Signal Gold [ Anaconda Mining ] auf dem Weg in eine goldige Zukunft! - 500 Beiträge pro Seite (Seite 3)

eröffnet am 01.01.18 17:06:11 von

neuester Beitrag 10.04.24 13:41:35 von

neuester Beitrag 10.04.24 13:41:35 von

Beiträge: 1.455

ID: 1.270.505

ID: 1.270.505

Aufrufe heute: 0

Gesamt: 108.091

Gesamt: 108.091

Aktive User: 0

ISIN: CA82664T1012 · WKN: A3DK3Q · Symbol: SGNL

0,1100

CAD

0,00 %

0,0000 CAD

Letzter Kurs 03.05.24 Toronto

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 185,00 | -9,76 | |

| 0,7000 | -11,39 | |

| 0,6700 | -14,92 | |

| 43,97 | -16,90 | |

| 12,000 | -25,00 |

Sehr geehrter Herr Stephansdom,

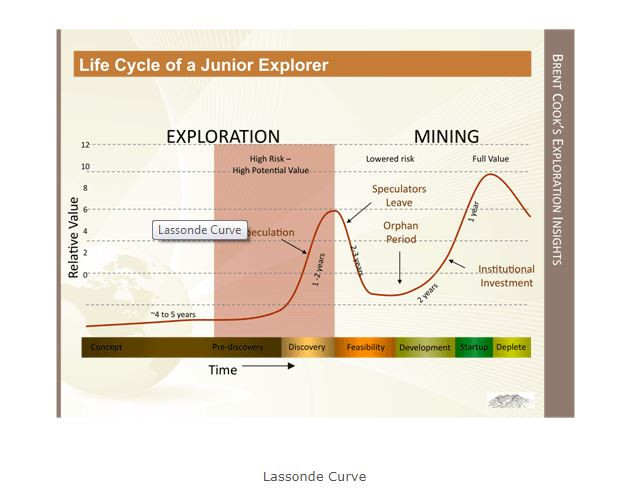

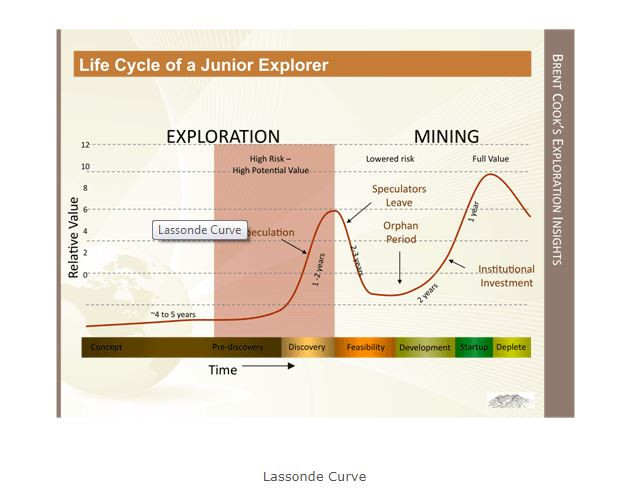

ich glaube worauf du hinaus willst ist klar, Anaconda ist ambitioniert bewertet, wenn man nur die aktuelle Produktion betrachtet, sehe ich auch so.

AAAAABER: an der Börse wird die Zukunft bewertet.Wir haben einen guten CEO der den momentan nicht unbedeutenden CF gezielt verwendet, um die Produktion möglichst schnell auszuweiten, was nächstes Jahr wiederum einen höheren CF verspricht. Könnte mir durchaus 30000 OZ vorstellen.

Dieser CF wird irgendwann sicher dafür verwendet werden, die Finanzierung für das Flaggschiff Goldboro voranzutreiben. Die Konditionen sollten weitaus besser sein, als ohne diesen besagten CF.

Wie gesagt, hier ist die Zukunft interessant. Wenn du mir noch eine anderes Unternehmen sagst, welches eine solch einzigartige Ausgangssituation hat, immer her damit.

ich glaube worauf du hinaus willst ist klar, Anaconda ist ambitioniert bewertet, wenn man nur die aktuelle Produktion betrachtet, sehe ich auch so.

AAAAABER: an der Börse wird die Zukunft bewertet.Wir haben einen guten CEO der den momentan nicht unbedeutenden CF gezielt verwendet, um die Produktion möglichst schnell auszuweiten, was nächstes Jahr wiederum einen höheren CF verspricht. Könnte mir durchaus 30000 OZ vorstellen.

Dieser CF wird irgendwann sicher dafür verwendet werden, die Finanzierung für das Flaggschiff Goldboro voranzutreiben. Die Konditionen sollten weitaus besser sein, als ohne diesen besagten CF.

Wie gesagt, hier ist die Zukunft interessant. Wenn du mir noch eine anderes Unternehmen sagst, welches eine solch einzigartige Ausgangssituation hat, immer her damit.

Antwort auf Beitrag Nr.: 65.011.905 von Oldiebutgoldie am 07.09.20 18:32:20einzigartig? gehts noch? 1 Mio Unzen?? AISC ???

Wo kommst her? machts gut und lobt euch die nächsten 10 Jahre hoch während andere Geld verdienen.

Wo kommst her? machts gut und lobt euch die nächsten 10 Jahre hoch während andere Geld verdienen.

Guten Morgen Goldies!

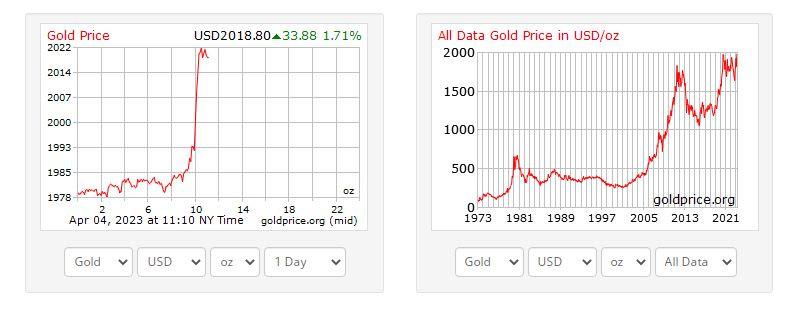

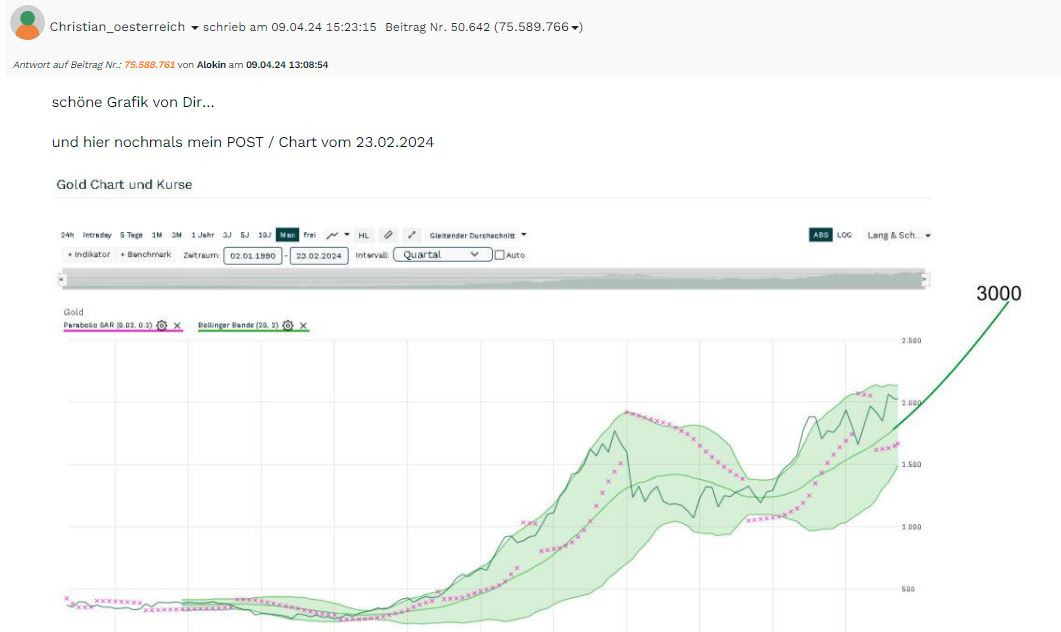

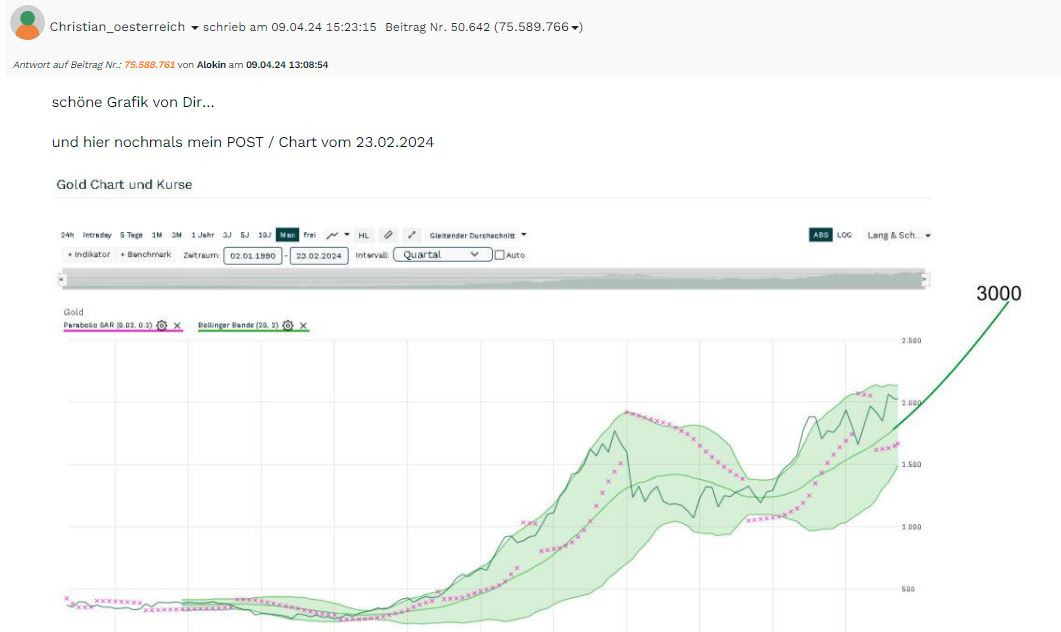

Schau mer mal was uns die neue Woche bringt - auch bezüglich des Goldpreises...

Viel Erfolg und auch eine gute Arbeitswoche!

Schau mer mal was uns die neue Woche bringt - auch bezüglich des Goldpreises...

Viel Erfolg und auch eine gute Arbeitswoche!

Antwort auf Beitrag Nr.: 65.011.365 von wasn am 07.09.20 17:35:31Grüße Dich!

Im Nachhinein denkt man sich wohl immer hätte ich vielleicht 20% zum Höchstkurs verkauft, dann bekäme ich jetzt 30% an Anteilen zurück zum günstigeren Preis.

Aber woran erkennt man bitte den Höchstkurs wenn er da ist?

Deshalb versuche ich in den Dips Aktien nachzukaufen bis mein Zielbereich erreicht ist.

Das mag für andere falsch sein aber für mich ist es richtig.

Zum Zocken nutze ich andere Anlagewerte.

Anaconda ist für mich die sichere Bank für die Zukunft.

Wenn es hier Rücksetzer gibt, dann sitze ich diese aus, um des weiteren Kursanstiegs Willen.

Dies ist jedoch nur meine bescheidene Strategie und diese muss niemand teilen.

Viel Erfolg auch Dir weiterhin!

Im Nachhinein denkt man sich wohl immer hätte ich vielleicht 20% zum Höchstkurs verkauft, dann bekäme ich jetzt 30% an Anteilen zurück zum günstigeren Preis.

Aber woran erkennt man bitte den Höchstkurs wenn er da ist?

Deshalb versuche ich in den Dips Aktien nachzukaufen bis mein Zielbereich erreicht ist.

Das mag für andere falsch sein aber für mich ist es richtig.

Zum Zocken nutze ich andere Anlagewerte.

Anaconda ist für mich die sichere Bank für die Zukunft.

Wenn es hier Rücksetzer gibt, dann sitze ich diese aus, um des weiteren Kursanstiegs Willen.

Dies ist jedoch nur meine bescheidene Strategie und diese muss niemand teilen.

Viel Erfolg auch Dir weiterhin!

Zitat von wasn: Ich stecke hier auch mit viel Geld drin.

Ich finde allerdings dass die Beweggründe hier zu schrieben davon unabhängig sein dürfen.

Ich möchte Dich zwar ebenfalls bitten Deine Wortwahl zu überdenken.

Für fachliche / sachliche faktenbasierte Kritik sollte hier aber der Raum gegeben werden können; man muss abweichende Meinungen ja nicht teilen.

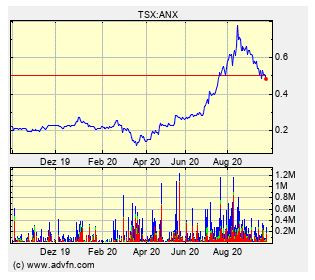

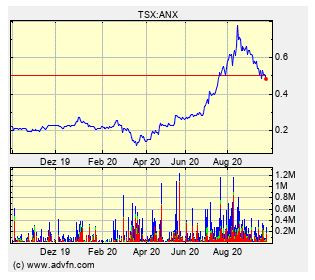

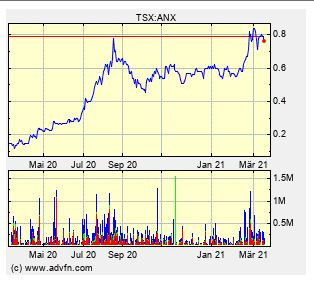

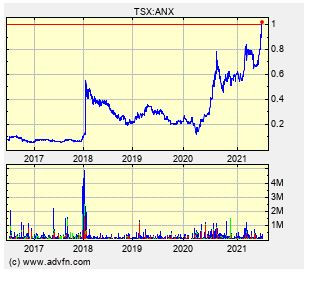

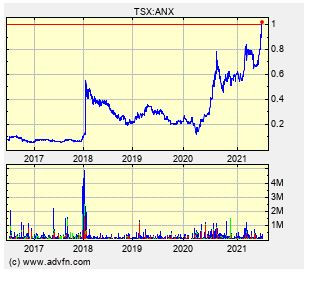

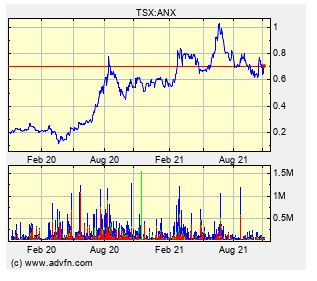

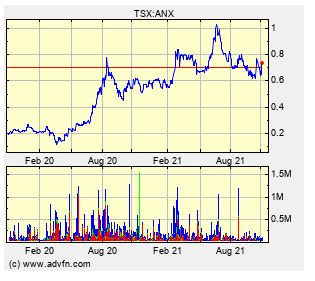

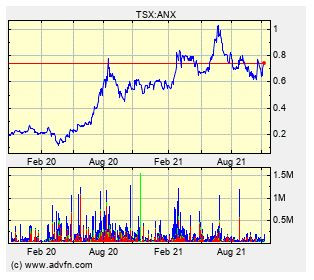

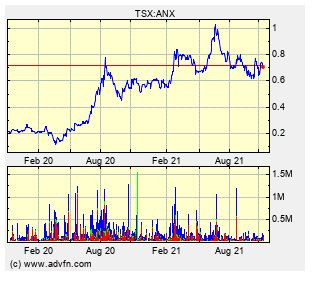

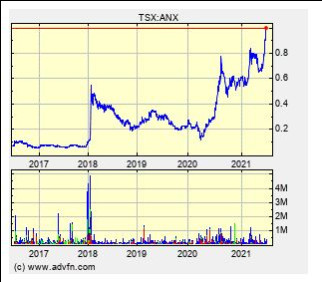

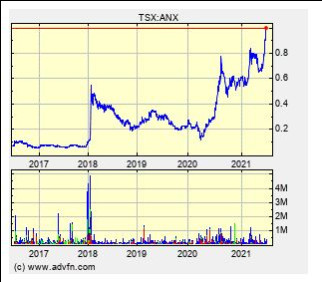

Ist natürlich Arbeit sich das Marktgeschehen kontinuierlich anzusehen. Ich habe das die letzten Jahre nicht gemacht und stand ein bisschen dumm da, als ANX kürzlich bei 78 ct. stand - fast ein Verdoppler im Bezug auf meinen Druchschnitts-EK

Also weg damit oder mehr erwarten?

Ich habe mich jedenfalls im Moment erst mal fürs festhalten entschieden.

Antwort auf Beitrag Nr.: 65.011.905 von Oldiebutgoldie am 07.09.20 18:32:20Danke!

Du hast es gut formuliert!

Vielleicht glücklicher als ich, denn dies ist in etwa auch meine Sichtweise zur weiteren Entwicklung was den Cash Flow anbelangt und die Finanzierung des Beasts.

Auch Dir viel Erfolg weiterhin!

Du hast es gut formuliert!

Vielleicht glücklicher als ich, denn dies ist in etwa auch meine Sichtweise zur weiteren Entwicklung was den Cash Flow anbelangt und die Finanzierung des Beasts.

Auch Dir viel Erfolg weiterhin!

Zitat von Oldiebutgoldie: Sehr geehrter Herr Stephansdom,

ich glaube worauf du hinaus willst ist klar, Anaconda ist ambitioniert bewertet, wenn man nur die aktuelle Produktion betrachtet, sehe ich auch so.

AAAAABER: an der Börse wird die Zukunft bewertet.Wir haben einen guten CEO der den momentan nicht unbedeutenden CF gezielt verwendet, um die Produktion möglichst schnell auszuweiten, was nächstes Jahr wiederum einen höheren CF verspricht. Könnte mir durchaus 30000 OZ vorstellen.

Dieser CF wird irgendwann sicher dafür verwendet werden, die Finanzierung für das Flaggschiff Goldboro voranzutreiben. Die Konditionen sollten weitaus besser sein, als ohne diesen besagten CF.

Wie gesagt, hier ist die Zukunft interessant. Wenn du mir noch eine anderes Unternehmen sagst, welches eine solch einzigartige Ausgangssituation hat, immer her damit.

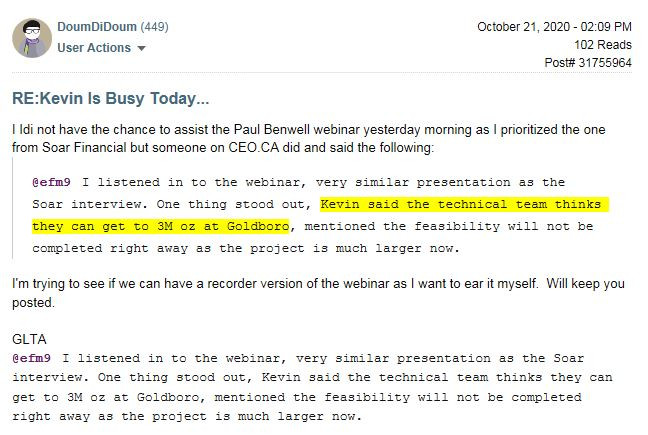

Bericht eines Investors aus Kanada:

winedoc

September 06, 2020 - 08:09 AM

Post# 31516400

Site Visit

Hey All

happy to report Logan is already deployed and drilling away to the west of the flooded ramp area

Anaconda means business and continues to drill to define our ounces in the ground

the largest and highest grade deposit in all of Nova Scotia

goANX

winedoc

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

winedoc

September 06, 2020 - 08:09 AM

Post# 31516400

Site Visit

Hey All

happy to report Logan is already deployed and drilling away to the west of the flooded ramp area

Anaconda means business and continues to drill to define our ounces in the ground

the largest and highest grade deposit in all of Nova Scotia

goANX

winedoc

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Eine weitere Sichtweise aus dem Kanadischen Bord:

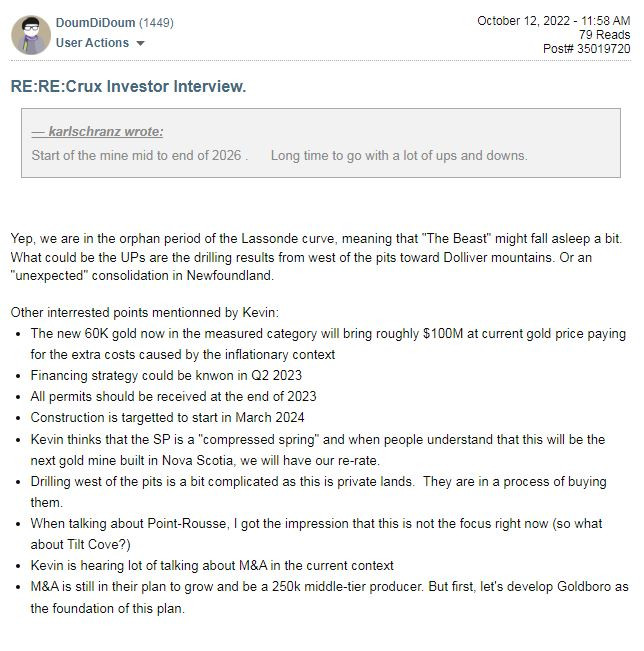

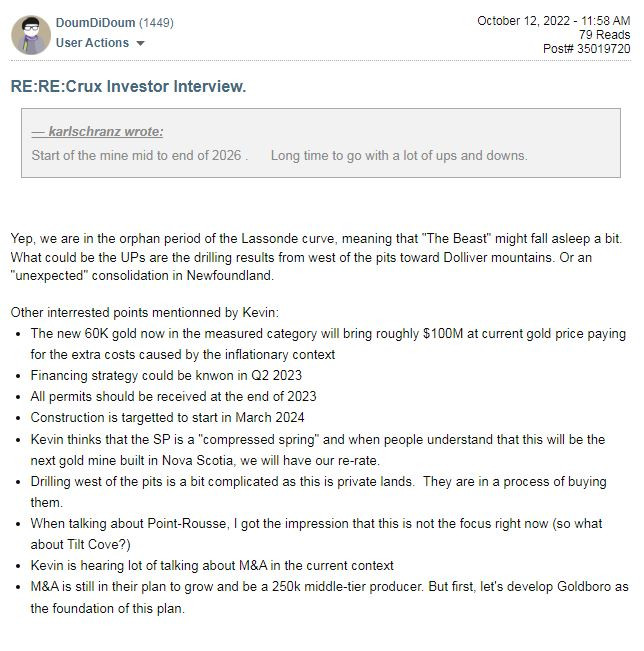

DoumDiDoum

September 05, 2020 - 10:23 AM

Post# 31515300

Weekly Stats And Saturday Coffee Thoughts

We got some drill results news this week but that did not attract new buyers. It looks like putting ore from Inferred to M+I category is not sexy for retail investors nowadays, they want to see discoveries of new zones. But we have to admit the last two weeks were not that "hot" for the juniors globally neither: a lot of investors took some profit during the last two weeks.

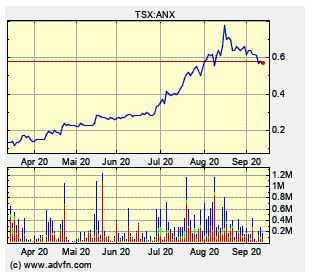

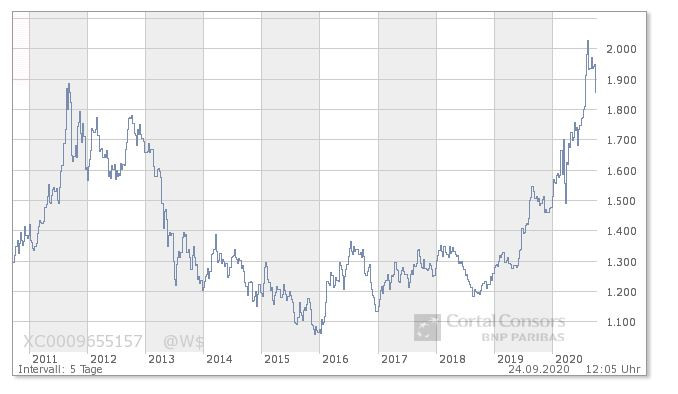

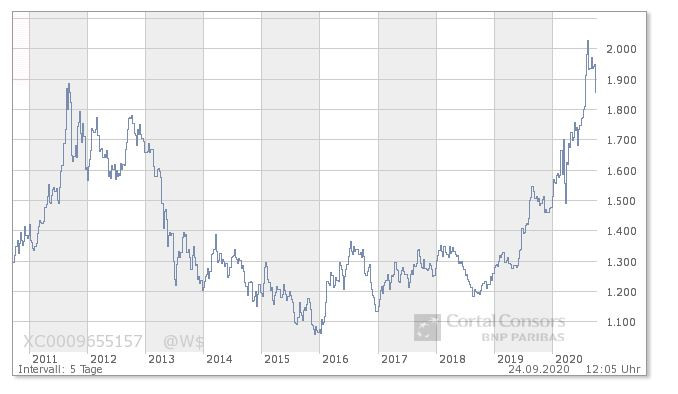

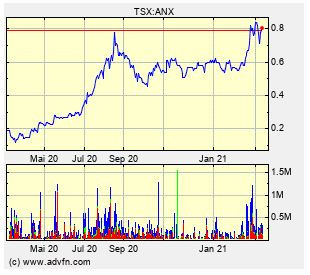

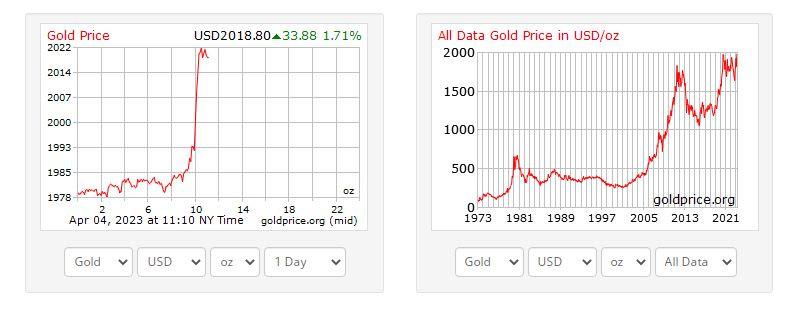

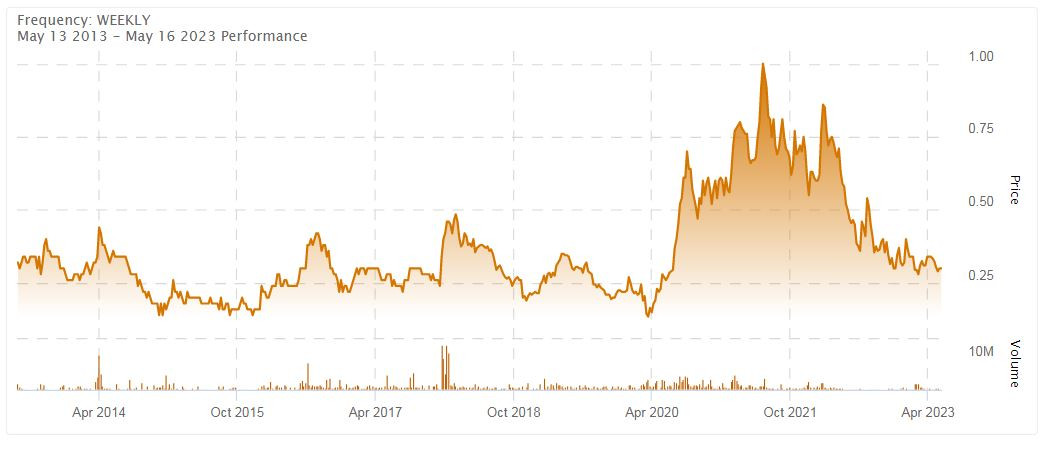

Trading around the 100M$ market cap for a while is healthy. Gold would need to get back and sustain the 2000$ level so we can benefit from the macro factors to get to the 80 cents level IMO.

That might happen soon as GAFA (Google, Apple, facebook, Amazone) stocks lost between 8% to 10% since their highs from last week and we might see other weeks like that as these stocks have been clearly overbought for a long time. Some of this liquidity will soon reach the gold sector and if we have a momentum, that might be the second leg of this gold bug. The big boys are keeping quiet for now in this accumulation phase. But when they will decide to let it go, we will have a lot of happy faces in the ANX community!

Good long weekend to all!

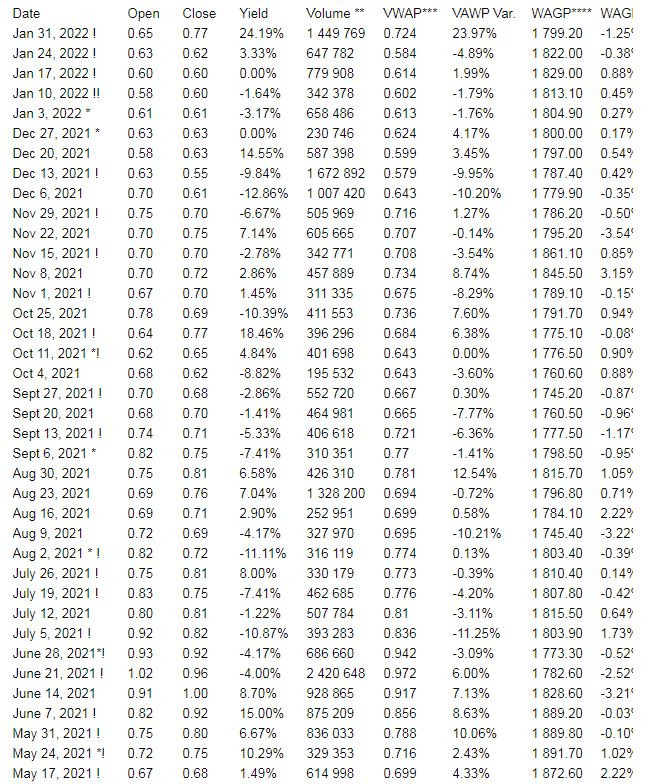

Date Open Close Yield Volume **

Aug 31, 2020 0,61 0,64 0,00% 975,488

Aug 24, 2020 0,69 0,64 -9,84% 1,412,524

Aug 17, 2020 0,64 0,70 14,75% 2,513,000

Aug 10, 2020 0,61 0,61 0,00% 2,997,939

Aug 3, 2020 * 0,54 0,61 12,96% 2,212,800

Jul 27, 2020 0,56 0,54 3,85% 1,868,600

Jul 20, 2020 0,49 0,52 15,56% 2,578,300

Jul 13, 2020 0,40 0,45 12,50% 1,191,300

Jul 06, 2020 0,37 0,40 8,11% 1,586,900

Jun 29, 2020 0,29 0,37 21,62% 1,673,500

* Market was open 4 days during the week in Canada

** Volume on the TSX only

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

DoumDiDoum

September 05, 2020 - 10:23 AM

Post# 31515300

Weekly Stats And Saturday Coffee Thoughts

We got some drill results news this week but that did not attract new buyers. It looks like putting ore from Inferred to M+I category is not sexy for retail investors nowadays, they want to see discoveries of new zones. But we have to admit the last two weeks were not that "hot" for the juniors globally neither: a lot of investors took some profit during the last two weeks.

Trading around the 100M$ market cap for a while is healthy. Gold would need to get back and sustain the 2000$ level so we can benefit from the macro factors to get to the 80 cents level IMO.

That might happen soon as GAFA (Google, Apple, facebook, Amazone) stocks lost between 8% to 10% since their highs from last week and we might see other weeks like that as these stocks have been clearly overbought for a long time. Some of this liquidity will soon reach the gold sector and if we have a momentum, that might be the second leg of this gold bug. The big boys are keeping quiet for now in this accumulation phase. But when they will decide to let it go, we will have a lot of happy faces in the ANX community!

Good long weekend to all!

Date Open Close Yield Volume **

Aug 31, 2020 0,61 0,64 0,00% 975,488

Aug 24, 2020 0,69 0,64 -9,84% 1,412,524

Aug 17, 2020 0,64 0,70 14,75% 2,513,000

Aug 10, 2020 0,61 0,61 0,00% 2,997,939

Aug 3, 2020 * 0,54 0,61 12,96% 2,212,800

Jul 27, 2020 0,56 0,54 3,85% 1,868,600

Jul 20, 2020 0,49 0,52 15,56% 2,578,300

Jul 13, 2020 0,40 0,45 12,50% 1,191,300

Jul 06, 2020 0,37 0,40 8,11% 1,586,900

Jun 29, 2020 0,29 0,37 21,62% 1,673,500

* Market was open 4 days during the week in Canada

** Volume on the TSX only

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Antwort auf Beitrag Nr.: 64.978.950 von tatamateband am 03.09.20 16:05:24Für mich: gut!

Zitat von tatamateband: Bohrergebnisse gut opet schlecht?

Antwort auf Beitrag Nr.: 65.016.174 von IQ4U am 08.09.20 10:03:39Ausstiegskurse werden kommen.

Antwort auf Beitrag Nr.: 65.016.174 von IQ4U am 08.09.20 10:03:39Ich denke morgen bin ich raus. Das wars hier fürs erste. Verständlich nach der Kursrallye. Auch positive postings bringen hier nichts in nächster Zeit. Falls Impstoff, Gold Süden, Anaconda Kurshalbierung. Meine Sichtweise.

Antwort auf Beitrag Nr.: 65.011.365 von wasn am 07.09.20 17:35:31Respekt!

Du hast aber auch Eier...

Für mich selbst habe ich immer Korrekturen bis zu +/- 30% auf dem Radar aber dann sollte auch gut sein.

Du hast aber auch Eier...

Für mich selbst habe ich immer Korrekturen bis zu +/- 30% auf dem Radar aber dann sollte auch gut sein.

Zitat von wasn: Ich stecke hier auch mit viel Geld drin.

Ich finde allerdings dass die Beweggründe hier zu schrieben davon unabhängig sein dürfen.

Ich möchte Dich zwar ebenfalls bitten Deine Wortwahl zu überdenken.

Für fachliche / sachliche faktenbasierte Kritik sollte hier aber der Raum gegeben werden können; man muss abweichende Meinungen ja nicht teilen.

Ist natürlich Arbeit sich das Marktgeschehen kontinuierlich anzusehen. Ich habe das die letzten Jahre nicht gemacht und stand ein bisschen dumm da, als ANX kürzlich bei 78 ct. stand - fast ein Verdoppler im Bezug auf meinen Druchschnitts-EK

Also weg damit oder mehr erwarten?

Ich habe mich jedenfalls im Moment erst mal fürs festhalten entschieden.

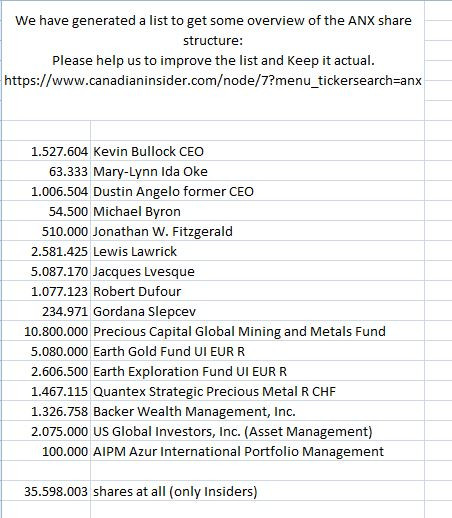

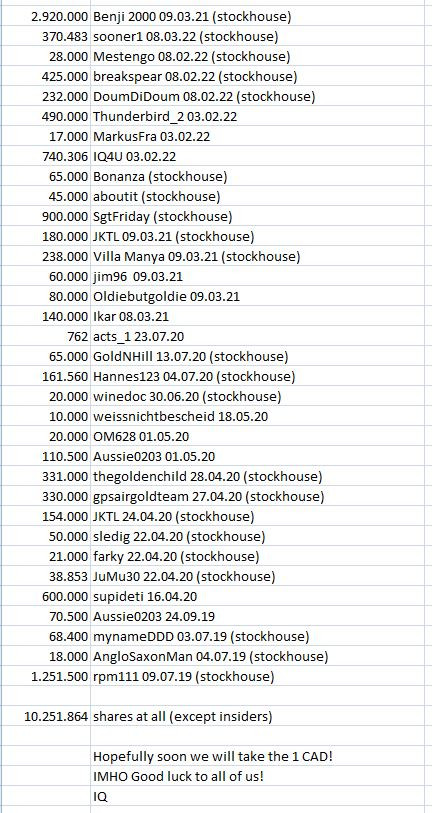

Klasse Nachricht in der Konsolidierungsphase!

Heute hat der CEO Kevin Bullock 50.000 Aktien am Freien Markt gekauft!

Das lobe ich mir!

SL - SC

Quelle: https://www.canadianinsider.com/node/7?menu_tickersearch=anx

Heute hat der CEO Kevin Bullock 50.000 Aktien am Freien Markt gekauft!

Das lobe ich mir!

SL - SC

Quelle: https://www.canadianinsider.com/node/7?menu_tickersearch=anx

Guten Morgen Goldies!

Was für ein Tag gestern...

Eine heftige Konsolidierungsphase würde ich sagen.

Aber was solls, insgesamt läuft es ja nun prächtig...

Was für ein Tag gestern...

Eine heftige Konsolidierungsphase würde ich sagen.

Aber was solls, insgesamt läuft es ja nun prächtig...

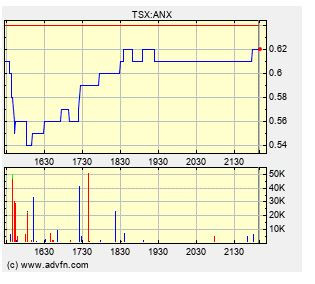

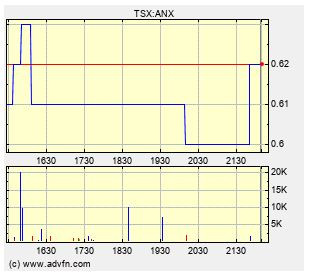

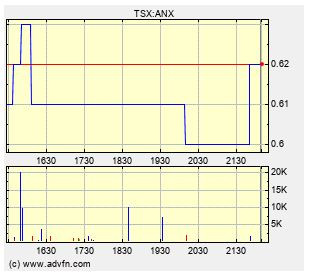

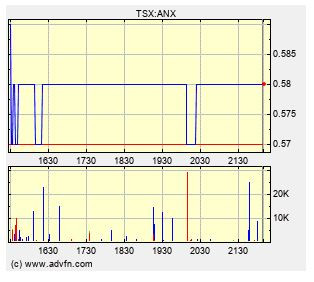

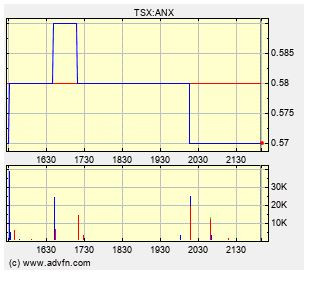

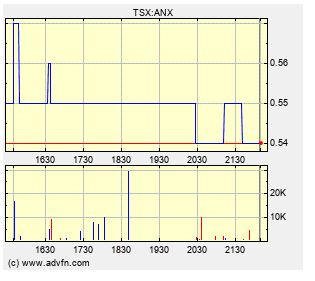

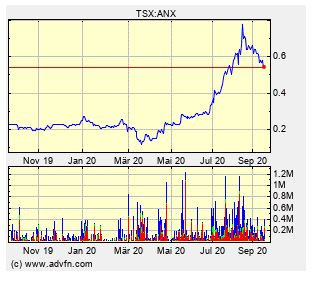

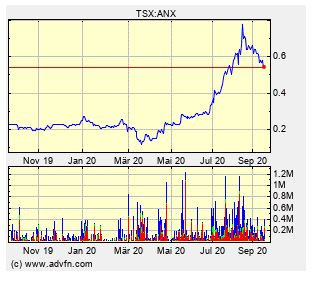

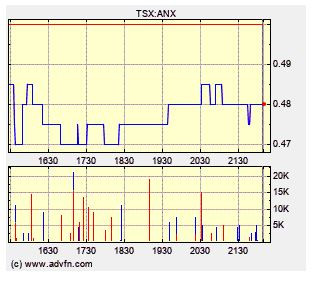

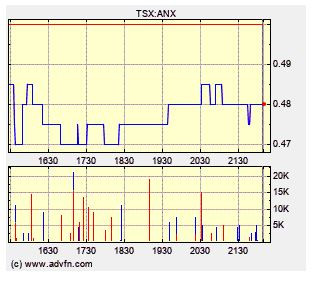

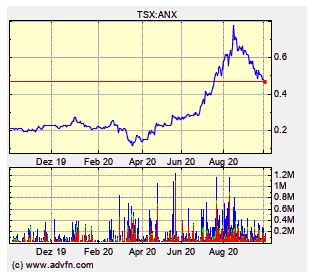

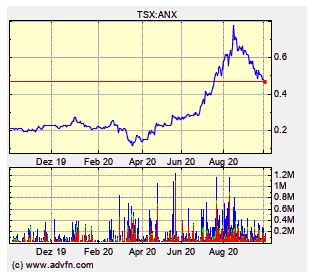

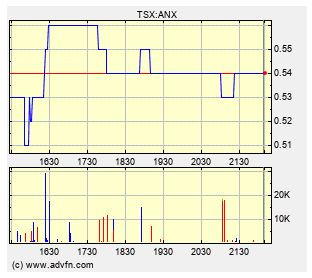

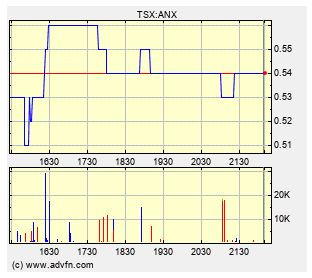

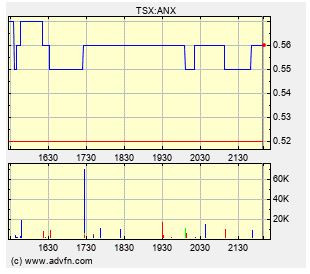

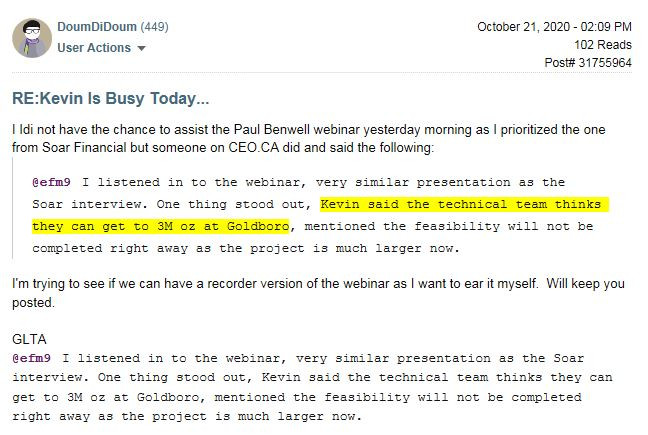

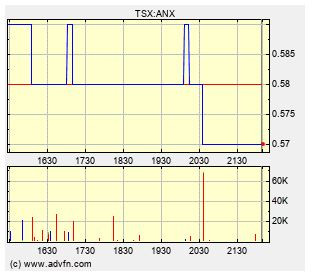

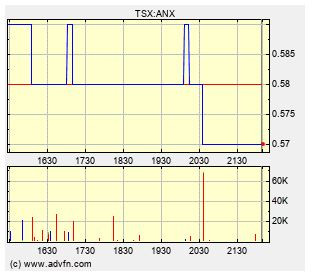

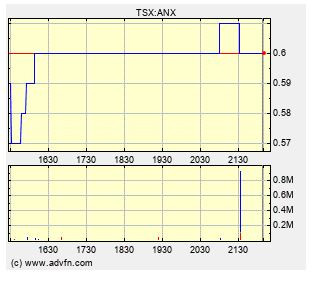

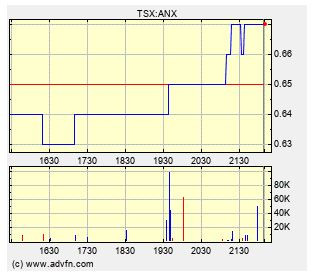

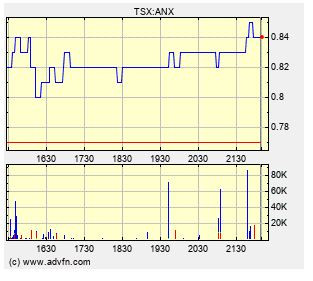

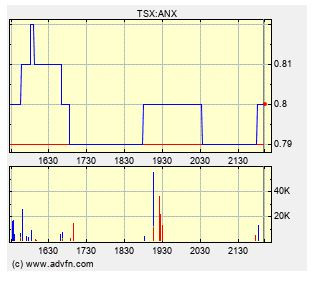

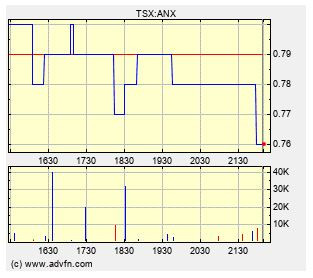

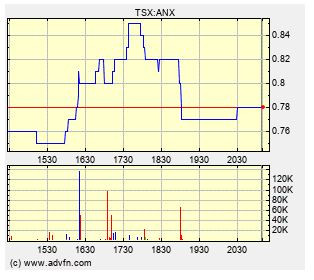

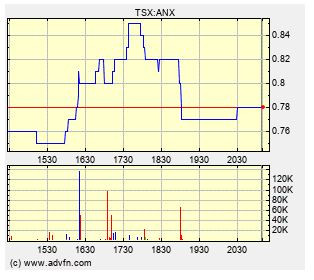

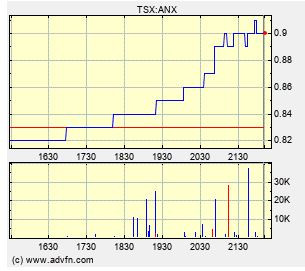

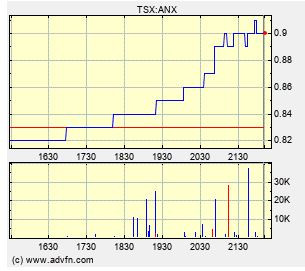

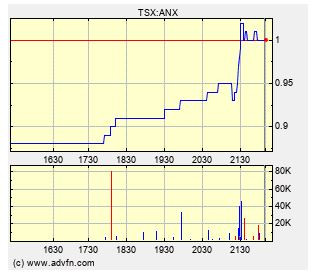

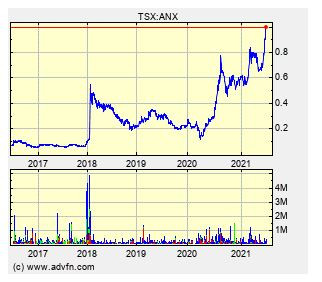

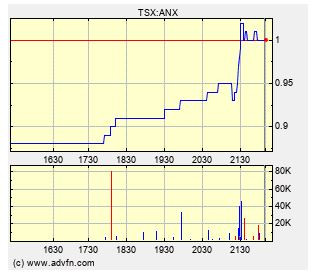

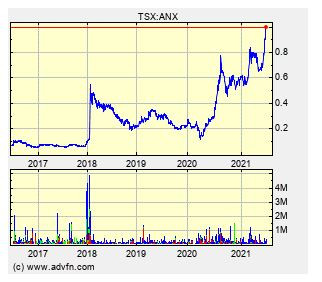

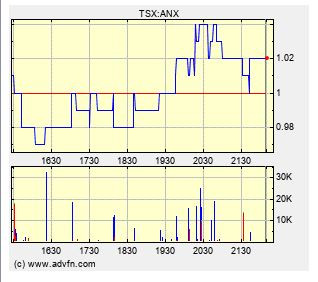

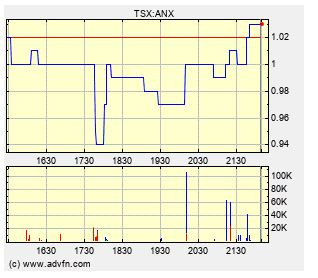

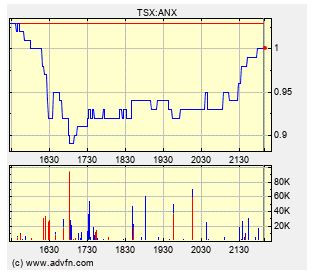

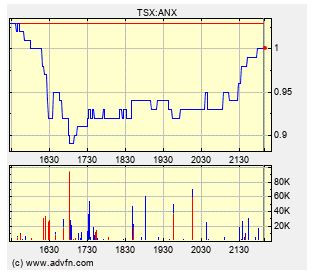

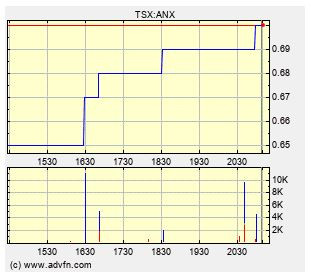

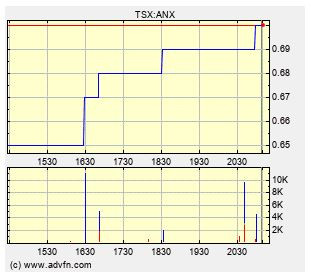

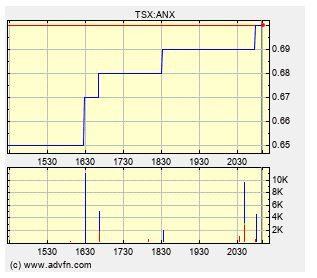

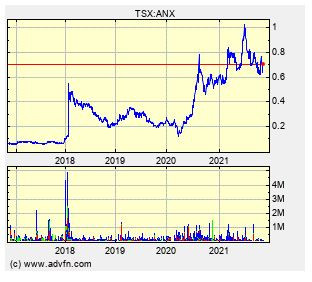

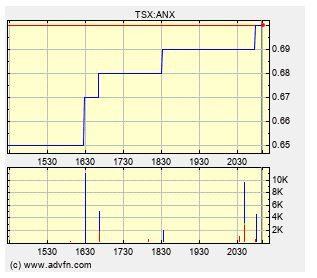

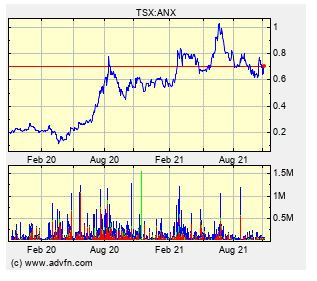

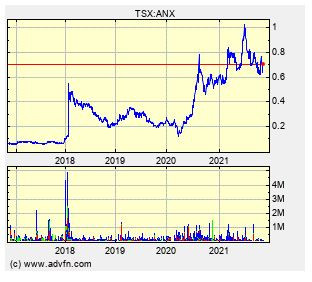

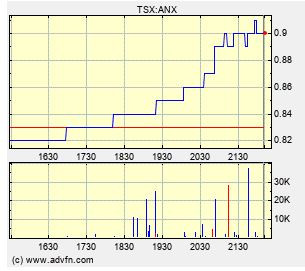

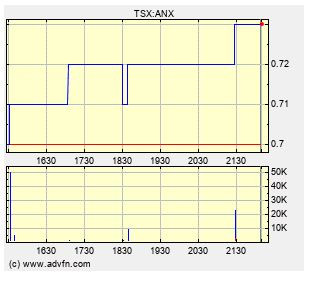

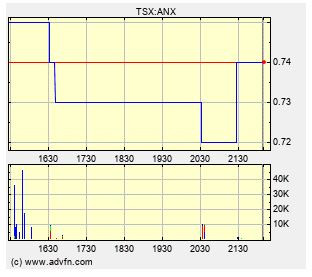

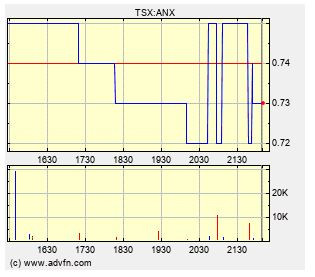

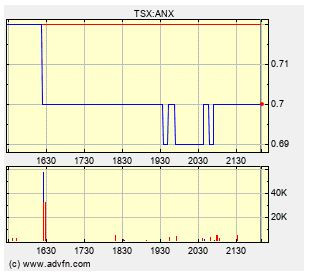

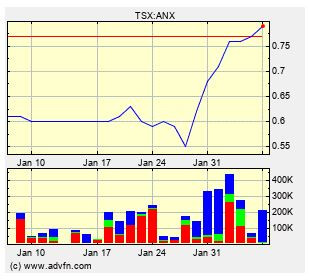

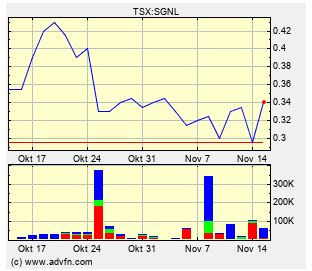

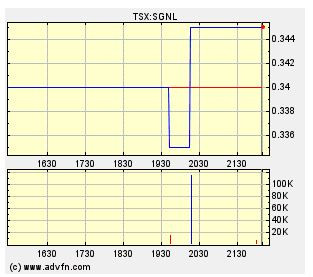

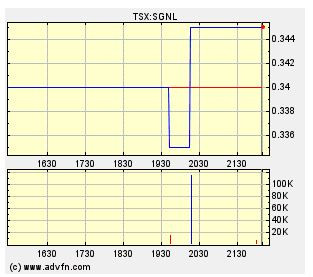

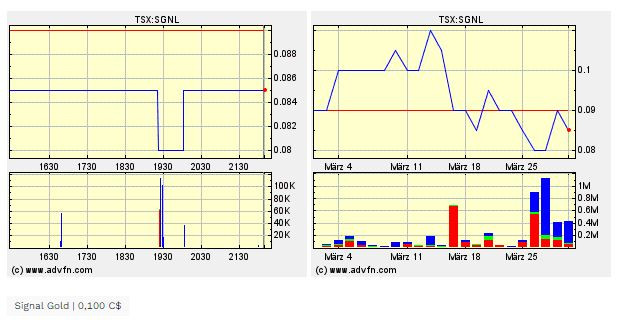

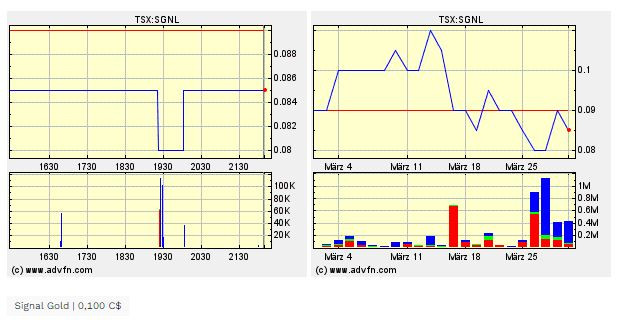

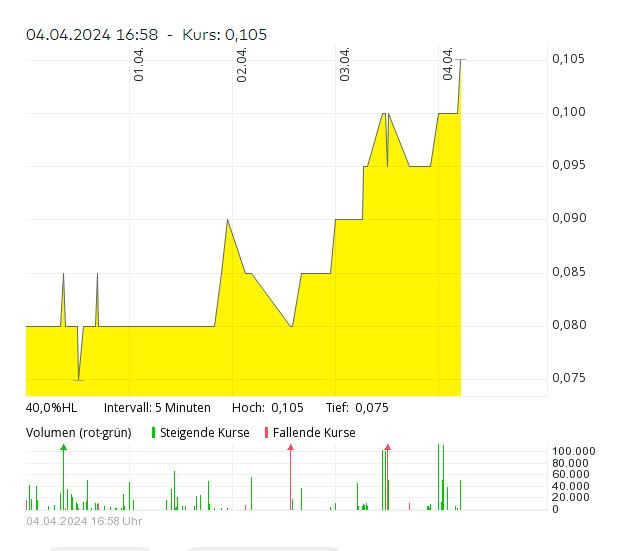

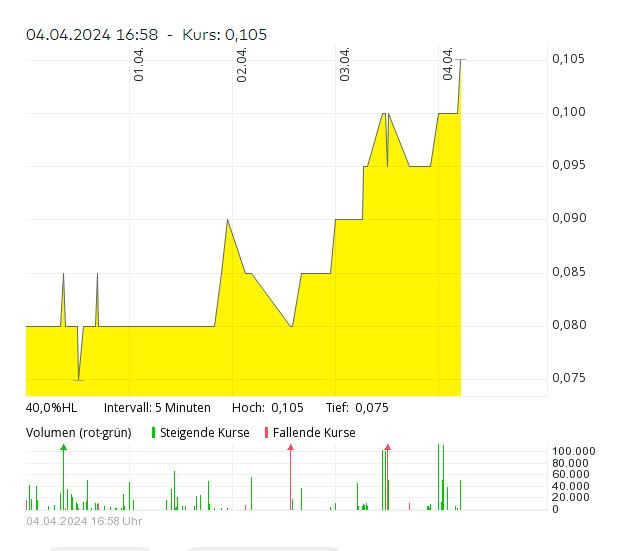

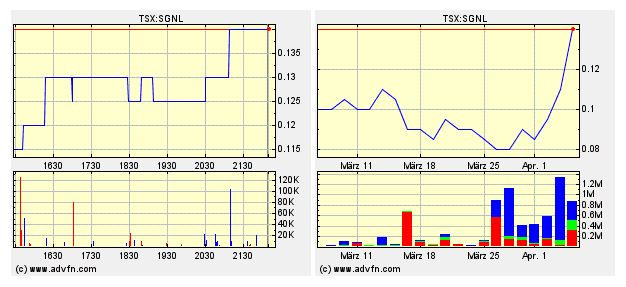

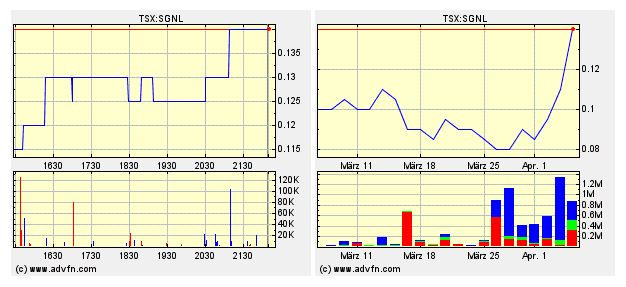

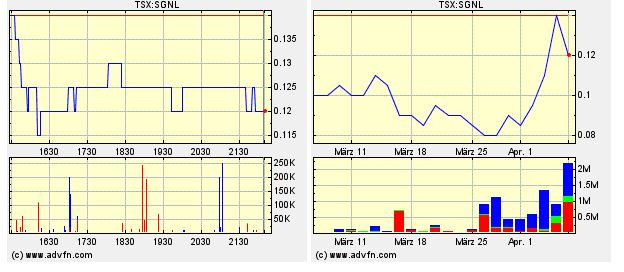

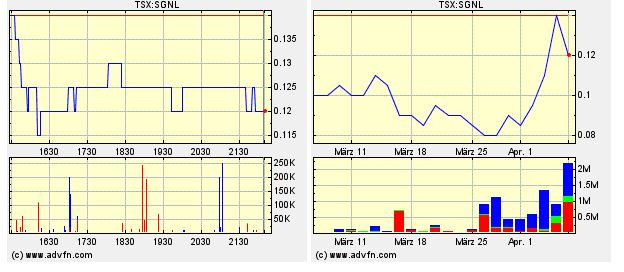

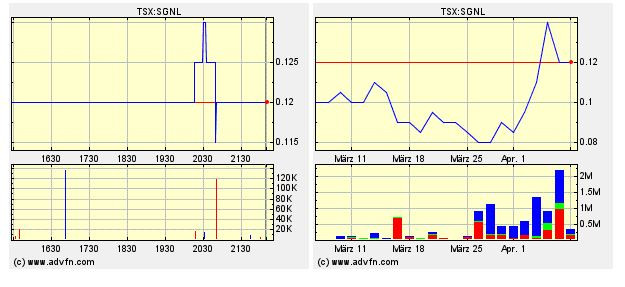

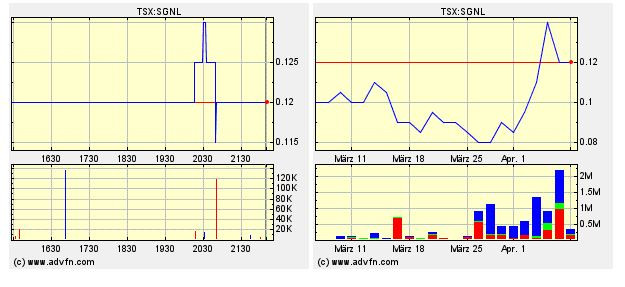

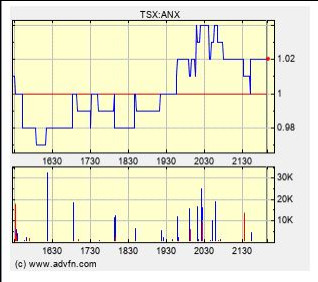

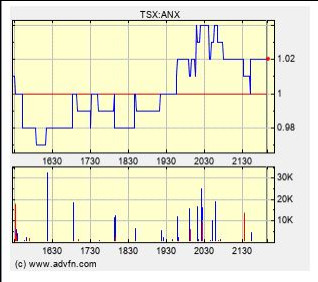

Handelsverlauf gestern an der Heimatbörse in Toronto:

Ein Investor ließ mich wissen er wolle noch ANX unter 0,40 EUR kaufen an einer deutschen Börse.

Gestern war nun Gelegenheit dazu...

Gestern war nun Gelegenheit dazu...

Ein Beitrag aus dem Kanadischen Bord:

OMPAR2016

September 08, 2020 - 08:10 PM

Post# 31524689

RE:Stock support...........

You are soo right gg. I talked with Dany today and he told me he has a plan to bring it back up higher than before. He told me that we are on consolidation and that virtual meeting were on to find new bigger investors. He told me that fall time should be very imteresting. Folks it is time note to give up your share too cheap.

Folks it is time note to give up your share too cheap.

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

OMPAR2016

September 08, 2020 - 08:10 PM

Post# 31524689

RE:Stock support...........

You are soo right gg. I talked with Dany today and he told me he has a plan to bring it back up higher than before. He told me that we are on consolidation and that virtual meeting were on to find new bigger investors. He told me that fall time should be very imteresting.

Folks it is time note to give up your share too cheap.

Folks it is time note to give up your share too cheap. Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Hallo Goldies!

Noch keine weiteren News!

Wünsche allerseits einen sonnigen schönen Tag für Euch!

Noch keine weiteren News!

Wünsche allerseits einen sonnigen schönen Tag für Euch!

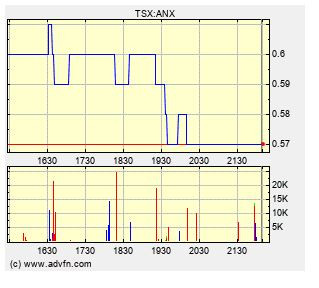

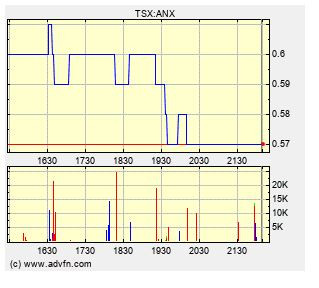

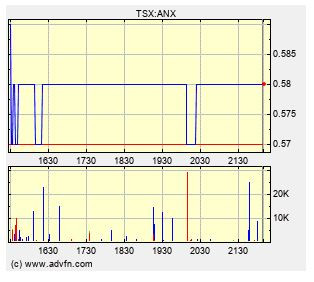

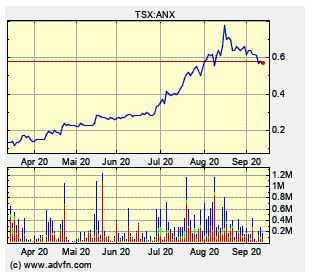

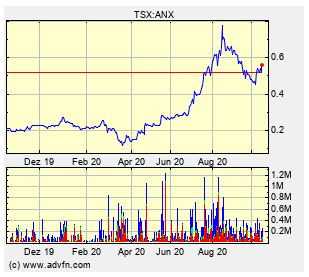

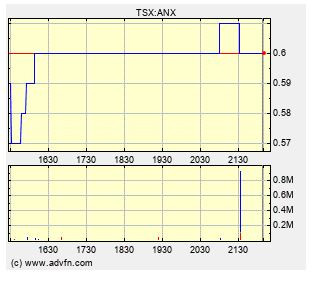

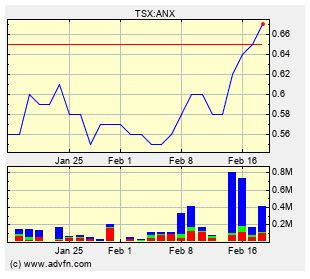

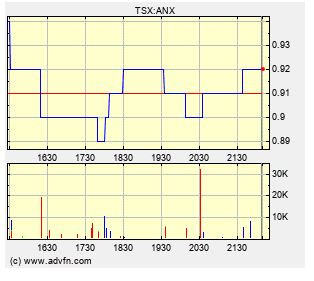

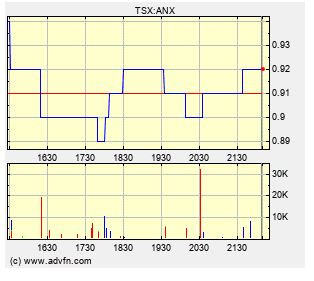

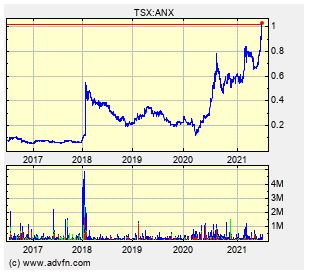

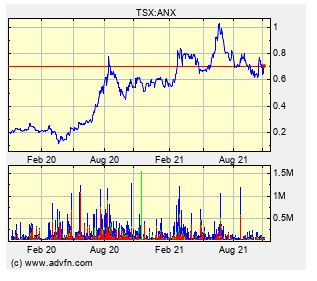

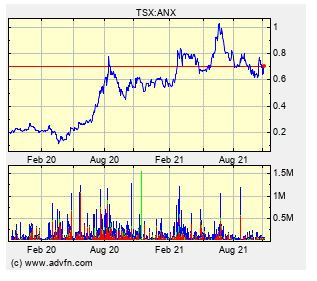

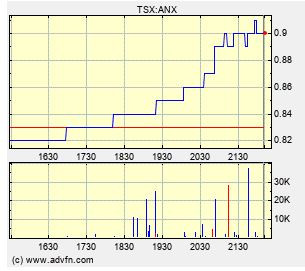

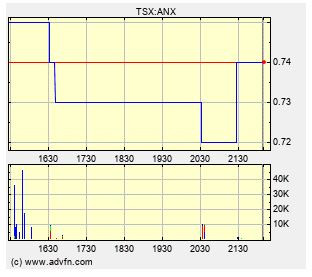

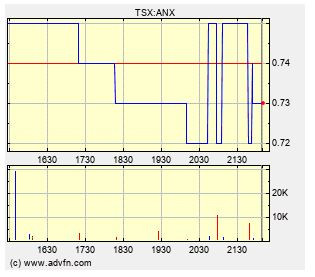

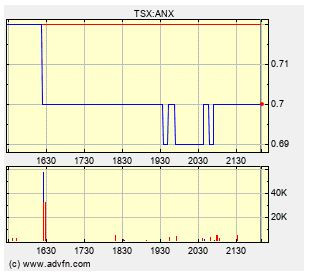

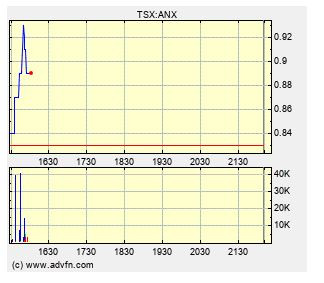

Handelsverlauf gestern an der Heimatbörse in Kanada:

Aus dem Kanadischen Bord:

rpm111

September 09, 2020 - 09:26 AM

Post# 31525844

no where near real value right now

ANX will be worth a lot and I mean a LOT more when they update the 43101 and they do their study. I can see a major rerate with the new price of gold . Remember those project are highly sensitive to price of GOLD. Also, we can see a second Wawe of Covid hit the world soon. ANX was one of the few miner to have not been hit by Covid due to it's location.

. Remember those project are highly sensitive to price of GOLD. Also, we can see a second Wawe of Covid hit the world soon. ANX was one of the few miner to have not been hit by Covid due to it's location.

I believe we aint see nothing YET.

GLTA

RPM

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

rpm111

September 09, 2020 - 09:26 AM

Post# 31525844

no where near real value right now

ANX will be worth a lot and I mean a LOT more when they update the 43101 and they do their study. I can see a major rerate with the new price of gold

. Remember those project are highly sensitive to price of GOLD. Also, we can see a second Wawe of Covid hit the world soon. ANX was one of the few miner to have not been hit by Covid due to it's location.

. Remember those project are highly sensitive to price of GOLD. Also, we can see a second Wawe of Covid hit the world soon. ANX was one of the few miner to have not been hit by Covid due to it's location.I believe we aint see nothing YET.

GLTA

RPM

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Guten Morgen Ihr Schlangenbeschwörer!

Im Westen nichts neues...

Genießt den Tag und das Wochenende!

SL - SC

Im Westen nichts neues...

Genießt den Tag und das Wochenende!

SL - SC

Ohmmmmmmmmmmmm

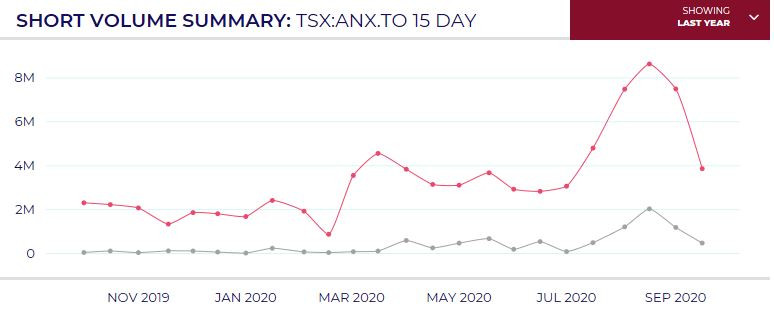

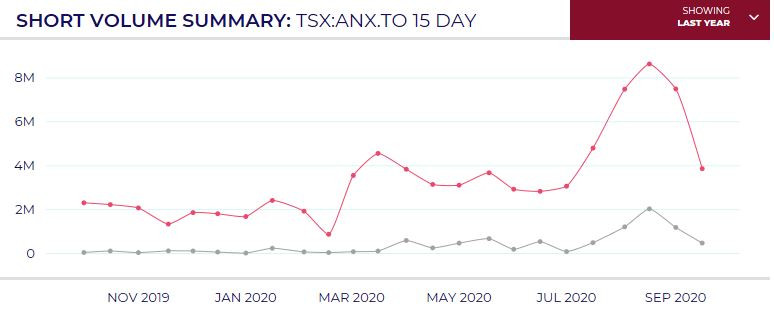

Antwort auf Beitrag Nr.: 65.052.822 von Ikar am 11.09.20 12:10:15Ich bin erstmal raus. Muss zugeben ich habe mich hier durch die postings verleiten lassen und bin zu spät rein. Obwohl der klare Menschenverstand was anderes gesagt hat. Der Anstieg war zu schnell und nur durch minimale Stückzahlen verursacht. Wie schon geschrieben, bei Impfstoff Gold down, hier überdurchschnittlich down.

Meine Meinung.

Meine Meinung.

Antwort auf Beitrag Nr.: 65.058.966 von fernotron2018 am 11.09.20 21:15:391. durch niedrige Stückzahlen, da hätte ich gerne mal einen Link dafür

es wurde eigentlich die ganze Zeit hohes Volumen gehandelt

Date Open Close Yield Volume ** Aug 31, 2020 0,61 0,64 0,00% 975,488 Aug 24, 2020 0,69 0,64 -9,84% 1,412,524 Aug 17, 2020 0,64 0,70 14,75% 2,513,000 Aug 10, 2020 0,61 0,61 0,00% 2,997,939 Aug 3, 2020 * 0,54 0,61 12,96% 2,212,800 Jul 27, 2020 0,56 0,54 3,85% 1,868,600 Jul 20, 2020 0,49 0,52 15,56% 2,578,300 Jul 13, 2020 0,40 0,45 12,50% 1,191,300 Jul 06, 2020 0,37 0,40 8,11% 1,586,900 Jun 29, 2020 0,29 0,37 21,62% 1,673,500 * Market was open 4 days during the week in Canada ** Volume on the TSX only Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-1001-101…

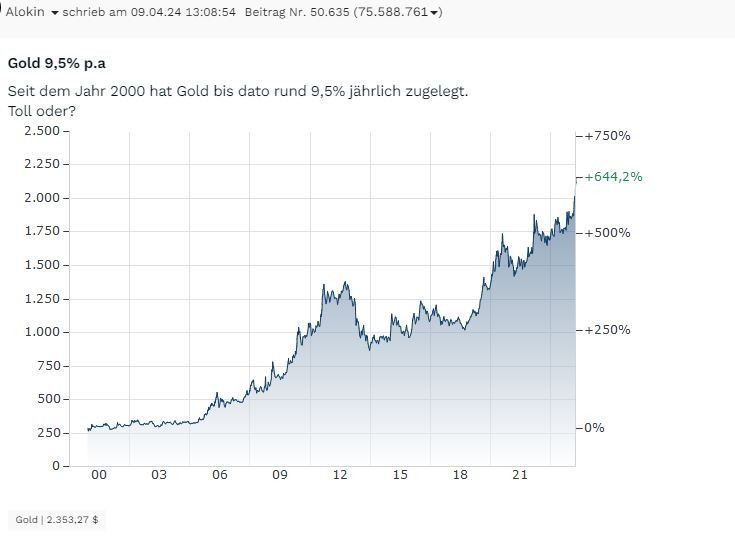

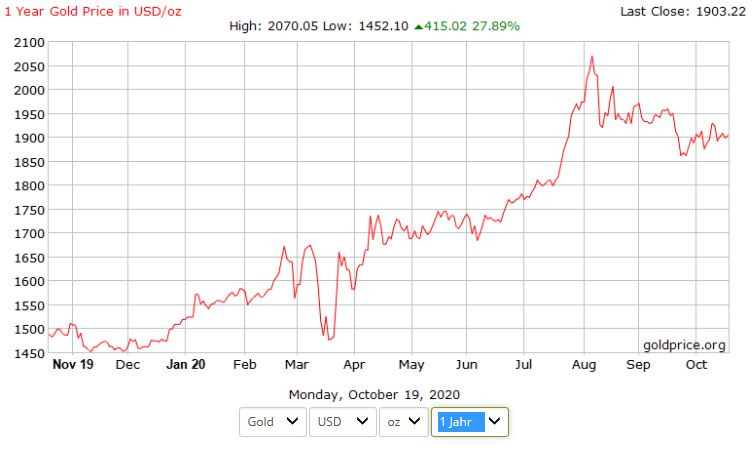

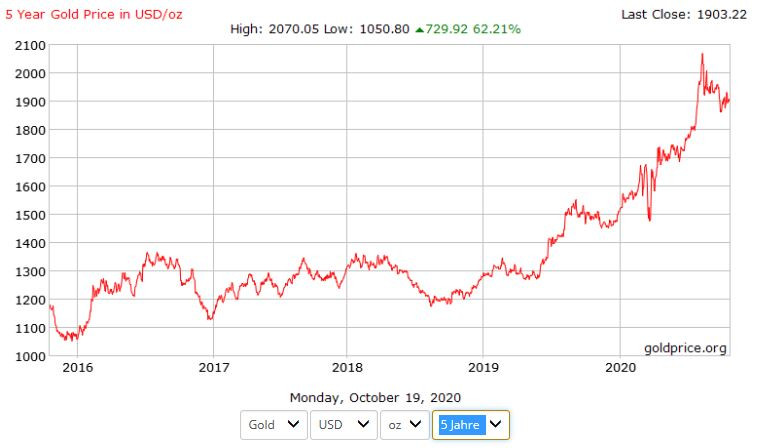

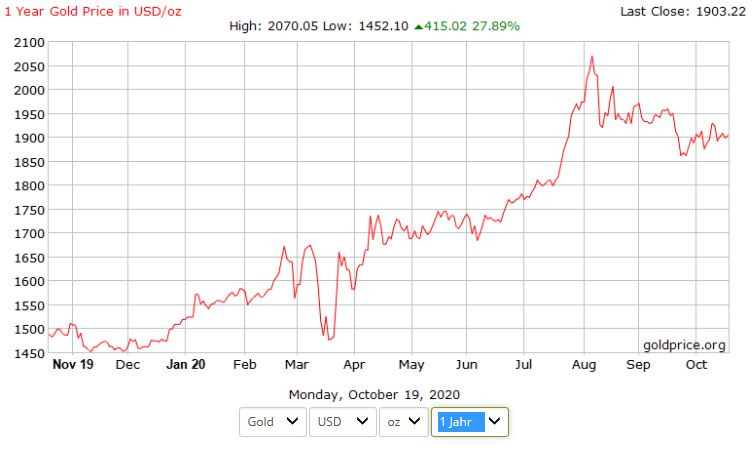

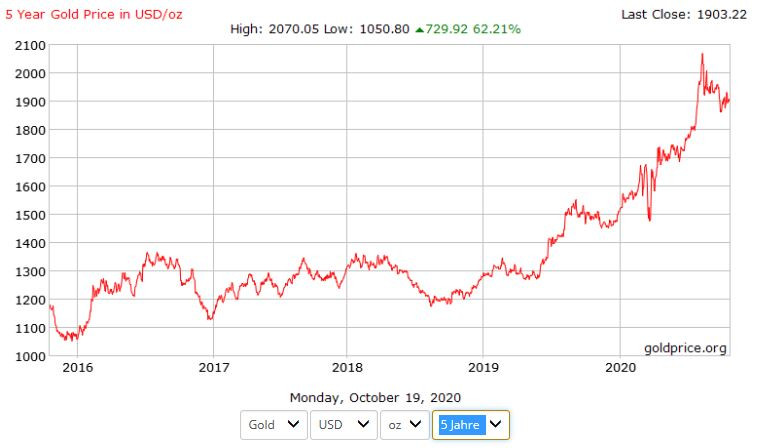

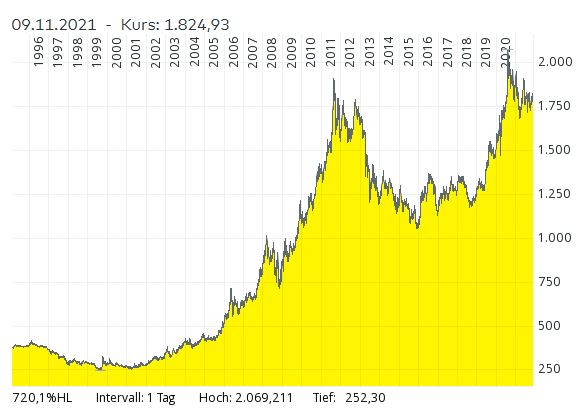

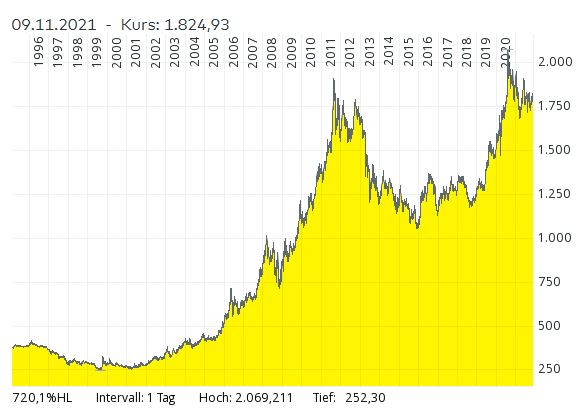

2. Goldpreis

schon vor der Corona Krise war der Goldpreis auf 1600 us$, auch nicht schlecht

Es wurde Billionen $ € Yen usw. in den Markt gespült um die Wirtschaften zu stützen

Wie soll das je bezahlt werden

Deshalb glaube ich an keinen Rücksetzer, allerdings an einer Inflation, insofern ist der Preis für Gold dann relativ zur Kaufkraft der jeweiligen Währung zu sehen

es wurde eigentlich die ganze Zeit hohes Volumen gehandelt

Date Open Close Yield Volume ** Aug 31, 2020 0,61 0,64 0,00% 975,488 Aug 24, 2020 0,69 0,64 -9,84% 1,412,524 Aug 17, 2020 0,64 0,70 14,75% 2,513,000 Aug 10, 2020 0,61 0,61 0,00% 2,997,939 Aug 3, 2020 * 0,54 0,61 12,96% 2,212,800 Jul 27, 2020 0,56 0,54 3,85% 1,868,600 Jul 20, 2020 0,49 0,52 15,56% 2,578,300 Jul 13, 2020 0,40 0,45 12,50% 1,191,300 Jul 06, 2020 0,37 0,40 8,11% 1,586,900 Jun 29, 2020 0,29 0,37 21,62% 1,673,500 * Market was open 4 days during the week in Canada ** Volume on the TSX only Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Anaconda Mining - Beginn einer neuen Zeitrechnung durch Fusion und Produktionserweiterung | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1270505-1001-101…

2. Goldpreis

schon vor der Corona Krise war der Goldpreis auf 1600 us$, auch nicht schlecht

Es wurde Billionen $ € Yen usw. in den Markt gespült um die Wirtschaften zu stützen

Wie soll das je bezahlt werden

Deshalb glaube ich an keinen Rücksetzer, allerdings an einer Inflation, insofern ist der Preis für Gold dann relativ zur Kaufkraft der jeweiligen Währung zu sehen

Antwort auf Beitrag Nr.: 65.060.487 von supideti am 12.09.20 09:19:46Hi supideti,

ich sehe es so in etwa wie Du auch!

Ich denke der Impfstoff wird auf den Goldpreis keine Auswirkung haben, die gravierend wäre.

Ich erwarte eher, dass Trumpi Dumpi und die EU weitere Milliarden per Knopfdruck "erschaffen" werden und deshalb Gold zum Jahresende durchaus im Bereich 2.200 USD stehen könnte. Dies ist jedoch nur meine Meinung und es kann alles anders kommen.

Bei Anaconda stehen wir jetzt auf dem Niveau zu dem die Liechtensteiner Investmentgesellschaft im Sommer für 5,5 Mio Dollar gekauft hat. Exakt 0,58 CAD.

Aber sei es drum, ich habe Zeit!

Ich kann warten auf den nächsten Kurssprung.

Hätte, hätte... dann könnte man über 0,70 CAD ein Drittel seiner Aktienzahl verkaufen und unter 0,60 CAD wieder billiger zurück kaufen mit schönem Gewinn oder einer größeren Aktienzahl.

Aber es soll durchaus noch Investoren hier geben bei denen nach der alten Spekulationsfrist der Ertrag steuerfrei ist.

Außerdem wie heißt es so schön: "Hin und her macht Kasse leer"

Also ich harre weiter der Dinge und freue mich an der klasse Kursentwicklung in diesem Jahr.

Leider kann ich derzeit nicht weiter nachkaufen...

Man kann auch sagen ich sei dumm wenn ich den Aktienkurs in 2-3 Jahren bei 7,00 CAD sehe jedoch kann ich damit leben, denn wenn es auch nur 2 Dollar und mehr werden bin ich rundum zufrieden.

Dann macht es wieder die Anzahl der Aktien, die man hält!

Also eine gute Woche!

SL - SC

ich sehe es so in etwa wie Du auch!

Ich denke der Impfstoff wird auf den Goldpreis keine Auswirkung haben, die gravierend wäre.

Ich erwarte eher, dass Trumpi Dumpi und die EU weitere Milliarden per Knopfdruck "erschaffen" werden und deshalb Gold zum Jahresende durchaus im Bereich 2.200 USD stehen könnte. Dies ist jedoch nur meine Meinung und es kann alles anders kommen.

Bei Anaconda stehen wir jetzt auf dem Niveau zu dem die Liechtensteiner Investmentgesellschaft im Sommer für 5,5 Mio Dollar gekauft hat. Exakt 0,58 CAD.

Aber sei es drum, ich habe Zeit!

Ich kann warten auf den nächsten Kurssprung.

Hätte, hätte... dann könnte man über 0,70 CAD ein Drittel seiner Aktienzahl verkaufen und unter 0,60 CAD wieder billiger zurück kaufen mit schönem Gewinn oder einer größeren Aktienzahl.

Aber es soll durchaus noch Investoren hier geben bei denen nach der alten Spekulationsfrist der Ertrag steuerfrei ist.

Außerdem wie heißt es so schön: "Hin und her macht Kasse leer"

Also ich harre weiter der Dinge und freue mich an der klasse Kursentwicklung in diesem Jahr.

Leider kann ich derzeit nicht weiter nachkaufen...

Man kann auch sagen ich sei dumm wenn ich den Aktienkurs in 2-3 Jahren bei 7,00 CAD sehe jedoch kann ich damit leben, denn wenn es auch nur 2 Dollar und mehr werden bin ich rundum zufrieden.

Dann macht es wieder die Anzahl der Aktien, die man hält!

Also eine gute Woche!

SL - SC

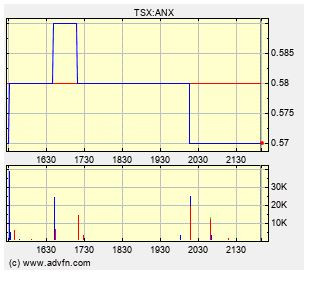

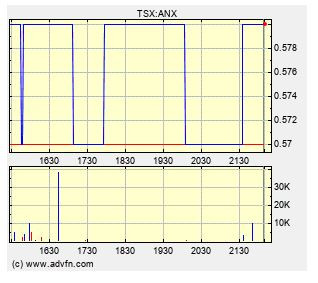

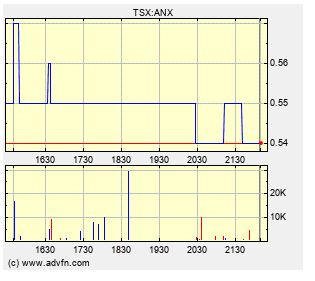

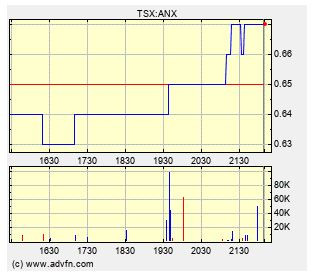

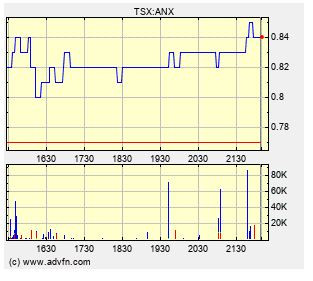

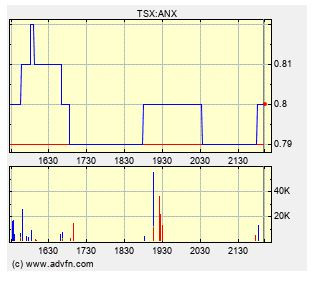

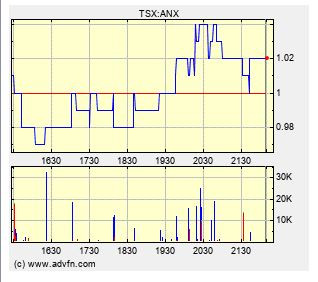

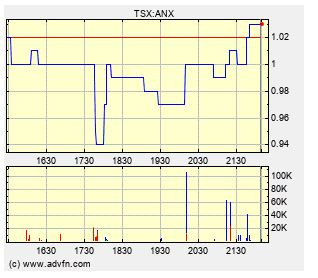

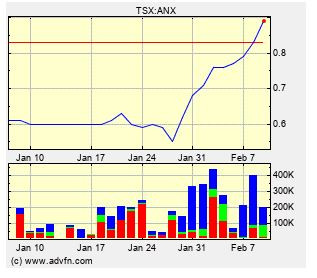

Handel am Freitag an der Heimatbörse in Kanada:

Da fällt einem doch nichts mehr dazu ein...

13.09.2020 21:24

Der US-Staatsanwaltschaft zufolge haben Banker von JPMorgan über viele Jahre systematisch die Preise für Gold, Silber, Platin und Palladium illegal verschoben und auf diese Weise Millionengewinne für sich selbst und für ihre Bank generiert. Gegen die Beschuldigten soll ein Anti-Mafia-Gesetz angewendet werden.

Quelle: https://deutsche-wirtschafts-nachrichten.de/506311/Edelmetal…

13.09.2020 21:24

Der US-Staatsanwaltschaft zufolge haben Banker von JPMorgan über viele Jahre systematisch die Preise für Gold, Silber, Platin und Palladium illegal verschoben und auf diese Weise Millionengewinne für sich selbst und für ihre Bank generiert. Gegen die Beschuldigten soll ein Anti-Mafia-Gesetz angewendet werden.

Quelle: https://deutsche-wirtschafts-nachrichten.de/506311/Edelmetal…

Ich persönlich erwarte, dass solche Nachrichten den Goldpreis weiter beflügeln werden.

Dies wird sich auch negativ auf meine Arbeit auswirken aber wir haben da keinerlei Einfluss drauf:

Pleitewelle: Die Ruhe vor dem Sturm

Je länger die Corona-Krise dauert, umso wahrscheinlicher wird es, dass etlichen Unternehmen die Puste ausgeht.

10.9.2020 - 12:55, BLZ

Berlin - Die schnelle Erholung in China allein werde die deutsche Exportwirtschaft „nicht aus dem Tal ziehen können“, prognostizierte das Deutsche Institut für Wirtschaftsforschung (DIW) am Donnerstag. Fast überall bestehe die Gefahr, „dass ein erneuter Rückschlag in den nächsten Monaten die Zahl der Unternehmensinsolvenzen sprunghaft steigen lässt“.

In Deutschland rutschten in den ersten sechs Monaten 2020 trotz des Wirtschaftseinbruchs infolge der Pandemie weniger Firmen in die Pleite als ein Jahr zuvor. Die Amtsgerichte meldeten nach Angaben des Statistischen Bundesamtes einen Rückgang um 6,2 Prozent auf 9006 Fälle. „Die wirtschaftliche Not vieler Unternehmen durch die Corona-Krise spiegelt sich somit bislang nicht in einem Anstieg der gemeldeten Unternehmensinsolvenzen wider“, bilanzierte die Wiesbadener Behörde.

Hauptgrund: Der Gesetzgeber hat die Insolvenzantragspflicht für Firmen seit 1. März 2020 ausgesetzt. Heißt: Unternehmen, die wegen der Corona-Krise in Bedrängnis geraten, sind seither nicht verpflichtet, einen Insolvenzantrag zu stellen.

Die Bundesregierung hat vor kurzem beschlossen, die zunächst bis Ende September geltende Sonderregelung bis Ende 2020 zu verlängern – allerdings nur für den Fall der Überschuldung eines Unternehmens und nicht bei bereits eingetretener Zahlungsunfähigkeit.

„Jetzt zu denken, die Krise sei schnell ausgestanden, wäre (...) falsch“, sagte DIW-Präsident Marcel Fratzscher am Donnerstag. „Wir müssen uns eingestehen, dass es Rückschläge geben kann und wird, beispielsweise Unternehmensinsolvenzen und auch einen Anstieg der Arbeitslosigkeit. Deshalb ist es richtig, dass die Bundesregierung viele Hilfsmaßnahmen verlängert hat.“

Allerdings warnen Ökonomen auch davor, dass mit staatlicher Unterstützung auch Unternehmen am Leben gehalten werden, die eigentlich nicht überlebensfähig sind – „Zombieunternehmen“ gewissermaßen.

Bundesbank-Präsident Jens Weidmann hatte jüngst zu Augenmaß beim Einsatz staatlicher Hilfen wie Kurzarbeit gemahnt: „Das Kurzarbeitergeld hilft Firmen, Beschäftigte zu halten, die sie nach der Krise wieder brauchen. Es könnte aber auch Arbeitskräfte an Unternehmen binden, die keine Zukunft haben, und so Strukturen einfrieren, die obsolet sind.“ Weidmanns Rat: „Letztlich sollte der Staat das Risiko mindern, dass Unternehmen das Kurzarbeitergeld nutzen, um Geschäftsmodelle ohne Zukunft zu erhalten.“

Die meisten Unternehmensinsolvenzen gab es nach Angaben des Bundesamtes im ersten Halbjahr im Handel – einschließlich Kfz-Werkstätten – mit 1485 Fällen. Firmen des Baugewerbes stellten 1462 Anträge, im Gastgewerbe wurden 1004 und im Bereich der freiberuflichen, wissenschaftlichen und technischen Dienstleistungen 974 Insolvenzen gemeldet. Im Schnitt waren die Betriebe größer als vor einem Jahr, die voraussichtlichen Forderungen der Gläubiger lagen mit 16,7 Milliarden Euro deutlich über den 10,2 Milliarden Euro des ersten Halbjahres 2019.

Die Zahl der eröffneten Regelinsolvenzverfahren in Deutschland nahm im August wie schon in den vorangegangenen Monaten ab. Auf Grundlage vorläufiger Angaben sank sie um 38,9 Prozent zum Vorjahresmonat.

Einer kürzlich veröffentlichten Studie des Instituts für Wirtschaftsforschung in Halle (IWH) zufolge hat die Zahl der Firmenpleiten in Deutschland im August den bisher tiefsten Stand in diesem Jahr erreicht: 697 Insolvenzanmeldungen von Unternehmen waren demnach 22 Prozent weniger als im Juli dieses Jahres sowie 26 Prozent weniger als im August 2019.

„Die von der Regierungskoalition für die Zeit ab Oktober beschlossene teilweise Rückkehr zur Insolvenzantragspflicht bei Zahlungsunfähigkeit wird zu einem moderaten Anstieg der Insolvenzantragstellungen führen“, prognostizierte IWH-Experte Steffen Müller.

Quelle: https://www.berliner-zeitung.de/wirtschaft-verantwortung/ple…

Dies wird sich auch negativ auf meine Arbeit auswirken aber wir haben da keinerlei Einfluss drauf:

Pleitewelle: Die Ruhe vor dem Sturm

Je länger die Corona-Krise dauert, umso wahrscheinlicher wird es, dass etlichen Unternehmen die Puste ausgeht.

10.9.2020 - 12:55, BLZ

Berlin - Die schnelle Erholung in China allein werde die deutsche Exportwirtschaft „nicht aus dem Tal ziehen können“, prognostizierte das Deutsche Institut für Wirtschaftsforschung (DIW) am Donnerstag. Fast überall bestehe die Gefahr, „dass ein erneuter Rückschlag in den nächsten Monaten die Zahl der Unternehmensinsolvenzen sprunghaft steigen lässt“.

In Deutschland rutschten in den ersten sechs Monaten 2020 trotz des Wirtschaftseinbruchs infolge der Pandemie weniger Firmen in die Pleite als ein Jahr zuvor. Die Amtsgerichte meldeten nach Angaben des Statistischen Bundesamtes einen Rückgang um 6,2 Prozent auf 9006 Fälle. „Die wirtschaftliche Not vieler Unternehmen durch die Corona-Krise spiegelt sich somit bislang nicht in einem Anstieg der gemeldeten Unternehmensinsolvenzen wider“, bilanzierte die Wiesbadener Behörde.

Hauptgrund: Der Gesetzgeber hat die Insolvenzantragspflicht für Firmen seit 1. März 2020 ausgesetzt. Heißt: Unternehmen, die wegen der Corona-Krise in Bedrängnis geraten, sind seither nicht verpflichtet, einen Insolvenzantrag zu stellen.

Die Bundesregierung hat vor kurzem beschlossen, die zunächst bis Ende September geltende Sonderregelung bis Ende 2020 zu verlängern – allerdings nur für den Fall der Überschuldung eines Unternehmens und nicht bei bereits eingetretener Zahlungsunfähigkeit.

„Jetzt zu denken, die Krise sei schnell ausgestanden, wäre (...) falsch“, sagte DIW-Präsident Marcel Fratzscher am Donnerstag. „Wir müssen uns eingestehen, dass es Rückschläge geben kann und wird, beispielsweise Unternehmensinsolvenzen und auch einen Anstieg der Arbeitslosigkeit. Deshalb ist es richtig, dass die Bundesregierung viele Hilfsmaßnahmen verlängert hat.“

Allerdings warnen Ökonomen auch davor, dass mit staatlicher Unterstützung auch Unternehmen am Leben gehalten werden, die eigentlich nicht überlebensfähig sind – „Zombieunternehmen“ gewissermaßen.

Bundesbank-Präsident Jens Weidmann hatte jüngst zu Augenmaß beim Einsatz staatlicher Hilfen wie Kurzarbeit gemahnt: „Das Kurzarbeitergeld hilft Firmen, Beschäftigte zu halten, die sie nach der Krise wieder brauchen. Es könnte aber auch Arbeitskräfte an Unternehmen binden, die keine Zukunft haben, und so Strukturen einfrieren, die obsolet sind.“ Weidmanns Rat: „Letztlich sollte der Staat das Risiko mindern, dass Unternehmen das Kurzarbeitergeld nutzen, um Geschäftsmodelle ohne Zukunft zu erhalten.“

Die meisten Unternehmensinsolvenzen gab es nach Angaben des Bundesamtes im ersten Halbjahr im Handel – einschließlich Kfz-Werkstätten – mit 1485 Fällen. Firmen des Baugewerbes stellten 1462 Anträge, im Gastgewerbe wurden 1004 und im Bereich der freiberuflichen, wissenschaftlichen und technischen Dienstleistungen 974 Insolvenzen gemeldet. Im Schnitt waren die Betriebe größer als vor einem Jahr, die voraussichtlichen Forderungen der Gläubiger lagen mit 16,7 Milliarden Euro deutlich über den 10,2 Milliarden Euro des ersten Halbjahres 2019.

Die Zahl der eröffneten Regelinsolvenzverfahren in Deutschland nahm im August wie schon in den vorangegangenen Monaten ab. Auf Grundlage vorläufiger Angaben sank sie um 38,9 Prozent zum Vorjahresmonat.

Einer kürzlich veröffentlichten Studie des Instituts für Wirtschaftsforschung in Halle (IWH) zufolge hat die Zahl der Firmenpleiten in Deutschland im August den bisher tiefsten Stand in diesem Jahr erreicht: 697 Insolvenzanmeldungen von Unternehmen waren demnach 22 Prozent weniger als im Juli dieses Jahres sowie 26 Prozent weniger als im August 2019.

„Die von der Regierungskoalition für die Zeit ab Oktober beschlossene teilweise Rückkehr zur Insolvenzantragspflicht bei Zahlungsunfähigkeit wird zu einem moderaten Anstieg der Insolvenzantragstellungen führen“, prognostizierte IWH-Experte Steffen Müller.

Quelle: https://www.berliner-zeitung.de/wirtschaft-verantwortung/ple…

Es nimmt einfach kein Ende:

Volumen steigt unaufhaltsam :

Anleihen in Höhe von 15,8 Billionen Dollar mit negativen Zinsen

Von Markus Frühauf

-Aktualisiert am 06.08.2020-15:02

Die Europäische Zentralbank in Frankfurt: Die Notenbank hat in der Pandemie ihre Anleihekäufe ausgeweitet.

Die Europäische Zentralbank in Frankfurt: Die Notenbank hat in der Pandemie ihre Anleihekäufe ausgeweitet. Bild: Lucas Bäuml

Festverzinsliche Wertpapiere werden für Anleger zum Minusgeschäft. Die Kaufprogramme der Notenbanken zwingen sie, in riskante Titel auszuweichen.

Quelle: https://www.faz.net/aktuell/finanzen/anleihen-in-hoehe-von-1…

Volumen steigt unaufhaltsam :

Anleihen in Höhe von 15,8 Billionen Dollar mit negativen Zinsen

Von Markus Frühauf

-Aktualisiert am 06.08.2020-15:02

Die Europäische Zentralbank in Frankfurt: Die Notenbank hat in der Pandemie ihre Anleihekäufe ausgeweitet.

Die Europäische Zentralbank in Frankfurt: Die Notenbank hat in der Pandemie ihre Anleihekäufe ausgeweitet. Bild: Lucas Bäuml

Festverzinsliche Wertpapiere werden für Anleger zum Minusgeschäft. Die Kaufprogramme der Notenbanken zwingen sie, in riskante Titel auszuweichen.

Quelle: https://www.faz.net/aktuell/finanzen/anleihen-in-hoehe-von-1…

Aus all diesen Gründen sehe ich den Goldpreis weiter steigen selbst wenn es bald einen Impfstoff gäbe:

„Chance vertan, Mr. President“ – Trumps gefährliche Schuldenspirale

Veröffentlicht am 13.09.2019 | Lesedauer: 5 Minuten

Frank Stocker

Von Frank Stocker

Finanz-Redakteur

Erstmals seit sieben Jahren hat das Haushaltsdefizit der USA wieder die Grenze von einer Billion Dollar überschritten. Dabei hatte Präsident Trump vor Beginn seiner Amtszeit noch eine ganz andere Ankündigung gemacht.

Der US-Schuldenberg wächst so schnell wie selten zuvor, und der US-Präsident macht keinerlei Anstalten zu sparen. Stattdessen soll die Notenbank durch Zinssenkungen an den Symptomen herumdoktern – ein gefährliches Spiel.

98

Er werde den Schuldenberg des US-Staates komplett abbauen, wenn er erst Präsident sei, sagte Donald Trump in einem Interview mit der „Washington Post“ im April 2016. Acht Jahre würde er dazu brauchen, also zwei Amtszeiten. Damals summierten sich die US-Schulden auf 19,5 Billionen Dollar und Trump befand sich noch im Wahlkampf.

Inzwischen ist seine erste Amtszeit schon zu zwei Dritteln vorüber, die Schulden betragen mehr als 22 Billionen Dollar und von einem Abbau ist keine Rede mehr. Im Gegenteil: Der US-Schuldenberg wächst immer schneller. Immer mehr zeichnet sich ab, dass die USA ihm überhaupt nur noch Herr werden können, wenn die Zinsen wieder sinken und auf ewig niedrig bleiben. Und das hat Auswirkungen auf das weltweite Zinsniveau, auch bei uns.

Allein in den ersten elf Monaten des laufenden US-Fiskaljahres, das am 30. September endet, betrug das Haushaltsdefizit des Bundes nach Angaben des Finanzministeriums über eine Billion Dollar. Es liegt damit 19 Prozent höher als im gleichen Zeitraum des Vorjahres.

Quelle: https://www.welt.de/finanzen/article200258276/Donald-Trump-U…

„Chance vertan, Mr. President“ – Trumps gefährliche Schuldenspirale

Veröffentlicht am 13.09.2019 | Lesedauer: 5 Minuten

Frank Stocker

Von Frank Stocker

Finanz-Redakteur

Erstmals seit sieben Jahren hat das Haushaltsdefizit der USA wieder die Grenze von einer Billion Dollar überschritten. Dabei hatte Präsident Trump vor Beginn seiner Amtszeit noch eine ganz andere Ankündigung gemacht.

Der US-Schuldenberg wächst so schnell wie selten zuvor, und der US-Präsident macht keinerlei Anstalten zu sparen. Stattdessen soll die Notenbank durch Zinssenkungen an den Symptomen herumdoktern – ein gefährliches Spiel.

98

Er werde den Schuldenberg des US-Staates komplett abbauen, wenn er erst Präsident sei, sagte Donald Trump in einem Interview mit der „Washington Post“ im April 2016. Acht Jahre würde er dazu brauchen, also zwei Amtszeiten. Damals summierten sich die US-Schulden auf 19,5 Billionen Dollar und Trump befand sich noch im Wahlkampf.

Inzwischen ist seine erste Amtszeit schon zu zwei Dritteln vorüber, die Schulden betragen mehr als 22 Billionen Dollar und von einem Abbau ist keine Rede mehr. Im Gegenteil: Der US-Schuldenberg wächst immer schneller. Immer mehr zeichnet sich ab, dass die USA ihm überhaupt nur noch Herr werden können, wenn die Zinsen wieder sinken und auf ewig niedrig bleiben. Und das hat Auswirkungen auf das weltweite Zinsniveau, auch bei uns.

Allein in den ersten elf Monaten des laufenden US-Fiskaljahres, das am 30. September endet, betrug das Haushaltsdefizit des Bundes nach Angaben des Finanzministeriums über eine Billion Dollar. Es liegt damit 19 Prozent höher als im gleichen Zeitraum des Vorjahres.

Quelle: https://www.welt.de/finanzen/article200258276/Donald-Trump-U…

Ich bin mal gespannt, ob Gold in dieser Woche die 2.000 Dollar wieder in Angriff nehmen wird und vielleicht sogar zurück erobern...?

We will see!

We will see!

Ich hoffe, dass jeder, der unter 0,60 CAD nachkaufen wollte dies nun auch getan hat...

SL - SC

Bob Moriarty: Anx short comments

Goldfinger: Now, let’s get into some specific companies. There was another question from a reader about ANX, which is Anaconda Mining (TSX:ANX, OTC:ANXGF). He’d like to hear your current views and opinions on Anaconda.

Bob Moriarty: Anaconda is a sleeper. It has excellent management. It’s in Nova Scotia and it’s in Newfoundland. They are a producing gold company and the only reason they’re not 10 times higher than what they are is because they’re producing under 100,000 ounces a year. They are well aware that their target is to pick up projects, increase production and to get above 100,000 ounces. I own Anaconda and I love it.

Link: http://energyandgold.com/2020/09/12/bob-moriarty-the-next-tw…

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

SL - SC

Bob Moriarty: Anx short comments

Goldfinger: Now, let’s get into some specific companies. There was another question from a reader about ANX, which is Anaconda Mining (TSX:ANX, OTC:ANXGF). He’d like to hear your current views and opinions on Anaconda.

Bob Moriarty: Anaconda is a sleeper. It has excellent management. It’s in Nova Scotia and it’s in Newfoundland. They are a producing gold company and the only reason they’re not 10 times higher than what they are is because they’re producing under 100,000 ounces a year. They are well aware that their target is to pick up projects, increase production and to get above 100,000 ounces. I own Anaconda and I love it.

Link: http://energyandgold.com/2020/09/12/bob-moriarty-the-next-tw…

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Läuft...

Aus dem Kanadischen Bord:

winedoc

September 12, 2020 - 10:28 AM

Post# 31548245

Site Visit

Hey All

Drove up to the minesite this morning. For those that dont know, the Goldbrook road is public and goes staright through the property, So I am not on private property giving updates....... just a drive by.

Logan is still drilling the west goldbrook area, quite far into the woods. presumably in fill drilling for potential open pit in that extension of the property and to add to reserves. Im told this may be targeting level 2 extension of the ramp area . Geologists may weigh in differently........

Two trucks at the core shack ....... working away inside

Im told by the gossip mill that the company working on the envirnmental permit is moving ahead nicely, takes a lot of time

Thankfully weather and scarcity of covid in Nova scotia and NFLD allows us to keep moving ahead

More gossip ....... that driling may commence on the Seal Hbr property. This had potential to be another deposit within trucking distance of Goldboro.

All I got for now

Winedoc

PS: shout out to new "lurkers" on stockhouse

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-m…

Aus dem Kanadischen Bord:

winedoc

September 12, 2020 - 10:28 AM

Post# 31548245

Site Visit

Hey All

Drove up to the minesite this morning. For those that dont know, the Goldbrook road is public and goes staright through the property, So I am not on private property giving updates....... just a drive by.

Logan is still drilling the west goldbrook area, quite far into the woods. presumably in fill drilling for potential open pit in that extension of the property and to add to reserves. Im told this may be targeting level 2 extension of the ramp area . Geologists may weigh in differently........

Two trucks at the core shack ....... working away inside

Im told by the gossip mill that the company working on the envirnmental permit is moving ahead nicely, takes a lot of time

Thankfully weather and scarcity of covid in Nova scotia and NFLD allows us to keep moving ahead

More gossip ....... that driling may commence on the Seal Hbr property. This had potential to be another deposit within trucking distance of Goldboro.

All I got for now

Winedoc

PS: shout out to new "lurkers" on stockhouse

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-m…

Aus dem Kanadischen Bord:

DoumDiDoum

September 12, 2020 - 08:46 AM

Post# 31548107

Weekly Stats

As 5er would say it, we definitely had a big "bump" this week. These bumps are opportunities to add to your position, as Kevin did at the end of last week.

Date Open Close Yield Volume **

Sept 7, 2020 * 0,61 0,57 -10,94% 975,488

Aug 31, 2020 0,61 0,64 0,00% 975,488

Aug 24, 2020 0,69 0,64 -8,57% 1,412,524

Aug 17, 2020 0,64 0,70 14,75% 2,513,000

Aug 10, 2020 0,61 0,61 0,00% 2,997,939

Aug 3, 2020 * 0,54 0,61 12,96% 2,212,800

Jul 27, 2020 0,56 0,54 3,85% 1,868,600

Jul 20, 2020 0,49 0,52 15,56% 2,578,300

Jul 13, 2020 0,40 0,45 12,50% 1,191,300

Jul 06, 2020 0,37 0,40 8,11% 1,586,900

Jun 29, 2020 0,29 0,37 21,62% 1,673,500

* Market was open 4 days during the week in Canada

** Volume on the TSX only

Quele: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

DoumDiDoum

September 12, 2020 - 08:46 AM

Post# 31548107

Weekly Stats

As 5er would say it, we definitely had a big "bump" this week. These bumps are opportunities to add to your position, as Kevin did at the end of last week.

Date Open Close Yield Volume **

Sept 7, 2020 * 0,61 0,57 -10,94% 975,488

Aug 31, 2020 0,61 0,64 0,00% 975,488

Aug 24, 2020 0,69 0,64 -8,57% 1,412,524

Aug 17, 2020 0,64 0,70 14,75% 2,513,000

Aug 10, 2020 0,61 0,61 0,00% 2,997,939

Aug 3, 2020 * 0,54 0,61 12,96% 2,212,800

Jul 27, 2020 0,56 0,54 3,85% 1,868,600

Jul 20, 2020 0,49 0,52 15,56% 2,578,300

Jul 13, 2020 0,40 0,45 12,50% 1,191,300

Jul 06, 2020 0,37 0,40 8,11% 1,586,900

Jun 29, 2020 0,29 0,37 21,62% 1,673,500

* Market was open 4 days during the week in Canada

** Volume on the TSX only

Quele: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Die Aufmerksamkeit gegenüber Anaconda steigt...

Und Weiteres aus dem Kanadischen Bord:

DoumDiDoum

September 12, 2020 - 08:37 AM

106 Reads

Post# 31548097

Article From Journal Pioneer

Mining company expands drilling at Nova Scotia, Newfoundland sites as gold price stays strong

Excerpts from the article that might explain why Kevin bought some shares recently:

“[talking about gold price] You see it moves up, and then consolidation, and then moves up, and consolidation, and that's very healthy for the gold price. There's global issues with politics, and there's global issues with finance. I don't see any of that settling quickly, so I think the gold price is going to be strong for quite some time."

In this climate, the goal for Anaconda is to increase gold production. Even weaker deposits that might not work out typically can prove to be profitable in these circumstances, he added.

"In that case, we're going as fast as we can with the development of Goldboro," he said. "We've been able to approve the development of Argyle ... and we're developing that now to keep production going there."

So hang on there, as 5er is saying, this "bump" will soon be forgotten!

GLTA

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Und Weiteres aus dem Kanadischen Bord:

DoumDiDoum

September 12, 2020 - 08:37 AM

106 Reads

Post# 31548097

Article From Journal Pioneer

Mining company expands drilling at Nova Scotia, Newfoundland sites as gold price stays strong

Excerpts from the article that might explain why Kevin bought some shares recently:

“[talking about gold price] You see it moves up, and then consolidation, and then moves up, and consolidation, and that's very healthy for the gold price. There's global issues with politics, and there's global issues with finance. I don't see any of that settling quickly, so I think the gold price is going to be strong for quite some time."

In this climate, the goal for Anaconda is to increase gold production. Even weaker deposits that might not work out typically can prove to be profitable in these circumstances, he added.

"In that case, we're going as fast as we can with the development of Goldboro," he said. "We've been able to approve the development of Argyle ... and we're developing that now to keep production going there."

So hang on there, as 5er is saying, this "bump" will soon be forgotten!

GLTA

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Guten Morgen!

...und täglich grüßt das Murmeltier!

Ich hoffe Ihr habt neben der Arbeit auch noch Zeit den tollen Spätsommer zu genießen...

Die Zeit wird es von selbst weiter bringen für Anaconda.

SL - SC

...und täglich grüßt das Murmeltier!

Ich hoffe Ihr habt neben der Arbeit auch noch Zeit den tollen Spätsommer zu genießen...

Die Zeit wird es von selbst weiter bringen für Anaconda.

SL - SC

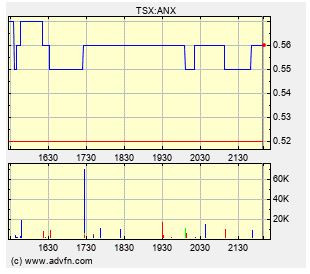

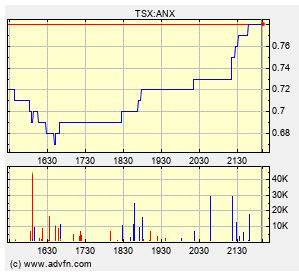

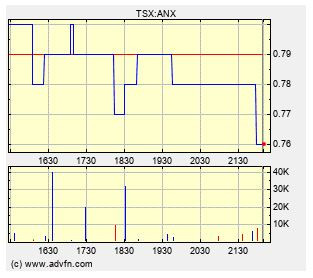

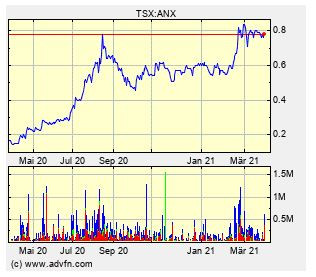

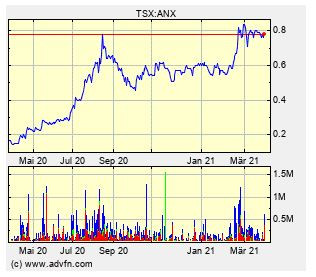

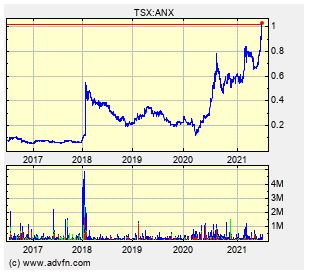

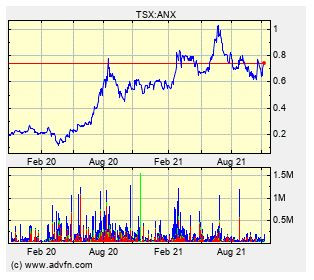

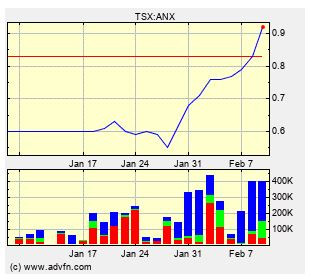

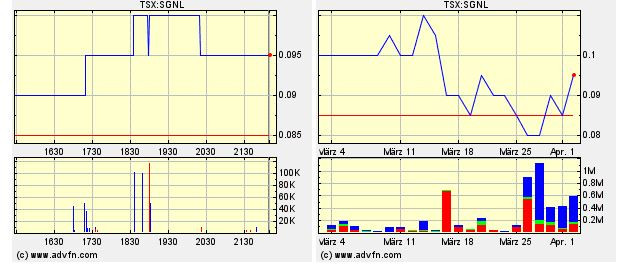

Handel gestern an der Heimatbörse in Kanada:

Immer mehr Aufmerksamkeit!

Anaconda ist auf der Watchlist der Laurentian Bank of Canada!

DoumDiDoum

September 14, 2020 - 06:52 PM

Post# 31557356

RE:ANX is on Laurentian Bank of Canada Securities' Watch List

Copy-paste the below URL and go to page 4 of the document.

https://www.linkedin.com/feed/update/urn:li:activity:6711283…

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Anaconda ist auf der Watchlist der Laurentian Bank of Canada!

DoumDiDoum

September 14, 2020 - 06:52 PM

Post# 31557356

RE:ANX is on Laurentian Bank of Canada Securities' Watch List

Copy-paste the below URL and go to page 4 of the document.

https://www.linkedin.com/feed/update/urn:li:activity:6711283…

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Just a little patience...

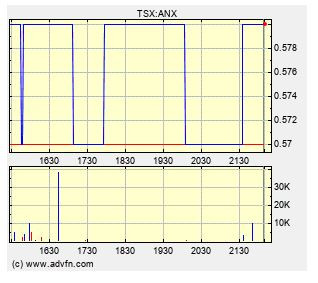

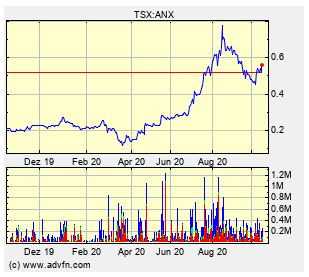

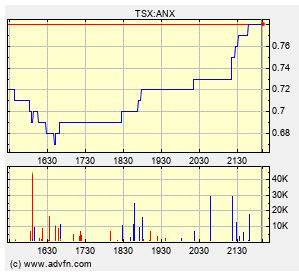

Handel gestern an der Heimatbörse in Kanada:

Schafft Gold heute den Sprung über die 1970 Dollar Marke?

Guten Morgen Goldies!

Mal sehen was der Tag so bringt...

Genießt den sonnigen Tag!

Mal sehen was der Tag so bringt...

Genießt den sonnigen Tag!

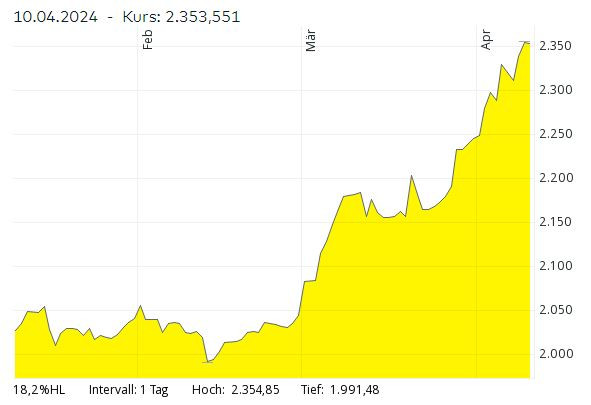

Gold konsolidiert weiter auf gleichbleibendem Niveau seitwärts über die Zeit:

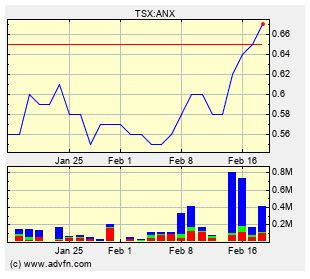

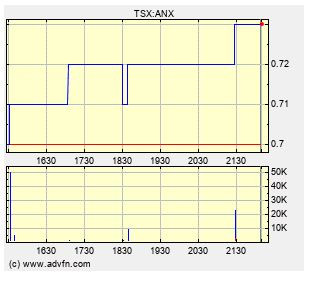

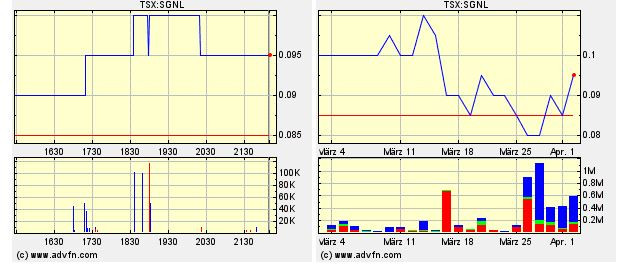

Handelsverlauf gestern an der Heimatbörse in Kanada:

Gold, Silber und Co. Edelmetalle: Neue Höchstkurse in Sicht?

16.09.2020

Gold, Silber und Palladium steigen im Preis. Dabei sind viele Anleger noch gar nicht investiert.

In jüngeren Jahren pflegte der inzwischen 90-jährige Warren Buffett über Goldanlagen zu spotten. „Gold wird in Afrika oder an einem Ort aus dem Boden gegraben. Dann schmelzen wir es ein, graben ein weiteres Loch, begraben es wieder und bezahlen die Leute, um es zu bewachen“, so sagte die Investmentlegende. „Es hat keinen Nutzen. Wer vom Mars aus zuschaut, kratzt sich am Kopf.“

Am Kopf kratzen musste sich in diesem Jahr jedoch kein Marsianer, sondern der Altmeister selbst. Denn 2020 ist ein Jahr für die Gold-Geschichtsbücher: Im August erreichte Gold mit rund 2050 Dollar pro Feinunze (31,1 Gramm) ein neues Allzeithoch. In vielen anderen Währungen hatte der Goldpreis schon deutlich früher neue Rekorde erzielt – auch in Euro. Die hohen Preise ziehen zunehmend mehr Investoren an. Der weltgrößte Gold-ETF GLD von Vermögensverwalter VanEck ist inzwischen auf über 1000 Tonnen Gold angewachsen – mehr als die Bestände der meisten Zentralbanken.

Gold zieht andere Edelmetalle mit

Gold hat in den aktuellen Corona- und Nullzinszeiten seinen Ruf als ultimativer Wertspeicher bestätigt...

Quelle: https://magazin.comdirect.de/maerkte-im-blick/edelmetalle-ne…

16.09.2020

Gold, Silber und Palladium steigen im Preis. Dabei sind viele Anleger noch gar nicht investiert.

In jüngeren Jahren pflegte der inzwischen 90-jährige Warren Buffett über Goldanlagen zu spotten. „Gold wird in Afrika oder an einem Ort aus dem Boden gegraben. Dann schmelzen wir es ein, graben ein weiteres Loch, begraben es wieder und bezahlen die Leute, um es zu bewachen“, so sagte die Investmentlegende. „Es hat keinen Nutzen. Wer vom Mars aus zuschaut, kratzt sich am Kopf.“

Am Kopf kratzen musste sich in diesem Jahr jedoch kein Marsianer, sondern der Altmeister selbst. Denn 2020 ist ein Jahr für die Gold-Geschichtsbücher: Im August erreichte Gold mit rund 2050 Dollar pro Feinunze (31,1 Gramm) ein neues Allzeithoch. In vielen anderen Währungen hatte der Goldpreis schon deutlich früher neue Rekorde erzielt – auch in Euro. Die hohen Preise ziehen zunehmend mehr Investoren an. Der weltgrößte Gold-ETF GLD von Vermögensverwalter VanEck ist inzwischen auf über 1000 Tonnen Gold angewachsen – mehr als die Bestände der meisten Zentralbanken.

Gold zieht andere Edelmetalle mit

Gold hat in den aktuellen Corona- und Nullzinszeiten seinen Ruf als ultimativer Wertspeicher bestätigt...

Quelle: https://magazin.comdirect.de/maerkte-im-blick/edelmetalle-ne…

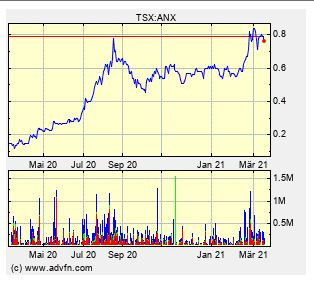

Handel am Freitag an der Heimatbörse in Kanada:

Ein Kanadischer Investor aus dem Bord:

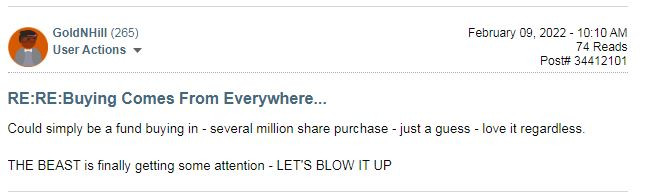

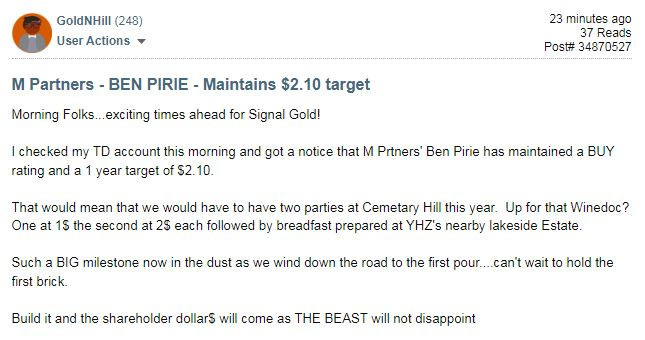

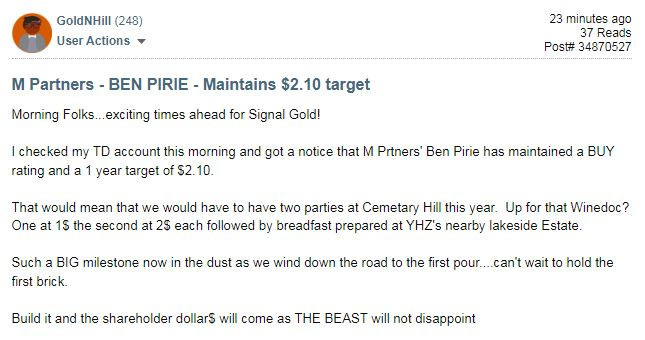

GoldNHill

September 18, 2020 - 11:43 AM

Post# 31581347

RE:ANX is losing it

Highly uninformed

There are plenty of irons in the fire with ANX...Drilling in three different area (so pending drill results), not to mention a updated resource estimate pending for Goldboro and an Economic Study pending in Q4...Tilt Cove could present another Nugget Pond deposit or two.

Price of gold in consolidation phase before the next move higher...all lining up nicely IMHO

Never a bad thing to make money...contrats on the teen purchase...tis FAR from the end...tis really just the beginning for this company which Goldboro will lead.

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

GoldNHill

September 18, 2020 - 11:43 AM

Post# 31581347

RE:ANX is losing it

Highly uninformed

There are plenty of irons in the fire with ANX...Drilling in three different area (so pending drill results), not to mention a updated resource estimate pending for Goldboro and an Economic Study pending in Q4...Tilt Cove could present another Nugget Pond deposit or two.

Price of gold in consolidation phase before the next move higher...all lining up nicely IMHO

Never a bad thing to make money...contrats on the teen purchase...tis FAR from the end...tis really just the beginning for this company which Goldboro will lead.

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Aus dem Stockhouse Bord:

V1crorygold

September 18, 2020 - 12:53 PM

Post# 31581894

Thanks for the cheap shares

Already a 80 k oz producer with exploration upside trading at discount. There mimes like pgm forecast to produce 80k oz a year not even in production with so at 2.70s abc is so cheap great buy! Thanks again

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

V1crorygold

September 18, 2020 - 12:53 PM

Post# 31581894

Thanks for the cheap shares

Already a 80 k oz producer with exploration upside trading at discount. There mimes like pgm forecast to produce 80k oz a year not even in production with so at 2.70s abc is so cheap great buy! Thanks again

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Des Pudels Kern:

ANX jetzt kaufen und 2 Jahre liegen lassen, dann rechnet dieser Investor mit einer ver-5 bis 10-Fachung des aktuellen Kurses...

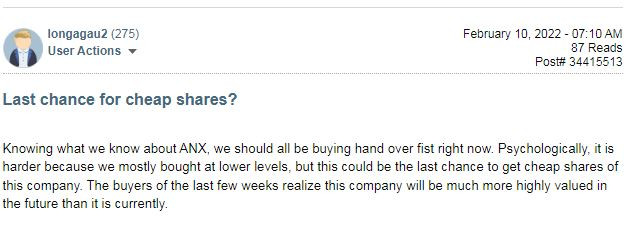

longagau2

September 18, 2020 - 01:49 PM

Post# 31582228

Everyone has different investment time horizons

For me, ANX is a probably 2+ year hold at this point. My anticipation is for it to be 5 to 10+ times higher in share price if these results continue and new production gets started. Anx at this point is almost like buying a producing mine at a discount and getting all the exploration for free. I'm not too worried about day to day fluctuations in anx or pog, but reading some of the posts from people with much much shorter time horizons is entertaining.

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

ANX jetzt kaufen und 2 Jahre liegen lassen, dann rechnet dieser Investor mit einer ver-5 bis 10-Fachung des aktuellen Kurses...

longagau2

September 18, 2020 - 01:49 PM

Post# 31582228

Everyone has different investment time horizons

For me, ANX is a probably 2+ year hold at this point. My anticipation is for it to be 5 to 10+ times higher in share price if these results continue and new production gets started. Anx at this point is almost like buying a producing mine at a discount and getting all the exploration for free. I'm not too worried about day to day fluctuations in anx or pog, but reading some of the posts from people with much much shorter time horizons is entertaining.

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

Ein weiterer Investor mit Kursziel 3 Dollar!

buffalogold

September 19, 2020 - 08:30 AM

Post# 31586623

I am a long time gold follower, but new to Bullboards and st

I heard this stock has enough promise to get to $3 easy. I bought in this week

Looking for more stocks like this

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

buffalogold

September 19, 2020 - 08:30 AM

Post# 31586623

I am a long time gold follower, but new to Bullboards and st

I heard this stock has enough promise to get to $3 easy. I bought in this week

Looking for more stocks like this

Quelle: https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

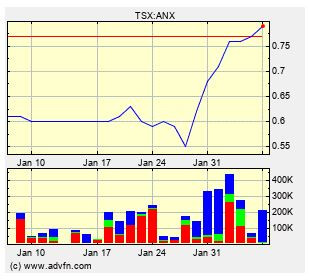

Guten Morgen Goldies!

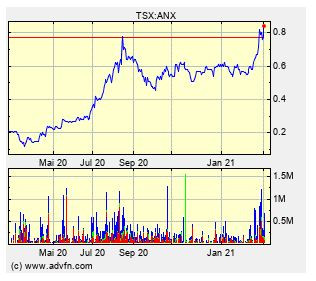

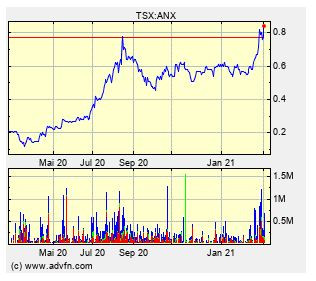

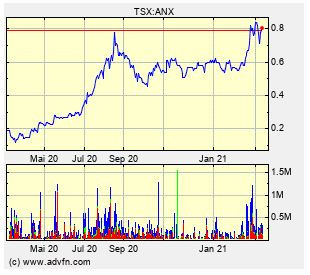

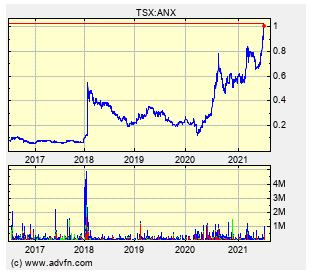

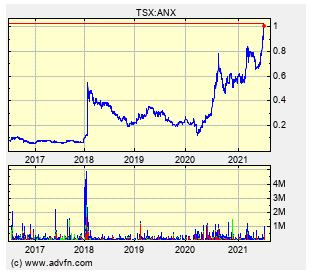

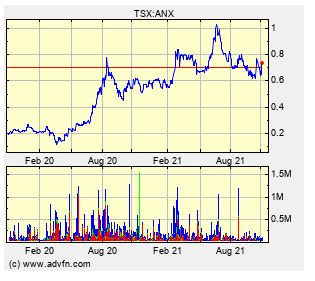

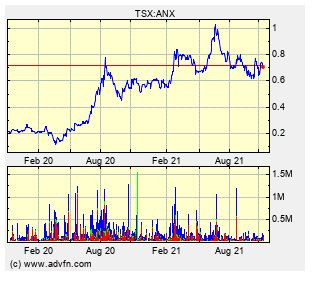

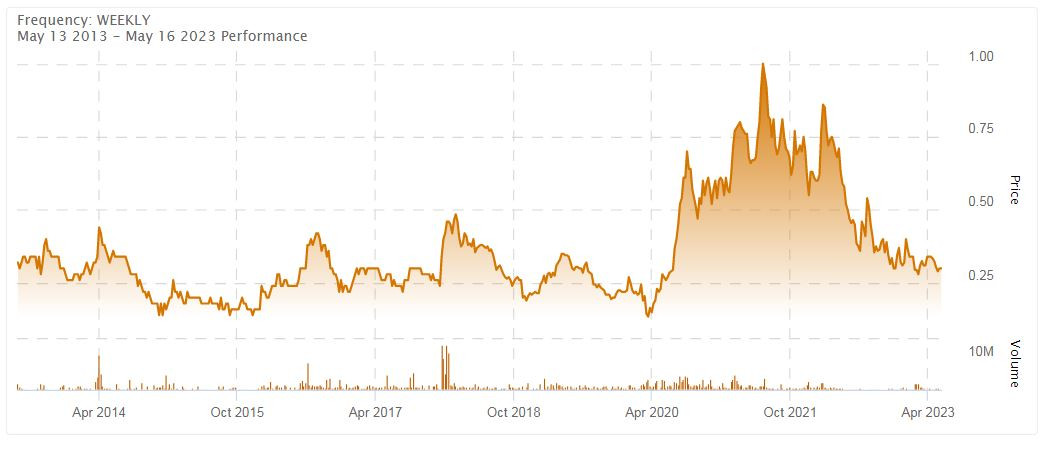

Jetzt konsolidiert Anaconda seit etwa einem Monat und Gold konsolidiert seit etwa 6 Wochen!

Im März und April konnte man prima im Bereich unter 0,20 CAD Aktien kaufen. Dies habe auch ich getan und bin nun happy über die große Kurssteigerung.

Wäre ich mir sicher gewesen, dass der Kurs von 0,78 CAD nochmal auf 0,54 CAD zurück fällt, dann hätte ich ca. 200-300 TSD Stück über 70 Cent verkauft und eine größere Stückzahl unter 60 Cent wieder zurück gekauft.

Aber, wer weiß dies wirklich?

Für mich ist die Situation gut erträglich, da ich ein Anaconda Langzeitinvestor bin und mir geht es nicht um 14 Tage. Wem es um solche Zeitspannen geht, der sollte meiner Meinung nach Optionsscheine handeln und keine Aktien.

Ich rechne nun persönlich damit, dass Gold vielleicht nochmal in den Bereich 1875 fällt und erst dann erneut zum Sprung über die 2000 Dollar Marke ansetzt.

Für Anaconda halte ich meine persönlichen Ziele aufrecht:

- Verkauf erstes Drittel meiner Aktien bei 3 Dollar

- Verkauf zweites Drittel meiner Aktien bei 5 Dollar

- Verkauf letztes Drittel meiner Aktien bei 7 Dollar

Zu diesem Plan ist zu sagen, dass mein erstes Verkaufsziel für mich derzeit als sicher gilt.

Mein zweites Verkaufsziel hängt dann von der Umsetzung der Produktionssteigerung und von der weiteren Goldpreisentwicklung ab.

Das selbe gilt auch für mein drittes Verkaufsziel. Hierzu sollte die Produktion dann weiterhin gesteigert werden und der Goldpreis weiter steigen. Dies alles ist für jeden gut nachzulesen auf der Homepage von Anaconda.

Zur Timeline ist zu sagen, dass ich ersten Aktien gerne innerhalb der nächsten 12 Monate verkaufen möchte. Dies alles ist meine persönliche Einschätzung und keinerlei Handelsempfehlung! Jeder sollte nach seinem Bauchgefühl handeln.

Ich muss nun sehen wie ich noch etwas Liquidität schaffe, um Anacondas nachzukaufen, denn ein Paar würden mir noch gut ins Körbchen passen zum Preis von unter 0,60 CAD. Solnge ich noch Anacondas zu dem Preis bekomme wie die Liechteeiner passt es für mich!

Nicht zu vergessen, dass die Liechtensteiner Investmentgesellschaft jetzt im Sommer zu 0,58 CAD eingestiegen ist mit 5,5 Millionen Dollar und das sind die Profis!

Sl - SC

Jetzt konsolidiert Anaconda seit etwa einem Monat und Gold konsolidiert seit etwa 6 Wochen!

Im März und April konnte man prima im Bereich unter 0,20 CAD Aktien kaufen. Dies habe auch ich getan und bin nun happy über die große Kurssteigerung.

Wäre ich mir sicher gewesen, dass der Kurs von 0,78 CAD nochmal auf 0,54 CAD zurück fällt, dann hätte ich ca. 200-300 TSD Stück über 70 Cent verkauft und eine größere Stückzahl unter 60 Cent wieder zurück gekauft.

Aber, wer weiß dies wirklich?

Für mich ist die Situation gut erträglich, da ich ein Anaconda Langzeitinvestor bin und mir geht es nicht um 14 Tage. Wem es um solche Zeitspannen geht, der sollte meiner Meinung nach Optionsscheine handeln und keine Aktien.

Ich rechne nun persönlich damit, dass Gold vielleicht nochmal in den Bereich 1875 fällt und erst dann erneut zum Sprung über die 2000 Dollar Marke ansetzt.

Für Anaconda halte ich meine persönlichen Ziele aufrecht:

- Verkauf erstes Drittel meiner Aktien bei 3 Dollar

- Verkauf zweites Drittel meiner Aktien bei 5 Dollar

- Verkauf letztes Drittel meiner Aktien bei 7 Dollar

Zu diesem Plan ist zu sagen, dass mein erstes Verkaufsziel für mich derzeit als sicher gilt.

Mein zweites Verkaufsziel hängt dann von der Umsetzung der Produktionssteigerung und von der weiteren Goldpreisentwicklung ab.

Das selbe gilt auch für mein drittes Verkaufsziel. Hierzu sollte die Produktion dann weiterhin gesteigert werden und der Goldpreis weiter steigen. Dies alles ist für jeden gut nachzulesen auf der Homepage von Anaconda.

Zur Timeline ist zu sagen, dass ich ersten Aktien gerne innerhalb der nächsten 12 Monate verkaufen möchte. Dies alles ist meine persönliche Einschätzung und keinerlei Handelsempfehlung! Jeder sollte nach seinem Bauchgefühl handeln.

Ich muss nun sehen wie ich noch etwas Liquidität schaffe, um Anacondas nachzukaufen, denn ein Paar würden mir noch gut ins Körbchen passen zum Preis von unter 0,60 CAD. Solnge ich noch Anacondas zu dem Preis bekomme wie die Liechteeiner passt es für mich!

Nicht zu vergessen, dass die Liechtensteiner Investmentgesellschaft jetzt im Sommer zu 0,58 CAD eingestiegen ist mit 5,5 Millionen Dollar und das sind die Profis!

Sl - SC

Antwort auf Beitrag Nr.: 65.140.360 von IQ4U am 21.09.20 10:30:36Wie vor Wochen vermutet, die 30 cent werden noch fallen. Über 30% Verlust dann in kurzer Zeit.

Antwort auf Beitrag Nr.: 65.140.360 von IQ4U am 21.09.20 10:30:36Schon was einsammeln können?

Vielerorts wurden meine Körbchen gefüllt, nur hier nicht. Vielleicht tauge ich nicht als Schlangenbeschwörer, nur als Schlangenanbeter.

Antwort auf Beitrag Nr.: 65.145.718 von fernotron2018 am 21.09.20 16:47:35Wenn es Dich beruhigt, das habe ich auch vom Höchstkurs 0,78 CAD gesehen.

Zitat von fernotron2018: Wie vor Wochen vermutet, die 30 cent werden noch fallen. Über 30% Verlust dann in kurzer Zeit.

Antwort auf Beitrag Nr.: 65.147.992 von Ikar am 21.09.20 19:28:46Ich bin quasi zu 100% investiert und benötige zuerst wieder freie Liquidität.

Zitat von Ikar: Schon was einsammeln können?

NEWS out yesterday:

Anaconda Mining Files Updated Mineral Resource Estimate and Mineral Reserves for the Point Rousse Gold Project

Mon, September 21, 2020, 11:15 PM GMT+2

TORONTO, ON / ACCESSWIRE / September 21, 2020 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) is pleased to announce the filing of a technical report prepared in accordance with National Instrument 43-101 ("43-101") reporting on updated Mineral Resource and Mineral Reserves estimates ("MRMR") for its 100%-owned Point Rousse Gold Project ("Point Rousse", or the "Project") in Newfoundland and Labrador, Canada. The technical report follows the previous announcement on August 4, 2020 outlining the updated MRMR for the Argyle Deposit ("Argyle") at Point Rousse (All dollar amounts are in CDN $ unless otherwise stated).

Highlights of the Mineral Resource and Mineral Reserves at Point Rousse Include:

Point Rousse Probable Mineral Reserve includes material from Argyle, the Pine Cove Mine and the Pine Cove Run of Mine ("ROM") stockpile and includes 706,443 tonnes at an average diluted grade of 1.90 grams per tonne ("g/t") gold containing 43,183 ounces, based on a gold price of $1,900 (US$1,425);

Point Rousse combined Indicated Mineral Resource of 1,470,000 tonnes at an average grade of 2.34 g/t gold containing 110,800 ounces, and a combined Inferred Mineral Resource of 515,000 tonnes at an average grade of 3.33 g/t gold containing 55,100 ounces;

Mineral Reserves from the Pine Cove Mine Pit and ROM stockpile include 170,851 tonnes at an average diluted grade of 1.40 g/t gold, which will provide mill throughput into late Q4 2020;

Mineral Reserves from the Argyle Deposit include 535,592 tonnes at an average diluted grade of 2.06 g/t gold containing 35,477 ounces; and

At Argyle a pre-tax net present value at a 5% discount rate ("NPV 5%") of $13.1M and an Internal Rate of Return ("IRR") of 262%, and an after-tax NPV 5% of $11.4M with an IRR of 245%, all based on a $1,900 (US$1,425) gold price.

"The Point Rousse Technical Report demonstrates strong economics of continued mining at Anaconda's Point Rousse Operation. While we continue to profitably process ore from the final benches of the Pine Cove Mine, we have commenced the development of the Argyle Gold Mine, which at a conservative gold price of C$1,900 will generate after-tax cumulative free cash flow of over $12.6 million. At current Canadian gold prices, Argyle could generate an after-tax net present value of over $20 million over the next 22 months. Meanwhile we are conducting a 4,000 metre drill program to extend mineralization at Stog'er Tight where we recently announced a drill discovery of broad, high-grade mineralization, that has not yet been incorporated into the mineral resource for Stog'er Tight outlined in the technical report. Leveraging our established infrastructure and strong operating team, we continue to demonstrate our ability to fast track successful exploration to production in the Baie Vert peninsula."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Point Rousse Mineral Reserve Estimate

The total Probable Mineral Reserves for the Point Rousse Project are as follows:

Table 1. Probable Mineral Reserves - Point Rousse Project (see notes for Effective Dates)

Deposit

Reserve Category

Cut-off Grade (g/t)

Tonnes (t)

Average Grade of Gold (g/t)

Contained Ounces of Gold

Argyle

Probable

0.56

535,592

2.06

35,477

Pine Cove - Mine+ROM

Probable

0.50

170,851

1.40

7,706

Pine Cove - Marginal Stockpile

Probable

0.50

252,560

0.55

4,466

Total Combined

Probable

959,003

47,649

Point Rousse Mineral Reserve Notes

Mineral Reserves were prepared in accordance with NI 43-101, the CIM Definition Standards for MRMR (2014) and 2019 CIM MRMR Best Practice Guidelines.

Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The Argyle Mineral Reserve is based on the Mineral Resource Estimate prepared by Mercator Geological Services Limited with an effective date August 4, 2020.

The Argyle Mineral Reserve Estimate has an effective date of August 4, 2020.

The Argyle Mineral Reserve Estimate is reported from Indicated Resource blocks at a 0.56 g/t cut-off within the optimized pit shell design developed by Dassault Systèmes Canada Inc.; base-case optimization parameters include: mining at $4.00 per tonne, combined processing and G&A at $29.00 per tonne, average pit slope angles of 48 degrees (north) and 35 degrees (south), daily mill throughput of 1,200 tonnes per day, and average process recovery of 87%, and a gold price of CAD$1,900/oz (US$1,425/oz).

The Pine Cove Mineral Reserve Estimate is based on the Mineral Resource Estimate prepared by Adiuvare Geology and Engineering Ltd. with effective date August 8, 2020 and internal reconciliation of stockpiled marginal and ROM with an Effective Date of August 31, 2020.

The Pine Cove Mineral Reserve has an effective date of August 31, 2020.

The Pine Cove Mineral Reserve Estimate is reported from Indicated Resource blocks at a 0.50 g/t cut-off as determined by ongoing mining at the Pine Cove Mine including mining costs of $3.50 per tonne mined, combined processing and G&A costs of $28.60 per tonne milled, daily mill throughput of 1,200 tonnes per day, an average process recovery of 87%, and a gold price of CAD$1,900/oz (US$1,425/oz).

Argyle Mineral Reserves Economics

As previously reported, total gold ounces scheduled for mining at Argyle over the 22-month life of mine is expected to be 35,477 ounces at an average grade of 2.06 g/t gold from 535,592 tonnes of ore mined (see Table 2). It is expected that Argyle ore will be mined using conventional open pit mining methods with waste rock being stored locally at site and ore being transported by truck to the Pine Cove Mill. It is expected that Argyle ore will be batch-processed at approximately 1,200 tonnes per day with additional material from Pine Cove stockpiles supplementing the mill capacity of 1,300 tonnes per day. This will be accomplished with stockpile management techniques and circuit inventory methods in the mill to account for different mill feeds.

Anaconda has received material permits to initiate development at Argyle, including a release from the Environmental Assessment and receipt of a Certificate of Approval (Department of Municipal Affairs and Environment), and the acceptance of the Development, Rehabilitation and Closure plan (Department of Natural Resources). Initial development activities have commenced, including cutting, land clearing and access construction, with mining of ore expected to commence in Q4 2020.

Argyle has robust economics with a pre-tax discounted NPV 5% of $13.05M with an IRR of 262%, and an after-tax NPV 5% of $11.4M with an IRR of 245%. Total initial capital requirements of $2.98M are required, mainly for pre-stripping of waste and site preparation.

Table 2: Key Assumptions and Costs Used in the Argyle Mineral Reserve (all prices shown are in Canadian Dollars)

Production Profile

Gold Price - Base Case

CAD$1,900/ounce

Total Tonnes Milled

535,592 tonnes

Diluted Head Grade

2.06 g/t gold

Total Gold Ounces Mined

35,477 ounces

Reserve Cut-Off Grade

0.56 g/t gold

Mine Life (LOM)

22 months

Total Waste Tonnes

4,346,119 tonnes

Strip Ratio

8.1:1

Daily Mill Throughput

1,200 tonnes per day

Gold Recovery

87%

Total Gold Production

30,865 ounces

Capital Requirements

Pre-production Capital Cost

$2.98M

LOM Sustaining Capital Cost

$2.69M

Unit Operating Costs

Mining Costs

$42.32/tonne milled

Processing Costs

$23.26/tonne milled

G&A

$4.90/tonne milled

LOM Operating Cash Costs(1)

CAD$1,219 per ounce sold (US$914)

LOM All-in Sustaining Cash Costs(1)

CAD$1,306 per ounce sold (US$980)

Project Economics

Royalties(2)

3% net smelter return

Income Tax/Mining Tax Rates

30%/15%

Pre-Tax

NPV (5% Discount Rate)

$13.05M

Internal Rate of Return

262%

Payback Period (months)

12

Cumulative Cash Flows

$14.34M

After-Tax

NPV (5% Discount Rate)

$11.44M

Internal Rate of Return

245%

Payback Period (months)

12

Cumulative Cash Flows

$12.57M

(1) Cash cost includes mining cost, mine-level G&A, mill and refining cost. This is a non-GAAP performance measure. please see "NON-IFRS Measures" below.

(2) A portion of the project is also subject to a 7.5% net profits interest ("NPI") with Royal Gold Inc. Depending on the price of gold in the future, operating and capital costs, the production profile of Argyle, the NPI could become payable at a future date.

Argyle Gold Price Sensitivity

An analysis of the Argyle economics was completed at a variety of gold selling prices, and on the base case CAD$1,900 optimized pit and Probable Mineral Reserves as outlined in Table 3. The analysis demonstrates robust economics for Argyle at CAD$1,900, with strong leverage to rising gold prices which have exceeded CAD$2,600 per ounce at times. At a gold price of CAD$2,600 per ounce (US$1,950) which is in line with recent market pricing, Argyle could produce a pre-tax NPV 5% of $32.7M and an IRR of 1,336% and an after-tax NPV 5% of $24.5M and an IRR of 1,273%.

Table 3: Gold Selling Price Sensitivity Analysis

Gold Price

$1,500

$1,700

Base Case

$1,900

$2,100

$2,300

$2,600

Pre-tax NPV 5%

$1.8M

$7.4M

$13.1M

$18.7M

$24.3M

$32.7M

Pre-tax IRR

28%

124%

262%

459%

1,732%

1,336%

After-tax NPV 5%

$1.2

$6.5M

$11.4M

$15.9M

$19.3M

$24.5M

After-tax IRR

21%

114%

245%

443%

687%

1,273%

Point Rousse Mineral Resources

The total Mineral Resources, inclusive of Mineral Reserves, for the Point Rousse Project are as follows:

Table 4. Total Mineral Resource Estimate - Point Rousse Project (See Notes for Effective Dates)

Point Rousse Mineral Resources

Open Pit (OP) Constrained

Deposit

Cut-off (g/t)

Indicated Tonnes (t)

Gold (g/t)

Ounces

Argyle

0.5

488,000

3.14

49,300

Pine Cove

0.5

722,000

1.64

38,100

Stog'er Tight

0.5

102,000

2.39

7,800

Combined Indicated

0.5

1,311,000

2.26

95,100

Deposit

Cut-off (g/t)

Inferred Tonnes (t)

Gold (g/t)

Ounces

Argyle

0.5

9,000

3.80

1,100

Pine Cove

0.5

13,000

1.56

700

Stog'er Tight

0.5

134,000

3.06

13,200

Combined Inferred

0.5

156,000

2.98

14,900

Point Rousse Mineral Resources

Out of Pit (OoP)

Deposit

Cut-off (g/t)

Indicated Tonnes (t)

Gold (g/t)

Ounces

Argyle

2.0

62,000

2.86

5,700

Pine Cove

2.0

83,000

3.01

8,000

Stog'er Tight

2.0

14,000

4.27

1,900

Combined Indicated

2.0

159,000

3.06

15,700

Deposit

Cut-off (g/t)

Inferred Tonnes (t)

Gold (g/t)

Ounces

Argyle

2.0

56,000

3.89

7,000

Pine Cove

2.0

93,000

2.93

8,800

Stog'er Tight

2.0

210,000

3.62

24,400

Combined Inferred

2.0

359,000

3.48

40,200

Combined Point Rousse Mineral Resources

Category

Cut-off (g/t)

Tonnes (t)

Gold (g/t)

Ounces

Indicated

0.5/2.0

1,470,000

2.34

110,800

Inferred

0.5/2.0

515,000

3.33

55,100

Mineral Resource Estimate Notes

Mineral Resources were prepared in accordance with NI 43-101, the CIM Definition Standards for MRMR (2014) and 2019 CIM MRMR Best Practice Guidelines.

Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Open Pit Mineral Resources occur within an optimized pit shell developed by Dassault Systèmes Canada Inc.; base-case optimization parameters include: mining at $4.00 per tonne, combined processing and G&A at $29.00 per tonne, and a gold price of CAD$1,900/oz (US$1,425/oz).

"Open Pit" Mineral Resources are reported at a cut-off grade of 0.50 g/t gold within the optimized pit shell and are considered to have reasonable prospects for eventual economic extraction by open pit mining methods.

"Out of Pit" Mineral Resources are external to the optimized pit shell and are reported at a cut-off grade of 2.00 g/t gold. They are considered to have reasonable prospects for eventual economic extraction using conventional underground mining methods based on a mining cost of $91 per tonne, processing and G&A cost of $29.00 per tonne, and a gold price of CAD$1,900/oz.

"Combined" Mineral Resources are the tonnage-weighted average summation of Open Pit and Out of Pit Mineral Resources.

Mineral Resources were interpolated using Ordinary Kriging methods applied to 1 metre downhole assay composites capped at 15 and 30 g/t gold (Pine Cove and Stog'er Tight) and 20 g/t gold (Argyle).

An average bulk density value of 2.77 g/cm3 was applied to all Mineral Resources.

Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

Mineral Resource tonnages and troy ounces have been rounded to the nearest 1,000 and 100, respectively; totals may vary due to rounding.

The following Mineral Resource Estimate Effective Dates apply: Argyle - August 4, 2020, Pine Cove - August 8, 2020, and Stog'er Tight - April 22, 2020.

Technical Report Filings and Qualified Person Statements

The technical report is available under the Company's profile on SEDAR at www.sedar.com and on the Company's website at www.anacondamining.com. For readers to fully understand the information in this news release, they should read the technical report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Resources and Mineral Reserves. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The technical report, entitled " NI 43-101 Technical Report, Mineral Resource and Mineral Reserve Update on the Point Rousse Project, Baie Verte, Newfoundland and Labrador, Canada " with a report date of September 18, 2020, was authored by Independent Qualified Persons Cath Pitman (P. Geo.) of Adiuvare Geology and Engineering Ltd., Michael Cullen (P. Geo) and Matthew Harrington (P. Geo) both of Mercator Geological Services Limited., , and Qualified Persons Kevin Bullock (P. Eng), Jordan Cramm (P.Eng.), Chris Budgell (P.Eng.), Paul McNeill (P.Geo.) and David Copeland (P. Geo) of Anaconda Mining.

This news release has been prepared and approved by Kevin Bullock, P.Eng., President and CEO and Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., and Michael Cullen, P.Geo., and Matthew Harrington, P.Geo. of Mercator Geological Services Limited., and Cath Pitman of Adiuvare Geology and Engineering Ltd., all qualified persons as defined under NI 43-101.

Mr. Harrington, P.Geo. is responsible for disclosure regarding the Argyle Mineral Resource Estimate. Ms. Cath Pitman, P. Geo is responsible for disclosure regarding the Pine Cove and Stog'er Tight Mineral Resource Estimate. Mr. Bullock, P.Eng. is responsible for disclosure regarding the Point Rousse Mineral Reserve Statement and related Project Economics. Mr. McNeill is responsible for all other scientific and technical information disclosed in this news release.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS