Signature Bank (Seite 2)

eröffnet am 24.04.22 11:07:23 von

neuester Beitrag 19.04.24 09:29:44 von

neuester Beitrag 19.04.24 09:29:44 von

Beiträge: 18

ID: 1.359.643

ID: 1.359.643

Aufrufe heute: 1

Gesamt: 12.054

Gesamt: 12.054

Aktive User: 0

ISIN: US82669G1040 · WKN: A0B9ZR · Symbol: SBNY

3,2000

USD

-3,03 %

-0,1000 USD

Letzter Kurs 07.05.24 Nasdaq OTC

Neuigkeiten

09.04.24 · wallstreetONLINE Redaktion |

24.05.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,9000 | +15,69 | |

| 33,80 | +13,61 | |

| 3,0300 | +11,40 | |

| 3,1000 | +10,71 | |

| 0,5107 | +10,49 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,9750 | -9,82 | |

| 0,9000 | -11,76 | |

| 14,750 | -14,14 | |

| 0,7200 | -14,29 | |

| 1.138,25 | -16,86 |

Beitrag zu dieser Diskussion schreiben

20.3.

Signature’s Deposits, Loans Assumed by NY Community Bancorp

https://finance.yahoo.com/news/york-community-bancorp-pursue…

...

Signature Bank’s deposits and some of its loans have been taken over by a unit of New York Community Bancorp, a move that could help calm some of the turmoil that has engulfed US regional banks.

NYCB’s Flagstar Bank of Hicksville, New York, agreed to purchase $38 billion of assets, including $25 billion in cash and about $13 billion in loans, from the Federal Deposit Insurance Corp., the lender said in a statement. It also assumed liabilities of about $36 billion, including $34 billion in deposits.

Signature’s 40 branches will operate as Flagstar locations as of Monday. The bank was seized on March 12 without another lender ready to take over, which regulators typically strive to have in place before shutting a bank.

As part of the deal, the FDIC gets equity appreciation rights in New York Community Bancorp common stock valued at up to $300 million.

While the sale didn’t manage to offload all of Signature, the deal demonstrates there are purchasers out there for such assets and strength among banks, said Todd Phillips, a fellow at the Roosevelt Institute and former FDIC attorney. “To the extent that the market is looking for a sign here, it definitely does show that there is still health in the banking system,” he said.

What’s Excluded

Flagstar’s bid excluded about $4 billion of deposits related to Signature’s digital banking business, the FDIC said. Those deposits will be provided directly to customers tied to digital banking, it said.

...

Much like Silicon Valley Bank, with clients made up almost entirely of businesses, Signature had a deposit base that was mostly uninsured. That may have attracted the attention of regulators looking into the stability of banks with large uninsured deposit bases.

Todd Baker, a senior fellow at Columbia University’s Richard Paul Richman Center for Business, Law, and Public Policy, called the FDIC’s deal a very positive sign. “I particularly liked the FDIC getting an equity kicker based on the performance of NYCB’s stock. This shows how the regulatory agencies are getting smarter.”

The FDIC had transferred all Signature Bank deposits and substantially all of the firm’s assets to Signature Bridge Bank NA before the Flagstar deal. New York Community Bancorp acquired Flagstar last year for about $2.6 billion.

NYCB is a major player in New York City real estate, with multi-family mortgage loans in the city making up nearly a third of NYCB’s total loan book as of year-end. In a filing earlier this month, the firm described multi-family loans as its “principal asset,” noting the majority of them are secured by rental apartment buildings.

“NYCB and Signature have similar strategies and culture as well as overlap in commercial real estate,” Bloomberg Intelligence analysts Herman Chan and Sergio Ferreira said in a research note Sunday before the announcement. “Yet buying Signature would seemingly bump the combined bank above $100 billion in assets and usher in tougher regulatory requirements.”

...

Signature’s Deposits, Loans Assumed by NY Community Bancorp

https://finance.yahoo.com/news/york-community-bancorp-pursue…

...

Signature Bank’s deposits and some of its loans have been taken over by a unit of New York Community Bancorp, a move that could help calm some of the turmoil that has engulfed US regional banks.

NYCB’s Flagstar Bank of Hicksville, New York, agreed to purchase $38 billion of assets, including $25 billion in cash and about $13 billion in loans, from the Federal Deposit Insurance Corp., the lender said in a statement. It also assumed liabilities of about $36 billion, including $34 billion in deposits.

Signature’s 40 branches will operate as Flagstar locations as of Monday. The bank was seized on March 12 without another lender ready to take over, which regulators typically strive to have in place before shutting a bank.

As part of the deal, the FDIC gets equity appreciation rights in New York Community Bancorp common stock valued at up to $300 million.

While the sale didn’t manage to offload all of Signature, the deal demonstrates there are purchasers out there for such assets and strength among banks, said Todd Phillips, a fellow at the Roosevelt Institute and former FDIC attorney. “To the extent that the market is looking for a sign here, it definitely does show that there is still health in the banking system,” he said.

What’s Excluded

Flagstar’s bid excluded about $4 billion of deposits related to Signature’s digital banking business, the FDIC said. Those deposits will be provided directly to customers tied to digital banking, it said.

...

Much like Silicon Valley Bank, with clients made up almost entirely of businesses, Signature had a deposit base that was mostly uninsured. That may have attracted the attention of regulators looking into the stability of banks with large uninsured deposit bases.

Todd Baker, a senior fellow at Columbia University’s Richard Paul Richman Center for Business, Law, and Public Policy, called the FDIC’s deal a very positive sign. “I particularly liked the FDIC getting an equity kicker based on the performance of NYCB’s stock. This shows how the regulatory agencies are getting smarter.”

The FDIC had transferred all Signature Bank deposits and substantially all of the firm’s assets to Signature Bridge Bank NA before the Flagstar deal. New York Community Bancorp acquired Flagstar last year for about $2.6 billion.

NYCB is a major player in New York City real estate, with multi-family mortgage loans in the city making up nearly a third of NYCB’s total loan book as of year-end. In a filing earlier this month, the firm described multi-family loans as its “principal asset,” noting the majority of them are secured by rental apartment buildings.

“NYCB and Signature have similar strategies and culture as well as overlap in commercial real estate,” Bloomberg Intelligence analysts Herman Chan and Sergio Ferreira said in a research note Sunday before the announcement. “Yet buying Signature would seemingly bump the combined bank above $100 billion in assets and usher in tougher regulatory requirements.”

...

die bislang drittgrößte Pleite einer US-Geschäftsbank, hier wohl durch den letztendlichen Auslöser die Verbindung zur Kryptowelt (und Private Equity) und offenbar weniger das nur moderate HTM-Buch (held-to-maturity):

13.3.

Why Signature Bank Failed

https://www.barrons.com/articles/signature-bank-failure-a0ad…

...

Signature Bank failed over the weekend. The bank’s connections with cryptocurrency seem to have spooked depositors after Silicon Valley Bank collapsed, prompting a run on the bank’s deposits which, in turn, prompted action from regulators.

Signature was taken over by New York Department of Banking Services on Sunday. The FDIC, Federal Reserve and Treasury Department said all depositors at Signature, as well as Silicon Valley Bank, would be protected.

Both banks had above-average levels of uninsured deposits and some atypical business uncertainty. That combination is turning out to be too much for bank investors.

Signature, which lent primarily to private equity and commercial businesses and had former congressman and co-author of the Dodd-Frank Act Barney Frank on its board, ended 2022 with about $110 billion in assets including $74 billion in loans. Deposits finished the year at about $89 billion with bank equity at $8 billion.

Signature also had a cryptocurrency business. While Signature didn’t have loans backed by cryptocurrencies or hold cryptocurrencies on its balance sheet, it had a payment platform for processing crypto transactions. But deposits associated with the crypto platform had been dropping, prompting some concern from Wall Street.

...

As the crisis at SVB mounted, Signature stock fell about 50%. The company reported deposit balances of about $89 billion and loan balances of about $72 billion on March 8.

The bank was closed “apparently due to similar funding pressures as it related to the company’s crypto banking,” wrote D.A. Davidson analyst Gary Tenner in a Monday report. He said deposits started to leave the bank, similar to what happened at SVB. Like SVB, roughly 90% of Signature’s deposits were uninsured, Tenner said, meaning balances held by individuals or businesses were above the $250,000 insurance limit guaranteed by the FDIC. The mounting run on those deposits is what closed the bank.

Someone could have stepped in to buy the bank, but that didn’t happen. It didn’t happen for SVB, either. In that case, uncertainty over SVB’s loan portfolio seems to have kept buyers away, Ironsides Macroeconomic founder Barry Knapp told Barron’s.

That doesn’t appear to be the case at Signature. SVB had roughly $91 billion in securities it was holding to maturity at the end of 2022. That was out of $212 billion in total assets. That’s more than 40% of assets. Signature’s held-to-maturity portfolio was about $8 billion, less than 10% of assets.

Potential acquirers might not have liked Signature’s exposure to private equity businesses. Signature had roughly $28 billion in loans to private equity out of a total loan book of roughly $75 billion. Signature also lent to commercial real estate businesses and other borrowers.

And Signature Bank’s “ties to the crypto industry” might have limited its appeal to other banks, wrote J.P. Morgan analyst Vivek Juneja on Monday.

A lack of capital wasn’t a concern. Signature’s so-called Tier 1 capital cushion was about 11%, putting it in the middle of the pack for large U.S. banks. JPMorgan Chase & Co (JPM) has a Tier 1 capital ratio of about 15%, as did SVB.

...

13.3.

Why Signature Bank Failed

https://www.barrons.com/articles/signature-bank-failure-a0ad…

...

Signature Bank failed over the weekend. The bank’s connections with cryptocurrency seem to have spooked depositors after Silicon Valley Bank collapsed, prompting a run on the bank’s deposits which, in turn, prompted action from regulators.

Signature was taken over by New York Department of Banking Services on Sunday. The FDIC, Federal Reserve and Treasury Department said all depositors at Signature, as well as Silicon Valley Bank, would be protected.

Both banks had above-average levels of uninsured deposits and some atypical business uncertainty. That combination is turning out to be too much for bank investors.

Signature, which lent primarily to private equity and commercial businesses and had former congressman and co-author of the Dodd-Frank Act Barney Frank on its board, ended 2022 with about $110 billion in assets including $74 billion in loans. Deposits finished the year at about $89 billion with bank equity at $8 billion.

Signature also had a cryptocurrency business. While Signature didn’t have loans backed by cryptocurrencies or hold cryptocurrencies on its balance sheet, it had a payment platform for processing crypto transactions. But deposits associated with the crypto platform had been dropping, prompting some concern from Wall Street.

...

As the crisis at SVB mounted, Signature stock fell about 50%. The company reported deposit balances of about $89 billion and loan balances of about $72 billion on March 8.

The bank was closed “apparently due to similar funding pressures as it related to the company’s crypto banking,” wrote D.A. Davidson analyst Gary Tenner in a Monday report. He said deposits started to leave the bank, similar to what happened at SVB. Like SVB, roughly 90% of Signature’s deposits were uninsured, Tenner said, meaning balances held by individuals or businesses were above the $250,000 insurance limit guaranteed by the FDIC. The mounting run on those deposits is what closed the bank.

Someone could have stepped in to buy the bank, but that didn’t happen. It didn’t happen for SVB, either. In that case, uncertainty over SVB’s loan portfolio seems to have kept buyers away, Ironsides Macroeconomic founder Barry Knapp told Barron’s.

That doesn’t appear to be the case at Signature. SVB had roughly $91 billion in securities it was holding to maturity at the end of 2022. That was out of $212 billion in total assets. That’s more than 40% of assets. Signature’s held-to-maturity portfolio was about $8 billion, less than 10% of assets.

Potential acquirers might not have liked Signature’s exposure to private equity businesses. Signature had roughly $28 billion in loans to private equity out of a total loan book of roughly $75 billion. Signature also lent to commercial real estate businesses and other borrowers.

And Signature Bank’s “ties to the crypto industry” might have limited its appeal to other banks, wrote J.P. Morgan analyst Vivek Juneja on Monday.

A lack of capital wasn’t a concern. Signature’s so-called Tier 1 capital cushion was about 11%, putting it in the middle of the pack for large U.S. banks. JPMorgan Chase & Co (JPM) has a Tier 1 capital ratio of about 15%, as did SVB.

...

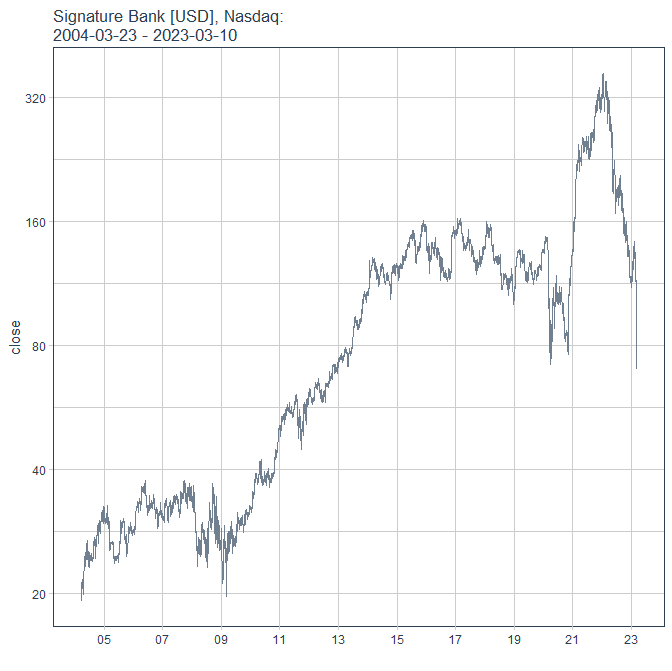

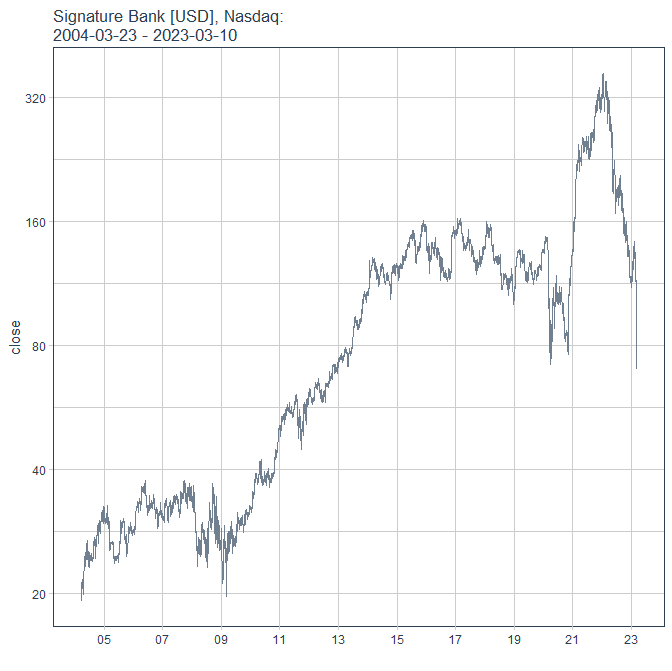

Die Signature Bank hat seit IPO in 2004 fast 19 Jahre durchgehalten und 22 Jahre seit Gründung in 2001:

https://en.wikipedia.org/wiki/Signature_Bank --> da schau her:

February 2018:

Signature Bank provided financial support for re-election races to a number of US Senators for their support of the Economic Growth, Regulatory Relief and Consumer Protection Act, according to Federal Election Commission data tallied by OpenSecrets. This bill exempted Signature Bank from post-crisis oversight rules. “We find it ridiculous and unacceptable that by virtue of … growing one day past $50bn, we will be burdened with rules intended for the mega 'too big to fail' banks,” Scott Shay, chairman of Signature, said.[47]

Der Rest dieses Wikipedia-Artikels ist auch lesenswert mMn.

https://en.wikipedia.org/wiki/Signature_Bank --> da schau her:

February 2018:

Signature Bank provided financial support for re-election races to a number of US Senators for their support of the Economic Growth, Regulatory Relief and Consumer Protection Act, according to Federal Election Commission data tallied by OpenSecrets. This bill exempted Signature Bank from post-crisis oversight rules. “We find it ridiculous and unacceptable that by virtue of … growing one day past $50bn, we will be burdened with rules intended for the mega 'too big to fail' banks,” Scott Shay, chairman of Signature, said.[47]

Der Rest dieses Wikipedia-Artikels ist auch lesenswert mMn.

Die Signature Bank wird abgewickelt, die Kunden werden (wie bei SVB) voll entschädigt.

Damit hatt es weitere Opfer im Kryptobereich gegeben, SVB war teilweise auch in Krypto tätig.

Link zum Artikel..

https://www.handelsblatt.com/finanzen/banken-versicherungen/…

Damit hatt es weitere Opfer im Kryptobereich gegeben, SVB war teilweise auch in Krypto tätig.

Link zum Artikel..

https://www.handelsblatt.com/finanzen/banken-versicherungen/…

Lt. Analysten von Piper Sandler und Wells Fargo ein Kauf

Die Signature Bank wird als Kauf angesehen, da sie die letzte große Bank auf dem Kryptomarkt inmitten der Probleme von Silvergate und SVB ist:Jared Shaw, ein Aktienanalyst bei Wells Fargo, schrieb über die Signature Bank und schlug vor, dass die Aktie eine Chance sein könnte. "Signature [is the] last game in crypto-town", sagte Shaw. "It is the only larger bank that still has a functioning on-ramp for institutional cryptocurrency investors. While SBNY has restricted its exposure to this area, this could provide some additional pricing power." Der Analyst von Wells Fargo fügte hinzu:

"Additionally, SBNY could use this as a catalyst to move away from in-kind deposits for service to a fee-for-service model, which may be more regulatory and capital friendly."

Shaws Investoren-Memo legt nahe, dass die Strategien von SBNY denen von Silvergate überlegen sein könnten und dass die Bereitstellung von Bankdienstleistungen für Kryptowährungsfirmen nicht der Hauptgrund für die finanziellen Schwierigkeiten von Silvergate war. Der Analyst von Wells Fargo betonte jedoch auch, dass das Engagement von SBNY in Kryptowährungsanlagen eingeschränkter sei.

"The difficulty for SI was being a mono-line provider to cryptocurrency", schließt Shaws Investoren-Memo. "At the end of the year, SBNY limited its exposure to cryptocurrency to 15% of deposits, which should help to decrease liquidity volatility, as we saw in ’22."

Quelle: https://news.bitcoin.com/signature-bank-considered-a-buy-as-…

Kennt jemand diese Bank?

09.04.24 · wallstreetONLINE Redaktion · Signature Bank |

24.05.23 · wallstreetONLINE Redaktion · JPMorgan Chase |