Wann und wie kommt der nächste Crash? (Seite 31)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 2

Gesamt: 179.936

Gesamt: 179.936

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 52 Minuten | 9318 | |

| heute 17:20 | 7176 | |

| vor 1 Stunde | 5993 | |

| heute 19:43 | 3342 | |

| vor 27 Minuten | 3288 | |

| heute 09:20 | 2590 | |

| vor 37 Minuten | 2384 | |

| heute 19:52 | 1946 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.935,00 | +0,20 | 206 | |||

| 2. | 2. | 180,28 | +0,16 | 103 | |||

| 3. | 3. | 8,6400 | +4,22 | 84 | |||

| 4. | 14. | 0,0164 | +0,61 | 73 | |||

| 5. | 4. | 3,8725 | +4,87 | 62 | |||

| 6. | 11. | 2.302,17 | +0,72 | 42 | |||

| 7. | 9. | 1,0000 | +3,63 | 41 | |||

| 8. | 6. | 6,6700 | -0,06 | 39 |

Beitrag zu dieser Diskussion schreiben

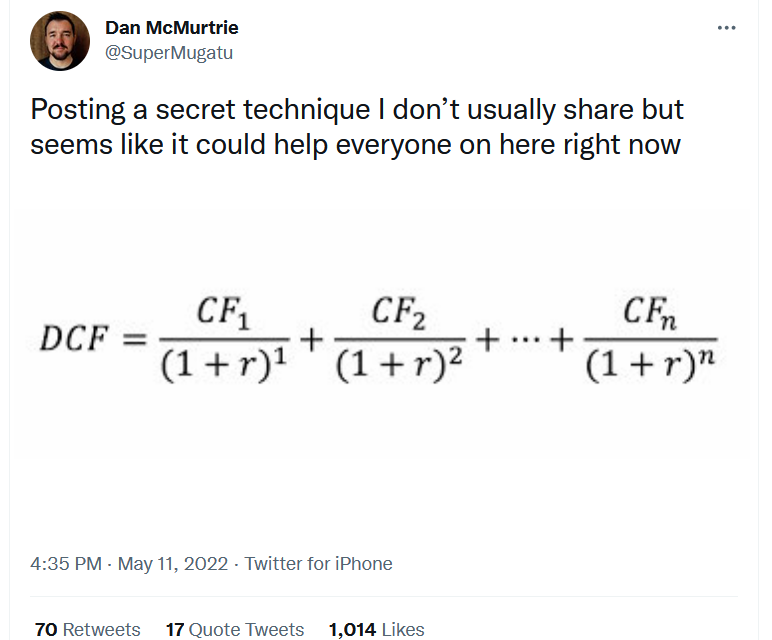

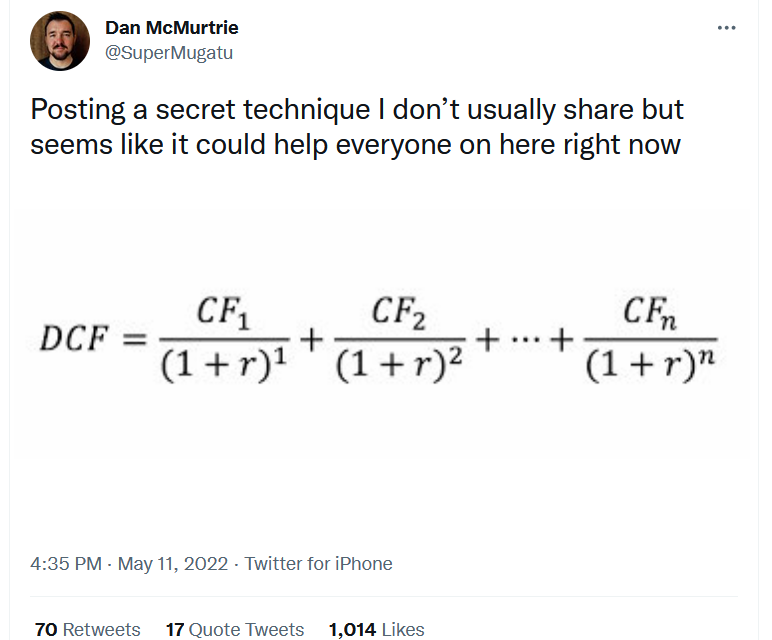

Antwort auf Beitrag Nr.: 71.525.214 von faultcode am 09.05.22 13:25:03erst verlieren sie ihr Geld und dann kommt der Spott auch noch dazu:

https://twitter.com/SuperMugatu/status/1524397820454834177

<ich habe die Formel ein bischen klarer hier gemacht>

Tag: DCF

https://twitter.com/SuperMugatu/status/1524397820454834177

<ich habe die Formel ein bischen klarer hier gemacht>

Tag: DCF

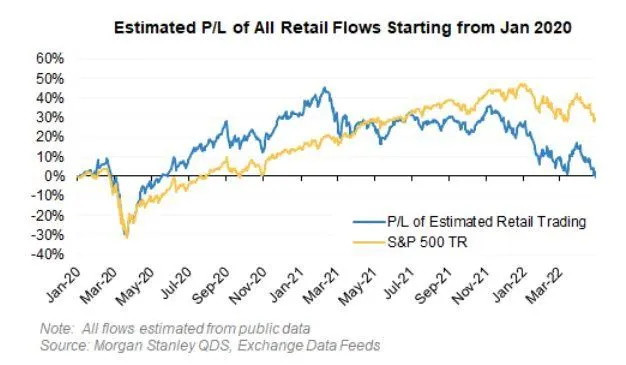

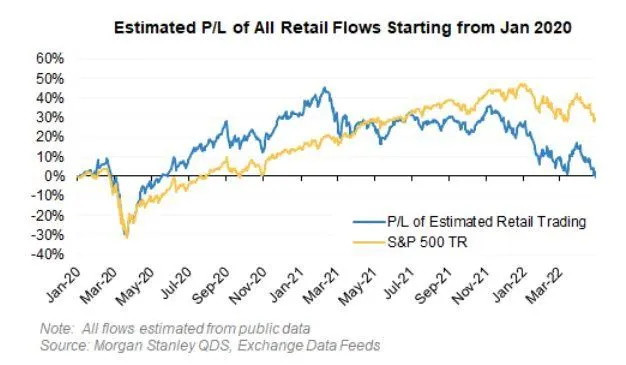

Antwort auf Beitrag Nr.: 71.520.621 von faultcode am 08.05.22 16:40:06Meme-Aktien -- und da geht es dahin:

8.5.

Day Trader Army Loses All the Money It Made in Meme-Stock Era

https://finance.yahoo.com/news/day-trader-army-loses-money-2…

...

For investors looking for signs of a market bottom, retail behavior is something to watch, according to Morgan Stanley analysts including Christopher Metli.

“Traditional capitulation is typically marked by a quick de-grossing by hedge funds + systematic macro strategies, where positioning is already light,” Metli wrote in a note last week. “Instead, the next leg of de-risking is likely to be more gradual, coming from asset allocators/real money/retail and is therefore likely slower to play out, making a precise bottom more difficult to call.”

There are signs that the day-trader crowd is souring on the market. In April, retail investors snapped up $14 billion in stocks, the second-slowest uptake in any month since late 2020, Morgan Stanley data show. In the options market, where they used to rush to bullish calls for quick profits, activity is now tilting toward bearish puts.

...

8.5.

Day Trader Army Loses All the Money It Made in Meme-Stock Era

https://finance.yahoo.com/news/day-trader-army-loses-money-2…

...

For investors looking for signs of a market bottom, retail behavior is something to watch, according to Morgan Stanley analysts including Christopher Metli.

“Traditional capitulation is typically marked by a quick de-grossing by hedge funds + systematic macro strategies, where positioning is already light,” Metli wrote in a note last week. “Instead, the next leg of de-risking is likely to be more gradual, coming from asset allocators/real money/retail and is therefore likely slower to play out, making a precise bottom more difficult to call.”

There are signs that the day-trader crowd is souring on the market. In April, retail investors snapped up $14 billion in stocks, the second-slowest uptake in any month since late 2020, Morgan Stanley data show. In the options market, where they used to rush to bullish calls for quick profits, activity is now tilting toward bearish puts.

...

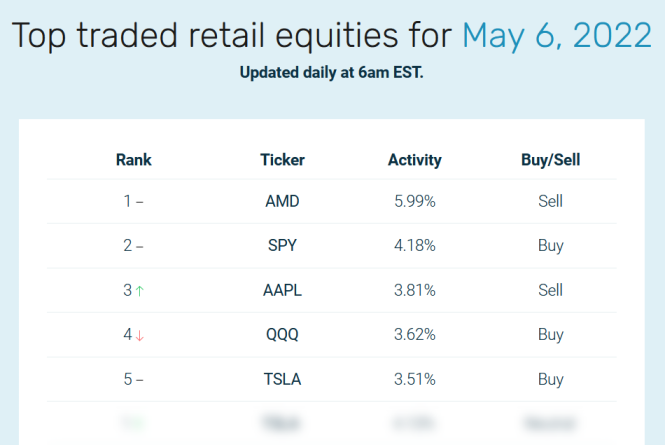

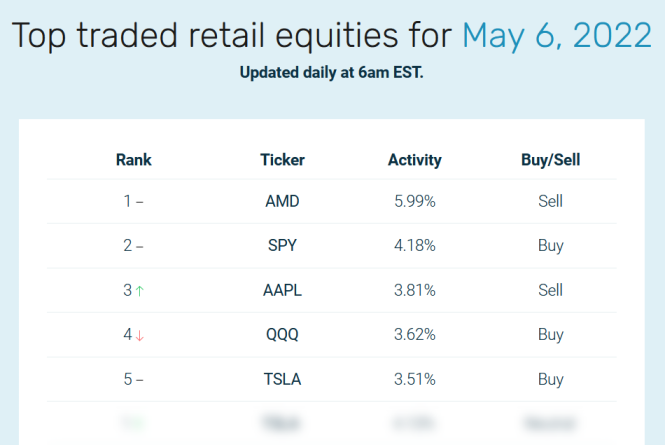

Antwort auf Beitrag Nr.: 71.502.404 von faultcode am 05.05.22 16:42:285.5.

Retail Trading Activity Tracker

https://data.nasdaq.com/retailtradingactivitytracker

...

Nov 11, 2021

Nasdaq Launches Retail Trading Activity Tracker, Available via Nasdaq Data Link

https://www.nasdaq.com/press-release/nasdaq-launches-retail-…

...

Nasdaq (Nasdaq: NDAQ) today announced the launch of the Retail Trading Activity Tracker, a new dataset that provides reliable information into the trading activity of self-directed retail investors in the U.S. equity market. The Retail Trading Activity Tracker tracks stocks and exchange traded funds (ETFs) traded by individuals as well as buy/sell ratios per ticker on a daily basis.

A free version of the tracker with the daily top ten most traded stocks and ETFs by share of retail activity will be available on Nasdaq Data Link and Nasdaq.com.

The Retail Trading Activity Tracker brings enhanced transparency into the trading activity of retail investors and makes it available to all market participants. The dataset is developed from publicly available data, the Securities Information Processor (SIP), backed by Nasdaq’s deep markets expertise and delivered through Nasdaq Data Link’s infrastructure, providing all investors insights into individual, self-directed trading activity in the U.S. public equity markets.

...

The Retail Trading Activity Tracker is to be released on Nasdaq Data Link with data history from 2016 to the present day. A free list of the top ten traded securities will be updated daily with trading data from the previous day.

...

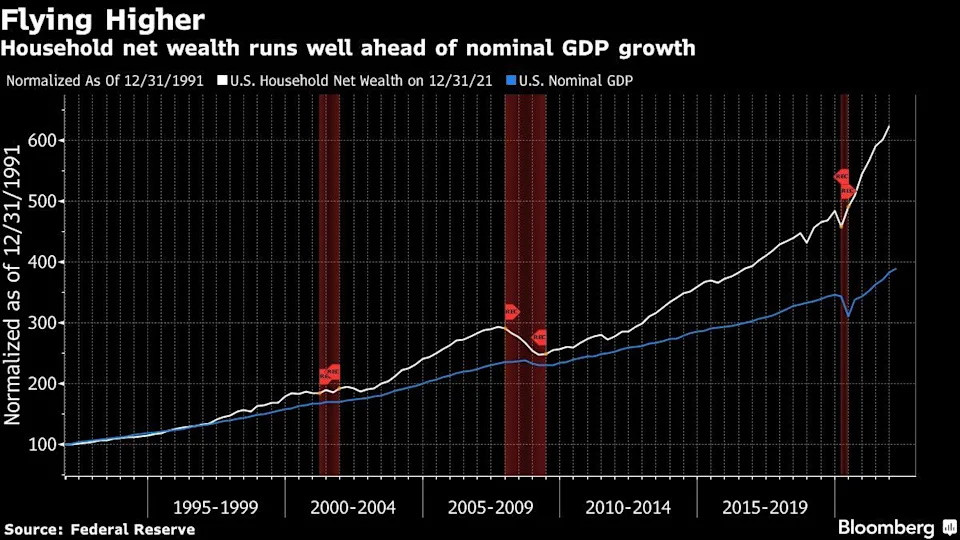

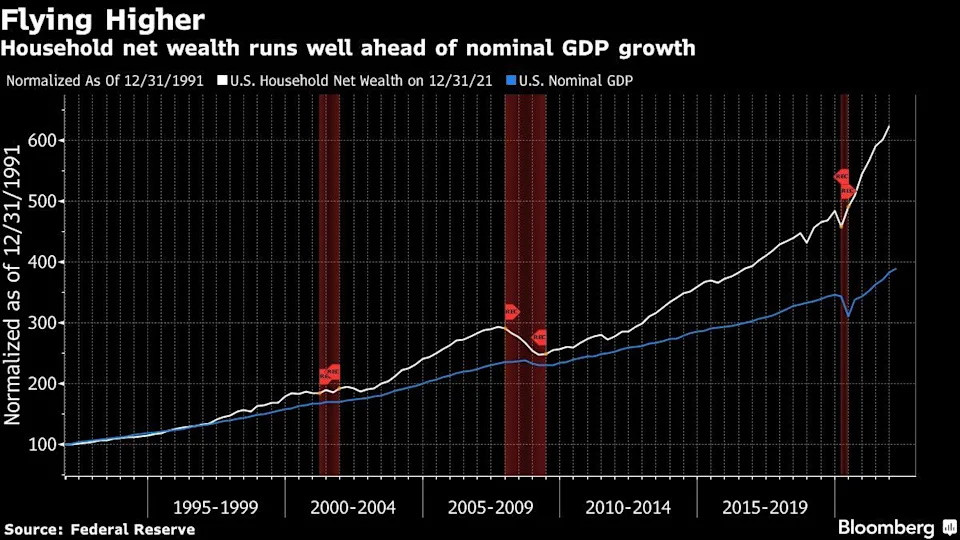

Zitat von faultcode: ...What’s underpinning Wright’s bearishness isn’t the Fed, inflation or the war. It’s the zealous behavior of investors during the past few years that sent everything from meme stocks to cryptocurrencies soaring. The stock market gains helped U.S. household wealth balloon to a record $150 trillion, or more than six times the size of the American economy, according to data compiled by the Fed....

Retail Trading Activity Tracker

https://data.nasdaq.com/retailtradingactivitytracker

...

Nov 11, 2021

Nasdaq Launches Retail Trading Activity Tracker, Available via Nasdaq Data Link

https://www.nasdaq.com/press-release/nasdaq-launches-retail-…

...

Nasdaq (Nasdaq: NDAQ) today announced the launch of the Retail Trading Activity Tracker, a new dataset that provides reliable information into the trading activity of self-directed retail investors in the U.S. equity market. The Retail Trading Activity Tracker tracks stocks and exchange traded funds (ETFs) traded by individuals as well as buy/sell ratios per ticker on a daily basis.

A free version of the tracker with the daily top ten most traded stocks and ETFs by share of retail activity will be available on Nasdaq Data Link and Nasdaq.com.

The Retail Trading Activity Tracker brings enhanced transparency into the trading activity of retail investors and makes it available to all market participants. The dataset is developed from publicly available data, the Securities Information Processor (SIP), backed by Nasdaq’s deep markets expertise and delivered through Nasdaq Data Link’s infrastructure, providing all investors insights into individual, self-directed trading activity in the U.S. public equity markets.

...

The Retail Trading Activity Tracker is to be released on Nasdaq Data Link with data history from 2016 to the present day. A free list of the top ten traded securities will be updated daily with trading data from the previous day.

...

Antwort auf Beitrag Nr.: 71.502.404 von faultcode am 05.05.22 16:42:28

https://twitter.com/carlquintanilla/status/15225343561741352…

https://twitter.com/carlquintanilla/status/15225343561741352…

...

“I believe we are in the biggest bear market in my life,” said Wright, co-founder of Sierra Investment Management, which oversees about $10 billion. “This is just the second inning. A lot more to come.”

...

But what’s unique about Sierra is its aggressive approach to shed risk. The $869 million Sierra Tactical All Asset Fund -- a so-called fund of funds that invests in mutual funds and exchange-traded funds, held less than 3% in U.S. stocks at the end of April. More than half of the fund is in cash. Fixed-rated bonds accounted for only 1% of its holdings, while commodities made up more than 9%. The rest of the portfolio is spread across assets including floating-rate bonds, foreign stocks and master limited partnerships.

It’s paying off this year. The fund has lost 2.3% in 2022, beating 91% of its peers tracked by Bloomberg.

What’s underpinning Wright’s bearishness isn’t the Fed, inflation or the war. It’s the zealous behavior of investors during the past few years that sent everything from meme stocks to cryptocurrencies soaring. The stock market gains helped U.S. household wealth balloon to a record $150 trillion, or more than six times the size of the American economy, according to data compiled by the Fed.

“There’s no other country on earth that has staked so much of their net wealth in stocks,” said Wright, who co-founded Sierra Investment with Kenneth Sleeper in 1987. “But we are at a very big peak of complacency.”

Using computer models, the Sierra fund, which Wright manages with Sleeper and Douglas Loeffler, sets trailing stop losses for its holdings. Once prices fall to those preset levels, the fund liquidates the holdings and moves to cash or other assets that are trending up. It targets retirees and other investors who want to minimize risk.

Such a conservative approach helps it limit losses in a market downturn. But it also hurts performance when the market goes straight up -- which it mostly has since the 2008 crisis. The fund returned 2.4% annually over the past five years, compared with an average gain of 5% among its peers, according to data compiled by Bloomberg. A portfolio made of 60% stocks and 40% bonds has returned 9% a year during the same period.

Wright didn’t specify the amount of losses he thinks are ahead, but pointed out that significant retreats in the 1970s and 1980s didn’t end until the market’s price-to-earnings ratio dropped below 10. Currently, while the S&P 500’s 12-month trailing P/E ratio has dropped to 21, from 32 in March 2021, it is still above the average of 19 over the past two decades.

“Young people have no clue what the downside might be, what causes drawdowns and how far it can go,” said Wright, one of the top 100 independent financial advisers, according to Barron’s.

...

4.5.

At 78, Investor Preps for ‘Biggest Bear Market in My Life’

https://finance.yahoo.com/news/78-investor-preps-biggest-bea…

“I believe we are in the biggest bear market in my life,” said Wright, co-founder of Sierra Investment Management, which oversees about $10 billion. “This is just the second inning. A lot more to come.”

...

But what’s unique about Sierra is its aggressive approach to shed risk. The $869 million Sierra Tactical All Asset Fund -- a so-called fund of funds that invests in mutual funds and exchange-traded funds, held less than 3% in U.S. stocks at the end of April. More than half of the fund is in cash. Fixed-rated bonds accounted for only 1% of its holdings, while commodities made up more than 9%. The rest of the portfolio is spread across assets including floating-rate bonds, foreign stocks and master limited partnerships.

It’s paying off this year. The fund has lost 2.3% in 2022, beating 91% of its peers tracked by Bloomberg.

What’s underpinning Wright’s bearishness isn’t the Fed, inflation or the war. It’s the zealous behavior of investors during the past few years that sent everything from meme stocks to cryptocurrencies soaring. The stock market gains helped U.S. household wealth balloon to a record $150 trillion, or more than six times the size of the American economy, according to data compiled by the Fed.

“There’s no other country on earth that has staked so much of their net wealth in stocks,” said Wright, who co-founded Sierra Investment with Kenneth Sleeper in 1987. “But we are at a very big peak of complacency.”

Using computer models, the Sierra fund, which Wright manages with Sleeper and Douglas Loeffler, sets trailing stop losses for its holdings. Once prices fall to those preset levels, the fund liquidates the holdings and moves to cash or other assets that are trending up. It targets retirees and other investors who want to minimize risk.

Such a conservative approach helps it limit losses in a market downturn. But it also hurts performance when the market goes straight up -- which it mostly has since the 2008 crisis. The fund returned 2.4% annually over the past five years, compared with an average gain of 5% among its peers, according to data compiled by Bloomberg. A portfolio made of 60% stocks and 40% bonds has returned 9% a year during the same period.

Wright didn’t specify the amount of losses he thinks are ahead, but pointed out that significant retreats in the 1970s and 1980s didn’t end until the market’s price-to-earnings ratio dropped below 10. Currently, while the S&P 500’s 12-month trailing P/E ratio has dropped to 21, from 32 in March 2021, it is still above the average of 19 over the past two decades.

“Young people have no clue what the downside might be, what causes drawdowns and how far it can go,” said Wright, one of the top 100 independent financial advisers, according to Barron’s.

...

4.5.

At 78, Investor Preps for ‘Biggest Bear Market in My Life’

https://finance.yahoo.com/news/78-investor-preps-biggest-bea…

Antwort auf Beitrag Nr.: 71.487.056 von faultcode am 04.05.22 01:19:01

https://twitter.com/jasongoepfert/status/1521934567204134919

https://twitter.com/jasongoepfert/status/1521934567204134919

3.5.

Former Fed Vice Chair Quarles Says U.S. Is Likely to Suffer Recession

https://finance.yahoo.com/news/former-fed-vice-chair-quarles…

...

Quarles, who left the Fed in December after his term as vice chair had expired, also suggested that the central bank would have acted earlier to try to rein in inflation but for uncertainty over President Joe Biden’s decisions on its leadership.

“Had clarity been provided, I think the Fed would have acted earlier,” Quarles said. But Biden “didn’t do that for a number of months,” he said.

Biden in November tapped Chair Jerome Powell for a second term. Powell the following month rejected the idea that he had held off on a hawkish policy tilt until Biden’s announcement.

Powell and his colleagues on Wednesday are expected to raise interest rates by 50 basis points and signal that further increases are in store.

...

Quarles, who is now chairman of asset manager Cynosure Group, said it wouldn’t take much of an increase in rates to have a big impact on the economy given the amount of debt that has been built up in the U.S.

“For an economy that has accustomed itself to interest rates as low as they have been for as long as they have been, it doesn’t take a very large nominal increase in interest rates to be a very significant percentage of debt service for a number of heavily indebted actors,” he said. “The effect on the economy could be fairly strong.”

Powell, by contrast, in March told U.S. lawmakers that “it’s more likely than not that we can achieve what we call a soft landing, and they’re far more common in our history than is generally understood.”

Quarles said it was “pretty clear” by last September that inflation was largely being driven by an excess of demand that the Fed needed to address.

...

“We would have been better served to start getting on top of it in September,” Quarles said. “That was hard to do until there was clarity as to what the leadership going forward of the Fed was going to be.”

In the event, the Fed kept interest rates pegged near zero until March of this year, when it raised them by a quarter percentage point. It also ended its quantitative easing program around that time.

Quarles voiced confidence that the central bank would succeed in getting inflation under control. “The Fed will get on top of inflation,” he said.

...

Former Fed Vice Chair Quarles Says U.S. Is Likely to Suffer Recession

https://finance.yahoo.com/news/former-fed-vice-chair-quarles…

...

Quarles, who left the Fed in December after his term as vice chair had expired, also suggested that the central bank would have acted earlier to try to rein in inflation but for uncertainty over President Joe Biden’s decisions on its leadership.

“Had clarity been provided, I think the Fed would have acted earlier,” Quarles said. But Biden “didn’t do that for a number of months,” he said.

Biden in November tapped Chair Jerome Powell for a second term. Powell the following month rejected the idea that he had held off on a hawkish policy tilt until Biden’s announcement.

Powell and his colleagues on Wednesday are expected to raise interest rates by 50 basis points and signal that further increases are in store.

...

Quarles, who is now chairman of asset manager Cynosure Group, said it wouldn’t take much of an increase in rates to have a big impact on the economy given the amount of debt that has been built up in the U.S.

“For an economy that has accustomed itself to interest rates as low as they have been for as long as they have been, it doesn’t take a very large nominal increase in interest rates to be a very significant percentage of debt service for a number of heavily indebted actors,” he said. “The effect on the economy could be fairly strong.”

Powell, by contrast, in March told U.S. lawmakers that “it’s more likely than not that we can achieve what we call a soft landing, and they’re far more common in our history than is generally understood.”

Quarles said it was “pretty clear” by last September that inflation was largely being driven by an excess of demand that the Fed needed to address.

...

“We would have been better served to start getting on top of it in September,” Quarles said. “That was hard to do until there was clarity as to what the leadership going forward of the Fed was going to be.”

In the event, the Fed kept interest rates pegged near zero until March of this year, when it raised them by a quarter percentage point. It also ended its quantitative easing program around that time.

Quarles voiced confidence that the central bank would succeed in getting inflation under control. “The Fed will get on top of inflation,” he said.

...

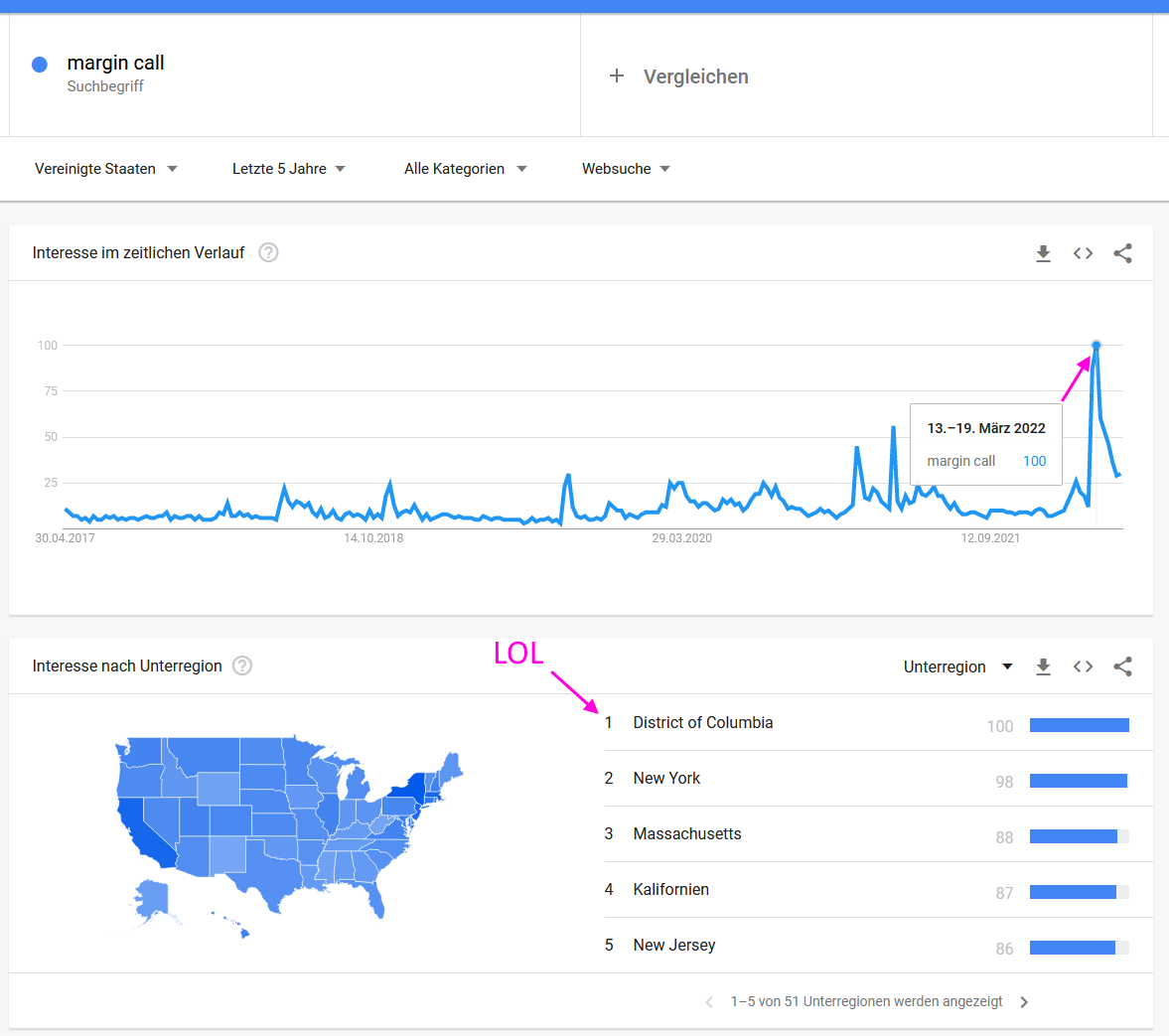

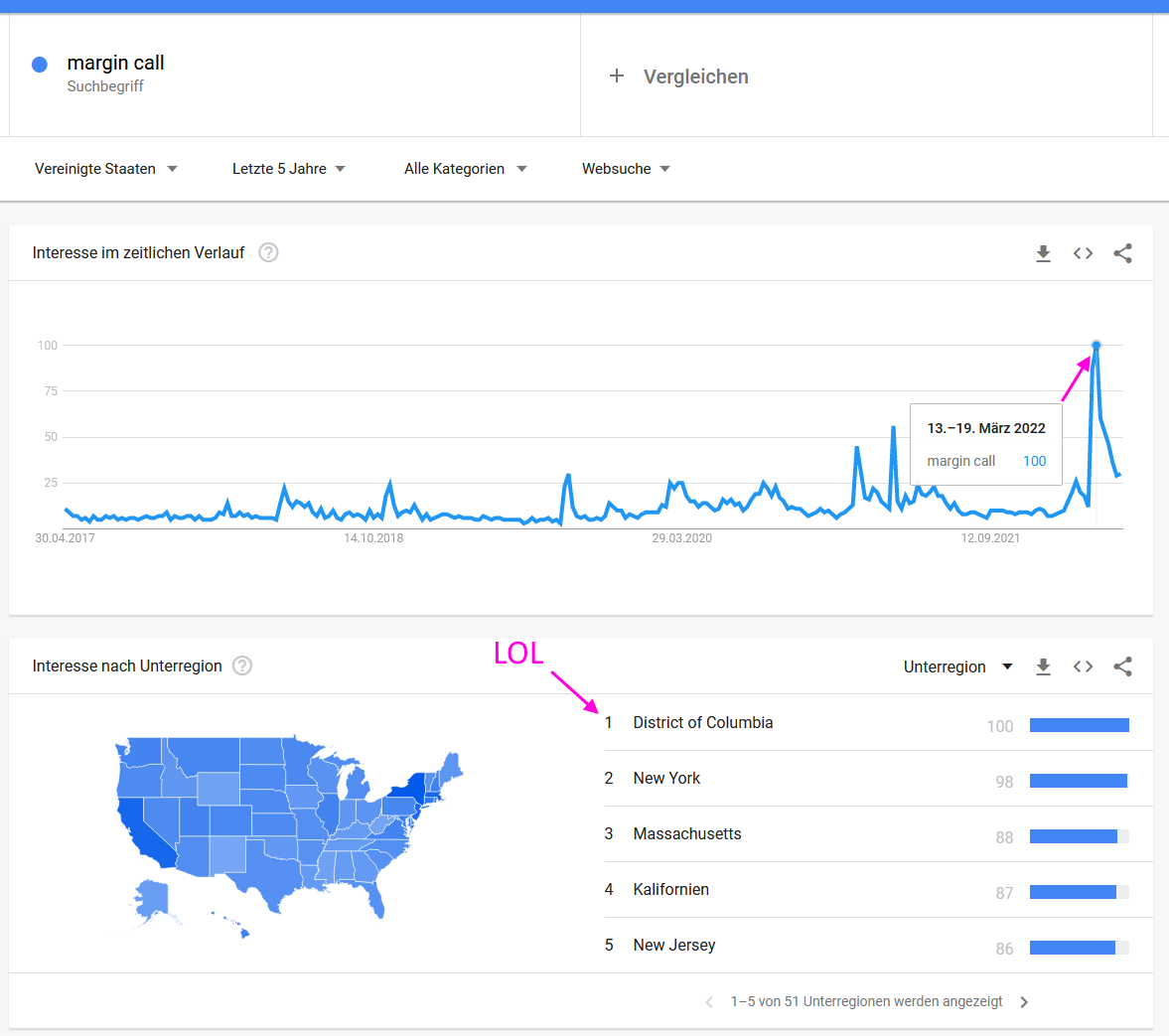

Antwort auf Beitrag Nr.: 70.624.099 von faultcode am 24.01.22 18:30:08margin call, Google Trends:

https://trends.google.com/trends/explore?date=today%205-y&ge…

https://trends.google.com/trends/explore?date=today%205-y&ge…

Antwort auf Beitrag Nr.: 70.750.374 von faultcode am 04.02.22 19:55:38Yield on 10-year inflation-protected Treasuries:

20.4.

Treasuries Approach Pre-Pandemic Norm With Real Yield Above Zero

https://finance.yahoo.com/news/u-10-real-yields-turn-0008487…

20.4.

Treasuries Approach Pre-Pandemic Norm With Real Yield Above Zero

https://finance.yahoo.com/news/u-10-real-yields-turn-0008487…

ZH:

14.4.

Goldman Quietly Sells Billions In Stocks For The Third Quarter In A Row

https://www.zerohedge.com/markets/goldman-quietly-sells-bill…

...

So fast forward to today, when the "Harvesting Progress" is ever present, shows that the bank continued to sell even more stock, and in the first quarter, sold an additional $1BN gross (the dispositions number rose from $18BN to $19BN), offset by an incremental $1BN in purchases ($7BN in Q1, up from $6BN in Q4).

Said otherwise, Goldman liquidated an additional gross $1BN in Q1, offset by $1BN in additions, for a new and improved "net dispositions" of $12 billion however due to the broader decline in the market, the mark ups since Year End 2019 declined from $9BN to $8BN, and a net notional of $18 billion in equity investments at the end of Q1 2022.

Who is Goldman selling to? Anyone who will buy, but here we would wager that retail investors - who were on tilt buying in 2021 - have been the proud recipients of billions in Goldman sales, especially those reading the permabullish notes from Goldman's chief equity strategist David Kostin (curiously, Goldman's "harvesting" asset management group did not get access to those).

This, in the financial literature is called the "distribution phase" or was until Kostin had no choice but to trim his year-end S&P price target from 5,100 to 4,900 and then to 4,700.

And so, with the investor call now over, unfortunately there was no discussion of the bank's stock sales, pardon harvesting for the second quarter in a row. At least three quarters ago some analyst asked a question about Goldman's efforts to reduce its equity investment portfolio, to which the bank said that it it has "made progress on improving its capital efficiency and is moving 'aggressively' to manage equity positions, especially since the environment is supportive."

What does that mean in English? Simple: in Q1, Goldman continued to "aggressively" dump its positions which are in the money in an environment that is "supportive", i.e., in which the dumb money is providing a constant bid into which whales such as Goldman can sell.

The last time Goldman was "aggressively" selling into a "supportive" market? Well, we have to go back all the way to 2007 and 2008 when Goldman was busy creating the very CDOs which its prop desk would then "aggressively" short. We all remember how prophetic that particular move turned out to be.

14.4.

Goldman Quietly Sells Billions In Stocks For The Third Quarter In A Row

https://www.zerohedge.com/markets/goldman-quietly-sells-bill…

...

So fast forward to today, when the "Harvesting Progress" is ever present, shows that the bank continued to sell even more stock, and in the first quarter, sold an additional $1BN gross (the dispositions number rose from $18BN to $19BN), offset by an incremental $1BN in purchases ($7BN in Q1, up from $6BN in Q4).

Said otherwise, Goldman liquidated an additional gross $1BN in Q1, offset by $1BN in additions, for a new and improved "net dispositions" of $12 billion however due to the broader decline in the market, the mark ups since Year End 2019 declined from $9BN to $8BN, and a net notional of $18 billion in equity investments at the end of Q1 2022.

Who is Goldman selling to? Anyone who will buy, but here we would wager that retail investors - who were on tilt buying in 2021 - have been the proud recipients of billions in Goldman sales, especially those reading the permabullish notes from Goldman's chief equity strategist David Kostin (curiously, Goldman's "harvesting" asset management group did not get access to those).

This, in the financial literature is called the "distribution phase" or was until Kostin had no choice but to trim his year-end S&P price target from 5,100 to 4,900 and then to 4,700.

And so, with the investor call now over, unfortunately there was no discussion of the bank's stock sales, pardon harvesting for the second quarter in a row. At least three quarters ago some analyst asked a question about Goldman's efforts to reduce its equity investment portfolio, to which the bank said that it it has "made progress on improving its capital efficiency and is moving 'aggressively' to manage equity positions, especially since the environment is supportive."

What does that mean in English? Simple: in Q1, Goldman continued to "aggressively" dump its positions which are in the money in an environment that is "supportive", i.e., in which the dumb money is providing a constant bid into which whales such as Goldman can sell.

The last time Goldman was "aggressively" selling into a "supportive" market? Well, we have to go back all the way to 2007 and 2008 when Goldman was busy creating the very CDOs which its prop desk would then "aggressively" short. We all remember how prophetic that particular move turned out to be.