LYNAS - auf dem Weg zu einem Rohstoffproduzent von Hightech-Rohstoffen (Seite 4917)

eröffnet am 09.02.07 13:14:18 von

neuester Beitrag 03.05.24 06:30:35 von

neuester Beitrag 03.05.24 06:30:35 von

Beiträge: 57.648

ID: 1.110.967

ID: 1.110.967

Aufrufe heute: 75

Gesamt: 9.813.102

Gesamt: 9.813.102

Aktive User: 0

ISIN: AU000000LYC6 · WKN: 871899 · Symbol: LYI

4,0930

EUR

+2,30 %

+0,0920 EUR

Letzter Kurs 10:01:28 Tradegate

Neuigkeiten

18.04.24 · Der Aktionär TV |

23.01.24 · kapitalerhoehungen.de |

22.01.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5500 | +17,02 | |

| 2,0500 | +13,89 | |

| 3,3400 | +10,60 | |

| 1,4300 | +10,00 | |

| 35,60 | +8,50 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7200 | -9,43 | |

| 0,7340 | -12,62 | |

| 0,6000 | -18,37 | |

| 0,6601 | -26,22 | |

| 1,1600 | -46,79 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 40.131.763 von JoJo49 am 10.09.10 12:27:39

Hin und wieder danken kostet nix.

Hin und wieder danken kostet nix.

Antwort auf Beitrag Nr.: 40.131.278 von Fuenfvorzwoelf am 10.09.10 11:17:18Hallo Fuenfvorzwoelf,

nichts zu danken und dafür habe ich u.a. auch diesen Thread eröffnet.

In den vergangen Monaten kann man aus den vielen Artikel zum Thema: REO diese nach Qualitätsmerkmalen selektieren, denn es sieht so aus das sich z.Z. fasst jeder Investmentberater/Journalist/Bankproduktverkäufer usw. meint sich mit diesem Thema profilieren zu müssen.

Zum Thema China kann ich mir nicht vorstellen das sie auf Grund der weltweiten Nachfrage bei weiter steigendem Bedarf sich selber ans Bein pinkeln werden, denn wenn ihre Wirtschaft zukünftig weiterhin so wachsen sollte, und darauf sind die Chinesen IHMO angewiesen, werden sie über kurz oder lang selber zum Importeur von REO werden.

China ist zwar immer noch mit über 90% der größte Hersteller von REO aber besitzt nur 35% der Ressourcen in ihrem Land.

@ ein schönes WE

Grüsse JoJo

PS - Manchmal wird man auch überrascht wenn sich Leute wie Tony Mariano zum positiven wandeln:

http://jutiagroup.com/2010/08/03/tony-mariano-the-special-sc…

Tony Mariano: The Special Science of Rare Earths

By The Gold Report, on August 3rd, 2010 in Expert Interviews

Source: Karen Roche and Sally Lowder of The Gold Report

The ability to separate the science from the promotional claims is among the expertise that Geological Consultant Tony Mariano, PhD, brings to the rare earth elements (REE) table. Tony, who for decades has combined long hours in the lab with even longer field visits to evaluate mineralization in its natural environment, is among the rare ones who can help companies evaluate a deposit for grade, tonnage and the prospects for economic recovery. A sharp technician who manages to keep his head out of the clouds and his feet on the ground, Tony shares some of his secrets, and some of his opinions about the hottest prospective properties, in this exclusive interview with The Gold Report.

The Gold Report: Jon Hykawy, technology analyst at Byron Capital Markets, recently told us that short supplies of heavy rare earths (HREEs) will be driving up their price and shifting the economies of mining projects in favor of companies that can produce large quantities of heavy rare earths. To what extent do you agree with that assessment?

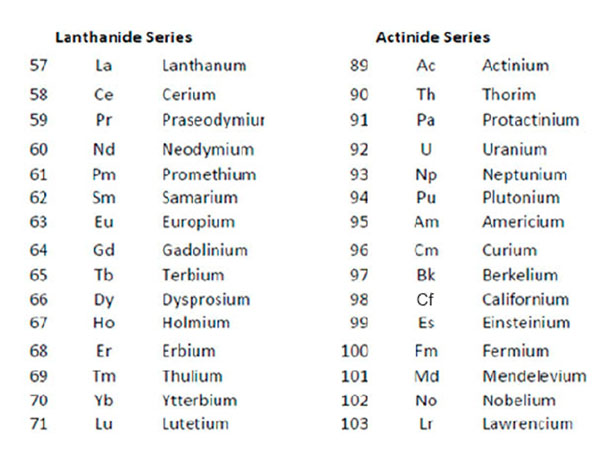

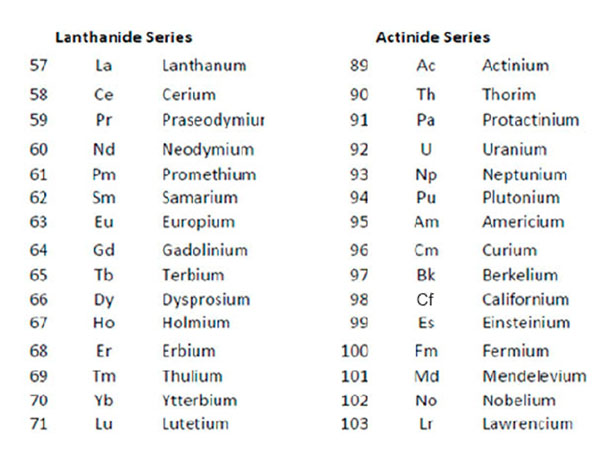

Tony Mariano: I believe that this may be true, however we must define our demarcation of the light rare earth elements (LREEs) and heavy rare earth elements. Individuals have their own ideas of where to start defining the heavies as opposed to the lights.

Currently the lanthanides in greatest demand are neodymium, europium, gadolinium, dysprosium and terbium; however, the demand for particular REEs is dynamic and can change at any time. Praseodymium is also of value because of its similar properties to neodymium.

When companies promote their deposits, they tend to come up with something along the lines of, "We have a certain percentage of the heavies and a certain percentage of the lights." The greater the percentage of the heavies they show, the more it is to their advantage, so they tend to start counting in areas that I would qualify as light rare earth elements.

When REEs are being discussed, people should define what they mean by the light and heavy rare earths. For me, the lights go midway through gadolinium. I would classify the heavies as terbium through lutetium. If you attempt to synthesize each of the REEs with a certain complex, phosphorus pentoxide (P2O5), for example, lanthanum through gadolinium will assume a monoclinic structure. Terbium through lutetium will assume a tetragonal structure similar to yttrium phosphate, and also similar to the mineral zircon. For me this demarcation is more rigorous from a scientific point of view. Otherwise the distinction between the LREEs and HREEs is arbitrary.

TGR: So the generally accepted notion that the HREEs are less common and therefore rarer and more valuable isn’t accurate?

TM: No, that’s not accurate. They’re heavies or they’re lights, period. Some are common. Some are not. Some of the heavies tend to be much rarer. Lutetium is a rare element, but yttrium—which always accompanies the heavy lanthanides—is not a rare element. In many areas, dysprosium, erbium and terbium are not that rare.

TGR: When investors hear the terms light rare earths and heavy rare earths, how should they be thinking as far as the economic viability of a deposit?

TM: I would imagine they have to pay attention to those that are currently in demand and place that into the equation. When they hear that a deposit has a certain amount of tonnage of certain elements, nowadays people tend to sit down and look at those elements’ market prices. Then they decide that they’ve got something great. To me this approach can be very misleading.

TGR: Why?

TM: You can find many deposits that show good grade and tonnage consisting of a large quantity of valuable elements. If one calculates the elements’ value based on current prices, the deposit looks like it’s of great value. However, those elements must be mineable and economic to process so they are competitive in the marketplace. In many occurrences that might not be the case.

TGR: The Chinese have become very good at finding rare earth deposits and processing them, and are dominant in this space. Recently they announced they will begin restricting rare earth exports, which seems to have created a rush to find deposits throughout North America. In general, where do you think the prospects look good?

TM: We know of a number of deposits in North America where we can acquire the light lanthanides. We can do well going from lanthanum into the mid-atomic number lanthanides. That would include deposits such as Molycorp Mineral’s (NYSE:MCP) Mountain Pass in California, Rare Element Resources Ltd.’s (TSX.V: RES) Bear Lodge carbonatite in Wyoming, and Wicheeda Lake in British Columbia, which is run by a private company, Spectrum Mining Corporation. [Editor's note: Molycorp Minerals (NYSE:MCP) went public 7/29/2010. See press release.]

The Mountain Pass deposit is rich in LREEs with ample grade and tonnage, and Molycorp has the technology to produce excellent REE concentrates for lanthanum, cerium, praseodymium, neodymium and samarium. And based on work that I have done in Wicheeda Lake, that mineralogy is amenable to physical concentration and there should be no problems in chemical processing.

Although we have sources in North America for LREEs in addition to those I just mentioned, to me they may have the best potential.

In terms of the heavies, we have several interesting HREE occurrences with some potential that are currently being investigated.

TGR: What are some of the deposits with the high ratio of heavies to lights that you’re interested in?

TM: I’ve been working for Ucore Rare Metals Inc. (TSX.V:UCU) on Bokan Mountain in Alaska. It’s on the southern tip of Prince of Wales Island. The accessibility there is the best of almost any deposit. It’s principally heavy rare earth enriched with yttrium and dysprosium, gadolinium, erbium and ytterbium. The heavy lanthanides dominate the mineralogy. At this time they are working to establish whether they have sufficient grade and tonnage, and whether it’s amenable to economic recovery.

They’re in the exploration process right now. As a matter of fact, I’m scheduled to go there August 8–13, with Ucore people and a number of others from the United States Geological Survey. The U.S. government is quite interested in these minerals because they are of military importance.

TGR: Let’s move on to some of the other deposits you’d like to talk about.

TM: I started the mineral exploration in Kipawa, Quebec, for Molycorp in the mid-1980s. Kipawa is enriched with the mineral eudialyte, which means "well decomposable" in Greek. I was able to establish that eudialyte contained yttrium and HREEs in anomalous amounts.

A number of years ago Matamec Explorations Inc. (TSX.V:MAT), a Canadian company from Québec, acquired the mineral rights on Kipawa. I’ve been basically working with Matamec and they are beginning to get some very interesting results.

TGR: What are you finding?

TM: First of all, it’s going to be very easy to make a eudialyte physical concentrate in Kipawa. In fact, the way I see it, it’s going to be easier to do this than in any other eudialyte deposit that I’ve worked on thus far. They are working on establishing that they indeed can process the eudialyte concentrate chemically to remove all of the lanthanides and yttrium and be able to bring them into the market. And do it at a cost that’s competitive.

TGR: So the ease of creating that eudialyte concentrate translates into a lower cost of production?

TM: Yes. But there are a lot of other additional costs. Using common sense, if a deposit is in a certain type of geologic occurrence where the rocks are very difficult to crush and separate, it’s going to be much more costly. And if a deposit is in a remote place it’s going to cost a lot more to mine and you need to get power, too. You need to get reagents. You need qualified people to do the mining. Also, speaking of other complications, the Parajito is currently owned by First Nations groups who have not allowed requests for access to the land and have yet to partner with a public company, so investment there is not possible at this time.

TGR: TGR: You mentioned Rare Element Resources’ Bear Lodge a bit earlier. What’s the story there?

TM: Bear Lodge is a light lanthanide deposit. I did the initial work on Bear Lodge in the ’70s—again for Molycorp. I did all of the mineralogy. I just came back from there in mid-July. Bear Lodge can provide light lanthanides and some of the mid-atomic number lanthanides in greater quantity than Mountain Pass, so that deposit has very good potential.

TGR: Now what about that deposit in South Africa? I’m not sure I can pronounce it.

TM: Steenkampskraal. That belongs to Great Western Minerals Group Ltd. (TSX.V:GWG; OTCQX:GWMGF), out of Saskatchewan.

TGR: Have you visited that site?

TM: No, I’ve never been there. I’ve worked on some of the minerals. Many years ago a Brazilian colleague of mine visited the occurrence there and he brought back minerals. I’ve done a lot of work on monazite from all over the world, including Steenkampskraal. So I know quite a bit about the mineral.

TGR: Hasn’t GWG entered into an option agreement with Search Minerals Inc.’s (TSX.V:SMY) wholly owned subsidiary, Alterra Resources, for a 50% working interest in Alterra’s Red Wine property in Labrador, too?

TM: Yes. Great Western Minerals Group is there. Medallion Resources Ltd. (TSX.V:MDL) also has an option agreement going in the Red Wine, and I’ll be going to visit the Medallion area shortly and will be able to give my opinion on this deposit and rank it relative to other eudialyte deposits. As a matter of fact, I’m working on 15 polished thin sections and slabs from the Red Wine that I obtained. This is principally a eudialyte deposit and it also contains alkali zirconosilicates—AZS—that have the heavy rare earths and may be amenable to economic recovery.

TGR: Is Medallion’s Eden Lake deposit primarily light earths?

TM: Yes, but it appears to have an interesting showing of some of the heavies as well. However, these things don’t come to you. It needs to be evaluated and it costs money to do that. These people are aware of that. They try to acquire people with the best background who are equipped to do these evaluations, such as Jim Clark, who is vice president of exploration for Rare Element Resources. He will join me on a field visit to collect rocks and evaluate Eden.

Plenty of academic people have worked on these things, but the academics are not exploration geologists. Even economic geology professors don’t make their living on exploration and true economics. They make their living teaching, hopefully teaching students and publishing academic papers. They make great contributions, but when they look at a deposit, they don’t focus on the things we geologists have to focus on in order to evaluate a deposit from an exploration and economic point of view.

So academic people have looked at Eden Lake and perhaps to some extent, some exploration people as well, but not exploration people with a background on rare earth deposits. By background I mean in the laboratory and in the field, areas in which Jim Clark and I both have expertise.

One has to look at these deposits. Once you study and understand them in the field and in the laboratory, you can make a value judgment about which have the best possibility of being able to take over the marketplace. These include Pajarito, Kipawa, Bokan Mountain, the Red Wine complex and the Norra Kärr project in Sweden.

TGR: That’s Tasman Metals Ltd.’s (TSX.V:TSM) project?

TM: Yes. I just visited there with Tasman, and I’m busy working on that also. Eudialyte deposits include the Ilimaussaq Intrusion in southern Greenland and eudialyte deposits in the Kola Peninsula of Russia as well. These occurrences have a lot of potential and they are very interesting deposits, but they have to be looked at.

TGR: Right. Now let me ask you about one more project and that is Strange Lake. You’ve obviously visited Strange Lake.

TM: I did a considerable amount of work in the early 1980s on Strange Lake. It’s a large A-type granite circular structure, close to 5 kilometers in diameter. I believe it was first discovered by Iron Ore Company of Canada (IOC). Now Quest Rare Minerals Ltd. (TSX.V:QRM) is exploring and defining Strange Lake.

This deposit is made up of a complexity of a number of different rare earth-bearing minerals that are very fine grain and are locked mostly in quartz and feldspar. So there are problems in processing, to say nothing of the remoteness of the deposit and some other issues that go beyond what I specialize in—like cost of transportation and social and political issues. However, recently they have made considerable progress in their drilling program, uncovering some areas of very attractive mineralization.

TGR: We’ve talked about Eden Lake, Mountain Pass, Bear Lodge, Wicheeda Lake, Bokan Mountain, Strange Lake, Pajarito, Kipawa, Red Wine, Steenkampskraal, Norra Kärr, the Ilimaussaq Intrusion and the Kola Peninsula. Have we left off any?

TM: There are so many deposits, it’s hard to keep them all in mind. The deposits I currently think have the most potential and deserve a closer look from the point of view of the heavy lanthanides are Pajarito and Kipawa. We need to look into the Red Wine to find out what indeed is there. And I hear there are some interesting things at the Douglas River deposit. I have a pretty good idea what the geology is, but I’ve never been to the Douglas River. I’m scheduled to go there August 23–30.

TGR: Where is Douglas River?

TM: It’s in Saskatchewan. It’s similar to the Maw zone in the lower part of the Athabasca—the uranium occurrence. It’s supposedly mineralized with xenotime. The mineral xenotime has about 29% to 31% yttrium oxide. About another 30% includes the other heavy lanthanides. So it’s a very attractive mineral. But again, it needs to be found in grade and tonnage to make it a bona fide deposit.

TGR: If Pajarito and the Kipawa are developed and begin to produce, will they deliver enough supply to satisfy the demand or will we need additional mines?

TM: I think they’d be able to satisfy the conditions for a number of years. Meanwhile, we’re very busy looking all over the world for more of these. Particularly since the lanthanides, the heavies and including the lights, as far as I’m concerned, have unique properties. This is particularly true of the lanthanides, where the valence electrons are suborbital, which imparts very special properties. And they’re being used extensively in many ways.

TGR: Early on in the conversation we touched on China beginning to restrict exports of the various rare earths. With some of these deposits potentially coming into production, are the fears that are being generated unfounded?

TM: Well. . .Bear in mind, once you find the deposit it’s very costly to get it going, to reproduce a Mountain Pass. So suppose people do find these different deposits and finally establish that they have the grade and tonnage and that the deposit is amenable to economic recovery. At that time a large capital is required to start a mine.

TGR: Tony, this has been a great education in the world of rare earths. We appreciate your time.

Anthony N. (Tony) Mariano, PhD, is a geological consultant on rare earths and other rare metals. For decades, he has been the "go-to" expert on the geology and mineralogy on rare earths, niobium-tantalum and other rare metals. A seasoned mineralogist and petrographer, Tony integrates his strong knowledge of geology and extractive metallurgy ("geometallurgy") to predict success or failure of proposed rare earth ventures. Companies around the world depend on his professional opinions on the potential economic viability of deposits based on mineralogical examination, lab work and field visits. After earning his PhD in geology from Boston University, Tony worked a number of years at Kennecott Research’s lab in Massachusetts, after which he began his career as a consulting geologist, specializing in carbonatite-hosted rare earth and niobium deposits.

übersetzt: http://translate.google.com/translate?js=n&prev=_t&hl=de&ie=…

nichts zu danken und dafür habe ich u.a. auch diesen Thread eröffnet.

In den vergangen Monaten kann man aus den vielen Artikel zum Thema: REO diese nach Qualitätsmerkmalen selektieren, denn es sieht so aus das sich z.Z. fasst jeder Investmentberater/Journalist/Bankproduktverkäufer usw. meint sich mit diesem Thema profilieren zu müssen.

Zum Thema China kann ich mir nicht vorstellen das sie auf Grund der weltweiten Nachfrage bei weiter steigendem Bedarf sich selber ans Bein pinkeln werden, denn wenn ihre Wirtschaft zukünftig weiterhin so wachsen sollte, und darauf sind die Chinesen IHMO angewiesen, werden sie über kurz oder lang selber zum Importeur von REO werden.

China ist zwar immer noch mit über 90% der größte Hersteller von REO aber besitzt nur 35% der Ressourcen in ihrem Land.

@ ein schönes WE

Grüsse JoJo

PS - Manchmal wird man auch überrascht wenn sich Leute wie Tony Mariano zum positiven wandeln:

http://jutiagroup.com/2010/08/03/tony-mariano-the-special-sc…

Tony Mariano: The Special Science of Rare Earths

By The Gold Report, on August 3rd, 2010 in Expert Interviews

Source: Karen Roche and Sally Lowder of The Gold Report

The ability to separate the science from the promotional claims is among the expertise that Geological Consultant Tony Mariano, PhD, brings to the rare earth elements (REE) table. Tony, who for decades has combined long hours in the lab with even longer field visits to evaluate mineralization in its natural environment, is among the rare ones who can help companies evaluate a deposit for grade, tonnage and the prospects for economic recovery. A sharp technician who manages to keep his head out of the clouds and his feet on the ground, Tony shares some of his secrets, and some of his opinions about the hottest prospective properties, in this exclusive interview with The Gold Report.

The Gold Report: Jon Hykawy, technology analyst at Byron Capital Markets, recently told us that short supplies of heavy rare earths (HREEs) will be driving up their price and shifting the economies of mining projects in favor of companies that can produce large quantities of heavy rare earths. To what extent do you agree with that assessment?

Tony Mariano: I believe that this may be true, however we must define our demarcation of the light rare earth elements (LREEs) and heavy rare earth elements. Individuals have their own ideas of where to start defining the heavies as opposed to the lights.

Currently the lanthanides in greatest demand are neodymium, europium, gadolinium, dysprosium and terbium; however, the demand for particular REEs is dynamic and can change at any time. Praseodymium is also of value because of its similar properties to neodymium.

When companies promote their deposits, they tend to come up with something along the lines of, "We have a certain percentage of the heavies and a certain percentage of the lights." The greater the percentage of the heavies they show, the more it is to their advantage, so they tend to start counting in areas that I would qualify as light rare earth elements.

When REEs are being discussed, people should define what they mean by the light and heavy rare earths. For me, the lights go midway through gadolinium. I would classify the heavies as terbium through lutetium. If you attempt to synthesize each of the REEs with a certain complex, phosphorus pentoxide (P2O5), for example, lanthanum through gadolinium will assume a monoclinic structure. Terbium through lutetium will assume a tetragonal structure similar to yttrium phosphate, and also similar to the mineral zircon. For me this demarcation is more rigorous from a scientific point of view. Otherwise the distinction between the LREEs and HREEs is arbitrary.

TGR: So the generally accepted notion that the HREEs are less common and therefore rarer and more valuable isn’t accurate?

TM: No, that’s not accurate. They’re heavies or they’re lights, period. Some are common. Some are not. Some of the heavies tend to be much rarer. Lutetium is a rare element, but yttrium—which always accompanies the heavy lanthanides—is not a rare element. In many areas, dysprosium, erbium and terbium are not that rare.

TGR: When investors hear the terms light rare earths and heavy rare earths, how should they be thinking as far as the economic viability of a deposit?

TM: I would imagine they have to pay attention to those that are currently in demand and place that into the equation. When they hear that a deposit has a certain amount of tonnage of certain elements, nowadays people tend to sit down and look at those elements’ market prices. Then they decide that they’ve got something great. To me this approach can be very misleading.

TGR: Why?

TM: You can find many deposits that show good grade and tonnage consisting of a large quantity of valuable elements. If one calculates the elements’ value based on current prices, the deposit looks like it’s of great value. However, those elements must be mineable and economic to process so they are competitive in the marketplace. In many occurrences that might not be the case.

TGR: The Chinese have become very good at finding rare earth deposits and processing them, and are dominant in this space. Recently they announced they will begin restricting rare earth exports, which seems to have created a rush to find deposits throughout North America. In general, where do you think the prospects look good?

TM: We know of a number of deposits in North America where we can acquire the light lanthanides. We can do well going from lanthanum into the mid-atomic number lanthanides. That would include deposits such as Molycorp Mineral’s (NYSE:MCP) Mountain Pass in California, Rare Element Resources Ltd.’s (TSX.V: RES) Bear Lodge carbonatite in Wyoming, and Wicheeda Lake in British Columbia, which is run by a private company, Spectrum Mining Corporation. [Editor's note: Molycorp Minerals (NYSE:MCP) went public 7/29/2010. See press release.]

The Mountain Pass deposit is rich in LREEs with ample grade and tonnage, and Molycorp has the technology to produce excellent REE concentrates for lanthanum, cerium, praseodymium, neodymium and samarium. And based on work that I have done in Wicheeda Lake, that mineralogy is amenable to physical concentration and there should be no problems in chemical processing.

Although we have sources in North America for LREEs in addition to those I just mentioned, to me they may have the best potential.

In terms of the heavies, we have several interesting HREE occurrences with some potential that are currently being investigated.

TGR: What are some of the deposits with the high ratio of heavies to lights that you’re interested in?

TM: I’ve been working for Ucore Rare Metals Inc. (TSX.V:UCU) on Bokan Mountain in Alaska. It’s on the southern tip of Prince of Wales Island. The accessibility there is the best of almost any deposit. It’s principally heavy rare earth enriched with yttrium and dysprosium, gadolinium, erbium and ytterbium. The heavy lanthanides dominate the mineralogy. At this time they are working to establish whether they have sufficient grade and tonnage, and whether it’s amenable to economic recovery.

They’re in the exploration process right now. As a matter of fact, I’m scheduled to go there August 8–13, with Ucore people and a number of others from the United States Geological Survey. The U.S. government is quite interested in these minerals because they are of military importance.

TGR: Let’s move on to some of the other deposits you’d like to talk about.

TM: I started the mineral exploration in Kipawa, Quebec, for Molycorp in the mid-1980s. Kipawa is enriched with the mineral eudialyte, which means "well decomposable" in Greek. I was able to establish that eudialyte contained yttrium and HREEs in anomalous amounts.

A number of years ago Matamec Explorations Inc. (TSX.V:MAT), a Canadian company from Québec, acquired the mineral rights on Kipawa. I’ve been basically working with Matamec and they are beginning to get some very interesting results.

TGR: What are you finding?

TM: First of all, it’s going to be very easy to make a eudialyte physical concentrate in Kipawa. In fact, the way I see it, it’s going to be easier to do this than in any other eudialyte deposit that I’ve worked on thus far. They are working on establishing that they indeed can process the eudialyte concentrate chemically to remove all of the lanthanides and yttrium and be able to bring them into the market. And do it at a cost that’s competitive.

TGR: So the ease of creating that eudialyte concentrate translates into a lower cost of production?

TM: Yes. But there are a lot of other additional costs. Using common sense, if a deposit is in a certain type of geologic occurrence where the rocks are very difficult to crush and separate, it’s going to be much more costly. And if a deposit is in a remote place it’s going to cost a lot more to mine and you need to get power, too. You need to get reagents. You need qualified people to do the mining. Also, speaking of other complications, the Parajito is currently owned by First Nations groups who have not allowed requests for access to the land and have yet to partner with a public company, so investment there is not possible at this time.

TGR: TGR: You mentioned Rare Element Resources’ Bear Lodge a bit earlier. What’s the story there?

TM: Bear Lodge is a light lanthanide deposit. I did the initial work on Bear Lodge in the ’70s—again for Molycorp. I did all of the mineralogy. I just came back from there in mid-July. Bear Lodge can provide light lanthanides and some of the mid-atomic number lanthanides in greater quantity than Mountain Pass, so that deposit has very good potential.

TGR: Now what about that deposit in South Africa? I’m not sure I can pronounce it.

TM: Steenkampskraal. That belongs to Great Western Minerals Group Ltd. (TSX.V:GWG; OTCQX:GWMGF), out of Saskatchewan.

TGR: Have you visited that site?

TM: No, I’ve never been there. I’ve worked on some of the minerals. Many years ago a Brazilian colleague of mine visited the occurrence there and he brought back minerals. I’ve done a lot of work on monazite from all over the world, including Steenkampskraal. So I know quite a bit about the mineral.

TGR: Hasn’t GWG entered into an option agreement with Search Minerals Inc.’s (TSX.V:SMY) wholly owned subsidiary, Alterra Resources, for a 50% working interest in Alterra’s Red Wine property in Labrador, too?

TM: Yes. Great Western Minerals Group is there. Medallion Resources Ltd. (TSX.V:MDL) also has an option agreement going in the Red Wine, and I’ll be going to visit the Medallion area shortly and will be able to give my opinion on this deposit and rank it relative to other eudialyte deposits. As a matter of fact, I’m working on 15 polished thin sections and slabs from the Red Wine that I obtained. This is principally a eudialyte deposit and it also contains alkali zirconosilicates—AZS—that have the heavy rare earths and may be amenable to economic recovery.

TGR: Is Medallion’s Eden Lake deposit primarily light earths?

TM: Yes, but it appears to have an interesting showing of some of the heavies as well. However, these things don’t come to you. It needs to be evaluated and it costs money to do that. These people are aware of that. They try to acquire people with the best background who are equipped to do these evaluations, such as Jim Clark, who is vice president of exploration for Rare Element Resources. He will join me on a field visit to collect rocks and evaluate Eden.

Plenty of academic people have worked on these things, but the academics are not exploration geologists. Even economic geology professors don’t make their living on exploration and true economics. They make their living teaching, hopefully teaching students and publishing academic papers. They make great contributions, but when they look at a deposit, they don’t focus on the things we geologists have to focus on in order to evaluate a deposit from an exploration and economic point of view.

So academic people have looked at Eden Lake and perhaps to some extent, some exploration people as well, but not exploration people with a background on rare earth deposits. By background I mean in the laboratory and in the field, areas in which Jim Clark and I both have expertise.

One has to look at these deposits. Once you study and understand them in the field and in the laboratory, you can make a value judgment about which have the best possibility of being able to take over the marketplace. These include Pajarito, Kipawa, Bokan Mountain, the Red Wine complex and the Norra Kärr project in Sweden.

TGR: That’s Tasman Metals Ltd.’s (TSX.V:TSM) project?

TM: Yes. I just visited there with Tasman, and I’m busy working on that also. Eudialyte deposits include the Ilimaussaq Intrusion in southern Greenland and eudialyte deposits in the Kola Peninsula of Russia as well. These occurrences have a lot of potential and they are very interesting deposits, but they have to be looked at.

TGR: Right. Now let me ask you about one more project and that is Strange Lake. You’ve obviously visited Strange Lake.

TM: I did a considerable amount of work in the early 1980s on Strange Lake. It’s a large A-type granite circular structure, close to 5 kilometers in diameter. I believe it was first discovered by Iron Ore Company of Canada (IOC). Now Quest Rare Minerals Ltd. (TSX.V:QRM) is exploring and defining Strange Lake.

This deposit is made up of a complexity of a number of different rare earth-bearing minerals that are very fine grain and are locked mostly in quartz and feldspar. So there are problems in processing, to say nothing of the remoteness of the deposit and some other issues that go beyond what I specialize in—like cost of transportation and social and political issues. However, recently they have made considerable progress in their drilling program, uncovering some areas of very attractive mineralization.

TGR: We’ve talked about Eden Lake, Mountain Pass, Bear Lodge, Wicheeda Lake, Bokan Mountain, Strange Lake, Pajarito, Kipawa, Red Wine, Steenkampskraal, Norra Kärr, the Ilimaussaq Intrusion and the Kola Peninsula. Have we left off any?

TM: There are so many deposits, it’s hard to keep them all in mind. The deposits I currently think have the most potential and deserve a closer look from the point of view of the heavy lanthanides are Pajarito and Kipawa. We need to look into the Red Wine to find out what indeed is there. And I hear there are some interesting things at the Douglas River deposit. I have a pretty good idea what the geology is, but I’ve never been to the Douglas River. I’m scheduled to go there August 23–30.

TGR: Where is Douglas River?

TM: It’s in Saskatchewan. It’s similar to the Maw zone in the lower part of the Athabasca—the uranium occurrence. It’s supposedly mineralized with xenotime. The mineral xenotime has about 29% to 31% yttrium oxide. About another 30% includes the other heavy lanthanides. So it’s a very attractive mineral. But again, it needs to be found in grade and tonnage to make it a bona fide deposit.

TGR: If Pajarito and the Kipawa are developed and begin to produce, will they deliver enough supply to satisfy the demand or will we need additional mines?

TM: I think they’d be able to satisfy the conditions for a number of years. Meanwhile, we’re very busy looking all over the world for more of these. Particularly since the lanthanides, the heavies and including the lights, as far as I’m concerned, have unique properties. This is particularly true of the lanthanides, where the valence electrons are suborbital, which imparts very special properties. And they’re being used extensively in many ways.

TGR: Early on in the conversation we touched on China beginning to restrict exports of the various rare earths. With some of these deposits potentially coming into production, are the fears that are being generated unfounded?

TM: Well. . .Bear in mind, once you find the deposit it’s very costly to get it going, to reproduce a Mountain Pass. So suppose people do find these different deposits and finally establish that they have the grade and tonnage and that the deposit is amenable to economic recovery. At that time a large capital is required to start a mine.

TGR: Tony, this has been a great education in the world of rare earths. We appreciate your time.

Anthony N. (Tony) Mariano, PhD, is a geological consultant on rare earths and other rare metals. For decades, he has been the "go-to" expert on the geology and mineralogy on rare earths, niobium-tantalum and other rare metals. A seasoned mineralogist and petrographer, Tony integrates his strong knowledge of geology and extractive metallurgy ("geometallurgy") to predict success or failure of proposed rare earth ventures. Companies around the world depend on his professional opinions on the potential economic viability of deposits based on mineralogical examination, lab work and field visits. After earning his PhD in geology from Boston University, Tony worked a number of years at Kennecott Research’s lab in Massachusetts, after which he began his career as a consulting geologist, specializing in carbonatite-hosted rare earth and niobium deposits.

übersetzt: http://translate.google.com/translate?js=n&prev=_t&hl=de&ie=…

Antwort auf Beitrag Nr.: 40.131.278 von Fuenfvorzwoelf am 10.09.10 11:17:18Für China ist Lynas kein Problem, sondern die Lösung. Damit können sie ihren REO-Export auf Null zurückfahren, ohne am Pranger zu stehen, weil sie die westliche HitecIndustrie kaputtmachen.

Es geht hier nicht um künstliche Verknappung und GewinnMaximierung, sondern um Rohstoffmangel mindestens in den nächsten 3 Jahren. Erst wenn viele REO-Fabriken existieren, und es sich lohnt, auch niedrig dosierte Erze zu verarbeiten, wird die Knappheit - bei hohen REO-Preisen - beendet.

Es geht hier nicht um künstliche Verknappung und GewinnMaximierung, sondern um Rohstoffmangel mindestens in den nächsten 3 Jahren. Erst wenn viele REO-Fabriken existieren, und es sich lohnt, auch niedrig dosierte Erze zu verarbeiten, wird die Knappheit - bei hohen REO-Preisen - beendet.

Antwort auf Beitrag Nr.: 40.130.245 von caphis am 10.09.10 08:23:53wenn Matal-Pages gar keine Veränderung zeigt heisst das für mich nur, dass die Preise nicht upgedated wurden. Ich glaube nicht, dass der Basket Preis am Montag fällt.

http://www.asianmetal.com/news/getProductsNewsEn.am?productT…

zeigt für CE eine steigende Preistendenz. Ich tippe also für Montag auf einen leicht gestiegenen Basket

mal sehen!

http://www.asianmetal.com/news/getProductsNewsEn.am?productT…

zeigt für CE eine steigende Preistendenz. Ich tippe also für Montag auf einen leicht gestiegenen Basket

mal sehen!

Hallo Mod,

vielen Dank für das "Cleanen".

Hallo Jojo,

vielen Dank für den interessanten Artikel.

Avalon's goal is to further increase profit margin by including a mill and a hydrometallurgical plant on site.

But because of the remote location and heavy infrastructure needs, the project will cost an estimated C$844 million ($792.6 million) to bring into production, which analysts see as a tough pill for investors to swallow.

Ich kann mir nicht vorstellen, dass das was wird. Die sind erstens vom Timing her im Vergleich zu Lynas völlig abgeschlagen, zwotens ist das doch alles viel zu teuer. Und wenn die Chinesen wollen, machen die den Markt wieder kaputt, kaum dass ein paar neue Minen und Verarbeiter aufgemacht haben. Ist die Frage, wie die Chinesen mit dem Problem Lynas umgehen.

vielen Dank für das "Cleanen".

Hallo Jojo,

vielen Dank für den interessanten Artikel.

Avalon's goal is to further increase profit margin by including a mill and a hydrometallurgical plant on site.

But because of the remote location and heavy infrastructure needs, the project will cost an estimated C$844 million ($792.6 million) to bring into production, which analysts see as a tough pill for investors to swallow.

Ich kann mir nicht vorstellen, dass das was wird. Die sind erstens vom Timing her im Vergleich zu Lynas völlig abgeschlagen, zwotens ist das doch alles viel zu teuer. Und wenn die Chinesen wollen, machen die den Markt wieder kaputt, kaum dass ein paar neue Minen und Verarbeiter aufgemacht haben. Ist die Frage, wie die Chinesen mit dem Problem Lynas umgehen.

Hallo User,

es wurden einige der aktuellen Beiträge aus diesem Thread entfernt.

Wir bitten Euch darüber hinaus ausschließlich zum eigentlichen Thema zu schreiben und Diskussionen über andere Werte in die passenden Threads zu verschieben, bzw. per Boardmail zu besprechen.

Ein schönes Wochenende wünscht Euch,

Euer w : o - Team

es wurden einige der aktuellen Beiträge aus diesem Thread entfernt.

Wir bitten Euch darüber hinaus ausschließlich zum eigentlichen Thema zu schreiben und Diskussionen über andere Werte in die passenden Threads zu verschieben, bzw. per Boardmail zu besprechen.

Ein schönes Wochenende wünscht Euch,

Euer w : o - Team

Antwort auf Beitrag Nr.: 40.129.631 von Fuenfvorzwoelf am 09.09.10 22:59:23...und ein IHMO sehr interessanten Bericht von Heute auf HC mit einem Presseartikel hauptsächlich bezogen auf Avelon.

Demnach können wir uns gelassen zurücklegen mit dem Hinweis, dass jeder überlegen sollte ob er in Avelon investieren sollte.

Grüsse JoJo

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=125291…

mine-to-market model is key for reo miners (qiktrade)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $1.225 | Price Chart | Announcements | Google LYC)

Post: 5702300 (Start of thread) Views: 136

Posted: 10/09/10 08:41 Stock Price (at time of posting): $1.23 Sentiment: Hold Disclosure: Stock Held From: 122.108.xxx.xxx

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The following is an article about the need for a rare earth mine to have an end to end setup (ie Mine-to-market model) to be able to successfully penetrate the market. In particular it highlights that just digging up the stuff isn't good enough - you need to be able to process it ..... and you need to be able to do it in the time before everyone else ramps up ------ ie Lynas is in the box seat.

Anyway the article below is generic then concentrates on Avalon who are doing lots of news releases at the moment (what about me? releases). They have the exact situation where they have the stuff in the ground but still have to dig it up and process it and the have a very large capital raising ahead of them ....... read big challenge. Lynas has a few years head start on Avalon.

Anyway here is the article (with link at end)

Mine-to-market model is key for rare earth miners

TORONTO (Reuters) - Rare earth elements are essential components in everything from iPhones to wind turbines, yet the average investor has never heard of them.

That may soon change. The buzz around this obscure group of 17 metals is growing as green technology fuels demand at the same time as supplies are shrinking. China, which produces over 90 percent of the world's supply, is chopping exports by almost half this year.

A looming global shortage has pushed numerous Canadian miners into the spotlight, all of them eager to chase down the Holy Grail of a massive rare earth deposit.

But like the legendary Grail, a viable rare earth mine outside of China may be difficult to find. Processing costs are huge, making it difficult to compete with Chinese producers even as promising new deposits are identified.

"We're going to run into shortages of rare earths within the next year or two," said Byron Capital Market analyst Jon Hykawy, adding that the heavy rare earths, used in electric vehicles, will likely run out first.

"But simply identifying a potential mine is not a reason to celebrate victory," he said. "I would say it is very tough to make a go of producing rare earths without at least separation and purification as a part of the model."

In the end, analysts say, it will take a deposit with the right mix of rare earth elements to make a non-Chinese mine into a profitable operation.

This means Canadian rare earth companies like Avalon, Great Western Minerals and Quest Rare Minerals face a daunting challenge breaking into a market dominated by the Chinese.

Cheap labor and lax environmental policies allowed China to undercut other global producers in the 1990s, leading to rare earth mine shutdowns around the world. Then, China reduced export quotas to build up its refining, processing and alloy production industry.

Currently, there are only a few non-Chinese companies that produce the rare earth powders and metal alloys needed for green technologies, military use and consumer electronics.

One of these companies is Great Western, a Saskatoon, Saskatchewan-based outfit that buys concentrates from China and makes alloys to sell to most major magnet manufacturers.

With China tightening its rare earth exports, Great Western has secured the rights to the Steenkampslraal mine in South Africa, which has high concentrates of rare earth oxide.

By 2013, Great Western plans to take rare earths through the entire process from mining to finished product, putting it in direct competition with the Chinese.

"Because of our full integration, we are unique in the industry," said Chief Executive Jim Engdahl. "We already have clients that are magnet manufacturers around the world."

The key to Great Western's potential is its mine-to-market model, said Hykawy, adding that vertically integrated miners are best placed to benefit from rapidly rising metal prices.

Cerium oxide, the lowest value rare earth, has jumped 930 percent since 2007 to over $35 per kilo, while the more valuable dysprosium has jumped 220 percent to $286 per kilo.

"The math is easy," Hykawy said.

HEAVY VERSUS LIGHT

But is vertical integration enough to ensure rare earth success? Independent commodities commentator and strategic metals expert Jack Lifton isn't so sure.

He puts more emphasis on mineral concentrations, favoring the heavy rare earths.

All rare earth deposits contain the 17 elements in varying concentration. The heavy rare earths are in far shorter supply, and as such, are more valuable.

"The Chinese have such enormous reserves of light rare earths that I find it very, very improbable that there could be a profitable light rare earth company developed outside of China," he said.

To get at the heavy elements, miners must also process the less valuable light ones. This could spell disaster for companies whose deposits are low in heavies, said Lifton.

"If I make 9,600 white Chevrolets, and 400 black ones, and only the black sell, please don't tell me that's good economics," he said. "Making something is not what counts, it's selling something that's important."

Avalon Rare Metals is one company that will have a lot of heavy rare earths to sell, if it can raise the money it needs to bring its Nechalacho mine into production.

The mine, located in northern Canada, has a low total concentration, but is rich in valuable dysprosium and terbium.

"That greater enrichment in heavy rare earths makes for a more valuable ore in the ground," said Avalon Chief Executive Don Bubar. "And much bigger potential profit margin on production."

Avalon's goal is to further increase profit margin by including a mill and a hydrometallurgical plant on site.

But because of the remote location and heavy infrastructure needs, the project will cost an estimated C$844 million ($792.6 million) to bring into production, which analysts see as a tough pill for investors to swallow.

"If Avalon came online it would solve the world's problems, but it wouldn't solve Avalon's problem," said Lifton. "Their problem is how do you raise that kind of money?"

One idea is to approach the Chinese for funding. While China has over half the global deposits of rare earths, its heavy resources are almost depleted, said Hykawy.

"If the 'heavy' deposits were to approach the Chinese for certain guarantees, it might make their financing approaches much simpler," he said. "Right now, we believe they are going to have a tough time."

(Reporting by Julie Gordon; Editing by Frank McGurty)

http://www.climatespectator.com.au/news/analysis-mine-market…

Demnach können wir uns gelassen zurücklegen mit dem Hinweis, dass jeder überlegen sollte ob er in Avelon investieren sollte.

Grüsse JoJo

http://www.hotcopper.com.au/post_single.asp?fid=1&tid=125291…

mine-to-market model is key for reo miners (qiktrade)

Forum: ASX - By Stock (Back)

Code: LYC - LYNAS CORPORATION LIMITED ( $1.225 | Price Chart | Announcements | Google LYC)

Post: 5702300 (Start of thread) Views: 136

Posted: 10/09/10 08:41 Stock Price (at time of posting): $1.23 Sentiment: Hold Disclosure: Stock Held From: 122.108.xxx.xxx

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

The following is an article about the need for a rare earth mine to have an end to end setup (ie Mine-to-market model) to be able to successfully penetrate the market. In particular it highlights that just digging up the stuff isn't good enough - you need to be able to process it ..... and you need to be able to do it in the time before everyone else ramps up ------ ie Lynas is in the box seat.

Anyway the article below is generic then concentrates on Avalon who are doing lots of news releases at the moment (what about me? releases). They have the exact situation where they have the stuff in the ground but still have to dig it up and process it and the have a very large capital raising ahead of them ....... read big challenge. Lynas has a few years head start on Avalon.

Anyway here is the article (with link at end)

Mine-to-market model is key for rare earth miners

TORONTO (Reuters) - Rare earth elements are essential components in everything from iPhones to wind turbines, yet the average investor has never heard of them.

That may soon change. The buzz around this obscure group of 17 metals is growing as green technology fuels demand at the same time as supplies are shrinking. China, which produces over 90 percent of the world's supply, is chopping exports by almost half this year.

A looming global shortage has pushed numerous Canadian miners into the spotlight, all of them eager to chase down the Holy Grail of a massive rare earth deposit.

But like the legendary Grail, a viable rare earth mine outside of China may be difficult to find. Processing costs are huge, making it difficult to compete with Chinese producers even as promising new deposits are identified.

"We're going to run into shortages of rare earths within the next year or two," said Byron Capital Market analyst Jon Hykawy, adding that the heavy rare earths, used in electric vehicles, will likely run out first.

"But simply identifying a potential mine is not a reason to celebrate victory," he said. "I would say it is very tough to make a go of producing rare earths without at least separation and purification as a part of the model."

In the end, analysts say, it will take a deposit with the right mix of rare earth elements to make a non-Chinese mine into a profitable operation.

This means Canadian rare earth companies like Avalon, Great Western Minerals and Quest Rare Minerals face a daunting challenge breaking into a market dominated by the Chinese.

Cheap labor and lax environmental policies allowed China to undercut other global producers in the 1990s, leading to rare earth mine shutdowns around the world. Then, China reduced export quotas to build up its refining, processing and alloy production industry.

Currently, there are only a few non-Chinese companies that produce the rare earth powders and metal alloys needed for green technologies, military use and consumer electronics.

One of these companies is Great Western, a Saskatoon, Saskatchewan-based outfit that buys concentrates from China and makes alloys to sell to most major magnet manufacturers.

With China tightening its rare earth exports, Great Western has secured the rights to the Steenkampslraal mine in South Africa, which has high concentrates of rare earth oxide.

By 2013, Great Western plans to take rare earths through the entire process from mining to finished product, putting it in direct competition with the Chinese.

"Because of our full integration, we are unique in the industry," said Chief Executive Jim Engdahl. "We already have clients that are magnet manufacturers around the world."

The key to Great Western's potential is its mine-to-market model, said Hykawy, adding that vertically integrated miners are best placed to benefit from rapidly rising metal prices.

Cerium oxide, the lowest value rare earth, has jumped 930 percent since 2007 to over $35 per kilo, while the more valuable dysprosium has jumped 220 percent to $286 per kilo.

"The math is easy," Hykawy said.

HEAVY VERSUS LIGHT

But is vertical integration enough to ensure rare earth success? Independent commodities commentator and strategic metals expert Jack Lifton isn't so sure.

He puts more emphasis on mineral concentrations, favoring the heavy rare earths.

All rare earth deposits contain the 17 elements in varying concentration. The heavy rare earths are in far shorter supply, and as such, are more valuable.

"The Chinese have such enormous reserves of light rare earths that I find it very, very improbable that there could be a profitable light rare earth company developed outside of China," he said.

To get at the heavy elements, miners must also process the less valuable light ones. This could spell disaster for companies whose deposits are low in heavies, said Lifton.

"If I make 9,600 white Chevrolets, and 400 black ones, and only the black sell, please don't tell me that's good economics," he said. "Making something is not what counts, it's selling something that's important."

Avalon Rare Metals is one company that will have a lot of heavy rare earths to sell, if it can raise the money it needs to bring its Nechalacho mine into production.

The mine, located in northern Canada, has a low total concentration, but is rich in valuable dysprosium and terbium.

"That greater enrichment in heavy rare earths makes for a more valuable ore in the ground," said Avalon Chief Executive Don Bubar. "And much bigger potential profit margin on production."

Avalon's goal is to further increase profit margin by including a mill and a hydrometallurgical plant on site.

But because of the remote location and heavy infrastructure needs, the project will cost an estimated C$844 million ($792.6 million) to bring into production, which analysts see as a tough pill for investors to swallow.

"If Avalon came online it would solve the world's problems, but it wouldn't solve Avalon's problem," said Lifton. "Their problem is how do you raise that kind of money?"

One idea is to approach the Chinese for funding. While China has over half the global deposits of rare earths, its heavy resources are almost depleted, said Hykawy.

"If the 'heavy' deposits were to approach the Chinese for certain guarantees, it might make their financing approaches much simpler," he said. "Right now, we believe they are going to have a tough time."

(Reporting by Julie Gordon; Editing by Frank McGurty)

http://www.climatespectator.com.au/news/analysis-mine-market…

Antwort auf Beitrag Nr.: 40.130.220 von Hirzenach am 10.09.10 08:17:47ich kopiers mal von HC:

"my calcs have basket price easing off a little (for the first time in a while), and this has been a key driver for us over the last 8 months, so it will be interesting to see if a pullback in the LYC basket price affects the sp both today and monday"

gruss

caphis

"my calcs have basket price easing off a little (for the first time in a while), and this has been a key driver for us over the last 8 months, so it will be interesting to see if a pullback in the LYC basket price affects the sp both today and monday"

gruss

caphis

Antwort auf Beitrag Nr.: 40.130.211 von caphis am 10.09.10 08:16:01Guten Morgen, sorry habe ich was verpasst, was ist am Montag ? DANKE

1,225 AUD = 0,891 EUR bei knapp 14 mio. vol., was gegenüber den letzten tagen weniger ist soweit ich das richtig sehe.

denke mal, es warten viele auf montag...

gruss caphis

denke mal, es warten viele auf montag...

gruss caphis

23.01.24 · kapitalerhoehungen.de · BASF |

22.01.24 · wallstreetONLINE Redaktion · Lynas Rare Earths |

08.08.23 · nebenwerte ONLINE · Lynas Rare Earths |

21.06.23 · Konstantin Oldenburger · Lynas Rare Earths |

09.05.23 · ESG Aktien · Lynas Rare Earths |