Archer Daniels Midland (Seite 3)

eröffnet am 21.05.12 16:52:52 von

neuester Beitrag 02.05.24 20:10:10 von

neuester Beitrag 02.05.24 20:10:10 von

Beiträge: 130

ID: 1.174.384

ID: 1.174.384

Aufrufe heute: 0

Gesamt: 16.233

Gesamt: 16.233

Aktive User: 0

ISIN: US0394831020 · WKN: 854161 · Symbol: ADM

62,44

USD

+0,66 %

+0,41 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

01.05.24 · Business Wire (engl.) |

30.04.24 · Business Wire (engl.) |

30.04.24 · Business Wire (engl.) |

30.04.24 · Business Wire (engl.) |

Werte aus der Branche Getränke/Tabak

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,5900 | +31,22 | |

| 10,000 | +25,00 | |

| 3,8800 | +14,12 | |

| 36,29 | +12,42 | |

| 4,7100 | +10,56 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 589,50 | -6,72 | |

| 12,050 | -6,95 | |

| 496,90 | -8,67 | |

| 369,55 | -8,76 | |

| 1,2900 | -41,36 |

Beitrag zu dieser Diskussion schreiben

archer ist aktuell sehr günstig, für mich gehört so ne Aktie mit KGV von 15 bewertet, Grundnahrungsmittel braucht man immer.

der Rückkauf sind ja gößer 5% der Aktien, das ist doch schon ordentlich und wird den kurs stabilisieren.

der Rückkauf sind ja gößer 5% der Aktien, das ist doch schon ordentlich und wird den kurs stabilisieren.

Antwort auf Beitrag Nr.: 75.437.748 von namidog am 12.03.24 12:17:15Wenn man bunge sieht, die ihren Quartalsgewinn um fast 90$cent ggü analystenschätzung übertroffen haben, und Umsatz ebenfalls gesteigert hatten, dann wundert mich, dass ADM so abschließt. Stecke allerdings bei Bunge nicht tiefer drin, um da wirklich beurteilen zu können ob das ADM jetzt schlechter ist als Bunge.

Ich sehe für ADM isoliert betrachtet das heutige Ergebnis ggü den letzten Markterwartungen positiv. Die Aktie ist arg abgestraft worden, von 70plus auf 52$. Und auch die 70$ im Herbst/Winter (bis nov/dez) hatten schon einen Abschlag ggü Sommer (>80 Euro).

Insofern denke ich dass vieles eingepreist war, und jetzt der EInbruch aus dem Bilanzskandal aufgeholt wird. ImhO…

Ich sehe für ADM isoliert betrachtet das heutige Ergebnis ggü den letzten Markterwartungen positiv. Die Aktie ist arg abgestraft worden, von 70plus auf 52$. Und auch die 70$ im Herbst/Winter (bis nov/dez) hatten schon einen Abschlag ggü Sommer (>80 Euro).

Insofern denke ich dass vieles eingepreist war, und jetzt der EInbruch aus dem Bilanzskandal aufgeholt wird. ImhO…

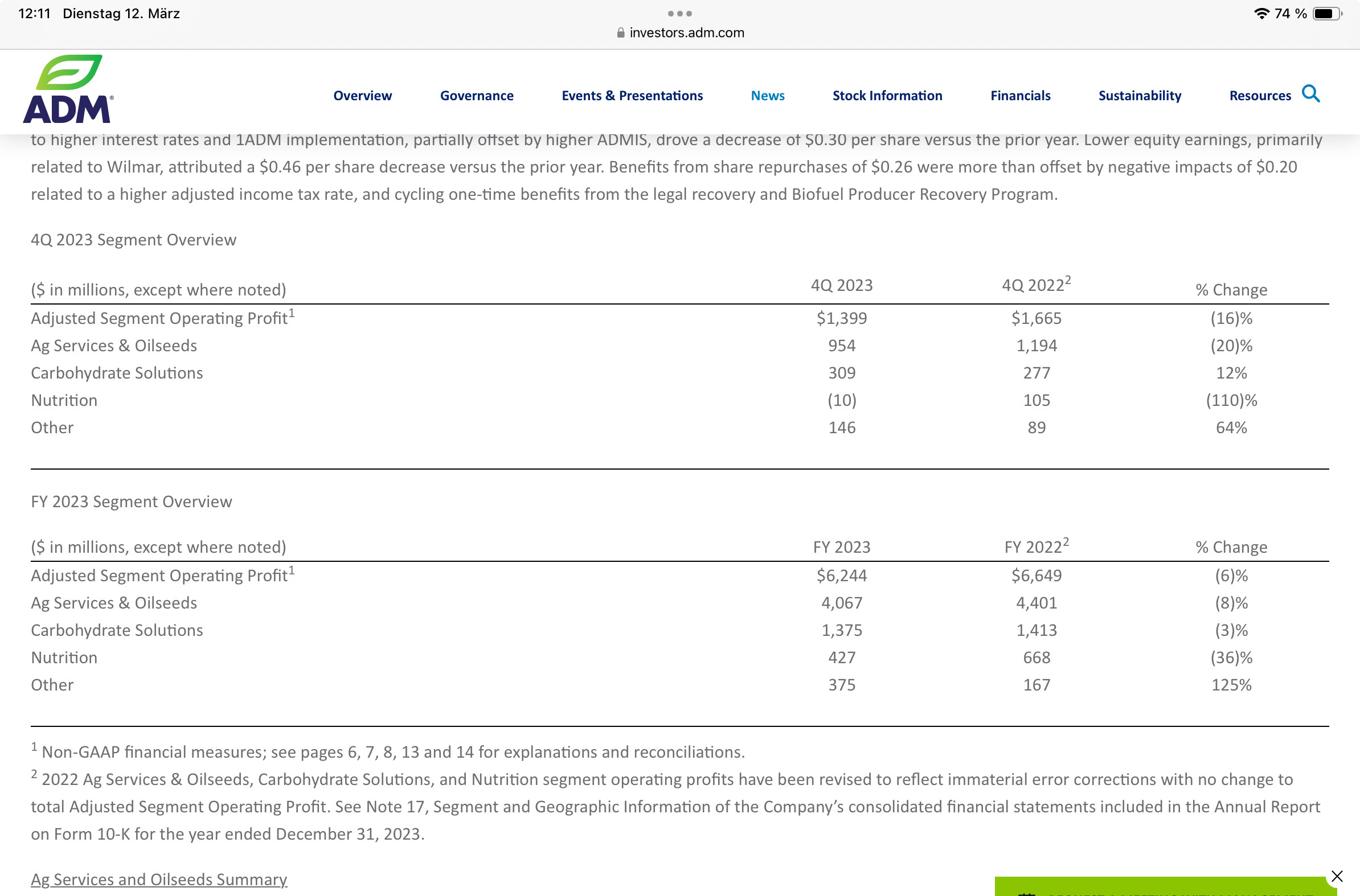

The Company provided guidance for the full year 2024. ADM expects adjusted earnings per share in the range of $5.25 to $6.25 per share, down 18% at the midpoint compared to 2023, reflecting moderating margin conditions and higher costs offsetting improved volumes.

- Announces Additional $2 Billion in Share Repurchases

Ist das gut oder schlecht?

- Announces Additional $2 Billion in Share Repurchases

Ist das gut oder schlecht?

Und update zu der Bilanzproblematik bei nutrition

https://investors.adm.com/news/news-details/2024/ADM-Provid…ADM Provides Update on Audit Committee Led Investigation

March 12, 2024

No Impact on Consolidated Financial Results

CHICAGO--(BUSINESS WIRE)-- ADM (NYSE: ADM) today provided an update with respect to the internal investigation led by the Audit Committee of its Board of Directors regarding certain accounting practices and procedures with respect to ADM’s Nutrition reporting segment, including as related to certain intersegment sales. The investigation was initially disclosed in January 2024.

“Our strong commitment to compliance and integrity in our financial reporting is evidenced by the diligence and breadth with which the Audit Committee has conducted its internal investigation. The adjustments related to the Company’s reporting segments do not impact our consolidated statement of earnings. Looking ahead, we have developed a remediation plan with respect to the identified material weakness to enhance the reliability of our financial statements with respect to the pricing and reporting of such sales,” said Chairman and CEO Juan Luciano. “We remain committed to strong internal controls. We look to continue our focus on execution and remain steadfast in delivering on our purpose of unlocking the power of nature to enrich the quality of life.”

Correction of Certain Segment-Specific Historical Financial Information

The Company has historically disclosed in the footnotes to its financial statements that intersegment sales have been recorded at amounts approximating market. In connection with the investigation, the Company identified and corrected certain intersegment sales that occurred between the Company’s Nutrition reporting segment and the Company’s Ag Services and Oilseeds and Carbohydrate Solutions reporting segments that were not recorded at amounts approximating market. Because intersegment sales occur between the Company’s reporting segments, the adjustments have no impact on the Company’s consolidated balance sheets and statements of earnings, comprehensive income (loss), or cash flows. In addition, the Company determined that the adjustments are not material to the Company’s consolidated financial statements taken as a whole for any period.

Antwort auf Beitrag Nr.: 75.433.350 von LTDHarry am 11.03.24 17:26:24Same here. Ich lasse laufen. Scheint nicht ganz so unproblematisch zu sein das ganze, jedenfalls dauert Klärung länger als gedacht, aber ich denke auch, bei bilanzskandalen will man von behördlicher Seite alles richtig machen, in sofern, wahrscheinlich geht es glimpflich aus, insbesondere wenn man den Antiel des Nutrition Geschäfts am Gesamtumsatz betrachtet.

Antwort auf Beitrag Nr.: 75.432.510 von namidog am 11.03.24 15:39:38Ich lasse es jedenfalls laufen wie seit vielen Jahren, es gab schon oft Up and Downs, aber die Dividenden wurden trotzdem immer zuverlässig gezahlt und jährlich erhöht!

Ich halte diesen Dividendking für Dividendeneinkünfte und nicht aus Spekulation. 😀

Ich halte diesen Dividendking für Dividendeneinkünfte und nicht aus Spekulation. 😀

Hallo,

was macht ihr im Vorfeld des Q4 Earnings? Laufen lassen oder mit Stopp Loss arbeiten? Habe Bedenken dass der SL auslöst und es danach nach oben geht :%

was macht ihr im Vorfeld des Q4 Earnings? Laufen lassen oder mit Stopp Loss arbeiten? Habe Bedenken dass der SL auslöst und es danach nach oben geht :%

Antwort auf Beitrag Nr.: 75.415.073 von Grisuu am 07.03.24 21:36:24Auf jedenfall sieht man genau, dass der Kurs um 21:00 (ca.) reagiert nach unten. Also ne stunde vor Börsenschluss. Da könnte evtl dann doch noch was nachbörslich kommen. Mal beobachten. Grundsätzlich ändert es nichts an meiner Position/Halten