ALAMOS GOLD INC. (NEW) - Die Neue --- Hält dieses Unternehmen . . . . . (Seite 33)

eröffnet am 14.07.15 23:59:19 von

neuester Beitrag 28.04.24 23:14:55 von

neuester Beitrag 28.04.24 23:14:55 von

Beiträge: 442

ID: 1.215.750

ID: 1.215.750

Aufrufe heute: 0

Gesamt: 33.294

Gesamt: 33.294

Aktive User: 0

ISIN: CA0115321089 · WKN: A14WBB · Symbol: AGI

20,470

CAD

-0,58 %

-0,120 CAD

Letzter Kurs 21:21:01 Toronto

Neuigkeiten

29.04.24 · Swiss Resource Capital AG Anzeige |

26.04.24 · Swiss Resource Capital AG Anzeige |

21.04.24 · wallstreetONLINE Redaktion |

15.04.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1400 | +18,89 | |

| 1,0000 | +16,28 | |

| 2,5950 | +15,33 | |

| 4,2400 | +11,87 | |

| 0,8947 | +11,85 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7000 | -11,39 | |

| 183,20 | -19,30 | |

| 0,7500 | -21,05 | |

| 12,000 | -25,00 | |

| 8,3600 | -39,81 |

Beitrag zu dieser Diskussion schreiben

Leider nicht mehr von Bedeutung .. Kumpel.

BRIEF-Alamos Gold Q4 Revenue About $162 Mln

Jan 11 (Reuters) - Alamos Gold Inc:

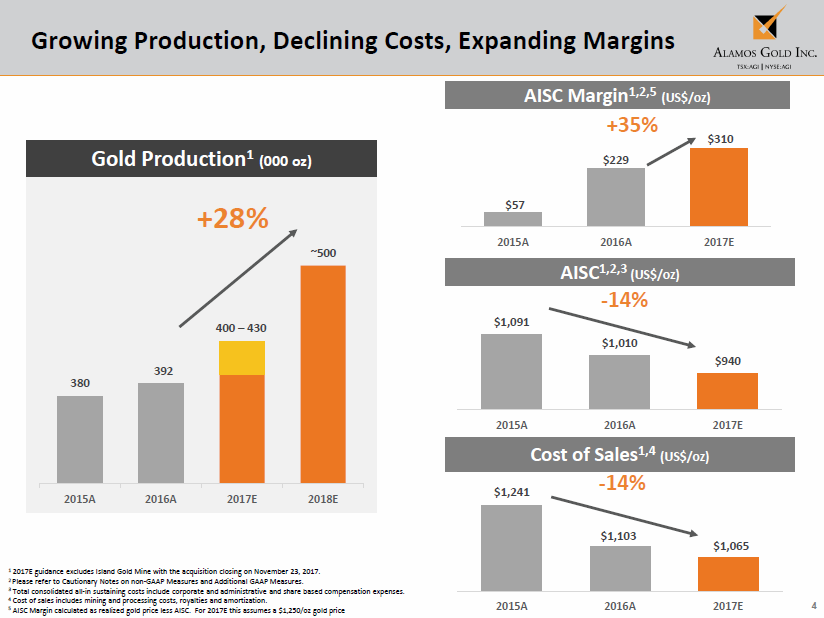

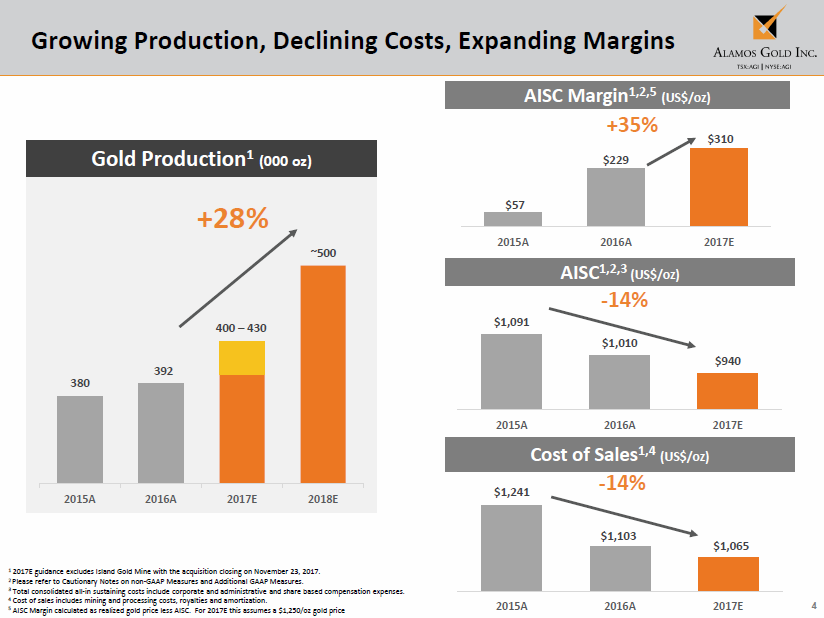

* ALAMOS REPORTS FOURTH QUARTER 2017 PRODUCTION AND PROVIDES 2018 OUTLOOK

* Q4 REVENUE ABOUT $162 MILLION

* SAYS PRODUCED 120,300 OUNCES OF GOLD IN Q4

* SAYS 2018 PRODUCTION GUIDANCE OF 480,000 TO 520,000 OUNCES OF GOLD, A 16% INCREASE OVER 2017

* SAYS SEES 2018 CAPITAL BUDGET FOR OPERATING MINES OF $146 TO $165 MILLION

http://www.alamosgold.com/news-and-media/news-releases/news-…

Jan 11 (Reuters) - Alamos Gold Inc:

* ALAMOS REPORTS FOURTH QUARTER 2017 PRODUCTION AND PROVIDES 2018 OUTLOOK

* Q4 REVENUE ABOUT $162 MILLION

* SAYS PRODUCED 120,300 OUNCES OF GOLD IN Q4

* SAYS 2018 PRODUCTION GUIDANCE OF 480,000 TO 520,000 OUNCES OF GOLD, A 16% INCREASE OVER 2017

* SAYS SEES 2018 CAPITAL BUDGET FOR OPERATING MINES OF $146 TO $165 MILLION

http://www.alamosgold.com/news-and-media/news-releases/news-…

Dieses Stück Gold- Land hat noch die alte Aurico Gold mit in die "Ehe" mit Alamos gebracht.

Das ist wohl schon eine Hauisnummer. Ich denke das Management der "Alten Herren" von Aurico gold haben das gesamte Unternehmen etwas zu billig verramscht. Aber das ist nur m. M. http://www.mining.com/alamos-establishes-1-6m-ounce-reserve-…

Alamos establishes 1.6M ounce reserve base at Manitoba mine

The Lynne Lake gold camp, courtesy of Alamos Gold Inc.

The Lynne Lake gold camp, courtesy of Alamos Gold Inc. Alamos Gold (TSX,NYSE:AGI) has come out of the gate with an impressive feasibility study conducted on its Lynn Lake Gold Project in Manitoba.

Toronto-based Alamos said the reports shows the past-producing gold camp with proven and probable reserves of 26.8 million tonnes graded 1.89 grams per tonne, with contained gold of 1.6 million ounces.

The feasibility study converts the previous measured and indicated resources, which stood at 40.3 million tonnes at 2.03 g/t, and 2.629 Moz contained.

Average gold production would be 170,000 ounces over the first six years, with life of mine production of 1.5 Moz. Alamos would produce gold at $745 an ounce, all-in sustaining costs, and expects to have total capital expenditures including reclamation of $486 million.

Antwort auf Beitrag Nr.: 56.464.616 von faultcode am 15.12.17 22:07:33

=> z.B.:

=> dieser Qualitäts-Wert (Türkei hin oder her) ist mMn immer noch günstig mit P/B Ratio: 1.158 (https://web.tmxmoney.com/quote.php?qm_symbol=agi)

ABX hat z.Z. (diesselbe Quelle) P/B Ratio: 1.715 (mit Big Data, IoT, etc.) => trotzdem, das würde ich mir zweimal überlegen...

=> zumindest dieser Wert riecht nach tendenziell steigenden Kursen in 2018... (auch bei Gold seitwärts - was sowieso niemand weiss )

)

Dezember-Präsentation

http://s1.q4cdn.com/556167425/files/doc_presentations/2017/1…=> z.B.:

=> dieser Qualitäts-Wert (Türkei hin oder her) ist mMn immer noch günstig mit P/B Ratio: 1.158 (https://web.tmxmoney.com/quote.php?qm_symbol=agi)

ABX hat z.Z. (diesselbe Quelle) P/B Ratio: 1.715 (mit Big Data, IoT, etc.) => trotzdem, das würde ich mir zweimal überlegen...

=> zumindest dieser Wert riecht nach tendenziell steigenden Kursen in 2018... (auch bei Gold seitwärts - was sowieso niemand weiss

)

) positive feasibility study conducted on Lynn Lake Gold Project ("Lynn Lake"), Manitoba, Canada

war doch klar, dass positiv

https://finance.yahoo.com/news/alamos-gold-announces-positiv…

=>

Feasibility Study Highlights:

- Declared an initial Proven and Probable mineral reserve of 26.8 million tonnes ("Mt") grading 1.89 grams per tonne of gold ("g/t Au"), containing 1.6 million ounces of gold

- Average annual gold production of 170,000 ounces over the first six years and 143,000 ounces over the first 10 years with life of mine production of 1.5 million ounces

- Life of mine total cash costs of $645 per ounce of gold and attractive mine-site all-in sustaining costs of $745 per ounce (+)

- Initial capital estimate of $338 million and total life of mine capital, including sustaining capital and reclamation costs, of $486 million

- After-tax net present value ("NPV") of $123 million at a 5% discount rate and an after-tax internal rate of return ("IRR") of 12.5%, representing a 4.6 year payback using base case gold and silver price assumptions of $1,250 and $16.00 per ounce, respectively and a USD/CAD foreign exchange rate of $0.75:1 (FC: das ist nicht gerade der Brüller)

- The Company has also identified a number of opportunities to enhance the overall economics of the project (++) through an evaluation of a smaller, higher grade mine plan, employing contract mining, and incorporating exploration success over the past year which has not be factored into the feasibility study

(+) => soll ich das wirklich glauben? Im nördlichen Manitoba? --> http://alamosgold.com/mines-and-projects/development-project…

(++) Aha! Economic enhancements wären also jetzt schon wünschenswert.

Lynn Lake liegt im absoluten Outback; das nächste grössere (Minen-)Städtchen in weit über 100 km Entfernung

=> da frägt man sich, warum dieser Schatz nicht schon längst gehoben wurde:

One of the highest grade open pit deposits in Canada with significant exploration potential (lt. AGI)

=> dennoch: es ist (mMn) richtig, mit so was im Bärenmarkt zu starten, als im Bullenmarkt, nur um dann im nächsten Bärenmarkt sein Gold (zu) billig verkaufen (zu müssen).

Alamos Gold Announces Completion of Acquisition of Richmont Mines

https://finance.yahoo.com/news/alamos-gold-announces-complet… Schade das ich diesen Bericht erst heute und nicht bereits Ende August gefunden und gelesen habe,

Aber leider kann man ja nicht alles was sich am Markt tut zum richtigen Zeitpunkt finden. Vielleicht schafft es ja ALAMOS GOLD jetzt in höheren Sphären Fuß zu fassen, vielleicht ?Now It Is Time To Invest In Richmont Mines

Aug. 29, 2017 11:47 AM ET|

12 comments|

About: Richmont Mines, Inc (RIC), Includes: KGC

Robinson Roacho

(533 followers)

Summary

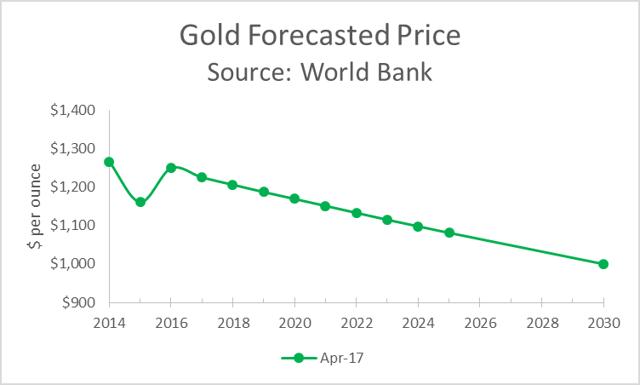

I believe that gold prices will continue to appreciate after a five-year correction period.

The Island Gold mine boosted the head grade by 29% to 9.51 g/ton.

The company is spending money where it should, and it is exploring heavily other horizons in the Island Gold mine.

Recently, I presented a report on Kinross Gold Corp (NYSE: KGC) that you could use as a starting point in your research to expose your portfolio to the precious metals sector. I believe that gold prices corrected through time and price from 2010 to 2015, and gold is ready to continue appreciating further due to unprecedented domestic and international geopolitical unrest. The World Bank, however, projects that gold prices will continue to fall until 2030 where gold will trade at $1,000 per ounce. If you believe, like me, that gold prices will continue to appreciate shortly, Richmont Mines (NYSE: RIC) offers an excellent investment prospect to leverage gold prices.

RCI has two production sites, Island Gold and Beaufor. Both sites performed better than the company expected, and the future looks bright with development in a high head grade horizon at Island Gold.

Island Gold

For 2Q17, Island Gold produced 26,110 gold ounces, up from 18,617 ounces for the same quarter a year ago. The 40% increase was primarily due to a record ore mined and higher grade. Along the same lines, grade increased from 7.51 g/ton to 9.73 g/ton. Moreover, the company continued development in the higher-grade third mining horizon. Therefore, the company should continue to enjoy sustained high grades.

https://seekingalpha.com/article/4102665-now-time-invest-ric…

Die Transaktion wird voraussichtlich am 23. November 2017 abgeschlossen, . . . .

. . . . vorbehaltlich der behördlichen Genehmigungen und der Erfüllung anderer üblicher Bedingungen. Das wird der Grund sein, dass die Aktie heute einen Luftsprung macht. Von mir aus könnte sie das jetzt jeden zweiten Tag veranstalten. Alamos Gold's Acquisition of Richmont Mines Receives Final Court Approval

11/21/2017

Download this Press Release (PDF 364 KB)

TORONTO, ONTARIO--(Marketwired - Nov. 21, 2017) - Alamos Gold Inc. ("Alamos") (TSX:AGI)(NYSE:AGI) and Richmont Mines Inc. ("Richmont") (TSX:RIC)(NYSE:RIC) are pleased to announce that they have been granted final court approval from the Quebec Superior Court (Commercial Division) of the plan of arrangement (the "Transaction") whereby Alamos will acquire all of the issued and outstanding shares of Richmont.

The Transaction is expected to close on November 23, 2017, subject to applicable regulatory approvals and the satisfaction of other customary conditions.

About Alamos Gold Inc.

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Young-Davidson mine in northern Ontario, Canada and the Mulatos and El Chanate mines in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States. Alamos employs more than 1,300 people and is committed to the highest standards of sustainable development. The Company's shares are traded on the TSX and NYSE under the symbol "AGI".

About Richmont Mines Inc.

Richmont Mines currently produces gold from the Island Gold Mine in Ontario and is also advancing development of the significant high-grade resource extension to the east and at depth. With more than 35 years of experience in gold production, exploration and development, and prudent financial management, the Corporation has successfully positioned the Island Gold Mine to cost-effectively build its Canadian reserve base and to enter its next phase of growth. The Corporation's shares are traded on the TSX and NYSE under the symbol "RIC".

For further information please visit the Alamos and Richmont websites at www.alamosgold.com or www.richmont-mines.com.

Hier ist die neueste Präsentation aus diesem Monat und gibt eine Übersicht auf das was kommt.

In 1 bzw. in 2 Jahren träumen sie von einer Produktion von ca. 1 Mill. Goldunzen. Das wäre das doppelte vom heutigen Stand, einshließlich der Island Gold Mine. sollte das so kommen, wird ALAMOS GOLD demnächst in einer anderen Preisklasse spielen.

Alamos Corporate Presentation – November 2017

http://s1.q4cdn.com/556167425/files/doc_presentations/2017/1…

ALAMOS GOLD hat nun RICHMONT MINES übernommen. Die Aktionäre von beiden Unternehmen haben

zu über 90 % der Übernahme zugestimmt. Ich gehe davon aus, dass die Behörden wohl nichts dagegen haben, da ja bereits am 23. 11. 2017 Vollzug gemeldet werden soll. Damit wird ALAMOS im nächsten Jahr ca. 120k Goldunzen mehr produzieren und kommt dann auf über 500.000 Unzen.

Sobald das alle erkannt und realisiert haben wird auch der Kurs wieder steigen, oder eben doch nicht. Wer weiß das schon heute, die nächste Zeit wird es zeigen.

Alamos Gold's Acquisition of Richmont Mines Receives Overwhelming Shareholder Approval

11/16/2017

Alamos Gold Inc. ("Alamos") (TSX:AGI)(NYSE:AGI) and Richmont Mines Inc. ("Richmont") (TSX:RIC)(NYSE:RIC) are pleased to announce that shareholders of both companies have overwhelmingly voted in favour of the plan of arrangement (the "Transaction") at their respective special meetings of shareholders held earlier today.

The Transaction, whereby Alamos will acquire all of the issued and outstanding shares of Richmont, was approved by 98.46% of votes cast by Alamos shareholders and 92.56% of votes cast by Richmont shareholders. A copy of the complete report on voting for each of Richmont and Alamos will be made available on SEDAR and EDGAR.

The Transaction is expected to close on November 23, 2017, subject to applicable regulatory approvals and the satisfaction of other customary conditions.

"With the acquisition of Richmont we are strengthening our asset base and profitability. We are very pleased with the strong support for the transaction and expect to create significant value for shareholders as we deliver on the expansion at Island Gold and continue to unlock its exploration potential," said John A. McCluskey, President and Chief Executive Officer of Alamos.

"This strategic transaction delivers on our commitment to create long-term sustainable value as our shareholders will benefit from having meaningful ownership in a diversified intermediate producer with a portfolio of high-quality assets and a proven and experienced management team while maintaining exposure to the significant potential of the Island Gold Mine," said Renaud Adams, President and Chief Executive Officer of Richmont.

About Alamos Gold Inc.

http://www.alamosgold.com/news-and-media/news-releases/news-…

21.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

15.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

06.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

30.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

24.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

19.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |