Auch die ESG-Blase wird platzen (Seite 3)

eröffnet am 13.10.21 20:21:15 von

neuester Beitrag 29.12.23 13:38:15 von

neuester Beitrag 29.12.23 13:38:15 von

Beiträge: 95

ID: 1.353.453

ID: 1.353.453

Aufrufe heute: 0

Gesamt: 7.039

Gesamt: 7.039

Aktive User: 0

ISIN: CH0126704169 · WKN: A1KP3F · Symbol: SXWESGET

294,30

PKT

-0,51 %

-1,51 PKT

Letzter Kurs 14.07.23 STOXX

Neuigkeiten

Beitrag zu dieser Diskussion schreiben

18.7.

EU Puts ESG Laggards on Notice Amid Investing ‘Revolution’

https://news.bloomberglaw.com/esg/eu-puts-esg-laggards-on-no…

• McGuinness says firms that don’t change have no future in EU

• Commissioner says profits aren’t the only thing that matters

...

Firms that fail to take ESG seriously face a bleak future in the European Union, as the bloc pushes ahead with the world’s most ambitious set of environmental, social and governance regulations.

That’s according to Mairead McGuinness, the EU’s commissioner for financial markets and services.

“What the European Union has been doing is quite extraordinary,” McGuinness said in an interview with Bloomberg Television’s Maria Tadeo in Brussels on Tuesday. “Profit is important but we’re now saying it’s not the only thing that matters.”

...

=> das wird nicht gut enden

Oftmals kann die Europäische Kommission die eigenen EU-Gesetze über Jahre hinweg nicht wirkungsvoll durchsetzen. Siehe die Beispiele Ungarn oder das Justizwesen in Polen.

Mairead McGuinness (European People's Party): https://de.wikipedia.org/wiki/Mairead_McGuinness

Schon merkwürdig, wenn vermeintlich Konservative mit einer "ESG-Revolution" daherkommen.

EU Puts ESG Laggards on Notice Amid Investing ‘Revolution’

https://news.bloomberglaw.com/esg/eu-puts-esg-laggards-on-no…

• McGuinness says firms that don’t change have no future in EU

• Commissioner says profits aren’t the only thing that matters

...

Firms that fail to take ESG seriously face a bleak future in the European Union, as the bloc pushes ahead with the world’s most ambitious set of environmental, social and governance regulations.

That’s according to Mairead McGuinness, the EU’s commissioner for financial markets and services.

“What the European Union has been doing is quite extraordinary,” McGuinness said in an interview with Bloomberg Television’s Maria Tadeo in Brussels on Tuesday. “Profit is important but we’re now saying it’s not the only thing that matters.”

...

=> das wird nicht gut enden

Oftmals kann die Europäische Kommission die eigenen EU-Gesetze über Jahre hinweg nicht wirkungsvoll durchsetzen. Siehe die Beispiele Ungarn oder das Justizwesen in Polen.

Mairead McGuinness (European People's Party): https://de.wikipedia.org/wiki/Mairead_McGuinness

Schon merkwürdig, wenn vermeintlich Konservative mit einer "ESG-Revolution" daherkommen.

Antwort auf Beitrag Nr.: 71.576.433 von faultcode am 14.05.22 13:48:05

logisch, siehe hier z.B.:

17.7.

BlackRock names Saudi Aramco CEO Amin Nasser to board

https://www.cnbc.com/2023/07/17/blackrock-names-saudi-aramco…

...

“His leadership experience, understanding of the global energy industry and the drivers of the shift towards a low carbon economy, as well as his knowledge of the Middle East region, will all contribute meaningfully to the BlackRock Board dialogue,” Fink added.

...

"low carbon economy" wird nun daraus gemacht

Zitat von faultcode: man hätte sowas ahnen können:

10.5.

BlackRock warns it will vote against more climate resolutions this year

Largest asset manager parts ways with most activists and says war in Ukraine has changed calculus

https://www.ft.com/content/4a538e2c-d4bb-4099-8f15-a28d0fefc…

...

logisch, siehe hier z.B.:

17.7.

BlackRock names Saudi Aramco CEO Amin Nasser to board

https://www.cnbc.com/2023/07/17/blackrock-names-saudi-aramco…

...

“His leadership experience, understanding of the global energy industry and the drivers of the shift towards a low carbon economy, as well as his knowledge of the Middle East region, will all contribute meaningfully to the BlackRock Board dialogue,” Fink added.

...

"low carbon economy" wird nun daraus gemacht

28.6.

...

Fund managers have grown weary of the growing political scorn aimed at the environmental, social and governance label. So many have decided to call their funds something else.

Thematic exchange-traded funds – ones that focus on stocks around a particular subject – have taken over as the most common way to launch products in areas like clean energy or gender diversity. According to a report by RBC Capital Markets, 56% of sustainable fund debuts so far in 2023 have been labeled thematic rather than ESG. This follows a similar breakdown seen last year, writes RBC’s Sara Mahaffy.

How toxic has the “ESG” label become? BlackRock Inc. Chief Executive Officer Larry Fink spent years positioning his firm as leader in ESG investing, only to face outcries from Republican politicians who pulled more than $3 billion in state funds from his firm. On Sunday, Fink said he’s retiring the “weaponized” term since it has been “misused by the far left and the far right.”

This is why Avantis Investors’ Phil McInnis says staying away from labels and focusing on client returns is the best bet.

“If I try to force tofu on a steak lover, or a rib-eye on a vegetarian, chances are nobody will be happy,” the chief investment strategist wrote in an email.

...

Fund managers have grown weary of the growing political scorn aimed at the environmental, social and governance label. So many have decided to call their funds something else.

https://finance.yahoo.com/news/sidestep-weaponized-esg-good-…

...

Fund managers have grown weary of the growing political scorn aimed at the environmental, social and governance label. So many have decided to call their funds something else.

Thematic exchange-traded funds – ones that focus on stocks around a particular subject – have taken over as the most common way to launch products in areas like clean energy or gender diversity. According to a report by RBC Capital Markets, 56% of sustainable fund debuts so far in 2023 have been labeled thematic rather than ESG. This follows a similar breakdown seen last year, writes RBC’s Sara Mahaffy.

How toxic has the “ESG” label become? BlackRock Inc. Chief Executive Officer Larry Fink spent years positioning his firm as leader in ESG investing, only to face outcries from Republican politicians who pulled more than $3 billion in state funds from his firm. On Sunday, Fink said he’s retiring the “weaponized” term since it has been “misused by the far left and the far right.”

This is why Avantis Investors’ Phil McInnis says staying away from labels and focusing on client returns is the best bet.

“If I try to force tofu on a steak lover, or a rib-eye on a vegetarian, chances are nobody will be happy,” the chief investment strategist wrote in an email.

...

Fund managers have grown weary of the growing political scorn aimed at the environmental, social and governance label. So many have decided to call their funds something else.

https://finance.yahoo.com/news/sidestep-weaponized-esg-good-…

...

At the start of 2022, Saab AB was struggling to attract investors. Its automotive unit long gone, the Swedish maker of Gripen fighter jets found itself shunned by fund managers wary of backing companies that profit from selling weapons.

Then Vladimir Putin invaded Ukraine, and everything changed. Defense spending is on the rise, orders have started to pour in, and investors have embarked on a rethink of the ethical criteria that kept them away. Saab, which had trouble drawing more than a handful of people to its investor meetings, saw its stock jump 40% within days of the assault.

“We had investors telling us, ‘We will never invest in Saab. You’re manufacturing dangerous products,’” Chief Executive Officer Micael Johansson said in an interview. “Just weeks later the same investors thought that maybe it wasn’t such a bad idea.”

Since then, the stock-market value of the Linköping-based company has almost tripled to 81.8 billion kronor ($7.54 billion), and order backlog reached a record 133 billion kronor at the end of the first quarter. Johansson set a new target for organic sales growth of around 10% annually through 2027.

...

31.5.

Sweden’s Saab Comes In From Cold as Investors Return to Defense

https://www.bnnbloomberg.ca/sweden-s-saab-comes-in-from-cold…

At the start of 2022, Saab AB was struggling to attract investors. Its automotive unit long gone, the Swedish maker of Gripen fighter jets found itself shunned by fund managers wary of backing companies that profit from selling weapons.

Then Vladimir Putin invaded Ukraine, and everything changed. Defense spending is on the rise, orders have started to pour in, and investors have embarked on a rethink of the ethical criteria that kept them away. Saab, which had trouble drawing more than a handful of people to its investor meetings, saw its stock jump 40% within days of the assault.

“We had investors telling us, ‘We will never invest in Saab. You’re manufacturing dangerous products,’” Chief Executive Officer Micael Johansson said in an interview. “Just weeks later the same investors thought that maybe it wasn’t such a bad idea.”

Since then, the stock-market value of the Linköping-based company has almost tripled to 81.8 billion kronor ($7.54 billion), and order backlog reached a record 133 billion kronor at the end of the first quarter. Johansson set a new target for organic sales growth of around 10% annually through 2027.

...

31.5.

Sweden’s Saab Comes In From Cold as Investors Return to Defense

https://www.bnnbloomberg.ca/sweden-s-saab-comes-in-from-cold…

24.4.

Bankers slam 'excessive' EU ESG bill that ratchets up legal risks

https://www.pionline.com/esg/bankers-slam-excessive-eu-esg-b…

...

Some of the most powerful lobbyists in Europe's finance industry are preparing to fight the passage of an ESG bill, after it won early backing from European Union lawmakers.

The Association for Financial Markets in Europe, whose members dominate the region's debt and equity capital markets, says a planned EU law designed to make it easier to sue companies for ESG violations ignores the unique status of financial firms.

The Corporate Sustainability Due Diligence Directive (CSDDD) moved a step closer to becoming law last week, after the EU Parliament's legal affairs committee struck a preliminary agreement to cover all sectors, including the finance industry. If passed, the law will force companies to pay a lot more attention to their value chains.

In practice, that means that human rights abuses or environmental damage that occurs in an EU corporation's value chain may expose that company to civil liability or regulatory penalties.

CSDDD has the potential to be one of the EU's most far-reaching pieces of environmental, social and governance rule-making. While ESG regulations passed to date impose disclosure requirements on companies, the due diligence directive would force them to act on the information they're disclosing. If they don't, they can be punished by regulators and sued by stakeholders.

...

Bankers slam 'excessive' EU ESG bill that ratchets up legal risks

https://www.pionline.com/esg/bankers-slam-excessive-eu-esg-b…

...

Some of the most powerful lobbyists in Europe's finance industry are preparing to fight the passage of an ESG bill, after it won early backing from European Union lawmakers.

The Association for Financial Markets in Europe, whose members dominate the region's debt and equity capital markets, says a planned EU law designed to make it easier to sue companies for ESG violations ignores the unique status of financial firms.

The Corporate Sustainability Due Diligence Directive (CSDDD) moved a step closer to becoming law last week, after the EU Parliament's legal affairs committee struck a preliminary agreement to cover all sectors, including the finance industry. If passed, the law will force companies to pay a lot more attention to their value chains.

In practice, that means that human rights abuses or environmental damage that occurs in an EU corporation's value chain may expose that company to civil liability or regulatory penalties.

CSDDD has the potential to be one of the EU's most far-reaching pieces of environmental, social and governance rule-making. While ESG regulations passed to date impose disclosure requirements on companies, the due diligence directive would force them to act on the information they're disclosing. If they don't, they can be punished by regulators and sued by stakeholders.

...

Daniel Kretinsky, CZ:

6.4.

Elusive Billionaire Mints It Betting Against Europe's Green Plans

https://www.energyconnects.com/news/utilities/2023/april/elu…

...

The potential sale of German coal mines and power plants owned by Swedish energy giant Vattenfall AB had become a flashpoint before the negotiations even began. Many in Germany wanted to see the planet- warming facilities shut down, not passed to someone else. The would-be buyer was a small Czech company few had heard of.

At times, when the 2016 talks hit an impasse, one of the executives representing the buyer would make a phone call or send a WhatsApp message. On the other end was Daniel Kretinsky, an elusive Czech businessman who controls EPH Group. Kretinsky was always available but stayed in the background, according to a person familiar with the negotiations, who declined to be identified because the meetings in Berlin were confidential.

...

In the span of a decade, Kretinsky has used that discreet dealmaking style to assemble one of the largest portfolios of fossil fuel businesses in Europe.

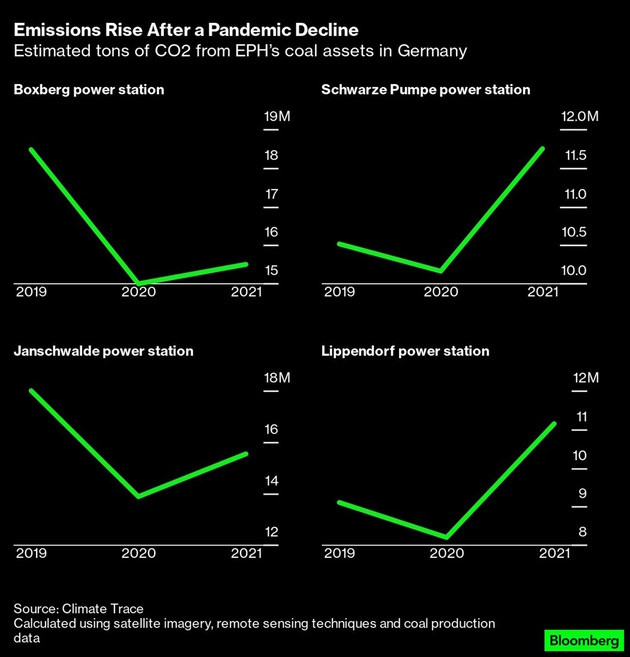

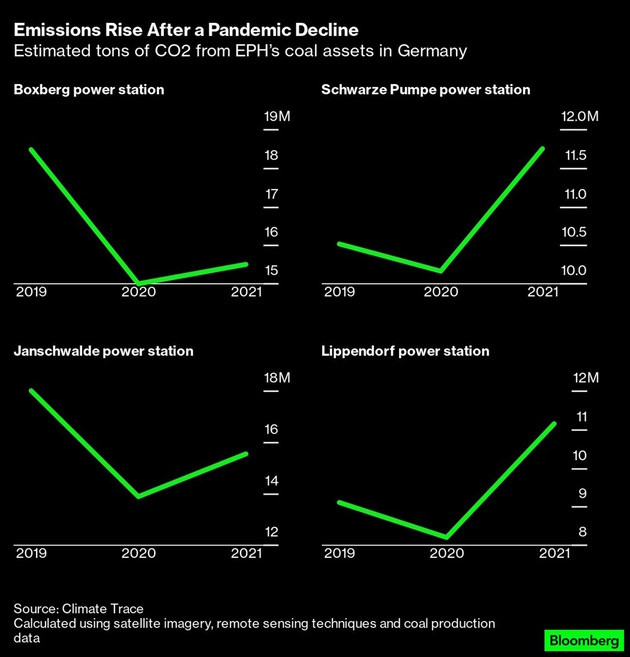

In the process, he’s moved millions of tons of carbon off the ledgers of the region’s highest-polluting energy companies and onto EPH’s books. EPH, of which he’s the majority shareholder, has become one of the largest polluters in Europe, the second-biggest coal miner in Germany and a major transporter of Russian gas into the continent.

Kretinsky was acting on a bold assumption: Europe’s vaunted green transition will be a messy, prolonged affair that requires burning coal and gas for longer than anticipated. The 47-year-old former lawyer has built a fossil fuel empire estimated at more than $17 billion by scooping up dirty assets at fire-sale prices from utilities rushing to decarbonize. Unencumbered by the investors and regulators that pressured those public companies to cut emissions, his privately held company has been able to freely reap the profits from burning dirty fuels. The gamble has paid off, for now, with the war in Ukraine stoking energy prices.

...

He’s one of the most striking beneficiaries of a worrying global trend: the transfer of publicly held fossil fuel assets into the arms of private businesses, which typically have looser climate goals and don’t answer to investors concerned about environmental, social and governance ( ESG) issues. Private entities acquired $13.6 billion worth of upstream oil and gas assets from publicly traded companies in 2022, a 31% jump from a year earlier, according to data compiled by consulting firm Wood Mackenzie for . A third of North Sea oil and gas infrastructure is already in private hands, according to Common Wealth, a UK nonprofit.

This pattern is extending the life of some of the world’s most polluting facilities and hampering Europe’s efforts to green its economy. It’s also a key reason carbon dioxide emissions often rise when fossil fuel majors divest.

...

Kretinsky became chair of EPH in 2009 after the private bank where he worked as a lawyer created the company to house a group of small Czech energy assets. His pivotal move came in 2013, when EPH took a significant stake in Slovakia’s Eustream gas pipeline, a reliable and steady source of cash. Over the next few years, Kretinsky snapped up coal mines in Germany and Poland, followed by more carbon-spewing assets in France, Ireland, Italy, the Netherlands and the UK.

In 2020, the year European lawmakers approved the world’s most ambitious climate plan, EPH was generating about half its electricity from coal and its plans to expand into gas outstripped those of every other European energy company, according to the environmental group Ember. The strategy worked. In 2021, EPH reported €18.9 billion ($20.4 billion) in revenue, rising more than €10 billion from the previous year, while the operating profit hit €1.5 billion. By June of last year, it had become the largest Czech company by revenue.

...

The two facilities were part of the focus of the 2016 negotiations in Berlin that Kretinsky had closely monitored. Today they’re prized assets in his portfolio, belonging to a company called LEAG, which is 50% owned by EPH.

Details of the controversial transaction weren’t disclosed. According to estimates by Osicka, the Czech buyers paid only €29 million. That would be a steal considering the properties had assets worth €3.4 billion, against liabilities and provisions of €2 billion. The real coup for Kretinsky, however, was that the transfer included about €1.7 billion in cash that Vattenfall’s utilities had set aside to cover the future cost of dismantling the mines and restoring the land.

And the German government said it would pay LEAG an additional €1.75 billion to switch off its lignite plants more quickly.

The European Union is now investigating whether that compensation plan was based on correct assumptions regarding the bloc’s carbon price.

...

6.4.

Elusive Billionaire Mints It Betting Against Europe's Green Plans

https://www.energyconnects.com/news/utilities/2023/april/elu…

...

The potential sale of German coal mines and power plants owned by Swedish energy giant Vattenfall AB had become a flashpoint before the negotiations even began. Many in Germany wanted to see the planet- warming facilities shut down, not passed to someone else. The would-be buyer was a small Czech company few had heard of.

At times, when the 2016 talks hit an impasse, one of the executives representing the buyer would make a phone call or send a WhatsApp message. On the other end was Daniel Kretinsky, an elusive Czech businessman who controls EPH Group. Kretinsky was always available but stayed in the background, according to a person familiar with the negotiations, who declined to be identified because the meetings in Berlin were confidential.

...

In the span of a decade, Kretinsky has used that discreet dealmaking style to assemble one of the largest portfolios of fossil fuel businesses in Europe.

In the process, he’s moved millions of tons of carbon off the ledgers of the region’s highest-polluting energy companies and onto EPH’s books. EPH, of which he’s the majority shareholder, has become one of the largest polluters in Europe, the second-biggest coal miner in Germany and a major transporter of Russian gas into the continent.

Kretinsky was acting on a bold assumption: Europe’s vaunted green transition will be a messy, prolonged affair that requires burning coal and gas for longer than anticipated. The 47-year-old former lawyer has built a fossil fuel empire estimated at more than $17 billion by scooping up dirty assets at fire-sale prices from utilities rushing to decarbonize. Unencumbered by the investors and regulators that pressured those public companies to cut emissions, his privately held company has been able to freely reap the profits from burning dirty fuels. The gamble has paid off, for now, with the war in Ukraine stoking energy prices.

...

He’s one of the most striking beneficiaries of a worrying global trend: the transfer of publicly held fossil fuel assets into the arms of private businesses, which typically have looser climate goals and don’t answer to investors concerned about environmental, social and governance ( ESG) issues. Private entities acquired $13.6 billion worth of upstream oil and gas assets from publicly traded companies in 2022, a 31% jump from a year earlier, according to data compiled by consulting firm Wood Mackenzie for . A third of North Sea oil and gas infrastructure is already in private hands, according to Common Wealth, a UK nonprofit.

This pattern is extending the life of some of the world’s most polluting facilities and hampering Europe’s efforts to green its economy. It’s also a key reason carbon dioxide emissions often rise when fossil fuel majors divest.

...

Kretinsky became chair of EPH in 2009 after the private bank where he worked as a lawyer created the company to house a group of small Czech energy assets. His pivotal move came in 2013, when EPH took a significant stake in Slovakia’s Eustream gas pipeline, a reliable and steady source of cash. Over the next few years, Kretinsky snapped up coal mines in Germany and Poland, followed by more carbon-spewing assets in France, Ireland, Italy, the Netherlands and the UK.

In 2020, the year European lawmakers approved the world’s most ambitious climate plan, EPH was generating about half its electricity from coal and its plans to expand into gas outstripped those of every other European energy company, according to the environmental group Ember. The strategy worked. In 2021, EPH reported €18.9 billion ($20.4 billion) in revenue, rising more than €10 billion from the previous year, while the operating profit hit €1.5 billion. By June of last year, it had become the largest Czech company by revenue.

...

The two facilities were part of the focus of the 2016 negotiations in Berlin that Kretinsky had closely monitored. Today they’re prized assets in his portfolio, belonging to a company called LEAG, which is 50% owned by EPH.

Details of the controversial transaction weren’t disclosed. According to estimates by Osicka, the Czech buyers paid only €29 million. That would be a steal considering the properties had assets worth €3.4 billion, against liabilities and provisions of €2 billion. The real coup for Kretinsky, however, was that the transfer included about €1.7 billion in cash that Vattenfall’s utilities had set aside to cover the future cost of dismantling the mines and restoring the land.

And the German government said it would pay LEAG an additional €1.75 billion to switch off its lignite plants more quickly.

The European Union is now investigating whether that compensation plan was based on correct assumptions regarding the bloc’s carbon price.

...

4.4.

ESG Asset Recount in Europe to Ax ‘Vague’ Fund Strategies

https://finance.yahoo.com/news/esg-asset-recount-europe-ax-0…

...

Fund managers offering hard-to-define strategies such as “ESG integration” will be excluded from the next major tally of Europe’s sustainable investing market.

The European Sustainable Investment Forum, whose most recent estimate put the market at $12 trillion, is in the process of developing a revised methodology to calculate its actual size.

Chairman Will Oulton said that as “expectations move beyond a basic ESG integration or simple sector-exclusions model, there will be an inevitable recalibration of what constitutes a sustainable investment.”

For anyone trying to get a sense of the real size of the market, “there is little interest today in those strategies that have a minimum level of non-binding ESG integration which have in the past been captured” in estimates, he said in an interview.

The forum, which is known as Eurosif, had been due to provide a revised estimate for 2022. But the review is now expected to be ready later this year as the group finalizes the new methodology, Oulton said. The delay comes amid mass downgrades that have repeatedly hit fund managers offering strategies built on environmental, social and governance metrics on stricter regulatory guidance.

“Fund managers need to start thinking about the way they communicate their ESG credentials, offerings, and commitments to clients,” said Emilie Rowe, head of financial services at Aspectus Group. Some firms “will need to make pretty stark changes when it comes to their communications strategy,” she said.

...

Eurosif = European Sustainable Investment Forum: https://www.eurosif.org/

ESG Asset Recount in Europe to Ax ‘Vague’ Fund Strategies

https://finance.yahoo.com/news/esg-asset-recount-europe-ax-0…

...

Fund managers offering hard-to-define strategies such as “ESG integration” will be excluded from the next major tally of Europe’s sustainable investing market.

The European Sustainable Investment Forum, whose most recent estimate put the market at $12 trillion, is in the process of developing a revised methodology to calculate its actual size.

Chairman Will Oulton said that as “expectations move beyond a basic ESG integration or simple sector-exclusions model, there will be an inevitable recalibration of what constitutes a sustainable investment.”

For anyone trying to get a sense of the real size of the market, “there is little interest today in those strategies that have a minimum level of non-binding ESG integration which have in the past been captured” in estimates, he said in an interview.

The forum, which is known as Eurosif, had been due to provide a revised estimate for 2022. But the review is now expected to be ready later this year as the group finalizes the new methodology, Oulton said. The delay comes amid mass downgrades that have repeatedly hit fund managers offering strategies built on environmental, social and governance metrics on stricter regulatory guidance.

“Fund managers need to start thinking about the way they communicate their ESG credentials, offerings, and commitments to clients,” said Emilie Rowe, head of financial services at Aspectus Group. Some firms “will need to make pretty stark changes when it comes to their communications strategy,” she said.

...

Eurosif = European Sustainable Investment Forum: https://www.eurosif.org/

3.4.

A $15 Billion Swap-Based ETF Exposes the Latest ESG Headache

https://news.bloomberglaw.com/esg/a-15-billion-swap-based-et…

...

One of the world’s biggest synthetic exchange-traded funds is starting to look like exhibit-A in the latest controversy to hit ESG ratings.

The $15 billion ETF, which is managed by Invesco Ltd., uses swaps to offer clients exposure to the S&P 500. The ETF currently has a AA rating at MSCI ESG Research, the biggest provider of such scores. Under European Union rules, however, the fund is registered as Article 6, meaning the product doesn’t target any environmental, social or governance goals.

...

A $15 Billion Swap-Based ETF Exposes the Latest ESG Headache

https://news.bloomberglaw.com/esg/a-15-billion-swap-based-et…

...

One of the world’s biggest synthetic exchange-traded funds is starting to look like exhibit-A in the latest controversy to hit ESG ratings.

The $15 billion ETF, which is managed by Invesco Ltd., uses swaps to offer clients exposure to the S&P 500. The ETF currently has a AA rating at MSCI ESG Research, the biggest provider of such scores. Under European Union rules, however, the fund is registered as Article 6, meaning the product doesn’t target any environmental, social or governance goals.

...

Antwort auf Beitrag Nr.: 73.111.281 von faultcode am 18.01.23 01:14:35

"peace" heißt es nun:

8.2.

Weinberg Capital Partners creates the Eiréné fund dedicated to French SMEs and mid-caps companies in the security and defense sector

https://www.weinbergcapital.com/en/all-news/weinberg-capital…

...

Eiréné, who in Greek mythology is the daughter of Zeus and Themis and embodies Peace, is in line with the historical approach of Weinberg Capital Partners in terms of ESG; peace being an essential condition for the development of ambitious societal and environmental policies.

...

A first closing, with more than 100 million euros in commitments, was made with institutional and private investors.

...

Zitat von faultcode: Die "ESG-Welle" ist mMn auch am Krieg in der Ukraine verebbt. Speziell Europa kann sich so ein rigoroses Konzept einfach nicht (mehr) leisten. ...

"peace" heißt es nun:

8.2.

Weinberg Capital Partners creates the Eiréné fund dedicated to French SMEs and mid-caps companies in the security and defense sector

https://www.weinbergcapital.com/en/all-news/weinberg-capital…

...

Eiréné, who in Greek mythology is the daughter of Zeus and Themis and embodies Peace, is in line with the historical approach of Weinberg Capital Partners in terms of ESG; peace being an essential condition for the development of ambitious societal and environmental policies.

...

A first closing, with more than 100 million euros in commitments, was made with institutional and private investors.

...

Die "ESG-Welle" ist mMn auch am Krieg in der Ukraine verebbt. Speziell Europa kann sich so ein rigoroses Konzept einfach nicht (mehr) leisten.

Jetzt kommen eben die Rohstoffe, die zuvor aus Russland kamen, vermehrt aus anderen Ländern. Bei diesen Lieferketten rigorose ESG-Standards tatsächlich anzuwenden, würde überhaupt nicht funktionieren ohne Europa quasi zum Stillstand zu bringen.

Beispiele zu Deutschland:

• weitere Braunkohle-Förderungen in West-Deutschland, vermutlich auf unabsehbare Zeit

• zeitweise Importe von Atom-Strom aus den Nachbarländern Belgien (und in Zukunft wahrscheinlich wieder Niederlande), Frankreich, Tschechische Republik (und in Zukunft vermutlich auch aus Polen)

• erhöhte Importe von Öl und Gas aus Aserbaidschan ("Doppelt so viel Gas"), alles andere als ein Hort der Menschenrechte: https://www.zdf.de/nachrichten/politik/eu-kommission-aserbai…

• Steinkohle aus Kolumbien, quasi als vergleichsweise günstige Rückversicherung bei "Dunkelflaute" in Deutschland; auch kein Land mit gehobenen ESG-Standards

• und über die deutsche Doppelmoral beim Erdgas-Fracking will ich mich gar nicht erst aufregen:

-- Fracking-Gas in der norddeutschen Tiefebene: pfui

-- Fracking-Gas aus den USA mit neuen Lieferverträgen in 2022 mit Laufzeiten von oft 15 Jahren: hui --> das stehen Kanzler und Vize-Kanzler gleich selber bei der Einweihung am neuen Terminal: https://www.zdf.de/nachrichten/wirtschaft/lng-terminal-lubmi…

• usw.

Das soll hier kein Plädoyer für erneute Rohstoff-Lieferungen aus Russland sein oder aussagen, daß zu obigen Beispielen ESG-konformere Quellen erschlossen werden sollen, nur wie mMn hierzulande die "ESG-Landschaft" aus meiner Sicht in Wahrheit aussieht:

=> jedes Folge-Produkt oder Dienstleistung, die auf obigen Beispielen (in der EU) aufbaut, kann mMn überhaupt nicht (voll) ESG-konform sein, so wie in den Regularien der EU z.B. festgelegt: https://www.consilium.europa.eu/en/press/press-releases/2022…

=> Folge: das oft kritisierte Greenwashing fängt in Europa vielfach auf den höchsten, politischen Ebenen an

Ich sage nicht, daß man nun ESG-Konzepte in Europa wieder vollkommen außer Acht lassen soll, aber ich sage: so wie bisher stolpert man von einem eklatanten Widerspruch in den nächsten.

Jetzt kommen eben die Rohstoffe, die zuvor aus Russland kamen, vermehrt aus anderen Ländern. Bei diesen Lieferketten rigorose ESG-Standards tatsächlich anzuwenden, würde überhaupt nicht funktionieren ohne Europa quasi zum Stillstand zu bringen.

Beispiele zu Deutschland:

• weitere Braunkohle-Förderungen in West-Deutschland, vermutlich auf unabsehbare Zeit

• zeitweise Importe von Atom-Strom aus den Nachbarländern Belgien (und in Zukunft wahrscheinlich wieder Niederlande), Frankreich, Tschechische Republik (und in Zukunft vermutlich auch aus Polen)

• erhöhte Importe von Öl und Gas aus Aserbaidschan ("Doppelt so viel Gas"), alles andere als ein Hort der Menschenrechte: https://www.zdf.de/nachrichten/politik/eu-kommission-aserbai…

• Steinkohle aus Kolumbien, quasi als vergleichsweise günstige Rückversicherung bei "Dunkelflaute" in Deutschland; auch kein Land mit gehobenen ESG-Standards

• und über die deutsche Doppelmoral beim Erdgas-Fracking will ich mich gar nicht erst aufregen:

-- Fracking-Gas in der norddeutschen Tiefebene: pfui

-- Fracking-Gas aus den USA mit neuen Lieferverträgen in 2022 mit Laufzeiten von oft 15 Jahren: hui --> das stehen Kanzler und Vize-Kanzler gleich selber bei der Einweihung am neuen Terminal: https://www.zdf.de/nachrichten/wirtschaft/lng-terminal-lubmi…

• usw.

Das soll hier kein Plädoyer für erneute Rohstoff-Lieferungen aus Russland sein oder aussagen, daß zu obigen Beispielen ESG-konformere Quellen erschlossen werden sollen, nur wie mMn hierzulande die "ESG-Landschaft" aus meiner Sicht in Wahrheit aussieht:

=> jedes Folge-Produkt oder Dienstleistung, die auf obigen Beispielen (in der EU) aufbaut, kann mMn überhaupt nicht (voll) ESG-konform sein, so wie in den Regularien der EU z.B. festgelegt: https://www.consilium.europa.eu/en/press/press-releases/2022…

=> Folge: das oft kritisierte Greenwashing fängt in Europa vielfach auf den höchsten, politischen Ebenen an

Ich sage nicht, daß man nun ESG-Konzepte in Europa wieder vollkommen außer Acht lassen soll, aber ich sage: so wie bisher stolpert man von einem eklatanten Widerspruch in den nächsten.