Online-Reiseportal eDreams Odigeo doch kein Flop? - 500 Beiträge pro Seite

eröffnet am 05.05.14 14:16:36 von

neuester Beitrag 03.12.19 10:45:21 von

neuester Beitrag 03.12.19 10:45:21 von

Beiträge: 29

ID: 1.194.060

ID: 1.194.060

Aufrufe heute: 0

Gesamt: 2.593

Gesamt: 2.593

Aktive User: 0

ISIN: LU1048328220 · WKN: A111C3 · Symbol: 1ED

6,6500

EUR

+3,10 %

+0,2000 EUR

Letzter Kurs 09:24:36 Frankfurt

Werte aus der Branche Hotels/Tourismus

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,7200 | +9,68 | |

| 9,5000 | +8,57 | |

| 1,0000 | +5,49 | |

| 4.000,00 | +5,26 | |

| 6,3000 | +5,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 39,20 | -2,97 | |

| 60,50 | -3,20 | |

| 5,3250 | -4,05 | |

| 40,20 | -4,06 | |

| 2,2300 | -4,29 |

Hallo zusammen,

wer von euch kann mir etwas zu eDreams Odigeo erzählen?

Das spanische Online-Reisebüro (u.a. seit 2011 Muttergesellschaft von Opodo) ist Anfang April an die Börsen gegangen und enttäuschte dort aber. Das heißt: zunächst. Denn so wie ich sehe, steigt der Kurs gerade wieder.

Ein interessanter Wert, wie ich finde, besonders, wenn man bedenkt, dass eDreams das erste spanische Unternehmen seit drei Jahren ist, dass an die Börse geht.

http://www.handelsblatt.com/finanzen/aktien/aktien-im-fokus/…

wer von euch kann mir etwas zu eDreams Odigeo erzählen?

Das spanische Online-Reisebüro (u.a. seit 2011 Muttergesellschaft von Opodo) ist Anfang April an die Börsen gegangen und enttäuschte dort aber. Das heißt: zunächst. Denn so wie ich sehe, steigt der Kurs gerade wieder.

Ein interessanter Wert, wie ich finde, besonders, wenn man bedenkt, dass eDreams das erste spanische Unternehmen seit drei Jahren ist, dass an die Börse geht.

http://www.handelsblatt.com/finanzen/aktien/aktien-im-fokus/…

Antwort auf Beitrag Nr.: 46.923.014 von OpasToupet am 05.05.14 14:16:36Kurs inzwischen gevierteilt...

wenn überhaupt, würde ich eher über die Anleihe nachdenken: http://www.wallstreet-online.de/anleihen/a1hfkq

Antwort auf Beitrag Nr.: 48.125.006 von R-BgO am 24.10.14 15:17:35

es gibt sogar noch eine: http://www.wallstreet-online.de/anleihen/a1gqjd

Zitat von R-BgO: wenn überhaupt, würde ich eher über die Anleihe nachdenken: http://www.wallstreet-online.de/anleihen/a1hfkq

es gibt sogar noch eine: http://www.wallstreet-online.de/anleihen/a1gqjd

habe mir jetzt trotzdem mal ein paar Ansichtsstücke geholt, da ich die Präsentationen zum Markt interessant finde: http://www.edreamsodigeo.com/wp-content/uploads/sites/19/201…

die Überlegungen dort sind auch für den Wettbewerb interessant

die Überlegungen dort sind auch für den Wettbewerb interessant

Antwort auf Beitrag Nr.: 48.125.798 von R-BgO am 24.10.14 16:35:33

Verlust in 2014: 180 MEUR

wilder Ritt,

nicht weit vom Tief bei 1,93 gekauft, zwischenzeitlich bei 4,00 und jetzt wieder bei 2,75Verlust in 2014: 180 MEUR

beide Anleihen immer noch deutlich unter pari;

operativ scheinen sie die Kurve gekriegt zu haben

operativ scheinen sie die Kurve gekriegt zu haben

Antwort auf Beitrag Nr.: 52.395.177 von R-BgO am 12.05.16 17:28:52

nur wegen der exorbitanten Finanzierungskosten bleiben am Ende nur 2,6% (=12 MEUR) Nettoergebnis hängen.

Die Anleihen notieren beide wieder in den 90ern.

ist schon irre, mit Flugtickets(!)

machen sie 14,5% operative Marge;nur wegen der exorbitanten Finanzierungskosten bleiben am Ende nur 2,6% (=12 MEUR) Nettoergebnis hängen.

Die Anleihen notieren beide wieder in den 90ern.

eDreams Odigeo claims flight retailer accolade, celebrates year since losses

Aug 26.2016

European online travel agency group, eDreams Odigeo, has marked its fifth quarter in a row since it returned to profitability.

The company’s first quarter 2016 results, ending 30 June, saw it hit a 30% increase in adjusted EBITDA year-on-year.

The results are a far cry from the losses it encountered just over 12 months ago – y/y adjusted EBITDA figures for the third and fourth quarters of the 2014-2015 financial period were down 29.5% and 10.8% respectively.

Revenues for the company in Q1 of the latest reporting segment were Euro 214.2 million, up 9% on the previous quarter.

The company says it is now the largest flight retailer in Europe. It is an affiliate of Booking.com for the accommodation channels on its main OTA brands, such as eDreams and Opodo.

CEO Dana Dunne says the results have come from strong performance in both its flight and non-flight businesses, including a “marked decrease in variable costs per booking”.

Aug 26.2016

European online travel agency group, eDreams Odigeo, has marked its fifth quarter in a row since it returned to profitability.

The company’s first quarter 2016 results, ending 30 June, saw it hit a 30% increase in adjusted EBITDA year-on-year.

The results are a far cry from the losses it encountered just over 12 months ago – y/y adjusted EBITDA figures for the third and fourth quarters of the 2014-2015 financial period were down 29.5% and 10.8% respectively.

Revenues for the company in Q1 of the latest reporting segment were Euro 214.2 million, up 9% on the previous quarter.

The company says it is now the largest flight retailer in Europe. It is an affiliate of Booking.com for the accommodation channels on its main OTA brands, such as eDreams and Opodo.

CEO Dana Dunne says the results have come from strong performance in both its flight and non-flight businesses, including a “marked decrease in variable costs per booking”.

Antwort auf Beitrag Nr.: 53.153.556 von R-BgO am 28.08.16 11:29:58

falls man das quartals-EBITDA

aufs Jahr hochrechnen darf, käme ich auf EV/EBITDA von rund 6x Wettbewerb?

...noch nie von denen gehört:http://mystifly.com/our-company/

With supplier network spread across 70+ Countries, airfare inventory of 900+ airlines, today Mystifly, a Global Airfare Consolidator has incorporation in USA, UK, Singapore, India, Brazil and Australia. Our flagship air ticketing platform – MyFareBox and technology variants in the form of white label solution, xml web services & corporate travel management tool are used by over 2500 customers in 60+ countries.

Headquartered in Bangalore (India), Mystifly was founded in 2009. Mystifly is an Anywhere-to-Anywhere global airfare marketplace, offering airfare consolidation from 900+ airlines including 170+ LCCs of 70+ point of sale countries across North America, South America, Middle East, Africa, Asia and Australia. Mystifly facilitates global travel companies to offer ticketing fulfillment services across diverse geographies to their customers with Fare types such as Ethnic Fares, Web Fares, Marine Fares, Tour Operator Fares, Student Fares, Labour Fares, Military Fares and so on, sourced from a plethora of Consolidator AirFares, Market Restricted Fares, Web Fares, Corporate Fares, Published and Private Fares. The results of the benefits experienced by global travel entities have transitioned Mystifly to a globally acclaimed airfare consolidator services company with 2500+ customers in 60+ countries including 22 of the top 50 UK TMCs, 60+ global OTAs, 9 of the top 10 Indian TMCs, 3 of the top 10 GCC TMCs and so on.

Mystifly, today is one of the biggest B2B global airfare consolidator services company that empowers travel business by providing travel technology solutions to Tour Operators, Travel Agents, Online Travel Agents, Corporates, Hotels and Travel Management Companies across the globe. A testimony to this is the fact that over 190 origin countries and 26000+ city pairs were ticketed through Mystifly in 2015 alone.

Ärger mit Ryanair:

https://www.tnooz.com/article/ryanair-regulator-edreams-crac…

eDreams Odigeo acquires hotel booking site BudgetPlaces

Jan 17.2017

https://www.tnooz.com/article/edreams-odigeo-acquires-budget…

Accommodation service BudgetPlaces has ended almost 14 years as an independent company and sold to travel group eDreams Odigeo.

Terms of the deal have not been disclosed.

eDreams Odigeo says the deal will not any impact on 2016-2017 capital expenditures as it follows the sale of part of its corporate travel division, TravelLink, to Flight Centre Travel Group in September last year, also for an undisclosed fee.

BudgetPlaces has around 7,500, directly-contracted properties on its books from 1,000 destinations around the globe.

The company was created under the EnGrande umbrella in 2003 in Barcelona, part of a portfolio of websites that included dozens of destination-specific brands for hotels in a specific area.

Palamon Capital Partners took a majority stake in EnGrande in April 2011, in a deal that was said to be in the region of €30 million.

eDreams Odigeo has only purchased the BudgetPlaces brand and portfolio of hotel contracts.

At the time of Palamon investment, the flagship BudgetPlaces brand had offices also in New York and Dublin, with 85 staff.

A statement says:

“The acquisition will give eDreams ODIGEO and its travel brands access to innovative technology and will improve product diversification, in line with the company’s business strategy.”

BudgetPlaces claims to be processing 50,000 room nights each month on the back of 210,000 online reservations per year.

Other brands in the eDreams Odigeo stable include online travel agencies, eDreams, Opodo and Go Voyages, as well as metasearch site Liligo and the remaining elements of the TravelLink corporate travel service.

Jan 17.2017

https://www.tnooz.com/article/edreams-odigeo-acquires-budget…

Accommodation service BudgetPlaces has ended almost 14 years as an independent company and sold to travel group eDreams Odigeo.

Terms of the deal have not been disclosed.

eDreams Odigeo says the deal will not any impact on 2016-2017 capital expenditures as it follows the sale of part of its corporate travel division, TravelLink, to Flight Centre Travel Group in September last year, also for an undisclosed fee.

BudgetPlaces has around 7,500, directly-contracted properties on its books from 1,000 destinations around the globe.

The company was created under the EnGrande umbrella in 2003 in Barcelona, part of a portfolio of websites that included dozens of destination-specific brands for hotels in a specific area.

Palamon Capital Partners took a majority stake in EnGrande in April 2011, in a deal that was said to be in the region of €30 million.

eDreams Odigeo has only purchased the BudgetPlaces brand and portfolio of hotel contracts.

At the time of Palamon investment, the flagship BudgetPlaces brand had offices also in New York and Dublin, with 85 staff.

A statement says:

“The acquisition will give eDreams ODIGEO and its travel brands access to innovative technology and will improve product diversification, in line with the company’s business strategy.”

BudgetPlaces claims to be processing 50,000 room nights each month on the back of 210,000 online reservations per year.

Other brands in the eDreams Odigeo stable include online travel agencies, eDreams, Opodo and Go Voyages, as well as metasearch site Liligo and the remaining elements of the TravelLink corporate travel service.

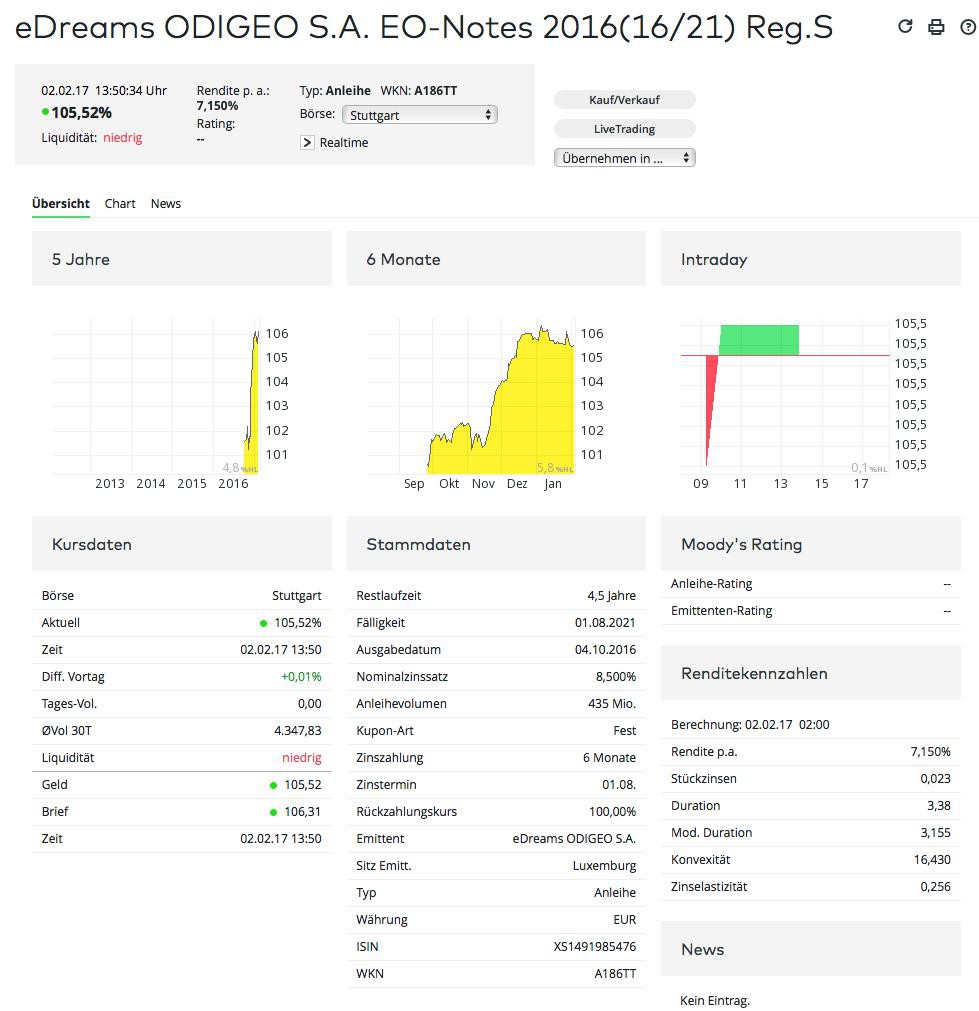

Sie haben im Herbst auch

die Anleihen refinanziert:Nun gibt es nur noch einen 2021er mit 8,5% Coupon, leider 100k Kindersicherung

Antwort auf Beitrag Nr.: 54.223.261 von R-BgO am 02.02.17 14:35:45

ist aber immer noch leverage pur.

trotz der bond-prepayment Prämie haben sie fast das gleiche Nettoergebnis erzielt

und Schulden um 40 MEUR gesenkt;ist aber immer noch leverage pur.

eDreams ODIGEO reviews strategic options including potential share sale process – The company also raises guidance for 2018 and 2020

Barcelona, 2 November 2017 –

eDreams ODIGEO, one of the world’s largest online travel companies, announces today that it is assessing and evaluating various strategic options for the Company, including a potential M&A transaction involving the Company’s shares, with the ultimate aim of maximising value creation for the benefit of all its stakeholders.

The unanimous decision by the Board of Directors to strategically review its options was prompted by unsolicited indications of interest from potential investors and follows the Company’s renewed strategic focus, operational success and strengthened financial position.

The review process remains at an early stage and there is therefore no certainty on the level of interest of potential investors or if any potential formal proposal will be satisfactory to the Company and its shareholders.

The Board of Directors has appointed Morgan Stanley & Co. International plc as its financial advisor for the strategic review process. There is no expected impact to the day-to-day running of the company and business continues as normal. The Company will issue further statements as appropriate.

eDreams ODIGEO also announces today it is raising its short-term guidance for fiscal year 2018 as well as long term guidance for fiscal year 2020. The increased guidance results from operational execution and leveraging scale, and more favourable terms in a number of contracts with the Company’s suppliers, and it is based on the continuity of its current strategies on product transparency and revenue diversification.

Barcelona, 2 November 2017 –

eDreams ODIGEO, one of the world’s largest online travel companies, announces today that it is assessing and evaluating various strategic options for the Company, including a potential M&A transaction involving the Company’s shares, with the ultimate aim of maximising value creation for the benefit of all its stakeholders.

The unanimous decision by the Board of Directors to strategically review its options was prompted by unsolicited indications of interest from potential investors and follows the Company’s renewed strategic focus, operational success and strengthened financial position.

The review process remains at an early stage and there is therefore no certainty on the level of interest of potential investors or if any potential formal proposal will be satisfactory to the Company and its shareholders.

The Board of Directors has appointed Morgan Stanley & Co. International plc as its financial advisor for the strategic review process. There is no expected impact to the day-to-day running of the company and business continues as normal. The Company will issue further statements as appropriate.

eDreams ODIGEO also announces today it is raising its short-term guidance for fiscal year 2018 as well as long term guidance for fiscal year 2020. The increased guidance results from operational execution and leveraging scale, and more favourable terms in a number of contracts with the Company’s suppliers, and it is based on the continuity of its current strategies on product transparency and revenue diversification.

Antwort auf Beitrag Nr.: 56.094.782 von R-BgO am 03.11.17 18:12:55https://skift.com/2018/01/29/edreams-odigeo-sale-attracts-pr…

eDreams Odiego has had a tough couple of years since its stock market floatation in 2014 and it now looks as though its time as a public company might be about to come to an end.

Reports in the UK press suggest there are a number of private equity companies interested in the business, while a well-placed source told Skift that the a merger or acquisition looks likely within weeks.

The Sunday Times reported a sale price for eDreams Odigeo of $703 million (£500 million), a figure well below its $1.5 billion valuation at the time of the IPO.

eDreams Odiego has had a tough couple of years since its stock market floatation in 2014 and it now looks as though its time as a public company might be about to come to an end.

Reports in the UK press suggest there are a number of private equity companies interested in the business, while a well-placed source told Skift that the a merger or acquisition looks likely within weeks.

The Sunday Times reported a sale price for eDreams Odigeo of $703 million (£500 million), a figure well below its $1.5 billion valuation at the time of the IPO.

EDreams Odigeo has ended a strategic review of the business,

https://skift.com/2018/03/08/edreams-odigeo-gives-up-on-its-…

Antwort auf Beitrag Nr.: 54.223.261 von R-BgO am 02.02.17 14:35:45

hab's jetzt riskiert:

zu 104,88% einen Bond erworben...

Antwort auf Beitrag Nr.: 58.581.794 von R-BgO am 31.08.18 12:25:54

aktuelle Präsentation:

https://www.edreamsodigeo.com/wp-content/uploads/sites/19/20…

Antwort auf Beitrag Nr.: 58.581.794 von R-BgO am 31.08.18 12:25:54

hoffen wir mal, dass nicht noch viel mehr vorzeitig zurückgezahlt wird...

Kindersicherung ist angeknackst:

auf der Abrechnung sind die 100k durch einen "Poolfaktor" von 97,7% reduziert, die wohl daher kommen, dass eine Teileinlösung bereits stattgefunden hat;hoffen wir mal, dass nicht noch viel mehr vorzeitig zurückgezahlt wird...

Antwort auf Beitrag Nr.: 58.781.336 von R-BgO am 24.09.18 13:19:17

Gesamt"ertrag":

minus 103,37 nach Steuern

Antwort auf Beitrag Nr.: 58.781.336 von R-BgO am 24.09.18 13:19:17

wer weiß, ob das nicht sogar Glück war...

bis aufs Ansichtsstück verkauft

Antwort auf Beitrag Nr.: 59.325.416 von R-BgO am 29.11.18 13:05:08

Könnte langsam wieder interessant werden. Aktie ist ja nicht teuer und gibt gewisse Übernahmephantasie.

Leider bei Wikifolio nicht kaufbar

Könnte langsam wieder interessant werden. Aktie ist ja nicht teuer und gibt gewisse Übernahmephantasie.

Leider bei Wikifolio nicht kaufbar

per 31.3.2019 mal wieder 10 MEUR Gewinn

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 153 | ||

| 89 | ||

| 71 | ||

| 69 | ||

| 43 | ||

| 40 | ||

| 39 | ||

| 38 | ||

| 31 | ||

| 31 |

| Wertpapier | Beiträge | |

|---|---|---|

| 25 | ||

| 24 | ||

| 21 | ||

| 19 | ||

| 18 | ||

| 18 | ||

| 18 | ||

| 17 | ||

| 17 | ||

| 16 |