Signal Gold [ Anaconda Mining ] auf dem Weg in eine goldige Zukunft! - 500 Beiträge pro Seite (Seite 2)

eröffnet am 01.01.18 17:06:11 von

neuester Beitrag 10.04.24 13:41:35 von

neuester Beitrag 10.04.24 13:41:35 von

Beiträge: 1.455

ID: 1.270.505

ID: 1.270.505

Aufrufe heute: 0

Gesamt: 108.054

Gesamt: 108.054

Aktive User: 0

ISIN: CA82664T1012 · WKN: A3DK3Q · Symbol: SGNL

0,1150

CAD

0,00 %

0,0000 CAD

Letzter Kurs 29.04.24 Toronto

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 1,0100 | +13,48 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7100 | -7,79 | |

| 3,3200 | -9,78 | |

| 3,9600 | -15,74 | |

| 12,000 | -25,00 | |

| 46,95 | -98,00 |

Anaconda arbeitet aber so lange nur 1 gram per tone abgebaut wirt kann eben nichts rauskommen auch

nicht bei Oben Pit wenn mal die 3-5 gram Lagerstäden abgebaut werden gehts schon besser Maschinen

gehn am besten wenn sie laufen auserdem mus low grat erst weg befor high grate kommt was wilst du also machen? Auserdem kann man auch die Infos lesen

nicht bei Oben Pit wenn mal die 3-5 gram Lagerstäden abgebaut werden gehts schon besser Maschinen

gehn am besten wenn sie laufen auserdem mus low grat erst weg befor high grate kommt was wilst du also machen? Auserdem kann man auch die Infos lesen

Wann gehen hier die Lichter aus??

Antwort auf Beitrag Nr.: 62.796.596 von IQ4U am 26.02.20 16:32:53@ IQ

120.000

120.000

Anaconda Mining suspends Tilt Cove exploration

2020-03-26 07:30 ET - News Release

Mr. Kevin Bullock reports

ANACONDA MINING PROVIDES CORPORATE UPDATE AND COVID-19 RESPONSE MEASURES AND PREPAREDNESS

Anaconda Mining Inc. is providing an update on operations in light of the COVID-19 pandemic, including its specific response measures to the risk of COVID-19. As of today, Point Rousse continues to operate and to the Company's knowledge, no employees, contractors, or consultants directly involved with Anaconda, whether at corporate or at site, have been diagnosed with COVID-19. The Company's corporate office remains closed for the foreseeable future, and where possible, employees across the Company, including those in the corporate office, are working from home.

The Company has made the decision to suspend its exploration programs at the Tilt Cove Gold Project several weeks earlier than planned, in light of issues related to personnel travel across multiple regions and ensuring adherence to the principals of social distancing. During this period, the team will continue to work from home and compile and interpret the results of the program completed to date. Certain other programs at Point Rousse, Argyle and Zone 278, will also continue.

"Anaconda is committed to the health and safety of our employees, contractors, and stakeholders and we are continuously monitoring this changing situation with respect to the COVID-19 pandemic. We continue to operate at Point Rousse, observing strict occupational health and safety protocols around social distancing, however we recognize the situation is rapidly evolving. The Company maintains a good financial position and is taking all actions to ensure financial flexibility for many possible scenarios over the short-term."

- Kevin Bullock, President and CEO, Anaconda Mining Inc.

At this point, production activities in Q1 2020 have not been impacted by the COVID-19 pandemic, and a number of strict health and safety protocols have been established to minimize risk to our employees and contractors, including strict social distancing policies, limitations on group sizes, additional cleaning, and sterilization measures. All work-related travel has been banned, and anyone returning from international or out of province travel must adhere to a two-week quarantine period.

The Company has established an internal committee that meets multiple times per week to monitor the situation and refine protocols based on recommendations from medical authorities. Anaconda will continue to closely monitor the situation and will provide updates as they become available.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

We seek Safe Harbor.

© 2020 Canjex Publishing Ltd. All rights reserved.

2020-03-26 07:30 ET - News Release

Mr. Kevin Bullock reports

ANACONDA MINING PROVIDES CORPORATE UPDATE AND COVID-19 RESPONSE MEASURES AND PREPAREDNESS

Anaconda Mining Inc. is providing an update on operations in light of the COVID-19 pandemic, including its specific response measures to the risk of COVID-19. As of today, Point Rousse continues to operate and to the Company's knowledge, no employees, contractors, or consultants directly involved with Anaconda, whether at corporate or at site, have been diagnosed with COVID-19. The Company's corporate office remains closed for the foreseeable future, and where possible, employees across the Company, including those in the corporate office, are working from home.

The Company has made the decision to suspend its exploration programs at the Tilt Cove Gold Project several weeks earlier than planned, in light of issues related to personnel travel across multiple regions and ensuring adherence to the principals of social distancing. During this period, the team will continue to work from home and compile and interpret the results of the program completed to date. Certain other programs at Point Rousse, Argyle and Zone 278, will also continue.

"Anaconda is committed to the health and safety of our employees, contractors, and stakeholders and we are continuously monitoring this changing situation with respect to the COVID-19 pandemic. We continue to operate at Point Rousse, observing strict occupational health and safety protocols around social distancing, however we recognize the situation is rapidly evolving. The Company maintains a good financial position and is taking all actions to ensure financial flexibility for many possible scenarios over the short-term."

- Kevin Bullock, President and CEO, Anaconda Mining Inc.

At this point, production activities in Q1 2020 have not been impacted by the COVID-19 pandemic, and a number of strict health and safety protocols have been established to minimize risk to our employees and contractors, including strict social distancing policies, limitations on group sizes, additional cleaning, and sterilization measures. All work-related travel has been banned, and anyone returning from international or out of province travel must adhere to a two-week quarantine period.

The Company has established an internal committee that meets multiple times per week to monitor the situation and refine protocols based on recommendations from medical authorities. Anaconda will continue to closely monitor the situation and will provide updates as they become available.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

We seek Safe Harbor.

© 2020 Canjex Publishing Ltd. All rights reserved.

Anaconda Mining appoints Oke to board

2020-03-31 08:32 ET - News Release

Mr. Kevin Bullock reports

ANACONDA MINING APPOINTS MARY-LYNN OKE TO THE BOARD OF DIRECTORS

Mary-Lynn Oke has joined Anaconda Mining Inc.'s board of directors. Ms. Oke brings over 23 years of business experience built through a career which has included tax, finance, corporate and senior leadership roles.

Ms. Oke was previously with Hudbay Minerals Inc., where she was the vice-president, finance, and the chief financial officer of the Manitoba business unit. Ms. Oke brings deep experience in financial reporting, mine project accounting, business acquisitions and divestitures, tax, treasury, capital structuring, supply chain management, and organizational redesign. Ms. Oke currently provides senior financial and advisory services to organizations assisting them to improve the efficiency and productivity of their businesses. She holds an honours bachelor of arts in business administration from the Richard Ivey School of Business and is a chartered professional accountant.

The company would also like to announce the resignation of Maruf Raza as a director of the company. Mr. Raza has been a director since 2012 and has provided invaluable financial leadership through the early part of the company's development. The company extends its gratitude to Mr. Raza for his contributions to the company and wishes him well in his continued and future endeavours.

"On behalf of Anaconda, I would like to welcome Mary-Lynn to our board of directors. Ms. Oke brings strong experience in mining, finance, tax and capital transactions that will benefit the company as it executes on its growth strategy. We would also like to thank Maruf Raza for his contributions during his tenure on the board and wish him well in the future," said Jonathan Fitzgerald, chairman of the board of directors, Anaconda Mining.

About Anaconda Mining Inc.

The company operates mining and milling operations in the prolific Baie Verte mining district of Newfoundland, which includes the fully permitted Pine Cove mill, tailings facility and deepwater port, as well as about 11,000 hectares of highly prospective mineral lands including those adjacent to the past-producing, high-grade Nugget Pond mine at its Tilt Cove gold project.

We seek Safe Harbor.

© 2020 Canjex Publishing Ltd. All rights reserved.

2020-03-31 08:32 ET - News Release

Mr. Kevin Bullock reports

ANACONDA MINING APPOINTS MARY-LYNN OKE TO THE BOARD OF DIRECTORS

Mary-Lynn Oke has joined Anaconda Mining Inc.'s board of directors. Ms. Oke brings over 23 years of business experience built through a career which has included tax, finance, corporate and senior leadership roles.

Ms. Oke was previously with Hudbay Minerals Inc., where she was the vice-president, finance, and the chief financial officer of the Manitoba business unit. Ms. Oke brings deep experience in financial reporting, mine project accounting, business acquisitions and divestitures, tax, treasury, capital structuring, supply chain management, and organizational redesign. Ms. Oke currently provides senior financial and advisory services to organizations assisting them to improve the efficiency and productivity of their businesses. She holds an honours bachelor of arts in business administration from the Richard Ivey School of Business and is a chartered professional accountant.

The company would also like to announce the resignation of Maruf Raza as a director of the company. Mr. Raza has been a director since 2012 and has provided invaluable financial leadership through the early part of the company's development. The company extends its gratitude to Mr. Raza for his contributions to the company and wishes him well in his continued and future endeavours.

"On behalf of Anaconda, I would like to welcome Mary-Lynn to our board of directors. Ms. Oke brings strong experience in mining, finance, tax and capital transactions that will benefit the company as it executes on its growth strategy. We would also like to thank Maruf Raza for his contributions during his tenure on the board and wish him well in the future," said Jonathan Fitzgerald, chairman of the board of directors, Anaconda Mining.

About Anaconda Mining Inc.

The company operates mining and milling operations in the prolific Baie Verte mining district of Newfoundland, which includes the fully permitted Pine Cove mill, tailings facility and deepwater port, as well as about 11,000 hectares of highly prospective mineral lands including those adjacent to the past-producing, high-grade Nugget Pond mine at its Tilt Cove gold project.

We seek Safe Harbor.

© 2020 Canjex Publishing Ltd. All rights reserved.

Anaconda produces 4,997 oz Au in Q1

2020-04-15 07:07 ET - News Release

Mr. Kevin Bullock reports

ANACONDA MINING REPORTS Q1 2020 PRODUCTION RESULTS AND PROVIDES CORPORATE UPDATE

Anaconda Mining Inc. has released production results and certain financial information from the three months ended March 31, 2020, as well as provided a corporate update concerning the continuing COVID-19 pandemic. All dollar amounts are in Canadian Dollars. The Company expects to file its first quarter financial statements and management discussion and analysis by May 13, 2020.

First Quarter 2020 Highlights

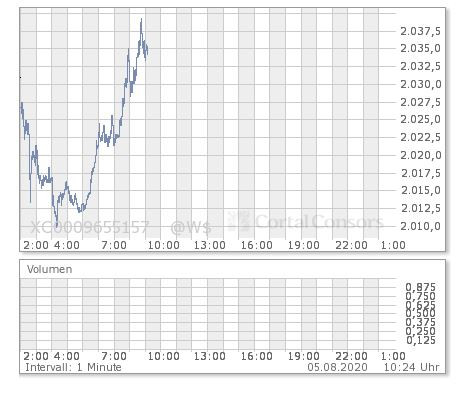

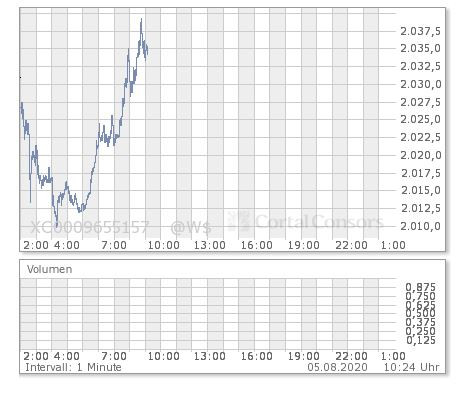

Anaconda sold 5,132 ounces of gold in Q1 2020, generating metal revenue of $10.5 million at an average realized gold price1 of $2,051 (US$1,526) per ounce sold.

Point Rousse produced 4,997 ounces of gold in Q1 2020, a 20% increase compared to Q1 2019, due to higher mill throughput.

Mine operations moved 103,222 tonnes of ore during the first quarter from the Pine Cove open pit at an average grade of 1.47 g/t at a strip ratio of 5.4 waste tonnes to ore tonnes. The Company ended the first quarter with over 45,000 tonnes of ore in stockpiles.

The Pine Cove Mill processed 113,136 tonnes during Q1 2020 and achieved a recovery rate of 87.4%, an increase in throughput of 42% compared to Q1 2019 when unplanned maintenance of the regrind mill led to lower mill availability.

Initiated exploration programs at multiple locations at the Point Rousse Project, which includes 5,500 metres of diamond and percussion drilling proximal to the Pine Cove, Argyle, and Stog'er Tight Deposits.

Subsequent to quarter-end, Anaconda completed the spin-out and financing of its Narrow Vein Mining Project, which will advance the innovative technology with no further financial commitment from the Company.

As at March 31, 2020, the Company had a cash balance of $6.4 million, preliminary working capital1 of $3.7 million, and additional available liquidity of $0.3 million2 from an undrawn revolving line of credit facility.

COVID-19 Pandemic and Preparedness Update - As of today, Point Rousse continues to operate and to the Company's knowledge, no employees, contractors, or consultants directly involved with Anaconda, whether at corporate or at site, have been diagnosed with COVID-19. Strict health and safety protocols, including social distancing, remain in place and are continually reviewed based on recommendations from medical authorities. As reported in the press release dated March 26, 2020, the Company's corporate office remains closed for the foreseeable future, and the exploration program at the Tilt Cove Gold Project has been suspended.

"While we face a time of pronounced uncertainty, Anaconda has started the year strong with over 5,100 ounces of gold sold in the first quarter of 2020 at record high Canadian dollar gold prices. Mining continues from the Pine Cove Pit and the Pine Cove Mill achieved another successful quarter of throughput, achieving mill availability of 97.8% and an average mill recovery of 87.4%. I would like to thank all the staff at Anaconda that have ensured sustained and consistent operations during this pandemic, in particular our personnel and contractors at Point Rousse who continue to operate safely and maintain proper social distancing protocols. As a result of the strong quarter, we are in a strong financial position with $6.4 million in cash, ensuring we have robust financial flexibility in the near-term."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

First Quarter Operating StatisticsThree months ended March 31, 2020Three months ended March 31, 2019

Mine Statistics

Ore production (tonnes) 103,222 77,367

Waste production (tonnes) 561,763 279,412

Total material moved (tonnes) 664,985 356,779

Waste: Ore ratio 5.4 3.6

Mill Statistics

Availability (%) 97.8 78.1

Dry tonnes processed 113,136 79,758

Tonnes per day 1,271 1,135

Grade (grams per tonne) 1.57 1.92

Recovery (%) 87.4 84.8

Gold Ounces Produced 4,997 4,176

Gold Ounces Sold 5,132 5,251

Operations Overview for the Three Months Ended March 31, 2020

Anaconda sold 5,132 ounces of gold during the first quarter of 2020, generating gold revenue of $10.5 million at an average realized gold price1 of $2,051 (US$1,526) per ounce sold. Gold production of 4,997 ounces was 20% higher than Q1 2019, due to better mill availability and resulting higher throughput. Low mill availability in Q1 2019 was due to planned maintenance on the main ball mill and unplanned maintenance for the regrind mill due to delayed shipment of trunnion liners, and the consequent decision to accelerate other maintenance programs. The Company remains on track to meet guidance and produce and sell between 18,000 and 19,000 ounces of gold from continued mining at the Pine Cove Pit.

1 Refer to Non-IFRS Measures Section below.

Point Rousse Mill Operations - The Pine Cove Mill processed 113,136 tonnes during Q1 2020, an increase of 42% compared to the first quarter of 2019 when a combination of the planned maintenance on the main ball mill with unplanned maintenance on the head of the regrind mill resulted in low mill availability, which impacted throughput.

Average grade during Q1 2020 was 1.57 g/t, a 18% decrease over the first quarter of 2019, when mining was focused at the higher-grade Stog'er Tight Mine, but an increase of 27% over Q4 2019.The mill achieved an average recovery rate of 87.4%, an increase from 84.8% achieved in Q1 2019 despite the lower grade profile in Q1 2020. The higher throughput and better recovery resulted in gold production of 4,997 ounces, an increase of 20% compared to the first quarter of 2019.

Point Rousse Mine Operations - During the first quarter of 2020, the mine operations produced 113,136 tonnes of ore from the Pine Cove Pit, which is expected to be the exclusive source for ore in 2020. Ore mined during Q1 2020 was up significantly compared to the first quarter of 2019, which reflects the higher mining rate at the Pine Cove Pit compared to the lower tonnage profile of mining at Stog'er Tight, which was the main mining area in the prior period. From a production perspective, the higher tonnes mined from Pine Cove has offset the higher relative grade profile of Stog'er Tight, as demonstrated by the 20% increase in gold ounces produced in Q1 2020. The Company ended the first quarter with an ore stockpile of over 45,000 tonnes.

The mine operations achieved a strip ratio of 5.4 waste tonnes to ore tonnes at the Pine Cove Pit, an increase compared to Q4 2019 as higher waste development was required to access ore zones for the second quarter. The strip ratio is expected to decrease throughout 2020. The strip ratio is higher compared to the first quarter of 2019 when planned pushbacks to the Pine Cove Pit were delayed to the second quarter of 2019.

Corporate Update

Subsequent to March 31, 2020, the Company, through a subsidiary called Novamera Inc., completed a $2.0 million financing with a venture capital firm to further the advancement of its Narrow Vein Mining Project (the "Project"). The Project is advancing drilling technology to recover ore from steeply dipping, narrow vein deposits that are considered uneconomic when applying traditional extraction methods. As part of the funding arrangement, the technology and related agreements were transferred to Novamera Inc., of which the Company retains a 34% undiluted interest and has no further financial obligations to advance the Project forward.

During the first quarter of 2020, the Company changed insurance companies which provide the surety bonds that backstop its performance obligations with respect to reclamation obligations at the Company's sites. Under the terms of the replacement surety bonds, the Company was required to provide collateral of $0.7 million, equivalent to 25% of the value of the bonds. The collateral was provided in the form of a letter of credit from the Royal Bank of Canada, which was carved out of the existing $1.0 million undrawn revolving line of credit. As a result, the Company currently maintains a revolving line of credit facility in the amount of $0.3 million.

As part of the appointment of Mary-Lynn Oke to the Board of Directors (see press release dated March 31, 2020), the Company granted 40,000 share units pursuant to the Company's Share Unit Plan.

Qualified Person

Kevin Bullock, P. Eng., President and CEO, Anaconda Mining Inc., is a "qualified person" as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

We seek Safe Harbor.

© 2020 Canjex Publishing Ltd. All rights reserved.

2020-04-15 07:07 ET - News Release

Mr. Kevin Bullock reports

ANACONDA MINING REPORTS Q1 2020 PRODUCTION RESULTS AND PROVIDES CORPORATE UPDATE

Anaconda Mining Inc. has released production results and certain financial information from the three months ended March 31, 2020, as well as provided a corporate update concerning the continuing COVID-19 pandemic. All dollar amounts are in Canadian Dollars. The Company expects to file its first quarter financial statements and management discussion and analysis by May 13, 2020.

First Quarter 2020 Highlights

Anaconda sold 5,132 ounces of gold in Q1 2020, generating metal revenue of $10.5 million at an average realized gold price1 of $2,051 (US$1,526) per ounce sold.

Point Rousse produced 4,997 ounces of gold in Q1 2020, a 20% increase compared to Q1 2019, due to higher mill throughput.

Mine operations moved 103,222 tonnes of ore during the first quarter from the Pine Cove open pit at an average grade of 1.47 g/t at a strip ratio of 5.4 waste tonnes to ore tonnes. The Company ended the first quarter with over 45,000 tonnes of ore in stockpiles.

The Pine Cove Mill processed 113,136 tonnes during Q1 2020 and achieved a recovery rate of 87.4%, an increase in throughput of 42% compared to Q1 2019 when unplanned maintenance of the regrind mill led to lower mill availability.

Initiated exploration programs at multiple locations at the Point Rousse Project, which includes 5,500 metres of diamond and percussion drilling proximal to the Pine Cove, Argyle, and Stog'er Tight Deposits.

Subsequent to quarter-end, Anaconda completed the spin-out and financing of its Narrow Vein Mining Project, which will advance the innovative technology with no further financial commitment from the Company.

As at March 31, 2020, the Company had a cash balance of $6.4 million, preliminary working capital1 of $3.7 million, and additional available liquidity of $0.3 million2 from an undrawn revolving line of credit facility.

COVID-19 Pandemic and Preparedness Update - As of today, Point Rousse continues to operate and to the Company's knowledge, no employees, contractors, or consultants directly involved with Anaconda, whether at corporate or at site, have been diagnosed with COVID-19. Strict health and safety protocols, including social distancing, remain in place and are continually reviewed based on recommendations from medical authorities. As reported in the press release dated March 26, 2020, the Company's corporate office remains closed for the foreseeable future, and the exploration program at the Tilt Cove Gold Project has been suspended.

"While we face a time of pronounced uncertainty, Anaconda has started the year strong with over 5,100 ounces of gold sold in the first quarter of 2020 at record high Canadian dollar gold prices. Mining continues from the Pine Cove Pit and the Pine Cove Mill achieved another successful quarter of throughput, achieving mill availability of 97.8% and an average mill recovery of 87.4%. I would like to thank all the staff at Anaconda that have ensured sustained and consistent operations during this pandemic, in particular our personnel and contractors at Point Rousse who continue to operate safely and maintain proper social distancing protocols. As a result of the strong quarter, we are in a strong financial position with $6.4 million in cash, ensuring we have robust financial flexibility in the near-term."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

First Quarter Operating StatisticsThree months ended March 31, 2020Three months ended March 31, 2019

Mine Statistics

Ore production (tonnes) 103,222 77,367

Waste production (tonnes) 561,763 279,412

Total material moved (tonnes) 664,985 356,779

Waste: Ore ratio 5.4 3.6

Mill Statistics

Availability (%) 97.8 78.1

Dry tonnes processed 113,136 79,758

Tonnes per day 1,271 1,135

Grade (grams per tonne) 1.57 1.92

Recovery (%) 87.4 84.8

Gold Ounces Produced 4,997 4,176

Gold Ounces Sold 5,132 5,251

Operations Overview for the Three Months Ended March 31, 2020

Anaconda sold 5,132 ounces of gold during the first quarter of 2020, generating gold revenue of $10.5 million at an average realized gold price1 of $2,051 (US$1,526) per ounce sold. Gold production of 4,997 ounces was 20% higher than Q1 2019, due to better mill availability and resulting higher throughput. Low mill availability in Q1 2019 was due to planned maintenance on the main ball mill and unplanned maintenance for the regrind mill due to delayed shipment of trunnion liners, and the consequent decision to accelerate other maintenance programs. The Company remains on track to meet guidance and produce and sell between 18,000 and 19,000 ounces of gold from continued mining at the Pine Cove Pit.

1 Refer to Non-IFRS Measures Section below.

Point Rousse Mill Operations - The Pine Cove Mill processed 113,136 tonnes during Q1 2020, an increase of 42% compared to the first quarter of 2019 when a combination of the planned maintenance on the main ball mill with unplanned maintenance on the head of the regrind mill resulted in low mill availability, which impacted throughput.

Average grade during Q1 2020 was 1.57 g/t, a 18% decrease over the first quarter of 2019, when mining was focused at the higher-grade Stog'er Tight Mine, but an increase of 27% over Q4 2019.The mill achieved an average recovery rate of 87.4%, an increase from 84.8% achieved in Q1 2019 despite the lower grade profile in Q1 2020. The higher throughput and better recovery resulted in gold production of 4,997 ounces, an increase of 20% compared to the first quarter of 2019.

Point Rousse Mine Operations - During the first quarter of 2020, the mine operations produced 113,136 tonnes of ore from the Pine Cove Pit, which is expected to be the exclusive source for ore in 2020. Ore mined during Q1 2020 was up significantly compared to the first quarter of 2019, which reflects the higher mining rate at the Pine Cove Pit compared to the lower tonnage profile of mining at Stog'er Tight, which was the main mining area in the prior period. From a production perspective, the higher tonnes mined from Pine Cove has offset the higher relative grade profile of Stog'er Tight, as demonstrated by the 20% increase in gold ounces produced in Q1 2020. The Company ended the first quarter with an ore stockpile of over 45,000 tonnes.

The mine operations achieved a strip ratio of 5.4 waste tonnes to ore tonnes at the Pine Cove Pit, an increase compared to Q4 2019 as higher waste development was required to access ore zones for the second quarter. The strip ratio is expected to decrease throughout 2020. The strip ratio is higher compared to the first quarter of 2019 when planned pushbacks to the Pine Cove Pit were delayed to the second quarter of 2019.

Corporate Update

Subsequent to March 31, 2020, the Company, through a subsidiary called Novamera Inc., completed a $2.0 million financing with a venture capital firm to further the advancement of its Narrow Vein Mining Project (the "Project"). The Project is advancing drilling technology to recover ore from steeply dipping, narrow vein deposits that are considered uneconomic when applying traditional extraction methods. As part of the funding arrangement, the technology and related agreements were transferred to Novamera Inc., of which the Company retains a 34% undiluted interest and has no further financial obligations to advance the Project forward.

During the first quarter of 2020, the Company changed insurance companies which provide the surety bonds that backstop its performance obligations with respect to reclamation obligations at the Company's sites. Under the terms of the replacement surety bonds, the Company was required to provide collateral of $0.7 million, equivalent to 25% of the value of the bonds. The collateral was provided in the form of a letter of credit from the Royal Bank of Canada, which was carved out of the existing $1.0 million undrawn revolving line of credit. As a result, the Company currently maintains a revolving line of credit facility in the amount of $0.3 million.

As part of the appointment of Mary-Lynn Oke to the Board of Directors (see press release dated March 31, 2020), the Company granted 40,000 share units pursuant to the Company's Share Unit Plan.

Qualified Person

Kevin Bullock, P. Eng., President and CEO, Anaconda Mining Inc., is a "qualified person" as such term is defined in National Instrument 43-101 and has reviewed and approved the technical information and data included in this press release.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

We seek Safe Harbor.

© 2020 Canjex Publishing Ltd. All rights reserved.

Antwort auf Beitrag Nr.: 63.334.231 von bigyawn am 15.04.20 13:22:59Im ask ordentlich.....

Antwort auf Beitrag Nr.: 63.041.095 von Ikar am 17.03.20 18:40:33Danke Ikar für Deinen Hinweis!

Ich habe ebenfalls nochmal nachgelegt.

Bitte helft mit und schaut auch bei

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten.

Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Maruf Raza. NIL

https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

404.000 supideti 03.07.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.032.900 Aktien insgesamt!

DANKE! Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE!

Hat noch jemand nachgekauft?

Bleibt gesund und haltet durch...

Ich habe ebenfalls nochmal nachgelegt.

Bitte helft mit und schaut auch bei

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten.

Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Maruf Raza. NIL

https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

404.000 supideti 03.07.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.032.900 Aktien insgesamt!

DANKE! Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE!

Hat noch jemand nachgekauft?

Bleibt gesund und haltet durch...

Antwort auf Beitrag Nr.: 63.346.699 von IQ4U am 16.04.20 13:12:15Frag mich nicht warum, aber aufgestockt

600.000

600.000

Antwort auf Beitrag Nr.: 63.347.143 von supideti am 16.04.20 13:47:32jetzt 600.000

Antwort auf Beitrag Nr.: 63.347.143 von supideti am 16.04.20 13:47:32Danke supideti!

Bitte helft mit und schaut auch unter

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten. Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Maruf Raza. NIL

https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

600.000 supideti 16.04.20

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.228.900 Aktien insgesamt! DANKE!

Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE! Hat noch jemand nachgekauft? Bleibt gesund und haltet durch...

Bitte helft mit und schaut auch unter

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten. Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Maruf Raza. NIL

https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

600.000 supideti 16.04.20

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.228.900 Aktien insgesamt! DANKE!

Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE! Hat noch jemand nachgekauft? Bleibt gesund und haltet durch...

... ich mache jetzt einmal ein ganz einfache Rechnung auf ...

... 1 Million Unzen in Goldboro (werden wahrscheinlich noch viel mehr) ...

... take-outs pro Unze ca 100 USD, keine Seltenheit, bei dem derzeitigen Goldpreis eher mehr ...

... 1 Million Unzen mal 100 = 100.000.000 geteilt durch 140.000.000 Aktien = 0,7142 USD per Aktie ...

... der Rest produzierende Mine, restliche Unzen aus den anderen Gebieten kommt dazu ...

... 0,7142 USD per Aktie = 0,6594 € per Aktie ... 🤠

... 1 Million Unzen in Goldboro (werden wahrscheinlich noch viel mehr) ...

... take-outs pro Unze ca 100 USD, keine Seltenheit, bei dem derzeitigen Goldpreis eher mehr ...

... 1 Million Unzen mal 100 = 100.000.000 geteilt durch 140.000.000 Aktien = 0,7142 USD per Aktie ...

... der Rest produzierende Mine, restliche Unzen aus den anderen Gebieten kommt dazu ...

... 0,7142 USD per Aktie = 0,6594 € per Aktie ... 🤠

Antwort auf Beitrag Nr.: 63.354.250 von Thunderbird_2 am 16.04.20 22:39:12... aber leider checkt die Anacondaaktie die hypothetische Rechnung (noch) nicht ...

... Realität entsteht aber aus den Träumen und vielleicht folgt die Praxis ja doch einmal der Theorie ...

... auf Dauer wird jede Fehlbewertung einer Aktie einmal korrigiert ...

... sonst wären es keine effizienten Märkte ...

⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄

💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲

... zu Weihnachten werden die „Langzeitinvestierten(idioten)“ hoffentlich richtig kräftig belohnt ...

... und ja auch ich (Volltrottel) halte noch 500000 Aktien ...

... und Kevin Bullock genießt mein vollstes Vertrauen ...

... in seinem Namen ist nicht umsonst der Name Bull enthalten ...

... Realität entsteht aber aus den Träumen und vielleicht folgt die Praxis ja doch einmal der Theorie ...

... auf Dauer wird jede Fehlbewertung einer Aktie einmal korrigiert ...

... sonst wären es keine effizienten Märkte ...

⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄⛄

💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲💲

... zu Weihnachten werden die „Langzeitinvestierten(idioten)“ hoffentlich richtig kräftig belohnt ...

... und ja auch ich (Volltrottel) halte noch 500000 Aktien ...

... und Kevin Bullock genießt mein vollstes Vertrauen ...

... in seinem Namen ist nicht umsonst der Name Bull enthalten ...

Antwort auf Beitrag Nr.: 63.354.250 von Thunderbird_2 am 16.04.20 22:39:12suche die Schwachstelle .........

Antwort auf Beitrag Nr.: 63.354.454 von Thunderbird_2 am 16.04.20 23:06:15Danke Thunderbird!

Bitte helft mit und schaut auch unter

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten. Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Maruf Raza. NIL

https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

500.000 Thunderbird_2 19.04.20

600.000 supideti 16.04.20

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.728.900 Aktien insgesamt!

DANKE! Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE! Hat noch jemand nachgekauft? Bleibt gesund und haltet durch...

Bitte helft mit und schaut auch unter

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten. Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Maruf Raza. NIL

https://stockhouse.com/companies/bullboard/t.anx/anaconda-mi…

500.000 Thunderbird_2 19.04.20

600.000 supideti 16.04.20

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.728.900 Aktien insgesamt!

DANKE! Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE! Hat noch jemand nachgekauft? Bleibt gesund und haltet durch...

Antwort auf Beitrag Nr.: 63.378.905 von IQ4U am 19.04.20 21:13:33keep the most unnecessary list in the world in good standing

Antwort auf Beitrag Nr.: 63.354.250 von Thunderbird_2 am 16.04.20 22:39:12Danke für Deine Auflistung und Gedanken!

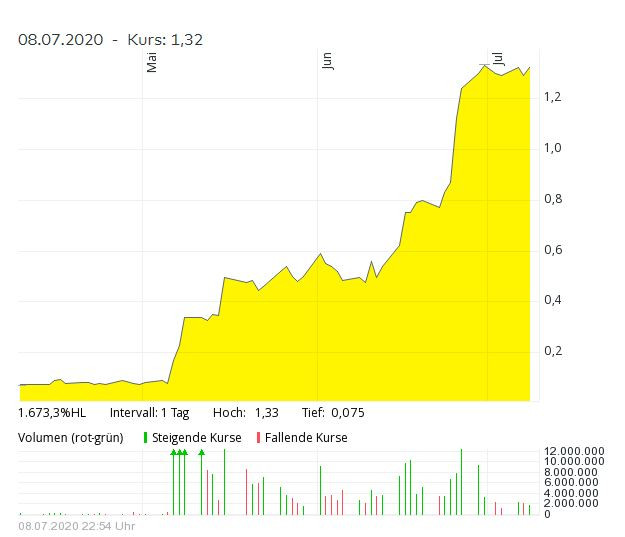

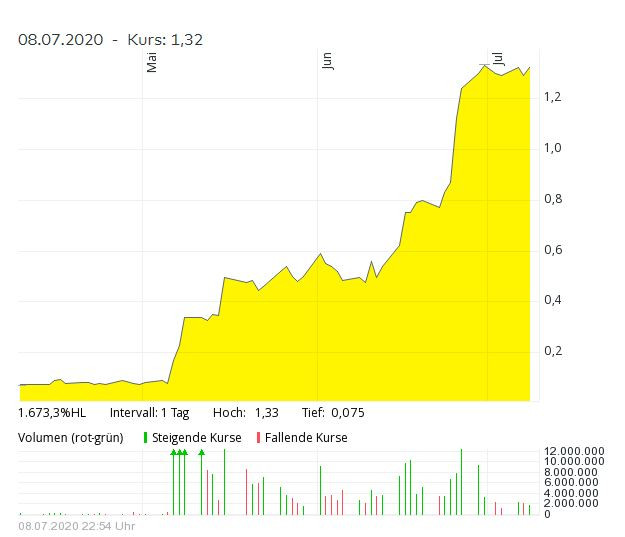

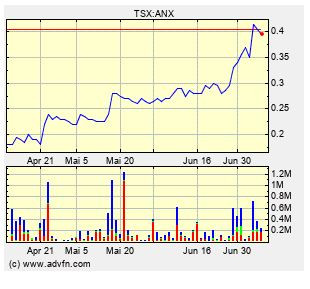

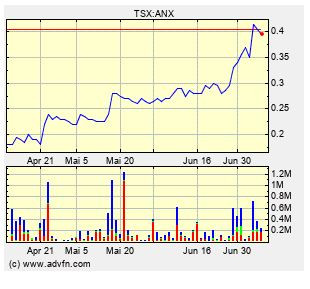

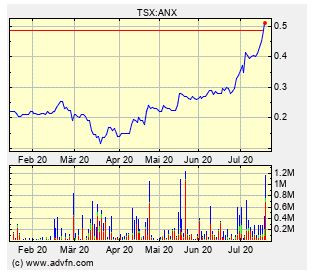

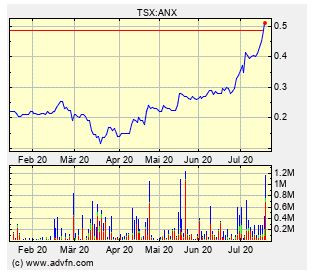

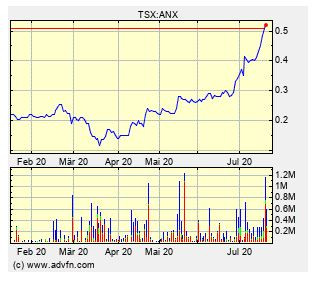

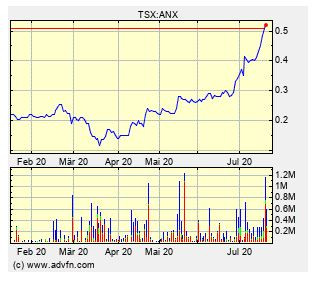

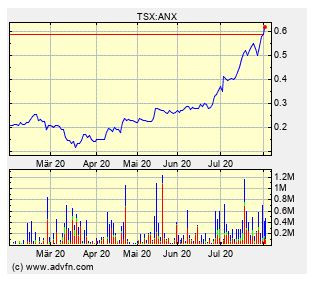

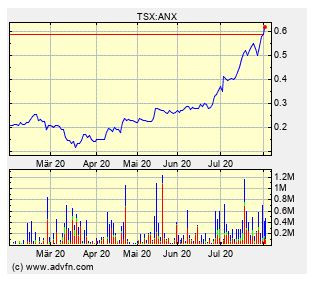

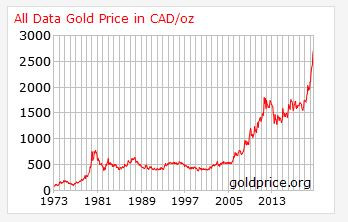

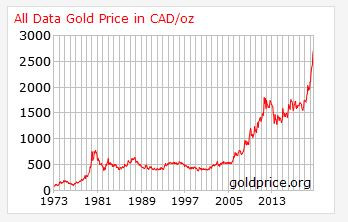

Ich kann mir nicht erklären weshalb bei diesen Aussichten der Kurs nicht längst jenseits der 0,40 CAD / 0,60 CAD ja, sogar jenseits des 1 CAD liegt. Wir haben einen Goldpreis von knapp 1700 USD.

Derzeit 2.363 CAD. Somit werden die Erträge durch den Goldunzen Verkauf von Quartal zu Quartal höher.

Dies sind die glänzende Aussichten was die Produktionserweiterung anbelangt. Es Kommt Monat für Monat mehr Geld in die Kasse. Da wird es doch Zeit für einen nachhaltigen Kursanstieg der Anaconda Aktie. Beim Crash im letzten Monat konnte man gut sehen, dass die Margin Calls gegriffen haben und unlimitierte Verkäufe getätigt wurden. Da konnte ich nicht widerstehen und habe nochmals gekauft.

Ich kann mir nicht erklären weshalb bei diesen Aussichten der Kurs nicht längst jenseits der 0,40 CAD / 0,60 CAD ja, sogar jenseits des 1 CAD liegt. Wir haben einen Goldpreis von knapp 1700 USD.

Derzeit 2.363 CAD. Somit werden die Erträge durch den Goldunzen Verkauf von Quartal zu Quartal höher.

Dies sind die glänzende Aussichten was die Produktionserweiterung anbelangt. Es Kommt Monat für Monat mehr Geld in die Kasse. Da wird es doch Zeit für einen nachhaltigen Kursanstieg der Anaconda Aktie. Beim Crash im letzten Monat konnte man gut sehen, dass die Margin Calls gegriffen haben und unlimitierte Verkäufe getätigt wurden. Da konnte ich nicht widerstehen und habe nochmals gekauft.

Zitat von Thunderbird_2: ... ich mache jetzt einmal ein ganz einfache Rechnung auf ...

... 1 Million Unzen in Goldboro (werden wahrscheinlich noch viel mehr) ...

... take-outs pro Unze ca 100 USD, keine Seltenheit, bei dem derzeitigen Goldpreis eher mehr ...

... 1 Million Unzen mal 100 = 100.000.000 geteilt durch 140.000.000 Aktien = 0,7142 USD per Aktie ...

... der Rest produzierende Mine, restliche Unzen aus den anderen Gebieten kommt dazu ...

... 0,7142 USD per Aktie = 0,6594 € per Aktie ... 🤠

Eines noch:

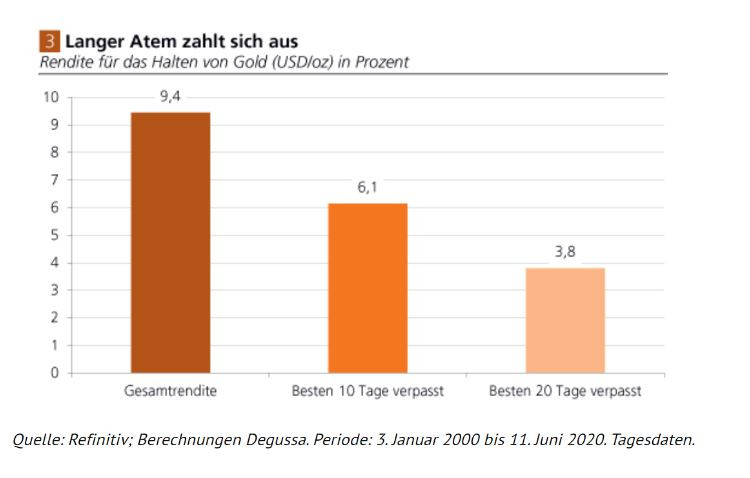

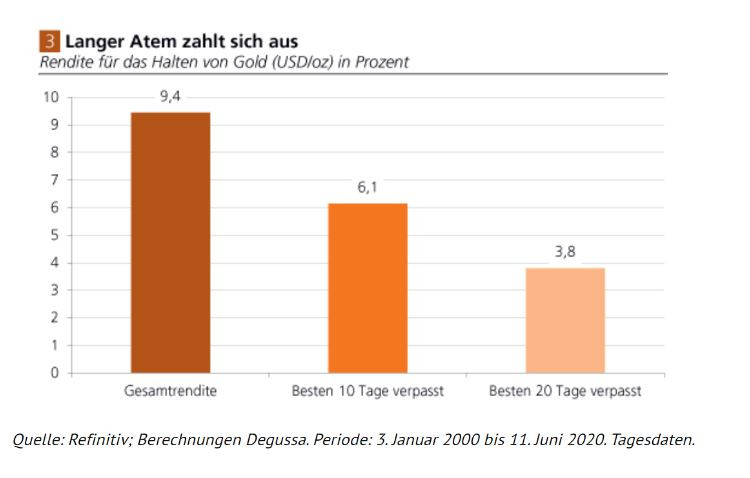

Hat jemand von Euch versucht innerhalb der letzten 4 Wochen Gold zu kaufen?

Bei 2 Banken hier vor Ort (Rot und Blau), ist nichts lieferbar derzeit.

Bei Onlineanbietern finde ich Goldunzen mit Aufschlägen von ca. 60-90 EUR pro Unze.

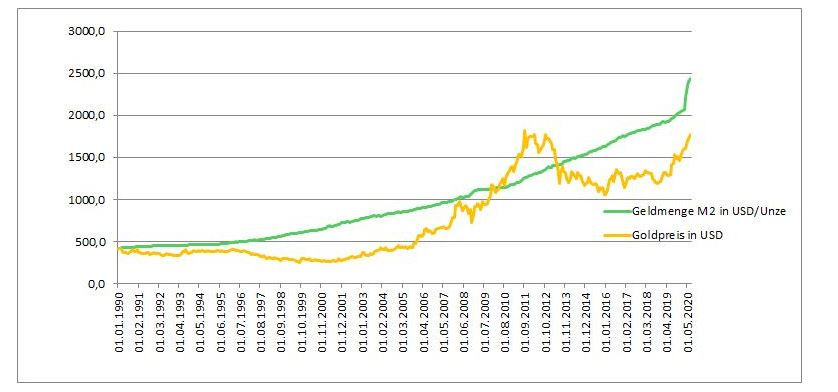

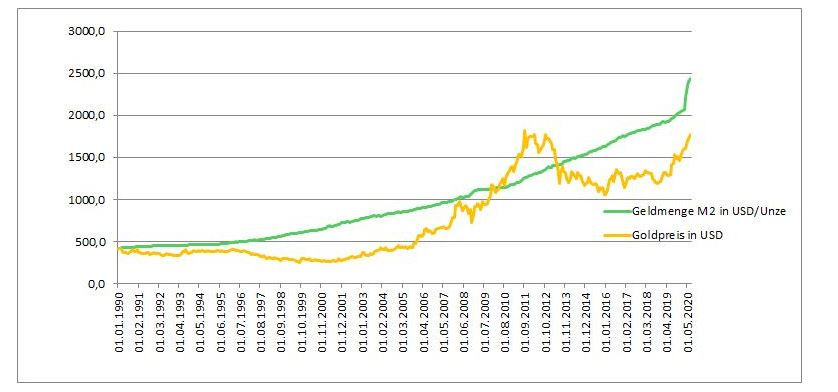

Ich gehe von einem weiter steigenden Goldpreis aus, da immer mehr Menschen einen Teil ihre ersparten Geldes von Euro auf dem Konto gegen Gold im Schliessfach eintauschen.

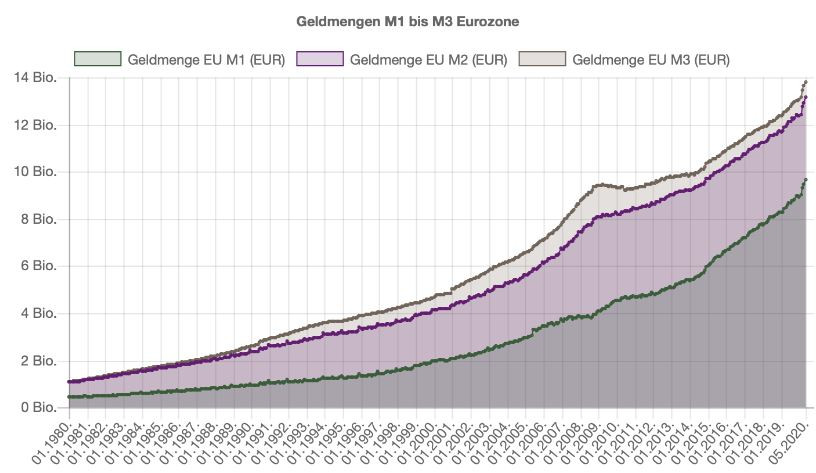

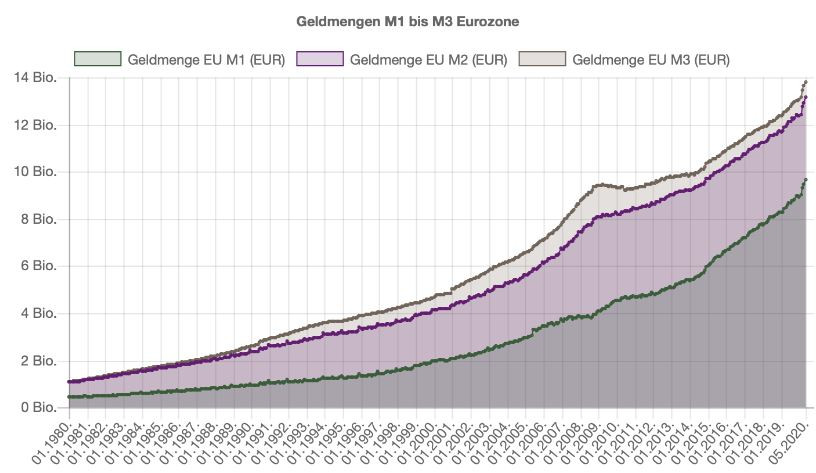

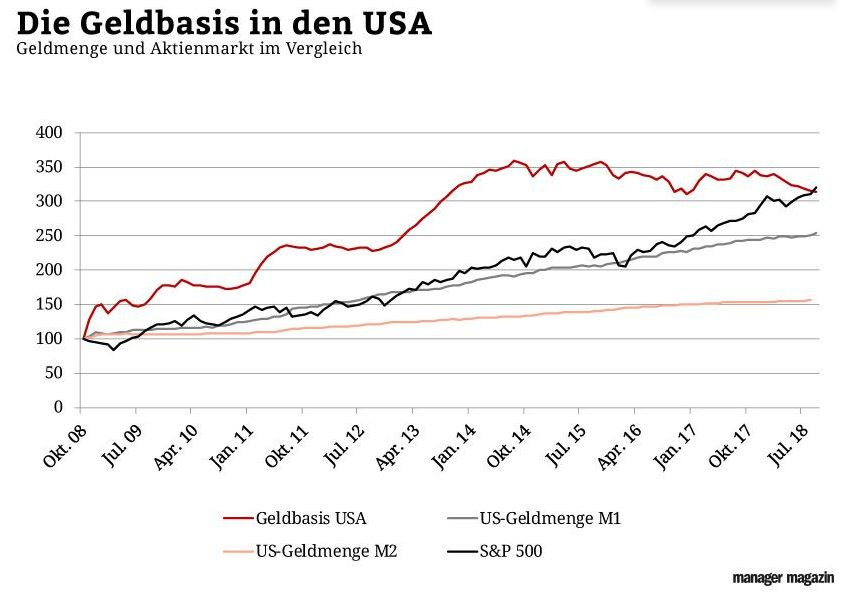

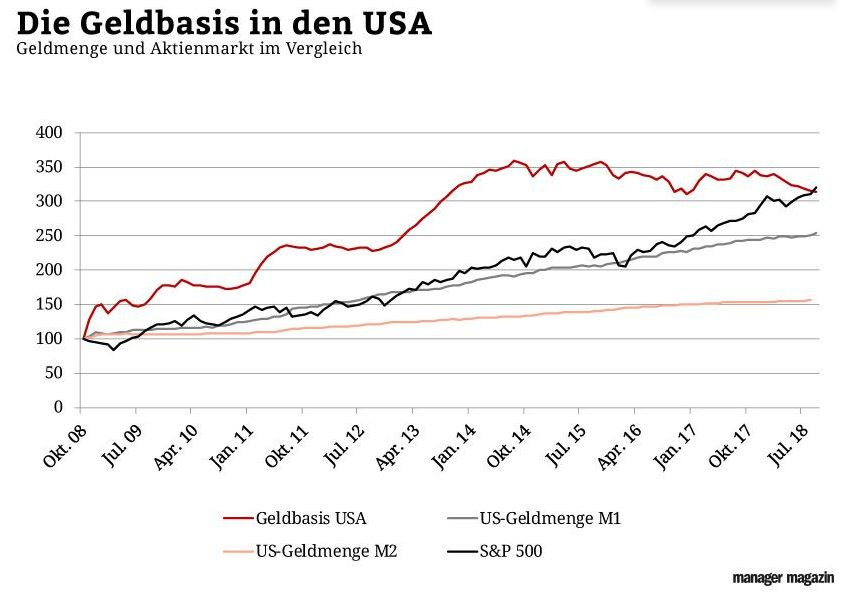

Ich denke wir stehen am Beginn einer Rezession und die enormen Geldmengen welche nun von den Staaten in die Märkte fließen dürften den Goldpreis weiter steigen lassen.

(Dies alles ist aber nur meine bescheidene Meinung und jeder sollte selbst entscheiden wo er investieren möchte.)

Also ich kann aus meinem Umfeld berichten: Unser Nachbar arbeitet bei einem Zulieferer von BMW, Daimler, Audi und VW. Die Firma steht voraussichtlich mindestens bis Ende Mai und darüber hinaus wisse man noch nicht, wann es wieder los geht. Um diesen direkten Zulieferer herum haben wir weitere kleine Betriebe welche dort als Subunternehmen zuliefern. Der Nachbar ist auf Kurzarbeit.

Unser Betrieb ist ebenfalls auf Kurzarbeit.

Bleibt gesund und haltet durch!

Hat jemand von Euch versucht innerhalb der letzten 4 Wochen Gold zu kaufen?

Bei 2 Banken hier vor Ort (Rot und Blau), ist nichts lieferbar derzeit.

Bei Onlineanbietern finde ich Goldunzen mit Aufschlägen von ca. 60-90 EUR pro Unze.

Ich gehe von einem weiter steigenden Goldpreis aus, da immer mehr Menschen einen Teil ihre ersparten Geldes von Euro auf dem Konto gegen Gold im Schliessfach eintauschen.

Ich denke wir stehen am Beginn einer Rezession und die enormen Geldmengen welche nun von den Staaten in die Märkte fließen dürften den Goldpreis weiter steigen lassen.

(Dies alles ist aber nur meine bescheidene Meinung und jeder sollte selbst entscheiden wo er investieren möchte.)

Also ich kann aus meinem Umfeld berichten: Unser Nachbar arbeitet bei einem Zulieferer von BMW, Daimler, Audi und VW. Die Firma steht voraussichtlich mindestens bis Ende Mai und darüber hinaus wisse man noch nicht, wann es wieder los geht. Um diesen direkten Zulieferer herum haben wir weitere kleine Betriebe welche dort als Subunternehmen zuliefern. Der Nachbar ist auf Kurzarbeit.

Unser Betrieb ist ebenfalls auf Kurzarbeit.

Bleibt gesund und haltet durch!

Bitte helft mit und schaut auch unter

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten.

Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Kevin Bullock 700,000

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Unternehmensführung insgesamt: 8.446.748 Aktien

500.000 Thunderbird_2 19.04.20

600.000 supideti 16.04.20

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.728.900 Aktien insgesamt! DANKE! Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE! Hat noch jemand nachgekauft? Bleibt gesund und haltet durch...

https://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten.

Wer hält wie viele Aktien und vor allem wie viel halten die Insider?

Kevin Bullock 700,000

Dustin Angelo. 780,255

Kevin Bullock NIL

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Unternehmensführung insgesamt: 8.446.748 Aktien

500.000 Thunderbird_2 19.04.20

600.000 supideti 16.04.20

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.728.900 Aktien insgesamt! DANKE! Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE! Hat noch jemand nachgekauft? Bleibt gesund und haltet durch...

Es tut gut zu sehen, dass der CEO Kevin Bullock mittlerweile 700.000 Aktien im freien Markt gekauft hat seit letztem Jahr.

Antwort auf Beitrag Nr.: 63.397.037 von IQ4U am 21.04.20 11:17:52Ihr habt sie ihm bezahlt. Total überhöhte Gehälter für die Performance . Bei 15 kaufen - bei 20 verkaufen .

Inoffizielle Anaconda Aktionärsliste

Bitte helft mit und schaut auch unterhttps://www.canadianinsider.com/node/7?menu_tickersearch=anx

nach, um die Liste möglichst aktuell zu halten.

Wer hält wie viele Aktien und vor allem wie viele halten die Insider?

Kevin Bullock 700,000

Dustin Angelo 780,255

Michael Byron NIL

Jonathan Fitzgerald 127,500

Lewis Lawrick. 2,088,156

Jacques 4,750,837

Unternehmensführung insgesamt: 8.446.748 Aktien

DoumDiDoum 21.04.20 (Stockhouse)

500.000 Thunderbird_2 19.04.20

600.000 supideti 16.04.20

120.000 Ikar 16.04.20

1.050.000 IQ4U 16.04.20

70.500 Aussie0203 24.09.19

68.400 mynameDDD 03.07.19 (stockhouse)

125.000 gpsairgoldteam 04.07.19 (stockhouse)

18.000 AngloSaxonMan 04.07.19 (stockhouse)

1.215.000 rpm111 09.07.19 (stockhouse)

2.962.000 Benji 2000 10.07.19 (stockhouse)

6.783.900 Aktien insgesamt! (ohne Unternehmensführung)

DANKE! Bitte helft mir diese Tabelle aktuell und möglichst richtig zu halten. DANKE! Hat noch jemand nachgekauft? Bleibt gesund und haltet durch...

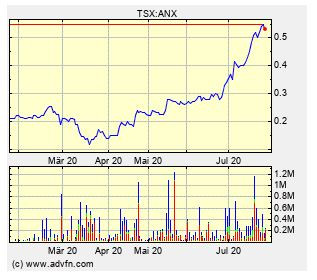

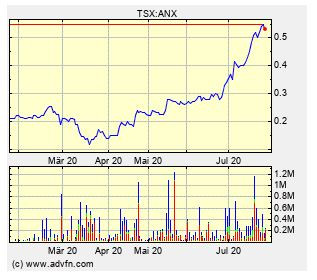

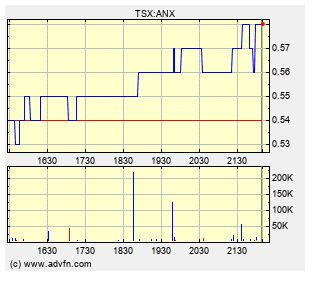

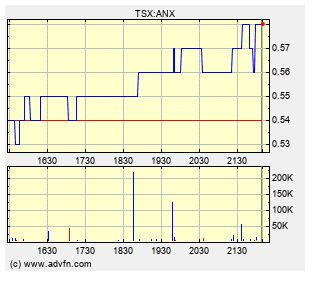

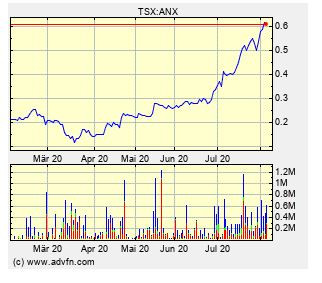

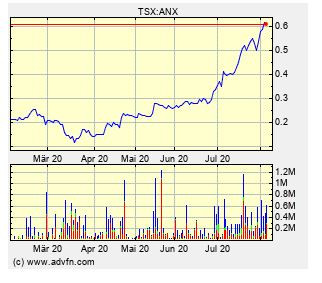

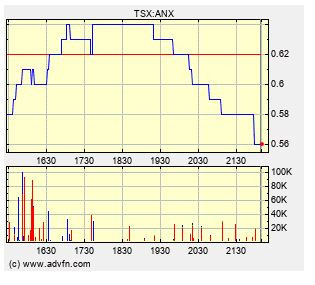

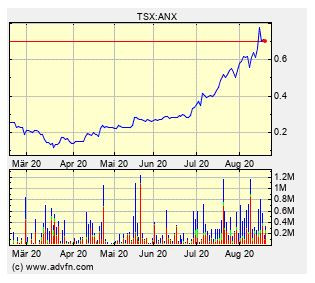

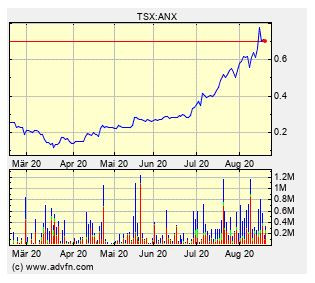

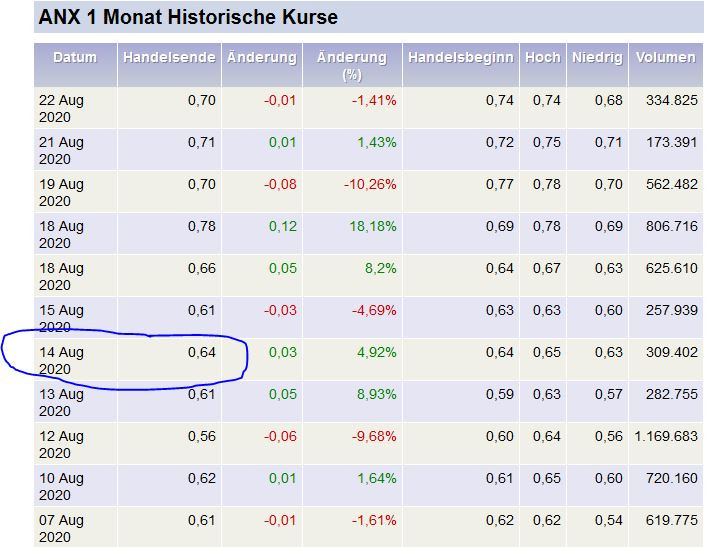

Ich meine der Tiefstkurs war am 18.03.2020 mit 0,115 CAD.

Die Verkäufe in den letzten Tagen scheinen für mich kurzfristige Spekulanten welche hier im letzten Monat einen billigen Schnapp gemacht haben und nun mit ordentlich Gewinn versilbern zu Kursen seit jenseits der 0,16 CAD.

Insofern könnte es jetzt weiter nordwärts gehen zusätzlich unterstützt mit durch den Goldpreis.

Die Verkäufe in den letzten Tagen scheinen für mich kurzfristige Spekulanten welche hier im letzten Monat einen billigen Schnapp gemacht haben und nun mit ordentlich Gewinn versilbern zu Kursen seit jenseits der 0,16 CAD.

Insofern könnte es jetzt weiter nordwärts gehen zusätzlich unterstützt mit durch den Goldpreis.

Die Bank of Amerika erwartet einen Goldpreis in Höhe von 3.000 USD innerhalb der nächsten 18 Monate wegen der derzeitigen Geldflut!

Gold to Reach $3,000—50% Above Its Record, Bank of America Says Elena Mazneva Bookmark April 21 2020, 4:33 PM April 22 2020, 3:38 AM (Bloomberg) -- Bank of America Corp. raised its 18-month gold-price target to $3,000 an ounce -- more than 50% above the existing price record -- in a report titled “The Fed can’t print gold.” The bank increased its target from $2,000 previously, as

Quelle:

https://www.bloombergquint.com/business/bofa-raises-gold-tar…

Gold to Reach $3,000—50% Above Its Record, Bank of America Says Elena Mazneva Bookmark April 21 2020, 4:33 PM April 22 2020, 3:38 AM (Bloomberg) -- Bank of America Corp. raised its 18-month gold-price target to $3,000 an ounce -- more than 50% above the existing price record -- in a report titled “The Fed can’t print gold.” The bank increased its target from $2,000 previously, as

Quelle:

https://www.bloombergquint.com/business/bofa-raises-gold-tar…

Schweizer Goldexporte mit Richtungsänderung

Die Schweiz, das Fieberthermometer des Goldes

Die Goldimporte und -exporte der Schweiz sind ein interessanter Indikator für weltweite Trends bei physischem Gold. Denn in den Alpen werden rund zwei Drittel der weltweiten Goldförderung verarbeitet. Seit Jahren kam das Gold tendenziell aus Großbritannien in die Schweiz, hinzu kamen Staaten Südamerikas, Thailand und die UAE. Nach dem Umschmelzen ging es dann in kleineren Barren in Richtung Asien auf die Reise – China, Indien und Hongkong waren bevorzugte Zielländer.

Nun hat die Eidgenössische Zollverwaltung die Importe und Exporte von Gold für den Monat März 2020 veröffentlicht. Danach haben sich die Exporte des gelben Metalls aus der Schweiz im vergangenen Monat auf 96,1 Tonnen mehr verdoppelt. Dies entspricht einem Wert von 4,68 Mrd. Schweizer Franken bzw. 4,44 Mrd. Euro.

Importiert wurde im März das meiste Gold erneut aus Großbritannien, nämlich 28,2 Tonnen, gefolgt von Argentinien mit 21,8 Tonnen, Chile mit 16,3 Tonnen und den UAE mit 14,4 Tonnen.

Exportiert wurde das meiste Gold aus der Schweiz aber diesmal mit großem Abstand in die USA, welche 43,2 Tonnen importierten. Es folgten Deutschland mit einem Bruttoimport von 16,9 Tonnen, wobei von Deutschland auch 5,4 Tonnen in die Schweiz geliefert wurden. An dritter Stelle stand die Türkei mit einem Import von 11,9 Tonnen, an vierter Stelle folgte Großbritannien mit Bruttoimporten von 6,8 Tonnen, was Nettoexporte von 21,4 Tonnen ergibt. Es folgte schließlich Indien mit Goldimporten von 6,6 Tonnen...

Quelle: https://www.berneckerresearch.de/Schweizer-Goldaussenhandel-…

Die Schweiz, das Fieberthermometer des Goldes

Die Goldimporte und -exporte der Schweiz sind ein interessanter Indikator für weltweite Trends bei physischem Gold. Denn in den Alpen werden rund zwei Drittel der weltweiten Goldförderung verarbeitet. Seit Jahren kam das Gold tendenziell aus Großbritannien in die Schweiz, hinzu kamen Staaten Südamerikas, Thailand und die UAE. Nach dem Umschmelzen ging es dann in kleineren Barren in Richtung Asien auf die Reise – China, Indien und Hongkong waren bevorzugte Zielländer.

Nun hat die Eidgenössische Zollverwaltung die Importe und Exporte von Gold für den Monat März 2020 veröffentlicht. Danach haben sich die Exporte des gelben Metalls aus der Schweiz im vergangenen Monat auf 96,1 Tonnen mehr verdoppelt. Dies entspricht einem Wert von 4,68 Mrd. Schweizer Franken bzw. 4,44 Mrd. Euro.

Importiert wurde im März das meiste Gold erneut aus Großbritannien, nämlich 28,2 Tonnen, gefolgt von Argentinien mit 21,8 Tonnen, Chile mit 16,3 Tonnen und den UAE mit 14,4 Tonnen.

Exportiert wurde das meiste Gold aus der Schweiz aber diesmal mit großem Abstand in die USA, welche 43,2 Tonnen importierten. Es folgten Deutschland mit einem Bruttoimport von 16,9 Tonnen, wobei von Deutschland auch 5,4 Tonnen in die Schweiz geliefert wurden. An dritter Stelle stand die Türkei mit einem Import von 11,9 Tonnen, an vierter Stelle folgte Großbritannien mit Bruttoimporten von 6,8 Tonnen, was Nettoexporte von 21,4 Tonnen ergibt. Es folgte schließlich Indien mit Goldimporten von 6,6 Tonnen...

Quelle: https://www.berneckerresearch.de/Schweizer-Goldaussenhandel-…

Antwort auf Beitrag Nr.: 63.403.565 von stephansdom am 21.04.20 18:31:41Ja, das sehe ich genauso.

Aber leider sind die Gehälter der Managements wohl bei den meisten an der Börse gelisteten Unternehmen überzogen.

Aber leider sind die Gehälter der Managements wohl bei den meisten an der Börse gelisteten Unternehmen überzogen.

Antwort auf Beitrag Nr.: 63.412.940 von IQ4U am 22.04.20 13:31:24Ich kenne keine Firma in diesen Bereich, die weniger bezahlt

Allerdings gibt es Minen/Explorer wo das Management keine Aktien kauft

Diese Variante ist mir lieber

Und wenn der bullock jetzt noch goldboro finanziert ohne Verwässerung dann bin ich restlos glücklich

Allerdings gibt es Minen/Explorer wo das Management keine Aktien kauft

Diese Variante ist mir lieber

Und wenn der bullock jetzt noch goldboro finanziert ohne Verwässerung dann bin ich restlos glücklich

Antwort auf Beitrag Nr.: 63.413.129 von supideti am 22.04.20 13:43:07so du kennst keine small caps die unter 600.000 zahlen???

Wieviele kennst du?

Wieviele kennst du?

Ask sieht im Moment wieder etwas besser aus.

Antwort auf Beitrag Nr.: 63.413.258 von stephansdom am 22.04.20 13:51:33Hast Du Einblick in Level2?

Ich wurde selbst ungeduldig was die Feasibility Studie für Goldboro anbelangt.

Mittlerweile muß ich sagen, dass ich es als Glücksfall sehe, dass diese noch nicht veröffentlicht wurde.

Mir ist jeder Monat später lieber, da wir tendentiell einen immer höheren Goldpreis haben von Monat zu Monat. Selbst wenn es noch einmal zu eine Folgecrash der Börsen käme und Gold bedingt durch Margin Calls noch einmal einsacken würde sollte dies doch sehr kurzfristig sein, ähnlich wie 2008/2009.

Ich hoffe insgeheim, dass Anaconda jeden Monat einen höheren Cashbestand hat und durch diesen bedingt zusammen mit dem Goldpreis letztlich Goldboro ohne weitere Verwässerung umsetzen kann.

Mittlerweile muß ich sagen, dass ich es als Glücksfall sehe, dass diese noch nicht veröffentlicht wurde.

Mir ist jeder Monat später lieber, da wir tendentiell einen immer höheren Goldpreis haben von Monat zu Monat. Selbst wenn es noch einmal zu eine Folgecrash der Börsen käme und Gold bedingt durch Margin Calls noch einmal einsacken würde sollte dies doch sehr kurzfristig sein, ähnlich wie 2008/2009.

Ich hoffe insgeheim, dass Anaconda jeden Monat einen höheren Cashbestand hat und durch diesen bedingt zusammen mit dem Goldpreis letztlich Goldboro ohne weitere Verwässerung umsetzen kann.

Habt Ihr Euch mal in Eurem Umfeld umgehört wer derzeit alles Goldmünzen und Barren kaufen möchte.

Die Alternative wäre natürlich, dass man den Gegenwert der eigenen Anaconda Aktien in Goldunzen "umtauscht".

Dies wäre dann die sicherste Variante, egal, ob der Goldpreis noch einmal abtaucht oder nicht.

Aber bei dieser Variante ist der Gewinn auf maximal ca. 100% limitiert.

Ich selbst spekuliere aber lieber auf meinen 10-20 Bagger hier mit Anaconda.

Dies bedingt durch die geplante 100.000 bis 150.000 Goldunzen Produktion pro Jahr.

Viel Erfolg allen investierten!

Die Alternative wäre natürlich, dass man den Gegenwert der eigenen Anaconda Aktien in Goldunzen "umtauscht".

Dies wäre dann die sicherste Variante, egal, ob der Goldpreis noch einmal abtaucht oder nicht.

Aber bei dieser Variante ist der Gewinn auf maximal ca. 100% limitiert.

Ich selbst spekuliere aber lieber auf meinen 10-20 Bagger hier mit Anaconda.

Dies bedingt durch die geplante 100.000 bis 150.000 Goldunzen Produktion pro Jahr.

Viel Erfolg allen investierten!

Antwort auf Beitrag Nr.: 63.413.204 von stephansdom am 22.04.20 13:48:501. mirwegen deutlich weniger

2. einige

2. einige

Es wäre jetzt schön, wenn die 0,22 CAD erklommen würden. 🤠

Antwort auf Beitrag Nr.: 63.413.258 von stephansdom am 22.04.20 13:51:33Siehst Du das Ask bis zu den 0,30 CAD?

Zitat von stephansdom: Ask sieht im Moment wieder etwas besser aus.

Anaconda benötigt etwas mehr Bekanntheit, dann dürfte das Interesse auch deutlich steigen. 😁

Schöne Kursentwicklung heute von Gold und von Anaconda:

Wenn wir Glück haben kennt der Goldpreis tatsächlich nur noch eine Richtung und dann wird auch unsere Schlange sich nicht mehr entziehen können auf neue Höhen zu steigen. 📈

Die Ölpreisentwicklung unterstreicht eindeutig wie es um die Weltwirtschaft steht, auch wenn der DOW und DAX dies noch nicht eindeutig eingepreist haben.

Ich hoffe, daß wir nun richtig Spaß haben werden mit unserer Schlange...

Also die 0,30 / 0,40 und 0,50 CAD haben wir längst verdient dafür, dass jetzt richtig Geld verdient wird.

Ich hoffe, daß wir nun richtig Spaß haben werden mit unserer Schlange...

Also die 0,30 / 0,40 und 0,50 CAD haben wir längst verdient dafür, dass jetzt richtig Geld verdient wird.

Antwort auf Beitrag Nr.: 63.417.992 von IQ4U am 22.04.20 19:03:07du denkst also die Weltwirtschaft und das Finanzsystem haben nichts mit "Gold" zu tun. Wird ein böses Erwachen geben.

Antwort auf Beitrag Nr.: 63.418.028 von stephansdom am 22.04.20 19:06:38Ich denke, dass die Zentralbanken nicht umsonst so massiv Gold gekauft haben wie es in den letzten Jahren der Fall war.

Außerdem weiß ich, dass es mehr Menschen gibt mit viel Geld auf dem Konto als man so annimmt.

Hier werden in letzter Zeit ebenfalls viele Unzen gekauft sofern überhaupt verfügbar.

Zusätzlich werden seit 2008 die Märkte mit schier unendlicher Menge an Geld geflutet.

Deshalb der Run in das gelbe Edelmetall.

Außerdem weiß ich, dass es mehr Menschen gibt mit viel Geld auf dem Konto als man so annimmt.

Hier werden in letzter Zeit ebenfalls viele Unzen gekauft sofern überhaupt verfügbar.

Zusätzlich werden seit 2008 die Märkte mit schier unendlicher Menge an Geld geflutet.

Deshalb der Run in das gelbe Edelmetall.

Antwort auf Beitrag Nr.: 63.418.139 von IQ4U am 22.04.20 19:13:35es gibt keinen Run - wir sind bei 1700.......

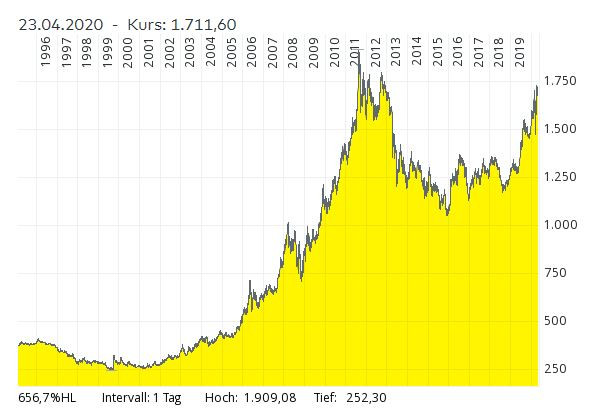

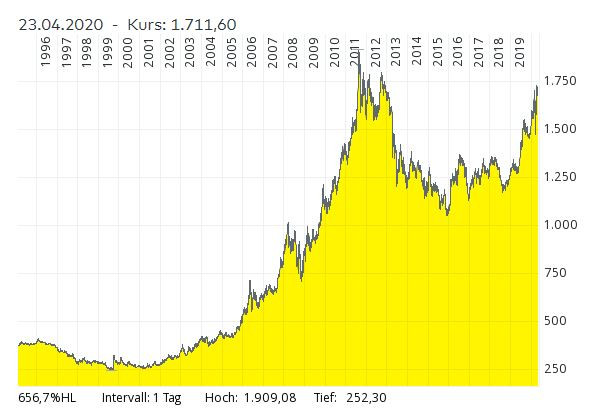

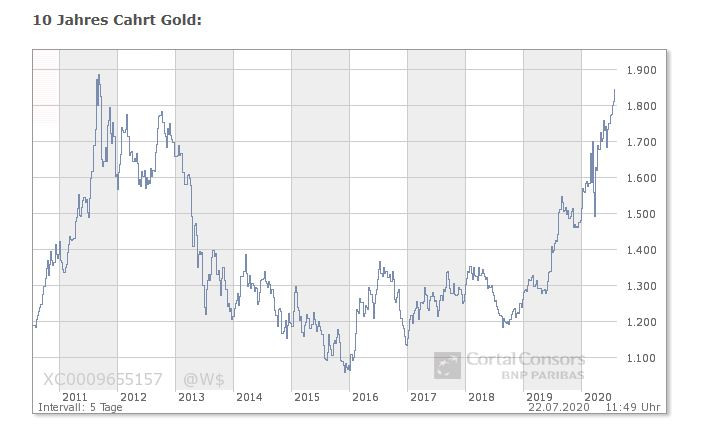

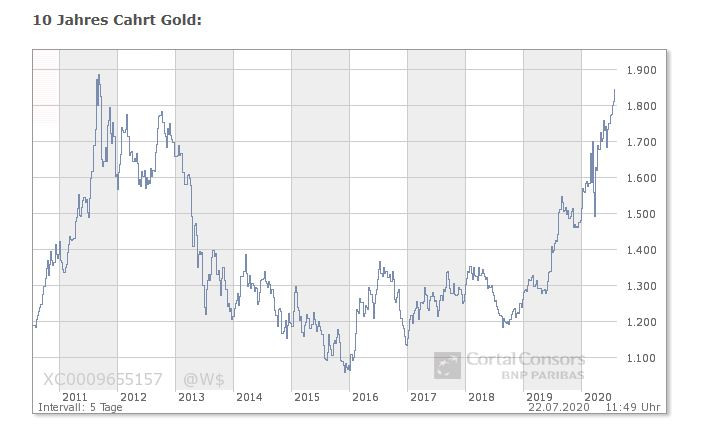

Antwort auf Beitrag Nr.: 63.419.276 von stephansdom am 22.04.20 20:38:54Wie, es gibt keinen Run???

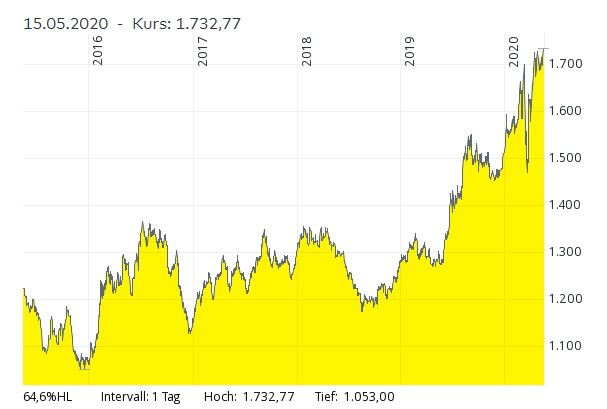

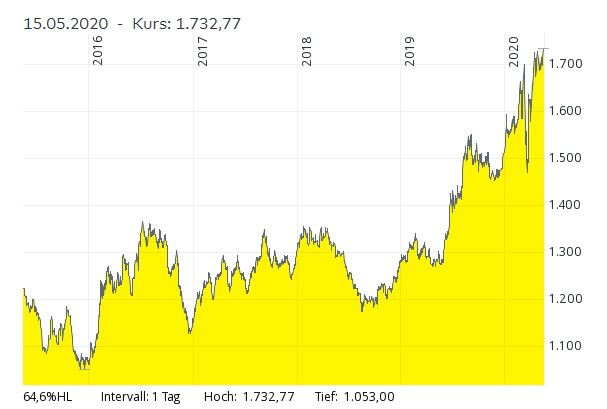

Na wenn das mal kein Run auf Gold ist von 1.053 auf 1.715, dann weiß ich ja auch nicht was ein Run ist...

Na wenn das mal kein Run auf Gold ist von 1.053 auf 1.715, dann weiß ich ja auch nicht was ein Run ist...

Antwort auf Beitrag Nr.: 63.421.019 von IQ4U am 22.04.20 22:50:20Es gab vor allem auch einen Run auf physisches Gold was dann auch aufgrund der Schließung der schmelzen in der Schweiz zu diesen irrsinnigen spread führte

Generell wurde deutlich mehr verkauft

Interessant wird es wie es dann nach funktionieren der Lieferketten wieder ausschaut

Bleibt es bei diesem extrem hohen Umsatz

Generell wurde deutlich mehr verkauft

Interessant wird es wie es dann nach funktionieren der Lieferketten wieder ausschaut

Bleibt es bei diesem extrem hohen Umsatz

Antwort auf Beitrag Nr.: 63.423.272 von supideti am 23.04.20 08:46:11Mich interessiert der physische Markt mehr

Super wäre wenn die Minen, schmelzen und mint‘s nicht hinterher kommen würden

Super wäre wenn die Minen, schmelzen und mint‘s nicht hinterher kommen würden

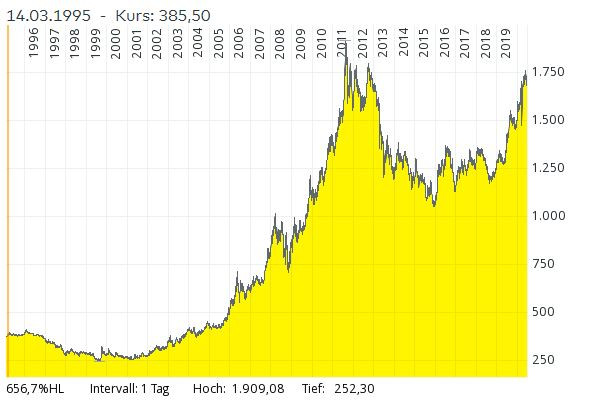

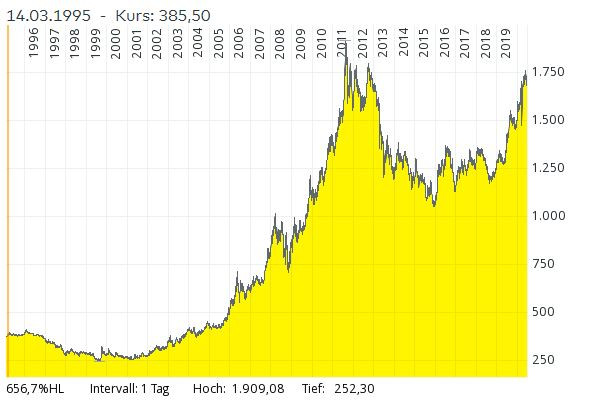

Antwort auf Beitrag Nr.: 63.421.019 von IQ4U am 22.04.20 22:50:20Und wie sieht es mit dem 10 Jahres Chart aus??? Du taugst zum Politiker😜

Antwort auf Beitrag Nr.: 63.427.595 von stephansdom am 23.04.20 13:10:27Man kann immer einen Zeitraum wählen, den man möchte, man kann auch den 20 Jahreschart nehmen....

Aber alles vom ATH in $ zu betrachten ist auch nicht gerade objektiv

In anderen Währungen haben wir bereits ATH

Aber alles vom ATH in $ zu betrachten ist auch nicht gerade objektiv

In anderen Währungen haben wir bereits ATH

Antwort auf Beitrag Nr.: 63.427.595 von stephansdom am 23.04.20 13:10:27Klar, man kann den Zeitraum wählen, den man möchte.

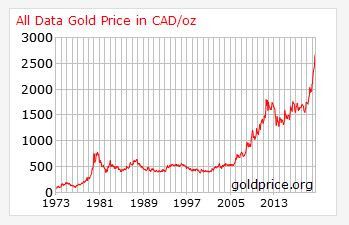

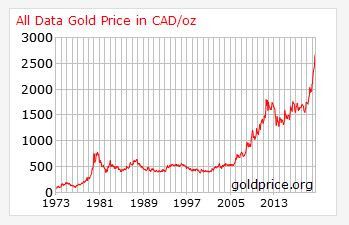

In Euro und in Kanadischen Dollar sind wir bereits auf neuem ATH.

In Euro und in Kanadischen Dollar sind wir bereits auf neuem ATH.

Antwort auf Beitrag Nr.: 63.427.595 von stephansdom am 23.04.20 13:10:27Wenn ich von Anaconda nicht überzeugt wäre würde ich meine Aktien verkaufen und nicht weiter zukaufen.

So ist das halt.

So ist das halt.

Antwort auf Beitrag Nr.: 63.423.344 von supideti am 23.04.20 08:51:05Ich denke mit Immobilien und Gold in physischer Form kann man sich am besten absichern.

Und zusätzlich erwarte ich bei den Goldminen die größtmöglichen Gewinnchancen auf die nächsten 1-2 Jahre gesehen. Je größer die Produktionssteigerung prozentual gesehen erfolgen wird, um so größer sollte auch der prozentuale Gewinn im Aktienkurs ab jetzt sein. (Nur meine bescheidene Meinung und keine Handlungsempfehlung!)

Und zusätzlich erwarte ich bei den Goldminen die größtmöglichen Gewinnchancen auf die nächsten 1-2 Jahre gesehen. Je größer die Produktionssteigerung prozentual gesehen erfolgen wird, um so größer sollte auch der prozentuale Gewinn im Aktienkurs ab jetzt sein. (Nur meine bescheidene Meinung und keine Handlungsempfehlung!)

Anaconda Mining Provides Update on the Goldboro Gold Project

TORONTO, ON / ACCESSWIRE / April 23, 2020 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to provide an update on its 100%-owned Goldboro Gold Project ("Goldboro" or the "Project") located in Nova Scotia, Canada. Given the revised permitting timelines for the Project as discussed below, as well as COVID-19 related delays, the Company has initiated optimization work on the Project based on opportunities identified as part of work undertaken in connection with the preparation of a Feasibility Study, including a robust drill program designed to upgrade certain Inferred Mineral Resources into Indicated Mineral Resources.

Key Takeaways

The Company has determined, in consultation with government regulatory agencies, that further baseline studies, including water monitoring, and predictive work will be required to support a Provincial Environmental Assessment Registration Document ("EARD"). In addition, further work is required with respect to the tailings pond placement due to evolving Federal regulatory requirements at the regional level, which is expected to extend the permitting timeline into the second half of 2021.

GHD, a leading environmental engineering firm that brings expertise and experience in mine permitting in Nova Scotia, is leading the permitting process for the Project and is overseeing data collection activities with McCallum Environmental Ltd. ("MEL") to support the EARD and the subsequent Industrial Approval Application.

The revised permitting timelines provide a timely opportunity to concurrently optimize the Project; preliminary mine planning work has identified significant areas of Inferred Mineral Resources proximal to planned development which, if converted, could add a significant amount of value to the Project.

In an effort to maximize shareholder value, Anaconda is initiating a 5,500-metre diamond drill program at Goldboro to convert and add Mineral Resources to the Feasibility Study, potentially extending the mine life and improving various economic parameters of the Project. The diamond drill program will be funded from existing flow-through funds.

Nordmin Engineering Inc., who brings significant experience with narrow-vein underground mining, has been engaged to optimize the mine plan and finalize the Feasibility Study, which is now expected to be completed in the fourth quarter of 2020.

"The revised permitting timeline has provided the Company a timely opportunity to optimize the Goldboro Gold Project, as it has identified many opportunities to increase the net present value of the Project. In particular, we are excited to initiate a robust 5,500-metre diamond drill program, which has the potential to further improve the Project's economics and extend mine life. We look forward to announcing the results in the third quarter of 2020. As we work to submit an updated Environmental Assessment and optimize the Project, Anaconda continues to engage with all of our community stakeholders and rightsholders including ongoing engagement with Nova Scotia Mi'kmaq, as the Company continues to progress Goldboro towards a development decision."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Permitting Process Update

During the first quarter of 2020, in light of feedback from Nova Scotia Environment and recent Anaconda personnel changes, a detailed review of all permitting activity to date was undertaken to identify further work required to support the filing of an EARD. As a result, it was determined that additional data collection and predictive work would be required. GHD is now leading the permitting activities for the Project and is overseeing the water monitoring program and other work to support the EARD and the subsequent Industrial Approval Application (GHD was involved in the permitting of the Moose River Consolidated Project in Nova Scotia and is involved with MEL with ongoing projects and permitting by St Barbara Limited in Nova Scotia).

Furthermore, there are evolving Federal regulatory requirements at the regional level with respect to waterways and the potential location of any mine waste (including tailings facilities), which the Company anticipates will require further assessment and predictive work and extend the permitting timelines. The Company expects to file the updated EARD in the third quarter of 2020 and as a result, based on the aforementioned matters, expects to receive required permits (including release from the Environmental Assessment, the Industrial Approval, and Mining Lease) in the second half of 2021.

Feasibility Study Update and Mineral Resources Conversion Drill Program

The revised permitting timeline has provided the Company a strong opportunity to optimize the Project, as it has identified many opportunities to increase the net present value of the Project based on initial results and feedback arising from the work undertaken to date in connection with the Feasibility Study. The Company has now engaged Nordmin Engineering Inc., replacing the previous consultants on the Study, to evaluate these opportunities and complete the Feasibility Study. Nordmin is well placed for this optimization work as they bring significant experience with narrow-vein underground mining. The Company continues to work with Ausenco Solutions Canada Inc. ("Ausenco"), who led and completed the process optimization and mill design for the Study (Ausenco was involved in the engineering and construction of Atlantic Gold Corporation's mill at the Moose River Consolidated Project in Nova Scotia).

Furthermore, Anaconda is initiating an approximately 5,500-metre diamond drill program at Goldboro with the aim of converting Inferred Mineral Resources proximal to planned development into Indicated Mineral Resources. Based on conversion rates observed to date in over 27,000 metres of drilling, the Company believes the drill program has the potential to add significant value by possibly extending the life of mine and improving the Project's economics. The diamond drill program will be funded from existing flow-through funds.

The Company has commenced activities required to permit the drill program, and critically consider logistical matters given the ongoing COVID-19 pandemic, to ensure that any drill programs are executed in a way that ensures the absolute health and safety of our personnel, contractors, and the communities where we operate.

Anaconda is now targeting to complete the Feasibility Study on the Project by the fourth quarter of 2020.

Qualified Person

Kevin Bullock, P. Eng., President and Chief Executive Officer, and Paul McNeill, P. Geo., VP Exploration, each with Anaconda Mining Inc., are "qualified person" as such term is defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects and have reviewed and approved the scientific and technical information and data included in this news release.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past-producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource, and the subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation, including the timing of permitting, filing of the EARD and the completion of the Feasibility Study. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, development and production, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, risks related to the COVID-19 pandemic, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2019, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Kevin Bullock

President and CEO

(647) 388-1842

kbullock@anacondamining.com

Anaconda Mining Inc

Lynn Hammond

VP, Corporate Affairs

(709) 330-1260

lhammond@anacondamining.com

Reseau ProMarket Inc.

Dany Cenac Robert

Investor Relations

(514) 722-2276 x456

Dany.Cenac-Robert@ReseauProMarket.com

SOURCE: Anaconda Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/586417/Anaconda-Mining-Provides-U…

Quelle: https://www.canadianinsider.com/anaconda-mining-provides-upd…

TORONTO, ON / ACCESSWIRE / April 23, 2020 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to provide an update on its 100%-owned Goldboro Gold Project ("Goldboro" or the "Project") located in Nova Scotia, Canada. Given the revised permitting timelines for the Project as discussed below, as well as COVID-19 related delays, the Company has initiated optimization work on the Project based on opportunities identified as part of work undertaken in connection with the preparation of a Feasibility Study, including a robust drill program designed to upgrade certain Inferred Mineral Resources into Indicated Mineral Resources.

Key Takeaways

The Company has determined, in consultation with government regulatory agencies, that further baseline studies, including water monitoring, and predictive work will be required to support a Provincial Environmental Assessment Registration Document ("EARD"). In addition, further work is required with respect to the tailings pond placement due to evolving Federal regulatory requirements at the regional level, which is expected to extend the permitting timeline into the second half of 2021.

GHD, a leading environmental engineering firm that brings expertise and experience in mine permitting in Nova Scotia, is leading the permitting process for the Project and is overseeing data collection activities with McCallum Environmental Ltd. ("MEL") to support the EARD and the subsequent Industrial Approval Application.

The revised permitting timelines provide a timely opportunity to concurrently optimize the Project; preliminary mine planning work has identified significant areas of Inferred Mineral Resources proximal to planned development which, if converted, could add a significant amount of value to the Project.

In an effort to maximize shareholder value, Anaconda is initiating a 5,500-metre diamond drill program at Goldboro to convert and add Mineral Resources to the Feasibility Study, potentially extending the mine life and improving various economic parameters of the Project. The diamond drill program will be funded from existing flow-through funds.

Nordmin Engineering Inc., who brings significant experience with narrow-vein underground mining, has been engaged to optimize the mine plan and finalize the Feasibility Study, which is now expected to be completed in the fourth quarter of 2020.

"The revised permitting timeline has provided the Company a timely opportunity to optimize the Goldboro Gold Project, as it has identified many opportunities to increase the net present value of the Project. In particular, we are excited to initiate a robust 5,500-metre diamond drill program, which has the potential to further improve the Project's economics and extend mine life. We look forward to announcing the results in the third quarter of 2020. As we work to submit an updated Environmental Assessment and optimize the Project, Anaconda continues to engage with all of our community stakeholders and rightsholders including ongoing engagement with Nova Scotia Mi'kmaq, as the Company continues to progress Goldboro towards a development decision."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Permitting Process Update

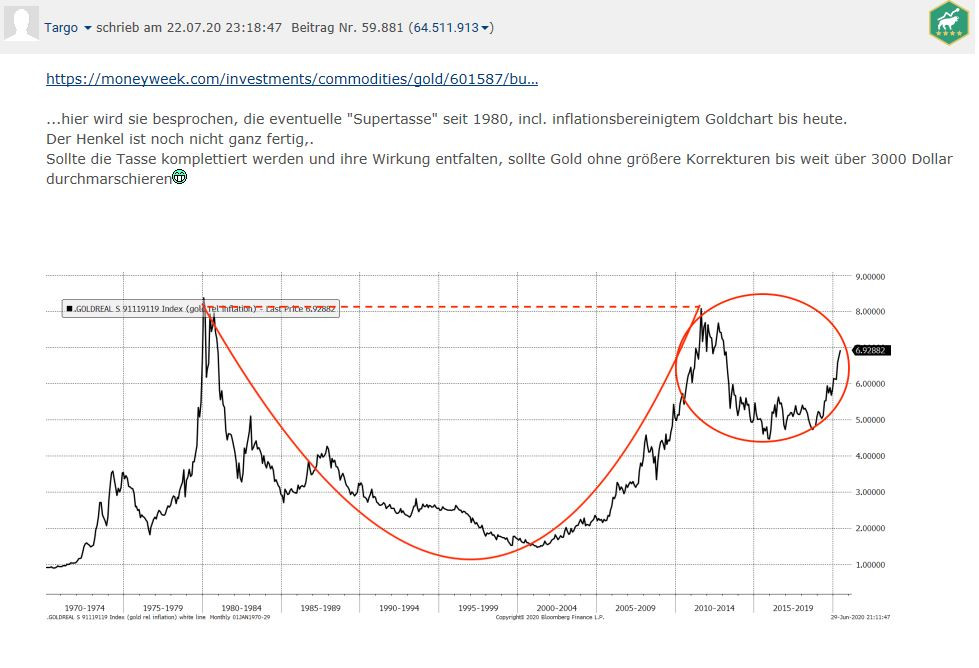

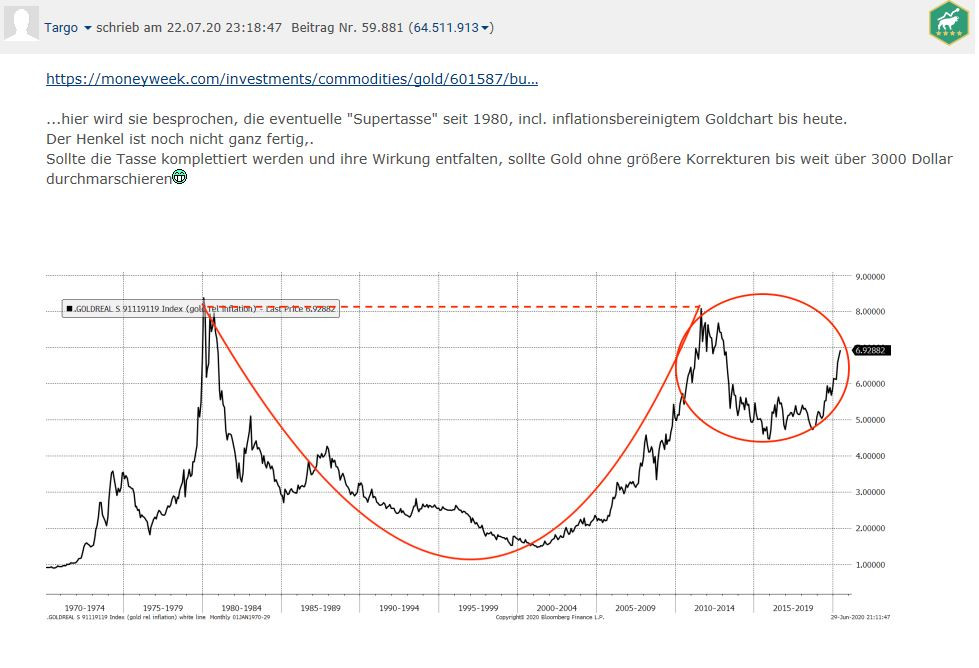

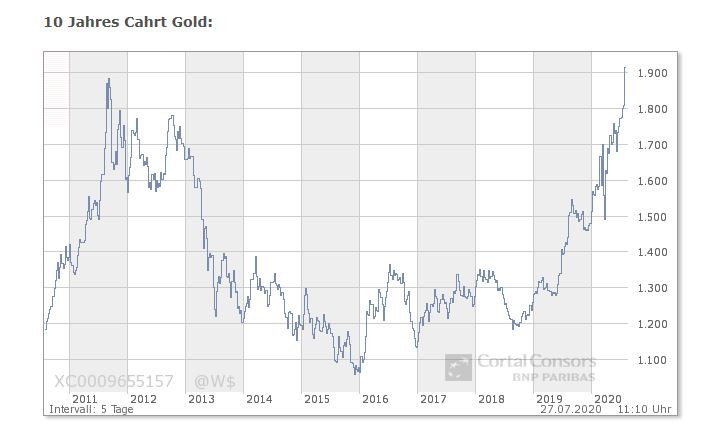

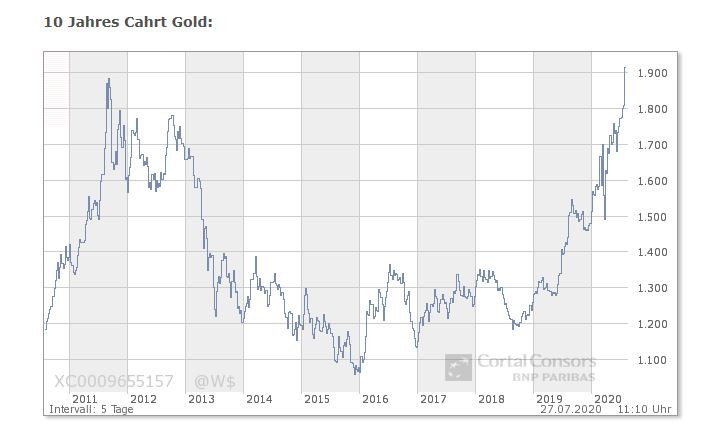

During the first quarter of 2020, in light of feedback from Nova Scotia Environment and recent Anaconda personnel changes, a detailed review of all permitting activity to date was undertaken to identify further work required to support the filing of an EARD. As a result, it was determined that additional data collection and predictive work would be required. GHD is now leading the permitting activities for the Project and is overseeing the water monitoring program and other work to support the EARD and the subsequent Industrial Approval Application (GHD was involved in the permitting of the Moose River Consolidated Project in Nova Scotia and is involved with MEL with ongoing projects and permitting by St Barbara Limited in Nova Scotia).