Africa Oil Corp. - World-Class East Africa Oil Exploration (Seite 75)

eröffnet am 23.06.11 21:04:25 von

neuester Beitrag 23.04.24 11:17:43 von

neuester Beitrag 23.04.24 11:17:43 von

Beiträge: 4.120

ID: 1.167.139

ID: 1.167.139

Aufrufe heute: 2

Gesamt: 628.605

Gesamt: 628.605

Aktive User: 0

ISIN: CA00829Q1019 · WKN: A0MZJC · Symbol: AFZ

1,7100

EUR

+3,83 %

+0,0630 EUR

Letzter Kurs 26.04.24 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,915 | +17,13 | |

| 9,0000 | +13,92 | |

| 13,810 | +10,39 | |

| 45,00 | +9,76 | |

| 5,2000 | +9,47 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 325,00 | -9,97 | |

| 0,9400 | -10,48 | |

| 4,0400 | -18,55 | |

| 9,3500 | -28,02 | |

| 0,900 | -28,57 |

Beitrag zu dieser Diskussion schreiben

Hallo,

hier ein interessanter Artikel auf Avanza:

https://www.avanza.se/placera/telegram/2015/05/15/africa-oil…

- Fokussierung auf die Blocks 10BB und 13T

- Projekt mit Tullow: Cheptuket in Block 12A mit weiterer Bohrung vor September 2016

- Rift Basin Area Block in Äthiopien

In diese Projekte soll das Geld fließen...und von dort aus in den Aktienkurs:-).

Gruss Remolus

hier ein interessanter Artikel auf Avanza:

https://www.avanza.se/placera/telegram/2015/05/15/africa-oil…

- Fokussierung auf die Blocks 10BB und 13T

- Projekt mit Tullow: Cheptuket in Block 12A mit weiterer Bohrung vor September 2016

- Rift Basin Area Block in Äthiopien

In diese Projekte soll das Geld fließen...und von dort aus in den Aktienkurs:-).

Gruss Remolus

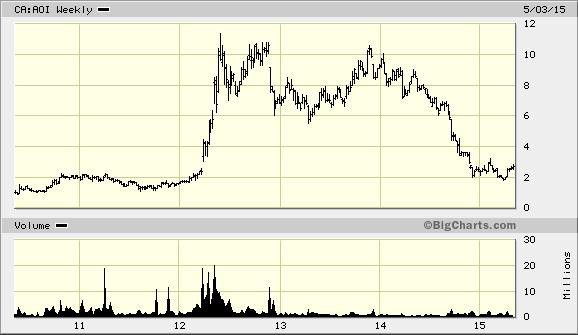

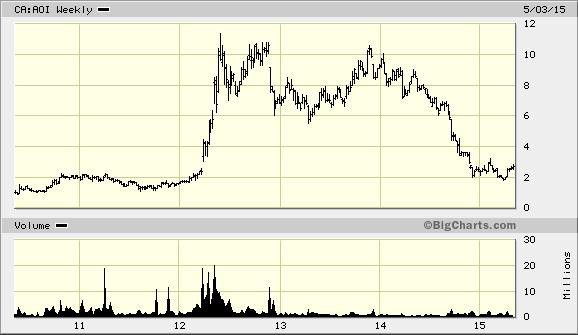

Vor längerer Zeit habe ich geschrieben AOI ist überbewertet, weil sie noch keine Ölproduktion verkaufen. Wenn man sich den Langfrist Chart (zB 5a) ansieht und selbst die erhöhte Anzahl der Aktien durch die Verwässerungen berücksichtigt, dann ist AOI mMn zZ unterbewertet. Zwar verkauft AOI noch immer keine Öl, hat aber inzwischen Öltanks für die Langzeit Fördertests gebaut und könnten wenn sie wollten (?) das Öl mit LKWs an die Küste bringen um es zu verkaufen. Vielleicht schreckt die Lundins dieses Konzept ein wenig ab, wenn man sieht dass für SNM diese Art von Verkauf in Kurdistan vielleicht nicht die beste Lösung hinsichtlich Schwarzmarkt ist? Wie auch immer. Die handvoll Ölfelder die TLW/AOI inzwischen in Kenia entdeckt haben können mMn jetzt in produzierbare Reserven umgewandelt werden und sollten dadurch einen höheren Wert bekommen.

Größtes Risiko: die Kenianer verbocken es wie: Turkana Stämme wollen unabhängig werden, aber dann wird es schwieriger für sie das Öl an die Küste zu bringen.Die religös Verrückten aus Somalia, Boko Haram fangen in dieser Gegend einen Partisanen Krieg an, Die herrschenden Politiker in Kenia verstaatlichen alles und/oder stecken sich die Ölfelder selber ein ... - ich hoffe, denke jedoch die Lundins/TLWs sind Afrika Profis, die wissen wie man mit diesen Risiken umgeht um erfolgreich dort Geschäfte zu machen.

Schön wäre noch eine richtig gute Bohrung als neuer Basin Opener, abgesehen vom zZ wieder steigenden Ölpreis

Größtes Risiko: die Kenianer verbocken es wie: Turkana Stämme wollen unabhängig werden, aber dann wird es schwieriger für sie das Öl an die Küste zu bringen.Die religös Verrückten aus Somalia, Boko Haram fangen in dieser Gegend einen Partisanen Krieg an, Die herrschenden Politiker in Kenia verstaatlichen alles und/oder stecken sich die Ölfelder selber ein ... - ich hoffe, denke jedoch die Lundins/TLWs sind Afrika Profis, die wissen wie man mit diesen Risiken umgeht um erfolgreich dort Geschäfte zu machen.

Schön wäre noch eine richtig gute Bohrung als neuer Basin Opener, abgesehen vom zZ wieder steigenden Ölpreis

Antwort auf Beitrag Nr.: 49.716.423 von texas2 am 05.05.15 21:38:58Ngamia 8 erhöht die Wahrscheinlichkeit, dass das ein gutes Ölfeld wird

By GEOFFREY IRUNGU, girungu@ke.nationmedia.com

Posted Tuesday, May 5 2015 at 18:27

IN SUMMARY

The drillers of the Ngamia well will now go into further testing to establish, amongst others, the flow of oil per day.

With the extensive appraisal in Kenya, Africa Oil said discoveries and testing so far made “will enable a draft Field Development Plan (FDP) to be prepared by end 2015” – meaning a preliminary plan for production of oil will be done this year.

Africa Oil says Ngamia-8, a well in the Lokichar Basin co-owned with Tullow Oil, has yielded 200 metres of oil improving the prospect of more finds in the region.

Tullow’s mega camp marks new operation phase

The firm also announced the Amosing-4 well in the same basin had been drilled and had successfully encountered 27 metres of net oil pay.

The firm added that testing of the flow in Amosing-1 and Amosing-2 wells – where oil was earlier discovered – had been completed, indicating a maximum rate of 5,600 and 6,000 barrels of oil daily respectively. The flow exceeded expectations according to the explorer.

Africa Oil owns a 50 per cent working interest in Kenya’s Blocks 1BB and 13T with Tullow holding the balance.

The drillers of the Ngamia well will now go into further testing to establish, amongst others, the flow of oil per day.

“Ngamia-8 will be completed as part of the Ngamia field extended well testing (EWT) planned for mid-year, which will also include the Ngamia-3 and Ngamia-6 wells,” said the firm.

Extensive appraisal programme in the South Lokichar Basin is continuing, including for Amosing wells. The company said the new Amosing-4 had shown the field containing oil could be more extensive.

It said the discovery of oil at Ekales-2 appraisal well—estimated at 60-100 metres of net oil pay—was “very positive for the future upside potential of the South Lokichar basin above the significant oil resources already discovered.”

READ: Tullow strikes oil in two new South Lokichar Basin wells

With the extensive appraisal in Kenya, Africa Oil said discoveries and testing so far made “will enable a draft Field Development Plan (FDP) to be prepared by end 2015” – meaning a preliminary plan for production of oil will be done this year.

“The current ambition of the joint venture partnership is to position the East Africa project, which will include the development of South Lokichar and Tullow’s Lake Albert resources and an export pipeline, for possible sanction (to proceed to development) by the end of 2016, subject to receipt of all necessary permits and approvals,” said Africa Oil.

It said progress was being made towards development of the oil resources, noting that there was ongoing collaboration between the governments of Kenya and Uganda on the oil export pipeline.

“We continue to be highly encouraged by the appraisal programme in the Lokichar Basin which is above our expectations and confirms our belief that this is a world-class asset. We are working closely with our partners and the Kenyan government to move the development project forward, particularly the export pipeline, which is the key to unlocking the value of this asset,” said Keith Hill, president and CEO of Africa Oil in the update.

By GEOFFREY IRUNGU, girungu@ke.nationmedia.com

Posted Tuesday, May 5 2015 at 18:27

IN SUMMARY

The drillers of the Ngamia well will now go into further testing to establish, amongst others, the flow of oil per day.

With the extensive appraisal in Kenya, Africa Oil said discoveries and testing so far made “will enable a draft Field Development Plan (FDP) to be prepared by end 2015” – meaning a preliminary plan for production of oil will be done this year.

Africa Oil says Ngamia-8, a well in the Lokichar Basin co-owned with Tullow Oil, has yielded 200 metres of oil improving the prospect of more finds in the region.

Tullow’s mega camp marks new operation phase

The firm also announced the Amosing-4 well in the same basin had been drilled and had successfully encountered 27 metres of net oil pay.

The firm added that testing of the flow in Amosing-1 and Amosing-2 wells – where oil was earlier discovered – had been completed, indicating a maximum rate of 5,600 and 6,000 barrels of oil daily respectively. The flow exceeded expectations according to the explorer.

Africa Oil owns a 50 per cent working interest in Kenya’s Blocks 1BB and 13T with Tullow holding the balance.

The drillers of the Ngamia well will now go into further testing to establish, amongst others, the flow of oil per day.

“Ngamia-8 will be completed as part of the Ngamia field extended well testing (EWT) planned for mid-year, which will also include the Ngamia-3 and Ngamia-6 wells,” said the firm.

Extensive appraisal programme in the South Lokichar Basin is continuing, including for Amosing wells. The company said the new Amosing-4 had shown the field containing oil could be more extensive.

It said the discovery of oil at Ekales-2 appraisal well—estimated at 60-100 metres of net oil pay—was “very positive for the future upside potential of the South Lokichar basin above the significant oil resources already discovered.”

READ: Tullow strikes oil in two new South Lokichar Basin wells

With the extensive appraisal in Kenya, Africa Oil said discoveries and testing so far made “will enable a draft Field Development Plan (FDP) to be prepared by end 2015” – meaning a preliminary plan for production of oil will be done this year.

“The current ambition of the joint venture partnership is to position the East Africa project, which will include the development of South Lokichar and Tullow’s Lake Albert resources and an export pipeline, for possible sanction (to proceed to development) by the end of 2016, subject to receipt of all necessary permits and approvals,” said Africa Oil.

It said progress was being made towards development of the oil resources, noting that there was ongoing collaboration between the governments of Kenya and Uganda on the oil export pipeline.

“We continue to be highly encouraged by the appraisal programme in the Lokichar Basin which is above our expectations and confirms our belief that this is a world-class asset. We are working closely with our partners and the Kenyan government to move the development project forward, particularly the export pipeline, which is the key to unlocking the value of this asset,” said Keith Hill, president and CEO of Africa Oil in the update.

Antwort auf Beitrag Nr.: 49.709.022 von vinumbonum am 05.05.15 09:41:38AOI muss sich Zeit kaufen, was sich auszahlen könnte wenn die eine geplante basin opener Bohrung ein Treffer wird. Die Treffer im Lokichar Becken lassen uns nicht mehr pleite gehen und das größte Risiko mMn wäre, dass Kenia die Ölindustrie verstaatlich oder es so wie Uganda verbockt.

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 1, 2015) - Africa Oil Corp. (TSX:AOI)(OMX:AOI) ("Africa Oil" or the "Company) is pleased to announce that it has entered into an investment agreement with Stampede Natural Resources S.a.r.l. ("Stampede"), an entity owned by a fund advised by Helios Investment Partners LLP ("Helios"), to sell, on a non-brokered private placement basis, 52,623,377 of its common shares at a price of CAD $2.31 for gross proceeds of CAD $121,560,000 (US $100 million(1)). Upon completing, Stampede would own approximately 12.37% of the issued and outstanding common shares of the Company.

Helios is an Africa-focused investment firm. The Company has agreed that its participation will entitle Stampede to nominate one non-executive director to the board of Africa Oil. In addition, the Company has granted certain rights to Stampede including the right to participate for its pro-rata share in future financings.

Net proceeds of the private placement will be used towards the Company's ongoing appraisal and development work program in East Africa.

An application will be made to the Toronto Stock Exchange (the "TSX") for approval of the private placement and the new shares will be admitted to listing on Nasdaq Stockholm following registration of an admittance to trading prospectus with the Swedish Financial Supervisory Authority (Sw. Finansinspektionen). The closing of the financing is subject to regulatory approval and certain other customary conditions. The Company expects the closing to occur on or around May 29, 2015.

Keith Hill, President and CEO of Africa Oil, commented, "We are very pleased to have been able to attract a large investor with the credentials and reputation of Helios into the Company which we consider as a strong endorsement of the Lokichar Basin project, despite the current oil price downturn. This relationship will not only be of short term benefit by strengthening our balance sheet and allowing us to continue with drilling operations and pre-development work, but also has the potential to provide a core investor as the development project progresses."

Andy Bartlett, Oil and Gas Partner at Helios commented, "Helios is delighted to invest in Africa Oil Corp, a company we consider to have one of the best management teams in the exploration and production sector. This is a flagship transaction for the firm to help develop Kenya's nascent petroleum sector. The capital is being deployed to further this exciting project which we consider to be world class in terms of potential. It has all the right characteristics for the sector in a lower oil price environment."

Babatunde Soyoye, founding Partner of Helios added, "This deal is a perfect example of Helios' differentiated strategy. It is our fourth oil and gas platform company making us the most active private equity group in African oil and gas. It combines both our oil and gas industry expertise, and our deep African knowledge. Kenya is one of the fastest growing economies in Africa and Helios is one of the largest foreign investors in the country."

The common shares issued in the financing will be subject to resale restrictions under Canadian securities laws for a period of four months plus one day from the date of the closing of the financing.

The securities offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or applicable state securities laws, and may not be offered or sold in the United States absent registration or an exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Africa Oil Corp.

Africa Oil Corp. is a Canadian oil and gas company with assets in Kenya and Ethiopia as well as Puntland (Somalia) through its equity interest in Africa Energy Corp. The Company is listed on the Toronto Stock Exchange and on Nasdaq Stockholm under the symbol "AOI".

About Helios

Helios Investment Partners LLP is an Africa-focused investment firm managing funds totalling over $3 billion. Helios' diverse LP base comprises a broad range of the world's leading investors, including sovereign wealth funds, corporate and public pension funds, endowments and foundations, funds of funds, family offices and development finance institutions across the US, Europe, Asia and Africa. Established in 2004, led and managed by a predominantly African team and based in London, Lagos and Nairobi, Helios has completed investments in countries across the African continent, including Nigeria, Ghana, Kenya, Tanzania, Angola, South Africa and Morocco. Helios' portfolio companies operate in more than 35 countries in all regions of the continent. Helios bridges international capital and know-how to African talent and enterprise. The firm has a record of successful investment in businesses from start-ups to large corporate carve-outs, building African market leaders in core economic sectors and driving strong returns via portfolio operations. Further details on Helios Investment Partners can be found at: www.heliosinvestment.com.

Credits to Stockbrain who already translated it:

AFRICA OIL When filled CASH EXPECTED last at least for 2H 2016 – CEO (Direct) 2015-05-04 16:14 STOCKHOLM (AFX)

After Africa Oil filled in with a further 100 million dollars in the account, after relatively recently recouped $ 125 million through a private placement to Africa Fund Helios deemed checkout enough to at least the second half of the year in 2016. It says CEO Keith Hill commented to the news agency Direkt after this weekend’s issue vengeance. “We have not really decided the budget for next year, but at least the second half of next year,” he says, indicating that the capex budget for 2016 could amount to around $ 100 million, about half of the current year’s capex budget of about 200 million. “100 million would be a reasonable figure for next year, while it is approximately $ 200 million relating to the year,” he continues. Previously, Africa Oil indicated that investment spending this year would land at 150-200 million. Keith Hill commented timing around this weekend maybe something unexpected issue statements: “We have a lot of wells we want to drill in the second half of this year and then we had to decide on this because we must forewarn 90 days in advance, we will use the rigs or not.”, He explains, and mentions that the company plans to drill six wells in the second half of 2015, a basin opening well, and the remaining five in the Kenyan Lokichar Basin, where oil has already been found. He continues: “This gives us a little breathing space. We do not sell or farm out any of our assets too cheaply without waiting until the price of oil has bounced up further,” commented CEO the company’s ambition to utfarmningsaffär or even a sale of the company. For Africa Oil whichever expected soon notice from the ongoing talks between the Ugandan and Kenyan governments on how the proposed pipeline to be drawn between the two countries: “I expect that we will have some kind of statement on this before the end of June,” commented Keith Hill and believes that the first oil from the pipeline believed during the first half of 2019 given that the pipeline started to be built around the turn of the year 2016/2017. Surrounding the Kenyan capital gains tax that was added to the surprising 37.5 percent of the oil sector in the fall is expected to likely new information during the next month in connection with a preliminary Kenyan draft budget for 2016, informs Keith Hill on.

Henrik Svensson +46 8 5191 7924 News Agency Direkt https://www.avanza.se/placera/telegram/2015/05/04/africa-oil…

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 1, 2015) - Africa Oil Corp. (TSX:AOI)(OMX:AOI) ("Africa Oil" or the "Company) is pleased to announce that it has entered into an investment agreement with Stampede Natural Resources S.a.r.l. ("Stampede"), an entity owned by a fund advised by Helios Investment Partners LLP ("Helios"), to sell, on a non-brokered private placement basis, 52,623,377 of its common shares at a price of CAD $2.31 for gross proceeds of CAD $121,560,000 (US $100 million(1)). Upon completing, Stampede would own approximately 12.37% of the issued and outstanding common shares of the Company.

Helios is an Africa-focused investment firm. The Company has agreed that its participation will entitle Stampede to nominate one non-executive director to the board of Africa Oil. In addition, the Company has granted certain rights to Stampede including the right to participate for its pro-rata share in future financings.

Net proceeds of the private placement will be used towards the Company's ongoing appraisal and development work program in East Africa.

An application will be made to the Toronto Stock Exchange (the "TSX") for approval of the private placement and the new shares will be admitted to listing on Nasdaq Stockholm following registration of an admittance to trading prospectus with the Swedish Financial Supervisory Authority (Sw. Finansinspektionen). The closing of the financing is subject to regulatory approval and certain other customary conditions. The Company expects the closing to occur on or around May 29, 2015.

Keith Hill, President and CEO of Africa Oil, commented, "We are very pleased to have been able to attract a large investor with the credentials and reputation of Helios into the Company which we consider as a strong endorsement of the Lokichar Basin project, despite the current oil price downturn. This relationship will not only be of short term benefit by strengthening our balance sheet and allowing us to continue with drilling operations and pre-development work, but also has the potential to provide a core investor as the development project progresses."

Andy Bartlett, Oil and Gas Partner at Helios commented, "Helios is delighted to invest in Africa Oil Corp, a company we consider to have one of the best management teams in the exploration and production sector. This is a flagship transaction for the firm to help develop Kenya's nascent petroleum sector. The capital is being deployed to further this exciting project which we consider to be world class in terms of potential. It has all the right characteristics for the sector in a lower oil price environment."

Babatunde Soyoye, founding Partner of Helios added, "This deal is a perfect example of Helios' differentiated strategy. It is our fourth oil and gas platform company making us the most active private equity group in African oil and gas. It combines both our oil and gas industry expertise, and our deep African knowledge. Kenya is one of the fastest growing economies in Africa and Helios is one of the largest foreign investors in the country."

The common shares issued in the financing will be subject to resale restrictions under Canadian securities laws for a period of four months plus one day from the date of the closing of the financing.

The securities offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or applicable state securities laws, and may not be offered or sold in the United States absent registration or an exemption from such registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Africa Oil Corp.

Africa Oil Corp. is a Canadian oil and gas company with assets in Kenya and Ethiopia as well as Puntland (Somalia) through its equity interest in Africa Energy Corp. The Company is listed on the Toronto Stock Exchange and on Nasdaq Stockholm under the symbol "AOI".

About Helios

Helios Investment Partners LLP is an Africa-focused investment firm managing funds totalling over $3 billion. Helios' diverse LP base comprises a broad range of the world's leading investors, including sovereign wealth funds, corporate and public pension funds, endowments and foundations, funds of funds, family offices and development finance institutions across the US, Europe, Asia and Africa. Established in 2004, led and managed by a predominantly African team and based in London, Lagos and Nairobi, Helios has completed investments in countries across the African continent, including Nigeria, Ghana, Kenya, Tanzania, Angola, South Africa and Morocco. Helios' portfolio companies operate in more than 35 countries in all regions of the continent. Helios bridges international capital and know-how to African talent and enterprise. The firm has a record of successful investment in businesses from start-ups to large corporate carve-outs, building African market leaders in core economic sectors and driving strong returns via portfolio operations. Further details on Helios Investment Partners can be found at: www.heliosinvestment.com.

Credits to Stockbrain who already translated it:

AFRICA OIL When filled CASH EXPECTED last at least for 2H 2016 – CEO (Direct) 2015-05-04 16:14 STOCKHOLM (AFX)

After Africa Oil filled in with a further 100 million dollars in the account, after relatively recently recouped $ 125 million through a private placement to Africa Fund Helios deemed checkout enough to at least the second half of the year in 2016. It says CEO Keith Hill commented to the news agency Direkt after this weekend’s issue vengeance. “We have not really decided the budget for next year, but at least the second half of next year,” he says, indicating that the capex budget for 2016 could amount to around $ 100 million, about half of the current year’s capex budget of about 200 million. “100 million would be a reasonable figure for next year, while it is approximately $ 200 million relating to the year,” he continues. Previously, Africa Oil indicated that investment spending this year would land at 150-200 million. Keith Hill commented timing around this weekend maybe something unexpected issue statements: “We have a lot of wells we want to drill in the second half of this year and then we had to decide on this because we must forewarn 90 days in advance, we will use the rigs or not.”, He explains, and mentions that the company plans to drill six wells in the second half of 2015, a basin opening well, and the remaining five in the Kenyan Lokichar Basin, where oil has already been found. He continues: “This gives us a little breathing space. We do not sell or farm out any of our assets too cheaply without waiting until the price of oil has bounced up further,” commented CEO the company’s ambition to utfarmningsaffär or even a sale of the company. For Africa Oil whichever expected soon notice from the ongoing talks between the Ugandan and Kenyan governments on how the proposed pipeline to be drawn between the two countries: “I expect that we will have some kind of statement on this before the end of June,” commented Keith Hill and believes that the first oil from the pipeline believed during the first half of 2019 given that the pipeline started to be built around the turn of the year 2016/2017. Surrounding the Kenyan capital gains tax that was added to the surprising 37.5 percent of the oil sector in the fall is expected to likely new information during the next month in connection with a preliminary Kenyan draft budget for 2016, informs Keith Hill on.

Henrik Svensson +46 8 5191 7924 News Agency Direkt https://www.avanza.se/placera/telegram/2015/05/04/africa-oil…

Antwort auf Beitrag Nr.: 49.696.578 von gabbo62 am 03.05.15 09:52:44Deine Spekulation trifft wohl - siehe heutige umfassende Stellungnahme KH auf Avanza zu den 100mille.

Die Verwässerung irritiert mich schon.Die Aussagen KH waren doch gegenteilig sehr eindeutig. Und nun 1 Tag nach update..... macht bissl´ Stirnrunzeln bei wischiwaschi Angabe Verwendung.....Trotzdem glaube ich, es sind jetzt gute Kaufkurse. Swedbank hat Kursziel von 30 SEK auf 28 gesenkt( avanza). Z.Z. an die 17,5 SEK.

Antwort auf Beitrag Nr.: 49.694.991 von gimo211 am 02.05.15 18:47:07Ein mögliches Szenario nach der erneuten Kapitalbeschaffung ist, dass sie die Explorationsarbeiten wieder forcieren wollen.

Antwort auf Beitrag Nr.: 49.694.403 von Remolus am 02.05.15 14:46:57Dieses PP ist tatsächlich vollkommen überraschend und es widerspricht den bisherigen Aussagen von Keith Hill - auch in den Conference Calls - und von Lukas Lundin. Also kann man wirklich annehmen, dass sie ihre Pläne geändert haben...

Eigentlich konnte man fest von einem farmout bei 13T und 10BB im Herbst ausgehen. Danach hätten sie etwa 25% an beiden Blocks behalten (Aussage von Lukas Lundin). Nun haben sie in kurzer Zeit insgesamt 220 Mio. Dollar vom Kapitalmarkt geholt. Das reicht bei dem durch Tullow signifikant reduzierten Programm vermutlich locker bis Ende 2016. Daher rechne ich nun nicht mehr mit einem farmout - sie behalten demnach bis auf weiteres 50% an diesen beiden Blocks.

Meine Spekulation ist, dass sie nun planen, beide Blocks im Verlauf von 2016 komplett zu verkaufen. Die nächste Ressourcen-Zertifizierung erfolgt vermutlich im Oktober. Da darf man (erneut laut LL) etwa 1,2 Milliarden bbls 2C in diesen beiden Blocks erwarten. Die EWT und die letzten bedeutenden Explorationserfolge (Ngamia-7, Ekales-2, Amosing-4) sind dafür eine gute Basis. Vielleicht gelingt ihnen ja im Verlauf von 2016 sogar noch eine weitere Erhöhung der 2C-Ressourcen...

Wenn sie einen Deal bei realistischen 6$ per bbls 2C in 2016 machen können, würde man also für diese beiden Blocks zwischen 3,5 und 4,5 Milliarden Dollar erzielen können. Für den potentiellen Käufer verbliebe noch ein relevantes Development- und Explorations-Upside (das schon genannte "Basin Axis Play und das non-conventional Potential...).

Für AOC verbliebe dann - neben einer gut gefüllten Kasse - die verbleibenden Blocks (vor allem die verbleibenden Kenya-Blocks 12A, 10BA und 9) und die Konzentration auf Exploration.

Ein ziemlich cooles Szenario - sollte das nun der Plan sein...

Pure spec of course!!

Eigentlich konnte man fest von einem farmout bei 13T und 10BB im Herbst ausgehen. Danach hätten sie etwa 25% an beiden Blocks behalten (Aussage von Lukas Lundin). Nun haben sie in kurzer Zeit insgesamt 220 Mio. Dollar vom Kapitalmarkt geholt. Das reicht bei dem durch Tullow signifikant reduzierten Programm vermutlich locker bis Ende 2016. Daher rechne ich nun nicht mehr mit einem farmout - sie behalten demnach bis auf weiteres 50% an diesen beiden Blocks.

Meine Spekulation ist, dass sie nun planen, beide Blocks im Verlauf von 2016 komplett zu verkaufen. Die nächste Ressourcen-Zertifizierung erfolgt vermutlich im Oktober. Da darf man (erneut laut LL) etwa 1,2 Milliarden bbls 2C in diesen beiden Blocks erwarten. Die EWT und die letzten bedeutenden Explorationserfolge (Ngamia-7, Ekales-2, Amosing-4) sind dafür eine gute Basis. Vielleicht gelingt ihnen ja im Verlauf von 2016 sogar noch eine weitere Erhöhung der 2C-Ressourcen...

Wenn sie einen Deal bei realistischen 6$ per bbls 2C in 2016 machen können, würde man also für diese beiden Blocks zwischen 3,5 und 4,5 Milliarden Dollar erzielen können. Für den potentiellen Käufer verbliebe noch ein relevantes Development- und Explorations-Upside (das schon genannte "Basin Axis Play und das non-conventional Potential...).

Für AOC verbliebe dann - neben einer gut gefüllten Kasse - die verbleibenden Blocks (vor allem die verbleibenden Kenya-Blocks 12A, 10BA und 9) und die Konzentration auf Exploration.

Ein ziemlich cooles Szenario - sollte das nun der Plan sein...

Pure spec of course!!

http://africaoilcorp.mwnewsroom.com/press-releases/africa-oi…

Das ist mal ne Überraschung...

Da haben sie Ihre Pläne wohl geändert.

Ob es was mit dem von Gimo gefundenen "Basin Axis Play"

zu tun hat?

Gruss Remolus

Das ist mal ne Überraschung...

Da haben sie Ihre Pläne wohl geändert.

Ob es was mit dem von Gimo gefundenen "Basin Axis Play"

zu tun hat?

Gruss Remolus

Sehr interessante neue Information in der Tullow-Overview-Presentation vom 15.April, Seite 26: http://www.tullowoil.com/Media/docs/default-source/3_investo…

Offenbar ein Mega-Upside Potential mit dem sogenannten "Basin Axis Play" welches zwischen den Bounding Fault discoveries und den Eastern Flank Pays eingezeichnet ist. Die Discoveries in den tieferen Zonen bei Ngamia-7 und Ekales-2 scheinen dieses Play bereits zu bestätigen...

Tullow: "South Lokichar Basin Axis Play: under evaluation, successful exploratory drilling at Ekales-2 & Ngamia-7"