Continental Gold Ltd - 500 Beiträge pro Seite (Seite 6)

eröffnet am 31.08.10 11:41:24 von

neuester Beitrag 25.10.21 14:58:10 von

neuester Beitrag 25.10.21 14:58:10 von

Beiträge: 2.767

ID: 1.159.632

ID: 1.159.632

Aufrufe heute: 0

Gesamt: 189.520

Gesamt: 189.520

Aktive User: 0

ISIN: CA21146A1084 · WKN: A14UZD · Symbol: LLA

3,6260

EUR

-0,44 %

-0,0160 EUR

Letzter Kurs 06.03.20 Tradegate

Neuigkeiten

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,9000 | +15,69 | |

| 41,00 | +12,30 | |

| 5,8100 | +11,73 | |

| 1,8500 | +10,78 | |

| 6,3000 | +10,33 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,300 | -10,87 | |

| 1,2000 | -14,29 | |

| 5,1400 | -15,46 | |

| 1.138,25 | -16,86 | |

| 1,3000 | -17,98 |

Antwort auf Beitrag Nr.: 60.969.316 von PatrickD1985 am 06.07.19 22:32:51"Sollte Gold allerdings steigen, dann muss man diese Kursziele natürlich deutlich anheben.

Bei 1600$ könnte die Bewertung von Minen das doppelte bis dreifache sein."

für dieses szenario gibt's richtige knallerwerte! alles tenbagger!

Bei 1600$ könnte die Bewertung von Minen das doppelte bis dreifache sein."

für dieses szenario gibt's richtige knallerwerte! alles tenbagger!

Antwort auf Beitrag Nr.: 60.970.090 von nicolani am 07.07.19 09:33:59Dann nenne mir doch mal ein paar davon

@PatrickD1985: Kleiner Hint:

Die Miner mit dem höheren AISC haben einen größeren Hebel, wenn der Goldpreis steigt als die mit einem niedrigen AISC.

Habs auch zuerst nicht verstanden, aber wenn man genauer drüber nachdenkt macht es sinn.

Ich bevorzuge aber einen Low-AISC, da verzichte ich gern auf einen Tenbagger .)

Die Miner mit dem höheren AISC haben einen größeren Hebel, wenn der Goldpreis steigt als die mit einem niedrigen AISC.

Habs auch zuerst nicht verstanden, aber wenn man genauer drüber nachdenkt macht es sinn.

Ich bevorzuge aber einen Low-AISC, da verzichte ich gern auf einen Tenbagger .)

Antwort auf Beitrag Nr.: 60.971.671 von KleinerInvestor am 07.07.19 17:50:38na prima, du kennst dich doch aus! ganz kurz zur erläuterung. wenn ein miner mit 1350.- aisc heute 50.- verdient, wieviel verdient er dann bei 1450.-? genau, 100.-, und das ist dann eine gewinnsteigerung von 100%!! und nun die frage, welches unternehmen schafft das schon, von heute auf morgen!

"Ich bevorzuge aber einen Low-AISC, da verzichte ich gern auf einen Tenbagger .)"

Passt ja für jetzt, aber der tag wird kommen, ist nicht mehr weit!

Passt ja für jetzt, aber der tag wird kommen, ist nicht mehr weit!

Antwort auf Beitrag Nr.: 60.969.172 von JamesMcFly am 06.07.19 21:27:34Nicht der Rede wert, ein Kleckerbetrag... 😇 😉

Antwort auf Beitrag Nr.: 60.974.242 von 90BVB09 am 08.07.19 09:48:24Dann kauf mal kraeftig zu

Antwort auf Beitrag Nr.: 60.978.421 von JamesMcFly am 08.07.19 18:21:41Lässt die Liqui-Lage leider nicht zu. Aber wie erwartet und natürlich auch auf den zurückfallenden Goldkurs zurückzuführen, ist man erst einmal an der 4 Dollarmarke abgeprallt...

Hat jemand von den Geos ggf. eine Meinung zu diesem Artikel:

http://angrygeologist.blogspot.com/2019/07/buritica-narrow-v…

?

http://angrygeologist.blogspot.com/2019/07/buritica-narrow-v…

?

Antwort auf Beitrag Nr.: 60.971.986 von nicolani am 07.07.19 19:02:02Also ich meinte es wären 150 aber da könnte ich mich auch irren

Antwort auf Beitrag Nr.: 60.982.441 von KleinerInvestor am 09.07.19 09:31:52

Für mich schaut das genauso aus wie mit Ari und Colossus.

Als weiter super Bohrergebnisse, weitere Kapitalerhöhungen zum

Bau der Mühle mit viel Zeitverlust und dann das Ende.

Bei Colossus hat man nicht an das dewatering gedacht und erst kurz

vor Pleite damit ernsthaft angefangen, Pumpen zu kaufen.

Lese hier gerne mit und lass mich überraschen

Zitat von KleinerInvestor: Hat jemand von den Geos ggf. eine Meinung zu diesem Artikel:

http://angrygeologist.blogspot.com/2019/07/buritica-narrow-v…

?

Für mich schaut das genauso aus wie mit Ari und Colossus.

Als weiter super Bohrergebnisse, weitere Kapitalerhöhungen zum

Bau der Mühle mit viel Zeitverlust und dann das Ende.

Bei Colossus hat man nicht an das dewatering gedacht und erst kurz

vor Pleite damit ernsthaft angefangen, Pumpen zu kaufen.

Lese hier gerne mit und lass mich überraschen

Antwort auf Beitrag Nr.: 60.988.694 von Info0815 am 09.07.19 19:50:16Ja, ich denke auch, dass hier die gleiche Story laeuft wie Colossus.

Fly

Fly

Antwort auf Beitrag Nr.: 60.988.694 von Info0815 am 09.07.19 19:50:16Ich hab die Story mit Colossus nicht tiefer verfolgt. Aber laut dem CNL CFO hat das Geo-Teram von NEM einigen Einfluss auf die Arbeiten vor Ort.

Gab es damals bei Colossus auch eine größere Company die das Projekt "gebackuped" hat? Ari kann ich als CEO nicht richtig einschätzen, aber ich denke das NEM schon aus Eigeninteresse die "Hand" drauf haben wird.

Ich bin vorsichtig optimistisch was CNL angeht.

Gab es damals bei Colossus auch eine größere Company die das Projekt "gebackuped" hat? Ari kann ich als CEO nicht richtig einschätzen, aber ich denke das NEM schon aus Eigeninteresse die "Hand" drauf haben wird.

Ich bin vorsichtig optimistisch was CNL angeht.

Antwort auf Beitrag Nr.: 60.988.148 von gast77 am 09.07.19 18:48:02ja klar, faux-pas de moi! sowas passiert, wenn man denkt! tut mir so leid wie möglich!

Antwort auf Beitrag Nr.: 60.982.441 von KleinerInvestor am 09.07.19 09:31:52

Mich wundert es ja nur, das hier keiner auf deinen super Link antwortet.

Das sollte doch mal diskutiert werden mit der realen Mächtigkeit solcher

Bohrergebnisse...

Ich verstehe hier zwar nicht alles, aber worauf es hinausläuft.

Bei Colossus hat Sandstorm viel Geld verloren.

Die hatten bestimmt Eckbertte vor Ort als Royalityfirma.

Zitat von KleinerInvestor: Hat jemand von den Geos ggf. eine Meinung zu diesem Artikel:

http://angrygeologist.blogspot.com/2019/07/buritica-narrow-v…

?

Mich wundert es ja nur, das hier keiner auf deinen super Link antwortet.

Das sollte doch mal diskutiert werden mit der realen Mächtigkeit solcher

Bohrergebnisse...

Ich verstehe hier zwar nicht alles, aber worauf es hinausläuft.

Bei Colossus hat Sandstorm viel Geld verloren.

Die hatten bestimmt Eckbertte vor Ort als Royalityfirma.

Der Laden ist ein Fake, das sagt doch der Artikel. Endlich spricht es jemand mal aus.

Fly

Fly

Antwort auf Beitrag Nr.: 60.989.357 von JamesMcFly am 09.07.19 21:13:05

Naja, soweit würde ich nicht gehen. Den Angry Geo kannte ich bis dato noch nicht. Als ich damals ein paar Dinge über AGB recherchiert habe, da hab ich auch vom Critical Investor - den ich sehr schätze - einen Artikel über die Geologie des Nova Scotia Gebiets gelesen, bei dem er zum Schluß kam, das AGB deutlich überbewertet war zu diesem Zeitpunkt, da war das MC bei C$266 mio, verkauft werden sie demnächst für läppische C$800 mio. Das zeigt mir, dass sich auch sehr erfahrene Leute mal irren können.

Ich werde versuchen in den Ferien ein paar alte Artikel vom Angy-Geo zu lesen, um zu schauen wie gut seine Trefferquote war/ist. Bzw. was sich davon alles bewahrheitet hat.

Zitat von JamesMcFly: Der Laden ist ein Fake, das sagt doch der Artikel. Endlich spricht es jemand mal aus.

Fly

Naja, soweit würde ich nicht gehen. Den Angry Geo kannte ich bis dato noch nicht. Als ich damals ein paar Dinge über AGB recherchiert habe, da hab ich auch vom Critical Investor - den ich sehr schätze - einen Artikel über die Geologie des Nova Scotia Gebiets gelesen, bei dem er zum Schluß kam, das AGB deutlich überbewertet war zu diesem Zeitpunkt, da war das MC bei C$266 mio, verkauft werden sie demnächst für läppische C$800 mio. Das zeigt mir, dass sich auch sehr erfahrene Leute mal irren können.

Ich werde versuchen in den Ferien ein paar alte Artikel vom Angy-Geo zu lesen, um zu schauen wie gut seine Trefferquote war/ist. Bzw. was sich davon alles bewahrheitet hat.

Antwort auf Beitrag Nr.: 60.989.357 von JamesMcFly am 09.07.19 21:13:05von wem wirst du denn bezahlt, ich lach mich tot! hier hast du doch gar keine leser! keine follower!

bis jetzt 238 aufrufe, wem willst du was erzählen, ich raff's nicht!

Antwort auf Beitrag Nr.: 60.989.432 von nicolani am 09.07.19 21:23:04

Background: Der ist aus dem anfahrenden Zug gesprungen, bevor dieser Reisegeschwindigkeit erreicht hat

Zitat von nicolani: von wem wirst du denn bezahlt, ich lach mich tot! hier hast du doch gar keine leser! keine follower!

Background: Der ist aus dem anfahrenden Zug gesprungen, bevor dieser Reisegeschwindigkeit erreicht hat

Antwort auf Beitrag Nr.: 60.989.459 von KleinerInvestor am 09.07.19 21:25:40Hi Nicolai, jetzt bleib mal bitte sachlich und du kannst dich ja gerne zu

dem Link äußern. Zu lang für dich und auf englisch, na dann.

Hier ist keiner darauf aus Follower zu haben. Interessenaustausch zur

eigenen Geldanlage ist angesagt...

dem Link äußern. Zu lang für dich und auf englisch, na dann.

Hier ist keiner darauf aus Follower zu haben. Interessenaustausch zur

eigenen Geldanlage ist angesagt...

Antwort auf Beitrag Nr.: 60.989.459 von KleinerInvestor am 09.07.19 21:25:40Ja, verdammte Axt, Dosto und ich sind raus und jetzt steigt das Ding nochmal. Und ich dachte, wir sind schon erfahren. Daher macht aus meiner Sicht bashen schon Sinn.

Fly

Fly

n

nmmmmkkknjejej3jj3 !

Dieser Beitrag wurde von MadMod moderiert. Grund: Beleidigung

Antwort auf Beitrag Nr.: 60.988.148 von gast77 am 09.07.19 18:48:02

😆😆 you made my day 😎

Zitat von gast77: Also ich meinte es wären 150 aber da könnte ich mich auch irren

😆😆 you made my day 😎

JamesMcFly

Sie verhalten sich wie ein Kindergartenkind! Ob hier jemand verkaufen wird, nur weil Sie Schwachsinn schreiben! Dafür wäre mir meine Zeit zu schade! 😂😂😂

Sie verhalten sich wie ein Kindergartenkind! Ob hier jemand verkaufen wird, nur weil Sie Schwachsinn schreiben! Dafür wäre mir meine Zeit zu schade! 😂😂😂

KI

Der Artikel ist ja sehr interessant, doch halt eben für eine Einschätzung eines Spezialisten.

Wir können der Sache nur entnehmen dass es Risiken gibt die in der Jorc so nicht abgebildet sind.

Narrow Veins die plötzlich enden: ist das signifikant, ist das common, ist das sizable im gesamt Kontext, hat hier einer den Stinkstiefel hervorgenommen?

Es gibt zu diesem Zeitpunkt genügend shorties die nochmals günstig reinkommen wollen und den Kurs drücken.

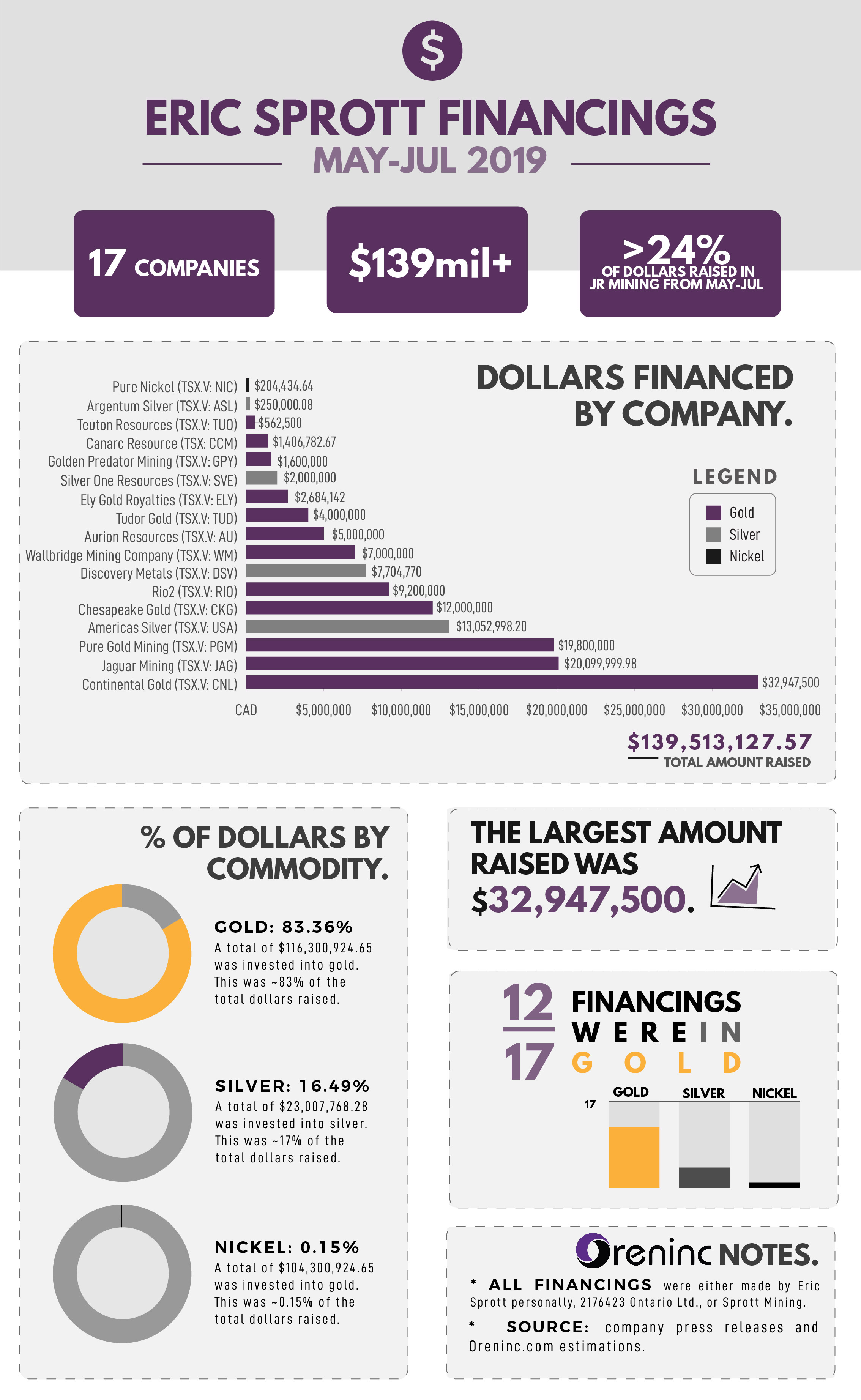

Auch denke ich dass ES ja gerade sein Paket geschnürt hat und es nicht getan hätte wenn er das als Risiko eingeschätzt hätte.

Betrachten wir mal die short positionen in den nächsten Tagen.

Der Artikel ist ja sehr interessant, doch halt eben für eine Einschätzung eines Spezialisten.

Wir können der Sache nur entnehmen dass es Risiken gibt die in der Jorc so nicht abgebildet sind.

Narrow Veins die plötzlich enden: ist das signifikant, ist das common, ist das sizable im gesamt Kontext, hat hier einer den Stinkstiefel hervorgenommen?

Es gibt zu diesem Zeitpunkt genügend shorties die nochmals günstig reinkommen wollen und den Kurs drücken.

Auch denke ich dass ES ja gerade sein Paket geschnürt hat und es nicht getan hätte wenn er das als Risiko eingeschätzt hätte.

Betrachten wir mal die short positionen in den nächsten Tagen.

Hier mal eine Übersetzung einer Reaktion (CEO) zu dem Angry-Artikel:

"Brent Cook sprach vor einigen Jahren über das gleiche Thema (enge Venen, Verdünnungsprobleme), bis er seine Meinung aus irgendeinem Grund änderte und vergaß, ob er einen Besuch vor Ort hatte. Newmonts Engagement hier deutet mir an, dass der Vergleich von Buritica mit Brucejack nicht ganz angemessen ist und im Gegensatz zu Brucejack haben sie diese breiten mineralisierten Zonen bei Buritica. Auch @tomszabo mag Buritica trotz Ari's Hintergrund und denkt, dass $CNL aus Sicht des Bergbaus eine sehr gute Arbeit geleistet hat. Angry Geo macht Spaß zu lesen, sie hat sehr interessante und gut fundierte Einblicke, aber im Nachhinein haben sich einige ihrer Ansichten als totaler Müll erwiesen. Sie war negativ auf Arizona Mining - sicherlich der größte Slam Dunk in der Basismetall-Exploration in letzter Zeit. Dann wieder war sie auf re Garibaldi und Excellon, um nur einige zu nennen. Ich werde weiterhin bis zu einer wesentlichen Änderung des Zinssatzes oder einer Übernahme warten."

Da scheint sich mein Instinkt bzgl. Profi + (falscher)Deutung zu bestätigen ohne das jetzt groß nachgewiesen zu haben.

"Brent Cook sprach vor einigen Jahren über das gleiche Thema (enge Venen, Verdünnungsprobleme), bis er seine Meinung aus irgendeinem Grund änderte und vergaß, ob er einen Besuch vor Ort hatte. Newmonts Engagement hier deutet mir an, dass der Vergleich von Buritica mit Brucejack nicht ganz angemessen ist und im Gegensatz zu Brucejack haben sie diese breiten mineralisierten Zonen bei Buritica. Auch @tomszabo mag Buritica trotz Ari's Hintergrund und denkt, dass $CNL aus Sicht des Bergbaus eine sehr gute Arbeit geleistet hat. Angry Geo macht Spaß zu lesen, sie hat sehr interessante und gut fundierte Einblicke, aber im Nachhinein haben sich einige ihrer Ansichten als totaler Müll erwiesen. Sie war negativ auf Arizona Mining - sicherlich der größte Slam Dunk in der Basismetall-Exploration in letzter Zeit. Dann wieder war sie auf re Garibaldi und Excellon, um nur einige zu nennen. Ich werde weiterhin bis zu einer wesentlichen Änderung des Zinssatzes oder einer Übernahme warten."

Da scheint sich mein Instinkt bzgl. Profi + (falscher)Deutung zu bestätigen ohne das jetzt groß nachgewiesen zu haben.

Antwort auf Beitrag Nr.: 60.989.018 von nicolani am 09.07.19 20:26:16Nico, ist doch kein Problem. In der Hitze des Gefechtes machen wir alle auch Fehler. Du solltest sehen dass wir das Zeugs lesen

Zweitens und wichtiger die 50 und 150 Story. Bei POG von +100.

Vorallem Firmen die gerade noch so Profitabel wirtschaften also ASCI 1100 - 1300 werden vom POG +100 enorm profitieren. In deinem Beispiel haste nen Faktor 3 drin wo das EBITDA hochschiessen kann.

Die marginalen werden alle stark überraschen mit ihrer Q2.

Könnte für kurstsichtig sorry kurzfristig Denkende Investoren ein Trade wert sein.

Also Fly dies hier ist nichts für Dich da margen stark. Da wird auch der POG nicht viel bewegen, denn es zerren andere Kräfte an der Aktie.

Zweitens und wichtiger die 50 und 150 Story. Bei POG von +100.

Vorallem Firmen die gerade noch so Profitabel wirtschaften also ASCI 1100 - 1300 werden vom POG +100 enorm profitieren. In deinem Beispiel haste nen Faktor 3 drin wo das EBITDA hochschiessen kann.

Die marginalen werden alle stark überraschen mit ihrer Q2.

Könnte für kurstsichtig sorry kurzfristig Denkende Investoren ein Trade wert sein.

Also Fly dies hier ist nichts für Dich da margen stark. Da wird auch der POG nicht viel bewegen, denn es zerren andere Kräfte an der Aktie.

Antwort auf Beitrag Nr.: 60.990.647 von lukas5 am 10.07.19 01:33:31

dumm nur wenn Das Gegenüber;

der Aussage;

WEIT, WEIT mehr Ahnung hat.

dann wird's eher peinlich.

Zitat von lukas5:Zitat von JamesMcFly: Ja, ich denke auch, dass hier die gleiche Story laeuft wie Colossus.

Fly

von Dir liest man seit Jahren nur dummes Gesülze

dumm nur wenn Das Gegenüber;

der Aussage;

WEIT, WEIT mehr Ahnung hat.

dann wird's eher peinlich.

Für die Zweifler

Continental Gold Announces that Newmont Goldcorp Exercises its Right to Maintain its Pro Rata Ownership

Würden die sowas tun wenn die Narrow veins ein problem wäre für die?

Continental Gold Announces that Newmont Goldcorp Exercises its Right to Maintain its Pro Rata Ownership

Würden die sowas tun wenn die Narrow veins ein problem wäre für die?

Antwort auf Beitrag Nr.: 61.021.682 von gast77 am 14.07.19 10:00:56ein klarer vertrauensbeweis, die glauben schon an den erfolg des unternehmens!

Antwort auf Beitrag Nr.: 61.020.965 von Popeye82 am 14.07.19 02:08:15damit kann ich leben. Mit Nullahnung ist man zwischen euch Schwätzern gut aufgehoben.Zumindestens hast Du ja mal einen vernünftigen Satz nauf die Reihe gebracht. Da hat Dir bestimmt jemand dabei geholfen.

Und was absolut oberpeinlich ist, ist, wenn man hier den Schlauen spielen wil und sobald Dosto ein bißchen gegenwind bringt im Achtung steht. Wie zb vor einigen Wochen bei Perseus. Da könnte man sich schon fast fremdschämen.

Und was absolut oberpeinlich ist, ist, wenn man hier den Schlauen spielen wil und sobald Dosto ein bißchen gegenwind bringt im Achtung steht. Wie zb vor einigen Wochen bei Perseus. Da könnte man sich schon fast fremdschämen.

Antwort auf Beitrag Nr.: 61.031.971 von lukas5 am 15.07.19 23:12:15Da ist man froh, dass es die "Ignore-Taste" gibt...vielleicht solltest du mal die Beiträge und Links von Popeye lesen, da könntest du was lernen, aber manche bleiben lieber ahnungslos und pöbeln hier rum...so jetzt ab auf "ignore"...

hier vom critical investor ein interessanter kommentar:

To me Buritica is so good not even Ari S can screw it up. Not sure what the fuss about sampling is all about, it is such a minor detail of the deposit. Not even sure why Continental made news out of it, first time I see sampling of stope development after FS. Who cares, they already have reserves, it makes no sense. Unless Newmont demanded it, but it seems nothing beats bulk sampling to me to test things, and the lenses seem continuous. Weird stuff. Narrow vein mining up to 2m no problem, smaller gets much more expensive. Vertical orientation of the lenses makes gravity chime in perfectly.

To me Buritica is so good not even Ari S can screw it up. Not sure what the fuss about sampling is all about, it is such a minor detail of the deposit. Not even sure why Continental made news out of it, first time I see sampling of stope development after FS. Who cares, they already have reserves, it makes no sense. Unless Newmont demanded it, but it seems nothing beats bulk sampling to me to test things, and the lenses seem continuous. Weird stuff. Narrow vein mining up to 2m no problem, smaller gets much more expensive. Vertical orientation of the lenses makes gravity chime in perfectly.

Antwort auf Beitrag Nr.: 61.031.971 von lukas5 am 15.07.19 23:12:15Hallo Lukas

es gibt halt die Schriftsteller - die Wortgeschliffenen

es gibt die Politiker - die Wortgewaltigen

es gibt die Arbeiter - die Wortschwachen

und es gibt die Denker - die Wortfaulen

Nicht jedem ist alles gegeben, Eigenes verhalte auf die Andern zu projektieren ist hmmm

da gibt es noch die Ignoranten - die Wortunbeholfenen

es gibt halt die Schriftsteller - die Wortgeschliffenen

es gibt die Politiker - die Wortgewaltigen

es gibt die Arbeiter - die Wortschwachen

und es gibt die Denker - die Wortfaulen

Nicht jedem ist alles gegeben, Eigenes verhalte auf die Andern zu projektieren ist hmmm

da gibt es noch die Ignoranten - die Wortunbeholfenen

Wo bleibt das Sommerloch bei den Minen als Nachkaufgelegenheit?

Antwort auf Beitrag Nr.: 61.061.305 von branigan am 19.07.19 08:05:56Ja, sollte bald mal kommen.

Elli, Dosto und ich stehen jetzt schon wie Greenhorns da. Aber vlt kommt ja bald tax loss selling season.

Fly

Elli, Dosto und ich stehen jetzt schon wie Greenhorns da. Aber vlt kommt ja bald tax loss selling season.

Fly

das ist die Antwort auf Dosto & Konsorten die uns hier abgeschrieben haben ...

Also lernt draus : NIEMALS auf DOSTO hören !!!

eher das Gegenteil tun ....

(ich habe nun 100 % hier 😎)

Also lernt draus : NIEMALS auf DOSTO hören !!!

eher das Gegenteil tun ....

(ich habe nun 100 % hier 😎)

Wenn man schon tatsächlich hier verkauft hat, dann hätte man den Erlös in andere Minen stecken müssen. Aber alles als Cash zu halten, war ziemlich bekloppt

Antwort auf Beitrag Nr.: 61.062.475 von branigan am 19.07.19 09:59:16Ich wollte bei Conti unten wieder rein, wieder so um die 1,75 CAD

Antwort auf Beitrag Nr.: 61.062.475 von branigan am 19.07.19 09:59:16

Fly hat nicht verkauft. Lasst euch doch nicht vereimern!

Zitat von branigan: Wenn man schon tatsächlich hier verkauft hat, dann hätte man den Erlös in andere Minen stecken müssen. Aber alles als Cash zu halten, war ziemlich bekloppt

Fly hat nicht verkauft. Lasst euch doch nicht vereimern!

Antwort auf Beitrag Nr.: 61.062.796 von mge am 19.07.19 10:33:40Verdammte Axt, jetzt faengt es erst richtig an zu fliegen, unglaublich, wer haette das gedacht, wie konnte man das nur hervorsehen…

Fly

Fly

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: bitte das Threadthema beachten, bleiben Sie bitte sachlich

Conti läuft in den letzten Tagen schlechter als die Werte, die bis vor kurzem geschwächelt haben. Conti ist vor Wochen schon angesprungen und hat jetzt nicht mehr so viel Potential wie die Werte, die noch ziemlich tief stehen. Conti kann man als Beimischung durchaus halten, aber die fetten Gewinne macht man jetzt mit anderen Werten.

Wenn Du nicht streust, McFly, biste selber schuld

Wenn Du nicht streust, McFly, biste selber schuld

Antwort auf Beitrag Nr.: 61.067.365 von branigan am 19.07.19 19:26:46Junge junge, es geht doch nicht darum, was gut oder schlecht gelaufen ist, es geht um die jeweilige Unternehmensbewertung.

Aber ja, Conti ist eine echte Enttaeuschung.

Fly

Aber ja, Conti ist eine echte Enttaeuschung.

Fly

!

Dieser Beitrag wurde von UniversalMODul moderiert. Grund: Bitte unterlassen Sie Provokationen gegenüber Anderen und bleiben Sie sachlich, Danke!

Antwort auf Beitrag Nr.: 61.067.476 von Popeye82 am 19.07.19 19:44:41Ja, kann den post auch nicht so wirklich nachvollziehen.

Naja, Dosto und ich sind zwar Lemminge, aber die Performance von Conti ist schon ganz gut, auch heute wieder. Glueckwunsch an alle.

Fly

Naja, Dosto und ich sind zwar Lemminge, aber die Performance von Conti ist schon ganz gut, auch heute wieder. Glueckwunsch an alle.

Fly

Antwort auf Beitrag Nr.: 61.067.437 von JamesMcFly am 19.07.19 19:38:11Mannomann, wenn die Bewertung so günstig ist, warum hast Du dann (angeblich) verkauft?

Günstige Bewertungen sind zwar gut und schön, aber entscheidend für Aktionäre dürfte immer noch die zu erwartende Kurssteigerung sein. Es gibt etliche günstige Aktien in allen möglichen Segmenten, die dennoch kaum steigen. Das ist also keine Garantie für große Aktionärsgewinne. Ob da mit Continental noch mehrere 100% zu machen sind, wurde meiner Erinnerung nach sogar von Dir selbst hier schon bezweifelt. Mit so tief gefallenen Werten wie z. B. Alio Gold, Argonaut Gold, Guyana Goldfields oder Premier Gold Mines ist bei einer EM-Hausse eine deutlich stärkere Kurssteigerung nicht unwahrscheinlich. Siehe Langfristcharts dieser Aktien.

Nichts anderes wollte ich aussagen.

Günstige Bewertungen sind zwar gut und schön, aber entscheidend für Aktionäre dürfte immer noch die zu erwartende Kurssteigerung sein. Es gibt etliche günstige Aktien in allen möglichen Segmenten, die dennoch kaum steigen. Das ist also keine Garantie für große Aktionärsgewinne. Ob da mit Continental noch mehrere 100% zu machen sind, wurde meiner Erinnerung nach sogar von Dir selbst hier schon bezweifelt. Mit so tief gefallenen Werten wie z. B. Alio Gold, Argonaut Gold, Guyana Goldfields oder Premier Gold Mines ist bei einer EM-Hausse eine deutlich stärkere Kurssteigerung nicht unwahrscheinlich. Siehe Langfristcharts dieser Aktien.

Nichts anderes wollte ich aussagen.

Antwort auf Beitrag Nr.: 61.069.486 von branigan am 20.07.19 09:36:34Ja, guenstig und noch erwartete Kursentwicklung liegen ja sehr nah beieinander. Daher geht das in die gleiche Richtung.

Natuerlich wird CNL keine mehrer 100% mehr machen und anderen bei steigendem Goldpreis eine bessere Performance erzielen. Aber es geht um das risk/reward Verhaeltnis, das sollte relevant sein. Natuerlich kann cih bein entsprrechendem Risiko auch sehr hohe Renditen erzielen.

Naja, an einem Tag wie gestern, wenn Gold um 1.5% faellt, dann ist es schon sehr beeindruckend, wenn Conti trotzdem explodiert. Habe ich selten gesehn. Das haben Dosto und ich wohl einfach falsch bewertet. Wir wollten bei 2 CAD wieder rein.

Fly

Natuerlich wird CNL keine mehrer 100% mehr machen und anderen bei steigendem Goldpreis eine bessere Performance erzielen. Aber es geht um das risk/reward Verhaeltnis, das sollte relevant sein. Natuerlich kann cih bein entsprrechendem Risiko auch sehr hohe Renditen erzielen.

Naja, an einem Tag wie gestern, wenn Gold um 1.5% faellt, dann ist es schon sehr beeindruckend, wenn Conti trotzdem explodiert. Habe ich selten gesehn. Das haben Dosto und ich wohl einfach falsch bewertet. Wir wollten bei 2 CAD wieder rein.

Fly

Ich denke man muss zwischen Invest und Spekulation unterscheiden. Einige traden CNL und bei denen ist dann der Ein- und Ausstiegskurs relevant. Andere investieren, da ist der zugrunde liegene Wert das Entscheidungskriterium. Für einen Investor könnten auch 4 CAD günstig sein, wenn er den Wert z.B. > 6 CAD sieht. Für einen Trader der bei 2 CAD gekauft und bei 4 CAD ausgestiegen ist, sind dann aktuell 4 CAD zu "teuer". Ist halt immer ansichtssache. Sollte der Goldrpeis "durchdrehen" könnten temporär auch deutliche Überbewertungen stattfinden, da würde auch ein Investor sich wahrscheinlich verabschieden. Für mich persönlich ist ein Verkauf deutlich schwieriger als ein Kauf. Billig kaufen kann fast jeder, aber teuer verkaufen ist eine Kunst, die ich auch noch lernen muss. Bin auch bei einigen Aktien zu früh raus, weil ich dachte der Preis liegt über dem Wert, dass nenn man dann Lehrgeld

Antwort auf Beitrag Nr.: 61.070.149 von KleinerInvestor am 20.07.19 12:14:01Verkaufen ist das schwierige, kaufen nicht. Da hast du absolut recht.

Man muss sich einen Exit festlegen. Und moeglichst auch daran halten, was dann auch wieder schwierig ist. Daher bin ich ein Freund von buyouts, das macht den Verkauf leichter.

Fly

Man muss sich einen Exit festlegen. Und moeglichst auch daran halten, was dann auch wieder schwierig ist. Daher bin ich ein Freund von buyouts, das macht den Verkauf leichter.

Fly

Antwort auf Beitrag Nr.: 61.071.595 von JamesMcFly am 20.07.19 20:03:54

Ja, Buyouts machen es natürlich sehr einfach, so wie bei AGB, da gibts dann nix nachzudenken. Aber ich denke Marketcap > NPV isz schonmal ein Anhaltspunkt.

Bei CNL könnte es natürlich nach hinten losgehen, da die FS ja schon etwas älter ist und sich die Werte mit Vergrößerung der Reourcse nach oben hin ändern können. Andersrum geht es natürlich auch, wenn nciht mal die Werte der FS erreicht werden.

Zitat von JamesMcFly: Verkaufen ist das schwierige, kaufen nicht. Da hast du absolut recht.

Man muss sich einen Exit festlegen. Und moeglichst auch daran halten, was dann auch wieder schwierig ist. Daher bin ich ein Freund von buyouts, das macht den Verkauf leichter.

Fly

Ja, Buyouts machen es natürlich sehr einfach, so wie bei AGB, da gibts dann nix nachzudenken. Aber ich denke Marketcap > NPV isz schonmal ein Anhaltspunkt.

Bei CNL könnte es natürlich nach hinten losgehen, da die FS ja schon etwas älter ist und sich die Werte mit Vergrößerung der Reourcse nach oben hin ändern können. Andersrum geht es natürlich auch, wenn nciht mal die Werte der FS erreicht werden.

Antwort auf Beitrag Nr.: 61.071.619 von KleinerInvestor am 20.07.19 20:12:07Bin kein so grosser Freund von NPVs, aber als Orientierung kann es schon dienen, je nachdem, in welcher Projektphase das Unternehmen auch ist.

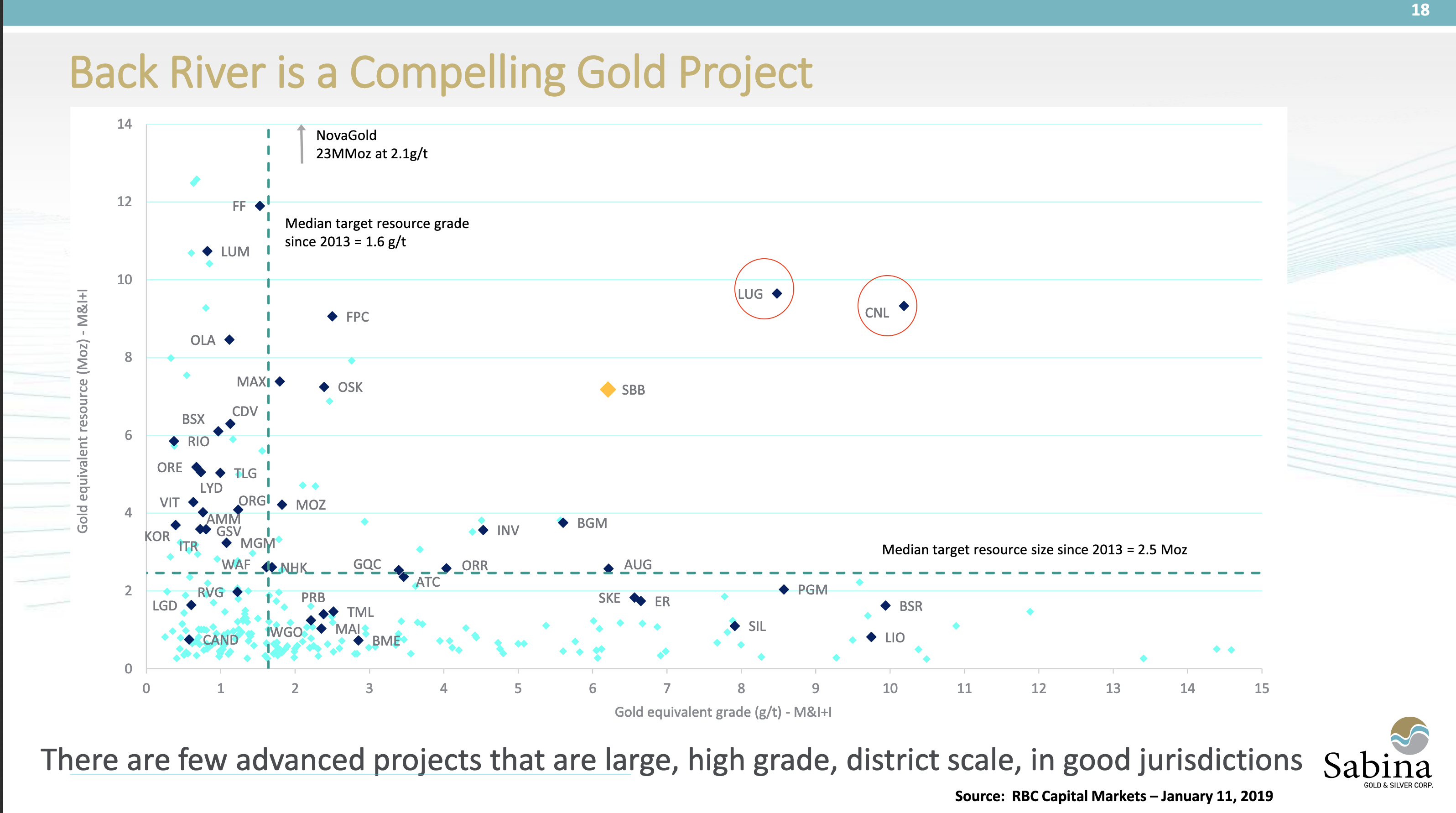

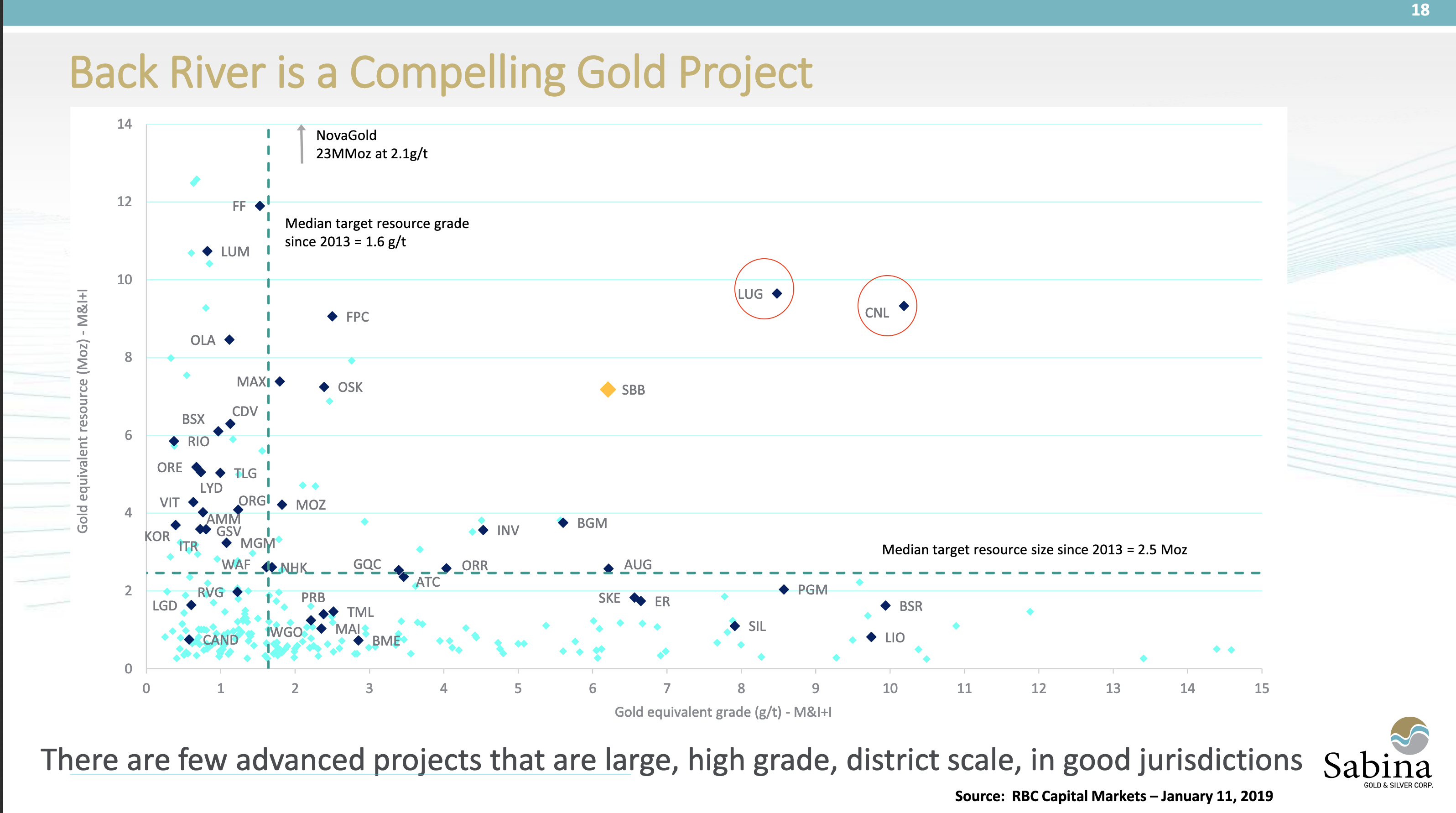

Als Bewertungsorientierung sollte auch Lundin Gold dienen. Ahenliches Deposit, wobei CNL qualitativ noch hochwertiger ist. Warum sollte CNL also nur halb so hoch bewertet sein?

Fly

Als Bewertungsorientierung sollte auch Lundin Gold dienen. Ahenliches Deposit, wobei CNL qualitativ noch hochwertiger ist. Warum sollte CNL also nur halb so hoch bewertet sein?

Fly

Antwort auf Beitrag Nr.: 61.071.880 von JamesMcFly am 20.07.19 21:49:17

vielleicht wegen:

- jurisdiction

- management

- trackrecord

- margin / projected FCF

- financing structure

aber genau weiss ich es nicht, da ich mich mit lundin bisher nicht so tief befasst habe

Zitat von JamesMcFly: Als Bewertungsorientierung sollte auch Lundin Gold dienen. Ahenliches Deposit, wobei CNL qualitativ noch hochwertiger ist. Warum sollte CNL also nur halb so hoch bewertet sein?

Fly

vielleicht wegen:

- jurisdiction

- management

- trackrecord

- margin / projected FCF

- financing structure

aber genau weiss ich es nicht, da ich mich mit lundin bisher nicht so tief befasst habe

lundin ist schon ne hausnummer! und läuft auch seit geraumer zeit!

Antwort auf Beitrag Nr.: 61.072.063 von nicolani am 20.07.19 23:22:48Cnl sollte definitiv höher bewertet sein !

Antwort auf Beitrag Nr.: 61.072.114 von JamesMcFly am 20.07.19 23:42:52also ich bin dafür!!

Schaut mal hab zufällig einen Vergleich zwischen LUG und CNL in der SBB Präsentation gefunden.

Also von den Grades schlägt CNL LUG. Denke wenn eine Resourcen Anpassung kommt, wird es bestimmt auch nicht schlechter!

Also von den Grades schlägt CNL LUG. Denke wenn eine Resourcen Anpassung kommt, wird es bestimmt auch nicht schlechter!

bei lug stehen aber noch bohrungen mit ergebnissen an, da kommt bestimmt noch was, so wie der kurs unter hohem volumen anzieht, da kann man blind einsteigen!

Antwort auf Beitrag Nr.: 61.082.869 von nicolani am 22.07.19 22:24:43

Wahnsinn, zurzeit explodiert aber auch alles. Das die guenstigen High Qualitei Projekte (auch Lundin) jetzt explodieren, ist klar. Es gibt nur noch CNL als vergleichbares Projekt.

Fly

Zitat von nicolani: bei lug stehen aber noch bohrungen mit ergebnissen an, da kommt bestimmt noch was, so wie der kurs unter hohem volumen anzieht, da kann man blind einsteigen!

Wahnsinn, zurzeit explodiert aber auch alles. Das die guenstigen High Qualitei Projekte (auch Lundin) jetzt explodieren, ist klar. Es gibt nur noch CNL als vergleichbares Projekt.

Fly

Schoener Ausverkauf heute, gibt es schon News?

Fly

Fly

allgemein schwacher tag heute für goldwerte, einfach dranbleiben!

osk ist heute auch aufgestiegen!

Antwort auf Beitrag Nr.: 61.089.688 von JamesMcFly am 23.07.19 19:11:39Nach dem heftigen Anstieg einfach nur normal.

Antwort auf Beitrag Nr.: 61.090.063 von ooy am 23.07.19 19:54:38Naja, -12% in der Spitze ohne News, das ist nicht so normal. Aber warte wir mal ab, was die Tage rauskommt.

Flu

Flu

Continental Gold bohrt in Buritica 40,2 m mit 6,43 g / t Au

Continental

Einfach echt tolle Bohrergebnisse! Jetzt muss nur noch der Goldpreis heute mitspielen!

Einfach echt tolle Bohrergebnisse! Jetzt muss nur noch der Goldpreis heute mitspielen!

Antwort auf Beitrag Nr.: 61.104.106 von Alfons1982 am 25.07.19 14:01:06wieso heute, bis zur FED-sitzung wird wohl mit dem goldpreis nicht viel passieren!

Der Abverkauf scheint zu beginnen, ich bin in Gold gut short positioniert.

Antwort auf Beitrag Nr.: 61.145.993 von JamesMcFly am 31.07.19 18:39:16

...wenn man das kein Intraday Reversal im Gold wird! Sei vorsichtig!

Gruß

Lenny

Zitat von JamesMcFly: Der Abverkauf scheint zu beginnen, ich bin in Gold gut short positioniert.

...wenn man das kein Intraday Reversal im Gold wird! Sei vorsichtig!

Gruß

Lenny

Antwort auf Beitrag Nr.: 61.145.993 von JamesMcFly am 31.07.19 18:39:16

Au weia 🙄

Aber bist bestimmt mit engen Stopp loss und großartigen Gewinn längst draußen 😄

Zitat von JamesMcFly: Der Abverkauf scheint zu beginnen, ich bin in Gold gut short positioniert.

Au weia 🙄

Aber bist bestimmt mit engen Stopp loss und großartigen Gewinn längst draußen 😄

Verdammt Axt, ich habe nicht mit stops gearbeitet. Jetzt muss ich auf einen Abverkauf vor dem WE hoffen.

Wie kann sowas nur passieren wie heute bei Gold.

Wie kann sowas nur passieren wie heute bei Gold.

Antwort auf Beitrag Nr.: 61.156.052 von JamesMcFly am 01.08.19 21:21:46

Ja mei, ist halt Casino !

Zitat von JamesMcFly: Verdammt Axt, ich habe nicht mit stops gearbeitet. Jetzt muss ich auf einen Abverkauf vor dem WE hoffen.

Wie kann sowas nur passieren wie heute bei Gold.

Ja mei, ist halt Casino !

Antwort auf Beitrag Nr.: 61.156.052 von JamesMcFly am 01.08.19 21:21:46

Das goldene Zeitalter ist angebrochen

Zitat von JamesMcFly: Wie kann sowas nur passieren wie heute bei Gold.

Das goldene Zeitalter ist angebrochen

Antwort auf Beitrag Nr.: 61.156.448 von KleinerInvestor am 01.08.19 22:05:46Wenn es so weiter geht, werde ich meine shorts schliessen muessen. Verdammte Axt

Antwort auf Beitrag Nr.: 61.156.475 von JamesMcFly am 01.08.19 22:09:29

Ich hoffe doch du hast dies konsequent umgesetzt? 🙄

Zitat von JamesMcFly: Wenn es so weiter geht, werde ich meine shorts schliessen muessen. Verdammte Axt

Ich hoffe doch du hast dies konsequent umgesetzt? 🙄

Gute Nachrichten wie ich finde

Bin mal gespannt ob Continental heute mal endlich nachhaltig über die 4 cad steigen kann, vor allem wenn man das mit Lundin Gokd vergleicht und sich den Goldpreis anschaut. Bin bei solchen hohen Kursen bei Gold, von einem deutlich höheren Kurs ausgegangen.

Bin mal gespannt ob Continental heute mal endlich nachhaltig über die 4 cad steigen kann, vor allem wenn man das mit Lundin Gokd vergleicht und sich den Goldpreis anschaut. Bin bei solchen hohen Kursen bei Gold, von einem deutlich höheren Kurs ausgegangen.

Antwort auf Beitrag Nr.: 61.197.419 von Alfons1982 am 07.08.19 15:09:21Ich denke mal, hier wird einiges verheimlicht und bald kommen bad news.

Nichstdestotrotz war der Austieg von Dosto und mir damlas echt doof,..., naja, jetzt hoffen, dass der Kurs nochmal runterkommt.

Flz

Nichstdestotrotz war der Austieg von Dosto und mir damlas echt doof,..., naja, jetzt hoffen, dass der Kurs nochmal runterkommt.

Flz

Antwort auf Beitrag Nr.: 61.199.258 von JamesMcFly am 07.08.19 17:16:55

Machs wie Pete86 auf CEO und shorte doch CNL, dann kannste doppelt verdienen

Zitat von JamesMcFly: Ich denke mal, hier wird einiges verheimlicht und bald kommen bad news.

Nichstdestotrotz war der Austieg von Dosto und mir damlas echt doof,..., naja, jetzt hoffen, dass der Kurs nochmal runterkommt.

Flz

Machs wie Pete86 auf CEO und shorte doch CNL, dann kannste doppelt verdienen

Antwort auf Beitrag Nr.: 61.199.288 von KleinerInvestor am 07.08.19 17:19:57

Habe zwar keine Ahnung was CEO und Pete86 sein soll, aber short ist mir ein wenig zu heiss.

Fly

Zitat von KleinerInvestor:Zitat von JamesMcFly: Ich denke mal, hier wird einiges verheimlicht und bald kommen bad news.

Nichstdestotrotz war der Austieg von Dosto und mir damlas echt doof,..., naja, jetzt hoffen, dass der Kurs nochmal runterkommt.

Flz

Machs wie Pete86 auf CEO und shorte doch CNL, dann kannste doppelt verdienen

Habe zwar keine Ahnung was CEO und Pete86 sein soll, aber short ist mir ein wenig zu heiss.

Fly

!

Dieser Beitrag wurde von MODelfin moderiert. Grund: Provokation, themenfremder Inhalt!

Dieser Beitrag wurde von MODelfin moderiert. Grund: Korrespondierendes Posting wurde entfernt

Hat zwar nix mit CNL direkt zu tun, aber ist ggf. trotzdem interessant und "verfolgenswert"

https://www.mining.com/colombian-authorities-file-claim-agai…

https://www.mining.com/colombian-authorities-file-claim-agai…

Antwort auf Beitrag Nr.: 61.203.029 von Popeye82 am 08.08.19 01:24:15http://www.mining-journal.com/gold-and-silver-news/news/1369…

Mann oh Mann, Gold steigt praktisch ins Unermessliche und hier, im Thread, ist nichts los.

Diese Aktie hat doch ordentlich Potential und trotzdem keine Käufer an der Börse (Deutschland) vorhanden?!?!

Woran mag es liegen?

Diese Aktie hat doch ordentlich Potential und trotzdem keine Käufer an der Börse (Deutschland) vorhanden?!?!

Woran mag es liegen?

Antwort auf Beitrag Nr.: 61.353.304 von hebsche am 27.08.19 18:27:27

Viel zu teuer der Laden, sehe hier nur Abwärtspotential.

Zitat von hebsche: Mann oh Mann, Gold steigt praktisch ins Unermessliche und hier, im Thread, ist nichts los.

Diese Aktie hat doch ordentlich Potential und trotzdem keine Käufer an der Börse (Deutschland) vorhanden?!?!

Woran mag es liegen?

Viel zu teuer der Laden, sehe hier nur Abwärtspotential.

Antwort auf Beitrag Nr.: 61.353.304 von hebsche am 27.08.19 18:27:27Die die Kaufen wollen haben sich bereits eingedeckt und warten auf die 8

Die andern warten auf dass die Mine zu produzieren beginnt.

Also im Moment kein Handlungsbedarf ausser man ist McFly

Die andern warten auf dass die Mine zu produzieren beginnt.

Also im Moment kein Handlungsbedarf ausser man ist McFly

Antwort auf Beitrag Nr.: 61.336.606 von Popeye82 am 25.08.19 10:30:38http://www.mining-journal.com/gold-and-silver-news/news/1370…

Continental Gold könnte im nächsten Jahr die 5 $-Marke überschreiten, aber eine Korrektur sieht kurzfristig wahrscheinlich aus.

https://seekingalpha.com/article/4289126-continental-gold-cr…

https://seekingalpha.com/article/4289126-continental-gold-cr…

Antwort auf Beitrag Nr.: 61.390.460 von KleinerInvestor am 02.09.19 09:53:25Hallo KI

Habe den Artikel auch gesehen. Leider ist mir der Schreiber etwas zu über-vorsichtig. Seine angekündigte Korrektur begründet er mit Chart technik, die hier eigentlich nicht viel aussagekraft hat, der Goldpreis eher. (meine bescheidene Meinung)

Bei den upsides ist er sehr posititv und beschreibt was hier alles in Petto ist, aber dann kommt er auf einen SP von 5$.

Hä???

Er rechnet mit einem Multiple von 5 wegen Columbien, negiert die potenziell besseren Grade und obendrauf blendet er die grössere Ressource aus; alles Faktoren die sich seit einem Jahr positiv entwickelt haben. Und vom POG haben wir noch nicht gesprochen.

Ich gehe hier von einem SP von 8 aus mit upsides beyond der 20iger Grenze denn bei 5 sind wir nämlich sehr bald schon +/-.

Grüsse gast

Habe den Artikel auch gesehen. Leider ist mir der Schreiber etwas zu über-vorsichtig. Seine angekündigte Korrektur begründet er mit Chart technik, die hier eigentlich nicht viel aussagekraft hat, der Goldpreis eher. (meine bescheidene Meinung)

Bei den upsides ist er sehr posititv und beschreibt was hier alles in Petto ist, aber dann kommt er auf einen SP von 5$.

Hä???

Er rechnet mit einem Multiple von 5 wegen Columbien, negiert die potenziell besseren Grade und obendrauf blendet er die grössere Ressource aus; alles Faktoren die sich seit einem Jahr positiv entwickelt haben. Und vom POG haben wir noch nicht gesprochen.

Ich gehe hier von einem SP von 8 aus mit upsides beyond der 20iger Grenze denn bei 5 sind wir nämlich sehr bald schon +/-.

Grüsse gast

Antwort auf Beitrag Nr.: 61.393.370 von gast77 am 02.09.19 16:50:01Hi gast77,

da liegen wir ja gar nicht mal soweit auseinander. Mein FCF Target ist C$9 bei CNL, wenn alles "glatt" geht und keine Überraschungen beim Capex oder Working Cap kommen.

Nicht mit eingerechnet, das Resourcen-Potential (welches noch nicht bekannt/offiziell ist).

da liegen wir ja gar nicht mal soweit auseinander. Mein FCF Target ist C$9 bei CNL, wenn alles "glatt" geht und keine Überraschungen beim Capex oder Working Cap kommen.

Nicht mit eingerechnet, das Resourcen-Potential (welches noch nicht bekannt/offiziell ist).

Bitte hier mal Stückzahlen posten, die jeder so hält.

Thx.

Thx.

Antwort auf Beitrag Nr.: 61.393.448 von JamesMcFly am 02.09.19 17:05:02

Das geht nur 3 Personengruppen was an: Familie, Stuerberater und das Finanzamt

Zitat von JamesMcFly: Bitte hier mal Stückzahlen posten, die jeder so hält.

Thx.

Das geht nur 3 Personengruppen was an: Familie, Stuerberater und das Finanzamt

Antwort auf Beitrag Nr.: 61.393.625 von KleinerInvestor am 02.09.19 17:30:41

Familie würde ich nicht einschließen, sonst finanzieren Mutti und Daddy ja nicht mehr das Bachelor Studium, wäre auch doof.

Finanzamt würde ich auch nichts sagen, sonst wollen sie nur Kohle.

Flz

Zitat von KleinerInvestor:Zitat von JamesMcFly: Bitte hier mal Stückzahlen posten, die jeder so hält.

Thx.

Das geht nur 3 Personengruppen was an: Familie, Stuerberater und das Finanzamt

Familie würde ich nicht einschließen, sonst finanzieren Mutti und Daddy ja nicht mehr das Bachelor Studium, wäre auch doof.

Finanzamt würde ich auch nichts sagen, sonst wollen sie nur Kohle.

Flz

McFly der Zug fährt weiter hier. Wird Zeit einzusteigen und den Ballast a la Shortzertifikate abzustoßen :-)

Antwort auf Beitrag Nr.: 61.400.735 von 90BVB09 am 03.09.19 16:27:06

Schauen wir mal, wird schon wieder abverkauft.

Wie viele Stücke hast du?

Zitat von 90BVB09: McFly der Zug fährt weiter hier. Wird Zeit einzusteigen und den Ballast a la Shortzertifikate abzustoßen :-)

Schauen wir mal, wird schon wieder abverkauft.

Wie viele Stücke hast du?

So, jetzt wird der Dreck hier auch endlich abverkauft. Da werden die Gewinne der letzten Wochen in ein paar Tagen abverkauft

Halbierung kommt bald.

Halbierung kommt bald.

Flz

Halbierung kommt bald.

Halbierung kommt bald.Flz

Antwort auf Beitrag Nr.: 61.430.789 von JamesMcFly am 06.09.19 19:52:50Schwachkopf

Antwort auf Beitrag Nr.: 61.430.867 von lukas5 am 06.09.19 20:01:04Schau dir doch den Kurs an, von 4,6 CAD auf 3,8 CAD innerhalb von ein paar Tagen.

Flz

Flz

!

Dieser Beitrag wurde von MODelfin moderiert. Grund: Beleidigung, Kritik bitte sachlich und ohne persönliche Angriffe, Danke.!

Dieser Beitrag wurde von MODelfin moderiert. Grund: Kritik bitte sachlich formulieren, Danke.!

Dieser Beitrag wurde von MODelfin moderiert. Grund: Bezug auf bereits moderierte Beiträge zuvor und nichts zum Thema, bitte ggf. per BM klären, Danke.!

Dieser Beitrag wurde von MODelfin moderiert. Grund: korrespondierend, bitte ggf. per BM und hier Beiträge zum Threadthema, Danke.

Antwort auf Beitrag Nr.: 61.431.098 von Lennypenny am 06.09.19 20:32:15Ja, Dosto und ich sind viel zu früh raus, und ja, das waren Anfängerfehler, aber deshalb kann man doch hoffen, wieder günstig reinzukommen.

Flz

Flz

!

Dieser Beitrag wurde von MODelfin moderiert. Grund: nichts zum Thema

Antwort auf Beitrag Nr.: 61.433.282 von JamesMcFly am 07.09.19 11:20:40selbst eine halbierung des Kurses bringt Dir nichts, da Du ja schon geschrieben hast, daß Du auf 0,50ct wartest. Bei den unmengen an Contiaktien die Du angeblich gehabt hast, mußt Du ja immense Verluste bei deren Verkauf am vorläufigen Tief gemacht haben. Mit anderen Gold und Silberweten hast Du ja scheinbar nichts gewonnen ,da Du ja als ausgemachter experte mit den guten Vernetzungen( siehe Sabina Gold)just in dem Moment als die Edelmetalle anfingen zu steigen Short gegangen bist.Hast also bisjetzt nur Verluste gebaut. Für jemanden der so gut informiert ist und schon, vor den eigentlich Beteiligten, von angeblich unterschriebenen Übernahmen Kenntnis erhälst, liegst Du oft überraschend falsch. siehe erneut Sabina.

Und warum Du jetzt ständig den Dosto bei Deinen eigenen Dummheiten mit ins Boot holst erschließt sich mir auch nicht.

Und warum Du jetzt ständig den Dosto bei Deinen eigenen Dummheiten mit ins Boot holst erschließt sich mir auch nicht.

Wo seht ihr denn hier ein gutes Niveau für einen Nachkauf? Auf Euro-Basis sieht 2,50 EUR ganz interessant, nur leider spielt das bei dem Wert hier ja keine große Rolle. Auf CAD-Basis sehe ich als Laie keine wirkliche Zone?! 2,50 und 2,0 CAD, aber soweit würde es sicherlich nur bei einem signifikanten Goldskursabschwung kommen.

Bin mir sehr unschlüssig? Vielleicht kann Senna ja mal etwas bildliches posten? 🤔

Bin mir sehr unschlüssig? Vielleicht kann Senna ja mal etwas bildliches posten? 🤔

Mann,Mann

2bis2,50 c Dollar, das sind 400 bis 500 mill Mk.

Die Firma hat 750 mill capax in die mine investiert, wollen sie das mit 250 mill unter bewerten?

Für 2dollar geh ich klinkenputzen und Kauf den laden

2bis2,50 c Dollar, das sind 400 bis 500 mill Mk.

Die Firma hat 750 mill capax in die mine investiert, wollen sie das mit 250 mill unter bewerten?

Für 2dollar geh ich klinkenputzen und Kauf den laden

Nächste unterstuezungen sind 3,50 dann 3

Das wurde dann gewesen sein solange gold nicht unter die 1.400 faellt

Das wurde dann gewesen sein solange gold nicht unter die 1.400 faellt

Antwort auf Beitrag Nr.: 61.439.696 von 90BVB09 am 09.09.19 09:00:30Bei 2.5 cad und spätestens bei 2 CAD wird es drehen. Reine Charttechnik. Also noch viel Luft nach unten. Fly

Wird schwierig das CNL auf 2,50 CAD geht bei diesen Bohrergebnissen:

42 metres @ 41.57 g/t gold and 21.09 g/t silver at 2.48 metres width

47 metres @ 24.87 g/t gold and 32.45 g/t silver at 2.69 metres width

20 metres @ 19.80 g/t gold and 381.37 g/t silver at 2.89 metres width

18 metres @ 13.04 g/t gold and 31.16 g/t silver at 2.43 metres width

100 metres @ 9.64 g/t gold and 57.57 g/t silver at 2.54 metres width

19 metres @ 9.53 g/t gold and 10.44 g/t silver at 2.23 metres width

26 metres @ 9.32 g/t gold and 36.62 g/t silver at 3.19 metres width

42 metres @ 9.60 g/t gold and 8.17 g/t silver at 2.68 metres width

https://www.newswire.ca/news-releases/continental-gold-annou…

42 metres @ 41.57 g/t gold and 21.09 g/t silver at 2.48 metres width

47 metres @ 24.87 g/t gold and 32.45 g/t silver at 2.69 metres width

20 metres @ 19.80 g/t gold and 381.37 g/t silver at 2.89 metres width

18 metres @ 13.04 g/t gold and 31.16 g/t silver at 2.43 metres width

100 metres @ 9.64 g/t gold and 57.57 g/t silver at 2.54 metres width

19 metres @ 9.53 g/t gold and 10.44 g/t silver at 2.23 metres width

26 metres @ 9.32 g/t gold and 36.62 g/t silver at 3.19 metres width

42 metres @ 9.60 g/t gold and 8.17 g/t silver at 2.68 metres width

https://www.newswire.ca/news-releases/continental-gold-annou…

Für jedes 1g/t Au was sich in der P&P Reserve erhöht kommen ca 440.000 Unzen dazu! Allein nach der P&P Reserve von ca 3,7m Unzen ist CNL fair bewertet aktuell, wenn man 160USD (Durschnittliche Bewertung pro P&P Unze der Peer) pro Unze ansetzt.

Antwort auf Beitrag Nr.: 61.441.385 von KleinerInvestor am 09.09.19 12:55:43Hallo KI

Danke für die updates

ich komme heute auf einen NPV von 1,27 Mia USD was dann einen SP von USD 5,6 ergeben würde.

Wenn die natürlich solche hochgradigen Erzkörper erschliesen steigt aus sehr schnell der jährliche output und die Marge was zusammen mit einem POG der über 1600 geht ein riesen leverage bildet. Also CAD 7,8 ist mE der lowest target kurs den ich sehe.

Danke für die updates

ich komme heute auf einen NPV von 1,27 Mia USD was dann einen SP von USD 5,6 ergeben würde.

Wenn die natürlich solche hochgradigen Erzkörper erschliesen steigt aus sehr schnell der jährliche output und die Marge was zusammen mit einem POG der über 1600 geht ein riesen leverage bildet. Also CAD 7,8 ist mE der lowest target kurs den ich sehe.

16,86 g/t Gold über eine Streichlänge von 314 Metern! Gigantisch!! Da träumen fast alle anderen von!

Antwort auf Beitrag Nr.: 61.442.141 von nicolani am 09.09.19 14:20:10Jap, das ist Macassa & Fosterville Niveau!

Antwort auf Beitrag Nr.: 61.442.141 von nicolani am 09.09.19 14:20:10nur KL ist mit 13 mrd cad bewertet!

Kann mir nicht vorstellen,dass bei den guten Bohrergebnissen und einem stabilen Goldpreis, wir die 2-2,50 cad sehen werden. Denke, das wir, eher die 5 cad anlaufen werden. Vor allem läuft ja der Bau Mine und beim letzten Update waren 75% geschafft! Dazu heute wieder super Bohrergebnisse. Das ganze Potential, ist noch im Kurs überhaupt nicht enthalten. Ich habe Zeit hier. Abgesehen von Kirkland, kenne ich kein Projekt, das kurz vor Produktion steht und so hohe High Grades hat.

Außerdem kommt es nicht darauf an, wiviel man in eine Aktie investiert, sondern was man am Ende rausbekommt. Deswegen sind Fragen wiviel einer investiert total uninteressant! !!!

Außerdem kommt es nicht darauf an, wiviel man in eine Aktie investiert, sondern was man am Ende rausbekommt. Deswegen sind Fragen wiviel einer investiert total uninteressant! !!!

also hier über 2-2,50 cad zu reden, geschweige auf diese einstiegskurse zu warten, ist vergeudete zeit!

Ich bleibe bei 2-2.5 CAD , das sollte dann ein guter Entry kurz vor der Produktion sein.

Flz

Flz

Wenn es bei den Grades, Bauvortschritt, Shareholder, FCF-Erwartungen auf 2 CAD fallen sollte, dann müsste entweder der Goldpreis massiv fallen oder ein unvorhergesehenes Ereignis (z.B. Regierungssturtz etc...) passieren. Aber dann bezweifle ich, dass du für den Preis reingehst. Du bist doch schon längst wieder drin

Antwort auf Beitrag Nr.: 61.443.119 von KleinerInvestor am 09.09.19 16:05:16Die News waren ok, es sieht auch alles ganz gut aus. Aber jetzt müssen erstmal die Gewinnmitnahmen raus und dann noch die zittrigen Hände. Das geht scharft auf 2 CAD und dann von dort Übernahme zu 6 CAD.

Flz

Flz

JamesMcFly

Die Gewinnmitnahmen haben wir schon seit dem hoch! Ging ja paar mal runter auf 4 cad und drunter! Jetzt verkaufen welche, die noch an eine größere Goldkorrektur glauben. Sobald Goldpreis nach oben drehen sollte, wird es hier dann wieder up gehen.

Die Gewinnmitnahmen haben wir schon seit dem hoch! Ging ja paar mal runter auf 4 cad und drunter! Jetzt verkaufen welche, die noch an eine größere Goldkorrektur glauben. Sobald Goldpreis nach oben drehen sollte, wird es hier dann wieder up gehen.

Charttechnick

Wer findet den ÷Gap÷

Wer findet den ÷Gap÷

Antwort auf Beitrag Nr.: 61.448.726 von dosto am 10.09.19 10:30:15

Bib zwar kein CTLer aber könnte es ggf. bei 3,30 CAD liegen?

Zitat von dosto: Charttechnick

Wer findet den ÷Gap÷

Bib zwar kein CTLer aber könnte es ggf. bei 3,30 CAD liegen?

Sie haben recht! Bei ca 3,30 cad ist noch ein GAP!

Im Bereich 2 und 2.5 CAD sind doch schöne Widerstände. Dahin werden wir laufen. Ich würde danach handeln.

Flz

Flz

Antwort auf Beitrag Nr.: 61.449.695 von JamesMcFly am 10.09.19 12:42:01Wer hindert sie, an ihrem handeln, keiner

Noch gibts dort nix zu handeln,also wohl buzzword Bingo was sie gerade anstellen.

Noch gibts dort nix zu handeln,also wohl buzzword Bingo was sie gerade anstellen.

Antwort auf Beitrag Nr.: 61.453.706 von dosto am 10.09.19 20:13:15

Naja, man kann auch short gehen, aber ist risikoreich. MIt geringem Risiko kann man einfach bis Ende des Jahres warten und bei 2 CAD schön zukaufen.

Zitat von dosto: Wer hindert sie, an ihrem handeln, keiner

Noch gibts dort nix zu handeln,also wohl buzzword Bingo was sie gerade anstellen.

Naja, man kann auch short gehen, aber ist risikoreich. MIt geringem Risiko kann man einfach bis Ende des Jahres warten und bei 2 CAD schön zukaufen.

Antwort auf Beitrag Nr.: 61.453.886 von JamesMcFly am 10.09.19 20:33:07Hier wartet wohl keiner auf ihr BINGO

Mir ist das Wurst, das ist eh meine Rapper Aktie,also wenn ich 50 cents Fischen kann,werd ich

Mir nicht ans bein pinkeln.

Hab grad keinen koeder zur hand

Mir ist das Wurst, das ist eh meine Rapper Aktie,also wenn ich 50 cents Fischen kann,werd ich

Mir nicht ans bein pinkeln.

Hab grad keinen koeder zur hand

Site visit: Continental stays on track at Buritica

https://www.northernminer.com/news/continental-stays-on-trac…

https://www.northernminer.com/news/continental-stays-on-trac…

Hier sieht es auch ziemlich übel aus. Einer der schlechtesten Performances in dem Sektor. Obwohl Gold so hoch steht, ist man hier kaum vorangekommen. Traurig für alle Investierten.

Antwort auf Beitrag Nr.: 61.599.427 von JamesMcFly am 30.09.19 18:34:19

Wenn du sowas schreibst gab es meist positive news:

...

Additionally, project construction is advancing more rapidly than planned and, as a result, the Company is pleased to update guidance for mechanical completion of the project from H1 2020 to Q1 2020. Ramp‑up to commercial production is anticipated to take 6-9 months from the date that mechanical completion for the project is achieved.

https://www.continentalgold.com/en/continental-gold-provides…

Zitat von JamesMcFly: Hier sieht es auch ziemlich übel aus. Einer der schlechtesten Performances in dem Sektor. Obwohl Gold so hoch steht, ist man hier kaum vorangekommen. Traurig für alle Investierten.

Wenn du sowas schreibst gab es meist positive news:

...

Additionally, project construction is advancing more rapidly than planned and, as a result, the Company is pleased to update guidance for mechanical completion of the project from H1 2020 to Q1 2020. Ramp‑up to commercial production is anticipated to take 6-9 months from the date that mechanical completion for the project is achieved.

https://www.continentalgold.com/en/continental-gold-provides…

Antwort auf Beitrag Nr.: 61.599.427 von JamesMcFly am 30.09.19 18:34:19

kann Dir ja egal sein. Bist doch schon lange draussen und kannst ja jetzt auf die 0,50 hoffen und schon mal ansparen

kann Dir ja egal sein. Bist doch schon lange draussen und kannst ja jetzt auf die 0,50 hoffen und schon mal ansparen

Fly

Wir sind hier im Endstadium der Konstruktion.

Da kann der Goldpreis hoch gehen oder nicht sehr viel wird es den Kurs nicht bewegen.

Hier spielen andere Mechanismen.

Wer hat der der bleibt dabei.

Wer will der hat schon.

Die neuen warten bis hier gefördert wird und alle unwegsamkeiten aus dem Weg geräumt wurden.

So wird der Kurs sich nicht bewegen die nächste Zeit.

Es sei denn die kommen wieder mit höheren Graden oder mit grösseren Ressourcen.

Schaut Euch den Kurs im Q2 wieder an. Bis dahin macht was anderes

grüsse gast77

Wir sind hier im Endstadium der Konstruktion.

Da kann der Goldpreis hoch gehen oder nicht sehr viel wird es den Kurs nicht bewegen.

Hier spielen andere Mechanismen.

Wer hat der der bleibt dabei.

Wer will der hat schon.

Die neuen warten bis hier gefördert wird und alle unwegsamkeiten aus dem Weg geräumt wurden.

So wird der Kurs sich nicht bewegen die nächste Zeit.

Es sei denn die kommen wieder mit höheren Graden oder mit grösseren Ressourcen.

Schaut Euch den Kurs im Q2 wieder an. Bis dahin macht was anderes

grüsse gast77

Hier kracht es ja auch ordentlich. Bald sind wir wieder bei Dostos Ausstiegskurs

Flz

Flz

Antwort auf Beitrag Nr.: 61.699.225 von JamesMcFly am 15.10.19 21:08:28

Gutes timing 😄

Aktuell 4,10 CAD / +5,1% 🤘

Zitat von JamesMcFly: Hier kracht es ja auch ordentlich. Bald sind wir wieder bei Dostos Ausstiegskurs

Flz

Gutes timing 😄

Aktuell 4,10 CAD / +5,1% 🤘

Antwort auf Beitrag Nr.: 61.699.225 von JamesMcFly am 15.10.19 21:08:28

erzähl doch keine Lügen & Schwachsinn

immer noch über 100 % von manch Träumereien von Kurse unter 2 Dollar

Zitat von JamesMcFly: Hier kracht es ja auch ordentlich. Bald sind wir wieder bei Dostos Ausstiegskurs

Flz

erzähl doch keine Lügen & Schwachsinn

immer noch über 100 % von manch Träumereien von Kurse unter 2 Dollar

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Antwort auf Beitrag Nr.: 61.713.982 von senna7 am 17.10.19 21:56:37

Ja, sorry, mich nervt es schon,dass ich nicht zu 2 CAD kaufen kann.

Flz

Zitat von senna7:Zitat von JamesMcFly: Hier kracht es ja auch ordentlich. Bald sind wir wieder bei Dostos Ausstiegskurs

Flz

erzähl doch keine Lügen & Schwachsinn

immer noch über 100 % von manch Träumereien von Kurse unter 2 Dollar

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Ja, sorry, mich nervt es schon,dass ich nicht zu 2 CAD kaufen kann.

Flz

und wieder haben sie mehr potential entdeckt.

"A total of 43 channel samples averaged greater than 2 g/t gold and 23 channel samples averaged more than 31 g/t silver."

Das wird hier richtig spannend.

https://seekingalpha.com/pr/17697216-continental-gold-grante…

"A total of 43 channel samples averaged greater than 2 g/t gold and 23 channel samples averaged more than 31 g/t silver."

Das wird hier richtig spannend.

https://seekingalpha.com/pr/17697216-continental-gold-grante…

Antwort auf Beitrag Nr.: 61.914.257 von gast77 am 13.11.19 17:49:51https://www.mining-journal.com/leadership/news/1375701/colom…

Grüsse von Popeye

Grüsse von Popeye

Es fehlen jetzt hier nur noch 17 % was die Konstruktion angeht. Ich bin mal gespannt, ob es hier reibungslos laufen wird, was den Produktionsbeginn angeht. Aktuell sieht es zwar gut aus, aber wir sind noch nicht über den Berg. Kurs hat jetzt mal einen kleinen Aufwärtstrend gebildet (3,75 cad- 4,39 cad).

If the Company exercises the Financing Option Offer, common shares would be issued on a private placement basis, at a price of C$4.20 per common share, subject to regulatory approval. Closing is expected to occur during the first half of December 2019, subject to the satisfaction of certain conditions, including that no material adverse effect shall have occurred.

Das bez financing von 50 Mio wg cash shortfall.

Das bez financing von 50 Mio wg cash shortfall.

gast77

Also doch noch eine Kaitalerhöhung! Was für ein scheiss. Da hätte ich mir Schrieben auch schenken können.

Also doch noch eine Kaitalerhöhung! Was für ein scheiss. Da hätte ich mir Schrieben auch schenken können.

Eine Finanzierung zu 4.2 CAD ist eine Katastrophe, heute crash auf min 2 CAD. Auch wenn jedem klar war, dass weitere Geld benötigt wird, ich will den Crash sehen.

Flz

Flz

Antwort auf Beitrag Nr.: 61.932.719 von JamesMcFly am 15.11.19 13:41:06

Deine Psyche wäre selbst für Sigmund Freud eine Herausforderung.

Zitat von JamesMcFly: Eine Finanzierung zu 4.2 CAD ist eine Katastrophe, heute crash auf min 2 CAD. Auch wenn jedem klar war, dass weitere Geld benötigt wird, ich will den Crash sehen.

Flz

Deine Psyche wäre selbst für Sigmund Freud eine Herausforderung.

Antwort auf Beitrag Nr.: 61.932.296 von Alfons1982 am 15.11.19 13:07:08Es war schon klar dass die noch Kapital benötigen um die Sache abzuschliessen und die Produktion aufzunehmen. (WC)

Das Positive wir wissen nun 50Mio sinds

Weiter wenn sie die KE option machen dann ist der SP mit 4.2 betoniert

Im übrigen sprechen sie auch noch mit Kapitalgeber, also KE noch nicht garantiert.

Man lese das IF zu beginn der Message.

Die 4.2 freuen mich, das ist der Knaller, denn wer immer hier einspringt macht das nicht um Geld zu verlieren. Für Fly sollte der Zug nun definitiv abgefahren sein.

Das Positive wir wissen nun 50Mio sinds

Weiter wenn sie die KE option machen dann ist der SP mit 4.2 betoniert

Im übrigen sprechen sie auch noch mit Kapitalgeber, also KE noch nicht garantiert.

Man lese das IF zu beginn der Message.

Die 4.2 freuen mich, das ist der Knaller, denn wer immer hier einspringt macht das nicht um Geld zu verlieren. Für Fly sollte der Zug nun definitiv abgefahren sein.

Antwort auf Beitrag Nr.: 61.933.550 von gast77 am 15.11.19 14:57:43Nichts da, ohne Fly wird nicht geflogen

Heute crash und die kommenden Wochen tax loss season. Und dann wird mit Fly geflogen

Heute crash und die kommenden Wochen tax loss season. Und dann wird mit Fly geflogen

Fly

Heute crash und die kommenden Wochen tax loss season. Und dann wird mit Fly geflogen

Heute crash und die kommenden Wochen tax loss season. Und dann wird mit Fly geflogen

Fly

gast77

Seit 2 Tagen leicht angeschlagen. Dementsprechend überfliege ich im ersten Moment manche Artikel, ohne genau und alles nachzulesen. Das sollte in Zukunft nicht mehr machen und dann gleich meinen Kommentar dazu schreiben.

Ja das stimmt. Dieses Thema war ja immer im Hintergrund präsent, ob Sie noch Gelder benötigen oder nicht. Wenn es jetzt bei den 50 Millionen bleibt, denke ich das wir damit leben können.

JamesMcFly

Ihre Einstiegskurse von 2 cad können Sie vergessen. Die kommen nicht mehr, außer es läuft jetzt alles aus dem Ruder und der Goldpreis schmiert ab. Danach sieht es aber nicht aus. Viel mehr unter die 4 cad sollte es nicht laufen. Sollte sich evtl. Sprott, daran nochmals beteiligen, gehe ich sogar von zuerst steigenden Kursen aus.

Seit 2 Tagen leicht angeschlagen. Dementsprechend überfliege ich im ersten Moment manche Artikel, ohne genau und alles nachzulesen. Das sollte in Zukunft nicht mehr machen und dann gleich meinen Kommentar dazu schreiben.

Ja das stimmt. Dieses Thema war ja immer im Hintergrund präsent, ob Sie noch Gelder benötigen oder nicht. Wenn es jetzt bei den 50 Millionen bleibt, denke ich das wir damit leben können.

JamesMcFly

Ihre Einstiegskurse von 2 cad können Sie vergessen. Die kommen nicht mehr, außer es läuft jetzt alles aus dem Ruder und der Goldpreis schmiert ab. Danach sieht es aber nicht aus. Viel mehr unter die 4 cad sollte es nicht laufen. Sollte sich evtl. Sprott, daran nochmals beteiligen, gehe ich sogar von zuerst steigenden Kursen aus.

mge

JamesMcFly ist halt manchmal wie Rumpelofen hier im Forum, nur mit dem Unterschied, in die entgegengesetzte Richtung. Der eine immer up und JamesMcFly immer down😂😂😂

JamesMcFly ist halt manchmal wie Rumpelofen hier im Forum, nur mit dem Unterschied, in die entgegengesetzte Richtung. Der eine immer up und JamesMcFly immer down😂😂😂

Continental Gold Provides Buriticá Project Update: Mill Facilities Mechanical Completion nears 90 percent

Continental Gold Inc.

TORONTO, Nov. 19, 2019 - Continental Gold Inc. (TSX:CNL; OTCQX:CGOOF) ("Continental" or the "Company") is pleased to provide a project update for its Buriticá project in northwestern Antioquia, Colombia. Construction of the project remains on schedule for mechanical completion in Q1 2020, ramping to commercial production approximately six to nine months thereafter.

Highlights

Mill facilities construction was 88 percent completed as of October 31, 2019.

Major milling equipment installation has been completed with piping, electrical and instrumentation advancing well.

Acceleration of underground development continues; Continental's mine crews achieved over 1.5 kilometres of lateral development in October, the highest monthly advance to-date.

Total lateral development advance is 19,800 metres, including ramps, sublevels and ore development.

Pre-production stockpile of 81,200 tonnes averaged 7.2 g/t gold at the end of October 2019 and is anticipated to continue increasing by approximately 10,000-15,000 tonnes per month.

The 110-kV powerline construction was completed in Q3 2019, with line and mine substation energization in November.

(Click here for progress photos)

Details

As of October 31, 2019, the Buriticá project mill facilities mechanical completion was 88 percent. All major milling equipment has been installed, and work is advancing in all areas for piping, electrical and instrumentation. The mill building was enclosed in November and there has been significant advance on the electrical room and mill control office. Liner installation is underway for both the SAG and ball mills. The tailing filtration building is nearly enclosed; roof structure work is well-advanced for the Merrill Crowe and tailing storage buildings. Construction of the approximately 32-kilometre powerline between the Chorodó substation on the power grid and the Buriticá project was completed in Q3 2019. The line and mine substation were energized in November and all underground mining areas are now being powered with energy from the new 110-kV powerline. The mill facilities remain on schedule for Q1 2020 mechanical completion. Ramp-up to commercial production is anticipated approximately six to nine months thereafter.

Underground development continues to exceed expectations as Continental's crews achieved 1,569 metres of lateral development in October. This was the highest monthly advance for the project to-date. Total lateral development advance, including ramps, sublevels and ore development is 19,800 metres. Crews are advancing daily at the Yaraguá and Veta Sur ramps and the Higabra adit, with focus on stope preparation prior to production startup. At the end-October 2019, the pre-production stockpile was 81,200 tonnes and averaged 7.2 g/t gold. Since early 2019, monthly definition drilling has been increasing with 15 drills focused on underground definition drilling. Ventilation circuit modifications were implemented following the completion of the 294-metre ventilation raise connecting shallow elevation Veta Sur development with deeper Veta Sur development in the Higabra tunnel. Two additional raises are presently being excavated as ore and waste passes in the Yaraguá system and are on schedule.

"We continue to be very pleased with Buriticá's progress," commented Donald Gray, Chief Operating Officer. "Our mine crews have been consistently exceeding planned development with monthly advance topping 1.5 kilometres in October, the highest monthly advance to date. Mill facilities construction—in particular piping, electrical and instrumentation—are advancing rapidly for mechanical completion, and we have already begun pre-commissioning in a number of areas. Our mine development and mill construction progress has positioned us well to achieve our 2020 goal of mechanical completion in Q1 and commercial production six to nine months thereafter. Comprehensive production mining and mill operations training is underway for our local workforce. We are very confident our crews will continue meeting the challenge to work safely and efficiently for this world-class operation."

About Continental Gold Inc.

Continental Gold is the leading large-scale gold mining company in Colombia and is presently developing it's 100% owned Buriticá project in Antioquia. Buriticá is one of the largest and highest-grade gold projects in the world and is being advanced utilizing best practices for mine construction, environmental care and community inclusion. Led by an international management team with a successful record of discovering, financing and developing large high-grade gold deposits in Latin America, the Buriticá project is on schedule with mechanical completion anticipated during the first quarter of 2020.

For information on the Buriticá project, please refer to the technical report, prepared in accordance with NI 43?101, entitled "NI 43?101 Buriticá Mineral Resource 2019?01, Antioquia, Colombia" and dated March 18, 2019 with an effective date of January 30, 2019, led by independent consultants Ivor Jones Pty Ltd. The technical report is available on SEDAR at www.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.continentalgold.com.

The scientific and technical information contained in this press release has been reviewed and approved by Donald Gray, Chief Operating Officer of the Company, who is a qualified person within the meaning of NI 43?101.

Continental Gold Inc.

TORONTO, Nov. 19, 2019 - Continental Gold Inc. (TSX:CNL; OTCQX:CGOOF) ("Continental" or the "Company") is pleased to provide a project update for its Buriticá project in northwestern Antioquia, Colombia. Construction of the project remains on schedule for mechanical completion in Q1 2020, ramping to commercial production approximately six to nine months thereafter.

Highlights

Mill facilities construction was 88 percent completed as of October 31, 2019.

Major milling equipment installation has been completed with piping, electrical and instrumentation advancing well.

Acceleration of underground development continues; Continental's mine crews achieved over 1.5 kilometres of lateral development in October, the highest monthly advance to-date.

Total lateral development advance is 19,800 metres, including ramps, sublevels and ore development.

Pre-production stockpile of 81,200 tonnes averaged 7.2 g/t gold at the end of October 2019 and is anticipated to continue increasing by approximately 10,000-15,000 tonnes per month.

The 110-kV powerline construction was completed in Q3 2019, with line and mine substation energization in November.

(Click here for progress photos)

Details

As of October 31, 2019, the Buriticá project mill facilities mechanical completion was 88 percent. All major milling equipment has been installed, and work is advancing in all areas for piping, electrical and instrumentation. The mill building was enclosed in November and there has been significant advance on the electrical room and mill control office. Liner installation is underway for both the SAG and ball mills. The tailing filtration building is nearly enclosed; roof structure work is well-advanced for the Merrill Crowe and tailing storage buildings. Construction of the approximately 32-kilometre powerline between the Chorodó substation on the power grid and the Buriticá project was completed in Q3 2019. The line and mine substation were energized in November and all underground mining areas are now being powered with energy from the new 110-kV powerline. The mill facilities remain on schedule for Q1 2020 mechanical completion. Ramp-up to commercial production is anticipated approximately six to nine months thereafter.

Underground development continues to exceed expectations as Continental's crews achieved 1,569 metres of lateral development in October. This was the highest monthly advance for the project to-date. Total lateral development advance, including ramps, sublevels and ore development is 19,800 metres. Crews are advancing daily at the Yaraguá and Veta Sur ramps and the Higabra adit, with focus on stope preparation prior to production startup. At the end-October 2019, the pre-production stockpile was 81,200 tonnes and averaged 7.2 g/t gold. Since early 2019, monthly definition drilling has been increasing with 15 drills focused on underground definition drilling. Ventilation circuit modifications were implemented following the completion of the 294-metre ventilation raise connecting shallow elevation Veta Sur development with deeper Veta Sur development in the Higabra tunnel. Two additional raises are presently being excavated as ore and waste passes in the Yaraguá system and are on schedule.

"We continue to be very pleased with Buriticá's progress," commented Donald Gray, Chief Operating Officer. "Our mine crews have been consistently exceeding planned development with monthly advance topping 1.5 kilometres in October, the highest monthly advance to date. Mill facilities construction—in particular piping, electrical and instrumentation—are advancing rapidly for mechanical completion, and we have already begun pre-commissioning in a number of areas. Our mine development and mill construction progress has positioned us well to achieve our 2020 goal of mechanical completion in Q1 and commercial production six to nine months thereafter. Comprehensive production mining and mill operations training is underway for our local workforce. We are very confident our crews will continue meeting the challenge to work safely and efficiently for this world-class operation."

About Continental Gold Inc.

Continental Gold is the leading large-scale gold mining company in Colombia and is presently developing it's 100% owned Buriticá project in Antioquia. Buriticá is one of the largest and highest-grade gold projects in the world and is being advanced utilizing best practices for mine construction, environmental care and community inclusion. Led by an international management team with a successful record of discovering, financing and developing large high-grade gold deposits in Latin America, the Buriticá project is on schedule with mechanical completion anticipated during the first quarter of 2020.

For information on the Buriticá project, please refer to the technical report, prepared in accordance with NI 43?101, entitled "NI 43?101 Buriticá Mineral Resource 2019?01, Antioquia, Colombia" and dated March 18, 2019 with an effective date of January 30, 2019, led by independent consultants Ivor Jones Pty Ltd. The technical report is available on SEDAR at www.sedar.com, on the OTCQX at www.otcmarkets.com and on the Company website at www.continentalgold.com.

The scientific and technical information contained in this press release has been reviewed and approved by Donald Gray, Chief Operating Officer of the Company, who is a qualified person within the meaning of NI 43?101.

!

Dieser Beitrag wurde von CloudMOD moderiert. Grund: kein erkennbarer Bezug zum Thema, Urheberrechtsverletzung

Der Markt lässt Conti aber noch nicht über die 4.5 CAD. Sobald man diese Hürde nimmt, geth es schnell.

Flz

Flz

Antwort auf Beitrag Nr.: 61.965.437 von JamesMcFly am 19.11.19 21:39:37Fly

ist doch klar,

wir wollen nicht sehen wie die Bauen.

Wir wollen sehen wie die giessen. (das ist der jetzige Vorteil von GMC, auch wenn Sies nicht wahrhaben wollen, oder ein bisschen neidisch hinterherhinken)

Und dass die jetzt jeden Kroeten Dollar schlucken muessen ist auch kein Thema.

Die CAPEX ist eh laengst ueberzogen, gedeht und sonst noch was.

Die Erbsenzähler like me werden das schon einzuordnen koennen.

Aber nur hypothetische Papier-Produktion ist einfach zu wenig, bei Conti ist und

wird alles ganz anders aussehen als jemals angedacht.

ist doch klar,

wir wollen nicht sehen wie die Bauen.

Wir wollen sehen wie die giessen. (das ist der jetzige Vorteil von GMC, auch wenn Sies nicht wahrhaben wollen, oder ein bisschen neidisch hinterherhinken)

Und dass die jetzt jeden Kroeten Dollar schlucken muessen ist auch kein Thema.

Die CAPEX ist eh laengst ueberzogen, gedeht und sonst noch was.

Die Erbsenzähler like me werden das schon einzuordnen koennen.

Aber nur hypothetische Papier-Produktion ist einfach zu wenig, bei Conti ist und

wird alles ganz anders aussehen als jemals angedacht.

Antwort auf Beitrag Nr.: 61.969.649 von dosto am 20.11.19 11:30:41Naja, GCM ist nicht vergleichbar. Conti sitzt auf einem Multi Millionen Deposit, GCM hat fast nichts vorzuweisen

Capex von 500 mio US ist doch im Rahmen.

Und wie die Produktionszahlen aussehen werden, das wird man dann sehen. Die Studien und alle weiteren Daten deuten jedoch darauf hin, das wir hier eine cash cow haben werden. Ich gehe mittelfristig sogar von AISC um die 500 USD aus.

Flz

Capex von 500 mio US ist doch im Rahmen.

Und wie die Produktionszahlen aussehen werden, das wird man dann sehen. Die Studien und alle weiteren Daten deuten jedoch darauf hin, das wir hier eine cash cow haben werden. Ich gehe mittelfristig sogar von AISC um die 500 USD aus.

Flz

Antwort auf Beitrag Nr.: 61.969.649 von dosto am 20.11.19 11:30:41Und so ist das Business. Kurz vor der Produktion lässt das Management seine Amigos nochmal günstig zu 4.2 CAD einkaufen. Der Zug wird bald abfahren, Kursziel 7 CAD.

Flz

Flz

Social license has been key to building a new mine – Continental Gold

Neils Christensen

Neils Christensen Wednesday November 20, 2019 14:54

(Kitco News) -While it’s important to get the technical aspects of a gold mine right, it also important that the company has the social license to operate, according to one Colombia mining executive.

By the first quarter of 2020, Colombia will see its first new gold mine in decades as Continental Gold (TSX: CNL) is expected to finish construction of its Buriticá mine by January. The new production couldn’t come at a more important time as the country has seen rising anti-mining sentiment from politicians and the public.

The Buriticá project has proven and probable reserves of nearly 14 million ounces. The mine is expected to produce 300,000 ounces of gold per year.

Luis Germán Meneses, country manager at Continental Gold, said in an interview with Kitco News on the sidelines of the Colombia Gold Symposium – going against the growing sentiment – the company has seen strong support for the expected mine. He added that all eyes are on the project.

“Not only are we a strategically important project, but we are also an example for all the enterprises dealing with the challenges of properly engaging with communities,” he said. “Even before you plant a drill bit you need to engage with the community and that is what we have done. You can now see the results of that effort.”

Meneses said that Continental, from the very beginning, has worked closely with community groups, local governments and national representatives to promote environmental sustainability and economic development

The company currently directly employs over 1,000 people but indirectly employs more than 4,700. Around 80% of the work force comes from the region and 18% of them are women.

“It has been an absolute revelation seeing the impact of having women in mining roles,” Meneses said in a discussion during the conference. ‘We saw a significant drop in accident levels when women started working in the mine.”

Meneses added that they have invested millions of dollars in community-led micro-businesses from financing chicken and sugar cane farms to helping people start catering and laundry services.

Instead of building a camp, the company worked with local residents, who provide housing for mine workers. Not only does the community benefit, but Menese said that the company is also developing a reliable supply chain for services and products.

“It is important to us that we buy as much as we can locally,” he said. “We are doing this to ensure that we have sustainable communities long after the mine is gone.”