Allianz SE: Oliver Bäte - der neue Joe Ackermann/Deutsche Bank ? (Seite 10)

eröffnet am 21.07.18 17:46:32 von

neuester Beitrag 11.11.23 15:06:16 von

neuester Beitrag 11.11.23 15:06:16 von

Beiträge: 127

ID: 1.284.917

ID: 1.284.917

Aufrufe heute: 0

Gesamt: 19.173

Gesamt: 19.173

Aktive User: 0

ISIN: DE0008404005 · WKN: 840400

274,05

EUR

+0,16 %

+0,45 EUR

Letzter Kurs 21:57:27 Lang & Schwarz

Neuigkeiten

10:02 Uhr · wallstreetONLINE Redaktion |

| Allianz Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

13:19 Uhr · dpa-AFX |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6550 | +43,17 | |

| 1,4600 | +43,14 | |

| 1,5400 | +21,26 | |

| 0,6650 | +16,67 | |

| 2,0450 | +16,03 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 30,85 | -9,93 | |

| 14,750 | -14,14 | |

| 5,1400 | -15,46 | |

| 1.138,25 | -16,86 | |

| 1,0750 | -21,82 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.602.428 von faultcode am 18.05.22 14:14:47und am Ende wird dann der Mist verkauft; fragt sich nur, was die Allianz die ganzen Jahre über dabei verdient hat oder besser gesagt, verloren hat:

17.5.

Allianz to Sell US Fund Management Unit to Voya After SEC Ban

https://finance.yahoo.com/news/allianz-sell-us-fund-manageme…

...

Allianz SE plans to sell the bulk of the US piece of its Allianz Global Investors business to Voya Financial Inc. after it was banned for a decade from some fund services in the nation.

Voya Investment Management will add about $120 billion of assets under management as well as some investment teams, the company said in a statement Tuesday. Allianz will take a 24% stake in Voya IM.

Allianz Global Investors US agreed to plead guilty to fraud and pay $5.8 billion in fines and restitution after a relatively low-risk group of investment funds collapsed in the wake of pandemic market gyrations. The guilty plea means it is “disqualified from providing advisory services to US registered investment funds for the next ten years, and will exit the business of conducting these fund services,” the Securities and Exchange Commission said in a statement Tuesday.

...

17.5.

Allianz to Sell US Fund Management Unit to Voya After SEC Ban

https://finance.yahoo.com/news/allianz-sell-us-fund-manageme…

...

Allianz SE plans to sell the bulk of the US piece of its Allianz Global Investors business to Voya Financial Inc. after it was banned for a decade from some fund services in the nation.

Voya Investment Management will add about $120 billion of assets under management as well as some investment teams, the company said in a statement Tuesday. Allianz will take a 24% stake in Voya IM.

Allianz Global Investors US agreed to plead guilty to fraud and pay $5.8 billion in fines and restitution after a relatively low-risk group of investment funds collapsed in the wake of pandemic market gyrations. The guilty plea means it is “disqualified from providing advisory services to US registered investment funds for the next ten years, and will exit the business of conducting these fund services,” the Securities and Exchange Commission said in a statement Tuesday.

...

Antwort auf Beitrag Nr.: 71.597.910 von faultcode am 18.05.22 00:03:43...

Prosecutors say that while Tournant assured big investors safety was his top priority, he secretly took huge, undisclosed risks. The result was a massive fraud that cost investors $7 billion, they say.

Tournant, the chief investment officer at Miami-based Structured Alpha, spent years “smoothing” performance data, lying about hedges against market downturns, and pretending risk managers at Allianz Global Investors US were carefully monitoring his every move, prosecutors charged in an indictment.

...

Prosecutors and regulators revealed new details of how they say Tournant, Taylor, and Bond-Nelson duped investors, consultants, colleagues and auditors.

As star performers at Allianz Global Investors US, Tournant and Taylor each earned $51.3 million from 2016 to 2020 and Bond-Nelson made $12 million, according to the SEC.

The cooperation of Taylor and Bond-Nelson wasn’t assured. At one point Tournant met Taylor at a vacant construction site, where they discussed fund reports they manipulated and how to respond to SEC investigators, according to the SEC complaint.

Tournant also encouraged Bond-Nelson, 51, to give false testimony to the agency. Bond-Nelson lied repeatedly to SEC investigators during his testimony in May 2021 before taking a bathroom break and not returning. Soon, he “decided to cooperate and assist the SEC staff in understanding the Structured Alpha fraud,” according to the agency complaint.

...

18.5.

Allianz Fund Managers’ Paydays Could Be Followed by Prison

https://finance.yahoo.com/news/allianz-fund-managers-big-pay…

--> dieses Phänomen ist in den USA durchaus bekannt und verbreitet. Es heißt: stUpiD gERMan moneY

Es fing nach meinem Kenntnisstand in den 90ern an, z.B. mit der Übernahme von Bankers Trust durch die Deutsche Bank, finalisiert im Juni 1999, nach einer langen Anbahnungsphase.

"Jeder" in den USA wusste, daß Bankers Trust ein Mistladen war, der bei den ganzen M&A's übrig geblieben war. Aber für den Spätzünder Deutsche Bank halt gut genug.

Prosecutors say that while Tournant assured big investors safety was his top priority, he secretly took huge, undisclosed risks. The result was a massive fraud that cost investors $7 billion, they say.

Tournant, the chief investment officer at Miami-based Structured Alpha, spent years “smoothing” performance data, lying about hedges against market downturns, and pretending risk managers at Allianz Global Investors US were carefully monitoring his every move, prosecutors charged in an indictment.

...

Prosecutors and regulators revealed new details of how they say Tournant, Taylor, and Bond-Nelson duped investors, consultants, colleagues and auditors.

As star performers at Allianz Global Investors US, Tournant and Taylor each earned $51.3 million from 2016 to 2020 and Bond-Nelson made $12 million, according to the SEC.

The cooperation of Taylor and Bond-Nelson wasn’t assured. At one point Tournant met Taylor at a vacant construction site, where they discussed fund reports they manipulated and how to respond to SEC investigators, according to the SEC complaint.

Tournant also encouraged Bond-Nelson, 51, to give false testimony to the agency. Bond-Nelson lied repeatedly to SEC investigators during his testimony in May 2021 before taking a bathroom break and not returning. Soon, he “decided to cooperate and assist the SEC staff in understanding the Structured Alpha fraud,” according to the agency complaint.

...

18.5.

Allianz Fund Managers’ Paydays Could Be Followed by Prison

https://finance.yahoo.com/news/allianz-fund-managers-big-pay…

--> dieses Phänomen ist in den USA durchaus bekannt und verbreitet. Es heißt: stUpiD gERMan moneY

Es fing nach meinem Kenntnisstand in den 90ern an, z.B. mit der Übernahme von Bankers Trust durch die Deutsche Bank, finalisiert im Juni 1999, nach einer langen Anbahnungsphase.

"Jeder" in den USA wusste, daß Bankers Trust ein Mistladen war, der bei den ganzen M&A's übrig geblieben war. Aber für den Spätzünder Deutsche Bank halt gut genug.

Welchen Kleinanleger interessiert das? Mich nicht, die Hauptsache, die Dividende fließt!

17.5.

Allianz Cooperator Used Bathroom Break to Run Out on the SEC

https://www.bnnbloomberg.ca/allianz-cooperator-used-bathroom…

A former portfolio manager for the Allianz SE unit that agreed to pay $5.8 billion over the implosion of its hedge funds in 2020 saw no escape from the questioning of the SEC’s lawyers.

So Stephen Bond-Nelson excused himself to use the bathroom and never returned.

At least, not until he decided to plead guilty and cooperate in the investigation of the fraud.

The U.S. Securities and Exchange Commission was the first to figure out that it wasn’t just the Covid-19 stock market plunge that led to the collapse of Allianz Global Investors’ Structured Alpha Funds, but also fund managers who allegedly deceived investors and regulators about Structured Alpha’s risk.

SEC Director of Enforcement Gurbir Grewal recounted the world’s longest bathroom break at a press conference Tuesday at which criminal charges against Allianz and the funds’ former chief investment officer, Gregoire Tournant, were announced. The key to identifying the misconduct, according to Manhattan U.S. Attorney Damian Williams, was the SEC’s detective work.

Tournant and Bond-Nelson “were under the mistaken impression that the SEC staff were moving too quickly and as a result might not have put all the pieces together,” Grewal said. “So they came up with cover stories that Bond-Nelson would tell the SEC enforcement staff during his testimony. They couldn’t have been more wrong.”

Grewal said that “after Bond-Nelson lied on the record, SEC enforcement staff confronted him on his lies. Realizing that the gig was up, Bond-Nelson took a restroom break during his testimony and he never came back.”

Until, upon further reflection, he did

<langer BBG-Artikel>

11.3.

Behind Allianz’s $4 Billion Fund Blowup, Red Flags and Fat Fees

https://finance.yahoo.com/news/behind-allianz-4-billion-fund…

...

All these months later, the big question remains: How could a few obscure money managers -- people on no one’s list of hedge-fund luminaries -- blow such a huge hole in Allianz, which traces its history to the days of Bismarck? The answer that emerges from court filings, Allianz marketing materials and people with first-hand knowledge of Structured Alpha’s investment strategy is a classic story of Wall Street salesmanship and greed, and a tale for these volatile times.

...

At the center of the debacle is Greg Tournant, 55, an equity-options whiz and one-time McKinsey & Co. consultant. A dual U.S.-French citizen, he arrived at Allianz Global Investors in the early 2000s by way of Oppenheimer Capital.

It turns out that Tournant and other fund managers behind Structured Alpha -- including longtime colleague Trevor Taylor -- previously ran into trouble during the 2008 financial crisis, with strategies that also involved options. Long before the pandemic, their small investment firm on Miami’s Brickell Avenue, aka, Wall Street South, collapsed when its trades went bad, according to two former employees there -- foreshadowing what was to come. Tournant and Taylor declined to comment.

At Allianz Global Investors U.S., Tournant and his Structured Alpha team were incentivized to pursue outsized returns. Instead of employing the usual formula for hedge-fund fees -- the “2 and 20” mix of management charges and a cut of profits -- they were compensated for one thing alone: performance. The bigger the investment gains, the bigger the payday. While Allianz made no secret of this arrangement, angry clients would later claim it was a recipe for bigger risks.

Tournant himself was heavily invested in the funds he managed and lost money along with clients, according to a person familiar with the matter. In early March of 2020, as he was grappling with the pandemic’s effect on his funds, Tournant went on medical leave for undisclosed reasons, the person said. Structured Alpha’s troubles continued after his departure.

In the finger-pointing that followed, some big investors accused the professional consultants they had hired to vet Structured Alpha of ignoring red flags and failing to understand what the funds were doing, according to lawsuits.

...

Roman Frenkel was a first-hand witness to the Structured Alpha team’s earlier failure when he worked at Innovative Options Management, the small Miami firm that Taylor founded and Tournant helped run briefly while continuing to manage money for Allianz. Disaster struck in 2008 when the collapse of Lehman Brothers rocked global finance, freezing up markets -- and with them, Innovative Options’ trades.

“The over-the-counter spreads were so great, they couldn’t close positions,” said Frenkel, who was chief compliance officer for Innovative Options. Instead of being part of the company’s planned expansion to waterfront offices, Frenkel ended up helping liquidate the business.

...

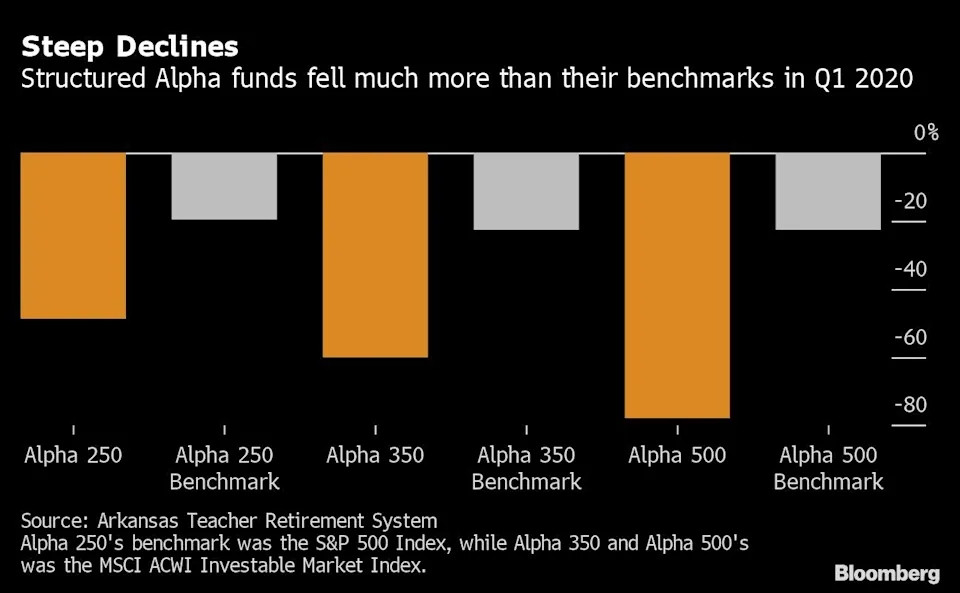

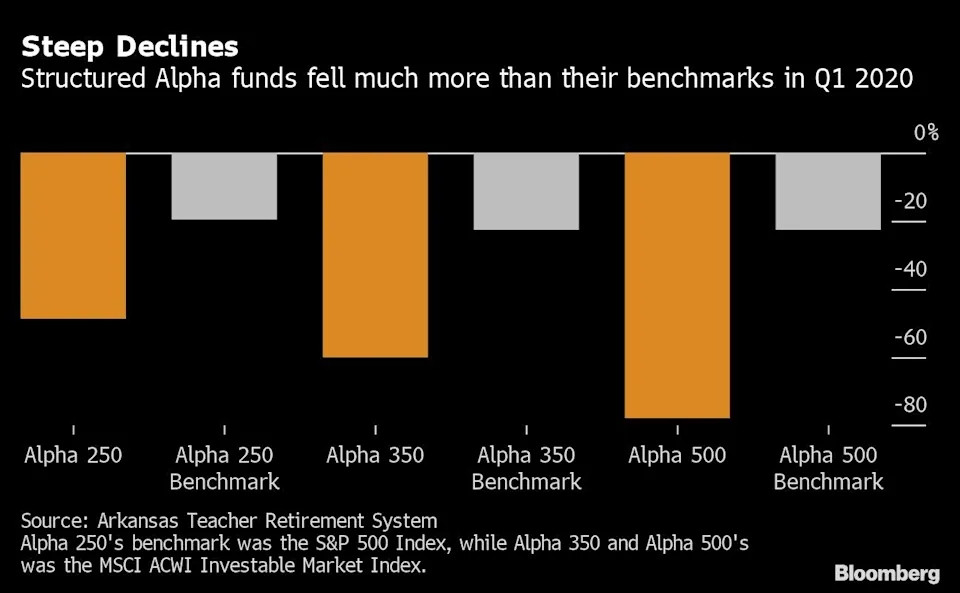

Another investor, the board of a pension fund run by the International Brotherhood of Electrical Workers, filed a lawsuit in 2020 that purported to identify what went wrong. The board alleged that when the pandemic started fueling wild volatility in February, Structured Alpha made a fateful bet against further market declines. It did so by selling options that would pay out for the purchasers, and hurt Structured Alpha, if the S&P 500 plunged, the pension said.

The trade proved disastrous for the Allianz fund managers when the index tanked in late February, and global markets experienced their largest single-week declines since the height of the 2008 financial crisis, the board claimed. By the end of March, Allianz announced it was liquidating two Structured Alpha funds.

...

The insurer warned last month that ongoing probes by the Justice Department and SEC are at a “sensitive” stage and it couldn’t yet predict the final price tag from regulatory settlements and private litigation. Bloomberg Intelligence analysts predicted Feb. 18 that the insurer’s 3.7 billion euro provision won’t likely be sufficient and that its legal costs might approach $6 billion.

...

___

=> irgendwie dieser Klassiker schon wieder: stupid german money in den USA, nun halt auch bei der Allianz

Vorher war dafür ja oftmals die Deutsche Bank zuständig

11.3.

Behind Allianz’s $4 Billion Fund Blowup, Red Flags and Fat Fees

https://finance.yahoo.com/news/behind-allianz-4-billion-fund…

...

All these months later, the big question remains: How could a few obscure money managers -- people on no one’s list of hedge-fund luminaries -- blow such a huge hole in Allianz, which traces its history to the days of Bismarck? The answer that emerges from court filings, Allianz marketing materials and people with first-hand knowledge of Structured Alpha’s investment strategy is a classic story of Wall Street salesmanship and greed, and a tale for these volatile times.

...

At the center of the debacle is Greg Tournant, 55, an equity-options whiz and one-time McKinsey & Co. consultant. A dual U.S.-French citizen, he arrived at Allianz Global Investors in the early 2000s by way of Oppenheimer Capital.

It turns out that Tournant and other fund managers behind Structured Alpha -- including longtime colleague Trevor Taylor -- previously ran into trouble during the 2008 financial crisis, with strategies that also involved options. Long before the pandemic, their small investment firm on Miami’s Brickell Avenue, aka, Wall Street South, collapsed when its trades went bad, according to two former employees there -- foreshadowing what was to come. Tournant and Taylor declined to comment.

At Allianz Global Investors U.S., Tournant and his Structured Alpha team were incentivized to pursue outsized returns. Instead of employing the usual formula for hedge-fund fees -- the “2 and 20” mix of management charges and a cut of profits -- they were compensated for one thing alone: performance. The bigger the investment gains, the bigger the payday. While Allianz made no secret of this arrangement, angry clients would later claim it was a recipe for bigger risks.

Tournant himself was heavily invested in the funds he managed and lost money along with clients, according to a person familiar with the matter. In early March of 2020, as he was grappling with the pandemic’s effect on his funds, Tournant went on medical leave for undisclosed reasons, the person said. Structured Alpha’s troubles continued after his departure.

In the finger-pointing that followed, some big investors accused the professional consultants they had hired to vet Structured Alpha of ignoring red flags and failing to understand what the funds were doing, according to lawsuits.

...

Roman Frenkel was a first-hand witness to the Structured Alpha team’s earlier failure when he worked at Innovative Options Management, the small Miami firm that Taylor founded and Tournant helped run briefly while continuing to manage money for Allianz. Disaster struck in 2008 when the collapse of Lehman Brothers rocked global finance, freezing up markets -- and with them, Innovative Options’ trades.

“The over-the-counter spreads were so great, they couldn’t close positions,” said Frenkel, who was chief compliance officer for Innovative Options. Instead of being part of the company’s planned expansion to waterfront offices, Frenkel ended up helping liquidate the business.

...

Another investor, the board of a pension fund run by the International Brotherhood of Electrical Workers, filed a lawsuit in 2020 that purported to identify what went wrong. The board alleged that when the pandemic started fueling wild volatility in February, Structured Alpha made a fateful bet against further market declines. It did so by selling options that would pay out for the purchasers, and hurt Structured Alpha, if the S&P 500 plunged, the pension said.

The trade proved disastrous for the Allianz fund managers when the index tanked in late February, and global markets experienced their largest single-week declines since the height of the 2008 financial crisis, the board claimed. By the end of March, Allianz announced it was liquidating two Structured Alpha funds.

...

The insurer warned last month that ongoing probes by the Justice Department and SEC are at a “sensitive” stage and it couldn’t yet predict the final price tag from regulatory settlements and private litigation. Bloomberg Intelligence analysts predicted Feb. 18 that the insurer’s 3.7 billion euro provision won’t likely be sufficient and that its legal costs might approach $6 billion.

...

___

=> irgendwie dieser Klassiker schon wieder: stupid german money in den USA, nun halt auch bei der Allianz

Vorher war dafür ja oftmals die Deutsche Bank zuständig

Antwort auf Beitrag Nr.: 69.257.103 von faultcode am 07.09.21 12:42:30

https://www.spiegel.de/wirtschaft/unternehmen/allianz-vorsta…

https://www.wsj.com/articles/allianz-asset-management-head-j…

https://www.spiegel.de/wirtschaft/unternehmen/allianz-vorsta…

https://www.wsj.com/articles/allianz-asset-management-head-j…

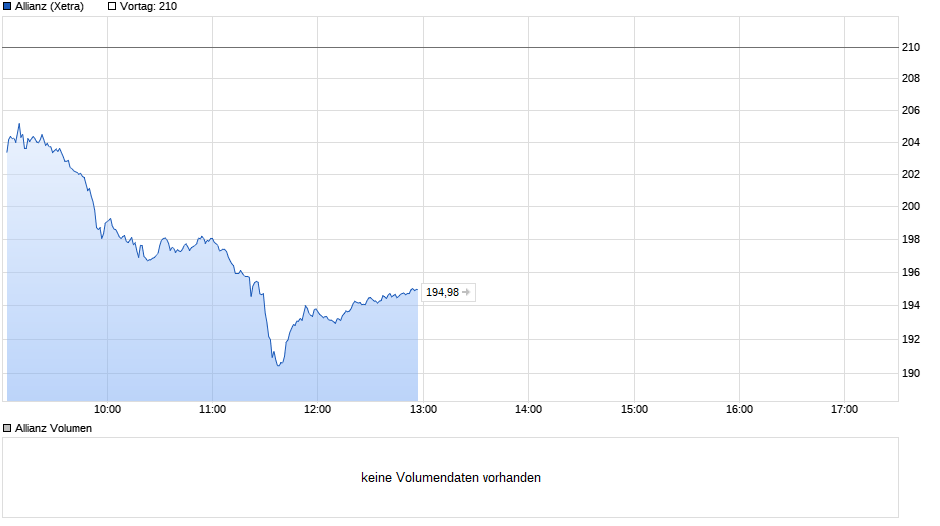

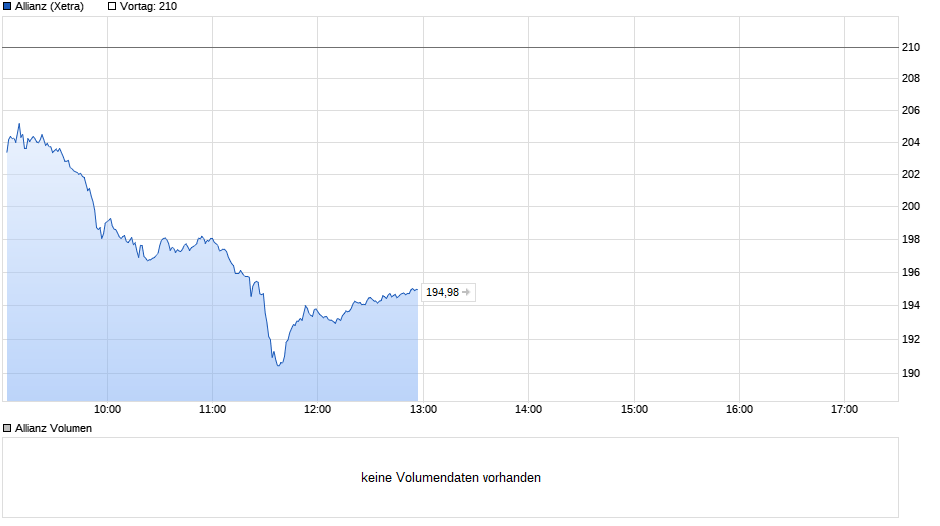

Die Wellen im Chart nach unten sehen sehr Vergleichbar aus... Das hat System bis zur 190 😳

Antwort auf Beitrag Nr.: 65.217.481 von faultcode am 28.09.20 21:47:4028.9.2020

fast ein Jahr danach kommt die vom Wirecard-Skandal schwer gebeutelte, aber nach Eigenangaben nun nach "Weltklasse" (*) strebende BaFin auch mit einer Untersuchung daher

7.9.

...BaFin ermittelt offenbar bei Allianz wegen Hedgefonds-Streit

https://www.finanzen.net/nachricht/aktien/nach-sec-allianz-a…

...

Die Bonner Behörde hat eigene Ermittlungen in dem Fall gestartet, wie mehrere mit der Sache vertraute Personen zur Nachrichtenagentur Reuters sagten.

...

Bei der BaFin seien mehrere Mitarbeiter aus verschiedenen Abteilungen mit dem Thema beschäftigt, sagten die Insider zu Reuters. Die Beamten prüften, ob Führungskräfte der Allianz außerhalb des Fondsbereichs von den Ereignissen, die zu den Milliardenverlusten führten, wussten oder daran beteiligt waren.

Die Ermittlungen bei der BaFin befänden sich noch in der Phase, in der Fakten zusammengetragen würden. Sie hätten aber an Fahrt aufgenommen, seit die Allianz Anfang August die US-Untersuchungen bekannt gemacht habe.

...

(*) 1.9. https://www.faz.net/aktuell/finanzen/bafin-praesident-branso…

Zitat von faultcode: ...

28.9.

U.S. pension funds sue Allianz after $4 billion in coronavirus losses

https://finance.yahoo.com/news/u-pension-funds-sue-allianz-1…

fast ein Jahr danach kommt die vom Wirecard-Skandal schwer gebeutelte, aber nach Eigenangaben nun nach "Weltklasse" (*) strebende BaFin auch mit einer Untersuchung daher

7.9.

...BaFin ermittelt offenbar bei Allianz wegen Hedgefonds-Streit

https://www.finanzen.net/nachricht/aktien/nach-sec-allianz-a…

...

Die Bonner Behörde hat eigene Ermittlungen in dem Fall gestartet, wie mehrere mit der Sache vertraute Personen zur Nachrichtenagentur Reuters sagten.

...

Bei der BaFin seien mehrere Mitarbeiter aus verschiedenen Abteilungen mit dem Thema beschäftigt, sagten die Insider zu Reuters. Die Beamten prüften, ob Führungskräfte der Allianz außerhalb des Fondsbereichs von den Ereignissen, die zu den Milliardenverlusten führten, wussten oder daran beteiligt waren.

Die Ermittlungen bei der BaFin befänden sich noch in der Phase, in der Fakten zusammengetragen würden. Sie hätten aber an Fahrt aufgenommen, seit die Allianz Anfang August die US-Untersuchungen bekannt gemacht habe.

...

(*) 1.9. https://www.faz.net/aktuell/finanzen/bafin-praesident-branso…

Antwort auf Beitrag Nr.: 65.217.481 von faultcode am 28.09.20 21:47:4028.09.2020

das hat ja nicht so gut geklappt bislang:

2.8.2021

...

Dem Versicherungskonzern zufolge hat das US-Justizministerium nach Klagen und einer Untersuchung der US-Wertpapieraufsichtsbehörde SEC selbst eine Untersuchung in Zusammenhang mit den sogenannten Structured Alpha Fonds der Konzerntochter Allianz Global Investors (AGI) eingeleitet.

Der Allianz-Vorstand sieht nun ein "relevantes Risiko", dass die mit dem Fonds verbundenen Angelegenheiten erhebliche Auswirkungen auf künftige Finanzergebnisse des Versicherungskonzerns haben könnten.

...

...Warnung vor Belastungen in den USA lässt Allianz einbrechen

https://www.ariva.de/news/aktie-im-fokus-warnung-vor-belastu…

US-Justizministerium klingt fast nie gut, denn möglicherweise könnten hier am Ende Criminal charges ins Haus stehen.

Zitat von faultcode: ...A spokesman for Allianz Global Investors said in a statement to Reuters: "While the losses were disappointing, the allegations made by claimants are legally and factually flawed, and we will defend ourselves vigorously against them."

...

das hat ja nicht so gut geklappt bislang:

2.8.2021

...

Dem Versicherungskonzern zufolge hat das US-Justizministerium nach Klagen und einer Untersuchung der US-Wertpapieraufsichtsbehörde SEC selbst eine Untersuchung in Zusammenhang mit den sogenannten Structured Alpha Fonds der Konzerntochter Allianz Global Investors (AGI) eingeleitet.

Der Allianz-Vorstand sieht nun ein "relevantes Risiko", dass die mit dem Fonds verbundenen Angelegenheiten erhebliche Auswirkungen auf künftige Finanzergebnisse des Versicherungskonzerns haben könnten.

...

...Warnung vor Belastungen in den USA lässt Allianz einbrechen

https://www.ariva.de/news/aktie-im-fokus-warnung-vor-belastu…

US-Justizministerium klingt fast nie gut, denn möglicherweise könnten hier am Ende Criminal charges ins Haus stehen.

Antwort auf Beitrag Nr.: 68.130.121 von faultcode am 10.05.21 15:02:44Es geht doch um eine Masse ähnlicher Fälle, da kann man nicht einfach nachgeben. Solche Detailfragen

werden die Anleger vielleicht bald gar nicht mehr so sehr interessieren, wenn wieder einmal nach

langer Zeit ein richtiger CRASH ansteht. Den wollen einige der großen angelsächsischen Investoren

wohl schon bald, auch eingedenk des berühmten Satzes: Sell in May - Mayday - Mayday...

werden die Anleger vielleicht bald gar nicht mehr so sehr interessieren, wenn wieder einmal nach

langer Zeit ein richtiger CRASH ansteht. Den wollen einige der großen angelsächsischen Investoren

wohl schon bald, auch eingedenk des berühmten Satzes: Sell in May - Mayday - Mayday...

13:19 Uhr · dpa-AFX · Allianz |

10:02 Uhr · wallstreetONLINE Redaktion · Allianz |

08:21 Uhr · dpa-AFX · Allianz |

05:52 Uhr · dpa-AFX · Allianz |

04:30 Uhr · wallstreetONLINE Redaktion · Carl Zeiss Meditec |

07.05.24 · BörsenNEWS.de · Allianz |

06.05.24 · dpa-AFX · Allianz |

05.05.24 · wallstreetONLINE Redaktion · Allianz |

05.05.24 · BörsenNEWS.de · Allianz |

03.05.24 · dpa-AFX · Allianz |

| Zeit | Titel |

|---|---|

| 21:13 Uhr | |

| 14:48 Uhr | |

| 06.12.23 |