Rohstoff-Explorer: Research oder Neuvorstellung (Seite 389)

eröffnet am 13.03.08 13:14:32 von

neuester Beitrag 01.05.24 21:08:23 von

neuester Beitrag 01.05.24 21:08:23 von

Beiträge: 29.536

ID: 1.139.490

ID: 1.139.490

Aufrufe heute: 7

Gesamt: 2.701.410

Gesamt: 2.701.410

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 25.04.24, 13:40 | 1043 | |

| gestern 18:36 | 271 | |

| heute 01:05 | 229 | |

| gestern 22:51 | 155 | |

| gestern 23:57 | 121 | |

| 03.12.04, 19:43 | 102 | |

| gestern 22:12 | 97 | |

| 26.04.24, 14:53 | 97 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.899,00 | -1,43 | 120 | |||

| 2. | 2. | 179,99 | -1,80 | 82 | |||

| 3. | 4. | 3,6925 | +0,27 | 59 | |||

| 4. | 3. | 8,2900 | +4,94 | 57 | |||

| 5. | 5. | 0,1935 | -0,77 | 41 | |||

| 6. | 6. | 6,6740 | -2,23 | 30 | |||

| 7. | 8. | 57.230,64 | -4,41 | 26 | |||

| 8. | 9. | 0,9650 | +16,27 | 25 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 56.588.207 von schnorps01 am 02.01.18 14:47:02

Definitiv, Respekt dass Du so frühzeitig das Potential gesehen hast.

Anfang Dezember hat mich Timesystem per BM um meine Einschätzung zu Sayona gebeten, damals hatte ich schon meine Meinung geändert und positive Rückmeldung gegeben. Leider aber persönlich keine Konsequenzen für mein Depot gezogen.

Wobei die Ressource ja nach wie vor nicht sonderlich spektakulär ist. Den Unterschied macht eindeutig das Top-Management mit den vielen erfahrenen Altura-Leute. Wahnsinn in welchem Tempo die das Projekt pushen.

Zitat von schnorps01: @Maigret: Bei Sayona Mining meintest Du in 10/17 noch da wäre noch nicht genug Fleisch am Knochen?

Meinung inzwischen geändert?

Definitiv, Respekt dass Du so frühzeitig das Potential gesehen hast.

Anfang Dezember hat mich Timesystem per BM um meine Einschätzung zu Sayona gebeten, damals hatte ich schon meine Meinung geändert und positive Rückmeldung gegeben. Leider aber persönlich keine Konsequenzen für mein Depot gezogen.

Wobei die Ressource ja nach wie vor nicht sonderlich spektakulär ist. Den Unterschied macht eindeutig das Top-Management mit den vielen erfahrenen Altura-Leute. Wahnsinn in welchem Tempo die das Projekt pushen.

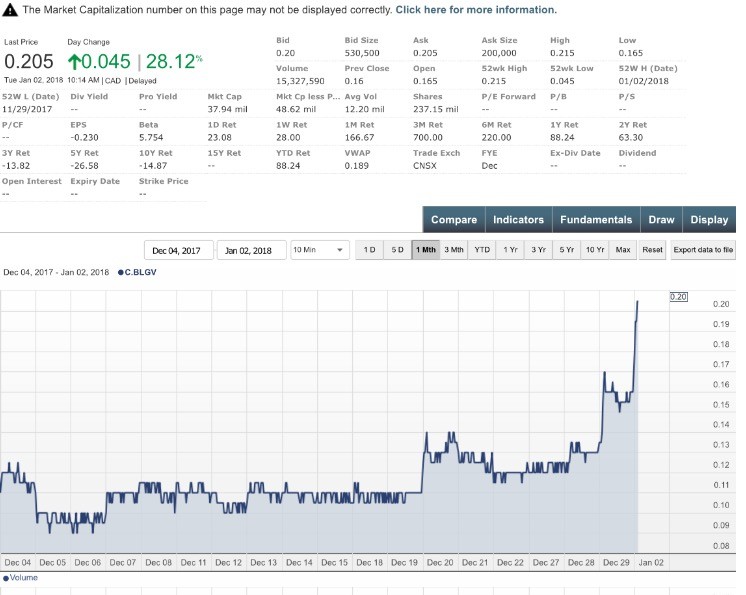

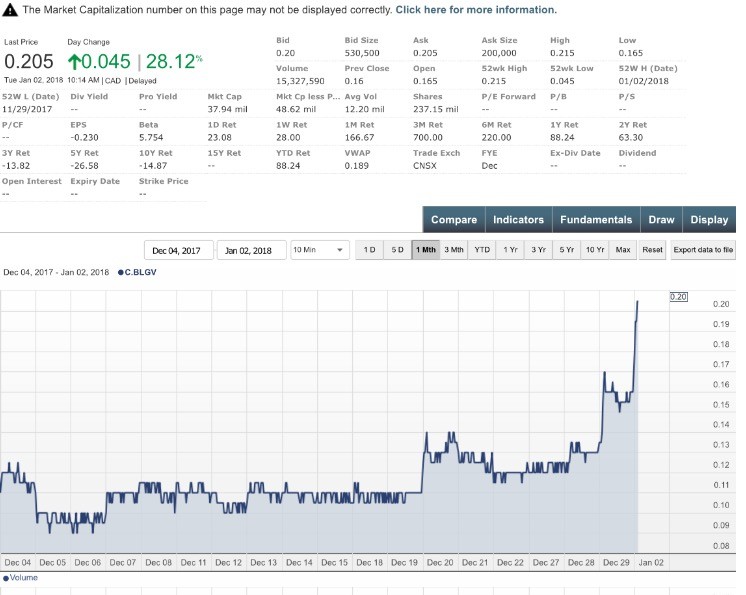

Antwort auf Beitrag Nr.: 56.398.786 von donnerpower am 08.12.17 08:15:03

100% schneller als gedacht bei Belgravia Capital...und das alles ohne News bis jetzt 🙃

Zitat von donnerpower:Zitat von donnerpower: Belgravia Capital

Neues Kürzel: C.BLGV

Guten Morgen , ab WE mir nochmal Belgravia angeschaut....vielen bekannt unter IC Potash

Nach der Neulistung seit zwei Tagen ,wird nun kräftig hinter den Kulissen spekuliert

am Freitag 28 MIo shares umgesetzt

Außerdem bei den Blockchain News über den Weg gelaufen

Belgravia Capital International Inc. (CSE:BLGV) is focused on the provision of clearly value-added services to the international Cannabis industry. This includes the production of specialized organic fertilizers for Cannabis Sativa plants, and the organization and development of blockchain technology software for seed to sale tracking and quality attestation of intermediate and consumer products. The wholly owned subsidiary of Belgravia, ICP Organics, is a research and development company incorporating agronomic and health perspectives in the Cannabis space. Blockchain technology, with its ability to provide robust and immutable histories of product tracking and also low cost integrated data bases for the Cannabis industry, is an ideal value-added approach to generating profitable Cannabis production and distribution activities. Belgravia is also developing a royalty-streaming subsidiary.

http://www.investorideas.com/news/2017/bitcoin/12011Stocks.a…" target="_blank" rel="nofollow ugc noopener">

http://www.investorideas.com/news/2017/bitcoin/12011Stocks.a…

Ich werde heute mal versuchen mir paar ins Depot zu legen ,

alleine durch den Verkauf Unternehmensanteile stehen hier zukünftig 15 Mio zu Verfügung , was quasi bei der aktuellen MK eine Risikolose Wette ist

http://www.belgraviacapital.ca/?content_id=552

Hier mal die konkurenz die teilweise um einiges höher bewertet sind

...unterschied zu Belgravia , sie müssen alle erst noch cash besorgen

ich rechne das bald mi einer starken Newsflow

Hier mal paar Chart von Konkurrenz Unternehmen

C.MYM

![]()

C.N

![]()

v.Lg

![]()

Erste Tranche soll bald folgen...

ICP Organics will invest up to Cdn$1 million into a number of facilities and companies with the intent of generating revenues and profits by the first quarter of 2018.

Canada’s IC Potash Corp. (TSX:ICP) is creating a new research and development subsidiary called ICP Organics to focus on enhancing yields for cannabis growers and increasing the health impact and effects for consumers.

The freshly formed company will invest up to Cdn$1 million into a number of facilities and companies with the intent of generating revenues and profits by the first quarter of 2018, IC Potash said in the statement.]

The Toronto-based company expects ICP Organics to become a new revenue source as the potash market continues to struggle, with prices for the fertilizer ingredient trading close to a ten-year low due to a glut of global supply.

The potash market has also suffered from increased competition following the breakup in 2013 of a Russian-Belarusian marketing cartel that previously helped limit supply.

And while they have slightly recovered in the past eight weeks, a potential move by the Indian government to cut potash subsidies by 17% in the next financial year would hit demand from one of the world's largest importers of the fertilizer, inevitably dragging prices down.

Diversifying towards the cannabis sector and organic fertilizers then seems like a good idea for IC Potash’s chief executive, Mehdi Azodi, who believes that healthy consumption of marijuana starts with organic growing practices.

“With the rise of medicinal and recreational Cannabis, there has been increased consumer awareness towards the presence of pesticides and other dangerous chemicals that have been found in Cannabis sold throughout Canada and around the world,” Azodi said.

He noted that once finalized the research and development program, ICP Organics would patent its formulations and move towards offtake agreements with select growers.

Investors reacted positively to the news. The stock was trading up 10.53% in Toronto at 9:30 am ET, changing hands at Cdn 0.105.

Read more at http://www.stockhouse.com/companies/bullboard/t.icp/belgravi…

Langsam sieht es für mich so aus das bei IC Potash Corp jetzt Belgravia schon lange der Wechsel und der Verkauf der ehemaligen Beteiligungen geplant worden ist.

Ich rechne bald mit einer sehr starken Newsflow...

...das hohe Handelsvolumen seit der nach einer Woche erst gelisteten neuen Belgravia immer noch ungewöhnlich hoch ( gestern SK 0,1154 bei 11,4 Mio Shares )

Veröffentlichung nur eines JV bei dem aktuellen Marktumfeld und das Teil hat in Toronto kein halt mehr...Wahnsinn wie der Sektor bei noch so kleinen News gerade reagiert...eine dreistellige MK im Q1 / 2018 wäre für mich keine Überraschung auch wenn sie fundamental nicht mal berechtigt sein sollte .

TORONTO, Dec. 05, 2017 (GLOBE NEWSWIRE) -- BELGRAVIA CAPITAL INTERNATIONAL INC. (CSE:BLGV) (OTCQB:BLGVF) (“Belgravia Capital”, or the “Company”) is pleased to comment on share price and trading volumes. Belgravia has previously announced expansion of business development and partnerships in the international Cannabis industry. While the Company is aggressively investigating potential specific partnership and joint venture opportunities in the cannabis industry, it is also investigating related partnership and joint ventures in blockchain technology assets, any incremental investments that may be made are currently at the negotiation stages. Once the current events become definitive and material individual investments are finalized, substantial details will be disseminated by way of public press release.

Mehdi Azodi, President and CEO of Belgravia Capital stated, “We have previously announced the strategy of developing cannabis related businesses incorporating services in the area of permissioned and private blockchains to ensure the integrity of intra-corporate and inter-corporate cannabis industry seed to sale data and related security and safety information. Further, as previously announced on October 17, 2017, the Company received USD $2.8 million composed of a cash receipt of USD $1.4 million and a promissory note which will be converted to cash on January 8, 2018, and further, it is expected that additional funds up to USD $12.2M will be received from Cartesian Capital Group controlled Intercontinental Potash Corp (USA) from New Mexico water sales. Those anticipated revenues are in connection with the Water Royalty, as more particularly described in the Company’s press release of October 17, 2017. Capital received will be invested in the Cannabis industry space and related technology concepts, including blockchain technologies as related to provenance, attestation, security, and trading concepts.”

(Quelle: GLOBE NEWSWIRE)

Nachtrag :

Auch selten wie ein CEO reagiert und seine Person in richtigen Schatten stellen möchte

Dear ....

Thank you for your note and reaching out directly.

To be perfectly blunt I don’t read the bullboards often, however I had a friend message me and say here Is a funny yet bizarre post about you. Every micro cap CEO at time reads these chats and the sad part is they have a fictional mind of their own. Very few know the facts and are either promoting a stock they bought or for some reason being negative.

I have been working and investing with IC Potash since 2013 and became the CEO in May 2016. I’ll give you a very detailed summary as I feel given your genuine note, I should elaborate and in part I’m very comfortable with my reputation on Bay St.

Here is a summary of how I took over ICP and converted it into BLGV. There are many large institutional investors who know me and have invested millions of dollars with me including YARA International a company with over 10B USD market cap, Resource Capital the largest mining fund in the world, Don Ross the single biggest equity investor in Canada, RDI which is a mining engineering firm and many retail investors of all income levels who have all have backed and endorsed me and strongly invested in IC Potash/BLGV.

-The company was attempting to build a Potash deposit with a $1B USD Capex, however it was unable to get financed

-A private equity firm from NYC got involved in 2014 to help finance the company and it lead to a proxy battle in 2015 which the CEO at the time Sid Himmel was asked to resign

-A retired older board member became the CEO in summer of 2015 and until spring of 2016 the company was going in a direction which I was not happy with, since I had raised significant capital and had been the face of the company for years on Bay st

-May 2016 I put in more capital and raised equity with several investors to help save the asset as it was going south fast, the stock was at $0.04 and the company had approx. $180,000

- I moved in, asked a few directors to resign and battled the large Private Equity firm, along the way there were several consultants and contractors getting paid massive salaries, I put an end to that, in fact in 2016 I didn’t get paid for the first 6 months of the year!! The board did re compensate me back in the end after I raised capital from friends and family

-March 2017, I launched a second subsidiary to focus on Cannabis and new age investments as I recognized Mining is tough and a bad cycle

-May 2017, the PE firm was very aggressive in financing the mining asset which resulted in me suing them to save the asset and getting some money back for it and developing a new company

The reality is 95% of junior mining assets go no where or bankrupt, the potash asset was headed there given there was debts, undiluted ownerships and preferred shares. Behind the scenes I fired and aggressively battled a lot of people I can provide you with references with bankers, brokers, investors, lawyers and analysts who will strongly endorse me and it’s evident in the market. Now there are people who don’t like me, due to the fact that I’m aggressive, tough and very litigious if someone BS’s or is nasty to me. I helped saved ICP from not going bankrupt and raised millions to save the company.

Belgravia Capital is focused on JV and partnerships, we will deploy cash to good projects and the market is pricing us with all the other juniors in the space. The stock was dead at $0.02 and has bounced back given the new direction.

Quest Rare Minerals: QRM I was a director of corporate affairs from mid 2011 to Feb 2013, the funny thing is I was FIRED from QRM because I was fighting the CEO and aggressively trying to change the direction of the company. The shares went from $0.02 to $9.29USD and I helped get it listed don NYSE MKT. I was not in charge of the direction and was fired for trying to save that company. The CEO got fired and the new team got the company bankrupted this year. I was gone for many years and openly will state I was FIRED for challenging their direction.

I’m based out of Toronto and my reputation is well known on Bay st, some love me and some don’t. I don’t sugar coat and I’m beyond assertive in addressing my opinions. If you wish to chat further, im happy to do so. If you want references I’m happy to provide them.

Just look at my board. Two major north American politicians, the head of BHP’s Potash division and the most powerful landman in US mining history. I think I have some good people supporting me.

Everything I wrote is public and happy to pass on any names you wish for references. Best reference of a public ceo is the share price and liquidity.

Thank you

Mehdi

Mehdi Azodi

President & CEO

416 779 3268

mazodi@blgv.ca

Belgraviacapital.ca

100% schneller als gedacht bei Belgravia Capital...und das alles ohne News bis jetzt 🙃

Kobalt

Da kauft jemand physisches Kobalt zu aktuellen Preisen, lagert es ein, um es dann später (zu höheren Preisen?) zu verkaufen. Artikel von platts:Cobalt prices climb after Cobalt 27's 800 mt purchase

New York (Platts)--21 Dec 2017 550 pm EST/2250 GMT

Cobalt prices, which are up about 140% so far this year, continued to climb this week, but at a slower pace compared with last week, after the market continued to digest news of Canadian investment vehicle Cobalt 27 Capital adding another 822 mt of the metal to its inventory, bringing its holdings to nearly 3,000 mt.

Toronto-based Cobalt 27 funded the purchase of the 822 mt, made over the last week, with capital raised from a bought deal share issue earlier this week, underwritten by a syndicate of banks co-led by TD Securities and Scotiabank.

Cobalt 27 paid an average price of $36.28/lb for the cobalt.

The Platts assessment for high-grade cobalt cathode rose to $36-$37/mt Thursday from $35-$36/lb December 14 and $32.50-$33.50/lb December 7, having started the year at $15.00-$15.70/lb.

Cobalt 27 describes itself as a minerals company offering a pure-play cobalt exposure. The company floated with an IPO in June and has used the proceeds of its share issues on buying physical cobalt and securing cobalt streaming and royalty deals.

In a blog posted on the company's website this week, Cobalt 27 founder and CEO Anthony Milewski said the idea behind the latest cobalt purchase was opportunistic.

He noted that Glencore's CEO, Ivan Glasenberg, had last week told investors on a conference call that there would not be enough cobalt in the world in 2030 to meet electric vehicle demand and would need additional mines.

Because of this, Milewski said, "We felt the time to act was now. We had been in discussions on a block of cobalt for some time."

He said that to his knowledge, there were no other companies that were buying and holding physical cobalt as long-term investments. "The Chinese government has a big position for military use," he said.

"This is an interesting moment because as the adoption of electric vehicles accelerate, it's reasonable to assume the OEMs and battery makers will come to us, because if you need a large cobalt position, it's very hard to go into the market to pick up 5, 10, 15 and 20 metric tons here and there," Milewski said.

Cobalt prices are at their highest level since October 2, 2018, when Platts assessed high-grade cobalt at $36.00-$37.50/lb.

He said the market could consider Cobalt 27 as an "above-ground mining company effectively."

According to Cobalt 27's website, the company holds 2,982.9 mt of physical cobalt. Last year's global cobalt market was about 110,000 mt. The company's holding comprises 2,270.3 mt of premium-grade cobalt and 712.6 mt of standard-grade cobalt.

All of the cobalt is insured and stored at secure warehouses located in Baltimore, Antwerp and Rotterdam. The company said all the warehouses were certified by the London Metal Exchange. It said its cobalt would be held on an allocated and segregated basis and not comingled with any other party's cobalt.

But cobalt prices are still below pre-2008/2009 crash peaks of $52-$53/lb seen in March 2008, when electric vehicle consumption of lithium-ion batteries barely registered in the eyes of most observers.

According to cobalt market participants, electric vehicles compete with battery demand for smartphones, aerospace (jet engines), industrial gas turbines, medical implants, high-speed steels, cutting tools, pigments, magnets and chemical applications, for the world's cobalt units.

Smartphones sales are at their highest-ever levels and the major aircraft engine manufacturers have multi-year order backlogs.

... Wir fühlten, dass die Zeit zum Handeln jetzt gekommen ist! ...

... Gilt m.E. auch für Kobalt-Aktien ...

Antwort auf Beitrag Nr.: 56.588.546 von Popeye82 am 02.01.18 15:15:26http://clients2.weblink.com.au/clients/tngltd/article.asp?as…

Antwort auf Beitrag Nr.: 56.588.546 von Popeye82 am 02.01.18 15:15:26Feasibility Study musste verbessert werden

Capex geändert (Senkung der Tivan-Raffinerie-Stufe 1) - von 647 Mio. (Jahr 2015 )

auf 541 Mio. A $ (Jahr 2017)

mal schaun , ist schwierig dort durch zu blicken aber ich sehe das dort echte Experten am Werke sind

noch viel Arbeit

Capex geändert (Senkung der Tivan-Raffinerie-Stufe 1) - von 647 Mio. (Jahr 2015 )

auf 541 Mio. A $ (Jahr 2017)

mal schaun , ist schwierig dort durch zu blicken aber ich sehe das dort echte Experten am Werke sind

noch viel Arbeit

Antwort auf Beitrag Nr.: 56.588.144 von donnerpower am 02.01.18 14:41:40Gerade bei TNG wurde nun schon zum dritten mal die Münzen umgedreht,( um zu schauen..............)

__________________________________________________________________

können Sie mal erÖRTERN(Schulgrausen, reloaded) Was Sie mit "§Münzen umdrehen" meinen??

__________________________________________________________________

können Sie mal erÖRTERN(Schulgrausen, reloaded) Was Sie mit "§Münzen umdrehen" meinen??

@Maigret: Bei Sayona Mining meintest Du in 10/17 noch da wäre noch nicht genug Fleisch am Knochen?

Meinung inzwischen geändert?

Meinung inzwischen geändert?

Hat mal jemand zu Sayona und Altura geschielt?

Altura geht ja nun zeitnah in Produktion und Sayona startet auch langsam durch....

Altura geht ja nun zeitnah in Produktion und Sayona startet auch langsam durch....

Nachdem ich schnelle 45% am Jahresende (einen Tag gehalten) mit dem Lithium Tipp SEI

(SPECIALITY METALS INTERNATIONAL) von thunder54 machen konnte, will ich euch nicht seinen neuen Tipp von heute Nacht vorenthalten:

ALICANTO MINERALS (AQI) - gold explorer in Guyana

Hier seine Kurzanalyse:

https://www.getrevue.co/profile/Thunder54/issues/asx-just-th…

+53% heute Nacht ist schon mal eine Ansage, thunder54 hat halt schon eine gewisse "Marktmacht", zumindest bei kleineren Werten und geringerem Freefloat.

Ich bin zu durchschnittlich 19 audcent drin (aktuell 21,5), würde mich über 100% Kursanstieg vom jetzigen Niveau nicht wirklich wundern.

Das thunder54's Tipps "nachhaltig" sind, hat er oft genug bewiesen.

(SPECIALITY METALS INTERNATIONAL) von thunder54 machen konnte, will ich euch nicht seinen neuen Tipp von heute Nacht vorenthalten:

ALICANTO MINERALS (AQI) - gold explorer in Guyana

Hier seine Kurzanalyse:

https://www.getrevue.co/profile/Thunder54/issues/asx-just-th…

+53% heute Nacht ist schon mal eine Ansage, thunder54 hat halt schon eine gewisse "Marktmacht", zumindest bei kleineren Werten und geringerem Freefloat.

Ich bin zu durchschnittlich 19 audcent drin (aktuell 21,5), würde mich über 100% Kursanstieg vom jetzigen Niveau nicht wirklich wundern.

Das thunder54's Tipps "nachhaltig" sind, hat er oft genug bewiesen.

Antwort auf Beitrag Nr.: 56.588.087 von tommy-hl am 02.01.18 14:35:23Habe da von TNG seit längeren ne kleine Position im Depot,

der Sektor ist aber nicht einfach , bin nicht immer up to date bei TNG aber aus Erfahrung kann ich sagen das bei diesem Beispiel einige Hürden zu bewältigen sind...angefangen bei den zukünftigen Finanzierungen

Gerade bei TNG wurde nun schon zum dritten mal die Münzen umgedreht um zu schauen wie man zukünftig das/die Projekte wirtschaftlich betreiben kann

der Sektor ist aber nicht einfach , bin nicht immer up to date bei TNG aber aus Erfahrung kann ich sagen das bei diesem Beispiel einige Hürden zu bewältigen sind...angefangen bei den zukünftigen Finanzierungen

Gerade bei TNG wurde nun schon zum dritten mal die Münzen umgedreht um zu schauen wie man zukünftig das/die Projekte wirtschaftlich betreiben kann