Wann und wie kommt der nächste Crash? (Seite 44)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 2

Gesamt: 179.936

Gesamt: 179.936

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 7963 | |

| heute 17:20 | 6940 | |

| vor 1 Stunde | 4983 | |

| vor 50 Minuten | 2832 | |

| vor 49 Minuten | 2784 | |

| heute 09:20 | 2583 | |

| vor 48 Minuten | 1934 | |

| vor 1 Stunde | 1589 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 17.937,42 | +0,20 | 229 | |||

| 2. | 3. | 8,7000 | +4,95 | 74 | |||

| 3. | 4. | 3,8950 | +5,27 | 73 | |||

| 4. | 2. | 180,00 | +0,01 | 72 | |||

| 5. | 14. | 0,0164 | +0,61 | 68 | |||

| 6. | 11. | 2.300,47 | +0,65 | 48 | |||

| 7. | 9. | 1,1800 | +22,28 | 43 | |||

| 8. | 6. | 6,6600 | -0,30 | 40 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 69.629.151 von faultcode am 18.10.21 18:04:53

https://twitter.com/business/status/1450063130298654720

https://www.bloomberg.com/news/articles/2021-10-18/mom-and-p…

=> irgendwo hin müssen die Stücke ja. Also zu den Retail investors

Zitat von faultcode: ...Erst müssen die "Eliten" hier noch einigermaßen rauskommen, wenn man es verschwörungstheoretisch formulieren möchte. ...

https://twitter.com/business/status/1450063130298654720

https://www.bloomberg.com/news/articles/2021-10-18/mom-and-p…

=> irgendwo hin müssen die Stücke ja. Also zu den Retail investors

Antwort auf Beitrag Nr.: 69.487.567 von faultcode am 03.10.21 01:30:29

18.10.

Jerome Powell Sold More Than a Million Dollars of Stock as the Market Was Tanking

Disclosure documents reveal that the spectacle of Fed officials personally trading stocks extended to the chair himself.

https://prospect.org/economy/powell-sold-more-than-million-d…

...

diese dümmliche Affäre (lanciert von oben) könnte mMn am Ende der Entwicklung zu einem Politik-Wechsel der FED führen mit "Tauben" raus, "Falken" rein.

Sprich: Gewinne für die Bezieher von Einkommen durch Arbeit, Verluste für die Besitzer von Vermögenswerten

Also ein Umschwenken der fortwährenden QE-Politik der FED seit der GFC 2009.

Zitat von faultcode: ...Erst müssen die "Eliten" hier noch einigermaßen rauskommen, wenn man es verschwörungstheoretisch formulieren möchte. ...

18.10.

Jerome Powell Sold More Than a Million Dollars of Stock as the Market Was Tanking

Disclosure documents reveal that the spectacle of Fed officials personally trading stocks extended to the chair himself.

https://prospect.org/economy/powell-sold-more-than-million-d…

...

diese dümmliche Affäre (lanciert von oben) könnte mMn am Ende der Entwicklung zu einem Politik-Wechsel der FED führen mit "Tauben" raus, "Falken" rein.

Sprich: Gewinne für die Bezieher von Einkommen durch Arbeit, Verluste für die Besitzer von Vermögenswerten

Also ein Umschwenken der fortwährenden QE-Politik der FED seit der GFC 2009.

Antwort auf Beitrag Nr.: 69.578.022 von faultcode am 12.10.21 23:15:58nun auch er:

13.10.

Deutsche Bank Chief Sewing Says Inflation Probably Here to Stay

https://www.bnnbloomberg.ca/deutsche-bank-chief-sewing-says-…

...

Deutsche Bank AG Chief Executive Officer Christian Sewing said the current bout of inflation will likely prove longer lasting, adding his voice to a widening group of leaders calling on central banks to react.

“The inflation rate in the currency union is unlikely to return in the medium term to the pre-pandemic level,” Sewing said Wednesday in remarks prepared for a press briefing of the German bank lobby BDB, of which he’s the president. “The time has come to talk about a perspective of exiting the monetary policy crisis mode.”

...

13.10.

Deutsche Bank Chief Sewing Says Inflation Probably Here to Stay

https://www.bnnbloomberg.ca/deutsche-bank-chief-sewing-says-…

...

Deutsche Bank AG Chief Executive Officer Christian Sewing said the current bout of inflation will likely prove longer lasting, adding his voice to a widening group of leaders calling on central banks to react.

“The inflation rate in the currency union is unlikely to return in the medium term to the pre-pandemic level,” Sewing said Wednesday in remarks prepared for a press briefing of the German bank lobby BDB, of which he’s the president. “The time has come to talk about a perspective of exiting the monetary policy crisis mode.”

...

Antwort auf Beitrag Nr.: 69.577.749 von faultcode am 12.10.21 22:31:30...

There isn’t just a ton of inflation, it’s starting to actually hurt people.

That’s according to Lars Florness, the chief executive of Fastenal Co., which makes supplies used by construction and industrial manufacturers.

In the conference call with analysts following Fastenal’s third-quarter results early Tuesday, Florness said, according to a FactSet transcript, that product and shipping cost inflation the company and its peers were facing “isn’t just high”:

“It’s brutally high. The chaos and…the impact, not just from a financial perspective, but from a toll that takes on our human capital, is immense.”

— Fastenal Chief Executive Lars Florness

...

12.10.

Inflation has shifted to ‘brutally high’ from ‘massive’ in three months, according to Fastenal CEO

https://www.marketwatch.com/story/inflation-has-shifted-to-b…

There isn’t just a ton of inflation, it’s starting to actually hurt people.

That’s according to Lars Florness, the chief executive of Fastenal Co., which makes supplies used by construction and industrial manufacturers.

In the conference call with analysts following Fastenal’s third-quarter results early Tuesday, Florness said, according to a FactSet transcript, that product and shipping cost inflation the company and its peers were facing “isn’t just high”:

“It’s brutally high. The chaos and…the impact, not just from a financial perspective, but from a toll that takes on our human capital, is immense.”

— Fastenal Chief Executive Lars Florness

...

12.10.

Inflation has shifted to ‘brutally high’ from ‘massive’ in three months, according to Fastenal CEO

https://www.marketwatch.com/story/inflation-has-shifted-to-b…

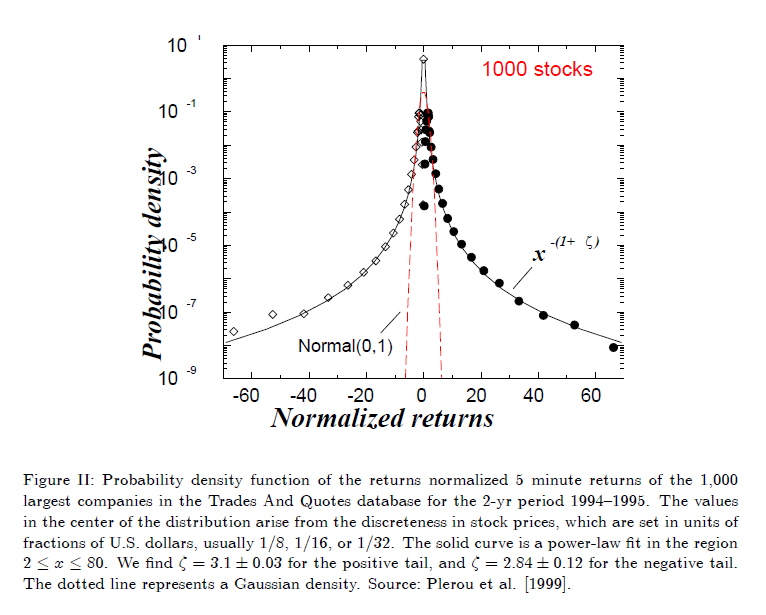

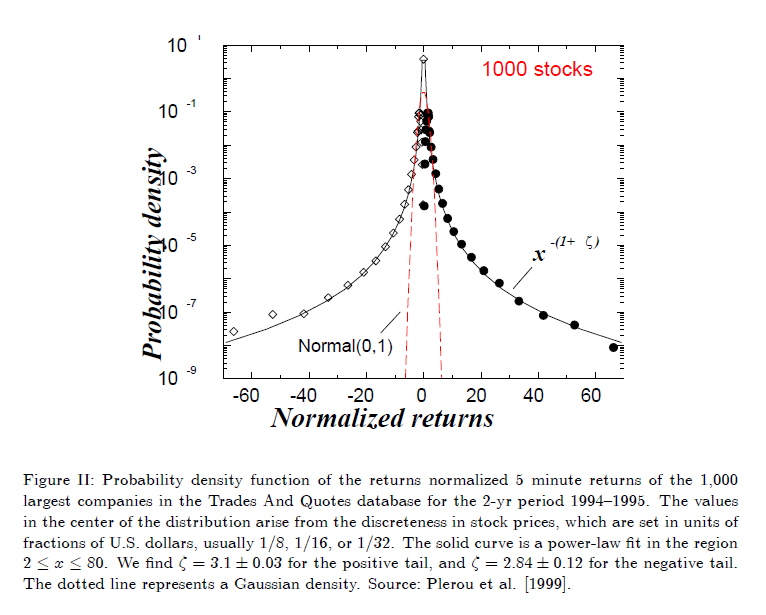

Institutional Investors and Stock Market Volatility

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=442940

2005 (2010)

Xavier Gabaix et al

https://scholar.harvard.edu/xgabaix/publications

Abstract

We present a theory of excess stock market volatility, in which market movements are due to trades by very large institutional investors in relatively illiquid markets. Such trades generate significant spikes in returns and volume, even in the absence of important news about fundamentals.

...

...

In our theory, spikes in trading volume and returns are created by a combination of news and the trades by large investors.

...

Note that the existence of prime movers does not preclude that, subsequently, many traders will move in the same way.

...

One prominent example of a large fund disrupting the market is Long Term Capital Management. Its collapse created a volatility spike that did not subside for several months.

...

A second example is the Brady [1988] report on the 1987 crash.

On the crash day of Monday, October 19, 1987, “this trading activity was concentrated in the hands of surprisingly few institutions. ... Sell programs by three portfolio insurers accounted for just under $2 billion in the stock market. ... Block sales by a few mutual funds accounted for about $900 million of stock sales,” on a total of $21 billion traded (p. v) and “One portfolio insurer alone sold $1.3 billion” (p. III-22). In the first half hour of trading, “roughly 25 percent of the volume ... came from one mutual fund group” (p. 30).

The report concludes that “much of the selling pressure was concentrated in the hands of surprisingly few institutions. A handful of large investors provided the impetus for the sharpness of the decline” (p.41). Of course, some of the investors in the Brady report are program traders, which amplify existing movements, rather than cause them.

...

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=442940

2005 (2010)

Xavier Gabaix et al

https://scholar.harvard.edu/xgabaix/publications

Abstract

We present a theory of excess stock market volatility, in which market movements are due to trades by very large institutional investors in relatively illiquid markets. Such trades generate significant spikes in returns and volume, even in the absence of important news about fundamentals.

...

...

In our theory, spikes in trading volume and returns are created by a combination of news and the trades by large investors.

...

Note that the existence of prime movers does not preclude that, subsequently, many traders will move in the same way.

...

One prominent example of a large fund disrupting the market is Long Term Capital Management. Its collapse created a volatility spike that did not subside for several months.

...

A second example is the Brady [1988] report on the 1987 crash.

On the crash day of Monday, October 19, 1987, “this trading activity was concentrated in the hands of surprisingly few institutions. ... Sell programs by three portfolio insurers accounted for just under $2 billion in the stock market. ... Block sales by a few mutual funds accounted for about $900 million of stock sales,” on a total of $21 billion traded (p. v) and “One portfolio insurer alone sold $1.3 billion” (p. III-22). In the first half hour of trading, “roughly 25 percent of the volume ... came from one mutual fund group” (p. 30).

The report concludes that “much of the selling pressure was concentrated in the hands of surprisingly few institutions. A handful of large investors provided the impetus for the sharpness of the decline” (p.41). Of course, some of the investors in the Brady report are program traders, which amplify existing movements, rather than cause them.

...

8.10.

Only Massive U.S. Jobs Miss Will Derail November Taper Bets

https://finance.yahoo.com/news/only-massive-jobs-miss-derail…

...

The number to watch for on Friday’s U.S. payrolls report is 200,000.

Anything below that would prompt investors to question the health of the economy and send Treasury yields lower in the near term, according to all eight strategists surveyed by Bloomberg.

Such a scenario would boost bets for a delay or a slower pace of Federal Reserve tapering. Yet, the figure is less than half of the median of economists’ estimates at 500,000.

While most investors see Fed tapering as a certainty on the horizon, they await clarity on its timing and speed. Inflationary pressures from supply-chain bottlenecks and the anticipated start of tapering in November have left yields poised to build on their third-quarter increases. That means the bar on a post-data pullback in Treasury yields is very high.

“A number that is 300,000 above or below consensus is likely to solicit a response from the Treasuries,” Subadra Rajappa, the head of U.S. rates strategy at Societe Generale, said.

...

Only Massive U.S. Jobs Miss Will Derail November Taper Bets

https://finance.yahoo.com/news/only-massive-jobs-miss-derail…

...

The number to watch for on Friday’s U.S. payrolls report is 200,000.

Anything below that would prompt investors to question the health of the economy and send Treasury yields lower in the near term, according to all eight strategists surveyed by Bloomberg.

Such a scenario would boost bets for a delay or a slower pace of Federal Reserve tapering. Yet, the figure is less than half of the median of economists’ estimates at 500,000.

While most investors see Fed tapering as a certainty on the horizon, they await clarity on its timing and speed. Inflationary pressures from supply-chain bottlenecks and the anticipated start of tapering in November have left yields poised to build on their third-quarter increases. That means the bar on a post-data pullback in Treasury yields is very high.

“A number that is 300,000 above or below consensus is likely to solicit a response from the Treasuries,” Subadra Rajappa, the head of U.S. rates strategy at Societe Generale, said.

...

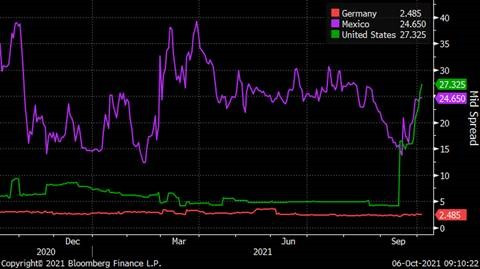

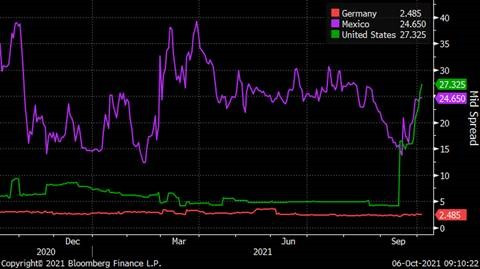

Antwort auf Beitrag Nr.: 69.518.517 von faultcode am 06.10.21 13:11:44US CDS spreads:

https://twitter.com/RBAdvisors/status/1445812223520149504

https://twitter.com/RBAdvisors/status/1445812223520149504

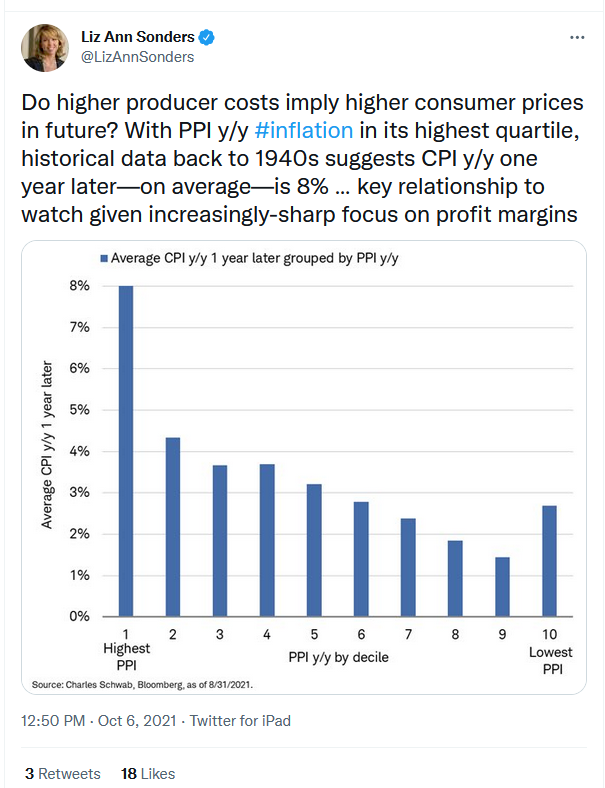

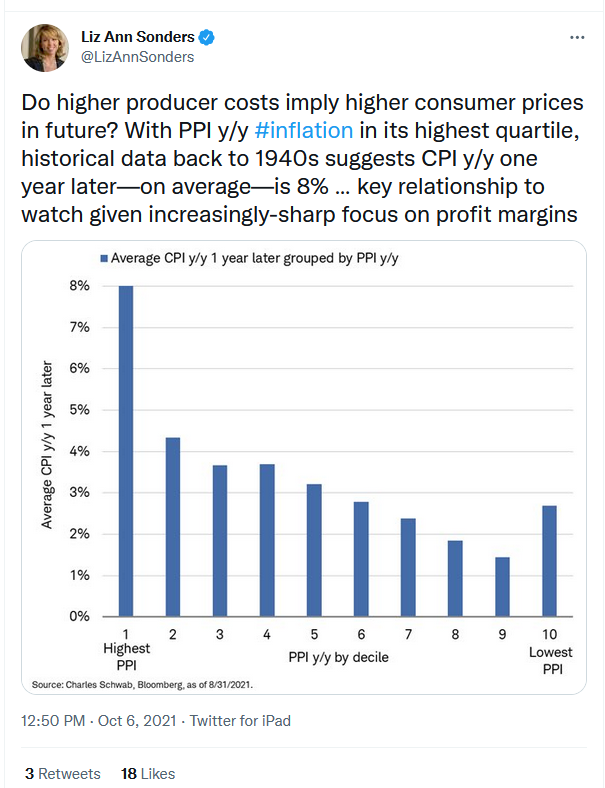

Antwort auf Beitrag Nr.: 69.470.995 von faultcode am 30.09.21 21:31:12The Fed -- Powell says factors pushing inflation higher could last until next summer

nach dem Producer Price Index (PPI) in USA sollte das auch diesmal sehr wahrscheinlich sein:

https://twitter.com/LizAnnSonders/status/1445702918955438090

nach dem Producer Price Index (PPI) in USA sollte das auch diesmal sehr wahrscheinlich sein:

https://twitter.com/LizAnnSonders/status/1445702918955438090