Freeport-McMoRan -- one of the cheapest companies in North America (Seite 8)

eröffnet am 29.05.07 06:45:54 von

neuester Beitrag 30.03.24 14:46:04 von

neuester Beitrag 30.03.24 14:46:04 von

Beiträge: 1.089

ID: 1.127.976

ID: 1.127.976

Aufrufe heute: 0

Gesamt: 112.079

Gesamt: 112.079

Aktive User: 0

ISIN: US35671D8570 · WKN: 896476 · Symbol: FPMB

49,00

EUR

+0,19 %

+0,10 EUR

Letzter Kurs 08:11:38 Tradegate

Neuigkeiten

26.04.24 · Business Wire (engl.) |

23.04.24 · wallstreetONLINE Redaktion |

Freeport-McMoRan First-Quarter 2024 Financial and Operating Results Release Available on Its Website 23.04.24 · Business Wire (engl.) |

17.04.24 · wallstreetONLINE Redaktion |

16.04.24 · Sharedeals |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 | |

| 0,8947 | +11,85 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,500 | -6,67 | |

| 4,7500 | -7,77 | |

| 3,3200 | -9,78 | |

| 12,000 | -25,00 | |

| 46,95 | -98,00 |

Beitrag zu dieser Diskussion schreiben

https://www.marketbeat.com/stocks/NYSE/FCX/price-target/

FCX (+98%) war nach Albemarle Corp (+102%) die zweitbeste Materials-Aktie im S&P 500 in 2020 (FactSet).

Damit waren 2 der Top-10-Werte im S&P 500 in 2020 Materials-Aktien

Der S&P 500 Materials (SRMA, SP500.15), in dem beide Komponenten sind, wurde klar geschlagen:

eine Performance-Übersicht:

https://www.barchart.com/stocks/indices/sp-sector/materials?…

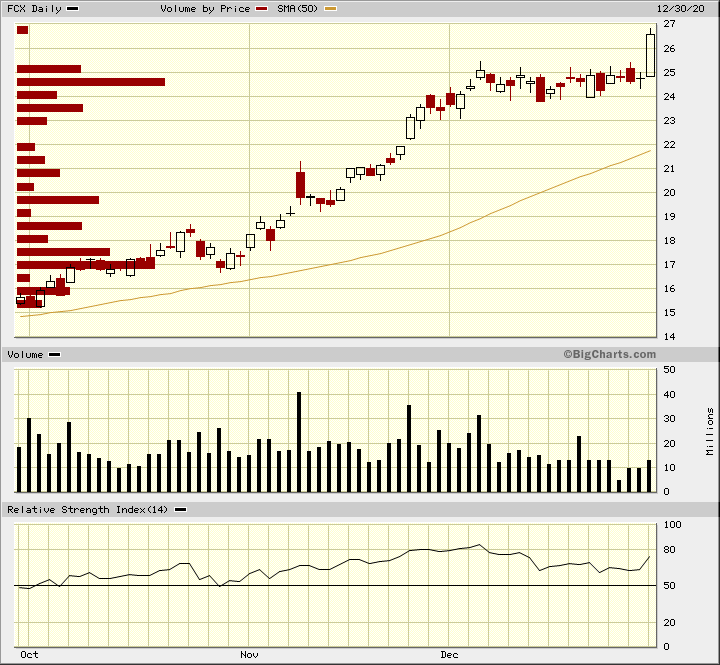

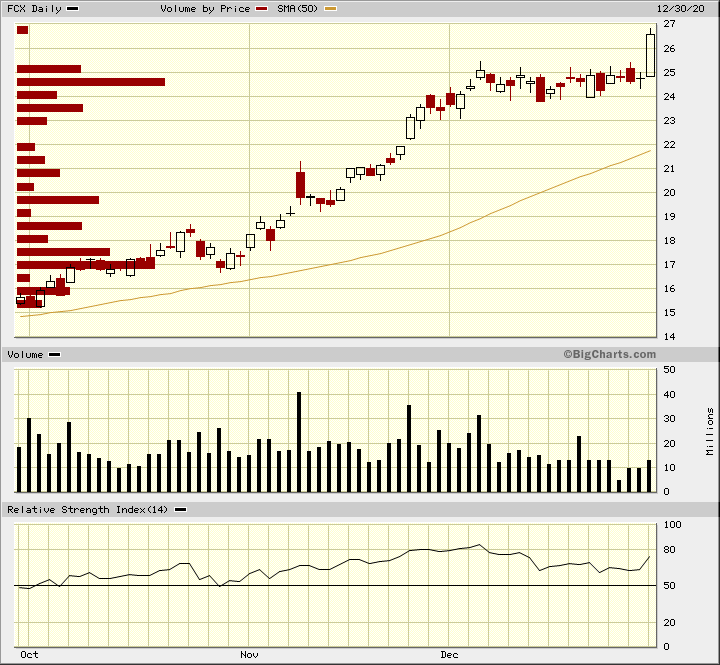

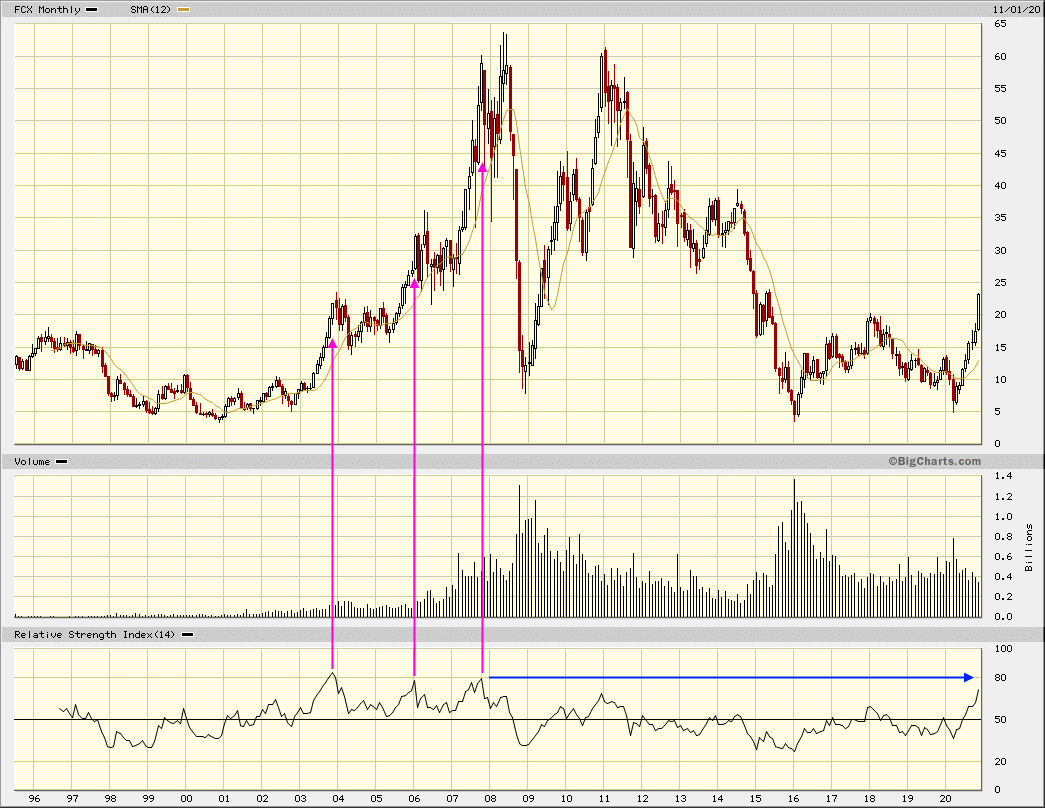

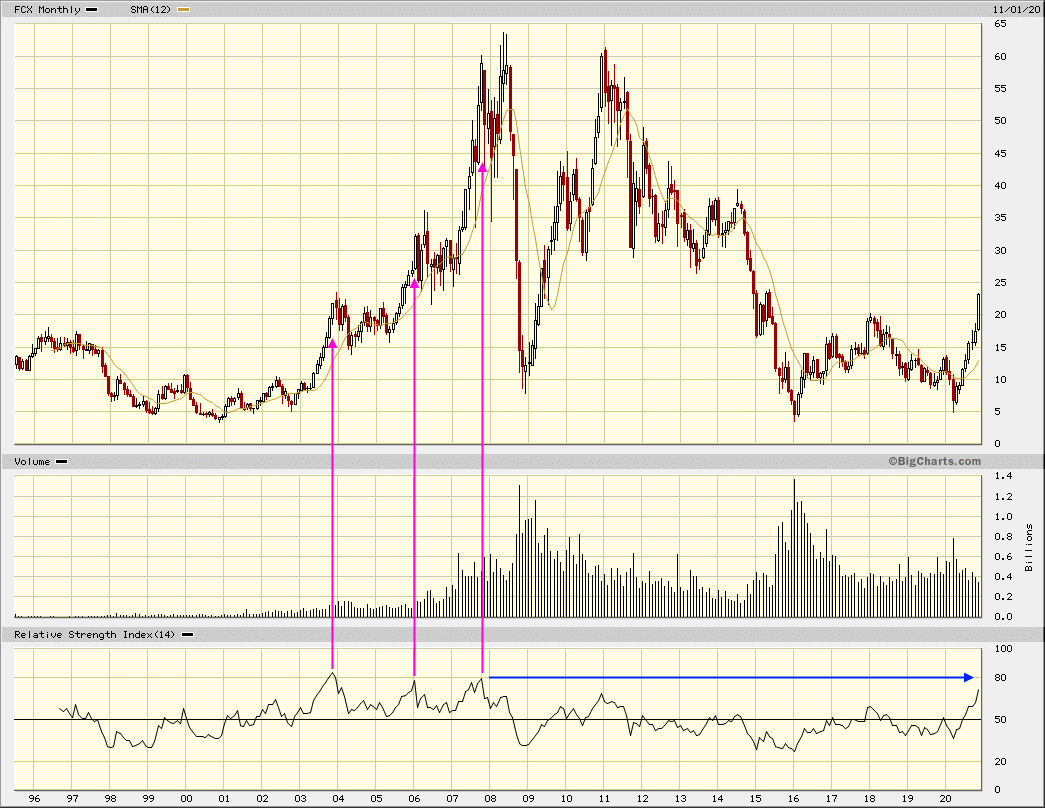

Antwort auf Beitrag Nr.: 66.160.090 von faultcode am 22.12.20 12:55:54Expansion Breakout in Vorbereitung:

Antwort auf Beitrag Nr.: 65.939.058 von faultcode am 03.12.20 18:16:5414.12.

Freeport-McMoRan Completes Sale of Undeveloped Project in the Democratic Republic of Congo for $550 Million

https://www.wallstreet-online.de/nachricht/13268617-freeport…

...

Freeport-McMoRan Inc. (NYSE: FCX) announced today that it has completed a sale of its interests in the Kisanfu undeveloped project to a wholly owned subsidiary of China Molybdenum Co., Ltd. (CMOC) for $550 million. After-tax net cash proceeds approximate $415 million.

The Kisanfu project, located in the Democratic Republic of Congo, is a large, undeveloped cobalt and copper resource discovered by Freeport’s exploration team. Following Freeport’s sale of its interest in the adjacent Tenke Fungurume mine in 2016, the Kisanfu project was no longer strategic to Freeport’s long-term strategy.

Richard C. Adkerson, President and Chief Executive Officer, said, “We are pleased to announce this transaction, which enhances our financial position.

We continue to execute our strategy focused on our attractive portfolio of large and high-quality copper assets with strong and established franchises in North America, South America and Indonesia.”

As of December 31, 2019, FCX did not have any proven and probable reserves associated with the Kisanfu project. FCX expects to record an after-tax gain of approximately $350 million in the fourth quarter of 2020 associated with this sale.

...

=> ich deute das auch so, daß Freeport kein Interesse (mehr) an Cobalt hat

Freeport-McMoRan Completes Sale of Undeveloped Project in the Democratic Republic of Congo for $550 Million

https://www.wallstreet-online.de/nachricht/13268617-freeport…

...

Freeport-McMoRan Inc. (NYSE: FCX) announced today that it has completed a sale of its interests in the Kisanfu undeveloped project to a wholly owned subsidiary of China Molybdenum Co., Ltd. (CMOC) for $550 million. After-tax net cash proceeds approximate $415 million.

The Kisanfu project, located in the Democratic Republic of Congo, is a large, undeveloped cobalt and copper resource discovered by Freeport’s exploration team. Following Freeport’s sale of its interest in the adjacent Tenke Fungurume mine in 2016, the Kisanfu project was no longer strategic to Freeport’s long-term strategy.

Richard C. Adkerson, President and Chief Executive Officer, said, “We are pleased to announce this transaction, which enhances our financial position.

We continue to execute our strategy focused on our attractive portfolio of large and high-quality copper assets with strong and established franchises in North America, South America and Indonesia.”

As of December 31, 2019, FCX did not have any proven and probable reserves associated with the Kisanfu project. FCX expects to record an after-tax gain of approximately $350 million in the fourth quarter of 2020 associated with this sale.

...

=> ich deute das auch so, daß Freeport kein Interesse (mehr) an Cobalt hat

...

Copper production must double in the next 30 years to meet demand driven by global trends towards decarbonisation and electrification, a senior BHP executive said on Thursday.

Copper, widely used in power and construction, is well placed to benefit from the decarbonisation targets of some the world's biggest economies including top carbon emitter and top metals consumer China.

"Decarbonisation and electrification are the main drivers for the future of metals commodities, delivering on the commitment of moves towards a low-carbon economy," Tariq Salaria, vice president for sales and marketing at BHP, said.

"To keep pace with these mega trends, copper production will have to double over the next 30 years," he said in a video broadcast at the China Nonferrous Metals Industry Chain conference in Shanghai.

"Copper has become synonymous with a low-carbon economy," he added, while calling for more Chinese participants in the Copper Mark sustainability initiative.

...

<he talks his book; trotzdem>

3.12.

BHP says copper output needs to double in 30 years, criticises pricing system

https://www.kitco.com/news/2020-12-03/BHP-says-copper-output…

Copper production must double in the next 30 years to meet demand driven by global trends towards decarbonisation and electrification, a senior BHP executive said on Thursday.

Copper, widely used in power and construction, is well placed to benefit from the decarbonisation targets of some the world's biggest economies including top carbon emitter and top metals consumer China.

"Decarbonisation and electrification are the main drivers for the future of metals commodities, delivering on the commitment of moves towards a low-carbon economy," Tariq Salaria, vice president for sales and marketing at BHP, said.

"To keep pace with these mega trends, copper production will have to double over the next 30 years," he said in a video broadcast at the China Nonferrous Metals Industry Chain conference in Shanghai.

"Copper has become synonymous with a low-carbon economy," he added, while calling for more Chinese participants in the Copper Mark sustainability initiative.

...

<he talks his book; trotzdem>

3.12.

BHP says copper output needs to double in 30 years, criticises pricing system

https://www.kitco.com/news/2020-12-03/BHP-says-copper-output…

Antwort auf Beitrag Nr.: 65.903.835 von faultcode am 01.12.20 12:48:30das kommt FCX und Co. zugute, v.a. ersteren, weil:

...

However, a third source involved in the talks said the problem for Freeport is that Grasberg's concentrate will risk exceeding the maximum permitted fluorine content of 1,000 parts per million, or 0.1%, in top copper consumer China.

"Grasberg will produce a lot more but the concentrates come with high fluorine," said the source, adding that the chemical impurity essentially limits destinations for Grasberg's concentrate. "That puts them in a weaker negotiating position."

Freeport did not respond to a request for comment.

"It is a big challenge for Freeport. (It's) hanging over the negotiations," said CRU analyst Hamish Sampson.

Grasberg is moving from open pit to underground mining. Freeport Indonesia Chief Executive Tony Wenas said in June it would produce 160,000 tonnes of ore per day in 2021.

27.11.

Miners, smelters still divided on copper processing charges

https://finance.yahoo.com/news/miners-smelters-still-divided…

...

However, a third source involved in the talks said the problem for Freeport is that Grasberg's concentrate will risk exceeding the maximum permitted fluorine content of 1,000 parts per million, or 0.1%, in top copper consumer China.

"Grasberg will produce a lot more but the concentrates come with high fluorine," said the source, adding that the chemical impurity essentially limits destinations for Grasberg's concentrate. "That puts them in a weaker negotiating position."

Freeport did not respond to a request for comment.

"It is a big challenge for Freeport. (It's) hanging over the negotiations," said CRU analyst Hamish Sampson.

Grasberg is moving from open pit to underground mining. Freeport Indonesia Chief Executive Tony Wenas said in June it would produce 160,000 tonnes of ore per day in 2021.

27.11.

Miners, smelters still divided on copper processing charges

https://finance.yahoo.com/news/miners-smelters-still-divided…

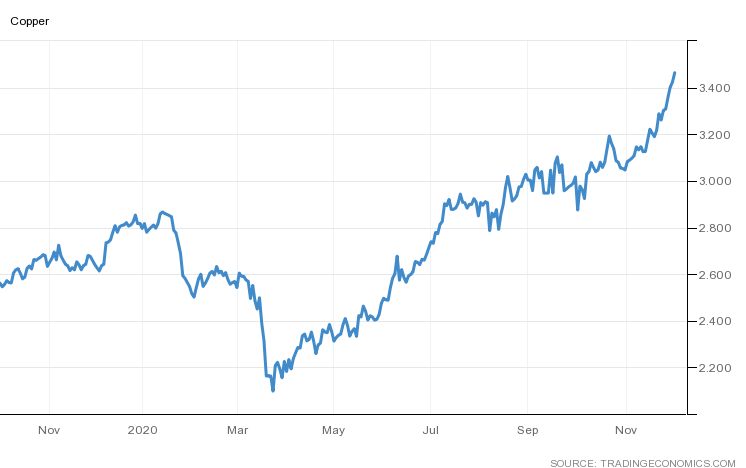

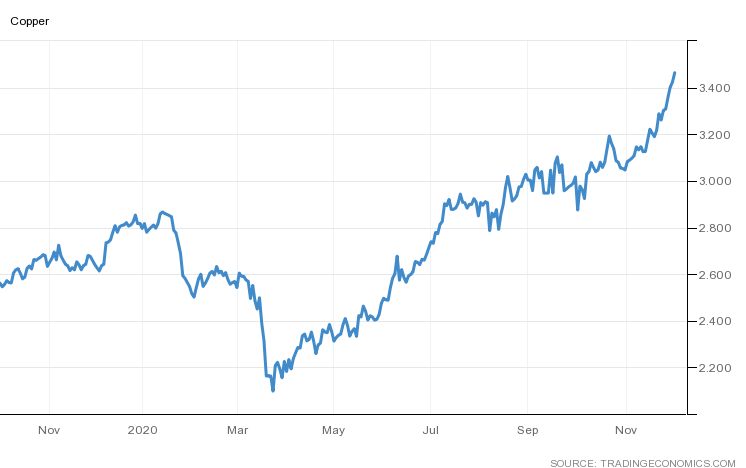

zur derzeitigen Kupfer-Spekulation:

30.11.

...Some chatter about a big short position held by a Chinese player being closed.

https://twitter.com/humenm/status/1333300940573724674

=>

30.11.

...Some chatter about a big short position held by a Chinese player being closed.

https://twitter.com/humenm/status/1333300940573724674

=>

Antwort auf Beitrag Nr.: 65.828.499 von faultcode am 24.11.20 19:13:25pre-market +3.4%

ich denke über eine Teilgewinn-Mitnahme nach, um den Rest bis auf wahnwitzige ~USD50 laufen zu lassen (als Plan):

Das Unternehmen hat immer noch so ~USD10Mrd an Long-Term Debt und zahlt u.a. dafür immer noch jedes Quartal um die USD120m an Zinsen

=> vor diesem Hintergrund würde mich eine weitere Verbesserung der Bilanzstruktur (als "step change") nicht wundern; mit entsprechenden Abkühl-Effekten für den Aktienkurs

ich denke über eine Teilgewinn-Mitnahme nach, um den Rest bis auf wahnwitzige ~USD50 laufen zu lassen (als Plan):

Das Unternehmen hat immer noch so ~USD10Mrd an Long-Term Debt und zahlt u.a. dafür immer noch jedes Quartal um die USD120m an Zinsen

=> vor diesem Hintergrund würde mich eine weitere Verbesserung der Bilanzstruktur (als "step change") nicht wundern; mit entsprechenden Abkühl-Effekten für den Aktienkurs

25.11.

Worldwide copper production dropped 0.8% in first eight months of 2020

https://www.kitco.com/news/2020-11-25/Worldwide-copper-produ…

...

World mine production fell about 4% in April and May due to COVID-19 restrictions that resulted in temporary mine shutdowns and reduced production levels, wrote the International Copper Study Group in a study released on Monday.

However, production started to recover by the end of May. The overall impact on the first eight months of the years saw production down 0.8%.

Peru's production was one of the hardest hit, with a 16.5% decline in mine output over the first eight months of 2020. During the worst of COVID-19, production dropped 38% in April-May compared to the same period of 2019.

Chile actually upped production slightly in the first eight months of the year due to clearing operational constraints from the year prior.

There were some regions where production was up sharply.

"Production in the Democratic Republic of Congo (DRC) and Panama increased significantly mainly due to the ramp-up of new

mines or expansions. In Indonesia, production grew by 23% as output levels improved following the transition of the country's

major two copper mines to different ore zones in 2019," wrote ICSG.

In the DRC, Ivanhoe Mines has been developing its Kamoa-Kakula project, what it calls the world's largest, undeveloped, high-grade copper discovery. Kakula Mine processing plant is scheduled for July 2021.

The Cobre Panama Mine is 120km west of Panama City. The first copper shipment was last year.

...

Worldwide copper production dropped 0.8% in first eight months of 2020

https://www.kitco.com/news/2020-11-25/Worldwide-copper-produ…

...

World mine production fell about 4% in April and May due to COVID-19 restrictions that resulted in temporary mine shutdowns and reduced production levels, wrote the International Copper Study Group in a study released on Monday.

However, production started to recover by the end of May. The overall impact on the first eight months of the years saw production down 0.8%.

Peru's production was one of the hardest hit, with a 16.5% decline in mine output over the first eight months of 2020. During the worst of COVID-19, production dropped 38% in April-May compared to the same period of 2019.

Chile actually upped production slightly in the first eight months of the year due to clearing operational constraints from the year prior.

There were some regions where production was up sharply.

"Production in the Democratic Republic of Congo (DRC) and Panama increased significantly mainly due to the ramp-up of new

mines or expansions. In Indonesia, production grew by 23% as output levels improved following the transition of the country's

major two copper mines to different ore zones in 2019," wrote ICSG.

In the DRC, Ivanhoe Mines has been developing its Kamoa-Kakula project, what it calls the world's largest, undeveloped, high-grade copper discovery. Kakula Mine processing plant is scheduled for July 2021.

The Cobre Panama Mine is 120km west of Panama City. The first copper shipment was last year.

...

Antwort auf Beitrag Nr.: 65.751.900 von faultcode am 18.11.20 13:03:33die Pumpe ist da!

...

https://www.marketwatch.com/articles/these-miners-are-a-buy-…

..und mit Freeport-McMoRan als "top pick" neben der Keith Neumeyer-Bude First Quantum Minerals

=> da müssten doch noch Kurse von > USD50 in 2021/22 drin sein, wenn die jetzt erst damit anfangen

...

https://www.marketwatch.com/articles/these-miners-are-a-buy-…

..und mit Freeport-McMoRan als "top pick" neben der Keith Neumeyer-Bude First Quantum Minerals

=> da müssten doch noch Kurse von > USD50 in 2021/22 drin sein, wenn die jetzt erst damit anfangen

23.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

17.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

16.04.24 · Sharedeals · Freeport-McMoRan |

16.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

04.04.24 · dpa-AFX · Freeport-McMoRan |

29.03.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |