Tencent, wachsender Internetgigant !! (Seite 185)

eröffnet am 08.07.14 17:52:58 von

neuester Beitrag 06.02.24 22:51:20 von

neuester Beitrag 06.02.24 22:51:20 von

Beiträge: 2.628

ID: 1.196.204

ID: 1.196.204

Aufrufe heute: 0

Gesamt: 343.014

Gesamt: 343.014

Aktive User: 0

ISIN: KYG875721634 · WKN: A1138D

32,26

EUR

-1,00 %

-0,33 EUR

Letzter Kurs 23.06.17 Xetra

Neuigkeiten

Big Tech aus China: Alibaba und Tencent: Starke Bilanzen, innovativ und dazu noch attraktiv bewertet 04.05.24 · wallstreetONLINE Redaktion |

26.04.24 · wallstreetONLINE Redaktion |

22.04.24 · Markus Weingran |

22.04.24 · Der Aktionär TV |

08.04.24 · BNP Paribas Anzeige |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3300 | +15,15 | |

| 6,1700 | +13,21 | |

| 19,450 | +11,97 | |

| 4,0000 | +11,11 | |

| 54,39 | +10,41 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5800 | -8,56 | |

| 2,4800 | -9,82 | |

| 0,7545 | -16,16 | |

| 6,2500 | -17,22 | |

| 0,5150 | -18,25 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 56.105.645 von tt123 am 05.11.17 20:22:32

Ok...ich hab´s in Euro berechnet...und..

...deine Frage war: was haltet ihr von der Marktkapitalisierung. Was willst du hören. Die MK ist zu hoch, zu niedrig, angemessen oder auch nicht?

Wenn man mit einer Aktie Geld verdienen will und man fragt sich wie steht die in einigen Jahren, Monaten, Wochen...da hilft dir die MK mal grad gar nix. Da braucht es doch viel mehr...aber sei´s drum. Hat jeder so sein eigenes Denken. Vielleicht antwortet dir ja jemand. Bin gespannt

Zitat von tt123: Bei 47,37 $ <-- ! komme ich eher auf 448Mrd $

Worum gehts denn bei Aktien sonst außer der Einschätzung des Wertes (der Marktkapitalisierung). Das macht man in der Regel anhand der Ertragskraft und dem Wachstum/Zukunftsaussichten.

Ok...ich hab´s in Euro berechnet...und..

...deine Frage war: was haltet ihr von der Marktkapitalisierung. Was willst du hören. Die MK ist zu hoch, zu niedrig, angemessen oder auch nicht?

Wenn man mit einer Aktie Geld verdienen will und man fragt sich wie steht die in einigen Jahren, Monaten, Wochen...da hilft dir die MK mal grad gar nix. Da braucht es doch viel mehr...aber sei´s drum. Hat jeder so sein eigenes Denken. Vielleicht antwortet dir ja jemand. Bin gespannt

Antwort auf Beitrag Nr.: 56.103.032 von Jotka108 am 05.11.17 11:37:47Bei 47,37 $ <-- ! komme ich eher auf 448Mrd $

Worum gehts denn bei Aktien sonst außer der Einschätzung des Wertes (der Marktkapitalisierung). Das macht man in der Regel anhand der Ertragskraft und dem Wachstum/Zukunftsaussichten.

Worum gehts denn bei Aktien sonst außer der Einschätzung des Wertes (der Marktkapitalisierung). Das macht man in der Regel anhand der Ertragskraft und dem Wachstum/Zukunftsaussichten.

Antwort auf Beitrag Nr.: 56.102.915 von tt123 am 05.11.17 11:19:00

Alibaba 404 Milliarden

Baidu 72 Milliarden (!)

Tencent 388 Milliarden (bei 40,90)

Wenn Baidu das Pendant zu Google sein soll, wäre da noch Luft nach oben.

Marktkapitalisierung ABT

Vielleicht interessant die Marktkapitalsierung der drei Großen China Internetunternehmen zu vergleichen:Alibaba 404 Milliarden

Baidu 72 Milliarden (!)

Tencent 388 Milliarden (bei 40,90)

Wenn Baidu das Pendant zu Google sein soll, wäre da noch Luft nach oben.

Antwort auf Beitrag Nr.: 56.102.915 von tt123 am 05.11.17 11:19:00

Aber zu deiner Frage kann ich dir nicht helfen. Wie soll man das auch bewerten. Schwierig...

Ich habe eine andere Frage: Tencent bringt China Literature Ltd. an die Börse. Habt ihr da eine Email erhalten von eurer Depotbank? Ich lese in anderen Foren, dass man Vorzugszeichnungen machen kann, wenn man in Tencent investiert ist. Ich bekam nichts, vermutlich hab ich zu wenige Tencents...?

Bin überhaupt zu dem Thema China Literature Limited unterinformiert und würde mich freuen, wenn hier jemand mehr dazu sagen könnte.

Schönen Sonntag noch!

Marktkapiatlisierung Tencent und IPO China Literature Limited

Hi, also ich komme da auf 386 Milliarden. Aktienanzahl 9.498.880.000 ? Aber zu deiner Frage kann ich dir nicht helfen. Wie soll man das auch bewerten. Schwierig...

Ich habe eine andere Frage: Tencent bringt China Literature Ltd. an die Börse. Habt ihr da eine Email erhalten von eurer Depotbank? Ich lese in anderen Foren, dass man Vorzugszeichnungen machen kann, wenn man in Tencent investiert ist. Ich bekam nichts, vermutlich hab ich zu wenige Tencents...?

Bin überhaupt zu dem Thema China Literature Limited unterinformiert und würde mich freuen, wenn hier jemand mehr dazu sagen könnte.

Schönen Sonntag noch!

Moin,

was haltet ihr von der Marktkapitalisierung? Wir sind inzwischen bei knapp 450 Mrd. $ angelangt.

was haltet ihr von der Marktkapitalisierung? Wir sind inzwischen bei knapp 450 Mrd. $ angelangt.

M Stanley Lifts TENCENT (00700.HK) Target to $420; Reiterated Overweight

http://www.aastocks.com/en/stocks/news/aafn-news/NOW.836908/…The broker's bull-case target price of TENCENT is $526, reflecting 47x non-GAAP 2018 P/E (estimate).

HKD 526 = EUR 58

Tencent hits record high

http://www.thestandard.com.hk/breaking-news.php?id=99024&sid…Mainland Sources: Tencent Music Seeks Investment Banks to Take Part in IPO

http://www.aastocks.com/en/stocks/news/aafn-content/NOW.8364…

Tencent-backed China Literature said to raise $1.1b in Hong Kong IPO

https://www.dealstreetasia.com/stories/tencent-arm-hong-kong…

Zahlen kommen am 15.11.2017 !!

Oberkassler

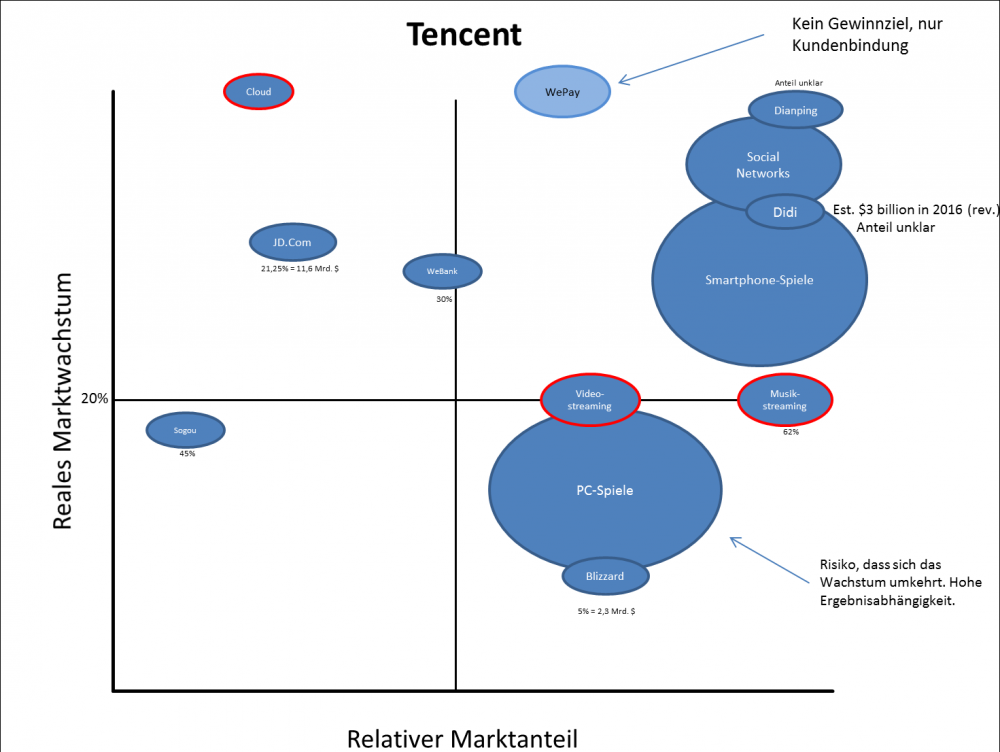

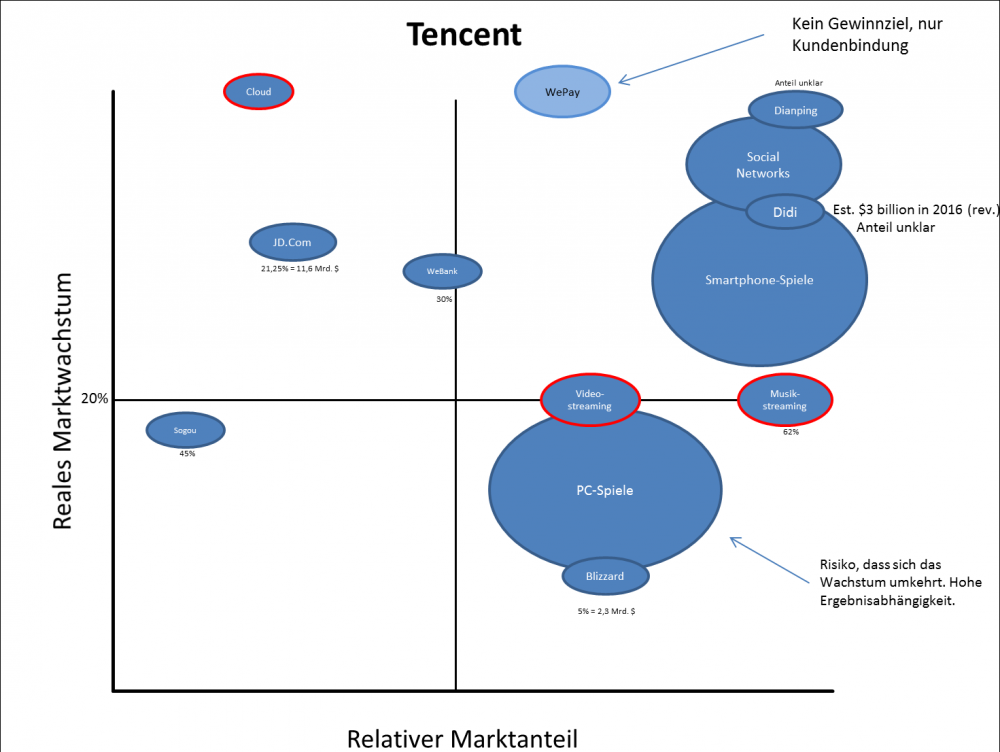

Ich habe mich mal an einer kleinen Übersicht versucht. Wenn jemand Ergänzungen hat, würde ich mich sehr freuen, Tencent ist ja relativ schwierig zu durchschauen. Anzumerken ist, dass große Segmente zwar auch größer dargestellt sind, aber die Proportionen nicht stimmen. Gaming und Social Networks dominieren noch stärker als es die Darstellung erkennen lässt.

Der Unternehmenswert wird zu großen Teilen durch Gaming getragen. Danach kommen die Einnahmen aus den sozialen Netzwerken und dann kommt lange nichts. Natürlich besteht hier eine Anfälligkeit. Tencent selbst hat zurückgehendes Wachstum im PC-Spiele-Markt (etwa die Hälfte vom gesamten Gaming-Segment) prognostiziert. Persönlich hoffe ich, dass es durch die Internationalisierung von Honor of Kings (Smartphone) aufgefangen wird.

Beim autonomen Fahren und auch KI scheint mir Baidu doch deutlich vor Tencent zu liegen. Bis Tencent hier Gewinne und anschließend relevante Gewinne einfahren wird, wird es noch sehr sehr lange dauern - wenn überhaupt. KI wird mittelfristig wohl "nur" zu geringeren Streuverlusten bei der Werbung führen.

Mittelfristig sehe ich die größte Chance von Tencent eher darin, dass WeChat richtig monetarisiert wird und dass es Payment, die Cloud und Streaming in ein paar Jahren doch in die Gewinnzone schaffen. Dann fallen die negativen Ergebnisbeiträge weg und es wird noch etwas darüber hinaus generiert. Das kann die Marge wieder steigen lassen.

Bei den Beteiligungen sehe ich vor allem Potential bei Didi, Sogou, JD, WeBank und Dianping. Aber Tencents Marktkapitalisierung ist einfach so hoch, dass diese stark expandierenden Unternehmen dennoch relativ wenig zum Unternehmenswert von Tencent beisteuern. Die Marktkapitalisierung liegt bei 423 Mrd. $ aktuell. Selbst wenn sich der Wert von z. B. JD verdoppelt ist der Effekt auf Tencents Wert überschaubar - und JD ist einer der größten Beteiligungen. Sehr lange wird eine sehr hohe Abhängigkeit gegenüber Gaming bestehen.

Beim autonomen Fahren und auch KI scheint mir Baidu doch deutlich vor Tencent zu liegen. Bis Tencent hier Gewinne und anschließend relevante Gewinne einfahren wird, wird es noch sehr sehr lange dauern - wenn überhaupt. KI wird mittelfristig wohl "nur" zu geringeren Streuverlusten bei der Werbung führen.

Mittelfristig sehe ich die größte Chance von Tencent eher darin, dass WeChat richtig monetarisiert wird und dass es Payment, die Cloud und Streaming in ein paar Jahren doch in die Gewinnzone schaffen. Dann fallen die negativen Ergebnisbeiträge weg und es wird noch etwas darüber hinaus generiert. Das kann die Marge wieder steigen lassen.

Bei den Beteiligungen sehe ich vor allem Potential bei Didi, Sogou, JD, WeBank und Dianping. Aber Tencents Marktkapitalisierung ist einfach so hoch, dass diese stark expandierenden Unternehmen dennoch relativ wenig zum Unternehmenswert von Tencent beisteuern. Die Marktkapitalisierung liegt bei 423 Mrd. $ aktuell. Selbst wenn sich der Wert von z. B. JD verdoppelt ist der Effekt auf Tencents Wert überschaubar - und JD ist einer der größten Beteiligungen. Sehr lange wird eine sehr hohe Abhängigkeit gegenüber Gaming bestehen.

Antwort auf Beitrag Nr.: 56.048.835 von TME90 am 28.10.17 14:45:09Vielleicht unterschätzt du auch die Beteiligungen Tencents im Bezug auf autonomes Fahren und künstliche Intelligenz.

Big Tech aus China: Alibaba und Tencent: Starke Bilanzen, innovativ und dazu noch attraktiv bewertet 04.05.24 · wallstreetONLINE Redaktion · E-Stoxx 50 |

26.04.24 · wallstreetONLINE Redaktion · Baidu |

20.03.24 · wallstreetONLINE Redaktion · Tencent |

12.03.24 · wallstreetONLINE Redaktion · Baidu |

27.02.24 · wallstreetONLINE Redaktion · Boeing |