US Geothermal - 500 Beiträge pro Seite (Seite 2)

eröffnet am 21.04.10 10:00:13 von

neuester Beitrag 12.01.19 08:38:56 von

neuester Beitrag 12.01.19 08:38:56 von

Beiträge: 970

ID: 1.157.268

ID: 1.157.268

Aufrufe heute: 0

Gesamt: 70.874

Gesamt: 70.874

Aktive User: 0

ISIN: US90338S2014 · WKN: A2DF6E

4,4600

EUR

+0,56 %

+0,0250 EUR

Letzter Kurs 24.04.18 Tradegate

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,4600 | +31,57 | |

| 5,2000 | +12,07 | |

| 0,5750 | +11,65 | |

| 12,560 | +9,98 | |

| 11,130 | +9,98 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 13,440 | -7,25 | |

| 34,42 | -12,31 | |

| 10,080 | -22,52 | |

| 8,4500 | -41,80 | |

| 3,9200 | -93,57 |

So übel sehen die Schätzungen gar nicht mal aus:

http://www.reuters.com/finance/stocks/financialHighlights?sy…

http://www.reuters.com/finance/stocks/financialHighlights?sy…

So schlecht sieht die Jahresperformance nicht aus:

Performance for US Geothermal Inc

% % vs. Rank in Industry

Period Actual S&P 500 Industry Rank

4 Week -1.43 -2.44 40 17

13 Week -19.77 -23.79 5 52

26 Week 25.45 14.13 82 51

52 Week 45.26 20.16 85 25

YTD 72.50 53.91 97 28

Note:: Rank is a percentile that ranges from 0 to 99, with 99 = best.

Performance for US Geothermal Inc

% % vs. Rank in Industry

Period Actual S&P 500 Industry Rank

4 Week -1.43 -2.44 40 17

13 Week -19.77 -23.79 5 52

26 Week 25.45 14.13 82 51

52 Week 45.26 20.16 85 25

YTD 72.50 53.91 97 28

Note:: Rank is a percentile that ranges from 0 to 99, with 99 = best.

Performance for US Geothermal Inc.

Period % % vs. Rank In Industry

Actual S&P 500 Industry Rank

4 Week -1.43 -2.44 40 17

13 Week -19.77 -23.79 5 52

26 Week 25.45 14.13 82 51

52 Week 45.26 20.16 85 25

YTD 72.50 53.91 97 28

Note:: Rank is a percentile that ranges from 0 to 99, with 99 = best.

Period % % vs. Rank In Industry

Actual S&P 500 Industry Rank

4 Week -1.43 -2.44 40 17

13 Week -19.77 -23.79 5 52

26 Week 25.45 14.13 82 51

52 Week 45.26 20.16 85 25

YTD 72.50 53.91 97 28

Note:: Rank is a percentile that ranges from 0 to 99, with 99 = best.

Welchen Stellenwert hat dieses Ranking für Sie?

(Warum eigentlich musste das 2.Mal gepostet werden?)

Wenn in Q1 der EPS=0,01 ist und in Q2 ein EPS=0 angenommen wird sowie lt. Reuters in Q3 ein EPS=0 und in Q4 ein EPS=0,01, ergibt sich in der Annahme ein EPS für das Gesamtjahr von 0,03 ... Welches Szenario spiegelt eine solche Entwicklung wieder?

Also wenn ich mir den Bericht von HTM namens "Year Ended December 31, 2013" anschaue (http://www.usgeothermal.com/Investors/FinancialReports.aspx), dann habe ich auch auf Seite 64 ein weiteres Verständnisproblem, wenn Reuters Angaben zum Umsatz macht, die im Widerspruch zu denen von HTM stehen.

Reuters: Q3/2013 = Mio.$5,30 (Spalte: 1 Year Ago)

HTM: Q3/2013 = Mio.$5,76

Reuters: Q4/2013 = Mio.$4,50 (Spalte: 1 Year Ago)

HTM: Q4/2013 = Mio.$9,55

Bzw. Seite 76

HTM: Gesamtjahr 2013 = Mio.$26,97

Reuters: Gesamtjahr 2013 = Mio.$23,40 (Spalte: 1 Year Ago)

Was sagt Ihre eigene Kalkulation zum Q2/2014 - DAS wäre interessant! Ansonten können wir aber auch noch 10 andere Seiten verlinken, die ihre Erwartungen an das Geschäftsjahr 2014 veröffentlicht haben, ohne dass man als Aussenstehender versteht, wie sie darauf kommen. Nicht zu empfehlen!

(Warum eigentlich musste das 2.Mal gepostet werden?)

Wenn in Q1 der EPS=0,01 ist und in Q2 ein EPS=0 angenommen wird sowie lt. Reuters in Q3 ein EPS=0 und in Q4 ein EPS=0,01, ergibt sich in der Annahme ein EPS für das Gesamtjahr von 0,03 ... Welches Szenario spiegelt eine solche Entwicklung wieder?

Also wenn ich mir den Bericht von HTM namens "Year Ended December 31, 2013" anschaue (http://www.usgeothermal.com/Investors/FinancialReports.aspx), dann habe ich auch auf Seite 64 ein weiteres Verständnisproblem, wenn Reuters Angaben zum Umsatz macht, die im Widerspruch zu denen von HTM stehen.

Reuters: Q3/2013 = Mio.$5,30 (Spalte: 1 Year Ago)

HTM: Q3/2013 = Mio.$5,76

Reuters: Q4/2013 = Mio.$4,50 (Spalte: 1 Year Ago)

HTM: Q4/2013 = Mio.$9,55

Bzw. Seite 76

HTM: Gesamtjahr 2013 = Mio.$26,97

Reuters: Gesamtjahr 2013 = Mio.$23,40 (Spalte: 1 Year Ago)

Was sagt Ihre eigene Kalkulation zum Q2/2014 - DAS wäre interessant! Ansonten können wir aber auch noch 10 andere Seiten verlinken, die ihre Erwartungen an das Geschäftsjahr 2014 veröffentlicht haben, ohne dass man als Aussenstehender versteht, wie sie darauf kommen. Nicht zu empfehlen!

100 GW Of US Geothermal Power Will Push US Past Gas

http://cleantechnica.com/2014/07/18/100-gw-of-us-geothermal-…

http://cleantechnica.com/2014/07/18/100-gw-of-us-geothermal-…

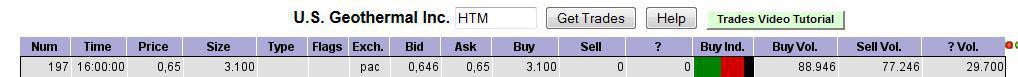

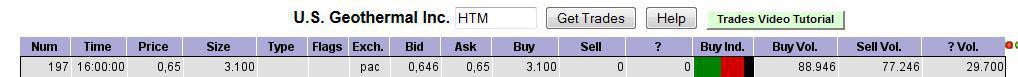

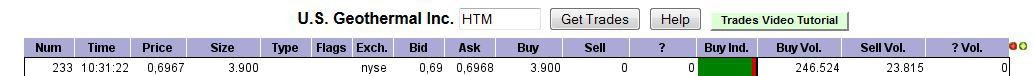

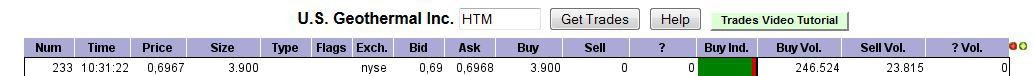

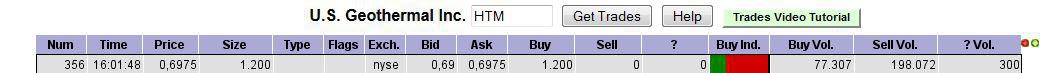

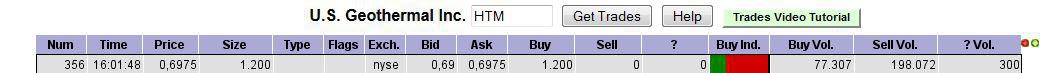

Unglaublich das die 65 noch steht...paar schöne Käufe auf der 65 wird aber direkt wieder gedrückt.

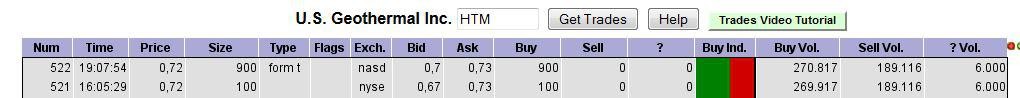

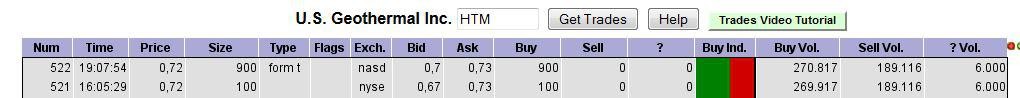

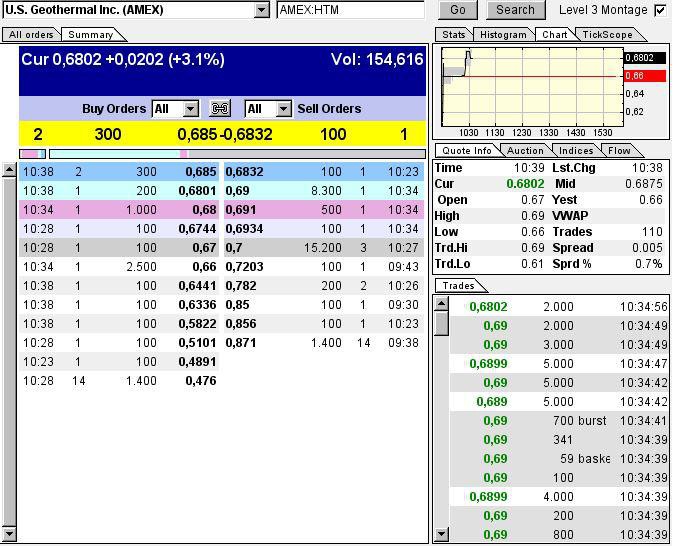

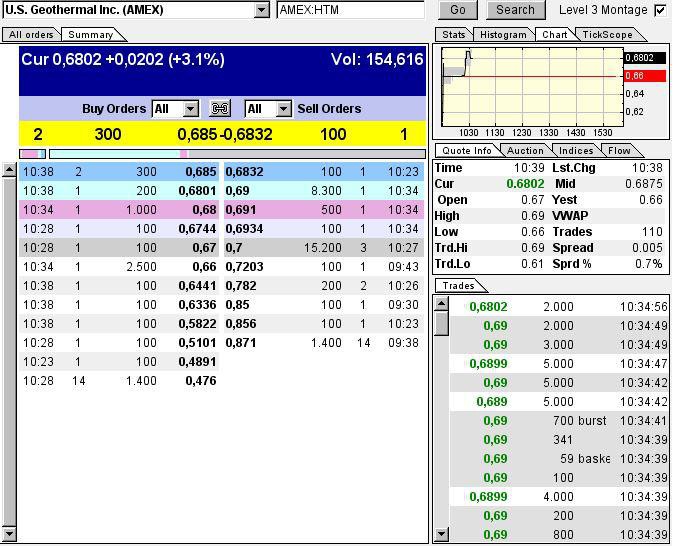

Leider kann ich nur die trades sehen im L2 und nicht die Pakete die dort liegen

Leider kann ich nur die trades sehen im L2 und nicht die Pakete die dort liegen

Antwort auf Beitrag Nr.: 47.346.330 von barnabas410 am 21.07.14 17:26:35Bei 0.62$ steht im Bid ein großes Paket von 69.500, ansonsten nur Kleinorders (unter 1000).

Im Ask stehen nur Kleinorders (unter 1000).

Das große Paket kann aber auch ganz schnell weggezogen werden.

Im Ask stehen nur Kleinorders (unter 1000).

Das große Paket kann aber auch ganz schnell weggezogen werden.

Antwort auf Beitrag Nr.: 47.347.022 von Miser am 21.07.14 19:09:49Danke dir

Muss unbedingt mal mein L2 changen, eh kein Bock mehr auf OTC...

So und jetzt noch der übliche screen

Ich hoffe das stört niemanden wenn ich das hier hochlade!?

Ansonsten kurz bescheid geben.

Muss unbedingt mal mein L2 changen, eh kein Bock mehr auf OTC...

So und jetzt noch der übliche screen

Ich hoffe das stört niemanden wenn ich das hier hochlade!?

Ansonsten kurz bescheid geben.

Antwort auf Beitrag Nr.: 47.348.440 von barnabas410 am 21.07.14 23:17:26OTC ist gut für den schnellen Dollar. Kleine Position kann man immer mal haben.

Geothermal sehe ich eher langfristig - besser als Sparbuch.

Geothermal sehe ich eher langfristig - besser als Sparbuch.

OTC ist gut für den schnellen Dollar, richtig. Halte meine Positionen aber ungern über Nacht und wenn ich dort tätig bin klebe ich den ganzen Tag vorm PC. Geht so schnell dort, das Sekunden entscheidend sein können.

Meiste dort ist eh Schrott.

Ja Geothermal werde ich auch laaaaaaaaaaange im Depot behalten.

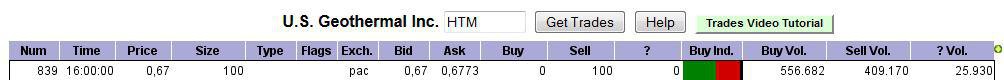

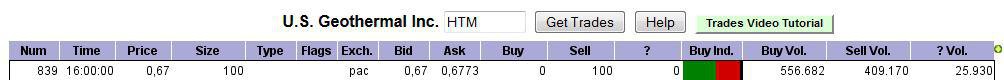

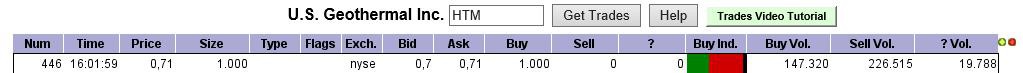

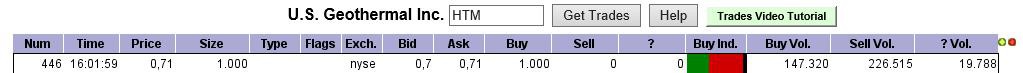

Bisher verläuft der Tag heute sehr positiv, Volumen steigt auch nach und nach wieder an.

Meiste dort ist eh Schrott.

Ja Geothermal werde ich auch laaaaaaaaaaange im Depot behalten.

Bisher verläuft der Tag heute sehr positiv, Volumen steigt auch nach und nach wieder an.

Antwort auf Beitrag Nr.: 47.354.324 von rechnerhand am 22.07.14 21:25:35Weiss nicht ob der sich von seinen Anteilen getrennt hat. Sollte es so sein wäre es in der aktuellen Situation relativ unklug.

Ich persönlich glaube, das die 6 hinter dem Komma bald Geschichte ist. Die Käufe überwiegen und das Volumen nimmt auch langsam aber sicher zu. Highest Trade lag heute bei 0,6978$...

Gegenüber dem Gesamtmarkt hält sich HTM ebenfalls hervorragend.

Wird Zeit das wir den Bereich um die 65-67 Cents nachhaltig hinter uns lassen.

Time will tell..

Ich persönlich glaube, das die 6 hinter dem Komma bald Geschichte ist. Die Käufe überwiegen und das Volumen nimmt auch langsam aber sicher zu. Highest Trade lag heute bei 0,6978$...

Gegenüber dem Gesamtmarkt hält sich HTM ebenfalls hervorragend.

Wird Zeit das wir den Bereich um die 65-67 Cents nachhaltig hinter uns lassen.

Time will tell..

U.S. Geothermal profits heat up

" ... Now, Gilles says he plans to build U.S. Geothermal into a large-scale power company. ..."

" ... "Now that we're profitable, we don't have to go out and sell shares - and further dilute our shares - in order to keep the lights on," Gilles said. "We're not in that boat anymore. ..."

http://www.idahostatesman.com/2014/07/23/3291847/us-geotherm…

" ... Now, Gilles says he plans to build U.S. Geothermal into a large-scale power company. ..."

" ... "Now that we're profitable, we don't have to go out and sell shares - and further dilute our shares - in order to keep the lights on," Gilles said. "We're not in that boat anymore. ..."

http://www.idahostatesman.com/2014/07/23/3291847/us-geotherm…

Antwort auf Beitrag Nr.: 47.356.050 von rechnerhand am 23.07.14 08:55:02.... solche Artikel sind das Salz in der Suppe ... und jeder, der mit Kochen und gutem Essen etwas "am Hut" hat, weiß, was dieser Artikel wert ist/sein wird.

... Sehr gut ... vor allem zwischen den Zeilen!

Pflichtlektüre!

... Sehr gut ... vor allem zwischen den Zeilen!

Pflichtlektüre!

Gute Aussichten für HTM. Haben es heir NOCH mit einem Pennystock zu tun, aber das Management ist einfach klasse...

Hmmmm...lecker, wenn ich sehe was da wieder gekauft wird

Hmmm, das schmeckt

Bin gespannt auf den Schlusskurs.

Bin gespannt auf den Schlusskurs.

Antwort auf Beitrag Nr.: 47.359.178 von barnabas410 am 23.07.14 16:22:38schon irgendwie skuril ... da weiß quasi jeder, der sich mit dem Titel auseinandersetzt, dass Mitte August die Zahlen für Q2 bzw. die ersten 6 Monate rauskommen und vermutlich (wie zu erwarten) kein positiver EPS generiert wird und dennoch "pumpt" sich der Wert gerade wieder (und gefühlt den 9. Handelstag in Folge) gen Norden.

Ich tippe ja mal, dass nach dem 14.08. noch mal eine gute Gelegenheit kommen sollte, bevor dann die Jahresendrally einsetzt.

Ich tippe ja mal, dass nach dem 14.08. noch mal eine gute Gelegenheit kommen sollte, bevor dann die Jahresendrally einsetzt.

Antwort auf Beitrag Nr.: 47.359.272 von rechnerhand am 23.07.14 16:36:36Eben drum, jeder weiss das die Zahlen nicht berauschend sein werden, ob hier dann der grosse abverkauf kommt? Ich denke nicht, immerhin wurde im 6er Bereich einiges gesammelt und die Aussichten sind langfristig gesehen sehr gut.

Der ein oder andere wird sich mit 20% zufrieden geben, aber die Mehrheit wird wohl langfristig orientiert sein.

Hoffen wir das es nicht nur ein "pump and dump" ist den wir hier z.Z. erleben.

Der ein oder andere wird sich mit 20% zufrieden geben, aber die Mehrheit wird wohl langfristig orientiert sein.

Hoffen wir das es nicht nur ein "pump and dump" ist den wir hier z.Z. erleben.

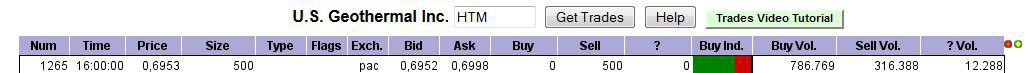

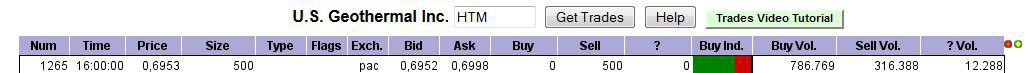

Gestern die eine Millionen geschaft

Antwort auf Beitrag Nr.: 47.359.938 von barnabas410 am 23.07.14 18:03:06Um das Statement von Dennis Gilles zu unterstreichen: " ... "Now that we're profitable, we don't have to go out and sell shares - and further dilute our shares - in order to keep the lights on," Gilles said. "We're not in that boat anymore. ..." wären entsprechende SEC Fillings Form 4 über Insiderkäufe die wahre Bestätigung!

... Kaufoptionen (z.B. zu .74$ p.Stk.) hat das Mgt. ja einige wie wir wissen.

... Kaufoptionen (z.B. zu .74$ p.Stk.) hat das Mgt. ja einige wie wir wissen.

Geothermal Industry Grows, With Help From Oil and Gas Drilling

JULY 23, 2014

http://www.nytimes.com/2014/07/24/business/geothermal-indust…

JULY 23, 2014

http://www.nytimes.com/2014/07/24/business/geothermal-indust…

Hallo Rechnerhand,

wie würden Sie US Geo gegen andere Mitbewerber einschätzen bzw. hat es überhaupt ernstzunehmende Konkurrenz?

Konnte nur Stocks finden die eher alle Abstürzen als das sie aufsteigen.

wie würden Sie US Geo gegen andere Mitbewerber einschätzen bzw. hat es überhaupt ernstzunehmende Konkurrenz?

Konnte nur Stocks finden die eher alle Abstürzen als das sie aufsteigen.

Antwort auf Beitrag Nr.: 47.364.116 von Sylwester am 24.07.14 11:18:42Hallo,

auf dem amerikanischen Markt ist sicherlich Ormat Tech. (ORA) benchmark für HTM, wobei deren YTD-Bilanz sich mal die 0% von oben und mal von unten anschaut. Ansonsten wurde das hier ganz gut zusammengefasst (Stand: 27.03.2014)

http://seekingalpha.com/article/2112693-u-s-geothermal-inc-t…

Wen haben Sie sich noch angeschaut?

auf dem amerikanischen Markt ist sicherlich Ormat Tech. (ORA) benchmark für HTM, wobei deren YTD-Bilanz sich mal die 0% von oben und mal von unten anschaut. Ansonsten wurde das hier ganz gut zusammengefasst (Stand: 27.03.2014)

http://seekingalpha.com/article/2112693-u-s-geothermal-inc-t…

Wen haben Sie sich noch angeschaut?

Antwort auf Beitrag Nr.: 47.364.380 von rechnerhand am 24.07.14 11:51:26Angeschaut habe ich mir zB RAM Power, Geodynamics, die beiden gingen von ein paar Dollar in den einstelligen Cent Bereich.

Alterra geht auch langsam nach unten wie die zuvor genannten, obwohl es jetzt wie ein Trendwechsel ausschaut.

Calpine ist auch damals von 20$ runter auf 6$ und hat vor kurzem das alte Allzeithoch von vor paar Jahren durchbrochen und sieht wieder rosiger aus.

Ob man Ormat Tech. als Benchmark nehmen kann? Die haben mit einem viel höheren Kapital angefangen, eine Aktie hatte zu Beginn ungefähr 40$ gekostet und jetzt...

Bin trotzdem gespannt wo die Reise hingehen wird!

Alterra geht auch langsam nach unten wie die zuvor genannten, obwohl es jetzt wie ein Trendwechsel ausschaut.

Calpine ist auch damals von 20$ runter auf 6$ und hat vor kurzem das alte Allzeithoch von vor paar Jahren durchbrochen und sieht wieder rosiger aus.

Ob man Ormat Tech. als Benchmark nehmen kann? Die haben mit einem viel höheren Kapital angefangen, eine Aktie hatte zu Beginn ungefähr 40$ gekostet und jetzt...

Bin trotzdem gespannt wo die Reise hingehen wird!

Antwort auf Beitrag Nr.: 47.364.742 von Sylwester am 24.07.14 12:36:49kein einfaches Thema, aber ich sehe gerne die indirekten Faktoren und nicht die absoluten Werte bzw. den Wert der Aktie alleine ... da hätte ich auch ein Problem den "Goliath" Ormat mit dem "David" HTM zu vergleichen ... mal abgesehen von der Diversifizierung bei ORA.

RPG kann ich zur Zeit überhaupt nicht ernst nehmen - die stecken bis über beide Ohren im "Überlebenskampf".

GDYMF und MGMXF überblicke zu wenig.

CPN hat eine gute Entwicklung hingelegt in den vergangenen Jahren und setzt neue aktiv neue Alzeithochs.

Das Potential bei HTM ist aber im Vergleich um ein Vielfaches höher, weil gerade am Beginn ... CPN wusste schon, warum man damals mit Gilles im Boot ein Auge auf HTM geworfen hat.

RPG kann ich zur Zeit überhaupt nicht ernst nehmen - die stecken bis über beide Ohren im "Überlebenskampf".

GDYMF und MGMXF überblicke zu wenig.

CPN hat eine gute Entwicklung hingelegt in den vergangenen Jahren und setzt neue aktiv neue Alzeithochs.

Das Potential bei HTM ist aber im Vergleich um ein Vielfaches höher, weil gerade am Beginn ... CPN wusste schon, warum man damals mit Gilles im Boot ein Auge auf HTM geworfen hat.

Antwort auf Beitrag Nr.: 47.365.464 von rechnerhand am 24.07.14 14:16:44

Geothermal: The Other Alternative Energy

http://finance.yahoo.com/tumblr/photoset-geothermal-the-othe…

http://finance.yahoo.com/tumblr/photoset-geothermal-the-othe…

durschnittliches Volumen und eine schöne Hammerausbildung ... könnte ein Umkehrsignal im Sinne einer Abschwächung sein.

Wäre vor dem Hintergrund der aktuellen Performance eine "gesunde" Bewegung.

Wäre vor dem Hintergrund der aktuellen Performance eine "gesunde" Bewegung.

Antwort auf Beitrag Nr.: 47.369.344 von rechnerhand am 24.07.14 22:50:30Ja, ja ... die Uhrzeit ... Sorry, es handelt sich natürlich nicht um eine Hammerausbildung (im Laufe eines Abwärtstrend), sondern eher um den sog. Hanging Man (im Laufe eines Aufwärtstrend).

Das Signal muss heute aber erst einmal Bestätigung finden.

Trotz alledem bislang eine super Wochenbilanz mit hervorragender PR.

Das Signal muss heute aber erst einmal Bestätigung finden.

Trotz alledem bislang eine super Wochenbilanz mit hervorragender PR.

Moin an alle Mitstreiter

Heute wird nicht viel passieren denke ich. Volumen wird unterdurchschnittlich sein, weil Freitag und der Gesamtmarkt ist auch nicht der Burner...

Ein kleines Plus würde ja schon reichen

Ein kleines Plus würde ja schon reichen

Nun, die Ankündigung des gestrigen Verlaufs hat sich heute bestätigt.

Viele haben sich von einigen oder allen Anteilen getrennt und der Tag beschert uns am Ende einer sehr guten Woche ein bärisches Verschlingen ... dem Vernehmen nach ein Anzeichen dafür, dass es auch in den kommenden Tagen seine Fortsetzung finden könnte und Verkäufe ausgelöst werden.

Da der bullische Trend nach wie vor aktiv ist, dürfte es sich hier mehr oder weniger um Gewinnmitnahmen handeln (dafür spricht das relativ geringe Volumen) und gute Einstiegsmöglichkeiten für alle anderen bieten.

Heute sind auch mehrere Artikel (mal wieder) aufgetaucht, die neben bspw. Apple auch zahlreichen anderen Blue Chips das Vorhaben zur "grünen" Energieerzeugung und -nutzung zusprechen wollen. Apple als Vorreiter und auch im Zusammenhang mit Geothermie, aber primär und zur Zeit mit Sonne und Wind aktiv.

Es wird aber auch oft und gerne der Begriff der Diversifizierung genannt und hier schliesst sich dann der Kreis zu u.A. HTM.

Im Hinblick auf ORA, CPN und wie sie alle heißen, stehen diese nicht alleine auf dem Bein der Geothermie. Mit Dennis Gilles (ehem. CPN) bei HTM halte ich es auch für sehr wahrscheinlich, dass mit den geplanten Wachstumsmaßnahmen auch eine Diversifizierunug einhergehen wird.

Ich bin wirklich sehr gespannt darauf, was in den kommenden Wochen aus dem Hause HTM in Bezug auf das Wachstum bekanntgegeben wird und ich möchte mir gar nicht ausmalen, was passiert, wenn einer der Blue Chips sich mit Dennis Gilles an einen runden Tisch setzt und die Zukunft bespricht.

Wochenendlektüre:

Desperately Seeking A Cheaper Kilowatt Hour

https://www.valuewalk.com/2014/07/kilowatt-hour/

Schönes Wochenende!

meint rechnerhand

Viele haben sich von einigen oder allen Anteilen getrennt und der Tag beschert uns am Ende einer sehr guten Woche ein bärisches Verschlingen ... dem Vernehmen nach ein Anzeichen dafür, dass es auch in den kommenden Tagen seine Fortsetzung finden könnte und Verkäufe ausgelöst werden.

Da der bullische Trend nach wie vor aktiv ist, dürfte es sich hier mehr oder weniger um Gewinnmitnahmen handeln (dafür spricht das relativ geringe Volumen) und gute Einstiegsmöglichkeiten für alle anderen bieten.

Heute sind auch mehrere Artikel (mal wieder) aufgetaucht, die neben bspw. Apple auch zahlreichen anderen Blue Chips das Vorhaben zur "grünen" Energieerzeugung und -nutzung zusprechen wollen. Apple als Vorreiter und auch im Zusammenhang mit Geothermie, aber primär und zur Zeit mit Sonne und Wind aktiv.

Es wird aber auch oft und gerne der Begriff der Diversifizierung genannt und hier schliesst sich dann der Kreis zu u.A. HTM.

Im Hinblick auf ORA, CPN und wie sie alle heißen, stehen diese nicht alleine auf dem Bein der Geothermie. Mit Dennis Gilles (ehem. CPN) bei HTM halte ich es auch für sehr wahrscheinlich, dass mit den geplanten Wachstumsmaßnahmen auch eine Diversifizierunug einhergehen wird.

Ich bin wirklich sehr gespannt darauf, was in den kommenden Wochen aus dem Hause HTM in Bezug auf das Wachstum bekanntgegeben wird und ich möchte mir gar nicht ausmalen, was passiert, wenn einer der Blue Chips sich mit Dennis Gilles an einen runden Tisch setzt und die Zukunft bespricht.

Wochenendlektüre:

Desperately Seeking A Cheaper Kilowatt Hour

https://www.valuewalk.com/2014/07/kilowatt-hour/

Schönes Wochenende!

meint rechnerhand

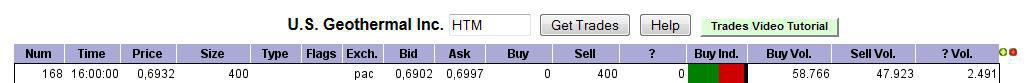

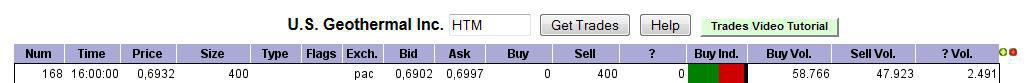

Hier noch das Volumen von Freitag

Bin mal gespannt wie es diese Woche weiter geht. MACD und Momentum sehen noch gut aus. Ich hoffe es bleibt bei einer kurzen Erholung und wir halten den Bereich zwischen 65 und 70 Cent.

Gibt gerade nicht viel zu berichten, bis auf, dass der mittelfristige Trend (SMA100) von oben getestet wurde. Bin gespannt, ob sich der Kurs heute davon erholt oder erneut die Marke .690$ von oben nach unten durchbricht.

Das bärische Muster ist noch aktiv.

Kurz- und langfristige Signale sind nach wie vor im Aufwärtstrend und mit Polster darüber der aktuelle Kurs.

PS: Enterprise value/share = 1.08$

Das bärische Muster ist noch aktiv.

Kurz- und langfristige Signale sind nach wie vor im Aufwärtstrend und mit Polster darüber der aktuelle Kurs.

PS: Enterprise value/share = 1.08$

Randnotiz:

5 Worst Sectors to Avoid This Week

http://investorplace.com/2014/07/5-worst-sectors-to-avoid-th…

Goldman Sachs Upgrades Calpine to Conviction-Buy (CPN)

http://www.wkrb13.com/markets/343148/goldman-sachs-upgrades-…

... GS darf auch gerne mal HTM "upgraden"

5 Worst Sectors to Avoid This Week

http://investorplace.com/2014/07/5-worst-sectors-to-avoid-th…

Goldman Sachs Upgrades Calpine to Conviction-Buy (CPN)

http://www.wkrb13.com/markets/343148/goldman-sachs-upgrades-…

... GS darf auch gerne mal HTM "upgraden"

Ups, das Volumen war ja heute sehr dürftig

Kaüferseite überwiegt aber, "Mögen die Bullen mit uns sein"

Kaüferseite überwiegt aber, "Mögen die Bullen mit uns sein"

Heute im Finish möglicherweise eine Ankündigung auf Chartebene zur Trendwende.

Mal schauen, ob das morgen bestätigt/untermauert werden kann.

Die Volumen in den vergangenen Tagen waren nicht gerade eine deutliche Bestätigung eines intensiven Kursverfalls. Von daher freue ich mich auf die kommende Bewegung Up.

Mal schauen, ob das morgen bestätigt/untermauert werden kann.

Die Volumen in den vergangenen Tagen waren nicht gerade eine deutliche Bestätigung eines intensiven Kursverfalls. Von daher freue ich mich auf die kommende Bewegung Up.

Antwort auf Beitrag Nr.: 47.403.212 von rechnerhand am 30.07.14 22:42:11Der Chart hat sich tatsächlich aufgehellt. Die Aktie hat sich oberhalb der Wolke etabliert und dürfte, wenn heute nichts gravierendes mehr passiert die Vormonatskerze bullish engulfen.

Durchaus möglich, dass die Aktie sich in einer Welle1 der Welle 3 einer Wave 3 einer GRANDWAVE 1 befindet.

Demnach gibt es zwei Szenarien - Anstieg auf ca. 80-90 US-Cent - möglicherweise auch mehr. Danach Korrekturphase - vermutlich eher kurz - mit anschliessendem Start der Welle 3 der Welle 3 einer WAVE 3 der Grandwave 1. Diese dynamisierende Impulswelle wäre dann jene welche den Widerstand bei 1.08 USD aushebelt und die Aktie sehr wahrscheinlich massiv ansteigen lässt.

Insofern stellt sich die Frage, ob Kursrücksetzer nicht Kaufgelegenheit darstellen. Zumindest scheint es der Markt derzeit so zu sehen. Die Aktie wird unterhalb von 0.70 USD offenbar gerne gekauft.

Viele Grüsse.

Disclaimer und wichtiger Hinweis:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Bedenken sie das Aktien steigen oder fallen können. Börsen und Finanzmärkte sind keine Einbahnstrassen und in aller Regel hochkomplexe Systeme, die sich in oftmals typischen wiederkehrenden Mustern und Marktverhalten wiederspiegeln. Diese gilt es zu analysieren und daraus entsprechende Schlussfolgerungen für die Zukunft zu ziehen.

Durchaus möglich, dass die Aktie sich in einer Welle1 der Welle 3 einer Wave 3 einer GRANDWAVE 1 befindet.

Demnach gibt es zwei Szenarien - Anstieg auf ca. 80-90 US-Cent - möglicherweise auch mehr. Danach Korrekturphase - vermutlich eher kurz - mit anschliessendem Start der Welle 3 der Welle 3 einer WAVE 3 der Grandwave 1. Diese dynamisierende Impulswelle wäre dann jene welche den Widerstand bei 1.08 USD aushebelt und die Aktie sehr wahrscheinlich massiv ansteigen lässt.

Insofern stellt sich die Frage, ob Kursrücksetzer nicht Kaufgelegenheit darstellen. Zumindest scheint es der Markt derzeit so zu sehen. Die Aktie wird unterhalb von 0.70 USD offenbar gerne gekauft.

Viele Grüsse.

Disclaimer und wichtiger Hinweis:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Bedenken sie das Aktien steigen oder fallen können. Börsen und Finanzmärkte sind keine Einbahnstrassen und in aller Regel hochkomplexe Systeme, die sich in oftmals typischen wiederkehrenden Mustern und Marktverhalten wiederspiegeln. Diese gilt es zu analysieren und daraus entsprechende Schlussfolgerungen für die Zukunft zu ziehen.

Schönen guten Tag die Herren,

mein persönliches Gefühl sagt mir das der Gesamtmarkt konsolidieren möchte.

Die Masse macht sich auf die suche nach Firmen die unterbewertet sind. HTM gehört wohl auch dazu.

Die aktie hat sich die letzten zwei Wochen, entgegen dem Gesamtmarkt recht gut entwickelt.

Grüsse und einen schönen, sonnigen Tag.

mein persönliches Gefühl sagt mir das der Gesamtmarkt konsolidieren möchte.

Die Masse macht sich auf die suche nach Firmen die unterbewertet sind. HTM gehört wohl auch dazu.

Die aktie hat sich die letzten zwei Wochen, entgegen dem Gesamtmarkt recht gut entwickelt.

Grüsse und einen schönen, sonnigen Tag.

sollte man kennen ...

Three Geothermal Bills Look to Speed Up US Development

http://www.renewableenergyworld.com/rea/news/article/2014/07…

Three Geothermal Bills Look to Speed Up US Development

http://www.renewableenergyworld.com/rea/news/article/2014/07…

Beeindruckender Rebound nach dem Test der .65$ ... und nachbörslich sogar auf .72$.

Gut, die .72$ werden mit Volumen bestätigt werden müssen und stehen für mich heute Abend auf nicht sonderlich starken Beinen.

Aber die Aufwärtsbewegung von .65$ auf .70$ bzw. .685$ mit überdurchschnittlichem Volumen zeigt die Richtung!

Der gesamte Markt in den USA hat heute ordentlich Flügel gelassen und könnte dazu beitragen, dass wieder mehr in fundamental gesunde Firmen investiert wird.

Gut, die .72$ werden mit Volumen bestätigt werden müssen und stehen für mich heute Abend auf nicht sonderlich starken Beinen.

Aber die Aufwärtsbewegung von .65$ auf .70$ bzw. .685$ mit überdurchschnittlichem Volumen zeigt die Richtung!

Der gesamte Markt in den USA hat heute ordentlich Flügel gelassen und könnte dazu beitragen, dass wieder mehr in fundamental gesunde Firmen investiert wird.

Wow - klare Ansage heute im Sog des Gesamtmarkt. Keine Käufe vs. hoher Abgabedruck!

Calpine(CPN) mit starken Zahlen in Q2 und in Summe im ersten Halbjahr - positiver Ausreißer heute!

Ich will mal hoffen, dass das fallende Messer langsam am Boden angekommen ist und in der kommenden Woche wieder in die Hand genommen werden kann.

Calpine(CPN) mit starken Zahlen in Q2 und in Summe im ersten Halbjahr - positiver Ausreißer heute!

Ich will mal hoffen, dass das fallende Messer langsam am Boden angekommen ist und in der kommenden Woche wieder in die Hand genommen werden kann.

*** Der gestrige Serverausfall bei w:o hat zur Folge, dass mein gestriger Beitrag gelöscht wurde. ***

San Emidio

Gerlach

Granite Creek Ranch

--> Nevada

After eliminating California as an option, Tesla has announced Nevada as a possible site for its $5 billion Gigafactory in a letter to shareholders, on Thursday

http://www.bidnessetc.com/23555-nevada-could-be-home-to-tesl…

Geothermal Power Growing in Nevada

http://www.ktvn.com/story/26193486/geothermal-power-growing-…

Gerlach

Granite Creek Ranch

--> Nevada

After eliminating California as an option, Tesla has announced Nevada as a possible site for its $5 billion Gigafactory in a letter to shareholders, on Thursday

http://www.bidnessetc.com/23555-nevada-could-be-home-to-tesl…

Geothermal Power Growing in Nevada

http://www.ktvn.com/story/26193486/geothermal-power-growing-…

Hoffentlich rührt Tesla die Werbetrommel für HTM mit

PS: @rechnerhand Sie haben Post!

PS: @rechnerhand Sie haben Post!

Schon am 03.08.2014 gepostet, aber dem Serverausfall zum Dank hier noch mal ... sinngemäß

Thema - mögliche Diversifizierung bei HTM in Richtung Lithiumgewinnung aus den Solen der Geothermie

http://www.simbolmaterials.com/

Simbol Materials’ lithium extraction could help Salton Sea

http://www.desertsun.com/story/tech/science/energy/2014/02/2…

Thema - mögliche Diversifizierung bei HTM in Richtung Lithiumgewinnung aus den Solen der Geothermie

http://www.simbolmaterials.com/

Simbol Materials’ lithium extraction could help Salton Sea

http://www.desertsun.com/story/tech/science/energy/2014/02/2…

Antwort auf Beitrag Nr.: 47.405.596 von Indextrader24 am 31.07.14 10:53:09Schwieriges Marktumfeld in der sich die Aktie derzeit befindet. Die Aktie sollte nach meinem dafürhalten jetzt nicht mehr unter 0.60 USD rutschen - auf Schlusskursbasis, ansonsten kann es passieren dass der Count schon wieder umgestellt werden muss.

Umgekehrt gilt allerdings oberhalb von 0.60 USD, dass ein erneueter Anstieg in Richtung 0.80/0.90 USD möglich ist. Dazu müsste das Unternehmen aber einige breaking news präsentieren, die derart gestaltet sind, dass die Aktie sich positive vom Gesamtmarkt abheben kann.

Der schöne Ansatz zum Monatsende wurde inzwischen wieder neutralisiert. Das Chartbild ist widersprüchlich. Der schwachen Eröffnung zum Monatsauftakt steht ein quartalsmässig durchaus optimistisches Chartbild gegenüber. Allerdings recht fragil wie man inzwischen erkennt.

Die Märkte sind scheinbar im risk off Modus. Dem muss das Unternehmen mit guten news kontern, ansonsten könnte es doch nochmal zu einer Abverkaufswelle kommen.

Fest steht, dass der letzte Anstieg durch seine Welleüberschneidung die gesamte Bewegung seit 1.08 USD inzwischen als Korrekturmuster ausweist. Diese Korrekturen sind recht tricky, da alternativ der letzte Anstieg bis 0.73 USD auch als Wave B gelabelt werden kann und durchaus nochmal eine Welle-c auftreten kann, die entweder als flat oder zigzag sich manifestieren kann. Möglicherweise geht das ganze hier noch weiter einige Wochen hin- und her.

Disclaimer und wichtiger Hinweis:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Bedenken sie das Aktien steigen oder fallen können. Börsen und Finanzmärkte sind keine Einbahnstrassen und in aller Regel hochkomplexe Systeme, die sich in oftmals typischen wiederkehrenden Mustern und Marktverhalten wiederspiegeln. Diese gilt es zu analysieren und daraus entsprechende Schlussfolgerungen für die Zukunft zu ziehen.

Umgekehrt gilt allerdings oberhalb von 0.60 USD, dass ein erneueter Anstieg in Richtung 0.80/0.90 USD möglich ist. Dazu müsste das Unternehmen aber einige breaking news präsentieren, die derart gestaltet sind, dass die Aktie sich positive vom Gesamtmarkt abheben kann.

Der schöne Ansatz zum Monatsende wurde inzwischen wieder neutralisiert. Das Chartbild ist widersprüchlich. Der schwachen Eröffnung zum Monatsauftakt steht ein quartalsmässig durchaus optimistisches Chartbild gegenüber. Allerdings recht fragil wie man inzwischen erkennt.

Die Märkte sind scheinbar im risk off Modus. Dem muss das Unternehmen mit guten news kontern, ansonsten könnte es doch nochmal zu einer Abverkaufswelle kommen.

Fest steht, dass der letzte Anstieg durch seine Welleüberschneidung die gesamte Bewegung seit 1.08 USD inzwischen als Korrekturmuster ausweist. Diese Korrekturen sind recht tricky, da alternativ der letzte Anstieg bis 0.73 USD auch als Wave B gelabelt werden kann und durchaus nochmal eine Welle-c auftreten kann, die entweder als flat oder zigzag sich manifestieren kann. Möglicherweise geht das ganze hier noch weiter einige Wochen hin- und her.

Disclaimer und wichtiger Hinweis:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Bedenken sie das Aktien steigen oder fallen können. Börsen und Finanzmärkte sind keine Einbahnstrassen und in aller Regel hochkomplexe Systeme, die sich in oftmals typischen wiederkehrenden Mustern und Marktverhalten wiederspiegeln. Diese gilt es zu analysieren und daraus entsprechende Schlussfolgerungen für die Zukunft zu ziehen.

Antwort auf Beitrag Nr.: 47.438.881 von Indextrader24 am 05.08.14 21:39:56Unternehmensmeldungen geplant:

14.08.2014 - Q2 bzw. Halbjahreszahlen

Ende Sommer - "... He said the company will announce another site purchase in the same vein as the Geyser acquisition by the end of summer. ..." http://www.idahostatesman.com/2014/07/23/3291847/us-geotherm…

14.08.2014 - Q2 bzw. Halbjahreszahlen

Ende Sommer - "... He said the company will announce another site purchase in the same vein as the Geyser acquisition by the end of summer. ..." http://www.idahostatesman.com/2014/07/23/3291847/us-geotherm…

Antwort auf Beitrag Nr.: 47.438.881 von Indextrader24 am 05.08.14 21:39:56Vielleicht muss man als strategischer Investor im gegenwärtigen Marktumfeld wegen der Gefahr möglicherweise bei 0.60 USD einfach rausgekegelt zu werden, den Stop knapp unterhalb der 200 Tagelnie platzieren, die derzeit bei 0.57 USD verläuft.

Per Close versteht sich. Intraday kann nämlich immer vieles passieren.

Disclaimer und wichtiger Hinweis:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Bedenken sie das Aktien steigen oder fallen können. Börsen und Finanzmärkte sind keine Einbahnstrassen und in aller Regel hochkomplexe Systeme, die sich in oftmals typischen wiederkehrenden Mustern und Marktverhalten wiederspiegeln. Diese gilt es zu analysieren und daraus entsprechende Schlussfolgerungen für die Zukunft zu ziehen.

Per Close versteht sich. Intraday kann nämlich immer vieles passieren.

Disclaimer und wichtiger Hinweis:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Bedenken sie das Aktien steigen oder fallen können. Börsen und Finanzmärkte sind keine Einbahnstrassen und in aller Regel hochkomplexe Systeme, die sich in oftmals typischen wiederkehrenden Mustern und Marktverhalten wiederspiegeln. Diese gilt es zu analysieren und daraus entsprechende Schlussfolgerungen für die Zukunft zu ziehen.

U.S. Geothermal Inc. to Discuss First Quarter 2014 Earnings Results on August 15, 2014

http://online.wsj.com/article/PR-CO-20140806-909210.html

http://online.wsj.com/article/PR-CO-20140806-909210.html

Ich finde den Gedanken immer besser ....

Tesla Considers California: Gigafactory Location Finalized?

http://www.bidnessetc.com/23727-tesla-considers-california-g…

Tesla Considers California: Gigafactory Location Finalized?

http://www.bidnessetc.com/23727-tesla-considers-california-g…

Zitat von rechnerhand: U.S. Geothermal Inc. to Discuss First Quarter 2014 Earnings Results on August 15, 2014

http://online.wsj.com/article/PR-CO-20140806-909210.html

Korrektur!

... natürlich das "Second Quarter" ...

http://www.marketwired.com/press-release/correction-from-sou…

Is the US Geothermal Industry Back on Track?

http://www.renewableenergyworld.com/rea/news/article/2014/08…

http://www.renewableenergyworld.com/rea/news/article/2014/08…

$18 Million To Awaken The Sleeping Geothermal Energy Giant

"...Geothermal Energy And Lithium, Too

Rounding out the $18 million is a third group of 9 projects that looks at ways to capture high-value minerals from geothermal brine, including lithium. Lithium is of particular interest because it’s the secret sauce behind the rechargeable lithium-ion batteries that enable electric vehicles as well as wind and solar energy storage.

The problem for the US clean tech industry is that domestic lithium production has been shrinking, partly as a result of low-cost imported lithium, mainly from South America.

A cost effective domestic geothermal brine extraction system would help buffer the US industry from global lithium market vagaries (btw the Obama Administration has a whole $120 million “critical materials” initiative aimed at ensuring domestic supplies for the clean tech industry).

Back in 2011 CleanTechnica noted that a company called Simbol Materials was already dipping a toe into brine extraction technology with a demonstration project at the Salton Sea in California. That project is still humming along. Aside from lithium, the system could result in enough financial bennies to provide for Salton Sea restoration projects.

http://cleantechnica.com/2014/08/09/energy-dept-18-million-n…

"...Geothermal Energy And Lithium, Too

Rounding out the $18 million is a third group of 9 projects that looks at ways to capture high-value minerals from geothermal brine, including lithium. Lithium is of particular interest because it’s the secret sauce behind the rechargeable lithium-ion batteries that enable electric vehicles as well as wind and solar energy storage.

The problem for the US clean tech industry is that domestic lithium production has been shrinking, partly as a result of low-cost imported lithium, mainly from South America.

A cost effective domestic geothermal brine extraction system would help buffer the US industry from global lithium market vagaries (btw the Obama Administration has a whole $120 million “critical materials” initiative aimed at ensuring domestic supplies for the clean tech industry).

Back in 2011 CleanTechnica noted that a company called Simbol Materials was already dipping a toe into brine extraction technology with a demonstration project at the Salton Sea in California. That project is still humming along. Aside from lithium, the system could result in enough financial bennies to provide for Salton Sea restoration projects.

http://cleantechnica.com/2014/08/09/energy-dept-18-million-n…

Geld: 0,65 x 40100

Das Interesse steigt vor den Zahlen.

Das Interesse steigt vor den Zahlen.

U.S. Geothermal Inc (HTM) Earnings Report: More Steady Progress? ORA & CPN

http://www.smallcapnetwork.com/U-S-Geothermal-Inc-HTM-Earnin…

http://www.smallcapnetwork.com/U-S-Geothermal-Inc-HTM-Earnin…

Hallöchen liebe Leute,

Endlich wieder Zeit für ein bisschen Börsengebumsel

Mal schauen ob wir heute noch die 0,7 sehen

Endlich wieder Zeit für ein bisschen Börsengebumsel

Mal schauen ob wir heute noch die 0,7 sehen

U.S. Geothermal Shares Are (Almost) Over the Hump (HTM)

http://www.smallcapnetwork.com/U-S-Geothermal-Shares-Are-Alm…

http://www.smallcapnetwork.com/U-S-Geothermal-Shares-Are-Alm…

Zitat von rechnerhand: Gemessen an den Angaben des mid-year update von U.S. Geothermal komme ich vorbehaltlich einer Kenntnis darüber, was in den einzelnen Monaten tatsächlich an den Standorten erzeugt wurde, auf einen prognostizierten Umsatz in Q2/2014 von 5,85Mio. $.

Das ergibt für das starke Q1 und das schwache Q2 (beide saisonal bedingt) einen kumulierten Ansatz von 14,35Mio. $.

Gemessen an den Vorgaben für das Gesamtjahr 2014: 27 - 31Mio.$ und einer 2.Jahreshälfte, halte ich das Erreichen der oberen Grenze von 30-31Mio. $ Umsatz in diesem Jahr für realisierbar (vorbehaltlich unplanmäßiger Reparaturen, Auslastungsdefiziten oder sonstiger Ausfälle).

Zitat von rechnerhand: Ich will meinen Gedanken zu dem Thema Umsatz in den ersten 6 Monaten 2014 noch etwas ausführen.

Dennis Gilles sprach ja in dem mid-year update davon, dass die Menge an MWh im ersten Halbjahr 2014: "... reflecting a 15% increase over the prior year period ... " darstellen.

Nehme ich mir die 4,886Mio.$ Umsatz aus den ersten 6 Monaten in 2013 und schlage da die 15% Steigerung rauf, lande ich bei ca. 5,62Mio.$.

Ich denke aber, dass der Umsatz bei ca. 5,85Mio.$ liegen wird.

Die 27%-ige Steigerung alleine vom Zugpferd in Neal Hot Springs dürfte mit den höchsten Erlösen pro MWh aller Kraftwerke dazu beitragen, dass der Umsatz im Verhältnis zur Leistung einen höheren Wert als 15% einnehmen wird und bei ca. 19,7% liegt.

Das betrifft aber alles alleine den Punkt 'Revenue/Energy Sales'!

Ich denke aber, dass der Umsatz nicht aussreichen wird, um in Q2 eine schwarze Null beim EPS zu erzielen und halte die (0,01) für realistisch.

Die Ausgabenseite bzw. die Verbindlichkeiten sind in insbesondere in Q2 schwer zu erfassen ...

Andere Meinungen?

Energy sales by plant:

Neal Hot Springs, Oregon 3,402,318$

San Emidio, Nevada 1,450,525$

Raft River, Idaho 907,194$

Energy credit sales 85,837$

Treffer!

Hot rocks - Why geothermal is the new fracking

http://www.economist.com/news/business/21612193-why-geotherm…

http://www.economist.com/news/business/21612193-why-geotherm…

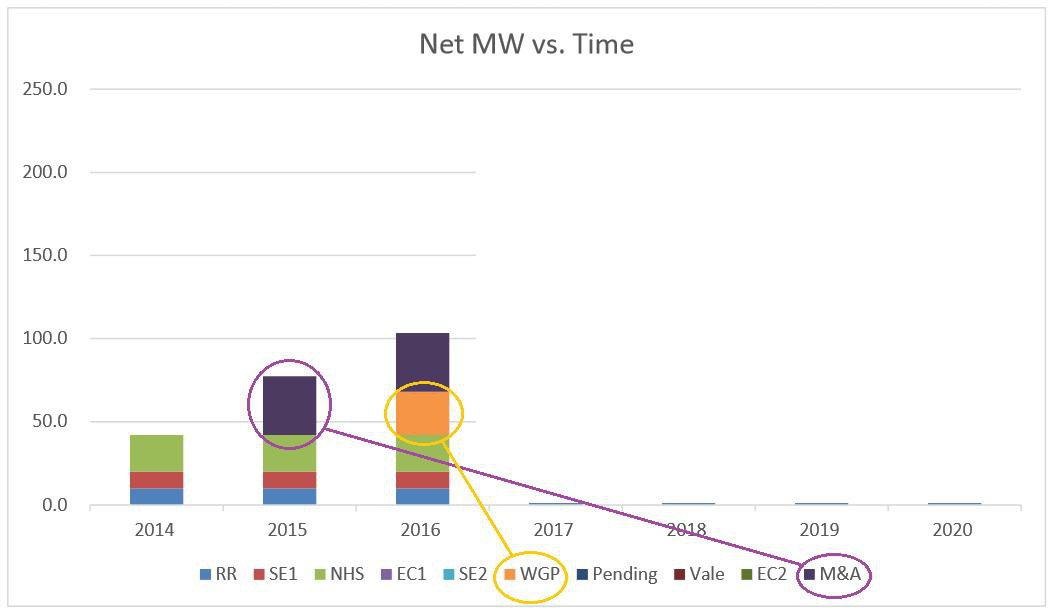

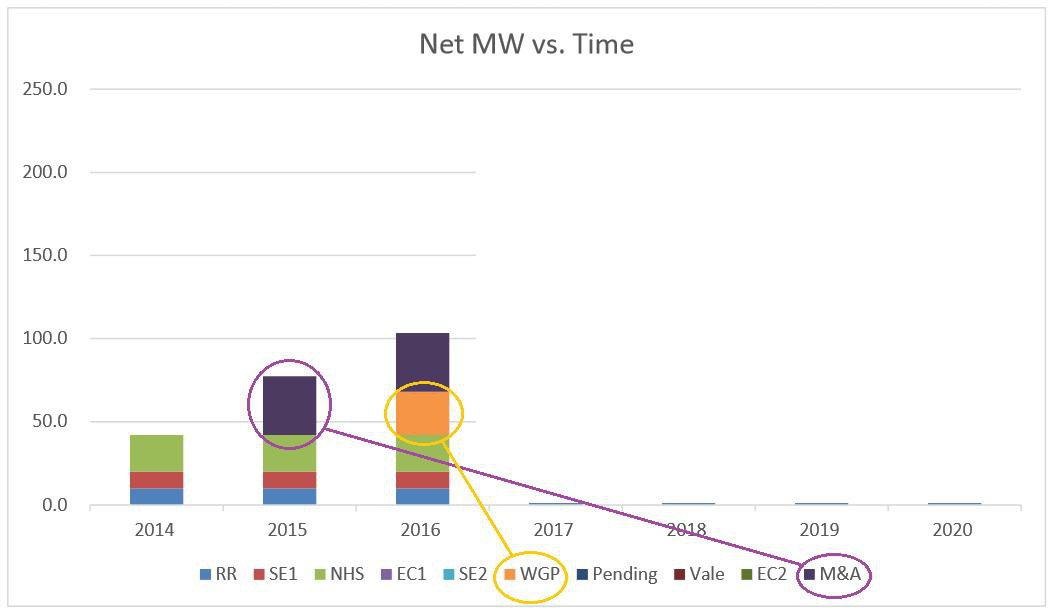

Q2/2014 bzw. Halbjahreszahlen 2014:

EPS: (0.01)

Die Anlagen laufen nach den geplanten Wartungen am Anschlag (Umsatzplus 19%), man sucht weiterhin nach Möglichkeiten für Wachstum+Investitionen, Planungen für Geysers sind nach wie vor aktiv, Mindest-Erwartungen auf Jahressicht für Umsatz+EBITDA leicht nach oben korrigiert (28 bzw. 14Mio.$) und einen Ausblick auf das Gesamtjahr 2015.

Wer nach dem "bitteren Beigeschmack" sucht, wird beim EPS und dem Ausblick für 2015 fündig, der keine Steigerung bzw. kein Wachstum in Aussicht stellt.

Der EPS war zu erwarten und ehrlich gesagt, auch das fehlende Wachstum aus heutiger Sicht in 2015 ist für mich keine Überraschung.

Dies ist aber vorbehaltlich der noch ausstehenden CC und der in Aussicht gestellten Aquise weiterer Assets und/oder Finanzierung noch nicht das Ende der Fahnenstange ....

http://finance.yahoo.com/news/u-geothermal-inc-reports-first…

EPS: (0.01)

Die Anlagen laufen nach den geplanten Wartungen am Anschlag (Umsatzplus 19%), man sucht weiterhin nach Möglichkeiten für Wachstum+Investitionen, Planungen für Geysers sind nach wie vor aktiv, Mindest-Erwartungen auf Jahressicht für Umsatz+EBITDA leicht nach oben korrigiert (28 bzw. 14Mio.$) und einen Ausblick auf das Gesamtjahr 2015.

Wer nach dem "bitteren Beigeschmack" sucht, wird beim EPS und dem Ausblick für 2015 fündig, der keine Steigerung bzw. kein Wachstum in Aussicht stellt.

Der EPS war zu erwarten und ehrlich gesagt, auch das fehlende Wachstum aus heutiger Sicht in 2015 ist für mich keine Überraschung.

Dies ist aber vorbehaltlich der noch ausstehenden CC und der in Aussicht gestellten Aquise weiterer Assets und/oder Finanzierung noch nicht das Ende der Fahnenstange ....

http://finance.yahoo.com/news/u-geothermal-inc-reports-first…

Lieber konservative Prognosen als zu großer Optimismus dem

ein böses Erwachen folgt.

So bleibt immer noch Platz für positive Überraschungen.

Denn eines ist sicher: Wir stehen erst am Anfang!

ein böses Erwachen folgt.

So bleibt immer noch Platz für positive Überraschungen.

Denn eines ist sicher: Wir stehen erst am Anfang!

Na?! Ehrlich!!

Wer beißt heute in die Couch, weil er nicht glauben kann, dass ein Unternehmen mit solider Basis, positiver Bilanz, funktionierendem Management und Potential auf allen Ebenen abgestraft wird, weil man für 2015 keinen signifikanten Umsatz- und Ertragswachstum in Aussicht gestellt bekommt?

Wer beißt heute in die Couch, weil er nicht glauben kann, dass ein Unternehmen mit solider Basis, positiver Bilanz, funktionierendem Management und Potential auf allen Ebenen abgestraft wird, weil man für 2015 keinen signifikanten Umsatz- und Ertragswachstum in Aussicht gestellt bekommt?

Börse handelt Zunkunft - wenn sie nicht rosarot gemalt wird bzw. die Erträge stagnieren,

dann wird verkauft.

Aber Panik sieht anders aus.

dann wird verkauft.

Aber Panik sieht anders aus.

Antwort auf Beitrag Nr.: 47.532.361 von Miser am 15.08.14 21:15:22Verkäufe werden gut abgefangen .... interessante Aussgangssituation für die kommende Woche.

Habe nochmal nachgelegt - ist alles eingepreist.

U.S. Geothermal's (HTM) CEO Dennis Gilles on Q2 2014 Results - Earnings Call Transcript

" .... For larger opportunities, then we'll look to other funding mechanisms, but to whoever wrote that in, I do want to point out that there has not been any dilution of the stock as to support any of the growth that's occurred since 2012. ....

"Kleinere" Investitionen wie die in Geysers wurden aus dem Cash-Bestand erworben, weil man sich bewußt so entschieden hat.

"Größere" Investitionen (>$6.4Mio. Geysers) könnten demnach auch durch zusätzliche Aktienplatzierungen gestemmt werden, obwohl das der Aussage im Idahostatesman (Profits heat up at Boise-based U.S. Geothermal) "Now that we're profitable, we don't have to go out and sell shares - and further dilute our shares - in order to keep the lights on," Gilles said. "We're not in that boat anymore." entgegensteht.

Gilt hier - bei Wachstum Finanzierung durch Cash, bei Stagnation Finanzierung durch zusätzliche Aktien oder auch anderes Fremdkapital (z.B.Kredite)?

Ich denke, bis Ende September wird es von HTM eine weitere Ankündigung zur Wachstumsstrategie geben. Warum?

.... weil es angekündigt wurde und weil ich Dennis Gilles auch so einschätze, dass er auf Basis solider Ergebnisse aus HTM eine "large-scale power company" machen wird.

http://seekingalpha.com/article/2427625-u-s-geothermals-htm-…

http://www.idahostatesman.com/2014/07/23/3291847/us-geotherm…

" .... For larger opportunities, then we'll look to other funding mechanisms, but to whoever wrote that in, I do want to point out that there has not been any dilution of the stock as to support any of the growth that's occurred since 2012. ....

"Kleinere" Investitionen wie die in Geysers wurden aus dem Cash-Bestand erworben, weil man sich bewußt so entschieden hat.

"Größere" Investitionen (>$6.4Mio. Geysers) könnten demnach auch durch zusätzliche Aktienplatzierungen gestemmt werden, obwohl das der Aussage im Idahostatesman (Profits heat up at Boise-based U.S. Geothermal) "Now that we're profitable, we don't have to go out and sell shares - and further dilute our shares - in order to keep the lights on," Gilles said. "We're not in that boat anymore." entgegensteht.

Gilt hier - bei Wachstum Finanzierung durch Cash, bei Stagnation Finanzierung durch zusätzliche Aktien oder auch anderes Fremdkapital (z.B.Kredite)?

Ich denke, bis Ende September wird es von HTM eine weitere Ankündigung zur Wachstumsstrategie geben. Warum?

.... weil es angekündigt wurde und weil ich Dennis Gilles auch so einschätze, dass er auf Basis solider Ergebnisse aus HTM eine "large-scale power company" machen wird.

http://seekingalpha.com/article/2427625-u-s-geothermals-htm-…

http://www.idahostatesman.com/2014/07/23/3291847/us-geotherm…

"Now that we're profitable, we don't have to go out and sell shares - and further dilute our shares - in order to keep the lights on," Gilles said. "We're not in that boat anymore."

Diese Aussage hatte ich auch noch in Hinterkopf als ich nachgekauft habe.

Man wird sehen was passiert. Ich glaube aber nicht, dass er seine Glaubwürdigkeit

so einfach aufs Spiel setzt.

Diese Aussage hatte ich auch noch in Hinterkopf als ich nachgekauft habe.

Man wird sehen was passiert. Ich glaube aber nicht, dass er seine Glaubwürdigkeit

so einfach aufs Spiel setzt.

Guten Morgen,

sieht mir nach einem "bearish engulfing" aus. Sehen wir heute eine weitere schwarze Kerze mit niedrigerem Kursniveau, könnte es nochmal runter gehen. Dann sehen wir vielleicht nochmal die 55-52 hinter dem Komma.

Es bleibt spannend...

sieht mir nach einem "bearish engulfing" aus. Sehen wir heute eine weitere schwarze Kerze mit niedrigerem Kursniveau, könnte es nochmal runter gehen. Dann sehen wir vielleicht nochmal die 55-52 hinter dem Komma.

Es bleibt spannend...

Das Chartbild sieht noch einen Tick schlechter als "bearish engulfing" aus, vor allem mit der Bullenfalle davor.

Die Verzögerungen bei den aktuellen Projekten und die steigenden Kosten bei den laufenden Projekten, lassen den Gewinn nicht signifikant steigen ... im Verhältnis zum Umsatzanstieg.

Kurzfristig wird sich die Unternehmenssituation nicht positiv im Umsatz/Gewinn verbessern lassen, wenngleich sie sich auf Jahressicht am oberen Ende der Prognose bewegen werden.

Hoffnung habe ich kurzfristig nur in der noch ausstehenden und angekündigten Expansion durch Dennis Gilles.

Die Verzögerungen bei den aktuellen Projekten und die steigenden Kosten bei den laufenden Projekten, lassen den Gewinn nicht signifikant steigen ... im Verhältnis zum Umsatzanstieg.

Kurzfristig wird sich die Unternehmenssituation nicht positiv im Umsatz/Gewinn verbessern lassen, wenngleich sie sich auf Jahressicht am oberen Ende der Prognose bewegen werden.

Hoffnung habe ich kurzfristig nur in der noch ausstehenden und angekündigten Expansion durch Dennis Gilles.

Puh, Glück gehabt!

Es gab keine bestätigung für das "bearish engulfing"

Der Markt bleibt wohl weiterhin unentschlossen was HTM angeht.

Es gab keine bestätigung für das "bearish engulfing"

Der Markt bleibt wohl weiterhin unentschlossen was HTM angeht.

Bin gesapnnt, ob sich ein ähnlicher Impuls am Ende der Wedge up Bewegung durchsetzen wird oder ggf. Meldungen aus dem Hause HTM das ganze beschleunigen können.

Die Stimmung ist auf jeden Fall so langsam mal wieder am Tief- / Umkehrpunkt angekommen.

... ohne Frage, Potential nach unten ist nach wie vor jede Menge, aber eben auch nach oben.

Die Stimmung ist auf jeden Fall so langsam mal wieder am Tief- / Umkehrpunkt angekommen.

... ohne Frage, Potential nach unten ist nach wie vor jede Menge, aber eben auch nach oben.

U.S. Geothermal Inc. - The Company Is Still Fairly Valued

http://seekingalpha.com/article/2437905-u-s-geothermal-inc-t…

http://seekingalpha.com/article/2437905-u-s-geothermal-inc-t…

... würde mich nicht wundern, wenn heute die Linie SMA200 von oben angetestet wird.

Geothermal Power Steaming Over Wind And Solar Energies

http://www.forbes.com/sites/kensilverstein/2014/08/25/geothe…

http://www.forbes.com/sites/kensilverstein/2014/08/25/geothe…

In fact, an MIT panel estimates that geothermal could provide 100,000 megawatts of electricity in the United States in 50 years. That would increase its stake to 10 percent of the power generation market. Furthermore: Geothermal power can run around the clock while it takes up much less land that either wind or solar energy.

Dann wird meine Tochter die aktien mal erben...

Dann wird meine Tochter die aktien mal erben...

Der Bruch der unteren Widerstandslinie der Wedge Formation ist jetzt ein Verkaufssignal?

Hat jemand einen Grund?

Antwort auf Beitrag Nr.: 47.615.682 von rechnerhand am 26.08.14 20:17:05Dürften wohl shorteindeckungen gewesen sein.

Wellentechnisch heterogenes Bild. Keine neuen Nachrichten heute gefunden...

Wie bewertet man die Erdbebenrisiken für die Kraftwerke ?

Was passiert bei einem Großbeben ?

Wie verändert sich der Untergrund ? Was passiert mit den Quellen... ?

Wellentechnisch heterogenes Bild. Keine neuen Nachrichten heute gefunden...

Wie bewertet man die Erdbebenrisiken für die Kraftwerke ?

Was passiert bei einem Großbeben ?

Wie verändert sich der Untergrund ? Was passiert mit den Quellen... ?

Antwort auf Beitrag Nr.: 47.616.360 von Indextrader24 am 26.08.14 21:33:49Schlusskurs 0.65 USD. Die Tagesgewinne zum größten Teil wieder abgegeben - folglich auch keine Anschlussnachfrage.

Die Konstellation ist fragil. So wie es scheint haben den Anstieg einige zum Ausstieg genutzt.

Hoffen wir mal, dass es kein schweres Erdbeben in der Region gibt, wie zuletzt in American Valley in Kalifornien.

Den Verlust eines Kraftwerkes kann sich US Geothermal nicht leisten. Vielleicht ist dies auch der Grund, dass der Markt sich schon seit Wochen zurück hält und die Anschlussnachfrage ausbleibt.

Vielleicht gibt es einen Geologen hier, der aushelfen kann in der Beurteilung der Erdbebenrisiken für die Standorte von US-Geothermal.

Viele Grüsse.

Die Konstellation ist fragil. So wie es scheint haben den Anstieg einige zum Ausstieg genutzt.

Hoffen wir mal, dass es kein schweres Erdbeben in der Region gibt, wie zuletzt in American Valley in Kalifornien.

Den Verlust eines Kraftwerkes kann sich US Geothermal nicht leisten. Vielleicht ist dies auch der Grund, dass der Markt sich schon seit Wochen zurück hält und die Anschlussnachfrage ausbleibt.

Vielleicht gibt es einen Geologen hier, der aushelfen kann in der Beurteilung der Erdbebenrisiken für die Standorte von US-Geothermal.

Viele Grüsse.

Antwort auf Beitrag Nr.: 47.616.714 von Indextrader24 am 26.08.14 22:06:45'n Abend,

das Risiko eines solchen Ereignisses habe ich ja schon früher einmal attestiert und zur Disposition gestellt. DAS gilt für alle Geothermie-Kraftwerke und schauen wir uns die Verteilung solcher an, so muss man das Risiko global betrachten und werten.

Klar - für HTM kann es quasi das Aus bedeuten, aber ich rechne damit, dass die Kollegen nicht erst durch ein Beben das erste Mal darüber nachdenken, das Risiko an der Stelle zu minimieren.

Frühwarnsysteme sind state of the art, genauso Abschaltmechanismen und die auch die Vorauswahl der Lokalisation.

"Wasch mich, aber mach mich nicht nass" - kann auch in diesem Segment nicht eingelöst werden.

das Risiko eines solchen Ereignisses habe ich ja schon früher einmal attestiert und zur Disposition gestellt. DAS gilt für alle Geothermie-Kraftwerke und schauen wir uns die Verteilung solcher an, so muss man das Risiko global betrachten und werten.

Klar - für HTM kann es quasi das Aus bedeuten, aber ich rechne damit, dass die Kollegen nicht erst durch ein Beben das erste Mal darüber nachdenken, das Risiko an der Stelle zu minimieren.

Frühwarnsysteme sind state of the art, genauso Abschaltmechanismen und die auch die Vorauswahl der Lokalisation.

"Wasch mich, aber mach mich nicht nass" - kann auch in diesem Segment nicht eingelöst werden.

Antwort auf Beitrag Nr.: 47.616.714 von Indextrader24 am 26.08.14 22:06:45Ich sehe auch keine Anschlussnachfrage, aber solche Ausbrüche im Verhältnis zu den Fundamentaldaten kann auch eine anstehende Info bedeuten bzw. Insiderkäufe.

Die Wedge-Formation ist faktisch geschlossen - ich bin gespannt an welcher Stelle die nächsten Akzente gesetzt werden, aber das war heute schon eine Variante.

Eine kleine Portion habe ich heute auch verkaufen können, behalte aber meinen Grossteil.

Nicht außer Acht lassen!!!

Underground energy debate powering up

http://www.utsandiego.com/news/2014/aug/26/california-geothe…

Die Wedge-Formation ist faktisch geschlossen - ich bin gespannt an welcher Stelle die nächsten Akzente gesetzt werden, aber das war heute schon eine Variante.

Eine kleine Portion habe ich heute auch verkaufen können, behalte aber meinen Grossteil.

Nicht außer Acht lassen!!!

Underground energy debate powering up

http://www.utsandiego.com/news/2014/aug/26/california-geothe…

Schlusskurs auf yahoo wurde vorhin bei 0.65 USD angezeigt - jetzt 0.67 USD.

Ist manchmal schon echt interessant wie die Kurse zustande kommen.

Nachbörslich offenbar der Versuch ein fake auszulösen mit 100 Aktien.

Das Problem was ich sehe ist, wie verhält sich die Aktie, wenn der Dow Jones Index in den kommenden Wochen in sich kollabieren sollte.

Der S&P ist bereits sehr nahe an einer grossen Extensionsmarke angekommen und läuft ebenso Gefahr in absehbarer Zukunft nach unten abzuschmieren.

Obama unterschreibt immer mehr Executive Orders für Notstandsgesetze.

Was wissen die, was wir nicht wissen?

Ist manchmal schon echt interessant wie die Kurse zustande kommen.

Nachbörslich offenbar der Versuch ein fake auszulösen mit 100 Aktien.

Das Problem was ich sehe ist, wie verhält sich die Aktie, wenn der Dow Jones Index in den kommenden Wochen in sich kollabieren sollte.

Der S&P ist bereits sehr nahe an einer grossen Extensionsmarke angekommen und läuft ebenso Gefahr in absehbarer Zukunft nach unten abzuschmieren.

Obama unterschreibt immer mehr Executive Orders für Notstandsgesetze.

Was wissen die, was wir nicht wissen?

Antwort auf Beitrag Nr.: 47.617.194 von Indextrader24 am 26.08.14 23:01:02Hmm ... harter Tobak, Indextrader.

Die Gefahr eines Vulkanausbruchs ist real. Unkalkulierbare Auswirkungen auf Flora und Fauna auch ok.

Galaktische Verschuldung weltweit ist auch real.

Was noch am ehesten zu HTM passt, ist die pot. Gefahr eines Vulkanausbruchs bzw. Erdbebens. Das andere ist mir zu abstrakt als dass ich dazu eine öffentliche Meinung vertreten kann. Fakt ist aber, ich beteilige mich nicht an diesen Endzeitprognosen, die das Leben mental verkürzen.

Alles andere gerne!

Die Gefahr eines Vulkanausbruchs ist real. Unkalkulierbare Auswirkungen auf Flora und Fauna auch ok.

Galaktische Verschuldung weltweit ist auch real.

Was noch am ehesten zu HTM passt, ist die pot. Gefahr eines Vulkanausbruchs bzw. Erdbebens. Das andere ist mir zu abstrakt als dass ich dazu eine öffentliche Meinung vertreten kann. Fakt ist aber, ich beteilige mich nicht an diesen Endzeitprognosen, die das Leben mental verkürzen.

Alles andere gerne!

Antwort auf Beitrag Nr.: 47.616.903 von rechnerhand am 26.08.14 22:23:27Kann - kann aber auch nicht. Hat in der Summe etwas Harami mässiges - von dem wir leider nicht wissen ob es jetzt bullish oder bearish zu deuten ist.

Man muss bedenken, dass es zu jedem Käufer auch einen Gegenpart gegeben haben muss - also jemand der verkauft hat. Beide Seiten haben auf ihre Weise recht.

Habe die Insiderkäufe gecheckt vorhin - konnte aber keine entdecken für die letzten Wochen. Sollte es welche gegeben haben, dann müssten die spätestens morgen veröffentlich werden. Da gibt es bekanntlich Berichtspflichten.

Auf der anderen Seite - wellentechnisch ist das letzte Verlaufshoch immer noch als X-wave möglich zu labeln.

Dann wäre der heutige Anstieg nichts anderes als eine Welle 2 einer Welle C down, die dann eine Y-welle - wo auch immer finalisiert.

Das der Kurs der Aktie im April anfingen zu "mutieren", anstatt zu maschieren - ist für mich Anlass auch die Risikoseite zu beleuchten.

Bei einem schweren Erdebeben, bei dem verschiedene Szenarien möglich sind, dürfte die Aktie vermutlich wie ein Stein abstürzen, wenn die Kraftwerke schwer beschädigt werden.

Nehmen wir mal an:

Szenario 1: Erdbeben zerstört kein Kraftwerk, aber die Verschiebung der Plattentektonik (Neal Hot Springs scheint ja auf einer Faultlinie errichtet worden zu sein) führt durch welche geologischen Prozesse auch immer zu einem versiegen der Quellen - oder durch krustale Mechanismen - zu einem deutlichen Abfall des Dampfdruckes und damit der Leistung. In dem Fall würde die Aktie sicherlich negativ reagieren. Der weitere Werdegang würde dann davon abhängen, ob man die Kraftwerke wieder irgendwie ans Laufen bringt und neue heisse Quellen findet.

Szenario 2: Ein Erdbeben zerstört ein Kraftwerk - aber die Quellen bleiben erhalten. In dem Fall käme es ebenfalls zum Produktionsaufall und einen sehr grossen Schaden. Ob das Unternehmen in einem solchen Ereignis überlebensfähig ist dürfte von vielerlei Faktoren abhängen. Habe mir im Hinblick auf ein solches Szenario auch mal den Chart für ein worst case angeschaut. Das erschreckende daran ist, dass der Markt scheinbar durchaus auch ein solches Szenario zu konstruieren scheint. Sprich es gibt valide Trendlinien die Abwärts gerichtet sind und interne Projektionen zu lassen.

Eine Kursmarke in so einem worst Case Szenario wäre 0.07 USD je Aktie - denn dort verläuft eine untere Trendkanalprojektion. Wäre HTM existentiell gefährdet im Rahmen eines solchen Szenarios, dann bestünde auch die Gefahr dass die Aktie gegen null geht.

Szenario 3: Ein Erdbeben zerstört sämtliche Assets - sprich Kraftwerke und Quellen - dann bliebe nur noch Guatemala. Auch in den Fall hängt dann das Überleben des Unternehmens davon ab, ob die Assets wie die Quellen wieder in Produktion gebracht werden können. Wenn die Kraftwerke nicht versichert sind, dann kann das ein existentielles Problem werden. Ob die überhaupt von Versicherungen in den Regionen gegen Erdbebenschäden versichert werden, weiss ich nicht. Denkbar ist, dass Versicherungen solche Risiken an solchen Standorten gar nicht erst übernehmen.

Natürlich sind auch Abstufungen möglich. Die Risikosenarien sehe ich aber durchaus - als mögliche Gefahr. Deshalb ist der stopp loss auch so wichtig.

Viele Grüsse.

Man muss bedenken, dass es zu jedem Käufer auch einen Gegenpart gegeben haben muss - also jemand der verkauft hat. Beide Seiten haben auf ihre Weise recht.

Habe die Insiderkäufe gecheckt vorhin - konnte aber keine entdecken für die letzten Wochen. Sollte es welche gegeben haben, dann müssten die spätestens morgen veröffentlich werden. Da gibt es bekanntlich Berichtspflichten.

Auf der anderen Seite - wellentechnisch ist das letzte Verlaufshoch immer noch als X-wave möglich zu labeln.

Dann wäre der heutige Anstieg nichts anderes als eine Welle 2 einer Welle C down, die dann eine Y-welle - wo auch immer finalisiert.

Das der Kurs der Aktie im April anfingen zu "mutieren", anstatt zu maschieren - ist für mich Anlass auch die Risikoseite zu beleuchten.

Bei einem schweren Erdebeben, bei dem verschiedene Szenarien möglich sind, dürfte die Aktie vermutlich wie ein Stein abstürzen, wenn die Kraftwerke schwer beschädigt werden.

Nehmen wir mal an:

Szenario 1: Erdbeben zerstört kein Kraftwerk, aber die Verschiebung der Plattentektonik (Neal Hot Springs scheint ja auf einer Faultlinie errichtet worden zu sein) führt durch welche geologischen Prozesse auch immer zu einem versiegen der Quellen - oder durch krustale Mechanismen - zu einem deutlichen Abfall des Dampfdruckes und damit der Leistung. In dem Fall würde die Aktie sicherlich negativ reagieren. Der weitere Werdegang würde dann davon abhängen, ob man die Kraftwerke wieder irgendwie ans Laufen bringt und neue heisse Quellen findet.

Szenario 2: Ein Erdbeben zerstört ein Kraftwerk - aber die Quellen bleiben erhalten. In dem Fall käme es ebenfalls zum Produktionsaufall und einen sehr grossen Schaden. Ob das Unternehmen in einem solchen Ereignis überlebensfähig ist dürfte von vielerlei Faktoren abhängen. Habe mir im Hinblick auf ein solches Szenario auch mal den Chart für ein worst case angeschaut. Das erschreckende daran ist, dass der Markt scheinbar durchaus auch ein solches Szenario zu konstruieren scheint. Sprich es gibt valide Trendlinien die Abwärts gerichtet sind und interne Projektionen zu lassen.

Eine Kursmarke in so einem worst Case Szenario wäre 0.07 USD je Aktie - denn dort verläuft eine untere Trendkanalprojektion. Wäre HTM existentiell gefährdet im Rahmen eines solchen Szenarios, dann bestünde auch die Gefahr dass die Aktie gegen null geht.

Szenario 3: Ein Erdbeben zerstört sämtliche Assets - sprich Kraftwerke und Quellen - dann bliebe nur noch Guatemala. Auch in den Fall hängt dann das Überleben des Unternehmens davon ab, ob die Assets wie die Quellen wieder in Produktion gebracht werden können. Wenn die Kraftwerke nicht versichert sind, dann kann das ein existentielles Problem werden. Ob die überhaupt von Versicherungen in den Regionen gegen Erdbebenschäden versichert werden, weiss ich nicht. Denkbar ist, dass Versicherungen solche Risiken an solchen Standorten gar nicht erst übernehmen.

Natürlich sind auch Abstufungen möglich. Die Risikosenarien sehe ich aber durchaus - als mögliche Gefahr. Deshalb ist der stopp loss auch so wichtig.

Viele Grüsse.

Antwort auf Beitrag Nr.: 47.617.344 von Indextrader24 am 26.08.14 23:18:07Hier kommt die Antwort ...

U.S. Geothermal Short Interest Up 4.2% in August (HTM)

http://www.mideasttime.com/u-s-geothermal-short-interest-up-…

U.S. Geothermal Short Interest Up 4.2% in August (HTM)

http://www.mideasttime.com/u-s-geothermal-short-interest-up-…

Antwort auf Beitrag Nr.: 47.630.511 von rechnerhand am 28.08.14 09:46:26Hallo Rechnerhand,

die Shortinterest interessiert mich nur am Rande. Denn die müssen auf jedenfall über kurz oder lang eindecken - sprich kaufen. Sie werden es tun, wenn runter gehen sollte - und die Shortseller werden es erst recht tun, wenn es nach oben geht, da diese auf der Oberseite stets in unlimitiertes Risiko haben.

Insofern können Shortseller einen Anstieg auf verstärken.

Wenn ich es richtig sehe ist der Schlusskurs bei 0.61 USD je Aktie. Die Wochenkerze kann auch als invertiertes hammering angesehen werden. Sollte dies der Fall sein, dann kann es durchaus sein, dass die Aktie auch wieder sehr schnell anzieht. Es darf halt nur nichts schlimmes passieren. Im Grunde gilt das aber für alle Unternehmen in dieser Welt.

Ob das Erdbeben das Geschäft beeinträchtigt hat werden wir wohl am 8 September erfahren. Ich denke, wenn dann nur marginal. Ansonsten wäre die Shortinterest wesentlich höher ausgefallen.

Ein Blick auf die Nachbeben in Kalifornien zeigt, dass es da nichts größeres mehr zuletzt gab.

Habe eine geologische Studie gefunden die besagt, dass ein Megathrust Quake statistisch an St. Andreas Spalte nur alle 500 Jahre auftritt. Wobei die Zeitspannen zwischen 390 und 570 Jahren varieren. Das letzte dieser Art war im Jahre 1700. Es kann also sein, dass ein solches Beben noch mehr als 150 Jahre auf sich warten lässt. Da die Kraftwerke aber eh an andere Stelle lokalisiert sind, erwarte ich selbst bei einem solchen Superbeben keine direkten Auswirkungen, wenn gleich man diese nie ganz ausschliessen kann.

Da ein solches bislang nicht passiert ist, sehe ich auch keinen Grund ein solches einzupreisen, ehe es nicht passiert, wenn es überhaupt während unserer kurzen Lebensspanne passiert.

Eine Studie schätzt das Risiko für ein solche Megathrustquake (>9) auf rund 10-15 Prozent für die nächsten 50 Jahre. Nun - die hat der Kurs wahrscheinlich dieser Tage entsprechend eingepreist. Für ein Beben der Stärke 7-8 liegt die Wahrscheinlichkeit bei ca. 25 Prozent auf Sicht der nächsten 50 Jahre.

Die Rede ist dabei von Kalifornien und nicht Nevada, wo die Geothermiewerke stehen. Also muss man wohl wie immer stets damit leben. Mit Geothermie ist zumindest kein Super-Gau wie bei AKW´s möglich.

Würde man unterstellen, dass es bei einem Erdbeben zu Störfallen in Atommeilern kommt, dann könnte die Geothermie sogar davon profitieren.

Wie der Markt all dies auslegen wird - bleibt abzuwarten. Die 200 Tagelinie steht - auch zum Monatsschluss. Invertierter weisser Hammer im weekly, könnte eventuell auf einen anstehenden Aufwärtsschub hinweisen. Entsprechend hohes Handelsvolumen heute.

Eröffnet die Aktie positiv in der kommenden Woche, dann würde ich einige Stücke dazu kaufen. Stop wie gehabt.

Viele Grüsse.

Disclaimer:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen.

die Shortinterest interessiert mich nur am Rande. Denn die müssen auf jedenfall über kurz oder lang eindecken - sprich kaufen. Sie werden es tun, wenn runter gehen sollte - und die Shortseller werden es erst recht tun, wenn es nach oben geht, da diese auf der Oberseite stets in unlimitiertes Risiko haben.

Insofern können Shortseller einen Anstieg auf verstärken.

Wenn ich es richtig sehe ist der Schlusskurs bei 0.61 USD je Aktie. Die Wochenkerze kann auch als invertiertes hammering angesehen werden. Sollte dies der Fall sein, dann kann es durchaus sein, dass die Aktie auch wieder sehr schnell anzieht. Es darf halt nur nichts schlimmes passieren. Im Grunde gilt das aber für alle Unternehmen in dieser Welt.

Ob das Erdbeben das Geschäft beeinträchtigt hat werden wir wohl am 8 September erfahren. Ich denke, wenn dann nur marginal. Ansonsten wäre die Shortinterest wesentlich höher ausgefallen.

Ein Blick auf die Nachbeben in Kalifornien zeigt, dass es da nichts größeres mehr zuletzt gab.

Habe eine geologische Studie gefunden die besagt, dass ein Megathrust Quake statistisch an St. Andreas Spalte nur alle 500 Jahre auftritt. Wobei die Zeitspannen zwischen 390 und 570 Jahren varieren. Das letzte dieser Art war im Jahre 1700. Es kann also sein, dass ein solches Beben noch mehr als 150 Jahre auf sich warten lässt. Da die Kraftwerke aber eh an andere Stelle lokalisiert sind, erwarte ich selbst bei einem solchen Superbeben keine direkten Auswirkungen, wenn gleich man diese nie ganz ausschliessen kann.

Da ein solches bislang nicht passiert ist, sehe ich auch keinen Grund ein solches einzupreisen, ehe es nicht passiert, wenn es überhaupt während unserer kurzen Lebensspanne passiert.

Eine Studie schätzt das Risiko für ein solche Megathrustquake (>9) auf rund 10-15 Prozent für die nächsten 50 Jahre. Nun - die hat der Kurs wahrscheinlich dieser Tage entsprechend eingepreist. Für ein Beben der Stärke 7-8 liegt die Wahrscheinlichkeit bei ca. 25 Prozent auf Sicht der nächsten 50 Jahre.

Die Rede ist dabei von Kalifornien und nicht Nevada, wo die Geothermiewerke stehen. Also muss man wohl wie immer stets damit leben. Mit Geothermie ist zumindest kein Super-Gau wie bei AKW´s möglich.

Würde man unterstellen, dass es bei einem Erdbeben zu Störfallen in Atommeilern kommt, dann könnte die Geothermie sogar davon profitieren.

Wie der Markt all dies auslegen wird - bleibt abzuwarten. Die 200 Tagelinie steht - auch zum Monatsschluss. Invertierter weisser Hammer im weekly, könnte eventuell auf einen anstehenden Aufwärtsschub hinweisen. Entsprechend hohes Handelsvolumen heute.

Eröffnet die Aktie positiv in der kommenden Woche, dann würde ich einige Stücke dazu kaufen. Stop wie gehabt.

Viele Grüsse.

Disclaimer:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen.

Antwort auf Beitrag Nr.: 47.649.453 von Indextrader24 am 29.08.14 22:18:11'n Abend Indextrader,

worweg - ich poste hier nicht ausschließlich Fakten, um Ihr Interesse zu befriedigen. Nichts für ungut! Ich bin auch dankbar für jede Geothermie bzw. HTM-bezogene Nachricht, die hier gepostet wird. Ein abschließendes Urteil kann und muss jeder für sich herausziehen oder gerne zur Diskussion ins Forum stellen.

Sie haben es ja auch geschrieben - die Wahrscheinlichkeit, dass vergleichbare Energieunternehmen durch ähnliche GAU's zum Stillstand kommen, dürfte um einiges höher liegen. Ich bleibe dabei, Geothermie ist auf mittelfristige Sicht gesehen derzeit konkurrenzlos (Sektor: regenerativ).

Eine etwaige Einpreisung dieser Risiken kann ich nicht erkennen.

Für mich sind die aktuelle Entwicklung bei HTM Grund genug, dass der Kurs aktuell zum Spielball des Systems wird.

Da wird, ohne dass wir aktuelle Veränderungen im Unternehmen kennen, keine Steigerung des Umsatz in 2015 in Aussicht gestellt (geschweige denn Gewinn) und auch Termine können aktuell bei lfd. Projekten nicht eingehalten werden, weil mal wieder die Bürokratie im Wege steht.

Die Entwicklung des Kurses wird maßgeblich von den kommenden Wochen abhängen, in den sich heraustellen wird, ob HTM eine strategische Vergrößerung umsetzen kann und zu welchen Konditionen. Ohne derartige Impulse halte ich eine Trendumkehr in den Bereich um die .70$ oder höher für spekulativ.

Charttechnisch bin ich bei Ihnen ... der Wochenausklang bzw. Monatsende könnten für die kommende Woche einen wenn auch kurzfristigen Trend up stehen ... allerdings ohne erkennbare Fundamentaldaten.

Was halten Sie von CVE:GGG (Graphene 3D Lab Inc.)?

Schönes Wochenende!

worweg - ich poste hier nicht ausschließlich Fakten, um Ihr Interesse zu befriedigen. Nichts für ungut! Ich bin auch dankbar für jede Geothermie bzw. HTM-bezogene Nachricht, die hier gepostet wird. Ein abschließendes Urteil kann und muss jeder für sich herausziehen oder gerne zur Diskussion ins Forum stellen.

Sie haben es ja auch geschrieben - die Wahrscheinlichkeit, dass vergleichbare Energieunternehmen durch ähnliche GAU's zum Stillstand kommen, dürfte um einiges höher liegen. Ich bleibe dabei, Geothermie ist auf mittelfristige Sicht gesehen derzeit konkurrenzlos (Sektor: regenerativ).

Eine etwaige Einpreisung dieser Risiken kann ich nicht erkennen.

Für mich sind die aktuelle Entwicklung bei HTM Grund genug, dass der Kurs aktuell zum Spielball des Systems wird.

Da wird, ohne dass wir aktuelle Veränderungen im Unternehmen kennen, keine Steigerung des Umsatz in 2015 in Aussicht gestellt (geschweige denn Gewinn) und auch Termine können aktuell bei lfd. Projekten nicht eingehalten werden, weil mal wieder die Bürokratie im Wege steht.

Die Entwicklung des Kurses wird maßgeblich von den kommenden Wochen abhängen, in den sich heraustellen wird, ob HTM eine strategische Vergrößerung umsetzen kann und zu welchen Konditionen. Ohne derartige Impulse halte ich eine Trendumkehr in den Bereich um die .70$ oder höher für spekulativ.

Charttechnisch bin ich bei Ihnen ... der Wochenausklang bzw. Monatsende könnten für die kommende Woche einen wenn auch kurzfristigen Trend up stehen ... allerdings ohne erkennbare Fundamentaldaten.

Was halten Sie von CVE:GGG (Graphene 3D Lab Inc.)?

Schönes Wochenende!

Antwort auf Beitrag Nr.: 47.649.561 von rechnerhand am 29.08.14 22:45:12Zu HTM - Schlusskurs jetzt doch 0.60 USD - nachbörslich 0.60 zu 0.68 USD. Dabei ein Kurs 0.69 USD - allerdings unbedeutendes Volumen.

Bei HTM ist die Konstellation insofern interessant, da das Unternehmen ja solide Cashflows erwirtschaftet und der Unternehmenswert unter dem Substanzwert liegt.

Die 6 Monatszahlen lagen inline mit meinen Erwartungen. Das zweite Quartal muss sogar etwas besser gewesen sein als ich dachte. Zumindest gab es von der Seite aus keine negative Überraschung. Saisonal dürften eher stärkere Quartale anstehen. Insofern rechne ich damit, dass man die Ziele für 2014 erreichen kann und selbst, wenn man nicht kurzfristig ein neues Projekt startet, so generiert der Cash flow zusammen mit dem zu erwartenden Gewinn einen Mehrwert, dahingehend, dass der Substanzwert per Saldo eher zunehmen sollte.

Da es die Tage eine Investorenkonferenz geben wird, darf man davon ausgehen, dass dann wahrscheinlich auch ein update kommen wird. Freilich gibt es auch Risiken - wie bei allen Aktienanlagen.

Ich betrachte das aus technischer Sicht. Sollte es im weekly zum 50/200 MDA bullish cross over kommen, was durchaus diskutiert werden kann, dann dürften die Shorts sich wohl eindecken und ihre Positionen schliessen. Denn in dem Fall entstünde ein hochvalides Kaufsignal im langfristigen Bereich. Ein Squeeze könnte dann eine Bewegung UP dann auch verstärken.

Umgekehrt gilt das Gegenteil.

Zur ihrer GGG. Sieht schon atemberaubend aus der Chart - von 0.03 auf 1.75 CAD$. Hot Stock nennt man sowas wohl. Im P&F sieht das ganze konstruktiv aus. Sollte die noch 8 Kreuze drauflegen, würde ich die Position aktiv schliessen. Wer da mit mischt, sollte Stops einsetzen. Der Markt scheint mir sehr eng zu sein durch die Grossinvestoren. Da reicht dann schon etwas Nachfrage oder Angebot und der Kurs bewegt sich in die eine oder andere Richtung.

Kann aber zu dem Geschäftsmodell bei GGG nichts sagen. Aber immer wieder interessant, wie Pennystocks, die lange dahin dümpelten, binnen weniger Tage und Wochen sich verhundertfachen können.

Wer da bei 0.10 CAD$ 100 000 Stück gekauft hat, der kann sich freuen. Sollte der Markt da sogar auf 10 CAD$ steigen, dann wird man wohl Millionär werden.

Wo haben Sie die Aktie aufgefischt?

Viele Grüsse und schönes WE.

Disclaimer:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen.