Anlagen- und Maschinenbau für Minenbetreiber etc. - Älteste Beiträge zuerst (Seite 6)

eröffnet am 08.02.17 20:51:00 von

neuester Beitrag 18.04.24 11:14:43 von

neuester Beitrag 18.04.24 11:14:43 von

Beiträge: 117

ID: 1.246.436

ID: 1.246.436

Aufrufe heute: 0

Gesamt: 8.766

Gesamt: 8.766

Aktive User: 0

ISIN: FI0009014575 · WKN: A0LBTW · Symbol: M6Q

10,610

EUR

0,00 %

0,000 EUR

Letzter Kurs 10:58:07 Tradegate

Werte aus der Branche Maschinenbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 51,00 | +15,91 | |

| 913,00 | +14,73 | |

| 7,4100 | +14,71 | |

| 14,740 | +14,30 | |

| 627,15 | +14,01 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,8820 | -9,63 | |

| 12,010 | -11,04 | |

| 0,6800 | -12,26 | |

| 6,0400 | -13,71 | |

| 1,3400 | -26,37 |

Outotec's Financial Statements Review January-December 2018 -- ilmenite smelter project

https://www.outotec.com/company/media/news/2019/outotecs-fin…=>

...

Financial guidance for 2019

Based on the current market outlook, we expect our sales to increase, and our aEBIT* to increase significantly from the 2018 aEBIT (EUR 63.8 million) without the provision for the ilmenite smelter project.

*Excluding restructuring- and acquisition-related items, as well as PPA amortizations...

=> Schadensprovision in SA ("provision for the ilmenite smelter project"):

Outotec has made a EUR 110 million provision for possible costs relating to the ilmenite smelter project in Saudi Arabia (Stock Exchange Releases on May 31, 2012; October 26, 2018; October 30, 2018 and February 8, 2019).

The currently estimated provision is based on progress made with the analysis of the furnace. The provision is booked in Outotec's fourth quarter 2018 result. The outcome of the analysis, together with other factors such as Outotec's contractual position, will determine the eventual liability and financial impact of this incident for Outotec.

Antwort auf Beitrag Nr.: 59.824.404 von faultcode am 08.02.19 13:26:56aus den "FINANCIAL STATEMENTS AND REPORT BY THE BOARD OF DIRECTORS":

=>

• die Personalstruktur ist viel zu Europa-lastig

• auch ist der Order backlog recht lau (*)

• Kupfer ist hier das maßgebliche Metall, und zwar mit Abstand

(*) das ist interessant, da es auch heißen könnte, daß bei den betreffenden Rohstoffen es weiter Preisauftrieb geben könnte, da die Kunden von Outotec sich mit Aufträgen wiederholt zurückhalten. Stichwort: Kapazitäten

=>

• die Personalstruktur ist viel zu Europa-lastig

• auch ist der Order backlog recht lau (*)

• Kupfer ist hier das maßgebliche Metall, und zwar mit Abstand

(*) das ist interessant, da es auch heißen könnte, daß bei den betreffenden Rohstoffen es weiter Preisauftrieb geben könnte, da die Kunden von Outotec sich mit Aufträgen wiederholt zurückhalten. Stichwort: Kapazitäten

Antwort auf Beitrag Nr.: 59.931.599 von faultcode am 21.02.19 13:34:41

=>

...Outotec has signed a contract with the Moroccan OCP Group for the delivery of a sulfuric acid plant for fertilizer production. The approximately EUR 80 million order has been booked into Outotec's 2019 first quarter order intake.

Outotec's delivery includes the engineering, procurement and construction of the plant, which is based on Outotec's sulfur burning system. The new acid plant will incorporate advanced proprietary technologies such as HEROS heat recovery system as well as a converter, absorption towers and an acid distribution system that are made of the Edmeston SX stainless steel alloy.

With more than 20 acid plants and several mining sites, OCP Group is a global fertilizer producer and leader in the phosphate industry. The acid plant will be built in connection with their existing chemical complexes and support in OCP's fertilizer production from phosphate rock from their mining processes as a raw material.

"Outotec's sulfuric acid technology has proven to be one of the leading technologies for decades. We are honored that OCP has selected our design for their new plant. With our leading technologies providing benefits such as safety, high reliability and enhanced heat recovery we are happy to help OCP reach their sustainability targets," says Kalle Härkki, head of Outotec's Metals, Energy & Water business...

Outotec to deliver sulfuric acid plant to Morocco

https://www.wallstreet-online.de/nachricht/11305794-outotec-…=>

...Outotec has signed a contract with the Moroccan OCP Group for the delivery of a sulfuric acid plant for fertilizer production. The approximately EUR 80 million order has been booked into Outotec's 2019 first quarter order intake.

Outotec's delivery includes the engineering, procurement and construction of the plant, which is based on Outotec's sulfur burning system. The new acid plant will incorporate advanced proprietary technologies such as HEROS heat recovery system as well as a converter, absorption towers and an acid distribution system that are made of the Edmeston SX stainless steel alloy.

With more than 20 acid plants and several mining sites, OCP Group is a global fertilizer producer and leader in the phosphate industry. The acid plant will be built in connection with their existing chemical complexes and support in OCP's fertilizer production from phosphate rock from their mining processes as a raw material.

"Outotec's sulfuric acid technology has proven to be one of the leading technologies for decades. We are honored that OCP has selected our design for their new plant. With our leading technologies providing benefits such as safety, high reliability and enhanced heat recovery we are happy to help OCP reach their sustainability targets," says Kalle Härkki, head of Outotec's Metals, Energy & Water business...

Antwort auf Beitrag Nr.: 60.087.504 von faultcode am 13.03.19 11:26:19

=>

...Outotec and Russian iron ore pellet producer JSC Stoilensky GOK (S-GOK), which is a part of NLMK Group, have entered into a contract to expand S-GOK's pellet plant located in Stary Oskol, Russia. The approximately EUR 15 million order has been booked in Outotec's 2019 first quarter order intake.

Outotec has delivered the technology for S-GOK's pellet plant (press release September 12, 2011), which has been in operation since 2017. The annual capacity of the pellet plant will be increased from 6 to 8 million tonnes. Outotec will be responsible for the engineering, supply of key equipment and automation system as well as advisory services for installation and commissioning of the expansion. Outotec's latest technology improvements in green pelletizing, cooling air process, and pallet car changing system will be applied, together with a digital solution package. Outotec's deliveries will take place at the end of 2020...

Outotec awarded a pellet plant expansion contract by JSC Stoilensky GOK in Russia

https://www.wallstreet-online.de/nachricht/11342867-outotec-…=>

...Outotec and Russian iron ore pellet producer JSC Stoilensky GOK (S-GOK), which is a part of NLMK Group, have entered into a contract to expand S-GOK's pellet plant located in Stary Oskol, Russia. The approximately EUR 15 million order has been booked in Outotec's 2019 first quarter order intake.

Outotec has delivered the technology for S-GOK's pellet plant (press release September 12, 2011), which has been in operation since 2017. The annual capacity of the pellet plant will be increased from 6 to 8 million tonnes. Outotec will be responsible for the engineering, supply of key equipment and automation system as well as advisory services for installation and commissioning of the expansion. Outotec's latest technology improvements in green pelletizing, cooling air process, and pallet car changing system will be applied, together with a digital solution package. Outotec's deliveries will take place at the end of 2020...

Saudi Arabian Mining Company (Ma'aden) awarded Outotec a EUR 140 million gold processing plant order

ganz dicker Auftrag und sehr wichtig --> heißt das doch, daß die Sache mit dem Ofen doch nicht so schlimm ist, um einen anderen Großauftrag in Saudi Arabia zu blockieren:https://www.wallstreet-online.de/nachricht/11417822-saudi-ar…

=>

...In a major international competitive bidding process, the Saudi Arabian Mining Company (Ma'aden) has awarded the consortium of Outotec and Larsen & Toubro with an engineering, procurement and construction contract to build a greenfield mineral concentrator and gold processing plant in the Kingdom of Saudi Arabia.

Outotec's share of the project is over EUR 140 million. The order is almost evenly shared between the reporting segments and will be booked into Outotec's second quarter 2019 order intake. The total value of the project is approximately EUR 540 million...

Outotec's delivery includes basic and detail engineering, procurement and delivery of process equipment, commissioning, start-up assistance and training services. The new gold processing plant is due to be completed in 2022. Ma'aden is the champion of the Saudi Arabian mining industry, and now internationally recognized mining company with global presence.

The Mansourah & Massarah mines and processing plant will be built in the Central Arabian gold region. The processing plant will be capable of processing up to four million tonnes of ore per annum. The concentrator and the gold processing plant is designed producing an average of 250,000 ounces of gold per year over the life of mine...

Antwort auf Beitrag Nr.: 60.457.277 von faultcode am 30.04.19 14:59:06

=>

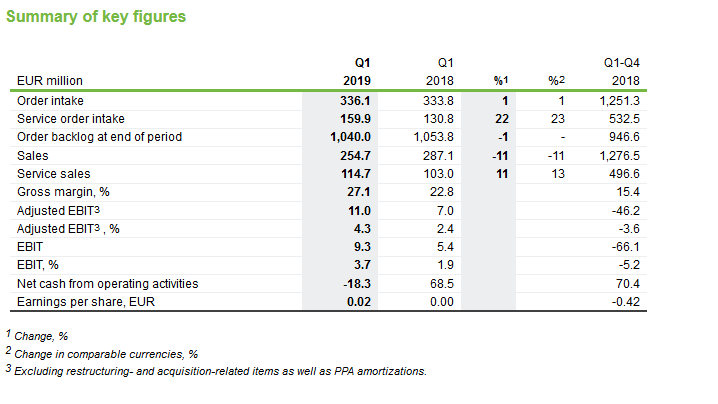

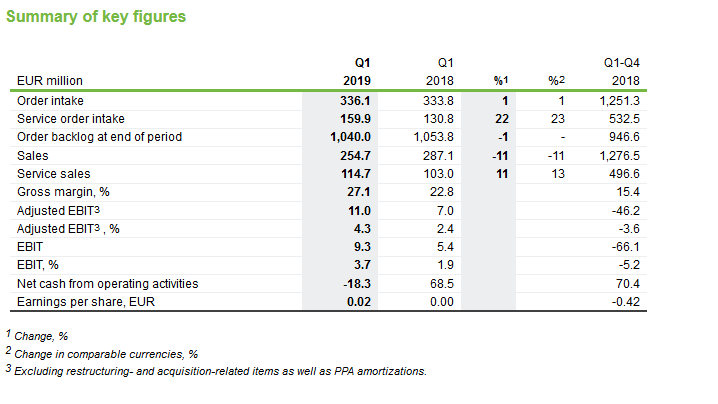

2019Q1

https://www.wallstreet-online.de/nachricht/11437383-outotec-…=>

Antwort auf Beitrag Nr.: 60.515.757 von faultcode am 08.05.19 13:01:35

=>

...Outotec has been awarded a contract to design and deliver a mine paste backfill system to OZ Minerals' Prominent Hill mine. The contract price is EUR 15 million and it has been booked into Outotec's 2019 second quarter order intake.

Outotec's supply includes the design and delivery of a complete paste backfill system as well as detailed design of the underground distribution network and fill management systems. The new paste backfill plant will be based on a unique process design, which allows flexibility to use continuously produced fresh tailings or store filter cake to meet the future backfill needs of the underground mining operation.

The new facility is expected to have a capacity of 215 m3 per hour...

Outotec to deliver a mine paste backfill system to Australia

https://www.wallstreet-online.de/nachricht/11458247-outotec-…=>

...Outotec has been awarded a contract to design and deliver a mine paste backfill system to OZ Minerals' Prominent Hill mine. The contract price is EUR 15 million and it has been booked into Outotec's 2019 second quarter order intake.

Outotec's supply includes the design and delivery of a complete paste backfill system as well as detailed design of the underground distribution network and fill management systems. The new paste backfill plant will be based on a unique process design, which allows flexibility to use continuously produced fresh tailings or store filter cake to meet the future backfill needs of the underground mining operation.

The new facility is expected to have a capacity of 215 m3 per hour...

Grossauftrag: Outotec awarded EUR 250 million copper plant for Baikal Mining Company in Russia

eigentlich: sehr großer Auftraghttps://www.wallstreet-online.de/nachricht/11514756-outotec-…

=>

...In addition to Outotec's announcement on June 7, 2019 at 2:10 pm, Outotec has now signed a contract with Baikal Mining Company for the design and delivery of a greenfield copper concentrator and hydrometallurgical plant for the Udokan project located in the Kalarsky District in the Russian Far East.

The contract price is approximately EUR 250 million of which approximately EUR 35 million will be booked in Outotec's second quarter order intake. Roughly two thirds of the order will be booked for Minerals Processing and one third for Metals, Energy & Water segment.

Outotec's delivery includes basic and detail engineering of the concentrator and copper hydrometallurgical plant, procurement, delivery of main process equipment as well as installation supervision, training and start-up services.

The new metallurgical complex is expected to operate with the annual capacity of 12 million tonnes of ore and producing 130,000 tonnes of copper as high grade sulphide concentrate and as cathodes. Outotec's main deliveries are expected to take place in 2020.

"Udokan is the world's third largest known undeveloped copper deposit. We are extremely pleased about being selected as a technology partner in this significant project. Our proven technologies and services enable Baikal Mining Company to develop their operations in a sustainable way and get the best value from their assets," says Markku Teräsvasara, CEO of Outotec.

"As a result of years of research, together with leading Russian and international engineering companies, we have developed a unique flowsheet for processing the Udokan copper deposit. With Outotec's expertise and technologies we can automate the processes to the maximum extent," says Valery Kazikayev Chairman of the Board of Directors of the Baikal Mining Company...

=> das Desaster in Saudi Arabien ist damit aber noch nicht ausgestanden:

Combination of Metso Minerals and Outotec – Metso Flow Control to Become an Independent Company

https://markets.businessinsider.com/news/stocks/combination-…--> in einfach:

* Metso Minerals ohne Flow Control (=Ventile) + Outotec => Metso Outotec

=>

...

Combination of Metso Minerals and Outotec to Create a Leading Company in Process Technology, Equipment and Services Serving the Minerals, Metals and Aggregates Industries

Metso Flow Control to Become a Separately Listed Independent Flow Control Equipment and Services Company under the Name of Neles

Transaction Highlights

* Metso and Outotec have agreed to combine Metso Minerals and Outotec to create a leading company in process technology, equipment and services serving the minerals, metals and aggregates industries. The Combined Company, comprising Metso Minerals and Outotec (but excluding Metso Flow Control), will be named “Metso Outotec”. It had illustrative combined sales of €3.9 billion in 2018 (approximately €4.2 billion including the impact of the recently announced acquisition of McCloskey by Metso)

* Metso Flow Control will be a pure-play listed entity under the name of Neles with 2018 sales of €593 million

* The combination of Metso Minerals and Outotec is highly complementary and will create a unique company in the industry. Metso Outotec will leverage the strengths of both companies, including technology and R&D, product and process excellence, scale and global service offering footprint. The combination will deliver significant benefits to all stakeholders

* Metso Minerals and Outotec expect to achieve run-rate annual pre-tax cost synergies of at least €100 million, and run-rate annual revenue synergies of at least €150 million, delivering significant value for shareholders

* The recently announced acquisition of McCloskey is expected to complement the business profile of Metso Outotec, expanding and strengthening the aggregates business

* Metso Outotec will benefit from strong free cash flow and a solid capital structure and will aim for an investment grade credit rating in line with the current Metso rating

* The dividend policy for Metso Outotec will be determined by the board of Metso Outotec following completion of the transaction. However, Metso Outotec is expected to have the capacity for an attractive dividend policy, consistent with Metso’s current dividend policy, while maintaining a strong balance sheet

* The combination will be implemented through a partial demerger of Metso, in which all assets and liabilities of Metso that relate to Metso Minerals will transfer to Outotec in exchange for newly-issued shares in Outotec to be delivered to Metso shareholders. Outotec shareholders will continue to own their shares in Outotec

* Upon completion, Metso shareholders will receive 4.3 newly-issued shares in Outotec for each share owned in Metso on the record date. This implies Metso shareholders would own approximately 78.0% of the shares and votes of Metso Outotec, and Outotec shareholders would own approximately 22.0% of the shares and votes of Metso Outotec. In addition, Metso shareholders will retain their current shares in Metso, which will be renamed Neles

* The current CEO of Metso, Mr. Pekka Vauramo, will become Metso Outotec’s CEO, and the current CEO of Outotec, Mr. Markku Teräsvasara, will become the Deputy CEO of Metso Outotec. Ms. Eeva Sipilä will become the CFO and Deputy CEO of Metso Outotec

* The board of Metso Outotec will include board members from both companies. It is proposed that Metso Outotec’s Chairman will be Mr. Mikael Lilius and that the Vice Chairman will be Mr. Matti Alahuhta

* The transaction is unanimously recommended by the boards of Metso and Outotec to their respective shareholders. The transaction is subject to, among other items, approval by a majority of two-thirds of votes cast and shares represented at the respective EGMs of Metso and Outotec in respect of the transaction, and regulatory approvals including competition clearances. As the transaction is proposed to be implemented by way of a partial demerger of Metso, it is also subject to a statutory creditor hearing process of Metso’s creditors

* Shareholders representing 33.6% of the shares and votes of Metso and shareholders representing 24.8% of the shares and votes of Outotec have irrevocably undertaken to vote in favor of the transaction

* Metso Outotec will apply and seek to develop the sustainability agendas of Metso and Outotec across the enlarged group

* A €1.55 billion backup and term loan facilities agreement has been entered into with Nordea Bank Abp initially for the benefit of Metso but which, upon completion of the transaction, will transfer to Metso Outotec to address certain potential financing and refinancing needs arising from or in connection with the transaction

* Metso Outotec’s headquarters will be in Helsinki, Finland and it will maintain its listing on Nasdaq Helsinki

* Completion is expected in the second quarter of 2020, subject to the approval of the transaction by the EGMs of both Metso and Outotec, the statutory creditor hearing process and receipt of all required regulatory and other approvals

..

Antwort auf Beitrag Nr.: 60.955.039 von faultcode am 04.07.19 15:11:37

+22%

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +11,29 | |

| -2,36 | |

| -1,15 | |

| -0,75 | |

| +0,17 | |

| +5,70 | |

| -0,19 | |

| -0,36 | |

| 0,00 | |

| +0,58 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 228 | ||

| 103 | ||

| 99 | ||

| 83 | ||

| 70 | ||

| 38 | ||

| 35 | ||

| 34 | ||

| 33 | ||

| 32 |