ALAMOS GOLD INC. (NEW) - Die Neue --- Hält dieses Unternehmen . . . . . (Seite 24)

eröffnet am 14.07.15 23:59:19 von

neuester Beitrag 09.05.24 16:36:03 von

neuester Beitrag 09.05.24 16:36:03 von

Beiträge: 443

ID: 1.215.750

ID: 1.215.750

Aufrufe heute: 1

Gesamt: 33.348

Gesamt: 33.348

Aktive User: 0

ISIN: CA0115321089 · WKN: A14WBB · Symbol: AGI

21,450

CAD

+1,90 %

+0,400 CAD

Letzter Kurs 09.05.24 Toronto

Neuigkeiten

06.05.24 · wallstreetONLINE Redaktion |

05.05.24 · wallstreetONLINE Redaktion |

29.04.24 · Swiss Resource Capital AG Anzeige |

26.04.24 · Swiss Resource Capital AG Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,3300 | +21,53 | |

| 0,8434 | +16,86 | |

| 4,6900 | +15,52 | |

| 1,4340 | +14,35 | |

| 65,12 | +14,25 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,3300 | -14,17 | |

| 10,320 | -15,27 | |

| 7,8100 | -15,93 | |

| 0,6601 | -26,22 | |

| 46,34 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 60.558.810 von boersentrader02 am 13.05.19 21:32:53Grüße

Wir beide scheinen die Einzigen zu sein , die den Wert im Portfolio haben. Mal zu :

Mal zu :

Die Aktie wird uns noch viel Freude bereiten

Du das dachte ich auch mal. Aber glauben kann ich das schon lange nicht mehr. Trotz guter Resultate und Q Berichte kommt das Teil nicht vom Fleck.

Wir beide scheinen die Einzigen zu sein , die den Wert im Portfolio haben.

Mal zu :

Mal zu :Die Aktie wird uns noch viel Freude bereiten

Du das dachte ich auch mal. Aber glauben kann ich das schon lange nicht mehr. Trotz guter Resultate und Q Berichte kommt das Teil nicht vom Fleck.

Die Aktie wird uns noch viel Freude bereiten.

Alamos Gold: Better Than Many This Reporting SeasonMay 8, 2019 1:42 AM ET

Vladimir Zernov

Alamos Gold reports Q1 results, mostly in line with analyst estimates.

The company continues to execute on its plan, proceeding with the development of Kirazli and buying back its shares.

All major catalysts are planned for 2020, so the stock needs near-term support from gold prices to have more upside after the recent pullback.

Unlike many gold miners’ reports this earnings season, Alamos Gold's (AGI) first-quarter report was a decent one. The company reported production of 125,300 ounces of gold at all-in sustaining costs (AISC) of $957 per ounce. With these results, Alamos Gold remains fully on track to reach its full-year production guidance of 480,000–520,000 ounces of gold at AISC of $920-960 per ounce.

From a financial point of view, the company remains in good shape. The cash position decreased from $206 million to $181 million as the company spent about $11 million on the share repurchase program, and its capex spending outpaced operating cash flow. However, Alamos Gold remains favorably positioned to continue current capital spending programs, including construction activities at Kirazli mine which is set to deliver initial production in late 2020.

Another potential positive catalyst for 2020 is the expansion of the lower mine at Young-Davidson, which is expected to drive strong free cash flow growth in the second half of 2020. Currently, Young-Davidson’s cost performance is sub-optimal (note the El Chanate ceased mining operations in October 2018):

Source: Alamos Gold Q1 report

The problem for Alamos Gold as a stock right now is that developments at Kirazli and Young-Davidson will happen in the second half of 2020, which is more than one year away from now. While the stock market is forward-looking, it also needs nearer-term catalysts to support the share price. Alamos Gold's shares are up almost 25% year to date despite the recent pullback, but the reason for this performance is the low base – the stock had a horrible fourth quarter of 2018. With roughly flat production planned for 2019, Alamos Gold's shares will likely need some help from gold prices to continue the upside trend which started back in January 2019. The slide from the recent presentation highlights the fact that there are no big catalysts expected this year:

Source: Alamos Gold presentation

I believe that the company is favorably positioned in the longer term. The absence of debt and the possession of sufficient capital for the ongoing projects are major strengths of Alamos Gold. With some help from the gold prices, the stock should be able to return to the $5.00-5.50 level seen earlier this year. Some investors may consider Turkish projects (Kirazli, as well as Agi Dagi and Camyurt) risky, but I’d argue that miners did not have material problems in the country in recent years despite currency fluctuations and somewhat heated political climate.

Right now, the stock is trying to gain ground above $4.50 which is good for near-term upside momentum. Longer-term, investors will have to wait until real big catalysts start coming in 2020, which means that gold price fluctuations will have a big impact on Alamos Gold's share prices. Having read a number of gold miners’ earnings reports this earnings season, I’m a bit surprised that the company's shares did not receive increased support as Alamos Gold looks materially better in comparison with many. Perhaps, a general investor fatigue with poor results of the gold mining sector is playing a role here. Anyway, the future looks promising for Alamos Gold, so stay tuned!

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.

https://seekingalpha.com/article/4261318-alamos-gold-better-…

Am Freitag wurden die neuen Bohrergebnisse von dem Island Goldfeld gemeldet . Und meines Erachtens

können die sich wohl recht gut sehen lassen. Aber schaut selber einmal nach und äussert eure Meinungen dazu. Alamos Gold Inc.

Brookfield Place, 181 Bay Street, Suite 3910, P.O. Box #823

Toronto, Ontario M5J 2T3

All amounts are in United States dollars, unless otherwise stated.

Alamos Gold Intersects High-Grade Mineralization in New Area of Focus Between Eastern and Main Extensions at Island Gold

Toronto, Ontario (May 9, 2019) - Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported new results from surface and underground exploration and delineation drilling at the Island Gold Mine. Drilling in 2019 continues to extend high-grade gold mineralization across each of the Main, Western, and Eastern Extensions. All reported drill widths are true width of the mineralized zones, unless otherwise stated.

•

Eastern Extension: high-grade mineralization intersected in a previously untested area between the Eastern and Main Extensions, within a 500 metre (“m”) gap between Inferred Mineral Resource blocks. This area is only 1,000 m from surface and relatively close to existing infrastructure. New highlights include:

•

46.11 g/t Au (25.81 g/t cut) over 4.67m (MH18-03);

•

Main Extension: high-grade mineralization extended 65 m up-plunge (MH13-5) and 65 m down-plunge (MH17-04) from the nearest previously reported intersections. High-grade mineralization has been extended over 1,000 m east of current mine workings and remains open along strike to the east and both up and down-plunge. New highlights include:

71.17 g/t Au (24.53 g/t cut) over 5.10 m (MH13-5);

40.75 g/t Au (34.01 g/t cut) over 5.15 m (MH17-04); and

30.01 g/t Au (15.13 g/t cut) over 4.96 m (MH12-5).

Note: Drillhole composite intervals reported as “cut” may include higher grade samples which have been cut to 225 g/t Au for Main and Extension 1 areas, and 160 g/t Au for Extension 2 Area.

“Drill results continue to demonstrate the tremendous growth potential of the Island Gold deposit across multiple areas of focus. The Main Extension continues to grow and we see excellent potential for this to continue with more than 90% of our exploration drill holes intersecting gold mineralization along the Island Gold Main Zone.

We are also particulary excited about the potential between the Main and Eastern Extensions having intersected high-grade mineralization in an area that has seen very little drilling to date. We have started to close the gap between high grade resources in both areas and see excellent potential for this to continue,” said John A. McCluskey, President and Chief Executive Officer.

https://www.sec.gov/Archives/edgar/data/1178819/000117881919…

Hier ist das Ergebnis von ALAMOS GOLD aus dem 1. Quartal 2019

Alamos Reports First Quarter 2019 ResultsAll amounts are in United States dollars, unless otherwise stated.

TORONTO, May 01, 2019 - Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its financial results for the quarter ended March 31, 2019.

“Alamos had a solid start to 2019, with strong performances at each operation. This included another record quarter of production from Island Gold, achieving budgeted mining rates at Young-Davidson, producing our two millionth ounce of gold at Mulatos and reducing consolidated cash costs by seven percent compared to a year ago. With the strong first quarter performance, we remain on track to achieve full year production and cost guidance,” said John A. McCluskey, President and Chief Executive Officer.

“Our various growth initiatives remain on schedule with the lower mine expansion at Young-Davidson and development of the Cerro Pelon project progressing well in the quarter. In addition, construction activities at Kirazlı will be ramping up through the year having received the Operating Permit during the quarter. These projects will be drivers of strong free cash flow growth starting in the second half of 2020 which will in turn support growing returns to our shareholders,” Mr. McCluskey added.

First Quarter 2019

Reported 125,300 ounces of gold production, reflecting strong performances from each site, including record quarterly gold production of 35,600 ounces and record quarterly free cash flow1 of $16.6 million from Island Gold

Produced the two millionth ounce of gold at Mulatos in March 2019, marking the end of the 5% royalty that has been paid since the start of production in 2005

Achieved underground mining rates of 6,500 tonnes per day at Young-Davidson, and produced 45,000 ounces of gold, both consistent with annual guidance

Sold 119,705 ounces of gold at an average realized price of $1,304 per ounce, in-line with the average London PM Fix for the quarter, for revenues of $156.1 million. Gold production exceeded gold sales with a portion of first quarter production sold subsequent to quarter end

Total cash costs1 of $732 per ounce, all-in sustaining costs ("AISC")1 of $957 per ounce, and cost of sales of $1,061 per ounce were in line with annual guidance. Total cash costs were 5% lower than the fourth quarter of 2018 and 7% lower than the first quarter of 2018 driven by low cost production growth at Island Gold

Reported adjusted net earnings1 of $10.3 million, or $0.03 per share1, reflecting adjustments for unrealized foreign exchange gains recorded within both deferred taxes and foreign exchange of $4.3 million, and other gains totaling $2.2 million

Realized net earnings of $16.8 million, or $0.04 per share

Generated cash flow from operating activities of $42.4 million ($61.7 million, or $0.16 per share, before changes in working capital1)

Ended the quarter with no debt and cash and cash equivalents of $180.6 million

Repurchased and canceled 2,565,752 common shares at a cost of $10.6 million, or $4.14 per share under its Normal Course Issuer Bid ("NCIB") announced in December 2018

Announced a doubling of the annual dividend, with a $0.01 per share dividend to be paid quarterly in 2019 (up from $0.01 per share semi-annually previously). The first quarterly dividend, paid on March 29, 2019, totaled $3.9 million

Received the Operating Permit for the Kirazlı project in Turkey, and has been granted all the major permits required for the start of construction

Subsequent to quarter-end, sold non-core royalties to Metalla Royalty & Streaming Ltd. ("Metalla") for proceeds of $8.0 million

(1) Refer to the “Non-GAAP Measures and Additional GAAP Measures” disclosure at the end of this press release and associated MD&A for a description and calculation of these measures.

Den Test findet ihr hier. bt02

https://www.minenportal.de/unternehmen_nachrichten.php?mid=3…

Ich glaube das auch, dass das Gold und die weiteren Edelmetalle, u. a. Silber in 2019

den Weg nach oben suchen werden. Mir soll das nur recht sein.

Commerzbank Analysen

Warum Gold 2019 steigen wird

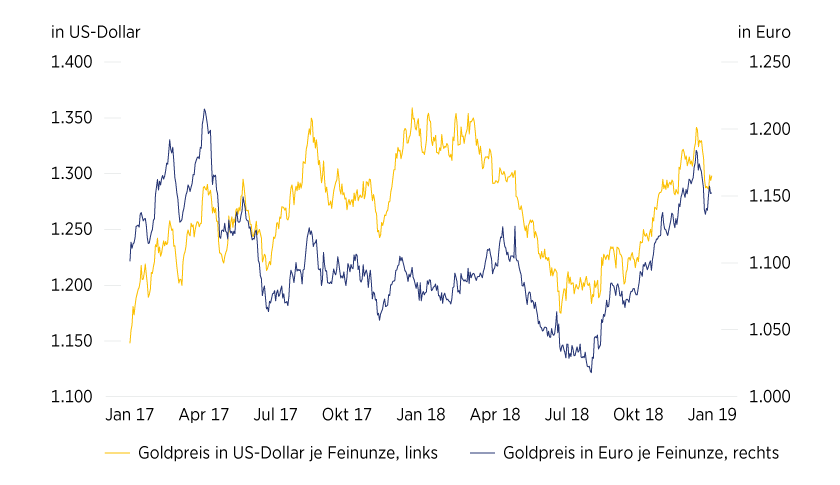

Der Goldpreis rutschte Anfang März wieder unter die Marke von 1.300 US-Dollar je Feinunze. Gold hat damit fast alle Gewinne seit Jahresbeginn wieder abgegeben. Wenige Wochen zuvor verzeichnete es bei knapp 1.350 US-Dollar je Feinunze noch ein 10-Monats-Hoch. Gold in Euro stieg im Februar sogar auf den höchsten Stand seit fast zwei Jahren bei fast 1.190 Euro je Feinunze, verlor dann aber ebenfalls deutlich.

Der Preisanstieg und auch der anschließende Rückgang vollzogen sich in beiden Währungen nahezu parallel (siehe Grafik 1). Gold hatte sich von der Währungsentwicklung in den ersten beiden Monaten 2019 also weitgehend abgekoppelt. Eine wichtigere Rolle bei der Goldpreisentwicklung spielte dagegen der Aktienmarkt. Dieser geriet Ende 2018 stark unter Druck, was Gold die Initialzündung für den Preisanstieg zu Jahresbeginn gab. Die deutliche Erholung der Aktienkurse änderte daran im Januar zwar noch nichts.

Die Gold-ETFs verzeichneten sogar den stärksten Monatszufluss seit fast zwei Jahren. Seit Anfang Februar kommt es aber wieder zu Umschichtungen von Gold zurück in Aktien, was sich in entsprechenden ETF-Abflüssen äußerte und Gold letztlich unter Druck setzte.

Somit scheint sich bei Gold ein mittlerweile bekanntes Muster zu wiederholen, nämlich stark in das Jahr zu starten, um danach wieder den Rückzug anzutreten. 2014, 2015 und 2018 verzeichnete Gold sein Jahreshoch jeweils in den ersten drei Monaten des Jahres. Das jüngste Hoch liegt zudem nicht weit von den Hochs der Jahre 2016, 2017 und 2018 entfernt.

Hat Gold sein Hoch damit schon gesehen? Wir denken nicht. Gold dürfte unseres Erachtens im Laufe des Jahres noch deutlich höhere Preise markieren als im Februar. Dafür sprechen mehrere Gründe:

Die US-Notenbank Fed hat Ende Januar angekündigt, die Leitzinsen nicht weiter anheben zu wollen. Zudem soll der Abbau der Fed-Bilanz voraussichtlich zum Jahresende auslaufen. Es gibt somit keinen Gegenwind für Gold durch weiter steigende Zinsen oder den fortgesetzten Entzug von Liquidität. In der Vergangenheit geriet der US-Dollar nach dem Ende eines Zinserhöhungszyklus zumeist unter Druck. Dass er es diesmal noch nicht tat, hängt vermutlich mit überlagernden Einflussfaktoren wie dem weiterhin schwelenden Handelskonflikt, dem Richtungswechsel auch anderer Zentralbanken weg von geplanten (weiteren) Zinserhöhungen und der schwächelnden Konjunktur in der Eurozone zusammen.

Die EZB hat der stärker ausgeprägten Konjunkturabschwächung in der Eurozone Rechnung getragen und den Zeitpunkt für die erste Zinserhöhung ins nächste Jahr geschoben. Zudem hat sie neue zielgerichtete Langfristtender (TLTROs) angekündigt, um eine unerwünschte monetäre Straffung zu verhindern. Diese würde bei einer Rückzahlung der in einem Jahr auslaufenden TLTROs entstehen. Durch diese Maßnahmen wird zwar eine stärkere Abwertung des US-Dollar gegenüber dem Euro verhindert. Eine längere Beibehaltung der ultralockeren EZB-Geldpolitik – wir rechnen auch 2020 nicht mit einer Zinserhöhung – sollte Gold aber ebenfalls zugutekommen. So liegen die Renditen deutscher Bundesanleihen bis einschließlich neun Jahren Laufzeit unter 0 Prozent.

Die deutsche Zehnjahresrendite kratzt an der Nulllinie. Abzüglich der Inflationsrate sind die Realzinsen somit deutlich negativ. Negative Realzinsen sind ein starkes Kaufargument für Gold.

https://www.ideas-magazin.de/2019/ausgabe-204/maerkte/warum-…" target="_blank" rel="nofollow ugc noopener">https://www.ideas-magazin.de/2019/ausgabe-204/maerkte/warum-…

Auch dieses ist eine Erfolgsgeschichte die ALAMOS GOLD in den gesamten Jahren geleistet hat.

Alamos Gold Achieves Two Million Ounce Milestone at its Mulatos MineWed April 3, 2019 8:00 AM|GlobeNewswire|About: AGI

TORONTO, April 03, 2019 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (AGI) (“Alamos” or the “Company”) is pleased to announce that its Mulatos mine produced its two millionth ounce of gold in March 2019. This milestone also marks the end of the 5% NSR royalty that the operation has been paying since the start of production in 2005.

At the current gold price, this represents a savings of approximately $65 per ounce, which has already been incorporated into previously disclosed guidance.

Matarachi Ceremony

This past week also marked the completion of a voluntary relocation of residents of the town of Mulatos to Matarachi which began in 2016. Alamos worked closely with the community during this relocation, investing in several projects that will provide long-term benefits, including the construction of 21 new homes, as well as a new education centre, church, and medical clinic. The Company is proud of these investments and this past week participated in an opening ceremony for these new facilities with the community of Matarachi and several key government officials including Jorge Vidal, Secretary of Economy of the State of Sonora representing the Governor Claudia Pavlovich; Yvonne Stinston, General Director of Mining Development of the Federal Government; and Berenice Porchas, Mayor of Sahuaripa.

“The Mulatos operation has been an incredible success story. It started producing gold in 2005 with approximately a seven-year mine life and 14 years later, the mine still has six years of reserves ahead of it. We would like to acknowledge all our employees, the local communities, and elected officials for their continued support in helping us achieve this significant milestone. The Mulatos District still holds great potential and we look forward to many more years of profitable production,” said John A. McCluskey, President and Chief Executive Officer.

https://seekingalpha.com/pr/17464979-alamos-gold-achieves-tw…

Das frage ich mich auch, warum die Aktie bei den Aussichten nicht ins Laufen kommt ?

Alamos Gold Looks Interesting After PullbackApr. 4, 2019 1:36 PM ET|

2 comments

|

About: Alamos Gold Inc. (AGI)

Vladimir Zernov

Summary

Alamos Gold's shares correct after upside together with gold prices, but there may be more positive momentum to come.

The company receives operational permit in Turkey, most likely eliminating market fears on the issue.

With prospects of increased production and no debt, the company looks interesting both for short-term and longer-term oriented traders and investors.

Back in January, I wrote that Alamos Gold (AGI) shares were set to gain momentum above $4.00 unless there was a material correction in gold prices. The stock went to $5.50 and then corrected below $5.00 during the recent gold price softness. In my opinion, it's just a temporary setback, and the stock is set to continue its upward movement assuming flat to positive gold price performance. Let's look at the key developments that happened since my previous article was published roughly three months ago:

The earnings report came without major surprises. The company reiterated its guidance: gold production of 480,000-520,000 ounces at all-in sustaining costs (AISC) of $920-960 per ounce. This guidance is a minor improvement from 2018 numbers, when Alamos Gold produced 505,000 ounces at AISC of $989 per ounce. This year, the company expects capex spending of $290-315 million compared to $222 million in 2018 due to increased growth spending on existing mines and investments in Turkey. The financial situation of the company remains very stable: Alamos Gold finished the year 2018 with $206 million of cash and no debt. Last year, the company generated $214 million of operating cash flow. Assuming Alamos Gold continues to deliver normal operational performance and gold prices do not dive, capital spending in 2019 won't cause a material hit to the company's cash position.

The company received operating permit for Kirazli project in Turkey. Turkey is not perceived as a premiere mining jurisdiction, so the lack of permit for a project unnerved some investors. However, I believe that the situation in each country regarding mining should be analyzed case by case, and that there were no signs of anything going wrong in Turkey - Eldorado Gold (EGO) has easily moved back and forth with its decisions on the Kisladag project, and no problems with the government were reported. Anyway, the permit in place is surely a positive catalyst.

Alamos Gold sold a portfolio of non-core royalties to Metalla Royalty & Streaming (OTCQX:MTAFF) and received $8 million in Metalla common shares. It will be interesting to find out during the next earnings report and earnings call whether Alamos Gold wants to keep these shares for some time or whether it plans to cash out. The company's financial situation allows it to wait as long as it wants at this point.

Currently, Alamos Gold's value preposition seems intact. Everything seems to be well with the Kirazli project, which will increase the company's production by 100,000 ounces during its first full year of production in 2021. Also, the company stated that it may further increase the dividend during the most recent earnings call. While the yield will still stay well below the cash cow stocks preferred by income-oriented investors, the increased focus on returning cash to shareholders rather than constantly burying it underground should be very much welcome in the gold mining space.

Momentum-wise, I'd expect increased interest in the stock when it returns back above $5.00 with a shorter-term target of $6.00. Speaking about the longer term, Alamos Gold remains interesting due to lack of debt and prospects of increased production in two years.

If you like my work, don't forget to click on the big orange "Follow" button at the top of the screen and hit the "Like" button at the bottom of this article.

Comments 2

by

Charles wagner

Comments828 | + Follow

Total mystery why AGI is still so cheap.

jmatson

Comments158 | + Follow

In addition to this as of 4/4/19:

http://tinyurl.com/yygjqew5

04 Apr 2019, 02:39 PM

https://seekingalpha.com/article/4252819-alamos-gold-looks-i…" target="_blank" rel="nofollow ugc noopener">https://seekingalpha.com/article/4252819-alamos-gold-looks-i…

8 mio. $ Transaktion, dass ist doch für Alamos kein großes Ding, ein paar Non-Core Assets zu veräußern...

ALAMOS verscherbelt nicht zum Kerngeschäft gehörende Aktivitäten. Haben sie das Geld so nötig,

. . . . oder warum tuen sie das ? Alamos Gold Announces Sale of Portfolio of Non-Core Royalties

04/01/2019

Download this Press Release (PDF 177 KB)

TORONTO, April 01, 2019 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported that it has entered into an agreement for the sale of a portfolio of non-core royalties to Metalla Royalty & Streaming Ltd. (“Metalla”) (TSXV:MTA) for proceeds of USD$8.0 million in Metalla common shares with the right to receive an additional USD$0.6 million upon Metalla’s exercise of the La Fortuna option.

The portfolio of 18 royalties being sold are all on assets not owned by Alamos. This includes a 2% NSR royalty on the El Realito property, adjacent to the La India mine in Sonora, Mexico and a 1.5% NSR royalty on the Wasamac project, and 1.0% NSR royalty on the Beaufor Mine, both located in Quebec, Canada. The majority of the remaining royalties being sold are on exploration stage properties.

As consideration for the portfolio of royalties, Alamos will be receiving 8,239,698 Metalla common shares, valued at USD$8.0 million, or CAD$1.30 per common share, based on the 10-day volume weighted average price preceding the agreement. Following completion of the transaction, Alamos will own approximately 6.26% of Metalla’s issued and outstanding common shares.

The sale of the royalties is consistent with the Company’s strategy of surfacing value from within its non-core assets.

About Alamos

ALAMOS GOLD hat 10 Jahre für die Enstehung dieser Mine benötigt wenn sie denn im Jahre 2020

zur Förderung von Gold anlaufen soll. Insgesamt werden bis dahin ca. 150 Mill. US $ verbraucht worden sein. Bis heute sind es erst einmal ca. 20 Mill. US $ aber dieses Jahr sollen weitere 75 Mill abgearbeitet sein und der Rest von ca. 60 Mill dann im nächsten Jahr (2020).

Erst danach wird die Förderung beginnen und zwar mit ca. 100k Ounzen zu ca. 400 US $ pro Ounze.

Das ganze wird dann 2021 die gesamte Kostenstruktur von ALAMOS in bedeutens niedrigeren Zonen bringen.

Und das wirdt dann auch für die Aktionäre bestimmt zu weiteren Erhöhungen der Dividenden und vielleicht auch zu höheren Kursen der Aktie führen.

Alamos Gold secures operating permit for Kirazlı Project

Canada-based intermediate gold producer Alamos Gold has received the operating permit from the Turkish Department of Energy and Natural Resources to start the earthworks at the open pit area of the Kirazlı project.

In January 2019, the company disclosed that it expects to spend $75m in 2019 on completing work on the water reservoir and ramping up major construction activities and earthworks.

Out of Kirazlı Prokect’s total initial capital budget of $152m, the remaining $60m will be spent in 2020 with initial production expected by the end of 2020.

In 2012, a pre-feasibility study was completed at the mine and the final environmental approval was received in August 2013.

According to the 2017 feasibility study, Kirazlı is expected to produce over 100,000 ounces of gold during its first full year of production at mine-site all-in sustaining costs of less than $400 per ounce.

The new permit is expected to bring consolidated production to over 600,000 ounces per year, while significantly lowering the company’s cost profile.

In January 2010, Alamos purchased the Kirazli and Aği Daği mines from Teck and Fronteer Development for approximately $90m. The Kirazli property is located approximately 25km north-west of Ağı Dağı mine and comprises of 1,541ha.

Power supply for the project is provided from the existing power line that feeds the Kirazli village. The company plans to construct a metering and switching substation on-site near the primary crusher.

Alamos was also expected to construct a reservoir in partnership with State Hydraulic Works, the local government agency, to provide process water for the mining operations.

The Kirazli project includes two contiguous licenses, one operating license and another exploration license, managed by Alamos’ Turkish subsidiaries Kuzey Biga and Doğu Biga.

The company said that the mine is classified as high-sulphidation, disseminated gold system and most of the mineralization hosted within the heterolithic phreatomagmatic or phreatic breccia bodies.

Mineralization at the mine comprises low-grade gold zone occurring above and below the supergene oxidation zone, while the deposit also contains high-grade gold mineralization.

https://compelo.com/energy/news/alamos-secures-kirazli-opera…

06.05.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

05.05.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

21.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

15.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

06.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

30.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

24.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |