Erneuerbare Energie in einem Wachstumsmarkt (Seite 3)

eröffnet am 29.10.10 11:00:11 von

neuester Beitrag 02.04.24 11:44:05 von

neuester Beitrag 02.04.24 11:44:05 von

Beiträge: 128

ID: 1.160.841

ID: 1.160.841

Aufrufe heute: 0

Gesamt: 12.811

Gesamt: 12.811

Aktive User: 0

ISIN: BRCMIGACNPR3 · WKN: 899018

2,3300

EUR

+0,43 %

+0,0100 EUR

Letzter Kurs 29.04.24 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 99,97 | +44,88 | |

| 5,0000 | +25,00 | |

| 1,1000 | +13,40 | |

| 44,00 | +10,33 | |

| 37,40 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 350,50 | -7,15 | |

| 3,2512 | -8,16 | |

| 11,444 | -11,15 | |

| 12,020 | -12,58 | |

| 5,9400 | -20,80 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.475.665 von ar13pk am 02.05.22 17:47:36ok, ich habe es jetzt auf der Website von Cemig gefunden. Es gibt 30% neue Shares...

https://ri.cemig.com.br/en/divulgacao-e-resultados/press-rel…

https://ri.cemig.com.br/en/divulgacao-e-resultados/press-rel…

2.5.

Brazil Analysts Lift Inflation Bets Again as New Rate Hike Looms

https://www.bnnbloomberg.ca/brazil-analysts-lift-inflation-b…

...

Policy makers led by Roberto Campos Neto will likely raise rates by a full percentage point to 12.75% on May 4 to tame cost of living increases. What comes next is more unclear, as board members have signaled they are ready to wrap up the tightening cycle which has already added 975 basis points to borrowing costs in just over one year.

Latin America’s largest economy has faced persistent energy shocks which drove annual inflation to 12.03% in mid-April, marking the highest level since 2003. Price pressures have recently shown to be widespread, affecting other sectors including services, food outside of the home and clothing.

...

Brazil Analysts Lift Inflation Bets Again as New Rate Hike Looms

https://www.bnnbloomberg.ca/brazil-analysts-lift-inflation-b…

...

Policy makers led by Roberto Campos Neto will likely raise rates by a full percentage point to 12.75% on May 4 to tame cost of living increases. What comes next is more unclear, as board members have signaled they are ready to wrap up the tightening cycle which has already added 975 basis points to borrowing costs in just over one year.

Latin America’s largest economy has faced persistent energy shocks which drove annual inflation to 12.03% in mid-April, marking the highest level since 2003. Price pressures have recently shown to be widespread, affecting other sectors including services, food outside of the home and clothing.

...

Ahoj všem,

mich wundert der heutige hohe Kursverlust, der nicht zum Dividendenabschlag passt, gibt es wieder neue Aktien?

mich wundert der heutige hohe Kursverlust, der nicht zum Dividendenabschlag passt, gibt es wieder neue Aktien?

Antwort auf Beitrag Nr.: 71.188.303 von faultcode am 24.03.22 18:27:5324.3.

https://www.bloomberg.com/news/articles/2022-04-01/6-600-mil…

...

Latin America is emerging as an oasis of stability amid the global bond rout spurred by the Ukraine war, benefiting from a 6,600-mile distance from the conflict.

...

Zitat von faultcode: Brasilien -- der neue sichere Hafen...

https://www.bloomberg.com/news/articles/2022-04-01/6-600-mil…

...

Latin America is emerging as an oasis of stability amid the global bond rout spurred by the Ukraine war, benefiting from a 6,600-mile distance from the conflict.

...

Antwort auf Beitrag Nr.: 71.188.303 von faultcode am 24.03.22 18:27:5324.3.

...

Brazil’s central bank president signaled aggressive interest rate hikes will end in May, prompting investors to dial back bets on a longer monetary tightening cycle.

...

https://finance.yahoo.com/news/brazil-central-bank-chief-thr…

...

Brazil’s central bank president signaled aggressive interest rate hikes will end in May, prompting investors to dial back bets on a longer monetary tightening cycle.

...

https://finance.yahoo.com/news/brazil-central-bank-chief-thr…

Brasilien -- der neue sichere Hafen

24.3.

Brazil’s Real and Stocks Are World’s Best as Foreigners Pile In

https://finance.yahoo.com/news/brazilian-real-climbs-stronge…

...

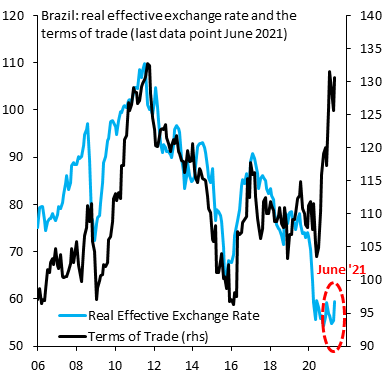

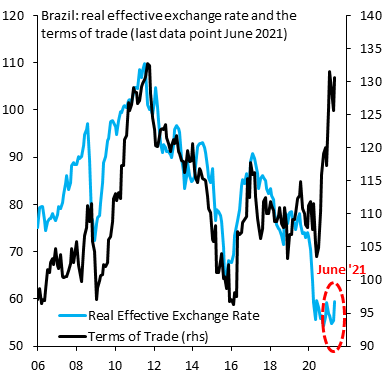

Brazil’s currency and stocks are leading world gains this year as foreign investors keep piling into the nation’s local assets, lured by high interest rates and the massive rally in commodity prices.

The real on Thursday strengthened to as much as 4.7663 per dollar, the highest since March 2020, extending its year-to-date advance to more than 16%, the largest among 31 major currencies.

Implied volatility in the currency, meanwhile, is at levels unseen since early February. As the real rallied, the return of the local benchmark stocks index in dollar terms jumped to more than 30%, the best among all national equity indexes tracked by Bloomberg.

Brazil’s markets have been attracting emerging-market investors despite heightened global volatility as local assets benefit from the massive rally in commodity prices and fixed-income securities offer juicy yields following an aggressive monetary policy tightening. Global investors were net buyers of Brazilian stocks in the local market in 53 of the 55 sessions through Mar. 22, adding over 83 billion reais ($17.3 billion) in that period.

“BRL continues to shine under the spotlight,” BBVA strategists led by Roberto Cobo wrote in a note Thursday. “There is still time for the carry trade to outperform as policymakers are waiting for more data before making drastic changes to the interest rate trajectory.”

...

24.3.

Brazil’s Real and Stocks Are World’s Best as Foreigners Pile In

https://finance.yahoo.com/news/brazilian-real-climbs-stronge…

...

Brazil’s currency and stocks are leading world gains this year as foreign investors keep piling into the nation’s local assets, lured by high interest rates and the massive rally in commodity prices.

The real on Thursday strengthened to as much as 4.7663 per dollar, the highest since March 2020, extending its year-to-date advance to more than 16%, the largest among 31 major currencies.

Implied volatility in the currency, meanwhile, is at levels unseen since early February. As the real rallied, the return of the local benchmark stocks index in dollar terms jumped to more than 30%, the best among all national equity indexes tracked by Bloomberg.

Brazil’s markets have been attracting emerging-market investors despite heightened global volatility as local assets benefit from the massive rally in commodity prices and fixed-income securities offer juicy yields following an aggressive monetary policy tightening. Global investors were net buyers of Brazilian stocks in the local market in 53 of the 55 sessions through Mar. 22, adding over 83 billion reais ($17.3 billion) in that period.

“BRL continues to shine under the spotlight,” BBVA strategists led by Roberto Cobo wrote in a note Thursday. “There is still time for the carry trade to outperform as policymakers are waiting for more data before making drastic changes to the interest rate trajectory.”

...

Antwort auf Beitrag Nr.: 70.432.825 von faultcode am 07.01.22 14:33:47

https://finance.yahoo.com/news/brazil-bid-goodbye-single-dig…

https://finance.yahoo.com/news/brazil-bid-goodbye-single-dig…

Brasilien immer noch in der Rezession, egal wie man das nun offiziell nennt:

6.1.

Brazil's Industrial Production Unexpectedly Drops Amid Recession

https://www.bnnbloomberg.ca/brazil-s-industrial-production-u…

6.1.

Brazil's Industrial Production Unexpectedly Drops Amid Recession

https://www.bnnbloomberg.ca/brazil-s-industrial-production-u…

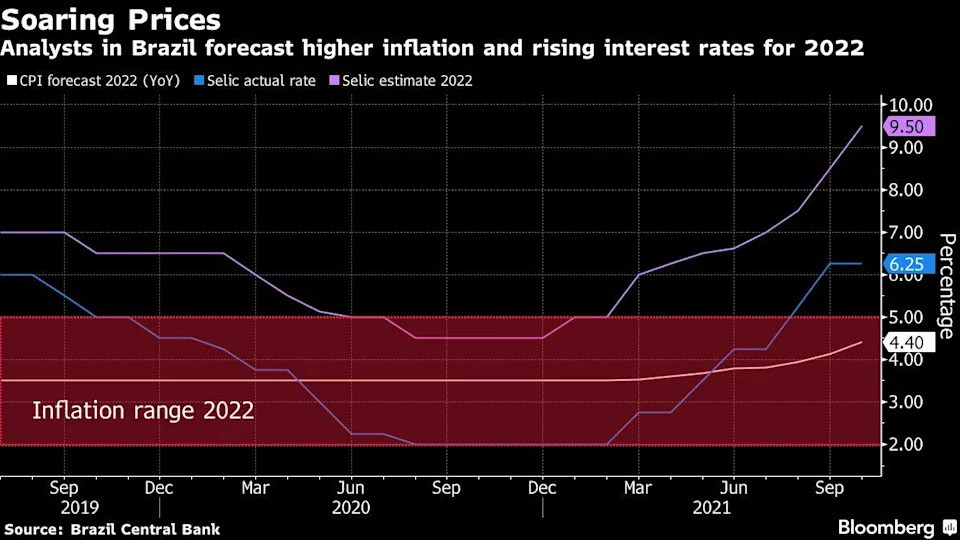

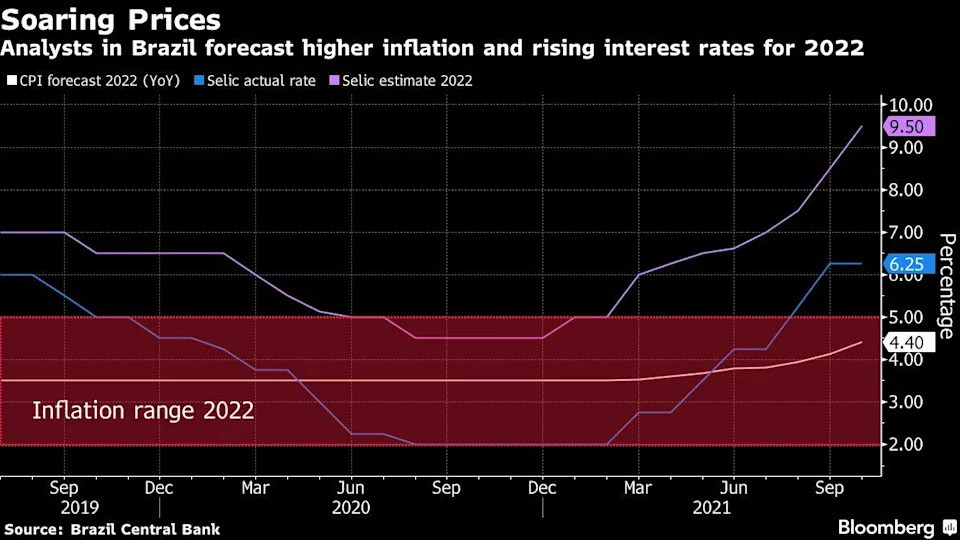

27.10.

Brazil Set for Biggest Rate Hike in Two Decades: Decision Guide

https://finance.yahoo.com/news/brazil-set-biggest-rate-hike-…

...

...

Brazil’s central bank is poised to deliver its biggest interest rate hike in nearly two decades as plans for greater public spending risk jeopardizing efforts to bring inflation down to target.

Most economists agree on the need to step up an already aggressive monetary tightening campaign, but are divided over how dramatic the increase will be. The majority of the 47 analysts surveyed by Bloomberg expect the benchmark Selic to jump by 150 basis points to 7.75%. Thirteen project a hike of 125 basis points, while five still see a third straight full percentage point rise.

The central bank, led by Roberto Campos Neto, has reasons to become even more hawkish after the government said it would bypass spending rules to boost handouts to the poor ahead of next year’s election. The news rattled investors and prompted the real to plunge last week. It also complicated an inflation outlook that’s already pressured by higher costs of food, electricity and fuel.

Policy makers had previously signaled plans for a full percentage point hike at this week’s meeting. Many economists now consider a move of such magnitude insufficient to clamp down on inflation that’s running at more than 10% a year, particularly as fiscal concerns send consumer price forecasts above target through 2024.

...

=> so was schhlägt bei Versorgern fast immer ins Kontor

Brazil Set for Biggest Rate Hike in Two Decades: Decision Guide

https://finance.yahoo.com/news/brazil-set-biggest-rate-hike-…

...

...

Brazil’s central bank is poised to deliver its biggest interest rate hike in nearly two decades as plans for greater public spending risk jeopardizing efforts to bring inflation down to target.

Most economists agree on the need to step up an already aggressive monetary tightening campaign, but are divided over how dramatic the increase will be. The majority of the 47 analysts surveyed by Bloomberg expect the benchmark Selic to jump by 150 basis points to 7.75%. Thirteen project a hike of 125 basis points, while five still see a third straight full percentage point rise.

The central bank, led by Roberto Campos Neto, has reasons to become even more hawkish after the government said it would bypass spending rules to boost handouts to the poor ahead of next year’s election. The news rattled investors and prompted the real to plunge last week. It also complicated an inflation outlook that’s already pressured by higher costs of food, electricity and fuel.

Policy makers had previously signaled plans for a full percentage point hike at this week’s meeting. Many economists now consider a move of such magnitude insufficient to clamp down on inflation that’s running at more than 10% a year, particularly as fiscal concerns send consumer price forecasts above target through 2024.

...

=> so was schhlägt bei Versorgern fast immer ins Kontor

Antwort auf Beitrag Nr.: 65.928.456 von faultcode am 02.12.20 22:33:02brasilianische Aktien sind im Schnitt zur Zeit vermutlich günstig:

https://twitter.com/RobinBrooksIIF/status/140487739952383591…

https://twitter.com/RobinBrooksIIF/status/140487739952383591…

Erneuerbare Energie in einem Wachstumsmarkt