Amarin - The Science Of Lipid Therapy (Seite 111)

eröffnet am 03.01.14 20:10:32 von

neuester Beitrag 04.04.24 15:47:54 von

neuester Beitrag 04.04.24 15:47:54 von

Beiträge: 1.840

ID: 1.190.027

ID: 1.190.027

Aufrufe heute: 1

Gesamt: 156.392

Gesamt: 156.392

Aktive User: 0

ISIN: US0231112063 · WKN: A0NBNG · Symbol: EH3A

0,9100

USD

-0,87 %

-0,0080 USD

Letzter Kurs 04.05.24 Nasdaq

Neuigkeiten

01.05.24 · globenewswire |

24.04.24 · globenewswire |

22.04.24 · globenewswire |

15.04.24 · globenewswire |

Amarin Highlights Key Data Providing Mechanistic Insights into Eicosapentaenoic Acid (EPA) at ACC.24 08.04.24 · globenewswire |

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2000 | +471,16 | |

| 13,110 | +38,44 | |

| 6,5000 | +27,45 | |

| 1,2100 | +21,00 | |

| 48,25 | +19,94 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 24,050 | -12,55 | |

| 4,0300 | -12,96 | |

| 6,2600 | -14,25 | |

| 3,8500 | -14,45 | |

| 36,70 | -22,87 |

Beitrag zu dieser Diskussion schreiben

Does Amarin Have a Dark Horse Suitor?

Gilead's decision to add Vascepa to an ongoing NASH study failed to grab much attention last week. But this development is quite intriguing for several reasons.

George Budwell

George Budwell

(TMFGBudwell)

Nov 24, 2019 at 6:38PM

Author Bio

Amarin (NASDAQ:AMRN), a mid-cap pharma company, has long been rumored to be a buyout candidate. The core reason is that the company's prescription omega-3 treatment, Vascepa (icosapent ethyl), hit the mark in a large, placebo-controlled cardiovascular outcomes trial -- a feat no other omega-3 therapy has ever accomplished. In fact, GlaxoSmithKline's competing omega-3 treatment, Lovaza, failed to show a similar cardiovascular benefit in its Ascend trial.

This novel, orally administered omega-3 pill could thus end up as a key component in the standard of care for patients at risk of cardiovascular disease, despite being on statin therapy. The big deal is that this target market is believed to encompass almost 10 million Americans at present. Even so, this already large patient population could grow significantly over the next decade because of the out-of-control obesity epidemic. So, conservatively speaking, Vascepa should rack up at least $2 billion in annual sales, depending on the scope of the drug's as-of-yet to be determined label for this indication.

Two men shaking hands over a table.

Image Source: Getty Images.

Buyout rumors aplenty

Amarin has repeatedly been linked to three pharma heavyweights as a possible takeover target. These not-so-secret names are Amgen, Pfizer, and Novartis (NYSE:NVS), and they have bubbled to the top of the M&A rumor mill because each company has an abiding interest in cardiovascular care, as well as the financial flexibility to pay top dollar for Amarin's hand.

This weekend, however, news broke that Novartis has decided to acquire The Medicines Company mainly for its experimental lipid-lowering treatment inclisiran. This $7 billion deal, in turn, probably spells the end of Novartis' long-rumored interest in Amarin.

Nonetheless, a new challenger may have quietly emerged from the shadows. Approximately two weeks ago, Gilead Sciences (NASDAQ:GILD) added Vascepa to an ongoing phase 2 study for patients with nonalcoholic steatohepatitis (NASH). The drug will be assessed as part of a triplet therapy that includes the biotech's non-steroidal farnesoid X receptor agonist cilofexor and the acetyl-CoA carboxylase inhibitor firsocostat. Top-line data from this ongoing trial is due out next May, according to clinicaltrials.gov.

Why would Gilead buy Amarin?

The lowdown is that Gilead is attempting to develop a top shelf combination treatment for NASH. By doing so, the biotech would be able to leap frog the first-generation of monotherapies set to hit the market as soon as 2020. And it might even be able to establish a competitive moat against the army of big pharmas and big biotechs racing to bring their own combo NASH treatments to market. Vascepa could be Gilead's ticket to unlocking the wide-open $65 billion NASH market.

Why might Vascepa be the missing ingredient in Gilead's NASH quest? Back in April, Gilead unleashed some promising data for the doublet therapy of cilofexor and firsocostat in NASH patients at the International Liver Congress. The drawback was that some of the patients evaluated in the trial exhibited a severe spike in triglyceride levels -- a known side-effect of firsocostat. Presumably, Gilead decided to add a Vascepa arm to explore the drug's ability to combat this potentially serious side effect.

What's more, Vascepa might also provide an all-important cardioprotective benefit in this at-risk patient population. And this second clinical benefit could be a game-changer for the therapy from a commercial standpoint. There is a well-established link between NASH and cardiovascular disease, after all.

What's the key takeaway? While this clinical trial news might turn out to be a big, fat nothingburger, it may also be the first sign that Gilead is considering an Amarin partnership, or perhaps a full-on buyout. The fact is that Gilead is one of the few biopharmas that could buy Amarin in cash without batting an eye. Moreover, Vascepa's potential dual purpose as an add-on to statin-therapy in patients with cardiovascular disease, and as part of a top-selling NASH cocktail, easily justifies the premium a buyout would entail.

Gilead's decision to add Vascepa to an ongoing NASH study failed to grab much attention last week. But this development is quite intriguing for several reasons.

George Budwell

George Budwell

(TMFGBudwell)

Nov 24, 2019 at 6:38PM

Author Bio

Amarin (NASDAQ:AMRN), a mid-cap pharma company, has long been rumored to be a buyout candidate. The core reason is that the company's prescription omega-3 treatment, Vascepa (icosapent ethyl), hit the mark in a large, placebo-controlled cardiovascular outcomes trial -- a feat no other omega-3 therapy has ever accomplished. In fact, GlaxoSmithKline's competing omega-3 treatment, Lovaza, failed to show a similar cardiovascular benefit in its Ascend trial.

This novel, orally administered omega-3 pill could thus end up as a key component in the standard of care for patients at risk of cardiovascular disease, despite being on statin therapy. The big deal is that this target market is believed to encompass almost 10 million Americans at present. Even so, this already large patient population could grow significantly over the next decade because of the out-of-control obesity epidemic. So, conservatively speaking, Vascepa should rack up at least $2 billion in annual sales, depending on the scope of the drug's as-of-yet to be determined label for this indication.

Two men shaking hands over a table.

Image Source: Getty Images.

Buyout rumors aplenty

Amarin has repeatedly been linked to three pharma heavyweights as a possible takeover target. These not-so-secret names are Amgen, Pfizer, and Novartis (NYSE:NVS), and they have bubbled to the top of the M&A rumor mill because each company has an abiding interest in cardiovascular care, as well as the financial flexibility to pay top dollar for Amarin's hand.

This weekend, however, news broke that Novartis has decided to acquire The Medicines Company mainly for its experimental lipid-lowering treatment inclisiran. This $7 billion deal, in turn, probably spells the end of Novartis' long-rumored interest in Amarin.

Nonetheless, a new challenger may have quietly emerged from the shadows. Approximately two weeks ago, Gilead Sciences (NASDAQ:GILD) added Vascepa to an ongoing phase 2 study for patients with nonalcoholic steatohepatitis (NASH). The drug will be assessed as part of a triplet therapy that includes the biotech's non-steroidal farnesoid X receptor agonist cilofexor and the acetyl-CoA carboxylase inhibitor firsocostat. Top-line data from this ongoing trial is due out next May, according to clinicaltrials.gov.

Why would Gilead buy Amarin?

The lowdown is that Gilead is attempting to develop a top shelf combination treatment for NASH. By doing so, the biotech would be able to leap frog the first-generation of monotherapies set to hit the market as soon as 2020. And it might even be able to establish a competitive moat against the army of big pharmas and big biotechs racing to bring their own combo NASH treatments to market. Vascepa could be Gilead's ticket to unlocking the wide-open $65 billion NASH market.

Why might Vascepa be the missing ingredient in Gilead's NASH quest? Back in April, Gilead unleashed some promising data for the doublet therapy of cilofexor and firsocostat in NASH patients at the International Liver Congress. The drawback was that some of the patients evaluated in the trial exhibited a severe spike in triglyceride levels -- a known side-effect of firsocostat. Presumably, Gilead decided to add a Vascepa arm to explore the drug's ability to combat this potentially serious side effect.

What's more, Vascepa might also provide an all-important cardioprotective benefit in this at-risk patient population. And this second clinical benefit could be a game-changer for the therapy from a commercial standpoint. There is a well-established link between NASH and cardiovascular disease, after all.

What's the key takeaway? While this clinical trial news might turn out to be a big, fat nothingburger, it may also be the first sign that Gilead is considering an Amarin partnership, or perhaps a full-on buyout. The fact is that Gilead is one of the few biopharmas that could buy Amarin in cash without batting an eye. Moreover, Vascepa's potential dual purpose as an add-on to statin-therapy in patients with cardiovascular disease, and as part of a top-selling NASH cocktail, easily justifies the premium a buyout would entail.

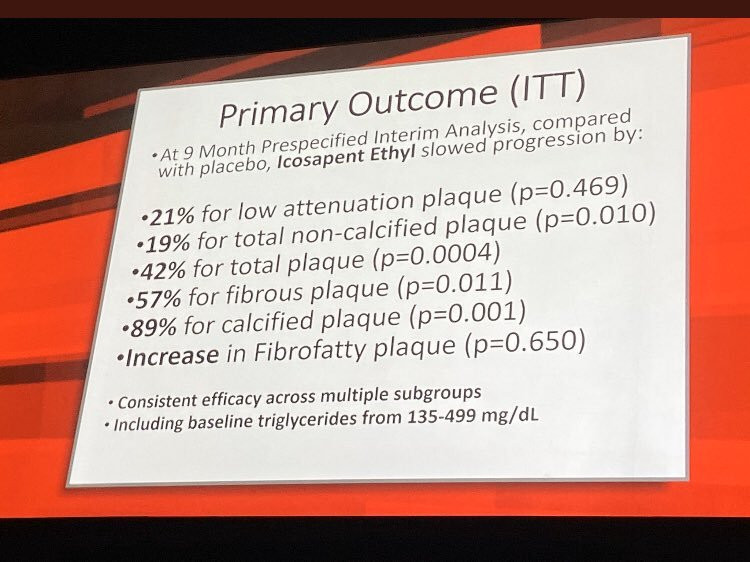

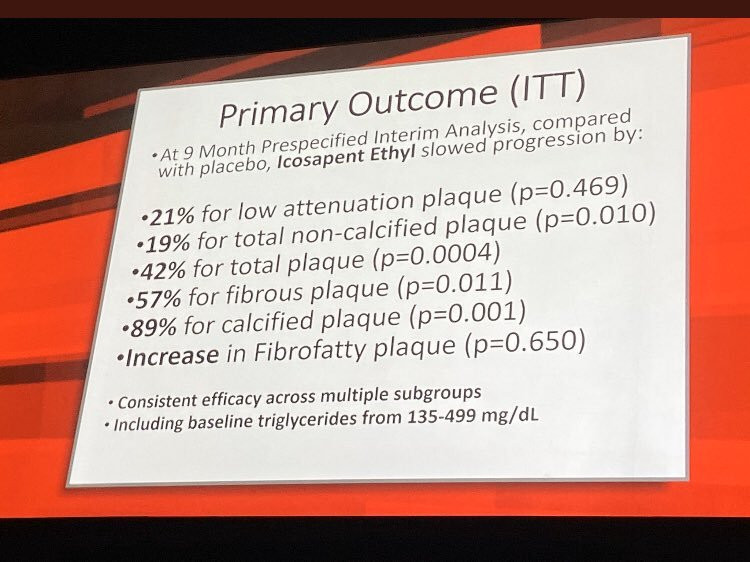

Ich meine diese Studie

https://clinicaltrials.gov/ct2/show/NCT02719327

Wenn ich die Interimsergebnisse anschaue, hoffe ich auf einen ähnlichen Effekt in den Gehirnarterien:

https://clinicaltrials.gov/ct2/show/NCT02719327

Wenn ich die Interimsergebnisse anschaue, hoffe ich auf einen ähnlichen Effekt in den Gehirnarterien:

Reduktion des Plaques hat Vascepa in der Evaporate Studie in 5 von 6 verschiedenen Parametern gezeigt, Vascepa wird auch bei Alzheimer in einer Studie erprobt, wenn dort die Gehirnarterien von Plaque befreit werden bzw. sich die Progression statistisch signifikant verringert haben wir eine 1000 Dollar Aktie:

Antwort auf Beitrag Nr.: 61.987.463 von Magnetfeldfredy am 22.11.19 06:42:08Hi Magnetfeldredy,

siehste und das meine ich mit "nicht aus der Ruhe bringen lassen" .

Wenn man selbst überzeugt ist von dem Wert und seine eigenen Recherchen gemacht hat, bestätigt diese Sichtweise nur das was man selbst denkt.

Aber ich kann es nachvollziehen, bei dem Auf und Ab hier mit Amarin bisher und so vielen Gerüchten ... usw. kann man schonmal echt die Nerven verlieren.

Ich sehe aber sehr zuversichtlich in die nahe Zukunft "nächsten" Wochen und wenn dann klar ist wie weit die Label Expansion ist kann man sicher auch weiterhin hier ein sehr erfolgreicher long "bleiben" wenn man noch Sitzfleisch hat und nicht an ersten Profit ran muss/möchte.

siehste und das meine ich mit "nicht aus der Ruhe bringen lassen" .

Wenn man selbst überzeugt ist von dem Wert und seine eigenen Recherchen gemacht hat, bestätigt diese Sichtweise nur das was man selbst denkt.

Aber ich kann es nachvollziehen, bei dem Auf und Ab hier mit Amarin bisher und so vielen Gerüchten ... usw. kann man schonmal echt die Nerven verlieren.

Ich sehe aber sehr zuversichtlich in die nahe Zukunft "nächsten" Wochen und wenn dann klar ist wie weit die Label Expansion ist kann man sicher auch weiterhin hier ein sehr erfolgreicher long "bleiben" wenn man noch Sitzfleisch hat und nicht an ersten Profit ran muss/möchte.

Is Amarin Really a $7 Stock?

Amarin's shares got walloped yesterday by a bearish analyst report.

George Budwell

George Budwell

(TMFGBudwell)

Nov 21, 2019 at 9:25AM

Author Bio

Yesterday, Amarin (NASDAQ:AMRN) lost over 10% of its value in response to a rather harsh report by Oppenheimer analyst Leland Gershell. The key issue that triggered this double-digit sell-off appears to be Gershell's uberbearish prediction that Amarin's stock could drop by as much as 70% to a lowly $7 per share over the next year.

The analyst's reasoning is based on two underlying assumptions:

Vascepa's sales will fall well short of expectations following its label expansion for patients at risk of cardiovascular disease. Amarin's stock has recently been trading at a price-to-sales ratio north of 20, so it's definitely fair to say that the market expects Vascepa's sales to grow by leaps and bounds soon. The current consensus estimate stands at $2.2 billion, according to EvaluatePharma. However, a broad label could easily double -- or perhaps quadruple -- this figure, given the sheer size of the market.

Amarin's prospects as a buyout candidate will quickly fade due to the emergence of competition in the space from AstraZeneca's Epanova, Acasti Pharma's CaPre, Matinas BioPharma's MAT9001, among others.

Here's why investors shouldn't get overly worked up by this bearish analyst report.

Woman staring at an open laptop computer with a look of shock on her face.

Image source: Getty Images.

Amarin: King of the omega-3 hill

While Gershell's take is certainly audacious, it simply doesn't line up with the facts on the ground. First off, Vascepa is the only omega-3 treatment in history to show a statistically significant cardiovascular benefit in a large, placebo-controlled trial. So while it's easy to point to the emergence of "superior competition" as a potential risk factor, the reality of the situation is that most -- if not all -- of these rival candidates could very well flop in terms of conveying a cardiovascular benefit. In fact, it would be rather surprising if any of these putative competitors emerged as a direct rival to Vascepa during the drug's prime years.

Keeping with this theme, the candidate with the best chance of knocking off Vascepa -- Acasti's CaPre -- probably wouldn't get through a full-on cardiovascular trial until Vascepa was in its twilight years from a patent protection standpoint. That's important because doctors aren't going to readily prescribe a medicine off-label for a wide swath of Americans just because it seems to stack up well against the standard of care. Eyeball tests don't fly when it comes to patient care. CaPre will have to complete a time-consuming cardiovascular outcomes trial before it will ever be prescribed in lieu of Vascepa, and that won't happen until almost the end of the next decade.

The take-home point is that Vascepa should easily grab the lion's share of the omega-3 treatment space for the whole of the next decade, thanks to its highly anticipated label expansion as an add-on to statin therapy in patients with elevated triglyceride levels.

Is Amarin still a strong buyout candidate?

On the buyout front, Amarin's prospects haven't changed whatsoever since Vascepa's positive adcom vote. Long story short, there is no logical reason to believe that Astra's Epanova is going to perform any better than its mixed fish oil predecessors, much less upstage Vascepa's unprecedented Reduce-It results. Moreover, the biggest competitive threats to Vascepa are upwards of a decade from truly materializing.

So, given the fact that there isn't a single product with a proven cardiovascular benefit currently being marketed by a small biopharma, it's more than reasonable to assume that Amarin does indeed have a huge target on its back right now. In other words, Amarin's shares have a much better chance of rocketing to $70 than crashing to $7 over the next 12 months.

Amarin's shares got walloped yesterday by a bearish analyst report.

George Budwell

George Budwell

(TMFGBudwell)

Nov 21, 2019 at 9:25AM

Author Bio

Yesterday, Amarin (NASDAQ:AMRN) lost over 10% of its value in response to a rather harsh report by Oppenheimer analyst Leland Gershell. The key issue that triggered this double-digit sell-off appears to be Gershell's uberbearish prediction that Amarin's stock could drop by as much as 70% to a lowly $7 per share over the next year.

The analyst's reasoning is based on two underlying assumptions:

Vascepa's sales will fall well short of expectations following its label expansion for patients at risk of cardiovascular disease. Amarin's stock has recently been trading at a price-to-sales ratio north of 20, so it's definitely fair to say that the market expects Vascepa's sales to grow by leaps and bounds soon. The current consensus estimate stands at $2.2 billion, according to EvaluatePharma. However, a broad label could easily double -- or perhaps quadruple -- this figure, given the sheer size of the market.

Amarin's prospects as a buyout candidate will quickly fade due to the emergence of competition in the space from AstraZeneca's Epanova, Acasti Pharma's CaPre, Matinas BioPharma's MAT9001, among others.

Here's why investors shouldn't get overly worked up by this bearish analyst report.

Woman staring at an open laptop computer with a look of shock on her face.

Image source: Getty Images.

Amarin: King of the omega-3 hill

While Gershell's take is certainly audacious, it simply doesn't line up with the facts on the ground. First off, Vascepa is the only omega-3 treatment in history to show a statistically significant cardiovascular benefit in a large, placebo-controlled trial. So while it's easy to point to the emergence of "superior competition" as a potential risk factor, the reality of the situation is that most -- if not all -- of these rival candidates could very well flop in terms of conveying a cardiovascular benefit. In fact, it would be rather surprising if any of these putative competitors emerged as a direct rival to Vascepa during the drug's prime years.

Keeping with this theme, the candidate with the best chance of knocking off Vascepa -- Acasti's CaPre -- probably wouldn't get through a full-on cardiovascular trial until Vascepa was in its twilight years from a patent protection standpoint. That's important because doctors aren't going to readily prescribe a medicine off-label for a wide swath of Americans just because it seems to stack up well against the standard of care. Eyeball tests don't fly when it comes to patient care. CaPre will have to complete a time-consuming cardiovascular outcomes trial before it will ever be prescribed in lieu of Vascepa, and that won't happen until almost the end of the next decade.

The take-home point is that Vascepa should easily grab the lion's share of the omega-3 treatment space for the whole of the next decade, thanks to its highly anticipated label expansion as an add-on to statin therapy in patients with elevated triglyceride levels.

Is Amarin still a strong buyout candidate?

On the buyout front, Amarin's prospects haven't changed whatsoever since Vascepa's positive adcom vote. Long story short, there is no logical reason to believe that Astra's Epanova is going to perform any better than its mixed fish oil predecessors, much less upstage Vascepa's unprecedented Reduce-It results. Moreover, the biggest competitive threats to Vascepa are upwards of a decade from truly materializing.

So, given the fact that there isn't a single product with a proven cardiovascular benefit currently being marketed by a small biopharma, it's more than reasonable to assume that Amarin does indeed have a huge target on its back right now. In other words, Amarin's shares have a much better chance of rocketing to $70 than crashing to $7 over the next 12 months.

Antwort auf Beitrag Nr.: 61.977.344 von Magnetfeldfredy am 20.11.19 23:17:07

Zitat von Magnetfeldfredy: Rastelly, ich kenne auch einen Fusballrastelli:

Hier ein Leland Buy - Rating von 12 USD -

aktueller Kurs MGEM = 0,6285

aktueller Kurs MGEM = 0,6285

Antwort auf Beitrag Nr.: 61.979.954 von Magnetfeldfredy am 21.11.19 10:37:18Der , der mit J.T. nie gesprochen hat.

John Thero heute in London, geil, was er zum Fraud Analysten von Oppenheimer sagt:

Oasis2

14m

$AMRN the CEO has just slammed the Oppenheimer analyst saying that it’s basically untrue what he said and that he had never spoke to this analyst. JT basically says it’s rubbish about what the analyst says about the competition. He praises the more thoughtful analysts out there like Michael Yee at Jefferies.

WOW!!

Oasis2

14m

$AMRN the CEO has just slammed the Oppenheimer analyst saying that it’s basically untrue what he said and that he had never spoke to this analyst. JT basically says it’s rubbish about what the analyst says about the competition. He praises the more thoughtful analysts out there like Michael Yee at Jefferies.

WOW!!

Antwort auf Beitrag Nr.: 61.977.344 von Magnetfeldfredy am 20.11.19 23:17:07Ja, auch diesen Spitznamen rührt bei mir aus dem Fussball.

Allerdings schon ein paar Tage her und jetzt in Natur "eisgrau" .

Habe diesen damals einfach als User übernommen.

Gruss RS😎

Allerdings schon ein paar Tage her und jetzt in Natur "eisgrau" .

Habe diesen damals einfach als User übernommen.

Gruss RS😎

Amarin - The Science Of Lipid Therapy