Altai Resources - Gas in Quebec - 500 Beiträge pro Seite

eröffnet am 15.10.17 15:04:42 von

neuester Beitrag 01.01.19 12:43:23 von

neuester Beitrag 01.01.19 12:43:23 von

Beiträge: 23

ID: 1.264.245

ID: 1.264.245

Aufrufe heute: 0

Gesamt: 954

Gesamt: 954

Aktive User: 0

ISIN: CA02136K1084 · WKN: 893520 · Symbol: ATI

0,0550

CAD

-8,33 %

-0,0050 CAD

Letzter Kurs 25.04.24 TSX Venture

Neuigkeiten

27.11.23 · globenewswire |

24.10.23 · globenewswire |

31.05.23 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4500 | +15,99 | |

| 7,3400 | +15,77 | |

| 9,6400 | +13,95 | |

| 7,9500 | +13,25 | |

| 1,7900 | +11,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 325,00 | -9,97 | |

| 0,9400 | -10,48 | |

| 4,3100 | -18,98 | |

| 1,3501 | -20,58 | |

| 9,3500 | -28,02 |

Hallo,

ich möchte hier die Altai Resources Inc. vorstellen.

Altai ist in erster Linie ein Gas-explorer.

Die Hauptproperty ist die Sorel-Trois Rivieres gas property in den St. Lawrance Lowlands in Quebec.

Diese property wurde in 2008 erworben.

Die news hierzu ist zu finden auf einer sehr ausführlichen Auflistung aller news auf der homepage von Altai:

http://www.altairesources.com/press_releases.aspx

Hier dann die news vom 14.10.2008.

Generell die homepage, ist ja eigentlich dann klar:

http://www.altairesources.com

ich möchte hier die Altai Resources Inc. vorstellen.

Altai ist in erster Linie ein Gas-explorer.

Die Hauptproperty ist die Sorel-Trois Rivieres gas property in den St. Lawrance Lowlands in Quebec.

Diese property wurde in 2008 erworben.

Die news hierzu ist zu finden auf einer sehr ausführlichen Auflistung aller news auf der homepage von Altai:

http://www.altairesources.com/press_releases.aspx

Hier dann die news vom 14.10.2008.

Generell die homepage, ist ja eigentlich dann klar:

http://www.altairesources.com

2011 wurde von seiten der Provinzregierung von Quebec Gas- und Ölbohrtätogkeiten in der Region untersagt:

"Altai Resources Inc. (ATI, TSX VENTURE; US SEC Rule 12g3-2(b) File # 82-2950) (“Altai” and the “Company”) notes that Bill 18 (2011, Chapter 13) has been recently adopted in the Quebec National Assembly to unilaterally revoke without compensation all the oil and gas exploration permits located in the St Lawrence River, West of Anticosti Island.

..."

In news vom 15.07.2011:

http://www.altairesources.com/press_releases.aspx

"Altai Resources Inc. (ATI, TSX VENTURE; US SEC Rule 12g3-2(b) File # 82-2950) (“Altai” and the “Company”) notes that Bill 18 (2011, Chapter 13) has been recently adopted in the Quebec National Assembly to unilaterally revoke without compensation all the oil and gas exploration permits located in the St Lawrence River, West of Anticosti Island.

..."

In news vom 15.07.2011:

http://www.altairesources.com/press_releases.aspx

Dann news vom 21.09.2017, also letztem Monat:

http://www.altairesources.com/press_releases.aspx

"Altai Resources Inc. (ATI, TSX VENTURE; US SEC Rule 12g3-2(b) File # 82-2950) (“Altai” or the “Company”) notes that the Ministry of Energy and Natural Resources in Quebec has published on September 20, 2017 the draft regulations to govern oil and gas activities in the province and for the implementation of the Petroleum Resources Act enacted in December 2016. The Company understands that the draft regulations may be implemented with or without amendments after forty-five days of public consultation.

..."

Heißt soviel wie: es wurden nun wohl neue Vorgaben geschaffen zur Regulierung der Exploartionstätigkeiten, mit anderen Worten - Exploration wird dann unter Beachtung dieser Vorgaben von seiten der Gesetzgeber wieder erlaubt sein.

Das wäre nach obiger Lesart der 4. November.

http://www.altairesources.com/press_releases.aspx

"Altai Resources Inc. (ATI, TSX VENTURE; US SEC Rule 12g3-2(b) File # 82-2950) (“Altai” or the “Company”) notes that the Ministry of Energy and Natural Resources in Quebec has published on September 20, 2017 the draft regulations to govern oil and gas activities in the province and for the implementation of the Petroleum Resources Act enacted in December 2016. The Company understands that the draft regulations may be implemented with or without amendments after forty-five days of public consultation.

..."

Heißt soviel wie: es wurden nun wohl neue Vorgaben geschaffen zur Regulierung der Exploartionstätigkeiten, mit anderen Worten - Exploration wird dann unter Beachtung dieser Vorgaben von seiten der Gesetzgeber wieder erlaubt sein.

Das wäre nach obiger Lesart der 4. November.

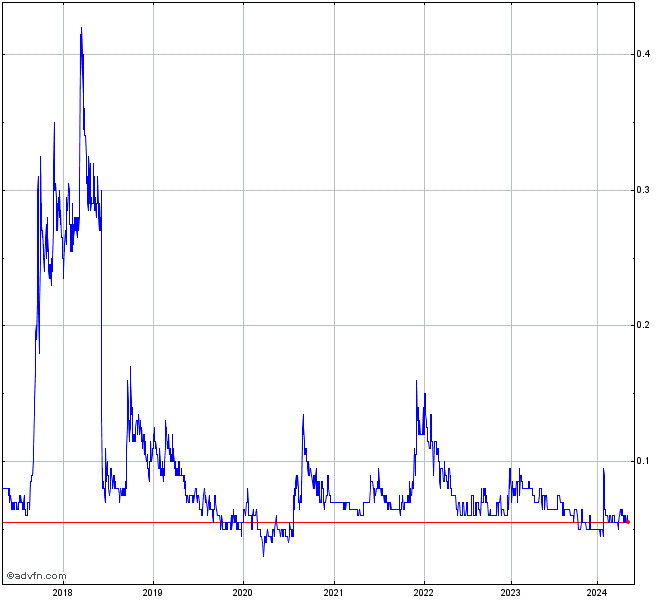

Antwort auf Beitrag Nr.: 55.956.336 von praesens am 15.10.17 15:13:24Hier der 7-Jahres-Chart.

Er zeigt den Einbruch 2011.

Und den aktuellen Wideranstieg seit September.

Er zeigt den Einbruch 2011.

Und den aktuellen Wideranstieg seit September.

Die Spekulation hier ist eine weitere Kurssteigerung von Altai (aktuell 25 cent) in Folge der Wiederaufnahme der Tätigkeiten auf Sorel-Trois Rivieres.

Unterlegt auch von der stärkeren Beachtung die natural gas zur Stromerzeugung in den letzten Jahren erfahren hat als sauberere Lösung im Vergleich zu Kohle und somit einer Art Zwischenschritt während des weiteren Ausbaus der erneuerbaren Energien. Ganz schlicht ausgedrückt.

Hierzu ein Artikel:

https://www.forbes.com/sites/jamestaylor/2017/01/10/natural-…

"Natural Gas Is The Future Of Energy, And It's Not Even Close

James Taylor , Contributor

I am president of the Spark of Freedom Foundation.

Opinions expressed by Forbes Contributors are their own.

Natural gas is the wave of the future in U.S. and global electricity production, with no other power source even close to matching natural gas’s potential over the next few decades. The United States is in perfect position to take advantage of this if American policymakers will remove government obstacles to natural gas production and export.

Michael Bastach points out in the Daily Caller that coal is likely to maintain its status as the global leader of electricity production through 2040. The reason for this is most countries – and especially rapidly developing countries – will continue to take advantage of the least expensive available power source. That energy source is coal.

BERLIN, GERMANY - DECEMBER 12: The natural-gas fueled Heizkraftwerk Berlin-Mitte power plant of Swedish energy company Vattenfall stands on December 12, 2016 in Berlin, Germany. The modern plant creates both heat for residential and office buildings in the city center as well as electricity. (Photo by Sean Gallup/Getty Images)

However, a closer look at the numbers Bastach cites – taken from the ExxonMobil 2017 Outlook for Energy – shows that while coal will remain the leading power source, its share of global electricity production will fall from 40 percent today to 30 percent in 2030. This is because there is growing pressure in many countries to put the brakes on debilitating air pollution. That is where natural gas comes in. The Outlook for Energy anticipates dramatic growth in global electricity production, with natural gas providing the lion’s share of that growth. Coal will remain king, but it will lose substantial market share to natural gas.

Natural gas is an on-demand energy source that substantially reduces air pollution relative to coal. The Outlook for Energy projects a 45 percent increase in global natural gas production and use by 2040. Also, although the Outlook for Energy projects coal will hold a narrow edge over natural gas in terms of electricity production, natural gas will surpass coal by 2040 in terms of all energy uses combined. Coal is more confined to electricity production, whereas natural gas is valuable in a wider range of energy uses.

In the United States, natural gas is cost-competitive with coal. The global market is a different story. Natural gas has gained cost parity with coal in the United States because of our abundant natural gas resources and technological advances related to fracking. Globally, however, natural gas is not as abundant, nor are fracking technologies and production infrastructure on a par with those in the United States. The anticipated growth in global natural gas power is tied to its value reducing air pollution rather than an anticipated cost parity with coal.

Even though American energy companies can produce natural gas more cost-effectively than other nations, the ability of American energy companies to export natural gas is currently limited. Our federal government and politically blue coastal states foolishly impede the construction of natural gas export facilities. Build export facilities and American companies will be able to take advantage of the projected increase in global natural gas usage.

Exporting natural gas will not come at the expense of American coal production or American coal jobs. China currently produces four times as much coal as America. Also, Australia, Indonesia, and Russia each dwarf America in terms of coal exports. Rather than American natural gas exports cannibalizing American coal exports, American natural gas exports will supplant Chinese, Australian, Indonesian, and Russian coal.

The global growth in natural gas usage forecast in the Outlook for Energy is expected to be met by more natural gas production and export from Russia, China, and other nations. This can and should change. Allow lower-priced American natural gas to compete in this growing global market and America will reap the economic windfall.

American natural gas is so abundant and inexpensive that natural gas exports will do little to constrict supply here in the United States. Foreign money will pour into the United States as other nations purchase American natural gas, and Americans will still pay low prices here at home.

At the federal level, the Trump administration and the new Congress should reverse restrictive natural gas policy that recently blocked construction of a large new export facility planned in the state of Washington. At the state level, policymakers in blue states should recognize that natural gas exports not only bring revenue to their states and our nation, but natural gas exports will also improve global air quality. If coastal blue states fail to recognize this and fail to eliminate export restrictions, Congress can and should act to eliminate the ability of local obstructionists to impede interstate commerce. As broadly as courts have interpreted the Interstate Commerce clause to give liberal federal government policies preemption over state laws, a more conservative Congress and Trump administration should give the goose the same treatment as the gander. Conservatives should apply these same legal precedents to end coastal extremists shutting down interstate and international commerce opportunities from states with abundant natural gas production."

Unterlegt auch von der stärkeren Beachtung die natural gas zur Stromerzeugung in den letzten Jahren erfahren hat als sauberere Lösung im Vergleich zu Kohle und somit einer Art Zwischenschritt während des weiteren Ausbaus der erneuerbaren Energien. Ganz schlicht ausgedrückt.

Hierzu ein Artikel:

https://www.forbes.com/sites/jamestaylor/2017/01/10/natural-…

"Natural Gas Is The Future Of Energy, And It's Not Even Close

James Taylor , Contributor

I am president of the Spark of Freedom Foundation.

Opinions expressed by Forbes Contributors are their own.

Natural gas is the wave of the future in U.S. and global electricity production, with no other power source even close to matching natural gas’s potential over the next few decades. The United States is in perfect position to take advantage of this if American policymakers will remove government obstacles to natural gas production and export.

Michael Bastach points out in the Daily Caller that coal is likely to maintain its status as the global leader of electricity production through 2040. The reason for this is most countries – and especially rapidly developing countries – will continue to take advantage of the least expensive available power source. That energy source is coal.

BERLIN, GERMANY - DECEMBER 12: The natural-gas fueled Heizkraftwerk Berlin-Mitte power plant of Swedish energy company Vattenfall stands on December 12, 2016 in Berlin, Germany. The modern plant creates both heat for residential and office buildings in the city center as well as electricity. (Photo by Sean Gallup/Getty Images)

However, a closer look at the numbers Bastach cites – taken from the ExxonMobil 2017 Outlook for Energy – shows that while coal will remain the leading power source, its share of global electricity production will fall from 40 percent today to 30 percent in 2030. This is because there is growing pressure in many countries to put the brakes on debilitating air pollution. That is where natural gas comes in. The Outlook for Energy anticipates dramatic growth in global electricity production, with natural gas providing the lion’s share of that growth. Coal will remain king, but it will lose substantial market share to natural gas.

Natural gas is an on-demand energy source that substantially reduces air pollution relative to coal. The Outlook for Energy projects a 45 percent increase in global natural gas production and use by 2040. Also, although the Outlook for Energy projects coal will hold a narrow edge over natural gas in terms of electricity production, natural gas will surpass coal by 2040 in terms of all energy uses combined. Coal is more confined to electricity production, whereas natural gas is valuable in a wider range of energy uses.

In the United States, natural gas is cost-competitive with coal. The global market is a different story. Natural gas has gained cost parity with coal in the United States because of our abundant natural gas resources and technological advances related to fracking. Globally, however, natural gas is not as abundant, nor are fracking technologies and production infrastructure on a par with those in the United States. The anticipated growth in global natural gas power is tied to its value reducing air pollution rather than an anticipated cost parity with coal.

Even though American energy companies can produce natural gas more cost-effectively than other nations, the ability of American energy companies to export natural gas is currently limited. Our federal government and politically blue coastal states foolishly impede the construction of natural gas export facilities. Build export facilities and American companies will be able to take advantage of the projected increase in global natural gas usage.

Exporting natural gas will not come at the expense of American coal production or American coal jobs. China currently produces four times as much coal as America. Also, Australia, Indonesia, and Russia each dwarf America in terms of coal exports. Rather than American natural gas exports cannibalizing American coal exports, American natural gas exports will supplant Chinese, Australian, Indonesian, and Russian coal.

The global growth in natural gas usage forecast in the Outlook for Energy is expected to be met by more natural gas production and export from Russia, China, and other nations. This can and should change. Allow lower-priced American natural gas to compete in this growing global market and America will reap the economic windfall.

American natural gas is so abundant and inexpensive that natural gas exports will do little to constrict supply here in the United States. Foreign money will pour into the United States as other nations purchase American natural gas, and Americans will still pay low prices here at home.

At the federal level, the Trump administration and the new Congress should reverse restrictive natural gas policy that recently blocked construction of a large new export facility planned in the state of Washington. At the state level, policymakers in blue states should recognize that natural gas exports not only bring revenue to their states and our nation, but natural gas exports will also improve global air quality. If coastal blue states fail to recognize this and fail to eliminate export restrictions, Congress can and should act to eliminate the ability of local obstructionists to impede interstate commerce. As broadly as courts have interpreted the Interstate Commerce clause to give liberal federal government policies preemption over state laws, a more conservative Congress and Trump administration should give the goose the same treatment as the gander. Conservatives should apply these same legal precedents to end coastal extremists shutting down interstate and international commerce opportunities from states with abundant natural gas production."

Hier eine sehr detailierte Beschreibung der property:

http://www.altairesources.com/canada_sorel.aspx

http://www.altairesources.com/canada_sorel.aspx

Angaben zur Firma (Aktienstruktur, Vorstand, Kontaktdaten, ...)

http://www.altairesources.com/page.aspx?id=26

Corporate Profile

Shares traded: TSX VENTURE EXCHANGE

Symbol: ATI

In USA: SEC Rule 12g3-2(b) File No. 82-2950

Common Shares Issued: 55,233,552

Fully-diluted: 56.3 million

Estimated float: 43.3 million

52 week range: High $0.35; low $0.04

Directors and Officers:

Niyazi Kacira, Ph.D.,P. Eng., MBA, FGAC, Director, Chairman and President

Maria Au, MBA, CPA, CGA, Secretary–Treasurer

Didier Pomerleau, MBA, M.Ed., LLM, Ph.D., Director

Mehmet F. Taner, Ph.D., FGAC, Director

Jeffrey S. Ackert, BSc (Hons) Geology, Director

Raymond Savoie, B.A., LI.L, Director

Transfer Agent: Computershare Investor Services Inc.

100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1

Tel: (800) 564-6253 (Toll free in North America only) / (514) 982-7555

Fax: (888) 453 0330 / (416) 263-9394

E-Mail: service@computershare.com

Investor Relations: E-Mail: info@altairesources.com

Website: www.altairesources.com

Maria Au, Altai Resources Inc.

Contact Us:

2550 Victoria Park Avenue

Suite 738

Toronto, Ontario, Canada

M2J 5A9

Tel: (416) 383-1328

Fax: (416) 383-1686

Email: info@altairesources.com

http://www.altairesources.com/page.aspx?id=26

Corporate Profile

Shares traded: TSX VENTURE EXCHANGE

Symbol: ATI

In USA: SEC Rule 12g3-2(b) File No. 82-2950

Common Shares Issued: 55,233,552

Fully-diluted: 56.3 million

Estimated float: 43.3 million

52 week range: High $0.35; low $0.04

Directors and Officers:

Niyazi Kacira, Ph.D.,P. Eng., MBA, FGAC, Director, Chairman and President

Maria Au, MBA, CPA, CGA, Secretary–Treasurer

Didier Pomerleau, MBA, M.Ed., LLM, Ph.D., Director

Mehmet F. Taner, Ph.D., FGAC, Director

Jeffrey S. Ackert, BSc (Hons) Geology, Director

Raymond Savoie, B.A., LI.L, Director

Transfer Agent: Computershare Investor Services Inc.

100 University Avenue, 8th Floor, Toronto, Ontario, Canada, M5J 2Y1

Tel: (800) 564-6253 (Toll free in North America only) / (514) 982-7555

Fax: (888) 453 0330 / (416) 263-9394

E-Mail: service@computershare.com

Investor Relations: E-Mail: info@altairesources.com

Website: www.altairesources.com

Maria Au, Altai Resources Inc.

Contact Us:

2550 Victoria Park Avenue

Suite 738

Toronto, Ontario, Canada

M2J 5A9

Tel: (416) 383-1328

Fax: (416) 383-1686

Email: info@altairesources.com

Sehr informativ auch hinsichtlich der Gesetzeslage und der Beschreibung der property ist die MD&A von August auf sedar .com

Und ... wir reden hier nicht von einem unterfinanzierten Explorer mit aktuellem pp-Bedarf.

Working capital laut MD&A etwas mehr als 3,6 mio $.

Die vergangenen Quartale wurden jeweils Verluste gemacht im niedrigen fünfstelligen Bereich.

Und ... wir reden hier nicht von einem unterfinanzierten Explorer mit aktuellem pp-Bedarf.

Working capital laut MD&A etwas mehr als 3,6 mio $.

Die vergangenen Quartale wurden jeweils Verluste gemacht im niedrigen fünfstelligen Bereich.

Schulden ca. 260.000 $ laut Halbjahresbericht von August.

Interessant - Umsatz in D über tradegate.

Also ich war´s nicht ...

Gruß, praesens

Also ich war´s nicht ...

Gruß, praesens

Antwort auf Beitrag Nr.: 55.956.456 von praesens am 15.10.17 16:01:01Quebec Oil and Gas Conference am 29. Oktober in Montreal:

http://www.apgq-qoga.com/en/conference-2017-2/

"Representatives of the industry in Quebec will be present, as well as those from other parts of Canada, the United States, and Europe. This year, the QOGA will have the pleasure of welcoming Pierre Arcand, Quebec’s Minister of Energy and Natural Resources, as the keynote speaker at the conference"

"We have an excellent group coming this year. SNC Lavelin, Schlumberger, GE, Baker Hughes, Precision Drilling and others are coming specifically to explore the future for Quebec Clean Gas."

http://www.apgq-qoga.com/en/conference-2017-2/

"Representatives of the industry in Quebec will be present, as well as those from other parts of Canada, the United States, and Europe. This year, the QOGA will have the pleasure of welcoming Pierre Arcand, Quebec’s Minister of Energy and Natural Resources, as the keynote speaker at the conference"

"We have an excellent group coming this year. SNC Lavelin, Schlumberger, GE, Baker Hughes, Precision Drilling and others are coming specifically to explore the future for Quebec Clean Gas."

... und aus wikipedia:

https://en.wikipedia.org/wiki/Utica_Shale

"Oil and gas

The Utica shale is a major source of tight gas in Quebec, and is rapidly becoming so in Ohio.

Quebec

Drilling and producing from the Utica Shale began in 2006 in Quebec, focusing on an area south of the St. Lawrence River between Montreal and Quebec City. Interest has grown in the region since Denver-based Forest Oil Corp. announced a significant discovery there after testing two vertical wells. Forest Oil said its Quebec assets may hold as much as four trillion cubic feet of gas reserves, and that the Utica shale has similar rock properties to the Barnett shale in Texas.

Forest Oil, which has several junior partners in the region, has drilled both vertical and horizontal wells. Calgary-based Talisman Energy has drilled five vertical Utica wells, and began drilling two horizontal Utica wells in late 2009 with its partner Questerre Energy, which holds under lease more than 1 million gross acres of land in the region. Other companies in the play are Quebec-based Gastem and Calgary-based Canbriam Energy.

The Utica Shale in Quebec potentially holds 4×1012 cu ft (110×109 m3) at production rates of 1×106 cu ft (28,000 m3) per day[4][5] From 2006 through 2009 24 wells, both vertical and horizontal, were drilled to test the Utica. Positive gas flow test results were reported, although none of the wells were producing at the end of 2009.[6] Gastem, one of the Utica shale producers, took its Utica Shale expertise to drill across the border in New York state.[7]

The Province of Quebec imposed a moratorium on hydraulic fracturing in March 2012.[8]

..."

https://en.wikipedia.org/wiki/Utica_Shale

"Oil and gas

The Utica shale is a major source of tight gas in Quebec, and is rapidly becoming so in Ohio.

Quebec

Drilling and producing from the Utica Shale began in 2006 in Quebec, focusing on an area south of the St. Lawrence River between Montreal and Quebec City. Interest has grown in the region since Denver-based Forest Oil Corp. announced a significant discovery there after testing two vertical wells. Forest Oil said its Quebec assets may hold as much as four trillion cubic feet of gas reserves, and that the Utica shale has similar rock properties to the Barnett shale in Texas.

Forest Oil, which has several junior partners in the region, has drilled both vertical and horizontal wells. Calgary-based Talisman Energy has drilled five vertical Utica wells, and began drilling two horizontal Utica wells in late 2009 with its partner Questerre Energy, which holds under lease more than 1 million gross acres of land in the region. Other companies in the play are Quebec-based Gastem and Calgary-based Canbriam Energy.

The Utica Shale in Quebec potentially holds 4×1012 cu ft (110×109 m3) at production rates of 1×106 cu ft (28,000 m3) per day[4][5] From 2006 through 2009 24 wells, both vertical and horizontal, were drilled to test the Utica. Positive gas flow test results were reported, although none of the wells were producing at the end of 2009.[6] Gastem, one of the Utica shale producers, took its Utica Shale expertise to drill across the border in New York state.[7]

The Province of Quebec imposed a moratorium on hydraulic fracturing in March 2012.[8]

..."

Mal was auf französisch - hat´s ja auch nicht oft hier

Kurz gefaßt, der Zeitraum für Gespräche / Einwendungen vorzubringen bezüglich der Freigabe der Explorationstätigkeiten wurde um 35 Tage verlängert bis zum 09.12. Hauptgrund ist, daß der Zeitraum bis 04.11. aufgrund zeitgleich stattfindender Wahlen als zu kurz gefaßt erachtet wurde:

http://www.newswire.ca/fr/news-releases/reglements-sur-les-h…

Règlements sur les hydrocarbures - Le ministre Pierre Moreau prolonge la période de prépublication de 35 jours

Source

Cabinet du ministre de l'Énergie et des Ressources naturelles

Oct. 18, 2017, 20:47 ET

Partager cet article

QUÉBEC, le 18 oct. 2017 /CNW Telbec/ - Le ministre de l'Énergie et des Ressources naturelles, ministre responsable du Plan Nord, M. Pierre Moreau, a indiqué qu'il prolonge de 35 jours la période initialement prévue de prépublication des règlements de mise en œuvre de la Loi sur les hydrocarbures. La population avait jusqu'au 4 novembre pour présenter ses commentaires sur les intentions du gouvernement d'encadrer l'exploration et l'exploitation des hydrocarbures. Cette prolongation permettra aux personnes et groupes intéressés de commenter les projets jusqu'au 9 décembre 2017.

Les quatre projets de règlements sont composés de plus de 800 articles qui nécessitent, de la part des différents intéressés, une analyse approfondie et globale. Ils soulèvent plusieurs enjeux qui interpellent les ministères et organismes, les entreprises, les citoyens, les divers groupes d'intérêts et, tout particulièrement, le milieu municipal.

« C'est dans une perspective de concertation et de collaboration avec les municipalités que nous prolongeons la période de prépublication afin de permettre notamment aux membres des conseils municipaux, qui seront élus le 5 novembre prochain, et aux citoyens qui le désirent, de se prononcer sur ces règlements. Les municipalités sont des gouvernements de proximité que nous avons reconnus et nous poursuivrons le travail avec eux. Cette prolongation leur donnera le temps suffisant pour formuler leurs commentaires, ce que je juge important considérant les impacts qu'auront ces règlements pour les citoyens et les générations futures ».

Pierre Moreau, ministre de l'Énergie et des Ressources naturelles, ministre responsable du Plan Nord

Le ministre a également fait savoir qu'à titre de ministre responsable de la Gaspésie-Îles-de-la-Madeleine et considérant que la région est particulièrement touchée par cet enjeu, il a déjà convenu avec le président de la Table des préfets de la Gaspésie-Îles-de-la-Madeleine qu'une rencontre avec les élus de la Gaspésie sera organisée au cours des prochaines semaines.

Fait saillant :

La Politique énergétique 2030 présente une vision rassembleuse et des cibles ambitieuses proposées par le gouvernement pour opérer une transformation majeure du profil énergétique au Québec.

Liens connexes :

Pour plus d'information sur le Plan d'action 2013-2020 sur les changements climatiques, consultez le site http://www.mddelcc.gouv.qc.ca/changementsclimatiques/plan-ac…

Pour plus d'information sur la Politique énergétique 2030 du Québec, consultez le site politiqueenergetique.gouv.qc.ca.

SOURCE Cabinet du ministre de l'Énergie et des Ressources naturelles

Renseignements : Catherine Poulin, Attachée de presse, Cabinet du ministre de l'Énergie et des Ressources naturelles, ministre responsable du Plan Nord, Tél. : 418 643-7295

Kurz gefaßt, der Zeitraum für Gespräche / Einwendungen vorzubringen bezüglich der Freigabe der Explorationstätigkeiten wurde um 35 Tage verlängert bis zum 09.12. Hauptgrund ist, daß der Zeitraum bis 04.11. aufgrund zeitgleich stattfindender Wahlen als zu kurz gefaßt erachtet wurde:

http://www.newswire.ca/fr/news-releases/reglements-sur-les-h…

Règlements sur les hydrocarbures - Le ministre Pierre Moreau prolonge la période de prépublication de 35 jours

Source

Cabinet du ministre de l'Énergie et des Ressources naturelles

Oct. 18, 2017, 20:47 ET

Partager cet article

QUÉBEC, le 18 oct. 2017 /CNW Telbec/ - Le ministre de l'Énergie et des Ressources naturelles, ministre responsable du Plan Nord, M. Pierre Moreau, a indiqué qu'il prolonge de 35 jours la période initialement prévue de prépublication des règlements de mise en œuvre de la Loi sur les hydrocarbures. La population avait jusqu'au 4 novembre pour présenter ses commentaires sur les intentions du gouvernement d'encadrer l'exploration et l'exploitation des hydrocarbures. Cette prolongation permettra aux personnes et groupes intéressés de commenter les projets jusqu'au 9 décembre 2017.

Les quatre projets de règlements sont composés de plus de 800 articles qui nécessitent, de la part des différents intéressés, une analyse approfondie et globale. Ils soulèvent plusieurs enjeux qui interpellent les ministères et organismes, les entreprises, les citoyens, les divers groupes d'intérêts et, tout particulièrement, le milieu municipal.

« C'est dans une perspective de concertation et de collaboration avec les municipalités que nous prolongeons la période de prépublication afin de permettre notamment aux membres des conseils municipaux, qui seront élus le 5 novembre prochain, et aux citoyens qui le désirent, de se prononcer sur ces règlements. Les municipalités sont des gouvernements de proximité que nous avons reconnus et nous poursuivrons le travail avec eux. Cette prolongation leur donnera le temps suffisant pour formuler leurs commentaires, ce que je juge important considérant les impacts qu'auront ces règlements pour les citoyens et les générations futures ».

Pierre Moreau, ministre de l'Énergie et des Ressources naturelles, ministre responsable du Plan Nord

Le ministre a également fait savoir qu'à titre de ministre responsable de la Gaspésie-Îles-de-la-Madeleine et considérant que la région est particulièrement touchée par cet enjeu, il a déjà convenu avec le président de la Table des préfets de la Gaspésie-Îles-de-la-Madeleine qu'une rencontre avec les élus de la Gaspésie sera organisée au cours des prochaines semaines.

Fait saillant :

La Politique énergétique 2030 présente une vision rassembleuse et des cibles ambitieuses proposées par le gouvernement pour opérer une transformation majeure du profil énergétique au Québec.

Liens connexes :

Pour plus d'information sur le Plan d'action 2013-2020 sur les changements climatiques, consultez le site http://www.mddelcc.gouv.qc.ca/changementsclimatiques/plan-ac…

Pour plus d'information sur la Politique énergétique 2030 du Québec, consultez le site politiqueenergetique.gouv.qc.ca.

SOURCE Cabinet du ministre de l'Énergie et des Ressources naturelles

Renseignements : Catherine Poulin, Attachée de presse, Cabinet du ministre de l'Énergie et des Ressources naturelles, ministre responsable du Plan Nord, Tél. : 418 643-7295

Antwort auf Beitrag Nr.: 55.991.916 von praesens am 20.10.17 14:45:16Interpretiere ich mal als: gibt noch Zeit zum Akkumulieren.

Gruß, praesens

Gruß, praesens

https://ca.finance.yahoo.com/news/jonathan-mastromattei-open…

"From Jonathan Mastromattei an Open Letter to Board of Directors of Altai Resources Inc.

[CNW Group]

CNW GroupOctober 23, 2017

OTTAWA, Oct. 23, 2017 /CNW/ - Dear Board of Directors,

I first of all would like to applaud how the Board and Management has navigated Altai Resources Inc. "Altai" (TSXV:ATI.V - News) through the difficult period of the past six years since the Quebec government imposed their moratorium on oil and gas exploration in 2011. In essence, from that period Altai was essentially placed into a dormant stage with the sole intent of conserving liquidity and working capital. In addition, I do applaud that the CEO has not taken a salary during this period and there have not been any dilutive shares issued during this period.

In light of the above, over the past three years as a long-term shareholder of Altai, I have openly attempted to engage Management on numerous occasions with the sole intent of surfacing and creating additional shareholder value for all shareholders. For the record, I have been a shareholder in Altai for over 3 years, and currently own 5.0% of the public common share float. Unfortunately, my efforts have come to no avail.

At the current time, with the recent developments of Quebec's Bill 106 passing and preliminary new regulations on exploration forthcoming the Quebec government's intent to begin some form of oil and gas production has changed the landscape in Quebec for the positive. In light of this, there isn't any better time than now for Altai to awaken to the current realities and act in manner that clearly reflects the best interests of all shareholders. I am disclosing that I have gathered the support from a Group of additional 25 independent shareholders both from North America and Europe who collectively own 4.4 million common shares as well. In summary, together we currently control 15.2% of the public common share float.

I, Jonathan Mastromattei, would like to be given the opportunity to be nominated for a board seat in the upcoming 2018 Annual General Meeting. In addition, I have highlighted a list of well-intentioned proposals that I feel will be in the best interests of all shareholders, management and company insiders. I, along with the Group "We", believe that these proposals will allow the company to trade at comparable multiples to its peers in the Quebec oil and gas exploration and production space.

Altai needs to update their website and make ever effort to post a new corporate presentation.

Since the Bill 106 release, multiple Quebec based oil and gas companies have stated their future plans for 2018. We would like Altai as well to communicate with shareholders on what their plan is with the company's Quebec natural gas property.

We would like the company to provide further detail on its' conventional gas acreage versus its' non-conventional acreage.

In past years, Altai has spent over 25 million dollars on its Sorel Trois-Rivieres natural gas property and since the moratorium these properties have been written down to one dollar. Every year since the write down, Management has indicated in their Management Discussion and Analysis report filings that the Sorel Trois-Rivieres properties are still a promising project for the future. Furthermore, that the value of the impaired assets will be re-evaluated when applicable regulations and various details of Bill 106 are known in the future.

We believe now is exactly the appropriate time for Management to engage with an independent petroleum consultant and evaluator of all of their properties to assess their current true value and potential for the future development. We believe taking these actions now may result in a material and significant mark up of understated assets on Altai's balance sheet.

We request Altai common shares become a dual-listed security on the OSLO Axess junior exchange. We are aware that the TSX Venture Exchange has a Memorandum of Understanding agreement with the Oslo Axess. In this agreement, there is it relatively easy process to become dual-listed and also in a cost-effective manner. In fact, several TSX Venture companies have been successfully dual-listed in Canada and in Norway. The Oslo Axess would facilitate entry into a much larger, separate and additionally liquid pool of potential investors and capital markets access. A listing on the Oslo Axess would without question provide a wider shareholder base for Altai. Further to note, both the TXS Venture and OSLO Axess exchanges are recognized for their strong representation in the resource sectors of the economy. In Norway, similar to Canada, there is significant demand and interest in the development of the energy sector. Lastly, based on my institutional data I have estimated that approximately 30% of the Altai public common share float is now owned by investors in the Scandinavian region. A dual-listing will clearly provide Scandinavian investors further liquidity and also easier access for current and potential investors to continue to invest in Altai's future.

In summary, Altai insiders and management own approximately 21% of the total common shares outstanding. And I want to equivocally state that at the current time this is a friendly open letter to once again engage in discussions with the Board and Management in an attempt to surface and create additional shareholder value for all shareholders. I, Jonathan Mastromattei, and the Group are looking out for the best interests of all shareholders in Altai Resources Inc. We strongly ask the Board to take these proposals into consideration and We look forward to working with the company in the future.

SOURCE Jonathan Mastromattei"

"From Jonathan Mastromattei an Open Letter to Board of Directors of Altai Resources Inc.

[CNW Group]

CNW GroupOctober 23, 2017

OTTAWA, Oct. 23, 2017 /CNW/ - Dear Board of Directors,

I first of all would like to applaud how the Board and Management has navigated Altai Resources Inc. "Altai" (TSXV:ATI.V - News) through the difficult period of the past six years since the Quebec government imposed their moratorium on oil and gas exploration in 2011. In essence, from that period Altai was essentially placed into a dormant stage with the sole intent of conserving liquidity and working capital. In addition, I do applaud that the CEO has not taken a salary during this period and there have not been any dilutive shares issued during this period.

In light of the above, over the past three years as a long-term shareholder of Altai, I have openly attempted to engage Management on numerous occasions with the sole intent of surfacing and creating additional shareholder value for all shareholders. For the record, I have been a shareholder in Altai for over 3 years, and currently own 5.0% of the public common share float. Unfortunately, my efforts have come to no avail.

At the current time, with the recent developments of Quebec's Bill 106 passing and preliminary new regulations on exploration forthcoming the Quebec government's intent to begin some form of oil and gas production has changed the landscape in Quebec for the positive. In light of this, there isn't any better time than now for Altai to awaken to the current realities and act in manner that clearly reflects the best interests of all shareholders. I am disclosing that I have gathered the support from a Group of additional 25 independent shareholders both from North America and Europe who collectively own 4.4 million common shares as well. In summary, together we currently control 15.2% of the public common share float.

I, Jonathan Mastromattei, would like to be given the opportunity to be nominated for a board seat in the upcoming 2018 Annual General Meeting. In addition, I have highlighted a list of well-intentioned proposals that I feel will be in the best interests of all shareholders, management and company insiders. I, along with the Group "We", believe that these proposals will allow the company to trade at comparable multiples to its peers in the Quebec oil and gas exploration and production space.

Altai needs to update their website and make ever effort to post a new corporate presentation.

Since the Bill 106 release, multiple Quebec based oil and gas companies have stated their future plans for 2018. We would like Altai as well to communicate with shareholders on what their plan is with the company's Quebec natural gas property.

We would like the company to provide further detail on its' conventional gas acreage versus its' non-conventional acreage.

In past years, Altai has spent over 25 million dollars on its Sorel Trois-Rivieres natural gas property and since the moratorium these properties have been written down to one dollar. Every year since the write down, Management has indicated in their Management Discussion and Analysis report filings that the Sorel Trois-Rivieres properties are still a promising project for the future. Furthermore, that the value of the impaired assets will be re-evaluated when applicable regulations and various details of Bill 106 are known in the future.

We believe now is exactly the appropriate time for Management to engage with an independent petroleum consultant and evaluator of all of their properties to assess their current true value and potential for the future development. We believe taking these actions now may result in a material and significant mark up of understated assets on Altai's balance sheet.

We request Altai common shares become a dual-listed security on the OSLO Axess junior exchange. We are aware that the TSX Venture Exchange has a Memorandum of Understanding agreement with the Oslo Axess. In this agreement, there is it relatively easy process to become dual-listed and also in a cost-effective manner. In fact, several TSX Venture companies have been successfully dual-listed in Canada and in Norway. The Oslo Axess would facilitate entry into a much larger, separate and additionally liquid pool of potential investors and capital markets access. A listing on the Oslo Axess would without question provide a wider shareholder base for Altai. Further to note, both the TXS Venture and OSLO Axess exchanges are recognized for their strong representation in the resource sectors of the economy. In Norway, similar to Canada, there is significant demand and interest in the development of the energy sector. Lastly, based on my institutional data I have estimated that approximately 30% of the Altai public common share float is now owned by investors in the Scandinavian region. A dual-listing will clearly provide Scandinavian investors further liquidity and also easier access for current and potential investors to continue to invest in Altai's future.

In summary, Altai insiders and management own approximately 21% of the total common shares outstanding. And I want to equivocally state that at the current time this is a friendly open letter to once again engage in discussions with the Board and Management in an attempt to surface and create additional shareholder value for all shareholders. I, Jonathan Mastromattei, and the Group are looking out for the best interests of all shareholders in Altai Resources Inc. We strongly ask the Board to take these proposals into consideration and We look forward to working with the company in the future.

SOURCE Jonathan Mastromattei"

Antwort auf Beitrag Nr.: 56.006.985 von praesens am 23.10.17 15:20:29Der Kurs hat sich gut entwickelt. Richtig interessant wird es hier aber erst noch - wenn definitiv klar ist, dass in den St. Lawrence Lowands wieder gebohrt werden darf.

In Canada deutet alles darauf hin.

Gruß, praesens

In Canada deutet alles darauf hin.

Gruß, praesens

Antwort auf Beitrag Nr.: 56.295.212 von praesens am 28.11.17 10:42:54Es könnte eine heftige short-Attacke ins Haus stehen ...!

Gruß, praesens

Gruß, praesens

Antwort auf Beitrag Nr.: 56.736.756 von praesens am 16.01.18 23:12:35Startschuss ...!!

Gruß, praesens

Gruß, praesens

Antwort auf Beitrag Nr.: 57.239.221 von praesens am 09.03.18 20:33:22SK 40 cent (+30%).

Antwort auf Beitrag Nr.: 57.240.010 von praesens am 09.03.18 22:08:39Na aber hallo !!!

Halte die Aktie derzeit für unterbewertet. Das Loss Selling ist beendet und in Quebec wollen sie Öl und Gas neuen Schwung verleihen. Könnte in den nächsten 1-2 Monaten hochlaufen. Hatte ja einen heftigen Absturz im Juni zu verzeichnen.

plus.lapresse.ca/screens/d43cfb1b-67e0-4870-b612-486976534704__7C___0.html?utm_medium=Twitter&utm_campaign=Microsite+Share&utm_content=Screen

plus.lapresse.ca/screens/d43cfb1b-67e0-4870-b612-486976534704__7C___0.html?utm_medium=Twitter&utm_campaign=Microsite+Share&utm_content=Screen

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -5,83 | |

| 0,00 | |

| 0,00 | |

| -4,76 | |

| -17,50 | |

| -12,86 | |

| -29,17 | |

| 0,00 | |

| +4,13 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 215 | ||

| 90 | ||

| 76 | ||

| 58 | ||

| 54 | ||

| 36 | ||

| 34 | ||

| 29 | ||

| 27 | ||

| 25 |