Banco de Sabadell (Seite 2)

eröffnet am 19.11.20 14:10:38 von

neuester Beitrag 02.02.24 13:06:16 von

neuester Beitrag 02.02.24 13:06:16 von

Beiträge: 14

ID: 1.334.424

ID: 1.334.424

Aufrufe heute: 1

Gesamt: 2.398

Gesamt: 2.398

Aktive User: 0

ISIN: ES0113860A34 · WKN: A0MRD4 · Symbol: BDSB

1,9225

EUR

-0,21 %

-0,0040 EUR

Letzter Kurs 16:01:38 Tradegate

Neuigkeiten

| Titel |

|---|

09.05.24 · dpa-AFX |

09.05.24 · dpa-AFX |

09.05.24 · dpa-AFX |

09.05.24 · dpa-AFX |

09.05.24 · dpa-AFX |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,2700 | +47,14 | |

| 5,8039 | +22,96 | |

| 2,7400 | +18,10 | |

| 12,000 | +17,65 | |

| 13,140 | +14,01 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,3100 | -12,26 | |

| 1,4500 | -13,69 | |

| 1,3000 | -17,98 | |

| 1,1000 | -18,52 | |

| 10,500 | -39,38 |

Beitrag zu dieser Diskussion schreiben

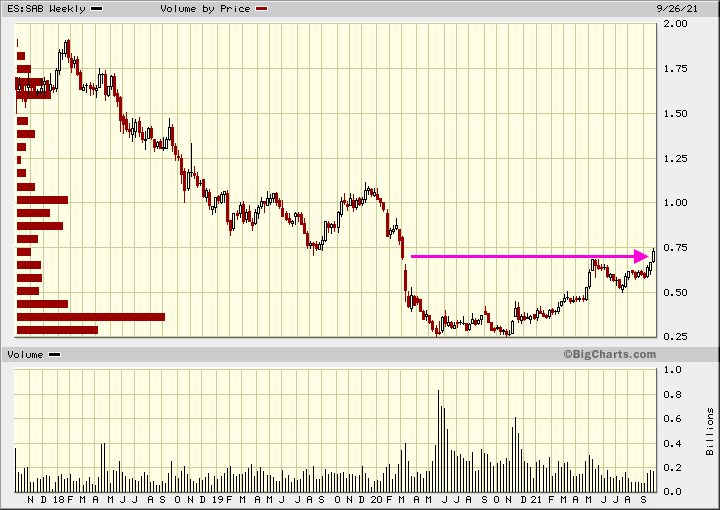

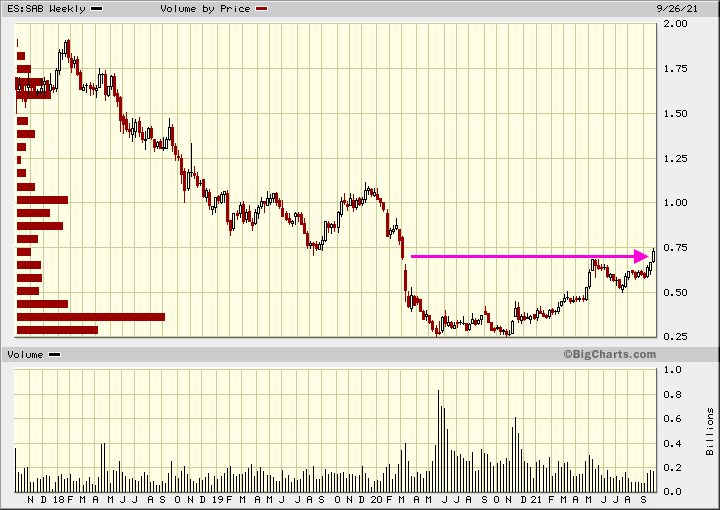

Antwort auf Beitrag Nr.: 68.100.842 von faultcode am 07.05.21 12:46:43das Geld kommt zurück, wie auch woanders im EURO-Bankensektor (*) - Ex-Griechenland:

(*) EURO STOXX Banks:

(*) EURO STOXX Banks:

Antwort auf Beitrag Nr.: 68.011.751 von faultcode am 01.05.21 00:12:46ohne Meldung (soweit ich sehe):

ansonsten:

30.4.

...

The Spanish bank plans to present its strategic plan on May 28.

...

https://www.marketwatch.com/story/banco-de-sabadell-expects-…

ansonsten:

30.4.

...

The Spanish bank plans to present its strategic plan on May 28.

...

https://www.marketwatch.com/story/banco-de-sabadell-expects-…

=>

<Google Translator>

https://murciaplaza.com/BancoSabadellgana73millonesdeeurosha…

22% less than the first quarter of 2020, before the pandemic -- Banco Sabadell earns 73 million euros until March and TSB returns to the profit path

04/30/2021 -

ALICANTE. Banco Sabadell closed the first quarter of 2021 with an attributable net profit of 73 million euros, 22.1% less compared to the same period in 2020, after an "excellent result of commercial activity and an increase in credit investment ".

Without taking into account TSB , the British subsidiary of the group based in Alicante, which returns to profits three years later, the net attributable profit stood at 71 million euros at the end of the first quarter, 29.8% less, as the bank communicated this Friday to the National Securities Market Commission ( CNMV ).

The financial institution has a CET1 'fully-loaded' capital ratio of 12% at the end of March 2021, remaining stable with respect to the previous quarter, and in terms of liquidity the LCR (Liquidity Coverage Ratio) ratio stands at March at 207% at the group level.

Income from the purely banking business - net interest margin and commissions - decreased 4.8% in year-on-year terms, to 1,175 million due to the lower incidence of the pandemic in the first quarter of 2020.

The net interest margin stands at the end of March 2021 at 833 million euros, down 5.8% year --in the quarter shows a reduction of 2.4% - and net commissions fell by 2.2% , up to 342 million euros, from the sale of Sabadell Asset Management - isolating this impact, commissions grew by 2.5% due to commissions from investment funds and demand accounts.

Total costs stood at 769 million at the end of March, which represents 1.2% less than the previous year due to the improvement in personnel costs - in the quarterly comparison they show a strong reduction of 28.4 % once the efficiency plan announced in the fourth quarter of last year has materialized, and which will mean cost savings of 141 million.

The group's efficiency ratio stood at 54.6% at the end of March 2021, which represents an improvement at the quarterly level, when it reached 55.4%, and the total capital ratio amounted to 16.7% at the end of March 2021.

Investment credit

Banco Sabadell's gross credit investment closed the first quarter with a balance of 150,334 million (110,441 million Ex TSB); organic investment growth stood at 5.9% year-on-year, and at 3.4% in the quarter, driven by growth in all geographies.

In Spain, the stock of live gross credit investment shows a growth of 4.2% year-on-year and 2.0% in the quarter, and in terms of new credit production in Spain, mortgage production has increased by 35% year-on-year , "with the best month of March in production in the history of Sabadell".

As of March 31, 2021, in Spain 8,847 million euros of ICO financing have been arranged and in the United Kingdom 606 million pounds of Bounce Back Loans; and, regarding deferrals, there is an outstanding balance of 2,218 million euros in Spain and an outstanding balance of 340 million pounds in the United Kingdom.

At the end of March, customer funds on the balance sheet totaled 153,800 million euros (112,656 million Ex TSB) and presented a growth of 6.8% year-on-year (3.0% Ex TSB) - in the quarter they showed a growth of 2 , 0% -.

Sight account balances amounted to 135,397 million euros (96,844 million Ex TSB), an increase of 13.9% year-on-year (10.7% ex TSB) and 3.9% (2.2% Ex TSB) in the quarter.

Total off-balance sheet customer funds amounted to € 39,478 million at the end of March, and total managed resources amounted to € 217,555 million (174,090 Ex TSB), which represents a year-on-year increase of 4.6% (1, 8% Ex TSB) and growth in the quarter of 3.7% (2.6% Ex TSB).

Troubled assets

Problem assets at the end of March show a balance of 7,507 million euros (6,127 million doubtful assets and 1,373 million foreclosed assets), while the coverage of problem assets stood at 52.8%, and the coverage of foreclosed assets 37.0%, thus improving over the previous quarter.

The group's NPL ratio stands at 3.7%, improving in the year-on-year comparison, and the group's cost of credit risk stood at 69bps at the end of the first quarter of 2021, compared to 86bps the previous quarter.

Strategic plan

Banco Sabadell plans to present its new strategic plan to the investor and analyst community on May 28.

The bank announced this Thursday that it has agreed to sell 100% of the capital stock of Bansabadell Renting to ALD Automotive for 59 million euros, according to the National Securities Market Commission (CNMV).

Finanzdaten

18. November 202012: 29 Uhr Vor einem Tag aktualisiert

UPDATE 1-BBVA-CEO sagt, dass die Sabadell-Aktien ohne Eile abrutschen

Von Jesús Aguado, Emma Pinedo

2 Min. Lesen

(Fügt Zitate vom BBVA-CEO hinzu, Aktienkurse)

MADRID, 18. November (Reuters). Die spanische BBVA hat am Mittwoch bei einer möglichen Fusion mit dem kleineren Rivalen Sabadell einen vorsichtigen Ton angegeben. Der CEO sagte, die Bank werde jedes Geschäft sorgfältig analysieren, bevor sie über ein weiteres Vorgehen entscheidet.

"Wir beginnen den Prozess, wir werden den Deal erst abschließen, wenn unsere Aktionäre eine klare Wertschöpfungsmöglichkeit haben." Wir sind nicht gezwungen, irgendetwas zu tun “, sagte Onur Genc, CEO von BBVA, und fügte hinzu, dass die Fusion alles andere als abgeschlossen sei.

Werbung

Sabadell-Aktien fielen nach den Kommentaren von Genc um 4,4% auf 1122 GMT. BBVA und Sabadell kündigten am Montag Fusionsgespräche an, um den zweitgrößten inländischen Kreditgeber nach Vermögenswerten zu schaffen, der die Sabadell-Aktien um 33% erhöht hatte.

Die Ankündigung von BBVA, das US-Geschäft zu verkaufen, hatte auch Spekulationen ausgelöst, einen Teil des Erlöses von 11,6 Milliarden US-Dollar für den Kauf seines Konkurrenten zu verwenden.

Genc sagte, die potenzielle Übernahme von Sabadell stehe in direktem Wettbewerb mit der Absicht von BBVA

Gruß WG

18. November 202012: 29 Uhr Vor einem Tag aktualisiert

UPDATE 1-BBVA-CEO sagt, dass die Sabadell-Aktien ohne Eile abrutschen

Von Jesús Aguado, Emma Pinedo

2 Min. Lesen

(Fügt Zitate vom BBVA-CEO hinzu, Aktienkurse)

MADRID, 18. November (Reuters). Die spanische BBVA hat am Mittwoch bei einer möglichen Fusion mit dem kleineren Rivalen Sabadell einen vorsichtigen Ton angegeben. Der CEO sagte, die Bank werde jedes Geschäft sorgfältig analysieren, bevor sie über ein weiteres Vorgehen entscheidet.

"Wir beginnen den Prozess, wir werden den Deal erst abschließen, wenn unsere Aktionäre eine klare Wertschöpfungsmöglichkeit haben." Wir sind nicht gezwungen, irgendetwas zu tun “, sagte Onur Genc, CEO von BBVA, und fügte hinzu, dass die Fusion alles andere als abgeschlossen sei.

Werbung

Sabadell-Aktien fielen nach den Kommentaren von Genc um 4,4% auf 1122 GMT. BBVA und Sabadell kündigten am Montag Fusionsgespräche an, um den zweitgrößten inländischen Kreditgeber nach Vermögenswerten zu schaffen, der die Sabadell-Aktien um 33% erhöht hatte.

Die Ankündigung von BBVA, das US-Geschäft zu verkaufen, hatte auch Spekulationen ausgelöst, einen Teil des Erlöses von 11,6 Milliarden US-Dollar für den Kauf seines Konkurrenten zu verwenden.

Genc sagte, die potenzielle Übernahme von Sabadell stehe in direktem Wettbewerb mit der Absicht von BBVA

Gruß WG

Banco de Sabadell