Peruvian Metals, ein interessanter Wert

eröffnet am 07.10.21 11:52:20 von

neuester Beitrag 16.06.22 12:52:35 von

neuester Beitrag 16.06.22 12:52:35 von

Beiträge: 15

ID: 1.353.249

ID: 1.353.249

Aufrufe heute: 0

Gesamt: 443

Gesamt: 443

Aktive User: 0

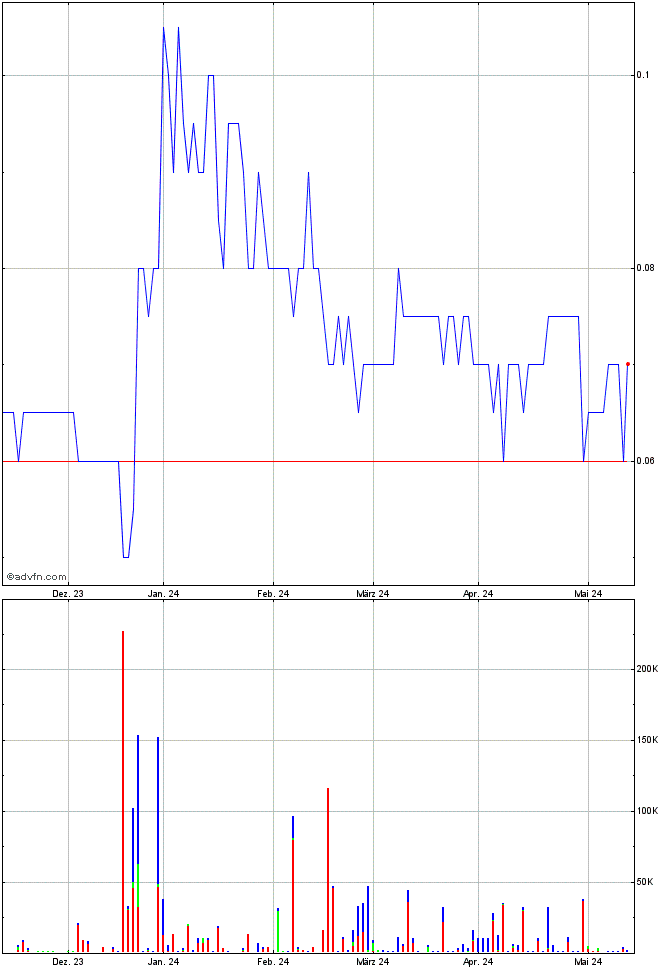

ISIN: CA7156971086 · WKN: A2N459 · Symbol: 6D71

0,0425

EUR

0,00 %

0,0000 EUR

Letzter Kurs 08:00:13 Frankfurt

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,1500 | +21,75 | |

| 0,5800 | +16,00 | |

| 0,5015 | +14,24 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,1200 | -6,67 | |

| 10,040 | -7,89 | |

| 1,1500 | -9,45 | |

| 3,3200 | -9,78 | |

| 46,98 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.351.215 von hbg55 am 13.04.22 15:16:54

2022-06-13 18:26 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METALS ANNOUNCES RECORD PRODUCTION AND FIRST SALES OF MINERAL CONCENTRATES AND OXIDE GOLD MATERIAL

Peruvian Metals Corp. has provided an update on mineral processing at its 80-per-cent-owned Aguila Norte processing plant located in northern Peru.

During the months of April and May 2022, the Plant completed five mineral campaigns processing a total of 4,942 metric tonnes (mt) for a yearly cumulative total of 12,514 tonnes and set a new record. This year's total production level for the first five months exceeds 2021 (9,998 mt) by more than 25%.

More importantly, the Company also achieved a significant milestone in May with the processing of purchased material. Processing during the month of May included a 313 mt batch of copper material purchased by the Company, grading 3.65 % Cu and 0.80 oz/t Ag. This resulted in the Company generating and delivering 58.82 mt of concentrate to Trading Partners Peru S.A.C. located in El Callao Lima Peru. Assaying by the trader returned results for the concentrate of 17.23 % Cu, 116 g/mt Ag and 3.56 g/mt Au. The Company will continue to purchase this copper material and expects to improve its recovery and overall grade of the concentrate.

In addition, Peruvian Metals is pleased to announce it recently processed a 339 mt batch of polymetallic material, which was also purchased by the Company. Assaying by the Company returned an average head grade of 11.5 oz/t Ag, 2.79% Pb and 9.61% Zn. The processing generated two concentrates resulting in 23 mt of a Lead-Silver concentrate grading 127 oz/t Ag, 34% Pb and 14% Zn and a second Zinc concentrate grading 44% Zn and 11 oz/mt Ag. Both concentrates are expected to be shipped shortly to the El Callao Port facility as the Company negotiates with metals traders for their final sales. It is important to note that the final sale price for the concentrates will depend on assay results provided by the metal trader. The Company is currently purchasing additional material from the same miners and will process the material once an excess of 300 mt has been accumulated.

The Company has also shipped and sold 31 mt of oxide gold material from it's 50% owned Palta Dorada Au-Ag-Cu property ("Palta Dorada") to Inca One's Kori One processing plant located in Southern Peru. The average grade of the material was 8.8 g/t Au and 74 g/t Ag. The Company is continuing to open up the old workings to access the sulphide Cu-Au-Ag material for the collection of a bulk sample to process at the Company's Aguila Norte Plant. The Company will continue to ship and sell the oxide gold material to third party toll mills designed to treat this type of oxide material.

Jeffrey Reeder, CEO of Peruvian Metals, comments: "We are extremely pleased to record our first concentrate sale and our first shipment of oxide gold material to the Kori One Processing plant. These activities represent a major milestone for the Company and advance our long-stated goals to leverage our collective assets (our fully operational mineral processing plant as well as our mineral claims) to drive increased profitability and shareholder value. Profit margins per tonne of material processed from purchased material are expected to be higher compared to treating third party material. While the Company will continue to develop relationships with local miners and process third party material, we will also focus on further increasing the amount of purchased material in our overall mix of processing activities and thereby expand the profitability at the Plant from current levels. As we continue to develop the infrastructure at Palta Dorada to access the high grade sulphide mineral, we will also continue to ship the oxide gold material from this 50% owned project to third-party toll mills for sale, which we believe represents another exciting, profitable activity. As a junior mining company, we believe we have developed a very unique approach and foundation by having our own production facility now generating revenue and profits as well as owning valuable claims that we can develop."...........

https://www.stockwatch.com/News/Item/Z-C!PER-3267019/C/PER

SK gestern...............cad 0,12 - gleichbedeutend mit ner MK von eben mal 12mios

da sollte noch EINIGES gehen...........IMO

hbg55

Peruvian's Aguila Norte processes 4,942 mt in 2 months

2022-06-13 18:26 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METALS ANNOUNCES RECORD PRODUCTION AND FIRST SALES OF MINERAL CONCENTRATES AND OXIDE GOLD MATERIAL

Peruvian Metals Corp. has provided an update on mineral processing at its 80-per-cent-owned Aguila Norte processing plant located in northern Peru.

During the months of April and May 2022, the Plant completed five mineral campaigns processing a total of 4,942 metric tonnes (mt) for a yearly cumulative total of 12,514 tonnes and set a new record. This year's total production level for the first five months exceeds 2021 (9,998 mt) by more than 25%.

More importantly, the Company also achieved a significant milestone in May with the processing of purchased material. Processing during the month of May included a 313 mt batch of copper material purchased by the Company, grading 3.65 % Cu and 0.80 oz/t Ag. This resulted in the Company generating and delivering 58.82 mt of concentrate to Trading Partners Peru S.A.C. located in El Callao Lima Peru. Assaying by the trader returned results for the concentrate of 17.23 % Cu, 116 g/mt Ag and 3.56 g/mt Au. The Company will continue to purchase this copper material and expects to improve its recovery and overall grade of the concentrate.

In addition, Peruvian Metals is pleased to announce it recently processed a 339 mt batch of polymetallic material, which was also purchased by the Company. Assaying by the Company returned an average head grade of 11.5 oz/t Ag, 2.79% Pb and 9.61% Zn. The processing generated two concentrates resulting in 23 mt of a Lead-Silver concentrate grading 127 oz/t Ag, 34% Pb and 14% Zn and a second Zinc concentrate grading 44% Zn and 11 oz/mt Ag. Both concentrates are expected to be shipped shortly to the El Callao Port facility as the Company negotiates with metals traders for their final sales. It is important to note that the final sale price for the concentrates will depend on assay results provided by the metal trader. The Company is currently purchasing additional material from the same miners and will process the material once an excess of 300 mt has been accumulated.

The Company has also shipped and sold 31 mt of oxide gold material from it's 50% owned Palta Dorada Au-Ag-Cu property ("Palta Dorada") to Inca One's Kori One processing plant located in Southern Peru. The average grade of the material was 8.8 g/t Au and 74 g/t Ag. The Company is continuing to open up the old workings to access the sulphide Cu-Au-Ag material for the collection of a bulk sample to process at the Company's Aguila Norte Plant. The Company will continue to ship and sell the oxide gold material to third party toll mills designed to treat this type of oxide material.

Jeffrey Reeder, CEO of Peruvian Metals, comments: "We are extremely pleased to record our first concentrate sale and our first shipment of oxide gold material to the Kori One Processing plant. These activities represent a major milestone for the Company and advance our long-stated goals to leverage our collective assets (our fully operational mineral processing plant as well as our mineral claims) to drive increased profitability and shareholder value. Profit margins per tonne of material processed from purchased material are expected to be higher compared to treating third party material. While the Company will continue to develop relationships with local miners and process third party material, we will also focus on further increasing the amount of purchased material in our overall mix of processing activities and thereby expand the profitability at the Plant from current levels. As we continue to develop the infrastructure at Palta Dorada to access the high grade sulphide mineral, we will also continue to ship the oxide gold material from this 50% owned project to third-party toll mills for sale, which we believe represents another exciting, profitable activity. As a junior mining company, we believe we have developed a very unique approach and foundation by having our own production facility now generating revenue and profits as well as owning valuable claims that we can develop."...........

https://www.stockwatch.com/News/Item/Z-C!PER-3267019/C/PER

SK gestern...............cad 0,12 - gleichbedeutend mit ner MK von eben mal 12mios

da sollte noch EINIGES gehen...........IMO

hbg55

PROCESSING PLANT ACHIEVES RECORD FIRST QUARTER 2022 PRODUCTION

Peruvian Metals' Aguila Norte processes 7,875 t in Q12022-04-11 14:39 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METAL'S AGUILA NORTE PROCESSING PLANT ACHIEVES RECORD FIRST QUARTER 2022 PRODUCTION

Peruvian Metals Corp. has provided an update on mineral processing at its 80-per-cent-owned Aguila Norte processing plant, located in northern Peru.

During the first quarter of 2022, the plant completed several mineral campaigns processing a total of 7,875 metric tonnes (mt). Production in the first quarter of this year exceeded production levels in the first quarter of 2021 (5,934 metric tonnes) by more than 32 per cent. The company is extremely pleased with the record first quarter production at a time when the rainy season in Peru has affected mining operations. The completion of additional concentrate drying areas in 2021 allowed for more material to be processed. Due to the improving weather conditions and with the expanded drying capacity, the company anticipates production levels will improve, resulting in increased revenue over the remainder of 2022. The company is also pleased to announce that it has started to purchase mineral from miners and this mineral is expected to be processed shortly.

Jeffrey Reeder, chief executive officer of Peruvian Metals, comments: "We are extremely pleased to record our best first quarter at Aguila Norte. Normally, this is a time where Peruvian miners and explorers are affected by the rainy season with less mineral available.

We fully expect that production levels will increase for the remainder of the year and expect a record year in 2022. We intend to process purchased mineral shortly and ship oxide gold material from our 50-per-cent-owned Palta Dorada project to a third party toll mill for sale. ".......

https://www.stockwatch.com/News/Item/Z-C!PER-3234262/C/PER

.....DAMIT sollten auch NEU- investoren sich ´anfreunden´ können..........IMO

hbg55

Antwort auf Beitrag Nr.: 71.300.538 von hbg55 am 06.04.22 23:01:25

.........uuuuuuuuups - DAS ging schneller als die polizei erlaubt.......nachfolg.

noch der entspr. link, um kompl. news zu studieren.......

https://www.stockwatch.com/News/Item/Z-C!PER-3231359/C/PER

hbg55

.........uuuuuuuuups - DAS ging schneller als die polizei erlaubt.......nachfolg.

noch der entspr. link, um kompl. news zu studieren.......

https://www.stockwatch.com/News/Item/Z-C!PER-3231359/C/PER

hbg55

Peruvian Metals begins trading on OTCQB

2022-04-04 14:32 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METALS TO COMMENCE TRADING ON THE OTCQB VENTURE MARKET AND ANNOUNCES CHANGE OF AUDITOR

Peruvian Metals Corp. has been approved to commence trading of its common shares on the OTCQB Venture Market, beginning today under the ticker symbol DUVNF.

"We are pleased to offer investors yet another avenue for trading our shares and look forward to increasing the awareness around our company for U.S. investors. We believe that trading on the OTCQB can lead to overall enhanced liquidity and visibility in global capital markets," said Jeffrey Reeder, CEO.

Recognized as an established public market by the U.S. Securities and Exchange Commission, the OTCQB has helped companies build considerable shareholder value including enhanced liquidity and valuation.............

2022-04-04 14:32 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METALS TO COMMENCE TRADING ON THE OTCQB VENTURE MARKET AND ANNOUNCES CHANGE OF AUDITOR

Peruvian Metals Corp. has been approved to commence trading of its common shares on the OTCQB Venture Market, beginning today under the ticker symbol DUVNF.

"We are pleased to offer investors yet another avenue for trading our shares and look forward to increasing the awareness around our company for U.S. investors. We believe that trading on the OTCQB can lead to overall enhanced liquidity and visibility in global capital markets," said Jeffrey Reeder, CEO.

Recognized as an established public market by the U.S. Securities and Exchange Commission, the OTCQB has helped companies build considerable shareholder value including enhanced liquidity and valuation.............

POSITIVES BEREINIGTES EBITDA FÜR DAS DRITTE QUARTAL

Peruvian Metals processes 2,997 tonnes material in Nov.2021-12-09 12:49 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METALS CONTINUE TO ACHIEVE 100% THROUGHPUT AT ITS AGUILA NORTE PLANT AND REPORTS POSITIVE ADJUSTED EBITDA FOR THIRD QUARTER

Peruvian Metals Corp. has provided an update regarding the mineral processing at its 80-per-cent-owned fully permitted Aguila Norte processing plant located in northern Peru.

During the month of November, Peruvian Metals processed 2,997 metric tonnes ("tonnes") of material for third parties. This amount exceeds the previous monthly record of 2,976 tonnes in October 2021.

As of November, the Plant has processed 25,799 tonnes in 2021 exceeding total tonnes processed in 2019 of 18,510 and 2020 of 13,185 tonnes.

The Company is also pleased to report third quarter positive adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), representing a third consecutive quarterly positive EBITDA in 2021. Fourth quarter EBITDA performance is expected to reflect similar performance with continued investments into the Company's wholly owned projects. To view an enhanced version of this graphic, please visit:https://orders.newsfilecorp.com/files/3210/107205_75d6744af4…

https://www.stockwatch.com/News/Item/Z-C!PER-3182603/C/PER

SK zum WE bei mini- vol. noch.................cad 0,19

.....bei DEN persp. schauts für MICH hier grad ziemlich einladend aus

Peruvian Metals hält auch Aktien von Silver X

Die Info ist zwar älter aber man sollte wissen, das durch den Verkauf von Corongo Exploraciónes ("Corongo") durch Peruvian Metals jetzt auch eine Beachtliche Stückzahlvon Aktien an Silber X hält.

Oro X Mining Corp. und Latitude Silver geben Überbrückungsdarlehen für Latitude Silver bekannt

20.05.2021 | 0:30 Uhr | CNW

VANCOUVER, 19. Mai 2021 - Oro X Mining Corp. (TSXV: OROX) (OTC Pink: WRPSF) ("Oro X" oder das "Unternehmen") und Mines & Metals Trading (Peru) PLC ("MMTP", ebenfalls kommerziell) bekannt als "Latitude Silver") geben bekannt, dass Oro X im Zusammenhang mit dem zuvor angekündigten Unternehmenszusammenschluss zwischen dem Unternehmen und MMTP (der "Unternehmenszusammenschluss") zugestimmt hat, ein Überbrückungsdarlehen in Höhe von 120.000 USD an MMTP (das "Darlehen" "). Das Darlehen wird durch eine Verpfändung aller Anteile einer hundertprozentigen MMTP-Tochtergesellschaft besichert. MMTP wird den Erlös des Darlehens verwenden, um die Explorations- und Erschließungsbohrungen auf dem Recuperada-Projekt bis Ende Juni fortzusetzen.

Die Parteien gehen davon aus, dass der Unternehmenszusammenschluss vor Ende Juni 2021 abgeschlossen wird.

Über Oro X Mining

Oro X Mining ist ein kanadisches Bergbauunternehmen, das vor kurzem die Übernahme von Latitude Silver und seines zu 100 % im Besitz befindlichen Silberprojekts Recuperada bekannt gegeben hat. Nach Abschluss der Akquisition von Latitude Silver wird das Unternehmen in Silver X Mining umbenannt. Gründer und Management des Unternehmens haben eine erfolgreiche Erfolgsbilanz bei der Steigerung des Shareholder Value. Weitere Informationen finden Sie auf unserer Website unter www.oroxmining.com

QUELLE Oro X Mining Corp.

https://www.rohstoff-welt.de/aktien/snapshot.php?nachrichten…

Edmonton, Alberta – (Newsfile Corp. – 5. März 2020) – Peruvian Metals Corp. (TSXV: PER) („Peruvian Metals“ oder das („Unternehmen“) freut sich bekannt zu geben, dass es die 100%ige Tochtergesellschaft des Unternehmens verkauft hat Corongo Exploraciónes ("Corongo") an Mines & Metals Trading (Peru) PLC ("MMTP") für 200.000 US-Dollar in bar und 600.000 US-Dollar in Aktien. Corongo hält mehrere Konzessionen mit einer Gesamtfläche von 2420 Hektar im Bergbaugebiet Huachocolpa in Süd-Zentral-Peru. MMTP ist ein privates Unternehmen mit Sitz auf der Isle of Man und besitzt die 600 Tonnen pro Tag Recuperada Mill in der Nähe der Liegenschaften von Corongo. MMTP hat vor kurzem mit Zincore Metals Inc. ( „Zincore“), um eine umgekehrte Übernahme („RTO“) von Zincore durch MMTP abzuschließen.

Der Bergbaubezirk Huachocolpa beherbergt mehrere produzierende und früher produzierende, in Erzgängen enthaltene polymetallische Grundmetallminen (Silber-Zink-Blei-Kupfer plus oder minus Gold). Der Bergbau und das Mahlen von Polymetallen sind weiterhin die dominierenden formellen Wirtschaftstätigkeiten in der Region, wobei Compañia Minera Kolpa SA und die Recuperada-Mühle von MMTP die größten Betriebe sind, die derzeit in der Region produzieren. MMTP wird nun ein großes Landpaket von insgesamt über 15.000 Hektar kontrollieren, wobei viele der erworbenen Konzessionen von Peruvian Metals an die Konzessionen von MMTP angrenzen. Peruvian Metals wird das Konzessionsgebiet Minas Maria Norte („Maria Norte“), das sich 13 km nordwestlich des Werks Recuperada befindet, behalten, indem es das Konzessionsgebiet an eine 100%ige Tochtergesellschaft des Unternehmens überträgt.

Transaktionsdetails

MMTP führt derzeit eine RTO mit Zincore durch, deren Abschluss im zweiten Quartal 2020 erwartet wird. Die aktuelle Bewertung der MMTP-Aktien basiert auf einer Pre-RTO-Finanzierung von 17,33 CDN pro Aktie. Peruvian Metals hat 200.000 US-Dollar erhalten und wird 45.008 MMTP-Aktien im Wert von 17,33 CDN oder 780.000 CDN erhalten. Nach Abschluss des RTO wird jede Aktie von MMTP in etwa 73,2 Zincore-Aktien getauscht. Peruvian Metals wird ungefähr 3,3 Millionen Aktien der neuen an der TSX-Venture notierten Unternehmenseinheit namens Latitude Base Metals erhalten. Informationen über das Unternehmen finden Sie unter http://latitudebasemetals.com/ .

https://peruvianmetals.com/2020/03/peruvian-metals-sells-bas…

Antwort auf Beitrag Nr.: 69.941.330 von hbg55 am 17.11.21 09:46:39

...und wie es aussieht fängt sie an am duft der 20iger gefallen zu finden.............

RT..................cad 0,21

...und wie es aussieht fängt sie an am duft der 20iger gefallen zu finden.............

RT..................cad 0,21

Antwort auf Beitrag Nr.: 69.825.402 von hbg55 am 05.11.21 19:20:02

....gestern wars nun so weit - für kurze zeit konnten wir am 20iger- duft schnuppern

mit nachfolg. meldung sollte dies m.e. auch lääääänger möglich sein.......hat man sich

doch ein weiteres hochgrad. proj. im bieter- verfahren sichern können.............

2021-11-10 14:40 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METALS ACQUIRES A NEW SILVER-LEAD-ZINC PROJECT IN NORTHERN PERU

Peruvian Metals Corp. has acquired a new high-grade silver-lead-zinc property by submitting a superior offer in a closed bid auction at the Peruvian Public Registry of Mining. Other bidders for the area included Newmont Peru SRL and Mitsui Mining & Smelting Co.

The company will designate a name for the project once it has discussed its intentions with the local community.

The new property covers an area of approximately 94 hectares and includes several old mine workings. The property is road accessible from Lima by a well paved highway and by 50 kilometres of dirt road. Historical reports from the area by Banco Minero del Peru note that a metallurgical sample was taken from the workings that averaged 13.16 ounces silver per tonne (oz/mt Ag) with 2.55 per cent lead (Pb) and 3.77 per cent zinc (Zn). Results from the metallurgical test show that two concentrates can be produced with the first averaging 63.03 per cent Pb, 6 per cent Zn and 317 oz/mt Ag. The second concentrate averaged 61.9 per cent zinc and 7.2 per cent lead. Please note that these results are historic and cannot be verified.

The area is underlain by tertiary volcanics belonging to the prospective Calipuy formation. Company geologists verified the potential of the area by mapping and sampling the workings and stockpiles left by the previous operators. Ten samples were taken from old stockpiles in four different areas with values ranging from 0.06 to 1.24 grams gold per ton (g/t Au), 0.71 to 47.82 oz/mt Ag, 0.34 per cent to 9.25 per cent Pb and 0.13 per cent to 4.93 per cent Zn averaging 0.49 g/t Au, 12.93 oz/mt Ag, 2.62 per cent Pb and 1.68 per cent Zn. It is important to note and highly likely that much of the high grade extracted from the underground workings and stockpiled have been shipped to toll mills for processing.

The company plans to initiate community discussions and plans to start the permitting process to reopen the underground workings for bulk sample extraction. The property has good infrastructure but will need to be improved. Another site visit by the company will be necessary this year to take additional samples for metallurgical tests and determine the condition of the underground adits for permitting purposes.

The company's Aguila Norte processing plant is accessible mainly by paved highway from this new project. Aguila Norte has an environmental permit (IGAC) from the Peruvian government and is currently at capacity of 100 tonnes per day level. The company expects to replace third party mineral with polymetallic mineral from this new area and from its 50 per cent own Palta Dorada Au-Ag-Cu property. The company can expand Aguila Norte's throughput beyond 100 tonnes per day once the mineral supply exceeds the capacity.

Jeffrey Reeder, chief executive officer of Peruvian Metals, comments: "We are very pleased to acquire this attractive silver-rich polymetallic property. This acquisition is in line with the company's main goal to secure its own feed for the Aguila Norte processing plant. This new addition to the company's property portfolio yet again demonstrates Peruvian Metals' ability to grow organically without entering expensive third party option deals.".....

https://www.stockwatch.com/News/Item/Z-C!PER-3165709/C/PER

SK bei knapp 500k vol.................cad 0,19

Peruvian Metals acquires silver-lead-zinc project

....gestern wars nun so weit - für kurze zeit konnten wir am 20iger- duft schnuppern

mit nachfolg. meldung sollte dies m.e. auch lääääänger möglich sein.......hat man sich

doch ein weiteres hochgrad. proj. im bieter- verfahren sichern können.............

2021-11-10 14:40 ET - News Release

Mr. Jeffrey Reeder reports

PERUVIAN METALS ACQUIRES A NEW SILVER-LEAD-ZINC PROJECT IN NORTHERN PERU

Peruvian Metals Corp. has acquired a new high-grade silver-lead-zinc property by submitting a superior offer in a closed bid auction at the Peruvian Public Registry of Mining. Other bidders for the area included Newmont Peru SRL and Mitsui Mining & Smelting Co.

The company will designate a name for the project once it has discussed its intentions with the local community.

The new property covers an area of approximately 94 hectares and includes several old mine workings. The property is road accessible from Lima by a well paved highway and by 50 kilometres of dirt road. Historical reports from the area by Banco Minero del Peru note that a metallurgical sample was taken from the workings that averaged 13.16 ounces silver per tonne (oz/mt Ag) with 2.55 per cent lead (Pb) and 3.77 per cent zinc (Zn). Results from the metallurgical test show that two concentrates can be produced with the first averaging 63.03 per cent Pb, 6 per cent Zn and 317 oz/mt Ag. The second concentrate averaged 61.9 per cent zinc and 7.2 per cent lead. Please note that these results are historic and cannot be verified.

The area is underlain by tertiary volcanics belonging to the prospective Calipuy formation. Company geologists verified the potential of the area by mapping and sampling the workings and stockpiles left by the previous operators. Ten samples were taken from old stockpiles in four different areas with values ranging from 0.06 to 1.24 grams gold per ton (g/t Au), 0.71 to 47.82 oz/mt Ag, 0.34 per cent to 9.25 per cent Pb and 0.13 per cent to 4.93 per cent Zn averaging 0.49 g/t Au, 12.93 oz/mt Ag, 2.62 per cent Pb and 1.68 per cent Zn. It is important to note and highly likely that much of the high grade extracted from the underground workings and stockpiled have been shipped to toll mills for processing.

The company plans to initiate community discussions and plans to start the permitting process to reopen the underground workings for bulk sample extraction. The property has good infrastructure but will need to be improved. Another site visit by the company will be necessary this year to take additional samples for metallurgical tests and determine the condition of the underground adits for permitting purposes.

The company's Aguila Norte processing plant is accessible mainly by paved highway from this new project. Aguila Norte has an environmental permit (IGAC) from the Peruvian government and is currently at capacity of 100 tonnes per day level. The company expects to replace third party mineral with polymetallic mineral from this new area and from its 50 per cent own Palta Dorada Au-Ag-Cu property. The company can expand Aguila Norte's throughput beyond 100 tonnes per day once the mineral supply exceeds the capacity.

Jeffrey Reeder, chief executive officer of Peruvian Metals, comments: "We are very pleased to acquire this attractive silver-rich polymetallic property. This acquisition is in line with the company's main goal to secure its own feed for the Aguila Norte processing plant. This new addition to the company's property portfolio yet again demonstrates Peruvian Metals' ability to grow organically without entering expensive third party option deals.".....

https://www.stockwatch.com/News/Item/Z-C!PER-3165709/C/PER

SK bei knapp 500k vol.................cad 0,19

wooow - grad setzten auffällige trades ein, die uns nicht nur jahres- sondern

sogar 5- jahres- HOCH bescheren..........

RT................cad 0,18

...bei DER dynamic evtl. sogar auch noch ne attacke auf die 20iger- marke möglich

sogar 5- jahres- HOCH bescheren..........

RT................cad 0,18

...bei DER dynamic evtl. sogar auch noch ne attacke auf die 20iger- marke möglich

Antwort auf Beitrag Nr.: 69.807.972 von hbg55 am 04.11.21 16:05:37

...als bereits ´prod. expl.´ profitiert PER natürlich gaaaanz direkt von den akt. hohen

rohstoff- preisen.......wie zb dem goldpreis, der heute wieder die markante marke von

usd 1800oz überwinden kann.................

akt..............usd 1812,70

...als bereits ´prod. expl.´ profitiert PER natürlich gaaaanz direkt von den akt. hohen

rohstoff- preisen.......wie zb dem goldpreis, der heute wieder die markante marke von

usd 1800oz überwinden kann.................

akt..............usd 1812,70