Opko Health - Der nächste Blockbuster (Seite 268)

eröffnet am 10.12.13 19:42:20 von

neuester Beitrag 07.05.24 22:55:13 von

neuester Beitrag 07.05.24 22:55:13 von

Beiträge: 3.051

ID: 1.189.336

ID: 1.189.336

Aufrufe heute: 3

Gesamt: 261.284

Gesamt: 261.284

Aktive User: 0

ISIN: US68375N1037 · WKN: A0MUUJ · Symbol: XCY

1,2500

USD

-3,85 %

-0,0500 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

07.05.24 · globenewswire |

03.05.24 · globenewswire |

05.03.24 · globenewswire |

27.02.24 · globenewswire |

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,8450 | +146,00 | |

| 0,5700 | +55,23 | |

| 0,7200 | +47,03 | |

| 5,4500 | +41,56 | |

| 1,0000 | +33,33 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,0000 | -12,50 | |

| 13,800 | -13,86 | |

| 4,1900 | -14,49 | |

| 0,9235 | -16,88 | |

| 5,2500 | -19,23 |

Beitrag zu dieser Diskussion schreiben

Fantastisch! Ich liebe diese Aktie.

Antwort auf Beitrag Nr.: 63.387.347 von Potatoehead am 20.04.20 16:17:26

Vermutlich irgendwas großes, was wir noch nicht wissen, aber hinter den Kulissen schon vorbereitet wird.

Wenn ein FDA-Approval kommt, gibt's womöglich zweistellige Kurse, denn sowas sichert langfristige Einnahmen fürs Unternehmen.

Können auch andere Gründe sein (OPKO kauft oft kleine Firmen, also kommt vielleicht eine Übernahme).

Oder die Massen gehen einfach wieder verstärkt in die Pharma-Aktien rein, weil sie davon ausgehen dass die Bärenmarkt-Rally bald vorbei ist.

Wir werden es in den nächsten Wochen erfahren, ich habe keine Eile.

Zitat von Potatoehead: Gibt's einen Grund für den Anstieg heut 🤔

Vermutlich irgendwas großes, was wir noch nicht wissen, aber hinter den Kulissen schon vorbereitet wird.

Wenn ein FDA-Approval kommt, gibt's womöglich zweistellige Kurse, denn sowas sichert langfristige Einnahmen fürs Unternehmen.

Können auch andere Gründe sein (OPKO kauft oft kleine Firmen, also kommt vielleicht eine Übernahme).

Oder die Massen gehen einfach wieder verstärkt in die Pharma-Aktien rein, weil sie davon ausgehen dass die Bärenmarkt-Rally bald vorbei ist.

Wir werden es in den nächsten Wochen erfahren, ich habe keine Eile.

Gibt's einen Grund für den Anstieg heut 🤔

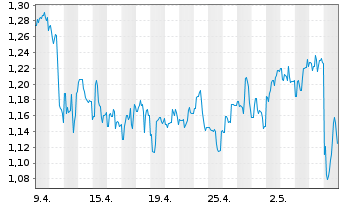

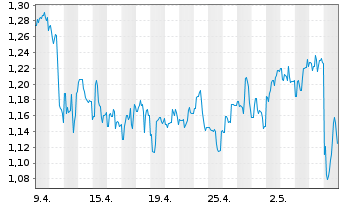

Im April ist ein Kanal klar erkennbar:

Anstehende Termine für OPKO HEALTH, INC.

12.05.20 Q1 2020 Ergebnisveröffentlichung (geplant)

05.08.20 Erstes Halbjahr 2020 Ergebnisveröffentlichung (geplant)

04.11.20 Q3 2020 Ergebnisveröffentlichung (geplant)

03.03.21 Jahr 2020 Ergebnisveröffentlichung (geplant)

https://ch.marketscreener.com/OPKO-HEALTH-INC-40449569/termi…

12.05.20 Q1 2020 Ergebnisveröffentlichung (geplant)

05.08.20 Erstes Halbjahr 2020 Ergebnisveröffentlichung (geplant)

04.11.20 Q3 2020 Ergebnisveröffentlichung (geplant)

03.03.21 Jahr 2020 Ergebnisveröffentlichung (geplant)

https://ch.marketscreener.com/OPKO-HEALTH-INC-40449569/termi…

Opko Health Inc. (NASDAQ:OPK): Is Short Squeeze Rally Coming Soon?

OPKO has come into the attention of investors because it has been backed strongly by the investment firm owned by Phillip Frost. Frost made his fortune after he sold his company Ivax to Teva Pharmaceuticals in 2005 in a deal worth $7.5 billion. While Frost is optimistic about the company and has projected billions in sales, the actual situation is different. In 2019, the company generated revenues of $900 million, and much of it was generated by its diagnostic subsidiary BioReference Labs.

In addition to that, it is interesting to note that most of the products and services that belong to OPKO have come through acquisitions. Investors are perhaps hopeful that the optimism of a successful healthcare entrepreneur like Frost is not misplaced. In recent years, the company has made plenty of acquisitions and also picked up minority stakes in some companies.

However, it should be noted that OPKO pays for its acquisitions in its own stock, and that is an indication that the company is bullish about its future. Additionally, Frost has also been buying shares in the company. The stock is up by 9% in the year so far despite the selloff in the wider market. Hence, there could well be a lot of value in the company for investors going forward.

https://oracledispatch.com/2020/04/17/opko-health-inc-nasdaq…

OPKO has come into the attention of investors because it has been backed strongly by the investment firm owned by Phillip Frost. Frost made his fortune after he sold his company Ivax to Teva Pharmaceuticals in 2005 in a deal worth $7.5 billion. While Frost is optimistic about the company and has projected billions in sales, the actual situation is different. In 2019, the company generated revenues of $900 million, and much of it was generated by its diagnostic subsidiary BioReference Labs.

In addition to that, it is interesting to note that most of the products and services that belong to OPKO have come through acquisitions. Investors are perhaps hopeful that the optimism of a successful healthcare entrepreneur like Frost is not misplaced. In recent years, the company has made plenty of acquisitions and also picked up minority stakes in some companies.

However, it should be noted that OPKO pays for its acquisitions in its own stock, and that is an indication that the company is bullish about its future. Additionally, Frost has also been buying shares in the company. The stock is up by 9% in the year so far despite the selloff in the wider market. Hence, there could well be a lot of value in the company for investors going forward.

https://oracledispatch.com/2020/04/17/opko-health-inc-nasdaq…

Why Is Everyone Talking About OPKO Health Stock?

The pharmaceutical and diagnostics specialist ran into some SEC-related controversy in 2018; now, it's a major player in the fight against COVID-19.

Nowadays, with OPKO valued at just $1 billion, Frost is using his cash to buy shares in his own company. And when insiders are buying, that's often a sign that a stock is undervalued by the market.

OPKO's stock is up 9% in 2020, while the broader market is down by a double-digit percentage. OPKO's subsidiary, BioReference Labs, is one of the major diagnostic outfits running tests for COVID-19 in the U.S. So investors are starting to feel optimistic about the company again. Perhaps the most bullish indicator, at least in the short term, is that the shorts are starting to feel the squeeze.

Just a few years ago, the market loved OPKO Health and its visionary CEO, running the stock up to a $7 billion valuation. The market was too optimistic back then, and the stock was hammered when Frost's vision didn't come together right away. But if you look at OPKO with fresh eyes, you might see a tremendous amount of potential -- and a CEO who has a history of finding unrecognized value.

https://www.fool.com/investing/2020/04/16/why-is-everyone-ta…

The pharmaceutical and diagnostics specialist ran into some SEC-related controversy in 2018; now, it's a major player in the fight against COVID-19.

Nowadays, with OPKO valued at just $1 billion, Frost is using his cash to buy shares in his own company. And when insiders are buying, that's often a sign that a stock is undervalued by the market.

OPKO's stock is up 9% in 2020, while the broader market is down by a double-digit percentage. OPKO's subsidiary, BioReference Labs, is one of the major diagnostic outfits running tests for COVID-19 in the U.S. So investors are starting to feel optimistic about the company again. Perhaps the most bullish indicator, at least in the short term, is that the shorts are starting to feel the squeeze.

Just a few years ago, the market loved OPKO Health and its visionary CEO, running the stock up to a $7 billion valuation. The market was too optimistic back then, and the stock was hammered when Frost's vision didn't come together right away. But if you look at OPKO with fresh eyes, you might see a tremendous amount of potential -- and a CEO who has a history of finding unrecognized value.

https://www.fool.com/investing/2020/04/16/why-is-everyone-ta…

Na, deswegen bin ich ja in der Aktie. Ich warte auf die Meldung zur Zulassung in Europa und auf FDA-Meldungen zu den anderen Produkten (im Artikel oben sind längst nicht alle aufgezählt). Die Aktie einfach im Depot schlafen lassen, irgendwann im Laufe von 2020 gibt's einen Kursausbruch nach oben. Die jetzige Tests-Geschichte interessiert mich nur am Rande, ich warte auf FDA-relevante Meldungen, alles andere juckt mich nicht.

Antwort auf Beitrag Nr.: 63.352.684 von Malecon am 16.04.20 20:27:43

Hoffentlich wird das Rayaldee in Europa zugelassen.

Aus dieser Somatrogon Studie sollten doch im März Halbzeitergebnisse veröffentlicht werden.

Wenn da noch positive News kommen, dann sollte die Stimmung gegenüber OPKO vor allem in USA stetig besser werden.

Wie seht ihr das?

Hoffentlich wird das Rayaldee in Europa zugelassen.

Aus dieser Somatrogon Studie sollten doch im März Halbzeitergebnisse veröffentlicht werden.

Wenn da noch positive News kommen, dann sollte die Stimmung gegenüber OPKO vor allem in USA stetig besser werden.

Wie seht ihr das?

Here's Why You Should Retain OPKO Health in Your Portfolio

OPKO Health, Inc. OPK is gaining traction on progress with RAYALDEE and a robust R&D pipeline. However,stiff competition has been offsetting the positives to some extent.

Let’s delve deeper into the factors working in favor of the company.

RAYALDEE Gains Prominence: Within the pharmaceutical business, RAYALDEE has been OPKO Health’s leading renal product in the U.S. market for the last two years. RAYALDEE is the first and only therapy approved by the FDA for the treatment of secondary hyperparathyroidism (SHPT) in adults with stage 3 or 4 chronic kidney disease. RAYALDEE has been witnessing a decent momentum, courtesy of successful efforts from the sales team.

Per the fourth-quarter 2019 earnings call, the company expects European approval for RAYALDEE and its first commercial launch later in 2020. Further, the open-label Phase 2 trial for RAYALDEE in hemodialysis patients is in progress, with initial data anticipated in first-quarter 2020. The company is optimistic about expanding RAYALDEE’s label and bolstering its market presence post which it will become a meaningful contributor to sales and earnings.

4Kscore Test Holds Promise: OPKO Health offers the 4Kscore test through BioReference, the company’s clinical service laboratory platform. In fourth-quarter 2019, 4Kscore test utilization was strong, with around to 18,000 tests performed. In December 2019, the FDA accepted a premarket approval submission for the 4Kscore test.

In November 2019, 4Kscore test received a final local coverage determination (LCD) from Novitas Solutions, which was effective Dec 30, 2019, with respect to reestablishing reimbursement for the important Medicare patient populations. This is also expected to continue driving growth for the company in the long term.

R&D Focus Solid: OPKO Health’s strong focus in research and development (R&D) is a positive. The company’s strong commitment toward innovation led to the introduction of several products, improvement in existing products and expansion of product lines as well as enhancements and new equipment in R&D facilities.

Per management, the company will continue to make solid investments in R&D programs throughout 2020. OPKO Health projects R&D expenses of $23-$28 million in first-quarter 2020 and $85-$125 million in 2020.

https://finance.yahoo.com/news/heres-why-retain-opko-health-…

OPKO Health, Inc. OPK is gaining traction on progress with RAYALDEE and a robust R&D pipeline. However,stiff competition has been offsetting the positives to some extent.

Let’s delve deeper into the factors working in favor of the company.

RAYALDEE Gains Prominence: Within the pharmaceutical business, RAYALDEE has been OPKO Health’s leading renal product in the U.S. market for the last two years. RAYALDEE is the first and only therapy approved by the FDA for the treatment of secondary hyperparathyroidism (SHPT) in adults with stage 3 or 4 chronic kidney disease. RAYALDEE has been witnessing a decent momentum, courtesy of successful efforts from the sales team.

Per the fourth-quarter 2019 earnings call, the company expects European approval for RAYALDEE and its first commercial launch later in 2020. Further, the open-label Phase 2 trial for RAYALDEE in hemodialysis patients is in progress, with initial data anticipated in first-quarter 2020. The company is optimistic about expanding RAYALDEE’s label and bolstering its market presence post which it will become a meaningful contributor to sales and earnings.

4Kscore Test Holds Promise: OPKO Health offers the 4Kscore test through BioReference, the company’s clinical service laboratory platform. In fourth-quarter 2019, 4Kscore test utilization was strong, with around to 18,000 tests performed. In December 2019, the FDA accepted a premarket approval submission for the 4Kscore test.

In November 2019, 4Kscore test received a final local coverage determination (LCD) from Novitas Solutions, which was effective Dec 30, 2019, with respect to reestablishing reimbursement for the important Medicare patient populations. This is also expected to continue driving growth for the company in the long term.

R&D Focus Solid: OPKO Health’s strong focus in research and development (R&D) is a positive. The company’s strong commitment toward innovation led to the introduction of several products, improvement in existing products and expansion of product lines as well as enhancements and new equipment in R&D facilities.

Per management, the company will continue to make solid investments in R&D programs throughout 2020. OPKO Health projects R&D expenses of $23-$28 million in first-quarter 2020 and $85-$125 million in 2020.

https://finance.yahoo.com/news/heres-why-retain-opko-health-…