3 Aktien, die die besten Investoren der Welt derzeit kaufen | Diskussion im Forum

eröffnet am 14.09.18 16:28:28 von

neuester Beitrag 19.01.23 13:35:17 von

neuester Beitrag 19.01.23 13:35:17 von

Beiträge: 87

ID: 1.288.515

ID: 1.288.515

Aufrufe heute: 0

Gesamt: 19.855

Gesamt: 19.855

Aktive User: 0

ISIN: US0378331005 · WKN: 865985 · Symbol: AAPL

169,30

USD

-0,60 %

-1,03 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

01.05.24 · wallstreetONLINE Redaktion |

| Apple Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

01.05.24 · dpa-AFX |

01.05.24 · BNP Paribas Anzeige |

Werte aus der Branche Hardware

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 7,5100 | +21,13 | |

| 0,9650 | +16,27 | |

| 3,9100 | +6,25 | |

| 17,100 | +5,56 | |

| 0,5700 | +4,59 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 16,120 | -5,40 | |

| 15,350 | -6,97 | |

| 2,0200 | -9,01 | |

| 2,1600 | -9,24 | |

| 738,30 | -14,03 |

Beitrag zu dieser Diskussion schreiben

17.1.

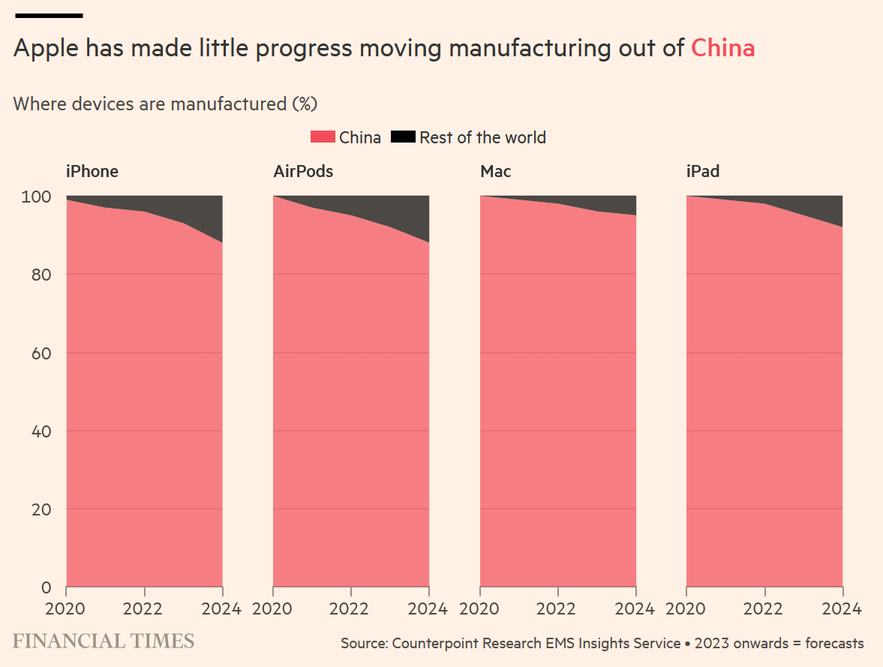

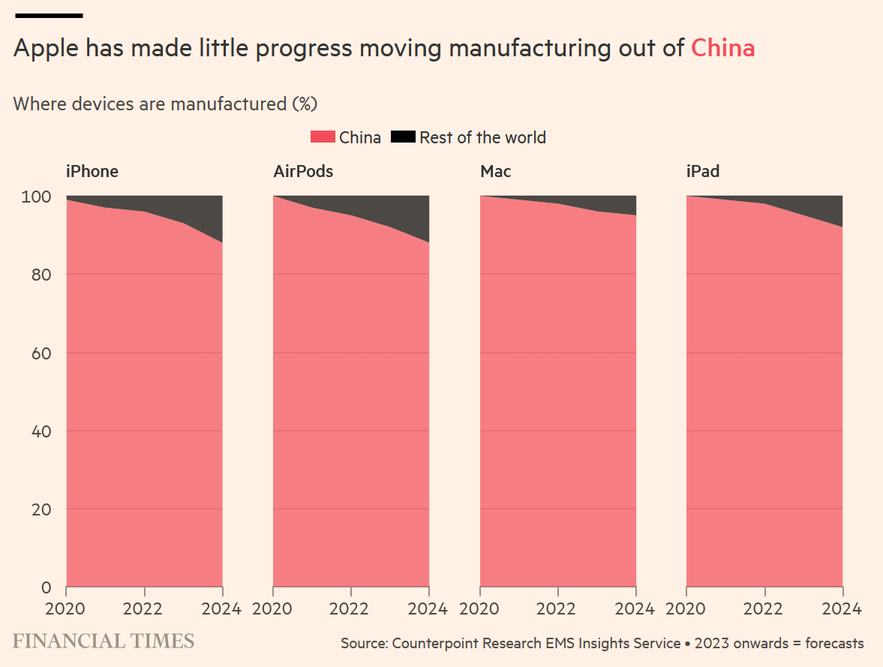

FT: How Apple tied its fortunes to China

The company spent two decades and billions of dollars building a supply chain of unprecedented sophistication. Now, a reckoning is coming

https://www.ft.com/content/d5a80891-b27d-4110-90c9-561b7836f…

...

O’Marah began to learn that Apple was not really “outsourcing” production to China, as commonly understood. Instead, he realised that Apple was starting to build up a supply and manufacturing operation of such complexity, depth and cost that the company’s fortunes have become tied to China in a way that cannot easily be unwound.

...

...

Cook should not be blamed by politicians for enmeshing Apple’s supply chain operations in China two decades ago, says Aaron Friedberg, author of Getting China Wrong. Washington was then encouraging companies to engage with China in the hopes that it would inculcate democratic values.

Where Cook erred, he adds, is by doubling down over the past decade despite mounting evidence that Xi was ramping up repression at home and taking a more combative stance in international affairs.

“The fact that Apple has allowed this to go as far as it did, as long as it did, has created this massive problem of disentangling itself,” Friedberg says. “I have no doubt they just wish all of this would go away, and they could go back to business as usual. Because there is just no obvious way out.”

FT: How Apple tied its fortunes to China

The company spent two decades and billions of dollars building a supply chain of unprecedented sophistication. Now, a reckoning is coming

https://www.ft.com/content/d5a80891-b27d-4110-90c9-561b7836f…

...

O’Marah began to learn that Apple was not really “outsourcing” production to China, as commonly understood. Instead, he realised that Apple was starting to build up a supply and manufacturing operation of such complexity, depth and cost that the company’s fortunes have become tied to China in a way that cannot easily be unwound.

...

...

Cook should not be blamed by politicians for enmeshing Apple’s supply chain operations in China two decades ago, says Aaron Friedberg, author of Getting China Wrong. Washington was then encouraging companies to engage with China in the hopes that it would inculcate democratic values.

Where Cook erred, he adds, is by doubling down over the past decade despite mounting evidence that Xi was ramping up repression at home and taking a more combative stance in international affairs.

“The fact that Apple has allowed this to go as far as it did, as long as it did, has created this massive problem of disentangling itself,” Friedberg says. “I have no doubt they just wish all of this would go away, and they could go back to business as usual. Because there is just no obvious way out.”

Antwort auf Beitrag Nr.: 72.058.901 von faultcode am 26.07.22 15:13:53$AAPL ist das letzte Market Cap > $2T-Tech-Unternehmen:

das ist das noch erleben durfte: Apple-Produkte mit offiziellen Preis-Nachlässen:

25.7.

Apple Prepares Rare iPhone Discount for China Buyers

https://finance.yahoo.com/news/apple-prepares-rare-iphone-di…

...

The company, usually reluctant to alter pricing, will take up to 600 yuan ($89) off the price of its top-line iPhone 13 Pro series between July 29 and Aug. 1, according to a notice on its website. To be eligible, buyers have to use one of a select number of payment platforms, such as Ant Group Co.’s Alipay. Certain AirPods and Apple Watch models are also part of the promotion.

The discounts come as China’s economy tries to bounce back from major Covid-19 lockdowns in business hubs Shanghai and Beijing, which have hurt sales of leading domestic smartphone brands from Xiaomi Corp. to Vivo and Oppo. Apple bucked the trend by registering healthy growth in China shipments in June, according to national statistics, though the discounts suggest even it has surplus inventory heading into the latter half of the year.

Weakening consumer demand, inflation and supply chain issues triggered a 9% fall in global smartphone shipments in the second quarter, research firm Canalys said this month. Chinese companies took the brunt of that hit, registering double-digit declines.

...

25.7.

Apple Prepares Rare iPhone Discount for China Buyers

https://finance.yahoo.com/news/apple-prepares-rare-iphone-di…

...

The company, usually reluctant to alter pricing, will take up to 600 yuan ($89) off the price of its top-line iPhone 13 Pro series between July 29 and Aug. 1, according to a notice on its website. To be eligible, buyers have to use one of a select number of payment platforms, such as Ant Group Co.’s Alipay. Certain AirPods and Apple Watch models are also part of the promotion.

The discounts come as China’s economy tries to bounce back from major Covid-19 lockdowns in business hubs Shanghai and Beijing, which have hurt sales of leading domestic smartphone brands from Xiaomi Corp. to Vivo and Oppo. Apple bucked the trend by registering healthy growth in China shipments in June, according to national statistics, though the discounts suggest even it has surplus inventory heading into the latter half of the year.

Weakening consumer demand, inflation and supply chain issues triggered a 9% fall in global smartphone shipments in the second quarter, research firm Canalys said this month. Chinese companies took the brunt of that hit, registering double-digit declines.

...

Antwort auf Beitrag Nr.: 68.289.938 von faultcode am 25.05.21 01:07:10Aber jetzt mal ehrlich: ich verwende ja gerade deswegen Apple und iPhone weil alle Apps darauf sicher sind und nicht jeder beliebige Softwareentwickler was "bastelt", was nur Viren und Probleme ins System bringt -> dieses Problem verfolgte mich bei Microsoft viel zu lange.

Ich finde diese Sicherheitspolitik von Apple sehr gut - deswegen kauf ich auch weiterhin bei Apple :-)

LG

IC

Ich finde diese Sicherheitspolitik von Apple sehr gut - deswegen kauf ich auch weiterhin bei Apple :-)

LG

IC

Antwort auf Beitrag Nr.: 64.921.673 von faultcode am 28.08.20 22:57:15

22.5.

Apple-Chef in der Defensive : Tim Cook spielt wiederholt den Unwissenden

https://www.faz.net/aktuell/wirtschaft/digitec/apple-chef-ti…

Bei seinem Auftritt im Prozess gegen Epic Games wird der Apple-Chef mit kritischen Fragen konfrontiert. Und einer Richterin, die überraschend klare Anmerkungen macht.

...

Zitat von faultcode: Apple pulls Epic’s App Store developer account, removing all of its games

https://twitter.com/MarketWatch/status/1299450018374594560

Schweine.

22.5.

Apple-Chef in der Defensive : Tim Cook spielt wiederholt den Unwissenden

https://www.faz.net/aktuell/wirtschaft/digitec/apple-chef-ti…

Bei seinem Auftritt im Prozess gegen Epic Games wird der Apple-Chef mit kritischen Fragen konfrontiert. Und einer Richterin, die überraschend klare Anmerkungen macht.

...

Antwort auf Beitrag Nr.: 59.549.749 von faultcode am 03.01.19 13:09:033.1.2019

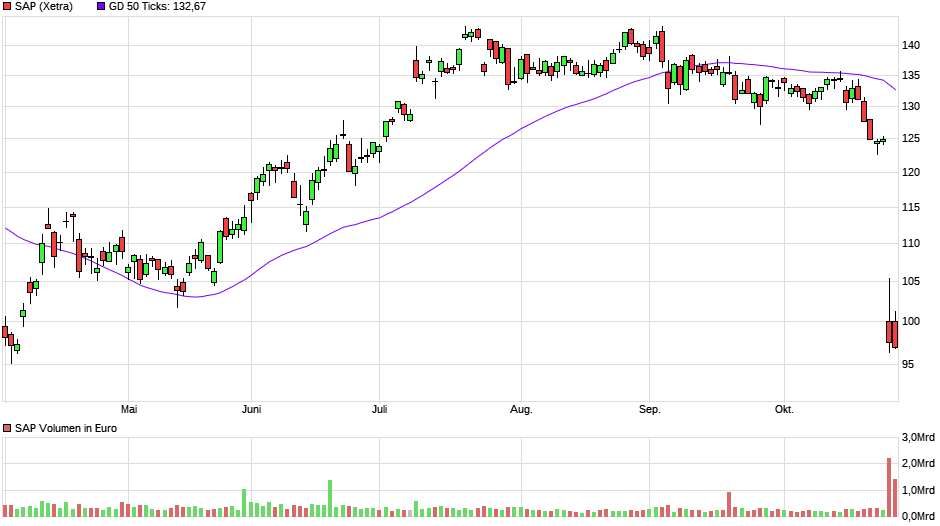

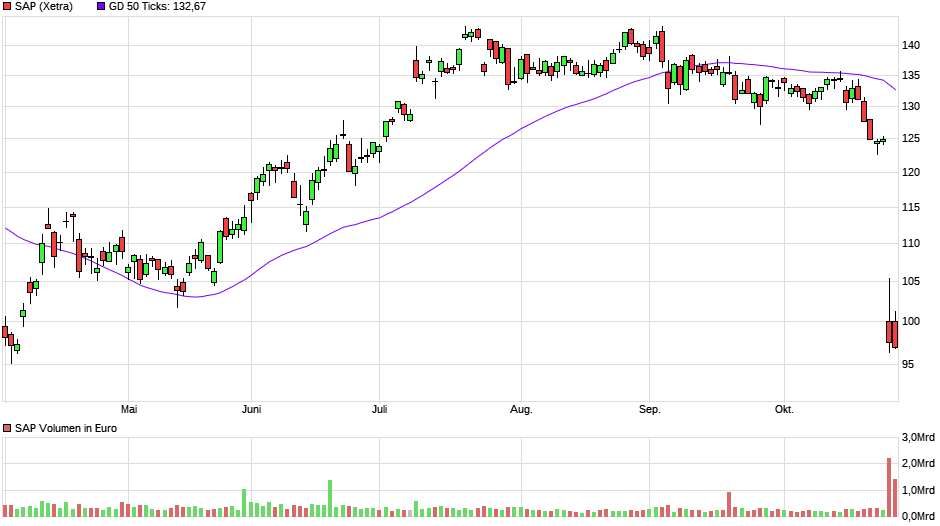

und das - natürlich nicht nur bei Apple, sondern und gerade auch auch bei SAP:

Natürlich, priced for perfection ist ein anderes Problem.

Man kann darüber nachdenken, warum "Business Intelligence" offenbar im eigenen Haus eher nicht funktioniert gemessen an den hohen Ansprüchen und den nach außen abgegebenen Prognosen:

We want our users to focus on what really brings them value, so we provide automated insights helping them answer common business questions, detect patterns and trends, and forecast potential outcomes. A significant area of investment for SAP Analytics Cloud is the automation of key use cases and augmentation of hidden insights.

(FC: Format)

aus:

SAP ANALYTICS

Business Intelligence, Statement of Direction

NOV 2019

Zitat von faultcode: wo bleibt bei Apple (und woanders) die omnipräsente "Business Intelligence" ?

...=> macht Apple überhaupt BI?

=> klar - die ganze Zeit über; sogar extra Jobs gibt's dafür...

und das - natürlich nicht nur bei Apple, sondern und gerade auch auch bei SAP:

Natürlich, priced for perfection ist ein anderes Problem.

Man kann darüber nachdenken, warum "Business Intelligence" offenbar im eigenen Haus eher nicht funktioniert gemessen an den hohen Ansprüchen und den nach außen abgegebenen Prognosen:

We want our users to focus on what really brings them value, so we provide automated insights helping them answer common business questions, detect patterns and trends, and forecast potential outcomes. A significant area of investment for SAP Analytics Cloud is the automation of key use cases and augmentation of hidden insights.

(FC: Format)

aus:

SAP ANALYTICS

Business Intelligence, Statement of Direction

NOV 2019

21.9.

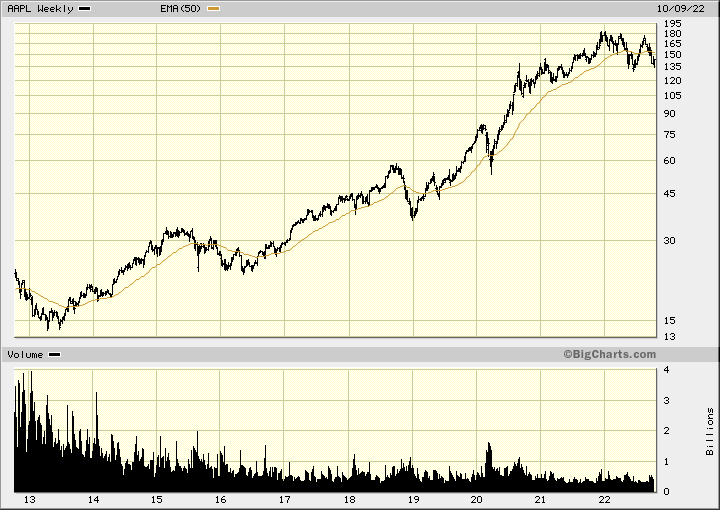

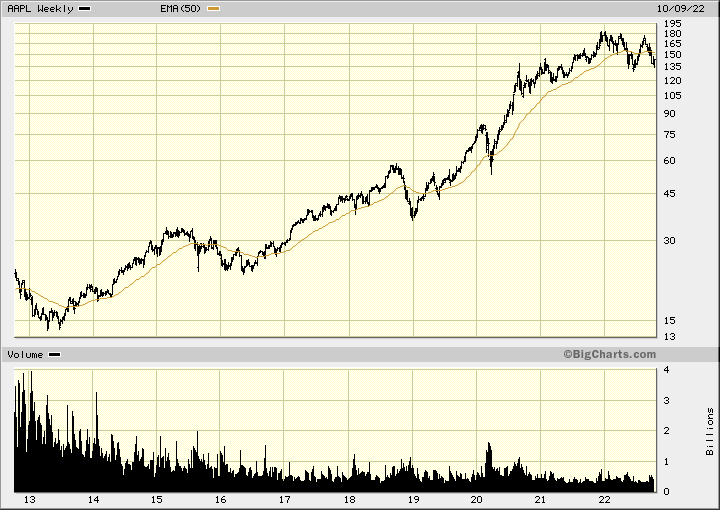

The 23% sell-off in Apple (NASDAQ: AAPL) from its Sept 2nd all-time high is adding credence to recent rumors that Warren Buffett is trimming his position.

At the recent highs, Mr. Buffett’s 980.6 million share position in Apple was worth approximately $135 billion, giving him a paper profit of about $100 billion. It also eclipsed 50% of Berkshire's entire public stock portfolio.

Traders note Apple saw a similar steady climb to the upside when Buffett was originally accumulating his position.

Investors will not know if Mr. Buffett has in fact sold Apple this quarter until mid-November when Berkshire releases its Q3 13F. Unless, of course, the Oracle wishes to disclose it sooner.

Apple (AAPL) Precipitous Sell-Off Adds Fuel to Buffett Rumors

https://www.streetinsider.com/Rumors/Apple+%28AAPL%29+Precip…

The 23% sell-off in Apple (NASDAQ: AAPL) from its Sept 2nd all-time high is adding credence to recent rumors that Warren Buffett is trimming his position.

At the recent highs, Mr. Buffett’s 980.6 million share position in Apple was worth approximately $135 billion, giving him a paper profit of about $100 billion. It also eclipsed 50% of Berkshire's entire public stock portfolio.

Traders note Apple saw a similar steady climb to the upside when Buffett was originally accumulating his position.

Investors will not know if Mr. Buffett has in fact sold Apple this quarter until mid-November when Berkshire releases its Q3 13F. Unless, of course, the Oracle wishes to disclose it sooner.

Apple (AAPL) Precipitous Sell-Off Adds Fuel to Buffett Rumors

https://www.streetinsider.com/Rumors/Apple+%28AAPL%29+Precip…

Antwort auf Beitrag Nr.: 64.926.161 von Himmelgrau am 29.08.20 18:24:02Das sind keine Gratisaktien

Antwort auf Beitrag Nr.: 64.925.189 von Roberto99 am 29.08.20 15:18:06Aber immerhin sind die Gratisaktien schon eingebucht und handelbar. Wird nicht bei jeder Bank so reibungslos funktionieren.

Schon gefreut was mein Depot für eine Megaperfomance in 2 Tagen hingelegt hat war aber nur der Apple Split der noch zum alten Preis drin steht

01.05.24 · dpa-AFX · Apple |

01.05.24 · wallstreetONLINE Redaktion · Apple |

30.04.24 · wO Newsflash · Apple |

30.04.24 · wallstreetONLINE Redaktion · Apple |

30.04.24 · dpa-AFX · Apple |

30.04.24 · dpa-AFX · Apple |

30.04.24 · wallstreetONLINE Redaktion · Apple |

| Zeit | Titel |

|---|---|

| 01.05.24 | |

| 11.02.24 | |

| 18.01.24 | |

| 27.11.23 | |

| 05.11.23 | |

| 22.08.23 | |

| 04.08.23 | |

| 02.07.23 |