Digital Realty - Datacenter-Betreiber - 500 Beiträge pro Seite

eröffnet am 19.01.11 16:15:20 von

neuester Beitrag 02.01.21 14:08:46 von

neuester Beitrag 02.01.21 14:08:46 von

Beiträge: 17

ID: 1.162.935

ID: 1.162.935

Aufrufe heute: 0

Gesamt: 3.420

Gesamt: 3.420

Aktive User: 0

ISIN: US2538681030 · WKN: A0DLFT · Symbol: FQI

131,56

EUR

-0,80 %

-1,06 EUR

Letzter Kurs 18:19:13 Tradegate

Neuigkeiten

Werte aus der Branche Immobilien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,6000 | +65,68 | |

| 0,5900 | +64,80 | |

| 1,8450 | +60,16 | |

| 4,5000 | +55,71 | |

| 6,8900 | +43,84 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,0000 | -33,11 | |

| 4,8700 | -37,64 | |

| 4,0600 | -39,49 | |

| 2,5000 | -46,58 | |

| 2,0500 | -50,00 |

zahlt derzeit ca. 4% Dividende p.a.

January 24, 2011 8:32 AM EST

Digital Realty Trust, Inc. (NYSE: DLR) announced the following Q410, FY10 lease results.

Digital Realty signed leases during the quarter ended December 31, 2010 totaling approximately 478,000 square feet of space. This includes over 89,000 square feet of Turn-Key Datacenter space leased at an average annual GAAP rental rate of $184.00 per square foot, approximately 234,000 square feet of Powered Base Building space leased at an average annual GAAP rental rate of $39.00 per square foot, and approximately 155,000 square feet of non-technical space leased at an average annual GAAP rental rate of $20.00 per square foot.

For the twelve months ended December 31, 2010, the Company signed leases totaling approximately 1.2 million square feet of space. This includes approximately 519,000 square feet of Turn-Key Datacenter space leased at an average annual GAAP rental rate of $172.00 per square foot, approximately 379,000 square feet of Powered Base Building space leased at an average annual GAAP rental rate of $45.00 per square foot, and over 262,000 square feet of non-technical space leased at an average annual GAAP rental rate of $22.00 per square foot.

Digital Realty Trust, Inc. (NYSE: DLR) announced the following Q410, FY10 lease results.

Digital Realty signed leases during the quarter ended December 31, 2010 totaling approximately 478,000 square feet of space. This includes over 89,000 square feet of Turn-Key Datacenter space leased at an average annual GAAP rental rate of $184.00 per square foot, approximately 234,000 square feet of Powered Base Building space leased at an average annual GAAP rental rate of $39.00 per square foot, and approximately 155,000 square feet of non-technical space leased at an average annual GAAP rental rate of $20.00 per square foot.

For the twelve months ended December 31, 2010, the Company signed leases totaling approximately 1.2 million square feet of space. This includes approximately 519,000 square feet of Turn-Key Datacenter space leased at an average annual GAAP rental rate of $172.00 per square foot, approximately 379,000 square feet of Powered Base Building space leased at an average annual GAAP rental rate of $45.00 per square foot, and over 262,000 square feet of non-technical space leased at an average annual GAAP rental rate of $22.00 per square foot.

nett entwickelt;

Company Release - 02/17/2012 07:00

SAN FRANCISCO, Feb. 17, 2012 /PRNewswire/ --Digital Realty Trust, Inc. (NYSE: DLR), a leading global provider of data center solutions, today announced financial results for its fourth quarter and for the full year ended December 31, 2011. All per share results are on a diluted share and unit basis.

Highlights:

Reported FFO of $4.06 per share for the year ended December 31, 2011, up 19.8% from $3.39 per share for the year ended December 31, 2010. Excluding certain items that do not represent ongoing expenses or revenue streams in each full year, 2011 core FFO was $4.09 per share, up 17.2% from 2010 core FFO of $3.49 per share;

Reported FFO of $1.02 per share for the fourth quarter of 2011, up 4.1% from $0.98 per share for the fourth quarter of 2010. Excluding certain items that do not represent ongoing expenses or revenue streams in each quarter, fourth quarter 2011 core FFO was $1.03 per share, up 7.3% from fourth quarter 2010 core FFO of $0.96 per share;

Reported net income for the year ended December 31, 2011 of $162.1 million and net income available to common stockholders of $130.9 million, or $1.32 per share, up 94.1% from $0.68 per share for the year ended December 31, 2010;

Set record for leases signed during the full year 2011, including leases signed for colocation space, which are expected to generate approximately $136.6 million in annual GAAP rental revenue;

Acquired five properties totaling approximately 704,000 square feet and five developable land parcels for approximately $242.3 million and an investment in an unconsolidated joint venture for $4.1 million in 2011;

Generated approximately $42.4 million of proceeds net of commissions from the issuance of approximately 668,000 shares of common stock under the At-the-Market ("ATM") equity distribution program at an average price of $64.08 per share during the fourth quarter of 2011. For the full year 2011, the Company generated an aggregate of approximately $456.8 million of proceeds net of commissions from the issuance of approximately 7.7 million shares under ATM equity distribution programs at an average price of $59.68 per share;

Increased quarterly common stock dividend by 7.4% for the first quarter of 2012 to $0.73 per share; and

Maintaining 2012 guidance range of $4.34 – $4.48 per share, up 8.6% at the midpoint from $4.06 per share in 2011.

Funds from operations ("FFO") on a diluted basis was $126.4 million in the fourth quarter of 2011, or $1.02 per share , up 1.0% from $1.01 per share in the previous quarter, and up 4.1% from $0.98 per share in the fourth quarter of 2010. For the year ended December 31, 2011, FFO was $485.0 million, or $4.06 per share, up 19.8% from $3.39 per share in 2010.

"Adjusting for items that do not represent ongoing expenses or revenues streams, fourth quarter 2011 core FFO was approximately $600,000 higher than reported FFO, or $1.03 per share, up 7.3% from fourth quarter 2010 core FFO of $0.96," said A. William Stein, Chief Financial Officer and Chief Investment Officer of Digital Realty. "Similarly, full year 2011 core FFO was $4.09 per share after adjusting for non-core items. This reflects a 17.2% increase over full year 2010 core FFO of $3.49 per share."

FFO is a supplemental non-GAAP performance measure used by the real estate industry to measure the operating performance of real estate investment trusts. FFO and core FFO should not be considered as substitutes for net income determined in accordance with U.S. GAAP as measures of financial performance. A reconciliation from U.S. GAAP net income available to common stockholders to FFO, a definition of FFO, a reconciliation from FFO to core FFO, and a definition of core FFO are included as an attachment to this press release.

Net income for the fourth quarter of 2011 was $47.2 million, compared to $37.7 million for the third quarter of 2011 and $36.3 million for the fourth quarter of 2010. Net income available to common stockholders in the fourth quarter of 2011 was $36.0 million, or $0.34 per share, compared to $31.9 million, or $0.31 per share, in the third quarter of 2011, and $24.9 million, or $0.27 per share in the fourth quarter of 2010. For the year ended December 31, 2011, net income was $162.1 million, up 53.8% over 2010 net income of $105.4 million. Net income available to common stockholders for the year ended December 31, 2011 was $130.9 million, or $1.32 per share, up 94.1% from $0.68 per share in 2010.

The Company reported total operating revenues of $270.6 million in the fourth quarter of 2011, up 13.4% from $238.7 million in the fourth quarter of 2010, and total operating revenues of $1.1 billion for the year 2011, up 22.8% from $865.4 million in 2010.

"Capturing global opportunities and delivering reliable, secure, cost effective solutions for customers require expertise, experience and resources," said Michael F. Foust, Chief Executive Officer of Digital Realty. "We believe that our global footprint and team of real estate, technical and financial professionals set us apart in the industry, and continue to be a crucial driver of our success."

Acquisitions Activity

In October 2011, the Company acquired a 10-acre development site in Dublin, Ireland for a purchase price of $6.3 million. The site is capable of supporting the phased development of approximately 11.5 megawatts of data center space across four buildings, totaling approximately 193,000 square feet of space. In December 2011, the Company completed the acquisition of a multi-tenant, fully leased 155,000 square foot data center facility located at 360 Spear Street, which is adjacent to its 365 Main Street facility in San Francisco, California, for $85.0 million. In December 2011, the Company also completed the acquisition of a three-story, 334,000 square foot data center facility in Atlanta, Georgia for $63.0 million.

During the full year 2011, the Company acquired five properties totaling approximately 704,000 square feet along with five developable land parcels for approximately $242.3 million and an investment in an unconsolidated joint venture for $4.1 million.

As of February 17, 2012, the Company's portfolio comprised 101 properties, excluding three properties held in unconsolidated joint ventures, consisting of 140 buildings totaling approximately 18.3 million net rentable square feet, including 2.4 million square feet of space held for redevelopment. The portfolio is strategically located in 31 key technology markets throughout North America, Europe, Singapore and Australia.

Balance Sheet Update

Total assets grew to approximately $6.1 billion at December 31, 2011 from $5.3 billion at December 31, 2010. Total debt slightly increased to $2.9 billion at December 31, 2011 from $2.8 billion at December 31, 2010. Stockholders' equity was over $2.5 billion at December 31, 2011, up from approximately $2.0 billion at December 31, 2010.

During the fourth quarter of 2011, under its second ATM equity distribution program, the Company generated approximately $42.4 million of proceeds net of commissions under its ATM equity distribution program from the issuance of approximately 668,000 shares at an average price of $64.08 per share. During the full year 2011, the Company generated an aggregate of approximately $456.8 million of proceeds net of commissions under ATM equity distribution programs from the issuance of approximately 7.7 million shares at an average price of $59.68 per share.

In November 2011, the Company closed its $1.5 billion Global Revolving Credit Facility. Also, in conjunction with the acquisition of the 360 Spear Street facility in December 2011, the Company assumed a $47.6 million secured loan at a rate of 6.3% with a maturity date in November 2013.

During the fourth quarter, holders of the Company's Series D Convertible Preferred Stock converted approximately 1.8 million shares of the Series D Convertible Preferred Stock with a liquidation preference value of $46.2 million into approximately 1.1 million newly issued shares of common stock.

For the full year 2011, holders of the Company's Series C Convertible Preferred Stock converted approximately 1.9 million shares of the Series C Convertible Preferred Stock with a liquidation preference value of $46.8 million into approximately 1.0 million newly issued shares of common stock. This comprised approximately 26.8% of the Series C Convertible Preferred Stock outstanding at December 31, 2010. For the full year, holders of the Series D Convertible Preferred Stock converted approximately 6.8 million shares of the Series D Convertible Preferred Stock with a liquidation preference value of $170.3 million into approximately 4.2 million newly issued shares of common stock. This comprised approximately 49.4% of the Series D Convertible Preferred Stock outstanding at December 31, 2010.

2012 Outlook

FFO per diluted share and unit for the year ending December 31, 2012 is projected to be between $4.34 and $4.48. This guidance represents expected FFO growth of 6.9% to 10.3% over the 2011 FFO of $4.06 per diluted share and unit. A reconciliation of the range of 2012 projected net income to projected FFO follows:

Low - High

Net income available to common stockholders per diluted share

$1.51 – 1.65

Add:

Real estate depreciation and amortization as adjusted for noncontrolling interests

$3.10

Less:

Dilutive impact of convertible stock and exchangeable debentures

($0.27)

Projected FFO per diluted share

$4.34 – 4.48

Company Release - 02/17/2012 07:00

SAN FRANCISCO, Feb. 17, 2012 /PRNewswire/ --Digital Realty Trust, Inc. (NYSE: DLR), a leading global provider of data center solutions, today announced financial results for its fourth quarter and for the full year ended December 31, 2011. All per share results are on a diluted share and unit basis.

Highlights:

Reported FFO of $4.06 per share for the year ended December 31, 2011, up 19.8% from $3.39 per share for the year ended December 31, 2010. Excluding certain items that do not represent ongoing expenses or revenue streams in each full year, 2011 core FFO was $4.09 per share, up 17.2% from 2010 core FFO of $3.49 per share;

Reported FFO of $1.02 per share for the fourth quarter of 2011, up 4.1% from $0.98 per share for the fourth quarter of 2010. Excluding certain items that do not represent ongoing expenses or revenue streams in each quarter, fourth quarter 2011 core FFO was $1.03 per share, up 7.3% from fourth quarter 2010 core FFO of $0.96 per share;

Reported net income for the year ended December 31, 2011 of $162.1 million and net income available to common stockholders of $130.9 million, or $1.32 per share, up 94.1% from $0.68 per share for the year ended December 31, 2010;

Set record for leases signed during the full year 2011, including leases signed for colocation space, which are expected to generate approximately $136.6 million in annual GAAP rental revenue;

Acquired five properties totaling approximately 704,000 square feet and five developable land parcels for approximately $242.3 million and an investment in an unconsolidated joint venture for $4.1 million in 2011;

Generated approximately $42.4 million of proceeds net of commissions from the issuance of approximately 668,000 shares of common stock under the At-the-Market ("ATM") equity distribution program at an average price of $64.08 per share during the fourth quarter of 2011. For the full year 2011, the Company generated an aggregate of approximately $456.8 million of proceeds net of commissions from the issuance of approximately 7.7 million shares under ATM equity distribution programs at an average price of $59.68 per share;

Increased quarterly common stock dividend by 7.4% for the first quarter of 2012 to $0.73 per share; and

Maintaining 2012 guidance range of $4.34 – $4.48 per share, up 8.6% at the midpoint from $4.06 per share in 2011.

Funds from operations ("FFO") on a diluted basis was $126.4 million in the fourth quarter of 2011, or $1.02 per share , up 1.0% from $1.01 per share in the previous quarter, and up 4.1% from $0.98 per share in the fourth quarter of 2010. For the year ended December 31, 2011, FFO was $485.0 million, or $4.06 per share, up 19.8% from $3.39 per share in 2010.

"Adjusting for items that do not represent ongoing expenses or revenues streams, fourth quarter 2011 core FFO was approximately $600,000 higher than reported FFO, or $1.03 per share, up 7.3% from fourth quarter 2010 core FFO of $0.96," said A. William Stein, Chief Financial Officer and Chief Investment Officer of Digital Realty. "Similarly, full year 2011 core FFO was $4.09 per share after adjusting for non-core items. This reflects a 17.2% increase over full year 2010 core FFO of $3.49 per share."

FFO is a supplemental non-GAAP performance measure used by the real estate industry to measure the operating performance of real estate investment trusts. FFO and core FFO should not be considered as substitutes for net income determined in accordance with U.S. GAAP as measures of financial performance. A reconciliation from U.S. GAAP net income available to common stockholders to FFO, a definition of FFO, a reconciliation from FFO to core FFO, and a definition of core FFO are included as an attachment to this press release.

Net income for the fourth quarter of 2011 was $47.2 million, compared to $37.7 million for the third quarter of 2011 and $36.3 million for the fourth quarter of 2010. Net income available to common stockholders in the fourth quarter of 2011 was $36.0 million, or $0.34 per share, compared to $31.9 million, or $0.31 per share, in the third quarter of 2011, and $24.9 million, or $0.27 per share in the fourth quarter of 2010. For the year ended December 31, 2011, net income was $162.1 million, up 53.8% over 2010 net income of $105.4 million. Net income available to common stockholders for the year ended December 31, 2011 was $130.9 million, or $1.32 per share, up 94.1% from $0.68 per share in 2010.

The Company reported total operating revenues of $270.6 million in the fourth quarter of 2011, up 13.4% from $238.7 million in the fourth quarter of 2010, and total operating revenues of $1.1 billion for the year 2011, up 22.8% from $865.4 million in 2010.

"Capturing global opportunities and delivering reliable, secure, cost effective solutions for customers require expertise, experience and resources," said Michael F. Foust, Chief Executive Officer of Digital Realty. "We believe that our global footprint and team of real estate, technical and financial professionals set us apart in the industry, and continue to be a crucial driver of our success."

Acquisitions Activity

In October 2011, the Company acquired a 10-acre development site in Dublin, Ireland for a purchase price of $6.3 million. The site is capable of supporting the phased development of approximately 11.5 megawatts of data center space across four buildings, totaling approximately 193,000 square feet of space. In December 2011, the Company completed the acquisition of a multi-tenant, fully leased 155,000 square foot data center facility located at 360 Spear Street, which is adjacent to its 365 Main Street facility in San Francisco, California, for $85.0 million. In December 2011, the Company also completed the acquisition of a three-story, 334,000 square foot data center facility in Atlanta, Georgia for $63.0 million.

During the full year 2011, the Company acquired five properties totaling approximately 704,000 square feet along with five developable land parcels for approximately $242.3 million and an investment in an unconsolidated joint venture for $4.1 million.

As of February 17, 2012, the Company's portfolio comprised 101 properties, excluding three properties held in unconsolidated joint ventures, consisting of 140 buildings totaling approximately 18.3 million net rentable square feet, including 2.4 million square feet of space held for redevelopment. The portfolio is strategically located in 31 key technology markets throughout North America, Europe, Singapore and Australia.

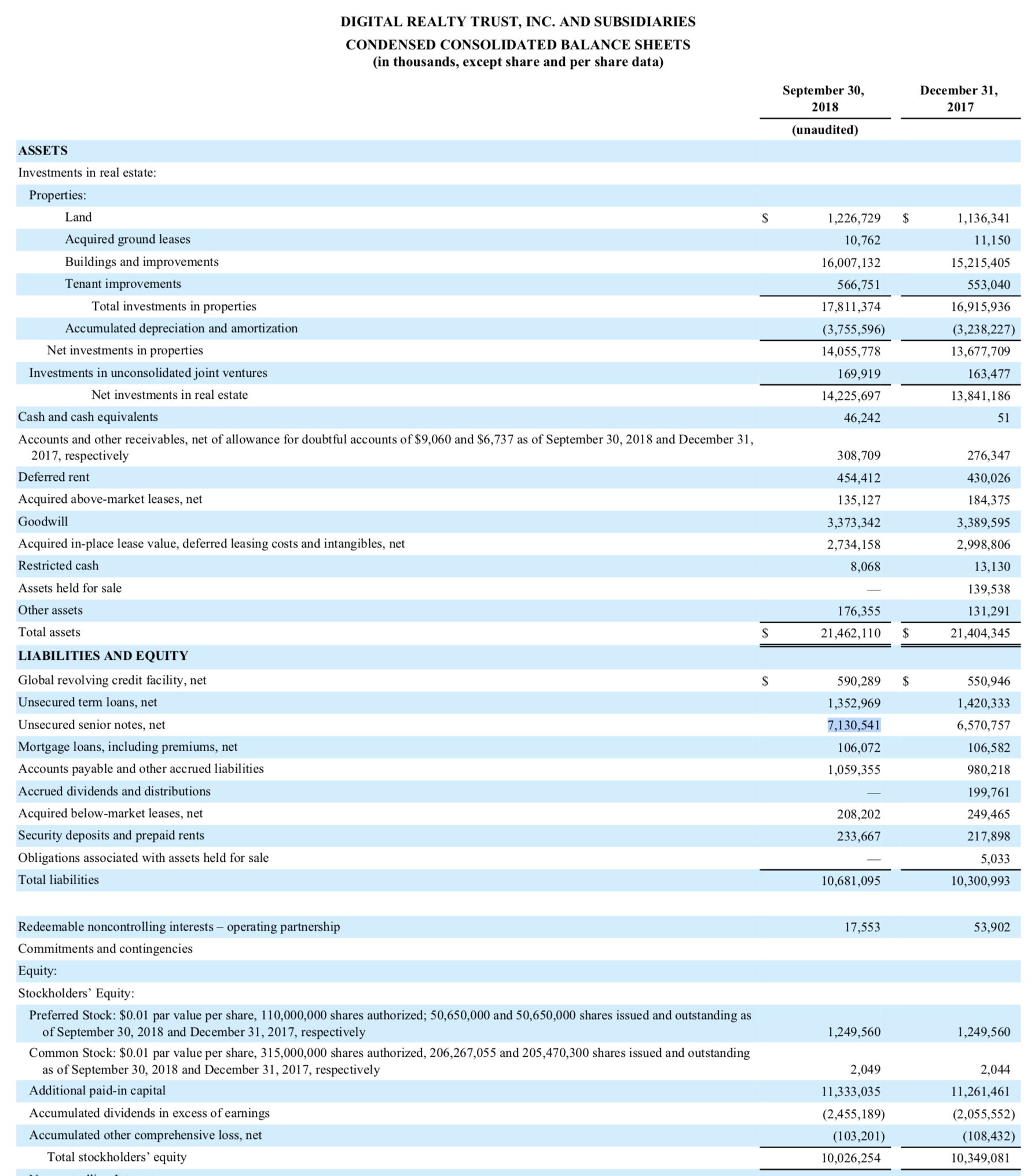

Balance Sheet Update

Total assets grew to approximately $6.1 billion at December 31, 2011 from $5.3 billion at December 31, 2010. Total debt slightly increased to $2.9 billion at December 31, 2011 from $2.8 billion at December 31, 2010. Stockholders' equity was over $2.5 billion at December 31, 2011, up from approximately $2.0 billion at December 31, 2010.

During the fourth quarter of 2011, under its second ATM equity distribution program, the Company generated approximately $42.4 million of proceeds net of commissions under its ATM equity distribution program from the issuance of approximately 668,000 shares at an average price of $64.08 per share. During the full year 2011, the Company generated an aggregate of approximately $456.8 million of proceeds net of commissions under ATM equity distribution programs from the issuance of approximately 7.7 million shares at an average price of $59.68 per share.

In November 2011, the Company closed its $1.5 billion Global Revolving Credit Facility. Also, in conjunction with the acquisition of the 360 Spear Street facility in December 2011, the Company assumed a $47.6 million secured loan at a rate of 6.3% with a maturity date in November 2013.

During the fourth quarter, holders of the Company's Series D Convertible Preferred Stock converted approximately 1.8 million shares of the Series D Convertible Preferred Stock with a liquidation preference value of $46.2 million into approximately 1.1 million newly issued shares of common stock.

For the full year 2011, holders of the Company's Series C Convertible Preferred Stock converted approximately 1.9 million shares of the Series C Convertible Preferred Stock with a liquidation preference value of $46.8 million into approximately 1.0 million newly issued shares of common stock. This comprised approximately 26.8% of the Series C Convertible Preferred Stock outstanding at December 31, 2010. For the full year, holders of the Series D Convertible Preferred Stock converted approximately 6.8 million shares of the Series D Convertible Preferred Stock with a liquidation preference value of $170.3 million into approximately 4.2 million newly issued shares of common stock. This comprised approximately 49.4% of the Series D Convertible Preferred Stock outstanding at December 31, 2010.

2012 Outlook

FFO per diluted share and unit for the year ending December 31, 2012 is projected to be between $4.34 and $4.48. This guidance represents expected FFO growth of 6.9% to 10.3% over the 2011 FFO of $4.06 per diluted share and unit. A reconciliation of the range of 2012 projected net income to projected FFO follows:

Low - High

Net income available to common stockholders per diluted share

$1.51 – 1.65

Add:

Real estate depreciation and amortization as adjusted for noncontrolling interests

$3.10

Less:

Dilutive impact of convertible stock and exchangeable debentures

($0.27)

Projected FFO per diluted share

$4.34 – 4.48

jetzt nicht mehr so: http://seekingalpha.com/article/1868321-digital-realty-high-…

@rbgo seit wann bist du investiert ? Ueberlege mir zu 50 usd ein paar ins depot zu legen...

Antwort auf Beitrag Nr.: 46.215.059 von skbond am 12.01.14 20:31:53mit minimaler Stückzahl seit 2012, seit heute mit erster Position

ist ja sehr gut gelaufen seit Mai, aber wirklich verstehen tue ich die Zahlen immer noch nicht...

weiter stillhalten?

weiter stillhalten?

stillhalten war bisher die richtige Entscheidung;

aber die paar Charakteristika,die ich verstehe, deuten alle nicht in die richtig Richtung:

Auszehrung des EK

Bewertung EV/EBITDA = 17x

Verschiebung der Gewinnanteile von den commons zu den preferreds

ist aber wohl typisch für income stocks, Ähnliches sieht man bei Tabak, MLP, etc.

aber die paar Charakteristika,die ich verstehe, deuten alle nicht in die richtig Richtung:

Auszehrung des EK

Bewertung EV/EBITDA = 17x

Verschiebung der Gewinnanteile von den commons zu den preferreds

ist aber wohl typisch für income stocks, Ähnliches sieht man bei Tabak, MLP, etc.

Die Euro am Sonntag beschäftigt sich mit den Data Centern in den USA. Danach hat Digital Realty Trust in Frankfurt-Sossenheim ein 27 ha großes Grundstück erworben und will dort ein 27 Megawett-Rechenzentrum errichten.

Die Nachfrage wird durch die Bereiche Cloud, Mobil, Video und Big Data angetrieben - künftig auch durch das Internet der Dinge und Virtual Reality.

Die Nachfrage wird durch die Bereiche Cloud, Mobil, Video und Big Data angetrieben - künftig auch durch das Internet der Dinge und Virtual Reality.

Digital Realty wraps $874M data-center buy from Equinox

Jul 5 2016, 16:54 ET | About: Digital Realty Trust, Inc. (DLR) | By: Jason Aycock, SA News Editor

Digital Realty (DLR +2.1%) has completed an $874M acquisition of eight European data centers from Equinix (EQIX -0.2%).

That deal is part of a divestment that Equinix undertook as a condition requested by the European Commission, tied to Equinix's purchase of TelecityGroup.

Equinix also entered a deal with Digital Realty to pay €189.75M for Digital Realty's opearting business in St. Denis, Paris, including real estate and data center there.

Digital Realty's purchase comes at a multiple of about 13 times the portfolio's expected 2016 EBITDA.

It includes five properties in London, two in Amsterdam and one in Frankfurt, and provides about 6.9 megawatts of fully installed power and 62,700 net sellable square feet.

Jul 5 2016, 16:54 ET | About: Digital Realty Trust, Inc. (DLR) | By: Jason Aycock, SA News Editor

Digital Realty (DLR +2.1%) has completed an $874M acquisition of eight European data centers from Equinix (EQIX -0.2%).

That deal is part of a divestment that Equinix undertook as a condition requested by the European Commission, tied to Equinix's purchase of TelecityGroup.

Equinix also entered a deal with Digital Realty to pay €189.75M for Digital Realty's opearting business in St. Denis, Paris, including real estate and data center there.

Digital Realty's purchase comes at a multiple of about 13 times the portfolio's expected 2016 EBITDA.

It includes five properties in London, two in Amsterdam and one in Frankfurt, and provides about 6.9 megawatts of fully installed power and 62,700 net sellable square feet.

Antwort auf Beitrag Nr.: 49.091.864 von R-BgO am 17.02.15 12:13:54

Erinnerungsstück behalten und mit einem Teil der Erlöse Series G preferreds gekauft, die 5,875% bringen.

So habe ich mehr Ertrag als vorher, aber auch keine upside mehr.

Umgeschlüsselt von "Services - Datacenter" zu "Bond statt Aktie"

heute mit dickem Gewinn verkauft: 2,5x Einstand,

wobei mir da sicher der dollar ordentlich geholfen hat;Erinnerungsstück behalten und mit einem Teil der Erlöse Series G preferreds gekauft, die 5,875% bringen.

So habe ich mehr Ertrag als vorher, aber auch keine upside mehr.

Umgeschlüsselt von "Services - Datacenter" zu "Bond statt Aktie"

Digital Realty To Merge With DuPont Fabros

June 09, 2017

Transaction to Enhance Digital Realty's Ability to Serve Top U.S. Data Center Metro Areas

Expands Hyper-Scale Product Offering and Solidifies Blue-Chip Customer Base

Immediately Accretive to Financial Metrics and Improves Balance Sheet Strength

SAN FRANCISCO and WASHINGTON, June 9, 2017 /PRNewswire/ --

Digital Realty (NYSE: DLR), a leading global provider of data center, colocation and interconnection solutions, and DuPont Fabros (NYSE: DFT), a leading owner, developer, operator and manager of enterprise-class, carrier-neutral, large scale multi-tenant data centers, announced today they have entered into a definitive agreement under which DuPont Fabros will merge with Digital Realty in an all-stock transaction. The consummation of the transaction is subject to customary closing conditions, including approval by the shareholders of Digital Realty and DuPont Fabros. Under the terms of the agreement, DuPont Fabros shareholders will receive a fixed exchange ratio of 0.545 Digital Realty shares per DuPont Fabros share, for a transaction valued at approximately $7.6 billion in enterprise value.

Transaction Delivers Key Strategic and Financial Benefits

Enhances Ability to Serve Top U.S. Metro Areas: DuPont Fabros' portfolio is concentrated in top U.S. data center metro areas across Northern Virginia, Chicago and Silicon Valley. The transaction will help grow Digital Realty's presence in strategic, high-demand metro areas with strong growth prospects, while achieving significant diversification benefits for DuPont Fabros' shareholders from the combination with Digital Realty's existing footprint of 145 properties across 33 global metropolitan areas.

Expands Hyper-Scale Product Offering:

DuPont Fabros' 12 purpose-built, in-service data centers will significantly expand Digital Realty's hyper-scale product offering and improve its ability to meet the rapidly growing needs of cloud and cloud-like customers, in addition to enterprise customers undertaking the shift to a hybrid cloud architecture. Conversely, the transaction enables DuPont Fabros to address a broader set of customers' data center requirements, with the addition of Digital Realty's colocation and interconnection product offerings.

Solidifies Blue-Chip Customer Base:

DuPont Fabros' impressive roster of blue-chip customers will further enhance the credit quality of Digital Realty's existing customer base. On a combined basis, investment grade or equivalent customers will represent more than 50% of total revenue. The transaction also significantly reduces DuPont Fabros' customer concentration. The combined company's top three customers will account for approximately 18% of revenue compared to 57% for the top three customers of DuPont Fabros on a standalone basis.

Development Pipeline Provides External Growth Potential:

DuPont Fabros' six data center development projects currently under construction are 48% pre-leased and represent a total expected investment of approximately $750 million, and amount to roughly a 26% expansion of its standalone critical load capacity. These projects are located in Ashburn, Chicago, Santa Clara and Toronto, all metro areas where Digital Realty has an existing presence. These six projects are expected to be delivered over the next 12 months, representing a solid pipeline of future growth potential. In addition, DuPont Fabros owns strategic land holdings in Ashburn and Oregon, which will support the future delivery of up to 163 megawatts of incremental capacity, along with 56 acres of land recently acquired in Phoenix.

Size and Scale Generate Incremental Benefits:

The two companies' operating models are highly complementary, and the combined organization is expected to provide the most comprehensive product offering in the data center sector. Given the enhanced size and scale, the combined company is also expected to have the most efficient cost structure and the highest EBITDA margin of any U.S.-based publicly-traded data center REIT.

Creates Substantial Anticipated Cost Efficiencies and Financial Benefits:

The combination of the two companies is expected to create an opportunity to realize up to $18 million of annualized overhead savings, resulting from both companies' complementary business operations. Upon closing, the transaction is expected to be immediately accretive to financial metrics, and is expected to further improve balance sheet strength.

"This strategic and complementary transaction significantly enhances Digital Realty's ability to support the growth of hyper-scale users in the top U.S. data center metro areas, while providing meaningful customer and geographic diversification for DuPont Fabros," said A. William Stein, Digital Realty's Chief Executive Officer. "The combination is expected to generate both operating and financial benefits, and I'd like to congratulate Scott Peterson, Mark Walker and their team on successfully negotiating the largest transaction in our company's history, a combination that we believe will enhance our ability to create significant long-term value for both sets of shareholders."

"We are excited to deliver this compelling transaction to our shareholders and execute upon two of the strategic objectives embodied in our corporate vision – diversifying our customer base and expanding our geographic presence," said Christopher P. Eldredge, DuPont Fabros' President & Chief Executive Officer. "As part of Digital Realty, our shareholders will continue to realize the benefits of our high-quality portfolio, with the added benefits of belonging to an even greater data center network with a truly global footprint and a well-diversified customer base. We also believe our shareholders will greatly benefit from Digital Realty's investment grade balance sheet and more attractive cost of capital. We look forward to working closely with the Digital Realty team over the coming months to close the transaction and bring our two companies together."

Transaction Details

The fixed exchange ratio represents a total enterprise value of approximately $7.6 billion, including $1.6 billion of assumed debt and excluding transaction costs. Digital Realty has obtained a fully committed bridge loan facility from BofA Merrill Lynch and Citigroup which will be available, if needed, to finance the transaction. The debt assumed in the transaction is expected to be permanently refinanced with a combination of investment grade corporate bonds and other financings. The transaction has been unanimously approved by the boards of directors of both Digital Realty and DuPont Fabros.

The transaction is expected to close in the second half of 2017 and is subject to the approval of DuPont Fabros and Digital Realty shareholders and other customary closing conditions.

BofA Merrill Lynch and Citigroup are acting as financial advisors and Latham & Watkins LLP is acting as legal advisor to Digital Realty. Goldman Sachs & Co. LLC is acting as financial advisor and Hogan Lovells US LLP is acting as legal advisor to DuPont Fabros.

June 09, 2017

Transaction to Enhance Digital Realty's Ability to Serve Top U.S. Data Center Metro Areas

Expands Hyper-Scale Product Offering and Solidifies Blue-Chip Customer Base

Immediately Accretive to Financial Metrics and Improves Balance Sheet Strength

SAN FRANCISCO and WASHINGTON, June 9, 2017 /PRNewswire/ --

Digital Realty (NYSE: DLR), a leading global provider of data center, colocation and interconnection solutions, and DuPont Fabros (NYSE: DFT), a leading owner, developer, operator and manager of enterprise-class, carrier-neutral, large scale multi-tenant data centers, announced today they have entered into a definitive agreement under which DuPont Fabros will merge with Digital Realty in an all-stock transaction. The consummation of the transaction is subject to customary closing conditions, including approval by the shareholders of Digital Realty and DuPont Fabros. Under the terms of the agreement, DuPont Fabros shareholders will receive a fixed exchange ratio of 0.545 Digital Realty shares per DuPont Fabros share, for a transaction valued at approximately $7.6 billion in enterprise value.

Transaction Delivers Key Strategic and Financial Benefits

Enhances Ability to Serve Top U.S. Metro Areas: DuPont Fabros' portfolio is concentrated in top U.S. data center metro areas across Northern Virginia, Chicago and Silicon Valley. The transaction will help grow Digital Realty's presence in strategic, high-demand metro areas with strong growth prospects, while achieving significant diversification benefits for DuPont Fabros' shareholders from the combination with Digital Realty's existing footprint of 145 properties across 33 global metropolitan areas.

Expands Hyper-Scale Product Offering:

DuPont Fabros' 12 purpose-built, in-service data centers will significantly expand Digital Realty's hyper-scale product offering and improve its ability to meet the rapidly growing needs of cloud and cloud-like customers, in addition to enterprise customers undertaking the shift to a hybrid cloud architecture. Conversely, the transaction enables DuPont Fabros to address a broader set of customers' data center requirements, with the addition of Digital Realty's colocation and interconnection product offerings.

Solidifies Blue-Chip Customer Base:

DuPont Fabros' impressive roster of blue-chip customers will further enhance the credit quality of Digital Realty's existing customer base. On a combined basis, investment grade or equivalent customers will represent more than 50% of total revenue. The transaction also significantly reduces DuPont Fabros' customer concentration. The combined company's top three customers will account for approximately 18% of revenue compared to 57% for the top three customers of DuPont Fabros on a standalone basis.

Development Pipeline Provides External Growth Potential:

DuPont Fabros' six data center development projects currently under construction are 48% pre-leased and represent a total expected investment of approximately $750 million, and amount to roughly a 26% expansion of its standalone critical load capacity. These projects are located in Ashburn, Chicago, Santa Clara and Toronto, all metro areas where Digital Realty has an existing presence. These six projects are expected to be delivered over the next 12 months, representing a solid pipeline of future growth potential. In addition, DuPont Fabros owns strategic land holdings in Ashburn and Oregon, which will support the future delivery of up to 163 megawatts of incremental capacity, along with 56 acres of land recently acquired in Phoenix.

Size and Scale Generate Incremental Benefits:

The two companies' operating models are highly complementary, and the combined organization is expected to provide the most comprehensive product offering in the data center sector. Given the enhanced size and scale, the combined company is also expected to have the most efficient cost structure and the highest EBITDA margin of any U.S.-based publicly-traded data center REIT.

Creates Substantial Anticipated Cost Efficiencies and Financial Benefits:

The combination of the two companies is expected to create an opportunity to realize up to $18 million of annualized overhead savings, resulting from both companies' complementary business operations. Upon closing, the transaction is expected to be immediately accretive to financial metrics, and is expected to further improve balance sheet strength.

"This strategic and complementary transaction significantly enhances Digital Realty's ability to support the growth of hyper-scale users in the top U.S. data center metro areas, while providing meaningful customer and geographic diversification for DuPont Fabros," said A. William Stein, Digital Realty's Chief Executive Officer. "The combination is expected to generate both operating and financial benefits, and I'd like to congratulate Scott Peterson, Mark Walker and their team on successfully negotiating the largest transaction in our company's history, a combination that we believe will enhance our ability to create significant long-term value for both sets of shareholders."

"We are excited to deliver this compelling transaction to our shareholders and execute upon two of the strategic objectives embodied in our corporate vision – diversifying our customer base and expanding our geographic presence," said Christopher P. Eldredge, DuPont Fabros' President & Chief Executive Officer. "As part of Digital Realty, our shareholders will continue to realize the benefits of our high-quality portfolio, with the added benefits of belonging to an even greater data center network with a truly global footprint and a well-diversified customer base. We also believe our shareholders will greatly benefit from Digital Realty's investment grade balance sheet and more attractive cost of capital. We look forward to working closely with the Digital Realty team over the coming months to close the transaction and bring our two companies together."

Transaction Details

The fixed exchange ratio represents a total enterprise value of approximately $7.6 billion, including $1.6 billion of assumed debt and excluding transaction costs. Digital Realty has obtained a fully committed bridge loan facility from BofA Merrill Lynch and Citigroup which will be available, if needed, to finance the transaction. The debt assumed in the transaction is expected to be permanently refinanced with a combination of investment grade corporate bonds and other financings. The transaction has been unanimously approved by the boards of directors of both Digital Realty and DuPont Fabros.

The transaction is expected to close in the second half of 2017 and is subject to the approval of DuPont Fabros and Digital Realty shareholders and other customary closing conditions.

BofA Merrill Lynch and Citigroup are acting as financial advisors and Latham & Watkins LLP is acting as legal advisor to Digital Realty. Goldman Sachs & Co. LLC is acting as financial advisor and Hogan Lovells US LLP is acting as legal advisor to DuPont Fabros.

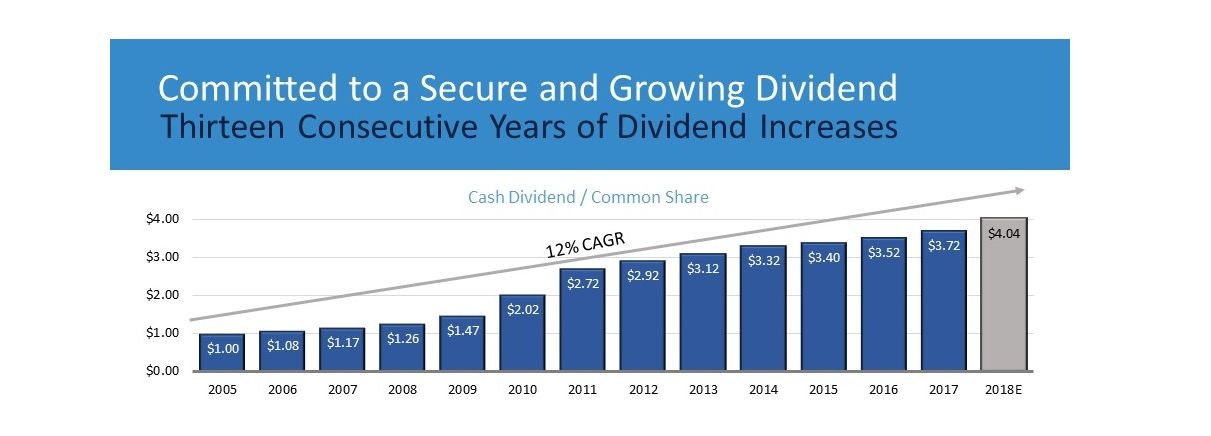

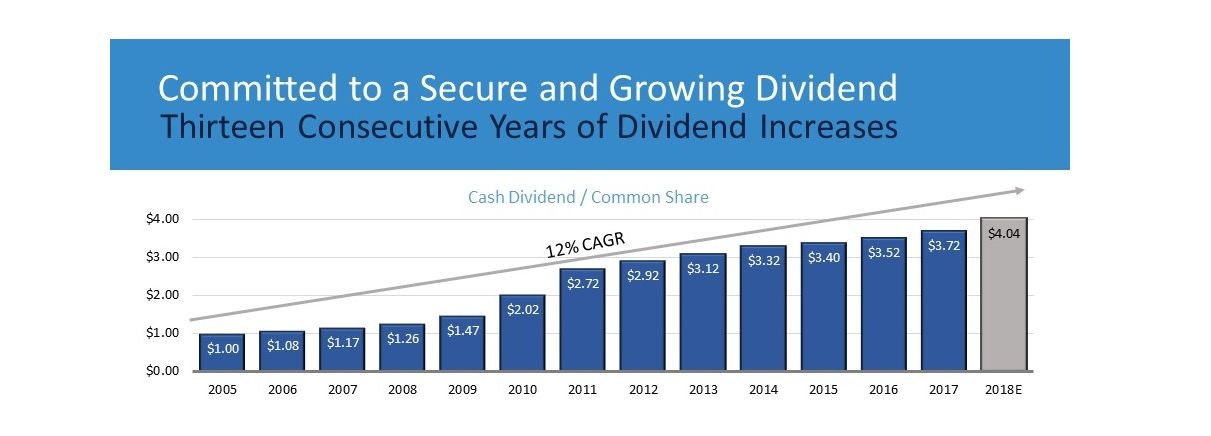

Antwort auf Beitrag Nr.: 54.009.596 von R-BgO am 04.01.17 16:57:16Zeit zum Wiedereinstieg? Beeindruckende Dividendenhistorie! Könnte mir vorstellen, dass noch viele goldene Jahre folgen #Digitalisierung

Zitat von R-BgO: wobei mir da sicher der dollar ordentlich geholfen hat;

Erinnerungsstück behalten und mit einem Teil der Erlöse Series G preferreds gekauft, die 5,875% bringen.

So habe ich mehr Ertrag als vorher, aber auch keine upside mehr.

Umgeschlüsselt von "Services - Datacenter" zu "Bond statt Aktie"

verdient wird nur ungefähr die Hälfte der Ausschüttung:

-ewig kann das nicht so weitergehen-

vorläufig schon

Antwort auf Beitrag Nr.: 54.009.596 von R-BgO am 04.01.17 16:57:16

heute verkauft

zu $25,55

Mit einem Investment in die Digital Realty Aktie ist es möglich Dividenden mit Rechenzentren zu kassieren.

Das Unternehmen steigert seine Dividenden nun seit mittlerweile 16 Jahren.

Aktuell bietet die Aktie eine Dividendenrendite von 3,21%

Mehr interessante Fakten gibt es hier:

https://www.dividendenaktien.net/aktien/digital-realty-trust

Das Unternehmen steigert seine Dividenden nun seit mittlerweile 16 Jahren.

Aktuell bietet die Aktie eine Dividendenrendite von 3,21%

Mehr interessante Fakten gibt es hier:

https://www.dividendenaktien.net/aktien/digital-realty-trust

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,97 | |

| -0,99 | |

| -0,21 | |

| -0,07 | |

| +0,05 | |

| +0,17 | |

| -0,49 | |

| -0,65 | |

| +0,18 | |

| +1,14 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 179 | ||

| 173 | ||

| 105 | ||

| 56 | ||

| 48 | ||

| 46 | ||

| 43 | ||

| 41 | ||

| 39 | ||

| 36 |