Starcore International Ventures - Goldproduzent mit KGV <3 bricht aus! (Seite 166)

eröffnet am 01.06.07 09:16:10 von

neuester Beitrag 11.04.24 21:22:53 von

neuester Beitrag 11.04.24 21:22:53 von

Beiträge: 2.519

ID: 1.128.155

ID: 1.128.155

Aufrufe heute: 2

Gesamt: 190.700

Gesamt: 190.700

Aktive User: 0

ISIN: CA85525T2020 · WKN: A2AACF · Symbol: V4JA

0,0805

EUR

+11,81 %

+0,0085 EUR

Letzter Kurs 12:15:49 Tradegate

Neuigkeiten

22.04.24 · IRW Press |

22.01.24 · IRW Press |

29.08.23 · IRW Press |

Starcore setzt mit dem Erwerb eines Projekts an der Côte d‘Ivoire auf geopolitische Diversifizierung 16.08.23 · IRW Press |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 0,9000 | +16,13 | |

| 15.699,00 | +15,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8950 | -7,25 | |

| 0,5100 | -8,11 | |

| 0,5400 | -8,47 | |

| 39,20 | -8,84 | |

| 46,88 | -97,99 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 36.900.186 von hbg55 am 01.04.09 19:10:07

...denke cad 0,10 hat sich in den last days schöööön als

unterstützungsmarke bewiesen..........uuuuund haben mehr und

mehr potential uns weiter gen norden auszurichten........

Recent Trades - Last 9

Time Ex Price Change Volume Buyer Seller Markers

15:38:09 T 0.12 +0.01 2,000 7 TD Sec 79 CIBC K

15:38:09 T 0.12 +0.01 8,000 7 TD Sec 36 Latimer K

15:36:03 T 0.12 +0.01 3,000 7 TD Sec 36 Latimer K

15:36:03 T 0.12 +0.01 2,000 7 TD Sec 33 Canaccord K

15:34:56 T 0.115 +0.005 5,000 7 TD Sec 1 Anonymous K

11:42:07 T 0.105 -0.005 2,000 1 Anonymous 7 TD Sec K

11:42:07 T 0.105 -0.005 1,000 33 Canaccord 7 TD Sec K

11:12:25 T 0.105 -0.005 3,000 1 Anonymous 7 TD Sec K

11:12:25 T 0.105 -0.005 1,500 33 Canaccord 7 TD Sec KL

...denke cad 0,10 hat sich in den last days schöööön als

unterstützungsmarke bewiesen..........uuuuund haben mehr und

mehr potential uns weiter gen norden auszurichten........

Recent Trades - Last 9

Time Ex Price Change Volume Buyer Seller Markers

15:38:09 T 0.12 +0.01 2,000 7 TD Sec 79 CIBC K

15:38:09 T 0.12 +0.01 8,000 7 TD Sec 36 Latimer K

15:36:03 T 0.12 +0.01 3,000 7 TD Sec 36 Latimer K

15:36:03 T 0.12 +0.01 2,000 7 TD Sec 33 Canaccord K

15:34:56 T 0.115 +0.005 5,000 7 TD Sec 1 Anonymous K

11:42:07 T 0.105 -0.005 2,000 1 Anonymous 7 TD Sec K

11:42:07 T 0.105 -0.005 1,000 33 Canaccord 7 TD Sec K

11:12:25 T 0.105 -0.005 3,000 1 Anonymous 7 TD Sec K

11:12:25 T 0.105 -0.005 1,500 33 Canaccord 7 TD Sec KL

Starcore appoints Gunning as director, COO

2009-04-06 10:12 ET - News Release

Mr. Robert Eadie reports

STARCORE APPOINTS NEW DIRECTOR

Starcore International Mines Ltd. has appointed David R. Gunning, PEng, as a director of the company and chief operating officer. Mr. Gunning has been working with the company as an independent consultant, supervising mine operations and exploration for Starcore's San Martin gold mine in Queretaro, Mexico.

Mr. Gunning is a graduate of the University of British Columbia and holds a BASc, in mining and mineral process engineering (mining option). A member of the Association of Professional Engineers and Geoscientists of British Columbia, Mr. Gunning is a practising mining engineer with more than 25 years experience in mineral exploration, development and operations in North and South America, Europe and Asia. Since 1996, he has provided operations and project management, resource estimations and property evaluations for various mining companies, primarily for precious metal projects.

"David's appointment adds a valuable dimension to Starcore's board," said Robert Eadie, president of Starcore. "His experience in the field of underground precious metal mining operations will assist Starcore in our efforts to expand, optimize and develop mining operations and to target further exploration. We are very pleased to have David join our management team."

The company expects to maintain or increase the current ore grades over the next quarter and continue exploration efforts to increase reserves and resources and to find higher-grade deposits.

2009-04-06 10:12 ET - News Release

Mr. Robert Eadie reports

STARCORE APPOINTS NEW DIRECTOR

Starcore International Mines Ltd. has appointed David R. Gunning, PEng, as a director of the company and chief operating officer. Mr. Gunning has been working with the company as an independent consultant, supervising mine operations and exploration for Starcore's San Martin gold mine in Queretaro, Mexico.

Mr. Gunning is a graduate of the University of British Columbia and holds a BASc, in mining and mineral process engineering (mining option). A member of the Association of Professional Engineers and Geoscientists of British Columbia, Mr. Gunning is a practising mining engineer with more than 25 years experience in mineral exploration, development and operations in North and South America, Europe and Asia. Since 1996, he has provided operations and project management, resource estimations and property evaluations for various mining companies, primarily for precious metal projects.

"David's appointment adds a valuable dimension to Starcore's board," said Robert Eadie, president of Starcore. "His experience in the field of underground precious metal mining operations will assist Starcore in our efforts to expand, optimize and develop mining operations and to target further exploration. We are very pleased to have David join our management team."

The company expects to maintain or increase the current ore grades over the next quarter and continue exploration efforts to increase reserves and resources and to find higher-grade deposits.

Antwort auf Beitrag Nr.: 36.900.186 von hbg55 am 01.04.09 19:10:07

.......na also, mit 0,12 sehen wir grad akt. TH....

Time Ex Price Change Volume Buyer Seller Markers

14:22:59 T 0.12 +0.035 1,000 36 Latimer 1 Anonymous K

14:22:59 T 0.12 +0.035 1,000 36 Latimer 33 Canaccord K

14:21:17 T 0.11 +0.025 2,000 7 TD Sec 7 TD Sec K

14:21:17 T 0.11 +0.025 7,000 7 TD Sec 2 RBC K

14:12:54 T 0.10 +0.015 10,000 33 Canaccord 33 Canaccord K

14:12:54 T 0.10 +0.015 10,000 88 Scotia iTRADE 33 Canaccord K

13:50:47 T 0.10 +0.015 13,000 88 Scotia iTRADE 2 RBC K

13:33:19 T 0.105 +0.015 300 85 Scotia 33 Canaccord E

12:06:12 T 0.10 +0.015 500 33 Canaccord 33 Canaccord E

12:06:12 T 0.10 +0.015 500 33 Canaccord 57 Interactive E

.......na also, mit 0,12 sehen wir grad akt. TH....

Time Ex Price Change Volume Buyer Seller Markers

14:22:59 T 0.12 +0.035 1,000 36 Latimer 1 Anonymous K

14:22:59 T 0.12 +0.035 1,000 36 Latimer 33 Canaccord K

14:21:17 T 0.11 +0.025 2,000 7 TD Sec 7 TD Sec K

14:21:17 T 0.11 +0.025 7,000 7 TD Sec 2 RBC K

14:12:54 T 0.10 +0.015 10,000 33 Canaccord 33 Canaccord K

14:12:54 T 0.10 +0.015 10,000 88 Scotia iTRADE 33 Canaccord K

13:50:47 T 0.10 +0.015 13,000 88 Scotia iTRADE 2 RBC K

13:33:19 T 0.105 +0.015 300 85 Scotia 33 Canaccord E

12:06:12 T 0.10 +0.015 500 33 Canaccord 33 Canaccord E

12:06:12 T 0.10 +0.015 500 33 Canaccord 57 Interactive E

...bei ner MK von knapp cad-mios 6,- für ne prod. goldmine

scheint MIR das risiko doch aaaaaarg begrenzt !!!

scheint MIR das risiko doch aaaaaarg begrenzt !!!

.....scheint MIR gegenwärtig ein guter zustiegs- zeitpunkt zu sein

Starcore Reports Positive Financial Results from the Second Quarter of 2009

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 17, 2009)

- Starcore International Mines Ltd. (TSX:SAM) (the "Company") has filed the results for the second quarter ended January 31, 2009, and the second complete year of its mining operations from the San Martin Mine. Starcore had revenues from metal sales of $5.3 million, earnings from mining operations of $1.2 million, and a net loss of $nil for the quarter ended January 31, 2009. Over the six month period ended January 31, 2009, the Company reports revenues of $12.0 million, earnings from mining operations of $2.2 million and a net loss of $0.1 million. The basic and diluted loss per share for the quarter and the six months ended January 31, 2009 was $nil.

The following table contains selected highlights from Starcore's consolidated income statement for the three and six month periods ended January 31, 2009:

--------------------------------------------------------------------------

For the three For the six

months ended months ended

January 31 January 31

000's 000's

--------------------------------------

2009 2008 2009 2008

--------------------------------------------------------------------------

Total Revenue $ 5,340 5,224 $ 11,969 12,849

Earnings from mining operations $ 1,210 48 $ 2,169 1,990

Net (loss) $ (22) $ (1,491) $ (131) $ (2,130)

Net (loss) per share-

basic and diluted $ (0.00) $ (0.02) $ (0.00) $ (0.04)

--------------------------------------------------------------------------

While mining revenue and earnings for 2009 was comparable to 2008, the revenue from mined ore was actually $1.18 million higher for the six months ended January 31, 2009 compared to the prior year, due mainly to poorer ore grades in 2008. The loss of purchased concentrate revenue in 2009 lowered gross revenues significantly by $2.1 million from the prior year, however, this had little effect on earnings from mining operations due to the low margin on purchased concentrate. Net loss was, therefore, lower overall as a result of the higher revenues and earnings from mining operations and due to management efforts to decrease administrative expenses.

The Company also had positive cash flow from operations of $0.1 million for the six months ended January 31, 2009.

The following table is selected information of mine production statistics for the San Martin mine for the second quarter of operations and the second complete year of operations under the Company.

--------------------------------------------------------------------------

Actual

results Actual

for results

3 months for

ended Year ended

January 31, January 31,

(Unaudited) Unit of measure 2009 2009

--------------------------------------------------------------------------

Production of Gold in Dore thousand ounces 5.0 19.0

Production of Silver in Dore thousand ounces 43.8 160.3

Equivalent ounces of Gold(i) thousand ounces 5.5 21.6

Milled thousands of tonnes 68.9 266.2

Operating Cost per

Equivalent Ounce US dollars/tonne 400 433

--------------------------------------------------------------------------

(i) assuming a 79:1 silver to gold equivalency ratio for three months and

62:1 for the year ended January 31, 2009.

Overall equivalent gold production was 5,500 ounces, which is comparable to the prior years' average of 5,400 ounces per quarter.

The Company expects to maintain or increase the current ore grades over the next quarter and continues exploration efforts to increase reserves of resources and to find higher grade deposits. Management also continues efforts to cut mine and administration costs, where possible, to improve earnings and cash flow.

Full financial statements are available on SEDAR at www.sedar.com and on Starcore's website at www.starcore.com.

ON BEHALF OF STARCORE INTERNATIONAL MINES LTD.

Gary Arca, Chief Financial Officer and Director

FOR FURTHER INFORMATION PLEASE CONTACT:

Starcore International Mines Ltd.

Gary Arca

(604) 602-4935 or Toll Free: 1-866-602-4935

(604) 602-4936 (FAX)

Email: info@starcore.com

Website: www.starcore.com

The Toronto Stock Exchange has not reviewed nor does it accept responsibility for the adequacy or accuracy of this press release.

Source: CCN Matthews (Marketwire) (March 17, 2009 - 5:17 PM EDT)

News by QuoteMedia

Starcore International earns $3.3-million in 2008

Starcore International Mines Ltd (C:SAM)

Shares Issued 60,690,789

Last Close 10/24/2008 $0.085

Monday October 27 2008 - News Release

Mr. Gary Arca reports

STARCORE REPORTS YEAR-END FINANCIAL RESULTS

Starcore International Mines Ltd. has filed the results for the year ended July 31, 2008. Starcore had revenues from metal sales of $7.0-million, earnings from mining operations of $310,000, and reports a loss of $650,000 for the quarter ended July 31, 2008. Over the year ended July 31, 2008, the company reports revenues of $27.07-million, earnings from mining operations of $3.31-million and a net loss of $2.57-million, which includes a $1.28-million non-cash stock-based compensation charge on option awards vested in the year.

SELECTED HIGHLIGHTS FROM CONSOLIDATED INCOME STATEMENT

(in thousands of dollars)

Three months ended Year ended

July 31, July 31, July 31, July 31,

2008 2007 2008 2007

Total revenue $ 6,999 $ 9,232 $ 27,066 $ 18,499

Earnings from mining operations $ 305 $ 3,121 $ 3,305 $ 6,175

Net (loss) $ (654) $ 352 $ (2,567) $ (2,218)

Net (loss) per share -- basic $ (0.02) $ 0.01 $ (0.04) $ (0.06)

Net (loss) per share -- fully diluted $ (0.02) $ 0.00 $ (0.04) $ (0.06)

The revenues and earnings from mining operations includes a full year of mining operations for the year ended July 31, 2008 compared to six months of operations in 2007, from the date of acquisition of the mine on February 1, 2007 to July 31, 2007. The relative decrease in revenue and earnings for 2008 was as a result of higher ore grades in the prior year and lower production costs as compared to 2008. Management efforts to decrease administrative expenses as well as lower stock-based compensation expense in 2008 and financing fee expenses acted to mitigate some of the loss of earnings from mine operations. The Company also had positive cash flow from operations of $3.6-million for the year ended July 31, 2008 compared to $3.5-million for the year ended July 31, 2007. The following table is selected information of mine production statistics for the San Martin mine for the six months ended July 31, 2008 and the first complete year of operations to January 31, 2008.

Actual results for Actual results for

six months ended year ended

(Unaudited) Unit of measure July 31, 2008 Jan. 31, 2008

Production of gold in dore thousand ounces 9.1 24.1

Production of silver in dore thousand ounces 72.1 213.1

Equivalent ounces of gold(*) thousand ounces 10.45 28.2

Milled thousands of tonnes 132.4 258.1

Operating cost per equivalent ounce U.S. dollars/tonne $460 $301

(*) Assuming a 52:1 silver:gold equivalency ratio

Overall equivalent gold production was lower at 9,100 ounces, compared to the prior years' six month average of 14,100 ounces due to lower ore grades. In the current quarter, however, ore grades have improved to 2.73 g/t gold and 24 g/t silver over the prior quarter amounts of 2.17 g/t and 24 g/t, respectively, as the Company was able to fully exploit ore bodies 29 to 31, which contain higher ore grades.

The Company expects to maintain or increase the current ore grades over the next quarter and continues exploration efforts to increase reserves of resources and to find higher grade deposits. Management also continues efforts to cut mine and administration costs, where possible, to improve earnings and cash flow.

Full financial statements are available on SEDAR at www.sedar.com and on Starcore's website at www.starcore.com.

© 2008 Canjex Publishing Ltd.

Starcore International Mines Ltd (C:SAM)

Shares Issued 60,690,789

Last Close 10/24/2008 $0.085

Monday October 27 2008 - News Release

Mr. Gary Arca reports

STARCORE REPORTS YEAR-END FINANCIAL RESULTS

Starcore International Mines Ltd. has filed the results for the year ended July 31, 2008. Starcore had revenues from metal sales of $7.0-million, earnings from mining operations of $310,000, and reports a loss of $650,000 for the quarter ended July 31, 2008. Over the year ended July 31, 2008, the company reports revenues of $27.07-million, earnings from mining operations of $3.31-million and a net loss of $2.57-million, which includes a $1.28-million non-cash stock-based compensation charge on option awards vested in the year.

SELECTED HIGHLIGHTS FROM CONSOLIDATED INCOME STATEMENT

(in thousands of dollars)

Three months ended Year ended

July 31, July 31, July 31, July 31,

2008 2007 2008 2007

Total revenue $ 6,999 $ 9,232 $ 27,066 $ 18,499

Earnings from mining operations $ 305 $ 3,121 $ 3,305 $ 6,175

Net (loss) $ (654) $ 352 $ (2,567) $ (2,218)

Net (loss) per share -- basic $ (0.02) $ 0.01 $ (0.04) $ (0.06)

Net (loss) per share -- fully diluted $ (0.02) $ 0.00 $ (0.04) $ (0.06)

The revenues and earnings from mining operations includes a full year of mining operations for the year ended July 31, 2008 compared to six months of operations in 2007, from the date of acquisition of the mine on February 1, 2007 to July 31, 2007. The relative decrease in revenue and earnings for 2008 was as a result of higher ore grades in the prior year and lower production costs as compared to 2008. Management efforts to decrease administrative expenses as well as lower stock-based compensation expense in 2008 and financing fee expenses acted to mitigate some of the loss of earnings from mine operations. The Company also had positive cash flow from operations of $3.6-million for the year ended July 31, 2008 compared to $3.5-million for the year ended July 31, 2007. The following table is selected information of mine production statistics for the San Martin mine for the six months ended July 31, 2008 and the first complete year of operations to January 31, 2008.

Actual results for Actual results for

six months ended year ended

(Unaudited) Unit of measure July 31, 2008 Jan. 31, 2008

Production of gold in dore thousand ounces 9.1 24.1

Production of silver in dore thousand ounces 72.1 213.1

Equivalent ounces of gold(*) thousand ounces 10.45 28.2

Milled thousands of tonnes 132.4 258.1

Operating cost per equivalent ounce U.S. dollars/tonne $460 $301

(*) Assuming a 52:1 silver:gold equivalency ratio

Overall equivalent gold production was lower at 9,100 ounces, compared to the prior years' six month average of 14,100 ounces due to lower ore grades. In the current quarter, however, ore grades have improved to 2.73 g/t gold and 24 g/t silver over the prior quarter amounts of 2.17 g/t and 24 g/t, respectively, as the Company was able to fully exploit ore bodies 29 to 31, which contain higher ore grades.

The Company expects to maintain or increase the current ore grades over the next quarter and continues exploration efforts to increase reserves of resources and to find higher grade deposits. Management also continues efforts to cut mine and administration costs, where possible, to improve earnings and cash flow.

Full financial statements are available on SEDAR at www.sedar.com and on Starcore's website at www.starcore.com.

© 2008 Canjex Publishing Ltd.

Taylor says buy Starcore International

Starcore International Mines Ltd (C:SAM)

Shares Issued 60,690,789

Last Close 9/30/2008 $0.13

Wednesday October 01 2008 - In the News

Jay Taylor in the Sept. 16, 2008, edition of Gold, Energy & Tech Stocks tells readers to buy Starcore International Mines Ltd., recently 15 cents. This is the first time he has recommended the stock. Starcore bought the San Martin gold mine in Mexico from Goldcorp in January, 2007, for $26-million. The company financed the acquisition with cash from a private placement and a $13-million loan from Investec Bank. The loan requires Starcore to sell 81,876 ounces of gold forward at $731 per ounce over the life of the loan, which matures on Jan. 31, 2013. During the first nine months of 2008, Starcore produced 24,100 ounces of gold and 213,100 ounces of silver from San Martin, for operating cash flow of $3.8-million. Mr. Taylor notes that further exploration at San Martin will benefit from the fact that Starcore has its own drill rigs, including a jumbo rig for deeper drilling, as well as its own 43-101 laboratory, which will help management to plan its continuing drill program. The newsletter writer says Starcore also owns two other properties in Mexico, San Pedrito and Cerro Delores, which could add shareholder value. Mr. Taylor can easily this stock doubling or tripling from its current share price.

© 2008 Canjex Publishing Ltd.

Starcore International Mines Ltd (C:SAM)

Shares Issued 60,690,789

Last Close 9/30/2008 $0.13

Wednesday October 01 2008 - In the News

Jay Taylor in the Sept. 16, 2008, edition of Gold, Energy & Tech Stocks tells readers to buy Starcore International Mines Ltd., recently 15 cents. This is the first time he has recommended the stock. Starcore bought the San Martin gold mine in Mexico from Goldcorp in January, 2007, for $26-million. The company financed the acquisition with cash from a private placement and a $13-million loan from Investec Bank. The loan requires Starcore to sell 81,876 ounces of gold forward at $731 per ounce over the life of the loan, which matures on Jan. 31, 2013. During the first nine months of 2008, Starcore produced 24,100 ounces of gold and 213,100 ounces of silver from San Martin, for operating cash flow of $3.8-million. Mr. Taylor notes that further exploration at San Martin will benefit from the fact that Starcore has its own drill rigs, including a jumbo rig for deeper drilling, as well as its own 43-101 laboratory, which will help management to plan its continuing drill program. The newsletter writer says Starcore also owns two other properties in Mexico, San Pedrito and Cerro Delores, which could add shareholder value. Mr. Taylor can easily this stock doubling or tripling from its current share price.

© 2008 Canjex Publishing Ltd.

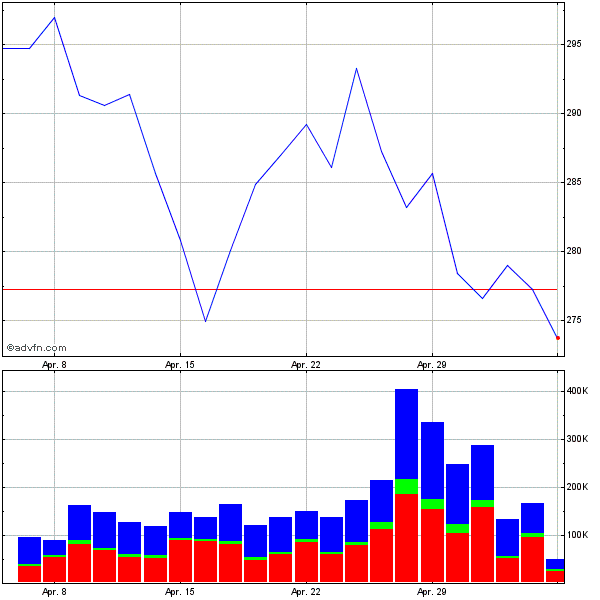

Antwort auf Beitrag Nr.: 34.705.505 von to_siam am 12.08.08 09:19:40

So, nachdem ich hier den allgemeinen Ausstieg verpennt habe, ist es nun gestern und heute doch passiert.

Der Kursverlauf sagt alles, um mit 70 % Verlust bin ich als God of Timing ja noch gut weggekommen.

Ich mache dann das Licht aus: Gute Nacht.

So, nachdem ich hier den allgemeinen Ausstieg verpennt habe, ist es nun gestern und heute doch passiert.

Der Kursverlauf sagt alles, um mit 70 % Verlust bin ich als God of Timing ja noch gut weggekommen.

Ich mache dann das Licht aus: Gute Nacht.

22.04.24 · IRW Press · Starcore International Mines |

22.01.24 · IRW Press · Starcore International Mines |

29.08.23 · IRW Press · Starcore International Mines |

Starcore setzt mit dem Erwerb eines Projekts an der Côte d‘Ivoire auf geopolitische Diversifizierung 16.08.23 · IRW Press · Starcore International Mines |