BHP Billiton - ein Basisinvestment im Rohstoffsektor (Seite 33)

eröffnet am 11.06.07 15:37:48 von

neuester Beitrag 26.04.24 14:21:22 von

neuester Beitrag 26.04.24 14:21:22 von

Beiträge: 733

ID: 1.128.624

ID: 1.128.624

Aufrufe heute: 41

Gesamt: 124.205

Gesamt: 124.205

Aktive User: 0

ISIN: AU000000BHP4 · WKN: 850524 · Symbol: BHP1

26,26

EUR

+1,35 %

+0,35 EUR

Letzter Kurs 20:23:30 Tradegate

Neuigkeiten

01.05.24 · wallstreetONLINE Redaktion |

15:31 Uhr · EQS Group AG |

01.05.24 · EQS Group AG |

30.04.24 · BNP Paribas Anzeige |

30.04.24 · EQS Group AG |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +16,28 | |

| 2,5950 | +15,33 | |

| 2,0400 | +13,33 | |

| 0,8947 | +11,85 | |

| 205,00 | +10,81 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 183,20 | -19,30 | |

| 0,7500 | -21,05 | |

| 1,1367 | -22,67 | |

| 12,000 | -25,00 | |

| 8,3600 | -39,81 |

Beitrag zu dieser Diskussion schreiben

Exxon, BHP to invest $291 mln to expand gas output off Australia

MELBOURNE, March 17 (Reuters) - Exxon Mobil Corp (XOM.N) and BHP Group (BHP.AX) said on Thursday they will go ahead with a project to boost gas output from their Gippsland Basin Kipper field off southeast Australia, which would help fill a looming gas shortage in the local market.Exxon's Esso Australia said the project would cost about A$400 million ($291 million) to extract an additional 200 petajoules (PJ) of gas over the coming five years, adding that about 30 PJ will be produced next year.

The country's regulators have warned that eastern Australia faces a gas shortfall from 2026, largely because the ageing gas fields in the Gippsland Basin Joint Venture, which has been the biggest supplier into the market for decades, are drying up. read more

Esso operates the joint venture in a 50-50 partnership with global miner BHP.

The extra production from the Gippsland Basin will come online ahead of five proposed liquefied natural gas (LNG) import terminals, looking to serve the same market. Only one of those has begun preliminary construction work. read more

BHP's stake in the Gippsland Basin joint venture is set to go to Woodside Petroleum (WPL.AX) pending a vote of the Australian company's shareholders in May on a merger with BHP's petroleum business. read more

BHP will continue to contribute its 50% share of the Gippsland Basin Joint Venture's development spending for as long as it remains a stakeholder, a BHP spokesperson said.

Esso Australia also said it was advancing funding decisions to begin production from the Turrum field in Bass Strait, offshore Victoria.

($1 = 1.3723 Australian dollars)

https://www.reuters.com/business/energy/exxon-unit-invest-29…

Antwort auf Beitrag Nr.: 70.999.415 von Galileo_Investments am 02.03.22 20:36:09

Jetzt wisst ihr warum ich einen Teilverkauf vornehmen wollte. Ich habe aber nichts verkauft. Leider.

VG G

Zitat von Galileo_Investments: Moin,

ich denke auch bei BHP über die realisierung von ein paar Teilgewinnen nach. Bei 34€ würde ich wohl mal was abstoßen. Denkt jemand ähnlich?

VG G

Jetzt wisst ihr warum ich einen Teilverkauf vornehmen wollte. Ich habe aber nichts verkauft. Leider.

VG G

Eigentlich hab ich gehofft wir stehen schon bei 40

Auch der Kohlepreis hat sich verdoppelt

https://www.wallstreet-online.de/rohstoffe/kohle-globalkohle…

https://www.wallstreet-online.de/rohstoffe/kohle-globalkohle…

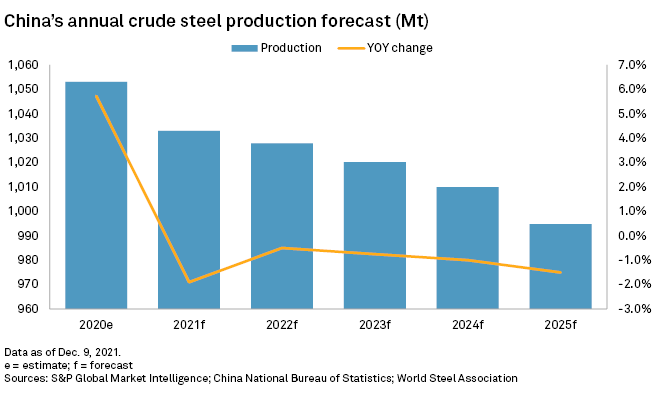

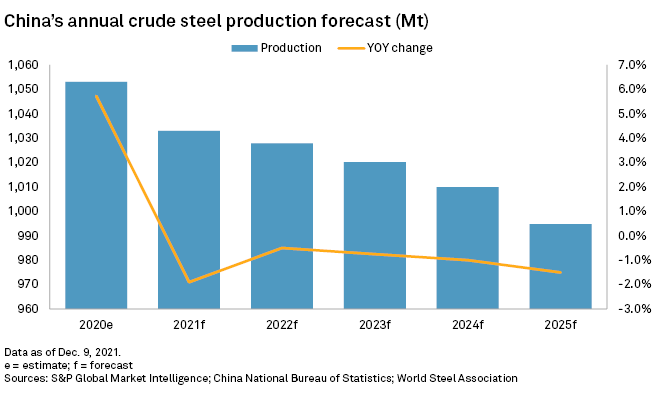

🤔 China is planning to reduce capacities of key raw materials, decrease steel energy consumption by 2% and reduce carbon emissions of electrolytic aluminum by 5% by 2025, the Ministry of Industry and Information Technology announced in late December 2021.

Ich werde hier nicht rausgehen.

Das Jahreshoch bei ca. 34 € kann sicherlich ein hartnäckigerer Widerstand werden, wobei es danach m.E. weiter hoch gehen wird.

Mit der Dividende vor Augen und der aktuelle Situation wäre ein Rücksetzer eher ein Nachkauf.

Das Jahreshoch bei ca. 34 € kann sicherlich ein hartnäckigerer Widerstand werden, wobei es danach m.E. weiter hoch gehen wird.

Mit der Dividende vor Augen und der aktuelle Situation wäre ein Rücksetzer eher ein Nachkauf.

Antwort auf Beitrag Nr.: 70.999.415 von Galileo_Investments am 02.03.22 20:36:09Die Frage für mich wäre wo, in was Investieren. Ideen?

Antwort auf Beitrag Nr.: 70.999.415 von Galileo_Investments am 02.03.22 20:36:09Ich würde drinbleiben. Aber weiß mans?

⁷7

⁷7

⁷7

⁷7

Moin,

ich denke auch bei BHP über die realisierung von ein paar Teilgewinnen nach. Bei 34€ würde ich wohl mal was abstoßen. Denkt jemand ähnlich?

VG G

ich denke auch bei BHP über die realisierung von ein paar Teilgewinnen nach. Bei 34€ würde ich wohl mal was abstoßen. Denkt jemand ähnlich?

VG G

Zitat von Oginvest: Nickel recently posted its highest closing price since 2011, with the Ukraine crisis adding to upside risks as buyers grapple with metal shortages fueled by rising demand from the electric-vehicle sector. For further details see the news article available below:

Yours sincerely

Sunrise Energy Metals

Nickel Tests Decade High on Battery Demand, Ukraine Tensions

2022-02-18 19:40:42.424 GMT

By Bloomberg News

(Bloomberg) -- Nickel posted its highest closing price since 2011, with the Ukraine crisis

adding to upside risks as buyers grapple with what Citigroup Inc. called an “extreme

shortage” fueled by rising demand from the electric-vehicle sector.

The rapid expansion of nickel’s battery market is set to stretch supplies at a time when global

inventories are the lowest in more than two years. Investors are also eyeing the standoff

between Moscow and the West over Ukraine, with officials from Russia and the U.S.

planning to meet next week. Any escalation could complicate flows from Russia, a major

nickel producer.

Intraday prices are nearing a decade high reached last month on the London Metal Exchange,

and a steep backwardation -- with cash prices much higher than futures -- pointing to a very

tight market. A deficit of battery-ready metal was a “potential powder keg” for prices,

Citigroup said in a note this week. Nickel will remain elevated with resilient EV sales, as well

as constrained production in China because of environmental regulations, Citic Futures Ltd.

wrote in a note. Data this week showed sales of new-energy vehicles in China more than

doubled in January.

There are fears that flows of commodities from energy to metals could be disrupted in the

event of a conflict in Ukraine and sanctions on Russia -- whose nickel exports account for

about 5% of global output. Moscow has repeatedly denied any plans to attack its smaller

neighbor, and the format of any potential sanctions is uncertain.

Meanwhile investors are still weighing the possible impact of a more hawkish Federal

Reserve on metal prices. Most traders expect the central bank to hike rates next month,

increasing the opportunity cost of holding non-interest bearing metal.

“The bear factor that might cap nickel’s price performance will be the U.S. Fed,” said Tom

Price, head of commodities strategy at Liberum Capital. “There is not much upside left to the

nickel price because of that.” Nickel rose 1.1% to settle at $24,144 a ton at 5:53 p.m. London

time, the highest settlement since August 2011. Other main LME metals were mixed, with

aluminum down 0.2% and copper up 0.3%.

--With assistance from Yvonne Yue Li.

BHP Billiton - ein Basisinvestment im Rohstoffsektor