Erneuerbare Energie in einem Wachstumsmarkt (Seite 4)

eröffnet am 29.10.10 11:00:11 von

neuester Beitrag 14.05.24 20:28:22 von

neuester Beitrag 14.05.24 20:28:22 von

Beiträge: 132

ID: 1.160.841

ID: 1.160.841

Aufrufe heute: 0

Gesamt: 13.020

Gesamt: 13.020

Aktive User: 0

ISIN: BRCMIGACNPR3 · WKN: 899018

1,8950

EUR

0,00 %

0,0000 EUR

Letzter Kurs 20.05.24 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,6000 | +19,28 | |

| 1.197,39 | +16,80 | |

| 16,160 | +11,53 | |

| 51,11 | +10,20 | |

| 4,1700 | +10,03 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 85,00 | -19,42 | |

| 76,75 | -22,86 | |

| 61,80 | -25,70 | |

| 236,00 | -30,79 | |

| 3,44 | -100,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 70.432.825 von faultcode am 07.01.22 14:33:47

https://finance.yahoo.com/news/brazil-bid-goodbye-single-dig…

https://finance.yahoo.com/news/brazil-bid-goodbye-single-dig…

Brasilien immer noch in der Rezession, egal wie man das nun offiziell nennt:

6.1.

Brazil's Industrial Production Unexpectedly Drops Amid Recession

https://www.bnnbloomberg.ca/brazil-s-industrial-production-u…

6.1.

Brazil's Industrial Production Unexpectedly Drops Amid Recession

https://www.bnnbloomberg.ca/brazil-s-industrial-production-u…

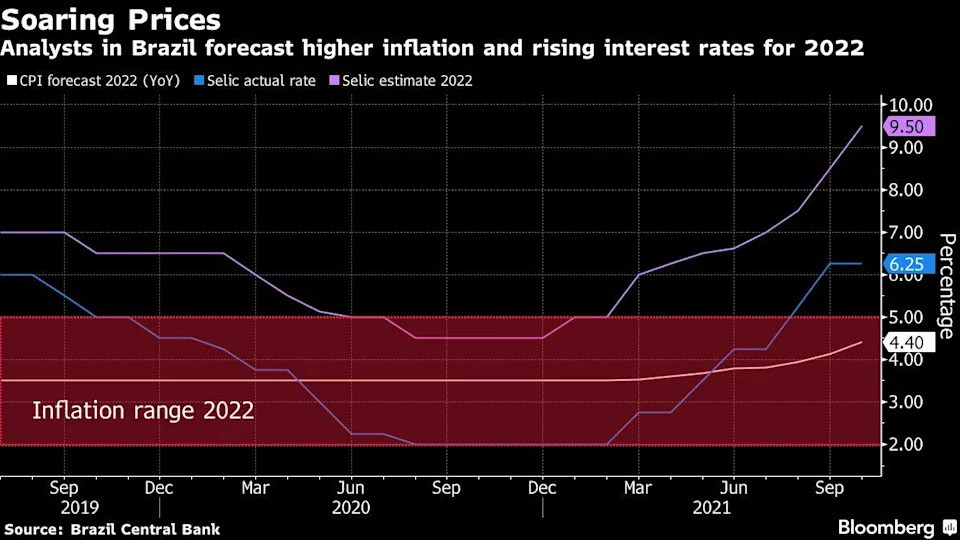

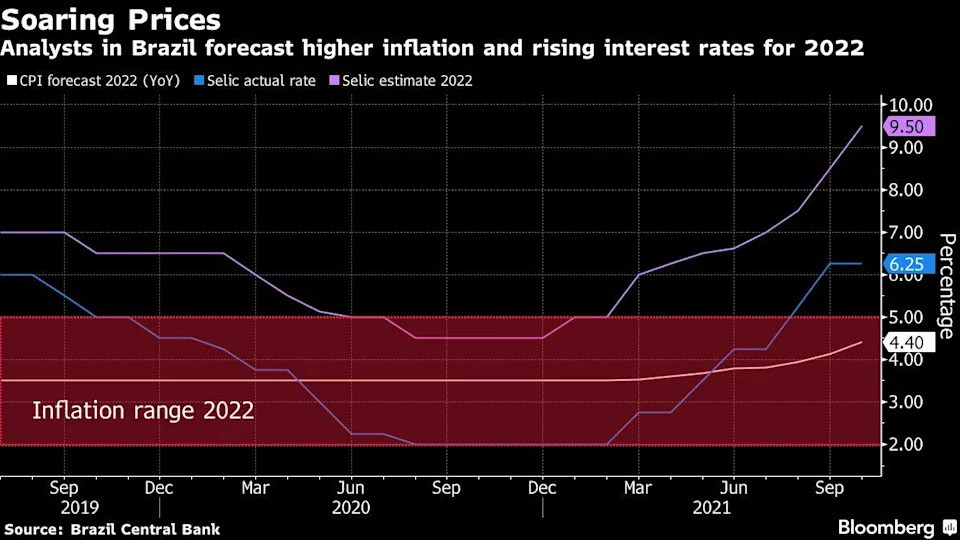

27.10.

Brazil Set for Biggest Rate Hike in Two Decades: Decision Guide

https://finance.yahoo.com/news/brazil-set-biggest-rate-hike-…

...

...

Brazil’s central bank is poised to deliver its biggest interest rate hike in nearly two decades as plans for greater public spending risk jeopardizing efforts to bring inflation down to target.

Most economists agree on the need to step up an already aggressive monetary tightening campaign, but are divided over how dramatic the increase will be. The majority of the 47 analysts surveyed by Bloomberg expect the benchmark Selic to jump by 150 basis points to 7.75%. Thirteen project a hike of 125 basis points, while five still see a third straight full percentage point rise.

The central bank, led by Roberto Campos Neto, has reasons to become even more hawkish after the government said it would bypass spending rules to boost handouts to the poor ahead of next year’s election. The news rattled investors and prompted the real to plunge last week. It also complicated an inflation outlook that’s already pressured by higher costs of food, electricity and fuel.

Policy makers had previously signaled plans for a full percentage point hike at this week’s meeting. Many economists now consider a move of such magnitude insufficient to clamp down on inflation that’s running at more than 10% a year, particularly as fiscal concerns send consumer price forecasts above target through 2024.

...

=> so was schhlägt bei Versorgern fast immer ins Kontor

Brazil Set for Biggest Rate Hike in Two Decades: Decision Guide

https://finance.yahoo.com/news/brazil-set-biggest-rate-hike-…

...

...

Brazil’s central bank is poised to deliver its biggest interest rate hike in nearly two decades as plans for greater public spending risk jeopardizing efforts to bring inflation down to target.

Most economists agree on the need to step up an already aggressive monetary tightening campaign, but are divided over how dramatic the increase will be. The majority of the 47 analysts surveyed by Bloomberg expect the benchmark Selic to jump by 150 basis points to 7.75%. Thirteen project a hike of 125 basis points, while five still see a third straight full percentage point rise.

The central bank, led by Roberto Campos Neto, has reasons to become even more hawkish after the government said it would bypass spending rules to boost handouts to the poor ahead of next year’s election. The news rattled investors and prompted the real to plunge last week. It also complicated an inflation outlook that’s already pressured by higher costs of food, electricity and fuel.

Policy makers had previously signaled plans for a full percentage point hike at this week’s meeting. Many economists now consider a move of such magnitude insufficient to clamp down on inflation that’s running at more than 10% a year, particularly as fiscal concerns send consumer price forecasts above target through 2024.

...

=> so was schhlägt bei Versorgern fast immer ins Kontor

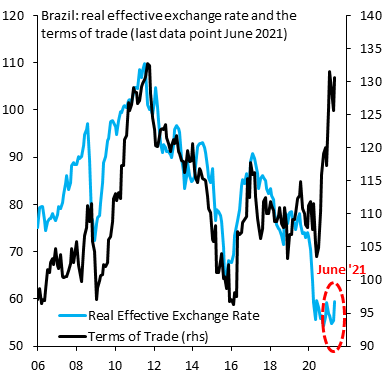

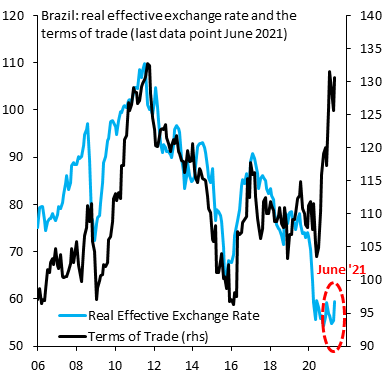

Antwort auf Beitrag Nr.: 65.928.456 von faultcode am 02.12.20 22:33:02brasilianische Aktien sind im Schnitt zur Zeit vermutlich günstig:

https://twitter.com/RobinBrooksIIF/status/140487739952383591…

https://twitter.com/RobinBrooksIIF/status/140487739952383591…

Antwort auf Beitrag Nr.: 65.599.211 von faultcode am 04.11.20 23:19:43bleibt auf hohem Niveau:

https://twitter.com/SergiLanauIIF/status/1333846971786858496

https://twitter.com/SergiLanauIIF/status/1333846971786858496

Antwort auf Beitrag Nr.: 65.599.211 von faultcode am 04.11.20 23:19:43

Antwort auf Beitrag Nr.: 62.728.924 von faultcode am 19.02.20 18:42:21es lief zuletzt nicht so schlecht in BRA:

--> ich überlege mir bei CIG aufzustocken.

Wahrscheinlich geht's dann wieder bergab auf Sicht von ~1/" Jahr

--> ich überlege mir bei CIG aufzustocken.

Wahrscheinlich geht's dann wieder bergab auf Sicht von ~1/" Jahr

es sehe garade, daß auch CIG in diesem ETF enthalten ist:

iShares Global Clean Energy UCITS ETF

https://www.ishares.com/de/privatanleger/de/produkte/251911/…

..wobei ich mich hier frage, ob das nun ein Mode-ETF ist oder nicht: https://www.godmode-trader.de/artikel/erneuerbare-energien-d…

--> die realisierte Rendite war jedenfalls miserabel, weil extrem timing-abhängig:

iShares Global Clean Energy UCITS ETF

https://www.ishares.com/de/privatanleger/de/produkte/251911/…

..wobei ich mich hier frage, ob das nun ein Mode-ETF ist oder nicht: https://www.godmode-trader.de/artikel/erneuerbare-energien-d…

--> die realisierte Rendite war jedenfalls miserabel, weil extrem timing-abhängig:

Antwort auf Beitrag Nr.: 61.028.671 von faultcode am 15.07.19 15:51:07die Zinsen in Brasilien sind weiter deutlich am Sinken:

https://tradingeconomics.com/brazil/interest-rate

https://tradingeconomics.com/brazil/interest-rate

Brazil's High-Flying Stocks May Gain Altitude as Rates Decline

https://www.bloomberg.com/news/articles/2019-07-15/brazil-s-…=>

• Ibovespa index seen poised for an extra gain of as much as 18%

• Rate cut to drive flows to local stock market, strategists say

=>

...

Brazilian stocks have extended their year-to-date gain to about 20% on renewed optimism that Latin America’s largest economy will finally overhaul its heavily indebted social security system. But the rally that has pushed the market to record highs still may have some juice left.

The benchmark Ibovespa index may climb 11% from current levels to about 115,000 by the end of 2019, according to the average forecast of 10 strategists surveyed by Bloomberg. Their targets range from 105,000 to 123,000, implying an increase of as much as 18%. That would mark the fourth year of double-digit gains for Brazilian stocks.

Reforming pensions should allow Brazil’s central bank to reduce the benchmark interest rate below the current, historically low 6.5%, pushing more funds into the local stock market, strategists say. While the domestic swap rates curve is pricing in an easing cycle of 108 basis point until the end of the year, some of the nation’s fund managers and economists see room for the Selic rate to reach 5%.

“A strong fiscal anchor will likely open room for deeper interest rate cuts,” Bradesco BBI analysts led by Andre Carvalho wrote in a July 10 report, raising their target for the Ibovespa to 122,000 from 116,000. “Low interest rates should help boost the capital markets and M&A activities, as well as reduce financial expenses and increase the attractiveness of bond-like stocks,” Carvalho said.

Bank of America has reiterated its overweight rating for Brazilian stocks in its Latin American portfolio, seeing the Ibovespa at 120,000 in the end of this year. “Flows into equities should keep supporting the market,” BofA’s Latin America equity strategist David Beker wrote in a note.

Passing pension reform is also expected to unlock a long-awaited rebound in Brazil’s economy. Since the beginning of the year, economists have been lowering their estimates for gross domestic product in 2019, as doubts about the country’s fiscal outlook have kept investments on hold.

...

Erneuerbare Energie in einem Wachstumsmarkt