a significant job putting together that package of properties you just am lewded to. Anyone the three, i preferred now, the urineium play, it's such a great partner with santoy but the knuckle play in ungava is interesting and for a penny stock this is a real good one.

>> Jim: Uranium, you guys at sprott still as bullish as ever?

>> Yup, without question. >> Oak, had $80 bucks today.

>> John embry: Apparently. Where's it going?

>> Well, everybody seems to think 100s on the way up. I hear robert friedlan say 200 away. The interesting thing about uranium is nobody cares about the price, really. As it applies to the cost of producing power because the real cost is in building the generator. So you can take a lot higher price. So many things the higher price destroys demand. In the case of uranium, that's not the case. So the price pretty well can go anywhere, depending on supply and demand condition. >> Okay, we have an e-mail from john in new westminster. Maxi gold. Mxd. Currently old it, last year the stock traded at over $2, now it's trading at 83 cents, can you tell me whether I should be buying or selling at this point.

>> You most certainly shouldn't be selling. The fact is, maxie's a good representative of what's been going on in the junior gold space. Ones with excellent promotion have done spectacularly well. Ones that may have good projects but are poorly promoted are just wasting away. Maxie falls into that category. They have a very interesting project property over in china. And there's not a lot-shares out standing. The current price, the stock is extraordinarily cheap. But you know, we await further developments, we've got to see more money coming back into the junior gold space. >> And you have a fair chunk niz do, yes.

>> All right, valley's in saskatoon. Hello, valley.

>> Oh, hi mr. Embry. I have a company that i bought shares in called buffalo gold and i bought that in the $2 range and I'd like to know with your expertise what you think of it?

>> Well I actually am long buffalo gold, too, and I have been for a while. It has an interesting promoter named damian reynolds who tends to get a little care rode away at times but i think this is really a good project and it's in a rather gamey part of the world over in papua new guinea, but nevertheless it's in a particularly good area. The drilling results to date have been very promising, I think the stock again, it's another one of those stocks that's for whatever reason it's falling out of favour, I've been buying at at these current prices. >> What parts the world do you stay out of?

>> I'm not comfortable in russia these days. I just do not like sort of what's going on there from rule of law point of view, and these guys seizing assets and what have you. I'm obviously out of venezuela. I don't understand why crystalex trades where it is, what chavez has been doing in that country. Bolivia, despite the fact that i own -- orvana makes me uncomfortable because moral lease is a similar nutcase to chavez, so consequently you got to be careful. The geopolitical risks are going up. >> Okay, we have an e-mail from gord on queen's stake and ygc resources what's your opinion on the recent merger between queen sake

>> John embry: Well the way the stock's trading I would say no the proprietior assures me he's done his due diligence. I reserve judgment. I -- this has been a very disappointing stock for me, and it stemmed from the fact that they couldn't operate that mine successfully. It is a great land package. And what they're going to do, as I understand the merge companies, is there's going to be big money raise. They're going basically phase the mine out, and they're going to do a major league exploration job on the jarrett canyon property which is a large property in nevada. That -- I mean, i would keep the stock if by owned it. I'd rather wait rather than buy it here but i think that ultimately the exploration, which is the best part of the thing, is going to come to the fore. Everybody's been concentrating on this failed mining effort. >> John will be back in just a moment to continue our chat on precious metals, like to ask you about silver in a moment. We'll take a look at your precious metals funds at sprott. More questions ahead. We'll beite back.

>> Closed captioning of this program is brought to you in part by report on business television.

>> We're back with john embry, the price of gold today. Futures, showing at 664 spot is what, just under what?

>> John embry: 6.50.

>> Jim: You watch the short positions what's that telling you?

>> The commitment of trader's report is cause for worry in the very short term. The commercials, the bouillon banks, the guys who are involved in sort of playing around with the market are extremely short here compared to the speculators, the long speculators, the tech fronts, so to speak. The black box guys who are long. Traditionally, they put enough pressure in the market with these speculators are long, and they break them and they sort of clean them out and they cover their shorts. Now one day this is going to fail. There's going to be a spectacular commercial failure and that's when gold price going to go nuts but I mean, i can't tell you it's going to be this time. Conceivably they're in a position to go down here. We're at a real key quebec cal level at 650 it clears 658 with gusto, I think 700s a lay-up very quickly. This is why we're having this battle right here and it is a battle at this level.

>> So that's the market you're watching? $6.58, spot gold. Darren's on the line in rena nevada hello, darren.

>> Hi jim. Jim, you do a great job every show. John, I just wanted to ask you about sole lex resources and I was just wondering if you could talk a little bit about how you value a company like this. Thanks very much. >> This is the uranium play.

>> Yes, it is. Uranium, zinc, lead, nickel, and silver. And this is one operating in peru.

>> There's so many names.

>> South america. So they're partnered with frontier pacific.

>> SoX.

>> In southern peru and a really interesting uranium play, how you value these things, i don't know. I find frontier pacific more interesting, because they've got half the play and also a wonderful gold project. They're doing the actual exploration, they're very excited about the potential for uranium in southern peru. Initial shows are very terrific, so i mean, i clearly stick with it. >> And kevin's in calgary. Hello, kevin.

>> Hi, how are you doing. I love your show. I just wanted to get mr. Embry's comments on silver and gold.

>> Arthur heinmaa: Currently have a position in silver. I want to take a position in gold and add to my silver, just wondering if I should wait for a pullback and if so, what kind of pullback are you expecting.

>> Well, my attitude here is i just was making the point. There's a possibility that the commercial's could push this thing down again here. I might not go all in, but if you haven't got any gold, i would certainly sort of buy right here, half of what you planned to buy. And then see, watch developments. If it breaks as I said clearly through 6.58 you better think about getting the rest of your money in, too. But you might get a pullback here, I'm sort of agnostic on that. >> Jim: Right. If there is a pull back.

>> John embry: Well the pullback will be schallly in my opinion and there's just too much physical demand. What happens when they push these things down with the paper toys, they just amplifies the physical demand. They're getting short. I mean, you can see, they trotted out the old imf red herrings. You know they're in trouble when that comes out. It comes out constantly when the gold prices rise. The central sbangs banks are getting short. Being see that, but it might be sold under the second wash ton agreement. They're not getting anywhere close their border. >> Jim: Let's take a peak at your fun at sprott. The golden precious minerals funds up a little bit. Fairly flat. One year return, 30%. 30.5%. Five years you've been grinding out, $36%. How are the juniors behaving right now? They're a little flat, aren't they?

>> With to put it mildly, flat is, we'd be putting it kindly. Right now there seems to be a buyers strike and a lot of juniors, there are some that are well prom promoted that are doing very well but there's a lot of companies with good projects, that can barely catch a bid and kind of sinking under their own weight. I think, given my view on the gold price, this is a wonderful time to be buying. This is sort of a gift, because if when the gold price really gets in motion here, some of these stocks are going fly and it's tougher to buy them in my opinion. I like buying things when they're cheap. So that's cheap bull stocks. >> So this is a buying opportunity right now. Let's go to jack in oakville. Hello, jack. Hi jim and john. Just calling about gold eagle, just wondering if you're still optimistic on it. Thanks.

>> Yeah, I own gold eagle. It's an interesting play. Like if you believe the optimists, there's a lot of high grade ounces up there at red lake. On their property. The problem is that it's deep. It's very deep. I'm still going with the optimists. It's a god looking situation, but you got to remember this stock's come were about 40 cents and it's trading over $8 bucks now. And they've also merged. They've merged with a lot more shares. And it's a good situation but it's no longer risk free. It's not something i would be running out to buy, necessarily, because it's come a long way. I'd rather look for the next 40 cent stock, it's going $8. >> You short stocks from time to time.

>> From time to time, like I'm not -- i've got a hedge -- off-shore hedge fund, but I'm not short anything right here. I think it's too explosive, bad stuff, good stuff. Everything will go, if the gold price does what I think it's going to do.

>> So you fully invested long.

>> I fully invested long.

>> Jim: Jane? Vancouver.

>> Caller: God mog, guys, I have a question about tetaliriak minerals, they were going to spin off copper to sharehold hes but in general, can you tell me whatever you know about this company? I've held it for years, it was sort of inhairt. I'd love hear your stuff, thanks. >> John embry: Well, it's interesting.

One flies under the radar, I've met with unof their representatives who's extraordinarily optimistic on this they're planning to spend the copper off. I'm not sure what their delay's about and they've got an interesting gold company, and there's still not enough ounces on it, but it's showing well and I would be inclined to stick with it. It's got very good sponsorship and I think it's fairly tightly held, it's got panamanian sponsorship, that's where the ore bodies are. So yeah, I would stick with it. >> We have a question from a viewer in prussels bellium.

Intrepid's been another one of the banes in my existence. Just had a terrible I'M. It looked fantastic. The great exploration play, resource down in argentina. Then they acquired a producing mine in australia. To make it worse, they've had a hedge on the hinge, which so -- they're consuming cash, and small companies that consume cash have a problem, so the stock has really been punished but i think now in the 50s, mid-50s I think the stock's reefd level, where i think they will you are vaive, obviously. It's been a real ugly trip. >> John, we'll be back in a moment, looking back to past picks and more of your calls on precious metals

>> Jim: Welcome back to "market call". Our guest today is john embry, and we've got paul in richmond hill. Hello paul.

>> Hi. Hi gentlemen, how are you. Great show.

>> Questions on african gold group. I bought a little bit of this, and around the $1.80 mark. They keep coming out with some news. Seems to be flat here. Tell me what I can do, buy, sell, hold, buy more? >> John embry: Well, i own over 10% of african gold. I really like the guy running at greg hawkins they're operating over in kenya or in ghana and maury. They're most promising project right now is in maui. The market, it's just indicative of the market. A the hoff these smaller stocks just can't catch any interest. I think it's an extraordinarily cheap stock. There's in the a lot of stock out there and considering what they've got in both of those country, their land package, I think, I think the stock looks terrific here. >> Okay, it's $1.90. How long have you owned it?

>> I've had it, I've been in it sort of for a couple of years anyway. I like the situation.

>> Daniel in montreal. Hello daniel?

>> Yes, hello. Great show, jim. Mr. Embry, i like your view on qgx and its future and do you still own it? Thank you.

>> Thank you.

>> Yeah, we have a large position. I own, i think 10% the company in one of my funds. I think this is one of the cheaper stocks on the board. It's totally misunderstood. It's in mongollia, which is viewed as a lot -- called by a hot of people. You can do business in mongollia. Robert friedland proved that by selling part of his country to rio tint tow. I think there will be some sort of a transaction on the coal project which will validate the under valuation of this company at this time. It's a give away at $1.70. John is in toronto. Hello, john. John's gone. He's going to ask about bofield. Bfd. What do you think of it.

>> I think it's ian hansen's other vehicle. They were talking brofly about melchior earlier. Beaufield's got a good package where the virginiaor body was sold to gold corp., As well as they're operate two or other exploration bands, but the key, why you buy this is for the properties. Stock had a huge run from 20 cents to 85 cents or something and it's pulled back sharply to 36 cents. It's very cheap again as a good speculation in this part of the world. >> Okay, your picks, john, from november 30th, southwestern resources was trading at 8:47. I've got it at 7:65 which is up a little more than 10%. You still have the same position?

>> I got more.

>> Do you?

>> Buy more. I think this is conceived with the most misunderstood stock in the plant. Everybody fussing about you know, the on yous in china, you know, the economic, the other economic -- at least five million there. But this is more than just one property this is one of the great generators of mining projects around. Like I mean, their land package in peru, we've got a 50/50 joint vent tour, hugely in concession with numont but another one with anglo and copper project and they've got zillions of projects in china and peru. Two countries they're sort of emphasizing and I think the stock at 7:65 is right on the floor if this stock doesn't get taken out sometime. >> 6%, are you still in the money.

>>> John: Yeah, I'm still in the money. The stock just seems to have a little on it.

>> Jim: So you're still calling it a buyer?

>> John embry: Oh absolutely.

>> Jean-francois tardiff: West dome, 2.28. They're down it 1.99.

>> Well, i recommended it, it wasn't 2.28. That was day after the day ran up in the recommendation.

>> Basically this one has two operating mines. Small operating mines, these are both good mines are going to be a premium value when the gold price goes up sharply, which it's going to do and i just think west dem's one of these little keepers that will be sort of dull dull dull, the gold price goes up everybody wants to own, but right now it's a struggle. >> Jim: All right, third choice. Venture? Looks like it's no change. $2.80 to $2.85 today, up a little bit.

>> Genco's a great silver play in mexico. The guy that was really involved with the discovery gammon lake is behind this and he said me at one occasion this is the best project he's ever worked on.

>> He worked on the gama lake project, not a lot of stock, so i like the stock very much.

>> We'll pause very briefly, and come back with the second half of our show. John embry, chief investment strategist with sprott asset management. We're talking precious metal, we'll take into silver and some of the other metals in just a moment. If you'd like to give us a call. We have another half hour ahead of us. >> You are watching report on business television.

Part 2

Embry Text from Feb 8 not yet proofread or checked against the tape.

Welcome back, this is "market call," john embry is our guest. Precious metals, john's top picks.

>> John embry: My opinion is 1500 companies are massacre raiding with some form of metals company. Just paper, paper prom promotions.

>> Jim: Have you had a guess --

>> John embry: A the lot of them don't trade much someone stuffs a project and off they go. At least i think i try to emphasize companies where there's really mining people really looking for something and with a decent chance ever finding something, because a, they're good and b they've got interesting projects. >> And your strategy, you own what? At any given time $100?

>> I try to keep it to $70 and my off-shore hedge, I at the to keep it to, we use more small stocks in there. I use maybe 50, maX. 40, 50.

>> Right. And you're going, you're going for the torque in buying these small companies.

>> Well, yeah. My view is that, you know, people can go and buy the large companies on their own. I find them fully priced relative to the whole list, but they'll go up with the gold price, make no mistake, but I just think that a lot of the smaller companies that are under appreciated and under owned today, if the gold price really catches fire and money floods into the space, they got to make up the under evaluation before they move on. But I think again, you got to be careful, you got of it a diversified list. It's tough rifle shooting these things. Some of them don't work. Queen's stake, a classic case, we got them all, it's turned out to be a disaster. >> Right, how many don't work? How many do you have to toss out?

>> Depends when you say work, I mean the vast majority of them don't work as mines.

>> But as perception taking the stock a lot higher I mean, i would say maybe 70, maybe a batting average, 70% winners, there are significant winners, i think that's peretto good, you've got a great rate of return.

>> You buy big chunks of the companies, you've said 10%.

>> But you got to buy them at the right time. They can't be over priced. You got to buy them right and if you're right, they work out and liquidity comes in and you can sell if you want. So -- but i wouldn't recommend, sort of people go out there and just sort of start buying big chunks of companies, because i think they're interesting and you better have a pretty good feel for like why you're buying it and where it is in its potential price group. >> That's what you do own that's my job.

>> Ruben in montreal with a question. Hello, ruben.

>> John, my question is this. I'm sure you probably are aware, panther recently released news and the news was that they pretty much didn't hit their targets that they had.

>> Being kind.

>> Caller: Yeah, on the two mines they tried to put back into production here. And my question basically is with this news out now and the numbers as they are what do you think of the situation going forward? >> I have great confidence in bob archer and his team, so they, like so many peep made the mistake of over promising and under delivering and the problem is mining's a tough business and so many mines have real start-up problems. You know if they're restarting, this is what I believe great panther's going through. Whether they meet their most optimistic forecasts from before, I'm not sure. But I like silver sufficiently and i think these are god projects, I would stick with the stock. Those were pretty grim number, i must confess. >> What are the prospects from silver, compared to gold?

>> Well I think silver, silver's poor man's gold and there's great debate over whether silver's an industrial metal or a monetary level like gold. And I think it will most assuredly step forward as a monetary metal before this is over. And because it's the uses for silver are proliferating, particularly in the medical fields and treating this. It's really a great, you know, commodity in that sense. If you get a combination of investment deman, because it's seen as a monetary metal, plus it's natural demand, i think the thing does actually better than gold. At least initially. I suspect I can see silver going from say currently 1350 roughly to 30 more easily than I can see gold going up by that percentage. In the short run. I me, I have no problems seeing silver at $30. Gold, it's going take a while to get to say $1500.

>> Where do you think it's going there.

>> Well, it's probably going -- gold and ser silver, they're not going anywhere. The fact the value, paper money's going down.

>> Jim: We'll be back in just moment john embry our guest, we'll take more of your calls right after this break.

>> Let's go to terry in vancouver.

>> Hi gentlemen, great show as usual. My question today is on gold ore resources. I'm wondering if i should continue to hang onto them. Thank you john, I'll hang up now. I'm not long this stock. I kind of regret it. It used to be long years ago, but it didn't really go anywhere for a long time and they didn't seem to have a project. Now they've got an interesting project over in sweden. As I said, i like god people with gold on that basis. I would certainly keep holding it all right hans welcome to the show. >> I see this morning, sprott is buying a lot of glen keR. On the market, and I've been holding it for the next year and i would like hold it for the nextier or so.

>> We have a large position but to my mine we are not buying any right now. They have two producing mines, one's in costa rica, the other's nicaragua.

>> Going forward, our producing mines because there's a huge shortage of personnel these days. And consequently it's going to be quite difficult to send some of these new mines and it's going to be way more costly than anybody thinks. People are getting quotes six months later and they're up 30 or 40% so I'm partial to any money producing, that's of legitimate mind. I think the stock on that basis, it's interesting, at its current price, it's been pretty pounded down over the lastier or two. >> Just to claire you identify, there's sprott assets and sprott security securities.

>> Two totally separate entity. I think sproth will be changing their names which will make things much better. There's enormous confusion. Eric sprott founded both of them but he disposed of his interest in sprott securities before I got to, it's going to be come up in for you years. So there's no relationship what over, other than we know them well, we respect them, but there's no financial involvement what over. >> You guys are sprott asset management. Peter's in toronto. Hello, peter.

>> Good afternoon, gentlemen, john, I'd like your opinion on eldorado gold. I had it about $5.75, it's resistance around seven. Just wondering your opinion with the turkey mines, there's risk involved, and be i enter it now or hold it and should i buying is else, liken ross, for example? Thank you.

>> I would most assuredly buy eldorado before I would buy kinross. I like eldorado. I don't own it currently. We owned it early on. We did very well in he will-rad dough. I have nothing but the highest admiration for the guy that runs it all right. I mean what he did with that company when it was really strugglingiers ago and looked like it was going bankrupt, it was nothing short of amazing, and he's done a fantastic job building his bock of assets and I don't have any problems with the turkish mines. I me, the ki shmd hleday is now up and running look like they're getting a lot of kings out of it. The ekanc humd rumd -- i can't even pronounce the other underground one they're working on, but it looks like a very prom missing situation. And they've goters, near china, they're one of the sort of early adopters there. They got into a great project that I own a lot of, they bought it. I was actually disappointed i got it for an extremely good price. I like he will-rad dome this sun before the big cap seen years, this is one of the god ones.

>> And francis is bradford.

>> Hello, I'd like mr. Embry's opinion on cumberland resources. I bought it around $4 and I'd like know if i should continue to hold or sell it and take my profrts and does mR. Em brault own it? I'll hang up and listen. Thank you. >> No unfortunately, i don't own it. This is one that I sort of regret missing, although I think at these prices I'm a little more sort of restrained. I think one thing people might be missing is that i think building mines up in the northern climbs of canada is going to turn out to be an extraordinarily costly process. They're going to be underestimating some of the, you know, costs in getting this thing into production, ultimately. It's been a great stock. But i think in my mind it's probably better, opportunities on the risk reward basis. >> You don't chase ones that get away?

>> No. I mean, as they say, i mean, there's always another bus coming along. I mean, i never sort of -- I'm not a momentum player. I like to buy stuff when it looks interesting and cheap to me.

>> One more call before the break and that is tim in thorold. Tim?

>> Good afternoon, gentlemen, great show.

>> I'd just like to ask a question about norwich gate resources. Your opinion on. Does it look like we have tackout at this point? And also any information in regard to the nevada properties? Cortez trends what do you think is happening out there. I'll listen for your comments. Thank you very much. >> I'm not a great fan of north gate. I mean, the people that run it have done a great job and I have nothing but compliments for what they've done. They've done it really well. They've dealt with a pretty difficult mine, but on the other hand they've benefited hugely from copper, which I think is coming back to earth. I'm not really keen on sort of companies with a lot of confidence right here. I'd much rather be in more pure gold plays, unless it was an extremely cheap stock. So consequently north gate's not one of my favourite, I think you can do better. >> When we come back, i want to ask you about holding physical gold. Buying coins and bricks and that type of it thing right after this stay with us.

>> Closed captioning of this program is brought to you in part by report on business television.

>> Jim: We're back with john embry. You hold physical gold, you buy it?

>> We do, yes we do.

>> So what's the best way to do that. I know you can hold it in your rrsp. You buy coins, bricks?

>> Well, it depends on your preference. I like coins because i like looking at them, but I mean, you buy a brick of told, it's nice, it's shiny but it's not as interesting as coins. Coins also carry a big premium, because people desire them more, and you sort of limit production and what have yoU. But my recommendation would be -- I think anybody that's interested in the gold space, the safest way to be in it is in bouillon or coins. I mean, there's risk in every mining venture, because joe yo political risks, mining failure, there's sicilian risk but there's also greater torque but I think as the core of your gold position, you should own some physical gold, and if you do, you might be able to do it through central gold trusts that I'm sort of a co-chairman of. That's a nice way to hold gold. You don't have to worry about storing because there's always the issue of where you're going to keep the stuff so your safety deposit box, keep it at home.

>> Bury it in the backyard.

>> You can do that. But consequently, i strongly recommend, if you're going to be in the gold space, you have some physical.

>> The men's coming out with a -- the mint's come out a new coin. >> I read that yesterday. They're contemplating putting out a $1 million gold coin which is going to the size of a pizza.

>> You should put one of those on the wall. How are you doing guys. My questions there to the east is about ten gold corporation here in manitoba.

>> I come from manitoba as you may know, and i am familiar with this mine. This is the mine up at bissett, and it's failed under everybody else's sponsorship.

>> I basically skeptical that i wouldn't own it personally, but a lot of people seem to like it. My experience sort of in the past, this going to be a struggle but time will tell. >> Spam on the line in st. Drath catharines go ahead.

>> Good afternoon, gentlemen. Love your show. I'd just like to ask john if knows anything of what a goldmining company in nevada calls starcor, sam on a venture exchange.

>> No. I thought this was the one that just -- starcor was the one that just took over in mexico.

>> This says starcore, trading at the 96 cents. That's the one you follow?

>> That's the one, yeah. But it just bought the lewis mine in mexico from, it used to be a gold corp. Asset. >> Market cap, $15 million?

>> Yeah. It's going to be a bigger market cap than that now.

>> I know we're done with the same stock, but will is a star spmd cor out there that's got a really interesting.

>> Up 1500 companies.

>> We've got gary in oak industrial, hello, gary.

>> Hi guy, good afternoon. I'm interested in echelon resources. They've had a good run of late. Just wondering if we could expand on so drilling results, they've been getting lately. >> Well, this is exelon which has had a nice move. It's a silver play in mexico. They're looking for monsterous mantos. They've got a really interesting theory on geology down there and they've got a smallist anding operation, but you own this stock because the potential of discoveries. We like the company very much. Good management.

>> And shannon's in dawson creek. Hello, shannon.

>> Hello. I was wondering if john had a long-term view of strata gold and if their south american project will be a mine, or will it if taken out by new month? >> That's a good question. I mean, i really like the geology in guyana. There's a lot of good stuff going on there. Guyana goldfield's been a huge winner. Sacre coeure is one that looks very interesting and vat that gold which has a relationship with new month. I believe they have a potential ore body there, and i suspect numont's really all over guy wran in A. Consequently, i wouldn't be surprised, given the relationship between the two companies if there's something significant there that that would be, would become a numont project. >> Ovais on the line in toronto.

>> Caller: I was just wondering if mr. Embry can give me some insight on cmqq resources?

>> Yeah, cmq's been an interesting one. So far it's been a massive failure as a stock. I own a fair amount of it. And it's got an interesting land package in nevada that's a really good view, work on it. John hog. At these prices, like the stock very much. They've cashed up again so they can sort of get on with their business this drilling it season but it's really struggled. They haven't delivered. >> Will would like to know about iamgold. He said "I was at B.C. Lays when you expressed frustration over I am 13 gold's take over from cambior and i agrowed. Should I continue to clutch my shares of iam gold or would i miss the party?

>> You won't miss the party. I am gold will go up with the gold price but won't go up as much as a number of other stocks I like mornt the problem with iamgold, now it's become an operator, which is god, I guess. But their big sort of exploration project is in ecuador. Ecuador is a little questionable because of the government. You see what happened to the aurellian stock, it's bp pounded. I think it's been over done, but there's nothing at iamgold that really sort of turns me on other than the fact it's not a terribly expensive stock. If you -- you're not going to get hurt at these levels but on the other hand you may -- on the other hand you may get more torque and something else. >> What do you think of the other mna activity we've seen over the last year so gold corp.?

>> Well, I think bema, I think some of them appear to be paying too much, quite frankly, but on the other hand, if the gold price goes up, they won't be looking to be paying as much, and maybe their stocks are overvalued, auto, and who knows who's over page, but i think some of the premiums being paid are silly, because consequently, most of these stocks, these larger stock, i think are efficiently valued by the market. And if the market says they're worth this much why are you paying 30% more to buoy another company, you know, not terribly dissimilar from your own as soon as aside from that, i think there's going to be lots more mna activity. But I like real merger, where you take two entities, you say, okay these are the fair values and we slam them together and sunday they look lake a better entity because the risk is diffused and you get a higher valuation, so I'm just going -- we're going is he more action in it. >> John, we'll save rest of your show talk about your topics will which we'll get in two minutes. Do stay with us. Three picks from john embryo.

>> Our final segment, john you've got three picks, we're going start with triaorg exploration, can you give us an idea of your cost base situation it had nothing other than to speak of around its red lake project it didn't have any money, then they've been involved with an australian operation. An australian operation is a huge polymetallic ore body, it's been mine in the past called the woodlawn district about 200 kilometers west of sydney. And they own 54% of the australian company. Which they'll also call triorigin. And it's trading at a price which gives $1.50 of equivalent value to the canadian company. So you're buying the australian entity at a discount of about a third. But just as importantly they've just raised money, which i gave them to drill their red lake property, which is arguably the largest unexplored part of that red lake green stone belt up there. So it's a really interesting drilling pay, with a good value base in the australian polymetallic exposure. I think the stock is, it's one of these stocks, nobody knows anything about, but it's really under valued.

>> Jim: Are you buying it currently?

>> John embry: No, i'm full up. Got well over 10%.

>> Next someone marathon, pgm.

>> Marathon's another one, my old friend, phil wallford has shown a lot of spunk aming back from that geomacmess and he's been involved with this. They put together a really large pgm copper ore body in ontario of all places. You don't see much pgm, platinum and palladium ore bodies in this part of the world. >> But they've got a very large, $68 million tons, which contain 7.75 million ounces of palladium's platinum and gold as well as a billion and a half pounds of copper. If you use copper as a buy project, you look like robust project. You get thin stock, 19 million shares now, and it doesn't trade much but the stock company's being valued at less than $80 million canadian and i think for the quality of the project they've got this stuff is not pie in the sky. It's there. I think the stock's again, try origin, some of these miss priced stock, it's very chep. >> Jim: 3.85. Where did you get in?

>> John embry: Probably $3.50.

>> Jim: And franconia mineral,.

>> John embry: Yeah, another huge polymetallic ore body in what i call the iron rainia minnesota. I used to play baseball. I have great memories of this place. I've seen a net asset value that's sort of calculating this thing that's about fine or six times what the stock's trading for. They're also drilling a bonanza copper play, i think they've got the base value and ore body body. I love ones that have solid value, you've got a real chance at homerun. Franconia, all three of those stocks have the same sort of characteristics. They're cheap. Then they have potential, exploration, for real exploration. >> 1.854. You got in there?

>> I got in originally around 70, 85 cents and I topped up again, i think it was a deal around 1.50.

>> We just got minute or so where are we in the overall scheme of things in terms of the market? You were at the vancouver show,.

>> John embry: It was crazy, seems out of keeping with the rest of of the space, very subdued yet this was a wonderful show joe bart ton put you on. He had 84 companies with booths and pre registrants and when i spoke the room was packed. I was astounded. >> A skeptic would say that's a sign the top.

>> John embry: Yeah but it's a one-off. I think it's a real small cawdry of people who are real believers and the vast majority don't know what we're talking about. I think there's a lot of people to be converted. I think we're very early in the second phase we've got many years to go and the price the end is going to surprise you.

>> Jim: We'll look forward to those conversations. Good to see you. John em brault, chief you vestment strategist sprottate asset management. Tomorrow on the show, chris rankin from canada accord

Part 1

Embry Text from Feb 8 not yet proofread or checked against the tape.

TV Channel 3 Thu Feb 08 09:30:34 2007

>> Jim: Welcome to "market call," thursday edition. I'm jim o'connell, our guest today is john embry from sprott asset management, here to answer your questions on precious metals for the next hour. John, we will come back. Good to see you. >> It's always nice to be here, jim.

>> What's your assessment of the way gold is performing right now.

>> I think gold is doing magnificent job in the face of considerable skepticism it's just pounding higher, and it's being driven, physical demand for all corners of the globe. It's coming from three source, the mines, scrap, and the central banks. The key is how account central banks being -- feeding gold in the market. When that stop, it's going go a lot higher than it is noW. >> Jim: How much higher?

>> I think--I'll give you 7:75 this year. Some people think of the all time high, i think now, the way things have been shaping up in the U.S., And sort of the global currency creation that's going on, i see thousands, easy now, and then beyond that we'll discuss what when it gets there.

>> Jim: So 1,000 sfleez and how many of is it is a U.S. Dollar story now.

>> A significant proportion is the U.S. Dollar but it's also what the U.S. Dollar is doing other countries who do not want the U.S. Dollar to fall so they're creating all sorts of their own money to cope buying the U.S. Dollar and keep this whole charade going and gold marking time, but it's showing -- I think, showing good vengE. >> You say you called it a charade. You think that the fed is deliberately covering data.

>> Oh, for sure. I mean, I think you -- I mean, i disbe half of what I hear from a country out of washington these days with respect to economic numbers and inflation numbers and everything. I think the situation is infinitely worse. Everything keeps talking about the bottoming and the housing market. It looks like a freefall and we're still in the middle of it. Stay tuned it's going to be an interesting year. >> So you think it's going to be sugar coated by the fed?

>> Absolutely.

>> Jim: You see a recession.

>> I think we could definitely have a recession at some point. This talk of higher rates to me seems absurd, really. Because the consumers almost -- you know, almost die doing now. Given you see the number of bankruptcies and housing foreclosures and whatever you. I mean, the savings rates, -1°%, this is remarkable. So yeah, i think it's going to be -- it's going to be an interesting year. >> It's just question before interest rates start to come down.

>> I still think that the next move and any significance in -- significance in interest rates could be down, down sharply but they got to be careful because they're still trying to jug dell with the economy and the U.S. Dollar. One's going to take it in the ear and I think they'd prefer it to be it the U.S. Dollar in the end rather than the economy.

>> We'll take some calls in just a moment. I don't know with us for the hour talking precious metals and here's our phone numbers if you'd like to give us a call. Be right back. >> Jim: Let's take some calls. Rank in mississauga. Hello, frank.

>> God afternoon, jim and john. John, orvana's trading at four times earnings and assuming a higher gold price eventually bringing the upper mineralized zon in production, which adds the years of life to the mine, it seems this stock is foolishly low even taking into account the bolivia factor. Would you agree? Would you be buying here?

>> I would definitely be buoying here the bolivia factor is over done. I do not think he will nationallize this mine. He was chatting to an analyst list friends of mine this morning and he calculates the company will have enough cash in the treasury by the end of september to justify its current stock price. It's yen rating cash so quickly. And you've got the upper mineralized zone, which is on a net asset value's probably worth what the stock's worth and you've got the ongoing production from the current mine. The stock is extraordinarily cheap but it lacks sponsorship because of the ball livian issue.

>> You own a big chunk of that?

>> Yeah, i own 10%.

>> Jim, jim in ottawa. Hello jim. Hello jim.

>> My question's on malchia resource, i see they've assembled a great package of claims for a junior. A joint claim in the otish mountain. There is also claims from west timmins, as well as property partners with ex trat that and gave have a, that has a nickel deposit, canadian royalties, and i was curious to have your opinion on this company considering your package of properties? >> John embry: Well i own this company. I actually purchased it in a tax shelter and so I mean, i clearly have a buy view since I'm long, but i think scrmd ens hansen has done a significant job putting together that package of properties you just am lewded to. Anyone the three, i preferred now, the urineium play, it's such a great partner with santoy but the knuckle play in ungava is interesting and for a penny stock this is a real good one.

>> Jim: Uranium, you guys at sprott still as bullish as ever?

>> Yup, without question. >> Oak, had $80 bucks today.

>> John embry: Apparently. Where's it going?

>> Well, everybody seems to think 100s on the way up. I hear robert friedlan say 200 away. The interesting thing about uranium is nobody cares about the price, really. As it applies to the cost of producing power because the real cost is in building the generator. So you can take a lot higher price. So many things the higher price destroys demand. In the case of uranium, that's not the case. So the price pretty well can go anywhere, depending on supply and demand condition. >> Okay, we have an e-mail from john in new westminster. Maxi gold. Mxd. Currently old it, last year the stock traded at over $2, now it's trading at 83 cents, can you tell me whether I should be buying or selling at this point.

>> You most certainly shouldn't be selling. The fact is, maxie's a good representative of what's been going on in the junior gold space. Ones with excellent promotion have done spectacularly well. Ones that may have good projects but are poorly promoted are just wasting away. Maxie falls into that category. They have a very interesting project property over in china. And there's not a lot-shares out standing. The current price, the stock is extraordinarily cheap. But you know, we await further developments, we've got to see more money coming back into the junior gold space. >> And you have a fair chunk niz do, yes.

>> All right, valley's in saskatoon. Hello, valley.

>> Oh, hi mr. Embry. I have a company that i bought shares in called buffalo gold and i bought that in the $2 range and I'd like to know with your expertise what you think of it?

>> Well I actually am long buffalo gold, too, and I have been for a while. It has an interesting promoter named damian reynolds who tends to get a little care rode away at times but i think this is really a good project and it's in a rather gamey part of the world over in papua new guinea, but nevertheless it's in a particularly good area. The drilling results to date have been very promising, I think the stock again, it's another one of those stocks that's for whatever reason it's falling out of favour, I've been buying at at these current prices. >> What parts the world do you stay out of?

>> I'm not comfortable in russia these days. I just do not like sort of what's going on there from rule of law point of view, and these guys seizing assets and what have you. I'm obviously out of venezuela. I don't understand why crystalex trades where it is, what chavez has been doing in that country. Bolivia, despite the fact that i own -- orvana makes me uncomfortable because moral lease is a similar nutcase to chavez, so consequently you got to be careful. The geopolitical risks are going up. >> Okay, we have an e-mail from gord on queen's stake and ygc resources what's your opinion on the recent merger between queen sake

>> John embry: Well the way the stock's trading I would say no the proprietior assures me he's done his due diligence. I reserve judgment. I -- this has been a very disappointing stock for me, and it stemmed from the fact that they couldn't operate that mine successfully. It is a great land package. And what they're going to do, as I understand the merge companies, is there's going to be big money raise. They're going basically phase the mine out, and they're going to do a major league exploration job on the jarrett canyon property which is a large property in nevada. That -- I mean, i would keep the stock if by owned it. I'd rather wait rather than buy it here but i think that ultimately the exploration, which is the best part of the thing, is going to come to the fore. Everybody's been concentrating on this failed mining effort. >> John will be back in just a moment to continue our chat on precious metals, like to ask you about silver in a moment. We'll take a look at your precious metals funds at sprott. More questions ahead. We'll beite back.

>> Closed captioning of this program is brought to you in part by report on business television.

>> We're back with john embry, the price of gold today. Futures, showing at 664 spot is what, just under what?

>> John embry: 6.50.

>> Jim: You watch the short positions what's that telling you?

>> The commitment of trader's report is cause for worry in the very short term. The commercials, the bouillon banks, the guys who are involved in sort of playing around with the market are extremely short here compared to the speculators, the long speculators, the tech fronts, so to speak. The black box guys who are long. Traditionally, they put enough pressure in the market with these speculators are long, and they break them and they sort of clean them out and they cover their shorts. Now one day this is going to fail. There's going to be a spectacular commercial failure and that's when gold price going to go nuts but I mean, i can't tell you it's going to be this time. Conceivably they're in a position to go down here. We're at a real key quebec cal level at 650 it clears 658 with gusto, I think 700s a lay-up very quickly. This is why we're having this battle right here and it is a battle at this level.

>> So that's the market you're watching? $6.58, spot gold. Darren's on the line in rena nevada hello, darren.

>> Hi jim. Jim, you do a great job every show. John, I just wanted to ask you about sole lex resources and I was just wondering if you could talk a little bit about how you value a company like this. Thanks very much. >> This is the uranium play.

>> Yes, it is. Uranium, zinc, lead, nickel, and silver. And this is one operating in peru.

>> There's so many names.

>> South america. So they're partnered with frontier pacific.

>> SoX.

>> In southern peru and a really interesting uranium play, how you value these things, i don't know. I find frontier pacific more interesting, because they've got half the play and also a wonderful gold project. They're doing the actual exploration, they're very excited about the potential for uranium in southern peru. Initial shows are very terrific, so i mean, i clearly stick with it. >> And kevin's in calgary. Hello, kevin.

>> Hi, how are you doing. I love your show. I just wanted to get mr. Embry's comments on silver and gold.

>> Arthur heinmaa: Currently have a position in silver. I want to take a position in gold and add to my silver, just wondering if I should wait for a pullback and if so, what kind of pullback are you expecting.

>> Well, my attitude here is i just was making the point. There's a possibility that the commercial's could push this thing down again here. I might not go all in, but if you haven't got any gold, i would certainly sort of buy right here, half of what you planned to buy. And then see, watch developments. If it breaks as I said clearly through 6.58 you better think about getting the rest of your money in, too. But you might get a pullback here, I'm sort of agnostic on that. >> Jim: Right. If there is a pull back.

>> John embry: Well the pullback will be schallly in my opinion and there's just too much physical demand. What happens when they push these things down with the paper toys, they just amplifies the physical demand. They're getting short. I mean, you can see, they trotted out the old imf red herrings. You know they're in trouble when that comes out. It comes out constantly when the gold prices rise. The central sbangs banks are getting short. Being see that, but it might be sold under the second wash ton agreement. They're not getting anywhere close their border. >> Jim: Let's take a peak at your fun at sprott. The golden precious minerals funds up a little bit. Fairly flat. One year return, 30%. 30.5%. Five years you've been grinding out, $36%. How are the juniors behaving right now? They're a little flat, aren't they?

>> With to put it mildly, flat is, we'd be putting it kindly. Right now there seems to be a buyers strike and a lot of juniors, there are some that are well prom promoted that are doing very well but there's a lot of companies with good projects, that can barely catch a bid and kind of sinking under their own weight. I think, given my view on the gold price, this is a wonderful time to be buying. This is sort of a gift, because if when the gold price really gets in motion here, some of these stocks are going fly and it's tougher to buy them in my opinion. I like buying things when they're cheap. So that's cheap bull stocks. >> So this is a buying opportunity right now. Let's go to jack in oakville. Hello, jack. Hi jim and john. Just calling about gold eagle, just wondering if you're still optimistic on it. Thanks.

>> Yeah, I own gold eagle. It's an interesting play. Like if you believe the optimists, there's a lot of high grade ounces up there at red lake. On their property. The problem is that it's deep. It's very deep. I'm still going with the optimists. It's a god looking situation, but you got to remember this stock's come were about 40 cents and it's trading over $8 bucks now. And they've also merged. They've merged with a lot more shares. And it's a good situation but it's no longer risk free. It's not something i would be running out to buy, necessarily, because it's come a long way. I'd rather look for the next 40 cent stock, it's going $8. >> You short stocks from time to time.

>> From time to time, like I'm not -- i've got a hedge -- off-shore hedge fund, but I'm not short anything right here. I think it's too explosive, bad stuff, good stuff. Everything will go, if the gold price does what I think it's going to do.

>> So you fully invested long.

>> I fully invested long.

>> Jim: Jane? Vancouver.

>> Caller: God mog, guys, I have a question about tetaliriak minerals, they were going to spin off copper to sharehold hes but in general, can you tell me whatever you know about this company? I've held it for years, it was sort of inhairt. I'd love hear your stuff, thanks. >> John embry: Well, it's interesting.

One flies under the radar, I've met with unof their representatives who's extraordinarily optimistic on this they're planning to spend the copper off. I'm not sure what their delay's about and they've got an interesting gold company, and there's still not enough ounces on it, but it's showing well and I would be inclined to stick with it. It's got very good sponsorship and I think it's fairly tightly held, it's got panamanian sponsorship, that's where the ore bodies are. So yeah, I would stick with it. >> We have a question from a viewer in prussels bellium.

Intrepid's been another one of the banes in my existence. Just had a terrible I'M. It looked fantastic. The great exploration play, resource down in argentina. Then they acquired a producing mine in australia. To make it worse, they've had a hedge on the hinge, which so -- they're consuming cash, and small companies that consume cash have a problem, so the stock has really been punished but i think now in the 50s, mid-50s I think the stock's reefd level, where i think they will you are vaive, obviously. It's been a real ugly trip. >> John, we'll be back in a moment, looking back to past picks and more of your calls on precious metals

>> Jim: Welcome back to "market call". Our guest today is john embry, and we've got paul in richmond hill. Hello paul.

>> Hi. Hi gentlemen, how are you. Great show.

>> Questions on african gold group. I bought a little bit of this, and around the $1.80 mark. They keep coming out with some news. Seems to be flat here. Tell me what I can do, buy, sell, hold, buy more? >> John embry: Well, i own over 10% of african gold. I really like the guy running at greg hawkins they're operating over in kenya or in ghana and maury. They're most promising project right now is in maui. The market, it's just indicative of the market. A the hoff these smaller stocks just can't catch any interest. I think it's an extraordinarily cheap stock. There's in the a lot of stock out there and considering what they've got in both of those country, their land package, I think, I think the stock looks terrific here. >> Okay, it's $1.90. How long have you owned it?

>> I've had it, I've been in it sort of for a couple of years anyway. I like the situation.

>> Daniel in montreal. Hello daniel?

>> Yes, hello. Great show, jim. Mr. Embry, i like your view on qgx and its future and do you still own it? Thank you.

>> Thank you.

>> Yeah, we have a large position. I own, i think 10% the company in one of my funds. I think this is one of the cheaper stocks on the board. It's totally misunderstood. It's in mongollia, which is viewed as a lot -- called by a hot of people. You can do business in mongollia. Robert friedland proved that by selling part of his country to rio tint tow. I think there will be some sort of a transaction on the coal project which will validate the under valuation of this company at this time. It's a give away at $1.70. John is in toronto. Hello, john. John's gone. He's going to ask about bofield. Bfd. What do you think of it.

>> I think it's ian hansen's other vehicle. They were talking brofly about melchior earlier. Beaufield's got a good package where the virginiaor body was sold to gold corp., As well as they're operate two or other exploration bands, but the key, why you buy this is for the properties. Stock had a huge run from 20 cents to 85 cents or something and it's pulled back sharply to 36 cents. It's very cheap again as a good speculation in this part of the world. >> Okay, your picks, john, from november 30th, southwestern resources was trading at 8:47. I've got it at 7:65 which is up a little more than 10%. You still have the same position?

>> I got more.

>> Do you?

>> Buy more. I think this is conceived with the most misunderstood stock in the plant. Everybody fussing about you know, the on yous in china, you know, the economic, the other economic -- at least five million there. But this is more than just one property this is one of the great generators of mining projects around. Like I mean, their land package in peru, we've got a 50/50 joint vent tour, hugely in concession with numont but another one with anglo and copper project and they've got zillions of projects in china and peru. Two countries they're sort of emphasizing and I think the stock at 7:65 is right on the floor if this stock doesn't get taken out sometime. >> 6%, are you still in the money.

>>> John: Yeah, I'm still in the money. The stock just seems to have a little on it.

>> Jim: So you're still calling it a buyer?

>> John embry: Oh absolutely.

>> Jean-francois tardiff: West dome, 2.28. They're down it 1.99.

>> Well, i recommended it, it wasn't 2.28. That was day after the day ran up in the recommendation.

>> Basically this one has two operating mines. Small operating mines, these are both good mines are going to be a premium value when the gold price goes up sharply, which it's going to do and i just think west dem's one of these little keepers that will be sort of dull dull dull, the gold price goes up everybody wants to own, but right now it's a struggle. >> Jim: All right, third choice. Venture? Looks like it's no change. $2.80 to $2.85 today, up a little bit.

>> Genco's a great silver play in mexico. The guy that was really involved with the discovery gammon lake is behind this and he said me at one occasion this is the best project he's ever worked on.

>> He worked on the gama lake project, not a lot of stock, so i like the stock very much.

>> We'll pause very briefly, and come back with the second half of our show. John embry, chief investment strategist with sprott asset management. We're talking precious metal, we'll take into silver and some of the other metals in just a moment. If you'd like to give us a call. We have another half hour ahead of us. >> You are watching report on business television.

Part 2

Embry Text from Feb 8 not yet proofread or checked against the tape.

Welcome back, this is "market call," john embry is our guest. Precious metals, john's top picks.

>> John embry: My opinion is 1500 companies are massacre raiding with some form of metals company. Just paper, paper prom promotions.

>> Jim: Have you had a guess --

>> John embry: A the lot of them don't trade much someone stuffs a project and off they go. At least i think i try to emphasize companies where there's really mining people really looking for something and with a decent chance ever finding something, because a, they're good and b they've got interesting projects. >> And your strategy, you own what? At any given time $100?

>> I try to keep it to $70 and my off-shore hedge, I at the to keep it to, we use more small stocks in there. I use maybe 50, maX. 40, 50.

>> Right. And you're going, you're going for the torque in buying these small companies.

>> Well, yeah. My view is that, you know, people can go and buy the large companies on their own. I find them fully priced relative to the whole list, but they'll go up with the gold price, make no mistake, but I just think that a lot of the smaller companies that are under appreciated and under owned today, if the gold price really catches fire and money floods into the space, they got to make up the under evaluation before they move on. But I think again, you got to be careful, you got of it a diversified list. It's tough rifle shooting these things. Some of them don't work. Queen's stake, a classic case, we got them all, it's turned out to be a disaster. >> Right, how many don't work? How many do you have to toss out?

>> Depends when you say work, I mean the vast majority of them don't work as mines.

>> But as perception taking the stock a lot higher I mean, i would say maybe 70, maybe a batting average, 70% winners, there are significant winners, i think that's peretto good, you've got a great rate of return.

>> You buy big chunks of the companies, you've said 10%.

>> But you got to buy them at the right time. They can't be over priced. You got to buy them right and if you're right, they work out and liquidity comes in and you can sell if you want. So -- but i wouldn't recommend, sort of people go out there and just sort of start buying big chunks of companies, because i think they're interesting and you better have a pretty good feel for like why you're buying it and where it is in its potential price group. >> That's what you do own that's my job.

>> Ruben in montreal with a question. Hello, ruben.

>> John, my question is this. I'm sure you probably are aware, panther recently released news and the news was that they pretty much didn't hit their targets that they had.

>> Being kind.

>> Caller: Yeah, on the two mines they tried to put back into production here. And my question basically is with this news out now and the numbers as they are what do you think of the situation going forward? >> I have great confidence in bob archer and his team, so they, like so many peep made the mistake of over promising and under delivering and the problem is mining's a tough business and so many mines have real start-up problems. You know if they're restarting, this is what I believe great panther's going through. Whether they meet their most optimistic forecasts from before, I'm not sure. But I like silver sufficiently and i think these are god projects, I would stick with the stock. Those were pretty grim number, i must confess. >> What are the prospects from silver, compared to gold?

>> Well I think silver, silver's poor man's gold and there's great debate over whether silver's an industrial metal or a monetary level like gold. And I think it will most assuredly step forward as a monetary metal before this is over. And because it's the uses for silver are proliferating, particularly in the medical fields and treating this. It's really a great, you know, commodity in that sense. If you get a combination of investment deman, because it's seen as a monetary metal, plus it's natural demand, i think the thing does actually better than gold. At least initially. I suspect I can see silver going from say currently 1350 roughly to 30 more easily than I can see gold going up by that percentage. In the short run. I me, I have no problems seeing silver at $30. Gold, it's going take a while to get to say $1500.

>> Where do you think it's going there.

>> Well, it's probably going -- gold and ser silver, they're not going anywhere. The fact the value, paper money's going down.

>> Jim: We'll be back in just moment john embry our guest, we'll take more of your calls right after this break.

>> Let's go to terry in vancouver.

>> Hi gentlemen, great show as usual. My question today is on gold ore resources. I'm wondering if i should continue to hang onto them. Thank you john, I'll hang up now. I'm not long this stock. I kind of regret it. It used to be long years ago, but it didn't really go anywhere for a long time and they didn't seem to have a project. Now they've got an interesting project over in sweden. As I said, i like god people with gold on that basis. I would certainly keep holding it all right hans welcome to the show. >> I see this morning, sprott is buying a lot of glen keR. On the market, and I've been holding it for the next year and i would like hold it for the nextier or so.

>> We have a large position but to my mine we are not buying any right now. They have two producing mines, one's in costa rica, the other's nicaragua.

>> Going forward, our producing mines because there's a huge shortage of personnel these days. And consequently it's going to be quite difficult to send some of these new mines and it's going to be way more costly than anybody thinks. People are getting quotes six months later and they're up 30 or 40% so I'm partial to any money producing, that's of legitimate mind. I think the stock on that basis, it's interesting, at its current price, it's been pretty pounded down over the lastier or two. >> Just to claire you identify, there's sprott assets and sprott security securities.

>> Two totally separate entity. I think sproth will be changing their names which will make things much better. There's enormous confusion. Eric sprott founded both of them but he disposed of his interest in sprott securities before I got to, it's going to be come up in for you years. So there's no relationship what over, other than we know them well, we respect them, but there's no financial involvement what over. >> You guys are sprott asset management. Peter's in toronto. Hello, peter.

>> Good afternoon, gentlemen, john, I'd like your opinion on eldorado gold. I had it about $5.75, it's resistance around seven. Just wondering your opinion with the turkey mines, there's risk involved, and be i enter it now or hold it and should i buying is else, liken ross, for example? Thank you.

>> I would most assuredly buy eldorado before I would buy kinross. I like eldorado. I don't own it currently. We owned it early on. We did very well in he will-rad dough. I have nothing but the highest admiration for the guy that runs it all right. I mean what he did with that company when it was really strugglingiers ago and looked like it was going bankrupt, it was nothing short of amazing, and he's done a fantastic job building his bock of assets and I don't have any problems with the turkish mines. I me, the ki shmd hleday is now up and running look like they're getting a lot of kings out of it. The ekanc humd rumd -- i can't even pronounce the other underground one they're working on, but it looks like a very prom missing situation. And they've goters, near china, they're one of the sort of early adopters there. They got into a great project that I own a lot of, they bought it. I was actually disappointed i got it for an extremely good price. I like he will-rad dome this sun before the big cap seen years, this is one of the god ones.

>> And francis is bradford.

>> Hello, I'd like mr. Embry's opinion on cumberland resources. I bought it around $4 and I'd like know if i should continue to hold or sell it and take my profrts and does mR. Em brault own it? I'll hang up and listen. Thank you. >> No unfortunately, i don't own it. This is one that I sort of regret missing, although I think at these prices I'm a little more sort of restrained. I think one thing people might be missing is that i think building mines up in the northern climbs of canada is going to turn out to be an extraordinarily costly process. They're going to be underestimating some of the, you know, costs in getting this thing into production, ultimately. It's been a great stock. But i think in my mind it's probably better, opportunities on the risk reward basis. >> You don't chase ones that get away?

>> No. I mean, as they say, i mean, there's always another bus coming along. I mean, i never sort of -- I'm not a momentum player. I like to buy stuff when it looks interesting and cheap to me.

>> One more call before the break and that is tim in thorold. Tim?

>> Good afternoon, gentlemen, great show.

>> I'd just like to ask a question about norwich gate resources. Your opinion on. Does it look like we have tackout at this point? And also any information in regard to the nevada properties? Cortez trends what do you think is happening out there. I'll listen for your comments. Thank you very much. >> I'm not a great fan of north gate. I mean, the people that run it have done a great job and I have nothing but compliments for what they've done. They've done it really well. They've dealt with a pretty difficult mine, but on the other hand they've benefited hugely from copper, which I think is coming back to earth. I'm not really keen on sort of companies with a lot of confidence right here. I'd much rather be in more pure gold plays, unless it was an extremely cheap stock. So consequently north gate's not one of my favourite, I think you can do better. >> When we come back, i want to ask you about holding physical gold. Buying coins and bricks and that type of it thing right after this stay with us.

>> Closed captioning of this program is brought to you in part by report on business television.

>> Jim: We're back with john embry. You hold physical gold, you buy it?

>> We do, yes we do.

>> So what's the best way to do that. I know you can hold it in your rrsp. You buy coins, bricks?

>> Well, it depends on your preference. I like coins because i like looking at them, but I mean, you buy a brick of told, it's nice, it's shiny but it's not as interesting as coins. Coins also carry a big premium, because people desire them more, and you sort of limit production and what have yoU. But my recommendation would be -- I think anybody that's interested in the gold space, the safest way to be in it is in bouillon or coins. I mean, there's risk in every mining venture, because joe yo political risks, mining failure, there's sicilian risk but there's also greater torque but I think as the core of your gold position, you should own some physical gold, and if you do, you might be able to do it through central gold trusts that I'm sort of a co-chairman of. That's a nice way to hold gold. You don't have to worry about storing because there's always the issue of where you're going to keep the stuff so your safety deposit box, keep it at home.

>> Bury it in the backyard.

>> You can do that. But consequently, i strongly recommend, if you're going to be in the gold space, you have some physical.

>> The men's coming out with a -- the mint's come out a new coin. >> I read that yesterday. They're contemplating putting out a $1 million gold coin which is going to the size of a pizza.

>> You should put one of those on the wall. How are you doing guys. My questions there to the east is about ten gold corporation here in manitoba.

>> I come from manitoba as you may know, and i am familiar with this mine. This is the mine up at bissett, and it's failed under everybody else's sponsorship.

>> I basically skeptical that i wouldn't own it personally, but a lot of people seem to like it. My experience sort of in the past, this going to be a struggle but time will tell. >> Spam on the line in st. Drath catharines go ahead.

>> Good afternoon, gentlemen. Love your show. I'd just like to ask john if knows anything of what a goldmining company in nevada calls starcor, sam on a venture exchange.

>> No. I thought this was the one that just -- starcor was the one that just took over in mexico.

>> This says starcore, trading at the 96 cents. That's the one you follow?

>> That's the one, yeah. But it just bought the lewis mine in mexico from, it used to be a gold corp. Asset. >> Market cap, $15 million?

>> Yeah. It's going to be a bigger market cap than that now.

>> I know we're done with the same stock, but will is a star spmd cor out there that's got a really interesting.

>> Up 1500 companies.

>> We've got gary in oak industrial, hello, gary.

>> Hi guy, good afternoon. I'm interested in echelon resources. They've had a good run of late. Just wondering if we could expand on so drilling results, they've been getting lately. >> Well, this is exelon which has had a nice move. It's a silver play in mexico. They're looking for monsterous mantos. They've got a really interesting theory on geology down there and they've got a smallist anding operation, but you own this stock because the potential of discoveries. We like the company very much. Good management.

>> And shannon's in dawson creek. Hello, shannon.