Ölpreise stark gestiegen - Brent auf höchstem Stand seit knapp 4 Jahren (Seite 10) | Diskussion im Forum

eröffnet am 25.09.18 16:17:49 von

neuester Beitrag 08.01.24 13:02:37 von

neuester Beitrag 08.01.24 13:02:37 von

Beiträge: 539

ID: 1.289.261

ID: 1.289.261

Aufrufe heute: 3

Gesamt: 87.226

Gesamt: 87.226

Aktive User: 0

ISIN: XC0009677409 · WKN: 967740

88,36

USD

+0,47 %

+0,42 USD

Letzter Kurs 13:14:06 Lang & Schwarz

Neuigkeiten

12:33 Uhr · dpa-AFX |

08:55 Uhr · dpa-AFX |

08:30 Uhr · BNP Paribas Anzeige |

08:08 Uhr · dpa-AFX |

25.04.24 · Shareribs Anzeige |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 75,38 | +19,99 | |

| 0,7740 | +11,21 | |

| 5,2000 | +9,47 | |

| 1,0600 | +8,16 | |

| 7,3300 | +7,79 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,000 | -13,39 | |

| 1,2501 | -15,25 | |

| 1,4000 | -18,13 | |

| 12,510 | -27,27 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

22.2.

OPEC+ Sees No Need to Pump Faster as Oil Heads Toward $100

https://finance.yahoo.com/news/iraq-says-opec-doesn-t-060758…

...

Several key OPEC+ members see no need to accelerate output increases even as oil heads toward $100 a barrel amid worsening tension over Ukraine.

Iraq and Nigeria said the group’s strategy of gradually raising production is enough to balance the market and the group has no need to be more aggressive.

Many delegates echoed that view privately on Tuesday, saying it wouldn’t make a difference if crude did hit triple digits.

...

OPEC+ Sees No Need to Pump Faster as Oil Heads Toward $100

https://finance.yahoo.com/news/iraq-says-opec-doesn-t-060758…

...

Several key OPEC+ members see no need to accelerate output increases even as oil heads toward $100 a barrel amid worsening tension over Ukraine.

Iraq and Nigeria said the group’s strategy of gradually raising production is enough to balance the market and the group has no need to be more aggressive.

Many delegates echoed that view privately on Tuesday, saying it wouldn’t make a difference if crude did hit triple digits.

...

Antwort auf Beitrag Nr.: 70.744.671 von faultcode am 04.02.22 12:30:03

auch hier schon:

February 18, 2022, 8:13 PM GMT+1

Any EU sanctions on Russia should not hit energy -Draghi

https://www.reuters.com/markets/asia/any-eu-sanctions-russia…

...

Any sanctions that may be imposed on Russia by the European Union should not include energy imports, Italian Prime Minister Mario Draghi said on Friday.

Draghi told reporters that the European Union was studying various sanctions options if Russia pushes ahead with a feared invasion of Ukraine.

"We are discussing sanctions with the EU and in the course of these discussions we have made our position known, that they should be concentrated on narrow sectors without including energy," Draghi said at a news conference.

Italy imports 90% of its gas requirements, with Russia a key supplier.

...

Zitat von faultcode:

klappt ja unheimlich gut mit irgendwelchen Wirtschafts-Sanktionen:...

auch hier schon:

February 18, 2022, 8:13 PM GMT+1

Any EU sanctions on Russia should not hit energy -Draghi

https://www.reuters.com/markets/asia/any-eu-sanctions-russia…

...

Any sanctions that may be imposed on Russia by the European Union should not include energy imports, Italian Prime Minister Mario Draghi said on Friday.

Draghi told reporters that the European Union was studying various sanctions options if Russia pushes ahead with a feared invasion of Ukraine.

"We are discussing sanctions with the EU and in the course of these discussions we have made our position known, that they should be concentrated on narrow sectors without including energy," Draghi said at a news conference.

Italy imports 90% of its gas requirements, with Russia a key supplier.

...

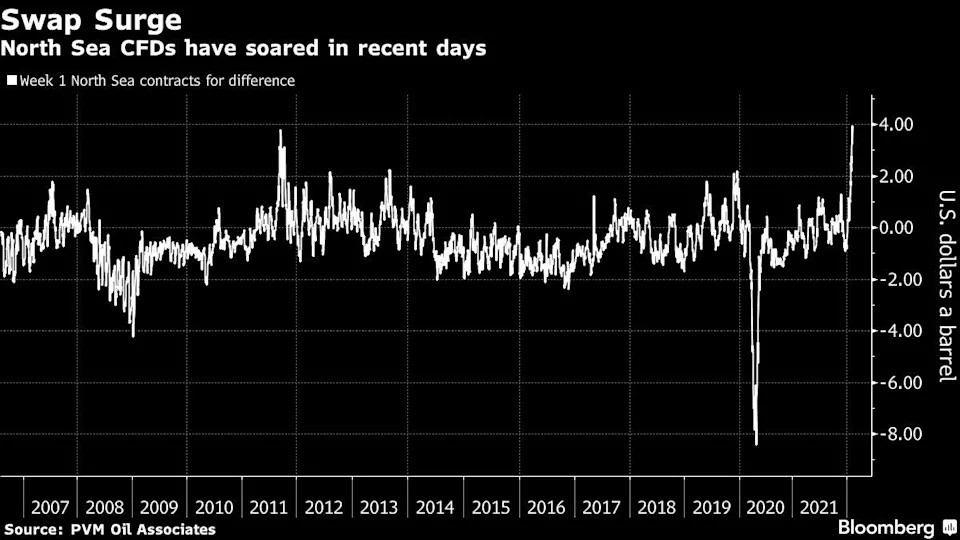

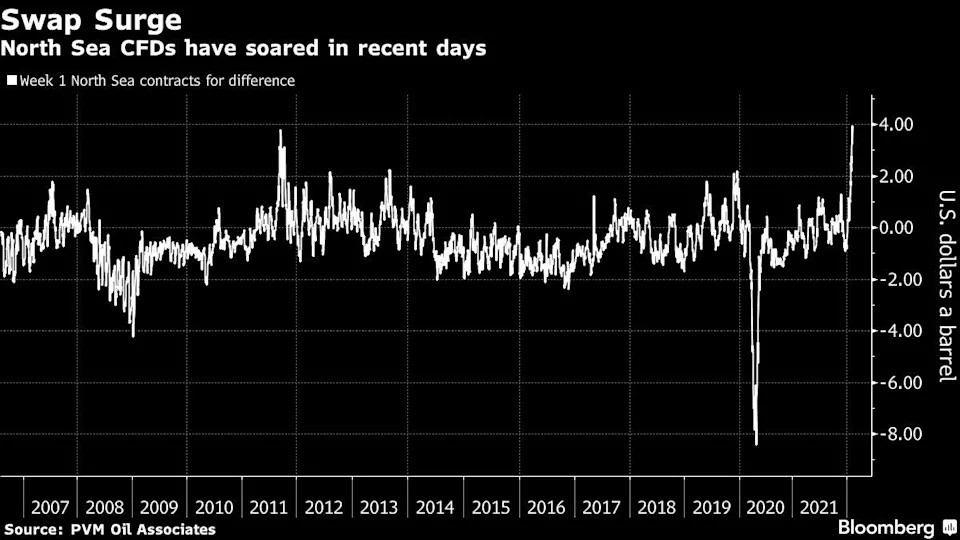

"super-backwardation"

8.2.

Arcane Oil Trade Is Latest Indication of Market Ripping Higher

<arcane = geheimnisvoll>

https://finance.yahoo.com/news/arcane-oil-market-latest-indi…

...

Derivatives that price crude for one week ahead -- known as contracts for difference -- are trading at the highest level since at least 2006, according to data from brokerage PVM Oil Associates.

That surge, coupled with a structure that indicates a scarcity of supply in the coming weeks, suggests an extreme level of strength in the North Sea market that prices much of the world’s oil.

The rally is mirrored in other corners of the oil market. Whether it’s crude oil, or refined products like diesel, futures curves are moving into the realm of super-backwardation -- where prompt prices are higher than those in the future -- indicating a scarcity of supply.

The latest runaway strength comes amid a heady mix of robust demand, patchy supply additions from the Organization of Petroleum Exporting Countries and its allies, and heightened geopolitical risks.

“The more people we speak to, the common theme remains that they have never seen a tight market like this before,” said Keshav Lohiya, founder of consultant Oilytics Ltd.

...

8.2.

Arcane Oil Trade Is Latest Indication of Market Ripping Higher

<arcane = geheimnisvoll>

https://finance.yahoo.com/news/arcane-oil-market-latest-indi…

...

Derivatives that price crude for one week ahead -- known as contracts for difference -- are trading at the highest level since at least 2006, according to data from brokerage PVM Oil Associates.

That surge, coupled with a structure that indicates a scarcity of supply in the coming weeks, suggests an extreme level of strength in the North Sea market that prices much of the world’s oil.

The rally is mirrored in other corners of the oil market. Whether it’s crude oil, or refined products like diesel, futures curves are moving into the realm of super-backwardation -- where prompt prices are higher than those in the future -- indicating a scarcity of supply.

The latest runaway strength comes amid a heady mix of robust demand, patchy supply additions from the Organization of Petroleum Exporting Countries and its allies, and heightened geopolitical risks.

“The more people we speak to, the common theme remains that they have never seen a tight market like this before,” said Keshav Lohiya, founder of consultant Oilytics Ltd.

...

Antwort auf Beitrag Nr.: 70.744.671 von faultcode am 04.02.22 12:30:03nebenbei: hier ist ein sehr langer und mMn sehr lehrreicher Artikel zu vergangenen, also auch gegen andere Länder, und möglichen zukünftigen (U.S.-)Wirtschafts-Sanktionen gegen Russland in der New York Times (Paywall):

29.1.2022

U.S. Sanctions Aimed at Russia Could Take a Wide Toll

The boldest measures that President Biden is threatening to deter an invasion of Ukraine could roil the entire Russian economy — but also those of other nations.

https://www.nytimes.com/2022/01/29/us/politics/russia-sancti…

...

Sanctions could be viewed as punishing the Russian people — a perception that might fuel President Vladimir V. Putin’s narrative that his country is being persecuted by the West.

...

29.1.2022

U.S. Sanctions Aimed at Russia Could Take a Wide Toll

The boldest measures that President Biden is threatening to deter an invasion of Ukraine could roil the entire Russian economy — but also those of other nations.

https://www.nytimes.com/2022/01/29/us/politics/russia-sancti…

...

Sanctions could be viewed as punishing the Russian people — a perception that might fuel President Vladimir V. Putin’s narrative that his country is being persecuted by the West.

...

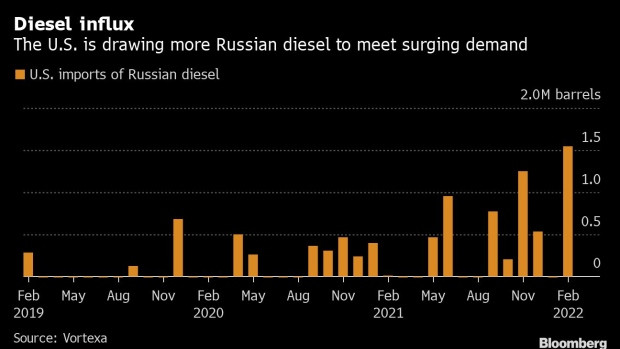

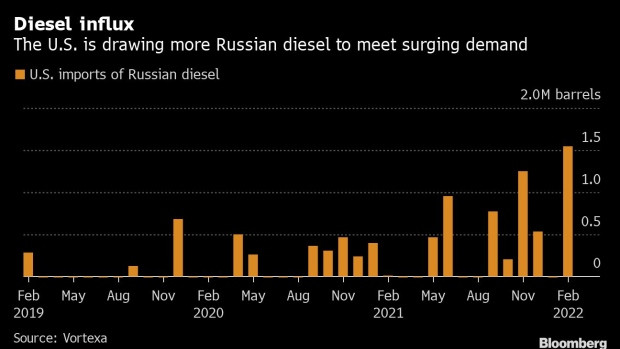

Antwort auf Beitrag Nr.: 70.705.446 von faultcode am 01.02.22 13:15:31klappt ja unheimlich gut mit irgendwelchen Wirtschafts-Sanktionen:

4.2.

U.S. Draws Most Russian Diesel in Years as Cold Weather Descends

https://www.bnnbloomberg.ca/u-s-draws-most-russian-diesel-in…

...

The U.S. East Coast is especially reliant on imported diesel because refining capacity has shrunk in recent years due to poor margins and an explosion. The Northeast is using the most fuel for power generation since 2018 as cold weather drove up natural gas prices.

The other main suppliers to the U.S. are facing problems of their own - Europe is grappling with its energy shortage and refinery outages while Canada was forced to shut an east coast refinery early in the pandemic.

...

<nein, ich bin ausdrücklich kein "Putin-Freund"; sehe aber hier und da schon auffallend kontra-intuitive Zahlen >

>

4.2.

U.S. Draws Most Russian Diesel in Years as Cold Weather Descends

https://www.bnnbloomberg.ca/u-s-draws-most-russian-diesel-in…

...

The U.S. East Coast is especially reliant on imported diesel because refining capacity has shrunk in recent years due to poor margins and an explosion. The Northeast is using the most fuel for power generation since 2018 as cold weather drove up natural gas prices.

The other main suppliers to the U.S. are facing problems of their own - Europe is grappling with its energy shortage and refinery outages while Canada was forced to shut an east coast refinery early in the pandemic.

...

<nein, ich bin ausdrücklich kein "Putin-Freund"; sehe aber hier und da schon auffallend kontra-intuitive Zahlen

>

>

Ich glaube, daß Öl in den nächsten Jahren noch deutlich teurer werden wird und vielleicht sogar neue ATHs erreichen wird. Bin leider immer noch unterinvestiert in dem Sektor, hab es irgendwie verpasst.

Antwort auf Beitrag Nr.: 70.348.505 von faultcode am 30.12.21 00:43:3916.1.

Oil Prices May Rise Even More on Tight Supply, Vitol Group Says

https://finance.yahoo.com/news/trader-vitol-says-oil-prices-…

...

The world’s biggest independent oil trader said crude prices, already up more than 10% this year, could rise even further because of tight supplies.

...

Muller said that while natural gas prices have climbed enough to cause some industrial users -- including in Pakistan and Europe -- to cut back on consumption, the oil market hadn’t reached that point.

...

He said China’s zero-tolerance policy toward Covid-19 would probably ensure there’s no omicron outbreak there big enough to significantly diminish the use of oil products.

“We’re nowhere near seeing a major demand hit in China,” said Muller, who’s based in Singapore. “The data is still not troublesome.”

Oil Prices May Rise Even More on Tight Supply, Vitol Group Says

https://finance.yahoo.com/news/trader-vitol-says-oil-prices-…

...

The world’s biggest independent oil trader said crude prices, already up more than 10% this year, could rise even further because of tight supplies.

...

Muller said that while natural gas prices have climbed enough to cause some industrial users -- including in Pakistan and Europe -- to cut back on consumption, the oil market hadn’t reached that point.

...

He said China’s zero-tolerance policy toward Covid-19 would probably ensure there’s no omicron outbreak there big enough to significantly diminish the use of oil products.

“We’re nowhere near seeing a major demand hit in China,” said Muller, who’s based in Singapore. “The data is still not troublesome.”

Goldman says oil could hit $100, demand might reach ‘new record high’ in the next two years

https://www.cnbc.com/2021/12/17/oil-investing-goldman-sachs-…Aber erst einmal den Hexensabbat, Omikron was sonst noch überstehen.

12:58 Uhr · dpa-AFX · Chevron Corporation |

12:33 Uhr · dpa-AFX · Öl (Brent) |

08:55 Uhr · dpa-AFX · TotalEnergies |

08:30 Uhr · BNP Paribas · Öl (Brent)Anzeige |

08:08 Uhr · dpa-AFX · Öl (Brent) |

25.04.24 · dpa-AFX · Öl (Brent) |

25.04.24 · dpa-AFX · Öl (Brent) |

25.04.24 · dpa-AFX · Öl (Brent) |

25.04.24 · dpa-AFX · Öl (Brent) |

| Zeit | Titel |

|---|---|

| 16.04.24 | |

| 07.04.24 | |

| 15.11.23 | |

| 16.10.23 | |

| 14.10.23 | |

| 23.09.23 | |

| 16.09.23 | |

| 04.09.23 | |

| 04.09.23 | |

| 01.09.23 |