Neuer Schwächeanfall beim Bitcoin (Seite 15) | Diskussion im Forum

eröffnet am 04.12.18 16:50:58 von

neuester Beitrag 24.11.23 15:31:39 von

neuester Beitrag 24.11.23 15:31:39 von

Beiträge: 320

ID: 1.293.902

ID: 1.293.902

Aufrufe heute: 0

Gesamt: 18.906

Gesamt: 18.906

Aktive User: 0

ISIN: EU0009652759 · WKN: 965275 · Symbol: EUR/USD

1,0715

USD

-0,14 %

-0,0016 USD

Letzter Kurs 14:50:20 Forex berechnet

Neuigkeiten

23.04.24 · wallstreetONLINE Redaktion |

13:21 Uhr · dpa-AFX |

13:03 Uhr · dpa-AFX |

10:18 Uhr · Markus Fugmann Anzeige |

08:32 Uhr · dpa-AFX |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.677.534 von faultcode am 29.05.22 23:55:46Celsius ("Crypto lender") -- nach dem Terra-Knall wohl derzeit die prekärste Krypto-Währung am Markt -- und möglicherweise auch mit Bitcoin-Verkäufen, aus dem Tether-Umfeld z.B., künstlich im Kurs gestützt (derzeit +24% in 24h), so meine Unterstellung:

20.5.

Crypto lender Celsius Network stung by sell-off in digital asset market

https://www.ft.com/content/61334d19-fb25-4492-83d0-78c3cfec4…

...

Celsius, which borrows cryptocurrencies from its customers and lends them out to earn a return, had just under $12bn of assets as of May 17, according to its website, down from more than $24bn in late December 2021. The company is one of the biggest players in the crypto lending business and says it has 1.7mn customers. Last year, it raised $750mn from investors including Canada’s second-largest pension fund, Caisse de dépôt et placement du Québec.

...

Celsius has sustained significant client outflows in recent months, including $750mn between May 6 and May 14, according to weekly statistics the company releases. Since March, net outflows have amounted to more than $1.1bn.

...

They added that the company has billions of dollars in liquidity and was providing customers with the funds they needed. Celsius’s own coin called CEL is trading at just 80 cents, down from a peak of $8 in June 2021. The group is the biggest holder of the token and includes it as an asset on its balance sheet, according to accounts filed in the UK.

...

Earlier this week, Celsius also said it had filed with US securities regulators to list its bitcoin mining subsidiary on Wall Street equities markets. Celsius generates revenue in part from “discretionary trading” of cryptocurrencies, including “speculative trades” on prices, according to its UK accounts. Mashinsky has insisted the company does not trade customer assets. “How we earn yield does not involve trading the asset itself,” he told the Financial Times last year.

...

Celsius’ shareholders include Tether, the stablecoin issuer whose eponymous token, also known as USDT, traded below its $1 peg earlier this month. Celsius borrows USDT directly from Tether under a facility that requires it to post bitcoin as collateral.

Last year, the company’s then-chief financial officer was arrested in Israel as part of an investigation not related to Celsius. He denied wrongdoing and has not been charged.

20.5.

Crypto lender Celsius Network stung by sell-off in digital asset market

https://www.ft.com/content/61334d19-fb25-4492-83d0-78c3cfec4…

...

Celsius, which borrows cryptocurrencies from its customers and lends them out to earn a return, had just under $12bn of assets as of May 17, according to its website, down from more than $24bn in late December 2021. The company is one of the biggest players in the crypto lending business and says it has 1.7mn customers. Last year, it raised $750mn from investors including Canada’s second-largest pension fund, Caisse de dépôt et placement du Québec.

...

Celsius has sustained significant client outflows in recent months, including $750mn between May 6 and May 14, according to weekly statistics the company releases. Since March, net outflows have amounted to more than $1.1bn.

...

They added that the company has billions of dollars in liquidity and was providing customers with the funds they needed. Celsius’s own coin called CEL is trading at just 80 cents, down from a peak of $8 in June 2021. The group is the biggest holder of the token and includes it as an asset on its balance sheet, according to accounts filed in the UK.

...

Earlier this week, Celsius also said it had filed with US securities regulators to list its bitcoin mining subsidiary on Wall Street equities markets. Celsius generates revenue in part from “discretionary trading” of cryptocurrencies, including “speculative trades” on prices, according to its UK accounts. Mashinsky has insisted the company does not trade customer assets. “How we earn yield does not involve trading the asset itself,” he told the Financial Times last year.

...

Celsius’ shareholders include Tether, the stablecoin issuer whose eponymous token, also known as USDT, traded below its $1 peg earlier this month. Celsius borrows USDT directly from Tether under a facility that requires it to post bitcoin as collateral.

Last year, the company’s then-chief financial officer was arrested in Israel as part of an investigation not related to Celsius. He denied wrongdoing and has not been charged.

Celsius: https://coinmarketcap.com/currencies/celsius/ (*)

28.5.

Celsius Sent me a Cease and Desist - This is my Response

(*)

28.5.

Celsius Sent me a Cease and Desist - This is my Response

(*)

Antwort auf Beitrag Nr.: 71.597.931 von faultcode am 18.05.22 00:12:08"stablecoin" TerraUSD ($UST):

23.5.

Korean police seek freeze on Luna Foundation Guard assets: KBS

https://www.theblockcrypto.com/linked/148253/korean-police-s…

...

Police authorities in South Korea are taking action to freeze assets tied to the non-profit group Luna Foundation Guard, according to KBS, the country's national broadcaster.

Per the publication, the Seoul Metropolitan Police Agency asked multiple exchanges to block Luna Foundation Guard (LFG) from withdrawing any corporate funds.

However, the exchanges are not bound by law to do so, meaning that whether or not those actions will be carried out is unclear, according to KBS.

Police said that they intervened after finding clues indicating that there were embezzled funds within LFG, per the report.

...

23.5.

Korean police seek freeze on Luna Foundation Guard assets: KBS

https://www.theblockcrypto.com/linked/148253/korean-police-s…

...

Police authorities in South Korea are taking action to freeze assets tied to the non-profit group Luna Foundation Guard, according to KBS, the country's national broadcaster.

Per the publication, the Seoul Metropolitan Police Agency asked multiple exchanges to block Luna Foundation Guard (LFG) from withdrawing any corporate funds.

However, the exchanges are not bound by law to do so, meaning that whether or not those actions will be carried out is unclear, according to KBS.

Police said that they intervened after finding clues indicating that there were embezzled funds within LFG, per the report.

...

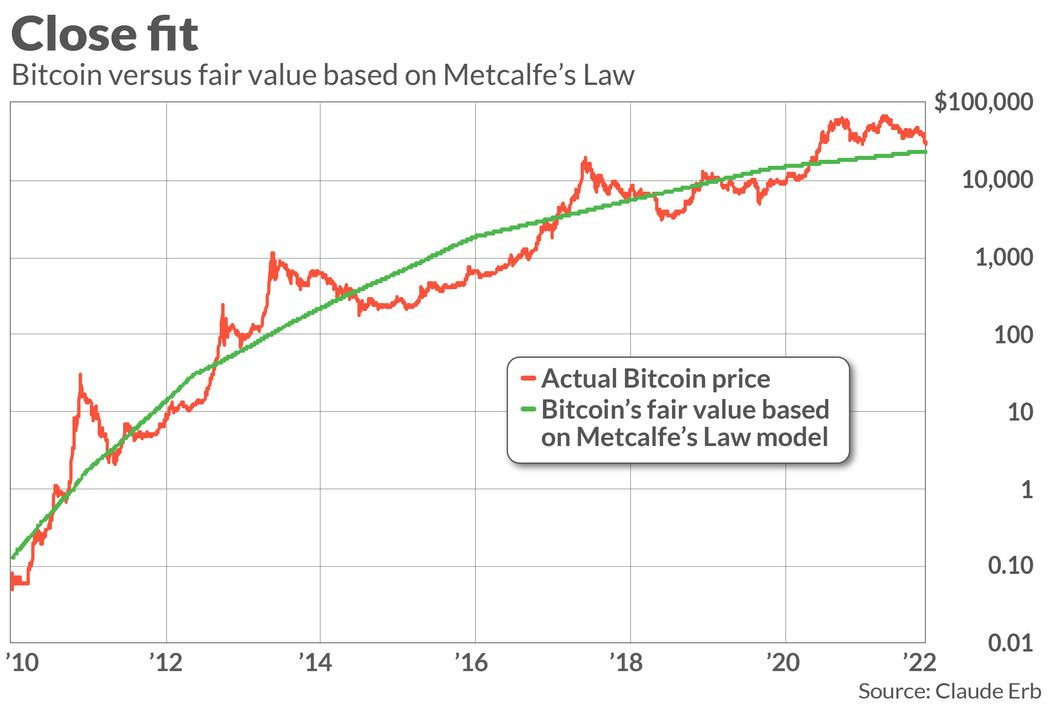

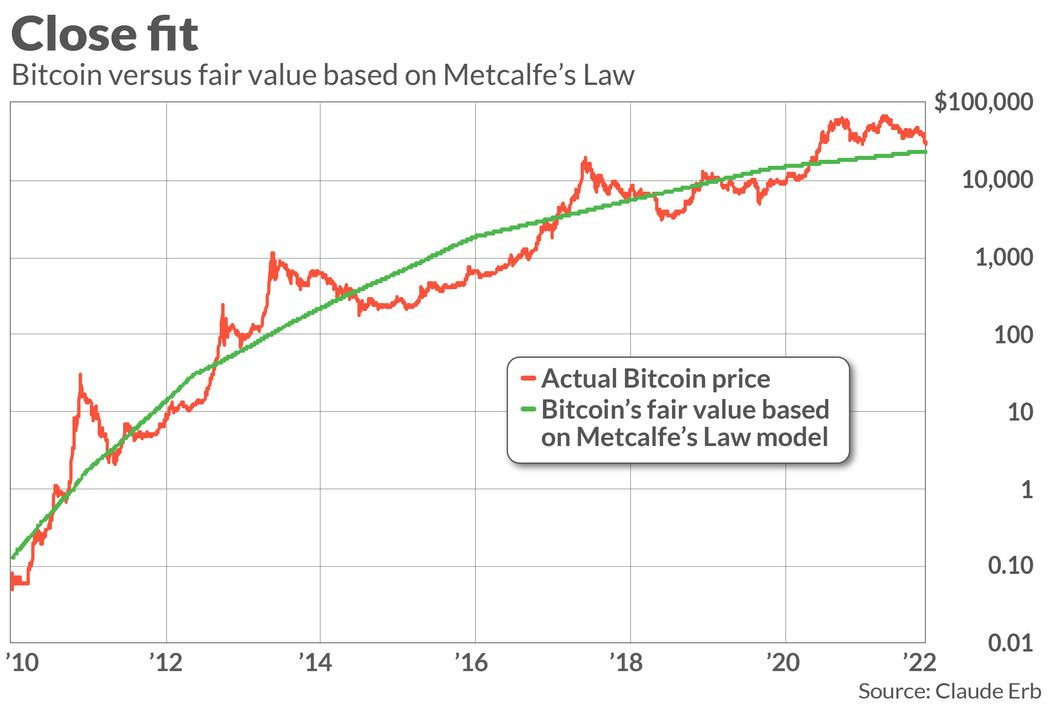

Claude Erb’s Metcalfe-Law based model: fairer Preis für einen Bitcoin:

https://www.marketwatch.com/story/if-terra-and-luna-hadnt-ta…

...

The valuation model that showed bitcoin to be overvalued hinges on Metcalfe’s Law, a formalization of what’s known as a network effect. This effect exists when the overall value of a network grows with the number of users. When Metcalfe’s Law applies, that value is proportional to the square of the number of users.

An analyst who has used Metcalfe’s Law to construct a fair value model for bitcoin is Claude Erb, a former commodities portfolio manager at TCW Group. Assuming that every bitcoin that has been mined so far represents one user in a bitcoin network, Erb calculates that bitcoin’s fair value currently is around $24,000.

...

Another reason to pay attention to Erb’s model is that it is plausible. Even if the value of the bitcoin network doesn’t precisely grow via Metcalfe’s Law — via the square of the number of connected users — it makes sense that the network’s value would grow as more people own and use the cryptocurrency.

Yet as Erb acknowledges, the Metcalfe Law model isn’t perfect. Many investors own more than one bitcoin, for example, so the number of connected users on the network is not the same as the number of bitcoins that have been mined. Furthermore, a not-insignificant number of bitcoins have been lost, further reducing the actual number of connected users.

Erb has told me that, in effect, he proposed his model as a challenge to those who believe that bitcoin’s value is much greater. “If someone wants to come up with a better fair value estimate for bitcoin than Metcalfe’s Law, fantastic,” he said.

...

https://www.marketwatch.com/story/if-terra-and-luna-hadnt-ta…

...

The valuation model that showed bitcoin to be overvalued hinges on Metcalfe’s Law, a formalization of what’s known as a network effect. This effect exists when the overall value of a network grows with the number of users. When Metcalfe’s Law applies, that value is proportional to the square of the number of users.

An analyst who has used Metcalfe’s Law to construct a fair value model for bitcoin is Claude Erb, a former commodities portfolio manager at TCW Group. Assuming that every bitcoin that has been mined so far represents one user in a bitcoin network, Erb calculates that bitcoin’s fair value currently is around $24,000.

...

Another reason to pay attention to Erb’s model is that it is plausible. Even if the value of the bitcoin network doesn’t precisely grow via Metcalfe’s Law — via the square of the number of connected users — it makes sense that the network’s value would grow as more people own and use the cryptocurrency.

Yet as Erb acknowledges, the Metcalfe Law model isn’t perfect. Many investors own more than one bitcoin, for example, so the number of connected users on the network is not the same as the number of bitcoins that have been mined. Furthermore, a not-insignificant number of bitcoins have been lost, further reducing the actual number of connected users.

Erb has told me that, in effect, he proposed his model as a challenge to those who believe that bitcoin’s value is much greater. “If someone wants to come up with a better fair value estimate for bitcoin than Metcalfe’s Law, fantastic,” he said.

...

17.5.

This 24-year-old quit his job at hedge fund powerhouse Citadel to build on Terra. It collapsed two months later

https://www.marketwatch.com/story/this-24-year-old-quit-his-…

...

This 24-year-old quit his job at hedge fund powerhouse Citadel to build on Terra. It collapsed two months later

https://www.marketwatch.com/story/this-24-year-old-quit-his-…

...

Antwort auf Beitrag Nr.: 71.583.762 von faultcode am 16.05.22 13:25:2516.5.

Did Terra operators bail out crypto whales?

https://newmoneyreview.com/index.php/2022/05/16/terra-operat…

...

The operators of the collapsed Terra stablecoin ($UST) last week allowed selected holders of the dollar token to cash out at close to 100 cents in the dollar, using cryptocurrency exchanges Gemini and Binance as a conduit.

According to the Luna Foundation Guard, which operates a reserve pool backing $UST and its related token, $LUNA, holders of $2.7bn in face value of $UST were able to sell them for bitcoin in two transactions last week, one with an effective bitcoin/UST exchange rate of $32,334 and the other with an effective exchange rate of $35,054.

The Luna Foundation Guard revealed this information in a series of tweets released this morning.

It did not disclose the timing of the transactions. However, evidence from Elliptic, a cryptocurrency research firm, suggested that the transactions took place on May 9 and early on May 10, when the $UST price traded in secondary markets as low as 60 cents in the dollar.

...

Changpeng Zhao, chief executive of Binance, has been active on Twitter over the weekend in an attempt to defend his exchange’s role in the Terra collapse, but has not addressed the topic of the bitcoin movements from the Luna Foundation Guard. Yesterday he was forced to deny rumours that Binance had invested $300m Terra’s second fundraising, conducted late last year.

Tyler and Cameron Winklevoss, the co-founders of Gemini, have not spoken of the Terra collapse on Twitter.

The two exchanges are now likely to come under increasing pressure to disclose which cryptocurrency market participants were able to exit their Terra stablecoin positions last Monday and Tuesday at close to par value, while retail holders of Terra and Luna have lost nearly all their money.

Did Terra operators bail out crypto whales?

https://newmoneyreview.com/index.php/2022/05/16/terra-operat…

...

The operators of the collapsed Terra stablecoin ($UST) last week allowed selected holders of the dollar token to cash out at close to 100 cents in the dollar, using cryptocurrency exchanges Gemini and Binance as a conduit.

According to the Luna Foundation Guard, which operates a reserve pool backing $UST and its related token, $LUNA, holders of $2.7bn in face value of $UST were able to sell them for bitcoin in two transactions last week, one with an effective bitcoin/UST exchange rate of $32,334 and the other with an effective exchange rate of $35,054.

The Luna Foundation Guard revealed this information in a series of tweets released this morning.

It did not disclose the timing of the transactions. However, evidence from Elliptic, a cryptocurrency research firm, suggested that the transactions took place on May 9 and early on May 10, when the $UST price traded in secondary markets as low as 60 cents in the dollar.

...

Changpeng Zhao, chief executive of Binance, has been active on Twitter over the weekend in an attempt to defend his exchange’s role in the Terra collapse, but has not addressed the topic of the bitcoin movements from the Luna Foundation Guard. Yesterday he was forced to deny rumours that Binance had invested $300m Terra’s second fundraising, conducted late last year.

Tyler and Cameron Winklevoss, the co-founders of Gemini, have not spoken of the Terra collapse on Twitter.

The two exchanges are now likely to come under increasing pressure to disclose which cryptocurrency market participants were able to exit their Terra stablecoin positions last Monday and Tuesday at close to par value, while retail holders of Terra and Luna have lost nearly all their money.

Antwort auf Beitrag Nr.: 71.563.185 von faultcode am 12.05.22 19:43:5516.5.

(LEAD) Crypto investor probed for alleged trespassing at Terraform CEO's home

https://en.yna.co.kr/view/AEN20220516006151315

...

A crypto investor accused of trespassing at the apartment of Do Kwon, co-founder and CEO of Terraform Labs, underwent a police investigation in Seoul on Monday.

The suspect, whose identity has been withheld, allegedly entered the apartment complex in eastern Seoul last week and then rang the doorbell, looking for Kwon, while his wife was at home.

Kwon is at the center of a massive collapse of the Terra cryptocurrency and its digital coin counterpart, Luna. A month after reaching a record high of US$119, the price of Luna now trades at near zero, while that of Terra trades at around 14 cents.

"I have lost about 2 to 3 billion won (US$2.3 million)," the suspect told reporters after undergoing an investigation at Seongdong Police Station, urging Kwon to take responsibility for the recent meltdown.

The suspect, who operates an online broadcasting channel, claims there are people who have taken their own lives due to the plunge of the stablecoins.

The investor further urged Kwon to apologize to over 200,000 investors who have lost their savings.

Following his visit, Kwon's spouse requested protection from the police, officers said.

Kwon earlier said in his blog post that Terraform Labs is working on ways to keep its Terra blockchain and ecosystem going despite the collapse of its cryptocurrency.

...

(LEAD) Crypto investor probed for alleged trespassing at Terraform CEO's home

https://en.yna.co.kr/view/AEN20220516006151315

...

A crypto investor accused of trespassing at the apartment of Do Kwon, co-founder and CEO of Terraform Labs, underwent a police investigation in Seoul on Monday.

The suspect, whose identity has been withheld, allegedly entered the apartment complex in eastern Seoul last week and then rang the doorbell, looking for Kwon, while his wife was at home.

Kwon is at the center of a massive collapse of the Terra cryptocurrency and its digital coin counterpart, Luna. A month after reaching a record high of US$119, the price of Luna now trades at near zero, while that of Terra trades at around 14 cents.

"I have lost about 2 to 3 billion won (US$2.3 million)," the suspect told reporters after undergoing an investigation at Seongdong Police Station, urging Kwon to take responsibility for the recent meltdown.

The suspect, who operates an online broadcasting channel, claims there are people who have taken their own lives due to the plunge of the stablecoins.

The investor further urged Kwon to apologize to over 200,000 investors who have lost their savings.

Following his visit, Kwon's spouse requested protection from the police, officers said.

Kwon earlier said in his blog post that Terraform Labs is working on ways to keep its Terra blockchain and ecosystem going despite the collapse of its cryptocurrency.

...

Antwort auf Beitrag Nr.: 71.563.248 von faultcode am 12.05.22 19:49:39...

ROBINSON:

What about the other major “stablecoin,” this “Tether”? Is that subject to the same kinds of risks?

WEAVER:

Yes and no. It is subject to the same kind of risks, but it’s different. It doesn’t have this algorithmic collapse model, but it does have the potential for bank runs causing collapse, because it’s unbacked.

Tether is almost certainly what we’d call a “wildcat bank.” So, back in the 1800s, we didn’t have the Federal Reserve. Do you ever wonder why those pieces of paper in your pocket are technically called “bank notes”? It’s because the original model was not the government issuing pieces of paper. The government only issued coins. But heavy or bulky coins are hard to deal with. So you take your coins to the local bank, and they would give you a banknote, literally an IOU saying “if you want a $1 gold coin, take this IOU back to the bank and you get this dollar gold coin.”

What happened is, basically, fraudulent banks sprang up. They were called wildcat banks because they’d often have animal pictures on the bank notes. What they would do is take deposits and issue pieces of paper, completely unbacked. And when state bank regulators would come along, the wildcat banks would have barrels of coins that were fake. All but the top layer was just junk, with a top layer of gold coins. Or they’d cart around a barrel to all the branch offices just ahead of the inspectors.

And Tether is clearly doing the same thing. Because if Tether was backed by real money, this would mean that there is some $80 billion worth of money from institutional savvy investors that wanted to invest in the cryptocurrency space, but didn’t want to just buy in CoinBase. So they had to go to this third party that has been caught lying about its reserves, run by who-knows-who—the CEO is basically MIA. [Slate reported in 2021 that he “hasn’t been seen in public in years.”] It keeps its reserves in the Bahamas. Why would you invest that way? It’s just complete nonsense.

So what’s really almost certainly happening with Tether is Tether creates new Tether tokens, loans them to their big colleagues in the cryptocurrency space—so Alameda Research and a couple of others like that. Alameda Research provides IOUs so Tether says they’re backed by loans. Then Alameda goes out and buys Bitcoin, driving up the price. And now the Tether is backed by Bitcoin. And so Tether in the end is backed by underlying cryptocurrency.

They refuse to get audited. [Bloomberg reported that Tether CFO, an Italian former plastic surgeon, was “urged … to hire an accounting firm to produce a full audit to reassure the public,” but “said Tether didn’t need to go that far to respond to critics.”] They refuse to even do more than the most basic attestation, which is literally “Here, accountant, sign this.” We’re honest, Scout’s pledge. It’s just a house of cards. And the problem is that when these houses of cards fail, they fail so catastrophically and so swiftly that things go from being worth $1 to being worth nothing in the space of three days.

...

13.5.

Why This Computer Scientist Says All Cryptocurrency Should “Die in a Fire”

UC-Berkeley’s Nicholas Weaver has been studying cryptocurrency for years. He thinks it’s a terrible idea that will end in disaster.

https://www.currentaffairs.org/2022/05/why-this-computer-sci…

https://twitter.com/ncweaver

ROBINSON:

What about the other major “stablecoin,” this “Tether”? Is that subject to the same kinds of risks?

WEAVER:

Yes and no. It is subject to the same kind of risks, but it’s different. It doesn’t have this algorithmic collapse model, but it does have the potential for bank runs causing collapse, because it’s unbacked.

Tether is almost certainly what we’d call a “wildcat bank.” So, back in the 1800s, we didn’t have the Federal Reserve. Do you ever wonder why those pieces of paper in your pocket are technically called “bank notes”? It’s because the original model was not the government issuing pieces of paper. The government only issued coins. But heavy or bulky coins are hard to deal with. So you take your coins to the local bank, and they would give you a banknote, literally an IOU saying “if you want a $1 gold coin, take this IOU back to the bank and you get this dollar gold coin.”

What happened is, basically, fraudulent banks sprang up. They were called wildcat banks because they’d often have animal pictures on the bank notes. What they would do is take deposits and issue pieces of paper, completely unbacked. And when state bank regulators would come along, the wildcat banks would have barrels of coins that were fake. All but the top layer was just junk, with a top layer of gold coins. Or they’d cart around a barrel to all the branch offices just ahead of the inspectors.

And Tether is clearly doing the same thing. Because if Tether was backed by real money, this would mean that there is some $80 billion worth of money from institutional savvy investors that wanted to invest in the cryptocurrency space, but didn’t want to just buy in CoinBase. So they had to go to this third party that has been caught lying about its reserves, run by who-knows-who—the CEO is basically MIA. [Slate reported in 2021 that he “hasn’t been seen in public in years.”] It keeps its reserves in the Bahamas. Why would you invest that way? It’s just complete nonsense.

So what’s really almost certainly happening with Tether is Tether creates new Tether tokens, loans them to their big colleagues in the cryptocurrency space—so Alameda Research and a couple of others like that. Alameda Research provides IOUs so Tether says they’re backed by loans. Then Alameda goes out and buys Bitcoin, driving up the price. And now the Tether is backed by Bitcoin. And so Tether in the end is backed by underlying cryptocurrency.

They refuse to get audited. [Bloomberg reported that Tether CFO, an Italian former plastic surgeon, was “urged … to hire an accounting firm to produce a full audit to reassure the public,” but “said Tether didn’t need to go that far to respond to critics.”] They refuse to even do more than the most basic attestation, which is literally “Here, accountant, sign this.” We’re honest, Scout’s pledge. It’s just a house of cards. And the problem is that when these houses of cards fail, they fail so catastrophically and so swiftly that things go from being worth $1 to being worth nothing in the space of three days.

...

13.5.

Why This Computer Scientist Says All Cryptocurrency Should “Die in a Fire”

UC-Berkeley’s Nicholas Weaver has been studying cryptocurrency for years. He thinks it’s a terrible idea that will end in disaster.

https://www.currentaffairs.org/2022/05/why-this-computer-sci…

https://twitter.com/ncweaver

13.5.

...

Rainbow-Bridge-Angriff

Am 1. Mai wurde laut einem Bericht von "Krypto News" die Regenbogenbrücke des NEAR-Protokolls von Hackern angegriffen. Allerdings wurde dieser Angriff vom Sicherheitssystem der Token-Bridge zwischen NEAR und Ethereum bemerkt und vollautomatisch neutralisiert, sodass keine Gelder erbeutet wurden.

Einzig die Kriminellen waren am Ende die Geschädigten, denn für ihr Unterfangen zahlten sie 2,5 ETH (mehr als 6.000 US-Dollar) über den Krypto-Mixer Tornado Cash ein.

Dabei wurde ein Smart Contract eingesetzt, der darauf abzielte, einige Gelder einzuzahlen, um so die Angreifer zu einem gültigen Rainbow Bridge Relayer zu machen. Jedoch bemerkten die Brückenwächter, dass der eingereichte Block nicht in der NEAR-Blockchain enthalten war. Daraufhin schickten sie zur Überprüfung eine sogenannte Challenge-Transaktion an Ethereum, die prompt fehlschlug. Der fabrizierte Block der Angreifer wurde deshalb rückgängig gemacht. Die Hacker blieben somit letztlich nicht nur erfolglos, sie haben auch die eingesetzten 2,5 ETH in den Sand gesetzt.

Alex Shevchenko, CEO von Aurora Labs, einer Ethereum Virtual Machine (EVM) auf NEAR kündigte in einem Tweet bereits zusätzliche Maßnahmen beim NEAR-Protokoll an, die darauf abzielen, dass die Kosten eines Angriffsversuchs steigen sollen.

...

Erfolgreicher Angriff auf Wormhole

Dagegen war drei Monate zuvor ein Angriff auf die Blockchain-Brücke Wormhole erfolgreich. Beim viertgrößten Kryptowährungsdiebstahl in der Geschichte war es Hackern gelungen, eine Sicherheitslücke auszunutzen und 320 Millionen US-Dollar zu erbeuten.

Fehlschlag: Kriminelle verlieren Geld bei Blockchain-Hackerangriff

https://www.finanzen.net/nachricht/devisen/angriff-vereitelt…

...

Rainbow-Bridge-Angriff

Am 1. Mai wurde laut einem Bericht von "Krypto News" die Regenbogenbrücke des NEAR-Protokolls von Hackern angegriffen. Allerdings wurde dieser Angriff vom Sicherheitssystem der Token-Bridge zwischen NEAR und Ethereum bemerkt und vollautomatisch neutralisiert, sodass keine Gelder erbeutet wurden.

Einzig die Kriminellen waren am Ende die Geschädigten, denn für ihr Unterfangen zahlten sie 2,5 ETH (mehr als 6.000 US-Dollar) über den Krypto-Mixer Tornado Cash ein.

Dabei wurde ein Smart Contract eingesetzt, der darauf abzielte, einige Gelder einzuzahlen, um so die Angreifer zu einem gültigen Rainbow Bridge Relayer zu machen. Jedoch bemerkten die Brückenwächter, dass der eingereichte Block nicht in der NEAR-Blockchain enthalten war. Daraufhin schickten sie zur Überprüfung eine sogenannte Challenge-Transaktion an Ethereum, die prompt fehlschlug. Der fabrizierte Block der Angreifer wurde deshalb rückgängig gemacht. Die Hacker blieben somit letztlich nicht nur erfolglos, sie haben auch die eingesetzten 2,5 ETH in den Sand gesetzt.

Alex Shevchenko, CEO von Aurora Labs, einer Ethereum Virtual Machine (EVM) auf NEAR kündigte in einem Tweet bereits zusätzliche Maßnahmen beim NEAR-Protokoll an, die darauf abzielen, dass die Kosten eines Angriffsversuchs steigen sollen.

...

Erfolgreicher Angriff auf Wormhole

Dagegen war drei Monate zuvor ein Angriff auf die Blockchain-Brücke Wormhole erfolgreich. Beim viertgrößten Kryptowährungsdiebstahl in der Geschichte war es Hackern gelungen, eine Sicherheitslücke auszunutzen und 320 Millionen US-Dollar zu erbeuten.

Fehlschlag: Kriminelle verlieren Geld bei Blockchain-Hackerangriff

https://www.finanzen.net/nachricht/devisen/angriff-vereitelt…

Antwort auf Beitrag Nr.: 71.563.248 von faultcode am 12.05.22 19:49:39

https://twitter.com/alifarhat79/status/1524739311115059201

https://twitter.com/alifarhat79/status/1524739311115059201

13:21 Uhr · dpa-AFX · EUR/USD |

13:03 Uhr · dpa-AFX · EUR/USD |

10:18 Uhr · Markus Fugmann · MicrosoftAnzeige |

08:32 Uhr · dpa-AFX · EUR/USD |

08:30 Uhr · BNP Paribas · EUR/USDAnzeige |

07:52 Uhr · dpa-AFX · EUR/USD |

25.04.24 · dpa-AFX · Bristol-Myers Squibb |

25.04.24 · dpa-AFX · EUR/USD |

25.04.24 · dpa-AFX · Deutsche Bank |

25.04.24 · dpa-AFX · EUR/USD |

| Zeit | Titel |

|---|---|

| 25.04.24 | |

| 14.04.24 | |

| 19.03.24 | |

| 28.12.23 | |

| 24.12.23 | |

| 17.12.23 | |

| 01.12.23 | |

| 23.10.23 | |

| 10.09.23 | |

| 24.08.23 |