Ausbruchstrade! COMMERCE RESOURCES CORP. (Seite 1094)

eröffnet am 18.01.07 19:42:57 von

neuester Beitrag 02.05.24 09:07:43 von

neuester Beitrag 02.05.24 09:07:43 von

Beiträge: 70.220

ID: 1.106.039

ID: 1.106.039

Aufrufe heute: 5

Gesamt: 6.585.314

Gesamt: 6.585.314

Aktive User: 0

ISIN: CA2006977045 · WKN: A2PQKV

0,0870

EUR

0,00 %

0,0000 EUR

Letzter Kurs 23:00:09 Lang & Schwarz

Neuigkeiten

12.04.24 · IRW Press |

11.04.24 · Accesswire |

04.03.24 · IRW Press |

04.03.24 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7875 | +17,54 | |

| 0,8000 | +11,11 | |

| 0,6300 | +8,62 | |

| 35,60 | +8,50 | |

| 5,1400 | +8,44 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5850 | -8,24 | |

| 0,6000 | -18,37 | |

| 0,6601 | -26,22 | |

| 1,1600 | -46,79 | |

| 46,67 | -97,98 |

Beitrag zu dieser Diskussion schreiben

Gelesen auf: OnVista

Original-Research: Commerce Resources Corp. (von Rockstone Research Ltd.): Ka...

03.07., 07:32 dpa-AFX

Original-Research: Commerce Resources Corp. - von Rockstone Research Ltd.

Einstufung von Rockstone Research Ltd. zu Commerce Resources Corp.

Unternehmen: Commerce Resources Corp.ISIN: CA2006971006

Anlass der Studie: Update #5 Empfehlung: Kaufen Letzte Ratingänderung: - Analyst: Stephan Bogner (Dipl. Kfm., FH)

Rockstone Research Ltd. berichtete schon öfters über das auf seltene Metalle spezialisierte Entwicklungsunternehmen Commerce Resources Corp. (WKN: A0J2Q3) und schilderten in mehreren Analysen, weshalb diese Aktie das Potential hat, zum Branchenprimus der Seltenen Erden aufzusteigen und andere Entwicklungsprojekte Schwierigkeiten haben.

Und tatsächlich stieg die Aktie seit Ende Dezember um mehr als 315% an, während praktisch der gesamte Seltene Erden Sektor stark an Boden verlor: Molycorp hat in gleicher Zeit mehr als 50% an Wert verloren, Lynas -45%,Quest Rare Metals -48% oder Avalon Rare Metals -23%.

Doch jetzt soll es erst richtig interessant werden, denn wie zu vernehmen ist könnte sich nun ein milliardenschweres Joint-Venture abzeichnen. Im Gegensatz zu Unternehmen wie Avalon strebt Commerce keinen Abnahmevertrag an, sondern eine direkte Beteiligung bzw. einen strategischen Partner, der den kostspieligen Minenbau stemmt.

Gestern veröffentlichte Commerce nach Börsenschluss eine Pressemitteilung mit Ergebnissen des letzten Bohrprogramms. Die Ergebnisse haben nicht nur Minenanalyst Stephan Bogner von Rockstone überrascht, sondern auch das gesamte Management. Daraufhin veröffentlichte Rockstone heute ein Research-Update zu Commerce Resources, in dem auch der Projekt-Geologe von Dahrouge Geological Consulting, Herr Darren Smith, in einem Interview zu Wort kommt und erklärt, weshalb die Ergebnisse für Aufsehen sorgen könnten: Die Ashram-Lagerstätte ist viel grösser und hochgradiger mit seltenen Metallen angereichert als bisher angenommen.

Nach Meinung von Rockstone dürfte es nun noch einfacher sein, die seit Monaten laufenden Verhandlungen mit möglichen Joint-Venture Partnern zu einem Abschluss zu bringen. Rockstone spekuliert in seiner neuesten Analyse auf die baldige Bekanntgabe einer strategischen Beteiligung mit einem Endabnehmer oder einer Raffinerie.

Im Falle der Bekanntmachung einer strategischen Partnerschaft mit einem namhaften Unternehmen rechnet Rockstone mit einer starken Aktienkursaufwertung von mehreren hundert Prozent, da Commerce aktuell eine Marktkapitalisierung von lediglich 30 Mio. Euro besitzt. Eine Marktbewertung von mehreren hundert Mio. Euro sei schliesslich bei einem Milliardenprojekt keine Seltenheit, insbesondere wenn der Partner einen bekannten Namen hat.

Original-Research: Commerce Resources Corp. (von Rockstone Research Ltd.): Ka...

03.07., 07:32 dpa-AFX

Original-Research: Commerce Resources Corp. - von Rockstone Research Ltd.

Einstufung von Rockstone Research Ltd. zu Commerce Resources Corp.

Unternehmen: Commerce Resources Corp.ISIN: CA2006971006

Anlass der Studie: Update #5 Empfehlung: Kaufen Letzte Ratingänderung: - Analyst: Stephan Bogner (Dipl. Kfm., FH)

Rockstone Research Ltd. berichtete schon öfters über das auf seltene Metalle spezialisierte Entwicklungsunternehmen Commerce Resources Corp. (WKN: A0J2Q3) und schilderten in mehreren Analysen, weshalb diese Aktie das Potential hat, zum Branchenprimus der Seltenen Erden aufzusteigen und andere Entwicklungsprojekte Schwierigkeiten haben.

Und tatsächlich stieg die Aktie seit Ende Dezember um mehr als 315% an, während praktisch der gesamte Seltene Erden Sektor stark an Boden verlor: Molycorp hat in gleicher Zeit mehr als 50% an Wert verloren, Lynas -45%,Quest Rare Metals -48% oder Avalon Rare Metals -23%.

Doch jetzt soll es erst richtig interessant werden, denn wie zu vernehmen ist könnte sich nun ein milliardenschweres Joint-Venture abzeichnen. Im Gegensatz zu Unternehmen wie Avalon strebt Commerce keinen Abnahmevertrag an, sondern eine direkte Beteiligung bzw. einen strategischen Partner, der den kostspieligen Minenbau stemmt.

Gestern veröffentlichte Commerce nach Börsenschluss eine Pressemitteilung mit Ergebnissen des letzten Bohrprogramms. Die Ergebnisse haben nicht nur Minenanalyst Stephan Bogner von Rockstone überrascht, sondern auch das gesamte Management. Daraufhin veröffentlichte Rockstone heute ein Research-Update zu Commerce Resources, in dem auch der Projekt-Geologe von Dahrouge Geological Consulting, Herr Darren Smith, in einem Interview zu Wort kommt und erklärt, weshalb die Ergebnisse für Aufsehen sorgen könnten: Die Ashram-Lagerstätte ist viel grösser und hochgradiger mit seltenen Metallen angereichert als bisher angenommen.

Nach Meinung von Rockstone dürfte es nun noch einfacher sein, die seit Monaten laufenden Verhandlungen mit möglichen Joint-Venture Partnern zu einem Abschluss zu bringen. Rockstone spekuliert in seiner neuesten Analyse auf die baldige Bekanntgabe einer strategischen Beteiligung mit einem Endabnehmer oder einer Raffinerie.

Im Falle der Bekanntmachung einer strategischen Partnerschaft mit einem namhaften Unternehmen rechnet Rockstone mit einer starken Aktienkursaufwertung von mehreren hundert Prozent, da Commerce aktuell eine Marktkapitalisierung von lediglich 30 Mio. Euro besitzt. Eine Marktbewertung von mehreren hundert Mio. Euro sei schliesslich bei einem Milliardenprojekt keine Seltenheit, insbesondere wenn der Partner einen bekannten Namen hat.

Nach den 18% am Donnerstag gab es ja hier einen kleinen Rücksetzter.

Normalerweise haben wir hier eine gute Ausgangslage für weiter steigende Kurse. Wie schätzt ihr die Entwicklung kurzfristig ein ?

Normalerweise haben wir hier eine gute Ausgangslage für weiter steigende Kurse. Wie schätzt ihr die Entwicklung kurzfristig ein ?

Favourable mineralogy helps Commerce Resources move its Quebec rare earth project towards pre-feasibility

by Greg Klein

Next Page 1 | 2

On schedule and under budget, winter-spring drilling at Commerce Resources’ (TSXV:CCE) Ashram deposit in northern Quebec wrapped up last week, bringing one of the world’s largest rare earth projects closer to pre-feasibility. Ashram advances at a time when China’s “costs of producing ‘cheap’ rare earths are becoming increasingly unsustainable in terms of the environment, the availability of reserves, the health of its communities and the political ramifications,” according to a 28-page report by Secutor Capital Management. The study adds that China “is beginning to worry about its own domestic supply, as China is its own biggest customer.”

The Ashram deposit makes Commerce Resources “one of the most

advanced REE juniors in regards to metallurgy which, in the REE space,

is everything,” according to a report by Secutor Capital Management.

That puts an interesting perspective on Commerce, “one of the most advanced REE juniors in regards to metallurgy which, in the REE space, is everything,” Secutor analysts Arie Papernick and Lilliana Paoletti stated. “The Ashram project hosts a substantial resource with a well-balanced rare earth oxide (REO) distribution. The deposit is enriched in light and heavy rare earths, including all five of the critical elements. The mineralogy is simple due to the presence of the minerals monazite, bastnaesite and xenotime, which currently dominate commercial processing. Unlike many of its competitors, Commerce is able to produce a 43.6% total rare earth oxide (TREO) mineral concentrate due to the deposit’s simple mineralogy, allowing significant cost reductions.”

According to Ashram’s 2012 preliminary economic assessment, the extent of those critical elements—neodymium, europium, terbium, dysprosium and yttrium—is “unusual in carbonatite deposits and especially those of such tonnage and grade.”

That resource used a cutoff of 1.25% total rare earth oxide to estimate a measured and indicated 29.3 million tonnes averaging 1.9% TREO, and an inferred 219.8 million tonnes averaging 1.88% TREO.

As the Secutor report emphasized, “REE mineralization is virtually completely contained within the minerals monazite, bastnaesite and xenotime, allowing Commerce Resources to use standard processing techniques. In the REE industry, the ability to use conventional metallurgy and processing is rather unique. Only four REE-bearing minerals out of over 200 have ever supplied the market in a material fashion. These four minerals currently, and historically, dominate commercial REE processing and are host to the REEs at Ashram.”

The 43.6% TREO concentrate, at a recovery of 70.7%, comprises “one of the highest-grade REE mineral concentrates which we are aware of produced by a junior mining company globally.”

It’s considerably higher than that of Ashram’s 2012 PEA, which anticipated reaching a target of 20% TREO at a recovery of 60% to 70% “through an established and commercially proven technology.” Yet the PEA’s base case considered a concentrate grading 10% TREO at 70% recovery.

In the REE industry, the ability to use conventional metallurgy and processing is rather unique.

—Secutor Capital Management analysts Arie Papernick

and Lilliana Paoletti

The study used a 10% discount rate to project Ashram’s pre-tax, pre-finance net present value at $2.32 billion and a 44% internal rate of return. The capex, including contingency, came to $763 million with payback in 2.25 years. The PEA envisioned a 4,000-tonne-per-day open pit operating for 25 years—based on just 15% of the total resource.

And although rare earth prices have dropped since 2012, “the project remains robust,” Secutor maintains.

The higher-grade concentrate, with its capex and opex ramifications, is just one of the reasons analysts Papernick and Paoletti see a potentially more impressive pre-feas. Ashram’s infrastructure costs might benefit from proximity to the Lac Otelnuk iron project, 80 kilometres south. A joint venture of Adriana Resources TSXV:ADI and WISCO International Resources Development & Investment, it’s the “largest iron ore deposit in Canada with the potential of becoming one of the largest in the world,” according to Adriana. The project’s 2011 PEA calculated a $12.9-billion capex which included power and, via the link at Schefferville 165 kilometres southeast, railway to the deep sea port of Sept-Iles. Since then the Quebec government has indicated it will only permit a multi-user rail service.

Lac Otelnuk has full feasibility scheduled for completion by year-end.

Previous Page 1 | 2

Plan Nord might offer additional potential. Stalled for nearly two years by Quebec’s former Parti Quebecois government, the northern infrastructure program formed an important part of the new Liberal government’s election platform.

Another possibility not considered in the PEA was a potential byproduct in fluorite, which “comprises the tailings of the final REE mineral concentrate and therefore follows the exact same flow sheet, requiring no additional processing to produce,” the Secutor study noted.

Developments since Ashram’s 2012 PEA

suggest potential cuts to infrastructure costs.

While the PEA considered an on-site hydrometallurgical plant, “a recently completed trade-off study indicated that a location off-site will be more economic due to better access to skilled personnel and consumables,” Papernick and Paoletti stated. Commerce’s pre-feas will consider a more convenient location along the St. Lawrence seaway, they added.

The pre-feas will also evaluate a lower-cost road-building plan. “The optimized route is easier to build, reducing construction costs, and requires shorter water crossings,” the analysts stated.

Additionally, Commerce states that infill drilling since 2012 shows potential for a lower strip ratio than considered by the PEA. Nearly 2,700 metres were sunk this year and last, finding impressive grades and widths almost at surface. Some of the best results from 2013 showed:

1.94% TREO over 144.57 metres, starting at 7.98 metres in downhole depth

(including 2.15% over 61.4 metres)

(and including 1.62% over 20.55 metres)

2.28% over 57.36 metres, starting at 4.39 metres

2.06% over 92.3 metres, starting at 5.18 metres

1.86% over 153.63 metres, starting at 7 metres

(including 1.51% over 30.64 metres)

2% over 129.05 metres, starting at 4.15 metres

True widths weren’t provided. The results expanded the deposit to the northwest and showed surface mineralization within the pit, where waste rock had been modelled in the PEA, Commerce stated.

Assays are pending for the most recent program but the company said all nine holes found mineralization over their entire length, with each ending in mineralization below the base of the currently proposed pit. Initial interpretation of several holes strongly indicates they intersected the deposit’s MHREO (middle and heavy rare earth element oxide) zone over significant widths, Commerce added.

Although Ashram’s obviously the focal point of the company’s 19,006-hectare Eldor property, a boulder sampling program over the Miranna area last year found some of the world’s highest tantalum grades, Commerce reported. The assays surpassed those of mining operations where grades above 300 parts per million tantalum pentoxide (Ta2O5) are considered high. The samples also showed niobium pentoxide (Nb2O5) and phosphorus pentoxide (P2O5), as well as rare earths.

Starting at locations roughly 775 metres east of the Ashram pit, selected results showed:

1,220 ppm Ta2O5, 15,700 ppm Nb2O5, 10.6% P2O5 and 0.46% TREO

580 ppm Ta2O5, 6,160 ppm Nb2O5, 9.1% P2O5 and 0.4% TREO

790 ppm Ta2O5, 9,640 ppm Nb2O5, 9.9% P2O5 and 0.45% TREO

380 ppm Ta2O5, 19,390 ppm Nb2O5, 9.9% P2O5 and 0.4% TREO

But as Ashram progresses towards pre-feasibility, “its main focus will be to continue to advance the metallurgy and to secure a joint venture partner,” the Secutor analysts stated. “Commerce is almost at the stage where it can begin to focus on the hydrometallurgy and on the evaluation of end products.”

Commerce also holds the Blue River project in southeastern British Columbia. Its Upper Fir deposit reached PEA in 2011, which the company said made it “a potential large-scale, low-cost producer of conflict-free tantalum, as well as significant niobium.” A June 2013 resource update marked a 33% jump in the indicated and an 18% boost in the inferred categories. Metallurgical advances, meanwhile, continue the project’s progress.

Disclaimer: Commerce Resources Corp is a client of OnPage Media Corp, the publisher of ResourceClips.com. The principals of OnPage Media may hold shares in Commerce Resources.

Previous Page 1 | 2

Pages: 1 2

Related posts:

Commerce Resources closes $2.54-million placement for Ashram rare earth deposit

Commerce Resources drilling to upgrade Ashram resource

Financing the ‘weird stuff’

Inescapable but obscure

Tagged with:

Adriana Resources Inc (ADI) · b.c. · british columbia · china · Commerce Resources Corp (CCE) · dysprosium · europium · fluorite · iron ore · neodymium · niobium · quebec · rare earths · REE · tantalum · terbium · yttrium

Comments are closed.

This article was posted by Greg Klein - Resource Clips on Tuesday, May 20th, 2014 at 10:07 am.

http://resourceclips.com/2014/05/20/ashram-advances/2/

by Greg Klein

Next Page 1 | 2

On schedule and under budget, winter-spring drilling at Commerce Resources’ (TSXV:CCE) Ashram deposit in northern Quebec wrapped up last week, bringing one of the world’s largest rare earth projects closer to pre-feasibility. Ashram advances at a time when China’s “costs of producing ‘cheap’ rare earths are becoming increasingly unsustainable in terms of the environment, the availability of reserves, the health of its communities and the political ramifications,” according to a 28-page report by Secutor Capital Management. The study adds that China “is beginning to worry about its own domestic supply, as China is its own biggest customer.”

The Ashram deposit makes Commerce Resources “one of the most

advanced REE juniors in regards to metallurgy which, in the REE space,

is everything,” according to a report by Secutor Capital Management.

That puts an interesting perspective on Commerce, “one of the most advanced REE juniors in regards to metallurgy which, in the REE space, is everything,” Secutor analysts Arie Papernick and Lilliana Paoletti stated. “The Ashram project hosts a substantial resource with a well-balanced rare earth oxide (REO) distribution. The deposit is enriched in light and heavy rare earths, including all five of the critical elements. The mineralogy is simple due to the presence of the minerals monazite, bastnaesite and xenotime, which currently dominate commercial processing. Unlike many of its competitors, Commerce is able to produce a 43.6% total rare earth oxide (TREO) mineral concentrate due to the deposit’s simple mineralogy, allowing significant cost reductions.”

According to Ashram’s 2012 preliminary economic assessment, the extent of those critical elements—neodymium, europium, terbium, dysprosium and yttrium—is “unusual in carbonatite deposits and especially those of such tonnage and grade.”

That resource used a cutoff of 1.25% total rare earth oxide to estimate a measured and indicated 29.3 million tonnes averaging 1.9% TREO, and an inferred 219.8 million tonnes averaging 1.88% TREO.

As the Secutor report emphasized, “REE mineralization is virtually completely contained within the minerals monazite, bastnaesite and xenotime, allowing Commerce Resources to use standard processing techniques. In the REE industry, the ability to use conventional metallurgy and processing is rather unique. Only four REE-bearing minerals out of over 200 have ever supplied the market in a material fashion. These four minerals currently, and historically, dominate commercial REE processing and are host to the REEs at Ashram.”

The 43.6% TREO concentrate, at a recovery of 70.7%, comprises “one of the highest-grade REE mineral concentrates which we are aware of produced by a junior mining company globally.”

It’s considerably higher than that of Ashram’s 2012 PEA, which anticipated reaching a target of 20% TREO at a recovery of 60% to 70% “through an established and commercially proven technology.” Yet the PEA’s base case considered a concentrate grading 10% TREO at 70% recovery.

In the REE industry, the ability to use conventional metallurgy and processing is rather unique.

—Secutor Capital Management analysts Arie Papernick

and Lilliana Paoletti

The study used a 10% discount rate to project Ashram’s pre-tax, pre-finance net present value at $2.32 billion and a 44% internal rate of return. The capex, including contingency, came to $763 million with payback in 2.25 years. The PEA envisioned a 4,000-tonne-per-day open pit operating for 25 years—based on just 15% of the total resource.

And although rare earth prices have dropped since 2012, “the project remains robust,” Secutor maintains.

The higher-grade concentrate, with its capex and opex ramifications, is just one of the reasons analysts Papernick and Paoletti see a potentially more impressive pre-feas. Ashram’s infrastructure costs might benefit from proximity to the Lac Otelnuk iron project, 80 kilometres south. A joint venture of Adriana Resources TSXV:ADI and WISCO International Resources Development & Investment, it’s the “largest iron ore deposit in Canada with the potential of becoming one of the largest in the world,” according to Adriana. The project’s 2011 PEA calculated a $12.9-billion capex which included power and, via the link at Schefferville 165 kilometres southeast, railway to the deep sea port of Sept-Iles. Since then the Quebec government has indicated it will only permit a multi-user rail service.

Lac Otelnuk has full feasibility scheduled for completion by year-end.

Previous Page 1 | 2

Plan Nord might offer additional potential. Stalled for nearly two years by Quebec’s former Parti Quebecois government, the northern infrastructure program formed an important part of the new Liberal government’s election platform.

Another possibility not considered in the PEA was a potential byproduct in fluorite, which “comprises the tailings of the final REE mineral concentrate and therefore follows the exact same flow sheet, requiring no additional processing to produce,” the Secutor study noted.

Developments since Ashram’s 2012 PEA

suggest potential cuts to infrastructure costs.

While the PEA considered an on-site hydrometallurgical plant, “a recently completed trade-off study indicated that a location off-site will be more economic due to better access to skilled personnel and consumables,” Papernick and Paoletti stated. Commerce’s pre-feas will consider a more convenient location along the St. Lawrence seaway, they added.

The pre-feas will also evaluate a lower-cost road-building plan. “The optimized route is easier to build, reducing construction costs, and requires shorter water crossings,” the analysts stated.

Additionally, Commerce states that infill drilling since 2012 shows potential for a lower strip ratio than considered by the PEA. Nearly 2,700 metres were sunk this year and last, finding impressive grades and widths almost at surface. Some of the best results from 2013 showed:

1.94% TREO over 144.57 metres, starting at 7.98 metres in downhole depth

(including 2.15% over 61.4 metres)

(and including 1.62% over 20.55 metres)

2.28% over 57.36 metres, starting at 4.39 metres

2.06% over 92.3 metres, starting at 5.18 metres

1.86% over 153.63 metres, starting at 7 metres

(including 1.51% over 30.64 metres)

2% over 129.05 metres, starting at 4.15 metres

True widths weren’t provided. The results expanded the deposit to the northwest and showed surface mineralization within the pit, where waste rock had been modelled in the PEA, Commerce stated.

Assays are pending for the most recent program but the company said all nine holes found mineralization over their entire length, with each ending in mineralization below the base of the currently proposed pit. Initial interpretation of several holes strongly indicates they intersected the deposit’s MHREO (middle and heavy rare earth element oxide) zone over significant widths, Commerce added.

Although Ashram’s obviously the focal point of the company’s 19,006-hectare Eldor property, a boulder sampling program over the Miranna area last year found some of the world’s highest tantalum grades, Commerce reported. The assays surpassed those of mining operations where grades above 300 parts per million tantalum pentoxide (Ta2O5) are considered high. The samples also showed niobium pentoxide (Nb2O5) and phosphorus pentoxide (P2O5), as well as rare earths.

Starting at locations roughly 775 metres east of the Ashram pit, selected results showed:

1,220 ppm Ta2O5, 15,700 ppm Nb2O5, 10.6% P2O5 and 0.46% TREO

580 ppm Ta2O5, 6,160 ppm Nb2O5, 9.1% P2O5 and 0.4% TREO

790 ppm Ta2O5, 9,640 ppm Nb2O5, 9.9% P2O5 and 0.45% TREO

380 ppm Ta2O5, 19,390 ppm Nb2O5, 9.9% P2O5 and 0.4% TREO

But as Ashram progresses towards pre-feasibility, “its main focus will be to continue to advance the metallurgy and to secure a joint venture partner,” the Secutor analysts stated. “Commerce is almost at the stage where it can begin to focus on the hydrometallurgy and on the evaluation of end products.”

Commerce also holds the Blue River project in southeastern British Columbia. Its Upper Fir deposit reached PEA in 2011, which the company said made it “a potential large-scale, low-cost producer of conflict-free tantalum, as well as significant niobium.” A June 2013 resource update marked a 33% jump in the indicated and an 18% boost in the inferred categories. Metallurgical advances, meanwhile, continue the project’s progress.

Disclaimer: Commerce Resources Corp is a client of OnPage Media Corp, the publisher of ResourceClips.com. The principals of OnPage Media may hold shares in Commerce Resources.

Previous Page 1 | 2

Pages: 1 2

Related posts:

Commerce Resources closes $2.54-million placement for Ashram rare earth deposit

Commerce Resources drilling to upgrade Ashram resource

Financing the ‘weird stuff’

Inescapable but obscure

Tagged with:

Adriana Resources Inc (ADI) · b.c. · british columbia · china · Commerce Resources Corp (CCE) · dysprosium · europium · fluorite · iron ore · neodymium · niobium · quebec · rare earths · REE · tantalum · terbium · yttrium

Comments are closed.

This article was posted by Greg Klein - Resource Clips on Tuesday, May 20th, 2014 at 10:07 am.

http://resourceclips.com/2014/05/20/ashram-advances/2/

Infill helps fulfil Commerce Resources’ REE ambitions, suggests extension to Ashram deposit

by Greg Klein | July 2, 2014

Another winter program has brought Commerce Resources’ Ashram project closer to pre-feas.

Delineation drilling has not only boosted Commerce Resources’ (TSXV:CCE) confidence in its Ashram rare earths resource but found a possible extension at depth. On July 2 the company released assays from 12 winter holes totalling 1,557 metres on the northern Quebec project. Their focus was Ashram’s Middle and Heavy Rare Earth Oxide zone. Some highlights show:

Hole EC14-098

2.06% total rare earth oxides (TREO) over 189.24 metres, starting at 4.92 metres in downhole depth

(including 2.13% over 172.66 metres)

(which includes 2.32% over 96.66 metres)

The hole ended in 2.49% TREO mineralization.

Hole EC14-099

1.8% over 186.92 metres, starting at 5.1 metres

(including 2.01% over 81 metres)

The hole ended in 1.39% mineralization.

Hole EC14-101

1.97% over 162.47 metres, starting at 10.06 metres

(including 2.25% over 56.32 metres)

The hole ended in 2.6% TREO mineralization.

Some intercepts that suggest the MHREO zone extends at depth show:

Hole EC14-103

1.6% over 42.39 metres, starting at 105.61 metres

Hole EC14-100

1.47% over 48.87 metres, starting at 39.1 metres

True widths weren’t provided. Three of the 12 holes were sunk to determine the position of a dyke to drain a shallow pond covering most of the deposit.

Commerce president Dave Hodge stated that the deposit features relatively simple rare earth mineralogy amenable to over 40% TREO mineral concentrate grades at high recovery, making Ashram “clearly a standout in the REE space.”

Located in Quebec’s Labrador Trough, Ashram is part of the 19,000-hectare Eldor property which reached its preliminary economic assessment in 2012. The project now advances to pre-feasibility.

The company has also reached PEA at its Upper Fir tantalum-niobium deposit in southeastern British Columbia.

Read more about Commerce Resources’ Ashram deposit.

Read more about rare earths in Canada.

Disclaimer: Commerce Resources Corp is a client of OnPage Media Corp, the publisher of ResourceClips.com. The principals of OnPage Media may hold shares in Commerce Resources.

http://resourceclips.com/2014/07/02/infill-helps-fulfil-comm…

by Greg Klein | July 2, 2014

Another winter program has brought Commerce Resources’ Ashram project closer to pre-feas.

Delineation drilling has not only boosted Commerce Resources’ (TSXV:CCE) confidence in its Ashram rare earths resource but found a possible extension at depth. On July 2 the company released assays from 12 winter holes totalling 1,557 metres on the northern Quebec project. Their focus was Ashram’s Middle and Heavy Rare Earth Oxide zone. Some highlights show:

Hole EC14-098

2.06% total rare earth oxides (TREO) over 189.24 metres, starting at 4.92 metres in downhole depth

(including 2.13% over 172.66 metres)

(which includes 2.32% over 96.66 metres)

The hole ended in 2.49% TREO mineralization.

Hole EC14-099

1.8% over 186.92 metres, starting at 5.1 metres

(including 2.01% over 81 metres)

The hole ended in 1.39% mineralization.

Hole EC14-101

1.97% over 162.47 metres, starting at 10.06 metres

(including 2.25% over 56.32 metres)

The hole ended in 2.6% TREO mineralization.

Some intercepts that suggest the MHREO zone extends at depth show:

Hole EC14-103

1.6% over 42.39 metres, starting at 105.61 metres

Hole EC14-100

1.47% over 48.87 metres, starting at 39.1 metres

True widths weren’t provided. Three of the 12 holes were sunk to determine the position of a dyke to drain a shallow pond covering most of the deposit.

Commerce president Dave Hodge stated that the deposit features relatively simple rare earth mineralogy amenable to over 40% TREO mineral concentrate grades at high recovery, making Ashram “clearly a standout in the REE space.”

Located in Quebec’s Labrador Trough, Ashram is part of the 19,000-hectare Eldor property which reached its preliminary economic assessment in 2012. The project now advances to pre-feasibility.

The company has also reached PEA at its Upper Fir tantalum-niobium deposit in southeastern British Columbia.

Read more about Commerce Resources’ Ashram deposit.

Read more about rare earths in Canada.

Disclaimer: Commerce Resources Corp is a client of OnPage Media Corp, the publisher of ResourceClips.com. The principals of OnPage Media may hold shares in Commerce Resources.

http://resourceclips.com/2014/07/02/infill-helps-fulfil-comm…

Mmhhhh für mich siehts eher danach aus das es wieder abwärts geht

Bin wieder raus mit kleinen Mini gewinn.

Euch weiterhin noch viel Glück.

Bin wieder raus mit kleinen Mini gewinn.

Euch weiterhin noch viel Glück.

Mit dem überspringen der 0,32 CAD-Marke wurde ein großes Kaufsignal ausgelöst. Der Langfristige Abwärtstrend aus dem ATH seit dem Jahr 2007 wurde überschritten.

Sollte sich dies als Nachhaltig herrausstellen, dann wären, über längere Zeit, Kurse bei ca 1 CAD das Ziel....

Sollte sich dies als Nachhaltig herrausstellen, dann wären, über längere Zeit, Kurse bei ca 1 CAD das Ziel....

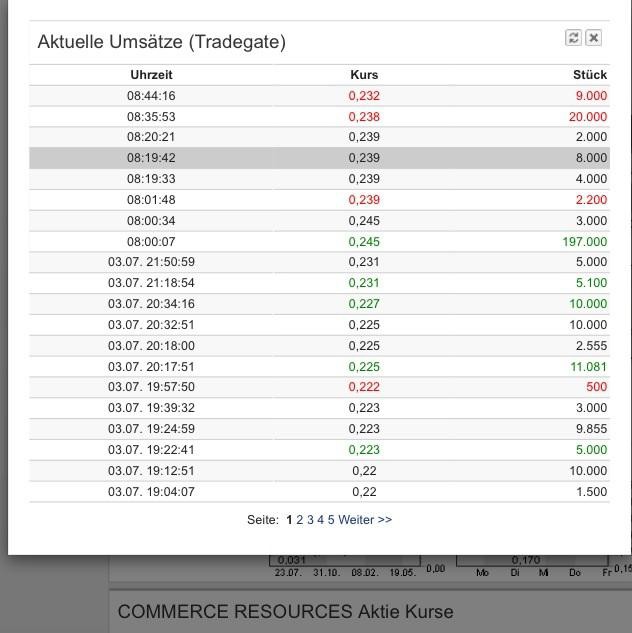

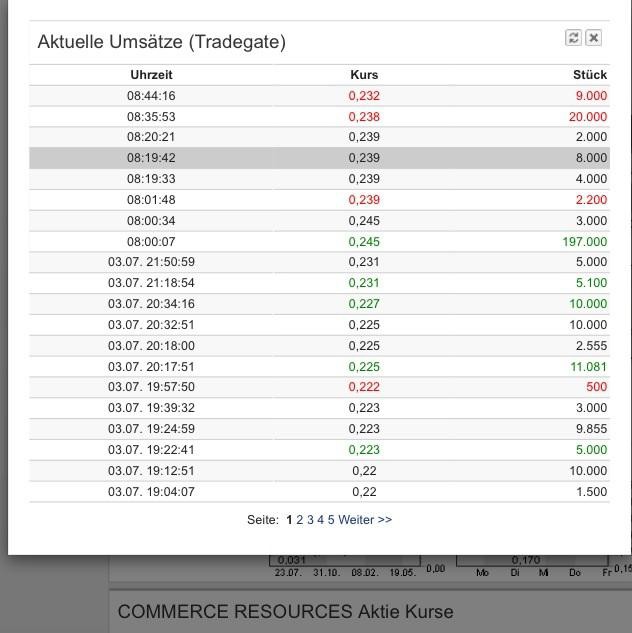

und da will einer noch mehr

255.000

0,233

255.000

0,233

Antwort auf Beitrag Nr.: 47.259.488 von ooy am 04.07.14 09:02:04

Antwort auf Beitrag Nr.: 47.259.462 von Edison09 am 04.07.14 08:58:33Wo denn? Sehe ich gar nicht...

12.04.24 · IRW Press · Commerce Resources |

04.03.24 · IRW Press · Commerce Resources |

01.03.24 · IRW Press · Commerce Resources |