Wann und wie kommt der nächste Crash? (Seite 55)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 1

Gesamt: 179.917

Gesamt: 179.917

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 21:55 | 313 | |

| gestern 23:58 | 207 | |

| gestern 23:09 | 146 | |

| heute 00:01 | 131 | |

| vor 1 Stunde | 107 | |

| gestern 23:31 | 105 | |

| heute 00:49 | 104 | |

| gestern 21:41 | 102 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.075,00 | +0,33 | 240 | |||

| 2. | 2. | 1,3800 | -1,43 | 98 | |||

| 3. | 3. | 0,1890 | -2,58 | 81 | |||

| 4. | 4. | 170,18 | +4,97 | 79 | |||

| 5. | 5. | 9,3325 | -3,69 | 75 | |||

| 6. | 6. | 7,0010 | +4,17 | 53 | |||

| 7. | 7. | 22,240 | -3,22 | 41 | |||

| 8. | 8. | 0,0160 | -24,17 | 38 |

Beitrag zu dieser Diskussion schreiben

das wird die Party-Stimmung nicht gerade haben:

..und das erst recht nicht:

..und das erst recht nicht:

Tag:

• US relative performance

Russell 2000 = kleinsten nach Marktkapitalisierung gewichteten US-Unternehmen des Russell 3000

Antwort auf Beitrag Nr.: 67.413.833 von faultcode am 11.03.21 12:09:2510.3.

"Now 9.5M accounts on r/wsb vs. 1.2M in Jan2021” —GS

https://twitter.com/choffstein/status/1369629858700083210

r/wsb = Reddit wallstreetbets

"Now 9.5M accounts on r/wsb vs. 1.2M in Jan2021” —GS

https://twitter.com/choffstein/status/1369629858700083210

r/wsb = Reddit wallstreetbets

Antwort auf Beitrag Nr.: 67.369.289 von faultcode am 08.03.21 22:58:11Robinhood - nun wissenschaftlich untersucht (aber erst Draft):

Januar 2021

The Equity Market Implications of the Retail Investment Boom, 2021-01

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3776421

=>

Abstract

Retail trading activity has soared during the COVID-19 pandemic. This paper quantifies the impact of the retail investment boom on the US stock market within a structural model. Using account holdings data from the online trading platform “Robinhood Markets Inc.” and 13F filings, we estimate retail and institutional demand curves and derive aggregate pricing implications via market clearing.

The inelastic nature of institutional demand allows Robinhood investors to have a substantial effect on stock returns during the COVID-19 pandemic. Despite their negligible market share of 0.2%, we find that Robinhood traders account for over 7% of the cross-sectional variation in stock returns during the second quarter of 2020.

We furthermore show that without the surge in retail trading activity the aggregate market capitalization of the smallest quintile of US stocks would have been over 30% lower.

Lastly, Robinhood traders are able to affect the price of some large individual companies that are being held primarily by passive institutional investors.

--> pssst: Tesla (FC - es gibt 2 oder drei Links im Papier im Zusammenhang mit Tesla)

...

6 Conclusion

This paper investigates the effects of retail trading activity on the US equity market within a structural model. To quantify the respective impact of retail and institutional demand on the US equity market, we use the Demand System Approach to Asset Pricing introduced by Koijen and Yogo (2019). We find that the majority of all institutional investors - who hold over 60% of the market - have inelastic demand.

Because they respond inelastically to price changes, the small retail sector can have substantial price effects. We show, that over 7% of the cross-sectional variation in stock returns during the pandemic can be attributed to the demand of Robinhood traders.

They furthermore alleviated the stock market crash during the first quarter of 2020 by 2%. By buying the small cap stocks that institutions were fire-selling they provided considerable liquidity to the US stock market.

Robinhood traders also boosted the recovery in Q2 by adding 1% to the aggregate stock market valuation. Given our approximation of their assets under management, this implies a multiplier effect of 5. The price impact of Robinhood traders is concentrated towards small cap stocks and the consumer staples industry. However, they are able to affect the price of some large companies, which are being held primarily by passive investors.

Our analysis sheds light on the intricate relationship between retail and institutional investors. The Demand System offers a feedback mechanism in which one agent's demand shock reverberates on another's demand function through market equity. We show that when institutions react sluggishly to non-fundamental price changes, the mechanism stifles and retail demand shocks can have substantial impacts on stock prices.

Our findings have important implications for policy makers. Large scale policies, such as the 2020 CARES act, have the potential to move prices considerably far from their fundamental values, if households invest rather than consume their share.

Moreover, the prominent role of Robinhood traders in driving returns evokes concerns about the future role of retail trading in equity markets. If - facilitated by novel fintech solutions - the retail sector continues to grow its wealth share, the extraordinary volatility observed during the pandemic may turn out to be the new normal.

Januar 2021

The Equity Market Implications of the Retail Investment Boom, 2021-01

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3776421

=>

Abstract

Retail trading activity has soared during the COVID-19 pandemic. This paper quantifies the impact of the retail investment boom on the US stock market within a structural model. Using account holdings data from the online trading platform “Robinhood Markets Inc.” and 13F filings, we estimate retail and institutional demand curves and derive aggregate pricing implications via market clearing.

The inelastic nature of institutional demand allows Robinhood investors to have a substantial effect on stock returns during the COVID-19 pandemic. Despite their negligible market share of 0.2%, we find that Robinhood traders account for over 7% of the cross-sectional variation in stock returns during the second quarter of 2020.

We furthermore show that without the surge in retail trading activity the aggregate market capitalization of the smallest quintile of US stocks would have been over 30% lower.

Lastly, Robinhood traders are able to affect the price of some large individual companies that are being held primarily by passive institutional investors.

--> pssst: Tesla (FC - es gibt 2 oder drei Links im Papier im Zusammenhang mit Tesla)

...

6 Conclusion

This paper investigates the effects of retail trading activity on the US equity market within a structural model. To quantify the respective impact of retail and institutional demand on the US equity market, we use the Demand System Approach to Asset Pricing introduced by Koijen and Yogo (2019). We find that the majority of all institutional investors - who hold over 60% of the market - have inelastic demand.

Because they respond inelastically to price changes, the small retail sector can have substantial price effects. We show, that over 7% of the cross-sectional variation in stock returns during the pandemic can be attributed to the demand of Robinhood traders.

They furthermore alleviated the stock market crash during the first quarter of 2020 by 2%. By buying the small cap stocks that institutions were fire-selling they provided considerable liquidity to the US stock market.

Robinhood traders also boosted the recovery in Q2 by adding 1% to the aggregate stock market valuation. Given our approximation of their assets under management, this implies a multiplier effect of 5. The price impact of Robinhood traders is concentrated towards small cap stocks and the consumer staples industry. However, they are able to affect the price of some large companies, which are being held primarily by passive investors.

Our analysis sheds light on the intricate relationship between retail and institutional investors. The Demand System offers a feedback mechanism in which one agent's demand shock reverberates on another's demand function through market equity. We show that when institutions react sluggishly to non-fundamental price changes, the mechanism stifles and retail demand shocks can have substantial impacts on stock prices.

Our findings have important implications for policy makers. Large scale policies, such as the 2020 CARES act, have the potential to move prices considerably far from their fundamental values, if households invest rather than consume their share.

Moreover, the prominent role of Robinhood traders in driving returns evokes concerns about the future role of retail trading in equity markets. If - facilitated by novel fintech solutions - the retail sector continues to grow its wealth share, the extraordinary volatility observed during the pandemic may turn out to be the new normal.

Antwort auf Beitrag Nr.: 66.927.482 von faultcode am 10.02.21 13:28:40

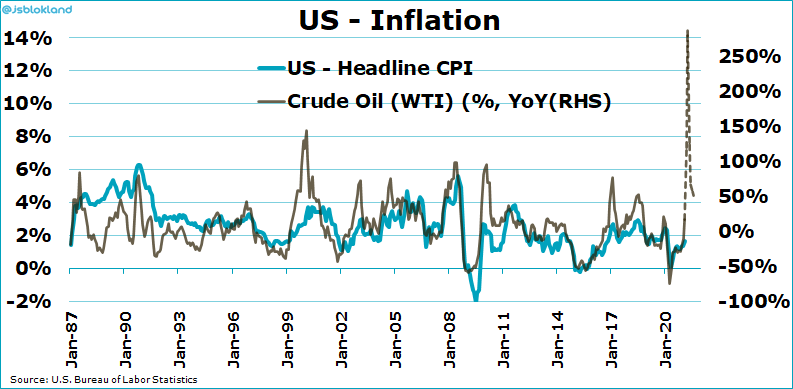

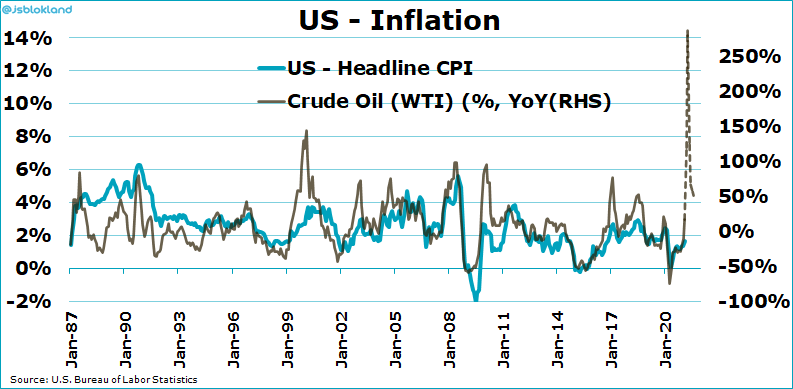

https://twitter.com/jsblokland/status/1369725033929707524

https://twitter.com/jsblokland/status/1369725033929707524

Antwort auf Beitrag Nr.: 66.809.569 von faultcode am 04.02.21 01:30:12

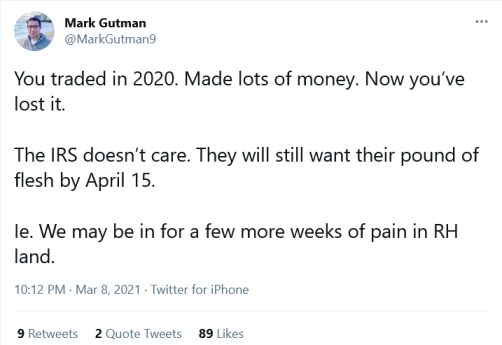

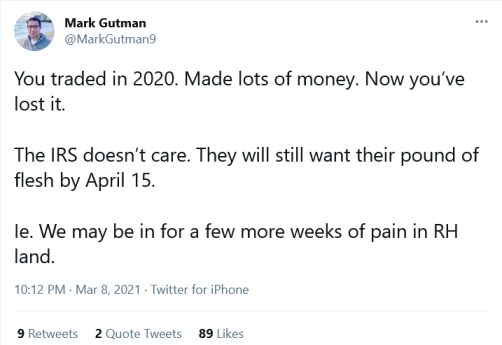

https://twitter.com/MarkGutman9/status/1369033294998802433

RH = Robinhood

Tag:

• Steuer

Zitat von faultcode: ...

man kann nur für ihn hoffen, daß der Naivling vorher noch mal mit einem Tax preparer gesprochen hat...

https://twitter.com/MarkGutman9/status/1369033294998802433

RH = Robinhood

Tag:

• Steuer

Antwort auf Beitrag Nr.: 67.329.465 von faultcode am 05.03.21 16:22:157.3.

When the Stock Boom Turns to Bust

https://www.wsj.com/articles/when-the-stock-boom-turns-to-bu…

You haven’t seen a real bear market until you’ve lost 90% of your money.

--> so ist es

...

Even after last week, it feels as if a lot of people think markets only go up. Buy the dip! Hold on for dear life! Feed the ducks when they’re quacking! Stocks. Bonds. SPACs. Real estate. Commodities. Crypto. $200,000 nonfungible tokens, known as NFTs, with clips of LeBron James. Even GameStop is flying again. The sentiment is: Assets go up; cash is for losers. That hasn’t been a bad bet. The March 2020 Covid insta-bear market quickly returned to an insta-bull market. So how do you know when to jump off the runaway train instead of being run over by one?

I don’t think I’m breaking new ground when I suggest that markets do go down. A lot. I was somewhat new to Wall Street when the crash of 1987 took 22.6% out of the Dow Jones Industrial Average. In retrospect, that’s nothing. A partner at an old-line investment bank once told me that you haven’t seen a real bear market until you’ve lost 90% of your money.

...

When the Stock Boom Turns to Bust

https://www.wsj.com/articles/when-the-stock-boom-turns-to-bu…

You haven’t seen a real bear market until you’ve lost 90% of your money.

--> so ist es

...

Even after last week, it feels as if a lot of people think markets only go up. Buy the dip! Hold on for dear life! Feed the ducks when they’re quacking! Stocks. Bonds. SPACs. Real estate. Commodities. Crypto. $200,000 nonfungible tokens, known as NFTs, with clips of LeBron James. Even GameStop is flying again. The sentiment is: Assets go up; cash is for losers. That hasn’t been a bad bet. The March 2020 Covid insta-bear market quickly returned to an insta-bull market. So how do you know when to jump off the runaway train instead of being run over by one?

I don’t think I’m breaking new ground when I suggest that markets do go down. A lot. I was somewhat new to Wall Street when the crash of 1987 took 22.6% out of the Dow Jones Industrial Average. In retrospect, that’s nothing. A partner at an old-line investment bank once told me that you haven’t seen a real bear market until you’ve lost 90% of your money.

...

Antwort auf Beitrag Nr.: 67.324.413 von faultcode am 05.03.21 12:09:21auch von der Seite gab's eine Bremsung:

4.3.

*U.S. MORTGAGE RATES JUMP NORTH OF 3% FOR FIRST TIME SINCE JULY

https://twitter.com/DeItaone/status/1367490187966746630

4.3.

*U.S. MORTGAGE RATES JUMP NORTH OF 3% FOR FIRST TIME SINCE JULY

https://twitter.com/DeItaone/status/1367490187966746630

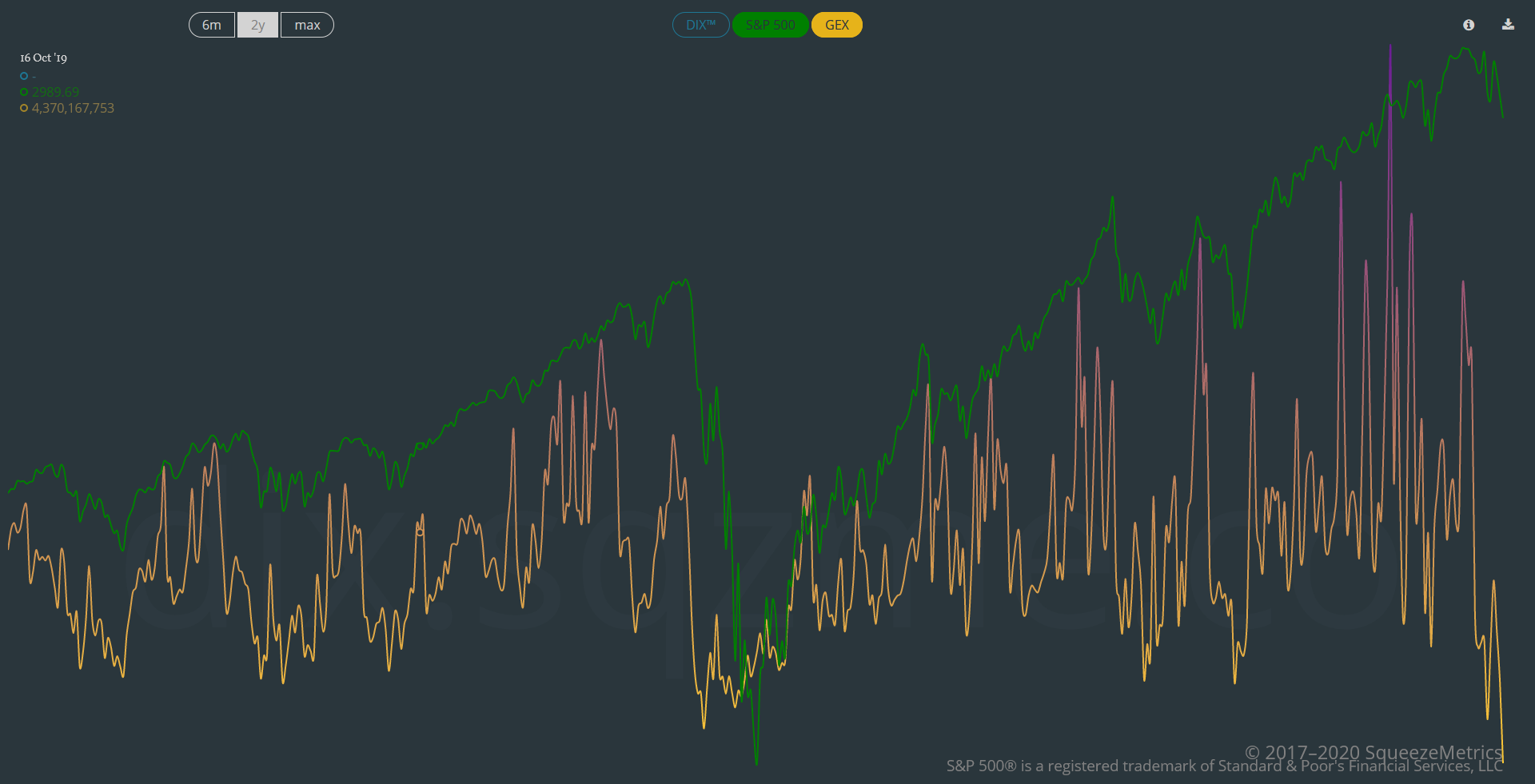

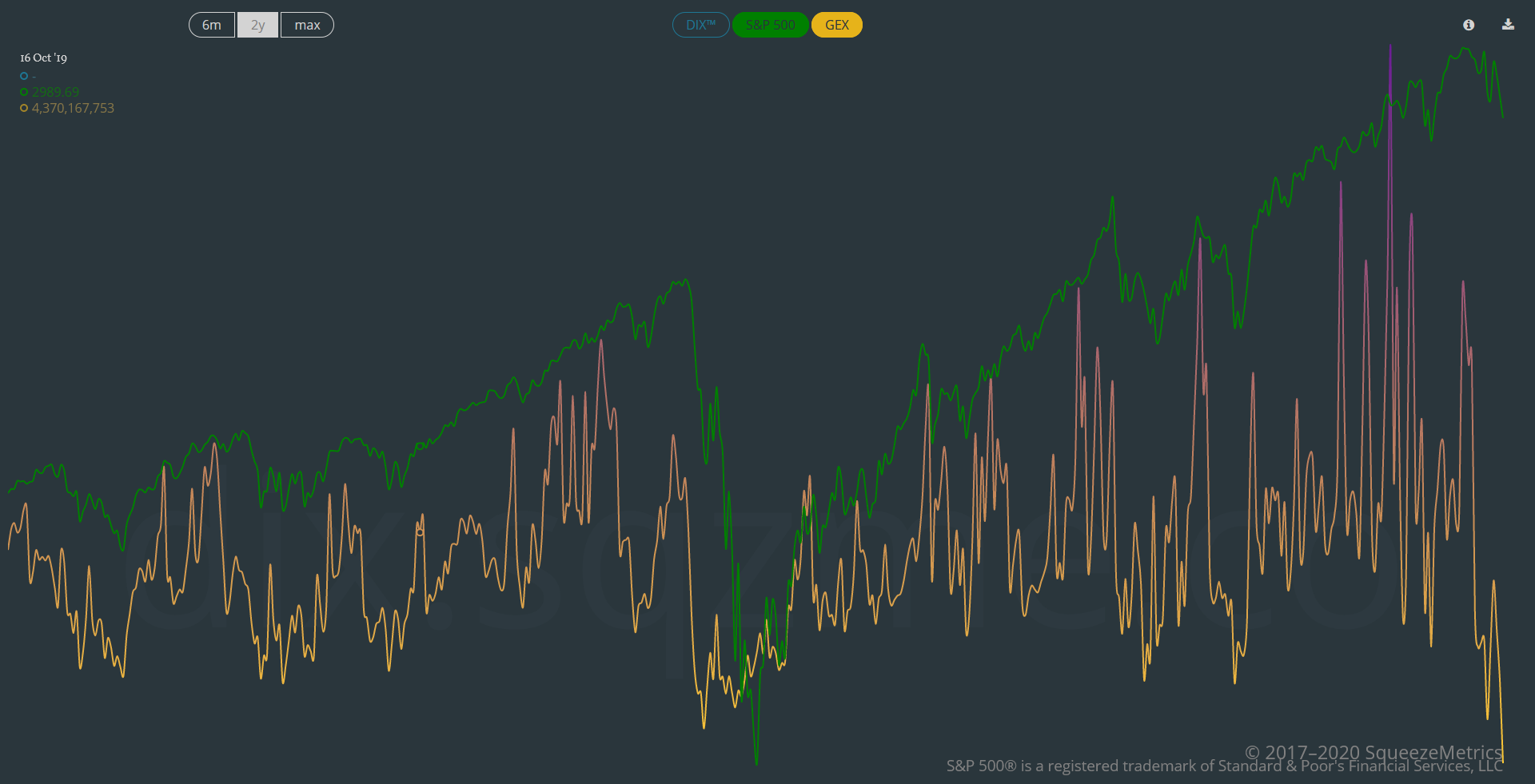

Antwort auf Beitrag Nr.: 66.717.086 von faultcode am 30.01.21 15:49:09der GEX sieht gar nicht gut aus => in Tendenz (mMn) weiter fallende Kurse:

=> der GEX liegt nun unter dem Niveau vom "Corona-Margin-Call-Crash" im März 2020.

Allerdings wurde seitdem auch weiterhin mehr Geld in Optionen gesteckt.

(der GEX ist ein absoluter Oscillator)

=> der GEX liegt nun unter dem Niveau vom "Corona-Margin-Call-Crash" im März 2020.

Allerdings wurde seitdem auch weiterhin mehr Geld in Optionen gesteckt.

(der GEX ist ein absoluter Oscillator)

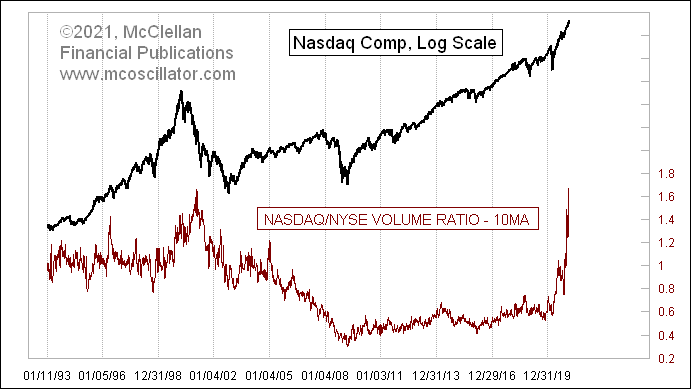

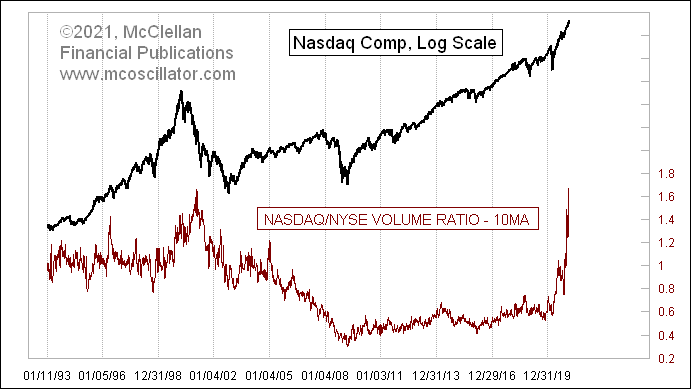

Antwort auf Beitrag Nr.: 67.205.874 von faultcode am 25.02.21 19:38:27Ui Ui Ui

https://twitter.com/McClellanOsc/status/1366591434283831298

https://twitter.com/McClellanOsc/status/1366591434283831298