Giyani Metals -- ehem. Giyani Gold - Die letzten 30 Beiträge

eröffnet am 27.07.16 09:25:44 von

neuester Beitrag 08.12.23 00:02:00 von

neuester Beitrag 08.12.23 00:02:00 von

Beiträge: 558

ID: 1.235.791

ID: 1.235.791

Aufrufe heute: 0

Gesamt: 49.497

Gesamt: 49.497

Aktive User: 0

ISIN: CA37637H1055 · WKN: A2DUU8

0,0660

EUR

0,00 %

0,0000 EUR

Letzter Kurs 19:55:14 Lang & Schwarz

Neuigkeiten

24.04.24 · globenewswire |

09.04.24 · globenewswire |

28.03.24 · globenewswire |

21.02.24 · globenewswire |

20.02.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,0000 | +45,45 | |

| 1,6860 | +17,57 | |

| 527,60 | +15,68 | |

| 4,6900 | +15,52 | |

| 5.957,50 | +12,92 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7300 | -8,75 | |

| 0,7000 | -10,26 | |

| 324,70 | -10,30 | |

| 0,6601 | -26,22 | |

| 47,07 | -97,97 |

Beitrag zu dieser Diskussion schreiben

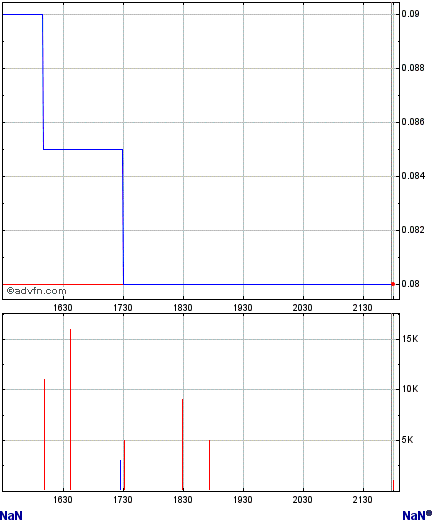

Danke. Ja, das kenne ich.

Aber irgendwie komme ich mit Yahoo besser zurecht als mit Tradingview, auch wenn es schöner aussieht.

Aber irgendwie komme ich mit Yahoo besser zurecht als mit Tradingview, auch wenn es schöner aussieht.

Antwort auf Beitrag Nr.: 74.931.466 von Nanostox am 07.12.23 22:50:43schönere charts gäbe es hier... musst mal gucken, ob das was für dich ist!

https://de.advfn.com/borse/TSXV/EMM/chart/trading-view

kannst auch paar linien einzeichnen und so zeugs...

https://de.advfn.com/borse/TSXV/EMM/chart/trading-view

kannst auch paar linien einzeichnen und so zeugs...

Wird jetzt interessant

Heute bei 0.115 C$ eingestiegen.Großartiger Artikel

https://www.miningmx.com/opinion/metal-heads/48458-new-age-i…

Lesezeichen...

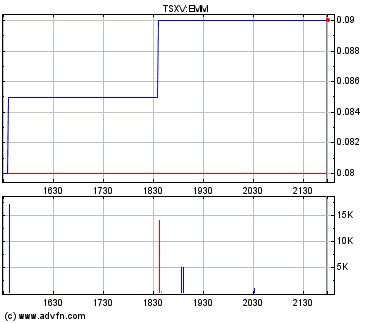

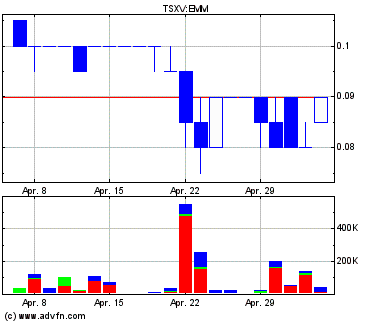

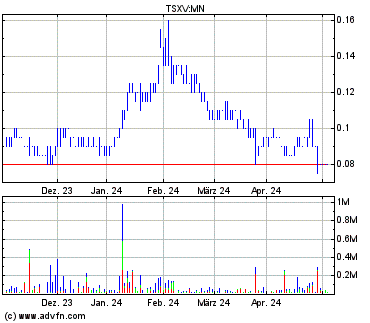

geht der hype im mangansektor demnächst noch über auf EMM?

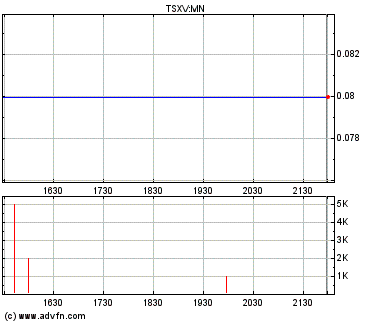

MN scheint seit neulich auch übern jordan zu machen... unglaublich...

MN scheint seit neulich auch übern jordan zu machen... unglaublich...

Servus, jemand auf den laufenden Stand mit Gesprächsbedarf?

Wenn ich das recht deute steht und fällt das Projekt mit der Metallurgie.

Sprich, nur wenn 99,9% Batterie taugliches Mangan hergestellt werden kann gehen die Zahlen aus der durchaus ordentlichen PEA auf.

Wenn ich das recht deute steht und fällt das Projekt mit der Metallurgie.

Sprich, nur wenn 99,9% Batterie taugliches Mangan hergestellt werden kann gehen die Zahlen aus der durchaus ordentlichen PEA auf.

Rock Island abgestossen und Geld in der Kasse. Passt doch.

Antwort auf Beitrag Nr.: 59.910.200 von links-zwo-drei-vier am 19.02.19 15:11:45- PEA based on the 1.1 million tonnes inferred mineral resource estimate that the Company announced on September 28, 2018

- 9-year potential project operating life producing 245,000 tonnes of high-purity electrolytic manganese metal (“HPEMM”)

- Pre-tax NPV of C$491 million (US$369 million) and after tax NPV of C$379 million (US$285 million), using a 10% discount rate

- Estimated C$144.4 million (US$108.5 million) in pre-production capital, C$13.2 million (US$9.9 million) in sustaining capital, C$23.7 million (US$17.8 million) in contingency at 15%, and C$6.7 million (US$5 million) closure costs for a total project capital of C$188 million (US$141.3 million)

- After-tax IRR of 90.6% and a 1.5 year payback period

- Project economics are based on a projected average price of US$4,700/tonne for HPEMM of 99.9% Mn over the project life

- Access to established logistics chain and infrastructure in a well-developed and mining friendly jurisdiction

- Initial attractive project economics and growing market demand for battery-grade manganese products should attract multiple offers of project financing from the mining investment community

- Opportunities exist to improve returns through further enhancement of K.Hill mineral resources into a mineral reserve and the addition of other deposits within the greater Giyani licence area including the existing Otse and Lobatse deposits

- Immediate next steps: continue hydrometallurgical testing with electro-refining to produce HPEMM samples for testing by battery makers and upgrade K.Hill into a mineral reserve through a targeted reserve drilling campaign and a feasibility study

- Further next steps: commence environmental impact assessment and feasibility study in preparation for the mine permit application in 2020

http://www.globenewswire.com/news-release/2019/08/15/1902419…

- 9-year potential project operating life producing 245,000 tonnes of high-purity electrolytic manganese metal (“HPEMM”)

- Pre-tax NPV of C$491 million (US$369 million) and after tax NPV of C$379 million (US$285 million), using a 10% discount rate

- Estimated C$144.4 million (US$108.5 million) in pre-production capital, C$13.2 million (US$9.9 million) in sustaining capital, C$23.7 million (US$17.8 million) in contingency at 15%, and C$6.7 million (US$5 million) closure costs for a total project capital of C$188 million (US$141.3 million)

- After-tax IRR of 90.6% and a 1.5 year payback period

- Project economics are based on a projected average price of US$4,700/tonne for HPEMM of 99.9% Mn over the project life

- Access to established logistics chain and infrastructure in a well-developed and mining friendly jurisdiction

- Initial attractive project economics and growing market demand for battery-grade manganese products should attract multiple offers of project financing from the mining investment community

- Opportunities exist to improve returns through further enhancement of K.Hill mineral resources into a mineral reserve and the addition of other deposits within the greater Giyani licence area including the existing Otse and Lobatse deposits

- Immediate next steps: continue hydrometallurgical testing with electro-refining to produce HPEMM samples for testing by battery makers and upgrade K.Hill into a mineral reserve through a targeted reserve drilling campaign and a feasibility study

- Further next steps: commence environmental impact assessment and feasibility study in preparation for the mine permit application in 2020

http://www.globenewswire.com/news-release/2019/08/15/1902419…

Giyani Announces Positive PEA Results for its K.Hill Manganese Project in Botswana with an After-Tax Net Present Value of C$379 Million (US$285 Million)

https://www.goldseiten.de/artikel/423093--Giyani-Announces-P…

L234

https://www.goldseiten.de/artikel/423093--Giyani-Announces-P…

L234

Sollte es das wirklich schon wieder gewesen sein?

die Frage ist doch:

wo stehen wir in 5 Jahren?

wo stehen wir in 5 Jahren?

das stimmt, jedoch sind wir heute eine ganze Ecke weiter.

Glta

Glta

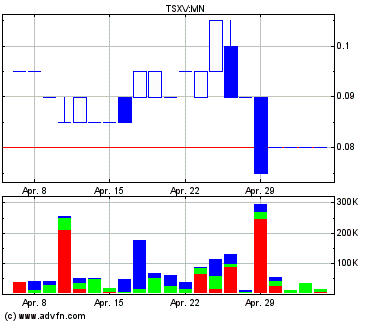

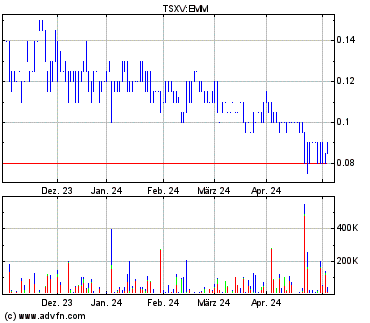

Leider gab es solche "Spitzen" schon immer, danach ging es - wie man am Chart sieht - wieder in den Keller...

Quelle: https://stockhouse.com/companies/quote?symbol=v.emm

Dann wollen wir einmal hoffen, das es diesmal anders verläuft und das Teil den Abwärtstrend verlässt.

LG

L234

Quelle: https://stockhouse.com/companies/quote?symbol=v.emm

Dann wollen wir einmal hoffen, das es diesmal anders verläuft und das Teil den Abwärtstrend verlässt.

LG

L234

haha - bitte nur die Überschrift lesen:

https://www.aktiencheck.de/exklusiv/Artikel-Giyani_Metals_Vo…

Die vom Käseblatt sind halt einfach spitze

https://www.aktiencheck.de/exklusiv/Artikel-Giyani_Metals_Vo…

Die vom Käseblatt sind halt einfach spitze

Antwort auf Beitrag Nr.: 60.820.940 von H2_Gewinner am 17.06.19 09:17:31WOW

läuft.

Präsentation Juni 2019:

https://giyanimetals.com/wp-content/uploads/2019/06/20190605…" target="_blank" rel="nofollow ugc noopener">https://giyanimetals.com/wp-content/uploads/2019/06/20190605…

L234

https://giyanimetals.com/wp-content/uploads/2019/06/20190605…" target="_blank" rel="nofollow ugc noopener">https://giyanimetals.com/wp-content/uploads/2019/06/20190605…

L234

Ist hier eigentlich niemand mehr investiert?

Es könnte doch noch was werden, wird aber sicherlich noch dauern....................

Giyani Metals Corp. May 24, 2019 (TSXV:EMM) (FRANKFURT:KT9) (WKN:A2DUU8) (“Giyani” or the “Company”) is pleased to announce that The Department of Environmental Affairs (“DEA”) in Botswana has approved the Environmental Management Plans (“EMP”) for its K.Hill and Otse manganese prospects and requested the Company to proceed to the next step of public review.

Giyani submitted three EMPs for its Botswana manganese prospects K.Hill, Otse, and Lobatse, in late 2018 and early 2019. The Company further submitted updated EMPs based on comments and clarifications from the DEA on the first submissions. On May 22, 2019 Giyani received final approval for the K.Hill and Otse EMPs clearing the way to the next and final step in the process which is a public review of the proposed EMPs in the government gazette and local newspapers. The public review notice will highlight the location and nature of the proposed activities, and the anticipated environmental impacts along with the mitigating measures the Company proposes to put in place to counter those impacts. The public review notice will be published in local newspapers and run at least once weekly for four consecutive weeks inviting written comments from interested parties. Giyani has booked the nearest available spot in the government gazette to start the public review notification process on June 7, 2019.

Robin Birchall, CEO of Giyani commented:

“We are delighted with the K.Hill and Otse EMP approvals and we anticipate receiving the Lobatse EMP approval in the near future. These significant milestones further our progress toward allowing the Company to proceed with its plans to remediate the sites at K.Hill and Otse. The remediation will allow us to process the manganese stockpiles in and around K.Hill and Otse and achieve our objective of improving the environmental conditions at those two prospects. In addition, these activities will generate revenues to help us further develop our projects towards becoming a leading independent producer of battery grade manganese.”

About Giyani

Giyani Metals Corp. is a Canadian junior exploration company focused on creating shareholder value by accelerating the development of its high-grade manganese project in the Kanye Basin, Botswana, Africa. Additional information and corporate documents may be found on www.sedar.com and on Giyani Metals Corp. website: http://giyanimetals.com/.

On behalf of the Board of Directors of Giyani Metals Corp.

Robin Birchall, CEO

Contact:

Giyani Metals Corporation

Robin Birchall

CEO, Director

+447711313019

Es könnte doch noch was werden, wird aber sicherlich noch dauern....................

Giyani Metals Corp. May 24, 2019 (TSXV:EMM) (FRANKFURT:KT9) (WKN:A2DUU8) (“Giyani” or the “Company”) is pleased to announce that The Department of Environmental Affairs (“DEA”) in Botswana has approved the Environmental Management Plans (“EMP”) for its K.Hill and Otse manganese prospects and requested the Company to proceed to the next step of public review.

Giyani submitted three EMPs for its Botswana manganese prospects K.Hill, Otse, and Lobatse, in late 2018 and early 2019. The Company further submitted updated EMPs based on comments and clarifications from the DEA on the first submissions. On May 22, 2019 Giyani received final approval for the K.Hill and Otse EMPs clearing the way to the next and final step in the process which is a public review of the proposed EMPs in the government gazette and local newspapers. The public review notice will highlight the location and nature of the proposed activities, and the anticipated environmental impacts along with the mitigating measures the Company proposes to put in place to counter those impacts. The public review notice will be published in local newspapers and run at least once weekly for four consecutive weeks inviting written comments from interested parties. Giyani has booked the nearest available spot in the government gazette to start the public review notification process on June 7, 2019.

Robin Birchall, CEO of Giyani commented:

“We are delighted with the K.Hill and Otse EMP approvals and we anticipate receiving the Lobatse EMP approval in the near future. These significant milestones further our progress toward allowing the Company to proceed with its plans to remediate the sites at K.Hill and Otse. The remediation will allow us to process the manganese stockpiles in and around K.Hill and Otse and achieve our objective of improving the environmental conditions at those two prospects. In addition, these activities will generate revenues to help us further develop our projects towards becoming a leading independent producer of battery grade manganese.”

About Giyani

Giyani Metals Corp. is a Canadian junior exploration company focused on creating shareholder value by accelerating the development of its high-grade manganese project in the Kanye Basin, Botswana, Africa. Additional information and corporate documents may be found on www.sedar.com and on Giyani Metals Corp. website: http://giyanimetals.com/.

On behalf of the Board of Directors of Giyani Metals Corp.

Robin Birchall, CEO

Contact:

Giyani Metals Corporation

Robin Birchall

CEO, Director

+447711313019

Giyani Receives Positive Leaching Results

......

Robin Birchall, CEO of Giyani commented:

“We are very pleased with the leaching results as they reflect a much higher recovery at 94% compared to the lower and more conservative 60% that was used for our maiden mineral resource estimate announced back in September 2018. These improved test results not only bode well for further hydrometallurgical tests but will also, ultimately, result in a lower cut-off grade for our K.Hill resource with the obvious corresponding impacts on the resource size.”

......

Quelle: https://www.goldseiten.de/artikel/412958--Giyani-Receives-Po…

L234

......

Robin Birchall, CEO of Giyani commented:

“We are very pleased with the leaching results as they reflect a much higher recovery at 94% compared to the lower and more conservative 60% that was used for our maiden mineral resource estimate announced back in September 2018. These improved test results not only bode well for further hydrometallurgical tests but will also, ultimately, result in a lower cut-off grade for our K.Hill resource with the obvious corresponding impacts on the resource size.”

......

Quelle: https://www.goldseiten.de/artikel/412958--Giyani-Receives-Po…

L234

Giyani Announces Private Placement Financing

https://stockhouse.com/news/press-releases/2019/04/04/giyani…

L234

https://stockhouse.com/news/press-releases/2019/04/04/giyani…

L234

GIYANIMETALS plans to obtain premium prices for its manganese in the battery electric vehicle market

10.03.2019, @McNugget

https://ceo.ca/@McNugget/wdg-giyanimetals-plans-to-obtain-pr…

L234

10.03.2019, @McNugget

https://ceo.ca/@McNugget/wdg-giyanimetals-plans-to-obtain-pr…

L234

Giyani Announces Stock Ticker Symbol Change on TSXV to “EMM”

...

Robin Birchall, CEO of Giyani commented:

“The new symbol was selected to be indicative of the Company’s plan to become a producer of high purity electrolytic manganese metal (EMM) for the battery electric vehicle market.”

...

Quelle: https://stockhouse.com/news/press-releases/2019/03/07/giyani…

L234

...

Robin Birchall, CEO of Giyani commented:

“The new symbol was selected to be indicative of the Company’s plan to become a producer of high purity electrolytic manganese metal (EMM) for the battery electric vehicle market.”

...

Quelle: https://stockhouse.com/news/press-releases/2019/03/07/giyani…

L234

Giyani ist nicht auf der kommenden PDAC (03.-06.03.2019)???

https://www.pdac.ca/convention/exhibits/investors-exchange/e…" target="_blank" rel="nofollow ugc noopener">https://www.pdac.ca/convention/exhibits/investors-exchange/e…

Sehr seltsam!

Anbei ein interessanter Beitrag aus Stockhouse vom User "wisly":

Interesting insights

Thought I would share some insights I have learned in a recent discussion with the management team. My discussion was in reference to a research report from Canaccord who initiated coverage with a SPECULATIVE BUY rating on a company that is doing the same thing (https://dgwa.org/wp-content/uploads/2019/02/CG-EMN.pdf).

Very useful report to help understand the plan that the WDG team has for Giyani.

WDG is doing the same thing but here are some of the key advantages that I learned from my discussion with them:

1. WDG DO NOT need to calcine their ore

2. Their leach tests show recoveries of 85%

3. Their grade is almost 5 times higher than EMN’s

4. Their contained Mn metal is about 1/3 of EMN’s in their first deposit. They also have a second deposit expected to be similar but 30-50% larger. In addition, they have another several thousand square kilometres of open ground within less than 100kms of their first two deposits.

5. They have the same infrastructure as the Czech republic, and considerably more friendly mining regime.

This all leads to lower opex and much lower capex due to grade and non-carbonate ores.

All of this will have concrete numbers applied to them in the next 2-3 months as they complete their PEA.

Good luck to everyone!

Quelle: https://stockhouse.com/companies/bullboard?symbol=v.wdg&post…

L234

https://www.pdac.ca/convention/exhibits/investors-exchange/e…" target="_blank" rel="nofollow ugc noopener">https://www.pdac.ca/convention/exhibits/investors-exchange/e…

Sehr seltsam!

Anbei ein interessanter Beitrag aus Stockhouse vom User "wisly":

Interesting insights

Thought I would share some insights I have learned in a recent discussion with the management team. My discussion was in reference to a research report from Canaccord who initiated coverage with a SPECULATIVE BUY rating on a company that is doing the same thing (https://dgwa.org/wp-content/uploads/2019/02/CG-EMN.pdf).

Very useful report to help understand the plan that the WDG team has for Giyani.

WDG is doing the same thing but here are some of the key advantages that I learned from my discussion with them:

1. WDG DO NOT need to calcine their ore

2. Their leach tests show recoveries of 85%

3. Their grade is almost 5 times higher than EMN’s

4. Their contained Mn metal is about 1/3 of EMN’s in their first deposit. They also have a second deposit expected to be similar but 30-50% larger. In addition, they have another several thousand square kilometres of open ground within less than 100kms of their first two deposits.

5. They have the same infrastructure as the Czech republic, and considerably more friendly mining regime.

This all leads to lower opex and much lower capex due to grade and non-carbonate ores.

All of this will have concrete numbers applied to them in the next 2-3 months as they complete their PEA.

Good luck to everyone!

Quelle: https://stockhouse.com/companies/bullboard?symbol=v.wdg&post…

L234