TCM - Der neue Thread nach der Umbenennung - 500 Beiträge pro Seite

eröffnet am 15.05.07 11:09:00 von

neuester Beitrag 13.11.09 21:47:21 von

neuester Beitrag 13.11.09 21:47:21 von

Beiträge: 170

ID: 1.127.391

ID: 1.127.391

Aufrufe heute: 2

Gesamt: 49.149

Gesamt: 49.149

Aktive User: 0

ISIN: CA8847681027 · WKN: A0MR6Q

0,5047

USD

+2,90 %

+0,0142 USD

Letzter Kurs 22.10.16 Nasdaq OTC

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,1500 | +19,35 | |

| 10,500 | +18,11 | |

| 65,49 | +17,62 | |

| 6.700,00 | +8,06 | |

| 41,10 | +7,87 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 72.500,00 | -9,94 | |

| 36,60 | -11,32 | |

| 0,6900 | -12,11 | |

| 2,7050 | -12,46 | |

| 0,5300 | -46,46 |

Da im alten Thread schin zig Beiträge gepostet wurden, denke ich sollten wir mit der Umbenennung unserer Aktie auch einen neuen Thread anfangen.

Antwort auf Beitrag Nr.: 29.321.390 von doktor291 am 15.05.07 11:09:00Hallo kannst Du mir mal sagen, wann die Aktie wieder irgendwo gelistet wirde

Valor-Nr.

in Canada lautet:

Thompson Creek (TOR) Price: CAD Chg. (in%): - Volume: -

Shs:Blue Pearl Mining Ltd:

Symbol: TCM Type: Aktie Industry: Diverse Dienstleistungen

Valor: 3107440 Domicile: Kanada Exchange: Toronto Stock Exchange Stammdaten

ISIN: CA8847681027

NSIN: CA: 884768102

CH: 3107440

Industry (Telekurs): Diverse Dienstleistungen

CFI-Code: ESXUFR

Nominal: CAD

Outstanding shares: 111'164'658

Callable: Nein

Gruss Boffe

in Canada lautet:

Thompson Creek (TOR) Price: CAD Chg. (in%): - Volume: -

Shs:Blue Pearl Mining Ltd:

Symbol: TCM Type: Aktie Industry: Diverse Dienstleistungen

Valor: 3107440 Domicile: Kanada Exchange: Toronto Stock Exchange Stammdaten

ISIN: CA8847681027

NSIN: CA: 884768102

CH: 3107440

Industry (Telekurs): Diverse Dienstleistungen

CFI-Code: ESXUFR

Nominal: CAD

Outstanding shares: 111'164'658

Callable: Nein

Gruss Boffe

Antwort auf Beitrag Nr.: 29.321.547 von boffe am 15.05.07 11:16:33Ab wann in Deutschland gelistet ???ß

Danke

Danke

Sie soll wohl wieder am heutigen Nachmittag in D gehandelt werden.

Die Frage ist wie schnell unsere Hausbanken bei der Umstellung sind.

Die Frage ist wie schnell unsere Hausbanken bei der Umstellung sind.

hat sich WKN, Symbol, ISIN in D'land geändert?

Antwort auf Beitrag Nr.: 29.321.961 von outofmind am 15.05.07 11:39:58A0MR6Q

Antwort auf Beitrag Nr.: 29.321.390 von doktor291 am 15.05.07 11:09:00Gerade weil im "alten" Thread so viele Beiträge gepostet wurden, sollten wir auch dort bleiben

Antwort auf Beitrag Nr.: 29.322.580 von schnucksche am 15.05.07 12:12:41Ich fahr besser zweigleisig.

Antwort auf Beitrag Nr.: 29.322.580 von schnucksche am 15.05.07 12:12:41@schnucksche

Recht hast Du, ich bleib auch im alten Thread. Dort kann man wenigstens viel blättern und Facts, Facts und noch viel mehr Facts nachlesen, wenn man viel Zeit hat...

Recht hast Du, ich bleib auch im alten Thread. Dort kann man wenigstens viel blättern und Facts, Facts und noch viel mehr Facts nachlesen, wenn man viel Zeit hat...

Hallo allerseits, ich bin auch seit einiger Zeit bei BPM investiert, wenn nun die Namensänderung kommt und auch die neue Kennung, inwieweit ist euch da was bekannt, das von Wallstreet online die Wachtlists und die Portolios umgestellt werden? Geht das automatisch, oder muss ich da selbst irgendwie aktiv werden?

Gruß Kobold78

Gruß Kobold78

Also meine Bank kennt die neue WKN noch nicht.

Antwort auf Beitrag Nr.: 29.323.222 von kobold78 am 15.05.07 12:49:26das ist doch heute und funktioniert alles automatisch, wenn die Technik mitspielt

Neuer Name - Neues Symbol - Neuer Thread:

http://www.wallstreet-online.de/informer/community/thread.ht…

Da TCM ein neues Symbol ist und Software, so auch die Forumsoftware, dumm ist und nicht mitdenken kann, ist für diese Software TCM eine neue Aktie.

Ich kenne das aus einem anderem Forum (hat aber nichts mit Aktien zu tun)

Dort sind die Threads aber auch best. Themen und Ordnungsnummern (wie eben hier die Aktie und deren Symbol oder WKN) zusortiert.

Die Ordnungsnummern hatten sich dort geändert. Für die Software des Forums war es wie ein neues Thema. D.h. es musste ein neuer Thread aufgemacht werden, obwohl zum gleichen Thema gehörend.

Evtl. ist es hier ja auch so.

BLE mit seinen Threads wird für die Software eine andere Aktie sein wie TCM.

Thompson Creek ist schon mal drin im WO-System (incl. erstem "Haupt"thread):http://www.wallstreet-online.de/informer/community/thread.ht…

http://www.wallstreet-online.de/informer/community/thread.ht…

Da TCM ein neues Symbol ist und Software, so auch die Forumsoftware, dumm ist und nicht mitdenken kann, ist für diese Software TCM eine neue Aktie.

Ich kenne das aus einem anderem Forum (hat aber nichts mit Aktien zu tun)

Dort sind die Threads aber auch best. Themen und Ordnungsnummern (wie eben hier die Aktie und deren Symbol oder WKN) zusortiert.

Die Ordnungsnummern hatten sich dort geändert. Für die Software des Forums war es wie ein neues Thema. D.h. es musste ein neuer Thread aufgemacht werden, obwohl zum gleichen Thema gehörend.

Evtl. ist es hier ja auch so.

BLE mit seinen Threads wird für die Software eine andere Aktie sein wie TCM.

Thompson Creek ist schon mal drin im WO-System (incl. erstem "Haupt"thread):http://www.wallstreet-online.de/informer/community/thread.ht…

Wo ist denn der andere (alte) Thread hin???

Kann ihn nirgends mehr finden.

Kann ihn nirgends mehr finden.

das frag ich mich auch. schliesslich sind da ja eine menge infos zusammengestellt worden.

Antwort auf Beitrag Nr.: 29.324.410 von doktor291 am 15.05.07 13:55:42Vielen Dank für die Info Herr "Doktor". Dann bin ich mal gespannt, ob die technik funktioniert.

Gruß Kobold78

Gruß Kobold78

Antwort auf Beitrag Nr.: 29.330.478 von guru2008 am 15.05.07 18:42:17wurde zu thomson creek mining verschoben

Antwort auf Beitrag Nr.: 29.330.448 von BronteSister am 15.05.07 18:40:45Wurde bereits auf das neue Symbol von Thompson Creek Metals abgeändert.

Hallo,

Habe heute morgen mit der DiBa gesprochen, es wurde mir gesagt

das es bis 2 Wochen dauert bis in Deutschland die Aktien umgewandelt werden.

Danach können sie erst wieder gehandelt werden. Das kann doch nicht sein oder?

Gruß

Habe heute morgen mit der DiBa gesprochen, es wurde mir gesagt

das es bis 2 Wochen dauert bis in Deutschland die Aktien umgewandelt werden.

Danach können sie erst wieder gehandelt werden. Das kann doch nicht sein oder?

Gruß

Antwort auf Beitrag Nr.: 29.337.597 von casaroro am 16.05.07 09:11:57bis zu zwei wochen wäre arg lang - aber einige tage kann es schon dauern. habe das theater bereits einige male bei verschiedenen brokern mitmachen müssen.

Bestimmt wurde es schon gepostet, aber ich bin im Urlaub und habe deswegen keine Zeit den ganzen Thread zu durchsuchen. Wuerde mir jemand bitte kurz sagen was mit den SG KOs passiert ist? Finde keinen Kurs mehr und unter dem neuen Namen ist auch noch nix.

Muchas Gracias

Muchas Gracias

aber geht wieder hoch sehr schön.

schönen Feiertag

schönen Feiertag

Warum existiert den Blue Pearl noch hier im Ticker etc.? Dachte die wären übernommen oder umbenannt worden in Thompson Creek??

das frage ich mich auch hatte mich leicht verwirrt aber jetzt ist alles klaro

huhahe wir sind nicht mehr hier sondern woanders

wo scheint etwas langsam zu sein

Antwort auf Beitrag Nr.: 29.345.393 von aktientrader1995 am 16.05.07 16:20:00hammer,

lese nur in der Stille mit aber hier muss ich mal sagen

hammer

schönen Feiertag

lese nur in der Stille mit aber hier muss ich mal sagen

hammer

schönen Feiertag

Antwort auf Beitrag Nr.: 29.347.583 von SpringAxl am 16.05.07 17:59:06was meinst du denn mit hammer?

weiss jemand wie lang die umstellung in der schweiz dauert? danke

hoffentlich reagiert der Kurs weiterhin so positiv

Antwort auf Beitrag Nr.: 29.398.328 von muenster12 am 21.05.07 06:28:27nur ein kurzer Moment der Freude

Antwort auf Beitrag Nr.: 29.400.001 von SpringAxl am 21.05.07 10:14:59da hattest du vollkommen recht,LEIDER Aber wie so oft bleibt einem nichts anderes übrig als die Situation aussitzen

Aber wie so oft bleibt einem nichts anderes übrig als die Situation aussitzen

Aber wie so oft bleibt einem nichts anderes übrig als die Situation aussitzen

Aber wie so oft bleibt einem nichts anderes übrig als die Situation aussitzen

Antwort auf Beitrag Nr.: 29.412.119 von muenster12 am 22.05.07 07:18:35was ist hier los warum passiert hier nichts?

Antwort auf Beitrag Nr.: 29.561.920 von SpringAxl am 31.05.07 19:05:11nee, die Aktie ist doof.

Wir sind jetzt alle woanders investiert

*Licht ausknips*

Wir sind jetzt alle woanders investiert

*Licht ausknips*

Antwort auf Beitrag Nr.: 29.561.948 von Der.Papst am 31.05.07 19:07:03bist Du gemein - immerhin hat er das Losungswort gesagt...(was ist hier los

:eek

:eek

:eek

:eek

Molybdän - Der Boom-Rohstoff!? – Teil 2

9. Juni 2007 , Armin Brack in Rohstoffe

Thompson Creek - Die Nummer eins der Branche

Die nordamerikanischen Thompson Creek Metals (ehemals Blue Pearl Minerals) dürfen sich dabei heute bereits als größter reiner börsennotierter Molybdän-Produzent bezeichnen. Insgesamt drei verschiedene Liegenschaften in der kanadischen Provinz British Columbia gehören zum Thompson:

Die wichtigste davon ist die gleichnamige Mine, die bereits 1983 von Standard Oil gebaut worden ist und weltweit die zweitgrößte Molybdän-Mine ist, wo im Tagebau gefördert werden kann. Die derzeit nachgewiesenen Reserven und Ressourcen reichen für einen weiteren Abbau von zehn Jahren. Aktuell gibt es 170 Millionen Pfund wirtschaftlich abbaubare Reserven, 370 Millionen Pfund nachgewiesene Ressourcen und 420 Millionen Pfund vermutete Reserven.

Angesichts des explodierenden Molybdän-Preises und der geologischen Beschaffenheit dürften sich die wirtschaftlich abbaubaren Reserven in den kommenden Jahren sogar noch deutlich erweitern lassen. Aktuell werden bereits 30.000 Tonnen täglich abgebaut, 2008 soll dies auf 50.000 Tonnen gesteigert werden.

Bei der zweiten Tagebaumine, Endako, konnten jüngst dank erfolgreicher Exploration die Reserven massiv nach oben angepasst werden. Nun wird von im Boden befindlichen Vorräten von 282 bis 463 Millionen Pfund Molybdän sowie einer Minenlaufzeit zwischen 21 und 35 Jahren ausgegangen. In diesem Jahr soll mit einer Studie nachgewiesen werden, dass sich diese auch wirtschaftlich abbauen lassen.

Hoffnungsträger der Kanadier ist das Davidson-Projekt, wo die größte Molybdän-Untertage-Mine der Welt aufgebaut werden soll. Die Besonderheit dabei sind die extrem hohen Konzentrationen von 0,36 bis 0,38 Prozent, die weltweit einzigartig sind. Die Kosten für den Minenbau sehen die Analysten von GMP Securities bei 55 Millionen US-Dollar. Weil Thompson derzeit täglich (!) rund 1,2 Millionen US-Dollar verdient können die Kosten aus dem laufenden Cash-Flow finanziert werden.

Ein weiterer wichtiger Vorteil: Das Erz kann direkt nach der Förderung zur weiteren Verarbeitung per LKW zur Endako-Liegenschaft befördert werden. Die Gesamtkosten können dadurch sehr niedrig gehalten werden. Zum Vergleich: Die Errichtung einer ganz neuen Mine kostet durchschnittlich circa 500 Millionen US-Dollar. Die Konkurrenz muss diesen Betrag zunächst einmal finanzieren und kann dann erst zum Produzenten werden.

Quartalszahlen übertreffen die Erwartungen

Zuletzt lief es bei dem Senkrechtstarter sogar noch besser als erwartet. Der Umsatz legte von 151 Millionen auf 275 Millionen US-Dollar zu, dabei wurde ein Cash-Flow von 105 Mio. US-Dollar erwirtschaftet. Der Gewinn je Aktie schnellte auf 0,46 US-Dollar. Analysten waren zuvor im Schnitt nur von 0,31 US-Dollar ausgegangen. Die Schulden wurden planmäßig von 320 Millionen auf 302 Millionen US-Dollar reduziert.

Kein Wunder, dass die Analysten im Anschluss ihre Schätzungen reihenweise anhoben. Sprott Securities setzt das Kursziel beispielsweise auf 28 kanadische Dollar, sofern sich der Molybdän-Preis über 20 US-Dollar halten sollte. Aktuell notiert die Aktie bei 18,37 US-Dollar und peilt damit nach einer Konsolidierung die alten Höchststände von 19,09 US-Dollar von Ende April an.

Thompson Creek ist damit ganz klar die Nummer eins unter den Molybdän-Aktien - und der einzige Produzent!

Moly Mines - Die spekulative Alternative

Wer nach einem Unternehmen in einem früheren Entwicklungsstadium sucht, für den könnte der australische Molybdän-Explorer Moly Mines (WKN: A0EAPA; ISIN: AU000000MOL6) eine interessante Alternative sein.

Mit CEO Derek Fisher hat man einen in der Branche hoch angesehenen Unternehmenslenker, der Großes vorhat. Man verfügt über stattliche Ressourcen von 600 Millionen Pfund, was einem Minenleben von 20 Jahren entspricht. Jetzt geht es darum, die Mine produktionsfähig zu machen. Ende 2008 bzw. Anfang 2009 soll es soweit sein.

Die Marktkapitalisierung von aktuell 164 Millionen Euro erscheint angesichts der hohen Ressourcen im Vergleich zu der von Thompson Creek extrem niedrig. Berücksichtigt werden muss dabei jedoch, dass bei Moly eben jene angesprochenen 500 Millionen US-Dollar an Kosten für den Bau der Mine anfallen werden. Diese können nicht ohne weitere verwässernde Kapitalerhöhungen gestemmt werden.

Die Aktie ist somit um einiges riskanter als der Marktführer, verfügt aber auch über ein enormes Potenzial, wenn der Bau der Mine nach Plan läuft. Sollte sich der Molybdän-Preis auch in den kommenden Jahren zumindest über 20 US-Dollar halten, hat das Papier Vervielfachungspotenzial.

MEIN FAZIT:

- Es ist momentan kein Ende des Molybdän-Booms in Sicht

- Molybdän-Anleger sollten aber genau die Stahlkonjunktur beobachten. Ein Einbruch dort dürfte auch zu kräftigen Einbrüchen beim Molybdän-Preis führen.

- Alle drei Hauptnachfrager befinden sich momentan in einer Boomphase: Stahl, Flugzeugbau und Ölindustrie. Gleichzeitig kann die Produktion nicht ausreichend stark gesteigert werden. Es besteht ein Angebotsdefizit.

- Anleger sollten auf Marktführer Thompson Creek setzen. Nur sehr risikobewusste Spekulanten können sich auch eine Moly Mines ins Depot legen.

Quelle www.dailyresearch.de

9. Juni 2007 , Armin Brack in Rohstoffe

Thompson Creek - Die Nummer eins der Branche

Die nordamerikanischen Thompson Creek Metals (ehemals Blue Pearl Minerals) dürfen sich dabei heute bereits als größter reiner börsennotierter Molybdän-Produzent bezeichnen. Insgesamt drei verschiedene Liegenschaften in der kanadischen Provinz British Columbia gehören zum Thompson:

Die wichtigste davon ist die gleichnamige Mine, die bereits 1983 von Standard Oil gebaut worden ist und weltweit die zweitgrößte Molybdän-Mine ist, wo im Tagebau gefördert werden kann. Die derzeit nachgewiesenen Reserven und Ressourcen reichen für einen weiteren Abbau von zehn Jahren. Aktuell gibt es 170 Millionen Pfund wirtschaftlich abbaubare Reserven, 370 Millionen Pfund nachgewiesene Ressourcen und 420 Millionen Pfund vermutete Reserven.

Angesichts des explodierenden Molybdän-Preises und der geologischen Beschaffenheit dürften sich die wirtschaftlich abbaubaren Reserven in den kommenden Jahren sogar noch deutlich erweitern lassen. Aktuell werden bereits 30.000 Tonnen täglich abgebaut, 2008 soll dies auf 50.000 Tonnen gesteigert werden.

Bei der zweiten Tagebaumine, Endako, konnten jüngst dank erfolgreicher Exploration die Reserven massiv nach oben angepasst werden. Nun wird von im Boden befindlichen Vorräten von 282 bis 463 Millionen Pfund Molybdän sowie einer Minenlaufzeit zwischen 21 und 35 Jahren ausgegangen. In diesem Jahr soll mit einer Studie nachgewiesen werden, dass sich diese auch wirtschaftlich abbauen lassen.

Hoffnungsträger der Kanadier ist das Davidson-Projekt, wo die größte Molybdän-Untertage-Mine der Welt aufgebaut werden soll. Die Besonderheit dabei sind die extrem hohen Konzentrationen von 0,36 bis 0,38 Prozent, die weltweit einzigartig sind. Die Kosten für den Minenbau sehen die Analysten von GMP Securities bei 55 Millionen US-Dollar. Weil Thompson derzeit täglich (!) rund 1,2 Millionen US-Dollar verdient können die Kosten aus dem laufenden Cash-Flow finanziert werden.

Ein weiterer wichtiger Vorteil: Das Erz kann direkt nach der Förderung zur weiteren Verarbeitung per LKW zur Endako-Liegenschaft befördert werden. Die Gesamtkosten können dadurch sehr niedrig gehalten werden. Zum Vergleich: Die Errichtung einer ganz neuen Mine kostet durchschnittlich circa 500 Millionen US-Dollar. Die Konkurrenz muss diesen Betrag zunächst einmal finanzieren und kann dann erst zum Produzenten werden.

Quartalszahlen übertreffen die Erwartungen

Zuletzt lief es bei dem Senkrechtstarter sogar noch besser als erwartet. Der Umsatz legte von 151 Millionen auf 275 Millionen US-Dollar zu, dabei wurde ein Cash-Flow von 105 Mio. US-Dollar erwirtschaftet. Der Gewinn je Aktie schnellte auf 0,46 US-Dollar. Analysten waren zuvor im Schnitt nur von 0,31 US-Dollar ausgegangen. Die Schulden wurden planmäßig von 320 Millionen auf 302 Millionen US-Dollar reduziert.

Kein Wunder, dass die Analysten im Anschluss ihre Schätzungen reihenweise anhoben. Sprott Securities setzt das Kursziel beispielsweise auf 28 kanadische Dollar, sofern sich der Molybdän-Preis über 20 US-Dollar halten sollte. Aktuell notiert die Aktie bei 18,37 US-Dollar und peilt damit nach einer Konsolidierung die alten Höchststände von 19,09 US-Dollar von Ende April an.

Thompson Creek ist damit ganz klar die Nummer eins unter den Molybdän-Aktien - und der einzige Produzent!

Moly Mines - Die spekulative Alternative

Wer nach einem Unternehmen in einem früheren Entwicklungsstadium sucht, für den könnte der australische Molybdän-Explorer Moly Mines (WKN: A0EAPA; ISIN: AU000000MOL6) eine interessante Alternative sein.

Mit CEO Derek Fisher hat man einen in der Branche hoch angesehenen Unternehmenslenker, der Großes vorhat. Man verfügt über stattliche Ressourcen von 600 Millionen Pfund, was einem Minenleben von 20 Jahren entspricht. Jetzt geht es darum, die Mine produktionsfähig zu machen. Ende 2008 bzw. Anfang 2009 soll es soweit sein.

Die Marktkapitalisierung von aktuell 164 Millionen Euro erscheint angesichts der hohen Ressourcen im Vergleich zu der von Thompson Creek extrem niedrig. Berücksichtigt werden muss dabei jedoch, dass bei Moly eben jene angesprochenen 500 Millionen US-Dollar an Kosten für den Bau der Mine anfallen werden. Diese können nicht ohne weitere verwässernde Kapitalerhöhungen gestemmt werden.

Die Aktie ist somit um einiges riskanter als der Marktführer, verfügt aber auch über ein enormes Potenzial, wenn der Bau der Mine nach Plan läuft. Sollte sich der Molybdän-Preis auch in den kommenden Jahren zumindest über 20 US-Dollar halten, hat das Papier Vervielfachungspotenzial.

MEIN FAZIT:

- Es ist momentan kein Ende des Molybdän-Booms in Sicht

- Molybdän-Anleger sollten aber genau die Stahlkonjunktur beobachten. Ein Einbruch dort dürfte auch zu kräftigen Einbrüchen beim Molybdän-Preis führen.

- Alle drei Hauptnachfrager befinden sich momentan in einer Boomphase: Stahl, Flugzeugbau und Ölindustrie. Gleichzeitig kann die Produktion nicht ausreichend stark gesteigert werden. Es besteht ein Angebotsdefizit.

- Anleger sollten auf Marktführer Thompson Creek setzen. Nur sehr risikobewusste Spekulanten können sich auch eine Moly Mines ins Depot legen.

Quelle www.dailyresearch.de

Antwort auf Beitrag Nr.: 29.832.748 von Videomart am 11.06.07 23:10:36... ist und weltweit die zweitgrößte Molybdän-Mine ist, wo im Tagebau gefördert werden kann...

Welche ist denn die größte und wem gehört die??

Gruß S&D

Welche ist denn die größte und wem gehört die??

Gruß S&D

Antwort auf Beitrag Nr.: 29.832.748 von Videomart am 11.06.07 23:10:36ich verstehe nicht den hype, im außerbörslichen Leben habe ich von dem Zeug noch nie gehört , hier alle paar threads. Was kann man damit machen?

Antwort auf Beitrag Nr.: 29.898.740 von muenster12 am 14.06.07 19:46:29

jetzt aber in den Bewertungsthread, marsch, marsch

jetzt aber in den Bewertungsthread, marsch, marsch

Antwort auf Beitrag Nr.: 29.832.748 von Videomart am 11.06.07 23:10:36EIN FAZIT:

- Es ist momentan kein Ende des Molybdän-Booms in Sicht

- Molybdän-Anleger sollten aber genau die Stahlkonjunktur beobachten. Ein Einbruch dort dürfte auch zu kräftigen Einbrüchen beim Molybdän-Preis führen.

- Alle drei Hauptnachfrager befinden sich momentan in einer Boomphase: Stahl, Flugzeugbau und Ölindustrie. Gleichzeitig kann die Produktion nicht ausreichend stark gesteigert werden. Es besteht ein Angebotsdefizit.

- Anleger sollten auf Marktführer Thompson Creek setzen. Nur sehr risikobewusste Spekulanten können sich auch eine Moly Mines ins Depot legen.

ich hoffe das deine Aussagen auch zutreffen, finde der Wert ist immer noch ziemlich verlockend

- Es ist momentan kein Ende des Molybdän-Booms in Sicht

- Molybdän-Anleger sollten aber genau die Stahlkonjunktur beobachten. Ein Einbruch dort dürfte auch zu kräftigen Einbrüchen beim Molybdän-Preis führen.

- Alle drei Hauptnachfrager befinden sich momentan in einer Boomphase: Stahl, Flugzeugbau und Ölindustrie. Gleichzeitig kann die Produktion nicht ausreichend stark gesteigert werden. Es besteht ein Angebotsdefizit.

- Anleger sollten auf Marktführer Thompson Creek setzen. Nur sehr risikobewusste Spekulanten können sich auch eine Moly Mines ins Depot legen.

ich hoffe das deine Aussagen auch zutreffen, finde der Wert ist immer noch ziemlich verlockend

Hi zusammen,

ich habe mal ne Frage. ich bin absolut neu auf dem Gebiet was Aktien angeht. Drauf gekommen bin ich eigentlich durch meinen Schwiegervater in Spee, der ebenfalls hier im Forum angemeldet ist.......

Was mich interessieren würde: rentiert es sich diese Aktie bei den aktuellen Kursen zu kaufen oder ist es erwägenswert zu warten ob sie n bissl fällt, weil nach aussage meines "Schwiegervaters" (nachfolgend SV) hatte er die Aktie mal bei 4 € gekauft und bei 8 wieder verkauft und ärgert sich logischerweise) jetzt drüber hat aber auch wieder n paar von denen hier ....

Also falls das von nöten ist:

meien Ziele sind:

-- vorerst mit ca 250 € so viel wie möglich zu erwirtschaften....

-- möglichst auf sichere Karten setzen

Vielen DAnk für eure Hilfe im Voraus

euer

Gio1986

ich habe mal ne Frage. ich bin absolut neu auf dem Gebiet was Aktien angeht. Drauf gekommen bin ich eigentlich durch meinen Schwiegervater in Spee, der ebenfalls hier im Forum angemeldet ist.......

Was mich interessieren würde: rentiert es sich diese Aktie bei den aktuellen Kursen zu kaufen oder ist es erwägenswert zu warten ob sie n bissl fällt, weil nach aussage meines "Schwiegervaters" (nachfolgend SV) hatte er die Aktie mal bei 4 € gekauft und bei 8 wieder verkauft und ärgert sich logischerweise) jetzt drüber hat aber auch wieder n paar von denen hier ....

Also falls das von nöten ist:

meien Ziele sind:

-- vorerst mit ca 250 € so viel wie möglich zu erwirtschaften....

-- möglichst auf sichere Karten setzen

Vielen DAnk für eure Hilfe im Voraus

euer

Gio1986

Antwort auf Beitrag Nr.: 30.600.174 von Gio1986 am 09.07.07 21:51:11250euro????

Hast Du paar Nullen vergessen-oder meinst Du das ernst?

Hast Du paar Nullen vergessen-oder meinst Du das ernst?

eigentlich miente ich das ernst weil ich ABSOLUTER neuling bin.......

da will ich nicht gleich meine hart gesparten 1500 € verkloppen.... bin ja erst 21 ^^

da will ich nicht gleich meine hart gesparten 1500 € verkloppen.... bin ja erst 21 ^^

Antwort auf Beitrag Nr.: 30.600.330 von Gio1986 am 09.07.07 21:58:05Das lohnt doch nicht!

Du zahlst ja sicher auch Gebühren bei Deiner Bank!

Für 250 euro bekommst nicht mal 20Stück!

Ende des Jahres stehen wir aber trotz allem sicherlich höher als 13euro....

Grüßle

Du zahlst ja sicher auch Gebühren bei Deiner Bank!

Für 250 euro bekommst nicht mal 20Stück!

Ende des Jahres stehen wir aber trotz allem sicherlich höher als 13euro....

Grüßle

welche aktie wäre dann zu empfehlen wenn man erst mal klein anfangen will? weil ich hab keine Ahnung von der ganzen SAchee (also nur so n bissl Schul - Rechnungswesen Know How....)

Antwort auf Beitrag Nr.: 30.600.508 von Gio1986 am 09.07.07 22:05:14Bei 250€ würde ich nicht in Aktien investieren.

Selbst bei einem günstigen Anbieter zahlst Du pro Transaktion etwa 10€. Kauf und Verkauf machen zusammen also etwa 20€. Dü müsstest also schon 8% plus machen, nur um die Gebühren zu finanzieren.

Selbst bei einem günstigen Anbieter zahlst Du pro Transaktion etwa 10€. Kauf und Verkauf machen zusammen also etwa 20€. Dü müsstest also schon 8% plus machen, nur um die Gebühren zu finanzieren.

Veröffentlicht von Prof. Dr. Hans J. Bocker am 19.07.2007 um 10:28 Uhr

Molybdän- Ein neuer Stern am Rohstoffhimmel

Unbekannt und ungenannt - nicht mehr lange Noch bis vor kurzer Zeit weckte der Mehrzahl der Leser der Tagespresse die Nennung des Fremdbegriffes "Molybdän" (in der Umgangssprache kurz "Moly") bestenfalls Assoziationen an einer molligen Dänin oder deren Hund, dem Grossen Dänen. Ansonsten folgte ein mattes Gähnen. Doch gähnen mittlerweile immer weniger, denn nach Preissteigerungen von 3 auf über 40 $ pro Pfund in wenigen Jahren - genauer, seit 2001 - (derzeit im Bereich von 32 $ im Angebot) wurden sogar verwöhnte Investoren argwöhnisch. Es musste ja auffallen, dass derlei Preisanstiege diejenigen von Gold und Silber im gleichen Zeitraum um ein Mehrfaches übertrafen: Grob gesprochen: Eine Verzehnfachung gegenüber einer Verdreifachung. Damit aber kam die an den Börsen so typische Gier - Verzeihung - lebhaftes Interesse - auf. Steile Preissanstiege oder markante Kursgewinne irgendeiner Aktie, Währung, eines Rohstoffes oder Metalles senden nun einmal Adrenalinstösse in die Blutkreisläufe der Investorengemeinschaft, wenngleich manchmal mit Verspätung. Die kanadische Finanzfirma Sprott Securities, die sich auf Metalle, und insbesondere Molybdän spezialisiert hat, geht sogar davon aus, dass das alte Preis-Hoch von über 40 $ pro Pfund bis Jahresende nominal wieder erreicht wird: Eine gute Nachricht für Anleger, die sich hier bereits engagiert haben. Bezeichnenderweise hat dieses kanadische Wertpapierhaus auch gleich noch einen Exchange Traded Fund, also einen börsengehandelten Fond, kurz ETF, aufgelegt. Ganz ähnlich wie bei den entsprechenden ETF - Schwester-Institutionen für Gold und Silber werden diese Titel sowohl mit Aktien (mit Molybdän-Bezug) wie auch mit physischem Metall - hinterlegt. In einem allerersten Schritt hat man für diesen Fond mit dem appetitlichen Namen "Sprott Moly" (nicht zu verwechseln mit Massenschwärmen kleiner Fische und ausführlich: Sprott Molybdenum Participation Corp.) 150 Millionen kan. $ eingesammelt. Diese Aktion hatte eine Art Schlaglicht-Wirkung in dessen Scheinwerferstrahlen das bisher unbekannte Moly steht. Endlich spricht jemand aus der Familie die Wertpapierhäuser diesem unbekannten Metall eine erste Anerkennung aus. Hinzu kommt, dass der globale Verbrauch von Molybdän seit Ende der 60-er Jahre um über 400% zugenommen hat. Solange China, Indien und Rest-Asien ihre Volkswirtschaften, insbesondere deren Metall-, Öl- und Kunststoffindustrien, im Schnellgang am Laufen halten - wobei insbesondere der Stahlindustrie (Südkorea führt) eine führende Rolle zukommt - sind weitere Steigerungen der Nachfrage klar vorprogrammiert. Die Preise für das Metall kletterten in den 70-er Jahren auf 50 $ pro Pfund (inflationsbereinigt heute etwa 148 $), fielen in den 80-er Jahren, dem Downswing des Rohstoffzyklus’ folgend, auf etwa 8-10 $ und in den 90-ern sogar auf etwa 3 $. Sie liegen derzeit etwas über 30 $ je Pfund. Kürzlich wurden in China sogar 36 $ am Spotmarkt gefordert. Um das alte Hoch der 70-er Jahre nach Kaufkraft zu erreichen, müsste der Preis also auf etwa 148 $ pro Pfund steigen, was in etwa einer Verfünffachung des heutigen Niveaus entspräche. Längerfristig wurden im Verlauf der Rohstoffzyklen die alten Höchststände nicht nur wieder erreicht, sondern auch deutlich überschritten. Man wird abwarten müssen, ob die Gesetze der Zyklen auch in künftigen Zeiten noch ihre Gültigkeit behalten. Die Wahrscheinlichkeit hierfür ist sehr hoch. Auch an den Terminmärkten ist das Metall noch weitgehend unbekannt und unentwickelt. Man kann auf fast alle Metalle Options- und Futureskontrakte eingehen bzw. abschliessen, jedoch nicht für Molybdän! Das dürfte sich bald ändern. Eine gewisse Anerkennung in diesem Bereich ist hier überfällig. Der über 15 Jahre anhaltende Bullenmarkt für Rohstoffe in den 60-er und 70-er Jahren wurde vom Aufstieg Japans (120 Millionen Einwohner) zur industriellen Grossmacht getragen. Die Situation im heutigen Bullenmarkt ist ähnlich - mit einem wichtigen Unterschied: Diesmal sind mehr als 20 Mal so viele Menschen in Asien involviert, was auf ein langes Leben des Rohstoffbooms hoffen lässt. Die verbrauchten Mengen sind enorm.

Beispiel Kupfer: Der tägliche Verbrauch der Welt passt in vier (4) Güterzüge mit je 100 Waggons und einer Länge von jeweils 1,6 Kilometer Länge. Die derzeit weltweit gehaltenen Kupfer-Vorräte reichen gerade für 4½ Tage des globalen Verbrauches. Die Neuentwicklungen so gut wie aller Metallminen reichen nicht aus, die Abbauraten der alten noch laufenden Minen zu ersetzen. Es gibt keinen zweiten chilenischen Kupfergürtel oder keine weiteren hochhaltigen Molybdänminen im Megaformat. Immer wildere grüne Vorschriften, lokale Proteste, immer grössere Hürden bei der Ausreichung von Bergbau-Permits, Enteignungen durch "volksnahe" Regierungen und immer längere Entwicklungszeiten für oft zweitklassige Vorkommen (erstklassige sind im Aussterben begriffen) sowie rasant steigende Kosten schaffen Preisauftriebe. Alles spricht für lukrative Rohstoff- und Metallinvestitionen in der richtigen Gegend und der richtigen Gesellschaft. Natürlich wird der Zyklus enden, doch dürften darüber noch viele Tonnen schwach konzentrierter Moly-Erze jahrelang unter den Brücken der Röstanlagen hinunter fliessen.

Das Metall und seine Bedeutung

Das chemische Element mit der zinnweiss-silbrigen Farbe findet sich unter "Mo" in der Gruppe 6 des Periodensystems der Elemente. Schon die alten Griechen kannten das mit vielen anderen Metallen legierbare, feste Schwermetall. Sie nannten es "molybdaina", was soviel wie Bleimasse oder Bleikugel bedeutet und sich von molybdos = Blei ableitet. Im Mittelalter wurde es häufig mit Bleiglanz verwechselt und auch "Wasserblei" oder "Reissblei" (wegen einer gewissen Sprödigkeit beim Verarbeiten) genannt. In der moderneren Welt entdeckte es Carl Wilhelm Scheele 1778 (Mozart war 22 Jahre alt) "offiziell": Damit war seine amtliche Einreihung ins Periodensystem gesichert. Mit einer Protonenzahl von 42, einem kubisch-raumzentrierten Schichtgitter (daher die ausgezeichneten Schmierwirkungen), einer Dichte von 10,22 g/ml (also 10 Mal so schwer wie Wasser und halb so schwer wie Gold) und einer relativen Atommasse von 95,94 stellt sich der Schmelzpunkt auf 2.617°C (fast doppelt so hoch wie Kohlenstoffstahl) und der Siedepunkt auf 5.560°C (einer der höchsten aller Stoffe überhaupt). Für pflanzliche, tierische und menschliche Organismen ist das Metall ein essentielles und absolut unentbehrliches Spurenelement. Moly-Kunstdünger - Gaben verhindern das Gilben der Blätter und kräftigen den Pflanzenwuchs. Wegen des hohen Schmelz- und des extrem hohen Siedepunktes verleiht es Kunststoffen und Plastik Feuerfestigkeit und dämpft auch die Rauchentwicklung sehr stark, beides Eigenschaften, die in einer Welt immer strengerer "grünen" Sicherheitsvorschriften und im Umweltschutz gesucht sind. Wenn Autos, die enorme Mengen Kunststoff (250 kg und mehr sind keine Seltenheit) enthalten, Küchen, Häuser oder technische Anlagen brennen oder schmoren, reduzieren schon kleine Moly-Beigaben Erstickungsgefahr und (Sicht- ) Vernebelungseffekte. Im Brandfalle bleibt dem Betroffenen wenigstens die Freude rauchfreier Entwicklung und der guten Übersicht über den fortschreitenden Raub der Flammen. Molybdän ist ein duktiles, nicht ganz leicht formbares Schwermetall. Eine dünne Oxydschicht gewährt Luftbeständigkeit. Von Wasser sowie der Mehrzahl der Säuren und Laugen wird es nicht angegriffen. Deshalb wird es in großen Quantitäten zur Herstellung von säure- und laugebeständigen Edelstählen und Nickelwerkstoffen eingesetzt. In seinen chemischen (kaum aber seinen physikalischen) Eigenschaften steht es Wolfram recht nahe. Molybdän wurde früher oft mit Bleiglanz oder Graphit verwechselt. Wegen seiner schwierigen Bearbeitbarkeit (es reisst leicht) fand Molybdän jahrhunderte hindurch kaum Beachtung. Erst gegen 1890 herum fanden die Ingenieure des französischen Rüstungsunternehmens deutschen Ursprungs Schneider & Co. ein kleines Geheimnis heraus. Wie so oft ist der Krieg der Vater aller Dinge: Bei der Herstellung von Panzerplatten verbesserten schon geringe Mo-Beimischungen deren Eigenschaften, wie Zähigkeit, Durchschlagswiderstand und Verbeulungseffekte in erstaunlicher Weise. Dieses Geheimnis blieb nicht lange in den französischen Rüstungsfabriken verborgen. Die Deutschen und später auch Engländer und Amerikaner begannen ihre Stähle ebenfalls mit Molybdän zu legieren und somit war ein erster grosser Nachfrageschub geboren. Die beiden Weltkriege trieben diese Nachfrage auf immer neue Höhen. Doch nach WK II stürzten die Preise ab. Im Zivilbereich blieb die Nachfrage gedämpft und Europa blieb abhängig vom Fremdbezug. Die einzige westeuropäische Mine wurde bis zum Jahre 1973 im norwegischen Knaben betrieben.

Wachsende Nachfrage

Wie schon erwähnt, war Molybdän der Öffentlichkeit und der weltweiten Investorengemeinschaft so gut wie unbekannt. Das Metall ist keineswegs so sexy wie Gold, Silber, Diamanten oder Platin und Palladium. 2006 stieg der Molybdänverbrauch weltweit um etwa 6%, und der chinesische Verbrauch um 20%. China, einst für fast 80% der weltweiten Mo-Lieferungen verantwortlich, stoppte im letzten Jahr die Ausfuhren und belegte die Exporte sogar mit Strafzöllen. Rasant steigender Eigenbedarf wie auch strategische Überlegungen spielten bei den entsprechenden Entscheidungen Pekings die Hauptrolle. Der globale Verbrauch wird Schätzungen zufolge bis 2018 von derzeit 400 Millionen Pfund auf 800 oder sogar 900 Millionen Pfund steigen. Woher diese Mengen kommen sollen, bleibt vorerst absolut rätselhaft. Neue Minen sind Seltenheiten, brauchen 5-10 Jahre bis zur Produktionsreife und Neufunde wiesen und weisen immer schwächere Konzentrationen auf. Auf jeden Fall sieht es gar nicht danach aus, als ob dramatische Preiseinbrüche zu erwarten wären. Die Welt-Stahlproduktion wächst um 10-11% pro Jahr. Die hierfür benötigten Moly-Mengen wachsen im Bedarf parallel mit. Ausserdem: Die grössten Mengen stammen als anfallendes Nebenprodukt aus der Kupfergewinnung. Doch hier vollzieht sich ein für die Moly-Preise günstiger Wandel: Weltweit erschöpfen sich die Minen mit Kupfer-Molybdän-Porphyr - Erzen rasch. Es wird zunehmend und notgedrungen auf Minen eines anderen Typus (insbesondere in Afrika) ausgewichen. Deren Gruben und Schächte jedoch enthalten vorwiegend Kupfer-Kobalt-Erze und kein oder nur sehr wenig Molybdän. "The trend is your friend": Dies trifft hier für die Moly-Preise und die Investoren der Branche eindeutig zu. Es gilt somit festzuhalten: "Reine" Molybdänvorkommen (also ohne physikalische Beimischung anderer Metalle, jedoch nicht in metallischer Form) sind also relativ selten (zu beachten: "reines" metallisches Moly tritt überhaupt nirgendwo auf, nur in chemischen Verbindungen, meist als Molybdänglanz). Ganz ähnlich wie Silber fällt es als Nebenprodukt, sozusagen zwangsweise, im Rahmen des Gewinnungsprozesses an (wer Rinder verarbeitet erhält ausser den begehrten Steaks auch Horn- und Knochenmehl, Häute und Eingeweide, erwünscht oder nicht). Nur jede fünfte aller "Moly"-Minen gehören zu diesem "reinen" Typ (wie beispielsweise New Cantech oder Blue Pearl), was dort die anderenfalls erzwungenen aufwendigen teueren Trenn- und Reinigungsverfahren erspart. Im Gegensatz hierzu fallen rund vier Fünftel des weltweit gewonnenen Schwermetalls (genau wie im Falle von Silber) als Nebenprodukt beim Abbau anderer Industriemetalle (meist mit Kupfer -physisch, nicht chemisch - verunreinigt) mit an. Weiterhin: Nickel ist derzeit wirkungs- und effekt-bezogen rund 5 Mal so teuer wie Moly (150 $ gegenüber 30 $ für gleiche Wirkung). In vielen Anwendungen in der Stahlindustrie bewirkt ein Pfund Molybdän das gleiche wie 5-7 Pfund Nickel. Daher wird Nickel zunehmend durch Moly ersetzt wobei die Stahlindustrie in diesem Verdrängungsprozess führt. Dieser Substitutionseffekt tritt vor allem in Bereich der Edelstahlproduktion auf, wo Rostfreiheit, Zähigkeit, Korrosionswiderstand, Druckfestigkeit, Säure- und Basenresistenz, Alterungsbeständigkeit (keine gefährlichen Alters-Mikrorisse bei Turbinenschaufeln und Rotoren) sowie Hoch- und Tieftemperaturverträglichkeit gefragt sind. Selbst wenn der Moly-Preis von derzeit etwa 30 auf demnächst 50 $ pro Pfund stiege, betrüge diese Preis-Nutzen-Differenz immer noch das Dreifache. Solange die Nickelpreise nicht in dramatischer Weise fallen, sind hier also Preisuntergrenzen für Moly eingebaut. Zumindest bis zu einem potentiellen Preissturz für Nickel wird die Stahlbranche diese Sparpotentiale keinesfalls übersehen. Über die Bedeutung des unbekannten Metalls geben auch die Verbrauchszahlen Auskunft: Im Jahre 2006 beispielsweise, wurden weltweit für Kupfer, Uran und Silber jeweils rund 8,6 Milliarden $ ausgegeben. Für Molybdän jedoch mussten kumulativ fast 11 Milliarden $ bezahlt werden. Der Markt ist also grösser als derjenige dieser drei individuell genannten und sehr bekannten Rohstoffe bzw. Metalle. Auch diese Tatsache ist weitgehend unbekannt. Der Markt hat gesprochen, sein Urteil war eindeutig, doch kaum jemand nahm diesen Urteilsspruch zur Kenntnis.

Vorkommen

Der Anteil von Molybdän in der Erdkruste beläuft sich auf ca. 0,00015 Gewichtsprozent. Es ist also relativ selten und die Konzentrationen bleiben sehr gering. Dies erschwert und verteuert einen wirtschaftlichen Abbau grundsätzlich. Die Vorkommen als solche sind weit verbreitet aber die Konzentrationen extrem niedrig. (Ludwig Thoma hat diese typische Grundsituation in "Josef Filsers gesammelten Briefwechsel" wie folgt ausgedrückt: er bäuerliche Landtagsabgeordnete Filser (für die führende Mehrheits-Partei der katholisch-königlich-Konservativen) wird gefragt, wie denn der Zahlenproporz im bayerischen Landtag wäre und die es um die Dominanz redegewandter Hochintellektueller der viel kleineren Gegenpartei bestellt sei. Darauf Filser: "Die Dimmeren sei mer schoh, aber die Mehreren sei mer ah." Die weltweit gestreuten Molybdän-Vorkommen reflektieren genau diesen Sachverhalt. Viel, aber "sehr dünn". Typische Prozentzahlen der Gehalte, wie sie die Minen veröffentlichen, beginnen daher mit 0,1...%. Das Metall tritt in freier Natur stets gebunden auf. Metallisch reine Vorkommen wurden bisher nicht bekannt. Als wichtigste dieser Bindungen bzw. der Molybdän-Mineralien gelten Molybdänit oder Molybdänglanz (MoS2, ein bleigrau bis blau-metallisch glänzendes Mineral), Powellit (Ca, Mo, WO4) und auch Wulfenit (Gelbbleierz, PbMoO4). Gelegentlich findet sich auch Molybdän(VI)-oxid und Molybdän(IV)-sulfid in den üblichen, sehr schwachen Konzentrationen. Ein erheblicher Teil der der Fachwelt bekannten Molybdän-Vorkommen der Erde finden sich in schwer zugänglichen Gebieten mit denkbar schwacher Infrastruktur oder auch in politisch instabilen Ländern bzw. in diktatorisch geführten Nationen wie China. Experten und deren Schätzungen zufolge sind die weltweit bekannten und vermuteten Moly-Reserven bis zum Jahre 2040 oder 2045 vollständig verbraucht. Neue Vorkommen werden im Prinzip quantitativ immer kleiner, weisen qualitativ immer schwächere Konzentrationen auf, sind regional immer schwerer zugänglich und liegen in grösseren Tiefen. Ergebnis: Höhere Kosten und damit steigende Preise! Ein bedenklicher Trend: Im Falle von Gold, Silber, Platin oder den meisten der übrigen Schlüsselrohstoffe wie Kupfer und Zink sind die billigen, "leichten", und großen Lager längst gefunden und weitgehend ausgebeutet worden (wie auch bei Öl). Dieser weltweit wirksame Trend mit dem die Volkswirtschaften künftig noch voll konfrontiert werden, schliesst Molybdän natürlich nicht aus. Die langfristig angelegten Sicherungsstrategien der vorausschauenden Asiaten, insbesondere Chinas und Südkoreas in Afrika, Südamerika und in anderen Ländern, wie Kanada, tragen dieser Tatsache voll Rechnung. Hilfreich für die künftige Preisentwicklung ist schliesslich auch die abzusehende Schliessung der grössten Moly-Mine der Welt: Henderson in Colorado wird in etwa fünf Jahren wegen Erschöpfung der Lagerstätten ausfallen. Die Vorräte sind am Ende und dürften ein Loch von ungefähr 17% in den weltweiten Angebotsstrom reissen. Mithin sind Verknappungen und somit wiederum Preissteigerungen vorprogrammiert. Der Kampf um die letzten Vorräte dürfte - ganz ähnlich wie bei Rohöl (und danach Wasser) - schon in wenigen Jahren einsetzen.

Bedarf

Der weltweite Bedarf für Molybdän steigt, wie schon erwähnt, jährlich mit einer Rate um 6%, während auf der Gegenseite die Produktionsmengen um wenigstens 1-2% pro Jahr zurückgehen, und dies ungeachtet der Tatsache, dass Chile als wichtigster Kupferproduzent seinen Ausstoss für 2008 und 2009 steigern will, was ein etwas höheres Moly-Angebot (Nebenprodukt) aus dieser Region zur Folge hätte. China verbraucht zurzeit ungefähr 14% der Weltproduktion mit Steigerungsraten um 20%. Das Land dürfte in wenigen Jahren mindestens 20 % absorbieren, falls seine Volkswirtschaft nicht in eine schwere Rezession verfällt. Geschähe dies und würde dieses möglicherweise noch mit einer massiven Rezession der USA Hand in Hand gehen, dann allerdings könnten die Molybdänpreise unter Druck geraten. Den gleichen Effekt könnte ein gigantischer Molybdänfund irgendwo auf der Welt auslösen. Geologen halten ein solches Ereignis jedoch für höchst unwahrscheinlich. Solange die Ölpreise hoch bleiben und tendenziell weiter steigen, wird auch Moly hoch bepreist, da die Ölindustrie mit Moly eng liiert, ja fast verheiratet ist: Stähle aller Art, Bohrgeräte, Gestänge, Bohrköpfe, Röhren, Behälter, Tanks, Pumpen, Ventile, Flansche, Hochdruckeinrichtungen, Tanker, Hafenanlagen, Raffinerien mit einer Vielfalt technischer Anwendungen, Grosstanklager, Tankwagen, Kanister, Motoren, Ölzusätze, Schmiermittel, feuerfeste Werkstoffe aller Art, Auspuffanlagen, Katalysatoren, Werkzeuge, Werkstätten, Reparaturanlagen, Werften, Kräne, Sonderfahrzeuge usw. - nichts läuft ohne Molybdän. Und die hier absorbierten Mengen sind hoch - bei steigender Tendenz. In der Vergangenheit liefen die Preisentwicklungen von Rohöl und Moly nahezu parallel. Höhere Ölpreise würden also nahezu automatisch preistreibend für Molybdän wirken. Ohne dieses strategische Metall kann "Big Oil" schlicht nicht existieren. Den gleichen Zwängen unterliegt sinngemäss auch die Schwesterbranche: Erdgas. Das Scheichtum Dubai plant den Bau einer Seewasser-Entsalzungsanlage von gewaltigen Ausmassen. Diese soll weit über 100 Jahre halten. Man denkt hierbei an die Nach-Öl-Zeit mit ihren fallenden Einnahmen, die bereits langsam aber sicher heraufzieht. Dauerhafte Grossprojekte sollen diesen Effekt der heraufziehenden Verarmung mildern. Diese Anlage soll voll mit Molybdän ausgekleidet werden (um die Lebensdauer auf Generationen hinaus zu verlängern), was mit den zu erneuernden Pipelines im Lande und in den Nachbarstaaten, eine gesamte Welt-Jahresproduktion absorbieren könnte. Die finanziellen Mittel, die notwendig wären, ein derartiges Megaprojekt durchzuziehen, könnte der Ölstaat im Prinzip aufbringen.

Im Einsatz unentbehrlich

Wolframverknappungen, wie sie in den Weltkriegen auftraten, führt stets zu vermehrtem Einsatz von Molybdän in der Produktion hochfester Werkstoffe. Als Legierungselement zur Steigerung von Festigkeit, Korrosions-, Alterungs-, Hitze- und Kältebeständigkeit trat es im Laufe der Jahrzehnte seinen metallurgischen Siegeszug an und wurde immer unentbehrlicher. Molybdänhaltige Hochleistungswerkstoffe wie beispielsweise Nicrofer, Hastelloy X, Inconel 718, Waspalloy, Haynes 282, Udimet 720, Rene 41, M963 oder Incoloy ermöglichen überhaupt erst eine Vielzahl technischer Verfahren und Prozesse und machen diese wirtschaftlich. Als ideales Schmiermittel kommt Molybdändisulfid auch bei erhöhten Temperaturen zum Einsatz. Es schmiert sowohl als Feststoff (besser noch als Graphit) als auch in Lösungen suspendiert (Motoren- und andere Öle). Die Schmierstoff und Ölbranche kann ohne Moly nicht mehr auskommen. Auch in elektronischen Bauteilen ist Molybdän zu finden. Hier dient das Metall den TFTs (Dünnschichttransistoren) als die leitende Metallschicht. Um Gasdichte für Stromdurchführungen zu erzielen, werden Molybdänfolien in der Quarzglasproduktion, für Halogenglühlampen und für Hochdruck-Gasentladungslampen benötigt. Molybdate werden zur Imprägnierung von Stoffen gebraucht, um Entflammbarkeit und Rauchentwicklungen (siehe oben) im Brandfalle drastisch zu senken. In der Röntgendiagnostik findet Moly als Targetmaterial in der Anode Verwendung (Röntgenröhren mit Molybdänanoden). Dies senkt die Energie der Strahlung und damit die Gefahr von Verbrennungen oder Bestrahlungsschäden sowohl für Patienten als auch für das die Apparate bedienende Personal in markanter Weise. Die Nuklearmediziner setzen Spalt-Molybdän in Radionuklidgeneratoren (RNG) ein. Wegen der günstigen Zerfallzeiten können wichtige Technetium-Isotope direkt vor Ort für Untersuchungszwecke gewonnen werden. Eine weitere erfreuliche Eigenschaft: Von allen Schwermetallen wirkt es offenbar am wenigsten toxisch auf menschliche Organismen. Wie schon angedeutet ist Molybdän für pflanzliches Leben absolut essentiell und stellt einen unentbehrlichen Mikronährstoff dar, der entscheidenden Einfluss auf die Assimilationsfähigkeit hat. Beispielsweise würden die in der Landwirtschaft so wichtigen Legumen aller Art - ohne das Spurenelement - für die menschliche Ernährung sowie als Tierfutter ausfallen. Die Bildung von Stickstoffsammlern wäre unmöglich. Molybdänmangel macht Böden unfruchtbar. Knöllchenbakterien beispielsweise und andere Pflanzensymbionten sterben ab. Sie können keinen Luftstickstoff mehr binden, keine Enzyme produzieren und keine schädlichen Nitrate mehr reduzieren oder neutralisieren. Dadurch fällt die natürliche Entgiftung der Böden weg. Das Gleiche gilt für Tiere und Menschen, die auf Harnsäurebildung und nachfolgender Entgiftung über die Nieren angewiesen sind. Ohne Moly geraten alle diese lebensnotwendigen De-Toxifizierungs-Prozesse ins Stocken. Menschliche Ernährung ohne Molybdän führt folglich zu schweren Störungen. 50-100 µg Molybdän pro Tag werden unbedingt benötigt. Manche Tierarten wachsen dank Molybdängaben im Futter sogar schneller. Moly-Dünger (siehe Tabelle) wird eingesetzt, wenn gilbende Blätter und andere Störungen im Pflanzenwuchs auf akuten Molybdänmangel hinweisen. Die sektoralen Verbräuche von Molybdän (sie sind alle "kritisch" für Wirtschaft) teilen sich grob gesprochen auf wie folgt: Edelstähle (rostfrei): 27 % Voll legierte Stähle: 13 % Werkzeug- und Hochgeschwindigkeits-Stähle: 10 % HSLA Stähle: 9 % Kohlenstoff Stähle: 9 % Katalysatoren: 8 % Molybdän Legierungen: 7 % Hochleistungs-Legierungen: 6 % Gusseisen: 3 % Schmierstoffe und Pigmente: 5 % Andere Anwendungen: 3 % Pipelines wurden nicht als Extra-Kategorie aufgeführt. Der entsprechende Bedarf steckt in den Zahlen für die Stähle. Wäre eine Wirtschaft ohne Molybdän denkbar? Ja, im Sinne der mittelalterlichen Agrarwirtschaft. Die Schaufeln und Hacken der Pächter und Halbsklaven-Heere (auf deren Niveau dann 95% der Bevölkerung absinken müsste), würden sich allerdings rasch abnutzen. Wäre der Wohlfahrtsstaat, ja wären Kriege ohne das Metall denkbar? Nein, unmöglich. Selbst die Gelddruckmaschinen benötigen Moly.

Breitgefächerte Anwendungspalette

Die Anwendungsbereiche für Molybdän sind also offenbar sehr vielfältig und Ersatz- bzw. Substitutionsstoffe sind nur in seltensten Fällen überhaupt zu finden, oder wenn, dann wären sie in der Anwendung einfach zu teuer. Gold und Silber könnten als Legierungsmetalle mit technisch erstaunlichen Wirkungen durchaus zum Einsatz kommen, doch verbieten die entsprechenden Preisstrukturen derartigen technologischen Einsatz. Was einem Ersatzstoff (mit weniger günstigen Eigenschaften) eventuelle noch am nächsten käme, ist teures und knappes Wolfram. Wie man es auch drehen und wenden mag, die moderne Wirtschaft ist in jedem Fall dringend auf Molybdän und seine regelmässigen Lieferungen angewiesen. Einige Anwendungsbereiche wurden bereits erwähnt. Doch ist die Anwendungspalette sehr viel weiter gespannt bzw. gefächert. Sie erstreckt sich u.a. über die Bereiche/Gebiete/Branchen:

http://www.goldseiten.de/content/kolumnen/artikel.php?storyi…

Molybdän- Ein neuer Stern am Rohstoffhimmel

Unbekannt und ungenannt - nicht mehr lange Noch bis vor kurzer Zeit weckte der Mehrzahl der Leser der Tagespresse die Nennung des Fremdbegriffes "Molybdän" (in der Umgangssprache kurz "Moly") bestenfalls Assoziationen an einer molligen Dänin oder deren Hund, dem Grossen Dänen. Ansonsten folgte ein mattes Gähnen. Doch gähnen mittlerweile immer weniger, denn nach Preissteigerungen von 3 auf über 40 $ pro Pfund in wenigen Jahren - genauer, seit 2001 - (derzeit im Bereich von 32 $ im Angebot) wurden sogar verwöhnte Investoren argwöhnisch. Es musste ja auffallen, dass derlei Preisanstiege diejenigen von Gold und Silber im gleichen Zeitraum um ein Mehrfaches übertrafen: Grob gesprochen: Eine Verzehnfachung gegenüber einer Verdreifachung. Damit aber kam die an den Börsen so typische Gier - Verzeihung - lebhaftes Interesse - auf. Steile Preissanstiege oder markante Kursgewinne irgendeiner Aktie, Währung, eines Rohstoffes oder Metalles senden nun einmal Adrenalinstösse in die Blutkreisläufe der Investorengemeinschaft, wenngleich manchmal mit Verspätung. Die kanadische Finanzfirma Sprott Securities, die sich auf Metalle, und insbesondere Molybdän spezialisiert hat, geht sogar davon aus, dass das alte Preis-Hoch von über 40 $ pro Pfund bis Jahresende nominal wieder erreicht wird: Eine gute Nachricht für Anleger, die sich hier bereits engagiert haben. Bezeichnenderweise hat dieses kanadische Wertpapierhaus auch gleich noch einen Exchange Traded Fund, also einen börsengehandelten Fond, kurz ETF, aufgelegt. Ganz ähnlich wie bei den entsprechenden ETF - Schwester-Institutionen für Gold und Silber werden diese Titel sowohl mit Aktien (mit Molybdän-Bezug) wie auch mit physischem Metall - hinterlegt. In einem allerersten Schritt hat man für diesen Fond mit dem appetitlichen Namen "Sprott Moly" (nicht zu verwechseln mit Massenschwärmen kleiner Fische und ausführlich: Sprott Molybdenum Participation Corp.) 150 Millionen kan. $ eingesammelt. Diese Aktion hatte eine Art Schlaglicht-Wirkung in dessen Scheinwerferstrahlen das bisher unbekannte Moly steht. Endlich spricht jemand aus der Familie die Wertpapierhäuser diesem unbekannten Metall eine erste Anerkennung aus. Hinzu kommt, dass der globale Verbrauch von Molybdän seit Ende der 60-er Jahre um über 400% zugenommen hat. Solange China, Indien und Rest-Asien ihre Volkswirtschaften, insbesondere deren Metall-, Öl- und Kunststoffindustrien, im Schnellgang am Laufen halten - wobei insbesondere der Stahlindustrie (Südkorea führt) eine führende Rolle zukommt - sind weitere Steigerungen der Nachfrage klar vorprogrammiert. Die Preise für das Metall kletterten in den 70-er Jahren auf 50 $ pro Pfund (inflationsbereinigt heute etwa 148 $), fielen in den 80-er Jahren, dem Downswing des Rohstoffzyklus’ folgend, auf etwa 8-10 $ und in den 90-ern sogar auf etwa 3 $. Sie liegen derzeit etwas über 30 $ je Pfund. Kürzlich wurden in China sogar 36 $ am Spotmarkt gefordert. Um das alte Hoch der 70-er Jahre nach Kaufkraft zu erreichen, müsste der Preis also auf etwa 148 $ pro Pfund steigen, was in etwa einer Verfünffachung des heutigen Niveaus entspräche. Längerfristig wurden im Verlauf der Rohstoffzyklen die alten Höchststände nicht nur wieder erreicht, sondern auch deutlich überschritten. Man wird abwarten müssen, ob die Gesetze der Zyklen auch in künftigen Zeiten noch ihre Gültigkeit behalten. Die Wahrscheinlichkeit hierfür ist sehr hoch. Auch an den Terminmärkten ist das Metall noch weitgehend unbekannt und unentwickelt. Man kann auf fast alle Metalle Options- und Futureskontrakte eingehen bzw. abschliessen, jedoch nicht für Molybdän! Das dürfte sich bald ändern. Eine gewisse Anerkennung in diesem Bereich ist hier überfällig. Der über 15 Jahre anhaltende Bullenmarkt für Rohstoffe in den 60-er und 70-er Jahren wurde vom Aufstieg Japans (120 Millionen Einwohner) zur industriellen Grossmacht getragen. Die Situation im heutigen Bullenmarkt ist ähnlich - mit einem wichtigen Unterschied: Diesmal sind mehr als 20 Mal so viele Menschen in Asien involviert, was auf ein langes Leben des Rohstoffbooms hoffen lässt. Die verbrauchten Mengen sind enorm.

Beispiel Kupfer: Der tägliche Verbrauch der Welt passt in vier (4) Güterzüge mit je 100 Waggons und einer Länge von jeweils 1,6 Kilometer Länge. Die derzeit weltweit gehaltenen Kupfer-Vorräte reichen gerade für 4½ Tage des globalen Verbrauches. Die Neuentwicklungen so gut wie aller Metallminen reichen nicht aus, die Abbauraten der alten noch laufenden Minen zu ersetzen. Es gibt keinen zweiten chilenischen Kupfergürtel oder keine weiteren hochhaltigen Molybdänminen im Megaformat. Immer wildere grüne Vorschriften, lokale Proteste, immer grössere Hürden bei der Ausreichung von Bergbau-Permits, Enteignungen durch "volksnahe" Regierungen und immer längere Entwicklungszeiten für oft zweitklassige Vorkommen (erstklassige sind im Aussterben begriffen) sowie rasant steigende Kosten schaffen Preisauftriebe. Alles spricht für lukrative Rohstoff- und Metallinvestitionen in der richtigen Gegend und der richtigen Gesellschaft. Natürlich wird der Zyklus enden, doch dürften darüber noch viele Tonnen schwach konzentrierter Moly-Erze jahrelang unter den Brücken der Röstanlagen hinunter fliessen.

Das Metall und seine Bedeutung

Das chemische Element mit der zinnweiss-silbrigen Farbe findet sich unter "Mo" in der Gruppe 6 des Periodensystems der Elemente. Schon die alten Griechen kannten das mit vielen anderen Metallen legierbare, feste Schwermetall. Sie nannten es "molybdaina", was soviel wie Bleimasse oder Bleikugel bedeutet und sich von molybdos = Blei ableitet. Im Mittelalter wurde es häufig mit Bleiglanz verwechselt und auch "Wasserblei" oder "Reissblei" (wegen einer gewissen Sprödigkeit beim Verarbeiten) genannt. In der moderneren Welt entdeckte es Carl Wilhelm Scheele 1778 (Mozart war 22 Jahre alt) "offiziell": Damit war seine amtliche Einreihung ins Periodensystem gesichert. Mit einer Protonenzahl von 42, einem kubisch-raumzentrierten Schichtgitter (daher die ausgezeichneten Schmierwirkungen), einer Dichte von 10,22 g/ml (also 10 Mal so schwer wie Wasser und halb so schwer wie Gold) und einer relativen Atommasse von 95,94 stellt sich der Schmelzpunkt auf 2.617°C (fast doppelt so hoch wie Kohlenstoffstahl) und der Siedepunkt auf 5.560°C (einer der höchsten aller Stoffe überhaupt). Für pflanzliche, tierische und menschliche Organismen ist das Metall ein essentielles und absolut unentbehrliches Spurenelement. Moly-Kunstdünger - Gaben verhindern das Gilben der Blätter und kräftigen den Pflanzenwuchs. Wegen des hohen Schmelz- und des extrem hohen Siedepunktes verleiht es Kunststoffen und Plastik Feuerfestigkeit und dämpft auch die Rauchentwicklung sehr stark, beides Eigenschaften, die in einer Welt immer strengerer "grünen" Sicherheitsvorschriften und im Umweltschutz gesucht sind. Wenn Autos, die enorme Mengen Kunststoff (250 kg und mehr sind keine Seltenheit) enthalten, Küchen, Häuser oder technische Anlagen brennen oder schmoren, reduzieren schon kleine Moly-Beigaben Erstickungsgefahr und (Sicht- ) Vernebelungseffekte. Im Brandfalle bleibt dem Betroffenen wenigstens die Freude rauchfreier Entwicklung und der guten Übersicht über den fortschreitenden Raub der Flammen. Molybdän ist ein duktiles, nicht ganz leicht formbares Schwermetall. Eine dünne Oxydschicht gewährt Luftbeständigkeit. Von Wasser sowie der Mehrzahl der Säuren und Laugen wird es nicht angegriffen. Deshalb wird es in großen Quantitäten zur Herstellung von säure- und laugebeständigen Edelstählen und Nickelwerkstoffen eingesetzt. In seinen chemischen (kaum aber seinen physikalischen) Eigenschaften steht es Wolfram recht nahe. Molybdän wurde früher oft mit Bleiglanz oder Graphit verwechselt. Wegen seiner schwierigen Bearbeitbarkeit (es reisst leicht) fand Molybdän jahrhunderte hindurch kaum Beachtung. Erst gegen 1890 herum fanden die Ingenieure des französischen Rüstungsunternehmens deutschen Ursprungs Schneider & Co. ein kleines Geheimnis heraus. Wie so oft ist der Krieg der Vater aller Dinge: Bei der Herstellung von Panzerplatten verbesserten schon geringe Mo-Beimischungen deren Eigenschaften, wie Zähigkeit, Durchschlagswiderstand und Verbeulungseffekte in erstaunlicher Weise. Dieses Geheimnis blieb nicht lange in den französischen Rüstungsfabriken verborgen. Die Deutschen und später auch Engländer und Amerikaner begannen ihre Stähle ebenfalls mit Molybdän zu legieren und somit war ein erster grosser Nachfrageschub geboren. Die beiden Weltkriege trieben diese Nachfrage auf immer neue Höhen. Doch nach WK II stürzten die Preise ab. Im Zivilbereich blieb die Nachfrage gedämpft und Europa blieb abhängig vom Fremdbezug. Die einzige westeuropäische Mine wurde bis zum Jahre 1973 im norwegischen Knaben betrieben.

Wachsende Nachfrage

Wie schon erwähnt, war Molybdän der Öffentlichkeit und der weltweiten Investorengemeinschaft so gut wie unbekannt. Das Metall ist keineswegs so sexy wie Gold, Silber, Diamanten oder Platin und Palladium. 2006 stieg der Molybdänverbrauch weltweit um etwa 6%, und der chinesische Verbrauch um 20%. China, einst für fast 80% der weltweiten Mo-Lieferungen verantwortlich, stoppte im letzten Jahr die Ausfuhren und belegte die Exporte sogar mit Strafzöllen. Rasant steigender Eigenbedarf wie auch strategische Überlegungen spielten bei den entsprechenden Entscheidungen Pekings die Hauptrolle. Der globale Verbrauch wird Schätzungen zufolge bis 2018 von derzeit 400 Millionen Pfund auf 800 oder sogar 900 Millionen Pfund steigen. Woher diese Mengen kommen sollen, bleibt vorerst absolut rätselhaft. Neue Minen sind Seltenheiten, brauchen 5-10 Jahre bis zur Produktionsreife und Neufunde wiesen und weisen immer schwächere Konzentrationen auf. Auf jeden Fall sieht es gar nicht danach aus, als ob dramatische Preiseinbrüche zu erwarten wären. Die Welt-Stahlproduktion wächst um 10-11% pro Jahr. Die hierfür benötigten Moly-Mengen wachsen im Bedarf parallel mit. Ausserdem: Die grössten Mengen stammen als anfallendes Nebenprodukt aus der Kupfergewinnung. Doch hier vollzieht sich ein für die Moly-Preise günstiger Wandel: Weltweit erschöpfen sich die Minen mit Kupfer-Molybdän-Porphyr - Erzen rasch. Es wird zunehmend und notgedrungen auf Minen eines anderen Typus (insbesondere in Afrika) ausgewichen. Deren Gruben und Schächte jedoch enthalten vorwiegend Kupfer-Kobalt-Erze und kein oder nur sehr wenig Molybdän. "The trend is your friend": Dies trifft hier für die Moly-Preise und die Investoren der Branche eindeutig zu. Es gilt somit festzuhalten: "Reine" Molybdänvorkommen (also ohne physikalische Beimischung anderer Metalle, jedoch nicht in metallischer Form) sind also relativ selten (zu beachten: "reines" metallisches Moly tritt überhaupt nirgendwo auf, nur in chemischen Verbindungen, meist als Molybdänglanz). Ganz ähnlich wie Silber fällt es als Nebenprodukt, sozusagen zwangsweise, im Rahmen des Gewinnungsprozesses an (wer Rinder verarbeitet erhält ausser den begehrten Steaks auch Horn- und Knochenmehl, Häute und Eingeweide, erwünscht oder nicht). Nur jede fünfte aller "Moly"-Minen gehören zu diesem "reinen" Typ (wie beispielsweise New Cantech oder Blue Pearl), was dort die anderenfalls erzwungenen aufwendigen teueren Trenn- und Reinigungsverfahren erspart. Im Gegensatz hierzu fallen rund vier Fünftel des weltweit gewonnenen Schwermetalls (genau wie im Falle von Silber) als Nebenprodukt beim Abbau anderer Industriemetalle (meist mit Kupfer -physisch, nicht chemisch - verunreinigt) mit an. Weiterhin: Nickel ist derzeit wirkungs- und effekt-bezogen rund 5 Mal so teuer wie Moly (150 $ gegenüber 30 $ für gleiche Wirkung). In vielen Anwendungen in der Stahlindustrie bewirkt ein Pfund Molybdän das gleiche wie 5-7 Pfund Nickel. Daher wird Nickel zunehmend durch Moly ersetzt wobei die Stahlindustrie in diesem Verdrängungsprozess führt. Dieser Substitutionseffekt tritt vor allem in Bereich der Edelstahlproduktion auf, wo Rostfreiheit, Zähigkeit, Korrosionswiderstand, Druckfestigkeit, Säure- und Basenresistenz, Alterungsbeständigkeit (keine gefährlichen Alters-Mikrorisse bei Turbinenschaufeln und Rotoren) sowie Hoch- und Tieftemperaturverträglichkeit gefragt sind. Selbst wenn der Moly-Preis von derzeit etwa 30 auf demnächst 50 $ pro Pfund stiege, betrüge diese Preis-Nutzen-Differenz immer noch das Dreifache. Solange die Nickelpreise nicht in dramatischer Weise fallen, sind hier also Preisuntergrenzen für Moly eingebaut. Zumindest bis zu einem potentiellen Preissturz für Nickel wird die Stahlbranche diese Sparpotentiale keinesfalls übersehen. Über die Bedeutung des unbekannten Metalls geben auch die Verbrauchszahlen Auskunft: Im Jahre 2006 beispielsweise, wurden weltweit für Kupfer, Uran und Silber jeweils rund 8,6 Milliarden $ ausgegeben. Für Molybdän jedoch mussten kumulativ fast 11 Milliarden $ bezahlt werden. Der Markt ist also grösser als derjenige dieser drei individuell genannten und sehr bekannten Rohstoffe bzw. Metalle. Auch diese Tatsache ist weitgehend unbekannt. Der Markt hat gesprochen, sein Urteil war eindeutig, doch kaum jemand nahm diesen Urteilsspruch zur Kenntnis.

Vorkommen

Der Anteil von Molybdän in der Erdkruste beläuft sich auf ca. 0,00015 Gewichtsprozent. Es ist also relativ selten und die Konzentrationen bleiben sehr gering. Dies erschwert und verteuert einen wirtschaftlichen Abbau grundsätzlich. Die Vorkommen als solche sind weit verbreitet aber die Konzentrationen extrem niedrig. (Ludwig Thoma hat diese typische Grundsituation in "Josef Filsers gesammelten Briefwechsel" wie folgt ausgedrückt: er bäuerliche Landtagsabgeordnete Filser (für die führende Mehrheits-Partei der katholisch-königlich-Konservativen) wird gefragt, wie denn der Zahlenproporz im bayerischen Landtag wäre und die es um die Dominanz redegewandter Hochintellektueller der viel kleineren Gegenpartei bestellt sei. Darauf Filser: "Die Dimmeren sei mer schoh, aber die Mehreren sei mer ah." Die weltweit gestreuten Molybdän-Vorkommen reflektieren genau diesen Sachverhalt. Viel, aber "sehr dünn". Typische Prozentzahlen der Gehalte, wie sie die Minen veröffentlichen, beginnen daher mit 0,1...%. Das Metall tritt in freier Natur stets gebunden auf. Metallisch reine Vorkommen wurden bisher nicht bekannt. Als wichtigste dieser Bindungen bzw. der Molybdän-Mineralien gelten Molybdänit oder Molybdänglanz (MoS2, ein bleigrau bis blau-metallisch glänzendes Mineral), Powellit (Ca, Mo, WO4) und auch Wulfenit (Gelbbleierz, PbMoO4). Gelegentlich findet sich auch Molybdän(VI)-oxid und Molybdän(IV)-sulfid in den üblichen, sehr schwachen Konzentrationen. Ein erheblicher Teil der der Fachwelt bekannten Molybdän-Vorkommen der Erde finden sich in schwer zugänglichen Gebieten mit denkbar schwacher Infrastruktur oder auch in politisch instabilen Ländern bzw. in diktatorisch geführten Nationen wie China. Experten und deren Schätzungen zufolge sind die weltweit bekannten und vermuteten Moly-Reserven bis zum Jahre 2040 oder 2045 vollständig verbraucht. Neue Vorkommen werden im Prinzip quantitativ immer kleiner, weisen qualitativ immer schwächere Konzentrationen auf, sind regional immer schwerer zugänglich und liegen in grösseren Tiefen. Ergebnis: Höhere Kosten und damit steigende Preise! Ein bedenklicher Trend: Im Falle von Gold, Silber, Platin oder den meisten der übrigen Schlüsselrohstoffe wie Kupfer und Zink sind die billigen, "leichten", und großen Lager längst gefunden und weitgehend ausgebeutet worden (wie auch bei Öl). Dieser weltweit wirksame Trend mit dem die Volkswirtschaften künftig noch voll konfrontiert werden, schliesst Molybdän natürlich nicht aus. Die langfristig angelegten Sicherungsstrategien der vorausschauenden Asiaten, insbesondere Chinas und Südkoreas in Afrika, Südamerika und in anderen Ländern, wie Kanada, tragen dieser Tatsache voll Rechnung. Hilfreich für die künftige Preisentwicklung ist schliesslich auch die abzusehende Schliessung der grössten Moly-Mine der Welt: Henderson in Colorado wird in etwa fünf Jahren wegen Erschöpfung der Lagerstätten ausfallen. Die Vorräte sind am Ende und dürften ein Loch von ungefähr 17% in den weltweiten Angebotsstrom reissen. Mithin sind Verknappungen und somit wiederum Preissteigerungen vorprogrammiert. Der Kampf um die letzten Vorräte dürfte - ganz ähnlich wie bei Rohöl (und danach Wasser) - schon in wenigen Jahren einsetzen.

Bedarf

Der weltweite Bedarf für Molybdän steigt, wie schon erwähnt, jährlich mit einer Rate um 6%, während auf der Gegenseite die Produktionsmengen um wenigstens 1-2% pro Jahr zurückgehen, und dies ungeachtet der Tatsache, dass Chile als wichtigster Kupferproduzent seinen Ausstoss für 2008 und 2009 steigern will, was ein etwas höheres Moly-Angebot (Nebenprodukt) aus dieser Region zur Folge hätte. China verbraucht zurzeit ungefähr 14% der Weltproduktion mit Steigerungsraten um 20%. Das Land dürfte in wenigen Jahren mindestens 20 % absorbieren, falls seine Volkswirtschaft nicht in eine schwere Rezession verfällt. Geschähe dies und würde dieses möglicherweise noch mit einer massiven Rezession der USA Hand in Hand gehen, dann allerdings könnten die Molybdänpreise unter Druck geraten. Den gleichen Effekt könnte ein gigantischer Molybdänfund irgendwo auf der Welt auslösen. Geologen halten ein solches Ereignis jedoch für höchst unwahrscheinlich. Solange die Ölpreise hoch bleiben und tendenziell weiter steigen, wird auch Moly hoch bepreist, da die Ölindustrie mit Moly eng liiert, ja fast verheiratet ist: Stähle aller Art, Bohrgeräte, Gestänge, Bohrköpfe, Röhren, Behälter, Tanks, Pumpen, Ventile, Flansche, Hochdruckeinrichtungen, Tanker, Hafenanlagen, Raffinerien mit einer Vielfalt technischer Anwendungen, Grosstanklager, Tankwagen, Kanister, Motoren, Ölzusätze, Schmiermittel, feuerfeste Werkstoffe aller Art, Auspuffanlagen, Katalysatoren, Werkzeuge, Werkstätten, Reparaturanlagen, Werften, Kräne, Sonderfahrzeuge usw. - nichts läuft ohne Molybdän. Und die hier absorbierten Mengen sind hoch - bei steigender Tendenz. In der Vergangenheit liefen die Preisentwicklungen von Rohöl und Moly nahezu parallel. Höhere Ölpreise würden also nahezu automatisch preistreibend für Molybdän wirken. Ohne dieses strategische Metall kann "Big Oil" schlicht nicht existieren. Den gleichen Zwängen unterliegt sinngemäss auch die Schwesterbranche: Erdgas. Das Scheichtum Dubai plant den Bau einer Seewasser-Entsalzungsanlage von gewaltigen Ausmassen. Diese soll weit über 100 Jahre halten. Man denkt hierbei an die Nach-Öl-Zeit mit ihren fallenden Einnahmen, die bereits langsam aber sicher heraufzieht. Dauerhafte Grossprojekte sollen diesen Effekt der heraufziehenden Verarmung mildern. Diese Anlage soll voll mit Molybdän ausgekleidet werden (um die Lebensdauer auf Generationen hinaus zu verlängern), was mit den zu erneuernden Pipelines im Lande und in den Nachbarstaaten, eine gesamte Welt-Jahresproduktion absorbieren könnte. Die finanziellen Mittel, die notwendig wären, ein derartiges Megaprojekt durchzuziehen, könnte der Ölstaat im Prinzip aufbringen.

Im Einsatz unentbehrlich

Wolframverknappungen, wie sie in den Weltkriegen auftraten, führt stets zu vermehrtem Einsatz von Molybdän in der Produktion hochfester Werkstoffe. Als Legierungselement zur Steigerung von Festigkeit, Korrosions-, Alterungs-, Hitze- und Kältebeständigkeit trat es im Laufe der Jahrzehnte seinen metallurgischen Siegeszug an und wurde immer unentbehrlicher. Molybdänhaltige Hochleistungswerkstoffe wie beispielsweise Nicrofer, Hastelloy X, Inconel 718, Waspalloy, Haynes 282, Udimet 720, Rene 41, M963 oder Incoloy ermöglichen überhaupt erst eine Vielzahl technischer Verfahren und Prozesse und machen diese wirtschaftlich. Als ideales Schmiermittel kommt Molybdändisulfid auch bei erhöhten Temperaturen zum Einsatz. Es schmiert sowohl als Feststoff (besser noch als Graphit) als auch in Lösungen suspendiert (Motoren- und andere Öle). Die Schmierstoff und Ölbranche kann ohne Moly nicht mehr auskommen. Auch in elektronischen Bauteilen ist Molybdän zu finden. Hier dient das Metall den TFTs (Dünnschichttransistoren) als die leitende Metallschicht. Um Gasdichte für Stromdurchführungen zu erzielen, werden Molybdänfolien in der Quarzglasproduktion, für Halogenglühlampen und für Hochdruck-Gasentladungslampen benötigt. Molybdate werden zur Imprägnierung von Stoffen gebraucht, um Entflammbarkeit und Rauchentwicklungen (siehe oben) im Brandfalle drastisch zu senken. In der Röntgendiagnostik findet Moly als Targetmaterial in der Anode Verwendung (Röntgenröhren mit Molybdänanoden). Dies senkt die Energie der Strahlung und damit die Gefahr von Verbrennungen oder Bestrahlungsschäden sowohl für Patienten als auch für das die Apparate bedienende Personal in markanter Weise. Die Nuklearmediziner setzen Spalt-Molybdän in Radionuklidgeneratoren (RNG) ein. Wegen der günstigen Zerfallzeiten können wichtige Technetium-Isotope direkt vor Ort für Untersuchungszwecke gewonnen werden. Eine weitere erfreuliche Eigenschaft: Von allen Schwermetallen wirkt es offenbar am wenigsten toxisch auf menschliche Organismen. Wie schon angedeutet ist Molybdän für pflanzliches Leben absolut essentiell und stellt einen unentbehrlichen Mikronährstoff dar, der entscheidenden Einfluss auf die Assimilationsfähigkeit hat. Beispielsweise würden die in der Landwirtschaft so wichtigen Legumen aller Art - ohne das Spurenelement - für die menschliche Ernährung sowie als Tierfutter ausfallen. Die Bildung von Stickstoffsammlern wäre unmöglich. Molybdänmangel macht Böden unfruchtbar. Knöllchenbakterien beispielsweise und andere Pflanzensymbionten sterben ab. Sie können keinen Luftstickstoff mehr binden, keine Enzyme produzieren und keine schädlichen Nitrate mehr reduzieren oder neutralisieren. Dadurch fällt die natürliche Entgiftung der Böden weg. Das Gleiche gilt für Tiere und Menschen, die auf Harnsäurebildung und nachfolgender Entgiftung über die Nieren angewiesen sind. Ohne Moly geraten alle diese lebensnotwendigen De-Toxifizierungs-Prozesse ins Stocken. Menschliche Ernährung ohne Molybdän führt folglich zu schweren Störungen. 50-100 µg Molybdän pro Tag werden unbedingt benötigt. Manche Tierarten wachsen dank Molybdängaben im Futter sogar schneller. Moly-Dünger (siehe Tabelle) wird eingesetzt, wenn gilbende Blätter und andere Störungen im Pflanzenwuchs auf akuten Molybdänmangel hinweisen. Die sektoralen Verbräuche von Molybdän (sie sind alle "kritisch" für Wirtschaft) teilen sich grob gesprochen auf wie folgt: Edelstähle (rostfrei): 27 % Voll legierte Stähle: 13 % Werkzeug- und Hochgeschwindigkeits-Stähle: 10 % HSLA Stähle: 9 % Kohlenstoff Stähle: 9 % Katalysatoren: 8 % Molybdän Legierungen: 7 % Hochleistungs-Legierungen: 6 % Gusseisen: 3 % Schmierstoffe und Pigmente: 5 % Andere Anwendungen: 3 % Pipelines wurden nicht als Extra-Kategorie aufgeführt. Der entsprechende Bedarf steckt in den Zahlen für die Stähle. Wäre eine Wirtschaft ohne Molybdän denkbar? Ja, im Sinne der mittelalterlichen Agrarwirtschaft. Die Schaufeln und Hacken der Pächter und Halbsklaven-Heere (auf deren Niveau dann 95% der Bevölkerung absinken müsste), würden sich allerdings rasch abnutzen. Wäre der Wohlfahrtsstaat, ja wären Kriege ohne das Metall denkbar? Nein, unmöglich. Selbst die Gelddruckmaschinen benötigen Moly.

Breitgefächerte Anwendungspalette

Die Anwendungsbereiche für Molybdän sind also offenbar sehr vielfältig und Ersatz- bzw. Substitutionsstoffe sind nur in seltensten Fällen überhaupt zu finden, oder wenn, dann wären sie in der Anwendung einfach zu teuer. Gold und Silber könnten als Legierungsmetalle mit technisch erstaunlichen Wirkungen durchaus zum Einsatz kommen, doch verbieten die entsprechenden Preisstrukturen derartigen technologischen Einsatz. Was einem Ersatzstoff (mit weniger günstigen Eigenschaften) eventuelle noch am nächsten käme, ist teures und knappes Wolfram. Wie man es auch drehen und wenden mag, die moderne Wirtschaft ist in jedem Fall dringend auf Molybdän und seine regelmässigen Lieferungen angewiesen. Einige Anwendungsbereiche wurden bereits erwähnt. Doch ist die Anwendungspalette sehr viel weiter gespannt bzw. gefächert. Sie erstreckt sich u.a. über die Bereiche/Gebiete/Branchen:

http://www.goldseiten.de/content/kolumnen/artikel.php?storyi…

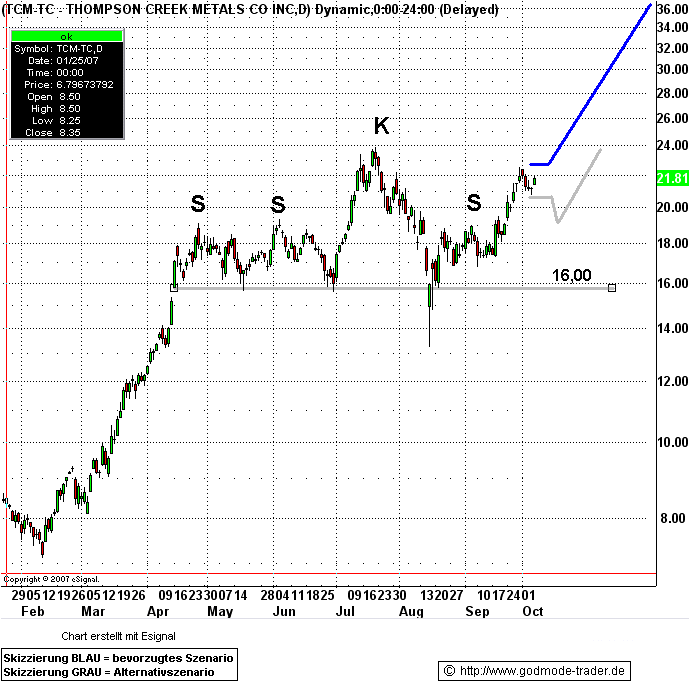

THOMPSON CREEK METALS vor gewaltiger Rallye

Datum 05.10.2007 - Uhrzeit 21:55 (© BörseGo AG 2007, Autor: Weygand Harald, Vorstand BörseGo AG, © GodmodeTrader - http://www.godmode-trader.de/)

WKN: A0MR6Q | ISIN: CA8847681027 | Intradaykurs:

THOMPSON CREEK METALS - Kürzel: TCM - ISIN: CA8847681027

(Ehemals Blue Pearl Mining)

Börse: TSE in CAD / Kursstand: 21,81 CAD (Kanada-Dollar)

Kursverlauf von 24.01.2007 bis 05.10.2007 (log. Kerzenchartdarstellung / 1 Kerze = 1 Tag)

Rückblick: Der Kursverlauf seit April dieses Jahres zeigt die Konturen eines langgestreckten SSKS Trendwendeprozesses, der aber durch den Anstieg der vergangenen Handelstage im Begriff ist, abgebrochen zu werden. Entscheidend war hier der Anstieg über 19 CAD, da hier die Peaks der 3 Schultern lokalisiert sind. Heute sehen wir bei der Aktie ein kleines Gap Up aus einer Bullflag. Die Aktie ist ein beliebter Aktientitel bei spekulativ ausgerichteten Marktteilnehmern. Deshalb und wegen dem derzeit außerordentlich positiven Chartbild nun diese charttechnische Besprechung.

Charttechnischer Ausblick: Die Aktie von THOMPSON CREEK METALS hat gute Chancen direkt weiter anzusteigen. Das mittelfristige charttechnisch ermittelte Kursziel liegt bei ca. 34 CAD. Mittel- bis langfristig sehen wir einen Zielbereich von ca. 50 CAD. Bezgl. der kurzfristigen Marschroute läßt sich festhalten, dass ein Kursverfall unter 20,70 CAD eine Konsolidierung bis 19 CAD einleiten würde. Ausgehend von 19 CAD könnte dann die weitere Anstiegsphase starten. Ein merklicher Rückfall unter 19, CAD würde für eine zeitlich ausgedehnte Korrekturphase sprechen.

Datum 05.10.2007 - Uhrzeit 21:55 (© BörseGo AG 2007, Autor: Weygand Harald, Vorstand BörseGo AG, © GodmodeTrader - http://www.godmode-trader.de/)

WKN: A0MR6Q | ISIN: CA8847681027 | Intradaykurs:

THOMPSON CREEK METALS - Kürzel: TCM - ISIN: CA8847681027

(Ehemals Blue Pearl Mining)

Börse: TSE in CAD / Kursstand: 21,81 CAD (Kanada-Dollar)

Kursverlauf von 24.01.2007 bis 05.10.2007 (log. Kerzenchartdarstellung / 1 Kerze = 1 Tag)

Rückblick: Der Kursverlauf seit April dieses Jahres zeigt die Konturen eines langgestreckten SSKS Trendwendeprozesses, der aber durch den Anstieg der vergangenen Handelstage im Begriff ist, abgebrochen zu werden. Entscheidend war hier der Anstieg über 19 CAD, da hier die Peaks der 3 Schultern lokalisiert sind. Heute sehen wir bei der Aktie ein kleines Gap Up aus einer Bullflag. Die Aktie ist ein beliebter Aktientitel bei spekulativ ausgerichteten Marktteilnehmern. Deshalb und wegen dem derzeit außerordentlich positiven Chartbild nun diese charttechnische Besprechung.

Charttechnischer Ausblick: Die Aktie von THOMPSON CREEK METALS hat gute Chancen direkt weiter anzusteigen. Das mittelfristige charttechnisch ermittelte Kursziel liegt bei ca. 34 CAD. Mittel- bis langfristig sehen wir einen Zielbereich von ca. 50 CAD. Bezgl. der kurzfristigen Marschroute läßt sich festhalten, dass ein Kursverfall unter 20,70 CAD eine Konsolidierung bis 19 CAD einleiten würde. Ausgehend von 19 CAD könnte dann die weitere Anstiegsphase starten. Ein merklicher Rückfall unter 19, CAD würde für eine zeitlich ausgedehnte Korrekturphase sprechen.

RHENIUM

Nachfolgend einige Artikel zum Thema Rhenium, welches als Beiprodukt

bei der Herstellung von reinem Molybdän gewonnen wird.

Der Stoff ist immens wichtig für den Einsatz in modernen Elektronikkomponenten (z.B. in Speicherchips).

Rhenium kostet etwa 5500 US$ per kg, bzw 2500 US$ per pound/ib.

Es fallen aber nur geringste Mengen dieses Metalls bei der Molybdängewinnung an, das Verhältnis ist etwa 1:100.000.

Aus diesem Grund wird Rhenium selbst bei einer Vermehrfachung des

aktuellen Preises immer nur ein "Zubrot" bei der Molybdänherstellung bleiben.

Nachfolgend einige Artikel zum Thema Rhenium, welches als Beiprodukt

bei der Herstellung von reinem Molybdän gewonnen wird.

Der Stoff ist immens wichtig für den Einsatz in modernen Elektronikkomponenten (z.B. in Speicherchips).

Rhenium kostet etwa 5500 US$ per kg, bzw 2500 US$ per pound/ib.

Es fallen aber nur geringste Mengen dieses Metalls bei der Molybdängewinnung an, das Verhältnis ist etwa 1:100.000.

Aus diesem Grund wird Rhenium selbst bei einer Vermehrfachung des

aktuellen Preises immer nur ein "Zubrot" bei der Molybdänherstellung bleiben.

"Rhenium does not occur as the free element in nature. Rhenium is found as minor components in the mineral gadolinite, which contains beryllium, and molybdenite, which contains molybdenum. In practice, it is extracted commonly as a byproduct from molybdenum smelter flue dust. Rhenium is US$6000 per Troy ounce."

"...I have written here before how critical molybdenum is to industrial products,... But some recent news about the very rare platinum group metal, rhenium, makes the restriction of the molybdenum supply problem even worse. It has been discovered that rhenium can be used in electronic memory devices to dramatically increase their capacity. This has caused a sharp multiplying of the price of rhenium in a very short time.