CGG - neue WKN nach reverse-split (Seite 4)

eröffnet am 24.07.16 12:03:36 von

neuester Beitrag 19.01.24 17:39:45 von

neuester Beitrag 19.01.24 17:39:45 von

Beiträge: 72

ID: 1.235.629

ID: 1.235.629

Aufrufe heute: 0

Gesamt: 7.052

Gesamt: 7.052

Aktive User: 0

ISIN: FR0013181864 · WKN: A2ALZS · Symbol: GDGE

0,4391

EUR

+5,25 %

+0,0219 EUR

Letzter Kurs 07.05.24 Tradegate

Neuigkeiten

07:30 Uhr · globenewswire |

07.05.24 · globenewswire |

26.04.24 · globenewswire |

24.04.24 · globenewswire |

10.04.24 · globenewswire |

Werte aus der Branche Dienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3000 | +128,07 | |

| 1,0000 | +66,67 | |

| 1,0100 | +60,32 | |

| 0,7297 | +55,26 | |

| 82,00 | +32,24 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,5200 | -20,70 | |

| 1,7000 | -22,73 | |

| 1,1500 | -23,33 | |

| 0,5005 | -39,70 | |

| 2,5000 | -54,13 |

Beitrag zu dieser Diskussion schreiben

CGG Übertreibung

Bei Nettoverlust 2,8 Mio USD (-158 Mio USD) sind bald 25% Kursverlust übertrieben. Umsatz hat ja auch schon zugelegt (alles zum 30.09).M

Neuer Artikel

Letzte BörseOnline: kaufempfehlung KZ wie zuvor 1,70€.M

Börseonline

Das liegt sicher an dem Hotstock Artikel in der letzten Börseonline. Bin jetzt auch eingestiegen. Kannte fen Wert vorher nicht, Inhalt des Artikels überzeugt, auch wenn es sich um Expeltanzen handelt.

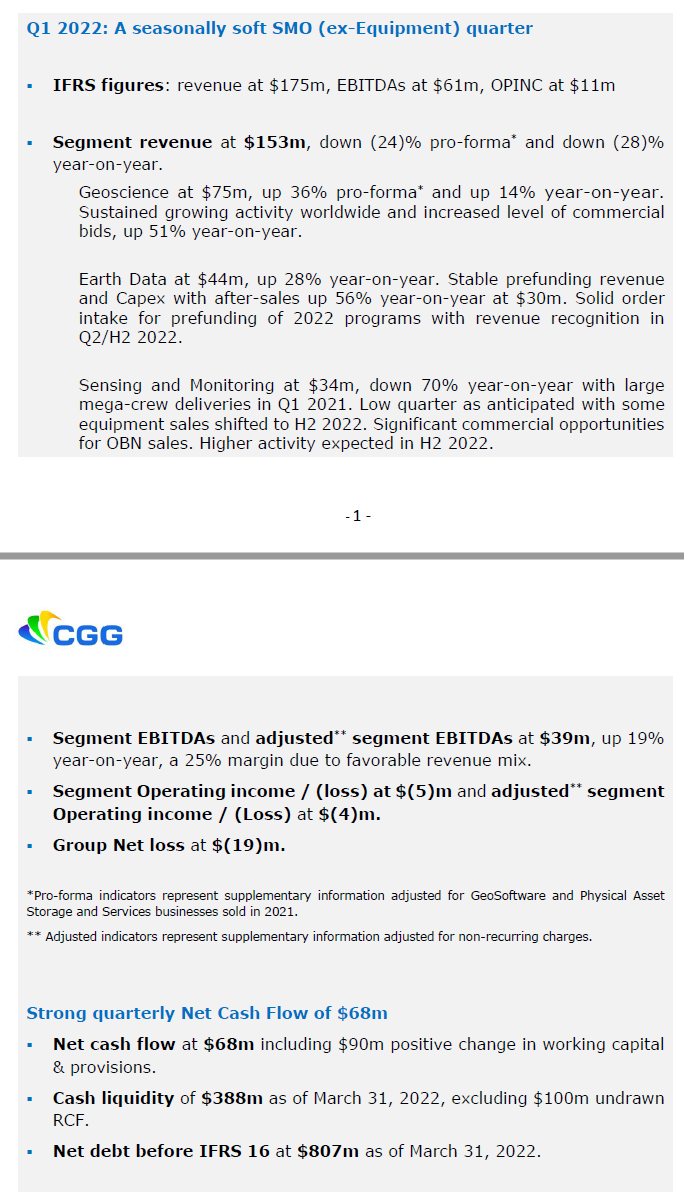

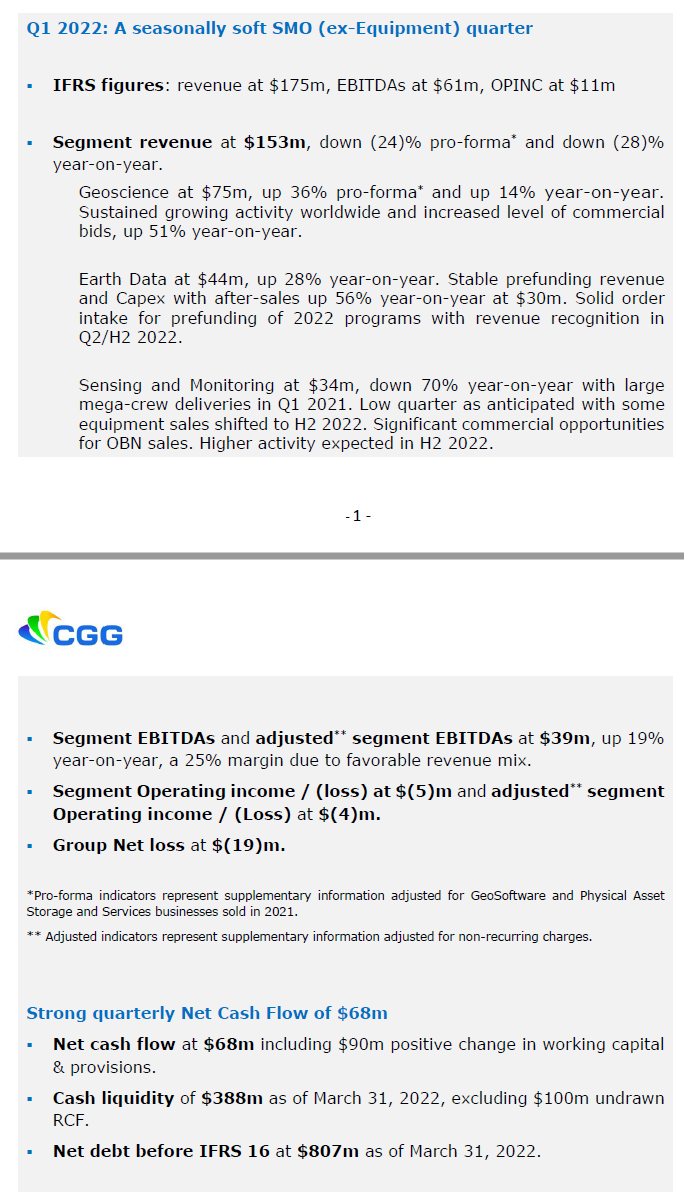

Antwort auf Beitrag Nr.: 71.047.802 von faultcode am 08.03.22 13:23:32Q1

https://www.cgg.com/newsroom/press-release/cgg-announces-its…

...

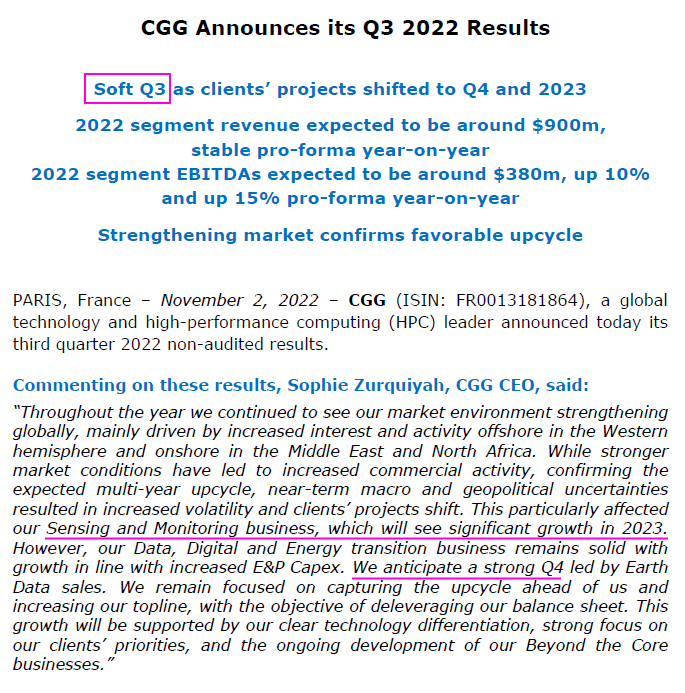

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:

“In the continued strengthening market environment, our Geoscience business had a robust quarter and is leading the recovery, driven by our clients’ requirements for better sub-surface imaging technology. Our Earth Data (ex-Multi-client) business is progressively benefiting from our clients’ increasing need to rapidly replace depleting reserves.

As anticipated, activity was seasonally low in our Sensing and Monitoring (ex-Equipment) business, which had a slow start to the year. At the end of March, the level of commercial bids significantly increased, and we expect an acceleration of our clients’ decision-making and spending, particularly in the second half of the year. In this context, we confirm our 2022 financial objectives and expect the strengthening business environment to drive CGG growth well into 2023 and beyond.”

...

https://www.cgg.com/newsroom/press-release/cgg-announces-its…

...

Commenting on these results, Sophie Zurquiyah, CGG CEO, said:

“In the continued strengthening market environment, our Geoscience business had a robust quarter and is leading the recovery, driven by our clients’ requirements for better sub-surface imaging technology. Our Earth Data (ex-Multi-client) business is progressively benefiting from our clients’ increasing need to rapidly replace depleting reserves.

As anticipated, activity was seasonally low in our Sensing and Monitoring (ex-Equipment) business, which had a slow start to the year. At the end of March, the level of commercial bids significantly increased, and we expect an acceleration of our clients’ decision-making and spending, particularly in the second half of the year. In this context, we confirm our 2022 financial objectives and expect the strengthening business environment to drive CGG growth well into 2023 and beyond.”

...

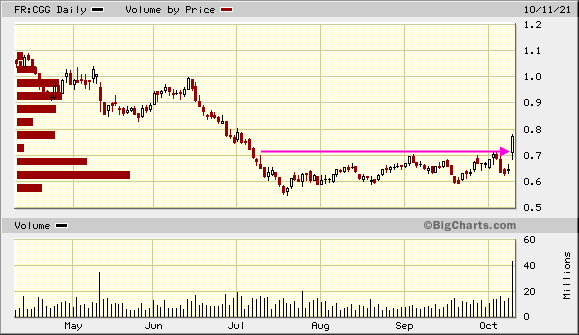

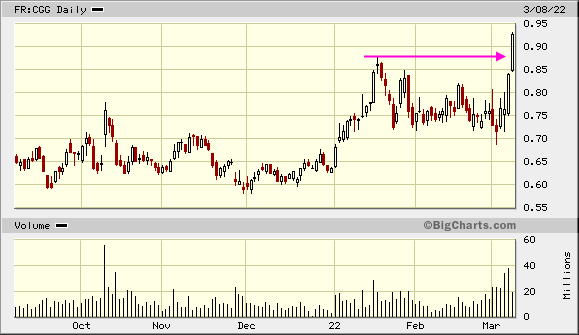

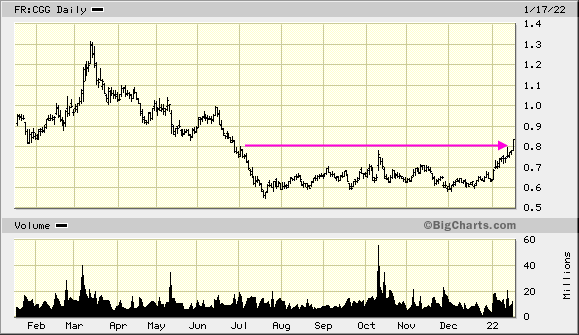

Antwort auf Beitrag Nr.: 70.530.278 von faultcode am 17.01.22 11:17:26CGG ist heute auch mächtig angesprungen:

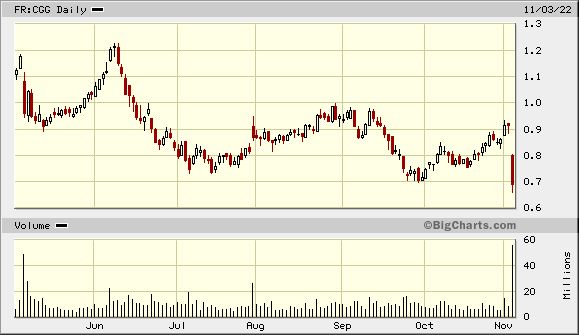

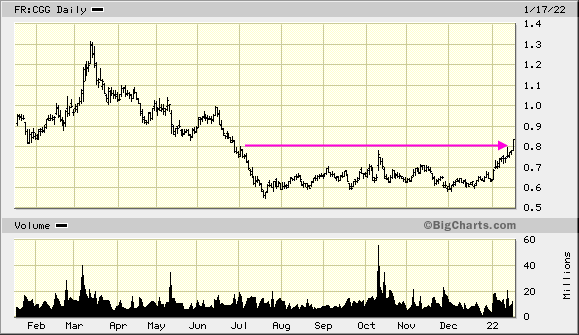

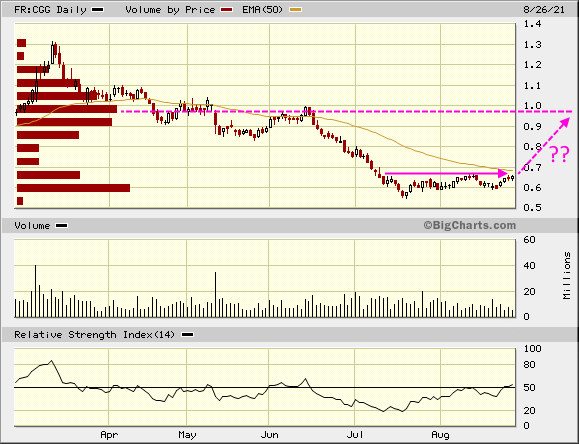

Antwort auf Beitrag Nr.: 69.561.918 von faultcode am 11.10.21 14:24:35heute mit dem nächsten Sprung: +6% an der Euronext Paris:

Achtung:

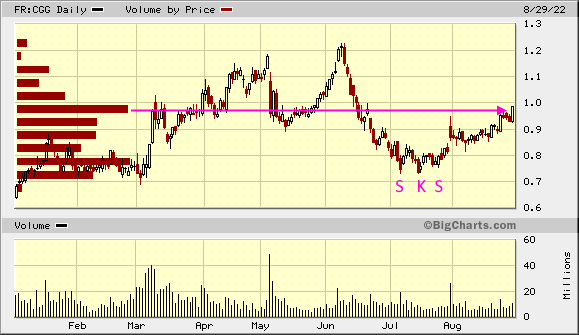

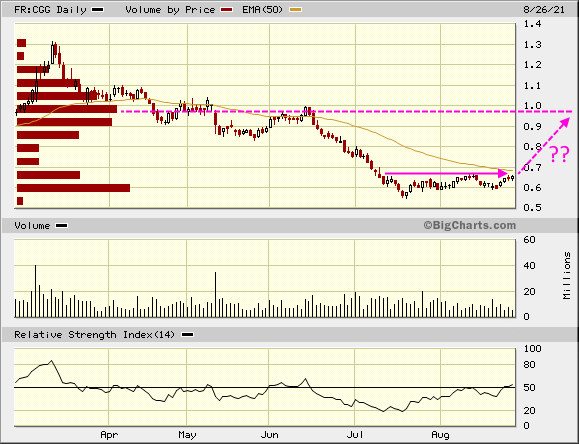

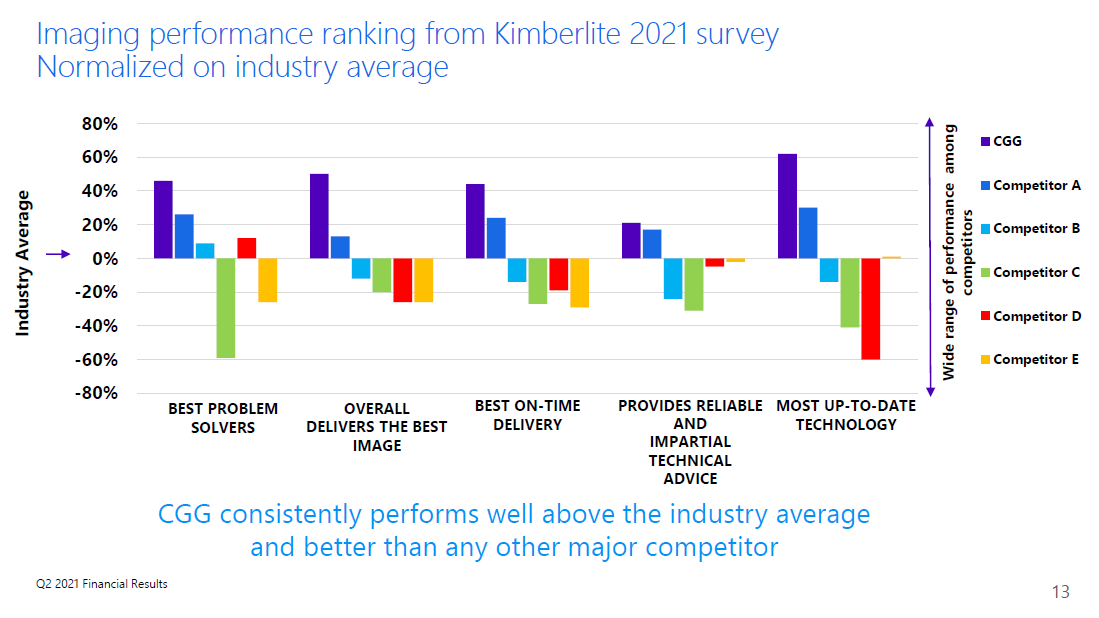

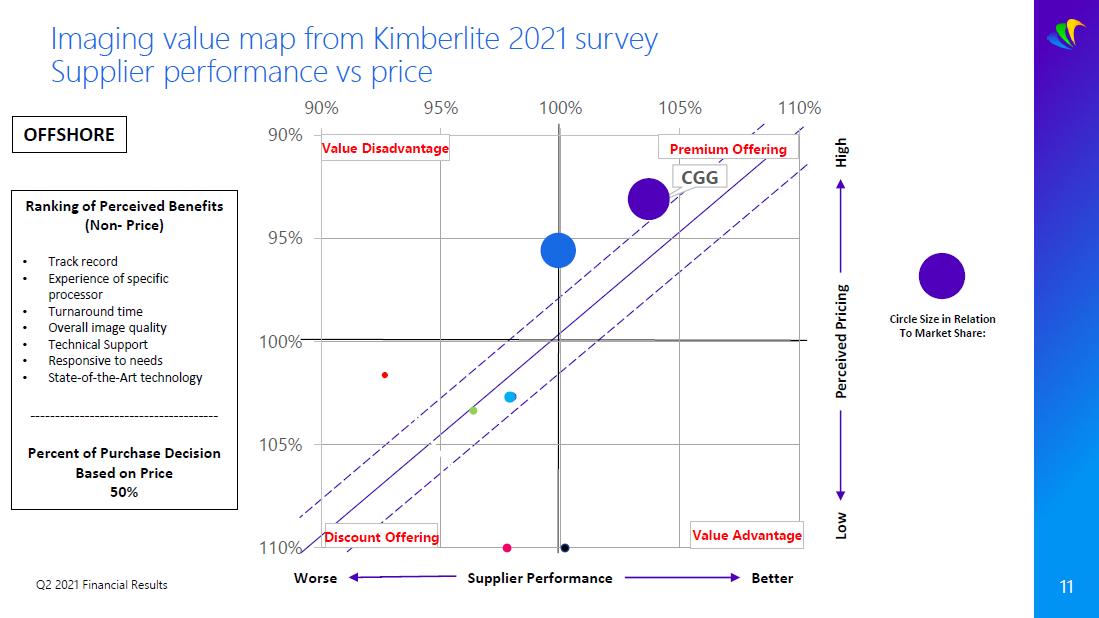

Q2: das ist meine Lieblingsfolie: teuer, aber gut

...

ansonsten:

...

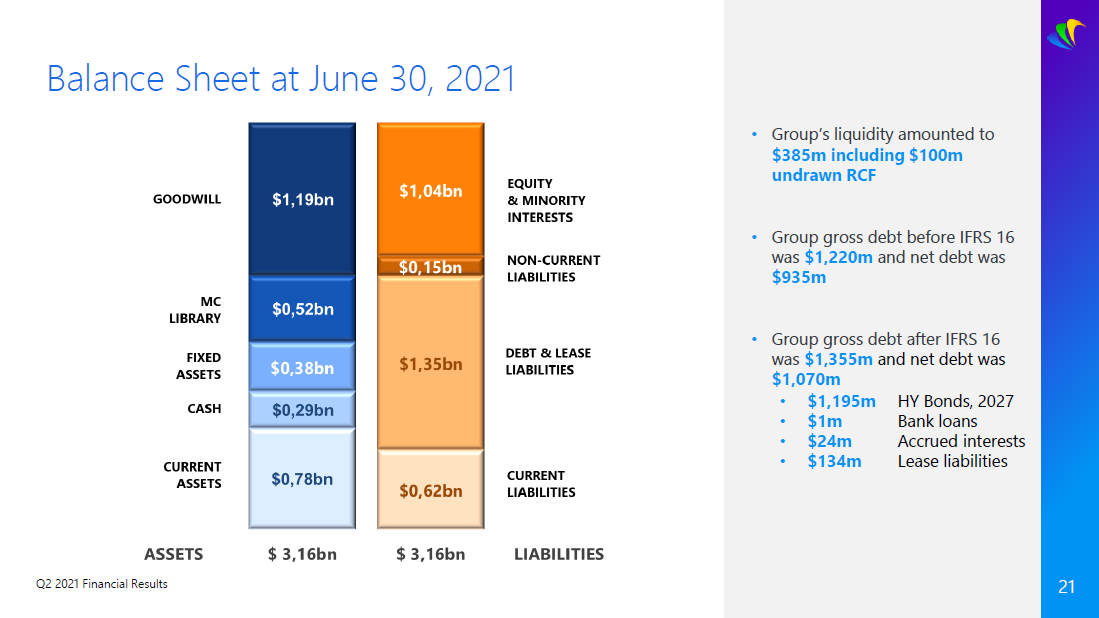

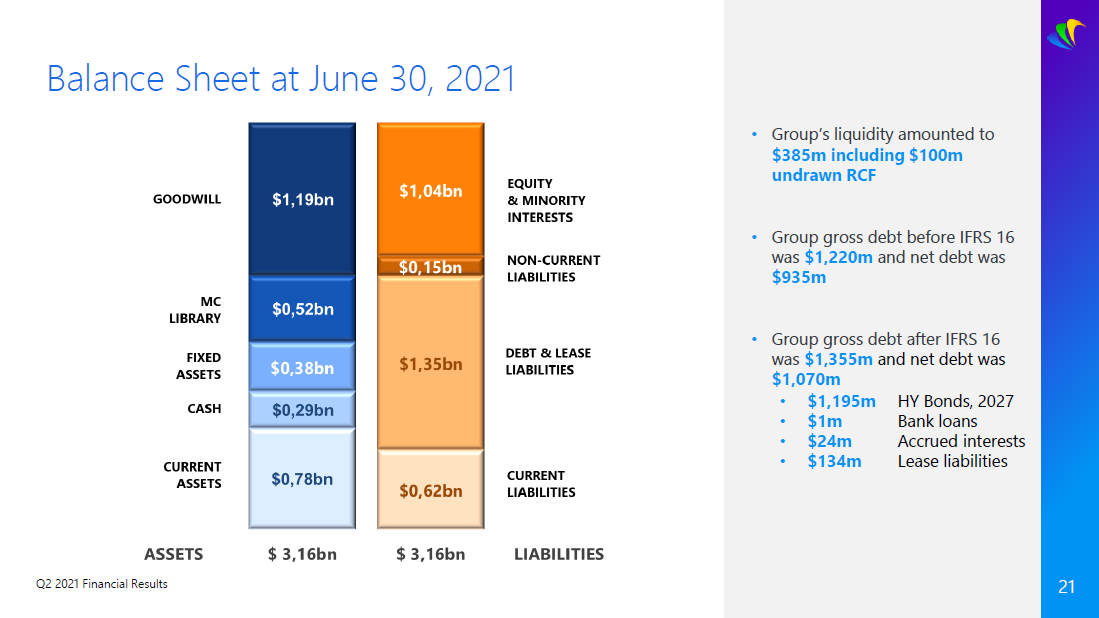

=> Goodwill > Equity + Min.Interests

...

Q2: das ist meine Lieblingsfolie: teuer, aber gut

...

ansonsten:

...

=> Goodwill > Equity + Min.Interests

...

CGG - neue WKN nach reverse-split